UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-33404

URANIUM RESOURCES, INC.

(Exact name of Registrant as specified in its charter)

|

DELAWARE |

|

75-2212772 |

|

|

|

|

|

6950 S. Potomac Street, Suite 300 |

|

80112 |

(303) 531-0470

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Common Stock, $0.001 par value per share |

|

NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

(Title of class)

Indicate by check mark if the Registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and a “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o |

|

Accelerated filer x |

|

Non-accelerated filer o |

|

Smaller reporting company o |

|

|

|

|

|

(Do not check if a |

|

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the Common Stock held by non-affiliates of the Registrant at June 29, 2012, was approximately $66,002,000. Number of shares of Common Stock, $0.001 par value, outstanding as of March 9, 2013: 19,773,334 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13 and 14 of Part III of this Form 10-K report are incorporated by reference to the Registrant’s Definitive Proxy Statement for the Registrant’s 2013 Annual Meeting of Stockholders.

Explanatory Note

As previously disclosed in a Current Report on Form 8-K filed on November 19, 2013, Uranium Resources, Inc. (the “Company,” “URI,” “we,” “us” or “our”) historically capitalized development costs after confirmation of the existence of a commercially minable uranium deposit. After discussions with the Staff of the United States Securities and Exchange Commission (the “SEC”), URI management determined that the Company’s capitalization practices were not in conformance with the SEC’s Industry Guide 7, which allows capitalization of development costs only after proven or probable reserves have been declared.

This Amendment No. 1 on Form 10-K/A (the “Amendment” or “Form 10-K/A”) amends and restates the Company’s Annual Report on Form 10-K for the year ended December 31, 2012, as originally filed with the SEC on March 18, 2013 (the “Original Form 10-K”). This Amendment amends and restates the Company’s consolidated financial statements and related disclosures as of December 31, 2011 and 2012 and for the years ended December 31, 2010, 2011 and 2012 (including restated financial information as of and for the interim periods contained therein) by reclassifying approximately $9.0 million of costs, approximately $3.9 million of which were recorded before 2010, from property, plant and equipment to mineral property expenses. The impact of the restatement is more fully described in Note 2 to the consolidated financial statements contained in this Amendment. As a result of the restatement, management has re-evaluated and amended its conclusions regarding the Company’s disclosure controls and procedures and internal control over financial reporting as contained in Item 9A of Part II.

In addition, URI management has also determined, consistent with Industry Guide 7, to disclose mineralized material in terms of tons and grade only in its filings with the SEC. Accordingly, the Company will no longer disclose pounds of mineralized uranium material contained in the ground, and this Amendment removes all such disclosure. The Company has also expanded its property disclosure in response to comments from the Staff of the SEC.

The following items of the Original Form 10-K have been modified or revised in this Form 10-K/A to reflect the restatement and other changes identified above:

· Part I, Item 1. “Business”;

· Part I, Item 2. “Properties”;

· Part II, Item 6. “Selected Financial Data”;

· Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”;

· Part II, Item 8. “Financial Statements and Supplementary Data”;

· Part II, Item 9A. “Controls and Procedures”; and

· Part IV, Item 15. “Exhibits and Financial Statement Schedules”.

The Company’s principal executive officer and principal financial officer have also provided currently dated certifications pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act of 2002 in connection with this Amendment.

This Amendment sets forth the Original Form 10-K in its entirety, except as required to reflect the effects of the restatement and other changes identified above. Except for disclosures affected by the restatement and other changes, this Amendment speaks as of the original filing date of the Original Form 10-K and does not modify or update other disclosures in the Original Form 10-K, including the nature and character of such disclosures, to reflect events occurring or items discovered after the original filing date of the Original Form 10-K.

This Amendment should be read in conjunction with the Company’s filings made with the SEC subsequent to the original filing date of the Original Form 10-K, together with any amendments to those filings, including the Company’s amended Quarterly Reports on Form 10-Q/A for the quarterly periods ended March 31, 2013, June 30, 2013 and September 30, 2013, as filed with the SEC on December 17, 2013.

URANIUM RESOURCES, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2012

|

1 | |||

|

|

1 | ||

|

|

|

1 | |

|

|

|

1 | |

|

|

|

1 | |

|

|

|

2 | |

|

|

|

2 | |

|

|

|

3 | |

|

|

|

3 | |

|

|

|

4 | |

|

|

|

4 | |

|

|

|

5 | |

|

|

|

6 | |

|

|

|

7 | |

|

|

|

8 | |

|

|

|

8 | |

|

|

|

9 | |

|

|

|

9 | |

|

|

9 | ||

|

|

16 | ||

|

|

16 | ||

|

|

|

16 | |

|

|

|

25 | |

|

|

|

52 | |

|

|

|

53 | |

|

|

|

53 | |

|

|

|

53 | |

|

|

54 | ||

|

|

|

Temporary Access Agreement with the Navajo Nation & Confidential Settlement Negotiations |

54 |

|

|

|

54 | |

|

|

|

54 | |

|

|

|

55 | |

|

|

|

56 | |

|

|

56 | ||

|

57 | |||

|

59 | |||

|

|

59 | ||

|

|

|

59 | |

|

|

|

59 | |

|

|

|

59 | |

|

|

59 | ||

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation |

61 | |

|

|

|

61 | |

|

|

|

Restatement and Revision of Previously Reported Consolidated Financial Information |

61 |

|

|

|

61 | |

|

|

|

64 | |

|

|

|

64 | |

|

|

|

64 | |

|

|

|

65 | |

|

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk |

65 | |

|

|

|

65 | |

|

|

65 | ||

|

|

|

65 | |

The “Company” or “Registrant” or “URI” is used in this annual report to refer to Uranium Resources, Inc. and its consolidated subsidiaries. This annual report contains “forward-looking statements.” These statements include, without limitation, statements relating to management’s expectations regarding the Company’s ability to remain solvent, capital requirements, mineralized materials, timing of receipt of mining permits, access rights, production capacity of mining operations planned for properties in South Texas and New Mexico and planned dates for commencement of production at such properties, business strategies and other plans and objectives of the Company’s management for future operations and activities and other such matters. The words “believes,” “plans,” “intends,” “strategy,” “projects,” “targets,” or “anticipates” and similar expressions identify forward-looking statements. The Company does not undertake to update, revise or correct any of the forward-looking information. Readers are cautioned that such forward-looking statements should be read in conjunction with the Company’s disclosures under Item 1A. “Risk Factors” beginning on page 9.

Certain terms used in this annual report and other industry terms are defined in the “Glossary of Certain Terms” appearing at the end of Part I hereto.

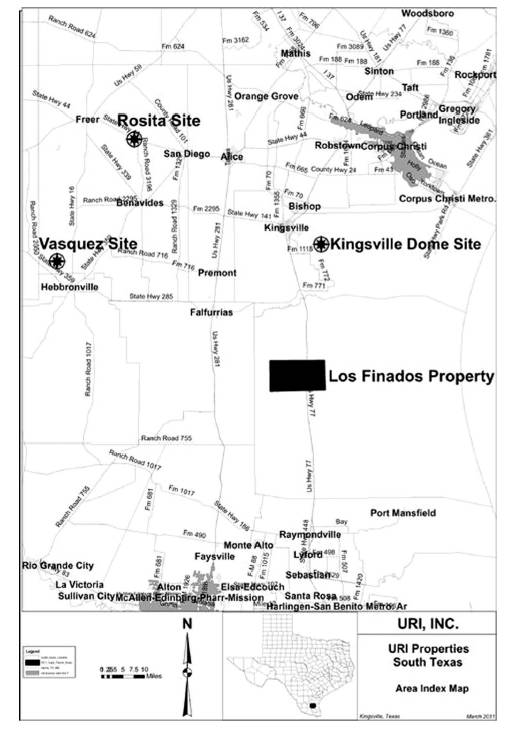

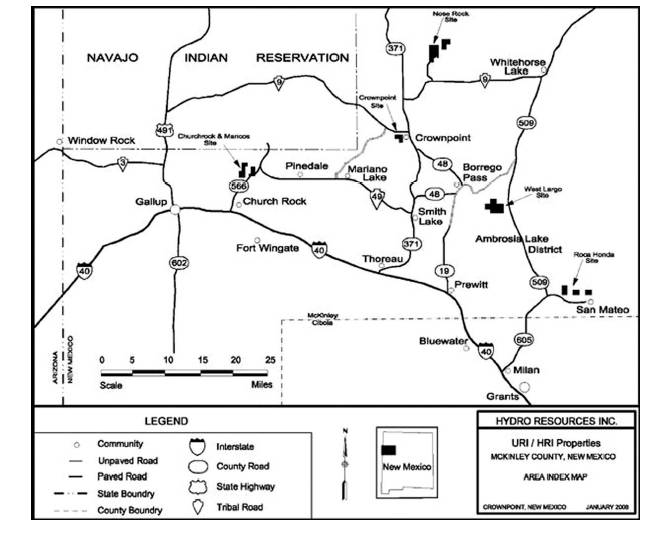

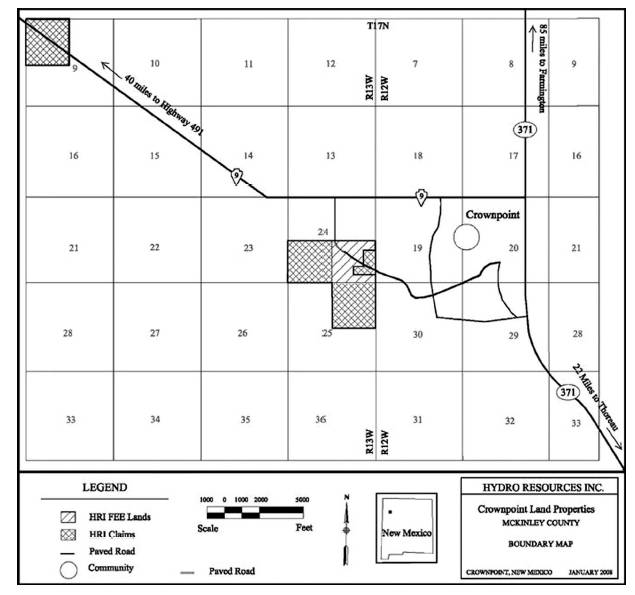

Uranium Resources, Inc. (URI) is a uranium exploration, development and production company. We were organized in 1977 to acquire and develop uranium mines in South Texas using the in-situ recovery mining process (ISR). URI has historically produced uranium by ISR methods in the state of Texas where the Company currently has ISR mining projects, including two licensed processing facilities. We also have 206,600 acres of mineral holdings in New Mexico and a NRC license to produce up to 3 million pounds per annum of uranium on certain of our New Mexico projects. The Company acquired these properties over the past 20 years along with an extensive information database of historic mining logs and analysis. None of URI’s properties are currently in production. As of March 1, 2013 we had 61 employees.

