As filled with the U.S. Securities and Exchange Commission on April 20, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Seven Stars Cloud Group, Inc.

(Exact name of registrant as specified in our charter)

| Nevada | 7380 | 20-1778374 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Room 4, Fenghuayuan Drive-in Movie Theater Park,

No. 21, Liangmaqiao Road, Chaoyang District

Beijing 10015 PRC

(212) 206-1216

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Bruno Wu

Chief Executive Officer

and Chairman of the Board

Room 4, Fenghuayuan Drive-in Movie Theater Park,

No. 21, Liangmaqiao Road, Chaoyang District

Beijing 10015 PRC

(212) 206-1216

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Copies to:

William Haddad

Cooley LLP

1114 Avenue of the Americas

New York, NY 10036

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | ||

| (Do not check if a smaller reporting company) | Smaller reporting company | x | |

| Emerging growth company | ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

Calculation of Registration Fee

| Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price Per Share(2) | Proposed Maximum Aggregate Offering Price(2) | Amount of Registration Fee | ||||||||||||

| Common stock, $0.0001 par value per share | 34,724,578 | $ | 2.805 | $ | 97,402,441.30 | $ | 12,126.60 | |||||||||

| Total | 34,724,578 | $ | 2.805 | $ | 97,402,441.30 | $ | 12,126.60 | |||||||||

| (1) | In the event of a stock split, stock dividend or other similar transaction involving the registrant’s common stock, in order to prevent dilution, the number of shares of common stock registered hereby shall be automatically increased to cover the additional common shares in accordance with Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the average high and low prices of the Common Stock as traded on the NASDSAQ on April 19, 2018. |

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated April 20, 2018

PRELIMINARY PROSPECTUS

34,724,578 Shares of Common Stock

The selling stockholders named in this prospectus (the “Selling Stockholders”) may offer and sell from time to time up to 34,724,578 shares of our common stock, par value $0.0001 per share:

The selling stockholders may offer, sell or distribute all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the shares of common stock. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The selling stockholders will bear all commissions and discounts, if any, attributable to their sale of shares of common stock. See “Plan of Distribution” beginning on page 67 of this prospectus.

Our common stock is listed on the Nasdaq Capital Market under the symbols “SSC”. On April 19, 2018 the last reported sales price of our common stock was $2.77 per share.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 9 of this prospectus, and under similar headings in any amendment or supplements to this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

, 2018

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus, any supplement to this prospectus or in any free writing prospectus, filed with the Securities and Exchange Commission. Neither we nor the selling stockholders have authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholders are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the selling stockholders, have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the Securities and Exchange Commission before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

| 3 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical information, this prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of our new and existing products or services; any projections of sales, earnings, revenue, margins or other financial items; any statements regarding the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in China; and all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including, and without limitation, those identified in Item 1A, “Risk Factors” included herein, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements included herein are made as of the date of this report. We undertake no obligation to update any of these forward-looking statements, whether written or oral, that may be made, from time to time, after the date of this report to conform our prior statements to actual results or revised expectations.

Except as otherwise indicated by the context, references in this report to “we,” “us,” “our,” “our Company,” “the Company,” “SSC” or “Seven Stars Cloud,” are to the business of Seven Stars Cloud Group, Inc. (formerly known as Wecast Network, Inc.), a Nevada corporation, and its consolidated subsidiaries and variable interest entities.

In addition, unless the context otherwise requires and for the purposes of this report only:

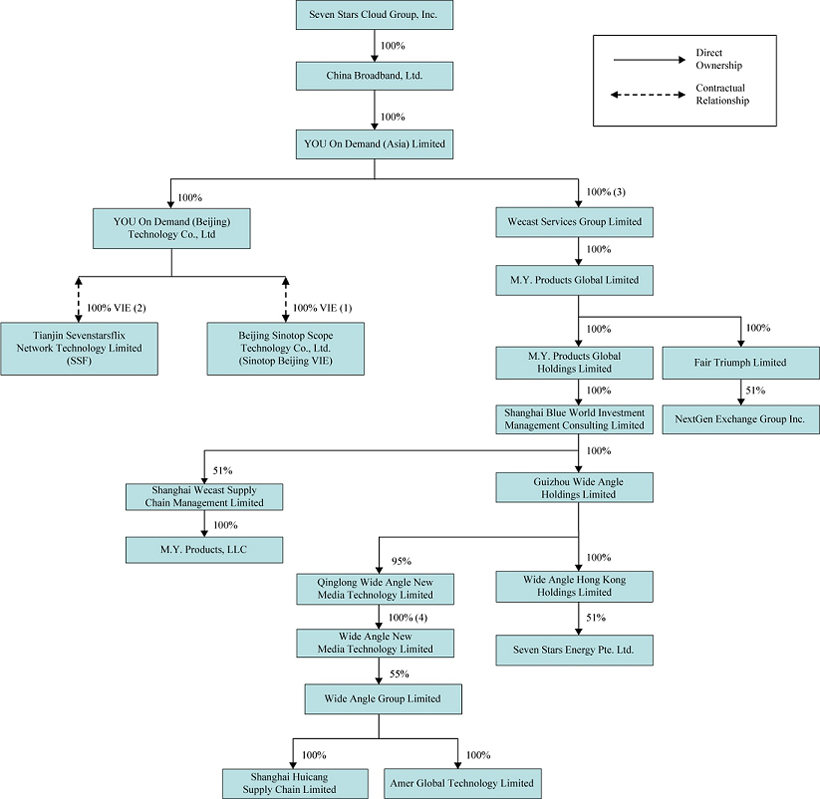

| . | “CB Cayman” refers to our wholly-owned subsidiary China Broadband, Ltd., a Cayman Islands company; | |

| . | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; | |

| . | “Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China; | |

| . | “Hua Cheng” refers to Hua Cheng Hu Dong (Beijing) Film and Television Communication Co., Ltd., a PRC company 39% owned by Sinotop Beijing and 20% owner of Zhong Hai Media; | |

| . | “PRC,” “China,” and “Chinese,” refer to the People’s Republic of China; | |

| . | “Renminbi” and “RMB” refer to the legal currency of China; | |

| . | “SAPPRFT” refers to the State Administration of Press, Publication, Radio, Film & Television, an executive branch under the State Council of the People’s Republic of China; | |

