UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-05624 | |||||||

|

| ||||||||

|

Morgan Stanley Institutional Fund, Inc. | ||||||||

|

(Exact name of registrant as specified in charter) | ||||||||

|

| ||||||||

|

522 Fifth Avenue, New York, New York |

|

10036 | ||||||

|

(Address of principal executive offices) |

|

(Zip code) | ||||||

|

| ||||||||

|

Arthur Lev | ||||||||

|

(Name and address of agent for service) | ||||||||

|

| ||||||||

|

Registrant’s telephone number, including area code: |

212-296-6990 |

| ||||||

|

| ||||||||

|

Date of fiscal year end: |

December 31, 2011 |

| ||||||

|

| ||||||||

|

Date of reporting period: |

December 31, 2011 |

| ||||||

Item 1 - Report to Shareholders

INVESTMENT MANAGEMENT

Morgan Stanley

Institutional Fund, Inc.

Global and International

Equity Portfolios

Active International Allocation

Portfolio

Asian Equity Portfolio

Emerging Markets Portfolio

Global Advantage Portfolio

Global Discovery Portfolio

Global Franchise Portfolio

Global Insight Portfolio

Global Opportunity Portfolio

Global Real Estate Portfolio

International Advantage Portfolio

International Equity Portfolio

International Opportunity Portfolio

International Real Estate Portfolio

International Small Cap Portfolio

Select Global Infrastructure Portfolio

U.S. Equity Portfolios

Advantage Portfolio

Focus Growth Portfolio

Growth Portfolio

(formerly Capital Growth Portfolio)