The Company manages its business under one reportable segment: uranium mining.

The Company’s vision is to be a leading U.S. uranium developer and producer. Our strategy is to create wealth for shareholders by advancing our projects in a way which both conserves cash and best positions us to return to production when uranium markets improve. In Texas, our focus is to add quality reserves within an economic distance of each licensed ISR processing facility through exploration activities and/or through value accretive acquisitions. In New Mexico, we will continue to progress the Churchrock Section 8 ISR project and also assess the potential of our significant resource base, for the development of larger scale projects on a standalone basis or with partners.

In March 2012, the Company entered into a merger agreement to acquire 100% of the equity capital of Neutron Energy, Inc. in a stock-for-stock transaction. The transaction was completed in August, 2012.

At the time the Merger Agreement was entered into, URI also entered into an investment agreement with Resource Capital Fund V L.P. (“RCF”) pursuant to which RCF provided $15 million in funding to URI through the purchase of 1,995,000 shares of URI’s common stock through two private placements.

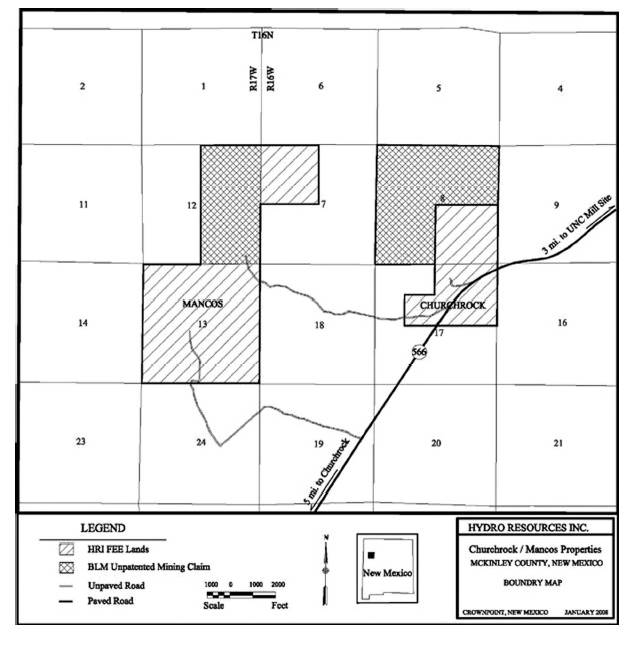

In July 2012, the Company’s wholly-owned subsidiary Hydro Resources, Inc. completed an agreement with the Navajo Nation regarding temporary access for its Churchrock Section 8 property. The Temporary Access Agreement (“Agreement”) is intended by both parties to settle the alleged trespass issue. Access provided under the Agreement is for regulatory requirements to include on-site visits with the Nuclear Regulatory Commission, but does not allow for any construction activities or earth disturbances.

In October 2012, the Company received findings resulting from the Section 8 / Navajo-Gallup Groundwater Report and Conjunctive Use Evaluation for its Churchrock Section 8 (“Section 8”) uranium ISR project. The study results indicated that existing Gallup, Fort Wingate, Rehoboth and Navajo Nation water wells will not be impacted by Section 8 ISR activities, during mining operations or into the future. Moreover, the evaluation concluded that there is no discernible risk that ISR activities would adversely affect groundwater allocated for the Navajo-Gallup Water Supply Project.

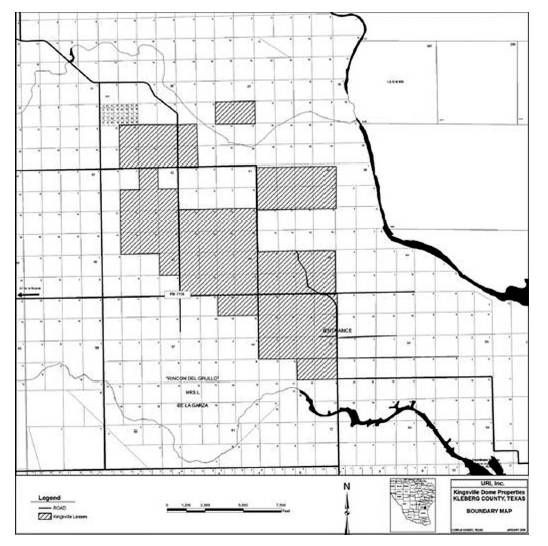

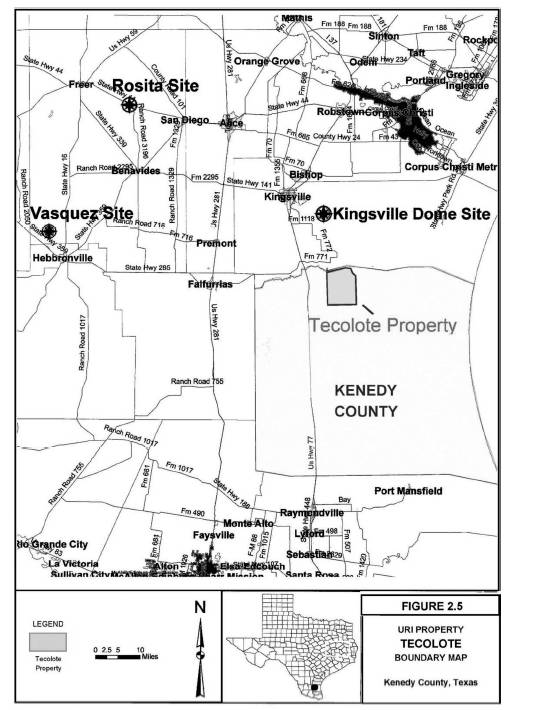

In December 2012, the Company completed the expansion and extension of its South Texas exploration agreement with Cameco Texas, Inc. and also signed an amendment to its uranium mining lease option in Kenedy County, Texas for the Tecolote tract, approximately 22,700 net acres that will be a part of the exploration program. Under the terms of the amended exploration agreement, both parties agreed to extend the exploration agreement to a five-phase, five-year exploration program to include Tecolote. Cameco has committed $4.3 million to increase its interest to 70% in the expanded program. Cameco will fund and be the exploration operator for Phase III. In addition to adding the 22,700 acres of Tecolote, the lease option amendment extended the original lease to 60 months with the election date to lease the acreage for production now being November 30, 2015.

Acquisition of Neutron Energy Inc. and Financing Agreement

In August 2012, we completed the acquisition of 100% of the equity capital (the “Transaction”) of Neutron Energy, Inc. (“Neutron”).

