Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Filed pursuant to Rule 424(b)(3)

Registration Statement No. 333-196880

PROSPECTUS SUPPLEMENT

(To Prospectus Dated June 30, 2014)

URANIUM RESOURCES, INC.

2,500,000 Shares of Common Stock

We are offering 2,500,000 shares of our common stock, par value $0.001 per share, at a price of $0.40 per share

Our common stock is currently traded on the NASDAQ Capital Market under the symbol "URRE" and on the ASX under the symbol "URI." On December 16, 2015, the last reported sale price of our common stock on the NASDAQ Capital Market was $0.52 per share.

The aggregate market value of our outstanding common stock held by non-affiliates is approximately $34.6 million, calculated based on 43.3 million shares of outstanding common stock held by non-affiliates on December 10, 2015 and a closing price per share our common stock of $0.80 on October 22, 2015. Following this offering, we will have sold securities with an aggregate market value of approximately $9.1 million pursuant to General Instruction I.B.6 of Form S-3 during the prior 12 calendar month period that ends on and includes the date hereof.

We have engaged Roth Capital Partners, LLC to act as placement agent in the offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of securities. See "Plan of Distribution" beginning on page S-35 of this prospectus supplement for more information regarding these arrangements.

Investing in our securities involves a high degree of risk. You should read "Risk Factors" beginning on page S-7 of this prospectus supplement and the reports we file with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended, incorporated by reference in this prospectus supplement, to read about factors to consider before purchasing our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

||||

| |

Per Share |

Total |

||

|---|---|---|---|---|

Public offering price |

$0.40 | $1,000,000 | ||

Placement agent fees(1) |

$0.028 | $70,000 | ||

Proceeds, before expenses, to us |

$0.372 | $930,000 | ||

|

||||

- (1)

- See "Plan of Distribution" on page S-35 of this prospectus supplement.

| Roth Capital Partners |

||

The date of this prospectus supplement is December 17, 2015.

We are responsible for the information contained and incorporated by reference in this prospectus supplement, the accompanying prospectus and any related free writing prospectus we prepare or authorize. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information that others may give you. We are not, and the placement agent is not, making an offer of our securities in any jurisdiction where the offer is not permitted. The information in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference and any written communication from us specifying the final terms of the offering is only accurate as of the date of the respective documents in which the information appears. Our business, financial condition, results of operations and prospects may have changed since those dates. Information in this prospectus supplement updates and modifies the information in the accompanying prospectus.

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 (File No. 333-196880) that we filed with the Securities and Exchange Commission (the "SEC") and that was declared effective by the SEC on June 30, 2014. Under this shelf registration process, we may, from time to time, offer common stock, debt securities, warrants and units, of which this offering is a part.

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering of common stock and also adds, updates and changes information contained in the accompanying prospectus and the documents incorporated herein by reference. The second part is the accompanying prospectus, which provides more general information about our common stock and other securities that do not pertain to this offering. To the extent that the information contained in this prospectus supplement conflicts with any information in the accompanying prospectus or any document incorporated by reference, the information in this prospectus supplement shall control. The information in this prospectus supplement may not contain all of the information that is important to you. You should read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference carefully before deciding whether to invest in our securities.

References to "URI," "we," "our" and "us" in this prospectus supplement and the accompanying prospectus are to Uranium Resources, Inc. and its consolidated subsidiaries, unless the context otherwise requires. This document includes trade names and trademarks of other companies. All such trade names and trademarks appearing in this document are the property of their respective holders.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents we have incorporated by reference contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements convey our current expectations or forecasts of future events. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are generally identifiable by use of the words "estimate," "project," "believe," "intend," "plan," "anticipate," "expect" and similar expressions. These forward-looking statements include management's expectations regarding our liquidity, burn rate, exploration plans, reserves and mineralized uranium material, capital requirements, timing of receipt of mining permits and access rights, acquisition or partnering opportunities, sales or exchanges, execution of definitive document and the closing of the anticipated transaction with Laramide Resources, production capacity of mining operations for properties in the Republic of Turkey, South Texas and New Mexico and planned dates for commencement of production at such properties. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Actual results could differ materially from those in forward-looking statements because of, among other reasons, the factors described below and in the periodic reports that we file with the SEC from time to time, including Forms 10-K, 10-Q and 8-K and any amendments thereto. The forward-looking statements are not guarantees of future performance. They are based on numerous assumptions that we believe are reasonable, but they are open to a wide range of uncertainties and business risks.

Key factors that could cause actual results to be different than expected or anticipated include, but are not limited to:

- •

- the availability of capital to URI;

- •

- the spot price and long-term contract price of uranium;

- •

- risks associated with our foreign operations;

S-ii

- •

- the ability of URI to enter into and successfully close acquisitions or other material transactions, including without limitation the

transaction with Laramide Resources;

- •

- government regulation of the mining industry and the nuclear power industry in the United States and the Republic of Turkey;

- •

- legislation and other actions by the Navajo Nation;

- •

- operating conditions at our mining projects;

- •

- the world-wide supply and demand of uranium;

- •

- weather conditions;

- •

- unanticipated geological, processing, regulatory and legal or other problems we may encounter;

- •

- currently pending or new litigation;

- •

- timely receipt of mining and other permits from regulatory agencies; and

- •

- the risks set forth herein under the caption "Risk Factors."

In light of these risks, uncertainties and assumptions, you are cautioned not to place undue reliance on forward-looking statements, which are inherently unreliable and speak only as of the date of this prospectus supplement, accompanying prospectus or as of the date of any document incorporated by reference in this prospectus supplement or accompanying prospectus, as applicable. When considering forward-looking statements, you should keep in mind the cautionary statements in this prospectus supplement, accompanying prospectus and the documents incorporated by reference. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in or incorporated by reference in this prospectus supplement and accompanying prospectus might not occur.

Anatolia Energy: Anatolia Energy Limited, an Australian public company, and its subsidiaries.

Dollar or "$": Unless otherwise indicated, or the context otherwise requires, references in this prospectus supplement to "$" or "dollar" are to the lawful currency of the United States.

Mineral: A naturally occurring inorganic element or compound having an orderly internal structure and characteristic chemical composition, crystal form, and physical properties.

Mineralized Material or Deposit: A mineralized body, which has been delineated by appropriate drilling and/or underground sampling to support a sufficient tonnage and average grade of metal(s). Under SEC standards, such a deposit does not qualify as a reserve until a comprehensive evaluation, based upon unit cost, grade, recoveries, and other factors, conclude current economic feasibility to extract it.

Reserves: That part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination.

Resource: The calculated amount of material in a mineral deposit, based on limited drilling information.

The Transaction: URI's acquisition of Anatolia Energy that closed on November 9, 2015, as described in more detail in "Recent Developments—Acquisition of Anatolia Energy Limited" in this prospectus supplement.

U3O8: Triuranium octoxide equivalent contained in uranium concentrates, referred to as uranium concentrate.

S-iii

This summary highlights selected information about Uranium Resources, Inc. This summary does not contain all of the information that may be important to you in making an investment decision. For a more complete understanding of Uranium Resources, Inc. you should read carefully this entire prospectus supplement and the accompanying prospectus, including the "Risk Factors" section and the other documents we refer to and incorporate by reference. Unless otherwise indicated, "common stock" means our common stock, par value $0.001 per share. Unless otherwise noted, all share and per share information has been adjusted to reflect the one-for-ten reverse stock split of our common stock that became effective January 22, 2013.

