|

Investment Company Act file number

|

811-05646

|

|

New Century Portfolios

|

|

(Exact name of registrant as specified in charter)

|

|

100 William Street, Suite 200 Wellesley, Massachusetts

|

02481

|

|

(Address of principal executive offices)

|

(Zip code)

|

|

Weston Financial Group, Inc. 100 William Street, Suite 200 Wellesley, MA 02481

|

|

(Name and address of agent for service)

|

|

Registrant's telephone number, including area code:

|

(781) 235-7055

|

|

Date of fiscal year end:

|

October 31, 2017

|

|

|

Date of reporting period:

|

April 30, 2017

|

New Century Capital

New Century Balanced

New Century International

New Century Alternative Strategies

SEMI-ANNUAL REPORT

Six Months Ended April 30, 2017

(Unaudited)

|

|||

|

100 William Street, Suite 200, Wellesley MA 02481

|

781-239-0445

|

888-639-0102

|

Fax 781-237-1635

|

|

LETTER TO SHAREHOLDERS

|

2-5

|

|

NEW CENTURY PORTFOLIOS

|

|

|

New Century Capital Portfolio

|

|

|

Portfolio Information

|

6

|

|

Schedule of Investments

|

7-8

|

|

New Century Balanced Portfolio

|

|

|

Portfolio Information

|

9

|

|

Schedule of Investments

|

10-11

|

|

New Century International Portfolio

|

|

|

Portfolio Information

|

12

|

|

Schedule of Investments

|

13-14

|

|

New Century Alternative Strategies Portfolio

|

|

|

Portfolio Information

|

15

|

|

Schedule of Investments

|

16-17

|

|

Statements of Assets and Liabilities

|

18

|

|

Statements of Operations

|

19

|

|

Statements of Changes in Net Assets

|

20-23

|

|

Financial Highlights

|

24-27

|

|

Notes to Financial Statements

|

28-37

|

|

About Your Portfolios’ Expenses

|

38-39

|

|

LETTER TO SHAREHOLDERS

|

April 2017

|

|

|

|

|

Nicole M. Tremblay, Esq.

President, CEO |

Matthew I. Solomon

Portfolio Manager |

Ronald A. Sugameli

Portfolio Manager |

|

1

|

Factset

|

|

2

|

Factset Geographical Revenue breakdown based on SPDR S&P 500 Index ETF (SPY)

|

|

3

|

Morningstar

|

|

4

|

NCCPX returned 5.54% compared to 3.19% for the Morningstar US Large Growth category for full year 2016 ranking in the 33rd percentile. All numbers obtained from Morningstar Direct.

|

PORTFOLIO INFORMATION

April 30, 2017 (Unaudited)

|

Asset Allocation (% of Net Assets)

|

|

|

Top Ten Long-Term Holdings

|

|

Security Description

|

% of Net Assets

|

|

Putnam Equity Income Fund - Class Y

|

6.8%

|

|

Vanguard Dividend Growth Fund - Investor Shares

|

6.5%

|

|

Loomis Sayles Growth Fund - Class Y

|

5.9%

|

|

Vanguard 500 Index Fund - Admiral Shares

|

5.7%

|

|

Glenmede Large Cap Growth Portfolio - Institutional Shares

|

5.3%

|

|

JPMorgan Value Advantage Fund - Institutional Class

|

5.1%

|

|

Glenmede Large Cap Core Portfolio - Institutional Shares

|

5.0%

|

|

T. Rowe Price Global Technology Fund

|

4.0%

|

|

Technology Select Sector SPDR Fund

|

3.9%

|

|

MFS Growth Fund - Class I

|

3.7%

|

|

NEW CENTURY CAPITAL PORTFOLIO

SCHEDULE OF INVESTMENTS April 30, 2017 (Unaudited) |

||||||||

|

INVESTMENT COMPANIES — 99.5%

|

Shares

|

Value

|

||||||

|

Large-Cap Funds — 55.5%

|

||||||||

|

American Funds AMCAP Fund - Class A

|

47,711

|

$

|

1,395,558

|

|||||

|

DFA U.S. Large Cap Value Portfolio - Institutional Class

|

56,293

|

2,049,637

|

||||||

|

Glenmede Large Cap Core Portfolio - Institutional Shares

|

168,912

|

4,305,574

|

||||||

|

Glenmede Large Cap Growth Portfolio - Institutional Shares

|

161,607

|

4,568,628

|

||||||

|

iShares S&P 500 Growth ETF (a)

|

15,700

|

2,105,527

|

||||||

|

iShares S&P 500 Value ETF (a)

|

10,605

|

1,102,284

|

||||||

|

JPMorgan Value Advantage Fund - Institutional Class

|

132,591

|

4,400,710

|

||||||

|

Loomis Sayles Growth Fund - Class Y

|

379,788

|

5,070,174

|

||||||

|

MFS Growth Fund - Class I

|

37,277

|

3,149,516

|

||||||

|

Putnam Equity Income Fund - Class Y

|

263,091

|

5,811,683

|

||||||

|

Sterling Capital Special Opportunities Fund - Institutional Shares

|

121,936

|

3,009,371

|

||||||

|

Vanguard 500 Index Fund - Admiral Shares

|

22,262

|

4,904,062

|

||||||

|

Vanguard Dividend Growth Fund - Investor Shares

|

223,632

|

5,584,097

|

||||||

|

47,456,821

|

||||||||

|

Sector Funds — 22.1%

|

||||||||

|

Fidelity Select Health Care Portfolio

|

4,213

|

900,676

|

||||||

|

Financial Select Sector SPDR Fund (a)

|

100,000

|

2,353,000

|

||||||

|

First Trust Dow Jones Internet Index Fund (a) (b)

|

26,000

|

2,398,240

|

||||||

|

iShares Nasdaq Biotechnology ETF (a)

|

6,000

|

1,785,840

|

||||||

|

Legg Mason Low Volatility High Dividend ETF (a)

|

60,000

|

1,793,400

|

||||||

|

SPDR S&P Aerospace & Defense ETF (a)

|

23,000

|

1,580,100

|

||||||

|

T. Rowe Price Global Technology Fund

|

209,776

|

3,404,664

|

||||||

|

Technology Select Sector SPDR Fund (a)

|

62,000

|

3,371,560

|

||||||

|

VanEck Vectors Gold Miners ETF (a)

|

60,000

|

1,333,800

|

||||||

|

18,921,280

|

||||||||

|

International Funds — 11.4%

|

||||||||

|

DFA Continental Small Company Portfolio - Institutional Class

|

92,342

|

2,333,478

|

||||||

|

DFA International Core Equity Portfolio - Institutional Class

|

240,353

|

3,088,533

|

||||||

|

Hartford International Value Fund (The) - Class Y

|

99,079

|

1,630,838

|

||||||

|

JOHCM International Select Fund - Class I

|

58,685

|

1,186,606

|

||||||

|

Matthews Emerging Asia Fund - Institutional Class

|

102,092

|

1,452,775

|

||||||

|

9,692,230

|

||||||||

|

Mid-Cap Funds — 10.5%

|

||||||||

|

Congress Mid Cap Growth Fund - Institutional Class

|

165,026

|

2,843,390

|

||||||

|

iShares S&P Mid-Cap 400 Growth ETF (a)

|

10,100

|

1,957,784

|

||||||

|

John Hancock Disciplined Value Mid Cap Fund - Class I

|

102,371

|

2,280,820

|

||||||

|

SPDR S&P MidCap 400 ETF Trust (a)

|

6,102

|

1,921,215

|

||||||

|

9,003,209

|

||||||||

|

Total Investment Companies (Cost $65,098,458)

|

$

|

85,073,540

|

||||||

|

NEW CENTURY CAPITAL PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

MONEY MARKET FUNDS — 0.6%

|

Shares

|

Value

|

||||||

|

Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Class, 0.63% (c) (Cost $494,481)

|

494,481

|

$

|

494,481

|

|||||

|

Total Investments at Value — 100.1% (Cost $65,592,939)

|

$

|

85,568,021

|

||||||

|

Liabilities in Excess of Other Assets — (0.1%)

|

(96,721

|

)

|

||||||

|

Net Assets — 100.0%

|

$

|

85,471,300

|

||||||

|

(a)

|

Exchange-traded fund.

