UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05583

Franklin Templeton

Variable Insurance Products Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway,

San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle,

One Franklin Parkway,

San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (650) 312-2000

Date of fiscal year end: 12/31

Date of reporting period: 06/30/15

| Item 1. | Reports to Stockholders. |

|

Semiannual Report June 30, 2015 |

Franklin Templeton

Variable Insurance Products Trust

Franklin Templeton Variable Insurance

Products Trust Semiannual Report

| Table of Contents | ||||

| Important Notes to Performance Information | i | |||

| *Statement of Additional Information Supplements for all Funds | SAI-1 | |||

| Fund Summaries | ||||

| FFC-1 | ||||

| FFA-1 | ||||

| FGR-1 | ||||

| FGI-1 | ||||

| FH-1 | ||||

| FI-1 | ||||

| FLG-1 | ||||

| MGD-1 | ||||

| MGD-8 | ||||

| MS-1 | ||||

| FRD-1 | ||||

| FSV-1 | ||||

| FSC-1 | ||||

| FSI-1 | ||||

| FUS-1 | ||||

| FVA-1 | ||||

| TD-1 | ||||

| TF-1 | ||||

| TGB-1 | ||||

| TG-1 | ||||

| TG-8 | ||||

| Index Descriptions | I-1 | |||

| Shareholder Information | SI-1 | |||

*Not part of the semiannual report. Retain for your records.

| Not FDIC Insured | | | May Lose Value | | | No Bank Guarantee |

MASTER CLASS – 2

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Performance Information

Performance data is historical and cannot predict or guarantee future results. Principal value and investment return will fluctuate with market conditions, and you may have a gain or loss when you withdraw your money. Inception dates of the funds may have preceded the effective dates of the subaccounts, contracts or their availability in all states.

When reviewing the index comparisons, please keep in mind that indexes have a number of inherent performance differentials over the funds. First, unlike the funds, which must hold a minimum amount of cash to maintain liquidity, indexes do not have a cash component. Second, the funds are actively managed and, thus, are subject to management fees to cover salaries of securities analysts or portfolio managers in addition to other expenses. Indexes are unmanaged and do not include any commissions or other expenses typically associated with investing in securities. Third, indexes often contain a different mix of securities than the fund to which they are compared. Additionally, please remember that indexes are simply a measure of performance and cannot be invested in directly.

| i |

SUPPLEMENT DATED JUNE 30, 2015

TO THE STATEMENT OF ADDITIONAL INFORMATION

DATED MAY 1, 2015

OF FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

The statement of additional information (SAI) is amended as follows:

In the section “Glossary of Investments, Techniques, Strategies and Their Risks” under the heading “Foreign securities” the following is added before the paragraph on page 40 that begins with “Developing markets or emerging markets:”

Investing through Stock Connect. Foreign investors may now invest in eligible China A shares (“Stock Connect Securities”) listed and traded on the Shanghai Stock Exchange (“SSE”) through the Shanghai – Hong Kong Stock Connect (“Stock Connect”) program. Stock Connect is a securities trading and clearing program developed by The Stock Exchange of Hong Kong Limited (“SEHK”), SSE, Hong Kong Securities Clearing Company Limited and China Securities Depository and Clearing Corporation Limited for the establishment of mutual market access between SEHK and SSE. In contrast to certain other regimes for foreign investment in Chinese securities, no individual investment quotas or licensing requirements apply to investors in Stock Connect Securities through Stock Connect. In addition, there are no lock-up periods or restrictions on the repatriation of principal and profits.

However, trading through Stock Connect is subject to a number of restrictions that may affect a Fund’s investments and returns. For example, a primary feature of the Stock Connect program is the application of the home market’s laws and rules to investors in a security. Thus, investors in Stock Connect Securities are generally subject to PRC securities regulations and SSE listing rules, among other restrictions. In addition, Stock Connect Securities generally may not be sold, purchased or otherwise transferred other than through Stock Connect in accordance with applicable rules. While Stock Connect is not subject to individual investment quotas, daily and aggregate investment quotas apply to all Stock Connect participants, which may restrict or preclude a Fund’s ability to invest in Stock Connect Securities. For example, an investor cannot purchase and sell the same security on the same trading day. Stock Connect also is generally available only on business days when both the SSE and the SEHK are open. Trading in the Stock Connect Program is subject to trading, clearance and settlement procedures that are untested in the PRC, which could pose risks to a Fund. Finally, the withholding tax treatment of dividends and capital gains payable to overseas investors currently is unsettled.

Stock Connect is in its initial stages. Further developments are likely and there can be no assurance as to whether or how such developments may restrict or affect a Fund’s investments or returns. In addition, the application and interpretation of the laws and regulations of Hong Kong and the PRC, and the rules, policies or guidelines published or applied by relevant regulators and exchanges in respect of the Stock Connect program, are uncertain, and they may have a detrimental effect on a Fund’s investments and returns.

Please keep this supplement with your Statement of Additional Information for future reference.

| SAI-1 |

SUPPLEMENT DATED MAY 1, 2015

TO THE STATEMENT OF ADDITIONAL INFORMATION

DATED MAY 1, 2015

OF FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

The statement of additional information (SAI) is amended as follows:

I. The section entitled “Calculation of Net Asset Value” in the SAI is removed in its entirety.

Please keep this supplement with your statement of additional information for future reference.

| SAI-2 |

Franklin Flex Cap Growth VIP Fund

We are pleased to bring you Franklin Flex Cap Growth VIP Fund’s semiannual report for the period ended June 30, 2015.

Class 2 Performance Summary as of June 30, 2015

The Fund’s Class 2 Shares delivered a +7.02% total return* for the six-month period ended June 30, 2015.

*The Fund has an expense reduction contractually guaranteed through at least 4/30/16 and a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end. Fund investment results reflect the expense reduction and fee waiver, to the extent applicable; without these reductions, the results would have been lower.

Performance reflects the Fund’s Class 2 operating expenses, but does not include any contract fees, expenses or sales charges. If they had been included, performance would be lower. These charges and deductions, particularly for variable life policies, can have a significant effect on contract values and insurance benefits. See the contract prospectus for a complete description of these expenses, including sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown.

| Semiannual Report | FFC-1 |

FRANKLIN FLEX CAP GROWTH VIP FUND

1. Source: Morningstar.

One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. Please see Index Descriptions following the Fund Summaries.

2. Source: Bureau of Labor Statistics.

3. Please see Index Descriptions following the Fund Summaries.

| FFC-2 | Semiannual Report |

FRANKLIN FLEX CAP GROWTH VIP FUND

employed. Our valuation analysis includes a range of potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

During the six months under review, most sectors represented in the Fund’s portfolio delivered positive returns and contributed to absolute performance. Relative to the Russell 3000® Growth Index, key contributors included stock selection in information technology (IT), as well as stock selection and an overweighting in health care.4 Also helping relative results was stock selection in financials.5

In the IT sector, video game developer Electronic Arts, network security company Palo Alto Networks and off-benchmark, Netherlands-based semiconductor company NXP Semiconductors were among the top performers. Electronic Arts performed well during the period under the new leadership of chief executive officer Andrew Wilson and chief financial officer Blake Jorgenson. The company benefited from three factors: the new generation of video game consoles, the proliferation of mobile gaming on smartphones and the margin-enhancing shift to digital game downloads. Palo Alto Networks demonstrated solid market share and operating income gains in an environment characterized by cyber attacks and strong enterprise security spending. NXP is a leading supplier of highly secure communication and microcontroller products. The company benefited from its leading intellectual properties in the fields of cryptography and near field communications. NXP products enable secure passports, toll passes and emerging wireless payments via smartphones and chip-based credit cards. The company will merge with Freescale Semiconductor, which will create one of the largest mixed-signal semiconductor companies in the world.

