As filed with the U.S. Securities and Exchange Commission on February 13, 2020

Registration No. 333-224382

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 7

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Ideanomics, Inc.

(Exact name of registrant as specified in our charter)

| Nevada | 7380 | 20-1778374 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

55 Broadway, 19th Floor

New York, NY 10006

(212) 206-1216

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Alfred Poor

Chief Executive Officer

55 Broadway, 19th Floor

New York, NY 10006

(212) 206-1216

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Copies to:

William Haddad

Venable LLP

Rockefeller Center, 1270 Avenue of the Americas

New York, NY 10020

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x |

| Non-accelerated filer | ¨ | ||

| Smaller reporting company | x | ||

| Emerging growth company | ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

Calculation of Registration Fee

| Title of Each Class

of Securities to be Registered | Amount

to be Registered(1) | Proposed Maximum Offering Price Per Share(2) | Proposed Maximum Aggregate Offering Price(2) | Amount

of Registration Fee (3) | ||||||||||||

| Common stock, $0.001 par value per share | 33,136,693 | $ | 0.82 | $ | 27,291,714 | $ | 3,526.94 | |||||||||

| Total | 33,136,693 | $ | 0.82 | $ | 27,291,714 | $ | 3,526.94 | |||||||||

| (1) | In the event of a stock split, stock dividend or other similar transaction involving the registrant’s common stock, in order to prevent dilution, the number of shares of common stock registered hereby shall be automatically increased to cover the additional common shares in accordance with Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the average high and low prices of the Common Stock as traded on the NASDAQ on December 30, 2019. |

| (3) | The Registrant previously paid $12,126.60 in connection with the initial filing of the Registration Statement on April 20, 2018 and $1,752.18 was previously paid in connection with the amended filing of the Registration Statement on August 24, 2018. |

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated February 13, 2020

PRELIMINARY PROSPECTUS

33,136,693 Shares of Common Stock

The selling stockholders named in this prospectus (the “Selling Stockholders”) may offer and sell from time to time up to 33,136,693 shares of our common stock, par value $0.001 per share:

The selling stockholders may offer, sell or distribute all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the shares of common stock. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The selling stockholders will bear all commissions and discounts, if any, attributable to their sale of shares of common stock. See “Plan of Distribution” beginning on page 108 of this prospectus.

Our common stock is listed on the Nasdaq Capital Market under the symbols “IDEX”. On February 12, 2020 the last reported sales price of our common stock was $ 0.54 per share.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 11 of this prospectus, and under similar headings in any amendment or supplements to this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

, 2020

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus, any supplement to this prospectus or in any free writing prospectus, filed with the Securities and Exchange Commission. Neither we nor the selling stockholders have authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholders are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the selling stockholders, have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the Securities and Exchange Commission before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

| i |

Special Note Regarding Forward Looking Statements

In addition to historical information, this prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act (as defined below), and Section 21E of the Exchange Act (as defined below). We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning our transition to become a next-generation financial technology company; our expectations regarding the market for our new and existing products and industry segment growth; our expectations regarding demand for and acceptance of our new and existing products or services; our expectations regarding our partnerships and joint ventures, acquisitions, investments; our beliefs regarding the potential benefits and opportunities from integrating digital artificial intelligence and blockchain technology as part of our product and services offerings; our business strategies and goals; any projections of sales, earnings, revenue, margins or other financial items; any statements regarding the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in the PRC; and all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including, and without limitation, those identified in Item 1A—“Risk Factors” included herein, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements included herein are made as of the date of this report. We undertake no obligation to update any of these forward-looking statements, whether written or oral, that may be made, from time to time, after the date of this report to conform our prior statements to actual results or revised expectations.

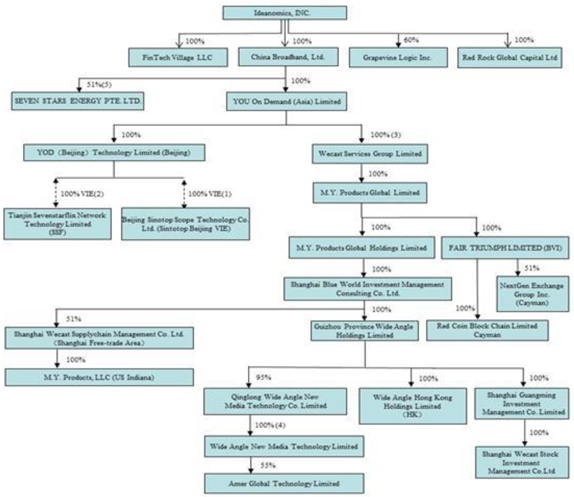

Except as otherwise indicated by the context, references in this report to “we,” “us,” “our,” “our Company,” “the Company,” “IDEX,” or “Ideanomics,” are to the business of Ideanomics, Inc. (formerly known as “Seven Star Cloud Group, Inc.,” “SSC” and “Wecast Network, Inc.”), a Nevada corporation, and its consolidated subsidiaries and variable interest entities.

In addition, unless the context otherwise requires and for the purposes of this report only:

| · | “CB Cayman” refers to our wholly-owned subsidiary China Broadband, Ltd., a Cayman Islands company; |

| · | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; |

| · | “GTD” refers to our minority shareholder, GT Dollar Pte. Ltd., a Singapore based information technology solution company; |

| · | “GTB” refers to cryptocurrency received from GTD for digital asset management service and disposal of certain assets; |

| · | “FINRA” refers to the Financial Industry Regulatory Authority; |

| · | “HK SAR” refers to the Hong Kong Special Administrative Region of the People’s Republic of China; |

| · |

“Hua Cheng” refers to Hua Cheng Hu Dong (Beijing) Film and Television Communication Co., Ltd., a PRC company that is 39% owned by Sinotop Beijing and is a 20% owner of Zhong Hai Media; |

| · | “Intelligenta” refers to the BDCG joint venture which was rebranded as Intelligenta. As part of the rebranding, Intelligenta’s strategy will now include credit services, corporation services, index services and products, and capital market services and products. |

| · | “Legacy YOD” business/segment refers to the premium content and integrated value-added service solutions for the delivery of VOD (defined below) and paid video programing to digital cable providers, Internet Protocol Television (“IPTV”) providers, Over-the-Top (“OTT”) streaming providers, mobile manufacturers and operators, as well as direct customers. |

| · | “PRC,” “China,” and “Chinese,” refer to the People’s Republic of China; |

| ii |

| · | “Renminbi” and “RMB” refer to the legal currency of the PRC; |

| · | “SEC” refers to the United States Securities and Exchange Commission; |

| · | “Securities Act” refers to the Securities Act of 1933, as amended; |

| · | “SSF” refers to Tianjin Sevenstarflix Network Technology Limited, a PRC company controlled by YOD Hong Kong through contractual arrangements; |

| · | “Shandong Broadcast” refers to Shandong Broadcast & TV Weekly Press, a PRC company; |