|

|

(b)

|

Non-income producing security.

|

|

(c)

|

The rate shown is the 7-day effective yield as of April 30, 2017.

|

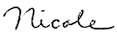

PORTFOLIO INFORMATION

April 30, 2017 (Unaudited)

|

Asset Allocation (% of Net Assets)

|

|

|

Top Ten Long-Term Holdings

|

|

Security Description

|

% of Net Assets

|

|

JPMorgan Value Advantage Fund - Institutional Class

|

7.6%

|

|

PIMCO Income Fund - Institutional Class

|

5.7%

|

|

First Eagle Global Fund - Class A

|

5.1%

|

|

iShares Core S&P 500 ETF

|

5.0%

|

|

Western Asset Core Plus Bond Fund - Class I

|

4.7%

|

|

Harding, Loevner International Equity Portfolio - Institutional Class

|

4.4%

|

|

SPDR S&P MidCap 400 ETF Trust

|

4.2%

|

|

Loomis Sayles Growth Fund - Class Y

|

4.2%

|

|

American Funds AMCAP Fund - Class A

|

4.1%

|

|

JPMorgan Hedged Equity Fund - Select Class

|

4.1%

|

|

NEW CENTURY BALANCED PORTFOLIO

SCHEDULE OF INVESTMENTS April 30, 2017 (Unaudited) |

||||||||

|

INVESTMENT COMPANIES — 95.1%

|

Shares

|

Value

|

||||||

|

Large-Cap Funds — 31.9%

|

||||||||

|

American Funds AMCAP Fund - Class A

|

70,861

|

$

|

2,072,698

|

|||||

|

DFA U.S. Large Cap Growth Portfolio - Institutional Class

|

96,330

|

1,615,447

|

||||||

|

iShares Core S&P 500 ETF (a)

|

10,600

|

2,539,336

|

||||||

|

JPMorgan Hedged Equity Fund - Select Class

|

114,221

|

2,066,267

|

||||||

|

JPMorgan Value Advantage Fund - Institutional Class

|

115,912

|

3,847,128

|

||||||

|

Loomis Sayles Growth Fund - Class Y

|

158,293

|

2,113,210

|

||||||

|

MFS Value Fund - Class I

|

51,962

|

1,972,982

|

||||||

|

16,227,068

|

||||||||

|

Fixed Income/Multi-Sector Bond Funds — 21.9%

|

||||||||

|

BlackRock Strategic Income Opportunities Portfolio - Institutional Shares

|

137,886

|

1,363,696

|

||||||

|

Dodge & Cox Income Fund

|

150,268

|

2,063,175

|

||||||

|

Goldman Sachs Emerging Markets Debt Fund - Institutional Shares

|

68,557

|

883,706

|

||||||

|

Loomis Sayles Bond Fund - Institutional Class

|

109,056

|

1,524,603

|

||||||

|

PIMCO Income Fund - Institutional Class

|

238,315

|

2,924,129

|

||||||

|

Western Asset Core Plus Bond Fund - Class I

|

205,937

|

2,397,109

|

||||||

|

11,156,418

|

||||||||

|

International Funds — 16.0%

|

||||||||

|

DFA Emerging Markets Core Equity Portfolio - Institutional Class

|

52,314

|

1,050,458

|

||||||

|

Dodge & Cox International Stock Fund

|

17,791

|

759,665

|

||||||

|

First Eagle Global Fund - Class A

|

45,194

|

2,590,054

|

||||||

|

Harding, Loevner International Equity Portfolio - Institutional Class

|

111,515

|

2,253,720

|

||||||

|

John Hancock International Growth Fund - Class I

|

62,862

|

1,482,910

|

||||||

|

8,136,807

|

||||||||

|

Sector Funds — 7.8%

|

||||||||

|

Legg Mason Low Volatility High Dividend ETF (a)

|

20,000

|

597,800

|

||||||

|

SPDR S&P Regional Banking ETF (a)

|

13,000

|

702,650

|

||||||

|

Vanguard Global Minimum Volatility Fund - Admiral Shares

|

65,480

|

1,672,350

|

||||||

|

Vanguard Market Neutral Fund - Investor Shares

|

81,451

|

983,928

|

||||||

|

3,956,728

|

||||||||

|

Mid-Cap Funds — 7.7%

|

||||||||

|

John Hancock Disciplined Value Mid Cap Fund - Class I

|

79,122

|

1,762,829

|

||||||

|

SPDR S&P MidCap 400 ETF Trust (a)

|

6,780

|

2,134,683

|

||||||

|

3,897,512

|

||||||||

|

High Yield Bond Funds — 6.0%

|

||||||||

|

Loomis Sayles Institutional High Income Fund

|

72,561

|

497,765

|

||||||

|

Loomis Sayles Senior Floating Rate and Fixed Income Fund - Class Y

|

181,638

|

1,809,117

|

||||||

|

VanEck Vectors Fallen Angel High Yield Bond ETF (a)

|

25,000

|

742,250

|

||||||

|

3,049,132

|

||||||||

|

NEW CENTURY BALANCED PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

INVESTMENT COMPANIES — 95.1% (Continued)

|

Shares

|

Value

|

||||||

|

Convertible Bond Funds — 2.6%

|

||||||||

|

AllianzGI Convertible & Income Fund II (b)

|

97,816

|

$

|

598,634

|

|||||

|

SPDR Bloomberg Barclays Convertible Securities ETF (a)

|

15,000

|

731,400

|

||||||

|

1,330,034

|

||||||||

|

Small-Cap Funds — 1.2%

|

||||||||

|

Brown Capital Management Small Company Fund - Institutional Class (c)

|

7,567

|

623,063

|

||||||

|

Total Investment Companies (Cost $39,653,150)

|

$

|

48,376,762

|

||||||

|

|

||||||||

|

STRUCTURED NOTES — 2.5%

|

Par Value

|

Value

|

||||||

|

JPMorgan Chase & Co., Certificates of Deposit Linked to the JPMorgan Efficiente Plus DS 5 Index, due 06/23/2020 (c) (Cost $1,250,000)

|

$

|

1,250,000

|

$

|

1,239,750

|

||||

|

|

||||||||

|

MONEY MARKET FUNDS — 3.6%

|

Shares

|

Value

|

||||||

|

Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Class, 0.63% (d) (Cost $1,840,871)

|

1,840,871

|

$

|

1,840,871

|

|||||

|

Total Investments at Value — 101.2% (Cost $42,744,021)

|

$

|

51,457,383

|

||||||

|

Liabilities in Excess of Other Assets — (1.2%)

|

(590,978

|

)

|

||||||

|

Net Assets — 100.0%

|

$

|

50,866,405

|

||||||

|

(a)

|

Exchange-traded fund.

|

|

(b)

|

Closed-end fund.

|

|

(c)

|

Non-income producing security.