In the health care sector, major contributors included Biogen, DexCom and our off-benchmark position in Valeant Pharmaceuticals International. Biotechnology company Biogen’s stock rose after the company presented positive phase I and II trial data for Aducanumab, a therapy for Alzheimer’s disease. Biogen heightened investor sentiment months before the data were released by issuing positive news about the drug. The company’s stock price, however, corrected following disappointing first-quarter results amid slowed growth of Tecfidera, a drug used to treat multiple sclerosis. DexCom, a manufacturer of glucose

monitoring systems for diabetes management, announced it expected the Food and Drug Administration to approve the

4. The IT sector comprises semiconductors and semiconductor equipment, software and services, and technology hardware and equipment in the SOI. The health care sector comprises health care equipment and services; and pharmaceuticals, biotechnology and life sciences in the SOI.

5. The financials sector comprises banks and diversified financials in the SOI.

| Semiannual Report | FFC-3 |

FRANKLIN FLEX CAP GROWTH VIP FUND

6. Sold by period-end.

| FFC-4 | Semiannual Report |

FRANKLIN FLEX CAP GROWTH VIP FUND

Class 2 Fund Expenses

| Class 2 | Beginning Account Value 1/1/15 |

Ending Account Value 6/30/15 |

Fund-Level Expenses 1/1/15–6/30/15 |

|||||||||

| Actual |

$1,000 | $1,070.20 | $4.93 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000 | $1,020.03 | $4.81 | |||||||||

*Expenses are calculated using the most recent six-month annualized expense ratio, net of expense waivers, for the Fund’s Class 2 shares (0.96%), which does not include any ongoing expenses of the Contract for which the Fund is an investment option, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

| Semiannual Report | FFC-5 |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Financial Highlights

Franklin Flex Cap Growth VIP Fund

| Six Months Ended June 30, 2015 (unaudited) |

Year Ended December 31, | |||||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||

| Class 2 | ||||||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$16.61 | $18.11 | $13.21 | $12.09 | $12.70 | $10.93 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Income from investment operationsa: | ||||||||||||||||||||||||

| Net investment income (loss)b |

(0.06 | ) | (0.08 | ) | (0.01 | ) | 0.01 | (0.02 | ) | (0.02 | ) | |||||||||||||

| Net realized and unrealized gains (losses) |

1.18 | 1.09 | 4.95 | 1.11 | (0.59 | ) | 1.79 | |||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total from investment operations |

1.12 | 1.01 | 4.94 | 1.12 | (0.61 | ) | 1.77 | |||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Less distributions from: | ||||||||||||||||||||||||

| Net investment income |

— | — | (— | )c | — | — | — | |||||||||||||||||

| Net realized gains |

(10.46 | ) | (2.51 | ) | (0.04 | ) | — | — | — | |||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total distributions |

(10.46 | ) | (2.51 | ) | (0.04 | ) | — | — | — | |||||||||||||||

|

|

|

|||||||||||||||||||||||

| Net asset value, end of period |

$7.27 | $16.61 | $18.11 | $13.21 | $12.09 | $12.70 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total returnd |

7.02% | 6.11% | 37.48% | 9.26% | (4.80)% | 16.19% | ||||||||||||||||||

| Ratios to average net assetse | ||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.30% | 1.20% | 1.18% | 1.18% | 1.16% | 1.18% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

0.96% | 0.95% | 0.93% | 0.93% | 0.93% | 0.93% | ||||||||||||||||||

| Net investment income (loss) |

(0.75)% | (0.46)% | (0.09)% | 0.09% | (0.14)% | (0.17)% | ||||||||||||||||||

| Supplemental data | ||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$93,663 | $93,354 | $169,123 | $159,122 | $188,527 | $227,774 | ||||||||||||||||||

| Portfolio turnover rate |

46.56% | 52.83% | 52.15% | 43.50% | 63.99% | 60.00% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

| FFC-6 | Semiannual Report | The accompanying notes are an integral part of these financial statements. |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL HIGHLIGHTS

Franklin Flex Cap Growth VIP Fund (continued)

| Six Months Ended June 30, 2015 (unaudited) |

Year Ended December 31, | |||||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||

| Class 4 | ||||||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$16.44 | $17.96 | $13.12 | $12.01 | $12.63 | $10.88 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Income from investment operationsa: | ||||||||||||||||||||||||

| Net investment income (loss)b |

(0.06 | ) | (0.10 | ) | (0.03 | ) | (— | )c | (0.03 | ) | (0.03 | ) | ||||||||||||

| Net realized and unrealized gains (losses) |

1.15 | 1.09 | 4.91 | 1.11 | (0.59 | ) | 1.78 | |||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total from investment operations |

1.09 | 0.99 | 4.88 | 1.11 | (0.62 | ) | 1.75 | |||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Less distributions from net realized gains |

(10.46 | ) | (2.51 | ) | (0.04 | ) | — | — | — | |||||||||||||||

|

|

|

|||||||||||||||||||||||

| Net asset value, end of period |

$7.07 | $16.44 | $17.96 | $13.12 | $12.01 | $12.63 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total returnd |

6.89% | 5.98% | 37.28% | 9.24% | (4.91)% | 16.08% | ||||||||||||||||||

| Ratios to average net assetse | ||||||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.40% | 1.30% | 1.28% | 1.28% | 1.26% | 1.28% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliates |

1.06% | 1.05% | 1.03% | 1.03% | 1.03% | 1.03% | ||||||||||||||||||

| Net investment income (loss) |

(0.85)% | (0.56)% | (0.19)% | (0.01)% | (0.24)% | (0.27)% | ||||||||||||||||||

| Supplemental data | ||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$32,911 | $31,355 | $251,339 | $216,607 | $270,598 | $263,746 | ||||||||||||||||||

| Portfolio turnover rate |

46.56% | 52.83% | 52.15% | 43.50% | 63.99% | 60.00% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

| The accompanying notes are an integral part of these financial statements. | Semiannual Report | FFC-7 |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Statement of Investments, June 30, 2015 (unaudited)