| · | “Shandong Media” refers to Shandong Lushi Media Co., Ltd., a PRC company and a joint venture with respect to which we previously directly owned 50%; effective July 1, 2012, our interest in Shandong Media was reduced to a 30% stake held by Sinotop Beijing, which we indirectly control; |

| · | “Sinotop Beijing” refers to Beijing Sino Top Scope Technology Co., Ltd., a PRC company controlled by YOD Hong Kong through contractual arrangements; |

| · | “U.S. dollars,” “dollars,” “USD,” “US$,” and “$” refer to the legal currency of the United States; |

| · | “U.S. Tax Reform” refers to the Tax Cuts and Jobs Act, enacted by the United States of America on December 22, 2017; |

| · | “VIEs” refers to our current variable interest entities Sinotop Beijing, and SSF; |

| · | “VOD” refers to video on demand, which includes near video on demand (“NVOD”), subscription video on demand (“SVOD”), and transactional video on demand (“TVOD”); |

| · | “Wecast Services” business/segment refers to all other operations other than Legacy YOD segment; |

| · | “WSG” refers to our wholly-owned subsidiary Wecast Services Group Limited (formerly known as Sun Video Group Hong Kong Limited), a Hong Kong company; |

| · | “Wecast SH” refers to Shanghai Wecast Supply Chain Management Limited, a PRC company that is 51% owned by the Company; |

| · | “WFOE” refers to Beijing China Broadband Network Technology Co., Ltd., a PRC company and a “wholly foreign-owned enterprise,” which we previously wholly owned and which was sold during the quarter ended March 31, 2014; |

| · | “Wide Angle” refers to Wide Angle Group Limited, a Hong Kong company that is 55% owned by the Company; |

| · | “YOD Hong Kong” refers to YOU On Demand (Asia) Limited, formerly Sinotop Group Limited, a Hong Kong company, which is wholly- owned by CB Cayman; |

| · | “YOD WFOE” refers to YOU On Demand (Beijing) Technology Co., Ltd., a PRC company and a “wholly foreign-owned enterprise,” which is wholly-owned by YOD Hong Kong; and |

| · | “Zhong Hai Media” refers to Zhong Hai Shi Xun Media Co., Ltd., a PRC company that was 80% owned by Sinotop Beijing until June 30, 2017. |

| · | “SSSIG” refers to Sun Seven Stars Investment Group Limited, a British Virgin Islands corporation, an affiliate of Dr. Wu. |

| iii |

The following summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The “Company,” “SSC” “we,” “our,” “us” or similar terms mean Ideanomics, Inc. and our consolidated subsidiaries.

General

Ideanomics, Inc. (Nasdaq: IDEX) is a Nevada corporation that primarily operates in the United States and Asia. The Company is comprised of two operating segments (i) our Legacy YOD business with primary operations in the PRC which has been winding down operations over the last 12 months and (ii) our Mobile Energy Group (MEG) (formally known as our Wecast Service) business, which is transitioning to focus on the commercial fleet market for electric vehicles in addition to the Company’s existing fintech advisory business. Our MEG business operates as an end-to-end solutions provider for the procurement, financing, charging and energy management needs for fleet operators of commercial Electronic Vehicles (EV). MEG operates through a series of joint ventures with the leading companies in the commercial EV space, principally in China, and earns fees for every transaction completed based on the spread for group buying of vehicles and fees derived from the arrangement of financing and energy management such as commercial purchasing of pre-paid electricity credits. MEG focuses on commercial EV rather than passenger EV, as commercial EV is on an accelerated adoption path when compared to consumer EV adoption – which is expected to take between ten to fifteen years. We focus on four distinct commercial vehicles types with supporting income streams: 1) Closed-area heavy commercial, in areas such as Mining, Airports, and Sea Ports; 2) Last-mile delivery light commercial; 3) Buses and Coaches; 4) Taxis. The purchase and financing of vehicles provides for one-time fees and the charging and energy management provides for recurring revenue streams. In July 2019 the company invested in Glory Connection Snd. Bhd, (Glory) a vehicle manufacturer based in Malaysia. Glory holds the only license granted so far for the manufacture of electric vehicles in Malaysia and is in the process of setting up its manufacturing and assembly capabilities.

We continue to develop our FinTech services which principally consist of our ownership of the Delaware Board of Trade (DBOT) ATS, Intelligenta for marketing AI solutions to the Financial Services industry and FinTech Village, a 58 acre development site in West Hartford, Connecticut.

The fintech business intends to offer customized services based on best-in-class blockchain, AI and other technologies to mature and emerging businesses across various industries. To do so, we are building a financial technology ecosystem through license agreements, joint ventures and strategic investments, which we refer to as our “Fintech Ecosystem”.

Fintech Ecosystem

We primarily rely upon third-party intellectual property (“IP”) for the AI and blockchain technology being developed for our Mobile Energy Group (MEG) (formally Wecast Services) segment. In evaluating prospective technologies we seek to acquire, in-license or promote through joint ventures, we are focused on identifying industry leaders with strong and established engineering teams and technologies that are substantially developed. In doing so, we believe we can reduce the risks of reliance on a single technology with speculative functionality and adoption potential, while enhancing our flexibility and adaptability in a rapidly evolving technological environment.

| 1 |

Our strategy is to leverage the technology and teams that comprise our Fintech Ecosystem to create customized solutions for the use cases presented to us by our Industry Ventures. The customization of these business applications would be undertaken by our acquired subsidiaries or the joint ventures, as applicable, with the business development efforts of our parent company focused on expanding the network of technologies in our Fintech Ecosystem and facilitating other synergies between our Fintech Ecosystem and our Industry Ventures. While the development and expansion of our Fintech Ecosystem is primarily driven by a desire to match specific technologies with specific use applications in our Industry Ventures, we believe that many of the technologies in our Fintech Ecosystem will have applications outside of our own Industry Ventures, and that the work in customizing technology to our Industry Ventures can be leveraged to develop products and services for third parties.

BDCG Joint Venture

Between December 2017 and April 2018, we formed BBD Digital Capital Group Ltd., a New York corporation (“BDCG”), as a joint venture with management partner Seasail, an affiliate of Big Business Data (“BBD”). We hold approximately 60% of the equity interest of BDCG and have the power to appoint three of the five directors of the board of BDCG. BDCG intends to capitalize on commodity and energy providers’ needs for more precise risk management services, more informed operational planning and more strategic decision-making, specifically in the trading of index funds, futures and commodities. BDCG focuses on developing AI-driven financial data services as well as building transactional platforms for index, futures and derivative trading, for both global commodity and energy clients. Planned financial data services also include risk management solutions, platforms for trading derivatives and indices, and debt and credit product offerings, with the primary objective being enhancing trading and risk management strategies.

BDCG leverages Pluto, Seasail’s AI technology, which Seasail licenses to BDCG. Pluto takes in dynamic, multi-variable inputs, such as, in the case of crude oil, information regarding trading, production origination, economic data and weather, and processes them according to flexible programmed models. For debt and credit products, BDCG has focused on data collection and integration capabilities based on “massive public data” and “acquired third-party data,” including credit and multi-party loans. BBD has accumulated the information of over 100 million companies. Such information contains more than 150 data tables and over 3,700 data fields, and the amount of data continues to grow rapidly. BDCG can use the data accumulated by BBD to create risk and index models. Once these models are layered into a rating and risk management system and loan approval system for trade finance, the AI system can make informed recommendations as to trading and risk management. Pluto is then sold and licensed to third party financial product stakeholders for these services.

