Page 1 of 24

| Exhibit 16(4)(k) | ||

| Aetna Insurance Company of America | ||

| Home Office: 151 Farmington Avenue | ||

| P.O. Box 30670 | ||

| Hartford, Connecticut 06150-0670 | ||

| (800) 531-4547 | ||

| You may call the toll-free number shown above for | ||

| answers to questions or to resolve a complaint. | ||

| Aetna Insurance Company of America, a stock | ||

| company, herein called Aetna, agrees to pay the | ||

| benefits stated in this Contract. | ||

| - -------------------------------------------------------------------------------- | ||

| Certificate of Group Annuity To the Certificate Holder: | ||

| Coverage | ||

| Aetna certifies that coverage is in force for you | ||

| under the stated Group Annuity Contract and | ||

| Certificate numbers. All data shown here is taken | ||

| from Aetna records and is based upon information | ||

| furnished by you. | ||

| This Certificate is a summary of the Group | ||

| Annuity Contract provisions. It replaces any and | ||

| all prior certificates or endorsements issued to | ||

| you under the stated Contract and Certificate | ||

| numbers. This Certificate is for information only | ||

| and is not a part of the Contract. | ||

| The variable features of the Group Contract are | ||

| described in parts III and IV. | ||

| - -------------------------------------------------------------------------------- | ||

| Right to Cancel | You may cancel your Account within 10 | |

| days by returning it to the agent from whom it | ||

| was purchased, or to Aetna at the address shown | ||

| above. Within seven days of receiving this | ||

| Certificate at its home office, Aetna will return | ||

| the amount of Purchase Payment(s) received, plus | ||

| any increase, or minus any decrease, on the | ||

| amount, if any, of Purchase Payment(s) allocated | ||

| to the Separate Account fund(s). | ||

| /s/ Dan Kearney | /s/ Maria F. McKeon | |

| President | Secretary | |

| - -------------------------------------------------------------------------------- | ||

| Contract Holder | Group Annuity Contract No. | |

| SPECIMEN | SPECIMEN | |

| - -------------------------------------------------------------------------------- | ||

| Certificate Holder | Certificate No. | |

| SPECIMEN | ||

| SPECIMEN | SPECIMEN | |

| - -------------------------------------------------------------------------------- | ||

| Annuitant Name | Type of Plan | |

| SPECIMEN | SPECIMEN | |

| - -------------------------------------------------------------------------------- | ||

| ALL PAYMENTS AND VALUES PROVIDED BY THE GROUP CONTRACT, WHEN BASED ON INVESTMENT | ||

| EXPERIENCE OF A SEPARATE ACCOUNT, ARE VARIABLE AND ARE NOT GUARANTEED AS TO | ||

| FIXED DOLLAR AMOUNT. THIS CERTIFICATE CONTAINS A MARKET VALUE ADJUSTMENT | ||

| FORMULA. APPLICATION OF A MARKET VALUE ADJUSTMENT MAY RESULT IN EITHER AN | ||

| INCREASE OR DECREASE IN THE CURRENT VALUE. THE MARKET VALUE ADJUSTMENT FORMULA | ||

| DOES NOT APPLY TO A GUARANTEED TERM AT THE TIME OF ITS MATURITY. | ||

| MP2CERT (5/97) | ||

| <PAGE> | ||

| Specifications | ||

| - ------------------------------- ------------------------------------------------ | ||

| Guaranteed Interest Rate There are guaranteed interest | ||

| rates for amounts held in the AG Account (See | ||

| Certificate Schedule I). | ||

| - ------------------------------- ------------------------------------------------ | ||

| Deductions from the | There will be deductions for mortality and expense | |

| Separate Account | risks and administrative fees. (See Certificate | |

| Schedule I and II). | ||

| - ------------------------------- ------------------------------------------------ | ||

| Deduction from | The Purchase Payment is subject to a deduction for | |

| Purchase Payment(s) | premium taxes, if any. (See 3.01.) | |

| - ------------------------------- ------------------------------------------------ | ||

| Surrender Fee | There will be a charge deducted upon surrender. | |

| (See Certificate Schedule I). | ||

| MP2CERT(5/97) | ||

| 2 | ||

| https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt | 03/26/2018 | |

Page 2 of 24

<PAGE>

Contract Schedule I

Accumulation Period

<TABLE>

<CAPTION>

Separate Account

-

-------------------------- ----------------------------------------------------------------------------------------------------

| <S> | <C> | |||

| Separate Account: | Variable Annuity Account I | |||

| Charges to Separate | A daily charge is deducted from any portion of the Current Value allocated to the Separate | |||

| Account: | Account. The deduction is the daily equivalent of the annual effective percentage shown in the | |||

| following chart: | __ | __ | ||

| Administrative Charge | | | 0.15% | | | |

| Mortality Risk Charge | | | 0.35% | | | |

| Expense Risk Charge | | | 0.90% | | | |

| ----- | ||||

| Total Separate Account | | | | | ||

| Charges | | | 1.40% | | | |

| |_ | _| | |||

AICA Guaranteed Account (AG Account)

- -------------------------------------------------------------------------------------------------------------------------------

Minimum Guaranteed [3.0%] (effective annual rate of return) Interest Rate: Separate Account and AG Account

- -------------------------------------------------------------------------------------------------------------------------------

Transfers: |

An unlimited number of Transfers are allowed during the Accumulation Period. Aetna allows [12] free Transfers in any calendar year. Thereafter, Aetna reserves the right to charge [$10] for each subsequent Transfer. |

Maintenance Fee: |

The annual Maintenance Fee is [$30]. If the Account's Current Value is $50,000 or more on the date the Maintenance Fee is to be deducted, the Maintenance Fee is [$0]. |

Annual Waiver of Surrender Fee: |

As provided in 3.14 (d), the amount that may be withdrawn without a surrender fee cannot exceed [10%] of the Current Value calculated on the date Aetna receives a surrender request in good order at its Home Office. |

MP2CERT(5/97)-1

3

<PAGE>

Contract Schedule I (Continued)

Accumulation Period

Separate Account and AG Account (Cont'd)

- -----------------------------------------------------------------------------------------------------------------------------

| Surrender Fee: | For each surrender, the Surrender Fee will be determined as follows: | ||

| Surrender Fee | |||

| Length of Time from Deposit of | (as percentage of | ||

| __ Net Purchase Payment (Years) | Net Purchase Payment) | ||

| | | Less than 2 years | 7% | | |

| | | 2 or more but less than 4 years | 6% | | |

| | | 4 or more but less than 5 years | 5% | | |

| | | 5 or more but less than 6 years | 4% | | |

| | | 6 or more but less than 7 years | 3% | | |

| |_ 7 years or more | 0% _| | ||

| Systematic | The specified payment or specified percentage may not be greater than [10%] of the Account's | ||

| Withdrawal | Current Value at time of election. | ||

| Option (SWO): | |||

| </TABLE> | |||

| See 1. GENERAL DEFINITIONS for explanations. | |||

MP2CERT(5/97)-1

4

<PAGE>

Contract Schedule II

Annuity Period

<TABLE>

<CAPTION>

Separate Account

-

-------------------------- ----------------------------------------------------------------------------------------------------

| <S> | <C> | |

| Charges to Separate | A daily charge at an annual effective rate of [1.25%] for Annuity mortality and expense risks. | |

| Account: | The administrative charge is established upon election of an Annuity option. | This charge will not |

| exceed [0.25%]. | ||

| https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt | 03/26/2018 | |

Page 3 of 24

Variable Annuity Assumed If a Variable Annuity is chosen, an assumed annual net return rate of [5.0%] may be elected. If Annual Net Return Rate: [5.0%] is not elected, Aetna will use an assumed annual net return rate of [3.5%].

The assumed annual net return rate factor for [3.5%] per year is [0.9999058].

The assumed annual net return rate factor for [5.0%] per year is [0.9998663].

If the portion of a Variable Annuity payment for any

Fund is not to decrease, the Annuity return factor

under the Separate Account for that Fund must be:

(a) [4.75%] on an annual basis plus an annual return of up to [0.25%] to offset the administrative charge set at the time Annuity payments commence if an assumed annual net return rate of [3.5%] is chosen; or

(b) [6.25%] on an annual basis plus an annual return of up to [0.25%] to offset the administrative charge set at the time Annuity payments commence, if an assumed annual net return rate of [5%] is chosen.

Fixed Annuity

-

-------------------------- ----------------------------------------------------------------------------------------------------

Minimum Guaranteed Interest Rate: </TABLE> |

[3.0%] (effective annual rate of return) |

See 1. GENERAL DEFINITIONS for explanations.