| Franklin Flex Cap Growth VIP Fund

|

||||||||||

| Shares | Value | |||||||||

| Common Stocks 95.1% |

||||||||||

| Automobiles & Components 0.4% |

||||||||||

| a | Tesla Motors Inc. |

1,850 | $ | 496,281 | ||||||

|

|

|

|||||||||

| Banks 3.0% |

||||||||||

| a | Signature Bank |

15,000 | 2,195,850 | |||||||

| a | SVB Financial Group |

11,500 | 1,655,770 | |||||||

|

|

|

|||||||||

| 3,851,620 | ||||||||||

|

|

|

|||||||||

| Capital Goods 3.9% |

||||||||||

| a | HD Supply Holdings Inc. |

67,500 | 2,374,650 | |||||||

| Honeywell International Inc. |

11,500 | 1,172,655 | ||||||||

| Roper Technologies Inc. |

7,700 | 1,327,943 | ||||||||

|

|

|

|||||||||

| 4,875,248 | ||||||||||

|

|

|

|||||||||

| Commercial & Professional Services 2.2% |

||||||||||

| a | IHS Inc., A |

11,500 | 1,479,245 | |||||||

| a | Stericycle Inc. |

9,500 | 1,272,145 | |||||||

|

|

|

|||||||||

| 2,751,390 | ||||||||||

|

|

|

|||||||||

| Consumer Durables & Apparel 4.5% |

||||||||||

| NIKE Inc., B |

27,000 | 2,916,540 | ||||||||

| a | TRI Pointe Homes Inc. |

92,500 | 1,415,250 | |||||||

| a | Under Armour Inc., A |

16,000 | 1,335,040 | |||||||

|

|

|

|||||||||

| 5,666,830 | ||||||||||

|

|

|

|||||||||

| Consumer Services 0.5% |

||||||||||

| Starbucks Corp. |

12,500 | 670,187 | ||||||||

|

|

|

|||||||||

| Diversified Financials 3.2% |

||||||||||

| a | Affiliated Managers Group Inc. |

14,500 | 3,169,700 | |||||||

| Intercontinental Exchange Inc. |

4,000 | 894,440 | ||||||||

|

|

|

|||||||||

| 4,064,140 | ||||||||||

|

|

|

|||||||||

| Energy 0.6% |

||||||||||

| a | Diamondback Energy Inc. |

6,000 | 452,280 | |||||||

| a | FMC Technologies Inc. |

8,000 | 331,920 | |||||||

|

|

|

|||||||||

| 784,200 | ||||||||||

|

|

|

|||||||||

| Food & Staples Retailing 0.5% |

||||||||||

| Whole Foods Market Inc. |

16,500 | 650,760 | ||||||||

|

|

|

|||||||||

| Food, Beverage & Tobacco 2.6% |

||||||||||

| Constellation Brands Inc., A |

16,500 | 1,914,330 | ||||||||

| a | Monster Beverage Corp. |

10,000 | 1,340,200 | |||||||

|

|

|

|||||||||

| 3,254,530 | ||||||||||

|

|

|

|||||||||

| Health Care Equipment & Services 9.7% |

||||||||||

| a | Cerner Corp. |

33,500 | 2,313,510 | |||||||

| a | DexCom Inc. |

16,500 | 1,319,670 | |||||||

| a | Edwards Lifesciences Corp. |

6,800 | 968,524 | |||||||

| a | Envision Healthcare Holdings Inc. |

70,000 | 2,763,600 | |||||||

| McKesson Corp. |

13,500 | 3,034,935 | ||||||||

| Medtronic PLC |

25,000 | 1,852,500 | ||||||||

|

|

|

|||||||||

| 12,252,739 | ||||||||||

|

|

|

|||||||||

| Materials 2.7% |

||||||||||

| Cytec Industries Inc. |

25,000 | 1,513,250 | ||||||||

| Ecolab Inc. |

17,000 | 1,922,190 | ||||||||

|

|

|

|||||||||

| 3,435,440 | ||||||||||

|

|

|

|||||||||

| FFC-8 | Semiannual Report |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Flex Cap Growth VIP Fund (continued)

| Shares | Value | |||||||||

| Common Stocks (continued) |

||||||||||

| Media 2.9% |

||||||||||

| a | Charter Communications Inc., A |

5,000 | $ | 856,250 | ||||||

| a | IMAX Corp. (Canada) |

9,000 | 362,430 | |||||||

| The Walt Disney Co. |

21,000 | 2,396,940 | ||||||||

|

|

|

|||||||||

| 3,615,620 | ||||||||||

|

|

|

|||||||||

| Pharmaceuticals, Biotechnology & Life Sciences 18.2% |

||||||||||

| a | Allergan PLC |

19,000 | 5,765,740 | |||||||

| a | Biogen Inc. |

10,500 | 4,241,370 | |||||||

| a | BioMarin Pharmaceutical Inc. |

3,800 | 519,764 | |||||||

| Bristol-Myers Squibb Co. |

25,000 | 1,663,500 | ||||||||

| a | Celgene Corp. |

33,000 | 3,819,255 | |||||||

| a | Celldex Therapeutics Inc. |

21,000 | 529,620 | |||||||

| a | Illumina Inc. |

7,000 | 1,528,520 | |||||||

| a | Jazz Pharmaceuticals PLC |

2,000 | 352,140 | |||||||

| a | Prestige Brands Holdings Inc. |

12,500 | 578,000 | |||||||

| a | Regeneron Pharmaceuticals Inc. |

1,900 | 969,247 | |||||||

| a | Revance Therapeutics Inc. |

10,200 | 326,196 | |||||||

| a | Valeant Pharmaceuticals International Inc. |

12,500 | 2,776,875 | |||||||

|

|

|

|||||||||

| 23,070,227 | ||||||||||

|

|

|

|||||||||

| Retailing 5.4% |

||||||||||

| Advance Auto Parts Inc. |

10,500 | 1,672,545 | ||||||||

| a | Amazon.com Inc. |

6,500 | 2,821,585 | |||||||

| a | The Priceline Group Inc. |

1,400 | 1,611,918 | |||||||

| Tractor Supply Co. |

8,000 | 719,520 | ||||||||

|

|

|

|||||||||

| 6,825,568 | ||||||||||

|

|

|

|||||||||

| Semiconductors & Semiconductor Equipment 4.7% |

||||||||||

| a | Cavium Inc. |

25,000 | 1,720,250 | |||||||

| a | Nanometrics Inc. |

20,468 | 329,944 | |||||||

| a | NXP Semiconductors NV (Netherlands) |

27,000 | 2,651,400 | |||||||

| Skyworks Solutions Inc. |

12,500 | 1,301,250 | ||||||||

|

|

|

|||||||||

| 6,002,844 | ||||||||||

|

|

|

|||||||||

| Software & Services 19.1% |

||||||||||

| a | Alibaba Group Holding Ltd., ADR (China) |

11,500 | 946,105 | |||||||

| a | CoStar Group Inc. |

7,700 | 1,549,702 | |||||||

| a | Electronic Arts Inc. |

29,500 | 1,961,750 | |||||||

| Equinix Inc. |

3,500 | 889,000 | ||||||||

| a | Facebook Inc., A |

35,000 | 3,001,775 | |||||||

| a | FleetCor Technologies Inc. |

13,000 | 2,028,780 | |||||||

| a | LinkedIn Corp., A |

11,500 | 2,376,245 | |||||||

| MasterCard Inc., A |

50,000 | 4,674,000 | ||||||||

| a | Mobileye NV |

12,500 | 664,625 | |||||||

| a | Salesforce.com Inc. |

23,500 | 1,636,305 | |||||||

| a | ServiceNow Inc. |

25,000 | 1,857,750 | |||||||

| a | Splunk Inc. |

6,300 | 438,606 | |||||||

| Visa Inc., A |

33,000 | 2,215,950 | ||||||||

|

|

|

|||||||||

| 24,240,593 | ||||||||||

|

|

|

|||||||||

| Technology Hardware & Equipment 9.0% |

||||||||||

| Apple Inc. |

70,000 | 8,779,750 | ||||||||

| a | FitBit Inc., A |

3,000 | 114,690 | |||||||

| Semiannual Report | FFC-9 |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Flex Cap Growth VIP Fund (continued)

| Shares | Value | |||||||||

| Common Stocks (continued) |

||||||||||

| Technology Hardware & Equipment (continued) |

||||||||||

| a | Palo Alto Networks Inc. |

14,000 | $ | 2,445,800 | ||||||

|

|

|

|||||||||

| 11,340,240 | ||||||||||

|

|

|

|||||||||

| Transportation 2.0% |

||||||||||

| a | Genesee & Wyoming Inc. |

15,000 | 1,142,700 | |||||||

| a | Spirit Airlines Inc. |

23,000 | 1,428,300 | |||||||

|

|

|

|||||||||

| 2,571,000 | ||||||||||

|

|

|

|||||||||

| Total Common Stocks (Cost $75,555,926) |

120,419,457 | |||||||||

|

|

|

|||||||||

| Short Term Investments (Cost $6,792,401) 5.4% |

||||||||||

| Money Market Funds 5.4% |

||||||||||

| a,b | Institutional Fiduciary Trust Money Market Portfolio |

6,792,401 | 6,792,401 | |||||||

|

|

|

|||||||||

| Total Investments (Cost $82,348,327) 100.5% |

127,211,858 | |||||||||

| Other Assets, less Liabilities (0.5)% |

(637,763 | ) | ||||||||

|

|

|

|||||||||

| Net Assets 100.0% |

$ | 126,574,095 | ||||||||

|

|

|

|||||||||

See Abbreviations on page FFC-19.