We believe we can leverage BDCG’s AI services for the creation of financial products, risk ratings and indexing, and selection and recommendation systems on behalf of key stakeholders. By using AI technology to analyze the digital securitized assets we intend to develop, we aim to elevate not only the quality of the financial product, but also interactions among stakeholders. We also intend to design the digital securitized assets we develop to have data attributes that can be integrated into BDCG’s approach for processing financial data.

Fundamental Interactions

In June 2018, we entered into a non-exclusive, royalty-bearing licensing agreement with Fundamental Interactions, Inc. (“FI”), which currently expires on June 25, 2021, with respect to certain blockchain technologies, including FI’s Velocity Ledger, a blockchain-based, software-as-a-service (SaaS) platform that operates as a private blockchain solution for financial services. Through this agreement, we intend to leverage core FI technology and the Velocity Ledger platform to support the tokenization, secondary trading and settlement of new blockchain-based securities.

FinTalk

In September 2018, we entered into an agreement for the acquisition of FinTalk, a secure mobile messaging, collaboration and information services platform that delivers encrypted text and media messaging, with high performance large file transfer capabilities.

| 2 |

Industry Ventures

We believe there are a number of industries that can benefit from the application of next-generation technologies, such as blockchain, AI, machine learning and big data. Our strategy is not only to promote the development of promising technologies through our Fintech Ecosystem, but also to acquire, invest in and form joint ventures with businesses in the various industries that we believe can be well served by our Fintech Ecosystem. In so doing, we believe that we can benefit both from growth in the Industry Ventures themselves, as well as from the enhanced potential for monetizing the technologies in our Fintech Ecosystem that would come with refining these technologies for our Industry Ventures.

Logistics Management and Financing

Our first group of Industry Ventures has focused on the logistics management and financing industry. Logistics management is the component of supply chain management that helps organizations plan, manage and implement processes to store and move goods from origin to destination. Logistics financing supports businesses where the order-to-delivery cycle may not correlate with cash flow needs. We believe that by ensuring that information is transparent, accurate and verifiable at various stages during the shipping process, blockchain-enabled logistics management platforms can streamline and standardize the product flow from sellers to buyers and eliminate standard transactional intermediaries in the freight and shipping industry. Further, we believe that by decreasing middle-man costs, we can greatly improve the efficiency of capital utilization, expand margins and accelerate inventory turnover for companies shipping and ordering goods. In addition, we believe that the transparency and security provided by blockchain technologies, combined with the computing power of AI technologies, can reduce existing logistics financing costs, including by improving risk management and decision making, and enable alternative logistics financing solutions.

To support the development of blockchain- and AI-based technologies for the logistics management and financing industries, we entered the commodities trading business, with the primary goal of learning about the needs of buyers and sellers in industries that rely heavily on the shipment of goods to inform our understanding of the features a blockchain platform would need in order to serve this industry vertical. Specifically, we elected to focus on the crude oil and consumer electronics businesses, which are industries that we estimate are sufficiently commoditized and high volume, in order to (i) serve as meaningful controls, (ii) identify inefficiencies in the logistics management and finance industries and (iii) generate data to support the potential future application of AI solutions.

Our crude oil trading business commenced in October 2017, when we formed our Singapore joint venture, Seven Stars Energy Pte. Ltd. (“SSE”), which is 51% owned by us. The other partner in the joint venture is a businessman based in Singapore with extensive experience in the oil trading industry and ownership or control of several large oil tankers. Our consumer electronics trading business commenced on January 2017, and is operated by our subsidiary Amer Global Technology Limited (“Amer”), in which we have a 55% interest. The end customers in our crude oil and consumer electronics trading businesses include about 15 to 20 corporations across the world. Our crude oil trading business does not currently integrate blockchain- or AI-based logistics solutions.

While we have begun phasing out of the crude oil trading business and the electronics trading business, we intend to continue to capitalize on our efforts and learning from these businesses so that we can leverage the applications of our technologies and FinTech Ecosystem across this business and as part of our Industry Ventures strategy.

Consumer Digital Products

Our second group of Industry Ventures focuses on consumer digital products. We believe that existing communities of consumers, merchants and service providers can significantly benefit from platforms that leverage blockchain technologies to aggregate content and services and products, such as blockchain-based digital membership cards, digital wallets, and loyalty programs that offer cash or other token-based rewards to users within these communities.

| 3 |

In September 2018, we purchased a 65.65% equity interest in Grapevine Logic Inc. (“Grapevine”), and an affiliate of Dr. Bruno Wu, our Chairman of the Board has an option to require us to acquire the remaining stake in Grapevine. Grapevine is an end-to-end influencer marketing platform that facilitates collaboration between advertisers and brands with video based social influencers and content creators. Through the Grapevine platform, more than 4,700 companies have been able to hire the services of over 177,000 social influencers, ultimately helping these companies to promote their products and strengthen their brand. We believe that Grapevine will help us develop strength in the consumer digital products industry vertical by providing the platform for connecting brands with content-producing influencers and their large-scale audience of consumer-driven followers to whom digital tokens, loyalty and discount cards, multi-purpose digital wallets, and other services may be marketed via Grapevine on behalf of Ideanomics, brand advertisers and influencers, all according to a follower’s areas of interest.

Also in September 2018, we announced the proposed joint venture with Asia Times Holdings (“AT”), a Hong Kong company which owns the Asia Times newspaper, to be named Asia Times Financial Limited (“ATF”). Effective February 20, 2019, the Company and AT agreed to terminate their subscription agreement so that the Company will retain approximately 4.0% interest in AT, and not be obligated to make any further investment into AT. In addition, the parties have agreed to terminate the Shareholder’s Agreement for the joint venture, Asia Times Financial.

Financial Services

As evidenced by the proliferation of offerings of blockchain-based tokens in recent years, and the rapid growth of an industry to support these offerings, we believe that a core use case for blockchain and AI technology lies in financial services, digital asset securitization, and blockchain-enabled trading platforms. We plan to provide consulting services to companies seeking financing both through the sales of blockchain based instruments, such as securitized assets represented by digital tokens, which we refer to as “digital securitized assets,” as well as through conventional means, such as sales of traditional equity and debt securities. We believe that this dual approach to financial transactions, coupled with a related AI and blockchain enabled financial services platform, will provide us with flexibility to address the needs of issuers and investors. We also aim to use AI-powered analytics from our technology investments for different use cases, such as the trading, pricing, indexing and ratings of digital tokens (including digital securitized assets). Although we do not yet offer products or services in this industry vertical, we believe that ultimately, the Industry Ventures we form, acquire, or invest in this area will become the core of our business.

