UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-05642 |

Nuveen Multi-Market Income Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Gifford R. Zimmerman

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: June 30

Date of reporting period: December 31, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

31 December 2019

Nuveen Closed-End Funds

| JMM | Nuveen Multi-Market Income Fund |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.nuveen.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting the financial intermediary (such as a broker-dealer or bank) through which you hold your Fund shares or, if you are a direct investor, by enrolling at www.nuveen.com/e-reports.

You may elect to receive all future shareholder reports in paper free of charge at any time by contacting your financial intermediary or, if you are a direct investor, (i) by calling 800-257-8787 and selecting option #2 or (ii) by logging into your Investor Center account at www.computershare.com/investor and clicking on “Communication Preferences.” Your election to receive reports in paper will apply to all funds held in your account with your financial intermediary or, if you are a direct investor, to all your directly held Nuveen Funds and any other directly held funds within the same group of related investment companies.

Semiannual Report

Life is Complex.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund dividends and statements from your financial advisor or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund dividends and statements directly from Nuveen.

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE

| 4 | ||||

| 5 | ||||

| 8 | ||||

| 9 | ||||

| 11 | ||||

| 12 | ||||

| 14 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 28 | ||||

| 30 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

3

Chair’s Letter to Shareholders

4

Comments

Nuveen Multi-Market Income Fund (JMM)

Nuveen Multi-Market Income Fund (JMM) features portfolio management by Nuveen Asset Management, LLC (“NAM” or the “Sub-Adviser”), an affiliate of Nuveen Fund Advisers, LLC, the Fund’s investment adviser. Throughout the reporting period, the portfolio management team has included Jason J. O’Brien, CFA, and Peter L. Agrimson, CFA.

Here the Funds’ portfolio management team discusses key investment strategies and the Fund’s performance for the six-month reporting period December 31, 2019.

What key strategies were used to manage the Fund during this six-month reporting period ended December 31, 2019?

The Fund’s investment objective is to achieve high monthly income consistent with prudent risk to capital. The management team invests the Fund’s assets primarily in debt securities, including, but not limited to, U.S. agency and privately issued mortgage-backed securities, corporate debt securities, and asset-backed securities. At least 65% of the Fund’s total assets must be invested in securities that, at the time of purchase, are rated investment grade or of comparable quality. The Fund may utilize derivatives. The Fund uses leverage.

How did the Fund perform during this six-month reporting period ended December 31, 2019?

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for the six-month, one-year, five-year and ten-year periods ended December 31, 2019. The Fund’s total return at net asset value (NAV) is compared with the performance of a corresponding market index. For the six-month reporting period ended December 31, 2019, JMM outperformed the Bloomberg Barclays U.S. Government/Mortgage Bond Index and slightly underperformed its blended benchmark, which is composed of 75% Bloomberg Barclays U.S. Government/Mortgage Index and 25% Bloomberg Barclays U.S. Corporate High-Yield Index.

The U.S. economy continued to grow at a modest pace during the reporting period, reflecting continued trade friction and global growth concerns. Consumer spending supported growth, while business spending remained disappointing and manufacturing contracted starting in September 2019. Weak global growth prompted central banks around the world to make a synchronized pivot to monetary stimulus. The Federal Reserve (Fed) cut rates three times during the reporting period in response to the global economic downshift along with trade related uncertainties in a benign inflation environment. Although businesses remained cautious, global growth stabilized as trade tensions eased, Brexit risk declined and China’s manufacturing sector improved. Financial markets responded positively with credit spreads

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

5

Portfolio Managers’ Comments (continued)

tightening, equity markets rallying and volatility declining. At their final 2019 meeting in December, Fed policymakers held rates steady while also signaling that they expect to leave rates unchanged in 2020.

During the reporting period, Treasury yields fell, but more so at the front end of the yield curve driven by the Fed rate cuts. Three-month T-bills ended the reporting period 57 basis points lower at 1.55%, while the yield on the 10-year Treasury fell by only 8 basis points to end at 1.92%. As a result, the Treasury yield curve re-steepened following the year’s earlier inversion, which happens when short-term interest rates are higher than longer terms rates. The three-month to 10-year Treasury spread turned positive for the first time since May 2019. Globally, yields also fell and at one point during the reporting period, more than $14 trillion worth of global bonds were trading with negative yields.

Investment grade credit spreads ended the year at year-to-date tights as macroeconomic tail risks receded throughout the reporting period. Progress toward U.S.-China and the U.S.-Mexico-Canada (USMCA) trade agreements helped to fuel the rally in risk assets. Geopolitical risks were further alleviated as the prospect of a “hard Brexit” was reduced with the decisive Conservative Party victory in the U.K. election in December. Also as noted, the Fed signaled the continuation of its accommodative monetary policy in 2020. As a result, investment grade credit significantly outperformed Treasuries during the reporting period and generated its best annual total return in a decade.

In the mortgage-backed securities (MBS) market, prepayment levels increased at the beginning of the reporting period after rates rallied and the yield curve flattened. Non-agency MBS, especially securities backed by non-qualified mortgage loans, exhibited substantially higher prepayments than many investors anticipated and therefore offered little value compared to agency MBS. However, prepayment rates declined more than expected into the end of reporting period as the mini refinance wave appeared to be over. The mortgage market outperformed Treasuries, but lagged well behind investment grade corporates despite a steeper yield curve as the reporting period progressed.

Securitized sectors displayed lower volatility with modest outperformance from commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS) versus Treasuries. Both high quality and credit spread product benefited from tighter spreads by the end of the year. The CMBS asset class benefited because it is a longer duration sector, which helped due to the market’s demand as rates fell. Light new supply also provided a moderate tailwind for the CMBS sector. Additionally, the economic environment continued to support consumer credit. An overwhelming majority of consumer oriented ABS assets performed well. The broader ABS market, which includes securitized corporate credit and a wide range of collateral types, also exhibited solid returns. However, we did see some pockets of deterioration especially in collateralized loan obligations (CLOs), which are collateralized by high yield leveraged loans.

The high yield market continued to be supported by dovish central banks and stable credit fundamentals, which kept recession at bay, while capital from around the globe continued to flow into the asset class in the hunt for yield. Although earnings momentum moderated in the fourth quarter, the supportive macro backdrop and more favorable business sentiment going into 2020 collapsed market volatility, providing a strong tailwind for valuations in the high yield market. Spreads tightened throughout the reporting period. The spread of the Bloomberg Barclays U.S. High Yield Index decreased 41 basis points over the reporting period to end at 336 basis points over Treasuries, taking the yield on the index from 5.87% to 5.19%. Although risk appetite did pick up later in the reporting period, the higher quality areas of the high yield market still significantly outperformed lower quality bonds for the reporting period as a whole.

The most significant driver of the Fund’s outperformance relative to its Bloomberg Barclays U.S. Government/Mortgage Bond benchmark was its sector allocations, particularly in securitized areas. We continued to position the Fund with an underweight to Treasury securities and broad overweights to securitized segments including CMBS, ABS and non-agency MBS. In particular, our focus on below AAA securities across all securitized sectors was a strong driver of positive returns as the lower rated investment grade segments of these markets outperformed the highest rated securities. Investors continued to favor these securities in their ongoing quest for higher quality yield.

6

In addition, security selection within high yield contributed modestly to performance, particularly an overweight to the single B rating category. As noted above, the single B segment of high yield significantly outperformed CCC rated securities during the reporting period. Also, security selection within the financial sector aided performance.

The Fund’s underperformance relative to its blended benchmark was in part due to our use of hedging to buffer future liabilities against higher interest rates because rates rallied into the end of the reporting period, falling across the Treasury yield curve. We had not anticipated three Fed rate cuts and a generally lower interest rate environment as we entered the reporting period.

Likewise, our yield curve positioning also modestly detracted from performance. We structured the Fund’s portfolio with an overweighting in three- and five-year maturities, while underweighting the front and back ends of the Treasury curve. The Fund’s underweight in the 30-year part of the curve hindered results as long rates fell slightly more than they did in the intermediate section, causing prices to increase more.

Given the strong performance in the high yield sector, our small underweight to the segment had a modest negative impact. We had lowered high yield exposure slightly during the reporting period as spreads tightened and valuations appeared rich. Within high yield, the Fund’s underweights to the BB rating category and the utilities sector also hindered performance.

We continued to manage the Fund with many of the same overarching investment themes. We focused on generating income through broad exposure to the securitized and corporate sectors of the bond market, with an emphasis on bottom-up security selection. From a positioning standpoint, we maintained the Fund’s overweights to CMBS, non-agency MBS and ABS. However, given elevated valuations in credit, we rotated out of some of the Fund’s positions in the high yield segment as securities reached spread targets. We reallocated into the CMBS and non-agency ABS sectors. At the end of the reporting period, the Fund was positioned with a small underweight in high yield credit and modest exposure to investment grade credit. We continued to position the Fund with a fairly significant underweight in Treasuries, given our relatively constructive economic view and the unattractive duration and yield profile of the sector.

At the end of the reporting period, the Fund’s duration remained modestly longer than the benchmark as a result of finding better relative value in bonds that have modestly longer durations. In terms of yield curve positioning, we maintained the Fund’s modest overweight to the three-year and five-year segments of the yield curve, while underweighting the shortest and longest ends. That said, our focus continues to be on credit selection and sector positioning as the most significant drivers of the Fund’s performance.