MP2CERT(5/97)-1

5

<PAGE>

Contract Schedule I

Accumulation Period

<TABLE>

<CAPTION>

Separate Account

-

-------------------------- ----------------------------------------------------------------------------------------------------

| <S> | <C> | |||

| Separate Account: | Variable Annuity Account I | |||

| Charges to Separate | A daily charge is deducted from any portion of the Current Value allocated to the Separate | |||

| Account: | Account. The deduction is the daily equivalent of the annual effective percentage shown in the | |||

| following chart: | __ | __ | ||

| Administrative Charge | | | 0.15% | | | |

| Mortality Risk Charge | | | 0.35% | | | |

| Expense Risk Charge | | | 0.90% | | | |

| ----- | ||||

| Total Separate Account | | | | | ||

| Charges | | | 1.40% | | | |

| |_ | _| | |||

AICA Guaranteed Account (AG Account)

- -------------------------------------------------------------------------------------------------------------------------------

Minimum Guaranteed Interest Rate: |

[3.0%] (effective annual rate of return) |

Separate Account and AG Account

- -------------------------------------------------------------------------------------------------------------------------------

| Transfers: | An unlimited number of Transfers are allowed during the Accumulation Period. Aetna allows [12] | |

| free Transfers in any calendar year. | Thereafter, Aetna reserves the right to charge [$10] for | |

| each subsequent Transfer. | ||

| Maintenance Fee: | The annual Maintenance Fee is [$30]. | If the Account's Current Value is $50,000 or more on the |

| date the Maintenance Fee is to be deducted, the Maintenance Fee is [$0]. | ||

| Annual Waiver of | As provided in 3.14 (d), the amount that may be withdrawn without a surrender fee cannot exceed [10%] of | |

| Surrender Fee: | the Current Value calculated on the date Aetna receives a surrender request in good order at its Home | |

| Office. | ||

| MP2CERT(5/97)-2 | ||

3

<PAGE>

Contract Schedule I (Continued)

Accumulation Period

Separate Account and AG Account (Cont'd)

- -------------------------------------------------------------------------------------------------------------------------------

| Surrender Fee: | For each surrender, the Surrender Fee will be determined as follows: | ||

| Surrender Fee | |||

| Length of Time from Deposit of | (as percentage of | ||

| __ | Net Purchase Payment (Years) | Net Purchase Payment) | |

| | | Less than 1 year | 3% | | |

| https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt | 03/26/2018 | ||

| Page 4 of 24 | |||

| | | More than 1 but less than 2 years | 2% | | |

| | | More than 2 but less than 3 years | 1% | | |

| | | More than 3 years | 0% | | |

| |_ | _| | ||

| Systematic | The specified payment or specified percentage may not be greater than [10%] of the Account's Current | ||

| Withdrawal | Value at time of election. | ||

| Option (SWO): | |||

| </TABLE> | |||

| See 1. GENERAL DEFINITIONS for explanations. | |||

MP2CERT(5/97)-2

4

<PAGE>

Contract Schedule II

Annuity Period

<TABLE>

<CAPTION>

Separate Account

-

------------------------------- -----------------------------------------------------------------------------------------------

| <S> | <C> | |

| Charges to Separate Account: | A daily charge at an annual effective rate of [1.25%] for Annuity mortality and expense | |

| risks. The administrative charge is established upon election of an Annuity option. This | ||

| charge will not exceed [0.25%]. | ||

| Variable Annuity Assumed | If a Variable Annuity is chosen, an assumed annual net return rate of [5.0%] may be elected. | |

| Annual Net Return Rate: | If [5.0%] is not elected, Aetna will use an assumed annual net return rate of [3.5%]. | |

| The assumed annual net return rate factor for [3.5%] per year is [0.9999058]. | ||

| The assumed annual net return rate factor for [5.0%] per year is [0.9998663]. | ||

| If the portion of a Variable Annuity payment for | ||

| any Fund is not to decrease, the Annuity return | ||

| factor under the Separate Account for that Fund | ||

| must be: | ||

| (a) | [4.75%] on an annual basis plus an annual return of up to [0.25%] to offset the administrative | |

| charge set at the time Annuity payments commence if an assumed annual net return rate of [3.5%] | ||

| is chosen; or | ||

| (b) | [6.25%] on an annual basis plus an annual return of up to [0.25%] to offset the administrative | |

| charge set at the time Annuity payments commence, if an assumed annual net return rate of [5%] | ||

| is chosen. | ||

Fixed Annuity

-

------------------------------- -----------------------------------------------------------------------------------------------

Minimum Guaranteed Interest Rate: </TABLE> |

[3.0%] (effective annual rate of return) |

See 1. GENERAL DEFINITIONS for explanations.

MP2CERT(5/97)-2

5

<PAGE>

Contract Schedule I

Accumulation Period

<TABLE>

<CAPTION>

Separate Account

-

-------------------------------- ----------------------------------------------------------------------------------------------

| <S> | <C> | |||

| Separate Account: | Variable Annuity Account I | |||

| Charges to Separate Account: | A daily charge is deducted from any portion of the Current Value allocated to the Separate Account. | |||

| The deduction is the daily equivalent of the annual effective percentage shown in the following | ||||

| chart: | __ | __ | ||

| Mortality Risk Charge | | | 0.35% | | | |

| Expense Risk Charge | | | 0.90% | | | |

| Total Separate Account | | | ----- | | | |

| Charges | | | 1.25% | | | |

| |_ | _| | |||

AICA Guaranteed Account (AG Account)

- -------------------------------------------------------------------------------------------------------------------------------

Minimum Guaranteed Interest Rate: |

[3.0%] (effective annual rate of return) |

Separate Account and AG Account

- -------------------------------------------------------------------------------------------------------------------------------

https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt

03/26/2018

Page 5 of 24 |

|

Transfers: |

An unlimited number of Transfers are allowed during the Accumulation Period. Aetna allows [12] free Transfers in any calendar year. Thereafter, Aetna reserves the right to charge [$10] for each subsequent Transfer. |

Maintenance Fee: |

The annual Maintenance Fee is [$30]. If the Account's Current Value is $50,000 or more on the date the Maintenance Fee is to be deducted, the Maintenance Fee is [$0]. |

Annual Waiver of Surrender Fee: |

As provided in 3.14 (d), the amount that may be withdrawn without a surrender fee cannot exceed [10%] of the Current Value calculated on the date Aetna receives a surrender request in good order at its Home Office. |

MP2CERT(5/97)-3

3

<PAGE>

Contract Schedule I (Continued)

Accumulation Period

Separate Account and AG Account (Cont'd)

- -------------------------------------------------------------------------------------------------------------------------------

Surrender Fee: Systematic Withdrawal Option (SWO): </TABLE> |

The Surrender Fee does not apply to this Contract. The specified payment or specified percentage may not be greater than [10%] of the Account's Current Value at time of election. |

See 1. GENERAL DEFINITIONS for explanations.

MP2CERT(5/97)-3

4

<PAGE>

Contract Schedule II

Annuity Period

<TABLE>

<CAPTION>

Separate Account

-

------------------------------ ------------------------------------------------------------------------------------------------

| <S> | <C> | |

| Charges to Separate Account: | A daily charge at an annual effective rate of [1.25%] for Annuity mortality and expense | |

| risks. The administrative charge is established upon election of an Annuity option. This | ||

| charge will not exceed [0.25%]. | ||

| Variable Annuity Assumed | If a Variable Annuity is chosen, an assumed annual net return rate of [5.0%] may be elected. | |

| Annual Net Return Rate: | If [5.0%] is not elected, Aetna will use an assumed annual net return rate of [3.5%]. | |

| The assumed annual net return rate factor for [3.5%] per year is [0.9999058]. | ||

| The assumed annual net return rate factor for [5.0%] per year is [0.9998663]. | ||

| If the portion of a Variable Annuity payment for any Fund is not to decrease, the Annuity return | ||

| factor under the Separate Account for that Fund must be: | ||

| (a) | [4.75%] on an annual basis plus an annual return of up to [0.25%] to offset the administrative | |

| charge set at the time Annuity payments commence if an assumed annual net return rate of [3.5%] | ||

| is chosen; or | ||

| (b) | [6.25%] on an annual basis plus an annual return of up to [0.25%] to offset the administrative | |

| charge set at the time Annuity payments commence, if an assumed annual net return rate of [5%] | ||

| is chosen. | ||

Fixed Annuity

- ------------------------------ ------------------------------------------------------------------------------------------------</TABLE>

Minimum Guaranteed Interest Rate: |

[3.0%] (effective annual rate of return) |

See 1. GENERAL DEFINITIONS for explanations.