Digital Asset Securitization

We believe that we can use AI- and blockchain-enabled technology to provide a seamless method and platform for the creation and trading of digital securitized assets. Specifically, we plan to facilitate the securitization of tangible and intangible assets, such as data and IP, into new financial products, to “tokenize” these financial products by digitally recording them on a blockchain, to enable advanced platforms and capabilities using AI and blockchain technology, and to support the distribution and monetization of digital securitized assets. In so doing, we can be a leader in the transition of traditional financial products, such as commodities, currencies, credit, leasing, real estate and other asset classes, into the asset digitalization era.

Creating digital securitized assets requires the conversion of illiquid, tangible and intangible assets into blockchain enabled securities that we anticipate will, subject to future regulatory approval, be easily traded via exchanges, and as such, are more liquid than the underlying asset. We refer to this process as “digital asset securitization.”

As a first step in this process, we are identifying and engaging in discussions, negotiations and, in some cases, joint ventures, with third parties that own the specific tangible and intangible assets to be securitized, who we refer to as “asset originators,” or that have relationships with asset originators. We may also elect to securitize assets owned by our Company. Next, we will work with domestic and international securities market professionals, including licensed broker-dealers, merchant banks, ratings agencies and financial institutions, to structure and document the securitization of the assets, creating an asset backed financial product that can be more easily distributed and traded. This securitization process may include the pooling of assets, whether within the same asset class or across asset classes or asset originator types, or fractionalization of ownership of individual assets.

Once assets have been securitized, the new asset backed financial product will be represented in the form of digital, blockchain based tokens. We refer to this process as “digital tokenization.” Digital tokens are representative units of value, analogous to a stock certificate or a book-entry position, each of which reflects a holder’s ownership of a security, the terms of which are established in the investment documentation. Each of these tokens will be created by a “smart contract,” a self-executing agreement whose lines of code will reflect the economic and governance terms determined in the asset securitization process.

| 4 |

We intend for our digital tokenization process largely to rely upon technologies already in use and accessible in today’s blockchain market, such as Ethereum’s ERC-20 tokens, thus reducing the need, costs and execution risks of new technology development. We also intend to enter into leverage our Fintech Ecosystem to use blockchains that may be optimized for tokenization of assets in specific industry verticals, including, potentially basing these technologies on FI’s Velocity Ledger. We believe there are myriad benefits that can potentially be afforded by tokenizing securities via Velocity Ledger, including new product creation and market exposure, competitive fees, fast deal execution, and access to institutional investors and broker dealers.

Trading and Financial Services Platforms

We believe that regulated alternative trading systems (“ATSs”) and sophisticated risk management software are important for the development of trading markets for blockchain based digital tokens, including the digital securitized assets we plan to originate as part of our financial services business. Accordingly, we are making strategic investments that are intended to promote the development of regulated ATSs that will enhance the blockchain token trading ecosystem and AI-based ratings systems to enhance the market viability of our digital securitized assets.

Between August 2017 and December 2018, we acquired approximately 36.92% of the capital stock of Delaware Board of Trade Holdings, Inc. (“DBOT”), which is a FINRA member firm and has filed an initial operations report on Form ATS to give notice of operations of DBOT ATS, LLC (“DBOT ATS”), and which we believe is well positioned to develop blockchain-enabled transactional platforms. DBOT operates three business lines, (i) DBOT ATS, which is intended to be an ATS for equity securities not listed on the New York Stock Exchange or the Nasdaq, (ii) DBOT Issuer Services LLC, which is focused on setting and maintaining issuer standards, as well as the provision of issuer services to DBOT designated issuers, and (iii) DBOT Technology Services LLC, which is focused on the provision of market data and marketplace connectivity.

DBOT has entered into agreements with FI (which is also a licensor to Ideanomics), pursuant to which FI is developing a blockchain enabled primary issuance and secondary trading platform for DBOT ATS using the Velocity Ledger. Under the agreements, DBOT will maintain licensing rights for the technology.

Our Fintech Revenue Model:

As part of our transitioning to a next-generation fintech company, we began developing our revenue and business model to be closely aligned with the technologies and industries that we support in our FinTech Ecosystem and Industry Ventures in a way that we can capitalize on the market demand for these products and services.

Our FinTech business and revenue model is directly connected with the agreements and partnerships that we engage in. The underlying economics vary on a case by case basis (due to the particular industry that they are a part of, and specific facts and circumstances for each agreement), but generally they have the following characteristics:

Digital Assets, Blockchain and AI:

| · | Proceeds of new digital asset creation (i.e. Token Generation Event) on behalf of subsidiary companies or third parties |

| · | Proceeds from the creation and issuance of financial instruments tied with new data-based products such as indexes and futures |

| · | Fees collected by the securitization, tokenization/primary digital issuance, and trading of digital assets |

| · | Revenue sharing agreements with strategic partners |

| · | FinTech consulting and advisory service fees related to these asset classes |

Asia Operations:

| · | Monetization of Electrical Vehicle Related Agreements: |

| · | Commissions: related to the underwriting performed by our partners for Asset Backed Securities (ABS) |

| · | Recharging Station Fees: Recurring Revenue streams for the reaching of electrical vehicles and their use of recharging station networks (as a transaction fee, or as a percentage of revenue or profit) |

| · | Electrical Vehicle Sales Commissions: bus sales commissions associated with the sales of electrical bus fleets |

| · | Revenue share agreements for the use of our AI capabilities associated with the transmission of data across the electrical vehicles, their charging stations, and related connectivity |

| 5 |

Lease Financing:

| · | Lease Financing Commissions |

| · | ABS Issuance Commissions |

| · | Electrical Vehicle Sales Commissions: bus sales commissions associated with the sales of electrical bus fleets |

U.S. Operations:

Licensing of Technologies / FinTech Village:

| · | Recurring licensing revenue derived from the licensing of our technology ecosystem |

| · | Licensing and recurring revenue from other technologies we intend to bring into our ecosystem |

Equity Investments:

Additionally, we benefit from the various equity interests that we have in our various subsidiaries, joint ventures, and partnerships across our Fintech Ecosystem and Industry Ventures. In cases where valuable intellectual property is generated by through these strategic investments, the Company will consider strategic licensing agreements and additional business models in exchange for our services to further enhance revenue.

Legacy YOD Segment

Since 2010, we have provided premium content and integrated value-added service solutions for the delivery of VOD and paid video programming to digital cable providers, IPTV providers, OTT streaming providers, mobile manufacturers and operators, as well as direct customers. The core revenues were generated from both minimum guarantee payments and revenue sharing arrangements with distribution partners as well as subscription or transactional fees from subscribers.