We used U.S. Treasury futures as part of an overall portfolio construction strategy to manage portfolio duration and yield curve exposure. These future positions had a negative impact on performance during the reporting period. The Fund also used interest rate swaps as part of an overall portfolio construction strategy to manage duration and overall portfolio yield curve exposure. The swap positions had a negative impact on performance during the reporting period.

The Fund may also purchase securities on a when-issued or forward commitment basis. Delivery and payment for securities that have been purchased in this manner can take place a month or more after the transaction date. Such securities do not earn interest, are subject to market fluctuation and may increase or decrease in value prior to their delivery. The purchase of securities on a when-issued or forward commitment basis may increase the volatility of the Fund’s net asset value if the Fund makes such purchases while remaining substantially fully invested.

7

Leverage

IMPACT OF THE FUND’S LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the returns of the Fund’s common shares relative to its comparative benchmarks was the Fund’s use of leverage through reverse repurchase agreements and mortgage dollar rolls. The Fund uses leverage because our research has shown that, over time, leveraging provides opportunities for additional income. The opportunity arises when short-term rates that the Fund pays on its leveraging instruments are lower than the interest the Fund earns on its portfolio securities that it has bought with the proceeds of that leverage. This has been particularly true in the recent market environment where short-term rates have been low by historical standards.

However, use of leverage can expose Fund common shares to additional price volatility. When the Fund uses leverage, the Fund’s common shares will experience a greater increase in their net asset value if the securities acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the securities acquired through leverage decline in value, which will make the shares’ net asset value more volatile, and total return performance more variable, over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. In recent quarters, fund leverage expenses have generally tracked the overall movement of short-term tax-exempt interest rates. While fund leverage expenses are somewhat higher than their all-time lows after the 2007-2009 financial crisis, which has contributed to a reduction in common share net income and long-term total return potential, leverage nevertheless continues to provide the opportunity for incremental common share income. Management believes that the potential benefits from leverage continue to outweigh the associated increase in risk and volatility previously described. The Fund’s use of leverage had a positive impact on performance during this reporting period.

As of December 31, 2019, the Fund’s percentages of leverage are shown in the accompanying table.

| JMM | ||||

| Effective Leverage* |

30.58 | % | ||

| Regulatory Leverage* |

0.00 | % | ||

| * | Effective leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of reverse repurchase agreements, certain derivative and other investments in the Fund’s portfolio that increase the Fund’s investment exposure. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. The Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of the Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

THE FUND’S LEVERAGE

Reverse Repurchase Agreements

As noted above, the Fund utilized reverse repurchase agreements in which, the Fund sells to a counterparty a security that it holds with a contemporaneous agreement to repurchase the same security at an agreed-upon price and date. The Fund’s transactions in reverse repurchase agreements are as shown in the accompanying table.

| Current Reporting Period | Subsequent to the Close of the Reporting Period |

|||||||||||||||||||||||||||||||||

| January 1, 2019 |

Sales |

Purchases |

December 31, 2019 | Average Balance Outstanding |

Sales |

Purchases |

February 27, 2020 | |||||||||||||||||||||||||||

| $21,393,000 | $95,680,000 | $(107,657,768) | $33,370,768 | $26,007,662 | $66,971,000 | $(100,341,768) | $— | |||||||||||||||||||||||||||

Refer to Notes to Financial Statements, Note 8 – Fund Leverage for further details.

8

Information

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Fund’s distributions is current as of December 31, 2019. The Fund’s distribution levels may vary over time based on the Fund’s investment activity and portfolio investment value changes.

During the current reporting period, the Fund’s distributions to common shareholders were as shown in the accompanying table.

| Monthly Distributions (Ex-Dividend Date) | Per Common Share Amounts |

|||

| July 2019 |

$ | 0.0300 | ||

| August |

0.0300 | |||

| September |

0.0300 | |||

| October |

0.0300 | |||

| November |

0.0300 | |||

| December 2019 |

$ | 0.0300 | ||

| Total Distributions from Net Investment Income |

$ | 0.1800 | ||

| Current Distribution Rate* |

4.86 | % |

| * | Current distribution rate is based on the Fund’s current annualized monthly distribution divided by the Fund’s current market price. The Fund’s monthly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the fiscal year the Fund’s cumulative net ordinary income and net realized gains are less than the amount of the Fund’s distributions, a return of capital for tax purposes. |

The Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit the Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to Note 6 – Income Tax Information for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

All monthly dividends paid by the Fund during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced from or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, per share amounts of the Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for the Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

9

Common Share Information (continued)

CHANGE IN METHOD OF PUBLISHING NUVEEN CLOSED-END FUND DISTRIBUTION AMOUNTS

During November 2019, the Nuveen Closed-End Funds discontinued the practice of announcing Fund distribution amounts and timing via press release. Instead, information about the Nuveen Closed-End Funds’ monthly and quarterly periodic distributions to shareholders are posted and can be found on Nuveen’s enhanced closed-end fund resource page, which is at www.nuveen.com/closed-end-fund-distributions, along with other Nuveen closed-end fund product updates. Shareholders can expect regular distribution information to be posted on www.nuveen.com on the first business day of each month. To ensure that our shareholders have timely access to the latest information, a subscribe function can be activated at this link here, or at this web page (www.nuveen.com/en-us/people/about-nuveen/for-the-media).

COMMON SHARE REPURCHASES

During August 2019, the Fund’s Board of Trustees reauthorized an open-market common share repurchase program, allowing the Fund to repurchase an aggregate of up to approximately 10% of its outstanding common shares.

As of December 31, 2019, and since the inception of the Fund’s repurchase program, the Fund has cumulatively repurchased and retired its outstanding common shares as shown in the accompanying table.

| JMM | ||||

| Common shares cummulatively repurchased and retired |

1,800 | |||

| Common shares authorized for repurchase |

945,000 | |||

During the current reporting period, the Fund did not repurchase any of its outstanding common shares.

OTHER SHARE INFORMATION

As of December 31, 2019, and during the current reporting period, the Fund’s common share price was trading at premium/(discount) to its NAV as shown in the accompanying table.

| Common share NAV |

$ | 8.01 | ||

| Common share price |

$ | 7.40 | ||

| Premium/(Discount) to NAV |

(7.62 | )% | ||

| 6-month average premium/(discount) to NAV |

(8.46 | )% |

10

Investment Policy Updates

Risk Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen Multi-Market Income Fund (JMM)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Investing in mortgage-backed securities entails credit risk, the risk that the servicer fails to perform its duties, liquidity risks, interest rate risks, structure risks, pre-payment risk, and geographical concentration risks. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. These and other risk considerations including hedging risk are described in more detail on the Fund’s web page at www.nuveen.com/JMM.

Investment Policy Updates

Change in Investment Policy

The Fund has recently adopted the following policy regarding limits to investments in illiquid securities:

While there are no such limits imposed by applicable regulations, certain Nuveen Closed-End Funds formerly had investment policies that placed limits on the Fund’s ability to invest in illiquid securities. All exchange-listed Nuveen Closed-End Funds now have no formal limit on their ability to invest in such illiquid securities, but the Fund’s portfolio management team will monitor such investments in the regular, overall management of the Fund’s portfolio securities.

11

| JMM | Nuveen Multi-Market Income Fund Performance Overview and Holding Summaries as of December 31, 2019 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of December 31, 2019

| Cumulative | Average Annual | |||||||||||||||

| 6-Month | 1-Year | 5-Year | 10-Year | |||||||||||||

| JMM at Common Share NAV | 2.27% | 7.70% | 3.98% | 6.54% | ||||||||||||

| JMM at Common Share Price | 3.45% | 13.53% | 5.09% | 6.66% | ||||||||||||

| Bloomberg Barclays U.S. Government/Mortgage Bond Index | 1.79% | 6.63% | 2.45% | 3.07% | ||||||||||||

| Blended Benchmark | 2.35% | 8.53% | 3.38% | 4.20% | ||||||||||||

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

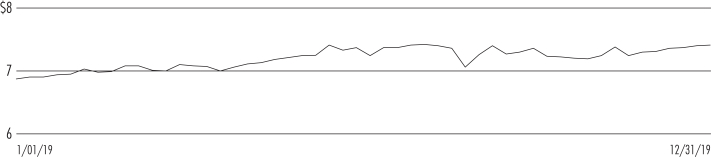

Common Share Price Performance — Weekly Closing Price

12

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

13

| JMM | Nuveen Multi-Market Income Fund

| |

| (Unaudited) |

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| LONG-TERM INVESTMENTS – 141.7% (99.7% of Total Investments) |

||||||||||||||||||||

| ASSET-BACKED AND MORTGAGE-BACKED SECURITIES – 115.3% (81.1% of Total Investments) |

| |||||||||||||||||||

| $ | 924 | 321 Henderson Receivables LLC, Series 2012-1A, 144A |

7.140% | 2/15/67 | A2 | $ | 1,113,585 | |||||||||||||

| 500 | 321 Henderson Receivables LLC, Series 2016-1A, 144A |

5.190% | 6/17/69 | Baa2 | 515,745 | |||||||||||||||

| 383 | 321 Henderson Receivables Trust Series 2012-2A, 144A |

6.770% | 10/17/61 | A2 | 457,054 | |||||||||||||||

| 244 | 321 Henderson Receivables VI LLC, Series 2010-1A, 144A |

9.310% | 7/15/61 | Aaa | 294,724 | |||||||||||||||

| 250 | ACE Securities Corp Manufactured Housing Trust, Series 2003-MH1, 144A |

6.500% | 8/15/30 | AA | 270,636 | |||||||||||||||

| 500 | Adams Outdoor Advertising LP, Series 2018-1 B, 144A |

5.653% | 11/15/48 | BBB | 516,389 | |||||||||||||||

| 1,675 | American Homes 4 Rent, Series 2015-SFR2, 144A |

0.000% | 10/17/52 | N/R | 17 | |||||||||||||||

| 175 | AMSR 2019-SFR1 Trust, Series 2019-SFR1 D, 144A |

3.247% | 1/19/39 | Baa2 | 171,752 | |||||||||||||||

| 520 | Applebee’s Funding LLC / IHOP Funding LLC, Series 2019-1A, 144A |

4.723% | 6/07/49 | BBB | 533,255 | |||||||||||||||

| 300 | Barclays Commercial Mortgage, Mortgage Pass-Through Certificates, Series 2015-SRCH, 144A |