|

|

(d)

|

The rate shown is the 7-day effective yield as of April 30, 2017.

|

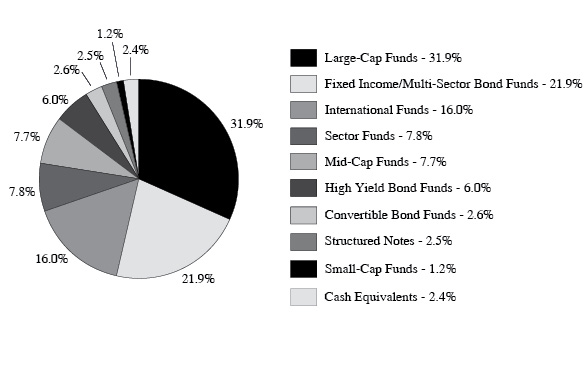

PORTFOLIO INFORMATION

April 30, 2017 (Unaudited)

|

Asset Allocation (% of Net Assets)

|

|

|

Top Ten Long-Term Holdings

|

|

Security Description

|

% of Net Assets

|

|

Invesco European Growth Fund - Class Y

|

7.7%

|

|

Oakmark International Fund - Institutional Class

|

7.3%

|

|

iShares MSCI Germany ETF

|

7.1%

|

|

Ivy International Core Equity Fund - Class I

|

5.5%

|

|

DFA Continental Small Company Portfolio - Institutional Class

|

5.4%

|

|

Hartford International Value Fund (The) - Class Y

|

5.3%

|

|

John Hancock International Growth Fund - Class I

|

4.7%

|

|

JOHCM International Select Fund - Class I

|

4.4%

|

|

Oppenheimer International Small-Mid Company Fund - Class I

|

4.4%

|

|

iShares MSCI United Kingdom ETF

|

3.9%

|

|

NEW CENTURY INTERNATIONAL PORTFOLIO

SCHEDULE OF INVESTMENTS April 30, 2017 (Unaudited) |

||||||||

|

INVESTMENT COMPANIES — 97.1%

|

Shares

|

Value

|

||||||

|

Diversified Funds — 45.5%

|

||||||||

|

Deutsche X-trackers MSCI EAFE Hedged Equity ETF (a)

|

10,000

|

$

|

300,100

|

|||||

|

DFA International Small Cap Value Portfolio - Institutional Class

|

55,035

|

1,156,286

|

||||||

|

Dodge & Cox International Stock Fund

|

23,187

|

990,096

|

||||||

|

FMI International Fund - Investor Class

|

34,739

|

1,118,599

|

||||||

|

Hartford International Value Fund (The) - Class Y

|

108,479

|

1,785,560

|

||||||

|

Ivy International Core Equity Fund - Class I

|

100,160

|

1,854,956

|

||||||

|

JOHCM International Select Fund - Class I

|

73,242

|

1,480,957

|

||||||

|

John Hancock International Growth Fund - Class I

|

66,918

|

1,578,594

|

||||||

|

MFS International Value Fund - Class I

|

27,950

|

1,132,552

|

||||||

|

Oakmark International Fund - Institutional Class (b)

|

94,404

|

2,449,793

|

||||||

|

Oppenheimer International Small-Mid Company Fund - Class I

|

34,933

|

1,480,453

|

||||||

|

15,327,946

|

||||||||

|

Europe Funds — 33.4%

|

||||||||

|

DFA Continental Small Company Portfolio - Institutional Class

|

72,462

|

1,831,116

|

||||||

|

Invesco European Growth Fund - Class Y

|

68,903

|

2,590,758

|

||||||

|

iShares Core MSCI Europe ETF (a)

|

25,000

|

1,142,375

|

||||||

|

iShares MSCI Germany ETF (a)

|

80,100

|

2,377,368

|

||||||

|

iShares MSCI Sweden Capped ETF (a)

|

29,500

|

976,745

|

||||||

|

iShares MSCI Switzerland Capped ETF (a)

|

30,600

|

1,017,144

|

||||||

|

iShares MSCI United Kingdom ETF (a)

|

40,073

|

1,326,416

|

||||||

|

11,261,922

|

||||||||

|

Asia/Pacific Funds — 14.3%

|

||||||||

|

Deutsche X-trackers MSCI Japan Hedged Equity ETF (a)

|

25,500

|

963,645

|

||||||

|

iShares MSCI Australia ETF (a)

|

30,100

|

676,046

|

||||||

|

iShares MSCI Japan ETF (a)

|

15,000

|

777,900

|

||||||

|

Matthews Emerging Asia Fund - Institutional Class

|

91,231

|

1,298,213

|

||||||

|

Matthews Japan Fund - Institutional Class

|

54,633

|

1,114,504

|

||||||

|

4,830,308

|

||||||||

|

Diversified Emerging Markets Funds — 3.9%

|

||||||||

|

DFA Emerging Markets Core Equity Portfolio - Institutional Class

|

64,505

|

1,295,256

|

||||||

|

Total Investment Companies (Cost $27,858,542)

|

$

|

32,715,432

|

||||||

|

NEW CENTURY INTERNATIONAL PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

MONEY MARKET FUNDS — 3.0%

|

Shares

|

Value

|

||||||

|

Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Class, 0.63% (c) (Cost $1,011,027)

|

1,011,027

|

$

|

1,011,027

|

|||||

|

Total Investments at Value — 100.1% (Cost $28,869,569)

|

$

|

33,726,459

|

||||||

|

Liabilities in Excess of Other Assets — (0.1%)

|

(41,476

|

)

|

||||||

|

Net Assets — 100.0%

|

$

|

33,684,983

|

||||||

|

(a)

|

Exchange-traded fund.

|

|

(b)

|

Non-income producing security.

|

|

(c)

|

The rate shown is the 7-day effective yield as of April 30, 2017.

|

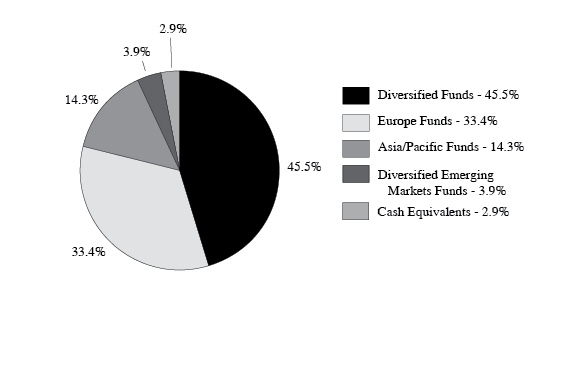

PORTFOLIO INFORMATION

April 30, 2017 (Unaudited)

|

Asset Allocation (% of Net Assets)

|

|

|

Top Ten Long-Term Holdings

|

|

Security Description

|

% of Net Assets

|

|

AQR Long-Short Equity Fund - Class I

|

7.7%

|

|

Boston Partners Long/Short Research Fund - Institutional Class

|

7.6%

|

|

First Eagle Global Fund - Class A

|

6.1%

|

|

Berwyn Income Fund

|

6.1%

|

|

Calamos Market Neutral Income Fund - Class A

|

6.1%

|

|

361 Managed Futures Strategy Fund - Class I

|

5.9%

|

|

John Hancock Global Absolute Return Strategies Fund - Class I

|

5.0%

|

|

Vanguard Market Neutral Fund - Investor Shares

|

4.2%

|

|

Kellner Merger Fund - Institutional Class

|

4.1%

|

|

AQR Managed Futures Strategy Fund - Class I

|

4.0%

|

|

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

SCHEDULE OF INVESTMENTS April 30, 2017 (Unaudited) |

||||||||

|

INVESTMENT COMPANIES — 95.6%

|

Shares

|

Value

|

||||||

|

Long/Short Equity Funds — 22.4%

|

||||||||

|

AQR Long-Short Equity Fund - Class I

|

416,369

|

$

|

5,695,922

|

|||||

|

Boston Partners Long/Short Research Fund - Institutional Class (b)

