UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05583

Franklin Templeton Variable Insurance Products Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (650) 312-2000

Date of fiscal year end: 12/31

Date of reporting period: 12/31/19

| Item 1. | Reports to Stockholders. |

Internet Delivery of Shareholder Reports: Effective January 1, 2021, as permitted by regulations adopted by the SEC, you may not be receiving paper copies of the Fund’s annual or semiannual shareholder reports by mail, unless you specifically request them from the insurance company that offers your variable annuity or variable life insurance contract or your financial intermediary. Instead of delivering paper copies of the report, the insurance company may choose to make the reports available on a website, and will notify you by mail each time a shareholder report is posted and provide you with a website link to access the report. Instructions for requesting paper copies will be provided by your insurance company.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the insurance company or your financial intermediary electronically by following the instructions provided by the insurance company or by contacting your financial intermediary.

You may elect to receive all future Fund shareholder reports in paper free of charge from the insurance company. You can inform the insurance company or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by following the instructions provided by the insurance company or by contacting your financial intermediary. Your election to receive reports in paper will apply to all portfolio companies available under your contract with the insurance company.

This notice is not legally a part of the shareholder report.

Franklin Templeton Variable Insurance

Products Trust Annual Report

| i | ||||

| Fund Summaries |

||||

| FFA-1 | ||||

| FFA-7 | ||||

| FFC-1 | ||||

| FI-1 | ||||

| FI-6 | ||||

| MGD-1 | ||||

| MS-1 | ||||

| FRD-1 | ||||

| FSV-1 | ||||

| FSV-6 | ||||

| FSC-1 | ||||

| FSI-1 | ||||

| TD-1 | ||||

| TF-1 | ||||

| TGB-1 | ||||

| TG-1 | ||||

| I-1 | ||||

| BOD-1 | ||||

| SI-1 | ||||

*Not part of the annual report. Retain for your records.

| Not FDIC Insured | May Lose Value | No Bank Guarantee |

MASTER CLASS – 4

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

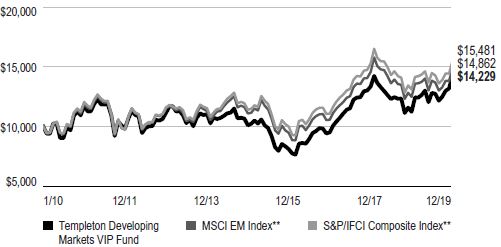

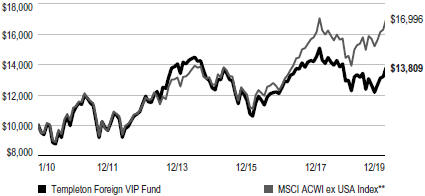

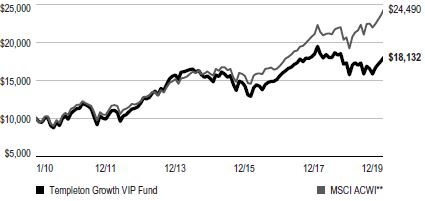

Performance Information

| Annual Report | i | |||

(Formerly, Franklin Founding Funds Allocation VIP Fund)

This annual report for Franklin Allocation VIP Fund covers the period ended December 31, 2019. As previously communicated, effective May 1, 2019, the Fund changed its name to Franklin Allocation VIP Fund and changed from a fund of funds that invested fixed percentages in three underlying funds to an actively managed fund that invests in a variety of equity and fixed income investments.

Class 4 Performance Summary as of December 31, 2019

Average annual total return of Class 4 shares* represents the average annual change in value, assuming reinvestment of dividends and capital gains. Average returns smooth out variations in returns, which can be significant; they are not the same as year-by-year results.

| Periods ended 12/31/19 | 1-Year | 5-Year | 10-Year | |||||||||

| Average Annual Total Return |

+19.56% | +5.05% | +7.34% | |||||||||

*On May 1, 2019, the Fund’s investment strategies changed. Performance prior to May 1, 2019, is attributable to the Fund’s performance before the strategy change. The Fund has an expense reduction and a fee waiver associated with any investments in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 4/30/20. Fund investment results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

Performance reflects the Fund’s Class 4 operating expenses, but does not include any contract fees, expenses or sales charges. If they had been included, performance would be lower. These charges and deductions, particularly for variable life policies, can have a significant effect on contract values and insurance benefits. See the contract prospectus for a complete description of these expenses, including sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown.

| Annual Report | FFA-1 | |||

FRANKLIN ALLOCATION VIP FUND

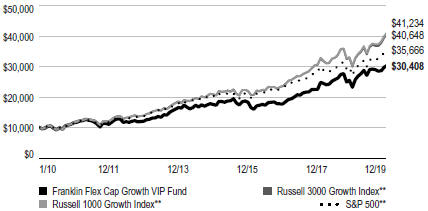

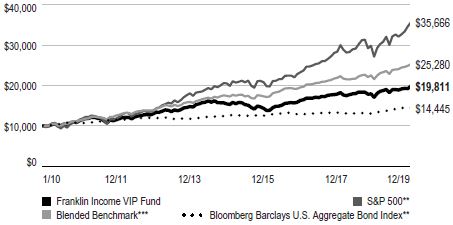

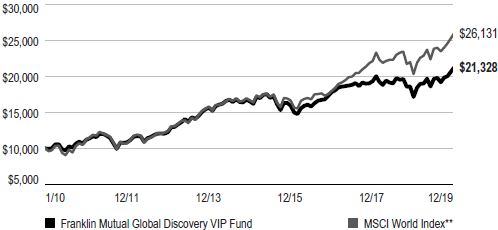

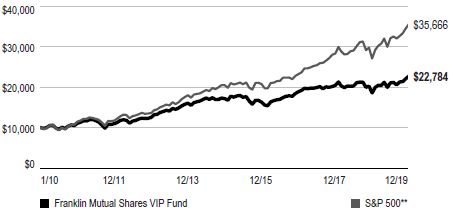

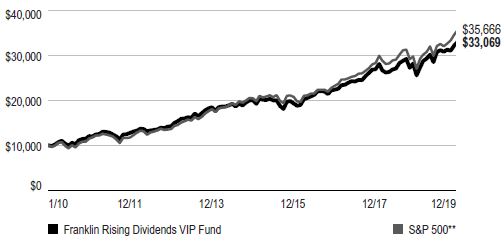

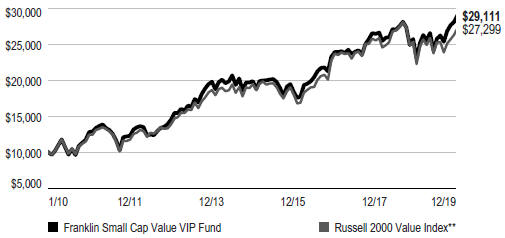

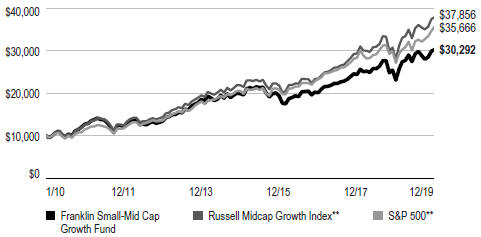

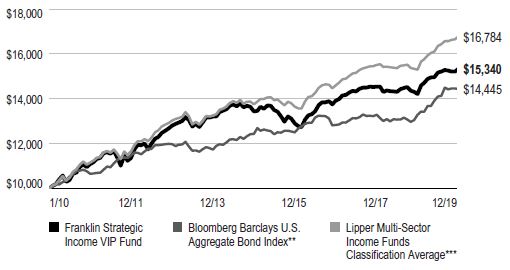

Total Return Index Comparison for a Hypothetical $10,000 Investment (1/1/10–12/31/19)

The graph below shows the change in value of a hypothetical $10,000 investment in the Fund over the indicated period and includes reinvestment of any income or distributions. The Fund’s performance* is compared to the performance of the Standard & Poor’s® 500 Index (S&P 500®), the MSCI World Index, the Bloomberg Barclays U.S. Aggregate Bond Index, MSCI World ex USA Index-NR and the Linked Allocation VIP Fund Benchmark (Blended Benchmark). One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. Please see Important Notes to Performance Information preceding the Fund Summaries.

**Source: Morningstar. Please see Index Descriptions following the Fund Summaries.

***Source: FactSet. The Fund’s Blended Benchmark was calculated internally and rebalanced monthly and was composed of 40% S&P 500, 40% Bloomberg Barclays U.S. Aggregate Bond Index and 20% MSCI World ex USA Index-NR. Net Returns (NR) include income net of tax withholding when dividends are paid. Please see Index Descriptions following the Fund Summaries.

| FFA-2 |

Annual Report | |||

FRANKLIN ALLOCATION VIP FUND

1. Source: Morningstar.

2. Source: FactSet. The Fund’s Blended Benchmark was calculated internally and rebalanced monthly and was composed of 40% S&P 500, 40% Bloomberg Barclays U.S. Aggregate Bond Index and 20% MSCI World ex USA Index-NR.

One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. Net Returns (NR) include income net of tax withholding when dividends are paid. Please see Index Descriptions following the Fund Summaries.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

| Annual Report | FFA-3 | |||

FRANKLIN ALLOCATION VIP FUND

3. Source: U.S. Bureau of Labor Statistics.

| FFA-4 |

Annual Report | |||

FRANKLIN ALLOCATION VIP FUND

| Annual Report | FFA-5 | |||

FRANKLIN ALLOCATION VIP FUND

Class 4 Fund Expenses

As an investor in a variable insurance contract (Contract) that indirectly provides for investment in an underlying mutual fund, you can incur transaction and/or ongoing expenses at both the Fund level and the Contract Level: (1) transaction expenses can include sales charges (loads) on purchases, surrender fees, transfer fees and premium taxes; and (2) ongoing expenses can include management fees, distribution and service (12b-1) fees, contract fees, annual maintenance fees, mortality and expense risk fees and other fees and expenses. All mutual funds and Contracts have some types of ongoing expenses. The table below shows Fund-level ongoing expenses and can help you understand these costs and compare them with those of other mutual funds offered through the Contract. The table assumes a $1,000 investment held for the six months indicated. Please refer to the Fund prospectus for additional information on operating expenses.

