UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-05624 | |||||||

|

| ||||||||

|

Morgan Stanley Institutional Fund, Inc. | ||||||||

|

(Exact name of registrant as specified in charter) | ||||||||

|

| ||||||||

|

522 Fifth Avenue, New York, New York |

|

10036 | ||||||

|

(Address of principal executive offices) |

|

(Zip code) | ||||||

|

| ||||||||

|

John H. Gernon 522 Fifth Avenue, New York, New York 10036 | ||||||||

|

(Name and address of agent for service) | ||||||||

|

| ||||||||

|

Registrant’s telephone number, including area code: |

212-296-0289 |

| ||||||

|

| ||||||||

|

Date of fiscal year end: |

December 31, |

| ||||||

|

| ||||||||

|

Date of reporting period: |

December 31, 2018 |

| ||||||

Item 1 - Report to Shareholders

INVESTMENT MANAGEMENT

Morgan Stanley Institutional Fund, Inc.

Active International Allocation Portfolio

Annual Report

December 31, 2018

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission ("SEC"), paper copies of the Fund's Annual and Semi-Annual Reports to Shareholders ("Shareholder Reports") will no longer be sent by mail, unless you specifically request paper copies of the Shareholder Reports from the Fund or from your financial intermediary, such as a broker-dealer or a bank. Instead, the Shareholder Reports will be made available on the Fund's website, https://www.morganstanley.com/im/shareholderreports and you will be notified by mail each time a Shareholder Report is posted and provided with a website link to access the Shareholder Report. If you already elected to receive Shareholder Reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive Shareholder Reports and other communications from the Fund electronically anytime by contacting your financial intermediary or, if you are a direct investor, please follow the instructions on the envelope.

Beginning on January 1, 2019, you may elect to receive all future Shareholder Reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your Shareholder Reports. If you invest directly with the Fund, please follow the instructions on the envelope to let the Fund know you wish to continue receiving paper copies of your Shareholder Reports. Your election to receive Shareholder Reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with a fund.

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Table of Contents

|

Shareholders' Letter |

2 |

||||||

|

Expense Example |

3 |

||||||

|

Investment Overview |

4 |

||||||

|

Portfolio of Investments |

7 |

||||||

|

Statement of Assets and Liabilities |

12 |

||||||

|

Statement of Operations |

14 |

||||||

|

Statements of Changes in Net Assets |

15 |

||||||

|

Financial Highlights |

17 |

||||||

|

Notes to Financial Statements |

21 |

||||||

|

Report of Independent Registered Public Accounting Firm |

32 |

||||||

|

Federal Tax Notice |

33 |

||||||

|

Privacy Notice |

34 |

||||||

|

Director and Officer Information |

37 |

||||||

This report is authorized for distribution only when preceded or accompanied by a prospectus or summary prospectus of the applicable Fund of Morgan Stanley Institutional Fund, Inc. To receive a prospectus and/or statement of additional information (SAI), which contains more complete information such as investment objectives, charges, expenses, policies for voting proxies, risk considerations and describes in detail each of the Fund's investment policies to the prospective investor, please call toll free 1 (800) 548-7786. Please read the prospectuses carefully before you invest or send money.

Additionally, you can access information about the Fund, including performance, characteristics and investment team commentary, through Morgan Stanley Investment Management's website: www.morganstanley.com/im/shareholderreports.

Market forecasts provided in this report may not necessarily come to pass. There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Fund in the future. There is no assurance that a fund will achieve its investment objective. Funds are subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund's shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. Please see the prospectus for more complete information on investment risks.

1

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Shareholders' Letter (unaudited)

Dear Shareholders,

We are pleased to provide this Annual report, in which you will learn how your investment in Active International Allocation Portfolio (the "Fund") performed during the latest twelve-month period.

Morgan Stanley Investment Management is a client-centric, investor-led organization. Our global presence, intellectual capital, and breadth of products and services enable us to partner with investors to meet the evolving challenges of today's financial markets. We aim to deliver superior investment service and to empower our clients to make the informed decisions that help them reach their investment goals.

As always, we thank you for selecting Morgan Stanley Investment Management, and look forward to working with you in the months and years ahead.

Sincerely,

John H. Gernon

President and Principal Executive Officer

January 2019

2

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Expense Example (unaudited)

Active International Allocation Portfolio

As a shareholder of the Fund, you incur two types of costs: (1) transactional costs, including redemption fees; and (2) ongoing costs, which may include advisory fees, administration fees, distribution and shareholder services fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the six-month period ended December 31, 2018 and held for the entire six-month period.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled "Actual Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the information for each class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

Beginning Account Value 7/1/18 |

Actual Ending Account Value 12/31/18 |

Hypothetical Ending Account Value |

Actual Expenses Paid During Period* |

Hypothetical Expenses Paid During Period* |

Net Expense Ratio During Period** |

||||||||||||||||||||||

|

Active International Allocation Portfolio Class I |

$ |

1,000.00 |

$ |

891.70 |

$ |

1,020.72 |

$ |

4.24 |

$ |

4.53 |

0.89 |

% |

|||||||||||||||

|

Active International Allocation Portfolio Class A |

1,000.00 |

890.70 |

1,019.36 |

5.53 |

5.90 |

1.16 |

|||||||||||||||||||||

|

Active International Allocation Portfolio Class L |

1,000.00 |

888.30 |

1,016.79 |

7.95 |

8.49 |

1.67 |

|||||||||||||||||||||

|

Active International Allocation Portfolio Class C |

1,000.00 |

887.10 |

1,015.17 |

9.47 |

10.11 |

1.99 |

|||||||||||||||||||||

* Expenses are calculated using each Fund Class' annualized net expense ratio (as disclosed), multiplied by the average account value over the period and multiplied by 184/365 (to reflect the most recent one-half year period).

** Annualized.

3

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Investment Overview (unaudited)

Active International Allocation Portfolio

The Fund seeks long-term capital appreciation.

Performance

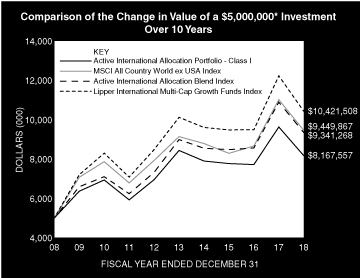

For the fiscal year ended December 31, 2018, the Fund's Class I shares had a total return based on net asset value and reinvestment of distributions per share of –15.14%, net of fees. The Fund's Class I shares underperformed the Fund's benchmark, the MSCI All Country World ex USA Index (the "Index"), which returned –14.20%.

Factors Affecting Performance

• Global equity markets see-sawed higher for the first nine months of 2018 and in the fourth quarter experienced two significant declines, one in early October and the second in early-mid December, which wiped out the gains for the year.

• For 2018, MSCI regional returns were all negative (based in U.S. dollars). The U.S. was a relative outperformer at –5%, followed by Japan at –13%, and Europe and emerging markets both at –15%. Sector performance for the Index for 2018 was as follows: utilities were flat, health care –6%, energy –8%, consumer staples –11%, real estate –12%, industrials –15%, technology and materials both –16%, financials and communication services both –17%, and consumer discretionary–20%.

• Looking back on 2018 performance, we believe a number of decisions worked well: overweights to technology and health care, underweight European financials/overweight emerging markets financials, and overweight positions in Indonesia.

• We began to add to defensives early in 2018 and in hindsight our timing was too early, but these positions were significant contributors to the second half and overall 2018 performance.

• Decisions that hindered performance were overweight positions in Germany, Spain and the Philippines, the allocation to the U.S. and the below-benchmark allocations to energy and to Brazil. We believe the cash position we raised in the fourth quarter of 2018 did protect the portfolio a bit in the downturn.

• The Fund utilizes stock index futures as an additional vehicle to implement the portfolio manager's macro investment decisions. For 2018, macro investment decisions made with the use of

stock index futures resulted in a realized loss for the Fund. The Fund used currency forward contracts to hedge some local currency exposure, which resulted in a loss for the Fund in the reporting period.