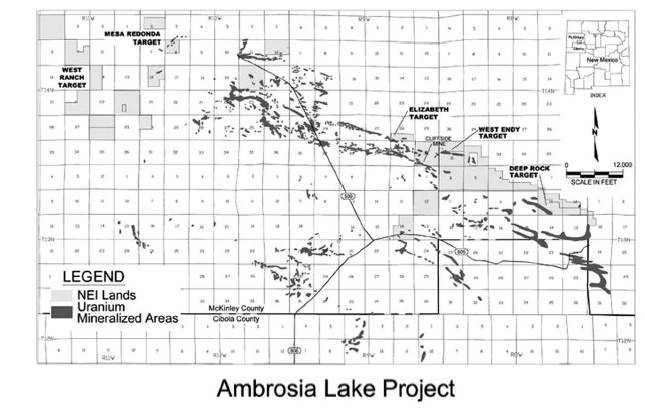

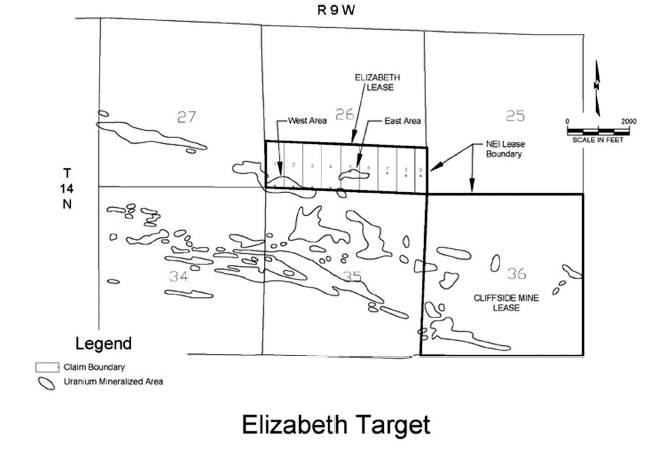

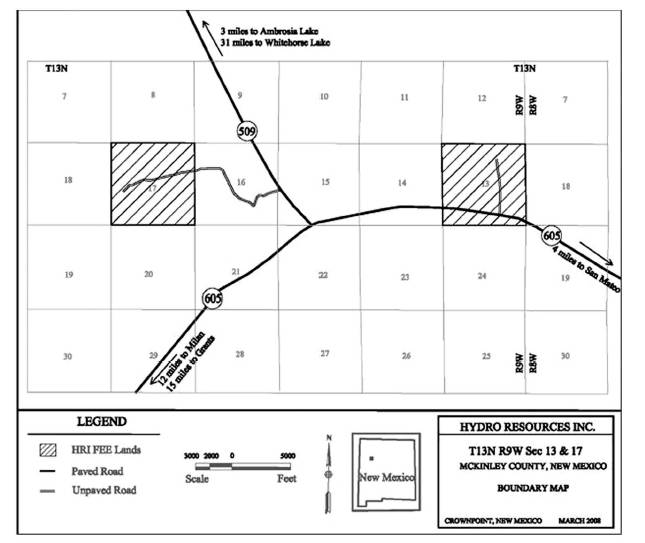

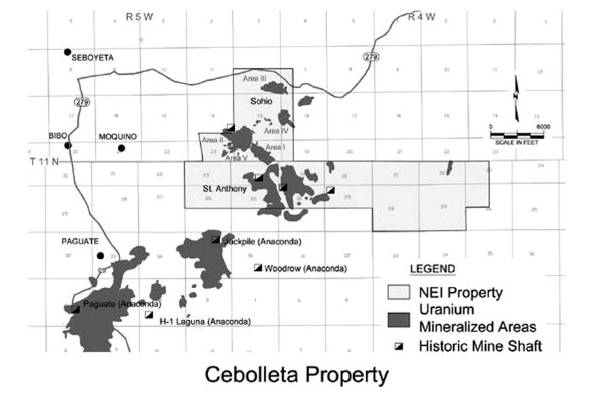

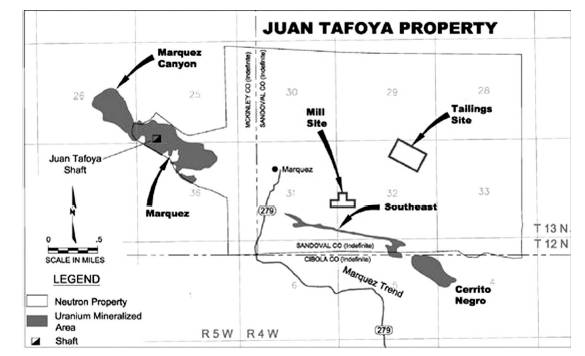

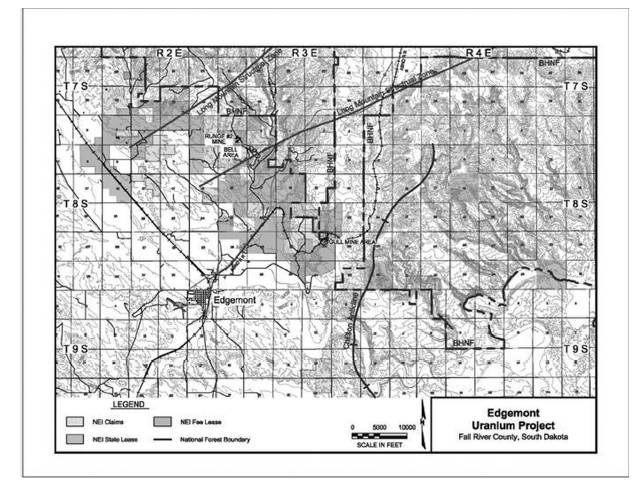

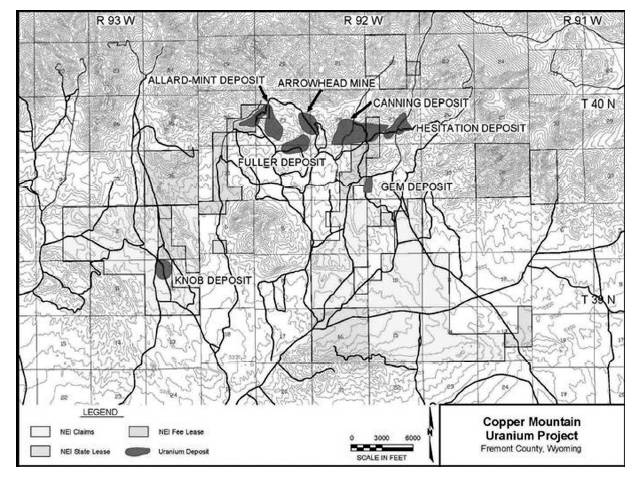

Neutron has significant uranium exploration and development assets located in the Grants Mineral Belt of New Mexico, including the Cebolleta and Juan Tafoya projects that cover 10,814 acres. The Cebolleta property contains 6.68 million tons of mineralized material at a grade of 0.176% U3O8 and 4.5 million tons of mineralized material at a grade of 0.09% U3O8, while the Juan Tafoya property contains 3.81 million tons of mineralized material at a grade of 0.149% U3O8 and 0.39 million tons of mineralized material at a grade of 0.112% U3O8. These properties are located on private lands and are planned to be mined using conventional techniques. Neutron also holds a suite of properties that neighbor certain URI properties west of Mt. Taylor, in the Ambrosia Lake region. These properties contain 3.2 million tons of mineralized material at a grade of 0.148% U3O8. Most of the mineralized material at the Ambrosia Lake projects is planned to be mined using conventional techniques, while there may be small isolated pockets which can be mined by ISR techniques. Neutron also has uranium assets in South Dakota and Wyoming.

As part of the Transaction, RCF purchased $20 million of the Company’s common stock to retire the majority of Neutron’s outstanding debt owed to RMB Australia Holdings Limited (“RMB”). The remainder of Neutron debt owed to RMB was converted into URI common stock, resulting in URI acquiring Neutron on a debt-free basis. RCF also provided $15 million in funding to URI through a private placement of $10 million at the time the merger agreement was signed and an additional $5 million after close of the merger.

The benefits of the merger to URI include that it positions the Company as one of the largest U.S. uranium development companies with total New Mexico land holdings for the combined company of over 206,600 acres. The transaction also added properties with resource development synergies on existing URI properties in the Ambrosia Lake region as well as a previously permitted, conventional mill site that provides URI with additional options for development of its conventional assets.

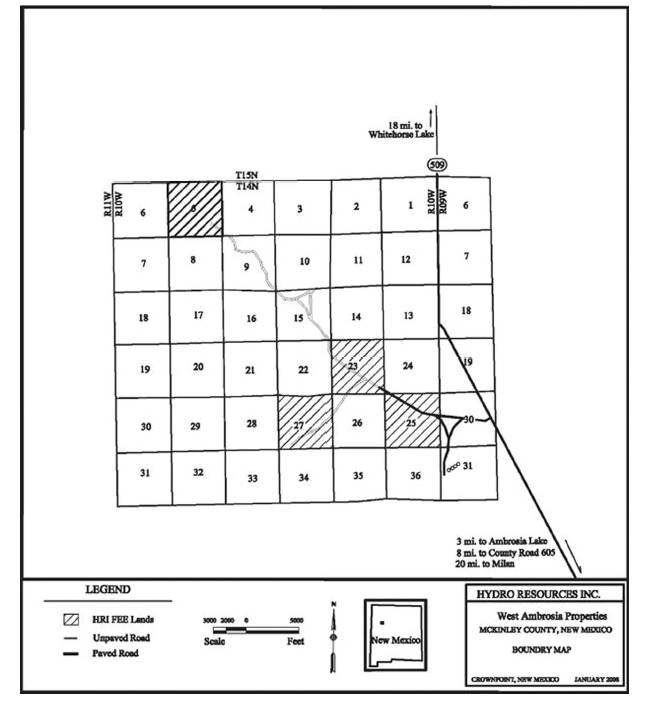

URI holds a NRC source materials license to build and operate an ISR uranium processing facility on company-owned property in McKinley County, New Mexico. The license allows for ISR mining at the Churchrock and Crownpoint projects. The license allows for the production of up to 1 million pounds per year from Churchrock Section 8 until a successful demonstration of restoration is made; after which the quantity of production can be increased and mining on other properties covered by the license can begin. Total production under the license is limited to 3 million pounds U3O8 per year. The Company completed a technical report on its Churchrock Section 8 project which was subjected to a peer review by an independent engineering firm in order to validate the economic determinations and engineering plans. The feasibility study was completed by the engineering firm in 2012. The Company’s ability to begin plant construction and wellfield development in New Mexico is subject to the receipt of necessary approvals for access to the property (See Item 2. “Properties—New Mexico—Churchrock/Mancos”) and availability of financing. Plans are to initially transport uranium loaded resin to one of the Company’s South Texas processing facilities which is expected to reduce capital requirements and accelerate the process to get to production.

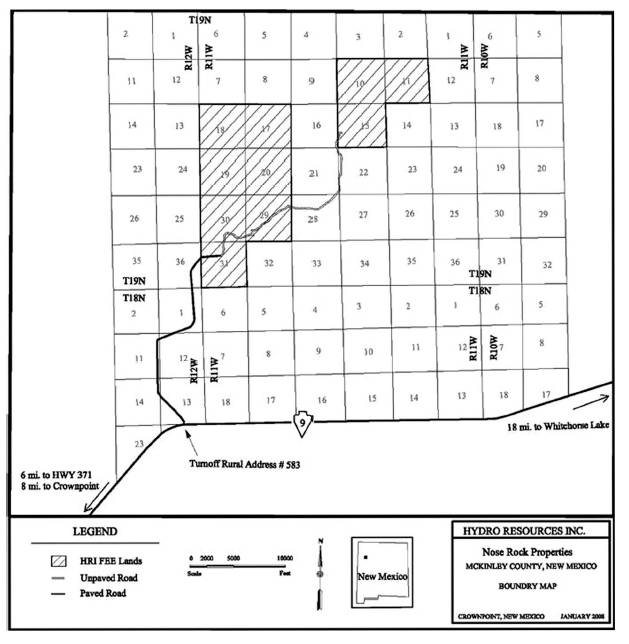

Exclusive of the Neutron properties acquired in the Transaction, the Company owns 183,000 acres of mineral holdings in New Mexico. A substantial amount of our acreage remains unexplored or currently has insufficient data to estimate in-place mineralized materials. These properties were acquired during the 1980s and 1990s along with a vast database of exploration logs and drill results that were developed by Conoco, Homestake Mining, Mobil Oil, Kerr-McGee, Phillips Petroleum, United Nuclear and Westinghouse Electric Corporation. Three of our properties were in various stages of being developed as conventional underground mines in the early 1980s with a total designed capacity to produce

approximately 4.5 million pounds U3O8 per year. We also possess a 16.5% royalty interest on a partial section of the inactive Mount Taylor Mine owned by Rio Grande Resources, a division of General Atomics.