Actual Fund Expenses

The table below provides information about the actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of ongoing Fund expenses but does not include the effect of ongoing Contract expenses, is used to calculate the “Ending Account Value.” You can estimate the Fund-level expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number under the headings “Actual” and “Fund-Level Expenses Paid During Period” (if Fund-Level Expenses Paid During Period were $ 7.50, then 8.6 x $ 7.50 = $64.50). In this illustration, the estimated expenses paid this period at the Fund level are $64.50.

Hypothetical Example for Comparison with Other Mutual Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other mutual funds offered through the Contract. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds offered through the Contract.

Please note that expenses shown in the table are meant to highlight ongoing costs at the Fund level only and do not reflect any ongoing expenses at the Contract level, or transaction expenses at either the Fund or Contract levels. In addition, while the Fund does not have transaction expenses, if the transaction and ongoing expenses at the Contract level were included, the expenses shown below would be higher. You should consult your Contract prospectus or disclosure document for more information.

| Actual (actual return after expenses) |

Hypothetical (5% annual return before expenses) |

|||||||||||

| Share Class |

Beginning Account Value 7/1/19 |

Ending Account Value 12/31/19 |

Fund-Level 7/1/19–12/31/191, 2 |

Ending Account Value 12/31/19 |

Fund-Level Expenses Paid During Period 7/1/19–12/31/191, 2 |

Net Annualized Expense Ratio2 | ||||||

|

|

|

|

| |||||||||

| Class 4 | $1,000 | $1,059.30 | $4.62 | $1,020.72 | $4.53 | 0.89% | ||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| FFA-6 |

Annual Report | |||

FFA P1 P2 P4 09/19

SUPPLEMENT DATED SEPTEMBER 12, 2019

TO THE PROSPECTUSES

DATED MAY 1, 2019 OF

FRANKLIN ALLOCATION VIP FUND

(A series of Franklin Templeton Variable Insurance Products Trust)

The prospectus is amended as follows:

I. The “Fund Summary – Average Annual Total Returns” table on page FFA-S8 in the Fund’s Class 1 prospectus is replaced with the following:

Average Annual Total Returns

For the periods ended December 31, 2018

| 1 Year | 5 Years | 10 Years | ||||||

| Franklin Allocation VIP Fund – Class 1 |

-9.34% | 2.26% | 8.62% | |||||

| S&P 500® Index (index reflects no deduction for fees, expenses or taxes) |

-4.38% | 8.50% | 13.12% | |||||

| Bloomberg Barclays U.S. Aggregate Index (index reflects no deduction for fees, expenses or taxes) |

0.01% | 2.52% | 3.48% | |||||

| MSCI World ex-US (Net Dividends) Index (index reflects no deduction for fees, expenses or taxes) |

-14.09% | 0.34% | 6.24% | |||||

| Linked Allocation VIP Fund Benchmark (index reflects no deduction for fees, expenses or taxes) |

-4.41% | 4.62% | 8.11% | |||||

II. The “Fund Summary – Average Annual Total Returns” table on page FFA-S8 in the Fund’s Class 2 prospectus is replaced with the following:

Average Annual Total Returns

For the periods ended December 31, 2018

| 1 Year | 5 Years | 10 Years | ||||||

| Franklin Allocation VIP Fund – Class 2 |

-9.65% | 2.01% | 8.35% | |||||

| S&P 500® Index (index reflects no deduction for fees, expenses or taxes) |

-4.38% | 8.50% | 13.12% | |||||

| Bloomberg Barclays U.S. Aggregate Index (index reflects no deduction for fees, expenses or taxes) |

0.01% | 2.52% | 3.48% | |||||

| MSCI World ex-US (Net Dividends) Index (index reflects no deduction for fees, expenses or taxes) |

-14.09% | 0.34% | 6.24% | |||||

| Linked Allocation VIP Fund Benchmark (index reflects no deduction for fees, expenses or taxes) |

-4.41% | 4.62% | 8.11% | |||||

| FFA-7 | ||||

III. The “Fund Summary – Average Annual Total Returns” table on page FFA-S8 in the Fund’s Class 4 prospectus is replaced with the following:

Average Annual Total Returns

For the periods ended December 31, 2018

| 1 Year | 5 Years | 10 Years | ||||||

| Franklin Allocation VIP Fund – Class 4 |

-9.58% | 1.92% | 8.24% | |||||

| S&P 500® Index (index reflects no deduction for fees, expenses or taxes) |

-4.38% | 8.50% | 13.12% | |||||

| Bloomberg Barclays U.S. Aggregate Index (index reflects no deduction for fees, expenses or taxes) |

0.01% | 2.52% | 3.48% | |||||

| MSCI World ex-US (Net Dividends) Index (index reflects no deduction for fees, expenses or taxes) |

-14.09% | 0.34% | 6.24% | |||||

| Linked Allocation VIP Fund Benchmark (index reflects no deduction for fees, expenses or taxes) |

-4.41% | 4.62% | 8.11% | |||||

Please keep this supplement with your prospectus for future reference.

| FFA-8 |

||||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Financial Highlights

Franklin Allocation VIP Fund

| Year Ended December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Class 1 |

||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$ 6.37 | $ 7.44 | $ 7.13 | $ 6.80 | $ 7.47 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb,c |

0.11 | 0.23 | 0.21 | 0.21 | 0.26 | |||||||||||||||

| Net realized and unrealized gains (losses) |

1.11 | (0.89 | ) | 0.63 | 0.64 | (0.68 | ) | |||||||||||||

| Total from investment operations |

1.22 | (0.66 | ) | 0.84 | 0.85 | (0.42 | ) | |||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.27 | ) | (0.24 | ) | (0.22 | ) | (0.29 | ) | (0.24 | ) | ||||||||||

| Net realized gains |

(0.46 | ) | (0.17 | ) | (0.31 | ) | (0.23 | ) | (0.01 | ) | ||||||||||

| Total distributions |

(0.73 | ) | (0.41 | ) | (0.53 | ) | (0.52 | ) | (0.25 | ) | ||||||||||

| Net asset value, end of year |

$ 6.86 | $ 6.37 | $ 7.44 | $ 7.13 | $ 6.80 | |||||||||||||||

| Total returnd |

20.04% | (9.34)% | 12.17% | 13.43% | (5.93)% | |||||||||||||||

| Ratios to average net assets |

||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

0.44% | 0.12% | 0.12% | 0.11% | 0.11% | |||||||||||||||

| Expenses net of waiver and payments by affiliates |

0.39% | 0.10% | 0.10% | 0.10% | 0.10% | |||||||||||||||

| Net investment income |

1.55% | 3.13% | 2.75% | 3.09% | 3.51% | |||||||||||||||

| Supplemental data |

||||||||||||||||||||

| Net assets, end of year (000’s) |

$842 | $984 | $1,047 | $1,025 | $1,083 | |||||||||||||||

| Portfolio turnover rate |

170.79% | 2.23% | 1.28% | 0.10% | 0.26% | |||||||||||||||

| Portfolio turnover rate excluding mortgage dollar rolls |

158.11% | e | 2.23% | 1.28% | 0.10% | 0.26% | ||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds and exchange traded funds in which the Fund invests.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle.

eSee Note 1(f) regarding mortgage dollar rolls.

| The accompanying notes are an integral part of these financial statements. | Annual Report | FFA-9 | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL HIGHLIGHTS

Franklin Allocation VIP Fund (continued)

| Year Ended December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Class 2 |

||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$ 6.32 | $ 7.39 | $ 7.08 | $ 6.75 | $ 7.42 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb,c |

0.09 | 0.21 | 0.18 | 0.19 | 0.24 | |||||||||||||||

| Net realized and unrealized gains (losses) |

1.11 | (0.89 | ) | 0.64 | 0.64 | (0.68 | ) | |||||||||||||

| Total from investment operations |

1.20 | (0.68 | ) | 0.82 | 0.83 | (0.44 | ) | |||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.25 | ) | (0.22 | ) | (0.20 | ) | (0.27 | ) | (0.22 | ) | ||||||||||

| Net realized gains |

(0.46 | ) | (0.17 | ) | (0.31 | ) | (0.23 | ) | (0.01 | ) | ||||||||||

| Total distributions |

(0.71 | ) | (0.39 | ) | (0.51 | ) | (0.50 | ) | (0.23 | ) | ||||||||||

| Net asset value, end of year |

$ 6.81 | $ 6.32 | $ 7.39 | $ 7.08 | $ 6.75 | |||||||||||||||

| Total returnd |

19.86% | (9.65)% | 11.98% | 13.18% | (6.21)% | |||||||||||||||

| Ratios to average net assets |

||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

0.69% | 0.37% | 0.37% | 0.36% | 0.36% | |||||||||||||||

| Expenses net of waiver and payments by affiliates |

0.64% | 0.35% | 0.35% | 0.35% | 0.35% | |||||||||||||||

| Net investment income |

1.30% | 2.88% | 2.50% | 2.84% | 3.26% | |||||||||||||||

| Supplemental data |

||||||||||||||||||||

| Net assets, end of year (000’s) |

$403,040 | $390,300 | $480,402 | $474,669 | $480,715 | |||||||||||||||

| Portfolio turnover rate |

170.79% | 2.23% | 1.28% | 0.10% | 0.26% | |||||||||||||||

| Portfolio turnover rate excluding mortgage dollar rolls |

158.11% | e | 2.23% | 1.28% | 0.10% | 0.26% | ||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds and exchange traded funds in which the Fund invests.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle.

eSee Note 1(f) regarding mortgage dollar rolls.

| FFA-10 |

Annual Report | The accompanying notes are an integral part of these financial statements. | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL HIGHLIGHTS

Franklin Allocation VIP Fund (continued)

| Year Ended December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Class 4 |

||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$ 6.46 | $ 7.53 | $ 7.21 | $ 6.87 | $ 7.54 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb,c |