Management Strategies

• 2018 marked a departure from the calm market environment that prevailed in 2017. Whether it was the significant worsening of global trade tensions, continued political upheaval in the eurozone and the U.K., a hawkish Federal Reserve (Fed) and the emergence of funding strains in several emerging markets, or simply just the realization that the global economic and market cycle is aging quickly, the fact is that most asset markets saw declines over the last year. From our vantage point, until there is more clarity on a range of issues from Brexit to ongoing global trade negotiations and a change in Fed policy from tightening to easing, markets are likely to churn and, in our view, more defensive positioning continues to be the best option. We do not anticipate a recession in any of the large global economies, but more of a continued slowdown from the peak growth seen earlier in 2018. While the volatility in asset prices has certainly not been pleasant, the positive is that global equities have de-rated significantly and are now substantially cheaper, while being supported by generally stable earnings expectations and valuations that for some market segments are at or near 30-year lows.

• The news in early January indicates that policy makers are alert and beginning to respond to flagging investor, business and consumer confidence. Recent reassuring comments from the Fed, positive news flow on U.S.-China trade negotiations and easing measures by China may indicate that a bottom may have been put in for now. Looking out further into 2019, as investor positioning and sentiment are much more negative than at the start of 2018, the surprise could be on the upside for growth and supportive policy moves. It is helpful to have a wall of worry and skepticism rather than euphoria to help form a base. At that same time, we continue to be mindful of the record stock of debt globally and the lack of tools held by most policy makers that would limit an economic acceleration and are therefore looking for those pockets of opportunity where fundamentals are likely to inflect positively despite an overall environment of more muted growth.

4

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Investment Overview (unaudited) (cont'd)

Active International Allocation Portfolio

• In 2017, equity markets were inordinately tame, and we expect that the market differentiation that began in 2018 is likely to persist into this year and beyond. This differentiation should mean that countries, sectors and companies that offer better fundamentals and growth prospects will be recognized and may be able to outperform less attractive market segments. We believe our multi-pronged strategy is well positioned to benefit from this differentiation and return opportunities among countries, sectors and stocks. We are avoiding areas where our work indicates that balance sheets are stretched, those that have large vulnerabilities to disruption and/or structural impediments to growth. As we start the new year, our focus is on identifying and investing in those areas that offer improving fundamentals, supportive structural stories and/or strong and defensible businesses that are now more attractively valued.

* Minimum Investment for Class I shares

In accordance with SEC regulations, the Fund's performance shown assumes that all recurring fees (including management fees) were deducted and all dividends and distributions were reinvested. The performance of Class A , L and C shares will vary from the performance of Class I shares based upon their different inception dates and will be negatively impacted by additional fees assessed to those classes.

5

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Investment Overview (unaudited) (cont'd)

Active International Allocation Portfolio

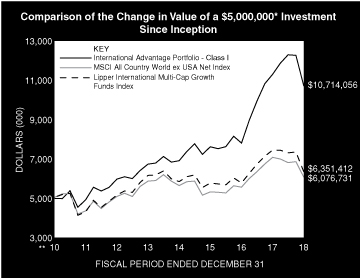

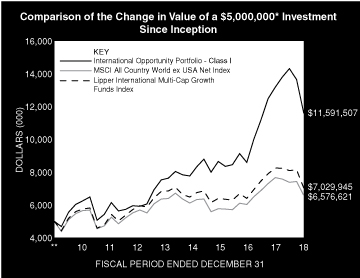

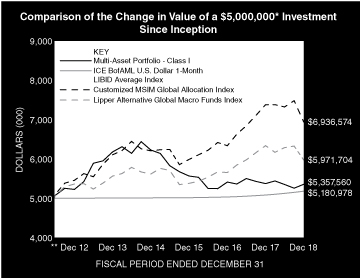

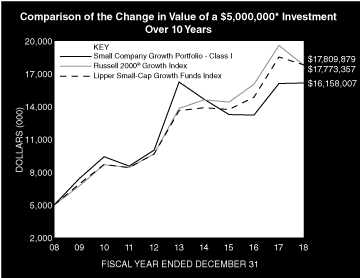

Performance Compared to the MSCI All Country World ex USA Index(1), the Active International Allocation Blend Index(2) and the Lipper International Multi-Cap Growth Funds Index(3)

|

Period Ended December 31, 2018 Total Returns(4) |

|||||||||||||||||||

|

Average Annual |

|||||||||||||||||||

|

One Year |

Five Years |

Ten Years |

Since Inception(9) |

||||||||||||||||

|

Fund — Class I Shares w/o sales charges(5) |

–15.14 |

% |

–0.64 |

% |

5.03 |

% |

5.19 |

% |

|||||||||||

|

Fund — Class A Shares w/o sales charges(6) |

–15.38 |

–0.98 |

4.72 |

4.35 |

|||||||||||||||

|

Fund — Class A Shares with maximum 5.25% sales charges(6) |

–19.83 |

–2.04 |

4.16 |

4.10 |

|||||||||||||||

|

Fund — Class L Shares w/o sales charges(7) |

–15.87 |

–1.50 |

— |

4.40 |

|||||||||||||||

|

Fund — Class C Shares w/o sales charges(8) |

–16.04 |

— |

— |

–2.69 |

|||||||||||||||

|

Fund — Class C Shares with maximum 1.00% deferred sales charges(8) |

–16.87 |

— |

— |

–2.69 |

|||||||||||||||

|

MSCI All Country World ex USA Index |

–14.20 |

0.68 |

6.57 |

5.30 |

|||||||||||||||

|

Active International Allocation Blend Index |

–14.20 |

0.78 |

6.45 |

5.11 |

|||||||||||||||

|

Lipper International Multi-Cap Growth Funds Index |

–14.74 |

0.60 |

7.62 |

N/A |

|||||||||||||||

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. Performance assumes that all dividends and distributions, if any, were reinvested. For the most recent month-end performance figures, please visit www.morganstanley.com/im/shareholderreports. Investment return and principal value will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance of share classes will vary due to difference in sales charges and expenses.

(1) The MSCI All Country World ex USA Index is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed and emerging markets, excluding the United States. The term ""free float"" represents the portion of shares outstanding that are deemed to be available for purchase in the public equity markets by investors. The performance of the Index is listed in U.S. dollars and assumes reinvestment of net dividends. Returns, including periods prior to January 1, 2001, are calculated using the return data of the MSCI All Country World ex USA Index (gross dividends) through December 31, 2000 and the return data of the MSCI All Country World ex USA Index (net dividends) after December 31, 2000. Net total return indices reinvest dividends after the deduction of withholding taxes, using (for international indices) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(2) The Active International Allocation Blend Index is performance linked benchmark of the old and new benchmark of the Fund, the old benchmark represented by MSCI EAFE Index (a benchmark measures the international equity market performance of developed markets excluding the United States and Canada) from the Fund's inception to 12/31/16 and the new benchmark represented by MSCI All Country World Ex USA Index for periods thereafer. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(3) The Lipper International Multi-Cap Growth Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper International Multi-Cap Growth Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. As of the date of this report, the Fund was in the Lipper International Multi-Cap Growth Funds classification.

(4) Total returns for the Fund reflect fees waived and expenses reimbursed, if applicable, by Morgan Stanley Investment Management Inc. (the "Adviser"). Without such waivers and reimbursements, total returns would have been lower.

(5) Commenced operations on January 17, 1992.

(6) Commenced offering on January 2, 1996.

(7) Commenced offering on June 14, 2012.

(8) Commenced offering on April 30, 2015.

(9) For comparative purposes, average annual since inception returns listed for the Indexes refer to the inception date of Class I of the Fund, not the inception of the Index.