MP2CERT(5/97)-3

5

<PAGE>

TABLE OF CONTENTS

| I. |

GENERAL DEFINITIONS |

| - |

--------------------------------------------------------------------------- |

| Page | |||

| 1.01 | Account | 8 | |

| 1.02 | Accumulation Period | 8 | |

| 1.03 | Adjusted Current Value | 8 | |

| 1.04 | AICA Guaranteed Account (AG Account) | 8 | |

| https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt | 03/26/2018 | ||

Page 6 of 24

| 1.05 | Annuitant | 8 |

| 1.06 | Annuity | 8 |

| 1.07 | Beneficiary | 8 |

| 1.08 | Certificate Holder | 8 |

| 1.09 | Code | 8 |

| 1.10 | Contract | 8 |

| 1.11 | Contract Holder | 9 |

| 1.12 | Current Value | 9 |

| 1.13 | Deposit Period | 9 |

| 1.14 | Dollar Cost Averaging | 9 |

| 1.15 | Fixed Annuity | 9 |

| 1.16 | Fund(s) | 9 |

| 1.17 | General Account | 9 |

| 1.18 | Guaranteed Rates -- AG Account | 9 |

| 1.19 | Guaranteed Term | 10 |

| 1.20 | Guaranteed Term(s) Groups | 10 |

| 1.21 | Maintenance Fee | 10 |

| 1.22 | Market Value Adjustment (MVA) | 10 |

| 1.23 | Matured Term Value | 10 |

| 1.24 | Matured Term Value Transfer | 10 |

| 1.25 | Maturity Date | 10 |

| 1.26 | Net Purchase Payment(s) | 11 |

| 1.27 | Nonunitized Separate Account | 11 |

| 1.28 | Purchase Payment(s) | 11 |

| 1.29 | Reinvestment | 11 |

| 1.30 | Separate Account | 11 |

| 1.31 | Surrender Value | 11 |

| 1.32 | Transfers | 12 |

| 1.33 | Valuation Period (Period) | 12 |

| 1.34 | Variable Annuity | 12 |

| II. |

GENERAL PROVISIONS |

| - |

--------------------------------------------------------------------------- |

| 2.01 | Change of Contract | 12 |

| 2.02 | Change of Fund(s) | 13 |

| 2.03 | Nonparticipating Contract | 13 |

| MP2CERT(5/97) | ||

6

<PAGE>

| Page | ||

| 2.04 | Payments and Elections | 13 |

| 2.05 | State Laws | 14 |

| 2.06 | Control of Contract | 14 |

| 2.07 | Designation of Beneficiary | 14 |

| 2.08 | Misstatements and Adjustments | 14 |

| 2.09 | Incontestability | 14 |

| 2.10 | Grace Period | 15 |

| 2.11 | Individual Certificates | 15 |

| III. |

PURCHASE PAYMENT, CURRENT VALUE, AND SURRENDER PROVISIONS |

| - |

--------------------------------------------------------------------------- |

| 3.01 | Net Purchase Payment | 15 |

| 3.02 | Certificate Holder's Account | 15 |

| 3.03 | Fund(s) Record Units -- Separate Account | 15 |

| 3.04 | Net Return Factor(s) -- Separate Account | 16 |

| 3.05 | Fund Record Unit Value -- Separate Account | 16 |

| 3.06 | Market Value Adjustment | 16 |

| 3.07 | Transfer of Current Value from the Funds or AG Account | |

| During the Accumulation Period | 18 | |

| 3.08 | Notice to the Certificate Holder | 19 |

| 3.09 | Loans | 19 |

| 3.10 | Systematic Distribution Options | 19 |

| 3.11 | Death Benefit Amount | 19 |

| 3.12 | Death Benefit Options Available to Beneficiary | 21 |

| 3.13 | Liquidation of Surrender Value | 23 |

| 3.14 | Surrender Fee | 23 |

| 3.15 | Payment of Surrender Value | 24 |

| 3.16 | Payment of Adjusted Current Value | 24 |

| IV. |

ANNUITY PROVISIONS |

| - |

--------------------------------------------------------------------------- |

| 4.01 | Choices | 24 |

| 4.02 | Terms of Annuity Options | 25 |

| 4.03 | Death of Annuitant/Beneficiary | 26 |

| 4.04 | Fund(s) Annuity Units -- Separate Account | 27 |

| 4.05 | Fund(s) Annuity Unit Value -- Separate Account | 28 |

| 4.06 | Annuity Net Return Factor(s) -- Separate Account | 28 |

| 4.07 | Annuity Options | 29 |

| MP2CERT(5/97) | ||

7

<PAGE>

<TABLE>

| I. |

GENERAL DEFINITIONS |

| - |

------------------------------------------------------------------------------------------------------------------------------- |

| <S> | <C> | ||

| 1.01 | Account: | A record established for each Certificate Holder to maintain the value of all | |

| Net Purchase Payments held on his/her behalf during the Accumulation Period. | |||

| https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt | 03/26/2018 | ||

| 1.02 |

Accumulation Period: |

| 1.03 |

Adjusted Current Value: |

| 1.04 |

AICA Guaranteed Account (AG Account): |

| 1.05 |

Annuitant: |

| 1.06 |

Annuity: |

| 1.07 |

Beneficiary: |

| 1.08 |

Certificate Holder: |

| 1.09 |

Code: |

| 1.10 |

Contract: |

MP2CERT(5/97)

8

<PAGE>

| 1.11 |

Contract Holder: |

| 1.12 |

Current Value: |

| 1.13 |

Deposit Period: |

| 1.14 |

Dollar Cost Averaging: |

| 1.15 |

Fixed Annuity: |

| 1.16 |

Fund(s): |

| 1.17 |

General Account: |

| 1.18 |

Guaranteed Rates -- AG Account: |

MP2CERT(5/97)

<PAGE>

9

Page 7 of 24

The period during which the Net Purchase Payment(s) are applied to an Account to provide future Annuity payment(s).

The Current Value of an Account plus or minus any aggregate AG Account MVA, if applicable. (See 1.22)

An accumulation option where Aetna guarantees stipulated rate(s) of interest for specified periods of time. All assets of Aetna, including amounts in the Nonunitized Separate Account, are available to meet the guarantees under the AG Account.

The person whose life is measured for purposes of the guaranteed death benefit and the duration of Annuity payments under this Contract.

Payment of an income:

(a) For the life of one or two persons;

(b) For a stated period; or

(c) For some combination of (a) and (b).

The individual or estate entitled to receive any death benefit due under the Contract. If the Account is held by joint Certificate Holders, the survivor will be deemed the designated Beneficiary and any other Beneficiary on record will be treated as the contingent Beneficiary.

A person who purchases an interest in this Contract as evidenced by a certificate. Aetna reserves the right to limit ownership to natural persons. If more than one Certificate Holder owns an Account, each Certificate Holder will be a joint Certificate Holder. Any joint Certificate Holder must be the spouse of the other joint Certificate Holder. Joint Certificate Holders have joint ownership rights and both must authorize exercising any ownership rights unless Aetna allows otherwise.

The Internal Revenue Code of 1986, as it may be amended from time to time.

This agreement between Aetna and the Contract Holder.

The entity to which the Contract is issued.

As of the most recent Valuation Period, the Net Purchase Payment and any additional amount deposited pursuant to 3.11 plus any interest added to the portion allocated to the AG Account; and plus or minus the investment experience of the portion allocated to the Funds since deposit; less all Maintenance Fees deducted, any amounts surrendered and any amounts applied to an Annuity.

A day, a calendar week, a calendar month, a calendar quarter, or any other period of time specified by Aetna during which Net Purchase Payment(s), Transfers and Reinvestments may be allocated to one or more AG Account Guaranteed Terms. Aetna reserves the right to shorten or to extend the Deposit Period.

During a Deposit Period, Aetna may offer any number of Guaranteed Terms and more than one Guaranteed Term of the same duration may be offered.

A program that permits the Certificate Holder to systematically transfer amounts from any of the Funds or an available AG Account Guaranteed Term to any of the Funds. Aetna reserves the right to establish terms and conditions governing Dollar Cost Averaging. Dollar Cost Averaging is not available when an SDO is in effect.

An Annuity with payments that do not vary in amount.

The open-end management investment companies (mutual funds) in which the Separate Account invests.

The Account holding the assets of Aetna, other than those assets held in Aetna's separate accounts.