0.08 | 0.20 | 0.18 | 0.19 | 0.23 | |||||||||||||||

| Net realized and unrealized gains (losses) |

1.13 | (0.89 | ) | 0.64 | 0.64 | (0.68 | ) | |||||||||||||

| Total from investment operations |

1.21 | (0.69 | ) | 0.82 | 0.83 | (0.45 | ) | |||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.24 | ) | (0.21 | ) | (0.19 | ) | (0.26 | ) | (0.21 | ) | ||||||||||

| Net realized gains |

(0.46 | ) | (0.17 | ) | (0.31 | ) | (0.23 | ) | (0.01 | ) | ||||||||||

| Total distributions |

(0.70 | ) | (0.38 | ) | (0.50 | ) | (0.49 | ) | (0.22 | ) | ||||||||||

| Net asset value, end of year |

$ 6.97 | $ 6.46 | $ 7.53 | $ 7.21 | $ 6.87 | |||||||||||||||

| Total returnd |

19.56% | (9.58)% | 11.78% | 12.92% | (6.24)% | |||||||||||||||

| Ratios to average net assets |

||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

0.79% | 0.47% | 0.47% | 0.46% | 0.46% | |||||||||||||||

| Expenses net of waiver and payments by affiliates |

0.74% | 0.45% | 0.45% | 0.45% | 0.45% | |||||||||||||||

| Net investment income |

1.20% | 2.78% | 2.40% | 2.74% | 3.16% | |||||||||||||||

| Supplemental data |

||||||||||||||||||||

| Net assets, end of year (000’s) |

$406,693 | $393,385 | $528,862 | $530,403 | $550,825 | |||||||||||||||

| Portfolio turnover rate |

170.79% | 2.23% | 1.28% | 0.10% | 0.26% | |||||||||||||||

| Portfolio turnover rate excluding mortgage dollar rolls |

158.11% | e | 2.23% | 1.28% | 0.10% | 0.26% | ||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds and exchange traded funds in which the Fund invests.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle.

eSee Note 1(f) regarding mortgage dollar rolls.

| The accompanying notes are an integral part of these financial statements. | Annual Report | FFA-11 | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Statement of Investments, December 31, 2019

Franklin Allocation VIP Fund

| Country/ Organization |

Shares/ Rights |

Value | ||||||

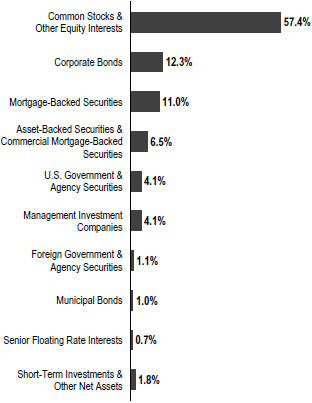

| Common Stocks and Other Equity Interests 57.4% |

||||||||

| Automobiles & Components 0.7% |

||||||||

| Aptiv PLC |

United States | 23,000 | $ | 2,184,310 | ||||

| BorgWarner Inc. |

United States | 7,564 | 328,126 | |||||

| Cie Generale des Etablissements Michelin SCA |

France | 8,174 | 1,000,091 | |||||

| General Motors Co. |

United States | 17,439 | 638,267 | |||||

| Gentex Corp. |

United States | 7,901 | 228,971 | |||||

| Isuzu Motors Ltd. |

Japan | 61,700 | 737,504 | |||||

| Lear Corp. |

United States | 1,768 | 242,570 | |||||

|

|

|

|||||||

| 5,359,839 | ||||||||

|

|

|

|||||||

| Banks 2.1% |

||||||||

| Bank of Ireland Group PLC |

Ireland | 144,599 | 791,668 | |||||

| BNP Paribas SA |

France | 34,750 | 2,058,806 | |||||

| FinecoBank Banca Fineco SpA |

Italy | 197,000 | 2,361,695 | |||||

| Hana Financial Group Inc. |

South Korea | 29,472 | 940,767 | |||||

| ING Groep NV |

Netherlands | 169,040 | 2,026,123 | |||||

| Kasikornbank PCL, fgn |

Thailand | 82,200 | 415,556 | |||||

| KB Financial Group Inc. |

South Korea | 52,538 | 2,165,621 | |||||

| KBC Groep NV |

Belgium | 30,000 | 2,256,133 | |||||

| Shinhan Financial Group Co. Ltd. |

South Korea | 19,766 | 741,231 | |||||

| Standard Chartered PLC |

United Kingdom | 197,696 | 1,865,337 | |||||

| Sumitomo Mitsui Financial Group Inc., ADR |

Japan | 193,000 | 1,430,130 | |||||

|

|

|

|||||||

| 17,053,067 | ||||||||

|

|

|

|||||||

| Capital Goods 6.6% |

||||||||

| 3M Co. |

United States | 8,277 | 1,460,228 | |||||

| Allegion PLC |

United States | 5,221 | 650,223 | |||||

| Allison Transmission Holdings Inc. |

United States | 2,065 | 99,781 | |||||

| AMETEK Inc. |

United States | 4,418 | 440,651 | |||||

| BAE Systems PLC |

United Kingdom | 98,353 | 735,729 | |||||

| The Boeing Co. |

United States | 9,354 | 3,047,159 | |||||

| BWX Technologies Inc. |

United States | 10,901 | 676,734 | |||||

| CAE Inc. |

Canada | 71,000 | 1,879,701 | |||||

| Carlisle Cos. Inc. |

United States | 3,000 | 485,520 | |||||

| Caterpillar Inc. |

United States | 3,646 | 538,441 | |||||

| CK Hutchison Holdings Ltd. |

Hong Kong | 197,000 | 1,878,406 | |||||

| Compagnie de Saint-Gobain |

France | 18,180 | 744,161 | |||||

| Cummins Inc. |

United States | 4,300 | 769,528 | |||||

| Deere & Co. |

United States | 3,386 | 586,658 | |||||

| Donaldson Co. Inc. |

United States | 8,200 | 472,484 | |||||

| Dover Corp. |

United States | 9,300 | 1,071,918 | |||||

| Emerson Electric Co. |

United States | 23,967 | 1,827,723 | |||||

| Fastenal Co. |

United States | 17,478 | 645,812 | |||||

| Ferguson PLC |

United Kingdom | 27,000 | 2,449,570 | |||||

| Fortive Corp. |

United States | 3,417 | 261,025 | |||||

| General Dynamics Corp. |

United States | 12,687 | 2,237,352 | |||||

| Graco Inc. |

United States | 4,502 | 234,104 | |||||

| GrafTech International Ltd. |

United States | 769 | 8,936 | |||||

| Honeywell International Inc. |

United States | 20,870 | 3,693,990 | |||||

| FFA-12 |

Annual Report | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS

Franklin Allocation VIP Fund (continued)

| Country/ Organization |

Shares/ Rights |

Value | ||||||||

|

Common Stocks and Other Equity Interests (continued) |

||||||||||

| Capital Goods (continued) |

||||||||||

| Huntington Ingalls Industries Inc. |

United States | 3,138 | $ | 787,261 | ||||||

| Illinois Tool Works Inc. |

United States | 10,967 | 1,970,002 | |||||||

| Ingersoll-Rand PLC |

United States | 7,056 | 937,884 | |||||||

| Johnson Controls International PLC |

United States | 22,700 | 924,117 | |||||||

| Lennox International Inc. |

United States | 477 | 116,374 | |||||||

| Lockheed Martin Corp. |

United States | 6,856 | 2,669,589 | |||||||

| Masco Corp. |

United States | 2,097 | 100,635 | |||||||

| MSC Industrial Direct Co. Inc., A |

United States | 1,157 | 90,790 | |||||||

| MTU Aero Engines AG |

Germany | 8,500 | 2,426,930 | |||||||

| Northrop Grumman Corp. |

United States | 8,205 | 2,822,274 | |||||||

| nVent Electric PLC |

United States | 15,000 | 383,700 | |||||||

| PACCAR Inc. |

United States | 4,676 | 369,872 | |||||||

| Pentair PLC |

United States | 13,800 | 633,006 | |||||||

| Raytheon Co. |

United States | 13,917 | 3,058,122 | |||||||

| Rockwell Automation Inc. |

United States | 3,421 | 693,334 | |||||||

| Roper Technologies Inc. |

United States | 10,100 | 3,577,723 | |||||||

| Sinopec Engineering Group Co. Ltd. |

China | 843,500 | 504,435 | |||||||

| Snap-on Inc. |

United States | 966 | 163,640 | |||||||

| Stanley Black & Decker Inc. |

United States | 4,952 | 820,745 | |||||||

| Toro Co. |

United States | 3,372 | 268,647 | |||||||

| United Technologies Corp. |

United States | 15,175 | 2,272,608 | |||||||

| W.W. Grainger Inc. |

United States | 3,014 | 1,020,299 | |||||||

| a WABCO Holdings Inc. |

United States | 819 | 110,975 | |||||||

| Watsco Inc. |

United States | 784 | 141,238 | |||||||

|

|

|

|||||||||

| 53,760,034 | ||||||||||

|

|

|

|||||||||

| Commercial & Professional Services 1.2% |

||||||||||

| Cintas Corp. |

United States | 6,559 | 1,764,896 | |||||||

| a Copart Inc. |

United States | 5,678 | 516,357 | |||||||

| Equifax Inc. |

United States | 3,490 | 489,019 | |||||||

| Experian PLC |

United Kingdom | 80,000 | 2,703,997 | |||||||

| a IAA Inc. |

United States | 1,064 | 50,072 | |||||||

| a IHS Markit Ltd. |

United States | 23,109 | 1,741,263 | |||||||

| KAR Auction Services Inc. |

United States | 942 | 20,526 | |||||||

| Matthews International Corp., A |

United States | 7,500 | 286,275 | |||||||

| Republic Services Inc. |

United States | 1,000 | 89,630 | |||||||

| Robert Half International Inc. |

United States | 3,964 | 250,326 | |||||||

| Rollins Inc. |

United States | 4,380 | 145,241 | |||||||

| Verisk Analytics Inc. |

United States | 9,761 | 1,457,708 | |||||||

|

|

|

|||||||||

| 9,515,310 | ||||||||||

|

|

|

|||||||||

| Consumer Durables & Apparel 1.1% |

||||||||||

| a Capri Holdings Ltd. |

United States | 4,344 | 165,723 | |||||||

| Carter’s Inc. |

United States | 1,286 | 140,611 | |||||||

| D.R. Horton Inc. |

United States | 2,493 | 131,506 | |||||||

| Garmin Ltd. |

United States | 4,046 | 394,728 | |||||||

| Hanesbrands Inc. |

United States | 4,752 | 70,567 | |||||||

| Hasbro Inc. |

United States | 3,251 | 343,338 | |||||||

| Annual Report | FFA-13 | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS

Franklin Allocation VIP Fund (continued)