4.957% | 8/10/35 | BBB– | 324,362 | |||||||||||||||

| 500 | Barclays Commercial Mortgage, Mortgage Pass-Through Certificates, Series 2015-STP, 144A |

4.284% | 9/10/28 | BBB– | 501,962 | |||||||||||||||

| 51 | Bayview Financial Acquisition Trust Series 2006C |

5.852% | 11/28/36 | Caa3 | 50,382 | |||||||||||||||

| 41 | Bayview Financial Acquisition Trust, Series 2006-C |

5.638% | 11/28/36 | A+ | 40,902 | |||||||||||||||

| 20 | Bayview Financial Acquisition Trust, Series 2006-D |

5.932% | 12/28/36 | Aaa | 21,250 | |||||||||||||||

| 11 | Bayview Financial Acquisition Trust, Series 2007-A |

6.205% | 5/28/37 | AA+ | 10,474 | |||||||||||||||

| 372 | Bayview Financial Mortgage Pass-Through Trust, Mortgage Pass-Through Certificate Series 2005-D |

5.500% | 12/28/35 | AA | 372,577 | |||||||||||||||

| 440 | BX Commercial Mortgage Trust 2019-XL, 144A, (1-Month LIBOR reference rate + 1.800% spread), (3) |

3.540% | 10/15/36 | N/R | 440,414 | |||||||||||||||

| 109 | Chase Funding Mortgage Loan Asset-Backed Certificates, Series 2003-3 |

5.160% | 3/25/33 | Ba1 | 110,353 | |||||||||||||||

| 500 | CHL GMSR Issuer Trust, Series 2018, 144A, (1-Month LIBOR reference rate + 2.750% spread), (3) |

4.411% | 5/25/23 | N/R | 501,440 | |||||||||||||||

| 425 | Citigroup Commercial Mortgage Trust 2015-GC29 |

4.136% | 4/10/48 | A– | 442,233 | |||||||||||||||

| 600 | Citigroup Commercial Mortgage Trust 2016-P5, 144A |

3.000% | 10/10/49 | BBB– | 531,400 | |||||||||||||||

| 450 | Citigroup Commercial Mortgage Trust 2018-TBR, 144A, (1-Month LIBOR reference rate + 1.800% spread), (3) |

3.540% | 12/15/36 | BBB– | 448,753 | |||||||||||||||

| 500 | Citigroup Commercial Mortgage Trust 2019-PRM, 144A |

4.350% | 5/10/36 | Baa3 | 519,437 | |||||||||||||||

| 775 | Commercial Mortgage Pass-Through Certificates 2015-CR22 |

4.125% | 3/10/48 | A– | 809,293 | |||||||||||||||

| 511 | Commercial Mortgage Pass-Through Certificates, Series 2015-CR26 |

4.484% | 10/10/48 | A– | 539,818 | |||||||||||||||

| 204 | Common bond Student Loan Trust, Series 2017-BGC, 144A |

4.440% | 9/25/42 | Aa3 | 202,367 | |||||||||||||||

| 500 | Connecticut Avenue Securities Trust 2019-R03, 144A, (1-Month LIBOR reference rate + 2.150% spread), (3) |

3.942% | 9/25/31 | Aaa | 503,764 | |||||||||||||||

| 1,000 | Connecticut Avenue Securities Trust 2019-R05, 144A, (1-Month LIBOR reference rate + 2.000% spread), (3) |

3.792% | 7/25/39 | B+ | 1,005,047 | |||||||||||||||

| 103 | Countrywide Alternative Loan Trust, Mortgage Pass Through Certificates, Series 2003-J3 |

5.250% | 11/25/33 | Aaa | 104,804 | |||||||||||||||

| 117 | Countrywide Alternative Loan Trust, Mortgage Pass Through Certificates, Series 2004-J2 |

6.500% | 3/25/34 | AA+ | 119,160 | |||||||||||||||

| 169 | Countrywide Asset-Backed Certificates Trust, Series 2004-13 |

5.103% | 5/25/35 | Aaa | 170,410 | |||||||||||||||

| 250 | CPT Mortgage Trust 2019, 144A |

2.997% | 11/13/39 | N/R | 232,772 | |||||||||||||||

| 146 | Credit Suisse CSMC Mortgage-Backed Trust, Pass-Through Certificates, Series 2006-7 |

6.000% | 8/25/36 | Caa3 | 108,888 | |||||||||||||||

| 434 | Credit Suisse First Boston Mortgage Securities Corporation, Mortgage-Backed Pass-Through Certificates, Series 2003-8 |

6.171% | 4/25/33 | AAA | 438,026 | |||||||||||||||

| 86 | Credit Suisse First Boston Mortgage Securities Corporation, Mortgage-Backed Pass-Through Certificates, Series 2005-11 6A7 |

6.000% | 12/25/35 | D | 6,362 | |||||||||||||||

| 333 | Credit-Based Asset Servicing and Securitization Pool 2007-SP1, 144A |

5.381% | 12/25/37 | AA | 336,735 | |||||||||||||||

| 250 | CSMC 2014-USA OA LLC 2014 E, 144A |

4.373% | 9/15/37 | BB– | 234,977 | |||||||||||||||

| 1,176 | DB Master Finance LLC 2017 1-A, 144A |

4.030% | 11/20/47 | BBB | 1,203,377 | |||||||||||||||

| 1,161 | Dominos Pizza Master Issuer LLC, Series 2015-1A, 144A |

4.474% | 10/25/45 | BBB+ | 1,217,576 | |||||||||||||||

| 123 | Domino’s Pizza Master Issuer LLC, Series DPABS 2017-1A A2II, 144A |

3.082% | 7/25/47 | BBB+ | 122,598 | |||||||||||||||

| 611 | Driven Brands Funding LLC, HONK-2018-1A, 144A |

4.739% | 4/20/48 | BBB– | 633,149 | |||||||||||||||

| 1,464 | Driven Brands Funding LLC, HONK-2019-1A, 144A |

4.641% | 4/20/49 | BBB– | 1,513,580 | |||||||||||||||

| 15 | Fannie Mae Mortgage Pool FN 596680, (4) |

7.000% | 9/01/31 | N/R | 16,475 | |||||||||||||||

| 15 | Fannie Mae Mortgage Pool FN 709700, (4) |

5.500% | 6/01/33 | N/R | 16,334 | |||||||||||||||

14

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| ASSET-BACKED AND MORTGAGE-BACKED SECURITIES (continued) |