| . | “SEC” refers to the United States Securities and Exchange Commission; | |

| . | “Securities Act” refers to the Securities Act of 1933, as amended; | |

| . | “Shandong Broadcast” refers to Shandong Broadcast & TV Weekly Press, a PRC company; | |

| . | “Shandong Media” refers to our previously owned 50% joint venture, Shandong Lushi Media Co., Ltd., a PRC company; effective July 1, 2012, Shandong Media became a 30% owned company by Sinotop Beijing; | |

| . | “Shandong Newspaper Entities” refers to Shandong Broadcast and Modern Movie; | |

| . | “Sinotop Beijing” refers to Beijing Sino Top Scope Technology Co., Ltd., a PRC company controlled by YOD Hong Kong through contractual arrangements; | |

| . | “U.S. dollars,” “dollars,” “USD,” “US$,” and “$” refer to the legal currency of the United States; | |

| . | “U.S. Tax Reform” refers to the Tax Cuts and Jobs Act, enacted by the United States of America on December 22, 2017; | |

| . | “VIEs” refers to our current variable interest entities Sinotop Beijing, and SSF; | |

| . | “VOD” refers to video on demand, which includes near video on demand (“NVOD”), subscription video on demand (“SVOD”), and transactional video on demand (“TVOD”); | |

| . | “WFOE” refers to our wholly-owned subsidiary Beijing China Broadband Network Technology Co., Ltd., a PRC company which was sold during the quarter ended March 31, 2014; | |

| “YOD Hong Kong” refers to YOU On Demand (Asia) Limited, formerly Sinotop Group Limited, a Hong Kong company wholly- owned by CB Cayman; | ||

| . | “SSF” refers to Tianjin Sevenstarflix Network Technology Limited, a PRC company controlled by YOD Hong Kong through contractual arrangements; | |

| . | “YOD WFOE” refers to YOU On Demand (Beijing) Technology Co., Ltd., a PRC company wholly-owned by YOD Hong Kong; | |

| . | “Zhong Hai Media” refers to Zhong Hai Shi Xun Media Co., Ltd., a PRC company 80% owned by Sinotop Beijing until June 30, 2017; |

| . | “Wecast Services” refers to our wholly-owned subsidiary Wecast Services Group Limited (formerly known as Sun Video Group Hong Kong Limited) a Hong Kong company; |

| . | “Wide Angle” refers to Wide Angle Group Limited, a Hong Kong company 55% owned by the Company; and |

| . | “Wecast SH” refers to Shanghai Wecast Supply Chain Management Limited, a PRC company 51% owned by the Company. |

In this report we are relying on and we refer to information and statistics regarding the media industry in China that we have obtained from various public sources. Any such information is publicly available for free and has not been specifically prepared for us for use or incorporation in this report or otherwise.

| 4 |

The following summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The “Company,” “SSC” “we,” “our,” “us” or similar terms mean Seven Stars Cloud Group, Inc. and our consolidated subsidiaries.

General

Seven Stars Cloud Group, Inc. (NASDAQ: SSC) was incorporated in the State of Nevada on October 19, 2004. Since 2010, it has been a premium content Video On Demand (“VOD”) services provider with primary operations in the People’s Republic of China through its subsidiaries and variable interest entities since 2010. It provided premium content and integrated value-added service solutions for the delivery of VOD and paid video programming to digital cable providers, Internet Protocol Television (“IPTV”) providers, Over-the-Top (“OTT”) streaming providers, mobile manufacturers and operators, as well as direct customers.

Starting from 2017, it is aiming to become a next generation Artificial-Intelligent (AI) & Blockchain-Powered, Fintech company. By managing and providing an infrastructure and environment that facilitates the transformation of traditional financial markets such as commodities, currency and credit into the asset digitalization era, SSC hopes to provide asset owners and holders a seamless method and platform for digital asset securitization, tokenization and trading. Separately, SSC is aiming to offer a closed supply chain trading ecosystem for corporate buyers and sellers designed to eliminate standard transactional intermediaries and create a more direct and margin-expanding path for principals.

Currently the Company is trying to establish a business ecosystem based on a “7-3-2-1” structural approach:

Seven (“7”) Product Engines:

a. Big commodity markets;

b. Currency markets;

c. Credit markets;

d. Fractal securitization of all third party securitization products;

e. Asset backed tokenization and other real physical asset backed securitization issuance and trading through the Initial Exchange Offering (“IEO”) network;

f. Blockchain-based securitization of private equity backed companies;

g. Supply chain finance and management for vertical products.

Grouped into Three ("3") Blockchain-Based Technology Platforms:

a. "Plutus": Powering Product Engines 1-3;

b. "Apollo": Powering Product Engines 4-6;

c. "Venus": Powering Product Engine 7.

Which are Distributed via Two ("2") Networks:

a. NextGen X IEO ("Initial Exchange Offering"): A global digital securitization offering & issuance network of exchange and Alternative Trading Services (ATS);

b. Vertical Product Industry Exchange.

All of Which Combined Create One ("1”) Multi-Faceted Value Hub providing the Following Functionality:

a. Asset Valuation, Rating & Pricing

b. I-Banking

c. Settlement

d. Others

2017 has been a year of transition from the Company’s legacy business to the Company’s new business.