| Country/ Organization |

Shares/ Rights |

Value | ||||||||

|

Common Stocks and Other Equity Interests (continued) |

||||||||||

| Consumer Durables & Apparel (continued) |

||||||||||

| Leggett & Platt Inc. |

United States | 3,602 | $ | 183,090 | ||||||

| a Lululemon Athletica Inc. |

United States | 3,282 | 760,341 | |||||||

| NIKE Inc., B |

United States | 40,458 | 4,098,800 | |||||||

| a NVR Inc. |

United States | 87 | 331,332 | |||||||

| Panasonic Corp., ADR |

Japan | 105,900 | 996,519 | |||||||

| PulteGroup Inc. |

United States | 3,695 | 143,366 | |||||||

| Tapestry Inc. |

United States | 8,755 | 236,122 | |||||||

| VF Corp. |

United States | 9,005 | 897,438 | |||||||

| Whirlpool Corp. |

United States | 475 | 70,077 | |||||||

|

|

|

|||||||||

| 8,963,558 | ||||||||||

|

|

|

|||||||||

| Consumer Services 1.2% |

||||||||||

| Carnival Corp. |

United States | 10,218 | 519,381 | |||||||

| Choice Hotels International Inc. |

United States | 959 | 99,189 | |||||||

| Darden Restaurants Inc. |

United States | 3,945 | 430,044 | |||||||

| Domino’s Pizza Inc. |

United States | 1,252 | 367,813 | |||||||

| Graham Holdings Co., B |

United States | 358 | 228,758 | |||||||

| H&R Block Inc. |

United States | 6,807 | 159,828 | |||||||

| Las Vegas Sands Corp. |

United States | 13,479 | 930,590 | |||||||

| McDonald’s Corp. |

United States | 12,726 | 2,514,785 | |||||||

| Six Flags Entertainment Corp. |

United States | 1,589 | 71,680 | |||||||

| Starbucks Corp. |

United States | 9,490 | 834,361 | |||||||

| a TAL Education Group, ADR |

China | 54,000 | 2,602,800 | |||||||

| Wyndham Destinations Inc. |

United States | 1,762 | 91,078 | |||||||

| Yum! Brands Inc. |

United States | 10,475 | 1,055,147 | |||||||

|

|

|

|||||||||

| 9,905,454 | ||||||||||

|

|

|

|||||||||

| Diversified Financials 1.6% |

||||||||||

| American Express Co. |

United States | 3,890 | 484,266 | |||||||

| a Berkshire Hathaway Inc., B |

United States | 6,144 | 1,391,616 | |||||||

| BlackRock Inc. |

United States | 1,465 | 736,456 | |||||||

| The Charles Schwab Corp. |

United States | 19,431 | 924,138 | |||||||

| Deutsche Boerse AG |

Germany | 17,000 | 2,671,911 | |||||||

| FactSet Research Systems Inc. |

United States | 1,064 | 285,471 | |||||||

| Flow Traders |

Netherlands | 26,411 | 637,985 | |||||||

| Intercontinental Exchange Inc. |

United States | 9,055 | 838,040 | |||||||

| Intermediate Capital Group PLC |

United Kingdom | 20,000 | 426,473 | |||||||

| Invesco Ltd. |

United States | 6,531 | 117,427 | |||||||

| Lazard Ltd., A |

United States | 3,263 | 130,390 | |||||||

| MarketAxess Holdings Inc. |

United States | 1,055 | 399,961 | |||||||

| MFA Financial Inc. |

United States | 3,230 | 24,710 | |||||||

| Moody’s Corp. |

United States | 2,263 | 537,259 | |||||||

| Morningstar Inc. |

United States | 520 | 78,681 | |||||||

| MSCI Inc. |

United States | 2,278 | 588,134 | |||||||

| S&P Global Inc. |

United States | 1,999 | 545,827 | |||||||

| Santander Consumer USA Holdings Inc. |

United States | 2,925 | 68,357 | |||||||

| SEI Investments Co. |

United States | 2,830 | 185,308 | |||||||

| State Street Corp. |

United States | 2,600 | 205,660 | |||||||

| FFA-14 |

Annual Report | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS

Franklin Allocation VIP Fund (continued)

| Country/ Organization |

Shares/ Rights |

Value | ||||||||

| Common Stocks and Other Equity Interests (continued) |

||||||||||

| Diversified Financials (continued) |

||||||||||

| T. Rowe Price Group Inc. |

United States | 7,539 | $ | 918,552 | ||||||

| UBS Group AG |

Switzerland | 28,367 | 358,380 | |||||||

|

|

|

|||||||||

| 12,555,002 | ||||||||||

| Energy 2.3% |

||||||||||

| a Apergy Corp. |

United States | 7,800 | 263,484 | |||||||

| BP PLC |

United Kingdom | 284,973 | 1,779,972 | |||||||

| Cabot Oil & Gas Corp., A |

United States | 27,616 | 480,795 | |||||||

| Chevron Corp. |

United States | 7,400 | 891,774 | |||||||

| Cimarex Energy Co. |

United States | 1,676 | 87,973 | |||||||

| Concho Resources Inc. |

United States | 4,018 | 351,856 | |||||||

| ConocoPhillips |

United States | 14,455 | 940,009 | |||||||

| Eni SpA |

Italy | 91,864 | 1,426,427 | |||||||

| EOG Resources Inc. |

United States | 6,400 | 536,064 | |||||||

| Equinor ASA |

Norway | 66,776 | 1,335,140 | |||||||

| Exxon Mobil Corp. |

United States | 27,226 | 1,899,830 | |||||||

| Galp Energia SGPS SA, B |

Portugal | 48,999 | 818,754 | |||||||

| HollyFrontier Corp. |

United States | 1,991 | 100,964 | |||||||

| Husky Energy Inc. |

Canada | 103,200 | 828,079 | |||||||

| Occidental Petroleum Corp. |

United States | 11,400 | 469,794 | |||||||

| ONEOK Inc. |

United States | 2,943 | 222,697 | |||||||

| Phillips 66 |

United States | 9,569 | 1,066,082 | |||||||

| Royal Dutch Shell PLC, B |

United Kingdom | 42,569 | 1,262,642 | |||||||

| SBM Offshore NV |

Netherlands | 40,838 | 759,785 | |||||||

| Schlumberger Ltd. |

United States | 14,300 | 574,860 | |||||||

| Tenaris SA |

Italy | 54,609 | 615,475 | |||||||

| Total SA |

France | 12,943 | 714,134 | |||||||

| Valero Energy Corp. |

United States | 11,045 | 1,034,364 | |||||||

|

|

|

|||||||||

| 18,460,954 | ||||||||||

| Food & Staples Retailing 1.1% |

||||||||||

| Casey’s General Stores Inc. |

United States | 922 | 146,589 | |||||||

| Costco Wholesale Corp. |

United States | 4,687 | 1,377,603 | |||||||

| The Kroger Co. |

United States | 14,245 | 412,962 | |||||||

| Matsumotokiyoshi Holdings Co. Ltd. |

Japan | 20,200 | 787,182 | |||||||

| Seven & I Holdings Co. Ltd., ADR |

Japan | 35,900 | 657,508 | |||||||

| a Sprouts Farmers Market Inc. |

United States | 2,414 | 46,711 | |||||||

| Sundrug Co. Ltd. |

Japan | 22,200 | 807,923 | |||||||

| Sysco Corp. |

United States | 14,000 | 1,197,560 | |||||||

| Walgreens Boots Alliance Inc. |

United States | 17,351 | 1,023,015 | |||||||

| Walmart Inc. |

United States | 20,000 | 2,376,800 | |||||||

|

|

|

|||||||||

| 8,833,853 | ||||||||||

| Food, Beverage & Tobacco 2.5% |

||||||||||

| Altria Group Inc. |

United States | 28,276 | 1,411,255 | |||||||

| Brown-Forman Corp., A |

United States | 1,486 | 93,276 | |||||||

| Brown-Forman Corp., B |

United States | 11,799 | 797,612 | |||||||

| Bunge Ltd. |

United States | 10,300 | 592,765 | |||||||

| Annual Report | FFA-15 | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS

Franklin Allocation VIP Fund (continued)