Since 2007, we have scanned approximately 18,800 drill logs in order to secure the data and we plan to continue these efforts as well as begin to digitize this data to allow for analysis of drill hole information using modern resource modeling techniques. These logs total nearly 23 million feet of hole drilled in the 1970s and 1980s with an estimated drilling and logging replacement cost of $700 million.

URI plans to utilize its historic exploration database to assess the projects that comprise its New Mexico resource base to determine the most economic and efficient mining method for each project and prioritize the future development of these assets as well as continue to advance uranium asset consolidation activities. The Company will continue to advance its discussions with entities that would benefit from the production of the uranium and continue outreach and communication efforts with the local communities, federal, State and local governments and the Navajo Nation to address legacy issues while continuing education efforts on the safety of today’s uranium mining practices with the objective of bridging the gap that currently exists between uranium mining entities and others with stakeholder interests in the State.

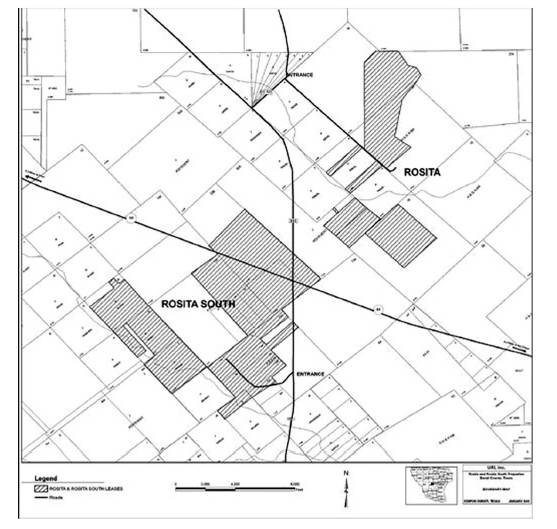

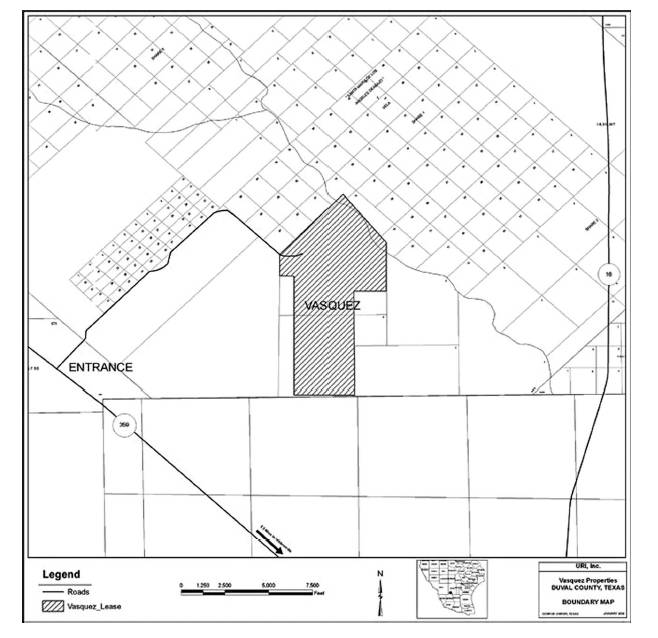

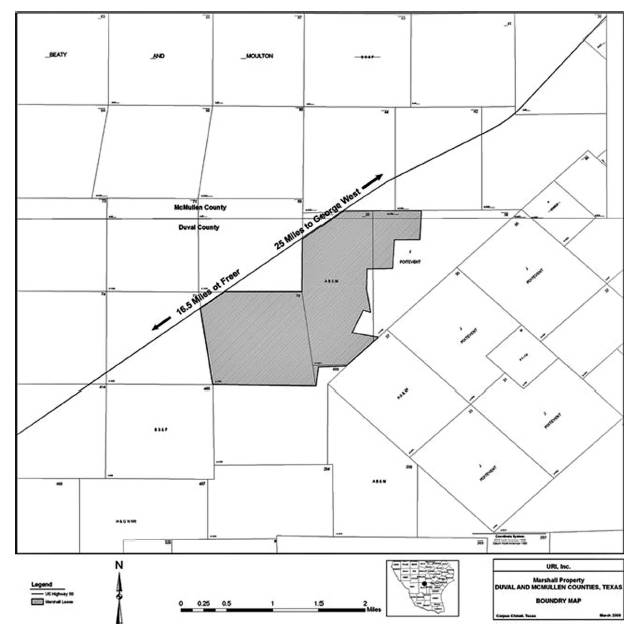

Texas Production History and Current Status

The Company developed and produced over 560,000 pounds U3O8 from the Longoria and Benavides projects in the early 1980s. These properties were fully restored between 1986 and 1991. From 1988 through 1999, we produced approximately 6.1 million pounds U3O8 from two South Texas projects: 3.5 million pounds from the Kingsville Dome project and 2.6 million pounds U3O8 from the Rosita project. In 1999, we shut-down production at both projects due to depressed uranium prices. We had no revenue from uranium sales between 2000 and the fourth quarter of 2004, and therefore had to rely on equity infusions to fund operations and maintain our critical employees and assets.

After uranium prices rose significantly in 2004, we placed our South Texas Vasquez property into production during the fourth quarter of that year. In April 2006, Kingsville Dome returned to production followed by a startup of Rosita in June 2008. From 2004 to the end of 2009, these three projects produced a total of 1.4 million pounds of U3O8.

The Vasquez project was mined out in 2008 and is now in restoration. Rosita production was shut-in in October 2008 due to depressed pricing and technical challenges in the first new wellfield that made mining uneconomical. The decline in uranium prices throughout 2008 also led to a decision in October 2008 to defer new wellfield development at Rosita and Kingsville Dome. Production continued in two existing wellfields at Kingsville Dome and was completed in July 2009. The Company has not had any operating mines in Texas since that time, and is currently evaluating the factors for resuming production at our South Texas projects.

Key operational elements of URI’s plan for its Texas properties include (1) positioning the Company to return to sustainable production in Texas by continuing to evaluate potential brownfield and greenfield exploration opportunities, advancing phase III of the Los Finados/Tecolote exploration project and evaluating synergistic opportunities on existing resources held by other entities and (2) continuing to maintain restoration activities in South Texas in accordance with the Company’s existing agreements and regulatory requirements.

Non-Reserve Mineralized Material in New Mexico

The following table estimates non-reserve mineralized uranium material on our New Mexico properties as of December 31, 2012. The estimate for each New Mexico property is based on studies and geologic reports prepared by prior owners, along with studies and reports prepared by geologists engaged by the Company. With the exception of the Cibola property, the estimates presented below were reviewed and affirmed by Behre Dolbear & Company (USA), Inc., an independent private geologic consulting firm in their report dated February 26, 2008. Non-reserve mineralized material attributed to the Cibola property was reviewed and verified in a Technical Report prepared by Broad Oak Associates, dated January 14, 2011. Since the date of the reports, the Company has maintained its ownership position of these properties, the properties have not been subject to any production activities and the estimates remain unchanged.

SUMMARY OF IN-PLACE NON-RESERVE MINERALIZED

MATERIAL IN NEW MEXICO

|

Property |

|

Tonnage |

|

Grade |

|

|

Mancos |

|

5.2 |

|

0.11 |

% |

|

Churchrock |

|

7.8 |

|

0.12 |

% |

|

Nose Rock |

|

7.6 |

|

0.15 |

% |

|

Cibola |

|

11.0 |

|

0.16 |

% |

|

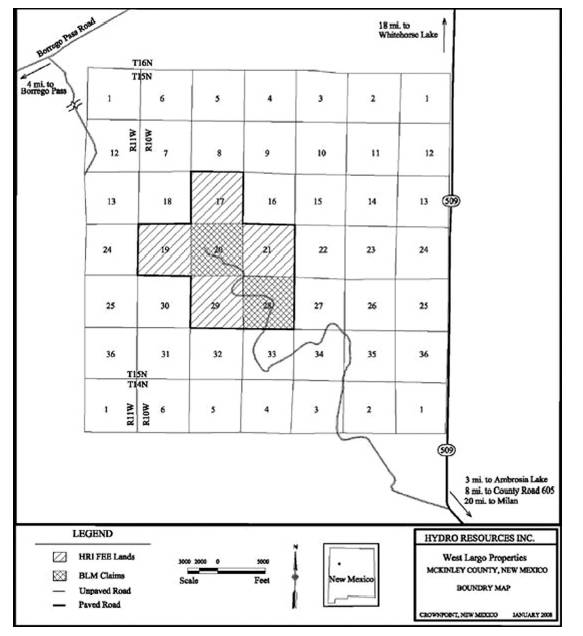

West Largo |

|

2.8 |

|

0.30 |

% |

|

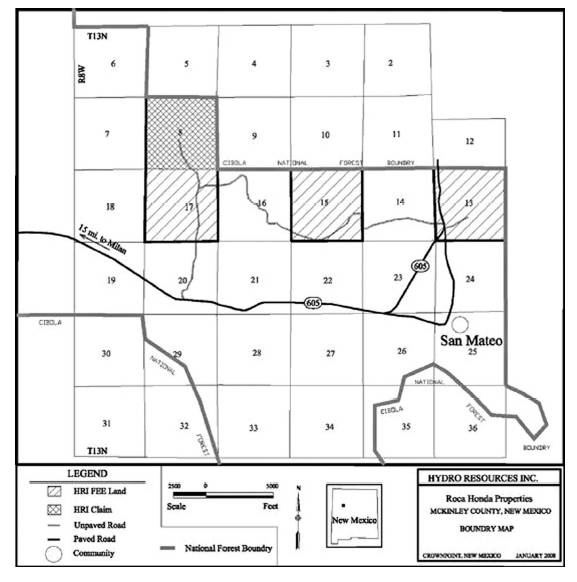

Roca Honda |

|

3.9 |

|

0.19 |

% |

|

Crownpoint |

|

4.8 |

|

0.16 |

% |

|

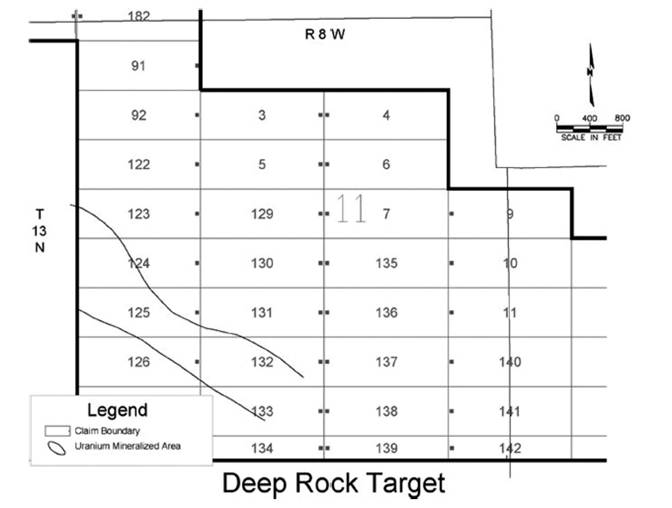

Ambrosia Lake |

|

3.2 |

|

0.14 |

% |

The Company believes the Mancos, Churchrock and Crownpoint properties will be amenable to ISR mining methods, the Cibola and Roca Honda properties to conventional mining and the Nose Rock, West Largo and Ambrosia Lake to ISR and/or conventional mining methods.