aNon-income producing.

bSee Note 3(e) regarding investments in Institutional Fiduciary Trust Money Market Portfolio.

| FFC-10 | Semiannual Report | The accompanying notes are an integral part of these financial statements. |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Financial Statements

Statement of Assets and Liabilities

June 30, 2015 (unaudited)

| Franklin Flex Cap Growth VIP Fund |

||||

| Assets: |

||||

| Investments in securities: |

||||

| Cost - Unaffiliated issuers |

$ | 75,555,926 | ||

| Cost - Sweep Money Fund (Note 3e) |

6,792,401 | |||

|

|

|

|||

| Total cost of investments |

$ | 82,348,327 | ||

|

|

|

|||

| Value - Unaffiliated issuers |

$ | 120,419,457 | ||

| Value - Sweep Money Fund (Note 3e) |

6,792,401 | |||

|

|

|

|||

| Total value of investments |

127,211,858 | |||

| Receivables: |

||||

| Investment securities sold |

6,595 | |||

| Capital shares sold |

20,450 | |||

| Dividends |

29,869 | |||

| Other assets |

51 | |||

|

|

|

|||

| Total assets |

127,268,823 | |||

|

|

|

|||

| Liabilities: |

||||

| Payables: |

||||

| Investment securities purchased |

360,063 | |||

| Capital shares redeemed |

186,640 | |||

| Management fees |

65,366 | |||

| Distribution fees |

57,264 | |||

| Trustees’ fees and expenses |

413 | |||

| Accrued expenses and other liabilities |

24,982 | |||

|

|

|

|||

| Total liabilities |

694,728 | |||

|

|

|

|||

| Net assets, at value |

$ | 126,574,095 | ||

|

|

|

|||

| Net assets consist of: |

||||

| Paid-in capital |

$ | 70,399,114 | ||

| Undistributed net investment income (loss) |

(484,089 | ) | ||

| Net unrealized appreciation (depreciation) |

44,863,531 | |||

| Accumulated net realized gain (loss) |

11,795,539 | |||

|

|

|

|||

| Net assets, at value |

$ | 126,574,095 | ||

|

|

|

|||

| Class 2: | ||||

| Net assets, at value |

$ | 93,662,955 | ||

|

|

|

|||

| Shares outstanding |

12,892,147 | |||

|

|

|

|||

| Net asset value and maximum offering price per share |

$ | 7.27 | ||

|

|

|

|||

| Class 4: | ||||

| Net assets, at value |

$ | 32,911,140 | ||

|

|

|

|||

| Shares outstanding |

4,652,800 | |||

|

|

|

|||

| Net asset value and maximum offering price per share |

$ | 7.07 | ||

|

|

|

|||

| The accompanying notes are an integral part of these financial statements. | Semiannual Report | FFC-11 |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL STATEMENTS

Statement of Operations

for the six months ended June 30, 2015 (unaudited)

| Franklin Flex Cap Growth VIP Fund |

||||

| Investment income: |

||||

| Dividends |

$ | 135,248 | ||

|

|

|

|||

| Expenses: |

||||

| Management fees (Note 3a) |

616,074 | |||

| Distribution fees: (Note 3c) |

||||

| Class 2 |

116,290 | |||

| Class 4 |

56,054 | |||

| Custodian fees (Note 4) |

437 | |||

| Reports to shareholders |

19,693 | |||

| Professional fees |

21,590 | |||

| Trustees’ fees and expenses |

719 | |||

| Other |

4,695 | |||

|

|

|

|||

| Total expenses |

835,552 | |||

| Expenses waived/paid by affiliates (Note 3e and 3f) |

(216,215 | ) | ||

|

|

|

|||

| Net expenses |

619,337 | |||

|

|

|

|||

| Net investment income (loss) |

(484,089 | ) | ||

|

|

|

|||

| Realized and unrealized gains (losses): |

||||

| Net realized gain (loss) from investments |

12,440,218 | |||

| Net change in unrealized appreciation (depreciation) on investments |

(3,487,098 | ) | ||

|

|

|

|||

| Net realized and unrealized gain (loss) |

8,953,120 | |||

|

|

|

|||

| Net increase (decrease) in net assets resulting from operations |

$ | 8,469,031 | ||

|

|

|

|||

| FFC-12 | Semiannual Report | The accompanying notes are an integral part of these financial statements. |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL STATEMENTS

Statements of Changes in Net Assets

| Franklin Flex Cap Growth VIP Fund | ||||||||

| Six Months Ended June 30, 2015 (unaudited) |

Year Ended December 31, 2014 |

|||||||

| Increase (decrease) in net assets: |

||||||||

| Operations: |

||||||||

| Net investment income (loss) |

$ | (484,089 | ) | $ | (1,796,043 | ) | ||

| Net realized gain (loss) |

12,440,218 | 136,983,635 | ||||||

| Net change in unrealized appreciation (depreciation) |

(3,487,098 | ) | (121,113,931 | ) | ||||

|

|

|

|||||||

| Net increase (decrease) in net assets resulting from operations |

8,469,031 | 14,073,661 | ||||||

|

|

|

|||||||

| Distributions to shareholders from: |

||||||||

| Net realized gains: |

||||||||

| Class 2 |

(55,457,455 | ) | (23,244,460 | ) | ||||

| Class 4 |

(20,021,151 | ) | (34,835,360 | ) | ||||

|

|

|

|||||||

| Total distributions to shareholders |

(75,478,606 | ) | (58,079,820 | ) | ||||

|

|

|

|||||||

| Capital share transactions: (Note 2) |

||||||||

| Class 2 |

49,448,958 | (59,517,033 | ) | |||||

| Class 4 |

19,425,412 | (192,229,021 | ) | |||||

|

|

|

|||||||

| Total capital share transactions |

68,874,370 | (251,746,054 | ) | |||||

|

|

|

|||||||

| Net increase (decrease) in net assets |

1,864,795 | (295,752,213 | ) | |||||

|

|

|

|||||||

| Net assets: |

||||||||

| Beginning of period |

124,709,300 | 420,461,513 | ||||||

|

|

|

|||||||

| End of period |

$ | 126,574,095 | $ | 124,709,300 | ||||

|

|

|

|||||||

| Undistributed net investment income (loss) included in net assets: |

||||||||

| End of period |

$ | (484,089 | ) | $ | — | |||

|

|

|

|||||||

| The accompanying notes are an integral part of these financial statements. | Semiannual Report | FFC-13 |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Notes to Financial Statements (unaudited)

Franklin Flex Cap Growth VIP Fund

| FFC-14 | Semiannual Report |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Franklin Flex Cap Growth VIP Fund (continued)

| Semiannual Report | FFC-15 |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Franklin Flex Cap Growth VIP Fund (continued)