| Country/ Organization |

Shares/ Rights |

Value | ||||||||

| Common Stocks and Other Equity Interests (continued) |

||||||||||

| Food, Beverage & Tobacco (continued) |

||||||||||

| The Coca-Cola Co. |

United States | 26,317 | $ | 1,456,646 | ||||||

| Constellation Brands Inc., A |

United States | 3,504 | 664,884 | |||||||

| Fevertree Drinks PLC |

United Kingdom | 70,000 | 1,940,452 | |||||||

| Flowers Foods Inc. |

United States | 5,137 | 111,678 | |||||||

| General Mills Inc. |

United States | 17,306 | 926,909 | |||||||

| The Hershey Co. |

United States | 5,001 | 735,047 | |||||||

| Hormel Foods Corp. |

United States | 8,367 | 377,435 | |||||||

| Ingredion Inc. |

United States | 1,745 | 162,198 | |||||||

| The J. M. Smucker Co. |

United States | 2,227 | 231,898 | |||||||

| Kellogg Co. |

United States | 4,136 | 286,046 | |||||||

| Kirin Holdings Co. Ltd. |

Japan | 50,100 | 1,101,808 | |||||||

| Lamb Weston Holdings Inc. |

United States | 3,432 | 295,255 | |||||||

| McCormick & Co. Inc. |

United States | 6,200 | 1,052,326 | |||||||

| Mondelez International Inc., A |

United States | 9,469 | 521,553 | |||||||

| a Monster Beverage Corp. |

United States | 26,249 | 1,668,124 | |||||||

| PepsiCo Inc. |

United States | 22,238 | 3,039,268 | |||||||

| Philip Morris International Inc. |

United States | 16,946 | 1,441,935 | |||||||

| Suntory Beverage & Food Ltd. |

Japan | 11,300 | 472,588 | |||||||

| Tyson Foods Inc. |

United States | 8,049 | 732,781 | |||||||

|

|

|

|||||||||

| 20,113,739 | ||||||||||

| Health Care Equipment & Services 3.7% |

||||||||||

| Abbott Laboratories |

United States | 22,460 | 1,950,875 | |||||||

| a ABIOMED Inc. |

United States | 1,312 | 223,814 | |||||||

| Baxter International Inc. |

United States | 2,515 | 210,304 | |||||||

| Becton, Dickinson and Co. |

United States | 8,843 | 2,405,031 | |||||||

| Cerner Corp. |

United States | 7,272 | 533,692 | |||||||

| Chemed Corp. |

United States | 346 | 151,984 | |||||||

| Cochlear Ltd. |

Australia | 17,000 | 2,680,591 | |||||||

| CVS Health Corp. |

United States | 6,800 | 505,172 | |||||||

| Danaher Corp. |

United States | 6,687 | 1,026,321 | |||||||

| Dentsply Sirona Inc. |

United States | 4,800 | 271,632 | |||||||

| a Edwards Lifesciences Corp. |

United States | 2,707 | 631,516 | |||||||

| GN Store Nord AS |

Denmark | 55,000 | 2,586,070 | |||||||

| a Haemonetics Corp. |

United States | 6,324 | 726,628 | |||||||

| HCA Holdings Inc. |

United States | 5,114 | 755,900 | |||||||

| a IDEXX Laboratories Inc. |

United States | 620 | 161,901 | |||||||

| a Intuitive Surgical Inc. |

United States | 2,922 | 1,727,340 | |||||||

| a Laboratory Corp. of America Holdings |

United States | 3,410 | 576,870 | |||||||

| a LivaNova PLC |

United Kingdom | 36,000 | 2,715,480 | |||||||

| Medtronic PLC |

United States | 17,800 | 2,019,410 | |||||||

| a Premier Inc., A |

United States | 586 | 22,198 | |||||||

| Quest Diagnostics Inc. |

United States | 5,773 | 616,499 | |||||||

| ResMed Inc. |

United States | 3,815 | 591,210 | |||||||

| Sinopharm Group Co. Ltd., H |

China | 157,200 | 573,943 | |||||||

| Stryker Corp. |

United States | 14,592 | 3,063,444 | |||||||

| Teleflex Inc. |

United States | 3,384 | 1,273,873 | |||||||

| FFA-16 |

Annual Report | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS

Franklin Allocation VIP Fund (continued)

| Country/ Organization |

Shares/ Rights |

Value | ||||||||

| Common Stocks and Other Equity Interests (continued) |

||||||||||

| Health Care Equipment & Services (continued) |

||||||||||

| Universal Health Services Inc., B |

United States | 1,289 | $ | 184,920 | ||||||

| a Varian Medical Systems Inc. |

United States | 2,004 | 284,588 | |||||||

| West Pharmaceutical Services Inc. |

United States | 9,000 | 1,352,970 | |||||||

|

|

|

|||||||||

| 29,824,176 | ||||||||||

| Household & Personal Products 1.0% |

||||||||||

| Church & Dwight Co. Inc. |

United States | 6,941 | 488,230 | |||||||

| Clorox Co. |

United States | 4,242 | 651,316 | |||||||

| Colgate-Palmolive Co. |

United States | 30,504 | 2,099,895 | |||||||

| Estee Lauder Cos. Inc., A |

United States | 6,568 | 1,356,555 | |||||||

| Kimberly-Clark Corp. |

United States | 6,764 | 930,388 | |||||||

| Nu Skin Enterprises Inc., A |

United States | 1,414 | 57,946 | |||||||

| The Procter & Gamble Co. |

United States | 20,713 | 2,587,054 | |||||||

|

|

|

|||||||||

| 8,171,384 | ||||||||||

| Insurance 0.2% |

||||||||||

| Aflac Inc. |

United States | 10,400 | 550,160 | |||||||

| American National Insurance Co. |

United States | 233 | 27,419 | |||||||

| Assured Guaranty Ltd. |

United States | 1,766 | 86,569 | |||||||

| Erie Indemnity Co., A |

United States | 3,000 | 498,000 | |||||||

| Fidelity National Financial Inc. |

United States | 1,930 | 87,526 | |||||||

| RenaissanceRe Holdings Ltd. |

United States | 540 | 105,851 | |||||||

|

|

|

|||||||||

| 1,355,525 | ||||||||||

| Materials 3.5% |

||||||||||

| Air Products and Chemicals Inc. |

United States | 15,822 | 3,718,012 | |||||||

| Alamos Gold Inc., A |

Canada | 83,100 | 500,262 | |||||||

| Albemarle Corp. |

United States | 21,500 | 1,570,360 | |||||||

| a Axalta Coating Systems Ltd. |

United States | 21,685 | 659,224 | |||||||

| Celanese Corp. |

United States | 9,616 | 1,183,922 | |||||||

| Eastman Chemical Co. |

United States | 2,680 | 212,417 | |||||||

| Ecolab Inc. |

United States | 10,021 | 1,933,953 | |||||||

| International Flavors & Fragrances Inc. |

United States | 2,716 | 350,418 | |||||||

| Johnson Matthey PLC |

United Kingdom | 29,607 | 1,174,821 | |||||||

| Koninklijke DSM NV |

Netherlands | 20,000 | 2,604,007 | |||||||

| Linde PLC |

United Kingdom | 14,985 | 3,190,307 | |||||||

| Lotte Chemical Corp. |

South Korea | 4,020 | 778,969 | |||||||

| LyondellBasell Industries NV, A |

United States | 10,246 | 968,042 | |||||||

| Martin Marietta Materials Inc. |

United States | 2,563 | 716,717 | |||||||

| NewMarket Corp. |

United States | 218 | 106,061 | |||||||

| Nucor Corp. |

United States | 9,120 | 513,274 | |||||||

| Packaging Corp. of America |

United States | 2,106 | 235,851 | |||||||

| Reliance Steel & Aluminum Co. |

United States | 486 | 58,203 | |||||||

| Royal Gold Inc. |

United States | 468 | 57,213 | |||||||

| Sonoco Products Co. |

United States | 2,793 | 172,384 | |||||||

| Steel Dynamics Inc. |

United States | 3,807 | 129,590 | |||||||

| Sumitomo Metal Mining Co. Ltd. |

Japan | 31,000 | 1,010,941 | |||||||

| Symrise AG |

Germany | 22,500 | 2,366,820 | |||||||

| Annual Report | FFA-17 | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS

Franklin Allocation VIP Fund (continued)

| Country/ Organization |

Shares/ Rights |

Value | ||||||||

| Common Stocks and Other Equity Interests (continued) |

||||||||||

| Materials (continued) |

||||||||||

| Umicore SA |

Belgium | 57,000 | $ | 2,771,686 | ||||||

| Valvoline Inc. |

United States | 2,506 | 53,654 | |||||||

| Wheaton Precious Metals Corp. |

Canada | 46,900 | 1,395,515 | |||||||

|

|

|

|||||||||

| 28,432,623 | ||||||||||

| Media & Entertainment 2.1% |

||||||||||

| a Alphabet Inc., A |

United States | 2,146 | 2,874,331 | |||||||

| a AMC Networks Inc., A |

United States | 1,033 | 40,803 | |||||||

| Ascential PLC |

United Kingdom | 467,885 | 2,427,947 | |||||||

| a Baidu Inc., ADR |

China | 7,800 | 985,920 | |||||||

| Cable One Inc. |

United States | 430 | 640,042 | |||||||

| Cinemark Holdings Inc. |

United States | 1,767 | 59,813 | |||||||

| Comcast Corp., A |

United States | 36,932 | 1,660,832 | |||||||

| CyberAgent Inc. |

Japan | 65,000 | 2,281,804 | |||||||

| a Facebook Inc., A |

United States | 11,928 | 2,448,222 | |||||||

| a IAC/InterActiveCorp. |

United States | 2,007 | 499,964 | |||||||

| The Interpublic Group of Cos. Inc. |

United States | 7,664 | 177,038 | |||||||

| John Wiley & Sons Inc., A |

United States | 1,300 | 63,076 | |||||||

| a Match Group Inc. |

United States | 1,273 | 104,526 | |||||||

| Omnicom Group Inc. |

United States | 6,087 | 493,169 | |||||||

| SES SA, IDR |

Luxembourg | 64,135 | 899,052 | |||||||

| The Walt Disney Co. |

United States | 11,212 | 1,621,592 | |||||||

|

|

|

|||||||||

| 17,278,131 | ||||||||||

| Pharmaceuticals, Biotechnology & Life Sciences 5.3% |

||||||||||

| AbbVie Inc. |

United States | 24,677 | 2,184,902 | |||||||

| Agilent Technologies Inc. |

United States | 8,185 | 698,262 | |||||||

| Amgen Inc. |

United States | 12,459 | 3,003,491 | |||||||

| Astellas Pharma Inc., ADR |

Japan | 30,200 | 514,306 | |||||||

| AstraZeneca PLC, ADR |

United Kingdom | 13,014 | 648,878 | |||||||

| Bayer AG |

Germany | 22,776 | 1,859,724 | |||||||

| a Biogen Inc. |

United States | 4,687 | 1,390,774 | |||||||

| Bristol-Myers Squibb Co. |

United States | 24,680 | 1,584,209 | |||||||

| a Bristol-Myers Squibb Co., rts., 2/01/49 |

United States | 5,348 | 16,098 | |||||||

| a Catalent Inc. |

United States | 21,889 | 1,232,351 | |||||||

| CSL Ltd. |

Australia | 15,000 | 2,902,305 | |||||||

| a Elanco Animal Health Inc. |

United States | 9,587 | 282,337 | |||||||

| Eli Lilly & Co. |

United States | 7,962 | 1,046,446 | |||||||

| a Exelixis Inc. |

United States | 6,973 | 122,864 | |||||||

| Gilead Sciences Inc. |

United States | 25,158 | 1,634,767 | |||||||

| a GW Pharmaceuticals PLC, ADR |

United Kingdom | 1,426 | 149,103 | |||||||

| Hikma Pharmaceuticals PLC |

United Kingdom | 100,000 | 2,636,980 | |||||||

| a Illumina Inc. |

United States | 3,446 | 1,143,176 | |||||||

| Johnson & Johnson |

United States | 26,805 | 3,910,045 | |||||||

| Merck & Co. Inc. |

United States | 22,588 | 2,054,379 | |||||||

| Merck KGaA |

Germany | 7,936 | 937,597 | |||||||

| a Mettler-Toledo International Inc. |

United States | 3,555 | 2,820,110 | |||||||

| a Neurocrine Biosciences Inc. |

United States | 3,209 | 344,935 | |||||||

| FFA-18 |

Annual Report | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS

Franklin Allocation VIP Fund (continued)