In early December 2016, in order to offset losses from a high upfront minimum guarantee licensing fees to studios, the Company announced a change to its business model with the Yanhua Operating Partnership, where Yanhua will act as the exclusive distribution operator (within the territory of the People's Republic of China) of the Company's licensed library of major studio films. The Yanhua Partnership modified and improved the Company's legacy major studio paid content business model by moving from a framework that included high and fixed cost upfront minimum guarantee payments, rising content costs from major Hollywood studios and low margins to a structure that will now include relatively nominal costs to the Company, upfront minimum guarantee payments to the Company and the opportunity to reach an even wider audience. With this partnership, Yanhua assumed all sales and marketing costs and will pay the Company a minimum guarantee in exchange for a percentage of the total revenue share. This completely transformed the legacy business by mitigating or removing the possibility of continuing to operate at a loss yet still providing the Company with the opportunity to benefit from revenue upside based on the Yanhua Partnership's success.

| 5 |

SSC still runs its legacy YOD business with limited resources. SSC launched its legacy VOD service through the acquisition of YOD Hong Kong (formerly Sinotop Group Limited) on July 30, 2010, through its subsidiary China CB Cayman. Through a series of contractual arrangements, YOD WFOE, the subsidiary of YOD Hong Kong, controls Sinotop Beijing, a corporation established in the PRC. Sinotop Beijing was the 80% owner of Zhong Hai Media until June 30, 2017, through which we provided: 1) integrated value–added business–to–business (“B2B”) service solutions for the delivery of VOD and enhanced premium content for digital cable; 2) integrated value–added business–to–business–to–customer (“B2B2C”) service solutions for the delivery of VOD and enhanced premium content for IPTV and OTT providers and; 3) a direct to user, or B2C, mobile video service app. The disposal of Zhong Hai Media is further described in Note 11 to the consolidated financial statements included in this report.

Pertaining to the Company’s efforts to become a next generation Artificial-Intelligent (AI) & Blockchain-Powered, Fintech company, in early Q1 2017, the Company completed a related-party transaction for the acquisition of Sun Video Group HK Limited ("SVG"), which has a 51% ownership stake in M.Y. Products, LLC ("MYP"), a global, smart supply chain management operator. Functioning as a global smart supply chain management company, the acquisition was consummated in an effort to support the Company's brand licensing and video commerce business with B2B services. With the aforementioned service offerings under one roof, the Company could now provide Chinese manufacturers the opportunity to improve profitability within the distribution chain and allowing manufacturers to capture more robust margins as well as reapportioning cost savings to marketing and branding, thereby improving revenue volume.

Also in early February 2017, the Company announced it had acquired 55% of Wide Angle Group Limited ("WAG"). The Company acquired 55% of the outstanding capital shares in WAG from the seller, BT Capital Global Limited. Coupling WAG's capabilities and offerings with those already existing under the SVG/MYP deal, including Supply Chain Management, Manufacturer Sourcing, Supply Chain Financing, VR (virtual reality)-Enabled Commerce Technology and AI-driven Big Data Technology Management, the Company was seeking to creating a diversified and robust business division, separate from the VOD business.

For 2017, through the acquisition and operation of the SVG and WAG, engine seven was operational. There are two revenue sources for engine seven “Supply Chain Finance and Management for Vertical Products”. They are supply chain management & structured finance and alternative finance & carry trade businesses. The Company is currently primarily engaged with consumer electronics and smart supply chain management operations. Our end customers include about 15 to 20 corporations across the world. Starting from October, through partnership with another business partner, our newly controlled Singapore joint venture has been conducting oil trading business in Singapore. Other than the trading business that Company already operated in 2017, the Company also intends to run the engine upon its Venus blockchain based platform, which includes TPaaS & VPaaS system. As of fourth quarter of 2017, TPaaS system went into trial operation.

Recent Developments

On January 10, 2018, the Board of Directors (the “Board”) of the Company appointed Mr. Kang Zhao to serve as an independent director of the Board. Pursuant to the Securities Purchase Agreement dated October 23, 2017, Hong Kong Guo Yuan Group Capital Holdings Limited (“Guo Yuan”), the purchaser of the securities, became entitled to designate one individual to join the Board. Guo Yuan has decided to replace its initial designee, Xin Wang, with Mr. Kang Zhao. There are no family relationships between Mr. Zhao and any of the Company’s officers and directors and there are no other transactions to which the Company or any of its subsidiaries is a party in which Mr. Zhao has a material interest subject to disclosure under Item 404(a) of Regulation S-K.

On January 12, 2018, the Company entered into a Stock Purchase Agreement (the “DBOT Purchase Agreement”) with Delaware Board of Trade Holdings, Inc. (“DBOT”) and DBOT-I LLC (the “Seller”) pursuant to which the Seller agreed to sell 500,000 shares of common stock of DBOT to the Company and the Company issued an aggregate of 320,000 shares of Common Stock of the Company to the Seller. The Seller agreed to a 1 year lock up period for the shares of common stock of the Company received by the Seller pursuant to the DBOT Purchase Agreement.

| 6 |

On March 4, 2018, the Company entered into another Stock Purchase Agreement (the “Sloves Purchase Agreement”) with Shawn Sloves (“Sloves”), China Broadband, Ltd., a wholly-owned subsidiary of SSC (the “Purchaser”) and DBOT pursuant to which Sloves agreed to sell 500,000 shares of common stock of DBOT to the Purchaser and the Company issued an aggregate of 320,000 shares of Common Stock of the Company to Sloves. Sloves agreed to a 1 year lock up period for the shares of common stock of the Company received by Sloves pursuant to the Sloves Purchase Agreement.

On March 17, 2018, the Company entered into a subscription agreement (the “Subscription Agreement”) with GT Dollar Pte. Ltd. (“GTD”) for a private placement of a total amount of $40.0 million. Pursuant to the terms of the Subscription Agreement, the Company (i) will issue and sell to GTD, an aggregate of 13,773,010 shares of the common stock of the Company, par value $0.001 per share (the “Common Stock”), for $1.82 per share, or a total purchase price of $25,066,878.20, and (ii) issue two convertible promissory notes (each a “Note” and together, the “Notes”) with a stated principal amount of $10 million and $4,933,121.80, respectively. GTD shall pay $30 million of the purchase price on or prior to March 31, 2018, in connection with the issuance of the 13,773,010 shares of Common Stock and the $4,933,121.80 Note, and the remaining $10 million on or prior to April 30, 2018, in connection with the issuance of the $10 million Note. The Subscription Agreement contains customary representations, warranties and covenants and a 9 month lock-up period for GTD from the date of the Subscription Agreement.

The Notes bear interest at the rate of 0.56% per annum and matures December 31, 2019. In the event of default, the Notes will become immediately due and payable. Until receipt of necessary shareholder approvals for the transactions contemplated by these agreements, the Notes may not be converted, to the extent that such conversion would result in GTD and its affiliates beneficially owning more than 19.9% of the Company’s outstanding shares of Common Stock. Once the necessary shareholder approval is received, the unpaid principal and interest on the Notes will automatically convert into shares of Common Stock at a conversion rate of $1.82.