In October 2016, we signed an agreement to form a five year partnership with Zhejiang Yanhua Culture Media Co., Ltd., a company organized under the laws of the PRC (“Yanhua”), where Yanhua will act as the exclusive distribution operator (within the territory of PRC) of our licensed library of major studio films (the “Yanhua Partnership”). We entered into the Yanhua Partnership and exclusive distribution agreement in order to offset losses from high upfront minimum guarantee licensing fees to studios. The Yanhua Partnership modified and improved our legacy major studio paid content business model by moving from a framework that included high and fixed costs and upfront minimum guaranteed payments, rising content costs from major Hollywood studios and low margins to a structure that will now include relatively nominal costs to our Company and the opportunity to reach an even wider audience. With the Yanhua Partnership, Yanhua assumed all sales and marketing costs and will pay us a minimum guarantee in exchange for a percentage of the total revenue share.

| 6 |

Pursuant to the Yanhua Partnership, the existing legacy Hollywood studio paid content as well as other IP content specified in the agreement, along with the corresponding authorized rights letter that we are entitled to, were transferred to Yanhua for RMB13,000,000 (approximately $2 million), to be paid in two equal installments in the amount of RMB6,500,000 (approximately $1 million). The first installment was received on December 30, 2016 and was recognized as revenue in 2017 based on the relative fair value of licensed content delivered to Yanhua. The second installment will be paid if the license content fees due to studios for the existing legacy Hollywood paid contents are settled. To date, the legacy Hollywood studio paid content and other IP has not been transferred, as the second installment was not yet made.

We still run our legacy YOD segment with limited resources and plan to continue to run it through the Yanhua Partnership, where Yanhua will act as the exclusive distribution operator (within the PRC) of our licensed library of major studio films. We launched our legacy VOD service through the acquisition of YOD Hong Kong (formerly Sinotop Group Limited) on July 30, 2010, by China CB Cayman. Through a series of contractual arrangements, YOD WFOE, the subsidiary of YOD Hong Kong, controls Sinotop Beijing, a corporation established in the PRC. Sinotop Beijing was the 80% owner of Zhong Hai Media until June 30, 2017, through which we provided: (1) integrated value–added business–to–business (“B2B”) service solutions for the delivery of VOD and enhanced premium content for digital cable; (2) integrated value–added business–to–business–to–customer (“B2B2C”) service solutions for the delivery of VOD and enhanced premium content for IPTV and OTT providers; and (3) a direct to user, or business-to-customer (“B2C”), mobile video service app. We sold Zhong Hai Media on June 30, 2017 to Hanghzou for a nominal amount.

Management Team with Significant FinTech, Blockchain and AI Experience

To support our transition to a next-generation AI and blockchain enabled fintech company, we have strategically secured a management team with diversified expertise in operations, technology, fintech, blockchain, AI, capital markets and the financial services industry, and largely transitioned our operations toward the United States, having 18 U.S. employees as of December 31, 2018 compared to three as of December 31, 2017. As of the date of this filing, key members of our management team include:

Dr. Bruno Wu. Our Chairman of the Board is an experienced investor, technology and media entrepreneur, and philanthropist. Dr. Wu has been actively involved with blockchain enabled and big data technologies since October 2011. After four years of investment and research, in 2015, Dr. Wu and Beijing Sun Seven Stars Culture Development Limited (“SSS”), an affiliate of Dr. Wu and a significant shareholder in our Company, proceeded to execute the strategy of becoming a leader in fintech and asset digitization services by aggregating AI, blockchain and other big data and cloud-based technologies, carefully sourced and selected on a global basis through joint ventures and partnerships. These partnerships focus on customizing and enabling actual business use case applications. Dr. Wu actively participated in the build out of a leading big data hub in Guiyang, China, particularly by endorsing the integration of AI and blockchain. Dr. Wu has committed to transforming our Company into a fintech and asset digitization services flagship, with multiple use case technology engines to be rolled out.

Mr. Alf Poor. Our Chief Executive Officer, and President of the Connecticut Fintech Village, is a former Chief Operating Officer at Global Data Sentinel, a cybersecurity company that specializes in identity management, file access control, protected sharing, reporting and tracking, AI and thread response, and backup and recovery. He is the former President and Chief Operating Officer of Agendize Services Inc., a company with an integrated suite of applications that help businesses generate higher quality leads, improve business efficiency and customer engagement. Mr. Poor is a client-focused and profitability-driven management executive with a track record of success at both rapidly-growing technology companies and large, multi-national, organizations.

| 7 |

Ms. Kate Lam is Managing Director, Digital Capital Markets. Ms. Lam has more than twenty years of financial markets experience in marketing multiple asset classes to Propellr, a fintech platform for multi-asset financing. She successfully obtained the SEC broker dealer license for Propellr Securities and integrated regulatory best practices into the platform. As CEO of the broker dealer, she worked closely with engineers and product managers to design specifications for investor vetting, as well as perform due diligences on financing deals. She was also the Head of Institutional Sales and Investor Relations for the company. Prior to Propellr, Ms. Lam held senior management positions at Deutsche Bank, Bear Stearns and Standard Chartered Bank with a client base spanning central banks, global and regional banks, asset managers, global insurance companies and hedge funds.

Dr. George Yuan. Dr. George Yuan is the Chief Technology Officer of BBDCG. Dr. Yuan is a world leading expert on dynamic ontology for credit risk assessment and risk management. He served as the leader for risk management consulting at KPMG (US) and the Director of China / Hong Kong Deloitte Financial Consulting. Dr. Yuan was selected as a National Distinguished Expert in Shanghai’s and Sichuan’s “The Thousand Talents Plan” in 2013 and 2018, and he is the Chief Editor for The Journal of Financial Engineering. Dr. Yuan’s is leading BDCG’s focus on AI driven financial data services as well as transactional platforms for index, futures and derivative trading, for both global commodity and energy clients. Dr. Yuan is the Chief Risk Officer and Chief Engineer of BDCG. Dr. Yuan has held a professorship at the Institute of Risk Management at Tongji University. Dr. Yuan’s study and work has centered around the valuation of financial derivatives and value-at-risk (“VaR”) modeling for market risk, credit risk and operational risk under the framework of the Basel II (Basel III) Accord, financial and credit derivatives pricing, portfolio optimization, risk limit design, commodity forward price curve design, complex position, commodity price risk assessment and asset valuation.

Preferred Stock

The Company has a multi-tiered capital structure that includes Series A Preferred Stock.

Ranking. With respect to rights upon liquidation, winding-up or dissolution, the Series A Preferred Stock ranks senior to our common stock and pari passu with any other series of our preferred stock established by our board of directors.

Voting. The holders of the Series A Preferred Stock are entitled to ten (10) votes for each one (1) share of common stock that is issuable upon conversion of a share of Series A Preferred Stock (each of the 7,000,000 shares of Series A Preferred Stock is convertible into 0.1333333 shares of Common Stock, or a total of 9,333,330 votes). Except as required by law, all shares of Series A Preferred Stock and all shares of common stock shall vote together as a single class.

Conversion. Each share of Series A Preferred Stock is convertible, at any time at the option of the holder, into ten (10) fully paid and nonassessable shares of common stock, subject to adjustment as provided in the Certificate of Designation.

Dividends. The Series A Preferred Stock is only entitled to receive dividends when and if declared by our board of directors.