|

|||||||||||||||||||

| $ | 5 | Fannie Mae Mortgage Pool FN 745279, (4) |

5.000% | 2/01/21 | N/R | $ | 4,679 | |||||||||||||

| 84 | Fannie Mae Mortgage Pool FN 745324, (4) |

6.000% | 3/01/34 | Aaa | 92,077 | |||||||||||||||

| 44 | Fannie Mae Mortgage Pool FN 763687, (4) |

6.000% | 1/01/34 | N/R | 48,442 | |||||||||||||||

| 70 | Fannie Mae Mortgage Pool FN 766070, (4) |

5.500% | 2/01/34 | N/R | 77,858 | |||||||||||||||

| 31 | Fannie Mae Mortgage Pool FN 828346, (4) |

5.000% | 7/01/35 | N/R | 34,176 | |||||||||||||||

| 15 | Fannie Mae Mortgage Pool FN 878059, (4) |

5.500% | 3/01/36 | N/R | 17,113 | |||||||||||||||

| 13 | Fannie Mae Mortgage Pool FN 882685, (4) |

6.000% | 6/01/36 | N/R | 14,334 | |||||||||||||||

| 53 | Fannie Mae Mortgage Pool FN 995018, (4) |

5.500% | 6/01/38 | N/R | 59,284 | |||||||||||||||

| 1,147 | Fannie Mae Mortgage Pool FN AW4182, (4) |

3.500% | 2/01/44 | N/R | 1,203,402 | |||||||||||||||

| 121 | Fannie Mae Mortgage Pool FN BH4019, (4) |

4.000% | 9/01/47 | N/R | 126,683 | |||||||||||||||

| 1,099 | Fannie Mae Mortgage Pool FN BM5024, (4) |

3.000% | 11/01/48 | Aaa | 1,119,311 | |||||||||||||||

| 441 | Fannie Mae Mortgage Pool FN BM5839, (4) |

3.500% | 11/01/47 | Aaa | 467,596 | |||||||||||||||

| 541 | Fannie Mae Mortgage Pool FN BM6038, (4) |

4.000% | 1/01/45 | Aaa | 575,576 | |||||||||||||||

| 2,543 | Fannie Mae Mortgage Pool FN MA3305, (4) |

3.500% | 3/01/48 | N/R | 2,639,942 | |||||||||||||||

| 778 | Fannie Mae Mortgage Pool FN MA3333, (4) |

4.000% | 4/01/48 | Aaa | 815,715 | |||||||||||||||

| 2,116 | Fannie Mae Mortgage Pool FN MA3444, (4) |

4.500% | 8/01/48 | Aaa | 2,233,097 | |||||||||||||||

| 1,496 | Fannie Mae Mortgage Pool FN MA3871, (4) |

3.000% | 12/01/49 | N/R | 1,516,571 | |||||||||||||||

| 6,177 | Fannie Mae Mortgage Pool FN MA3872, (4) |

3.500% | 12/01/49 | N/R | 6,362,112 | |||||||||||||||

| 3,487 | Fannie Mae Mortgage Pool FN MA3873, (4) |

4.000% | 12/01/49 | N/R | 3,634,027 | |||||||||||||||

| 82 | Fannie Mae REMIC, Series 2002-W1 |

5.638% | 2/25/42 | Aaa | 88,722 | |||||||||||||||

| 412 | Fannie Mae REMIC, Series 2003-W1 |

3.384% | 12/25/42 | AAA | 145,022 | |||||||||||||||

| 266 | Fannie Mae REMIC, Series 2018-81 |

3.000% | 11/25/48 | Aaa | 37,202 | |||||||||||||||

| 500 | Finance of America Structured Securities Trust 2018-HB1, 144A |

4.392% | 9/25/28 | A2 | 500,133 | |||||||||||||||

| 1,272 | Focus Brands Funding LLC, Series 2017-1A, 144A |

5.093% | 4/30/47 | BBB | 1,336,948 | |||||||||||||||

| 300 | Four Seas LP, Series 2017-1A, 144A |

4.950% | 8/28/27 | N/R | 299,233 | |||||||||||||||

| 18 | Freddie Mac Gold Pool C00676, (4) |

6.500% | 11/01/28 | N/R | 20,022 | |||||||||||||||

| 2,567 | Freddie Mac Gold Pool G08528, (4) |

3.000% | 4/01/43 | Aaa | 2,644,066 | |||||||||||||||

| 1,026 | Freddie Mac Gold Pool G08566, (4) |

3.500% | 1/01/44 | N/R | 1,078,254 | |||||||||||||||

| 980 | Freddie Mac Gold Pool G08572, (4) |

3.500% | 2/01/44 | Aaa | 1,029,744 | |||||||||||||||

| 2,148 | Freddie Mac Gold Pool G08747, (4) |

3.000% | 2/01/47 | Aaa | 2,199,709 | |||||||||||||||

| 1,319 | Freddie Mac Gold Pool G18497, (4) |

3.000% | 1/01/29 | N/R | 1,358,631 | |||||||||||||||

| 1,449 | Freddie Mac Gold Pool G60138, (4) |

3.500% | 8/01/45 | Aaa | 1,545,534 | |||||||||||||||

| 1,617 | Freddie Mac Gold Pool Q40718, (4) |

3.500% | 5/01/46 | N/R | 1,683,325 | |||||||||||||||

| 2,321 | Freddie Mac Gold Pool Q40841, (4) |

3.000% | 6/01/46 | N/R | 2,377,033 | |||||||||||||||

| 500 | Freddie Mac MultiFamily Mortgage Trust, Structured Pass Through Certificates, Series 2017-K724, 144A |

3.485% | 11/25/23 | BBB– | 505,133 | |||||||||||||||

| 1,000 | Freddie Mac Structured Agency Credit Risk Debt Notes, Series STARC 2019-HQA1, 144A, (1-Month LIBOR reference rate + 2.350% spread), (3) |

4.142% | 2/25/49 | B+ | 1,010,252 | |||||||||||||||

| 500 | GMAT Trust Mortgage Pool 2013-1A, 144A |

5.000% | 11/25/43 | N/R | 292,794 | |||||||||||||||

| 78 | Goldman Sachs Mortgage Securities Corporation, GSMPS Mortgage Pass Through Certificates, Series 2001-2, 144A |

7.500% | 6/19/32 | D | 76,713 | |||||||||||||||

| 456 | Goldman Sachs Mortgage Securities Corporation, GSMPS Mortgage Pass Through Certificates, Series 2003-3, 144A |

7.000% | 6/25/43 | BBB | 510,931 | |||||||||||||||

| 35 | Goldman Sachs Mortgage Securities Corporation, Mortgage Pass-Through Certificates, Series 2003-10 1A1 |

4.651% | 10/25/33 | A | 35,956 | |||||||||||||||

| 403 | Goldman Sachs Mortgage Securities Corporation, Mortgage Pass-Through Certificates, Series 2005-RP1, 144A |

8.500% | 1/25/35 | B2 | 458,462 | |||||||||||||||

| 563 | Goldman Sachs Mortgage Securities Corporation, Mortgage Pass-Through Certificates, Series 2005-RP2 1A2, 144A |

7.500% | 3/25/35 | AAA | 611,972 | |||||||||||||||

| 556 | Goldman Sachs Mortgage Securities Corporation, Mortgage Pass-Through Certificates, Series 2005-RP3 1A2, 144A |

7.500% | 9/25/35 | AAA | 585,540 | |||||||||||||||

| 355 | Goldman Sachs Mortgage Securities Corporation, Mortgage Pass-Through Certificates, Series 2005-RP3 1A3, 144A |

8.000% | 9/25/35 | B3 | 385,612 | |||||||||||||||

| 500 | Goldman Sachs Mortgage Securities Trust, Mortgage Pass Through Certificates, Series 2013-GC16, 144A |

5.311% | 11/10/46 | Baa2 | 536,819 | |||||||||||||||

| 550 | Goldman Sachs Mortgage Securities Trust, Mortgage Pass Through Certificates, Series 2015-GC30 |

4.052% | 5/10/50 | N/R | 567,362 | |||||||||||||||

| 500 | Goldman Sachs Mortgage Securities Trust, Mortgage Pass Through Certificates, Series 2015-GC32 |

3.345% | 7/10/48 | BBB– | 471,684 | |||||||||||||||

| 175 | Government National Mortgage Association Pool 604567, (4) |

5.500% | 8/15/33 | N/R | 196,537 | |||||||||||||||

| 92 | Government National Mortgage Association Pool 631574, (4) |

6.000% | 7/15/34 | N/R | 104,205 | |||||||||||||||

| 250 | Horizon Aircraft Finance III Ltd, Series 2019-2B, 144A |

4.458% | 11/15/39 | BBB | 248,565 | |||||||||||||||

| 245 | Impac Secured Assets Corporation, Mortgage Pass-Through Certificates, Series 2000-3 |

8.000% | 10/25/30 | CCC | 247,150 | |||||||||||||||

15

| JMM | Nuveen Multi-Market Income Fund (continued) | |

| Portfolio of Investments December 31, 2019 | ||

| (Unaudited) | ||

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| ASSET-BACKED AND MORTGAGE-BACKED SECURITIES (continued) |

|

|||||||||||||||||||

| $ | 500 | JPMDB Commercial Mortgage Securities Trust, Series 2017-C7, 144A |

3.000% | 10/15/50 | BBB– | $ | 443,493 | |||||||||||||

| 275 | JPMorgan Alternative Loan Trust 2006-S1, Mortgage Pass-Through Certificates |

6.500% | 3/25/36 | D | 225,560 | |||||||||||||||

| 500 | JPMorgan Chase Commercial Mortgage Securities Corporation, Series 2016-JP4, 144A |

3.439% | 12/15/49 | BBB– | 453,805 | |||||||||||||||

| 500 | JPMorgan Chase Commercial Mortgage Securities Trust 2018-BCON, 144A |

3.756% | 1/05/31 | BBB– | 508,248 | |||||||||||||||

| 315 | Master Performing Loan Trust 2005-1, 144A |

7.500% | 8/25/34 | D | 319,718 | |||||||||||||||

| 824 | Mid-State Capital Corporation Trust Notes, Series 2004-1 A |

6.005% | 8/15/37 | AA+ | 878,537 | |||||||||||||||

| 723 | Mid-State Capital Corporation Trust Notes, Series 2005-1 |

5.745% | 1/15/40 | AA | 776,819 | |||||||||||||||

| 56 | Mid-State Trust 2004-A |

8.900% | 8/15/37 | A1 | 62,815 | |||||||||||||||

| 408 | Mid-State Trust 2010-1, 144A |

5.250% | 12/15/45 | AA | 423,817 | |||||||||||||||

| 350 | Mid-State Trust 2010-1, 144A |

7.000% | 12/15/45 | A | 368,816 | |||||||||||||||

| 233 | Mid-State Trust XI |

5.598% | 7/15/38 | BBB | 248,056 | |||||||||||||||

| 500 | Morgan Stanley Bank of America Merrill Lynch Trust, Series 2016-C28 |

4.628% | 1/15/49 | A3 | 525,350 | |||||||||||||||

| 80 | Morgan Stanley Mortgage Loan Trust, Pass Through Certificates, 2006-2 |

5.750% | 2/25/36 | N/R | 81,887 | |||||||||||||||

| 267 | Mortgage Asset Securitization Transaction inc., Alternative Loan Trust Mortgage Pass-Through Certificates Series 2004-1 |