Corporate Information

We (formerly China Broadband, Inc.) were incorporated in Nevada on October 22, 2004 pursuant to a reorganization of a California entity formed in 1988. Prior to January 2007 we were a blank check shell company. On January 23, 2007, we acquired CB Cayman, which at the time was a party to the cooperation agreement with our PRC-based WFOE, in a reverse acquisition transaction. Our principal executive offices are located at Room 4, Fenghuayuan Drive-in Movie Theater Park, No. 21, Liangmaqiao, Chaoyang District, Beijing 10014, PRC, and our telephone number is (212) 206-1216. Our corporate website address is www.sevenstars.com. Information contained on or accessible through our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

| 7 |

The Offering

| Shares offered by the selling stockholders | We are registering the resale by the selling stockholders named in this prospectus, or their permitted transferees, of an aggregate of 34,724,578 shares of common stock. |

| Terms of the offering | The selling stockholders will determine when and how they will dispose of the shares of common stock registered under this prospectus for resale. |

| Shares outstanding prior to the offering | As of April 10, 2018, we had 68,865,056 shares of common stock issued and outstanding. |

| Shares outstanding after the offering | 68,865,056 shares of common stock. |

| Use of proceeds | We will not receive any of the proceeds from the sale of the shares of common stock by the selling stockholders. |

| Nasdaq ticker symbol | Our common stock are listed on the Nasdaq Capital Market under the symbol “SSC”. |

For additional information concerning the offering, see “Plan of Distribution” beginning on page 67.

| 8 |

Investing in our securities involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, before deciding whether to purchase any of our securities. If any of these risks actually occur, it could harm our business, financial condition, results of operations and cash flows and our prospects. In that event, the price of our securities could decline and you could lose part or all of your investment.

RISKS RELATED TO OUR BUSINESS

Substantial doubt about our ability to continue as a going concern.

As discussed in Note 3 to the consolidated financial statements included in this report, the Company has incurred significant losses during 2017 and 2016 and has relied on debt and equity financings to fund our operations. As of December 31, 2017, the Company had accumulated deficit of $125.9 million. Management’s plans regarding these matters are also described in Note 3 to the consolidated financial statements included in this report.

The Company must continue to rely on proceeds from debt and equity issuances to pay for ongoing operating expenses in order to execute its business plan. On March 28, 2016, the Company completed a common stock financing for $10.0 million. In addition, the Company completed five separate common stock financings as follows: (i) with Seven Star Works Co. Ltd. (“SSW”) for $4.0 million on July 19, 2016; (ii) with Harvest Alternative Investment Opportunities SPC (“Harvest”) for $4.0 million on August 12, 2016; (iii) with Sun Seven Stars Hong Kong Cultural Development Limited (“SSSHK”) for $2.0 million on November 17, 2016; (iv) with certain investors, officers & directors and affiliates in a private placement for $2.0 million on May 19, 2017 and (v) with Hong Kong Guo Yuan Group Capital Holdings Limited for $10 million on October 23, 2017. In March, 2018, the Company entered into another common stock financing with GT Dollar Pte. Ltd. for a private placement of a total amount of $40.0 million. Although the Company may attempt to raise funds by issuing debt or equity instruments, however additional financing may not be available to the Company on terms acceptable to the Company or at all or such resources may not be received in a timely manner.

These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements have been prepared assuming that the Company will continue as a going concern and, accordingly, do not include any adjustments that might result from the outcome of this uncertainty. If we are in fact unable to continue as a going concern, our shareholders may lose their entire investment in our Company.

The Company is in the process of transforming its business model and this transformation may not be successful.

The Company is in the process of transforming its business model to provide Supply Chain + Digital Finance Solutions. In connection with this transformation, the Company is in the process of considerable changes, which attempted to assemble a new management team, reconfigure the business structure, and expand the Company’s mission and business lines. It is uncertain whether these efforts will prove beneficial or whether we will be able to develop the necessary business models, infrastructure and systems to support the business. This includes having or hiring the right talent to execute our business strategy. Market acceptance of new product and service offerings will be dependent in part on our ability to include functionality and usability that address customer requirements, and optimally price our products and services to meet customer demand and cover our costs.

Any failure to implement this plan in accordance with our expectations will have a material adverse effect on our financial results. Even if the anticipated benefits and savings are realized in part, there may be consequences, internal control issues, or business impacts that were not expected. Additionally, as a result of our restructuring efforts in connection with our business transformation plan, we may experience a loss of continuity, loss of accumulated knowledge or loss of efficiency during transitional periods. Reorganization and restructuring can require a significant amount of management and other employees' time and focus, which may divert attention from operating activities and growing our business. If we fail to achieve some or all of the expected benefits of these activities, it could have a material adverse effect on our competitive position, business, financial condition, results of operations and cash flows.

Our operating results are likely to fluctuate significantly and may differ from market expectations.

Our annual and quarterly operating results have varied significantly in the past, and may vary significantly in the future, due to a number of factors which could have an adverse impact on our business. Our revenue may fluctuate as we expect a disproportionate amount of our revenues generated from Wecast Services quarter over quarter due to the customers’ seasonal demand, as normally holiday demand would increase our revenue. Furthermore, as launch dates of our new products will might not be the same as what we planned, we expect the financial performance might fluctuate significantly depending on timing, quantity and outcome of such product launches.

| 9 |

The transformation of our business will put added pressure on our management and operational infrastructure, impeding our ability to meet any potential increased demand for our services and possibly hurting our future operating results.

Our business plan is to significantly grow our operations to meet anticipated growth in demand for the services that we offer, and by the introduction of new goods or services. Growth in our businesses will place a significant strain on our personnel, management, financial systems and other resources. The evolution of our business also presents numerous risks and challenges, including:

| . | our ability to successfully and rapidly expand sales to potential new distributors in response to potentially increasing demand; |

| . | the costs associated with such growth, which are difficult to quantify, but could be significant; and |

| . | rapid technological change. |

To accommodate any such growth and compete effectively, we will need to obtain additional funding to improve information systems, procedures and controls and expand, train, motivate and manage our employees, and such funding may not be available in sufficient quantities, if at all. If we are not able to manage these activities and implement these strategies successfully to expand to meet any increased demand, our operating results could suffer.