| Country/ Organization |

Shares/ Rights |

Value | ||||||||

| Common Stocks and Other Equity Interests (continued) |

||||||||||

| Pharmaceuticals, Biotechnology & Life Sciences (continued) |

||||||||||

| Pfizer Inc. |

United States | 63,147 | $ | 2,474,099 | ||||||

| a PTC Therapeutics Inc. |

United States | 2,600 | 124,878 | |||||||

| a Reata Pharmaceuticals Inc. |

United States | 700 | 143,101 | |||||||

| a Regeneron Pharmaceuticals Inc. |

United States | 588 | 220,782 | |||||||

| Roche Holding AG |

Switzerland | 3,897 | 1,264,567 | |||||||

| Sanofi |

France | 10,624 | 1,067,758 | |||||||

| Santen Pharmaceutical Co. Ltd. |

Japan | 115,000 | 2,207,407 | |||||||

| Takeda Pharmaceutical Co. Ltd., ADR |

Japan | 84,900 | 1,675,077 | |||||||

| a Waters Corp. |

United States | 3,896 | 910,300 | |||||||

|

|

|

|||||||||

| 43,206,008 | ||||||||||

| Real Estate 1.4% |

||||||||||

| American Tower Corp. |

United States | 5,854 | 1,345,366 | |||||||

| CK Asset Holdings Ltd. |

Hong Kong | 186,630 | 1,347,219 | |||||||

| Crown Castle International Corp. |

United States | 7,085 | 1,007,133 | |||||||

| EPR Properties |

United States | 2,075 | 146,578 | |||||||

| Equinix Inc. |

United States | 1,198 | 699,273 | |||||||

| Gaming and Leisure Properties Inc. |

United States | 4,956 | 213,356 | |||||||

| Kimco Realty Corp. |

United States | 9,753 | 201,985 | |||||||

| Mitsui Fudosan Co. Ltd. |

Japan | 41,700 | 1,025,281 | |||||||

| National Retail Properties Inc. |

United States | 4,982 | 267,135 | |||||||

| OMEGA Healthcare Investors Inc. |

United States | 6,174 | 261,469 | |||||||

| Public Storage |

United States | 4,964 | 1,057,133 | |||||||

| Realty Income Corp. |

United States | 9,040 | 665,615 | |||||||

| Simon Property Group Inc. |

United States | 6,987 | 1,040,783 | |||||||

| Spirit Realty Capital Inc. |

United States | 2,899 | 142,573 | |||||||

| STORE Capital Corp. |

United States | 5,345 | 199,048 | |||||||

| Swire Pacific Ltd., A |

Hong Kong | 45,600 | 423,680 | |||||||

| Ventas Inc. |

United States | 5,956 | 343,899 | |||||||

| VEREIT Inc. |

United States | 28,432 | 262,712 | |||||||

| WP Carey Inc. |

United States | 3,655 | 292,546 | |||||||

|

|

|

|||||||||

| 10,942,784 | ||||||||||

| Retailing 3.3% |

||||||||||

| a Alibaba Group Holding Ltd., ADR |

China | 3,245 | 688,264 | |||||||

| a Amazon.com Inc. |

United States | 2,238 | 4,135,466 | |||||||

| a AutoZone Inc. |

United States | 544 | 648,073 | |||||||

| Best Buy Co. Inc. |

United States | 7,259 | 637,340 | |||||||

| a boohoo Group PLC |

United Kingdom | 690,000 | 2,722,420 | |||||||

| a Booking Holdings Inc. |

United States | 307 | 630,495 | |||||||

| a Burlington Stores Inc. |

United States | 506 | 115,383 | |||||||

| Dick’s Sporting Goods Inc. |

United States | 2,306 | 114,124 | |||||||

| Dollar General Corp. |

United States | 6,350 | 990,473 | |||||||

| Expedia Group Inc. |

United States | 2,351 | 254,237 | |||||||

| Foot Locker Inc. |

United States | 4,007 | 156,233 | |||||||

| The Gap Inc. |

United States | 7,717 | 136,437 | |||||||

| Genuine Parts Co. |

United States | 4,077 | 433,100 | |||||||

| The Home Depot Inc. |

United States | 6,374 | 1,391,954 | |||||||

| Annual Report | FFA-19 | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS

Franklin Allocation VIP Fund (continued)

| Country/ Organization |

Shares/ Rights |

Value | ||||||||

| Common Stocks and Other Equity Interests (continued) |

||||||||||

| Retailing (continued) |

||||||||||

| Kingfisher PLC |

United Kingdom | 219,553 | $ | 631,008 | ||||||

| Kohl’s Corp. |

United States | 5,312 | 270,646 | |||||||

| L Brands Inc. |

United States | 7,263 | 131,606 | |||||||

| Lowe’s Cos. Inc. |

United States | 4,200 | 502,992 | |||||||

| Macy’s Inc. |

United States | 9,207 | 156,519 | |||||||

| a MercadoLibre Inc. |

Argentina | 3,900 | 2,230,566 | |||||||

| Nordstrom Inc. |

United States | 3,423 | 140,103 | |||||||

| a O’Reilly Automotive Inc. |

United States | 2,303 | 1,009,313 | |||||||

| Penske Automotive Group Inc. |

United States | 707 | 35,506 | |||||||

| Pool Corp. |

United States | 1,044 | 221,725 | |||||||

| Ross Stores Inc. |

United States | 24,299 | 2,828,890 | |||||||

| Seria Co. Ltd. |

Japan | 7,600 | 207,702 | |||||||

| Target Corp. |

United States | 16,841 | 2,159,185 | |||||||

| Tiffany & Co. |

United States | 4,900 | 654,885 | |||||||

| The TJX Cos. Inc. |

United States | 22,989 | 1,403,708 | |||||||

| Tractor Supply Co. |

United States | 3,601 | 336,477 | |||||||

| a Ulta Beauty Inc. |

United States | 1,743 | 441,223 | |||||||

| a Urban Outfitters Inc. |

United States | 2,199 | 61,066 | |||||||

| Williams-Sonoma Inc. |

United States | 2,642 | 194,028 | |||||||

|

|

|

|||||||||

| 26,671,147 | ||||||||||

| Semiconductors & Semiconductor Equipment 2.9% |

||||||||||

| Analog Devices Inc. |

United States | 17,200 | 2,044,048 | |||||||

| Applied Materials Inc. |

United States | 24,271 | 1,481,502 | |||||||

| ASML Holding NV, N.Y. shs |

Netherlands | 4,222 | 1,249,459 | |||||||

| Infineon Technologies AG |

Germany | 135,000 | 3,074,848 | |||||||

| Intel Corp. |

United States | 24,208 | 1,448,849 | |||||||

| KLA Corp. |

United States | 4,277 | 762,033 | |||||||

| Lam Research Corp. |

United States | 3,869 | 1,131,295 | |||||||

| Maxim Integrated Products Inc. |

United States | 7,553 | 464,585 | |||||||

| Monolithic Power Systems |

United States | 2,900 | 516,258 | |||||||

| NVIDIA Corp. |

United States | 3,387 | 796,961 | |||||||

| NXP Semiconductors NV |

Netherlands | 14,297 | 1,819,436 | |||||||

| QUALCOMM Inc. |

United States | 9,599 | 846,920 | |||||||

| Skyworks Solutions Inc. |

United States | 5,654 | 683,455 | |||||||

| Taiwan Semiconductor Manufacturing Co. Ltd. |

Taiwan | 153,000 | 1,693,123 | |||||||

| Texas Instruments Inc. |

United States | 36,445 | 4,675,529 | |||||||

| Xilinx Inc. |

United States | 7,178 | 701,793 | |||||||

|

|

|

|||||||||

| 23,390,094 | ||||||||||

| Software & Services 6.8% |

||||||||||

| Accenture PLC, A |

United States | 18,687 | 3,934,922 | |||||||

| a Adobe Inc. |

United States | 877 | 289,243 | |||||||

| a Adyen NV |

Netherlands | 3,501 | 2,870,050 | |||||||

| Amdocs Ltd. |

United States | 4,013 | 289,698 | |||||||

| a Aspen Technology Inc. |

United States | 1,261 | 152,493 | |||||||

| a Atlassian Corp. PLC |

United States | 900 | 108,306 | |||||||

| a Autodesk Inc. |

United States | 5,142 | 943,351 | |||||||

| FFA-20 |

Annual Report | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS

Franklin Allocation VIP Fund (continued)