Insight Portfolio

Opportunity Portfolio

Small Company Growth Portfolio

U.S. Real Estate Portfolio

Fixed Income Portfolio

Emerging Markets Debt Portfolio

Annual

Report

December 31, 2011

2011 Annual Report

December 31, 2011

Table of Contents

| Shareholders' Letter | 2 | ||||||

| Investment Advisory Agreement Approval | 3 | ||||||

| Performance Summary | 6 | ||||||

| Expense Examples | 8 | ||||||

| Investment Overview and Portfolios of Investments | |||||||

| Global and International Equity Portfolios: | |||||||

| Active International Allocation Portfolio | 11 | ||||||

| Asian Equity Portfolio | 25 | ||||||

| Emerging Markets Portfolio | 30 | ||||||

| Global Advantage Portfolio | 37 | ||||||

| Global Discovery Portfolio | 41 | ||||||

| Global Franchise Portfolio | 45 | ||||||

| Global Insight Portfolio | 48 | ||||||

| Global Opportunity Portfolio | 52 | ||||||

| Global Real Estate Portfolio | 56 | ||||||

| International Advantage Portfolio | 62 | ||||||

| International Equity Portfolio | 66 | ||||||

| International Opportunity Portfolio | 70 | ||||||

| International Real Estate Portfolio | 74 | ||||||

| International Small Cap Portfolio | 79 | ||||||

| Select Global Infrastructure Portfolio | 85 | ||||||

| U.S. Equity Portfolios: | |||||||

| Advantage Portfolio | 90 | ||||||

| Focus Growth Portfolio | 94 | ||||||

| Growth Portfolio (formerly Capital Growth Portfolio) | 98 | ||||||

| Insight Portfolio | 102 | ||||||

| Opportunity Portfolio | 106 | ||||||

| Small Company Growth Portfolio | 111 | ||||||

| U.S. Real Estate Portfolio | 116 | ||||||

| Fixed Income Portfolio: | |||||||

| Emerging Markets Debt Portfolio | 120 | ||||||

| Statements of Assets and Liabilities | 126 | ||||||

| Statements of Operations | 138 | ||||||

| Statements of Changes in Net Assets | 143 | ||||||

| Financial Highlights | 167 | ||||||

| Notes to Financial Statements | 241 | ||||||

|

Report of Independent Registered Public Accounting Firm |

256 | ||||||

| Federal Income Tax Information | 257 | ||||||

| U.S. Privacy Policy | 259 | ||||||

| Director and Officer Information | 262 | ||||||

This report is authorized for distribution only when preceded or accompanied by prospectuses of the Morgan Stanley Institutional Fund, Inc. To receive a prospectus and/or SAI, which contains more complete information such as investment objectives, charges, expenses, policies for voting proxies, risk considerations, and describes in detail each of the Portfolio's investment policies to the prospective investor, please call toll free 1-(800) 548-7786. Please read the prospectuses carefully before you invest or send money.

Additionally, you can access portfolio information including performance, characteristics, and investment team commentary through Morgan Stanley Investment Management's website: www.morganstanley.com/im.

Market forecasts provided in this report may not necessarily come to pass. There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Portfolio in the future. There is no assurance that a Portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that market values of securities owned by the Portfolio will decline and, therefore, the value of the Portfolio's shares may be less than what you paid for them. Accordingly, you can lose money investing in Portfolios. Please see the prospectus for more complete information on investment risks.

1

2011 Annual Report

December 31, 2011

Shareholders' Letter (unaudited)

Dear Shareholders:

We are pleased to present to you the Fund's Annual Report for the year ended December 31, 2011. Our Fund currently offers 23 portfolios providing investors with a full array of global and domestic equity and fixed-income products. The Fund's portfolios, together with the portfolios of the Morgan Stanley Institutional Fund Trust, provide investors with a means to help them meet specific investment needs and to allocate their investments among equities and fixed income.

Sincerely,

Arthur Lev

President and Principal Executive Officer

January 2012

2

2011 Annual Report

December 31, 2011

Investment Advisory Agreement Approval (unaudited)

Global Insight and Insight Portfolios ("Portfolios")

At the organizational meeting of the Portfolios, the Board of Directors, including the independent Directors, considered the following factors in approving the Investment Advisory Agreement with respect to the Portfolios:

Nature, Extent and Quality of Services

The Board reviewed and considered the nature and extent of the investment advisory services to be provided by the Adviser (as defined herein) under the advisory agreement, including portfolio management, investment research and equity and fixed income securities trading. The Board also reviewed and considered the nature and extent of the non-advisory, administrative services to be provided by the Adviser under the administration agreement, including accounting, clerical, bookkeeping, compliance, business management and planning, and the provision of supplies, office space and utilities at the Adviser's expense. (The advisory and administration agreements together are referred to as the "Management Agreement.")

The Board reviewed and considered the qualifications of the portfolio managers, the senior administrative managers and other key personnel of the Adviser who will provide the administrative and advisory services to the Portfolios. The Board determined that the Adviser's portfolio managers and key personnel are well qualified by education and/or training and experience to perform the services in an efficient and professional manner. The Board concluded that the nature and extent of the advisory and administrative services to be provided were necessary and appropriate for the conduct of the business and investment activities of the Portfolios and supported its decision to approve the Management Agreement.

Performance, Fees and Expenses of the Portfolios

The Board considered that the Adviser plans to arrange for a public offering of shares of the Portfolios to raise assets for investment and that the offering had not yet begun and concluded that, since the Portfolios currently had no assets to invest (other than seed capital required under the Investment Company Act) and had no track record of performance, this was not a factor it needed to address at the present time.

The Board reviewed the advisory and administrative fee rates (the "management fee rates") proposed to be paid by the Portfolios under the Management Agreement relative to comparable funds advised by the Adviser, when applicable, and compared to their peers as determined by Lipper, Inc., and reviewed the anticipated total expense ratios of the Portfolios. The Board considered that the Portfolios require the Adviser to develop processes, invest in additional resources and incur additional risks to successfully manage the Portfolios and concluded that the proposed management fee rates and anticipated total expense ratios would be competitive with their peer group averages.