Uranium Resources, Inc. is a uranium exploration, development and production company. We were organized in 1977 to acquire and develop uranium projects in South Texas using the in-situ recovery ("ISR") process. Following our acquisition of Anatolia Energy Limited, we are focused on advancing to near-term production the Temrezli ISR project in Turkey. URI also controls extensive exploration properties under nine exploration and operating licenses covering approximately 44,700 acres with numerous exploration targets, including the potential satellite Sefaatli project, which is 25 miles southwest of the Temrezli project. We have historically produced uranium by ISR methods in the State of Texas where we currently have ISR projects and two licensed processing facilities. We also have approximately 190,000 acres of mineral holdings in the prolific Grants Mineral Belt of the State of New Mexico and 17,000 acres in the South Texas uranium province, a portion of which we have entered into a binding letter of intent to sell. URI acquired these properties over the past 25 years along with an extensive information database of historic drill-hole logs and analysis. None of URI's properties are currently in production.

Our principal executive offices are located at 6950 South Potomac St., Suite 300, Centennial, CO 80112, and our telephone number is (303) 531-0470. Our website is located at www.uraniumresources.com. Information contained on our website or that can be accessed through our website is not incorporated by reference into this prospectus supplement.

For additional information as to our business, properties and financial condition, please refer to the documents cited in "Where You Can Find More Information."

Liquidity and Expenses

We had approximately $3.8 million in cash at September 30, 2015 and approximately $1.5 million at November 9, 2015. On average, URI expended approximately $1.1 million of cash per month during the first three quarters of 2015, expects to spend approximately $1.2 million per month during the remainder of 2015 (excluding Anatolia transaction costs of $1.5 million), increasing to $2.0 million per month during the first half of 2016 for Temrezli permitting and construction planning activities and increasing to $3.1 million per month during the last half of 2016 as construction of the Temrezli central processing plant begins. If additional capital is not available in sufficient amounts or on a timely basis, URI will experience liquidity problems, and URI would face the need to significantly curtail current operations, change our planned business strategies and pursue other remedial measures.

URI ceased uranium production activities in 2009 due to sustained low uranium prices and does not anticipate receiving significant sales revenue and related cash inflows for 2015 or 2016. URI expects that its existing cash balances, excluding the net proceeds from the offering, would provide it the necessary liquidity to fund its current operations through the end of 2015. URI also continues to look for ways to reduce its monthly cash expenditures at its current operations and to explore opportunities to raise additional funds or further monetize its non-core assets, although there can be no assurance that such efforts will be successful.

S-1

Acquisition of Anatolia Energy Limited

On November 9, 2015, URI completed the acquisition of Anatolia Energy Limited, an Australian public company, pursuant to the scheme implementation agreement between the parties dated June 3, 2015 (the "Transaction"). Upon the closing of the Transaction, each Anatolia Energy share outstanding immediately prior to closing was transferred to URI in exchange for 0.06579 URI shares, or approximately 20.5 million URI shares in the aggregate, and Anatolia Energy became a wholly-owned subsidiary of URI. URI also issued approximately 7.0 million replacement options and replacement performance shares relating to approximately 0.8 million URI shares to holders of Anatolia Energy's options and performance shares, respectively. Immediately after the closing of the Transaction, the former Anatolia Energy shareholders held approximately 40% of the outstanding common stock of the combined company (or approximately 43% on a fully diluted basis), and the shares of common stock held by continuing URI shareholders represented approximately 60% of the outstanding common stock of the combined company.

Laramide Asset Sale

Also on November 9, 2015, URI entered into a letter of intent with Laramide Resources for the sale of URI's Churchrock and Crownpoint properties in New Mexico. Under the terms of the letter of intent, URI and certain of its subsidiaries have agreed, subject to the execution of definitive documentation, to transfer ownership of the Churchrock and Crownpoint properties to Laramide Resources or its subsidiaries. In exchange, URI will receive from Laramide Resources at closing cash in the amount of $5,250,000 and a note receivable in the amount of $7,250,000 payable in three equal installments over the next three years. Laramide Resources will also assume any liabilities related to reclamation and remediation on the subject lands.

Definitive documentation on the terms above is expected to be executed in the fourth quarter of 2015 with closing of the transaction expected to occur during the first half of 2016, subject to customary conditions, including applicable regulatory approvals.

Energy Fuels Asset Exchange

On June 26, 2015, URI and certain of its subsidiaries entered into a purchase and exchange agreement with Energy Fuels Inc. and one of its subsidiaries, pursuant to which URI transferred its ownership interest in the Roca Honda Project to Energy Fuels in exchange for $2.5 million in cash, $375,000 in Energy Fuels' stock, and certain other consideration. The transaction closed on July 31, 2015.

Set forth below is a brief overview of URI's projects. For additional information about the projects, please refer to the documents cited in "Where You Can Find More Information."

Turkey

Following the closing of the Transaction, URI is focused on advancing to near-term production the Temrezli ISR project in Central Turkey. In Turkey, URI controls extensive exploration properties under nine exploration and operating licenses covering approximately 44,700 acres (over 18,000 ha) with numerous exploration targets, including the potential satellite Sefaatli Project, which is 25 miles (40 km) southwest of the Temrezli Project. The project area enjoys year-round accessibility via sealed roads and a number of unsealed local tracks. Sparsely populated, but with access to major

S-2

infrastructure such as water and power, the area is gently undulating. The majority of the project area is owned by local families who work the land for grain production.

Temrezli Project. The Temrezli Project is wholly owned and operated by URI. Uranium was first discovered by Turkey's Uranium Division of the Department of Energy, Raw Material and Exploration ("MTA") in the early 1980s. MTA continued to explore the region for the next 10 years. Following a change to the Turkish Mining Law in 2004 the private sector has been able to explore for radioactive substances. Anatolia Energy, through its subsidiary Adur, commenced exploration at the Temrezli Project in 2010 and confirmed the MTA's findings. The uranium mineralization is considered to be epigenetic and related to strata controlled redox boundaries influenced by permeability changes and/or stratabound reductants such as organic material or iron sulfides.

Anatolia Energy released a preliminary feasibility study in February 2015 indicating a cash operating cost of $16.89 per pound U3O8 and all-in operating costs of approximately $30.17 per pound U3O8. URI has retained Roscoe Postle Associates, Inc. to update the February 2015 preliminary feasibility study, something that URI currently anticipates to have ready in Q1 2016. Included in the update to the preliminary feasibility study will be the consideration of the capital cost savings and other synergies expected to be realized through the Transaction.

Sefaatli Project. The Sefaatli project area contains the district's most significant uranium occurrences outside of our Temrezli project area. The Sefaatli project is located approximately 25 miles (40 km) southwest of the Temrezli Project. The Sefaatli project has been strengthened by the granting of two new exploration licenses, which expire in May 2018.