Liquidation. Upon the occurrence of a liquidation event, the holders of the Series A Preferred Stock then outstanding will be entitled to receive, out of the assets of the Company available for distribution to its stockholders, an amount equal to $0.50 per share, as may be adjusted from time to time, plus all accrued, but unpaid dividends, before any payment shall be made or any assets distributed to the holders of common stock or any other class or series of stock issued by the Company not designated as ranking senior to or pari passu with the Series A Preferred Stock in respect of the right to participate in distributions or payments upon a liquidation event. For purposes of the Certificate of Designation, a “liquidation event” means any liquidation, dissolution or winding up of the Company, either voluntary or involuntary, and upon the election of the holders of a majority of the then outstanding Series A Preferred Stock shall be deemed to be occasioned by, or to include, (i) the acquisition of the Company by another entity by means of any transaction or series of related transactions (including, without limitation, any reorganization, merger, consolidation, or other transaction in which control of the Company is transferred, but, excluding any merger effected exclusively for the purpose of changing the domicile of the Company) unless the Company’s stockholders of record as constituted immediately prior to such acquisition or sale will, immediately after such acquisition or sale (by virtue of securities issued as consideration for the Company’s acquisition or sale or otherwise) hold at least 50% of the voting power of the surviving or acquiring entity or (ii) a sale of all or substantially all of the assets of the Company.

| 8 |

Corporate Information

Ideanomics, Inc. (formerly China Broadband, Inc., Seven Stars Cloud Group, Inc. and WeCast) was incorporated in Nevada on October 22, 2004 pursuant to a reorganization of a California entity formed in 1988. Prior to January 2007 we were a blank check shell company. On January 23, 2007, we acquired CB Cayman, which at the time was a party to the cooperation agreement with our PRC-based WFOE, in a reverse acquisition transaction. Our principal executive offices are located at 55 Broadway, 19th Floor, New York, NY 10006, and our telephone number is (212) 206-1216. Our corporate website address is www.ideanomics.com. Information contained on or accessible through our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

Recent Developments

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On January 10, 2020, Ideanomics, Inc. (the “Company”) received a letter from the Listing Qualifications Staff (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that the bid price for the Company’s common stock for the last 30 consecutive business days had closed below the minimum $1.00 per share required for continued listing under Nasdaq Listing Rule 5550(a)(2).

Under Nasdaq Listing Rule 5810(c)(3)(A), the Company has been granted a 180 calendar day grace period, or until July 8, 2020, to regain compliance with the minimum bid price requirement. The continued listing standard will be met if the Company evidences a closing bid price of at least $1.00 per share for a minimum of 10 consecutive business days during the 180 calendar day grace period. In order for Nasdaq to consider granting the Company additional time beyond July 8, 2020, the Company would be required, among other things, to meet the continued listing requirement for market value of publicly held shares as well as all other standards for initial listing on Nasdaq, with the exception of the minimum bid price requirement. If measured today, the Company would qualify for Nasdaq’s consideration of an extension because the Company currently has stockholders’ equity of at least $5 million. In the event the Company does not regain compliance with the $1.00 bid price requirement by July 8, 2020, eligibility for Nasdaq’s consideration of a second 180 day grace period would be determined on the Company’s compliance with the above referenced criteria on July 8, 2020.

The Company is diligently working to evidence compliance with the minimum bid price requirement for continued listing on Nasdaq; however, there can be no assurance that the Company will be able to regain compliance or that Nasdaq will grant the Company a further extension of time to regain compliance, if necessary. If the Company fails to regain compliance with the Nasdaq continued listing standards, its common stock will be subject to delisting from Nasdaq.

Issuance of common stock for True-Up related to purchase of the Delaware Board of Trade

On January 31, 2020 the Company issued 10,883,668 shares of the company’s common stock pursuant to the terms of the True-Up provisions of the securities purchase agreement for the Company’s acquisition of the Delaware Board of Trade (DBOT). The securities purchase agreement required the Company to issue additional shares of the Company’s common stock (“True-Up Common Stock”) in the event the stock price of the common stock was below $2.11 at the close of trading on January 30, 2020, the day immediately preceding the lock-up date. The common stock issuance is subject to the restrictions of Rule 144A of the Securities Act of 1933. At the date of acquisition, the Company accounted for the additional True-Up Common Stock consideration as a liability in accordance with ASC 480 and recorded a liability at fair value of $2,217,034. As of September 30, 2019, we remeasured this liability to $2,327,919 and the remeasurement loss of $(110,885) was recorded in the other income/(expense) of the income statement. The Company is in the process of completing another remeasurement as of December 31, 2019 the result of which will be reported in the financial results for the fourth quarter. The 10,883,668 shares issued for the True-Up are included in the 178,727,383 Shares Outstanding after the Offering set out on page 10 of this S-1 filing. In the event that the stock price of the common stock is $0.54 (which was the Company’s closing price on February 12, 2019) on April 19, 2020 the Company would be required to issue 4,138,383 additional shares of common stock in order to comply with the terms of the True-Up provisions of the securities purchase agreement with DBOT .

Impairment Charge on the Company’s holdings of Cryptocurrencies.

As of December 31, 2019 the Company had holdings of cryptocurrency classified as Indefinite Lived Intangible Assets with a value of $61.1 million. As required by US GAAP the company has performed an impairment analysis as of December 31, 2019 and the preliminary and unaudited conclusion of this analysis is that the cryptocurrency has a de-minis value and an impairment charge estimated to be in the range of $60 million should be recorded in the financial results for the fourth quarter of 2019. This charge is non-cash and will be recorded in Other Expense.

| 9 |

The Offering

| Shares offered by the selling stockholders | We are registering the resale by the selling stockholders named in this prospectus, or their permitted transferees, of an aggregate of 33,136,693(1) shares of common stock. |

Shares offered by the Company |

None |

| Terms of the offering | The selling stockholders will determine when and how they will dispose of the shares of common stock registered under this prospectus for resale. |

| Shares outstanding prior to the offering | As of February 5, 2020, we had 160,301,387 shares of common stock issued and outstanding. |

| Shares outstanding after the offering | 178,727,293 (2) shares of common stock. |

| Use of proceeds | We will not receive any of the proceeds from the sale of the shares of common stock by the selling stockholders. However, we may receive up to a maximum of approximately $9,829,240 of gross proceeds from the exercise of the Warrants (as defined in footnote 1 below) (based on an initial exercise price of $1.00 and $1.50 per share) by selling stockholders to the extent they are exercised on a cash basis, which proceeds we expect to use for general corporate purposes and for working capital. No assurances can be given that all or any portion of the Warrants will ever be exercised. |

| Nasdaq ticker symbol | Our common stock are listed on the Nasdaq Capital Market under the symbol “IDEX”. |

For additional information concerning the offering, see “Plan of Distribution” beginning on page 108.

| (1) | Consists of (i) 14,710,787 shares of common stock; (ii) 9,430,000 shares of common stock underlying convertible notes (the “Notes”); (iii) 8,995,996 shares of common stock underlying warrants (the “Warrants”) to purchase common stock. | |

| (2) | Assumes conversion of the Notes and the exercise of the Warrants. |

| 10 |

Investing in our securities involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, before deciding whether to purchase any of our securities. If any of these risks actually occur, it could harm our business, financial condition, results of operations and cash flows and our prospects. In that event, the price of our securities could decline and you could lose part or all of your investment.