Aetna will declare the interest rate(s) applicable to a specific Guaranteed Term at the start of the Deposit Period for that Guaranteed Term. The rate(s) are guaranteed by Aetna for the period beginning with the first day of the Deposit Period and ending on the Maturity Date. Guaranteed Rates are credited beginning with the date of allocation. The Guaranteed Rates are annual effective yields. That is, interest is credited daily at a rate that will produce the Guaranteed Rate over the period of a year. No Guaranteed Rate will ever be less than the Minimum Guaranteed Rate shown on Contract Schedule I.

https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt

03/26/2018

| 1.18 |

Guaranteed Rates -- AG Account (Cont'd): |

| 1.19 |

Guaranteed Term: |

| 1.20 |

Guaranteed Term(s) Groups: |

| 1.21 |

Maintenance Fee: |

| 1.22 |

Market Value Adjustment (MVA): |

| 1.23 |

Matured Term Value: |

| 1.24 |

Matured Term Value Transfer: |

| 1.25 |

Maturity Date: |

MP2CERT(5/97)

10

<PAGE>

Page 8 of 24

For Guaranteed Terms of one year or less, one Guaranteed Rate is credited for the full Guaranteed Term. For longer Guaranteed Terms, an initial Guaranteed Rate is credited from the date of deposit to the end of a specified period within the Guaranteed Term. There may be different Guaranteed Rate(s) declared for subsequent specified time intervals throughout the Guaranteed Term.

The period of time specified by Aetna for which a specific Guaranteed Rate(s) is offered on amounts invested during a specific Deposit Period. Guaranteed Terms are made available subject to Aetna's terms and conditions, including, but not limited to, Aetna's right to restrict allocations to new Net Purchase Payments (such as by prohibiting Transfers into a particular Guaranteed Term from any other Guaranteed Term or from any of the Funds, or by prohibiting Reinvestment of a Matured Term Value to a particular Guaranteed Term. More than one Guaranteed Term of the same duration may be offered during a Deposit Period.

All AG Account Guaranteed Term(s) of the same duration (from the close of the Deposit Period until the designated Maturity Date).

The Maintenance Fee (see Contract Schedule I) will be deducted during the Accumulation Period from the Current Value on each anniversary of the date the Account is established and upon surrender of the entire Account.

An adjustment that may apply to an amount withdrawn or transferred from an AG Account Guaranteed Term prior to the end of that Guaranteed Term. The adjustment reflects the change in the value of the investment due to changes in interest rates since the date of deposit and is computed using the formula given in 3.06. The adjustment is expressed as a percentage of each dollar being withdrawn.

The amount payable on an AG Account Guaranteed Term's Maturity Date.

During the calendar month following an AG Account Maturity Date, the Certificate Holder may notify Aetna's home office in writing to Transfer or surrender all or part of the Matured Term Value, plus interest at the new Guaranteed Rate accrued thereon, from the AG Account without an MVA. This provision only applies to the first such written request received from the Certificate Holder during this period for any Matured Term Value.

The last day of an AG Account Guaranteed Term.

| 1.26 | Net Purchase Payment(s): | The Purchase Payment less premium taxes, as applicable. | |

| 1.27 | Nonunitized Separate Account: | A separate account set up by Aetna under Title 38, Section 38a-433, of the | |

| Connecticut General Statutes, that holds assets for AG Account Terms. There | |||

| are no discrete units for this Account. The Certificate Holder does not | |||

| participate in the investment gain or loss from the assets held in the | |||

| Nonunitized Separate Account. Such gain or loss is borne entirely by Aetna. | |||

| These assets may be chargeable with liabilities arising out of any other | |||

| business of Aetna. | |||

| 1.28 | Purchase Payment(s): | Payment(s) accepted by Aetna at its home office. Aetna reserves the right to | |

| refuse to accept any Purchase Payment at any time for any reason. No advance | |||

| notice will be given to the Contract Holder or Certificate Holder. | |||

| 1.29 | Reinvestment: | Aetna will mail a notice to the Certificate Holder at least 18 calendar days | |

| before a Guaranteed Term's Maturity Date. This notice will contain the Terms | |||

| available during the current Deposit Periods with their Guaranteed Rate(s) and | |||

| projected Matured Term Value. If no specific direction is given by the | |||

| Certificate Holder prior to the Maturity Date, each Matured Term Value will be | |||

| reinvested in the current Deposit Period for a Guaranteed Term of the same | |||

| duration. If a Guaranteed Term of the same duration is unavailable, each | |||

| Matured Term Value will automatically be reinvested in the current Deposit | |||

| Period for the next shortest Guaranteed Term available. If no shorter | |||

| Guaranteed Term is available, the next longer Guaranteed Term will be used. | |||

| Aetna will mail a confirmation statement to the Certificate Holder the next | |||

| business day after the Maturity Date. This notice will state the Guaranteed | |||

| Term and Guaranteed Rate(s) which will apply to the reinvested Matured Term | |||

| Value. | |||

| 1.30 | Separate Account: | A separate account that buys and holds shares of the Fund(s). Income, gains or | |

| losses, realized or unrealized, are credited or charged to the Separate Account | |||

| without regard to other income, gains or losses of Aetna. Aetna owns the | |||

| assets held in the Separate Account and is not a trustee as to such amounts. | |||

| This Separate Account generally is not guaranteed and is held at market value. | |||

| The assets of the Separate Account, to the extent of reserves and other | |||

| contract liabilities of the Account, shall not be charged with other Aetna | |||

| liabilities. | |||

| 1.31 | Surrender Value: | The amount payable by Aetna upon the surrender of any portion of an Account. | |

| MP2CERT(5/97) | |||

| 11 | |||

| <PAGE> | |||

| 1.32 | Transfers: | The movement of invested amounts among the available Fund(s) and/or any AG | |

| Account Guaranteed Term made available subject to terms and conditions | |||

| https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt | 03/26/2018 | ||

| Page 9 of 24 | ||

| established by Aetna during the Accumulation Period or, during the Annuity | ||

| Period, among the available Funds under a Variable Annuity. | ||

| 1.33 | Valuation Period (Period): | The period of time for which a Fund determines its net asset value, usually |

| from 4:15 p.m. Eastern time each day the New York Stock Exchange is open until | ||

| 4:15 p.m. the next such day, or such other day that one or more of the Funds | ||

| determines its net asset value. | ||

| 1.34 | Variable Annuity: | An Annuity with payments that vary with the net investment results of one or |

| more Funds under the Separate Account. | ||

| II. | GENERAL PROVISIONS | |

- -------------------------------------------------------------------------------------------------------------------------------

| 2.01 | Change of Contract: | Only an authorized officer of Aetna may change the terms of this Contract. | |

| Aetna will notify the Contract Holder in writing at least 30 days before the | |||

| effective date of any change. Any change will not affect the amount or terms | |||

| of any Annuity which begins before the change. | |||

| Aetna reserves the right to refuse to accept any Purchase Payment at any time for any | |||

| reason. This applies to an initial Purchase Payment to establish a new Account or to | |||

| subsequent Purchase Payments to existing Accounts under the Contract. No advance | |||

| notice will be given to the Contract Holder or Certificate Holder. | |||

| Aetna may make any change that affects the AG Account Market Value Adjustment (3.06) | |||

| with at least 30 days' advance written notice to the Contract Holder and the | |||

| Certificate Holder. Any such change shall become effective for any new Term and will | |||

| apply to all present and future Accounts. | |||

| Any change that affects any of the following under this Contract will not apply to | |||

| Accounts in existence before the effective date of the change: | |||

| (a) | Net Purchase Payment (1.26) | ||

| (b) | AG Account Guaranteed Rate (1.18) | ||

| (c) | Net Return Factor(s) -- Separate Account (3.04) | ||

| (d) | Current Value (1.12) | ||

| (e) | Surrender Value (1.31) | ||

| (f) | Fund(s) Annuity Unit Value -- Separate Account (4.05) | ||

| (g) | Annuity options (4.07) | ||

| (h) | Fixed Annuity Interest Rates (4.01) | ||

| (i) | Transfers (1.32). | ||

| MP2CERT(5/97) | |||

12

<PAGE>

| 2.01 | Change of Contract (Cont'd): | Any change that affects the Annuity options and the tables for the options may | |

| be made: | |||

| (a) | No earlier than 12 months after the effective date of this Contract; | ||

| and | |||

2.02 Change of Fund(s):

| 2.03 |

Nonparticipating Contract: |

| 2.04 |

Payments and Elections: |

MP2CERT(5/97)

(b) No earlier than 12 months after the effective date of any prior change.

Any Account established on or after the effective date of any change will be subject to the change. If the Contract Holder does not agree to any change under this provision, no new Accounts may be established under this Contract. This Contract may also be changed as deemed necessary by Aetna to comply with federal or state law.