Our new engine seven supply chain business might not be successful as we expected.

Our current and future supply chain business operations are also impacted by the policies and regulations of the PRC government. Central government, provincial and local authorities and agencies regulate many aspects of Chinese industries, including but not limited to provision of (i) supply chain solutions, financial services, retail services and operation of high technology businesses; (ii) security laws and regulations; (iii) foreign exchange; (iv) taxes, duties and fees; and (v) customs. Failure to comply with relevant laws and regulations in our operations may result in various penalties and affect our business, operations, prospects and financial condition. There is no assurance that the laws and regulations of relevant government agencies will not change and no assurance that additional or more stringent laws or regulations will not be imposed. Moreover, compliance with such laws or regulations may require us to incur capital expenditures or other obligations or liabilities.

The emergence of “New Retail” (seamless integration of online and offline retail offering a consumer-centric, omni-channel and global shopping experience through digitization and just-in-time delivery) and transformation of the logistics and supply chain industry affect the demand for our supply chain services and our business opportunities. Our future supply chain business and growth are significantly affected by the emergence of New Retail, the continued global development of e-commerce, particularly in China, and the demand for integrated supply chain solutions. If New Retail, the e-commerce industry in China and the demand for integrated supply chain solutions fail to develop as we expect, our supply chain business and growth could be harmed. In addition, macroeconomic and other factors that reduce demand for supply chain services globally or in China could also have a material adverse impact on our future supply chain business

In order to comply with PRC regulatory requirements, we operate our legacy YOD businesses through companies with which we have contractual relationships. By virtue of these contractual relationships, we control the economic interests and have the power to direct the activities of these entities, and are therefore determined to be the primary beneficiary of these entities, but we do not have any equity ownership interest in these entities. If the PRC government determines that our contractual agreements with these entities are not in compliance with applicable regulations, our business in the PRC could be materially adversely affected.

We do not have direct or indirect equity ownership of our VIEs, which collectively operate all of our legacy YOD businesses in China, but instead have entered into contractual arrangements with our VIEs and each of its individual legal shareholder(s) pursuant to which we received an economic interest in, and have the power to direct the activities of the VIEs, in a manner substantially similar to a controlling equity interest. Although we believe that our business operations are in compliance with the current laws in China, we cannot be sure that the PRC government would view our operating arrangements to be in compliance with PRC regulations that may be adopted in the future. If we are determined not to be in compliance, the PRC government could levy fines, revoke our business and operating licenses, require us to restrict or discontinue our operations, restrict our right to collect revenues, require us to restructure our business, corporate structure or operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that could be harmful to our business. As a result, our legacy YOD business in the PRC could be materially adversely affected.

| 10 |

We rely on contractual arrangements with our VIEs for our operations, which may not be as effective for providing control over these entities as direct ownership.

Our legacy YOD operations and financial results are dependent on our VIEs in which we have no equity ownership interest and must rely on contractual arrangements to control and operate the businesses of our VIEs. These contractual arrangements may not be as effective for providing control over the VIEs as direct ownership. For example, the VIEs may be unwilling or unable to perform its contractual obligations under our commercial agreements. Consequently, we may not be able to conduct our operations in the manner currently planned. In addition, the VIEs may seek to renew their agreements on terms that are disadvantageous to us. Although we have entered into a series of agreements that provide us with the ability to control the VIEs, we may not succeed in enforcing our rights under them insofar as our contractual rights and legal remedies under PRC law are inadequate. In addition, if we are unable to renew these agreements on favorable terms when these agreements expire or to enter into similar agreements with other parties, our legacy YOD business may not be able to operate or expand, and our operating expenses may significantly increase.

Our arrangements with our VIEs and its respective shareholders may be subject to a transfer pricing adjustment by the PRC tax authorities which could have an adverse effect on our income and expenses.

We could face material and adverse tax consequences if the PRC tax authorities determine that our contracts with our VIEs and their respective shareholders were not entered into based on arm’s length negotiations. Although our contractual arrangements are similar to those of other companies conducting similar operations in China, if the PRC tax authorities determine that these contracts were not entered into on an arm’s length basis, they may adjust our income and expenses for PRC tax purposes in the form of a transfer pricing adjustment. Such an adjustment may require that we pay additional PRC taxes plus applicable penalties and interest, if any.

If we do not obtain shareholder approval of certain potential common stock issuances to BT Capital Global Limited, or BT Capital, a promissory note held by BT Capital will be due, and we may not have the resources to repay such note.

Under the rules of the NASDAQ Capital Market, we generally may not issue more than 4.99% of our outstanding shares in connection with an acquisition where a related party has an interest in the target, unless we obtain shareholder approval. On January 30, 2017, we entered into an Securities Purchase Agreement (the “Securities Purchase Agreement”) with BT Capital for the purchase by us of all of the outstanding capital stock of Sun Video Group Hong Kong Limited (“SVG”), an affiliate of the Company’s chairman Bruno Wu, for an aggregate purchase price of (i) $800,000; and (ii) a convertible promissory note (the “SVG Note”) with the principal and interest thereon convertible into shares of the Company’s common stock at a conversion rate of $1.50 per share. BT has guaranteed that SVG will achieve certain financial goals within 12 months of the closing. The SVG Note has a stated principal amount of $50 million, bears interest at the rate of 0.56% per annum and matures on December 31, 2017. In the event of default, the SVG Note will become immediately due and payable, subject to certain limitations set forth in the Securities Purchase Agreement. Effective on December 31, 2017, the Company and BT entered into Amendment No. 1 to the Note pursuant to which the maturity date of the Note, which was December 31, 2017, is now extended to December 31, 2018. All other terms and conditions of the transaction remain the same.

Under the terms of the Securities Purchase Agreement, until receipt of necessary Company’s shareholder approvals, the SVG Note is not convertible into shares of Company common stock.

Although we will put this proposal to our shareholders for their approval, no assurances can be given that we will obtain such shareholder approval. If we fail to obtain such shareholder approval by December 31, 2018 (unless such maturity date for the SVG Note is extended), BT Capital may require us to satisfy all of our obligations under the SVG Note, including the payment in full of all principal and interest, and may pursue other legal or equitable remedies against us. Our ability to make such cash payments will depend on available cash resources at that time, and there can be no assurance that we will have the cash necessary to make such payments. Early payment of the SVG Note could therefore have a significantly adverse effect on our liquidity and financial condition.