RISKS RELATED TO OUR BUSINESS AND STRATEGY

Substantial doubt about our ability to continue as a going concern.

This Annual Report on Form 10-K for the year ended December 31, 2018 includes disclosures and an opinion from our independent registered public accounting firm stating that our recurring losses and negative cash flows from operations raise substantial doubt about our ability to continue as a going concern. Our consolidated financial statements as of December 31, 2018 were prepared under the assumption that we will continue as a going concern and do not include any adjustments that might result from the outcome of this uncertainty. As of December 31, 2018, we had accumulated deficit of $150.0 million, with liabilities of $49.8 million and cash on hand of $3.1 million. As of September 30, 2019, we had accumulated deficit of 138.47 million, with liabilities of $47.26 million and cash on hand of $1.69 million.

We will need to rely on proceeds from debt and equity issuances to pay for ongoing operating expenses in order to execute its business plan. Management has taken several actions to ensure that the Company will continue as a going concern, including debit financings and reductions in YOD legacy segment related expenses and discretionary expenditures.

While we believe that our existing resources will be sufficient to fund our planned operations until September 30, 2020, we cannot provide assurances that our estimates are accurate, that we will be successful in transforming our business model or that we will be able to generate sufficient cash from operations or raise additional capital through equity and/or debt financings, collaborative or other funding arrangements with partners, or through other sources of financing on favorable terms or at all. If we are in fact unable to continue as a going concern, our shareholders may lose their entire investment in our Company.

We expect to require additional financing in the future to meet our business requirements. Such capital raising may be costly, difficult or not possible to obtain and, if obtained, could significantly dilute current stockholders’ equity interests

We must continue to rely on proceeds from debt and equity issuances to pay for ongoing operating expenses and repay existing debt in order to execute our business plan. Although we may attempt to raise funds by issuing debt or equity instruments, additional financing may not be available to us on terms acceptable us or at all or such resources may not be received in a timely manner. If we are unable to raise additional capital when required or on acceptable terms, we may be required to scale back or to discontinue certain operations, scale back or discontinue the development of new business lines, reduce headcount, sell assets, file for bankruptcy, reorganize, merge with another entity, or cease operations.

We are in the process of transforming our business model, such that there is only a limited basis to evaluate our business and prospects. This transformation may continue to evolve, and ultimately may not be successful.

We are in the process of transforming our business model to become a next generation AI- and blockchain-enabled fintech company. In connection with this transformation, we are in the process of considerable changes, including initiatives to assemble a new management team, reconfigure the business structure, and expand our mission and business lines. It is uncertain whether these efforts will prove beneficial or whether we will be able to develop the necessary business models, infrastructure and systems to support the business. This includes having or hiring the right talent to execute our business strategy, and building a team with the technological capability and know-how to build the products and provide the services we envision. Market acceptance of new product and service offerings will be dependent in part on our ability to include functionality and usability that address customer requirements, and optimally price our products and services to meet customer demand and cover our costs.

Although we have been operating our legacy YOD business for several years, because our new Mobile Energy Group (MEG) (formally Wecast Services) segment has only been developed since 2017, there is only a limited basis upon which to evaluate our business and prospects. Our future success depends, in part, on our ability to implement our business plans and complete the transformation we envision. An investor in our stock should consider the challenges, expenses, and difficulties we will face as a company seeking to provide new types of fintech solutions in a competitive market. For example, we have not generated and may never generate revenue from any AI- or blockchain-enabled products or services. Any failure to implement our business plans in accordance with our expectations may have a material adverse effect on our financial results.

| 11 |

Further, as digital assets and blockchain technologies become more widely available, we expect the services and products associated with them to evolve. Government regulation may cause us to potentially change our future business in order to comply fully with the federal securities and other laws as well as applicable state securities laws. As a result, to stay current with the industry, our business model may need to continue to evolve as well. From time to time, we may modify aspects four business model relating to our products and services. We cannot offer any assurance that these or any other modifications will be successful or will not have an adverse effect to our business.

Even if we implement our plan in accordance with our expectations, our assumptions regarding costs and growth of revenue may differ substantially from reality. Furthermore, even if the anticipated benefits and savings are realized in part, there may be consequences, internal control issues, or business impacts that were not expected. Additionally, as a result of our restructuring efforts in connection with our business transformation plan, we may experience a loss of continuity, loss of accumulated knowledge or loss of efficiency during transitional periods. Reorganization and restructuring can require a significant amount of management and other employees’ time and focus, which may divert attention from operating activities and growing our business. If we fail to achieve some or all of the expected benefits of these activities, it could have a material adverse effect on our competitive position, business, financial condition, results of operations and cash flows.

Our operating results are likely to fluctuate significantly and may differ from market expectations.

Our annual and quarterly operating results have varied significantly in the past, and may vary significantly in the future, due to a number of factors which could have an adverse impact on our business. Our revenue may fluctuate as we expect a disproportionate amount of our revenues generated from our Mobile Energy Group (MEG) (formally Wecast Services) segment quarter over quarter due to the customers’ seasonal demand, as normally holiday demand for consumer electronics would increase our revenue. Furthermore, as the launch dates of our new products may not be the same as what we have planned, we expect the financial performance might fluctuate significantly depending on timing, quantity and outcome of such product launches.

The transformation of our business will put added pressure on our management and operational infrastructure, impeding our ability to meet any potential increased demand for our services and possibly hurting our future operating results.

Our business plan is to significantly grow our operations to meet anticipated growth in demand for the services that we offer, and by the introduction of new goods or services. Growth in our businesses will place a significant strain on our personnel, management, financial systems and other resources. The evolution of our business also presents numerous risks and challenges, including:

| · | our ability to successfully and rapidly expand sales to potential new distributors in response to potentially increasing demand; |

| · | the costs associated with such growth, which are difficult to quantify, but could be significant; and |

| · | rapid technological change. |

To accommodate any such growth and compete effectively, we will need to obtain additional funding to improve information systems, procedures and controls and expand, train, motivate and manage our employees, and such funding may not be available in sufficient quantities, if at all. If we are not able to manage these activities and implement these strategies successfully to expand to meet any increased demand, our operating results could suffer.

The success of our business is dependent on our ability to retain our existing key employees and to add and retain senior officers to our management.

We depend on the services of our key employees. Our success will largely depend on our ability to retain these key employees and to attract and retain qualified senior and middle level managers to our management team. In addition, in connection with our transition to a new AI- & blockchain-enabled fintech business model, we have recruited certain members of management and employees with extensive knowledge of the blockchain market or technology, and the loss of their expertise could diminish our business.