| Country/ Organization |

Shares/ Rights |

Value | ||||||||

| Common Stocks and Other Equity Interests (continued) |

||||||||||

| Software & Services (continued) |

||||||||||

| Automatic Data Processing Inc. |

United States | 12,815 | $ | 2,184,958 | ||||||

| AVEVA Group PLC |

United Kingdom | 21,000 | 1,294,994 | |||||||

| Booz Allen Hamilton Holding Corp. |

United States | 1,799 | 127,963 | |||||||

| Broadridge Financial Solutions Inc. |

United States | 3,465 | 428,066 | |||||||

| a Cadence Design Systems Inc. |

United States | 3,830 | 265,649 | |||||||

| Citrix Systems Inc. |

United States | 1,818 | 201,616 | |||||||

| Cognizant Technology Solutions Corp., A |

United States | 11,134 | 690,531 | |||||||

| a CyberArk Software Ltd. |

Israel | 15,000 | 1,748,700 | |||||||

| International Business Machines Corp. |

United States | 10,451 | 1,400,852 | |||||||

| a InterXion Holding NV |

Netherlands | 26,000 | 2,179,122 | |||||||

| Intuit Inc. |

United States | 11,913 | 3,120,372 | |||||||

| Jack Henry & Associates Inc. |

United States | 2,222 | 323,679 | |||||||

| Keywords Studios PLC |

Ireland | 127,000 | 2,519,713 | |||||||

| Mastercard Inc., A |

United States | 13,875 | 4,142,936 | |||||||

| Microsoft Corp. |

United States | 61,073 | 9,631,212 | |||||||

| Paychex Inc. |

United States | 10,204 | 867,952 | |||||||

| a PTC Inc. |

United States | 8,021 | 600,693 | |||||||

| The Sage Group PLC |

United Kingdom | 280,000 | 2,777,636 | |||||||

| a salesforce.com Inc. |

United States | 3,653 | 594,124 | |||||||

| SAP SE |

Germany | 19,000 | 2,563,724 | |||||||

| a ServiceNow Inc. |

United States | 6,455 | 1,822,376 | |||||||

| a Shopify Inc., A |

Canada | 7,000 | 2,783,060 | |||||||

| a Twilio Inc., A |

United States | 2,562 | 251,793 | |||||||

| a Tyler Technologies Inc. |

United States | 1,096 | 328,822 | |||||||

| a VeriSign Inc. |

United States | 2,859 | 550,872 | |||||||

| Visa Inc., A |

United States | 13,484 | 2,533,644 | |||||||

| a Workday Inc., A |

United States | 3,620 | 595,309 | |||||||

|

|

|

|||||||||

| 55,118,431 | ||||||||||

| Technology Hardware & Equipment 2.2% |

||||||||||

| Amphenol Corp., A |

United States | 5,833 | 631,306 | |||||||

| Apple Inc. |

United States | 25,462 | 7,476,916 | |||||||

| Cisco Systems Inc. |

United States | 50,098 | 2,402,700 | |||||||

| Cognex Corp. |

United States | 2,687 | 150,580 | |||||||

| a F5 Networks Inc. |

United States | 1,900 | 265,335 | |||||||

| HP Inc. |

United States | 47,342 | 972,878 | |||||||

| a Keysight Technologies Inc. |

United States | 4,162 | 427,146 | |||||||

| Motorola Solutions Inc. |

United States | 4,272 | 688,390 | |||||||

| NetApp Inc. |

United States | 6,367 | 396,346 | |||||||

| Samsung Electronics Co. Ltd. |

South Korea | 52,005 | 2,510,298 | |||||||

| TE Connectivity Ltd. |

United States | 12,149 | 1,164,360 | |||||||

| a Trimble Inc. |

United States | 17,458 | 727,824 | |||||||

| Ubiquiti Inc. |

United States | 298 | 56,316 | |||||||

| a ViaSat Inc. |

United States | 4,447 | 325,498 | |||||||

|

|

|

|||||||||

| 18,195,893 | ||||||||||

| Annual Report | FFA-21 | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS

Franklin Allocation VIP Fund (continued)

| Country/ Organization |

Shares/ Rights |

|

Value | |||||||

| Common Stocks and Other Equity Interests (continued) |

||||||||||

| Telecommunication Services 0.8% |

||||||||||

| AT&T Inc. |

United States | 37,596 | $ | 1,469,252 | ||||||

| China Mobile Ltd. |

China | 166,320 | 1,398,042 | |||||||

| Singapore Telecommunications Ltd. |

Singapore | 260,600 | 652,856 | |||||||

| Telefonica Deutschland Holding AG |

Germany | 99,448 | 288,183 | |||||||

| Verizon Communications Inc. |

United States | 23,329 | 1,432,401 | |||||||

| Vodafone Group PLC |

United Kingdom | 824,215 | 1,602,078 | |||||||

|

|

|

|||||||||

| 6,842,812 | ||||||||||

| Transportation 2.0% |

||||||||||

| A.P. Moeller-Maersk AS, B |

Denmark | 515 | 742,604 | |||||||

| Alaska Air Group Inc. |

United States | 24,235 | 1,641,921 | |||||||

| C.H. Robinson Worldwide Inc. |

United States | 4,222 | 330,160 | |||||||

| Canadian National Railway Co. |

Canada | 6,314 | 571,101 | |||||||

| Canadian Pacific Railway Ltd. |

Canada | 3,272 | 834,196 | |||||||

| Delta Air Lines Inc. |

United States | 16,077 | 940,183 | |||||||

| DSV Panalpina A/S |

Denmark | 21,500 | 2,477,443 | |||||||

| Expeditors International of Washington Inc. |

United States | 4,782 | 373,092 | |||||||

| J.B. Hunt Transport Services Inc. |

United States | 5,801 | 677,441 | |||||||

| Kansas City Southern |

United States | 4,795 | 734,402 | |||||||

| Landstar System Inc. |

United States | 1,060 | 120,702 | |||||||

| a Lyft Inc., A |

United States | 1,925 | 82,814 | |||||||

| Norfolk Southern Corp. |

United States | 1,800 | 349,434 | |||||||

| Old Dominion Freight Line Inc. |

United States | 501 | 95,080 | |||||||

| Southwest Airlines Co. |

United States | 14,008 | 756,152 | |||||||

| a Uber Technologies Inc. |

United States | 4,538 | 134,960 | |||||||

| Union Pacific Corp. |

United States | 21,021 | 3,800,387 | |||||||

| United Parcel Service Inc., B |

United States | 16,177 | 1,893,680 | |||||||

|

|

|

|||||||||

| 16,555,752 | ||||||||||

| Utilities 1.8% |

||||||||||

| Alliant Energy Corp. |

United States | 5,988 | 327,663 | |||||||

| Ameren Corp. |

United States | 4,173 | 320,486 | |||||||

| American Electric Power Co. Inc. |

United States | 3,548 | 335,321 | |||||||

| American Water Works Co. Inc. |

United States | 4,619 | 567,444 | |||||||

| Atmos Energy Corp. |

United States | 2,942 | 329,092 | |||||||

| Consolidated Edison Inc. |

United States | 8,367 | 756,963 | |||||||

| Dominion Energy Inc. |

United States | 10,618 | 879,383 | |||||||

| DTE Energy Co. |

United States | 5,118 | 664,675 | |||||||

| E.ON SE |

Germany | 89,716 | 958,229 | |||||||

| Evergy Inc. |

United States | 4,028 | 262,183 | |||||||

| Eversource Energy |

United States | 7,424 | 631,560 | |||||||

| Exelon Corp. |

United States | 24,694 | 1,125,799 | |||||||

| Hawaiian Electric Industries Inc. |

United States | 2,856 | 133,832 | |||||||

| a Korea Electric Power Corp. |

South Korea | 26,869 | 646,163 | |||||||

| NextEra Energy Inc. |

United States | 9,408 | 2,278,241 | |||||||

| OGE Energy Corp. |

United States | 5,155 | 229,243 | |||||||

| PPL Corp. |

United States | 13,039 | 467,839 | |||||||

| Public Service Enterprise Group Inc. |

United States | 14,881 | 878,723 | |||||||

| FFA-22 |

Annual Report | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS

Franklin Allocation VIP Fund (continued)

| Country/ Organization |

Shares/ Rights |

Value | ||||||||||||||

| Common Stocks and Other Equity Interests (continued) |

||||||||||||||||

| Utilities (continued) |

||||||||||||||||

| Sempra Energy |

United States | 2,018 | $ | 305,687 | ||||||||||||

| The Southern Co. |

United States | 18,720 | 1,192,464 | |||||||||||||

| Veolia Environnement SA |

France | 34,604 | 920,106 | |||||||||||||

| Xcel Energy Inc. |

United States | 3,771 | 239,421 | |||||||||||||

|

|

|

|||||||||||||||

|

|

14,450,517 |

| ||||||||||||||

|

|

|

|||||||||||||||

| Total Common Stocks and Other Equity Interests |

464,956,087 | |||||||||||||||

|

|

|

|||||||||||||||

| Management Investment Companies (Cost $35,760,635) 4.1% |

||||||||||||||||

| Diversified Financials 4.1% |

||||||||||||||||

| b Templeton Global Bond VIP Fund, Class 1 |

United States | 1,978,021 | 33,013,162 | |||||||||||||

|

|

|

|||||||||||||||

| Principal Amount* |

||||||||||||||||

| Corporate Bonds 12.3% |

||||||||||||||||

| Banks 2.4% |

||||||||||||||||

| c Akbank T.A.S., senior note, 144A, 5.125%, 3/31/25 |

Turkey | 200,000 | 196,185 | |||||||||||||

| Bank of America Corp., sub. bond, 4.183%, 11/25/27 |

United States | 2,240,000 | 2,428,111 | |||||||||||||

| Barclays PLC, senior note, 3.932% to 5/07/24, FRN thereafter, 5/07/25 |

United Kingdom | 800,000 | 840,876 | |||||||||||||

| d BDO Unibank Inc., senior note, Reg S, 2.95%, 3/06/23 |

Philippines | 200,000 | 202,152 | |||||||||||||

| c BPCE SA, |

||||||||||||||||

| sub. note, 144A, 5.15%, 7/21/24 |

France | 1,000,000 | 1,097,665 | |||||||||||||

| sub. note, 144A, 4.875%, 4/01/26 |

France | 500,000 | 550,845 | |||||||||||||

| Citigroup Inc., senior note, 3.352% to 4/24/24, FRN thereafter, 4/24/25 |

United States | 2,300,000 | 2,393,559 | |||||||||||||

| Credit Suisse Group Funding Guernsey Ltd., senior note, 3.80%, 9/15/22 |

Switzerland | 2,300,000 | 2,394,165 | |||||||||||||

| JPMorgan Chase & Co., senior bond, 3.54% to 5/01/27, FRN thereafter, 5/01/28 |

United States | 1,350,000 | 1,433,852 | |||||||||||||

| d Realkredit Danmark A/S, |

||||||||||||||||

| secured bond, Reg S, 1.00%, 4/01/27 |

Denmark | 2,530,000 | DKK | 402,838 | ||||||||||||

| senior bond, 10F, Reg S, 1.00%, 4/01/29 |

Denmark | 2,000,000 | DKK | 318,700 | ||||||||||||

| Regions Financial Corp., senior note, 3.80%, 8/14/23 |

United States | 1,310,000 | 1,386,719 | |||||||||||||

| c Standard Chartered PLC, senior note, 144A, 4.05%, 4/12/26 |

United Kingdom | 1,500,000 | 1,598,136 | |||||||||||||

| Truist Financial Corp., sub. bond, 3.875%, 3/19/29 |

United States | 2,000,000 | 2,169,201 | |||||||||||||

| e Wells Fargo Bank NA, senior note, FRN, 2.082%, (3-month USD LIBOR + 0.65%), 9/09/22 |