The assets of the Separate Account are segregated by Fund. If the shares of any Fund are no longer available for investment by the Separate Account or if in our judgment, further investment in such shares should become inappropriate in view of the purpose of the Contract, Aetna may cease to make such Fund shares available for investment under the Contract prospectively, or Aetna may substitute shares of another Fund for shares already acquired. Aetna may also, from time to time, add additional Funds. Any elimination, substitution or addition of Funds will be done in accordance with applicable state and federal securities laws. Aetna reserves the right to substitute shares of another Fund for shares already acquired without a proxy vote.

The Contract Holder, Certificate Holders or Beneficiaries will not have a right to share in the earnings of Aetna.

While the Certificate Holder is living, Aetna will pay the Certificate Holder any Annuity payments as and when due. After the Certificate Holder's death, or at the death of the first Certificate Holder if the Account is owned jointly, any Annuity payments required to be made will be paid in accordance with 4.03. Aetna will determine other payments and/or elections as of the end of the Valuation Period in which the request is received at its home office. Such payments will be made within seven calendar days of receipt at its home office of a written claim for payment which is in good order, except as provided in 3.15.

https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt

03/26/2018

13

<PAGE>

| 2.05 |

State Laws: |

| 2.06 |

Control of Contract: |

2.07 Designation of Beneficiary:

| 2.08 |

Misstatements and Adjustments: |

| 2.09 |

Incontestability: |

MP2CERT(5/97)

14

<PAGE>

Page 10 of 24

The Contract and the Certificates comply with the laws of the state in which they are delivered. Any surrender, death, or Annuity payments are equal to or greater than the minimum required by such laws. Annuity tables for legal reserve valuation shall be as required by state law. Such tables may be different from Annuity tables used to determine Annuity payments.

This is a Contract between the Contract Holder and Aetna. The Contract Holder has title to the Contract. Contract Holder rights are limited to accepting or rejecting Contract modifications. The Certificate Holder has all other rights to amounts held in his or her Account.

Each Certificate Holder shall own all amounts held in his or her Account. Each Certificate Holder may make any choices allowed by this Contract for his or her Account. Choices made under this Contract must be in writing. If the Account is owned jointly, both Certificate Holders must authorize any Certificate Holder change in writing. Until receipt of such choices at Aetna's home office, Aetna may rely on any previous choices made.

The Contract is not subject to the claims of any creditors of the Contract Holder or the Certificate Holder, except to the extent permitted by law.

The Certificate Holder may assign or transfer his or her rights under the Contract. Aetna reserves the right not to accept assignment or transfer to a nonnatural person. Any assignment or transfer made must be submitted to Aetna's home office in writing and will not be effective until accepted by Aetna.

Each Certificate Holder shall name his or her Beneficiary. If the Account is owned jointly, both joint Certificate Holders must agree in writing to the Beneficiary designated. The Beneficiary may be changed at any time. Changes to a Beneficiary must be submitted to Aetna's home office in writing and will not be effective until accepted by Aetna. If the Account is owned jointly, at the death of one joint Certificate Holder, the survivor will be deemed the Beneficiary; any other Beneficiary on record will be deemed a contingent Beneficiary.

If Aetna finds the age of any Annuitant to be misstated, the correct facts will be used to adjust payments.

Aetna cannot cancel this Contract because of any error of fact.

| 2.10 | Grace Period: | This Contract will remain in effect even if Purchase Payments are not continued |

| except as provided in the Payment of Adjusted Current Value provision (see | ||

| 3.17). | ||

| 2.11 | Individual Certificates: | Aetna shall issue a certificate to each Certificate Holder. The certificate |

| will summarize certain provisions of the Contract. Certificates are for | ||

| information only and are not a part of the Contract. | ||

| III. | PURCHASE PAYMENT, CURRENT VALUE, AND SURRENDER PROVISIONS | |

- -------------------------------------------------------------------------------------------------------------------------------

| 3.01 | Net Purchase Payment: | This amount is the actual Purchase Payment less any premium tax. | Aetna |

| reserves the right to pay premium taxes when due and deduct the amount from the | |||

| Current Value when we pay the tax or at a later date. | |||

| Each Net Purchase payment will be allocated, as directed by the Certificate Holder | |||

| among: | |||

| 3.02 |

Certificate Holder's Account: |

| 3.03 |

Fund(s) Record Units -- Separate Account: |

(a) AG Account Guaranteed Terms made available subject to terms and conditions established by Aetna; and

(b) The Fund(s) in which the Separate Account invests.

For each Net Purchase Payment, the Certificate Holder shall tell Aetna the percentage of each Purchase Payment to allocate to any available AG Account Guaranteed Terms and/or each Fund. Unless different allocation instructions are received for any subsequent Net Purchase Payment, the allocation will be the same as for the initial Net Purchase Payment. If the same Guaranteed Term is no longer available, the Net Purchase Payment will be allocated to the next shortest Guaranteed Term available in the current Deposit Period. If no shorter Guaranteed Term is available, the next longer Guaranteed Term will be used.

Aetna will maintain an Account for each Certificate Holder.

Aetna will declare from time to time the acceptability and the minimum amount for additional Purchase Payments.

The portion of the Net Purchase Payment(s) applied to each Fund under the Separate Account will determine the number of Fund record units for that Fund. This number is equal to the portion of the Net Purchase Payment(s) applied to each Fund divided by the Fund record unit value (see 3.05) for the Valuation Period in which the Purchase Payment is received in good order at Aetna's home office.

https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt

03/26/2018

MP2CERT(5/97)

15

<PAGE>

| 3.04 |

Net Return Factor(s) -- Separate Account: |

3.05 Fund Record Unit Value -- Separate Account:

3.06 Market Value Adjustment:

MP2CERT(5/97)

16

<PAGE>

| 3.06 |

Market Value Adjustment (Cont'd): |

Page 11 of 24

The net return factor(s) are used to compute all Separate Account record units for any Fund.

The net return factor(s) for each Fund is equal to 1.0000000 plus the net return rate.

The net return rate is equal to:

(a) The value of the shares of the Fund held by the Separate Account at the end of the Valuation Period; minus

(b) The value of the shares of the Fund held by the Separate Account at the start of the Valuation Period; plus or minus

(c) Taxes (or reserves for taxes) on the Separate Account (if any); divided by

(d) The total value of the Fund(s) record units and Fund(s) annuity units of the Separate Account at the start of the Valuation Period; minus

(e) A daily Separate Account charge at an annual rate as shown on Contract Schedule I for mortality and expense risks, which may include profit; and a daily administrative charge.

A net return rate may be more or less than 0%. The value of a share of the Fund is equal to the net assets of the Fund divided by the number of shares outstanding.

A Fund record unit value is computed by multiplying the net return factors for the current Valuation Period by the Fund record unit value for the previous Period. The dollar value of Fund record units, Separate Account assets, and Variable Annuity payments may go up or down due to investment gain or loss.

An MVA will apply to any withdrawal from the AG Account before the end of a Guaranteed Term when the withdrawal is:

(a) A Transfer; except for Transfers under the Dollar Cost Averaging program or, as specified in 1.24 Matured Term Value Transfer;

(b) A full or partial surrender (including a free withdrawal under 3.14); except for a payment made (1) under an SDO (see 3.10), or (2) under a qualified Contract, when the amount withdrawn is equal to the required minimum distribution for the Account calculated using a method permitted under the Code and agreed to by Aetna; or

(c) Due to election of an Annuity (see 4.07).

Full and partial surrenders and Transfers made within six months after the date of the Annuitant's death will be the greater of:

(a) The aggregate MVA amount which is the sum of all market value adjusted amounts calculated due to a withdrawal of amounts. This total may be greater or less than the Current Value of those amounts; or

(b) The applicable portion of the Current Value in the AG Account.

After the six-month period, the surrender or Transfer will be the aggregate MVA amount, which may be greater or less than the Current Value of those amounts.

The greater of the aggregate MVA amount or the applicable portion of the Current Value applies to amounts withdrawn from the AG Account on account of an election of Annuity options 2 or 3 (see 4.07).

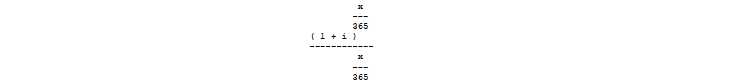

Market value adjusted amounts will be equal to the amount withdrawn multiplied by the following ratio:

| ( 1 + j ) | ||

| Where: | ||

| i | is the Deposit Period Yield | |

| j | is the Current Yield | |

| x | is the number of days remaining, (computed from Wednesday of the week of | |

| withdrawal) in the Guaranteed Term. | ||

| https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt | 03/26/2018 | |

MP2CERT(5/97)

17 <PAGE>

3.07 Transfer of Current Value from the Funds or AG Account During the Accumulation Period:

MP2CERT(5/97)

18

<PAGE>

3.08 Notice to the Certificate Holder:

| 3.09 |

Loans: |

| 3.10 |

Systematic Distribution Options: |

Page 12 of 24

The Deposit Period Yield will be determined as follows:

(a) At the close of the last business day of each week of the Deposit Period, a yield will be computed as the average of the yields on that day of U.S.