We have recruited executives and management both in the United States and the PRC to assist in our ability to manage the business and to recruit and oversee employees. While we believe we offer compensation packages that are consistent with market practice, we cannot be certain that we will be able to hire and retain sufficient personnel to support our business. In addition, severe capital constraints have limited our ability to attract specialized personnel. Moreover, our budget limitations will restrict our ability to hire qualified personnel. The loss of any of our key employees, or failure to find a suitable successor, would significantly harm our business. Our future success will also depend on our ability to identify, hire, develop and retain skilled key employees. We do not maintain key person life insurance on any of our employees. Future sales or acquisitions by us may also cause uncertainty among our current employees and employees of an acquired entity, which could lead to the departure of key employees. Such departures could have an adverse impact on our business and the anticipated benefits of a sale or acquisition.

| 12 |

Changes in our management team may adversely affect our operations.

Over the last several months, we have experienced turnover or changes in our senior management. On April 6, 2018, our CFO, Mr. Simon Wu announced his resignation as our CFO. On April 11, 2018, our Board of Directors (the “Board”) appointed Mr. Jason Wu to serve as interim CFO. Effective June 1, 2018, the Board appointed Mr. Federico Tovar as our new CFO. On September 10, 2018, the Board appointed Mr. Brett McGonegal as Co-CEO, and on November 14, 2018 appointed him as CEO and Director. On February 20 2019, Mr. Brett McGonegal announced his resignation as our CEO, and the Board of Directors appointed its Chief Operations Officer, Mr. Alfred Poor, as the CEO. On April 30, 2019, the Company, its Board of Directors, and the Audit committee unanimously accepted the resignation of Mr. Federico Tovar, the Company’s Chief Financial Officer. Effective May 1, 2019, Mrs. Cecilia Xu, our Corporate Controller, assumed the duties of interim Chief Financial Officer of Ideanomics, Inc. Mrs. Xu, 41, joined the Company in October 2018 as Corporate Controller, and has served in that role until May 1, 2019. Mr. Conor McCarthy was appointed Chief Financial Officer on September 9, 2019 and Mrs. Xu relinquished her role as Interim Chief Financial Officer. Mrs. Xu remains in her position as Corporate Controller.

While we expect to engage in an orderly transition process as we integrate newly appointed officers and managers, we face a variety of risks and uncertainties relating to management transition, including diversion of management attention from business concerns, failure to retain other key personnel or loss of institutional knowledge. These risks and uncertainties could result in operational and administrative inefficiencies and added costs, which could adversely impact our results of operations, stock price and research and development of our products.

We are highly dependent on the services of Dr. Bruno Wu, our Chairman.

We are highly dependent on the services of Dr. Bruno Wu, our Chairman and largest stockholder, particularly as it relates to our operations in the PRC and Asia. Although Dr. Wu spends significant time with Ideanomics and is highly active in our management, he does not devote his full time and attention to Ideanomics. Dr. Wu also currently serves as CEO of Sun Seven Stars Investment Group.

Our international operations expose us to a number of risks.

Our international activities are significant to our revenues and profits, and we plan to further expand internationally. In certain international market segments, we have relatively little operating experience and may not benefit from any first-to-market advantages or otherwise succeed. It is costly to establish, develop, and maintain international operations and platforms, and promote our brand internationally.

Our international sales and operations are subject to a number of risks, including:

| · | local economic and political conditions; |

| · | government regulation of e-commerce and other services, electronic devices, and competition, and restrictive governmental actions (such as trade protection measures, including export duties and quotas and custom duties and tariffs), nationalization, and restrictions on foreign ownership; |

| · | restrictions on sales or distribution of certain products or services and uncertainty regarding liability for products, services, and content, including uncertainty as a result of less Internet-friendly legal systems, local laws, lack of legal precedent, and varying rules, regulations, and practices regarding the physical and digital distribution of media products and enforcement of IP rights; |

| · | limitations on the repatriation and investment of funds and foreign currency exchange restrictions; |

| · | limited technology infrastructure; |

| · | environmental and health and safety liabilities and expenditures relating to the disposal and remediation of hazardous substances into the air, water and ground; |

| · | shorter payable and longer receivable cycles and the resultant negative impact on cash flow; |

| · | laws and regulations regarding consumer and data protection, privacy, network security, encryption, payments, and restrictions on pricing or discounts; |

| · | geopolitical events, including war and terrorism. |

| 13 |

We may face challenges in expanding our international and cross-border businesses and operations.

As we expand our international and cross-border businesses into an increasing number of international markets, we will face risks associated with expanding into markets in which we have limited or no experience and in which we may be less well-known. We may be unable to attract a sufficient number of customers and other participants, fail to anticipate competitive conditions or face difficulties in operating effectively in these new markets. The expansion of our international and cross-border businesses will also expose us to risks inherent in operating businesses globally, including:

| · | inability to recruit international and local talent and challenges in replicating or adapting our Company policies and procedures to operating environments different than that of the PRC; |

| · | lack of acceptance of our product and service offerings; |

| · | challenges and increased expenses associated with staffing and managing international and cross-border operations and managing an organization spread over multiple jurisdictions; |

| · | trade barriers, such as import and export restrictions, customs duties and other taxes, competition law regimes and other trade restrictions, as well as other protectionist policies; |

| · | differing and potentially adverse tax consequences; |

| · | increased and conflicting regulatory compliance requirements; |

| · | challenges caused by distance, language and cultural differences; |

| · | increased costs to protect the security and stability of our information technology systems, IP and personal data, including compliance costs related to data localization laws; |

| · | availability and reliability of international and cross-border payment systems and logistics infrastructure; |

| · | exchange rate fluctuations; and |

| · | political instability and general economic or political conditions in particular countries or regions. |

As we expand further into new regions and markets, these risks could intensify, and efforts we make to expand our international and cross-border businesses and operations may not be successful. Failure to expand our international and cross-border businesses and operations could materially and adversely affect our business, financial condition and results of operations.

Transactions conducted through our international and cross-border platforms may be subject to different customs, taxes and rules and regulations, and we may be adversely affected by the complexity of and developments in customs and import/export laws, rules and regulations in the PRC and other jurisdictions. For example, effective as of April 8, 2016, the Notice on Tax Policies of Cross-Border E-Commerce Retail Importation, or the New Cross-Border E-commerce Tax Notice, replaced the previous system for taxing consumer goods imported into the PRC and introduced a 16% value-added tax, or VAT, on most products sold through e-commerce platforms and consumption tax on high-end cosmetics.

We may also have operations in various markets with volatile economic or political environments and may pursue growth opportunities in a number of newly developed and emerging markets. These investments may expose us to heightened risks of economic, geopolitical, or other events, including governmental takeover (i.e., nationalization) of our manufacturing facilities or IP, restrictive exchange or import controls, disruption of operations as a result of systemic political or economic instability, outbreak of war or expansion of hostilities, and acts of terrorism, each of which could have a substantial adverse effect on our financial condition and results of operations. Further, the U.S. government, other governments, and international organizations could impose additional sanctions that could restrict us from doing business directly or indirectly in or with certain countries or parties, which could include affiliates.

| 14 |

As we acquire, dispose of or restructure our businesses, product lines, and technologies, we may encounter unforeseen costs and difficulties that could impair our financial performance