Additionally, as described in the Technical Report on the Uranium Resources at the Cibola Project, we have historical reports prepared by prior operators and their independent consultants that show the St. Anthony area of the Cibola property contains 4.5 million tons of non-reserve mineralized material at an average grade of 0.09%. This non-reserve mineralized material is considered historical in nature and no other calculations have yet been completed because the St. Anthony digital data base preparation and modeling is continuing. Upon completion of the modeling we anticipate the technical report will be updated by the independent firm.

The following table summarizes our estimates of Proven Reserves for our Kingsville Dome and Rosita properties in South Texas. For each property, the estimated recovery factor is 65%, and the reserves are based on a price of $16.00 per pound of U3O8. These estimates have been produced by the Company’s professional engineering and geologic staff.

SUMMARY OF IN-PLACE RESERVES IN SOUTH TEXAS

|

Property |

|

Tonnage |

|

Grade |

|

Proven Uranium |

|

|

Kingsville Dome |

|

0.035 |

|

0.071 |

% |

0.050 |

|

|

Rosita |

|

0.133 |

|

0.080 |

% |

0.224 |

|

|

Rosita South(1) |

|

0.129 |

|

0.077 |

% |

0.198 |

|

|

Rosita(1) |

|

0.112 |

|

0.086 |

% |

0.192 |

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

0.664 |

|

(1) The Company is in the process of finalizing the necessary permits for these areas and expects the required permits will be granted.

In March 2006, we entered into contracts with Itochu Corporation and UG USA, Inc. (superseding prior agreements), each of which calls for delivery of one-half of our actual production from our Texas properties (excluding our Los Finados project and another large potential exploration play). The terms of these 2006 contracts are summarized below.

The Itochu Contract. Under the Itochu contract all production from the Vasquez property was sold at a price equal to the average spot price for the eight weeks prior to the date of delivery less $6.50 per pound, with a floor for the spot price of $37.00 per pound and a ceiling of $46.50 per pound. Other Texas production will be sold at a price equal to the average spot price for the eight weeks prior to the date of delivery less $7.50 per pound, with a floor for the spot price of $37.00 per pound and a ceiling of $43.00 per pound. On non-Vasquez production the price paid will be increased by 30% of the difference between the actual spot price and the $43.00 ceiling up to and including $50.00 per pound. If the spot price is over $50.00 per pound, the price on all Texas production will be increased by 50% of such excess. The floor and ceiling and sharing arrangement over the ceiling applies to 3.65 million pounds of deliveries, after which there is no floor or ceiling.

Itochu has the right to cancel any deliveries on six-month’s notice. Since the inception of the new contract through December 31, 2012, we have delivered approximately 510,000 pounds to Itochu.

The UG Contract. Under the UG contract all production from the Vasquez property and other Texas production will be sold at a price equal to the month-end long-term contract price for the second month prior to the month of delivery less $6 per pound until (i) 600,000 pounds have been sold in a particular delivery year and (ii) an aggregate of 3 million pounds of uranium has been sold. After the 600,000 pounds in any year and 3 million pounds total have been sold, UG will have a right of first refusal to purchase other Texas production at a price equal to the average spot price for a period prior to the date of delivery less 4%. In consideration of UG’s agreement to restructure its previously existing contract, we paid UG $12 million in cash. Through December 31, 2012, we have delivered approximately 482,000 pounds to UG.

The Itochu and UG contracts contain provisions which exclude the Company’s requirement to deliver uranium produced from two specifically identified large ranch properties in South Texas. Uranium produced from the Company’s Los Finados project is one of the properties that is not subject to the conditions of these contracts.

Overview of the Uranium Industry

The only significant commercial use for uranium is as a fuel for nuclear power plants for the generation of electricity. According to the World Nuclear Association (“WNA”), as of February 2013, there were 435 nuclear power plants operable in the world with annual requirements of about 160 million pounds of uranium. In addition, the WNA lists 65 reactors under construction, 167 being planned and 317 being proposed.

Based on reports by Ux Consulting Company, LLC, (“Ux”), the preliminary estimate for worldwide production of uranium in 2012 is 148 million pounds. Ux reported that the gap between production and demand was filled by secondary supplies, such as inventories held by governments, utilities and others in the fuel cycle, including the highly enriched uranium, or HEU, inventories which are a result of the agreement between the US and Russia to blend down nuclear warheads. These secondary supplies are currently meeting over 25% of worldwide demand but are depleting.

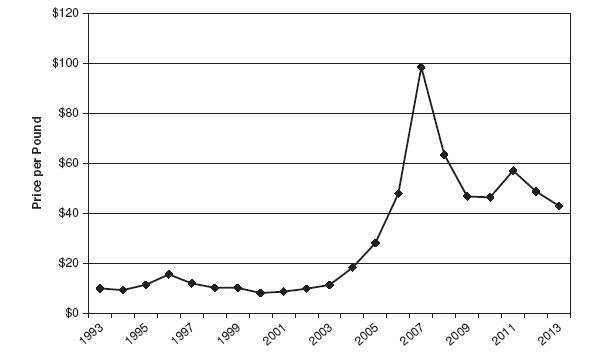

Spot market prices rose from $21.00 per pound in January 2005 to a high of $136.00 per pound in June 2007 in anticipation of sharply higher projected demand as a result of a resurgence in nuclear power and the depletion or unavailability of secondary supplies. The sharp price increase was driven in part by high levels of utility buying, which resulted in most utilities covering their requirements through 2009. A decrease in near-term utility demand coupled with rising levels of supplies from producers and traders led to downward pressure on uranium prices since the third quarter of 2007. In 2012, the spot price of uranium reached a high of $52.50 per pound in January and dropped to a low of $40.75 per pound in November. The year end 2012 spot price was $43.50 per pound. As of February 25, 2013, the spot price was $42.00 per pound and the long-term contract price was $56.00 per pound.

The following graph shows annual average spot prices per pound from 1992 to 2013 and the average weekly price for the period January 1, 2013 to February 25, 2013, as reported by Ux Consulting.

Ux Average Annual U3O8 Spot Price

The ISR mining process is a form of solution mining. It differs dramatically from conventional mining techniques. The ISR technique avoids the movement and milling of significant quantities of rock and ore as well as mill tailing waste associated with more traditional mining methods. It is generally more cost-effective and environmentally benign than conventional mining. Historically, the majority of United States uranium production resulted from either open pit surface mines or underground mining.

The ISR process was first tested for the production of uranium in the mid-1960s and was first applied to a commercial-scale project in 1975 in South Texas. It was well established in South Texas by the late 1970’s, where it was employed in about twenty commercial projects, including two operated by us.

In the ISR process, groundwater fortified with oxygen and other solubilizing agents is pumped into a permeable ore body causing the uranium contained in the ore to dissolve. The resulting solution is pumped to the surface. The fluid-bearing uranium is then circulated to an ion exchange column on the surface where uranium is extracted from the fluid onto resin beads. The fluid is then re-injected into the ore body. When the ion exchange column’s resin beads are loaded with uranium, they are removed and flushed with a salt-water solution, which strips the uranium from the beads. This leaves the uranium in slurry, which is then dried and packaged for shipment as uranium concentrates. For greater operating efficiency and lower capital expenditures, when developing new wellfields we use a wellfield-specific remote ion exchange methodology as opposed to a central plant as we had done historically. Instead of piping the solutions over large distances through large diameter pipelines and mixing the waters of several wellfields together, each wellfield is being mined using a dedicated satellite ion exchange facility. This allows ion exchange to take place at the wellfield instead of at the central plant. A wellfield consists of a series of injection wells, production (extraction) wells and monitoring wells drilled in specified patterns. Wellfield pattern is crucial to minimizing costs and maximizing efficiencies of production. The satellite facilities allow mining of each wellfield using its own native groundwater.

Environmental Considerations and Permitting

Uranium mining is regulated by the federal government, states and, in some cases, by Indian tribes. Compliance with such regulation has a material effect on the economics of our operations and the timing of project development. Our primary regulatory costs have been related to obtaining licenses and permits from federal and state agencies before the commencement of mining activities. The current environmental regulatory requirements for the ISR industry are well established. Many ISR mines have gone full cycle without any significant environmental impact. However, the public anti-nuclear lobby can make environmental permitting difficult and timing unpredictable.

U.S. regulations pertaining to climate change continue to evolve in both the U.S. and internationally. We do not anticipate any adverse impact from these regulations that would be unique to our operations.

Radioactive Material License. Before commencing ISR operations in Texas and either ISR or conventional mining activity in New Mexico, we must obtain a radioactive material license. Under the federal Atomic Energy Act, the United States Nuclear Regulatory Commission has primary jurisdiction over the issuance of a radioactive material license. However, the Atomic Energy Act also allows for states with regulatory programs deemed satisfactory by the Commission to take primary responsibility for issuing the radioactive material license. The Commission has ceded jurisdiction for such licenses to Texas, but not to New Mexico. Such ceding of jurisdiction by the Commission is hereinafter referred to as the “granting of primacy.”