Texas

In Texas, URI has the Kingsville Dome licensed processing facility and approximately 17,000 acres (6,900 ha) of prospective ISR projects. URI plans on relocating key components of the Rosita processing facility from Texas to Turkey for use at the Temrezli Project. The wellfields at Kingsville Dome and Rosita have reserves of over 600,000 pounds of in-place uranium within 400,000 tons at an average grade of approximately 0.08%. These wellfields and the Kingsville Dome facility are on standby for a restart of production when there is a sustained improvement in the uranium market.

New Mexico

In New Mexico, URI controls minerals rights encompassing approximately 190,000 acres (76,900 ha), a portion of which we have entered into a binding letter of intent to sell. URI holds substantial non-reserve mineralized material of over 40 million tons at an average grade of 0.15% at its properties in the prolific Grants Mineral Belt in New Mexico, which holds one of the largest known concentrations of sandstone-hosted uranium deposits in the world.

S-3

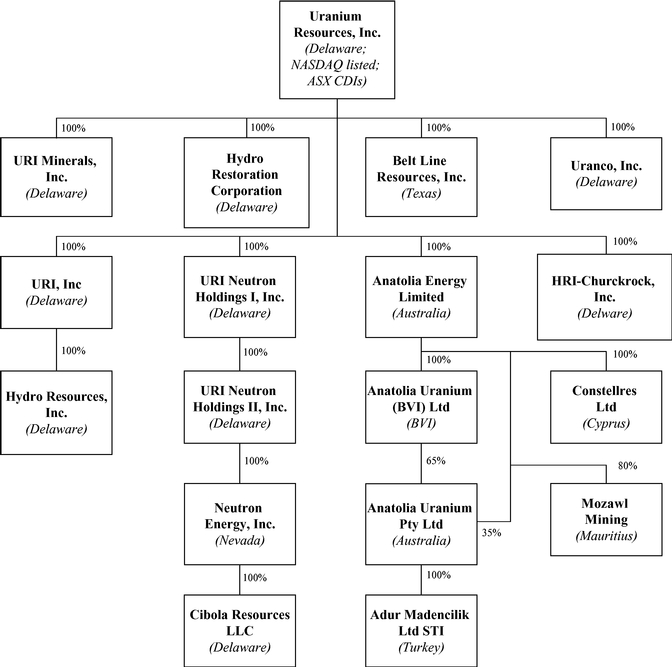

The structure of the URI group as of the date of this prospectus supplement is as follows:

S-4

The following summary is provided solely for your convenience and is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus supplement and the accompanying prospectus. For a more detailed description of our common stock, see "Description of Securities—Common Stock" in the accompanying prospectus.

Issuer |

Uranium Resources, Inc. | |

Shares of common stock offered |

2,500,000 shares |

|

Shares of common stock to be outstanding after this offering |

54,266,608 shares of our common stock(1) |

|

Use of proceeds |

We expect that the net proceeds from this offering will be approximately $0.9 million after deducting the placement agent's fees and our estimated expenses. We intend to use the net proceeds from this offering for general corporate purposes, which may include technical studies, restoration commitments, capital expenditures and working capital. See "Use of Proceeds." |

|

Listing |

Our common stock is listed on the NASDAQ Capital Market under the symbol "URRE", and the ASX under the symbol "URI". |

|

Risk factors |

An investment in our common stock involves risks, and prospective investors should carefully consider the matters discussed under "Risk Factors" beginning on page S-7 of this prospectus supplement and the reports we file with the SEC pursuant to the Securities Exchange Act of 1934, as amended (the "Exchange Act"), incorporated by reference in this prospectus supplement and the accompanying prospectus before making an investment in our common stock. |

- (1)

- The number of shares of common stock to be outstanding after this offering is based on 51,766,608 shares of common stock outstanding as of December 10, 2015 and, 147,831 shares issuable upon the exercise of outstanding options issued under our equity incentive plans, 7,003,314 shares issuable upon the exercise of options issued to former Anatolia Energy option holders in connection with the Transaction, 769,258 shares issuable upon the exercise of performance shares issued to former Anatolia Energy performance shareholders in connection with the Transaction, 392,426 shares issuable upon the vesting of outstanding restricted stock units, 2,200,000 shares underlying warrants issued in connection with our March 2015 registered direct offering, and 3,076,923 shares issuable upon the conversion of amounts outstanding under the RCF loan agreement.

S-5

Summary URI Unaudited Pro Forma Condensed Consolidated Financial Information

The following summary pro forma information is based on the unaudited pro forma condensed consolidated financial information and accompanying notes included in this prospectus supplement, which are derived from the historical consolidated financial statements of URI and Anatolia Energy, as adjusted to reflect the Transaction. The unaudited pro forma condensed consolidated balance sheet as of June 30, 2015 gives effect to the Transaction as if it had occurred on June 30, 2015. The unaudited pro forma condensed consolidated statements of operations for the six months ended June 30, 2015 and for the year ended December 31, 2014 both give effect to the Transaction as if it had occurred on January 1, 2014.

You should read the pro forma data in conjunction with the information in this prospectus supplement under the heading "URI Unaudited Pro Forma Condensed Consolidated Financial Information" and the historical financial statements of URI and Anatolia Energy including the notes thereto, which are incorporated herein by reference. The unaudited pro forma condensed consolidated financial statements are presented for illustrative purposes only and do not necessarily reflect the results of operations or the financial position of URI that actually would have resulted had the Transaction occurred at the dates indicated, or project the results of operations or financial position of URI for any future date or period. All dollar amounts are in thousands.

| |

Pro Forma Consolidated Uranium Resources, Inc. |

|||

|---|---|---|---|---|

Balance Sheet Data at June 30, 2015: |

||||

Cash and cash equivalents |

$ | 8,572 | ||

Total assets |

67,553 | |||

Total liabilities |

17,180 | |||

Total Stockholders' Equity |

50,373 | |||

Statements of Operations Data as for the six months ending June 30, 2015: |

||||

Total operating expenses |

$ | (8,194 | ) | |

Total other expense |

(1,459 | ) | ||

Net loss |

(9,653 | ) | ||

S-6

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below, as well as the other information included or incorporated by reference in this prospectus supplement, before making an investment decision. Our business, financial condition, results of operations and cash flows could be materially adversely affected by any of these risks. The market or trading price of our securities could decline due to any of these risks. In addition, please read "Disclosure Regarding Forward-Looking Statements" in this prospectus supplement, where we describe additional uncertainties associated with our business and the forward-looking statements included or incorporated by reference in this prospectus supplement. Please note that additional risks not presently known to us or that we currently deem immaterial may also impair our business and operations.

Risks Related to Our Business

Our foreign operations subject us to a number of significant regulatory and legal risks that may have a material adverse impact on our prospects, projects, financial condition and results of operations.