7.000% | 1/25/34 | Aaa | 276,896 | |||||||||||||||

| 258 | Mortgage Asset Securitization Transaction inc., Alternative Loan Trust Mortgage Pass-Through Certificates, 2004-5 6A1 |

7.000% | 6/25/34 | AA+ | 267,419 | |||||||||||||||

| 215 | Mortgage Asset Securitization Transactions inc., Mortgage Pass Through Certificates, Series 2003-11 |

5.250% | 12/25/33 | A | 217,348 | |||||||||||||||

| 500 | MSCG Trust 2015-ALDR, 144A |

3.462% | 6/07/35 | BBB– | 473,303 | |||||||||||||||

| 1,000 | Natixis Commercial Mortgage Securities Trust 2019-MILE, 144A, (1-Month LIBOR reference rate + 2.750% spread), (3) |

4.490% | 7/15/36 | N/R | 999,998 | |||||||||||||||

| 330 | New Residential Mortgage LLC, Series 2018-FNT1, 144A |

4.690% | 5/25/23 | N/R | 331,719 | |||||||||||||||

| 342 | New Residential Mortgage LLC, Series 2018-FNT2, 144A |

4.920% | 7/25/54 | N/R | 344,896 | |||||||||||||||

| 466 | New Residential Mortgage Loan Trust, Series 2014-1A, 144A |

6.065% | 1/25/54 | BBB | 496,504 | |||||||||||||||

| 767 | New Residential Mortgage Loan Trust, Series 2015-2A, 144A |

5.526% | 8/25/55 | Baa3 | 811,383 | |||||||||||||||

| 298 | NRZ Excess Spread-Collateralized Notes Series 2018-PLS1, 144A |

4.374% | 1/25/23 | N/R | 299,718 | |||||||||||||||

| 311 | NRZ Excess Spread-Collateralized Notes Series 2018-PLS2, 144A |

4.593% | 2/25/23 | N/R | 313,247 | |||||||||||||||

| 494 | Planet Fitness Master Issuer LLC, Series PLNT 2018-1A, 144A |

4.666% | 9/05/48 | BBB | 513,648 | |||||||||||||||

| 500 | PNMAC FMSR ISSUER TRUST 2018-FT1, 144A, (1-Month LIBOR reference rate + 2.350% spread), (3) |

4.011% | 4/25/23 | N/R | 500,529 | |||||||||||||||

| 500 | PNMAC GMSR ISSUER TRUST 2018-GT1, 144A, (1-Month LIBOR reference rate + 2.850% spread), (3) |

4.642% | 2/25/23 | N/R | 502,950 | |||||||||||||||

| 500 | PNMAC GMSR ISSUER TRUST 2018-GT2, 144A, (1-Month LIBOR reference rate + 2.650% spread), (3) |

4.311% | 8/25/25 | N/R | 501,697 | |||||||||||||||

| 500 | Progress Residential Trust, Series 2017- SFR2, 144A |

3.595% | 12/17/34 | Baa2 | 500,295 | |||||||||||||||

| 372 | RALI Trust, Series RALI 2005-QS12 |

5.500% | 8/25/35 | Caa2 | 360,108 | |||||||||||||||

| 485 | RBS Commercial Funding inc. 2013-SMV Trust, 144A |

3.584% | 3/11/31 | A+ | 480,488 | |||||||||||||||

| 378 | Residential Asset Securities Corporation , Home Equity Mortgage Asset Backed Pass Through Certificates, Series 2004-KS1 |

5.721% | 2/25/34 | AA+ | 383,229 | |||||||||||||||

| 500 | RMF Buyout Issuance Trust 2018-1, 144A |

4.448% | 11/25/28 | Baa1 | 499,727 | |||||||||||||||

| 117 | Salomon Brothers Commercial Mortgage Trust Pass-Through VII Certificates, Series 2003-1 A2, 144A |

6.000% | 9/25/33 | BB | 117,416 | |||||||||||||||

| 279 | Sesac Finance LLC, Series 2019-1, 144A |

5.216% | 7/25/49 | N/R | 288,349 | |||||||||||||||

| 559 | Sierra Timeshare 2019-3 Receivables Funding LLC, Series 201-3A, 144A |

4.180% | 8/20/36 | BB | 556,845 | |||||||||||||||

| 571 | Sonic Capital LLC, Series 2013-1A, 144A |

3.750% | 7/20/43 | BBB | 570,037 | |||||||||||||||

| 495 | Sonic Capital LLC, Series 2018-1A, 144A |

4.026% | 2/20/48 | BBB | 505,682 | |||||||||||||||

| 750 | STACR Trust 2018-HRP2, 144A, (1-Month LIBOR reference rate + 2.400% spread), (3) |

4.192% | 2/25/47 | BBB– | 767,844 | |||||||||||||||

| 374 | STARR Trust, Series 2018-1, 144A |

4.089% | 5/15/43 | A | 381,304 | |||||||||||||||

| 473 | START Ireland Trust 2019-I, 144A |

5.095% | 3/15/44 | BBB | 483,909 | |||||||||||||||

| 230 | Structured Receivables Finance 2010-A LLC, 144A |

5.218% | 1/16/46 | AAA | 239,189 | |||||||||||||||

| 609 | Taco Bell Funding LLC, Series 2016-1A A23, 144A |

4.970% | 5/25/46 | BBB | 650,685 | |||||||||||||||

| 488 | Taco Bell Funding LLC, Series 2016-1A A2II, 144A |

4.377% | 5/25/46 | BBB | 490,717 | |||||||||||||||

| 350 | Thunderbolt Aircraft Lease Ltd, Series 2017A, 144A |

4.212% | 5/17/32 | A | 357,433 | |||||||||||||||

| 100 | Tricon American Homes 2016-SFR1 Trust, 144A |

4.878% | 11/17/33 | N/R | 101,554 | |||||||||||||||

| 450 | UBS-Barclays Commercial Mortgage Trust 2013-C5, 144A |

4.082% | 3/10/46 | A3 | 457,366 | |||||||||||||||

| 500 | Vericrest Opportunity Loan Trust 2019-NPL2, 144A |

6.292% | 2/25/49 | N/R | 502,726 | |||||||||||||||

| 150 | Vericrest Opportunity Loan Trust 2019-NPL7, 144A |

3.967% | 10/25/49 | N/R | 149,304 | |||||||||||||||

| 500 | Verus Securitization Trust 2017-1, 144A |

5.273% | 1/25/47 | A | 502,762 | |||||||||||||||

16

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| ASSET-BACKED AND MORTGAGE-BACKED SECURITIES (continued) |

|

|||||||||||||||||||

| $ | 1,000 | VOLT LXXXIV LLC Trust 2019-NP10, 144A |

3.967% | 12/27/49 | N/R | $ | 998,632 | |||||||||||||

| 311 | Washington Mutual MSC Mortgage Pass-Through Certificates Series 2003-MS4 Trust |

5.500% | 2/25/33 | N/R | 315,296 | |||||||||||||||

| 19 | Washington Mutual MSC Mortgage Pass-Through Certificates Series 2004-RA3 Trust |

6.128% | 8/25/38 | Aaa | 19,889 | |||||||||||||||

| 980 | Wendy’s Funding LLC, Series 2018-1A, 144A |

3.573% | 3/15/48 | BBB | 990,241 | |||||||||||||||

| 498 | Wendy’s Funding LLC, Series 2019-1A, 144A |

3.783% | 6/15/49 | BBB | 507,415 | |||||||||||||||

| 250 | WF-RBS Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates, Series 2011-C2, 144A |

5.392% | 2/15/44 | Aa2 | 255,460 | |||||||||||||||

| 750 | WF-RBS Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates, Series 2011-C3, 144A |