2. Shares of Beneficial Interest

At June 30, 2015, there were an unlimited number of shares authorized (without par value). Transactions in the Fund’s shares were as follows:

| Six Months Ended June 30, 2015 |

Year Ended December 31, 2014 |

|||||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||||

| Class 2 Shares: | ||||||||||||||||||

| Shares sold |

334,094 | $ | 5,377,237 | 1,271,685 | $ | 22,546,625 | ||||||||||||

| Shares issued in reinvestment of distributions |

7,659,869 | 55,457,455 | 1,454,597 | 23,244,460 | ||||||||||||||

| Shares redeemed |

(722,709 | ) | (11,385,734 | ) | (6,444,966 | ) | (105,308,118 | ) | ||||||||||

|

|

|

|||||||||||||||||

| Net increase (decrease) |

7,271,254 | $ | 49,448,958 | (3,718,684 | ) | $ | (59,517,033 | ) | ||||||||||

|

|

|

|||||||||||||||||

| Class 4 Shares: | ||||||||||||||||||

| Shares sold |

203,851 | $ | 3,378,936 | 1,157,788 | $ | 20,021,648 | ||||||||||||

| Shares issued in reinvestment of distributions |

2,839,880 | 20,021,151 | 2,201,982 | 34,835,359 | ||||||||||||||

| Shares redeemed |

(298,769 | ) | (3,974,675 | ) | (15,445,351 | ) | (247,086,028 | ) | ||||||||||

|

|

|

|||||||||||||||||

| Net increase (decrease) |

2,744,962 | $ | 19,425,412 | (12,085,581 | ) | $ | (192,229,021 | ) | ||||||||||

|

|

|

|||||||||||||||||

3. Transactions With Affiliates

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers and/or directors of the following subsidiaries:

| Subsidiary | Affiliation | |

| Franklin Advisers, Inc. (Advisers) |

Investment manager | |

| Franklin Templeton Services, LLC (FT Services) |

Administrative manager | |

| Franklin Templeton Distributors, Inc. (Distributors) |

Principal underwriter | |

| Franklin Templeton Investor Services, LLC (Investor Services) |

Transfer agent |

| FFC-16 | Semiannual Report |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Franklin Flex Cap Growth VIP Fund (continued)

a. Management Fees

The Fund pays an investment management fee to Advisers based on the average daily net assets of the Fund as follows:

| Annualized Fee Rate | Net Assets | |

| 1.000% |

Up to and including $100 million | |

| 0.900% |

Over $100 million, up to and including $250 million | |

| 0.850% |

Over $250 million, up to and including $10 billion | |

| 0.800% |

Over $10 billion, up to and including $12.5 billion | |

| 0.775% |

Over $12.5 billion, up to and including $15 billion | |

| 0.750% |

In excess of $15 billion |

b. Administrative Fees

Under an agreement with Advisers, FT Services provides administrative services to the Fund. The fee is paid by Advisers based on the Fund’s average daily net assets, and is not an additional expense of the Fund.

c. Distribution Fees

The Board has adopted distribution plans for Class 2 and Class 4 shares pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s compensation distribution plans, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to 0.35% per year of its average daily net assets of each class. Some distribution fees are not charged on shares held by affiliates. The Board has agreed to limit the current rate to 0.25% per year for Class 2. The plan year, for purposes of monitoring compliance with the maximum annual plan rates, is February 1 through January 31.

d. Transfer Agent Fees

Investor Services, under terms of an agreement, performs shareholder servicing for the Fund and is not paid by the Fund for the services.

e. Investments in Institutional Fiduciary Trust Money Market Portfolio

The Fund invests in Institutional Fiduciary Trust Money Market Portfolio (Sweep Money Fund), an affiliated open-end management investment company. Management fees paid by the Fund are waived on assets invested in the Sweep Money Fund, as noted in the Statement of Operations, in an amount not to exceed the management and administrative fees paid directly or indirectly by the Sweep Money Fund. Prior to January 1, 2014, the waiver was accounted for as a reduction to management fees.

f. Waiver and Expense Reimbursements

Advisers has contractually agreed in advance to waive or limit its fees and to assume as its own expense certain expenses otherwise payable by the Fund so that the expenses (excluding distribution fees, and acquired fund fees and expenses) for Class 2 and Class 4 of the Fund do not exceed 0.71%, based on the average net assets of each class (other than certain non-routine expenses or costs, including those relating to litigation, indemnification, reorganizations, and liquidations) until April 30, 2016.

4. Expense Offset Arrangement

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the period ended June 30, 2015, there were no credits earned.

| Semiannual Report | FFC-17 |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Franklin Flex Cap Growth VIP Fund (continued)

5. Income Taxes

At June 30, 2015, the cost of investments and net unrealized appreciation (depreciation) for income tax purposes were as follows:

| Cost of investments |

$ | 82,578,354 | ||

|

|

|

|||

| Unrealized appreciation |

$ | 44,975,117 | ||

| Unrealized depreciation |

(341,613 | ) | ||

|

|

|

|||

| Net unrealized appreciation (depreciation) |

$ | 44,633,504 | ||

|

|

|

Differences between income and/or capital gains as determined on a book basis and a tax basis are primarily due to differing treatments of wash sales.

6. Investment Transactions

Purchases and sales of investments (excluding short term securities) for the period ended June 30, 2015, aggregated $ 56,895,981 and $ 69,188,559, respectively.

7. Credit Facility

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $2 billion (Global Credit Facility) which matures on February 12, 2016. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.07% based upon the unused portion of the Global Credit Facility. These fees are reflected in other expenses in the Statement of Operations. During the period ended June 30, 2015, the Fund did not use the Global Credit Facility.

8. Fair Value Measurements

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s financial instruments and are summarized in the following fair value hierarchy:

| • | Level 1 – quoted prices in active markets for identical financial instruments |

| • | Level 2 – other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.) |

| • | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of financial instruments) |

The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At June 30, 2015, all of the Fund’s investments in financial instruments carried at fair value were valued using Level 1 inputs. For detailed categories, see the accompanying Statement of Investments.

| FFC-18 | Semiannual Report |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Franklin Flex Cap Growth VIP Fund (continued)

9. New Accounting Pronouncements

In June 2014, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2014-11, Transfers and Servicing (Topic 860), Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures. The ASU changes the accounting for certain repurchase agreements and expands disclosure requirements related to repurchase agreements, securities lending, repurchase-to-maturity and similar transactions. The ASU is effective for certain transactions accounted for as a sale for interim and annual reporting periods beginning after December 15, 2014, and transactions accounted for as secured borrowings for annual periods beginning after December 15, 2014, and for interim periods beginning after March 15, 2015. Management has reviewed the requirements and believes the adoption of this ASU will not have a material impact on the financial statements.

10. Subsequent Events

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

Abbreviations

| Selected Portfolio | ||

| ADR | American Depositary Receipt | |

| Semiannual Report | FFC-19 |

Franklin Founding Funds Allocation VIP Fund

This semiannual report for Franklin Founding Funds Allocation VIP Fund covers the period ended June 30, 2015.

Class 2 Performance Summary as of June 30, 2015

The Fund’s Class 2 shares delivered a +0.60% total return* for the six-month period ended June 30, 2015.

*The Fund has an expense reduction contractually guaranteed through at least 4/30/16. Fund investment results reflect the expense reduction, to the extent applicable; without this reduction, the results would have been lower.

Performance reflects the Fund’s Class 2 operating expenses, but does not include any contract fees, expenses or sales charges. If they had been included, performance would be lower. These charges and deductions, particularly for variable life policies, can have a significant effect on contract values and insurance benefits. See the contract prospectus for a complete description of these expenses, including sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown.

| Semiannual Report | FFA-1 |

FRANKLIN FOUNDING FUNDS ALLOCATION VIP FUND

Fund Goals and Main Investments

Franklin Founding Funds Allocation VIP Fund seeks capital appreciation, with income as a secondary goal. Under normal market conditions, the Fund invests equal portions in Class 1 shares of Franklin Income VIP Fund, Franklin Mutual Shares VIP Fund and Templeton Growth VIP Fund.

Fund Risks

All investments involve risks, including possible loss of principal. Because the Fund invests in underlying funds that may engage in a variety of investment strategies involving certain risks, the Fund may be subject to these same risks. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bonds are affected by changes in interest rates and the creditworthiness of their issuers. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds adjust to a rise in interest rates, the Fund’s share price may decline. Higher yielding, lower rated corporate bonds entail a greater degree of credit risk compared to investment-grade securities. Foreign investing carries additional risks such as currency and market volatility and political or social instability, risks that are heightened in developing countries. Value securities may not increase in price as anticipated or may decline further in value. The Fund’s prospectus also includes a description of the main investment risks.