Our acquisition of Anatolia Energy significantly increased the importance of foreign operations to our future prospects and growth, and our foreign operations expose us to a number of risks. These risks include such things as:

- •

- enforcement of unfamiliar or uncertain foreign real estate, mineral tenure, contract, water use, mine safety and environmental laws

and policies;

- •

- challenges to mining, processing and related permits and licenses, or to applications for permits and licenses, by or on behalf of

regulatory authorities, indigenous populations, non-governmental organizations or other third parties;

- •

- war, crime, terrorism, sabotage, civil unrest and uncertain political and economic environments;

- •

- renegotiation, nullification or forced modification of existing contracts, licenses, permits, approvals, concessions or the like;

- •

- corruption;

- •

- challenges in overseeing employees and contractors, including the risk that our employees and independent contractors may engage in

unauthorized or illegal activity;

- •

- exchange and currency controls and fluctuations;

- •

- limitations on foreign exchange and repatriation of earnings;

- •

- restrictions on mineral production and price controls;

- •

- seizure of mineral production and expropriation or nationalization of property;

- •

- changes in legislation, including changes related to taxation, new or increased mining royalty interests, import and export

regulations, foreign ownership, foreign trade and foreign investment;

- •

- high rates of inflation; and

- •

- labor practices and disputes.

In addition, we face the numerous risks as a new acquirer that our expectations may not be realized and that we may encounter unexpected problems. After the closing of the Transaction, we have begun to review Anatolia Energy's operations in Turkey, including compliance with local laws and applicable permitting requirements. In the event we confirm material noncompliance, we could face fines or restrictions on our ability to develop our projects in Turkey, which could have a material adverse effect on our prospects, projects, financial condition and results of operations.

S-7

In addition, regulatory, permitting and business arrangements in foreign jurisdictions are subject to extensive laws and regulations intended to prevent improper payments, fraud, kickbacks, self-dealing and other abusive practices. These laws and regulations may restrict or prohibit a wide range of business arrangements that are commonplace in such foreign jurisdictions, and violations of such laws and regulations could result in regulatory sanctions and serious harm to our reputation. We have adopted a code of business conduct and ethics, but it is not always possible to identify and deter misconduct, and the precautions we take to detect and prevent this activity may not be effective in controlling unknown or unmanaged risks or losses or in protecting us from governmental investigations or other actions or lawsuits stemming from a failure to be in compliance with such laws or regulations. If any such actions are instituted against us, and we are not successful in defending ourselves, those actions could have a significant impact on our business, including the imposition of significant civil, criminal and administrative penalties.

If we fail to comply with the continued listing requirements of The NASDAQ Capital Market, our common stock may be delisted and the liquidity and value of our common stock and our ability to raise additional capital could be negatively impacted.

URI's common stock is primarily traded on the NASDAQ Capital Market. On August 12, 2015, we received notice from NASDAQ that we had failed to maintain compliance with the $1.00 per share minimum bid price for 30 consecutive business days. We have a period of 180 calendar days to regain compliance with the minimum bid price requirement. We will regain compliance with the minimum bid requirement if at any time before February 8, 2016, the bid price for our common stock closes at $1.00 per share or above for a minimum of 10 consecutive business days. In the event that we do not regain compliance with the minimum bid price rule by February 8, 2016, we may be eligible for an additional 180 days to cure the situation, but if the situation is not cured then our shares could be delisted from NASDAQ.

A delisting of our stock could negatively impact the liquidity and value of our shares, as well as our ability to raise additional capital for the continuation of our operations. In particular, if we were delisted from the NASDAQ Capital Market and were not able to list our common stock on another national securities exchange, we would no longer be eligible to use Form S-3 registration statements and could no longer sell shares through "at-the-market" offerings, including pursuant to our At-The-Market Sales Agreement with BTIG LLC. Being delisted could also cause a loss of confidence by our investors and employees, and result in fewer business development opportunities. Further, if our stock is delisted, a reliable trading market for our securities could cease to exist, which may result in negative tax consequences.

URI is not producing uranium at this time. As a result, we currently have no sources of operating cash. If we cannot monetize certain existing assets, partner with another company that has cash resources, find other means of generating revenue other than uranium production and/or access additional sources of private or public capital, we may not be able to remain in business.

As a result of low uranium prices, we ceased production of uranium in 2009. While we have approximately 664,000 pounds of reserves at our South Texas properties, we are not planning to commence production at any of our South Texas properties until we are able to acquire additional reserves or mineralized material and uranium prices recover to levels that will ensure that production, once resumed, is sustainable in the 300,000 to 500,000 pound range per year. Our ability to begin plant construction and wellfield development in Turkey and New Mexico is subject to availability of financing and activation of our permits and licenses. In addition, in the event the sale to Laramide Resources is not completed, we expect that we will need to secure significant capital for the development of our Churchrock project in advance of beginning development activities on the project. We do not have a committed source of financing for the development of our Churchrock project. There can be no

S-8

assurance that we will be able to obtain financing for this project, our Temrezli or our other New Mexico projects. Our inability to develop the Temrezli New Mexico properties would have a material adverse effect on our future operations.

Until we begin uranium production, we have no way to generate cash inflows unless we monetize certain of our assets or through financing activities. Our future uranium production, cash flow and income are dependent upon the results of exploration as well as our ability to bring on new, as yet unidentified wellfields and to acquire and develop additional reserves. We can provide no assurance that our properties will be placed into production or that we will be able to continue to find, develop, acquire and finance additional reserves. If we cannot monetize certain existing assets, partner with another company that has cash resources, find other means of generating revenue other than uranium production and/or access additional sources of private or public capital, we may not be able to remain in business and our stockholders may lose their entire investment.

Our ability to function as an operating mining company will be dependent on our ability to mine our properties at a profit sufficient to finance further mining activities and for the acquisition and development of additional properties. The volatility of uranium prices makes long-range planning uncertain and raising capital difficult.

Our ability to operate on a positive cash flow basis will be dependent on mining sufficient quantities of uranium at a profit sufficient to finance our operations and for the acquisition and development of additional mining properties. Any profit will necessarily be dependent upon, and affected by, the long and short term market prices of uranium, which are subject to significant fluctuation. Uranium prices have been and will continue to be affected by numerous factors beyond our control. These factors include the demand for nuclear power, political and economic conditions in uranium producing and consuming countries, uranium supply from secondary sources and uranium production levels and costs of production. A significant, sustained drop in uranium prices may make it impossible to operate URI's business at a level that will permit us to cover our fixed costs or to remain in operation.

If we are unable to raise additional capital, our business may fail and stockholders may lose their entire investment.

We had approximately $3.8 million in cash at September 30, 2015 and approximately $1.5 million at November 9, 2015. On average, URI expended approximately $1.1 million of cash per month during the first three quarters of 2015, expects to spend approximately $1.2 million per month during the remainder of 2015 (excluding Anatolia transaction costs of $1.5 million), increasing to $2.0 million per month during the first half of 2016 for Temrezli permitting and construction planning activities and increasing to $3.1 million per month during the last half of 2016 as construction of the Temrezli central processing plant begins. There can be no assurance that URI will be able to obtain additional capital after it exhausts its current cash. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of such securities would likely result in substantial dilution to existing stockholders. If we borrow money, we will have to pay interest and may also have to agree to restrictions that limit our operating flexibility.

If additional capital is not available in sufficient amounts or on a timely basis, URI will experience liquidity problems, and URI could face the need to significantly curtail current operations, change our planned business strategies and pursue other remedial measures. Any curtailment of business operations would have a material negative effect on operating results, the value of our outstanding stock is likely to fall, and our business may fail, causing our stockholder to lose their entire investment.

S-9

The benefits of integrating URI and Anatolia Energy may not be realized.