6

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Portfolio of Investments

Active International Allocation Portfolio

|

Shares |

Value (000) |

||||||||||

|

Common Stocks (92.5%) |

|||||||||||

|

Argentina (1.0%) |

|||||||||||

|

Banco Macro SA ADR |

21,600 |

$ |

955 |

||||||||

|

BBVA Banco Frances SA ADR |

29,600 |

335 |

|||||||||

|

Despegar.com Corp. (a)(b) |

9,300 |

116 |

|||||||||

|

Grupo Financiero Galicia SA ADR |

11,500 |

317 |

|||||||||

|

1,723 |

|||||||||||

|

Austria (0.1%) |

|||||||||||

|

Andritz AG |

2,809 |

129 |

|||||||||

|

Belgium (1.7%) |

|||||||||||

|

Anheuser-Busch InBev SA N.V. |

35,512 |

2,350 |

|||||||||

|

UCB SA |

4,981 |

406 |

|||||||||

|

Umicore SA |

4,583 |

183 |

|||||||||

|

2,939 |

|||||||||||

|

Brazil (0.8%) |

|||||||||||

|

Banco Bradesco SA (Preference) |

38,940 |

388 |

|||||||||

|

Banco Santander Brasil SA (Units) (c) |

22,600 |

250 |

|||||||||

|

Itau Unibanco Holding SA (Preference) |

42,388 |

390 |

|||||||||

|

Lojas Renner SA |

17,800 |

196 |

|||||||||

|

Raia Drogasil SA |

7,400 |

109 |

|||||||||

|

1,333 |

|||||||||||

|

Canada (1.0%) |

|||||||||||

|

Agnico Eagle Mines Ltd. |

21,600 |

872 |

|||||||||

|

Goldcorp, Inc. |

89,400 |

875 |

|||||||||

|

1,747 |

|||||||||||

|

Chile (1.3%) |

|||||||||||

|

Banco de Chile |

1,040,882 |

149 |

|||||||||

|

Banco de Credito e Inversiones SA |

2,359 |

153 |

|||||||||

|

Banco Santander Chile |

7,351,145 |

547 |

|||||||||

|

Enel Americas SA |

4,865,043 |

856 |

|||||||||

|

Itau CorpBanca |

15,688,824 |

147 |

|||||||||

|

SACI Falabella |

68,955 |

504 |

|||||||||

|

2,356 |

|||||||||||

|

China (3.7%) |

|||||||||||

|

Alibaba Group Holding Ltd. ADR (a) |

12,000 |

1,645 |

|||||||||

|

Baidu, Inc. ADR (a) |

5,000 |

793 |

|||||||||

|

China Mengniu Dairy Co., Ltd. (a)(d) |

24,000 |

74 |

|||||||||

|

CSPC Pharmaceutical Group Ltd. (d) |

46,000 |

66 |

|||||||||

|

JD.com, Inc. ADR (a) |

6,600 |

138 |

|||||||||

|

Tencent Holdings Ltd. (d) |

92,900 |

3,682 |

|||||||||

|

6,398 |

|||||||||||

|

Denmark (1.8%) |

|||||||||||

|

DSV A/S |

1,895 |

125 |

|||||||||

|

Novo Nordisk A/S Series B |

57,408 |

2,639 |

|||||||||

|

Novozymes A/S Series B |

6,145 |

275 |

|||||||||

|

Vestas Wind Systems A/S |

1,348 |

102 |

|||||||||

|

3,141 |

|||||||||||

|

Egypt (0.7%) |

|||||||||||

|

Commercial International Bank Egypt SAE |

306,818 |

1,285 |

|||||||||

|

Shares |

Value (000) |

||||||||||

|

Finland (0.6%) |

|||||||||||

|

Neste Oyj |

2,554 |

$ |

197 |

||||||||

|

Nokia Oyj |

110,241 |

637 |

|||||||||

|

Orion Oyj, Class B |

2,195 |

76 |

|||||||||

|

Wartsila Oyj Abp |

6,723 |

107 |

|||||||||

|

1,017 |

|||||||||||

|

France (8.2%) |

|||||||||||

|

Accor SA |

1,832 |

78 |

|||||||||

|

Air Liquide SA |

4,946 |

612 |

|||||||||

|

Airbus SE |

5,515 |

527 |

|||||||||

|

Atos SE |

1,887 |

153 |

|||||||||

|

Bureau Veritas SA |

14,281 |

290 |

|||||||||

|

Capgemini SE |

4,960 |

490 |

|||||||||

|

Cie de Saint-Gobain |

9,069 |

302 |

|||||||||

|

Cie Generale des Etablissements Michelin SCA |

1,659 |

164 |

|||||||||

|

Danone SA |

27,839 |

1,962 |

|||||||||

|

Dassault Systemes SE |

5,767 |

681 |

|||||||||

|

Edenred |

13,744 |

504 |

|||||||||

|

Engie SA |

40,095 |

573 |

|||||||||

|

EssilorLuxottica SA |

4,581 |

578 |

|||||||||

|

Gecina SA REIT |

439 |

57 |

|||||||||

|

Hermes International |

463 |

256 |

|||||||||

|

Kering SA |

1,106 |

517 |

|||||||||

|

L'Oreal SA |

2,311 |

530 |

|||||||||

|

Legrand SA |

6,555 |

369 |

|||||||||

|

LVMH Moet Hennessy Louis Vuitton SE |

1,997 |

587 |

|||||||||

|

Pernod Ricard SA |

4,095 |

672 |

|||||||||

|

Remy Cointreau SA |

572 |

65 |

|||||||||

|

Safran SA |

3,213 |

386 |

|||||||||

|

Sanofi |

20,368 |

1,760 |

|||||||||

|

Societe BIC SA |

2,385 |

243 |

|||||||||

|

Sodexo SA |

1,718 |

176 |

|||||||||

|

STMicroelectronics N.V. |

7,689 |

110 |

|||||||||

|

Television Francaise 1 |

8,274 |

67 |

|||||||||

|

Thales SA |

1,015 |

118 |

|||||||||

|

TOTAL SA |

28,333 |

1,497 |

|||||||||

|

Vivendi SA |

4,595 |

112 |

|||||||||

|

14,436 |

|||||||||||

|

Germany (11.4%) |

|||||||||||

|

Adidas AG |

5,217 |

1,090 |

|||||||||

|

Allianz SE (Registered) |

8,904 |

1,787 |

|||||||||

|

BASF SE |

9,194 |

636 |

|||||||||

|

Bayer AG (Registered) |

51,509 |

3,572 |

|||||||||

|

Bayerische Motoren Werke AG |

4,266 |

346 |

|||||||||

|

Bayerische Motoren Werke AG (Preference) |

579 |

41 |

|||||||||

|

Beiersdorf AG |

3,335 |

348 |

|||||||||

|

Brenntag AG |

3,042 |

131 |

|||||||||

|

Commerzbank AG (a) |

75,123 |

498 |

|||||||||

|

Continental AG |

2,122 |

293 |

|||||||||

|

Daimler AG (Registered) |

12,470 |

656 |

|||||||||

|

Deutsche Boerse AG |

4,013 |

483 |

|||||||||

|

Deutsche Wohnen SE |

13,273 |

608 |

|||||||||

The accompanying notes are an integral part of the financial statements.

7

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Portfolio of Investments (cont'd)