The success of our business is dependent on our ability to retain our existing key employees and to add and retain senior officers to our management.

We depend on the services of our key employees. Our success will largely depend on our ability to retain these key employees and to attract and retain qualified senior and middle level managers to our management team. We have recruited executives and management both in U.S. and China to assist in our ability to manage the business and to recruit and oversee employees. While we believe we offer compensation packages that are consistent with market practice, we cannot be certain that we will be able to hire and retain sufficient personnel to support our business. In addition, severe capital constraints have limited our ability to attract specialized personnel. Moreover, our budget limitations will restrict our ability to hire qualified personnel. The loss of any of our key employees would significantly harm our business. We do not maintain key person life insurance on any of our employees.

The Company experiences significant competitive pressure, which may negatively impact its results.

The market for the Company’s products and services is very competitive and subject to rapid technological advances, new market entrants, non-traditional competitors, changes in industry standards and changes in customer needs and consumption models. Not only does the Company compete with global distributors, it also competes for customers with regional distributors and some of the Company’s own suppliers that maintain direct sales efforts. In addition, as the Company expands its offerings and geographies, the Company may encounter increased competition from current or new competitors. The Company’s failure to maintain and enhance its competitive position could adversely affect its business and prospects. Furthermore, the Company’s efforts to compete in the marketplace could cause deterioration of gross profit margins and, thus, overall profitability.

| 11 |

The size of the Company’s competitors varies across market sectors, as do the resources the Company has allocated to the sectors and geographic areas in which it does business. Therefore, many competitors will have greater resources or a more extensive customer or supplier base than the Company has in one or more of its market sectors and geographic areas, which may result in the Company not being able to effectively compete in certain markets which could impact the Company’s profitability and prospects.

Our International Operations Expose Us to a Number of Risks.

Our international activities are significant to our revenues and profits, and we plan to further expand internationally. In certain international market segments, we have relatively little operating experience and may not benefit from any first-to-market advantages or otherwise succeed. It is costly to establish, develop, and maintain international operations and platforms, and promote our brand internationally.

Our international sales and operations are subject to a number of risks, including:

| • | local economic and political conditions; |

| • | government regulation of e-commerce and other services, electronic devices, and competition, and restrictive governmental actions (such as trade protection measures, including export duties and quotas and custom duties and tariffs), nationalization, and restrictions on foreign ownership; |

| • | restrictions on sales or distribution of certain products or services and uncertainty regarding liability for products, services, and content, including uncertainty as a result of less Internet-friendly legal systems, local laws, lack of legal precedent, and varying rules, regulations, and practices regarding the physical and digital distribution of media products and enforcement of intellectual property rights; |

| • | limitations on the repatriation and investment of funds and foreign currency exchange restrictions; |

| • | limited technology infrastructure; |

| • | shorter payable and longer receivable cycles and the resultant negative impact on cash flow; |

| • | laws and regulations regarding consumer and data protection, privacy, network security, encryption, payments, and restrictions on pricing or discounts; |

| • | geopolitical events, including war and terrorism. |

We derived a substantial portion of our revenue from several major customers. If we lose any of these customers, or if the volume of business with these distribution partners decline, our revenues may be significantly affected.

We have agreements with only one distribution partner to operate all legacy YOD business, and two customers individually accounted for more than 10% of our Wecast Service third party revenue. Due to our reliance on those customers, any of the following events may cause a material decline in our revenue and have a material adverse effect on our results of operations:

| . | reductions, delays or cessation of purchases from one or more significant customer; |

| . | loss of one or more significant customer and our inability to find new customers that can generate the same volume of business; and |

| . | failure of any customer to make timely payment of our products and services. |

We cannot be certain whether these relationships will continue to develop or if these significant customers will continue to generate significant revenue for us in the future.

If we fail to develop and maintain an effective system of internal control over financial reporting, our ability to accurately and timely report our financial results or prevent fraud may be adversely affected, and investor confidence and market price of our shares may be adversely impacted.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX 404”), the SEC adopted rules requiring public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports on Form 10-K. Under current law, we became subject to these requirements beginning with our annual report for the fiscal year ended December 31, 2007. Our internal control over financial reporting and our disclosure controls and procedures have been ineffective, and failure to improve them could lead to future errors in our financial statements that could require a restatement or untimely filings, which could cause investors to lose confidence in our reported financial information, and a decline in our stock price.

| 12 |

In 2016, a material weakness was identified in the internal control of financial reporting related to the design, documentation and implementation of effective internal controls over the review of the cash flow forecasts used in the accounting for licensed content recoverability. Specifically, the Company did not design and maintain effective internal controls related to management’s review of the data inputs and assumptions used in its cash flow forecasts for licensed content recoverability. License content forecasts are highly subjective, even though we no longer operate any license content business in 2017 and onwards, management believes that this material weakness is still existed.

Management used the framework set forth in the report entitled Internal Control - Integrated Framework (2016) issued by the Committee of Sponsoring Organizations of the Treadway Commission. As of December 31, 2017, our management has concluded that our internal control over financial reporting is ineffective based on this assessment. See “Item 9A. Controls and Procedures - Management Annual Report on Internal Control over Financial Reporting.”

If we fail to develop and maintain effective internal control over financial reporting in the future, our management may not be able to conclude that we have effective internal control over financial reporting at a reasonable assurance level. This could in turn result in the loss of investor confidence in the reliability of our financial statements and negatively impact the trading price of our shares.

RISKS RELATED TO DOING BUSINESS IN CHINA

U.S. financial regulatory and law enforcement agencies, including without limitation the U.S. Securities and Exchange Commission, U.S. Department of Justice and U.S. national securities exchanges, have limited ability, and in fact may have no ability, to conduct investigations within the People’s Republic of China concerning the Company, our PRC-based officers, directors, market research services or other professional services or experts.