To be successful on a going forward basis, we will need to combine and integrate the operations of URI and Anatolia Energy into one company. Integration will require substantial management attention and could detract attention from the day-to-day business of the combined company. We could encounter difficulties in the integration process, such as the need to revisit assumptions about reserves, future production, revenues, capital expenditures and operating costs, including synergies, the loss of key employees or commercial relationships or the need to address unanticipated liabilities. If we cannot integrate URI and Anatolia Energy businesses successfully, it may fail to realize the expected benefits of the Transaction.

The market price of URI's common stock may decline as a result of the Transaction.

The market price of URI's common stock may decline as a result of the Transaction if the integration of Anatolia Energy's business is unsuccessful, the perceived benefits of the Transaction are not achieved as rapidly or to the extent anticipated by financial analysts or investors, or the effect of the Transaction on the combined company's financial results after the completion of the Transaction is not consistent with the expectations of financial analysts or investors.

URI has incurred and will continue to incur significant transaction and combination-related costs in connection with the Transaction.

URI and Anatolia Energy have and will continue to incur significant costs associated with combining the operations of the two companies. URI's fees and expenses related to the Transaction included financial advisor fees, filing fees, legal and accounting fees, regulatory fees and mailing costs. Furthermore, the combined company will continue incur costs associated with combining the operations of the two companies. However, it is difficult to predict the amount of these costs. The combined company may incur additional unanticipated costs as a consequence of difficulties arising from efforts to integrate the companies.

The Transaction resulted in changes to URI's board of directors and management that may affect the strategy and operations of the combined company.

Upon completion of the Transaction, the Board of Directors of URI offered to appoint two new directors to the Board designated by Anatolia Energy. Those individuals are Pat Burke and Paul Cronin. There can be no assurance that either will accept such offers, nor that the newly-constituted Board of Directors will function effectively as a team and that there will not be any adverse effect on our business as a result.

The Transaction is expected to result in an ownership change for URI under Section 382 of the Code, potentially limiting the use of URI's net operating loss carryforwards and certain other tax attributes in future years. In addition, URI's ability to use its net operating loss carryforwards may be further limited if taxable income does not reach sufficient levels.

As of December 31, 2014, URI had approximately $173.5 million of net operating loss ("NOL") carryforwards available to reduce U.S. federal taxable income in future years. Under Section 382 of the Code, if a corporation undergoes an "ownership change," the corporation's ability to use its pre-change NOL carryforwards and other pre-change tax attributes to offset its postchange income and taxes may be limited. In general, an "ownership change" occurs if there is a cumulative change in ownership by "5-percent shareholders" that exceeds 50 percentage points over a rolling three-year period.

The Transaction is expected to result in an ownership change under Section 382 of the Code for URI, potentially limiting the use of URI's NOL carryforwards in future taxable years for U.S. federal income tax purposes. These limitations may affect the timing of when these NOL carryforwards can be

S-10

used which, in turn, may impact the timing of when cash is used to pay the taxes of URI and have a negative impact on URI's financial position and results of operations. In addition, URI's ability to use its NOL carryforwards will be dependent on its ability to generate taxable income. Some portion of the NOL carryforwards could expire before URI generates sufficient taxable income.

Approximately 20.5% of our common stock is beneficially owned by a significant stockholder.

As of December 10, 2015, approximately 15.8% of our common stock is owned by Resource Capital Fund V L.P. ("RCF"). In addition, under the terms of the RCF loan agreement, RCF has the right to acquire an additional 3.1 million shares of our common stock upon conversion of the $8.0 million currently drawn under a loan agreement between RCF and URI, which would increase RCF's ownership to approximately 20.5% of our common stock. In addition, under a stockholders' agreement between RCF and URI, RCF is entitled to have two designees placed in nomination for a seat on the Board so long as any amounts remain outstanding under the loan agreement or RCF's partially-diluted ownership exceeds 25% of our common stock, and RCF has the right to participate in future equity offerings by URI in proportion to its percentage ownership (assuming conversion of amounts drawn under the RCF loan agreement) of the outstanding shares of our common stock.

Because of RCF's ownership of URI common stock, RCF has the ability to exercise a substantial degree of control over matters requiring stockholder approval. Those matters include the election of directors, amendments to the certificate of incorporation and approval of significant corporate transactions. This control could have the effect of delaying or preventing a change of control of URI or changes in management and will make the approval of certain transactions difficult without the support of RCF, including transactions in which other stockholders might otherwise receive a premium for their shares over the then-current market price. In addition, RCF could privately sell its stake in URI without other stockholders realizing any premium. RCF may also have other interests that are different from, in addition to or not always consistent with URI's interests or with the interests of other stockholders.

Restrictions under our secured loan agreement may prevent us from taking actions that we believe would be in the best interest of our business, and defaults under the secured loan agreement may result in RCF talking possession and disposing of any collateral.

Our loan agreement with RCF contains certain restrictions on our activities, including covenants that may restrict us from, among other things:

- •

- incurring additional indebtedness;

- •

- paying dividends on, redeeming or repurchasing our capital stock;

- •

- making investments or acquisitions;

- •

- creating liens;

- •

- selling assets;

- •

- guaranteeing indebtedness; and

- •

- consolidating, merging or transferring all or substantially all of our assets.

These restrictions may prevent us from taking actions that we believe would be in the best interest of our business. If we violate any of these covenants and are unable to obtain waivers, we would be in default under our loan agreement with RCF and payment of the indebtedness could be accelerated. If our indebtedness is accelerated, we may not be able to repay that indebtedness or borrow sufficient funds to refinance it. Our obligations under the loan agreement are secured by pledges of the equity interests of our subsidiaries and a lien on substantially all of our assets, and if we default on our

S-11

obligations under the loan agreement, among other remedies, RCF could take possession and dispose of any collateral under the loan agreement and related documents, which would have a material adverse effect on our business, operations, financial condition, and liquidity. Even if we are able to obtain new financing upon a default under the loan agreement, it may not be on commercially reasonable terms or on terms that are acceptable to us. In addition, complying with these covenants may also cause us to take actions that are not favorable to holders of our common stock and may make it more difficult for us to successfully execute our business strategy and compete against companies that are not subject to such restrictions.

We have previously identified a material weakness in our internal control over financial reporting, and if we cannot maintain an effective system of internal control over financial reporting in the future, we may need to restate our financial statements and we may be delayed or prevented from accessing the capital markets.

We are subject to the requirements of the Sarbanes-Oxley Act of 2002, particularly Section 404, and the applicable SEC rules and regulations that require an annual management report on our internal controls over financial reporting. The management report includes, among other matters, management's assessment of the effectiveness of our internal controls over financial reporting.

We identified a material weakness in our internal control over financial reporting for certain financial periods in 2012 and 2013 and we may not be capable of maintaining an effective system of internal control in the future. Our ability to identify and remediate any material weaknesses in our internal controls could affect our ability to prepare financial reports in a timely manner, control our policies, procedures, operations, and assets, assess and manage our operational, regulatory and financial risks, and integrate any acquired businesses. Any failures to ensure full compliance with internal control and financial reporting requirements in the future could result in a restatement, cause us to fail to timely meet our reporting obligations, delay or prevent us from accessing the capital markets, and harm our reputation and the market price for our common stock.