Active International Allocation Portfolio

|

Shares |

Value (000) |

||||||||||

|

Germany (cont'd) |

|||||||||||

|

E.ON SE |

33,170 |

$ |

328 |

||||||||

|

Fresenius Medical Care AG & Co., KGaA |

6,022 |

391 |

|||||||||

|

GEA Group AG |

9,660 |

249 |

|||||||||

|

Hannover Rueck SE (Registered) |

1,596 |

215 |

|||||||||

|

Henkel AG & Co., KGaA |

1,161 |

114 |

|||||||||

|

Henkel AG & Co., KGaA (Preference) |

6,784 |

741 |

|||||||||

|

Infineon Technologies AG |

33,471 |

666 |

|||||||||

|

Merck KGaA |

4,793 |

495 |

|||||||||

|

Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen (Registered) |

3,877 |

846 |

|||||||||

|

Porsche Automobil Holding SE (Preference) |

3,698 |

219 |

|||||||||

|

QIAGEN N.V. (a) |

12,900 |

444 |

|||||||||

|

QIAGEN N.V. (a) |

24,063 |

821 |

|||||||||

|

RWE AG |

5,480 |

119 |

|||||||||

|

SAP SE |

23,453 |

2,336 |

|||||||||

|

Uniper SE |

7,027 |

182 |

|||||||||

|

United Internet AG (Registered) |

12,921 |

565 |

|||||||||

|

Vonovia SE |

12,764 |

579 |

|||||||||

|

Zalando SE (a) |

6,559 |

169 |

|||||||||

|

19,968 |

|||||||||||

|

Hong Kong (0.8%) |

|||||||||||

|

AIA Group Ltd. |

122,800 |

1,010 |

|||||||||

|

Hong Kong Exchanges & Clearing Ltd. |

13,350 |

383 |

|||||||||

|

1,393 |

|||||||||||

|

Hungary (0.2%) |

|||||||||||

|

OTP Bank Nyrt |

7,656 |

309 |

|||||||||

|

India (5.4%) |

|||||||||||

|

Ashok Leyland Ltd. |

691,924 |

1,013 |

|||||||||

|

Eicher Motors Ltd. |

1,565 |

517 |

|||||||||

|

Housing Development Finance Corp., Ltd. |

39,997 |

1,128 |

|||||||||

|

ICICI Bank Ltd. |

189,283 |

978 |

|||||||||

|

IndusInd Bank Ltd. |

51,883 |

1,190 |

|||||||||

|

Marico Ltd. |

292,091 |

1,560 |

|||||||||

|

Maruti Suzuki India Ltd. |

10,517 |

1,122 |

|||||||||

|

Shree Cement Ltd. |

3,949 |

975 |

|||||||||

|

Zee Entertainment Enterprises Ltd. |

138,122 |

940 |

|||||||||

|

9,423 |

|||||||||||

|

Indonesia (3.2%) |

|||||||||||

|

Astra International Tbk PT |

1,008,100 |

580 |

|||||||||

|

Bank Central Asia Tbk PT |

1,981,900 |

3,583 |

|||||||||

|

Charoen Pokphand Indonesia Tbk PT |

406,700 |

204 |

|||||||||

|

Gudang Garam Tbk PT |

26,500 |

154 |

|||||||||

|

Hanjaya Mandala Sampoerna Tbk PT |

491,700 |

127 |

|||||||||

|

Kalbe Farma Tbk PT |

1,161,400 |

123 |

|||||||||

|

Telekomunikasi Indonesia Persero Tbk PT |

2,542,800 |

664 |

|||||||||

|

Unilever Indonesia Tbk PT |

80,300 |

254 |

|||||||||

|

5,689 |

|||||||||||

|

Ireland (0.7%) |

|||||||||||

|

Kerry Group PLC, Class A |

4,867 |

481 |

|||||||||

|

Ryanair Holdings PLC ADR (a) |

9,477 |

676 |

|||||||||

|

1,157 |

|||||||||||

|

Shares |

Value (000) |

||||||||||

|

Japan (10.3%) |

|||||||||||

|

Asahi Group Holdings Ltd. |

7,200 |

$ |

281 |

||||||||

|

Astellas Pharma, Inc. |

21,700 |

276 |

|||||||||

|

Central Japan Railway Co. |

2,192 |

466 |

|||||||||

|

Dai-ichi Life Holdings, Inc. |

24,400 |

378 |

|||||||||

|

Daiichi Sankyo Co., Ltd. |

7,500 |

241 |

|||||||||

|

Daikin Industries Ltd. |

4,200 |

442 |

|||||||||

|

Daito Trust Construction Co., Ltd. |

956 |

131 |

|||||||||

|

East Japan Railway Co. |

5,300 |

471 |

|||||||||

|

Eisai Co., Ltd. |

5,900 |

459 |

|||||||||

|

FANUC Corp. |

5,150 |

774 |

|||||||||

|

FUJIFILM Holdings Corp. |

9,800 |

378 |

|||||||||

|

Honda Motor Co., Ltd. |

15,113 |

395 |

|||||||||

|

Hoya Corp. |

7,800 |

477 |

|||||||||

|

ITOCHU Corp. |

21,951 |

370 |

|||||||||

|

Kao Corp. |

8,400 |

619 |

|||||||||

|

Keyence Corp. |

2,800 |

1,411 |

|||||||||

|

Kose Corp. |

1,100 |

174 |

|||||||||

|

Makita Corp. |

5,600 |

198 |

|||||||||

|

Mitsubishi Corp. |

24,300 |

663 |

|||||||||

|

Mitsubishi UFJ Financial Group, Inc. |

46,206 |

228 |

|||||||||

|

Murata Manufacturing Co., Ltd. |

2,900 |

400 |

|||||||||

|

Nabtesco Corp. |

1,900 |

41 |

|||||||||

|

Nexon Co., Ltd. (a) |

49,800 |

636 |

|||||||||

|

Nidec Corp. |

4,800 |

550 |

|||||||||

|

Nintendo Co., Ltd. |

1,808 |

478 |

|||||||||

|

Nissan Motor Co., Ltd. |

27,805 |

224 |

|||||||||

|

Obic Co., Ltd. |

1,300 |

100 |

|||||||||

|

Omron Corp. |

4,404 |

159 |

|||||||||

|

Ono Pharmaceutical Co., Ltd. |

7,700 |

156 |

|||||||||

|

Oriental Land Co., Ltd. |

3,200 |

325 |

|||||||||

|

Panasonic Corp. |

19,100 |

171 |

|||||||||

|

Recruit Holdings Co., Ltd. |

20,100 |

481 |

|||||||||

|

Santen Pharmaceutical Co., Ltd. |

9,100 |

130 |

|||||||||

|

Shimano, Inc. |

4,350 |

618 |

|||||||||

|

Shiseido Co., Ltd. |

10,300 |

640 |

|||||||||

|

SMC Corp. |

2,105 |

629 |

|||||||||

|

SoftBank Group Corp. |

8,700 |

574 |

|||||||||

|

Sony Corp. |

12,893 |

621 |

|||||||||

|

Tokio Marine Holdings, Inc. |

11,620 |

552 |

|||||||||

|

Toyota Motor Corp. |

18,155 |

1,055 |

|||||||||

|

Unicharm Corp. |

13,300 |

430 |

|||||||||

|

Yamaha Corp. |

2,400 |

102 |

|||||||||

|

Yaskawa Electric Corp. |

2,800 |

68 |

|||||||||

|

17,972 |

|||||||||||

|

Malaysia (1.4%) |

|||||||||||

|

CIMB Group Holdings Bhd |

122,200 |

169 |

|||||||||

|

DiGi.Com Bhd |

107,100 |

117 |

|||||||||

|

Genting Bhd |

77,500 |

114 |

|||||||||

|

Genting Malaysia Bhd |

102,300 |

75 |

|||||||||

|

IHH Healthcare Bhd |

70,900 |

92 |

|||||||||

|

Malayan Banking Bhd |

122,900 |

282 |

|||||||||

The accompanying notes are an integral part of the financial statements.

8

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Portfolio of Investments (cont'd)