The Texas Commission of Environmental Quality (TCEQ) is the administrative agency with jurisdiction in Texas over the radioactive material license. For operations in New Mexico, radioactive material licensing is handled directly by the United States Nuclear Regulatory Commission.

See Item 2, “Properties” for the status of our radioactive material license for New Mexico and Texas.

Underground Injection Control (“UIC”) Permits. The federal Safe Drinking Water Act creates a nationwide regulatory program protecting groundwater. This law is administered by the United States Environmental Protection Agency (the “USEPA”). However, to avoid the burden of dual federal and state regulation, the Safe Drinking Water Act allows for the UIC permits issued by states to satisfy the UIC permit required under the Safe Drinking Water Act under two conditions. First, the state’s program must have been granted primacy. Second, the USEPA must have granted, upon request by the state, an aquifer exemption. The USEPA may delay or decline to process the state’s application if the USEPA questions the state’s jurisdiction over the mine site.

Texas has been granted primacy for its UIC programs, and the Texas Commission on Environmental Quality administers UIC permits. The TCEQ also regulates air quality and surface deposition or discharge of treated wastewater associated with the ISR mining process.

New Mexico has also been granted primacy for its UIC program. Properties located in Indian Country remain subject to the jurisdiction of the USEPA. Some of our properties are located in areas that may be in Indian Country. The Navajo Nation has been determined eligible for treatment as a state, but it has not requested the grant of primacy from the USEPA for uranium related UIC activity. Until the Navajo Nation has been granted primacy, ISR uranium mining activities within Indian Country will require a UIC permit from the USEPA. Despite some procedural differences, the substantive requirements of the Texas, New Mexico and USEPA underground injection control programs are very similar.

See Item 2, “Properties” and Item 3, “Legal Proceedings” for a description of the status of our UIC permits in Texas and New Mexico.

Mining Permits. All uranium producing states have regulations governing the development, operation and closure of conventional mines, including Texas and New Mexico. In New Mexico, the Mining and Minerals Division of the Energy, Minerals and Natural Resources Department is responsible for issuing permits under the authority of the New Mexico Mining Act of 1978. Well established regulations specify what information is necessary to support mine permit applications and a well-defined application review process. The primary focus of the agency’s review is to ensure that the proposed mine will protect the environment surrounding the mine area, comply with relevant environmental standards, and be reclaimed to a self-sustaining ecosystem or other approved post-mine land use. Application reviews require consultation with other state agencies, public notice and public hearing opportunities. In addition to mine permits, a discharge permit must be obtained from the New Mexico Environment Department for mine facilities such as ore pads, waste rock piles and tailings impoundments.

Other. In addition to radioactive material licenses and UIC permits, we are also required to obtain from governmental authorities a number of other permits or exemptions, such as for wastewater discharge, for land application of treated wastewater, and for air emissions.

In order for a licensee to receive final release from further radioactive material license obligations after all of its mining and post-mining clean-up have been completed, approval must be issued by the TCEQ for Texas properties along with concurrence from the United States Nuclear Regulatory Commission and for properties in New Mexico by the United States Nuclear Regulatory Commission.

In addition to the costs and responsibilities associated with obtaining and maintaining permits and the regulation of production activities, we are subject to environmental laws and regulations applicable to the ownership and operation of real property in general, including, but not limited to, the potential responsibility for the activities of prior owners and operators.

Reclamation and Restoration Costs and Bonding Requirements

At the conclusion of ISR mining, a mine site is decommissioned and decontaminated, and each wellfield is restored and reclaimed. Restoration involves returning the aquifer to its pre-mining use and removing evidence of surface disturbance. Restoration can be accomplished by flushing the ore zone with native ground water and/or using reverse osmosis to remove ions, minerals and salts to provide clean water for reinjection to flush the ore zone. Decommissioning and decontamination entails dismantling and removing the structures, equipment and materials used at the site during the mining and restoration activities.

The Company is required by the State of Texas regulatory agencies to obtain financial surety relating to certain of its future restoration and reclamation obligations. The Company has a combination of bank Letters of Credit (the “L/Cs”) and performance bonds issued for the benefit of the Company to satisfy such regulatory requirements. The L/Cs were issued by Bank of America and the performance bonds have been issued by United States Fidelity and Guaranty Company (“USF&G”). The L/Cs relate primarily to our operations at our Kingsville Dome and Vasquez projects and amounted to $5,873,000 and $5,858,000, at December 31, 2012 and 2011, respectively. The L/Cs are collateralized in their entirety by certificates of deposit.

The performance bonds were $2,834,000 on December 31, 2012 and 2011, and related primarily to our operations at Kingsville Dome and Rosita. USF&G has required that the Company deposit funds fully collateralizing the bonds.

We estimate that our actual reclamation liabilities for prior operations at Kingsville Dome, Vasquez and Rosita at December 31, 2012, are about $6.7 million of which the net present value of $4.5 million is recorded as a liability on our balance sheet as of December 31, 2012.

The Company’s financial surety obligations are reviewed and revised periodically by the Texas regulators. In New Mexico, surety bonding will be required before commencement of mining and will be subject to annual review and revision by the United States Nuclear Regulatory Commission and the State of New Mexico or the USEPA.

Water is essential to the ISR process. It is readily available in South Texas. In Texas, water is subject to capture, and we do not have to acquire water rights through a state administrative process. In New Mexico, water rights are administered through the New Mexico State Engineer and can be subject to Indian tribal jurisdictional claims. New water rights or changes in purpose or place of use or points of diversion of existing water rights, such as those in the San Juan and Gallup Basins where our properties are located, must be obtained by permit from the State Engineer. Applications may be approved subject to conditions that govern exercise of the water rights.

Jurisdiction over water rights becomes an issue in New Mexico when an Indian nation, such as the Navajo Nation, objects to the State Engineer’s authority and claims tribal jurisdiction over Indian Country. This issue may result in litigation between the Indian nation and the state, which may delay action on water right applications, and can require applications to the appropriate Indian nation and continuing jurisdiction by the Indian nation over use of the water. The foregoing issues have arisen in connection with certain of our New Mexico properties.

In New Mexico, we hold approved water rights to provide sufficient water to conduct mining at the Churchrock project and Section 24 for the Crownpoint project for the projected life of these mines. We also hold two unprotested senior water rights applications that, when approved by the New Mexico State Engineer, would provide sufficient water for future extensions of the Crownpoint project.

A primary area of competition is in the identification and acquisition of properties with high prospects of potential producible reserves. We compete with multiple exploration companies for both properties as well as skilled personnel. There is global competition for uranium properties, capital, customers and the employment and retention of qualified personnel. In the production and marketing of uranium, there are a number of producing entities, some of which are government controlled and all of which are significantly larger and better capitalized than we are. Many of these organizations also have substantially greater financial, technical, manufacturing and distribution resources than we have.

Our uranium production also competes with uranium recovered from the de-enrichment of highly enriched uranium obtained from the dismantlement of United States and Russian nuclear weapons and imports to the United States of uranium from the former Soviet Union and from the sale of uranium inventory held by the United States Department of Energy. In addition, there are numerous entities in the market that compete with us for properties and are attempting to become licensed to operate ISR facilities. If we are unable to successfully compete for properties, capital, customers or employees or alternative uranium sources, it could have a materially adverse effect on our results of operations.

With respect to sales of uranium, the Company competes primarily based on price. We market uranium to utilities and commodity brokers and are in direct competition with supplies available from various sources worldwide. We believe we compete with multiple operating companies in the mining and sale of uranium.

Our Internet website address is www.uraniumresources.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports of Form 8-K, and amendments to those reports filed or furnished pursuant to section 13(a) of 15(d) of the Exchange Act, are available free of charge through our website under the tab “Investor Relations” as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission. We also make available on our website copies of materials regarding our corporate governance policies and practices, including our Code of Ethics, Nominating and Governance Committee Charter, Audit Committee Charter and Compensation Committee Charter. You may also obtain a printed copy of the foregoing materials by sending a written request to: Uranium Resources, Inc., 6950 S. Potomac Street, Suite 300, Centennial, Colorado 80112, Attention: Information Request or by calling 303.531.0470. The information found on our Internet website is not part of this or any report filed or furnished to the SEC.

Our business activities are subject to significant risks, including those described below. Every investor or potential investor in our securities should carefully consider these risks. If any of the described risks actually occurs, our business, financial position and results of operations could be materially adversely affected. Such risks are not the only ones we face and additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business.

We may not have sufficient cash to fund our operations through December 31, 2013, and if we are unable to raise additional capital, our business may fail and stockholders may lose their entire investment.

We had $4.7 million in cash at December 31, 2012. Even with the net proceeds from our February 2013 rights offering, we currently do not have sufficient cash to fund our operations through December 31, 2013 and we will need to raise additional capital to fund our operations through December 31, 2013 and beyond. Additional financing may come in the form of an offering of common stock or other securities, sales of common stock pursuant to our at-the-market financing arrangement with BTIG LLC or borrowings from a bank or one of our stockholders. If additional shares are issued to raise capital, our existing stockholders will suffer dilution to their stock ownership and the value of our outstanding shares may fall. If we borrow more money, we will have to pay interest and may also have to agree to restrictions that limit our operating flexibility. Our ability to obtain additional financing is subject to a number of factors, including the market price of uranium, market conditions, investor acceptance of our business plan and investor sentiment. We have no commitments for additional financing and there can be no assurance that additional funds will be available when needed, or on terms acceptable to us, if at all.

If adequate funds are not available, we may be required to change our planned business strategies. Among other things, we may not be able to successfully develop our properties. There can be no assurance that we will be able to raise sufficient funds to allow the Company to move forward with its future development. If we are unable to secure additional capital, we would need to curtail business operations which would have a material negative effect on operating results, the value of our outstanding stock is likely to fall, and our business may fail, causing our stockholders to lose their entire investment.

The Company is not producing uranium at this time. As a result, we currently have no sources of operating cash. If we cannot monetize certain existing Company assets, partner with another company that has cash resources, find other means of generating revenue other than uranium production and/or access additional sources of private or public capital, we may not be able to remain in business.