|

357,075

|

5,645,359

|

||||||

|

Vanguard Market Neutral Fund - Investor Shares

|

258,511

|

3,122,809

|

||||||

|

Weitz Partners III Opportunity Fund - Institutional Class (b)

|

143,855

|

2,205,300

|

||||||

|

16,669,390

|

||||||||

|

Arbitrage Funds — 17.3%

|

||||||||

|

Calamos Market Neutral Income Fund - Class A

|

343,320

|

4,542,124

|

||||||

|

Kellner Merger Fund - Institutional Class

|

290,071

|

3,083,456

|

||||||

|

Touchstone Merger Arbitrage Fund - Institutional Class

|

259,493

|

2,875,187

|

||||||

|

Vivaldi Merger Arbitrage Fund - Class I

|

228,113

|

2,386,063

|

||||||

|

12,886,830

|

||||||||

|

Global Macro Funds — 17.1%

|

||||||||

|

BlackRock Multi-Asset Income Fund - Institutional Shares

|

238,360

|

2,607,657

|

||||||

|

First Eagle Global Fund - Class A

|

79,779

|

4,572,126

|

||||||

|

Franklin Mutual Global Discovery Fund - Class Z

|

55,612

|

1,822,420

|

||||||

|

John Hancock Global Absolute Return Strategies Fund - Class I (b)

|

359,972

|

3,693,312

|

||||||

|

12,695,515

|

||||||||

|

Managed Futures Funds — 12.9%

|

||||||||

|

361 Managed Futures Strategy Fund - Class I (b)

|

401,936

|

4,385,123

|

||||||

|

AQR Managed Futures Strategy Fund - Class I

|

329,270

|

2,979,895

|

||||||

|

ASG Managed Futures Strategy Fund - Class Y

|

229,469

|

2,251,093

|

||||||

|

9,616,111

|

||||||||

|

High Yield/Fixed Income Funds — 7.4%

|

||||||||

|

PIMCO Income Fund - Institutional Class

|

199,410

|

2,446,761

|

||||||

|

T. Rowe Price Institutional Floating Rate Fund - Investor Class

|

157,474

|

1,584,184

|

||||||

|

Templeton Global Bond Fund - Class A

|

11,936

|

147,648

|

||||||

|

Templeton Global Income Fund (d)

|

194,923

|

1,296,238

|

||||||

|

5,474,831

|

||||||||

|

Asset Allocation Funds — 7.2%

|

||||||||

|

Berwyn Income Fund

|

330,581

|

4,552,095

|

||||||

|

FPA Crescent Fund

|

24,391

|

831,002

|

||||||

|

5,383,097

|

||||||||

|

Natural Resources Funds — 6.5%

|

||||||||

|

Alerian MLP ETF (a)

|

75,000

|

945,000

|

||||||

|

ETRACS Alerian MLP Infrastructure Index ETN (e)

|

23,491

|

661,506

|

||||||

|

Oppenheimer SteelPath MLP Select 40 Fund - Class Y (b)

|

233,987

|

2,264,998

|

||||||

|

SPDR Gold Shares (a) (b) (c)

|

4,800

|

579,696

|

||||||

|

Tortoise MLP & Pipeline Fund - Institutional Class

|

25,145

|

354,040

|

||||||

|

4,805,240

|

||||||||

|

Option Hedged Funds — 2.8%

|

||||||||

|

JPMorgan Hedged Equity Fund - Select Class

|

114,590

|

2,072,925

|

||||||

|

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

INVESTMENT COMPANIES — 95.6% (Continued)

|

Shares

|

Value

|

||||||

|

Real Estate Funds — 2.0%

|

||||||||

|

CBRE Clarion Global Real Estate Income Fund (d)

|

48,500

|

$

|

371,510

|

|||||

|

Vanguard REIT ETF (a)

|

9,500

|

786,505

|

||||||

|

Voya Global Real Estate Fund - Class I

|

19,279

|

367,847

|

||||||

|

1,525,862

|

||||||||

|

Total Investment Companies (Cost $63,740,691)

|

$

|

71,129,801

|

||||||

|

STRUCTURED NOTES — 3.5%

|

Par Value

|

Value

|

||||||

|

JPMorgan Chase & Co., 5 Year Dual Directional Notes Linked to the S&P 500 Index, due 03/31/2021 (b)

|

$

|

900,000

|

$

|

1,015,740

|

||||

|

JPMorgan Chase & Co., Certificates of Deposit Linked to the JPMorgan Efficiente Plus DS 5 Index, due 06/23/2020 (b)

|

1,600,000

|

1,586,880

|

||||||

|

Total Structured Notes (Cost $2,500,000)

|

$

|

2,602,620

|

||||||

|

MONEY MARKET FUNDS — 0.6%

|

Shares

|

Value

|

||||||

|

Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Class, 0.63% (f) (Cost $478,905)

|

478,905

|

$

|

478,905

|

|||||

|

Total Investments at Value — 99.7% (Cost $66,719,596)

|

$

|

74,211,326

|

||||||

|

Other Assets in Excess of Liabilities — 0.3%

|

226,488

|

|||||||

|

Net Assets — 100.0%

|

$

|

74,437,814

|

||||||

|

(a)

|

Exchange-traded fund.

|

|

(b)

|

Non-income producing security.

|

|

(c)

|

For federal income tax purposes, structured as a grantor trust.

|

|

(d)

|

Closed-end fund.

|

|

(e)

|

Exchange-traded note.

|

|

(f)

|

The rate shown is the 7-day effective yield as of April 30, 2017.

|

|

NEW CENTURY PORTFOLIOS

STATEMENTS OF ASSETS AND LIABILITIES April 30, 2017 (Unaudited) |

||||||||||||||||

|

|

New Century

Capital

Portfolio

|

New Century

Balanced

Portfolio

|

New Century

International

Portfolio

|

New Century

Alternative

Strategies

Portfolio

|

||||||||||||

|

ASSETS

|

||||||||||||||||

|

Investments in securities:

|

||||||||||||||||

|

At acquisition cost

|

$

|

65,592,939

|

$

|

42,744,021

|

$

|

28,869,569

|

$

|

66,719,596

|

||||||||

|

At value (Note 1A)

|

$

|

85,568,021

|

$

|

51,457,383

|

$

|

33,726,459

|

$

|

74,211,326

|

||||||||

|

Cash

|

—

|

—

|

—

|

4,900

|

||||||||||||

|

Dividends receivable

|

274

|

10,601

|

282

|

1,194

|

||||||||||||

|

Receivable for investment securities sold

|

—

|

182,158

|

—

|

301,007

|

||||||||||||

|

Receivable for capital shares sold

|

50

|

300

|

25

|

25

|

||||||||||||

|

Other assets

|

2,951

|

1,749

|

1,219

|

2,607

|

||||||||||||

|

TOTAL ASSETS

|

85,571,296

|

51,652,191

|

33,727,985

|

74,521,059

|

||||||||||||

|

LIABILITIES

|

||||||||||||||||

|

Payable for investment securities purchased

|

—

|

731,855

|

—

|

—

|

||||||||||||

|

Payable to Adviser (Note 2)