5.335% | 3/15/44 | A1 | 770,036 | |||||||||||||||

| $ | 87,279 | Total Asset-Backed and Mortgage-Backed Securities (cost $85,847,065) |

|

87,327,982 | ||||||||||||||||

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| CORPORATE BONDS – 23.0% (16.2% of Total Investments) |

||||||||||||||||||||

| Aerospace & Defense – 0.4% | ||||||||||||||||||||

| $ | 125 | Bombardier Inc, 144A |

7.875% | 4/15/27 | B | $ | 128,594 | |||||||||||||

| 150 | Triumph Group Inc |

5.250% | 6/01/22 | CCC | 149,250 | |||||||||||||||

| 275 | Total Aerospace & Defense |

277,844 | ||||||||||||||||||

| Auto Components – 0.3% | ||||||||||||||||||||

| 200 | Panther BF Aggregator 2 LP / Panther Finance Co Inc, 144A |

8.500% | 5/15/27 | B | 212,500 | |||||||||||||||

| Automobiles – 0.2% | ||||||||||||||||||||

| 100 | Ford Motor Co, (4) |

7.450% | 7/16/31 | BBB | 118,627 | |||||||||||||||

| Building Products – 0.3% | ||||||||||||||||||||

| 200 | American Woodmark Corp, 144A |

4.875% | 3/15/26 | BB | 205,000 | |||||||||||||||

| Capital Markets – 0.7% | ||||||||||||||||||||

| 200 | Donnelley Financial Solutions Inc |

8.250% | 10/15/24 | B | 204,500 | |||||||||||||||

| 225 | Jefferies Finance LLC / JFIN Co-Issuer Corp, 144A |

7.250% | 8/15/24 | BB– | 231,750 | |||||||||||||||

| 100 | LPL Holdings Inc, 144A |

4.625% | 11/15/27 | BB | 102,000 | |||||||||||||||

| 525 | Total Capital Markets |

538,250 | ||||||||||||||||||

| Chemicals – 1.9% | ||||||||||||||||||||

| 250 | Calumet Specialty Products Partners LP / Calumet Finance Corp, 144A |

11.000% | 4/15/25 | B– | 271,875 | |||||||||||||||

| 200 | CF Industries Inc |

3.450% | 6/01/23 | BB+ | 205,816 | |||||||||||||||

| 250 | Chemours Co |

5.375% | 5/15/27 | Ba3 | 221,250 | |||||||||||||||

| 375 | NOVA Chemicals Corp, 144A |

5.000% | 5/01/25 | BB+ | 382,500 | |||||||||||||||

| 250 | OCI NV, 144A |

6.625% | 4/15/23 | BB | 260,625 | |||||||||||||||

| 100 | Univar Solutions USA Inc, 144A |

5.125% | 12/01/27 | BB | 104,378 | |||||||||||||||

| 1,425 | Total Chemicals |

1,446,444 | ||||||||||||||||||

| Commercial Services & Supplies – 1.5% | ||||||||||||||||||||

| 100 | APX Group Inc |

8.750% | 12/01/20 | CCC | 100,000 | |||||||||||||||

| 225 | Covanta Holding Corp |

5.875% | 7/01/25 | B1 | 237,375 | |||||||||||||||

| 250 | GFL Environmental Inc, 144A |

7.000% | 6/01/26 | CCC+ | 264,100 | |||||||||||||||

| 200 | Prime Security Services Borrower LLC / Prime Finance Inc, 144A |

5.750% | 4/15/26 | BB– | 217,376 | |||||||||||||||

| 78 | RR Donnelley & Sons Co |

7.875% | 3/15/21 | B– | 80,730 | |||||||||||||||

| 250 | Waste Pro USA Inc, 144A |

5.500% | 2/15/26 | B+ | 260,625 | |||||||||||||||

| 1,103 | Total Commercial Services & Supplies |

1,160,206 | ||||||||||||||||||

| Communications Equipment – 0.1% | ||||||||||||||||||||

| 100 | CommScope Inc, 144A |

8.250% | 3/01/27 | B– | 105,250 | |||||||||||||||

| Consumer Finance – 0.2% | ||||||||||||||||||||

| 200 | Curo Group Holdings Corp, 144A |

8.250% | 9/01/25 | B– | 175,996 | |||||||||||||||

17

| JMM | Nuveen Multi-Market Income Fund (continued) | |

| Portfolio of Investments December 31, 2019 | ||

| (Unaudited) | ||

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| Diversified Financial Services – 0.3% | ||||||||||||||||||||

| $ | 225 | Quicken Loans Inc, 144A |

5.250% | 1/15/28 | Ba1 | $ | 232,875 | |||||||||||||

| Diversified Telecommunication Services – 1.7% | ||||||||||||||||||||

| 500 | Qwest Corp |

6.750% | 12/01/21 | BBB– | 537,942 | |||||||||||||||

| 200 | Sprint Capital Corp |

6.875% | 11/15/28 | B+ | 215,500 | |||||||||||||||

| 200 | Telenet Finance Luxembourg Notes Sarl, 144A |

5.500% | 3/01/28 | BB+ | 213,457 | |||||||||||||||

| 300 | Zayo Group LLC / Zayo Capital Inc, 144A |

5.750% | 1/15/27 | B | 304,875 | |||||||||||||||

| 1,200 | Total Diversified Telecommunication Services |

1,271,774 | ||||||||||||||||||

| Electric Utilities – 0.2% | ||||||||||||||||||||

| 200 | Talen Energy Supply LLC |

6.500% | 6/01/25 | B3 | 170,686 | |||||||||||||||

| Energy Equipment & Services – 1.1% | ||||||||||||||||||||

| 250 | Archrock Partners LP / Archrock Partners Finance Corp, 144A |

6.875% | 4/01/27 | B+ | 264,374 | |||||||||||||||

| 250 | Ensign Drilling Inc, 144A |

9.250% | 4/15/24 | BB– | 235,938 | |||||||||||||||

| 200 | Transocean Inc, 144A |

9.000% | 7/15/23 | B– | 211,250 | |||||||||||||||

| 250 | Valaris plc |

7.750% | 2/01/26 | B– | 141,238 | |||||||||||||||

| 950 | Total Energy Equipment & Services |

852,800 | ||||||||||||||||||

| Equity Real Estate Investment Trust – 0.3% | ||||||||||||||||||||

| 250 | Iron Mountain Inc, 144A |

5.250% | 3/15/28 | BB– | 260,000 | |||||||||||||||

| Food & Staples Retailing – 0.4% | ||||||||||||||||||||

| 250 | Albertsons Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC, 144A |

7.500% | 3/15/26 | BB– | 280,625 | |||||||||||||||

| Food Products – 0.3% | ||||||||||||||||||||

| 200 | Post Holdings Inc, 144A |

5.625% | 1/15/28 | B+ | 215,500 | |||||||||||||||

| Gas Utilities – 0.7% | ||||||||||||||||||||

| 250 | AmeriGas Partners LP / AmeriGas Finance Corp |

5.500% | 5/20/25 | BB | 270,000 | |||||||||||||||

| 55 | NGL Energy Partners LP / NGL Energy Finance Corp |

6.125% | 3/01/25 | B+ | 51,837 | |||||||||||||||

| 200 | Suburban Propane Partners LP/Suburban Energy Finance Corp |

5.875% | 3/01/27 | BB– | 208,000 | |||||||||||||||

| 505 | Total Gas Utilities |

529,837 | ||||||||||||||||||

| Health Care Providers & Services – 0.8% | ||||||||||||||||||||

| 100 | Centene Corp, 144A |

4.250% | 12/15/27 | BBB– | 102,875 | |||||||||||||||

| 100 | Centene Corp, 144A |

4.625% | 12/15/29 | BBB– | 105,385 | |||||||||||||||

| 146 | Encompass Health Corp |

5.750% | 11/01/24 | B+ | 147,643 | |||||||||||||||

| 250 | Tenet Healthcare Corp, 144A |

6.250% | 2/01/27 | Ba3 | 269,062 | |||||||||||||||

| 596 | Total Health Care Providers & Services |

624,965 | ||||||||||||||||||

| Health Care Technology – 0.1% | ||||||||||||||||||||

| 200 | Exela Intermediate LLC / Exela Finance Inc, 144A |

10.000% | 7/15/23 | CCC– | 80,000 | |||||||||||||||

| Hotels, Restaurants & Leisure – 0.4% | ||||||||||||||||||||

| 250 | Viking Cruises Ltd, 144A |

5.875% | 9/15/27 | B+ | 267,188 | |||||||||||||||

| Household Durables – 1.0% | ||||||||||||||||||||

| 200 | Beazer Homes USA Inc |

5.875% | 10/15/27 | B– | 202,000 | |||||||||||||||

| 250 | M/I Homes Inc |

5.625% | 8/01/25 | BB– | 261,875 | |||||||||||||||

| 300 | Mattamy Group Corp, 144A |

6.500% | 10/01/25 | BB | 320,250 | |||||||||||||||

| 750 | Total Household Durables |

784,125 | ||||||||||||||||||

| Insurance – 0.7% | ||||||||||||||||||||

| 250 | Genworth Holdings Inc |

4.800% | 2/15/24 | B | 244,328 | |||||||||||||||

| 250 | Nationstar Mortgage Holdings Inc, 144A |

8.125% | 7/15/23 | B | 264,630 | |||||||||||||||

| 500 | Total Insurance |

508,958 | ||||||||||||||||||

18

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| Leisure Products – 0.4% | ||||||||||||||||||||