Treasury Notes which mature in the last three months of the Guaranteed Term.

(b) The Deposit Period Yield is the average of those yields for the Deposit Period. If withdrawal is made before the close of the Deposit Period, it is the average of those yields on each week preceding withdrawal.

The Current Yield is the average of the yields on the last business day of the week preceding withdrawal on the same U.S. Treasury Notes included in the Deposit Period Yield.

In the event that no U.S. Treasury Notes which mature in the last three months of the Guaranteed Term exist, Aetna reserves the right to use the U.S. Treasury Notes that mature in the following quarter.

Before an Annuity option is elected, all or any portion of the Adjusted Current Value of the Certificate Holder's Account may be transferred from any Fund or Guaranteed Term of the AG Account:

(a) To any other Fund; or

(b) To any Guaranteed Term of the AG Account made available subject to terms and conditions specified by Aetna in the current Deposit Period.

Transfer requests can be submitted as a percentage or as a dollar amount. Aetna may establish a minimum transfer amount. Within a Guaranteed Term Group, the amount to be surrendered or transferred will be withdrawn first from the oldest Deposit Period, then from the next oldest, and so on until the amount requested is satisfied.

The Certificate Holder may make an unlimited number of Transfers during the Accumulation Period. The number of free Transfers allowed by Aetna is shown on Contract Schedule I. Additional Transfers may be subject to a Transfer fee as shown on Contract Schedule I.

Amounts transferred from the AG Account under the Dollar Cost Averaging program, or amounts transferred as a Matured Term Value on or within one calendar month of a Term's Maturity Date do not count against the annual Transfer limit.

Amounts allocated to AG Account Guaranteed Terms may not be transferred to the Funds or to another Guaranteed Term during a Deposit Period or for 90 days after the close of a Deposit Period except for (1) Matured Term Value(s) during the calendar month following the Term's Maturity Date; (2) amounts used as a premium for an Annuity option; (3) amounts transferred under the Dollar Cost Averaging program; and (4) amounts distributed under the Systematic Withdrawal Option.

The Certificate Holder will receive quarterly statements from Aetna of:

(a) The value of any amounts held in:

| (1) |

The AG Account; and |

| (2) |

The Fund(s) under the Separate Account. |

(b) The number of any Fund(s) record units; and

(c) The Fund(s) record unit value.

Such number or values will be as of a specific date no more than 60 days before the date of the notice.

Loans are not available under this Contract.

Aetna may, from time to time, make one or more systematic distribution options (SDOs) available during the Accumulation Period. When an SDO is elected, Aetna will make automatic payments from the Certificate Holder's Account. No Surrender Fee or MVA will apply to the automatic payments made under an SDO.

Any SDO will be subject to the following criteria:

| (a) | Any SDO will be available to similarly situated contracts uniformly, | |

| and on the basis of objective criteria consistently applied; | ||

| (b) | The availability of any SDO may be limited by terms and conditions | |

| applicable to the election of such SDO; and | ||

| (c) | Aetna may discontinue the availability of an SDO at any time. Except to the | |

| extent required to comply with applicable law, discontinuance of an SDO will | ||

| apply only to future elections and will not affect SDOs in effect at the time | ||

| https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt | 03/26/2018 | |

3.11 Death Benefit Amount:

MP2CERT(5/97)

19

<PAGE>

3.11 Death Benefit Amount (Cont'd):

MP2CERT(5/97)

| 20 | |

| <PAGE> | |

| 3.12 | Death Benefit Options Available to |

| Beneficiary: | |

Page 13 of 24

an option is discontinued.

If the Certificate Holder or Annuitant dies before Annuity payments start, the Beneficiary is entitled to a death benefit under the Account. If the Account is owned jointly, the death benefit is paid at the death of the first joint Certificate Holder to die. The claim date is the date when proof of death and the Beneficiary's claim are received in good order at Aetna's home office. The amount of the death benefit is determined as follows:

(a) Death of Annuitant: The guaranteed death benefit is the greatest of:

| (1) |

The sum of all Purchase Payment(s) made to the Account (as of the date of death) minus the sum of all amounts surrendered, applied to an Annuity, or deducted from the Account; |

| (2) |

The highest step up value, as of the date of death, prior to the Annuitant's 75th birthday. A step-up value is determined on each anniversary of the Effective Date. Each step-up value is calculated as the Account's Current Value on the Effective Date anniversary, increased by the amount of any Purchase Payment(s) made, and decreased by the sum of all amounts surrendered, deducted, and/or applied to an Annuity option since the Effective Date anniversary. |

| (3) |

The Account's Current Value as of the date of death. |

The excess, if any, of the guaranteed death benefit value over the Account's Current Value is determined as of the date of death. Any excess amount will be deposited to the Account and allocated to Aetna Variable Encore Fund as of the claim date. The Current Value on the claim date plus any excess amount deposited becomes the Account's Current Value.

(b) Death of the Certificate Holder if the Certificate Holder is not the Annuitant: The death benefit amount is the Account's Adjusted Current Value on the claim date. A Surrender Fee may apply to any full or partial surrender (see 3.14 and Contract Schedule I).

(c) Death of spousal Beneficiary who continued the Account: The death benefit amount equals the Account's Adjusted Current Value on the claim date, less any applicable Surrender Fee (see 3.14 and Contract Schedule I) on Purchase Payments made since the death of the Annuitant.

(d) Death of the spousal beneficiary of a Certificate Holder who was not the Annuitant and who continued the Account: The death benefit amount equals the Account's Adjusted Current Value on the claim date. A Surrender Fee may apply to any full or partial surrender (see 3.14 and Contract Schedule I).

Prior to any election, or until amounts must be otherwise distributed under this section, the Current Value will be retained in the Account. The Beneficiary has the right to allocate or reallocate any amount to any of the available investment options (subject to an MVA if applicable). The following options are available to the Beneficiary:

(a) When the Certificate Holder is the Annuitant if the Annuitant dies (or when the Certificate Holder is a nonnatural person if the Annuitant dies):

(1) If the Beneficiary is the surviving spouse, the spousal Beneficiary will be the successor Certificate Holder and may exercise all Certificate Holder rights under the Contract and continue in the Accumulation Period, or may elect (i) or (ii) below.

Under the Code, distributions from the Account are not required until the spousal Beneficiary's death. The spousal Beneficiary may elect to:

| (i) | Apply some or all of the Adjusted Current Value to an Annuity | ||

| option (see 4.07); | |||

| (ii) | Receive, at any time, a lump sum payment equal to the Adjusted | ||

| Current Value of the Account. | |||

| (2) | If the Beneficiary is other than the surviving spouse, options (i) or | ||

| (ii) above apply. Any portion of the Adjusted Current Value not | |||

| applied to an Annuity option within one year of the death must be | |||

| distributed within five years of the date of death. | |||

| (3) | If no Beneficiary exists, a lump sum payment equal to the Adjusted | ||

| Current Value must be made to the Annuitant's estate within five years | |||

| of the date of death. | |||

| (4) | If the Beneficiary is an entity, a lump sum payment equal to the | ||

| Adjusted Current Value must be made within five years of the date of | |||

| death. | |||

| https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt | 03/26/2018 | ||

MP2CERT(5/97)

21

<PAGE>

| 3.12 |

Death Benefit Options Available to Beneficiary (Cont'd): |

MP2CERT(5/97)