The Navajo Nation's ban on uranium mining in what it considers to be Navajo Indian Country and its opposition to the transportation of radioactive substances over and across what it views as Navajo Nation lands may have a material adverse effect on our future operations.

In April 2005, the Navajo Nation ("Nation") Council passed the Diné Natural Resources Protection Act of 2005, 18 Navajo Nation Code §1303, which prohibits uranium mining and processing on any sites within "Navajo Indian Country" as defined by 7 Navajo Nation Code § 254(A). The ban may impede or prevent us from developing and operating our properties located in federally defined Indian Country for two reasons. First, the Nation takes a more expansive view of its own jurisdiction over "Navajo Indian Country" than does current federal law. Specifically, 7 N.N.C. § 254(A) provides that the term "Navajo Indian Country" applies to all land within the exterior boundaries of the Navajo Indian Reservation or of the Eastern Navajo Agency, Navajo Indian allotments, dependent Indian communities, and all land held in trust for, owned in fee by, or leased by the United States to the Nation. This may conflict with federal law as codified by Congress and interpreted by the federal courts. The term "Indian Country" is derived from jurisdictional determinations in criminal law enforcement proceedings under the federal Indian Country statute, 18 U.S.C. § 1151, and understood to encompass territory situated within Indian reservations, land owned by Indian Allottees, and land within a dependent Indian community. Second, while the United States Court of Appeals for the Tenth Circuit has specifically held, en banc, that our Section 8 property in Churchrock, New Mexico is not Indian Country, approximately one-third of our in-place mineralized uranium material is located elsewhere in federally defined Indian Country. Consequently, with respect to the Nation, our ability to operate will be adversely affected unless Navajo law is modified or a waiver or other exemption is provided.

S-12

In February 2012, the Navajo Nation Council passed The Radioactive and Related Substances, Equipment, Vehicles, Persons and Materials Transportation Act of 2012 which would prohibit the transport across Nation lands of any equipment, vehicles, persons or materials for the purposes of exploring for or mining, producing, processing or milling any uranium ore, yellowcake, radioactive waste or other radioactive products on or under the surface of or adjacent to Nation lands unless the transporter has first (i) obtained Nation consent and a federal grant of easement, (ii) consented to full subject matter and personal jurisdiction of the Nation, and (iii) agreed to terms and conditions regarding clean-up and remediation. The Act would also require the Navajo Nation Environmental Protection Agency ("NNEPA") to promulgate regulations implementing notice requirements, license fees, bonding requirements, route restrictions and curfews for the transportation of radioactive substances over and across Nation lands or otherwise within Navajo Indian Country. The Act, which may conflict with federal laws and regulations governing the transport of radioactive materials, could have a material adverse effect on our future operations, including our ability to transport equipment and personnel to and from our properties and to transport resin from New Mexico to our processing facilities in Texas or the Republic of Turkey.

In April 2012, the Nation's Division of Natural Resources issued a Notice of Violation and Order to Comply with the Navajo Nation Civil Trespass Act (the "NOV") against our subsidiary Hydro Resources, Inc. ("HRI"). The NOV assessed a $50 civil assessment for alleged trespass on Section 9, Township 16 North, Range 16 West, N.M.P.M. ("Section 9"), which is land held in trust by the United States for the benefit of the Nation ("Trust Lands"). The NOV stated that HRI's Section 8 Churchrock property cannot be reached from New Mexico State Highway 566 without crossing either Section 9 or Section 17, both of which are Trust Lands, and that the Highway 566 right-of-way does not abut or extend into the Section 8 Churchrock property. The NOV demanded that HRI cease entering upon and crossing Section 9 and Section 17 for the purpose of transporting vehicles, equipment and/or personnel to the Section 8 Churchrock property until HRI either (i) provided documentation of a validly existing right-of-way or easement; or (ii) obtained an appropriate right-of-way from the Nation.

In July 2012, HRI and the Nation resolved the NOV by entering into a Temporary Access Agreement (the "Agreement"). Under the terms of the Agreement, HRI and its contractors may now access Section 8 through either Section 9 or 17 to support site visits by the Nuclear Regulatory Commission and to satisfy other administrative permitting and licensing requirements related to the Churchrock Project. The Agreement does not extend to construction-related or earth-disturbing activities. HRI has further agreed to remediate any radioactive contamination now existing on Sections 8 and 17 surface lands created by prior operators prior to commencing mining operations on Section 8. Under the terms and for the duration of this Agreement, HRI has agreed to the jurisdiction of the Navajo Nation with respect to the subject matter of the Agreement. HRI and the Nation have been engaged in additional settlement discussions since 2012 in order to determine effective compliance with the remediation requirement included in the Agreement and to address longer-term surface access to the entire licensed Project site consistent with applicable law. If further agreement with the Nation is not reached, our development plan could be materially adversely affected.

Certain of our mineral properties may be subject to defects in title and we are at risk of loss of ownership.

Many of our mining properties are unpatented mining claims to which we have only possessory title. The validity of unpatented mining claims is often uncertain and such validity is always subject to contest. Unpatented mining claims are generally considered subject to greater title risk than patented mining claims or other real property interests that are owned in fee simple. Because unpatented mining claims are self-initiated and self-maintained, they possess some unique vulnerabilities not associated with other types of property interests. It is impossible to ascertain the validity of unpatented mining claims from public real property records, and, therefore, it can be difficult or impossible to confirm that all of the requisite steps have been followed for location, perfection and maintenance of an unpatented

S-13

mining claim. The present status of our unpatented mining claims located on public lands allows us the exclusive right to remove locatable minerals, such as uranium. We are also allowed to use the surface of the land solely for purposes related to mining and processing the mineral-bearing ores. However, legal ownership of the public land remains with the federal government. We remain at risk that the mining claims may be lost either to the federal government or to rival private claimants due to failure to comply with statutory requirements. In addition, we may not have, or may not be able to obtain, all necessary surface rights to develop a property.

We may incur significant costs related to defending the title to our properties. A successful claim contesting our title to a property may cause us to compensate other persons or perhaps reduce our interest in the affected property or lose our rights to explore and develop that property. This could result in us not being compensated for our prior expenditures relating to the property.

Exploration and development of uranium properties are risky and subject to great uncertainties.

The exploration for and development of uranium deposits involve significant risks. It is impossible to ensure that the current and future exploration programs on our existing properties will establish reserves. Whether a uranium ore body will be commercially viable depends on a number of factors, including, but not limited to: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; uranium prices, which cannot be predicted and which have been highly volatile in the past; mining, processing and transportation costs; perceived levels of political risk and the willingness of lenders and investors to provide project financing; availability of labor, labor costs and possible labor strikes; availability of drilling rigs; and governmental regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting materials, foreign exchange, environmental protection, employment, worker safety, transportation, and reclamation and closure obligations. Most exploration projects do not result in the discovery of commercially mineable deposits of uranium and there can be no assurance that any of our exploration stage properties will be commercially mineable or can be brought into production.

We may enter into acquisitions or other material transactions at any time, including promptly after this offering.