A substantial part of our assets and our current operations are conducted in the PRC, and some of our officers, directors and other professional service providers are nationals and residents of China. U.S. financial regulatory and law enforcement agencies, including without limitation the U.S. Securities and Exchange Commission (the “SEC”), U.S. Department of Justice and U.S. national securities exchanges, have limited ability, and in fact may have no ability, to conduct investigations within the PRC concerning the Company, and China may have limited or no agreements in place to facilitate cooperation with the SEC’s Division of Enforcement for investigations within its jurisdiction.

Adverse changes in political, economic and other policies of the Chinese government could have a material adverse effect on the overall economic growth of China, which could materially and adversely affect the growth of our business and our competitive position.

Our business operations are conducted in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The Chinese economy differs from the economies of most developed countries in many respects, including:

| . | the degree of government involvement; |

| . | the level of development; |

| . | the growth rate; |

| . | the control of foreign exchange; |

| . | the allocation of resources; |

| . | an evolving and rapidly changing regulatory system; and |

| . | a lack of sufficient transparency in the regulatory process. |

While the Chinese economy has experienced significant growth in the past 30 years, growth has been uneven, both geographically and across various sectors of the economy. The Chinese economy has also experienced certain adverse effects due to the global financial crisis. In addition, the growth rate of China’s gross domestic product has slowed in recent years to 6.7% in 2016 and 6.9% in 2017, according to the National Bureau of Statistics of China. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall Chinese economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments, foreign currency exchange restrictions or changes in tax regulations that are applicable to us.

The Chinese economy has been transitioning from a planned economy to a more market-oriented economy. Although in recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of the productive assets in China is still owned by the Chinese government. The continued control of these assets and other aspects of the national economy by the Chinese government could materially and adversely affect our business. The Chinese government also exercises significant control over Chinese economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

| 13 |

Any adverse change in the economic conditions or government policies in China could have a material adverse effect on overall economic growth, which in turn could lead to a reduction in demand for our products and consequently have a material adverse effect on our businesses.

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and to us, which could cause material adverse effects to our business operations.

We conduct part of our business through our subsidiaries and VIEs in the PRC. Our subsidiaries and VIEs are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign invested entities established in the PRC (“FIEs”). The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. For example, on January 19, 2015, MOFCOM published a draft of the PRC law on Foreign Investment (Draft for Comment), of the Draft Foreign Investment Law, which was open for public comments until February 17, 2015. At the same time, MOFCOM published an accompanying explanatory note of the Draft Foreign Investment Law, or the Explanatory Note, which contains important information about the Draft Foreign Investment Law, including its drafting philosophy and principles, main content, plans to transition to the new legal regime and treatment of business in China controlled by FIEs, primarily through contractual arrangements such as VIE arrangements. The Draft Foreign Investment Law is intended to replace the current foreign investment legal regime consisting of three laws: the Sino-Foreign Equity Joint Venture Enterprise Law, the Sino-Foreign Cooperative Joint Venture Enterprise Law and the Wholly Foreign-Invested Enterprise Law, as well as detailed implementing rules. The Draft Foreign Investment Law proposes significant changes to the PRC foreign investment legal regime and may have a material impact on Chinese companies listed or to be listed overseas. The proposed Draft Foreign Investment Law is to regulate FIEs the same way as PRC domestic entities, except for those FIEs that operate in industries deemed to be either “restricted” or “prohibited” in a “Negative List.” As the Negative List has yet to be published, it is unclear whether it will differ from the current list of industries subject to restrictions or prohibitions on foreign investment. The Draft Foreign Investment Law also provides that only FIEs operating in industries on the Negative List will require entry clearance and other approvals that are not required of PRC domestic entities. As a result of the entry clearance and approvals, certain FIEs operating in industries on the Negative List may not be able to continue to conduct their operations through contractual arrangements. Moreover, it is uncertain whether business industries in which our VIEs operate will be subject to the foreign investment restrictions or prohibitions set forth in the “negative list” to be issued.

The Draft Foreign Investment Law has not taken a position on what actions will be taken with respect to the existing VIE structures, while it is soliciting comments from the public on this point by illustrating several possible options. Under these varied options, a company that has a VIE structure and conducts the business on the “negative list” at the time of enactment of the new Foreign Investment Law has either the option or obligation to disclose its corporate structure to the authorities, while the authorities may either permit the company to continue to maintain the VIE structure (if the company is deemed ultimately controlled by PRC nationals), or require the company to dispose of its businesses and/or VIE structure based on circumstantial considerations. The Draft Foreign Investment Law also provides that only FIEs operating in industries on the Negative List will require entry clearance and other approvals that are not required of PRC domestic entities. As a result of such entry clearance and approvals or certain restructuring of our corporate structure and operations, to be completed by companies with existing VIE structure like us, we face substantial uncertainties as to whether these actions can be timely completed, or at all, and our business and financial condition may be materially and adversely affected.

Although the overall effect of legislation over the past three decades has significantly enhanced the protections afforded to various forms of foreign investment in China, China has not developed a fully integrated legal system. Recently enacted laws, rules and regulations may not sufficiently cover all aspects of economic activities in China or may be subject to significant degree of interpretation by PRC regulatory agencies and courts. Since the PRC legal system continues to evolve rapidly, the interpretations of many laws, regulations, and rules are not always uniform, and enforcement of these laws, regulations, and rules involve uncertainties, which may limit legal protections available to you and to us. In addition, the PRC legal system is based in part on government policies and internal rules, some of In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management’s attention. In addition, some of our executive officers and directors are residents of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to affect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations and entities.

| 14 |

We depend upon contractual arrangements with our VIEs for the success of our legacy YOD business and these arrangements may not be as effective in providing operational control as direct ownership of these businesses and may be difficult to enforce.

Our operations are partially conducted in the PRC, where the PRC government restricts or prohibits foreign-owned enterprises from owning certain other operations in the PRC. Accordingly, we depend on our VIEs, in which we have no direct ownership interest, to provide those services through contractual agreements among the parties and to hold some of our assets. These arrangements may not be as effective in providing control over our operations through direct ownership of these businesses. Due to our VIE structure, we have to rely on contractual rights to effect control and management of our VIEs, which exposes us to the risk of potential breach of contract by the VIEs or their shareholders. A failure by our VIEs or their shareholders to perform their obligations under our contractual arrangements with them could have an adverse effect on our business and financial condition. Furthermore, if the shareholders of our VIEs were involved in proceedings that had an adverse impact on their shareholder interests in such VIEs or on our ability to enforce relevant contracts related to the VIE structure, our legacy YOD business would be adversely affected.