22

<PAGE>

3.13 Liquidation of Surrender Value:

| 3.14 |

Surrender Fee: |

Page 14 of 24

(b) When the Certificate Holder is not the Annuitant when the Certificate Holder dies:

| (1) |

If the Beneficiary is the Certificate Holder's surviving spouse, the |

|

| spousal |

Beneficiary will be the successor Certificate Holder and may |

|

| exercise |

all Certificate Holder rights under the Contract and continue |

|

| in |

the Accumulation Period, or may elect (i) or (ii), below. Under the |

|

| Code, |

distributions from the Account are not required until the |

|

| spousal |

Beneficiary's death. The spousal Beneficiary may elect to: |

|

| (i) |

Apply some or all of the Adjusted Current Value to Annuity option 2 or 3 (see 4.07); |

|

| (ii) |

Receive, at any time, a lump sum payment equal to the Surrender Value. |

|

| (2) |

If the Beneficiary is other than the Certificate Holder's surviving |

|

| spouse, |

options (i) or (ii) under (1) above apply. Any portion of the |

|

| death |

benefit not applied to an Annuity option within one year of the |

|

| Certificate |

Holder's death must be distributed within five years of |

|

| the |

date of death. |

|

| (3) |

If no Beneficiary exists, a lump sum payment equal to the Surrender |

|

| Value |

must be made to the Certificate Holder's estate within five |

|

| years |

of the date of death. |

|

| (4) |

If the Beneficiary is an entity, a lump sum payment equal to the |

|

| Surrender |

Value must be made within five years of the date of death. |

|

(c) When the Certificate Holder is a natural person and not the Annuitant, when the Annuitant dies, the Beneficiary (or the Certificate Holder if no Beneficiary exists) may elect to:

| (i) |

Apply all or some of the Adjusted Current Value to an Annuity option within 60 days of the date of death; or |

| (ii) |

Receive a lump sum payment equal to the Adjusted Current Value. |

All or any portion of the Account's Current Value may be surrendered at any time. Surrender requests can be submitted as a percentage of the Account value or as a specific dollar amount. Net Purchase Payment amounts are withdrawn first, and then the excess value, if any. For any partial surrender, amounts are withdrawn on a pro rata basis from the Fund(s) and/or the Guaranteed Term(s) Groups of the AG Account in which the Current Value is invested. Within a Guaranteed Term Group, the amount to be surrendered or transferred will be withdrawn first from the oldest Deposit Period, then from the next oldest, and so on until the amount requested is satisfied.

After deduction of the Maintenance Fee, if applicable, the surrendered amount shall be reduced by a Surrender Fee, if applicable. An MVA may apply to amounts surrendered from the AG Account.

The Surrender Fee only applies to the Net Purchase Payment(s) portion surrendered and varies according to the elapsed time since deposit (see Contract Schedule I). Net Purchase Payment amounts are withdrawn in the same order they were applied.

No Surrender Fee is deducted from any portion of the Current Value which is paid:

(a) To a Beneficiary due to the Annuitant's death before Annuity payments start, up to a maximum of the aggregate Net Purchase Payment(s) minus the total of all partial surrenders, amounts applied to an Annuity and deductions made prior to the Annuitant's date of death;

(b) As a premium for an Annuity option (see 4.07);

(c) As a distribution under a systematic distribution option (see 3.10);

(d) At least 12 months after the date of the first Purchase Payment to the Account, in an amount not to exceed the amount shown on Contract Schedule I under Annual Waiver of Surrender Fee. This waiver of the Surrender Fee applies to the first full or partial surrender in the calendar year. This waiver is not available if a systematic distribution option has been in effect at any time during the calendar year.

(e) For a full surrender of the Account where the Current Value of the Account is $2,500 or less and no surrenders have been taken from the Account within the prior 12 months;

https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt

03/26/2018

MP2CERT(5/97)

23

<PAGE>

3.14 Surrender Fee (Cont'd):

| 3.15 |

Payment of Surrender Value: |

3.16 Payment of Adjusted Current Value:

Page 15 of 24

(f) By Aetna under 3.16; or

(g) If the Annuitant has spent at least 45 consecutive days in a licensed nursing care facility and each of the following conditions are met:

| (1) |

more than one calendar year has elapsed since the date the certificate was issued; and |

| (2) |

the surrender is requested within 3 years of admission to a licensed nursing care facility. |

This waiver does not apply if the Annuitant was in a nursing care facility at the time the certificate was issued.

(h) Under a qualified Contract when the amount withdrawn is equal to the minimum distribution required by the Code for the Account calculated using a method permitted under the Code and agreed to by Aetna.

Under certain emergency conditions, Aetna may defer payment:

(a) For a period of up to 6 months (unless not allowed by state law); or

(b) As provided by federal law.

Upon 90 days' written notice to the Certificate Holder, Aetna will terminate any Account if the Current Value becomes less than $2,500 immediately following any partial surrender. Aetna does not intend to exercise this right in cases where an Account Current Value is reduced to $2,500 or less solely due to investment performance. A Surrender Fee will not be deducted from the Adjusted Current Value.

| IV. |

ANNUITY PROVISIONS |

| - |

------------------------------------------------------------------------------------------------------------------------------- |

4.01 Choices:

MP2CERT(5/97)

<PAGE>

4.01 Choices (Cont'd):

| 4.02 |

Terms of Annuity Options |

The Certificate Holder may tell Aetna to apply any portion of the Adjusted Current Value (minus any premium tax, if applicable,) to any Annuity option (see 4.07). The first Annuity payment may not be earlier than one calendar year after the initial Purchase Payment nor later than the later of:

(a) The first day of the month following the Annuitant's 85th birthday; or

(b) The tenth anniversary of the last Purchase Payment. In lieu of the election of an Annuity, the Certificate Holder may tell Aetna to make a lump sum payment.

24

When an Annuity option is chosen, Aetna must also be told if payments are to be made other than monthly and whether to pay:

(a) A Fixed Annuity using the General Account;

(b) A Variable Annuity using any of the Fund(s) available under this Contract for Annuity purposes; or

(c) A combination of (a) and (b).

If a Fixed Annuity is chosen, the Annuity purchase rate for the option chosen reflects the Minimum Guaranteed Interest Rate (see Contract Schedule II), but may reflect higher interest rates. If a Variable Annuity is chosen, the initial Annuity payment for the option chosen reflects the assumed annual return rate elected. (see Contract Schedule II).

During the Annuity Period when a Variable Annuity has been elected, at the request of the Certificate Holder, all or any portion of the amount allocated to a Fund may be transferred to any other Fund available during the Annuity Period. Four transfers, without charge, are allowed each calendar year. Aetna reserves the right to change the number of transfers allowed.

Transfer requests must be expressed as a percentage of the allocation among the Funds of the amount upon which the Variable Annuity will be based. Aetna reserves the right to establish a minimum transfer amount. Transfers will be effective as of the Valuation Period in which Aetna receives a transfer request in good order at its Home Office.

(a) When payments start, the age of the Annuitant plus the number of years for which payments are guaranteed must not exceed 95.

(b) An Annuity option may not be elected if the first payment would be less than $50 or if the total payments in a year would be less than $250 (less if required by state law). Aetna reserves the right to increase the minimum first Annuity payment amount and the annual minimum Annuity payment amount based upon increases reflected in the Consumer Price Index-Urban, (CPI-U)

https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt

03/26/2018

MP2CERT(5/97)

25

<PAGE>

| 4.02 |

Terms of Annuity Options (Cont'd): |

4.03 Death of Annuitant/Beneficiary:

MP2CERT(5/97)

26

<PAGE>

| 4.03 |

Death of Annuitant/Beneficiary (Cont'd): |

| 4.04 |

Fund(s) Annuity Units -- Separate Account: |

Page 16 of 24

since July 1, 1993.

(c) If a Fixed Annuity is chosen Aetna will use the applicable current settlement rate if it will provide higher Fixed Annuity payments.

(d) For purposes of calculating the guaranteed first payment of a Variable Annuity or the payments for a Fixed Annuity, the Annuitant's and second Annuitant's adjusted age will be used. The Annuitant's and second Annuitant's adjusted age is his or her age as of the birthday closest to the Annuity commencement date reduced by one year for Annuity commencement dates occurring during the period of time from July 1, 1993 through December 31, 1999. The Annuitant's and second Annuitant's age will be reduced by two years for Annuity commencement dates occurring during the period of time from January 1, 2000 through December 31, 2009. The Annuitant's and second Annuitant's age will be reduced by one additional year for Annuity commencement dates occurring in each succeeding decade.

The Annuity purchase rates for options 2 and 3 are based on mortality from 1983 Table a.

(e) Assumed Annual Net Return Rate is the interest rate used to determine the amount of the first Annuity payment under a Variable Annuity as shown on Contract Schedule II. The Separate Account must earn this rate plus enough to cover the mortality and expense risks charges (which may include profit) and administrative charges if future Variable Annuity Payments are to remain level, (see Annuity return factor under Variable Annuity Assumed Annual Net Return Rate on Contract Schedule II).

(f) Once elected, Annuity payments cannot be commuted to a lump sum except for Variable Annuity payments under option 1 (see 4.07). The life expectancy of the Annuitant or the Annuitant and second Annuitant shall be irrevocable upon the election of an Annuity option.

(a) Certificate Holder is Annuitant: When the Certificate Holder is the Annuitant and the Annuitant dies under option 1 or 2, or both the Annuitant and the second Annuitant die under option 3(d), the present value of any remaining guaranteed payments will be paid in one sum to the Beneficiary, or upon election by the Beneficiary, any remaining payments will continue to the Beneficiary. If option 3 has been elected and the Certificate Holder dies, the remaining payments will continue to the successor payee. If no successor payee has been designated, the Beneficiary will be treated as the successor payee.