Active International Allocation Portfolio

|

Shares |

Value (000) |

||||||||||

|

Malaysia (cont'd) |

|||||||||||

|

Malaysia Airports Holdings Bhd |

57,400 |

$ |

116 |

||||||||

|

Petronas Chemicals Group Bhd |

82,700 |

186 |

|||||||||

|

Public Bank Bhd |

205,500 |

1,229 |

|||||||||

|

2,380 |

|||||||||||

|

Malta (0.0%) |

|||||||||||

|

BGP Holdings PLC (a)(e)(f) |

72,261 |

— |

@ |

||||||||

|

Netherlands (3.4%) |

|||||||||||

|

Heineken N.V. |

5,442 |

480 |

|||||||||

|

Koninklijke Philips N.V. |

65,002 |

2,291 |

|||||||||

|

Unilever N.V. CVA |

38,935 |

2,115 |

|||||||||

|

Wolters Kluwer N.V. |

19,131 |

1,130 |

|||||||||

|

6,016 |

|||||||||||

|

Peru (1.2%) |

|||||||||||

|

Cia de Minas Buenaventura SA ADR |

15,000 |

244 |

|||||||||

|

Credicorp Ltd. |

7,200 |

1,596 |

|||||||||

|

Southern Copper Corp. |

6,700 |

206 |

|||||||||

|

2,046 |

|||||||||||

|

Poland (2.6%) |

|||||||||||

|

Dino Polska SA (a) |

48,295 |

1,235 |

|||||||||

|

Jeronimo Martins SGPS SA |

76,511 |

906 |

|||||||||

|

Powszechna Kasa Oszczednosci Bank Polski SA |

109,948 |

1,159 |

|||||||||

|

Powszechny Zaklad Ubezpieczen SA |

109,506 |

1,287 |

|||||||||

|

4,587 |

|||||||||||

|

Portugal (0.1%) |

|||||||||||

|

Galp Energia SGPS SA |

12,270 |

194 |

|||||||||

|

South Africa (0.0%) |

|||||||||||

|

Old Mutual Ltd. |

21,154 |

31 |

|||||||||

|

Spain (2.4%) |

|||||||||||

|

Aena SME SA |

4,497 |

697 |

|||||||||

|

Amadeus IT Group SA |

19,720 |

1,373 |

|||||||||

|

Endesa SA |

29,309 |

675 |

|||||||||

|

Grifols SA |

22,454 |

587 |

|||||||||

|

Industria de Diseno Textil SA |

26,756 |

682 |

|||||||||

|

Repsol SA |

12,277 |

197 |

|||||||||

|

4,211 |

|||||||||||

|

Sweden (1.5%) |

|||||||||||

|

Essity AB, Class B |

13,601 |

334 |

|||||||||

|

Hennes & Mauritz AB, Class B |

16,318 |

232 |

|||||||||

|

Hexagon AB, Class B |

9,186 |

424 |

|||||||||

|

Telefonaktiebolaget LM Ericsson, Class B |

181,320 |

1,598 |

|||||||||

|

2,588 |

|||||||||||

|

Switzerland (6.1%) |

|||||||||||

|

Baloise Holding AG (Registered) |

833 |

115 |

|||||||||

|

Geberit AG (Registered) |

1,694 |

660 |

|||||||||

|

Givaudan SA (Registered) |

246 |

571 |

|||||||||

|

Nestle SA (Registered) |

57,551 |

4,679 |

|||||||||

|

Partners Group Holding AG |

198 |

120 |

|||||||||

|

Roche Holding AG (Genusschein) |

14,431 |

3,569 |

|||||||||

|

Shares |

Value (000) |

||||||||||

|

Swiss Life Holding AG (Registered) (a) |

995 |

$ |

384 |

||||||||

|

Zurich Insurance Group AG |

2,096 |

626 |

|||||||||

|

10,724 |

|||||||||||

|

Taiwan (1.6%) |

|||||||||||

|

Airtac International Group |

32,000 |

309 |

|||||||||

|

Taiwan Semiconductor Manufacturing Co., Ltd. |

341,000 |

2,475 |

|||||||||

|

2,784 |

|||||||||||

|

United Kingdom (11.8%) |

|||||||||||

| ASOS PLC (a) |

2,403 |

69 |

|||||||||

|

AstraZeneca PLC |

27,591 |

2,063 |

|||||||||

|

AstraZeneca PLC ADR |

9,910 |

376 |

|||||||||

|

BAE Systems PLC |

130,645 |

763 |

|||||||||

|

British American Tobacco PLC |

46,513 |

1,483 |

|||||||||

|

Burberry Group PLC |

8,172 |

180 |

|||||||||

|

Diageo PLC |

27,352 |

972 |

|||||||||

|

Ferguson PLC |

3,224 |

206 |

|||||||||

|

GlaxoSmithKline PLC |

74,410 |

1,412 |

|||||||||

|

Glencore PLC (a) |

94,670 |

349 |

|||||||||

|

Indivior PLC (a) |

16,953 |

24 |

|||||||||

|

Intertek Group PLC |

3,793 |

231 |

|||||||||

|

Johnson Matthey PLC |

2,526 |

90 |

|||||||||

|

Melrose Industries PLC |

34,621 |

72 |

|||||||||

|

Micro Focus International PLC |

11,865 |

207 |

|||||||||

|

Prudential PLC |

14,422 |

258 |

|||||||||

|

Reckitt Benckiser Group PLC |

16,042 |

1,225 |

|||||||||

|

RELX PLC (a) |

67,046 |

1,380 |

|||||||||

|

RELX PLC |

20,956 |

430 |

|||||||||

|

Rolls-Royce Holdings PLC (a) |

510,738 |

1 |

|||||||||

|

Royal Dutch Shell PLC, Class A |

42,335 |

1,243 |

|||||||||

|

Royal Dutch Shell PLC, Class B |

31,111 |

926 |

|||||||||

|

Sage Group PLC (The) |

72,435 |

555 |

|||||||||

|

Shire PLC |

53,396 |

3,103 |

|||||||||

|

Smith & Nephew PLC |

35,901 |

668 |

|||||||||

|

TechnipFMC PLC |

3,806 |

77 |

|||||||||

|

Unilever PLC |

44,586 |

2,334 |

|||||||||

|

20,697 |

|||||||||||

|

United States (7.5%) |

|||||||||||

|

Allergan PLC |

2,900 |

388 |

|||||||||

|

Alphabet, Inc., Class A (a) |

900 |

940 |

|||||||||

|

American Tower Corp. REIT |

2,400 |

380 |

|||||||||

|

Biogen, Inc. (a) |

2,100 |

632 |

|||||||||

|

Booking Holdings, Inc. (a) |

530 |

913 |

|||||||||

|

Bristol-Myers Squibb Co. |

12,100 |

629 |

|||||||||

|

Charles River Laboratories International, Inc. (a) |

2,300 |

260 |

|||||||||

|

Cognex Corp. |

7,900 |

306 |

|||||||||

|

Editas Medicine, Inc. (a) |

4,400 |

100 |

|||||||||

|

Halliburton Co. |

12,600 |

335 |

|||||||||

|

ICON PLC (a) |

4,120 |

532 |

|||||||||

|

Incyte Corp. (a) |

3,100 |

197 |

|||||||||

|

Intellia Therapeutics, Inc. (a) |

6,300 |

86 |

|||||||||

|

Intuitive Surgical, Inc. (a) |

600 |

287 |

|||||||||

|

Mastercard, Inc., Class A |

3,200 |

604 |

|||||||||

The accompanying notes are an integral part of the financial statements.

9

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Portfolio of Investments (cont'd)

Active International Allocation Portfolio

|

Shares |

Value (000) |

||||||||||

|

United States (cont'd) |

|||||||||||

|

Medtronic PLC |

7,400 |

$ |

673 |

||||||||

|

MercadoLibre, Inc. |

700 |

205 |

|||||||||

|

Microsoft Corp. |

8,300 |

843 |

|||||||||

|

Newmont Mining Corp. |

25,000 |

866 |

|||||||||

|

Palo Alto Networks, Inc. (a) |

2,900 |

546 |

|||||||||

|

PepsiCo, Inc. |

3,200 |

354 |

|||||||||

|

Schlumberger Ltd. |

53,800 |

1,941 |

|||||||||

|

Visa, Inc., Class A |

8,900 |

1,174 |

|||||||||

|

13,191 |

|||||||||||

|

Total Common Stocks (Cost $148,800) |

161,864 |

||||||||||

|

Short-Term Investments (5.3%) |

|||||||||||

|

Securities held as Collateral on Loaned Securities (0.0%) |

|||||||||||

|

Investment Company (0.0%) |

|||||||||||

|

Morgan Stanley Institutional Liquidity Funds — Treasury Securities Portfolio — Institutional Class (See Note G) |

19,001 |

19 |

|||||||||

|

Face Amount (000) |

|||||||||||

|

Repurchase Agreements (0.0%) |

|||||||||||

|

Barclays Capital, Inc., (2.90%, dated 12/31/18, due 1/2/19; proceeds $1; fully collateralized by a U.S. Government obligation; 2.50% due 5/15/24; valued at $1) |

$ |

1 |

1 |

||||||||

|

HSBC Securities USA, Inc., (2.95%, dated 12/31/18, due 1/2/19; proceeds $3; fully collateralized by U.S. Government obligations; 0.00% - 2.75% due 1/31/19 - 2/15/42; valued at $3) |

3 |

3 |

|||||||||

|

4 |

|||||||||||

|

Total Securities held as Collateral on Loaned Securities (Cost $23) |

23 |

||||||||||

|

Shares |

Value (000) |

||||||||||

|

Investment Company (5.3%) |

|||||||||||

|

Morgan Stanley Institutional Liquidity Funds — Treasury Securities Portfolio — Institutional Class (See Note G) (Cost $9,252) |

9,252,146 |

$ |

9,252 |

||||||||

|

Total Short-Term Investments (Cost $9,275) |

9,275 |

||||||||||

|

Total Investments (97.8%) (Cost $158,075) Including $44 of Securities Loaned (g)(h)(i) |

171,139 |

||||||||||

|

Other Assets in Excess of Liabilities (2.2%) |

3,929 |

||||||||||

|

Net Assets (100.0%) |

$ |

175,068 |

|||||||||

Country assignments and aggregations are based generally on third party vendor classifications and information, and may be different from the assignments and aggregations under the policies set forth in the Fund's prospectus and/or statement of additional information relating to geographic classifications.

@ Value is less than $500.

(a) Non-income producing security.

(b) All or a portion of this security was on loan at December 31, 2018.