Performance Overview

You can find the Fund’s six-month total return in the Performance Summary. In comparison, the Standard & Poor’s® 500 Index (S&P 500®) generated a +1.23% total return and the MSCI World Index produced a +2.95% total return for the same period.1

Economic and Market Overview

The global economy expanded moderately during the six months under review despite slowing growth in some countries. As measured by the MSCI World Index, stocks in global developed markets advanced overall during the six-month period amid a generally accommodative monetary policy environment and signs of economic improvement in Europe and Japan. Oil prices rebounded from earlier lows as demand picked up despite rising inventories and strong global supply, while gold prices declined marginally during the period under review.

U.S. economic growth was mixed during the six months under review. In 2015’s first quarter, U.S. dollar strength, low energy prices, and a labor dispute at West Coast ports led exports to decline. In the second quarter, business capital spending rebounded and manufacturing and non-manufacturing activities increased, contributing to strong job gains. During the six-month period, the U.S. Federal Reserve Board (Fed) kept its target interest rate at 0%–0.25% while considering when an increase would be appropriate, based on labor market and inflation data.

Outside the U.S., the U.K. economy slowed in 2015’s first quarter as the mining and agriculture sectors contracted. In the eurozone, economic growth improved somewhat during the six-month period. The region avoided deflation as the annual inflation rate rose in May. The European Central Bank (ECB) maintained its benchmark interest rates during the period and also expanded its asset purchases to boost inflation and the economy. The region generally benefited from a weaker euro that helped exports, the ECB’s accommodative policy and an improved 2015 eurozone growth forecast, which helped limit fears about Greece’s debt situation.

The Japanese economy continued to grow in 2015’s first quarter after exiting recession in the previous quarter, driven by an increase in private demand as business investment and private consumption rose. The Bank of Japan maintained its monetary policy during the review period but lowered its economic growth and inflation forecasts at its April meeting.

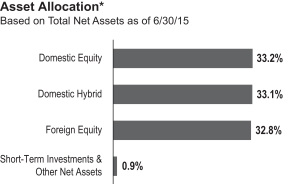

*The asset allocation is based on the Statement of Investments (SOI), which classifies each underlying fund into a broad asset class.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s SOI.

1. Source: Morningstar.

One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. Please see Index Descriptions following the Fund Summaries.

| FFA-2 | Semiannual Report |

FRANKLIN FOUNDING FUNDS ALLOCATION VIP FUND

2. Source: MSCI. Please see Index Descriptions following the Fund Summaries.

3. Please see Index Descriptions following the Fund Summaries.

| Semiannual Report | FFA-3 |

FRANKLIN FOUNDING FUNDS ALLOCATION VIP FUND

Class 2 Fund Expenses

| Class 2 | Beginning Account Value 1/1/15 |

Ending Account Value 6/30/15 |

Fund-Level Expenses 1/1/15–6/30/15 |

Fund-Level Expenses 1/1/15–6/30/15 |

||||||||||||

| Actual |

$1,000 | $1,006.00 | $1.74 | $5.02 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000 | $1,023.06 | $1.76 | $5.06 | ||||||||||||

*Expenses are calculated using the most recent six-month annualized expense ratio excluding expenses of the underlying funds, net of expense waivers, for the Fund’s Class 2 shares (0.35%), which does not include any ongoing expenses of the Contract for which the Fund is an investment option, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

**Expenses are calculated using the most recent six-month annualized expense ratio including expenses of the underlying funds, net of expense waivers, for the Fund’s Class 2 shares (1.01%), which does not include any ongoing expenses of the Contract for which the Fund is an investment option, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

| FFA-4 | Semiannual Report |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Financial Highlights

Franklin Founding Funds Allocation VIP Fund

| Six Months Ended June 30, 2015 |

Year Ended December 31, | |||||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||

| Class 1 | ||||||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$7.47 | $7.47 | $8.55 | $7.63 | $7.73 | $7.15 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Income from investment operationsa: | ||||||||||||||||||||||||

| Net investment incomeb,c |

0.19 | 0.22 | 0.30 | 0.26 | 0.25 | 0.24 | ||||||||||||||||||

| Net realized and unrealized gains (losses) |

(0.13 | ) | 0.02 | 1.42 | 0.90 | (0.35 | ) | 0.52 | ||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total from investment operations |

0.06 | 0.24 | 1.72 | 1.16 | (0.10 | ) | 0.76 | |||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Less distributions from: | ||||||||||||||||||||||||

| Net investment income |

(0.24 | ) | (0.23 | ) | (1.15 | ) | (0.24 | ) | (— | )d | (0.18 | ) | ||||||||||||

| Net realized gains |

(0.01 | ) | (0.01 | ) | (1.65 | ) | — | — | (— | )d | ||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total distributions |

(0.25 | ) | (0.24 | ) | (2.80 | ) | (0.24 | ) | (— | )d | (0.18 | ) | ||||||||||||

|

|

|

|||||||||||||||||||||||

| Net asset value, end of period |

$7.28 | $7.47 | $7.47 | $8.55 | $7.63 | $7.73 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total returne |

0.72% | 3.05% | 24.14% | 15.56% | (1.28)% | 10.64% | ||||||||||||||||||

| Ratios to average net assetsf | ||||||||||||||||||||||||

| Expenses before waiver and payments by affiliatesg |

0.11% | 0.11% | 0.11% | 0.11% | 0.11% | 0.11% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliatesg |

0.10% | 0.10% | 0.10% | 0.10% | 0.10% | 0.10% | ||||||||||||||||||

| Net investment incomec |

4.72% | 2.88% | 3.67% | 4.06% | 3.44% | 3.04% | ||||||||||||||||||

| Supplemental data | ||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$1,165 | $1,114 | $952 | $767 | $470 | $437 | ||||||||||||||||||

| Portfolio turnover rate |

2.50% | 4.80% | 3.91% | 28.46% | h | 58.42% | 17.81% | |||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds in which the Fund invests.

dAmount rounds to less than $0.01 per share.

eTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gDoes not include expenses of the Underlying Funds in which the Fund invests. The weighted average indirect expenses of the Underlying Funds was 0.66% for the period ended June 30, 2015.

hExcludes the value of portfolio securities delivered as a result of a redemption in-kind.

| The accompanying notes are an integral part of these financial statements. | Semiannual Report | FFA-5 |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL HIGHLIGHTS

Franklin Founding Funds Allocation VIP Fund (continued)

| Six Months Ended June 30, 2015 (unaudited) |

Year Ended December 31, | |||||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||

| Class 2 | ||||||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$7.42 | $7.42 | $8.51 | $7.59 | $7.71 | $7.14 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Income from investment operationsa: | ||||||||||||||||||||||||

| Net investment incomeb,c |

0.17 | 0.20 | 0.27 | 0.25 | 0.23 | 0.21 | ||||||||||||||||||

| Net realized and unrealized gains (losses) |

(0.12 | ) | 0.02 | 1.42 | 0.89 | (0.35 | ) | 0.52 | ||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total from investment operations |

0.05 | 0.22 | 1.69 | 1.14 | (0.12 | ) | 0.73 | |||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Less distributions from: | ||||||||||||||||||||||||

| Net investment income |

(0.22 | ) | (0.21 | ) | (1.13 | ) | (0.22 | ) | (— | )d | (0.16 | ) | ||||||||||||

| Net realized gains |

(0.01 | ) | (0.01 | ) | (1.65 | ) | — | — | (— | )d | ||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total distributions |

(0.23 | ) | (0.22 | ) | (2.78 | ) | (0.22 | ) | (— | )d | (0.16 | ) | ||||||||||||

|

|

|

|||||||||||||||||||||||

| Net asset value, end of period |

$7.24 | $7.42 | $7.42 | $8.51 | $7.59 | $7.71 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total returne |