If the Account has joint Certificate Holder's, the surviving joint Certificate Holder will be deemed the successor payee.

(b) Certificate Holder is Not Annuitant: When the Certificate Holder is not the Annuitant and the Certificate Holder dies, the remaining payments will continue to the successor payee. If no successor payee has been designated, the Beneficiary will be treated as the successor payee. If the Account has joint Certificate Holder's, the surviving joint Certificate Holder will be deemed the successor payee.

If the Annuitant dies under option 1 or 2, or both the Annuitant and the second Annuitant die under option 3(d), the present value of any remaining guaranteed payments will be paid in one sum to the Beneficiary, or upon the election by the Beneficiary, any remaining payments will continue to the Beneficiary. If option 3 has been elected, and the Annuitant dies, the remaining payments will continue to the Certificate Holder.

(c) No Beneficiary Named/Surviving: If there is no Beneficiary, the present value of any remaining payments will be paid in one sum to the Certificate Holder, or if the Certificate Holder is not living, then to the Certificate Holder's estate.

(d) If the Beneficiary or the successor payee dies while receiving Annuity payments, the present value of any remaining guaranteed payments will be paid in one sum to the successor Beneficiary/payee, or upon election by the successor Beneficiary/payee, any remaining payments will continue to the successor Beneficiary/payee. If no successor Beneficiary/payee has been designated, the present value of any remaining guaranteed payments will be paid in one sum to the Beneficiary's/payee's estate.

(e) The present value will be determined as of the Valuation Period in which proof of death acceptable to Aetna and a request for payment is received at Aetna's home office. The interest rate used to determine the first payment will be used to calculate the present value.

The number of each Fund's Annuity Units is based on the amount of the first Variable Annuity payment which is equal to:

https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt

03/26/2018

MP2CERT(5/97)

27

<PAGE>

| 4.04 |

Fund(s) Annuity Units -- Separate Account Cont'd): |

| 4.05 |

Fund(s) Annuity Unit Value -- Separate Account: |

| 4.06 |

Annuity Net Return Factor(s) -- Separate Account: |

MP2CERT(5/97)

28

<PAGE>

| 4.06 |

Annuity Net Return Factor(s) -- Separate Account (Cont'd): |

| 4.07 |

Annuity Options: |

Page 17 of 24

(a) The portion of the Current Value applied to pay a Variable Annuity (minus any premium tax); divided by

(b) 1,000; multiplied by

(c) The payment rate for the option chosen.

Such amount, or portion, of the variable payment will be divided by the appropriate Fund Annuity unit value (see 4.05) on the tenth Valuation Period before the due date of the first payment to determine the number of each Fund Annuity units. The number of each Fund Annuity units remains fixed. Each future payment is equal to the sum of the products of each Fund Annuity unit value multiplied by the appropriate number of units. The Fund Annuity unit value on the tenth Valuation Period prior to the due date of the payment is used.

For any Valuation Period, a Fund Annuity unit value is equal to:

(a) The value for the previous Period; multiplied by

(b) The Annuity net return factor(s) (see 4.06 below) for the Period; multiplied by

(c) A factor to reflect the assumed annual net return rate (see Contract Schedule II).

The dollar value of a Fund Annuity unit values and Annuity payments may go up or down due to investment gain or loss.

The Annuity net return factor(s) are used to compute all Separate Account Annuity Payments for any Fund.

The Annuity net return factor(s) for each Fund is equal to 1.0000000 plus the net return rate.

The net return rate is equal to:

(a) The value of the shares of the Fund held by the Separate Account at the end of a Valuation Period; minus

(b) The value of the shares of the Fund held by the Separate Account at the start of the Valuation Period; plus or minus

(c) Taxes (or reserves for taxes) on the Separate Account (if any); divided by

(d) The total value of the Fund(s) record units and Fund(s) Annuity units of the Separate Account at the start of the Valuation Period; minus

(e) A daily charge for Annuity mortality and expense risks, which may include profit, and a daily administrative charge (at the annual rate as shown on Contract Schedule II).

A net return rate may be more or less than 0%.

The value of a share of the Fund is equal to the net assets of the Fund divided by the number of shares outstanding.

Payments shall not be changed due to changes due to changes in the mortality or expense results or administrative charges.

Option 1 -- Payments for a Stated Period of Time: Payments are made for the number of years specified by the Certificate Holder. The number of years must be at least five and not more than 30.

Option 2 - Life Income based on the life of one Annuitant: Payments are made until the death of the Annuitant. When this option is elected, the Certificate Holder must also choose one of the following:

(a) payments cease at the death of the Annuitant;

(b) payments are guaranteed for a specified period from five to 30 years;

(c) cash refund: when the Annuitant dies, the Beneficiary will receive a lump sum payment equal to the amount applied to the Annuity option (less any premium tax, if applicable) less the total amount of Annuity payments made prior to such death. This cash refund feature is only available if the total amount applied to the Annuity option is allocated to a Fixed Annuity.

Option 3 -- Life Income Based on the lives of two Annuitants: Payments are made for the lives of two Annuitants, one of whom is designated the second Annuitant, and cease only when both Annuitants have died. When this option is elected, the Certificate

https://www.sec.gov/Archives/edgar/data/925981/0000950146-97-001811.txt

03/26/2018

Page 18 of 24

Holder must also choose one of the following:

(a) 100% of the payment to continue after the first death; (b) 66-2/3% of the payment to continue after the first death; (c) 50% of the payment to continue after the first death;

(d) 100% of the payment to continue after the first death and payments are guaranteed for a period of five to 30 years;

(e) 100% of the payment to continue at the death of the designated second Annuitant and 50% of the payment to continue at the death of the Annuitant; or

(f) 100% of the payment continues after the first death with a cash refund feature. When the Annuitant and designated second Annuitant die, the Beneficiary will receive a lump sum payment equal to the amount applied to the Annuity option (less any premium tax) less the total amount of Annuity payments paid prior to such death. This cash refund feature is only available if the total amount applied to the Annuity option is allocated to a Fixed Annuity.

MP2CERT(5/97)

29

<PAGE>

| 4.07 | Annuity Options (Cont'd): | If a Fixed Annuity is chosen under Option 1, Option 2 (a) or (b), or Option 3 |

| (a) or (d), the Certificate Holder may elect, at the time the Annuity option is | ||

| selected, an annual increase of one, two or three percent compounded annually. | ||

| As allowed under applicable state law, Aetna reserves the right to offer additional | ||

| Annuity options. | ||

| </TABLE> | ||

MP2CERT(5/97)

30

<PAGE>

OPTION 1: Payments for a Specified Period

- --------------------------------------------------------------------------------Monthly Amount for Each $1,000* Rates for a Fixed Annuity with a 3% Guaranteed Interest Rate - --------------------------------------------------------------------------------

Years Payment Years Payment

-

---------------------- --------------------- --------------------- -------------

| 5 | 17.91 | 18 | 5.96 |

| 6 | 15.14 | 19 | 5.73 |

| 7 | 13.16 | 20 | 5.51 |

| 8 | 11.68 | 21 | 5.32 |

| 9 | 10.53 | 22 | 5.15 |

| 10 | 9.61 | 23 | 4.99 |

| 11 | 8.86 | 24 | 4.84 |

| 12 | 8.24 | 25 | 4.71 |

| 13 | 7.71 | 26 | 4.59 |

| 14 | 7.26 | 27 | 4.47 |

| 15 | 6.87 | 28 | 4.37 |

| 16 | 6.53 | 29 | 4.27 |

| 17 | 6.23 | 30 | 4.18 |

- --------------------------------------------------------------------------------

First Month Amount for Each $1,000*

Rates for a Variable Annuity with a 3.5% Assumed Interest Rate

- --------------------------------------------------------------------------------

Years Payment Years Payment

-

---------------------- --------------------- --------------------- -------------

| 5 | 18.12 | 18 | 6.20 |

| 6 | 15.35 | 19 | 5.97 |

| 7 | 13.38 | 20 | 5.75 |

| 8 | 11.90 | 21 | 5.56 |

| 9 | 10.75 | 22 | 5.39 |

| 10 | 9.83 | 23 | 5.24 |

| 11 | 9.09 | 24 | 5.09 |

| 12 | 8.46 | 25 | 4.96 |

| 13 | 7.94 | 26 | 4.84 |

| 14 | 7.49 | 27 | 4.73 |

| 15 | 7.10 | 28 | 4.63 |

| 16 | 6.76 | 29 | 4.53 |

| 17 | 6.47 | 30 | 4.45 |

- --------------------------------------------------------------------------------

First Month Amount for Each $1,000*