(c) Consists of one or more classes of securities traded together as a unit; stocks with attached warrants.

(d) Security trades on the Hong Kong exchange.

(e) Security has been deemed illiquid at December 31, 2018.

(f) At December 31, 2018, the Fund held a fair valued security valued at less than $500, representing less than 0.05% of net assets. This security has been fair valued as determined in good faith under procedures established by and under the general supervision of the Company's Directors.

(g) Securities are available for collateral in connection with open foreign currency forward exchange contracts and futures contracts.

(h) The approximate fair value and percentage of net assets, $137,898,000 and 78.8%, respectively, represent the securities that have been fair valued under the fair valuation policy for international investments as described in Note A-1 within the Notes to the Financial Statements.

(i) At December 31, 2018, the aggregate cost for federal income tax purposes is approximately $159,260,000. The aggregate gross unrealized appreciation is approximately $23,749,000 and the aggregate gross unrealized depreciation is approximately $11,687,000, resulting in net unrealized appreciation of approximately $12,062,000.

ADR American Depositary Receipt.

CVA Certificaten Van Aandelen.

REIT Real Estate Investment Trust.

The accompanying notes are an integral part of the financial statements.

10

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Portfolio of Investments (cont'd)

Active International Allocation Portfolio

Foreign Currency Forward Exchange Contracts:

The Fund had the following foreign currency forward exchange contracts open at December 31, 2018:

|

Counterparty |

Contracts to Deliver (000) |

In Exchange For (000) |

Delivery Date |

Unrealized Appreciation (Depreciation) (000) |

|||||||||||||||

|

Citibank NA |

EUR |

1,593 |

$ |

1,824 |

3/14/19 |

$ |

(12 |

) |

|||||||||||

|

Goldman Sachs International |

$ |

2,745 |

MYR |

11,469 |

3/14/19 |

28 |

|||||||||||||

|

JPMorgan Chase Bank NA |

$ |

2,432 |

MXN |

49,593 |

3/14/19 |

64 |

|||||||||||||

|

State Street Bank and Trust Co. |

HKD |

35,433 |

$ |

4,538 |

3/14/19 |

3 |

|||||||||||||

|

State Street Bank and Trust Co. |

$ |

2,402 |

GBP |

1,894 |

3/14/19 |

20 |

|||||||||||||

|

State Street Bank and Trust Co. |

$ |

1,902 |

JPY |

212,626 |

3/14/19 |

48 |

|||||||||||||

|

$ |

151 |

||||||||||||||||||

Futures Contracts:

The Fund had the following futures contracts open at December 31, 2018:

|

Number of Contracts |

Expiration Date |

Notional Amount (000) |

Value (000) |

Unrealized Appreciation (Depreciation) (000) |

|||||||||||||||||||

|

Long: |

|||||||||||||||||||||||

|

FTSE 100 Index (United Kingdom) |

30 |

Mar-19 |

— |

@ |

$ |

2,546 |

$ |

4 |

|||||||||||||||

|

FTSE KLCI Index (Malaysia) |

139 |

Jan-19 |

7 |

2,845 |

56 |

||||||||||||||||||

|

MEX BOLSA Index (Mexico) |

118 |

Mar-19 |

1 |

2,508 |

38 |

||||||||||||||||||

|

MSCI Emerging Market E Mini (United States) |

47 |

Mar-19 |

2 |

2,272 |

(57 |

) |

|||||||||||||||||

|

SGX NIFTY 50 (Singapore) |

80 |

Jan-19 |

— |

@ |

1,748 |

(9 |

) |

||||||||||||||||

|

$ |

32 |

||||||||||||||||||||||

@ Amount is less than $500.

EUR — Euro

GBP — British Pound

HKD — Hong Kong Dollar

JPY — Japanese Yen

MXN — Mexican Peso

MYR — Malaysian Ringgit

USD — United States Dollar

Portfolio Composition*

|

Classification |

Percentage of Total Investments |

||||||

|

Other** |

74.2 |

% |

|||||

|

Pharmaceuticals |

11.0 |

||||||

|

Banks |

9.4 |

||||||

|

Short-Term Investments |

5.4 |

||||||

|

Total Investments |

100.0 |

%*** |

|||||

* Percentages indicated are based upon total investments (excluding Securities held as Collateral on Loaned Securities) as of December 31, 2018.

** Industries and/or investment types representing less than 5% of total investments.

*** Does not include open long futures contracts with a value of approximately $11,919,000 and net unrealized appreciation of approximately $32,000. Does not include open foreign currency forward exchange contracts with net unrealized appreciation of approximately $151,000.

The accompanying notes are an integral part of the financial statements.

11

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Active International Allocation Portfolio

|

Statement of Assets and Liabilities |

December 31, 2018 (000) |

||||||

|

Assets: |

|||||||

|

Investments in Securities of Unaffiliated Issuers, at Value(1) (Cost $148,294) |

$ |

161,640 |

|||||

|

Investments in Securities of Affiliated Issuers, at Value (Cost $9,781) |

9,499 |

||||||

|

Total Investments in Securities, at Value (Cost $158,075) |

171,139 |

||||||

|

Foreign Currency, at Value (Cost $48) |

41 |

||||||

|

Receivable for Investments Sold |

6,744 |

||||||

|

Receivable for Variation Margin on Futures Contracts |

613 |

||||||

|

Receivable for Fund Shares Sold |

504 |

||||||

|

Tax Reclaim Receivable |

398 |

||||||

|

Unrealized Appreciation on Foreign Currency Forward Exchange Contracts |

163 |

||||||

|

Dividends Receivable |

147 |

||||||

|

Receivable from Affiliate |

17 |

||||||

|

Receivable from Securities Lending Income |

1 |

||||||

|

Other Assets |

41 |

||||||

|

Total Assets |

179,808 |

||||||

|

Liabilities: |

|||||||

|

Payable for Investments Purchased |

3,543 |

||||||

|

Payable for Fund Shares Redeemed |

669 |

||||||

|

Payable for Advisory Fees |

232 |

||||||

|

Payable for Professional Fees |

95 |

||||||

|

Payable for Directors' Fees and Expenses |

30 |

||||||

|

Collateral on Securities Loaned, at Value |

23 |

||||||

|

Deferred Capital Gain Country Tax |

21 |

||||||

|

Payable for Custodian Fees |

20 |

||||||

|

Payable for Sub Transfer Agency Fees — Class I |

10 |

||||||

|

Payable for Sub Transfer Agency Fees — Class A |

8 |

||||||

|

Payable for Sub Transfer Agency Fees — Class L |

1 |

||||||

|

Payable for Sub Transfer Agency Fees — Class C |

— |

@ |

|||||

|

Payable for Shareholder Services Fees — Class A |

11 |

||||||

|

Payable for Distribution and Shareholder Services Fees — Class L |

3 |

||||||

|

Payable for Distribution and Shareholder Services Fees — Class C |

— |

@ |

|||||

|

Unrealized Depreciation on Foreign Currency Forward Exchange Contract |

12 |

||||||

|

Payable for Administration Fees |

12 |

||||||

|

Payable for Transfer Agency Fees — Class I |

3 |

||||||

|

Payable for Transfer Agency Fees — Class A |

4 |

||||||

|

Payable for Transfer Agency Fees — Class L |

1 |

||||||

|

Payable for Transfer Agency Fees — Class C |

1 |

||||||

|

Bank Overdraft |

1 |

||||||

|

Other Liabilities |

40 |

||||||

|

Total Liabilities |

4,740 |

||||||

|

Net Assets |

$ |

175,068 |

|||||

|

Net Assets Consist of: |

|||||||

|

Paid-in-Capital |

$ |

174,574 |

|||||

|

Total Distributable Earnings |

494 |

||||||

|

Net Assets |

$ |

175,068 |

|||||

The accompanying notes are an integral part of the financial statements.