|

71,083

|

24,838

|

24,127

|

48,871

|

||||||||||||

|

Payable to Distributor (Note 3)

|

18,886

|

9,024

|

3,276

|

15,318

|

||||||||||||

|

Other accrued expenses and liabilities

|

10,027

|

20,069

|

15,599

|

19,056

|

||||||||||||

|

TOTAL LIABILITIES

|

99,996

|

785,786

|

43,002

|

83,245

|

||||||||||||

|

NET ASSETS

|

$

|

85,471,300

|

$

|

50,866,405

|

$

|

33,684,983

|

$

|

74,437,814

|

||||||||

|

Net assets consist of:

|

||||||||||||||||

|

Paid-in capital

|

$

|

57,031,656

|

$

|

38,763,784

|

$

|

27,630,520

|

$

|

66,006,601

|

||||||||

|

Accumulated (distributions in excess of) net investment income

|

218,276

|

(10,560

|

)

|

199,621

|

(260,101

|

)

|

||||||||||

|

Accumulated net realized gains on investments

|

8,246,286

|

3,399,819

|

997,952

|

1,199,584

|

||||||||||||

|

Net unrealized appreciation on investments

|

19,975,082

|

8,713,362

|

4,856,890

|

7,491,730

|

||||||||||||

|

Net assets

|

$

|

85,471,300

|

$

|

50,866,405

|

$

|

33,684,983

|

$

|

74,437,814

|

||||||||

|

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value)

|

4,859,083

|

3,449,667

|

2,742,918

|

5,767,436

|

||||||||||||

|

Net asset value, offering price and redemption price per share (a)

|

$

|

17.59

|

$

|

14.75

|

$

|

12.28

|

$

|

12.91

|

||||||||

|

(a)

|

Redemption price may differ from the net asset value per share depending upon the length of time held (Note 1B).

|

|

NEW CENTURY PORTFOLIOS

STATEMENTS OF OPERATIONS For the Six Months Ended April 30, 2017 (Unaudited) |

||||||||||||||||

|

|

New Century

Capital

Portfolio

|

New Century

Balanced

Portfolio

|

New Century

International

Portfolio

|

New Century

Alternative

Strategies

Portfolio

|

||||||||||||

|

INVESTMENT INCOME

|

||||||||||||||||

|

Dividends

|

$

|

857,986

|

$

|

714,683

|

$

|

459,235

|

$

|

479,388

|

||||||||

|

EXPENSES

|

||||||||||||||||

|

Investment advisory fees (Note 2)

|

419,395

|

254,492

|

172,976

|

286,276

|

||||||||||||

|

Distribution fees (Note 3)

|

104,480

|

56,485

|

36,325

|

80,157

|

||||||||||||

|

Accounting fees

|

25,307

|

19,264

|

16,402

|

23,495

|

||||||||||||

|

Trustees’ fees (Note 2)

|

27,927

|

16,430

|

10,704

|

24,439

|

||||||||||||

|

Legal and audit fees

|

21,912

|

14,975

|

11,827

|

19,735

|

||||||||||||

|

Administration fees (Note 2)

|

22,494

|

13,887

|

9,860

|

19,879

|

||||||||||||

|

Transfer agent fees

|

14,383

|

10,942

|

9,324

|

13,351

|

||||||||||||

|

Other expenses

|

4,045

|

17,166

|

14,785

|

13,611

|

||||||||||||

|

Total expenses

|

639,943

|

403,641

|

282,203

|

480,943

|

||||||||||||

|

Less fee reductions by the Adviser (Note 2)

|

—

|

(18,516

|

)

|

(22,738

|

)

|

—

|

||||||||||

|

Net expenses

|

639,943

|

385,125

|

259,465

|

480,943

|

||||||||||||

|

NET INVESTMENT INCOME (LOSS)

|

218,043

|

329,558

|

199,770

|

(1,555

|

)

|

|||||||||||

|

REALIZED AND UNREALIZED GAINS ON INVESTMENTS

|

||||||||||||||||

|

Net realized gains on investments

|

7,905,229

|

3,309,872

|

1,875,351

|

974,851

|

||||||||||||

|

Long-term capital gain distributions from regulated investment companies

|

443,299

|

275,610

|

112,124

|

376,919

|

||||||||||||

|

Net change in unrealized appreciation (depreciation) on investments

|

1,309,251

|

298,650

|

811,745

|

1,260,866

|

||||||||||||

|

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS

|

9,657,779

|

3,884,132

|

2,799,220

|

2,612,636

|

||||||||||||

|

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

9,875,822

|

$

|

4,213,690

|

$

|

2,998,990

|

$

|

2,611,081

|

||||||||

|

NEW CENTURY PORTFOLIOS

STATEMENTS OF CHANGES IN NET ASSETS |

||||||||

|

New Century

Capital Portfolio |

||||||||

|

|

Six Months Ended

April 30, 2017 (Unaudited)

|

Year Ended

October 31, 2016

|

||||||

|

FROM OPERATIONS

|

||||||||

|

Net investment income

|

$

|

218,043

|

$

|

90,713

|

||||

|

Net realized gains from security transactions

|

7,905,229

|

3,618,803

|

||||||

|

Long-term capital gain distributions from regulated investment companies

|

443,299

|

2,649,996

|

||||||

|

Net change in unrealized appreciation (depreciation) on investments

|

1,309,251

|

(7,043,896

|

)

|

|||||

|

Net increase (decrease) in net assets from operations

|

9,875,822

|

(684,384

|

)

|

|||||

|

DISTRIBUTIONS TO SHAREHOLDERS

|

||||||||

|

From net investment income (Note 1E)

|

(90,464

|

)

|

(38,209

|

)

|

||||

|

From net realized gains on security transactions (Note 1E)

|

(6,370,790

|

)

|

(9,727,080

|

)

|

||||

|

Decrease in net assets from distributions to shareholders

|

(6,461,254

|

)

|

(9,765,289

|

)

|

||||

|

FROM CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Proceeds from shares sold

|

301,790

|

866,488

|

||||||

|

Proceeds from redemption fees collected (Note 1B)

|

480

|

16

|

||||||

|

Net asset value of shares issued in reinvestment of distributions to shareholders

|

6,331,926

|

9,343,709

|

||||||

|

Payments for shares redeemed

|

(12,551,732

|

)

|

(19,478,889

|

)

|

||||

|

Net decrease in net assets from capital share transactions

|

(5,917,536

|

)

|

(9,268,676

|

)

|

||||

|

TOTAL DECREASE IN NET ASSETS

|

(2,502,968

|

)

|

(19,718,349

|

)

|

||||

|

NET ASSETS

|

||||||||

|

Beginning of period

|

87,974,268

|

107,692,617

|

||||||

|

End of period

|

$

|

85,471,300

|

$

|

87,974,268

|

||||

|

ACCUMULATED NET INVESTMENT INCOME

|

$

|

218,276

|

$

|

90,697

|

||||

|

CAPITAL SHARE ACTIVITY

|

||||||||

|

Shares sold

|

17,565

|

50,821

|

||||||

|

Shares reinvested

|

385,623

|

556,504

|

||||||

|

Shares redeemed

|

(728,960

|

)

|

(1,154,538

|

)

|

||||

|

Net decrease in shares outstanding

|

(325,772

|

)

|

(547,213

|

)

|

||||

|

Shares outstanding, beginning of period

|

5,184,855

|

5,732,068

|

||||||

|

Shares outstanding, end of period

|

4,859,083

|

5,184,855

|

||||||

|

NEW CENTURY PORTFOLIOS

STATEMENTS OF CHANGES IN NET ASSETS |

||||||||

|

New Century

Balanced Portfolio |

||||||||

|

|

Six Months Ended

April 30, 2017 (Unaudited)