United States | 1,700,000 | 1,702,953 | |||||||||||||

|

|

|

|||||||||||||||

|

|

19,115,957 |

| ||||||||||||||

|

|

|

|||||||||||||||

| Capital Goods 0.5% |

||||||||||||||||

| c Beacon Roofing Supply Inc., senior note, 144A, 4.875%, 11/01/25 |

United States | 200,000 | 201,417 | |||||||||||||

| Caterpillar Financial Services Corp., senior note, I, 2.65%, 5/17/21 |

United States | 1,500,000 | 1,517,303 | |||||||||||||

| General Electric Co., |

||||||||||||||||

| senior bond, 3.10%, 1/09/23 |

United States | 500,000 | 510,872 | |||||||||||||

| senior bond, 4.125%, 10/09/42 |

United States | 103,000 | 106,041 | |||||||||||||

| Annual Report | FFA-23 | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS

Franklin Allocation VIP Fund (continued)

| Country/ Organization |

Principal Amount* |

Value | ||||||||||||||

| Corporate Bonds (continued) |

||||||||||||||||

| Capital Goods (continued) |

||||||||||||||||

| c Harsco Corp., senior note, 144A, 5.75%, 7/31/27 |

United States | 200,000 | $ | 213,759 | ||||||||||||

| Lockheed Martin Corp., senior bond, 3.55%, 1/15/26 |

United States | 500,000 | 536,321 | |||||||||||||

| United Technologies Corp., senior bond, 4.50%, 6/01/42 |

United States | 800,000 | 958,167 | |||||||||||||

| c Vertiv Group Corp., senior note, 144A, 9.25%, 10/15/24 |

United States | 200,000 | 215,417 | |||||||||||||

|

|

|

|||||||||||||||

| 4,259,297 | ||||||||||||||||

|

|

|

|||||||||||||||

| Commercial & Professional Services 0.1% |

||||||||||||||||

| c Ashtead Capital Inc., secured note, second lien, 144A, 4.125%, 8/15/25 |

United Kingdom | 850,000 | 875,500 | |||||||||||||

| c Intrado Corp., senior note, 144A, 8.50%, 10/15/25 |

United States | 300,000 | 240,750 | |||||||||||||

|

|

|

|||||||||||||||

| 1,116,250 | ||||||||||||||||

|

|

|

|||||||||||||||

| Consumer Services 0.2% |

||||||||||||||||

| Marriott International Inc., senior note, 3.60%, 4/15/24 |

United States | 1,100,000 | 1,158,420 | |||||||||||||

| c Stars Group Holdings BV/Stars Group U.S. Co-Borrower LLC, senior note, 144A, 7.00%, 7/15/26 |

Canada | 100,000 | 108,560 | |||||||||||||

| c Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp., senior bond, 144A, 5.25%, 5/15/27 |

United States | 200,000 | 212,750 | |||||||||||||

|

|

|

|||||||||||||||

| 1,479,730 | ||||||||||||||||

|

|

|

|||||||||||||||

| Diversified Financials 1.1% |

||||||||||||||||

| Capital One Financial Corp, senior note, 3.20%, 1/30/23 |

United States | 200,000 | 205,635 | |||||||||||||

| Capital One Financial Corp., senior note, 3.75%, 3/09/27 |

United States | 1,100,000 | 1,173,063 | |||||||||||||

| DY9 Leasing LLC, secured bond, 2.372%, 3/19/27 |

United States | 722,826 | 732,922 | |||||||||||||

| c FirstCash Inc., senior note, 144A, 5.375%, 6/01/24 |

United States | 200,000 | 207,583 | |||||||||||||

| The Goldman Sachs Group Inc., senior note, 3.50%, 1/23/25 |

United States | 1,900,000 | 1,993,254 | |||||||||||||

| Jyske Realkredit A/S, secured note, 1.00%, 4/01/26 |

Denmark | 2,220,000 | DKK | 353,378 | ||||||||||||

| Morgan Stanley, senior bond, 3.591% to 7/22/27, FRN thereafter, 7/22/28 |

United States | 1,800,000 | 1,913,162 | |||||||||||||

| Private Export Funding Corp., secured bond, 2.80%, 5/15/22 |

United States | 1,600,000 | 1,637,462 | |||||||||||||

| d TNB Global Ventures Capital Bhd., senior note, Reg S, 3.244%, 10/19/26 |

Malaysia | 300,000 | 301,824 | |||||||||||||

| c UBS Group AG, senior note, 144A, 4.125%, 9/24/25 |

Switzerland | 700,000 | 761,388 | |||||||||||||

|

|

|

|||||||||||||||

| 9,279,671 | ||||||||||||||||

|

|

|

|||||||||||||||

| Energy 1.7% |

||||||||||||||||

| c Aker BP ASA, senior note, 144A, 4.75%, 6/15/24 |

Norway | 200,000 | 207,998 | |||||||||||||

| Baker Hughes a GE Co. LLC/Baker Hughes Co-obligator Inc., senior bond, 4.08%, 12/15/47 |

United States | 900,000 | 921,677 | |||||||||||||

| c California Resources Corp., secured note, second lien, 144A, 8.00%, 12/15/22 |

United States | 100,000 | 44,500 | |||||||||||||

| Canadian Natural Resources Ltd., senior bond, 3.90%, 2/01/25 |

Canada | 1,350,000 | 1,439,352 | |||||||||||||

| Cheniere Corpus Christi Holdings LLC, senior secured note, first lien, 5.875%, 3/31/25 |

United States | 200,000 | 225,309 | |||||||||||||

| Cheniere Energy Partners LP, senior secured note, first lien, 5.25%, 10/01/25 |

United States | 200,000 | 208,916 | |||||||||||||

| Enable Midstream Partners LP, senior bond, 4.95%, 5/15/28 |

United States | 300,000 | 303,777 | |||||||||||||

| Energy Transfer Operating LP, senior bond, 6.05%, 6/01/41 |

United States | 700,000 | 789,969 | |||||||||||||

| Enterprise Products Operating LLC, senior bond, 6.125%, 10/15/39 |

United States | 700,000 | 915,125 | |||||||||||||

| Kinder Morgan Inc., senior bond, 5.55%, 6/01/45 |

United States | 800,000 | 957,705 | |||||||||||||

| MPLX LP, senior bond, 5.50%, 2/15/49 |

United States | 425,000 | 482,152 | |||||||||||||

| Murphy Oil USA Inc., senior bond, 4.75%, 9/15/29 |

United States | 100,000 | 105,792 | |||||||||||||

| Occidental Petroleum Corp., senior note, 2.60%, 8/13/21 |

United States | 700,000 | 705,276 | |||||||||||||

| FFA-24 |

Annual Report | |||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS

Franklin Allocation VIP Fund (continued)

| Country/ Organization |

Principal Amount* |

Value | ||||||||||

| Corporate Bonds (continued) |

||||||||||||

| Energy (continued) |

||||||||||||

| Oceaneering International Inc., senior note, 4.65%, 11/15/24 |

United States | 200,000 | $ | 196,500 | ||||||||

| Reliance Industries Ltd., senior note, 2.06%, 1/15/26 |

United States | 812,500 | 816,776 | |||||||||

| c Schlumberger Holdings Corp., senior note, 144A, 3.75%, 5/01/24 |

United States | 1,800,000 | 1,896,605 | |||||||||

| Total Capital International SA, senior note, 3.455%, 2/19/29 |

France | 670,000 | 726,019 | |||||||||

| TransCanada PipeLines Ltd., senior bond, 4.875%, 5/15/48 |

Canada | 200,000 | 236,062 | |||||||||

| Valero Energy Corp., senior bond, 4.00%, 4/01/29 |

United States | 1,000,000 | 1,079,149 | |||||||||

| The Williams Cos. Inc., |

||||||||||||

| senior bond, 4.125%, 11/15/20 |

United States | 1,350,000 | 1,366,221 | |||||||||

| senior bond, 4.85%, 3/01/48 |

United States | 320,000 | 349,845 | |||||||||

|

|

|

|||||||||||

|

|

13,974,725 |

| ||||||||||

|

|

|

|||||||||||

| Food & Staples Retailing 0.3% |

||||||||||||

| c Cencosud SA, senior note, 144A, 4.375%, 7/17/27 |

Chile | 300,000 | 296,308 | |||||||||

| c CK Hutchison International 19 Ltd., senior note, 144A, 3.25%, 4/11/24 |

Hong Kong | 1,275,000 | 1,308,840 | |||||||||

| The Kroger Co., senior bond, 5.40%, 1/15/49 |

United States | 550,000 | 670,912 | |||||||||

| Walgreens Boots Alliance Inc., senior note, 3.80%, 11/18/24 |

United States | 500,000 | 520,073 | |||||||||

|

|

|

|||||||||||

|

|

2,796,133 |