| $ | 250 | Mattel Inc, 144A |

6.750% | 12/31/25 | BB– | $ | 268,700 | |||||||||||||

| Machinery – 0.7% | ||||||||||||||||||||

| 200 | Mueller Water Products Inc, 144A |

5.500% | 6/15/26 | BB | 210,750 | |||||||||||||||

| 150 | Navistar International Corp, 144A |

6.625% | 11/01/25 | B+ | 152,813 | |||||||||||||||

| 156 | Titan Acquisition Ltd / Titan Co-Borrower LLC, 144A |

7.750% | 4/15/26 | CCC+ | 154,440 | |||||||||||||||

| 506 | Total Machinery |

518,003 | ||||||||||||||||||

| Media – 1.7% | ||||||||||||||||||||

| 500 | Altice France SA/France, 144A |

7.375% | 5/01/26 | B | 536,820 | |||||||||||||||

| 250 | Entercom Media Corp, 144A |

7.250% | 11/01/24 | B– | 263,125 | |||||||||||||||

| 250 | Nielsen Finance LLC / Nielsen Finance Co, 144A |

5.000% | 4/15/22 | BB | 250,937 | |||||||||||||||

| 200 | VTR Finance BV, 144A |

6.875% | 1/15/24 | BB– | 204,500 | |||||||||||||||

| 1,200 | Total Media |

1,255,382 | ||||||||||||||||||

| Metals & Mining – 1.0% | ||||||||||||||||||||

| 250 | Alcoa Nederland Holding BV, 144A |

6.125% | 5/15/28 | BB+ | 270,624 | |||||||||||||||

| 150 | Freeport-McMoRan Inc |

3.875% | 3/15/23 | Ba1 | 152,735 | |||||||||||||||

| 100 | Freeport-McMoRan Inc |

5.250% | 9/01/29 | Ba1 | 107,130 | |||||||||||||||

| 250 | Tronox Inc, 144A |

6.500% | 4/15/26 | B | 257,550 | |||||||||||||||

| 750 | Total Metals & Mining |

788,039 | ||||||||||||||||||

| Oil, Gas & Consumable Fuels – 2.0% | ||||||||||||||||||||

| 250 | Denbury Resources Inc, 144A |

9.000% | 5/15/21 | B | 241,875 | |||||||||||||||

| 250 | Enable Midstream Partners LP |

4.400% | 3/15/27 | BBB– | 249,413 | |||||||||||||||

| 100 | EnLink Midstream LLC |

5.375% | 6/01/29 | BBB– | 94,000 | |||||||||||||||

| 200 | Genesis Energy LP / Genesis Energy Finance Corp |

5.625% | 6/15/24 | B+ | 193,000 | |||||||||||||||

| 275 | PBF Holding Co LLC / PBF Finance Corp |

7.250% | 6/15/25 | BB | 293,563 | |||||||||||||||

| 200 | Southwestern Energy Co |

7.500% | 4/01/26 | BB | 185,000 | |||||||||||||||

| 250 | Whiting Petroleum Corp |

6.625% | 1/15/26 | BB– | 170,370 | |||||||||||||||

| 100 | WPX Energy Inc |

5.250% | 10/15/27 | BB | 105,500 | |||||||||||||||

| 1,625 | Total Oil, Gas & Consumable Fuels |

1,532,721 | ||||||||||||||||||

| Pharmaceuticals – 0.7% | ||||||||||||||||||||

| 100 | Bausch Health Cos Inc, 144A |

5.000% | 1/30/28 | B | 102,639 | |||||||||||||||

| 225 | Endo Dac / Endo Finance LLC / Endo Finco Inc, 144A |

5.875% | 10/15/24 | B+ | 218,250 | |||||||||||||||

| 220 | Teva Pharmaceutical Finance Netherlands III BV |

6.750% | 3/01/28 | BB | 223,346 | |||||||||||||||

| 545 | Total Pharmaceuticals |

544,235 | ||||||||||||||||||

| Real Estate Management & Development – 0.7% | ||||||||||||||||||||

| 250 | Hunt Cos Inc, 144A |

6.250% | 2/15/26 | BB– | 246,875 | |||||||||||||||

| 250 | Kennedy-Wilson Inc |

5.875% | 4/01/24 | BB | 256,250 | |||||||||||||||

| 500 | Total Real Estate Management & Development |

503,125 | ||||||||||||||||||

| Road & Rail – 0.7% | ||||||||||||||||||||

| 200 | Avis Budget Car Rental LLC / Avis Budget Finance Inc, 144A |

6.375% | 4/01/24 | BB | 207,500 | |||||||||||||||

| 70 | Hertz Corp, 144A |

7.625% | 6/01/22 | BB– | 72,800 | |||||||||||||||

| 250 | United Rentals North America Inc |

4.875% | 1/15/28 | BB– | 260,307 | |||||||||||||||

| 520 | Total Road & Rail |

540,607 | ||||||||||||||||||

| Specialty Retail – 1.1% | ||||||||||||||||||||

| 205 | L Brands Inc |

6.875% | 11/01/35 | Ba2 | 183,475 | |||||||||||||||

| 200 | PetSmart Inc, 144A |

8.875% | 6/01/25 | CCC+ | 197,500 | |||||||||||||||

| 250 | PGT Escrow Issuer Inc, 144A |

6.750% | 8/01/26 | B | 267,812 | |||||||||||||||

| 200 | Staples Inc, 144A |

10.750% | 4/15/27 | B– | 203,000 | |||||||||||||||

| 855 | Total Specialty Retail |

851,787 | ||||||||||||||||||

| Wireless Telecommunication Services – 0.4% | ||||||||||||||||||||

| 250 | Hughes Satellite Systems Corp |

6.625% | 8/01/26 | BB | 277,500 | |||||||||||||||

| $ | 17,205 | Total Corporate Bonds (cost $17,122,756) |

17,399,549 | |||||||||||||||||

19

| JMM | Nuveen Multi-Market Income Fund (continued) | |

| Portfolio of Investments December 31, 2019 | ||

| (Unaudited) | ||

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| SOVEREIGN DEBT – 1.5% (1.1% of Total Investments) |

||||||||||||||||||||

| Argentina – 0.1% | ||||||||||||||||||||

| $ | 200 | Argentine Republic Government International Bond |

4.625% | 1/11/23 | Caa2 | $ | 98,700 | |||||||||||||

| Bahrain – 0.4% | ||||||||||||||||||||

| 250 | Bahrain Government International Bond, 144A |

7.000% | 10/12/28 | BB– | 295,761 | |||||||||||||||

| Egypt – 0.6% | ||||||||||||||||||||

| 400 | Egypt Government International Bond, 144A |

5.875% | 6/11/25 | B+ | 425,000 | |||||||||||||||

| El Salvador – 0.1% | ||||||||||||||||||||

| 100 | El Salvador Government International Bond, 144A |

5.875% | 1/30/25 | B+ | 105,375 | |||||||||||||||

| Sri Lanka – 0.3% | ||||||||||||||||||||

| 250 | Sri Lanka Government International Bond, 144A |

6.125% | 6/03/25 | B | 243,108 | |||||||||||||||

| $ | 1,200 | Total Sovereign Debt (cost $1,184,487) |

1,167,944 | |||||||||||||||||

| Principal Amount (000) |

Description (1), (5) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| CONTINGENT CAPITAL SECURITIES – 0.9% (0.6% of Total Investments) | ||||||||||||||||||||

| Banks – 0.6% | ||||||||||||||||||||

| $ | 200 | Banco Bilbao Vizcaya Argentaria SA |

6.500% | N/A (6) | Ba2 | $ | 211,500 | |||||||||||||

| 200 | Societe Generale SA, 144A |

6.750% | N/A (6) | BB+ | 220,750 | |||||||||||||||

| 400 | Total Banks |

432,250 | ||||||||||||||||||

| Capital Markets – 0.3% | ||||||||||||||||||||

| 200 | UBS Group AG, 144A |

7.000% | N/A (6) | BBB– | 218,500 | |||||||||||||||

| $ | 600 | Total Contingent Capital Securities (cost $600,000) |

650,750 | |||||||||||||||||

| Principal Amount (000) |

Description (1) | Optional Call Provision (7) |

Ratings (2) | Value | ||||||||||||||||

| MUNICIPAL BONDS – 0.7% (0.5% of Total Investments) | ||||||||||||||||||||

| Tax Obligation/General – 0.7% | ||||||||||||||||||||

| $ | 500 | Illinois State, General Obligation Bonds, Pension Funding Series 2003, 5.100%, 6/01/33 |

No Opt. Call | BBB | $ | 539,430 | ||||||||||||||

| $ | 500 | Total Municipal Bonds (cost $515,570) |

539,430 | |||||||||||||||||

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| $1,000 PAR (OR SIMILAR) INSTITUTIONAL PREFERRED – 0.3% (0.2% of Total Investments) | ||||||||||||||||||||

| Commercial Services & Supplies – 0.3% | ||||||||||||||||||||

| $ | 200 | AerCap Global Aviation Trust, 144A |

6.500% | 6/15/45 | BB+ | $ | 220,500 | |||||||||||||

| $ | 200 | Total $1,000 Par (or similar) Institutional Preferred (cost $202,726) |