|

Year Ended

October 31, 2016

|

||||||

|

FROM OPERATIONS

|

||||||||

|

Net investment income

|

$

|

329,558

|

$

|

672,904

|

||||

|

Net realized gains from security transactions

|

3,309,872

|

926,598

|

||||||

|

Long-term capital gain distributions from regulated investment companies

|

275,610

|

1,342,604

|

||||||

|

Net change in unrealized appreciation (depreciation) on investments

|

298,650

|

(2,344,434

|

)

|

|||||

|

Net increase in net assets from operations

|

4,213,690

|

597,672

|

||||||

|

DISTRIBUTIONS TO SHAREHOLDERS

|

||||||||

|

From net investment income (Note 1E)

|

(388,036

|

)

|

(632,267

|

)

|

||||

|

From net realized gains on security transactions (Note 1E)

|

(2,307,773

|

)

|

(3,890,567

|

)

|

||||

|

Decrease in net assets from distributions to shareholders

|

(2,695,809

|

)

|

(4,522,834

|

)

|

||||

|

FROM CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Proceeds from shares sold

|

167,158

|

1,006,156

|

||||||

|

Proceeds from redemption fees collected (Note 1B)

|

200

|

198

|

||||||

|

Net asset value of shares issued in reinvestment of distributions to shareholders

|

2,631,297

|

4,229,591

|

||||||

|

Payments for shares redeemed

|

(6,519,595

|

)

|

(16,017,119

|

)

|

||||

|

Net decrease in net assets from capital share transactions

|

(3,720,940

|

)

|

(10,781,174

|

)

|

||||

|

TOTAL DECREASE IN NET ASSETS

|

(2,203,059

|

)

|

(14,706,336

|

)

|

||||

|

NET ASSETS

|

||||||||

|

Beginning of period

|

53,069,464

|

67,775,800

|

||||||

|

End of period

|

$

|

50,866,405

|

$

|

53,069,464

|

||||

|

ACCUMULATED (DISTRIBUTIONS IN EXCESS OF) NET INVESTMENT INCOME

|

$

|

(10,560

|

)

|

$

|

47,918

|

|||

|

CAPITAL SHARE ACTIVITY

|

||||||||

|

Shares sold

|

11,519

|

71,134

|

||||||

|

Shares reinvested

|

187,414

|

305,606

|

||||||

|

Shares redeemed

|

(450,575

|

)

|

(1,149,905

|

)

|

||||

|

Net decrease in shares outstanding

|

(251,642

|

)

|

(773,165

|

)

|

||||

|

Shares outstanding, beginning of period

|

3,701,309

|

4,474,474

|

||||||

|

Shares outstanding, end of period

|

3,449,667

|

3,701,309

|

||||||

|

NEW CENTURY PORTFOLIOS

STATEMENTS OF CHANGES IN NET ASSETS |

||||||||

|

New Century

International Portfolio |

||||||||

|

|

Six Months Ended

April 30, 2017 (Unaudited) |

Year Ended October 31, 2016

|

||||||

|

FROM OPERATIONS

|

||||||||

|

Net investment income

|

$

|

199,770

|

$

|

319,719

|

||||

|

Net realized gains (losses) from security transactions

|

1,875,351

|

(1,758,247

|

)

|

|||||

|

Long-term capital gain distributions from regulated investment companies

|

112,124

|

862,196

|

||||||

|

Net change in unrealized appreciation (depreciation) on investments

|

811,745

|

(776,603

|

)

|

|||||

|

Net increase (decrease) in net assets from operations

|

2,998,990

|

(1,352,935

|

)

|

|||||

|

DISTRIBUTIONS TO SHAREHOLDERS

|

||||||||

|

From net investment income (Note 1E)

|

(319,368

|

)

|

(373,058

|

)

|

||||

|

From net realized gains on security transactions (Note 1E)

|

—

|

(5,094,715

|

)

|

|||||

|

Decrease in net assets from distributions to shareholders

|

(319,368

|

)

|

(5,467,773

|

)

|

||||

|

FROM CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Proceeds from shares sold

|

159,586

|

1,808,686

|

||||||

|

Net asset value of shares issued in reinvestment of distributions to shareholders

|

313,557

|

5,263,023

|

||||||

|

Payments for shares redeemed

|

(9,432,106

|

)

|

(13,274,556

|

)

|

||||

|

Net decrease in net assets from capital share transactions

|

(8,958,963

|

)

|

(6,202,847

|

)

|

||||

|

TOTAL DECREASE IN NET ASSETS

|

(6,279,341

|

)

|

(13,023,555

|

)

|

||||

|

NET ASSETS

|

||||||||

|

Beginning of period

|

39,964,324

|

52,987,879

|

||||||

|

End of period

|

$

|

33,684,983

|

$

|

39,964,324

|

||||

|

ACCUMULATED NET INVESTMENT INCOME

|

$

|

199,621

|

$

|

319,219

|

||||

|

CAPITAL SHARE ACTIVITY

|

||||||||

|

Shares sold

|

14,008

|

168,809

|

||||||

|

Shares reinvested

|

28,046

|

461,669

|

||||||

|

Shares redeemed

|

(829,174

|

)

|

(1,143,375

|

)

|

||||

|

Net decrease in shares outstanding

|

(787,120

|

)

|

(512,897

|

)

|

||||

|

Shares outstanding, beginning of period

|

3,530,038

|

4,042,935

|

||||||

|

Shares outstanding, end of period

|

2,742,918

|

3,530,038

|

||||||

|

NEW CENTURY PORTFOLIOS

STATEMENTS OF CHANGES IN NET ASSETS |

||||||||

|

New Century Alternative

Strategies Portfolio

|

||||||||

|

|

Six Months Ended

April 30, 2017 (Unaudited)

|

Year Ended

October 31, 2016

|

||||||

|

FROM OPERATIONS

|

||||||||

|

Net investment income (loss)

|

$

|

(1,555

|

)

|

$

|

854,132

|

|||

|

Net realized gains (losses) from security transactions

|

974,851

|

(922,743

|

)

|

|||||

|

Long-term capital gain distributions from regulated investment companies

|

376,919

|

913,690

|

||||||

|

Net change in unrealized appreciation (depreciation) on investments

|

1,260,866

|

(118,695

|

)

|

|||||

|

Net increase in net assets from operations

|

2,611,081

|

726,384

|

||||||

|

DISTRIBUTIONS TO SHAREHOLDERS

|

||||||||

|

From net investment income (Note 1E)

|

(168,712

|

)

|

(698,410

|

)

|

||||

|

From net realized gains on security transactions (Note 1E)

|

(27,607

|

)

|

(477,295

|

)

|

||||

|

Decrease in net assets from distributions to shareholders

|

(196,319

|

)

|

(1,175,705

|

)

|

||||

|

FROM CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Proceeds from shares sold

|

457,720

|

2,312,118

|

||||||

|

Proceeds from redemption fees collected (Note 1B)

|

14

|

433

|

||||||

|

Net asset value of shares issued in reinvestment of distributions to shareholders

|

193,317

|

1,142,885

|

||||||

|

Payments for shares redeemed

|

(7,314,221

|

)

|

(17,444,193

|

)

|

||||

|

Net decrease in net assets from capital share transactions

|

(6,663,170

|

)

|

(13,988,757

|

)

|

||||

|

TOTAL DECREASE IN NET ASSETS

|

(4,248,408

|

)