0.60% | 2.85% | 23.77% | 15.33% | (1.54)% | 10.25% | ||||||||||||||||||

| Ratios to average net assetsf | ||||||||||||||||||||||||

| Expenses before waiver and payments by affiliatesg |

0.36% | 0.36% | 0.36% | 0.36% | 0.36% | 0.36% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliatesg |

0.35% | 0.35% | 0.35% | 0.35% | 0.35% | 0.35% | ||||||||||||||||||

| Net investment incomec |

4.47% | 2.63% | 3.42% | 3.81% | 3.19% | 2.79% | ||||||||||||||||||

| Supplemental data | ||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$536,039 | $557,704 | $547,506 | $472,686 | $448,101 | $488,057 | ||||||||||||||||||

| Portfolio turnover rate |

2.50% | 4.80% | 3.91% | 28.46% | h | 58.42% | 17.81% | |||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds in which the Fund invests.

dAmount rounds to less than $0.01 per share.

eTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gDoes not include expenses of the Underlying Funds in which the Fund invests. The weighted average indirect expenses of the Underlying Funds was 0.66% for the period ended June 30, 2015.

hExcludes the value of portfolio securities delivered as a result of a redemption in-kind.

| FFA-6 | Semiannual Report | The accompanying notes are an integral part of these financial statements. |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL HIGHLIGHTS

Franklin Founding Funds Allocation VIP Fund (continued)

| Six Months Ended June 30, 2015 (unaudited) |

Year Ended December 31, | |||||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||

| Class 4 | ||||||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the period) |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$7.54 | $7.54 | $8.49 | $7.58 | $7.71 | $7.14 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Income from investment operationsa: | ||||||||||||||||||||||||

| Net investment incomeb,c |

0.17 | 0.20 | 0.26 | 0.30 | 0.24 | 0.19 | ||||||||||||||||||

| Net realized and unrealized gains (losses) |

(0.13 | ) | 0.02 | 1.43 | 0.83 | (0.37 | ) | 0.54 | ||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total from investment operations |

0.04 | 0.22 | 1.69 | 1.13 | (0.13 | ) | 0.73 | |||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Less distributions from: | ||||||||||||||||||||||||

| Net investment income |

(0.21 | ) | (0.21 | ) | (0.99 | ) | (0.22 | ) | (— | )d | (0.16 | ) | ||||||||||||

| Net realized gains |

(0.01 | ) | (0.01 | ) | (1.65 | ) | — | — | (— | )d | ||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total distributions |

(0.22 | ) | (0.22 | ) | (2.64 | ) | (0.22 | ) | (— | )d | (0.16 | ) | ||||||||||||

|

|

|

|||||||||||||||||||||||

| Net asset value, end of period |

$7.36 | $7.54 | $7.54 | $8.49 | $7.58 | $7.71 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total returne |

0.45% | 2.75% | 23.68% | 15.17% | (1.67)% | 10.24% | ||||||||||||||||||

| Ratios to average net assetsf | ||||||||||||||||||||||||

| Expenses before waiver and payments by affiliatesg |

0.46% | 0.46% | 0.46% | 0.46% | 0.46% | 0.46% | ||||||||||||||||||

| Expenses net of waiver and payments by affiliatesg |

0.45% | 0.45% | 0.45% | 0.45% | 0.45% | 0.45% | ||||||||||||||||||

| Net investment incomec |

4.37% | 2.53% | 3.32% | 3.71% | 3.09% | 2.69% | ||||||||||||||||||

| Supplemental data | ||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$649,348 | $702,324 | $676,781 | $493,813 | $2,860,928 | $3,036,272 | ||||||||||||||||||

| Portfolio turnover rate |

2.50% | 4.80% | 3.91% | 28.46% | h | 58.42% | 17.81% | |||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds in which the Fund invests.

dAmount rounds to less than $0.01 per share.

eTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gDoes not include expenses of the Underlying Funds in which the Fund invests. The weighted average indirect expenses of the Underlying Funds was 0.66% for the period ended June 30, 2015.

hExcludes the value of portfolio securities delivered as a result of a redemption in-kind.

| The accompanying notes are an integral part of these financial statements. | Semiannual Report | FFA-7 |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Statement of Investments, June 30, 2015 (unaudited)

Franklin Founding Funds Allocation VIP Fund

| Shares | Value | |||||||||

| Investments in Underlying Fundsa |

||||||||||

| Domestic Equity 33.2% |

||||||||||

| Franklin Mutual Shares VIP Fund, Class 1 |

16,815,586 | $ | 393,652,857 | |||||||

|

|

|

|||||||||

| Domestic Hybrid 33.1% |

||||||||||

| Franklin Income VIP Fund, Class 1 |

25,231,943 | 392,609,031 | ||||||||

|

|

|

|||||||||

| Foreign Equity 32.8% |

||||||||||

| Templeton Growth VIP Fund, Class 1 |

26,663,630 | 389,555,629 | ||||||||

|

|

|

|||||||||

| Total Investments in Underlying Funds (Cost $851,373,690) 99.1% |

1,175,817,517 | |||||||||

| Other Assets, less Liabilities 0.9% |

10,734,917 | |||||||||

|

|

|

|||||||||

| Net Assets 100.0% |

$ | 1,186,552,434 | ||||||||

|

|

|

|||||||||

aSee Note 3(d) regarding investments in Underlying Funds.

| FFA-8 | Semiannual Report | The accompanying notes are an integral part of these financial statements. | |||||

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Financial Statements

Statement of Assets and Liabilities

June 30, 2015 (unaudited)

| Franklin Founding Funds Allocation VIP Fund |

||||

| Assets: |

||||

| Investments in Underlying Funds: (Note 3d) |

||||

| Cost |

$ | 851,373,690 | ||

|

|

|

|||

| Value |

$ | 1,175,817,517 | ||

| Cash |

11,312,261 | |||

| Receivables from capital shares sold |

406,389 | |||

| Other assets |

513 | |||

|

|

|

|||

| Total assets |

1,187,536,680 | |||

|

|

|

|||

| Liabilities: |

||||

| Payables: |

||||

| Capital shares redeemed |

197,514 | |||

| Administrative fees |

87,135 | |||

| Distribution fees |

625,786 | |||

| Reports to shareholders |

53,990 | |||

| Accrued expenses and other liabilities |

19,821 | |||

|

|

|

|||

| Total liabilities |

984,246 | |||

|

|

|

|||

| Net assets, at value |

$ | 1,186,552,434 | ||

|

|

|

|||

| Net assets consist of: |

||||

| Paid-in capital |

$ | 885,970,754 | ||

| Undistributed net investment income |

25,499,289 | |||

| Net unrealized appreciation (depreciation) |

324,443,827 | |||

| Accumulated net realized gain (loss) |

(49,361,436 | ) | ||

|

|

|

|||

| Net assets, at value |

$ | 1,186,552,434 | ||

|

|

|

|||

| Class 1: | ||||

| Net assets, at value |

$ | 1,165,136 | ||

|

|

|

|||

| Shares outstanding |

159,986 | |||

|

|

|

|||

| Net asset value and maximum offering price per share |

$ | 7.28 | ||

|

|

|

|||

| Class 2: | ||||

| Net assets, at value |

$ | 536,038,874 | ||

|

|

|

|||

| Shares outstanding |

74,026,307 | |||

|

|

|

|||

| Net asset value and maximum offering price per share |

$ | 7.24 | ||

|

|

|

|||

| Class 4: | ||||

| Net assets, at value |

$ | 649,348,424 | ||

|

|

|

|||

| Shares outstanding |

88,168,720 | |||

|

|

|

|||

| Net asset value and maximum offering price per share |

$ | 7.36 | ||

|

|

|

|||

| The accompanying notes are an integral part of these financial statements. | Semiannual Report | FFA-9 |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL STATEMENTS