As all of these contractual arrangements are governed by PRC law and provide for the resolution of disputes through either arbitration or litigation in the PRC, they would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. We would have to rely for enforcement on legal remedies under PRC law, including specific performance, injunctive relief or damages, which might not be effective. As these PRC governmental authorities have wide discretion in granting such approvals, we could fail to obtain such approval. In addition, our VIE contracts might not be enforceable in China if PRC governmental authorities, courts or arbitral tribunals took the view that such contracts contravened PRC law or were otherwise not enforceable for public policy reasons. In the event we were unable to enforce these contractual arrangements, we would not be able to exert effective control over our VIEs, and our ability to conduct our legacy YOD business, and our financial condition and results of operations, would be severely adversely affected.

You may have difficulty enforcing judgments against us.

Most of our assets are located outside of the United States and a substantial part of our current operations are conducted in the PRC. In addition, some of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons is located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, that are not residents in the United States and the substantial majority of whose assets are located outside of the United States. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts. Recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedures Law. Courts in China may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security, or the public interest. So it is uncertain whether a PRC court would enforce a judgment rendered against us by a court in the United States.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property, and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

The enforcement of the PRC labor contract law may materially increase our costs and decrease our net income.

China adopted a new Labor Contract Law, effective on January 1, 2008, issued its implementation rules and regulations, effective on September 18, 2008, and amended the Labor Contract Law, effective on July 1, 2013. The Labor Contract Law and related rules and regulations impose more stringent requirements on employers with regard to, among other things, minimum wages, severance payment and non-fixed-term employment contracts, time limits for probation periods, as well as the duration and the times that an employee can be placed on a fixed-term employment contract. Due to the limited period of effectiveness of the Labor Contract Law, its implementation rules and regulations and its amendment, and the lack of clarity with respect to its implementation and the potential penalties and fines, it is uncertain how it will impact our current employment policies and practices. In particular, compliance with the Labor Contract Law and its implementation rules and regulations may increase our operating expenses. In the event that we decide to terminate some of our employees or otherwise change our employment or labor practices, the Labor Contract Law and its implementation rules and regulations may also limit our ability to effect those changes in a manner that we believe to be cost-effective or desirable, and could result in a material decrease in our profitability.

| 15 |

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion, significant stock market volatility and highly fluctuating rates of inflation. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. In 2010 and 2011, for example, the Chinese economy experienced high inflation and to curb the accelerating inflation, the People’s Bank of China (“PBOC”), China central bank, raised benchmark interest rates three times in 2011. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and services and our company.

Restrictions on currency exchange may limit our ability to receive and use our sales effectively.

At present, a substantial part of our sales will be settled in RMB, and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including primarily the restriction that FIEs may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in China authorized to conduct foreign exchange business. In addition, foreign exchange transactions under the capital account remain subject to limitations and require approvals from, or registration with, SAFE and other relevant PRC governmental authorities and companies are required to open and maintain separate foreign exchange accounts for capital account items. This could affect our ability to obtain foreign currency through debt or equity financing for our subsidiaries and the variable interest entities. Recent volatility in the RMB foreign exchange rate as well as capital flight out of China may lead to further foreign exchange restrictions and policies or practices which adversely affect our operations and ability to convert RMB. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between the U.S. dollar and RMB and between those currencies and other currencies in which our sales may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars, as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Since July 2005, the RMB has no longer been pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Restrictions under PRC law on our PRC subsidiaries’ ability to make dividends and other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our business.

At present, part of our sales are earned by our PRC operating entities. However, PRC regulations restrict the ability of our PRC subsidiaries to make dividends and other payments to their offshore parent companies. PRC legal restrictions permit payments of dividends by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiaries are also required under PRC laws and regulations to allocate at least 10% of their annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of their registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances, or cash dividends. Any limitations on the ability of our PRC subsidiaries to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

| 16 |

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident shareholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us or otherwise materially adversely affect us.

SAFE has promulgated several regulations, including the Notice Concerning Foreign Exchange Controls on Domestic Residents’ Financing and Roundtrip Investment Through Offshore Special Purpose Vehicles (“Circular 75”), effective on November 1, 2005, and the Circular on Issues Concerning Foreign Exchange Administration Over the Overseas Investment and Financing and Roundtrip Investment by Domestic Residents Via Special Purpose Vehicles (“Circular 37”), effective on July 4, 2015, which replaced Circular 75. Under Circular 37, PRC residents must register with local branches of SAFE in connection with their direct establishment or indirect control of an offshore entity for the purpose of holding domestic or offshore assets or interests, referred to as a “special purpose vehicle” in Circular 37. In addition, amendments to the registration must be made in the event of any material change, such as an increase or decrease in share capital contributed by the individual PRC resident shareholder, share transfer or exchange, merger, division or other material event. Failure to comply with the specified registration procedures may result in restrictions being imposed on the foreign exchange activities of the relevant PRC entity, including the payment of dividends and other distributions to its offshore parent, as well as restrictions on capital inflows from the offshore entity to the PRC entity. Further, failure to comply with the SAFE registration requirements may result in penalties under PRC law for evasion of foreign exchange regulations.

We have asked our shareholders who are PRC residents as defined in Circular 37 and related rules to register with the relevant branch of SAFE, as currently required, in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiaries. However, we cannot provide any assurances that they can obtain the above SAFE registrations required by Circular 37 and related rules. Moreover, because Circular 37 is newly issued, there is uncertainty over how Circular 37 and related rules will be interpreted and implemented and how or whether SAFE will apply it to us, and we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries’ ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 37 and related rules by our PRC resident beneficial holders. In addition, such PRC residents may not always be able to complete the necessary registration procedures required by Circular 37 and related rules. We have little control over either our present or prospective direct or indirect shareholders or the outcome of such registration procedures.

We may be unable to complete a business combination transaction efficiently or on favorable terms due to complicated merger and acquisition regulations which became effective on September 8, 2006.