We are regularly engaged in a review of opportunities to acquire properties, to partner with other companies on projects or to acquire or merge with companies. We currently, and generally at any time, have such opportunities in various stages of active review, including, for example, our engagement of consultants and advisors to analyze particular opportunities, technical, financial and other confidential information, submission of indications of interest and participation in discussions or negotiations for acquisitions. Any such acquisition could be material to us. We could issue common stock or incur additional indebtedness to fund our acquisitions. Issuances of common stock may dilute existing stockholders. In addition, any such acquisition or other transaction may have other transaction specific risks associated with it, including risks related to the completion of the transaction, the project or the jurisdictions in which the project is located. We could enter into one or more acquisitions or other transactions at any time, including promptly after this offering.

The developments at the Fukushima Daiichi Nuclear Power Plant in Japan continue to have a negative impact on the uranium markets and public acceptance of nuclear energy is uncertain.

The developments at the Fukushima Daiichi Nuclear Power Plant following the earthquake and tsunami that struck parts of Japan in March 2011 created heightened concerns regarding the safety of nuclear power plants and the ability to safeguard the material used to fuel nuclear power plants. The impact on the perception of the safety of nuclear power resulting from this event may cause increased volatility of uranium prices in the near to mid-term as well as uncertainty involving the continued use and expansion of nuclear power in certain countries. A reduction in the current or the future

S-14

generation of electricity from nuclear power could result in a reduced requirement for uranium to fuel nuclear power plants which may negatively impact URI in the future.

Maintaining the demand for uranium at current levels and future growth in demand will depend upon acceptance of nuclear technology as a means of generating electricity. The developments at the Fukushima Daiichi Nuclear Power Plant may affect public acceptance of nuclear technology. Lack of public acceptance of nuclear technology would adversely affect the demand for nuclear power and potentially increase the regulation of the nuclear power industry.

The only significant market for uranium is nuclear power plants world-wide, and there are a limited number of customers.

We are dependent on a limited number of electric utilities that buy uranium for nuclear power plants. Because of the limited market for uranium, a reduction in purchases of newly produced uranium by electric utilities for any reason (such as plant closings) would adversely affect the viability of our business.

The price of alternative energy sources affects the demand for and price of uranium.

The attractiveness of uranium as an alternative fuel to generate electricity may be dependent on the relative prices of oil, gas, coal and hydro-electricity and the possibility of developing other low-cost sources of energy. If the prices of alternative energy sources decrease or new low-cost alternative energy sources are developed, the demand for uranium could decrease, which may result in a decrease in the price of uranium.

We may not be able to mine a substantial portion of our uranium in New Mexico until a mill is built in New Mexico.

A substantial portion of our uranium in New Mexico lends itself most readily to conventional mining methods and may not be able to be mined unless a mill is built in New Mexico. We have no immediate plans to build, nor are we aware of any third party's plan to build, a mill in New Mexico and there can be no guarantee that a mill will be built. In the event that a mill is not built, a substantial portion of our uranium may not be able to be mined. Our inability to mine all or a portion of our uranium in New Mexico would have a material adverse effect on future operations.

Our operations are each subject to environmental risks.

We are required to comply with environmental protection laws, regulations and permitting requirements in the United States and the Republic of Turkey, and we anticipate that we will be required to continue to do so in the future. We have expended significant resources, both financial and managerial, to comply with environmental protection laws, regulations and permitting requirements, and we anticipate that we will be required to continue to do so in the future. The material laws and regulations within the U.S. include the Atomic Energy Act, Uranium Mill Tailings Radiation Control Act of 1978, or UMTRCA, Clean Air Act, Clean Water Act, Safe Drinking Water Act, Federal Land Policy Management Act, National Park System Mining Regulations Act, the State Mined Land Reclamation Acts or State Department of Environmental Quality regulations and the Dodd-Frank Wall Street Reform and Consumer Protection Act, and the rules and regulations of the NNEPA, as applicable.

We are required to comply with the Atomic Energy Act, as amended by UMTRCA, by applying for and maintaining an operating license from the NRC and the state of Texas. Uranium operations must conform to the terms of such licenses, which include provisions for protection of human health and the environment from endangerment due to radioactive materials. The licenses encompass

S-15

protective measures consistent with the Clean Air Act and the Clean Water Act. Mining operations may be subject to other laws administered by the USEPA and other agencies.

The uranium industry is subject not only to the worker health and safety and environmental risks associated with all mining businesses, but also to additional risks uniquely associated with uranium ISR, mining and milling. The possibility of more stringent regulations exists in the areas of worker health and safety, storage of hazardous materials, standards for heavy equipment used in ISR, mining or milling, the disposition of wastes, the decommissioning and reclamation of exploration, mining and ISR sites, climate change and other environmental matters, each of which could have a material adverse effect on the cost or the viability of a particular project.

We cannot predict what environmental legislation, regulation or policy will be enacted or adopted in the future or how future laws and regulations will be administered or interpreted. The recent trend in environmental legislation and regulation, generally, is toward stricter standards, and this trend is likely to continue in the future. This recent trend includes, without limitation, laws and regulations relating to air and water quality, reclamation, waste handling and disposal, the protection of certain species and the preservation of certain lands. These regulations may require the acquisition of permits or other authorizations for certain activities. These laws and regulations may also limit or prohibit activities on certain lands. Compliance with more stringent laws and regulations, as well as potentially more vigorous enforcement policies or stricter interpretation of existing laws, may necessitate significant capital outlays, may materially affect our results of operations and business or may cause material changes or delays our intended activities.

Our operations may require additional analysis in the future including environmental, cultural and social impact and other related studies. Certain activities require the submission and approval of environmental impact assessments. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. We cannot provide assurance that we will be able to obtain or maintain all necessary permits that may be required to continue our operation or exploration of our properties or, if feasible, to commence development, construction or operation of mining facilities at such properties on terms which enable operations to be conducted at economically justifiable costs. If we are unable to obtain or maintain permits or water rights for development of our properties or otherwise fail to manage adequately future environmental issues, our operations could be materially and adversely affected.

Closure and remediation costs for environmental liabilities may exceed the provisions we have made.

Natural resource companies are required to close their operations and rehabilitate the lands in accordance with a variety of environmental laws and regulations. Estimates of the total ultimate closure and rehabilitation costs for uranium operations are significant and based principally on current legal and regulatory requirements and closure plans that may change materially. Any underestimated or unanticipated rehabilitation costs could materially affect our financial position, results of operations and cash flows. Environmental liabilities are accrued when they become known, are probable and can be reasonably estimated. Whenever a previously unrecognized remediation liability becomes known, or a previously estimated reclamation cost is increased, the amount of that liability and additional cost will be recorded at that time and could materially reduce our consolidated net income in the related period.

The laws and regulations governing closure and remediation in a particular jurisdiction are subject to review at any time and may be amended to impose additional requirements and conditions which may cause our provisions for environmental liabilities to be underestimated and could materially affect our financial position or results of operations.

S-16

Because mineral exploration and development activities are inherently risky, we may be exposed to environmental liabilities and other dangers. If we are unable to maintain adequate insurance, or liabilities exceed the limits of our insurance policies, we may be unable to continue operations.