Statement of Operations

for the six months ended June 30, 2015 (unaudited)

| Franklin Founding Funds Allocation VIP Fund |

||||

| Investment income: |

||||

| Dividends from Underlying Funds (Note 3d) |

$ | 29,569,903 | ||

|

|

|

|||

| Expenses: |

||||

| Administrative fees (Note 3a) |

613,189 | |||

| Distribution fees: (Note 3b) |

||||

| Class 2 |

686,069 | |||

| Class 4 |

1,181,615 | |||

| Reports to shareholders |

47,392 | |||

| Professional fees |

16,338 | |||

| Trustees’ fees and expenses |

2,696 | |||

| Other |

6,362 | |||

|

|

|

|||

| Total expenses |

2,553,661 | |||

| Expenses waived/paid by affiliates (Note 3e) |

(72,792 | ) | ||

|

|

|

|||

| Net expenses |

2,480,869 | |||

|

|

|

|||

| Net investment income |

27,089,034 | |||

|

|

|

|||

| Realized and unrealized gains (losses): |

||||

| Net realized gain (loss) from sale of investments in Underlying Funds (Note 3d) |

5,867,736 | |||

| Net change in unrealized appreciation (depreciation) on investments in Underlying Funds |

(24,727,651 | ) | ||

|

|

|

|||

| Net realized and unrealized gain (loss) |

(18,859,915 | ) | ||

|

|

|

|||

| Net increase (decrease) in net assets resulting from operations |

$ | 8,229,119 | ||

|

|

|

|||

| FFA-10 | Semiannual Report | The accompanying notes are an integral part of these financial statements. |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL STATEMENTS

Statements of Changes in Net Assets

| Franklin Founding Funds Allocation VIP Fund | ||||||||

| Six Months June 30, 2015 |

Year December 31, |

|||||||

| Increase (decrease) in net assets: |

||||||||

| Operations: |

||||||||

| Net investment income |

$ | 27,089,034 | $ | 33,255,768 | ||||

| Net realized gain (loss) |

5,867,736 | 1,584,965 | ||||||

| Net change in unrealized appreciation (depreciation) |

(24,727,651 | ) | (1,653,471 | ) | ||||

|

|

|

|||||||

| Net increase (decrease) in net assets resulting from operations |

8,229,119 | 33,187,262 | ||||||

|

|

|

|||||||

| Distributions to shareholders from: |

||||||||

| Net investment income: |

||||||||

| Class 1 |

(36,795 | ) | (32,764 | ) | ||||

| Class 2 |

(15,525,526 | ) | (15,578,364 | ) | ||||

| Class 4 |

(17,645,320 | ) | (19,895,877 | ) | ||||

| Net realized gains: |

||||||||

| Class 1 |

(1,845 | ) | (924 | ) | ||||

| Class 2 |

(848,940 | ) | (475,173 | ) | ||||

| Class 4 |

(1,013,211 | ) | (618,180 | ) | ||||

|

|

|

|||||||

| Total distributions to shareholders |

(35,071,637 | ) | (36,601,282 | ) | ||||

|

|

|

|||||||

| Capital share transactions: (Note 2) |

||||||||

| Class 1 |

82,435 | 164,958 | ||||||

| Class 2 |

(9,093,407 | ) | 11,105,994 | |||||

| Class 4 |

(38,735,289 | ) | 28,046,285 | |||||

|

|

|

|||||||

| Total capital share transactions |

(47,746,261 | ) | 39,317,237 | |||||

|

|

|

|||||||

| Net increase (decrease) in net assets |

(74,588,779 | ) | 35,903,217 | |||||

| Net assets: |

||||||||

| Beginning of period |

1,261,141,213 | 1,225,237,996 | ||||||

|

|

|

|||||||

| End of period |

$ | 1,186,552,434 | $ | 1,261,141,213 | ||||

|

|

|

|||||||

| Undistributed net investment income included in net assets: |

||||||||

| End of period |

$ | 25,499,289 | $ | 31,617,896 | ||||

|

|

|

|||||||

| The accompanying notes are an integral part of these financial statements. | Semiannual Report | FFA-11 |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Notes to Financial Statements (unaudited)

Franklin Founding Funds Allocation VIP Fund

| FFA-12 | Semiannual Report |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

NOTES TO FINANCIAL STATEMENTS

Franklin Founding Funds Allocation VIP Fund (continued)

2. Shares of Beneficial Interest

At June 30, 2015, there were an unlimited number of shares authorized (without par value). Transactions in the Fund’s shares were as follows:

| Six Months Ended June 30, 2015 |

Year Ended December 31, 2014 |

|||||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||||

| Class 1 Shares: | ||||||||||||||||||

| Shares sold |

13,554 | $ | 103,680 | 37,779 | $ | 289,740 | ||||||||||||

| Shares issued in reinvestment of distributions |

5,229 | 38,640 | 4,341 | 33,688 | ||||||||||||||

| Shares redeemed |

(7,884 | ) | (59,885 | ) | (20,435 | ) | (158,470 | ) | ||||||||||

|

|

|

|||||||||||||||||

| Net increase (decrease) |

10,899 | $ | 82,435 | 21,685 | $ | 164,958 | ||||||||||||

|

|

|

|||||||||||||||||

| Class 2 Shares: | ||||||||||||||||||

| Shares sold |

3,221,994 | $ | 24,332,577 | 11,044,608 | $ | 83,657,513 | ||||||||||||

| Shares issued in reinvestment of distributions |

2,227,819 | 16,374,466 | 2,082,171 | 16,053,537 | ||||||||||||||

| Shares redeemed |

(6,598,388 | ) | (49,800,450 | ) | (11,722,596 | ) | (88,605,056 | ) | ||||||||||

|

|

|

|||||||||||||||||

| Net increase (decrease) |

(1,148,575 | ) | $ | (9,093,407 | ) | 1,404,183 | $ | 11,105,994 | ||||||||||

|

|

|

|||||||||||||||||

| Class 4 Shares: | ||||||||||||||||||

| Shares sold |

1,873,838 | $ | 14,361,530 | 13,809,688 | $ | 106,773,129 | ||||||||||||

| Shares issued in reinvestment of distributions |

2,494,456 | 18,658,531 | 2,616,589 | 20,514,057 | ||||||||||||||

| Shares redeemed |

(9,404,929 | ) | (71,755,350 | ) | (12,995,650 | ) | (99,240,901 | ) | ||||||||||

|

|

|

|||||||||||||||||

| Net increase (decrease) |

(5,036,635 | ) | $ | (38,735,289 | ) | 3,430,627 | $ | 28,046,285 | ||||||||||

|

|

|

|||||||||||||||||

| Semiannual Report | FFA-13 |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Franklin Founding Funds Allocation VIP Fund (continued)

3. Transactions With Affiliates

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers and/or directors/trustees of certain of the Underlying Funds and of the following subsidiaries:

| Subsidiary | Affiliation | |

| Franklin Templeton Services, LLC (FT Services) |

Administrative manager | |

| Franklin Templeton Distributors, Inc. (Distributors) |

Principal underwriter | |

| Franklin Templeton Investor Services, LLC (Investor Services) |

Transfer agent |

a. Administrative Fees

The Fund pays an administrative fee to FT Services of 0.10% per year of the average daily net assets of the Fund for administrative services including monitoring and rebalancing the percentage of the Fund’s investments in the Underlying Funds.

b. Distribution Fees

The Board has adopted distribution plans for Class 2 and Class 4 shares pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s compensation distribution plans, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to 0.35% per year of its average daily net assets of each class. Some distribution fees are not charged on shares held by affiliates. The Board has agreed to limit the current rate to 0.25% per year for Class 2. The plan year, for purposes of monitoring compliance with the maximum annual plan rates, is February 1 through January 31.

c. Transfer Agent Fees

Investor Services, under terms of an agreement, performs shareholder servicing for the Fund and is not paid by the Fund for the services.