|

(14,438,078

|

)

|

||||

|

NET ASSETS

|

||||||||

|

Beginning of period

|

78,686,222

|

93,124,300

|

||||||

|

End of period

|

$

|

74,437,814

|

$

|

78,686,222

|

||||

|

ACCUMULATED DISTRIBUTIONS IN EXCESS OF NET INVESTMENT INCOME

|

$

|

(260,101

|

)

|

$

|

(89,834

|

)

|

||

|

CAPITAL SHARE ACTIVITY

|

||||||||

|

Shares sold

|

36,052

|

188,920

|

||||||

|

Shares reinvested

|

15,270

|

94,297

|

||||||

|

Shares redeemed

|

(573,187

|

)

|

(1,422,856

|

)

|

||||

|

Net decrease in shares outstanding

|

(521,865

|

)

|

(1,139,639

|

)

|

||||

|

Shares outstanding, beginning of period

|

6,289,301

|

7,428,940

|

||||||

|

Shares outstanding, end of period

|

5,767,436

|

6,289,301

|

||||||

|

NEW CENTURY CAPITAL PORTFOLIO

FINANCIAL HIGHLIGHTS |

||||||||||||||||||||||||

|

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period

|

||||||||||||||||||||||||

|

|

Six Months

Ended

April 30, 2017

(Unaudited)

|

Years Ended October 31, |

||||||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||||||

|

PER SHARE OPERATING PERFORMANCE

|

||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$

|

16.97

|

$

|

18.79

|

$

|

21.15

|

$

|

20.81

|

$

|

17.55

|

$

|

16.11

|

||||||||||||

|

Income (loss) from investment operations:

|

||||||||||||||||||||||||

|

Net investment income (loss)

|

0.05

|

0.02

|

0.02

|

(0.01

|

)

|

(0.00

|

)(a)

|

(0.01

|

)

|

|||||||||||||||

|

Net realized and unrealized gains (losses) on investments

|

1.87

|

(0.10

|

)

|

0.24

|

2.29

|

4.11

|

1.54

|

|||||||||||||||||

|

Total from investment operations

|

1.92

|

(0.08

|

)

|

0.26

|

2.28

|

4.11

|

1.53

|

|||||||||||||||||

|

Less distributions:

|

||||||||||||||||||||||||

|

Distributions from net investment income

|

(0.02

|

)

|

(0.01

|

)

|

—

|

—

|

—

|

—

|

||||||||||||||||

|

Distributions from net realized gains

|

(1.28

|

)

|

(1.73

|

)

|

(2.62

|

)

|

(1.94

|

)

|

(0.85

|

)

|

(0.09

|

)

|

||||||||||||

|

Total distributions

|

(1.30

|

)

|

(1.74

|

)

|

(2.62

|

)

|

(1.94

|

)

|

(0.85

|

)

|

(0.09

|

)

|

||||||||||||

|

Proceeds from redemption fees collected (Note 1B)

|

0.00

|

(a)

|

0.00

|

(a)

|

0.00

|

(a)

|

0.00

|

(a)

|

0.00

|

(a)

|

—

|

|||||||||||||

|

Net asset value, end of period

|

$

|

17.59

|

$

|

16.97

|

$

|

18.79

|

$

|

21.15

|

$

|

20.81

|

$

|

17.55

|

||||||||||||

|

TOTAL RETURN (b)

|

11.86

|

%(c)

|

(0.34

|

%)

|

1.20

|

%

|

11.53

|

%

|

24.45

|

%

|

9.57

|

%

|

||||||||||||

|

RATIOS/SUPPLEMENTAL DATA

|

||||||||||||||||||||||||

|

Net assets, end of period (000’s)

|

$

|

85,471

|

$

|

87,974

|

$

|

107,693

|

$

|

114,954

|

$

|

112,828

|

$

|

87,664

|

||||||||||||

|

Ratio of expenses to average net assets (d)

|

1.47

|

%(f)

|

1.48

|

%

|

1.44

|

%

|

1.41

|

%

|

1.43

|

%

|

1.46

|

%

|

||||||||||||

|

Ratio of net investment income (loss) to average net assets (e)

|

0.50

|

%(f)

|

0.09

|

%

|

0.09

|

%

|

(0.06

|

%)

|

(0.00

|

%)

|

(0.05

|

%)

|

||||||||||||

|

Portfolio turnover

|

25

|

%(c)

|

48

|

%

|

32

|

%

|

26

|

%

|

28

|

%

|

7

|

%

|

||||||||||||

|

(a)

|

Amount rounds to less than $0.01 per share.

|

|

(b)

|

Total return is a measure of the change in the value of an investment in the Portfolio over the periods covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares.

|

|

(c)

|

Not annualized.

|

|

(d)

|

The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests.

|

|

(e)

|

Recognition of net investment income (loss) by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests.

|

|

(f)

|

Annualized.

|

|

NEW CENTURY BALANCED PORTFOLIO

FINANCIAL HIGHLIGHTS |

||||||||||||||||||||||||

|

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period

|

||||||||||||||||||||||||

|

|

Six Months

Ended

April 30, 2017

(Unaudited)

|

Years Ended October 31, |

||||||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||||||

|

PER SHARE OPERATING PERFORMANCE

|

||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$

|

14.34

|

$

|

15.15

|

$

|

16.80

|

$

|

16.68

|

$

|

14.56

|

$

|

13.59

|

||||||||||||

|

Income (loss) from investment operations:

|

||||||||||||||||||||||||

|

Net investment income

|

0.09

|

0.16

|

0.19

|

0.15

|

0.18

|

0.17

|

||||||||||||||||||

|

Net realized and unrealized gains (losses) on investments

|

1.09

|

0.06

|

(a)

|

(0.51

|

)

|

1.10

|

2.12

|

0.97

|

||||||||||||||||

|

Total from investment operations

|

1.18

|

0.22

|

(0.32

|

)

|

1.25

|

2.30

|

1.14

|

|||||||||||||||||

|

Less distributions:

|

||||||||||||||||||||||||

|

Distributions from net investment income

|

(0.11

|

)

|

(0.14

|

)

|

(0.19

|

)

|

(0.19

|

)

|

(0.18

|

)

|

(0.17

|

)

|

||||||||||||

|

Distributions from net realized gains

|

(0.66

|

)

|

(0.89

|

)

|

(1.14

|

)

|

(0.94

|

)

|

—

|

—

|

||||||||||||||

|

Total distributions

|

(0.77

|

)

|

(1.03

|

)

|

(1.33

|

)

|

(1.13

|

)

|

(0.18

|

)

|

(0.17

|

)

|

||||||||||||

|

Proceeds from redemption fees collected (Note 1B)

|

0.00

|

(b)

|

0.00

|

(b)

|

0.00

|

(b)

|

—

|

0.00

|

(b)

|

0.00

|

(b)

|

|||||||||||||

|

Net asset value, end of period

|

$

|

14.75

|

$

|

14.34

|

$

|

15.15

|

$

|

16.80

|

$

|

16.68

|

$

|

14.56

|

||||||||||||

|

TOTAL RETURN (c)

|

8.46

|

%(d)

|

1.70

|

%

|

(2.04

|

%)

|

7.81

|

%

|

15.97

|

%

|

8.54

|

%

|

||||||||||||

|

RATIOS/SUPPLEMENTAL DATA

|

||||||||||||||||||||||||

|

Net assets, end of period (000’s)

|

$

|

50,866

|

$

|

53,069

|

$

|

67,776

|

$

|

73,737

|

$

|

71,457

|

$

|

66,826

|

||||||||||||

|

Ratio of expenses to average net assets:

|

||||||||||||||||||||||||

|

Before fee reductions (Note 2) (e)

|

1.57

|

%(g)

|

1.50

|

%

|

1.40

|

%

|

1.40

|

%

|

1.43

|

%

|

1.45

|

%

|

||||||||||||

|

After fee reductions (Note 2) (e)

|

1.50

|

%(g)

|

1.50

|

%

|

1.40

|

%

|

1.40

|

%

|

1.43

|

%

|

1.45

|

%

|

||||||||||||

|

Ratio of net investment income to average net assets:

|

||||||||||||||||||||||||

|

Before fee reductions (Note 2) (f)

|

1.21

|

%(g)

|

1.15

|

%

|

1.11

|

%

|

0.88

|

%

|

1.17

|

%

|

1.18

|

%

|

||||||||||||

|

After fee reductions (Note 2) (f)

|

1.28

|

%(g)

|

1.15

|

%

|

1.11

|

%

|

0.88

|

%

|

1.17

|

%

|

1.18

|

%

|

||||||||||||

|

Portfolio turnover

|

12

|

%(d)

|

34

|

%

|

33

|

%

|

16

|

%

|

21

|

%

|

13

|

%

|

||||||||||||

|

(a)

|

Represents a balancing figure derived from other amounts in the financial highlights table that captures all other changes affecting net asset value per share. This per share amount does not correlate to the aggregate of the net realized and unrealized losses on the Statement of Operations for the year ended October 31, 2016, primarily due to the timing of capital gains declared by the underlying investment companies in which the Portfolio invests.

|

|

(b)

|

Amount rounds to less than $0.01 per share.

|

|

(c)

|

Total return is a measure of the change in the value of an investment in the Portfolio over the periods covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares.

|

|

(d)

|

Not annualized.

|

|

(e)

|

The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests.

|

|

(f)

|

Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests.

|

|

(g)

|

Annualized.

|

|

NEW CENTURY INTERNATIONAL PORTFOLIO

FINANCIAL HIGHLIGHTS |

||||||||||||||||||||||||

|

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period

|

||||||||||||||||||||||||

|

|

Six Months

Ended

April 30, 2017

(Unaudited)

|

Years Ended October 31, |

||||||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||||||

|

PER SHARE OPERATING PERFORMANCE

|

||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$

|

11.32

|

$

|

13.11

|

$

|

14.90

|

$

|

16.24

|

$

|

13.92

|

$

|

13.41

|

||||||||||||

|

Income (loss) from investment operations:

|

||||||||||||||||||||||||

|

Net investment income

|

0.09

|

0.10

|

0.16

|

0.11

|

0.11

|

0.15

|

||||||||||||||||||

|

Net realized and unrealized gains (losses) on investments

|

0.98

|

(0.43

|

)

|

(0.13

|

)

|

(0.22

|

)

|

2.37

|

0.46

|

|||||||||||||||

|

Total from investment operations

|

1.07

|

(0.33

|

)

|

0.03

|

(0.11

|

)

|

2.48

|

0.61

|

||||||||||||||||

|

Less distributions:

|

||||||||||||||||||||||||

|

Distributions from net investment income

|

(0.11

|

)

|

(0.10

|

)

|

(0.17

|

)

|

(0.10

|

)

|

(0.16

|

)

|

(0.10

|

)

|

||||||||||||

|

Distributions from net realized gains

|

—

|

(1.36

|

)

|

(1.65

|

)

|

(1.13

|

)

|

—

|

—

|

|||||||||||||||

|

Total distributions

|

(0.11

|

)

|

(1.46

|

)

|

(1.82

|

)

|

(1.23

|

)

|

(0.16

|

)

|

(0.10

|

)

|

||||||||||||

|

Proceeds from redemption fees collected (Note 1B)

|

—

|

—

|

0.00

|

(a)

|

0.00

|

(a)

|

0.00

|

(a)

|

0.00

|

(a)

|

||||||||||||||

|

|

||||||||||||||||||||||||

|

Net asset value, end of period

|

$

|

12.28

|

$

|

11.32

|

$

|

13.11

|

$

|

14.90

|

$

|

16.24

|

$

|

13.92

|

||||||||||||

|

TOTAL RETURN (b)

|

9.50

|

%(c)

|

(2.60

|

%)

|

0.45

|

%

|

(0.89

|

%)

|

17.95

|

%

|

4.60

|

%

|

||||||||||||

|

RATIOS/SUPPLEMENTAL DATA

|

||||||||||||||||||||||||

|

Net assets, end of period (000’s)

|

$

|

33,685

|

$

|

39,964

|

$

|

52,988

|

$

|

56,073

|

$

|

62,708

|

$

|

57,266

|

||||||||||||

|

Ratios of expenses to average net assets:

|

||||||||||||||||||||||||

|

Before fee reductions (Note 2) (d)

|

1.63

|

%(f)

|

1.58

|

%

|

1.50

|

%

|

1.47

|

%

|

1.43

|

%

|

1.50

|

%

|

||||||||||||

|

After fee reductions (Note 2) (d)

|

1.50

|

%(f)

|

1.50

|

%

|

1.50

|

%

|

1.47

|

%

|

1.43

|

%

|

1.50

|

%

|

||||||||||||

|

Ratios of net investment income to average net assets:

|

||||||||||||||||||||||||

|

Before fee reductions (Note 2) (e)

|

1.02

|

%(f)

|

0.64

|

%

|

1.12

|

%

|

0.66

|

%

|

0.67

|

%

|

1.03

|

%

|

||||||||||||

|

After fee reductions (Note 2) (e)

|

1.15

|

%(f)

|

0.72

|

%

|

1.12

|

%

|

0.66

|

%

|

0.67

|

%

|

1.03

|

%

|

||||||||||||

|

Portfolio turnover

|

38

|

%(c)

|

45

|

%

|

54

|

%

|

22

|

%

|

32

|

%

|

4

|

%

|

||||||||||||

|

(a)

|

Amount rounds to less than $0.01 per share.

|

|

(b)

|

Total return is a measure of the change in the value of an investment in the Portfolio over the periods covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares.

|

|

(c)

|

Not annualized.

|

|

(d)

|

The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests.

|

|

(e)

|

Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests.

|

|

(f)

|

Annualized.

|

|

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

FINANCIAL HIGHLIGHTS |

||||||||||||||||||||||||

|

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period

|

||||||||||||||||||||||||

|

|

Six Months

Ended

April 30, 2017

(Unaudited)

|

Years Ended October 31, |

||||||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||||||

|

PER SHARE OPERATING PERFORMANCE

|

||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$

|

12.51

|

$

|

12.54

|

$

|

13.14

|

$

|

13.02

|

$

|

12.24

|

$

|

11.80

|

||||||||||||

|

Income (loss) from investment operations:

|

||||||||||||||||||||||||

|

Net investment income (loss)

|

(0.00

|

)(a)

|

0.12

|

0.12

|

0.09

|

0.05

|

0.14

|

|||||||||||||||||

|

Net realized and unrealized gains (losses) on investments

|

0.43

|

0.02

|

(b)

|

(0.58

|

)

|

0.11

|

0.80

|

0.47

|

||||||||||||||||

|

Total from investment operations

|

0.43

|

0.14

|

(0.46

|

)

|

0.20

|

0.85

|

0.61

|

|||||||||||||||||

|

Less distributions:

|

||||||||||||||||||||||||

|

Distributions from net investment income

|

(0.03

|

)