The business of mineral exploration and extraction involves a high degree of risk. Few properties that are explored are ultimately developed into production. Unusual or unexpected formations, formation pressures, fires, power outages, labor disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labor are other risks involved in extraction operations and the conduct of exploration programs. Previous mining operations may have caused environmental damage at certain of our properties. It may be difficult or impossible to assess the extent to which such damage was caused by us or by the activities of previous operators, in which case, any indemnities and exemptions from liability may be ineffective. If any of our properties are found to have commercial quantities of uranium, we would be subject to additional risks respecting any development and production activities.

Although we carry liability insurance with respect to our mineral exploration operations, we may become subject to liability for damage to life and property, environmental damage, cave-ins or hazards against which we cannot insure or against which we may elect not to insure because of cost or other business reasons. In addition, the insurance industry is undergoing change and premiums are being increased. If we are unable to procure adequate insurance because of cost, unavailability or otherwise, we might be forced to cease operations.

Reserve and other mineralized material calculations are estimates only, and are subject to uncertainty due to factors including the price of uranium, inherent variability of the ore and recoverability of uranium in the recovery process.

The calculation of reserves, other mineralized material tons and grades are estimates and depend upon geological interpretation and geostatistical relationships or assumptions drawn from drilling and sampling analysis, which may prove to be unpredictable. There is a degree of uncertainty attributable to the calculation of reserves and mineralized material and their corresponding grades. Until reserves and other mineralized materials are actually mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of reserves and other mineralized materials may vary depending on the price of uranium. Any material change in the quantity of reserves, other mineralized materials, mineralization or grade may affect the economic viability of our properties.

Our inability to obtain financial surety would threaten our ability to continue in business.

Future financial surety requirements to comply with federal and state environmental and remediation requirements and to secure necessary licenses and approvals will increase significantly as future development and production occurs at certain of our sites in Texas and New Mexico. The amount of the financial surety for each producing property is subject to annual review and revision by regulators. We expect that the issuer of the financial surety instruments will require us to provide cash collateral for a significant amount of the face amount of the bond to secure the obligation. In the event we are not able to raise, secure or generate sufficient funds necessary to satisfy these requirements, we will be unable to develop our sites and bring them into production, which inability will have a material adverse impact on our business and may negatively affect our ability to continue to operate.

Competition from better-capitalized companies affects prices and our ability to acquire both properties and personnel.

There is global competition for uranium properties, capital, customers and the employment and retention of qualified personnel. In the production and marketing of uranium, there are a number of producing entities, some of which are government controlled and all of which are significantly larger

S-17

and better capitalized than we are. Many of these organizations also have substantially greater financial, technical, manufacturing and distribution resources than we have.

Our future uranium production will also compete with uranium recovered from the de-enrichment of highly enriched uranium obtained from the dismantlement of United States and Russian nuclear weapons and imports to the United States of uranium from the former Soviet Union and from the sale of uranium inventory held by the United States Department of Energy. In addition, there are numerous entities in the market that compete with us for properties and are attempting to become licensed to operate ISR and/or underground mining facilities. If we are unable to successfully compete for properties, capital, customers or employees or with alternative uranium sources, it could have a materially adverse effect on our results of operations.

Because we have limited capital, inherent mining risks pose a significant threat to us compared with our larger competitors.

Because we have limited capital we may be unable to withstand significant losses that can result from inherent risks associated with mining, including environmental hazards, industrial accidents, flooding, earthquake, interruptions due to weather conditions and other acts of nature which larger competitors could withstand. Such risks could result in damage to or destruction of our infrastructure and production facilities, as well as to adjacent properties, personal injury, environmental damage and processing and production delays, causing monetary losses and possible legal liability. Our business could be harmed if we lose the services of our key personnel.

Our business and mineral exploration programs depend upon our ability to employ the services of geologists, engineers and other experts. In operating our business and in order to continue our programs, we compete for the services of professionals with other mineral exploration companies and businesses. In addition, several entities have expressed an interest in hiring certain of our employees. Our ability to maintain and expand our business and continue our exploration programs may be impaired if we are unable to continue to employ or engage those parties currently providing services and expertise to us or identify and engage other qualified personnel to do so in their place. To retain key employees, we may face increased compensation costs, including potential new stock incentive grants and there can be no assurance that the incentive measures we implement will be successful in helping us retain our key personnel.

Risks Related to the Offering and our Common Stock

The availability for sale of a large amount of shares may depress the market price of URI's common stock.

As of December 10, 2015, approximately 51.8 million shares of our common stock were outstanding, all of which, except for the shares owned by RCF and Insight Transportation Services LLC, are freely transferable. As of December 10, 2015, there were 147,831 shares issuable upon the exercise of outstanding options issued under our equity incentive plans, 7,003,314 shares issuable upon the exercise of options issued to former Anatolia Energy option holders in connection with the Transaction, 769,258 shares issuable upon the exercise of performance shares issued to former Anatolia Energy performance shareholders in connection with the Transaction, 392,426 shares issuable upon the vesting of outstanding restricted stock units, 2,200,000 shares underlying warrants issued in connection with our March 2015 registered direct offering, and 3,076,923 shares issuable upon the conversion of amounts outstanding under the RCF loan agreement.

The availability for sale of a large amount of shares by any one or several stockholders may depress the market price of our common stock and impair our ability to raise additional capital through the public sale of our common stock. We have has no arrangement with any of the holders of the foregoing shares to address the possible effect on the price of our common stock of the sale by them of their shares.

S-18

Terms of subsequent financings may adversely impact our stockholders.

In order to finance our future production plans and working capital needs, we may have to raise funds through the issuance of equity or debt securities. Depending on the type and the terms of any financing we pursue, stockholders' rights and the value of their investment in our common stock could be reduced. A financing could involve one or more types of securities including common stock, convertible debt or warrants to acquire common stock. These securities could be issued at or below the then prevailing market price for our common stock. We currently have no authorized preferred stock. In addition, if we issue secured debt securities, the holders of the debt would have a claim to our assets that would be prior to the rights of stockholders until the debt is paid. Interest on these debt securities would increase costs and negatively impact operating results. If the issuance of new securities results in diminished rights to holders of our common stock, the market price of our common stock could be negatively impacted.

Shareholders could be diluted if we were to use common stock to raise capital.

We may need to seek additional capital to carry our business plan. This financing could involve one or more types of securities including common stock, convertible debt or warrants to acquire common stock. These securities could be issued at or below the then prevailing market price for our common stock. Any issuance of additional shares of our common stock could be dilutive to existing stockholders and could adversely affect the market price of our common stock.

Our management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds and the proceeds may not be invested successfully.

We have not designated any portion of the net proceeds from this offering to be used for any particular purpose. Accordingly, our management will have broad discretion as to the use of the net proceeds from any offering by us and could use them for purposes other than those contemplated at the time of this offering. You will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that the proceeds will be invested in a way that does not yield a favorable, or any, return for our company.

S-19

We expect that the net proceeds from this offering will be approximately $0.9 million after deducting the placement agent's fees and our estimated expenses. There can be no assurance we will sell any or all of the securities offered hereby. Because there is no minimum offering amount required as a condition to closing this offering, we may sell less than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us.

We intend to use the net proceeds from this offering for general corporate purposes, which may include technical studies, restoration commitments, capital expenditures and working capital.