As a result of low uranium prices, we ceased production of uranium in 2009. While we have approximately 664,000 pounds of reserves at our South Texas properties, we are not planning to commence production at any of our South Texas properties until we are able to acquire additional reserves or mineralized material and uranium prices recover to levels that will ensure that production, once resumed, is sustainable in the 300,000 to 500,000 pound range per year. Our ability to begin plant construction and wellfield development in New Mexico is subject to the receipt of necessary approvals for access to the property, availability of financing and activation of our permits and licenses. Our ability to initiate construction and development is dependent on resolution of access issues relating to Churchrock Section 8 (see “—The Navajo Nation’s ban on uranium mining in what it considers to be Navajo Indian Country and its opposition to the transportation of radioactive substances over and across what it views as Navajo Nation lands may have a material adverse effect on our future operations” below). In addition, we expect that we will need to secure significant capital for the development of our Churchrock project in advance of beginning development activities on the project. We do not have a committed source of financing for the development of our Churchrock project. There can be no assurance that we will be able to obtain financing for this project or our other New Mexico projects. Our inability to develop the New Mexico properties would have a material adverse effect on our future operations.

Until we begin uranium production we have no way to generate cash inflows unless we monetize certain Company assets or through financing activities. Our future uranium production, cash flow and income are dependent upon the results of exploration as well as our ability to bring on new, as yet unidentified wellfields and to acquire and develop additional reserves. We can provide no assurance that our properties will be placed into production or that we will be able to continue to find, develop, acquire and finance additional reserves. If we cannot monetize certain existing Company assets, partner with another company that has cash resources, find other means of generating revenue other than uranium production and/or access additional sources of private or public capital, we may not be able to remain in business and our stockholders may lose their entire investment.

Our ability to function as an operating mining company will be dependent on our ability to mine our properties at a profit sufficient to finance further mining activities and for the acquisition and development of additional properties. The volatility of uranium prices makes long-range planning uncertain and raising capital difficult.

We have deferred activities for exploration, delineation and development of new wellfields at all of our South Texas projects except for the Los Finados/Tecolote project. This decision limits our ability to be immediately ready to begin production should uranium prices improve suddenly. Our ability to operate on a positive cash flow basis will be dependent on mining sufficient quantities of uranium at a profit sufficient to finance our operations and for the acquisition and development of additional mining properties. Any profit will necessarily be dependent upon, and affected by, the long and short term market prices of uranium, which are subject to significant fluctuation. Uranium prices have been and will continue to be affected by numerous factors beyond our control. These factors include the demand for nuclear power, political and economic conditions in uranium producing and consuming countries, uranium supply from secondary sources and uranium production levels and costs of production. A significant, sustained drop in uranium prices may make it impossible to operate URI’s or Neutron’s business at a level that will permit us to cover our fixed costs or to remain in operation.

The Navajo Nation’s ban on uranium mining in what it considers to be Navajo Indian Country and its opposition to the transportation of radioactive substances over and across what it views as Navajo Nation lands may have a material adverse effect on our future operations.

In April 2005, the Navajo Nation (“Nation”) Council passed the Diné Natural Resources Protection Act of 2005, 18 Navajo Nation Code §1303, which prohibits uranium mining and processing on any sites within “Navajo Indian Country” as defined by 7 Navajo Nation Code § 254(A). The ban may impede or prevent us from developing and operating our properties located in federally defined Indian Country for two reasons. First, the Navajo Nation takes a more expansive view of its own jurisdiction over “Navajo Indian Country” than does current federal law. Specifically, 7 N.N.C. § 254(A) provides that the term “Navajo Indian Country” applies to all land within the exterior boundaries of the Navajo Indian Reservation or of the Eastern Navajo Agency, Navajo Indian allotments, dependent Indian communities, and all land held in trust for, owned in fee by, or leased by the United States to the Navajo Nation. This may conflict with federal law as codified by Congress and interpreted by the federal courts. The term “Indian Country” is derived from jurisdictional determinations in criminal law enforcement proceedings under the federal Indian Country statute, 18 U.S.C. § 1151, and understood to encompass territory situated within Indian reservations, land owned by Indian Allottees, and land within a dependent Indian community. Second,

while the United States Court of Appeals for the Tenth Circuit has specifically held, en banc, that the Company’s Section 8 property in Churchrock, New Mexico is not Indian Country, approximately 32.5% of our in-place mineralized uranium material is located elsewhere in federally defined Indian Country. Consequently, with respect to the Navajo Nation, our ability to mine will be adversely affected unless Navajo law is modified or a waiver or other exemption is provided.

In February 2012, the Navajo Nation Council passed The Radioactive and Related Substances, Equipment, Vehicles, Persons and Materials Transportation Act of 2012 which would prohibit the transport across Nation lands of any equipment, vehicles, persons or materials for the purposes of exploring for or mining, producing, processing or milling any uranium ore, yellowcake, radioactive waste or other radioactive products on or under the surface of or adjacent to Nation lands unless the transporter has first (i) obtained Nation consent and a federal grant of easement, (ii) consented to full subject matter and personal jurisdiction of the Nation, and (iii) agreed to terms and conditions regarding clean-up and remediation. The Act would also require the Navajo Nation Environmental Protection Agency (“NNEPA”) to promulgate regulations implementing notice requirements, license fees, bonding requirements, route restrictions and curfews for the transportation of radioactive substances over and across Nation lands or otherwise within Navajo Indian Country. The Act, which may conflict with federal laws and regulations governing the transport of radioactive materials, could have a material adverse effect on our future operations, including our ability to transport equipment and personnel to and from our properties and to transport resin from New Mexico to our processing facilities in Texas.

In April 2012, the Nation’s Division of Natural Resources issued a Notice of Violation and Order to Comply with the Navajo Nation Civil Trespass Act (the “NOV”) against the Company’s subsidiary Hydro Resources, Inc. (“HRI”). The NOV assessed a $50 civil assessment for alleged trespass on Section 9, Township 16 North, Range 16 West, N.M.P.M. (“Section 9”), which is land held in trust by the United States for the benefit of the Nation (“Trust Lands”). The NOV stated that HRI’s Section 8 Churchrock property cannot be reached from New Mexico State Highway 566 without crossing either Section 9 or Section 17, both of which are Trust Lands, and that the Highway 566 right-of-way does not abut or extend into the Section 8 Churchrock property. The NOV demanded that HRI cease entering upon and crossing Section 9 and Section 17 for the purpose of transporting vehicles, equipment and/or personnel to the Section 8 Churchrock property until HRI either (i) provided documentation of a validly existing right-of-way or easement; or (ii) obtained an appropriate right-of-way from the Nation. In July 2012, HRI and the Nation resolved the NOV by entering into a Temporary Access Agreement (the “Agreement”). Under the terms of the Agreement, HRI and its contractors may now access Section 8 through either Section 9 or 17 to support site visits by the Nuclear Regulatory Commission and to satisfy other administrative permitting and licensing requirements related to the Churchrock Project. The Agreement does not extend to construction-related or earth-disturbing activities. HRI has further agreed to remediate any radioactive contamination now existing on Sections 8 and 17 surface lands created by prior operators prior to commencing mining operations on Section 8. Under the terms and for the duration of this Agreement, HRI has agreed to the jurisdiction of the Navajo Nation with respect to the subject matter of the Agreement. HRI and the Nation are now actively engaged in settlement negotiations in order to determine effective compliance with the remediation requirement included in the Agreement, including applicable clean-up standards, enforcement, and waste disposal, and to address longer-term surface access to the entire licensed Project site consistent with applicable law. If further agreement with the Nation is not reached, our development plan could be materially adversely affected.

Certain of our mineral properties may be subject to defects in title and we are at risk of loss of ownership.

Many of our mining properties are unpatented mining claims to which we have only possessory title. The validity of unpatented mining claims is often uncertain and such validity is always subject to contest. Unpatented mining claims are generally considered subject to greater title risk than patented mining claims or other real property interests that are owned in fee simple. Because unpatented mining claims are self-initiated and self-maintained, they possess some unique vulnerabilities not associated with other types of property interests. It is impossible to ascertain the validity of unpatented mining claims from public real property records, and therefore it can be difficult or impossible to confirm that all of the requisite steps have been followed for location, perfection and maintenance of an unpatented mining claim. The present status of our unpatented mining claims located on public lands allows us the exclusive right to mine and remove locatable minerals, such as uranium. We are also allowed to use the surface of the land solely for purposes related to mining and processing the mineral-bearing ores. However, legal ownership of the public land remains with the federal government. We remain at risk that the mining claims may be lost either to the federal government or to rival private claimants due to failure to comply with statutory requirements. In addition, we may not have, or may not be able to obtain, all necessary surface rights to develop a property.

We may incur significant costs related to defending the title to our properties. A successful claim contesting our title to a property may cause us to compensate other persons or perhaps reduce our interest in the affected property or lose our rights to explore and develop that property. This could result in us not being compensated for our prior expenditures relating to the property.

Exploration and development of uranium properties are risky and subject to great uncertainties.

The exploration for and development of uranium deposits involve significant risks. It is impossible to ensure that the current and future exploration programs on our existing properties will establish reserves. Whether a uranium ore body will be commercially viable depends on a number of factors, including, but not limited to: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; uranium prices, which cannot be predicted and which have been highly volatile in the past; mining, processing and transportation costs; perceived levels of political risk and the willingness of lenders and investors to provide project financing; availability of labor, labor costs and possible labor strikes; availability of drilling rigs, and governmental regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting materials, foreign exchange, environmental protection, employment, worker safety, transportation, and reclamation and closure obligations. Most exploration projects do not result in the discovery of commercially mineable deposits of uranium and there can be no assurance that any of our exploration stage properties will be commercially mineable or can be brought into production.

The developments at the Fukushima Daiichi Nuclear Power Plant in Japan continue to have a negative impact on the uranium markets and public acceptance of nuclear energy is uncertain.

The developments at the Fukushima Daiichi Nuclear Power Plant following the earthquake and tsunami that struck parts of Japan in March 2011 created heightened concerns regarding the safety of nuclear power plants and the ability to safeguard the material used to fuel nuclear power plants. The impact on the perception of the safety of nuclear power resulting from this event may cause increased volatility of uranium prices in the near to mid-term as well as uncertainty involving the continued use and expansion of nuclear power in certain countries. A reduction in the current or the future generation of electricity from nuclear power could result in a reduced requirement for uranium to fuel nuclear power plants which may negatively impact the Company in the future.