12

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Active International Allocation Portfolio

|

Statement of Assets and Liabilities (cont'd) |

December 31, 2018 (000) |

||||||

|

CLASS I: |

|||||||

|

Net Assets |

$ |

119,925 |

|||||

| Shares Outstanding $0.001 par value shares of beneficial interest (unlimited shares authorized) (not in 000's) |

9,938,100 |

||||||

|

Net Asset Value, Offering and Redemption Price Per Share |

$ |

12.07 |

|||||

|

CLASS A: |

|||||||

|

Net Assets |

$ |

50,726 |

|||||

| Shares Outstanding $0.001 par value shares of beneficial interest (unlimited shares authorized) (not in 000's) |

4,105,360 |

||||||

|

Net Asset Value, Redemption Price Per Share |

$ |

12.36 |

|||||

|

Maximum Sales Load |

5.25 |

% |

|||||

|

Maximum Sales Charge |

$ |

0.68 |

|||||

|

Maximum Offering Price Per Share |

$ |

13.04 |

|||||

|

CLASS L: |

|||||||

|

Net Assets |

$ |

4,375 |

|||||

| Shares Outstanding $0.001 par value shares of beneficial interest (unlimited shares authorized) (not in 000's) |

355,048 |

||||||

|

Net Asset Value, Offering and Redemption Price Per Share |

$ |

12.32 |

|||||

|

CLASS C: |

|||||||

|

Net Assets |

$ |

42 |

|||||

| Shares Outstanding $0.001 par value shares of beneficial interest (unlimited shares authorized) (not in 000's) |

3,387 |

||||||

|

Net Asset Value, Offering and Redemption Price Per Share |

$ |

12.34 |

|||||

|

(1) Including: Securities on Loan, at Value: |

$ |

44 |

|||||

@ Amount is less than $500.

The accompanying notes are an integral part of the financial statements.

13

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Active International Allocation Portfolio

|

Statement of Operations |

Year Ended December 31, 2018 (000) |

||||||

|

Investment Income: |

|||||||

|

Dividends from Securities of Unaffiliated Issuers (Net of $298 of Foreign Taxes Withheld) |

$ |

4,996 |

|||||

|

Dividends from Securities of Affiliated Issuers (Note G) |

265 |

||||||

|

Income from Securities Loaned — Net |

56 |

||||||

|

Total Investment Income |

5,317 |

||||||

|

Expenses: |

|||||||

|

Advisory Fees (Note B) |

1,351 |

||||||

|

Shareholder Services Fees — Class A (Note D) |

150 |

||||||

|

Distribution and Shareholder Services Fees — Class L (Note D) |

42 |

||||||

|

Distribution and Shareholder Services Fees — Class C (Note D) |

— |

@ |

|||||

|

Administration Fees (Note C) |

166 |

||||||

|

Professional Fees |

149 |

||||||

|

Shareholder Reporting Fees |

137 |

||||||

|

Registration Fees |

55 |

||||||

|

Custodian Fees (Note F) |

49 |

||||||

|

Sub Transfer Agency Fees — Class I |

24 |

||||||

|

Sub Transfer Agency Fees — Class A |

22 |

||||||

|

Sub Transfer Agency Fees — Class C |

— |

@ |

|||||

|

Pricing Fees |

28 |

||||||

|

Transfer Agency Fees — Class I (Note E) |

8 |

||||||

|

Transfer Agency Fees — Class A (Note E) |

12 |

||||||

|

Transfer Agency Fees — Class L (Note E) |

4 |

||||||

|

Transfer Agency Fees — Class C (Note E) |

2 |

||||||

|

Directors' Fees and Expenses |

9 |

||||||

|

Other Expenses |

34 |

||||||

|

Total Expenses |

2,242 |

||||||

|

Waiver of Advisory Fees (Note B) |

(108 |

) |

|||||

|

Reimbursement of Class Specific Expenses — Class I (Note B) |

(32 |

) |

|||||

|

Reimbursement of Class Specific Expenses — Class C (Note B) |

(2 |

) |

|||||

|

Rebate from Morgan Stanley Affiliate (Note G) |

(33 |

) |

|||||

|

Net Expenses |

2,067 |

||||||

|

Net Investment Income |

3,250 |

||||||

|

Realized Gain (Loss): |

|||||||

|

Investments Sold (Net of $2 of Capital Gain Country Tax) |

7,040 |

||||||

|

Investments in Affiliates |

(233 |

) |

|||||

|

Foreign Currency Forward Exchange Contracts |

(362 |

) |

|||||

|

Foreign Currency Translation |

(391 |

) |

|||||

|

Futures Contracts |

(1,927 |

) |

|||||

|

Net Realized Gain |

4,127 |

||||||

|

Change in Unrealized Appreciation (Depreciation): |

|||||||

|

Investments (Net of Decrease in Deferred Capital Gain Country Tax of $23) |

(38,914 |

) |

|||||

|

Investments in Affiliates |

61 |

||||||

|

Foreign Currency Forward Exchange Contracts |

(49 |

) |

|||||

|

Foreign Currency Translation |

(63 |

) |

|||||

|

Futures Contracts |

(622 |

) |

|||||

|

Net Change in Unrealized Appreciation (Depreciation) |

(39,587 |

) |

|||||

|

Net Realized Gain and Change in Unrealized Appreciation (Depreciation) |

(35,460 |

) |

|||||

|

Net Decrease in Net Assets Resulting from Operations |

$ |

(32,210 |

) |

||||

@ Amount is less than $500.

The accompanying notes are an integral part of the financial statements.

14

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Active International Allocation Portfolio

|

Statements of Changes in Net Assets |

Year Ended December 31, 2018 (000) |

Year Ended December 31, 2017 (000) |

|||||||||

|

Increase (Decrease) in Net Assets: |

|||||||||||

|

Operations: |

|||||||||||

|

Net Investment Income |

$ |

3,250 |

$ |

3,025 |

|||||||

|

Net Realized Gain |

4,127 |

19,186 |

|||||||||

|

Net Change in Unrealized Appreciation (Depreciation) |

(39,587 |

) |

29,205 |

||||||||

|

Net Increase (Decrease) in Net Assets Resulting from Operations |

(32,210 |

) |

51,416 |

||||||||

|

Dividends and Distributions to Shareholders: |

|||||||||||

|

Class I |

(2,041 |

) |

(3,170 |

)* |

|||||||

|

Class A |

(655 |

) |

(1,073 |

)* |

|||||||

|

Class L |

(29 |

) |

(75 |

)* |

|||||||

|

Class C |

(— |

@) |

(— |

@)* |

|||||||

|

Total Dividends and Distributions to Shareholders |

(2,725 |

) |

(4,318 |

) |

|||||||

|

Capital Share Transactions:(1) |

|||||||||||

|

Class I: |

|||||||||||

|

Subscribed |

10,181 |

6,465 |

|||||||||

|

Distributions Reinvested |

2,032 |

3,157 |

|||||||||

|

Redeemed |

(23,890 |

) |

(57,220 |

) |

|||||||

|

Class A: |

|||||||||||

|

Subscribed |

9,153 |

6,669 |

|||||||||

|

Distributions Reinvested |

646 |

1,059 |

|||||||||

|

Redeemed |

(14,703 |

) |

(11,227 |

) |

|||||||

|

Class L: |

|||||||||||

|

Exchanged |

50 |

— |

|||||||||

|

Distributions Reinvested |

28 |

74 |

|||||||||

|

Redeemed |

(1,267 |

) |

(928 |

) |

|||||||

|

Class C: |

|||||||||||

|

Subscribed |

27 |

13 |

|||||||||

|

Distributions Reinvested |

— |

@ |

— |

@ |

|||||||

|

Redeemed |

— |

@ |

— |

||||||||

|

Net Decrease in Net Assets Resulting from Capital Share Transactions |

(17,743 |

) |

(51,938 |

) |

|||||||

|

Redemption Fees |

— |

@ |

1 |

||||||||

|

Total Decrease in Net Assets |

(52,678 |

) |

(4,839 |

) |

|||||||

|

Net Assets: |

|||||||||||

|

Beginning of Period |

227,746 |

232,585 |

|||||||||

|

End of Period |

$ |

175,068 |

$ |

227,746 |

† |

||||||

The accompanying notes are an integral part of the financial statements.