220,500 | |||||||||||||||||

| Total Long-Term Investments (cost $105,472,604) |

107,306,155 | |||||||||||||||||||

20

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Value | ||||||||||||||||

| SHORT-TERM INVESTMENTS – 0.4% (0.3% of Total Investments) |

|

|||||||||||||||||||

| REPURCHASE AGREEMENTS – 0.4% (0.3% of Total Investments) |

|

|||||||||||||||||||

| $ | 319 | Repurchase Agreement with Fixed Income Clearing

Corporation, |

0.650% | 1/02/20 | $ | 319,234 | ||||||||||||||

| Total Short-Term Investments (cost $319,234) |

|

319,234 | ||||||||||||||||||

| Total Investments (cost $105,791,838) – 142.1% |

107,625,389 | |||||||||||||||||||

| Reverse Repurchase Agreements – (44.0)% (8) |

(33,370,768 | ) | ||||||||||||||||||

| Other Assets Less Liabilities – 1.9% (9) |

1,505,119 | |||||||||||||||||||

| Net Assets Applicable to Common Shares – 100% |

$ | 75,759,740 | ||||||||||||||||||

Investments in Derivatives

Futures Contracts

| Description | Contract Position |

Number of Contracts |

Expiration Date |

Notional Amount* |

Value | Unrealized Appreciation (Depreciation) |

Variation Margin Receivable/ (Payable) |

|||||||||||||||||||||

| U.S. Treasury 2-Year Note |

Short | (23 | ) | 3/20 | $ | (4,960,758 | ) | $ | (4,956,500 | ) | $ | 4,258 | $ | (1,078 | ) | |||||||||||||

| U.S. Treasury 10-Year Note |

Short | (39 | ) | 3/20 | (5,061,984 | ) | (5,008,453 | ) | 53,531 | 4,266 | ||||||||||||||||||

| U.S. Treasury 10-Year Ultra Note |

Short | (15 | ) | 3/20 | (2,142,392 | ) | (2,110,547 | ) | 31,845 | 2,578 | ||||||||||||||||||

| U.S. Treasury Long Bond |

Short | (11 | ) | 3/20 | (1,759,522 | ) | (1,714,969 | ) | 44,553 | 3,781 | ||||||||||||||||||

| U.S. Treasury Ultra Bond |

Long | 35 | 3/20 | 6,540,738 | 6,357,969 | (182,770 | ) | (40,469 | ) | |||||||||||||||||||

| $ | (7,383,918 | ) | $ | (7,432,500 | ) | $ | (48,583 | ) | $ | (30,922 | ) | |||||||||||||||||

| Total receivable for variation margin on futures contracts |

|

$ | 10,625 | |||||||||||||||||||||||||

| Total payable for variation margin on futures contracts |

|

$ | (41,547 | ) | ||||||||||||||||||||||||

| * | The aggregate amount of long and short positions is $6,540,738 and $(13,924,656), respectively. |

Interest Rate Swaps – OTC Uncleared

| Counterparty | Notional Amount |

Fund Pay/Receive Floating Rate |

Floating Rate Index | Fixed Rate (Annualized) |

Fixed Rate Payment Frequency |

Effective Date (10) |

Optional Termination Date |

Maturity Date |

Value | Unrealized Appreciation (Depreciation) |

||||||||||||||||||||||||||||||

| Morgan Stanley Capital Services LLC |

$ | 17,000,000 | Receive | 1-Month LIBOR | 1.994 | % | Monthly | 6/01/18 | 7/01/25 | 7/01/27 | $ | (521,039 | ) | $ | (521,039 | ) | ||||||||||||||||||||||||

21

| JMM | Nuveen Multi-Market Income Fund (continued) | |

| Portfolio of Investments December 31, 2019 | ||

| (Unaudited) | ||

For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

| (1) | All percentages shown in the Portfolio of Investments are based on net assets applicable to common shares unless otherwise noted. |

| (2) | For financial reporting purposes, the ratings disclosed are the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. |

| (3) | Variable rate security. The rate shown is the coupon as of the end of the reporting period. |

| (4) | Investment, or portion of investment, has been pledged to collateralize the net payment obligations for investments in derivatives and/or reverse repurchase agreements. As of the end of the reporting period, investments with a value of $35,431,114 have been pledged as collateral for reverse repurchase agreements. |

| (5) | Contingent Capital Securities (“CoCos”) are hybrid securities with loss absorption characteristics built into their terms for the benefit of the issuer. For example, the terms may specify an automatic write-down of principal or a mandatory conversion into the issuer’s common stock under certain adverse circumstances, such as the issuer’s capital ratio falling below a specified level. |

| (6) | Perpetual security. Maturity date is not applicable. |

| (7) | Optional Call Provisions: Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage backed securities may be subject to periodic principal paydowns. |

| (8) | Reverse Repurchase Agreements as a percentage of Total Investments is 31.0% |

| (9) | Other assets less liabilities includes the unrealized appreciation (depreciation) of certain over-the-counter (“OTC”) derivatives as presented on the Statement of Assets and Liabilities, when applicable. The unrealized appreciation (depreciation) of OTC cleared and exchange-traded derivatives is recognized as part of the cash collateral at brokers and/or the receivable or payable for variation margin as presented on the Statement of Assets and Liabilities, when applicable. |

| (10) | Effective date represents the date on which both the Fund and counterparty commence interest payment accruals on each contract. |

| 144A | Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified institutional buyers. |

| LIBOR | London Inter-Bank Offered Rate |

See accompanying notes to financial statements.

22

Statement of Assets and Liabilities

December 31, 2019

(Unaudited)

| Assets |

||||

| Long-term investments, at value (cost $105,472,604) |

$ | 107,306,155 | ||

| Short-term investments, at value (cost approximates value) |

319,234 | |||

| Cash |

155,469 | |||

| Cash collateral at broker for investments in futures contracts(1) |

872,577 | |||

| Cash collateral at broker for investments in swaps(1) |

644,796 | |||

| Receivable for: |

||||

| Interest |

622,414 | |||

| Variation margin on futures contracts |

10,625 | |||

| Other assets |

55 | |||

| Total assets |

109,931,325 | |||

| Liabilities |

||||

| Reverse repurchase agreements |

33,370,768 | |||

| Unrealized depreciation on interest rate swaps |

521,039 | |||

| Payable for variation margin on futures contracts |

41,547 | |||

| Accrued expenses: |

||||

| Interest |

70,630 | |||

| Management fees |

78,952 | |||

| Trustees fees |

1,013 | |||

| Other |

87,636 | |||

| Total liabilities |

34,171,585 | |||

| Net assets applicable to common shares |

$ | 75,759,740 | ||

| Common shares outstanding |

9,462,350 | |||

| Net asset value (“NAV”) per common share outstanding |

$ | 8.01 | ||

| Net assets applicable to common shares consist of: |

||||

| Common shares, $0.01 par value per share |

$ | 94,624 | ||

| Paid-in surplus |

82,347,966 | |||

| Total distributable earnings |

(6,682,850 | ) | ||

| Net assets applicable to common shares |

$ | 75,759,740 | ||

| Authorized common shares |

Unlimited |

| (1) | Cash pledged to collateralize the net payment obligations for investments in derivatives. |

See accompanying notes to financial statements.

23

Six Months Ended December 31, 2019

(Unaudited)

| Investment Income |

||||

| Dividends |

$ | 11,802 | ||

| Interest |

2,318,505 | |||

| Total investment income |

2,330,307 | |||

| Expenses |

||||

| Management fees |

456,350 | |||

| Interest expense |

325,567 | |||

| Custodian fees |

49,281 | |||

| Trustees fees |

1,139 | |||

| Professional fees |

19,884 | |||

| Shareholder reporting expenses |

14,581 | |||

| Shareholder servicing agent fees |

3,159 | |||

| Stock exchange listing fees |

3,459 | |||

| Investor relations expense |

3,541 | |||

| Other |

11,909 | |||

| Total expenses |

888,870 | |||

| Net investment income (loss) |

1,441,437 | |||

| Realized and Unrealized Gain (Loss) |

||||

| Net realized gain (loss) from: |

||||

| Investments |

162,900 | |||

| Futures contracts |

(243,555 | ) | ||

| Swaps |

17,636 | |||

| Change in net unrealized appreciation (depreciation) of: |

||||

| Investments |

146,692 | |||

| Futures contracts |

147,557 | |||

| Swaps |

(49,121 | ) | ||

| Net realized and unrealized gain (loss) |

182,109 | |||

| Net increase (decrease) in net assets applicable to common shares from operations |

$ | 1,623,546 |

See accompanying notes to financial statements.

24

Statement of Changes in Net Assets

(Unaudited)

| Six Months Ended 12/31/19 |

Year |

|||||||

| Operations |

||||||||

| Net investment income (loss) |

$ | 1,441,437 | $ | 3,057,077 | ||||

| Net realized gain (loss) from: |

||||||||

| Investments |

162,900 | 191,132 | ||||||

| Futures contracts |

(243,555 | ) | (599,944 | ) | ||||

| Swaps |

17,636 | 58,371 | ||||||

| Change in net unrealized appreciation (depreciation) of: |

||||||||

| Investments |

146,692 | 2,576,872 | ||||||

| Futures contracts |

147,557 | (215,090 | ) | |||||

| Swaps |

(49,121 | ) | (1,230,891 | ) | ||||

| Net increase (decrease) in net assets applicable to common shares from operations |

1,623,546 | 3,837,527 | ||||||

| Distributions to Common Shareholders |

||||||||

| Dividends |

(1,703,223 | ) | (3,406,446 | ) | ||||