Maintaining the demand for uranium at current levels and future growth in demand will depend upon acceptance of nuclear technology as a means of generating electricity. The developments at the Fukushima Daiichi Nuclear Power Plant may affect public acceptance of nuclear technology. Lack of public acceptance of nuclear technology would adversely affect the demand for nuclear power and potentially increase the regulation of the nuclear power industry.

The only significant market for uranium is nuclear power plants world-wide, and there are a limited number of customers.

We are dependent on a limited number of electric utilities that buy uranium for nuclear power plants. Because of the limited market for uranium, a reduction in purchases of newly produced uranium by electric utilities for any reason (such as plant closings) would adversely affect the viability of our business.

The price of alternative energy sources affects the demand for and price of uranium.

The attractiveness of uranium as an alternative fuel to generate electricity may be dependent on the relative prices of oil, gas, coal, and hydro-electricity and the possibility of developing other low-cost sources of energy. If the prices of alternative energy sources decrease or new low-cost alternative energy sources are developed, the demand for uranium could decrease, which may result in a decrease in the price of uranium.

We may not be able to mine a substantial portion of our uranium in New Mexico until a mill is built in New Mexico.

A substantial portion of our uranium in New Mexico lends itself most readily to conventional mining methods and may not be able to be mined unless a mill is built in New Mexico. We have no immediate plans to build, nor are we aware of any third party’s plan to build, a mill in New Mexico and there can be no guarantee that a mill will be built. In the event that a mill is not built, a substantial portion of our uranium may not be able to be mined. Our inability to mine all or a portion of our uranium in New Mexico would have a material adverse effect on future operations.

Our operations are each subject to environmental risks.

We are required to comply with environmental protection laws, regulations and permitting requirements, and we anticipate that we will be required to continue to do so in the future. We have expended significant resources, both financial and managerial, to comply with environmental protection laws, regulations and permitting requirements and we anticipate that we will be required to continue to do so in the future. The material laws and regulations within the U.S. include the

Atomic Energy Act, Uranium Mill Tailings Radiation Control Act of 1978, or UMTRCA, Clean Air Act, Clean Water Act, Safe Drinking Water Act, Federal Land Policy Management Act, National Park System Mining Regulations Act, the State Mined Land Reclamation Acts or State Department of Environmental Quality regulations and the Dodd-Frank Wall Street Reform and Consumer Protection Act, and the rules and regulations of the NNEPA, as applicable.

We are required to comply with the Atomic Energy Act, as amended by UMTRCA, by applying for and maintaining an operating license from the NRC and the state of Texas. Uranium operations must conform to the terms of such licenses, which include provisions for protection of human health and the environment from endangerment due to radioactive materials. The licenses encompass protective measures consistent with the Clean Air Act and the Clean Water Act. Mining operations may be subject to other laws administered by the USEPA and other agencies.

The uranium industry is subject not only to the worker health and safety and environmental risks associated with all mining businesses, but also to additional risks uniquely associated with uranium mining and milling. The possibility of more stringent regulations exists in the areas of worker health and safety, storage of hazardous materials, standards for heavy equipment used in mining or milling, the disposition of wastes, the decommissioning and reclamation of exploration, mining and ISR sites, climate change and other environmental matters, each of which could have a material adverse effect on the cost or the viability of a particular project.

We cannot predict what environmental legislation, regulation or policy will be enacted or adopted in the future or how future laws and regulations will be administered or interpreted. The recent trend in environmental legislation and regulation, generally, is toward stricter standards, and this trend is likely to continue in the future. This recent trend includes, without limitation, laws and regulations relating to air and water quality, mine reclamation, waste handling and disposal, the protection of certain species and the preservation of certain lands. These regulations may require the acquisition of permits or other authorizations for certain activities. These laws and regulations may also limit or prohibit activities on certain lands. Compliance with more stringent laws and regulations, as well as potentially more vigorous enforcement policies or stricter interpretation of existing laws, may necessitate significant capital outlays, may materially affect our results of operations and business or may cause material changes or delays to our intended activities.

Our operations may require additional analysis in the future including environmental, cultural and social impact and other related studies. Certain activities require the submission and approval of environmental impact assessments. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers, and employees. We cannot provide assurance that we will be able to obtain or maintain all necessary permits that may be required to continue our operation or exploration of our properties or, if feasible, to commence development, construction or operation of mining facilities at such properties on terms which enable operations to be conducted at economically justifiable costs. If we are unable to obtain or maintain permits or water rights for development of our properties or otherwise fail to manage adequately future environmental issues, our operations could be materially and adversely affected.

Mine closure and remediation costs for environmental liabilities may exceed the provisions we have made.

Natural resource companies are required to close their operations and rehabilitate the lands that they mine in accordance with a variety of environmental laws and regulations. Estimates of the total ultimate closure and rehabilitation costs for uranium mining operations are significant and based principally on current legal and regulatory requirements and mine closure plans that may change materially. Any underestimated or unanticipated rehabilitation costs could materially affect our financial position, results of operations and cash flows. Environmental liabilities are accrued when they become known, are probable and can be reasonably estimated. Whenever a previously unrecognized remediation liability becomes known, or a previously estimated reclamation cost is increased, the amount of that liability and additional cost will be recorded at that time and could materially reduce our consolidated net income in the related period.

The laws and regulations governing mine closure and remediation in a particular jurisdiction are subject to review at any time and may be amended to impose additional requirements and conditions which may cause our provisions for environmental liabilities to be underestimated and could materially affect our financial position or results of operations.

Because mineral exploration and development activities are inherently risky, we may be exposed to environmental liabilities and other dangers. If we are unable to maintain adequate insurance, or liabilities exceed the limits of our insurance policies, we may be unable to continue operations.

The business of mineral exploration and extraction involves a high degree of risk. Few properties that are explored are ultimately developed into production. Unusual or unexpected formations, formation pressures, fires, power outages, labor disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labor are other risks involved in extraction operations and the conduct of exploration programs. Previous mining operations may have caused environmental damage at certain of our properties. It may be difficult or impossible to assess the extent to which such damage was caused by us or by the activities of previous operators, in which case, any indemnities and exemptions from liability may be ineffective. If any of our properties are found to have commercial quantities of uranium, we would be subject to additional risks respecting any development and production activities.

Although we carry liability insurance with respect to our mineral exploration operations, we may become subject to liability for damage to life and property, environmental damage, cave-ins or hazards against which we cannot insure or against which we may elect not to insure because of cost or other business reasons. In addition, the insurance industry is undergoing change and premiums are being increased. If we are unable to procure adequate insurance because of cost, unavailability or otherwise, we might be forced to cease operations.

Reserve and other mineralized material calculations are estimates only, and are subject to uncertainty due to factors including the price of uranium, inherent variability of the ore and recoverability of uranium in the mining process.

The calculation of reserves, other mineralized material and grading are estimates and depend upon geological interpretation and statistical inferences or assumptions drawn from drilling and sampling analysis, which may prove to be unpredictable. There is a degree of uncertainty attributable to the calculation of reserves, mineralized material and corresponding grades. Until reserves and other mineralized materials are actually mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of reserves and other mineralized materials and ore may vary depending on the price of uranium. Any material change in the quantity of reserves, other mineralized materials, mineralization or grade may affect the economic viability of our properties.

Our inability to obtain financial surety would threaten our ability to continue in business.

Future financial surety requirements to comply with federal and state environmental and remediation requirements and to secure necessary licenses and approvals will increase significantly as future development and production occurs at certain of our sites in Texas and New Mexico. The amount of the financial surety for each producing property is subject to annual review and revision by regulators. We expect that the issuer of the financial surety instruments will require us to provide cash collateral for a significant amount of the face amount of the bond to secure the obligation. In the event we are not able to raise, secure or generate sufficient funds necessary to satisfy these requirements, we will be unable to develop our sites and bring them into production, which inability will have a material adverse impact on our business and may negatively affect our ability to continue to operate.

Competition from better-capitalized companies affects prices and both our ability to acquire properties and personnel.

There is global competition for uranium properties, capital, customers and the employment and retention of qualified personnel. In the production and marketing of uranium, there are a number of producing entities, some of which are government controlled and all of which are significantly larger and better capitalized than we are. Many of these organizations also have substantially greater financial, technical, manufacturing and distribution resources than we have.

Our future uranium production will also compete with uranium recovered from the de-enrichment of highly enriched uranium obtained from the dismantlement of United States and Russian nuclear weapons and imports to the United States of uranium from the former Soviet Union and from the sale of uranium inventory held by the United States Department of Energy. In addition, there are numerous entities in the market that compete with us for properties and are attempting to become licensed to operate ISR and/or underground mining facilities. If we are unable to successfully compete for properties, capital, customers or employees or alternative uranium sources, it could have a materially adverse effect on our results of operations.

Because we have limited capital, inherent mining risks pose a significant threat to us compared with our larger competitors.

Because we have limited capital we may be unable to withstand significant losses that can result from inherent risks associated with mining, including environmental hazards, industrial accidents, flooding, earthquake, interruptions due to weather conditions and other acts of nature which larger competitors could withstand. Such risks could result in damage to or destruction of our infrastructure and production facilities, as well as to adjacent properties, personal injury, environmental damage and processing and production delays, causing monetary losses and possible legal liability.

Our business could be harmed if we lose the services of our key personnel.

Our business and mineral exploration programs depend upon our ability to employ the services of geologists, engineers and other experts. In operating our business and in order to continue our programs, we compete for the services of professionals with other mineral exploration companies and businesses. In addition, several entities have expressed an interest in hiring certain of our employees. Our ability to maintain and expand our business and continue our exploration programs may be impaired if we are unable to continue to employ or engage those parties currently providing services and expertise to us or identify and engage other qualified personnel to do so in their place. To retain key employees, we may face increased compensation costs, including potential new stock incentive grants and there can be no assurance that the incentive measures we implement will be successful in helping us retain our key personnel.

Approximately 38.8% of URI’s common stock is controlled by two significant stockholders and management.