15

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Active International Allocation Portfolio

|

Statements of Changes in Net Assets (cont'd) |

Year Ended December 31, 2018 (000) |

Year Ended December 31, 2017 (000) |

|||||||||

|

(1) Capital Share Transactions: |

|||||||||||

|

Class I: |

|||||||||||

|

Shares Subscribed |

736 |

501 |

|||||||||

|

Shares Issued on Distributions Reinvested |

164 |

221 |

|||||||||

|

Shares Redeemed |

(1,720 |

) |

(4,302 |

) |

|||||||

|

Net Decrease in Class I Shares Outstanding |

(820 |

) |

(3,580 |

) |

|||||||

|

Class A: |

|||||||||||

|

Shares Subscribed |

668 |

489 |

|||||||||

|

Shares Issued on Distributions Reinvested |

51 |

73 |

|||||||||

|

Shares Redeemed |

(1,056 |

) |

(826 |

) |

|||||||

|

Net Decrease in Class A Shares Outstanding |

(337 |

) |

(264 |

) |

|||||||

|

Class L: |

|||||||||||

|

Shares Exchanged |

4 |

— |

|||||||||

|

Shares Issued on Distributions Reinvested |

2 |

5 |

|||||||||

|

Shares Redeemed |

(90 |

) |

(69 |

) |

|||||||

|

Net Decrease in Class L Shares Outstanding |

(84 |

) |

(64 |

) |

|||||||

|

Class C: |

|||||||||||

|

Shares Subscribed |

2 |

1 |

|||||||||

|

Shares Issued on Distributions Reinvested |

— |

@@ |

— |

@@ |

|||||||

|

Shares Redeemed |

(— |

@@) |

— |

||||||||

|

Net Increase in Class C Shares Outstanding |

2 |

1 |

|||||||||

The following information was previously reported in the December 31, 2017 financial statements. The distribution information for the year ended December 31, 2017 presented on the Statements of Changes in Net Assets is presented for comparative purposes to the December 31, 2018 financial statements, which conform to the SEC Final Rule on Disclosure Update and Simplification which was effective November 5, 2018.

* Dividends and Distributions to Shareholders for the year ended December 31, 2017 were as follows:

|

Class I: |

|||||||

|

Net Investment Income |

$ |

(3,170 |

) |

||||

|

Class A: |

|||||||

|

Net Investment Income |

$ |

(1,073 |

) |

||||

|

Class L: |

|||||||

|

Net Investment Income |

$ |

(75 |

) |

||||

|

Class C: |

|||||||

|

Net Investment Income |

$ |

(— |

@) |

||||

† Distributions in Excess of Net Investment Income for the year ended December 31, 2017 was $(477).

@ Amount is less than $500.

@@ Amount is less than 500 shares.

The accompanying notes are an integral part of the financial statements.

16

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Financial Highlights

Active International Allocation Portfolio

|

Class I |

|||||||||||||||||||||||

|

Year Ended December 31, |

|||||||||||||||||||||||

|

Selected Per Share Data and Ratios |

2018 |

2017 |

2016(1) |

2015 |

2014 |

||||||||||||||||||

|

Net Asset Value, Beginning of Period |

$ |

14.46 |

$ |

11.83 |

$ |

12.20 |

$ |

12.52 |

$ |

13.75 |

|||||||||||||

|

Income (Loss) from Investment Operations: |

|||||||||||||||||||||||

|

Net Investment Income(2) |

0.23 |

0.19 |

0.26 |

0.22 |

0.34 |

||||||||||||||||||

|

Net Realized and Unrealized Gain (Loss) |

(2.41 |

) |

2.74 |

(0.34 |

) |

(0.42 |

) |

(1.22 |

) |

||||||||||||||

|

Total from Investment Operations |

(2.18 |

) |

2.93 |

(0.08 |

) |

(0.20 |

) |

(0.88 |

) |

||||||||||||||

|

Distributions from and/or in Excess of: |

|||||||||||||||||||||||

|

Net Investment Income |

(0.21 |

) |

(0.30 |

) |

(0.29 |

) |

(0.12 |

) |

(0.35 |

) |

|||||||||||||

|

Redemption Fees |

0.00 |

(3) |

0.00 |

(3) |

0.00 |

(3) |

0.00 |

(3) |

0.00 |

(3) |

|||||||||||||

|

Net Asset Value, End of Period |

$ |

12.07 |

$ |

14.46 |

$ |

11.83 |

$ |

12.20 |

$ |

12.52 |

|||||||||||||

|

Total Return(4) |

(15.14 |

)% |

24.76 |

% |

(0.67 |

)% |

(1.63 |

)% |

(6.37 |

)% |

|||||||||||||

|

Ratios and Supplemental Data: |

|||||||||||||||||||||||

|

Net Assets, End of Period (Thousands) |

$ |

119,925 |

$ |

155,550 |

$ |

169,589 |

$ |

197,733 |

$ |

219,467 |

|||||||||||||

|

Ratio of Expenses to Average Net Assets(6) |

0.88 |

%(5) |

0.88 |

%(5) |

0.76 |

%(5) |

0.89 |

%(5) |

0.88 |

%(5) |

|||||||||||||

|

Ratio of Net Investment Income to Average Net Assets(6) |

1.67 |

%(5) |

1.44 |

%(5) |

2.18 |

%(5) |

1.66 |

%(5) |

2.53 |

%(5) |

|||||||||||||

|

Ratio of Rebate from Morgan Stanley Affiliates to Average Net Assets |

0.02 |

% |

0.02 |

% |

0.01 |

% |

0.01 |

% |

0.02 |

% |

|||||||||||||

|

Portfolio Turnover Rate |

43 |

% |

22 |

% |

40 |

% |

30 |

% |

32 |

% |

|||||||||||||

|

(6) Supplemental Information on the Ratios to Average Net Assets: |

|||||||||||||||||||||||

|

Ratios Before Expense Limitation: |

|||||||||||||||||||||||

|

Expenses to Average Net Assets |

0.97 |

% |

1.14 |

% |

0.94 |

% |

0.92 |

% |

0.99 |

% |

|||||||||||||

|

Net Investment Income to Average Net Assets |

1.58 |

% |

1.18 |

% |

2.00 |

% |

1.63 |

% |

2.42 |

% |

|||||||||||||

(1) Reflects prior period Custodian out-of-pocket expenses that were reimbursed in September 2016. The amount of the reimbursement was immaterial on a per share basis and did not impact the total return of Class I shares. The Ratio of Expenses to Average Net Assets would have been 0.13% higher and the Ratio of Net Investment Income to Average Net Assets would have been 0.13% lower had the Custodian not reimbursed the Fund.

(2) Per share amount is based on average shares outstanding.

(3) Amount is less than $0.005 per share.

(4) Calculated based on the net asset value as of the last business day of the period.

(5) The Ratios of Expenses and Net Investment Income reflect the rebate of certain Fund expenses in connection with the investments in Morgan Stanley affiliates during the period. The effect of the rebate on the ratios is disclosed in the above table as "Ratio of Rebate from Morgan Stanley Affiliates to Average Net Assets."

The accompanying notes are an integral part of the financial statements.

17

Morgan Stanley Institutional Fund, Inc.

Annual Report — December 31, 2018

Financial Highlights

Active International Allocation Portfolio

|

Class A |

|||||||||||||||||||||||

|

Year Ended December 31, |

|||||||||||||||||||||||

|

Selected Per Share Data and Ratios |

2018 |

2017 |

2016(1) |

2015 |

2014 |

||||||||||||||||||

|

Net Asset Value, Beginning of Period |

$ |

14.79 |

$ |

12.10 |

$ |

12.47 |

$ |

12.79 |

$ |

14.03 |

|||||||||||||

|

Income (Loss) from Investment Operations: |

|||||||||||||||||||||||

|

Net Investment Income(2) |

0.19 |

0.14 |

0.21 |

0.17 |

0.30 |

||||||||||||||||||

|

Net Realized and Unrealized Gain (Loss) |

(2.46 |

) |

2.80 |

(0.34 |

) |

(0.42 |

) |

(1.24 |

) |

||||||||||||||

|

Total from Investment Operations |

(2.27 |

) |

2.94 |

(0.13 |

) |

(0.25 |

) |

(0.94 |

) |

||||||||||||||

|

Distributions from and/or in Excess of: |

|||||||||||||||||||||||

|

Net Investment Income |

(0.16 |

) |

(0.25 |

) |

(0.24 |

) |

(0.07 |

) |

(0.30 |

) |

|||||||||||||

|

Redemption Fees |

0.00 |

(3) |

0.00 |

(3) |

0.00 |

(3) |

0.00 |

(3) |

0.00 |

(3) |

|||||||||||||

|

Net Asset Value, End of Period |

$ |

12.36 |

$ |

14.79 |

$ |

12.10 |

$ |

12.47 |

$ |

12.79 |