Economies of Scale

The Board considered the growth prospects of the Portfolios and the structure of the proposed management fee schedules, which include breakpoints for each of the Portfolios. The Board considered that the Portfolios' potential growth was uncertain and concluded that it would be premature to consider economies of scale as a factor in approving the Management Agreement at the present time.

Profitability of the Adviser and Affiliates

Since the Portfolios have not begun operations and have not paid any fees to the Adviser, the Board concluded that this was not a factor that needed to be considered at the present time.

Other Benefits of the Relationship

The Board considered other benefits to the Adviser and its affiliates derived from their relationship with the Portfolios and other funds advised by the Adviser. These benefits may include, among other things, "float" benefits derived from handling of checks for purchases and sales, research received by the Adviser generated from commission dollars spent on funds' portfolio trading and fees for distribution and/or shareholder servicing. Since the Portfolios have not begun operations and have not paid any fees to the Adviser, the Board concluded that these benefits were not a factor that needed to be considered at the present time.

3

2011 Annual Report

December 31, 2011

Investment Advisory Agreement Approval (unaudited) (cont'd)

Resources of the Adviser and Historical Relationship Between the Portfolios and the Adviser

The Board considered whether the Adviser is financially sound and has the resources necessary to perform its obligations under the Management Agreement. The Board also reviewed and considered the historical relationship between the Fund and the Adviser, including the organizational structure of the Adviser, the policies and procedures formulated and adopted by the Adviser for managing the Portfolios' operations and the Board's confidence in the competence and integrity of the senior managers and key personnel of the Adviser. The Board concluded that the Adviser has the financial resources necessary to fulfill its obligations under the Management Agreement and that it is beneficial for the Portfolios to enter into this relationship with the Adviser.

Other Factors and Current Trends

The Board considered the controls and procedures adopted and implemented by the Adviser and monitored by the Fund's Chief Compliance Officer and concluded that the conduct of business by the Adviser indicates a good faith effort on its part to adhere to high ethical standards in the conduct of the Fund's business.

General Conclusion

After considering and weighing all of the above factors, the Board concluded that it would be in the best interest of the Portfolios' and their future shareholders to approve the Management Agreement, which will remain in effect for two years and thereafter must be approved annually by the Board of the Fund if it is to continue in effect. In reaching this conclusion the Board did not give particular weight to any single factor referenced above. It is possible that individual Board members may have weighed these factors differently in reaching their individual decisions to approve the Management Agreement.

4

(This Page has been left blank intentionally.)

2011 Annual Report

December 31, 2011

Performance Summary (unaudited)

| Inception Dates | One Year Total Return |

Five Years Average Annual Total Return |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class I | Class P | Class H | Class L | Class I | Class P | Class H | Class L | Index | Class I | Class P | Class H | Class L | Index | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global and International Equity Portfolios: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Active International Allocation | 1/17/92 | 1/2/96 | — | — | –14.56 | % | –14.75 | % | — | % | — | % | –12.14 | % | (1 | ) | –3.66 | % | –3.90 | % | — | % | — | % | –4.72 | % | (1 | ) | |||||||||||||||||||||||||||||||||||||||

| Asian Equity | 12/28/10 | 12/28/10 | 12/28/10 | 12/28/10 | –16.88 | –17.08 | –17.08 | –17.57 | –17.31 | (2 | ) | — | — | — | — | — | (2 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

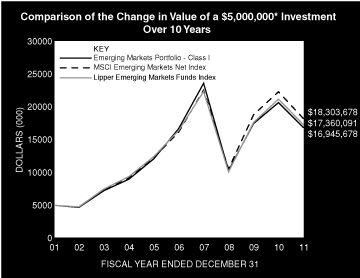

| Emerging Markets | 9/25/92 | 1/2/96 | — | — | –18.41 | –18.63 | — | — | –18.42 | (3 | ) | 0.23 | –0.02 | — | — | 2.40 | (3 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

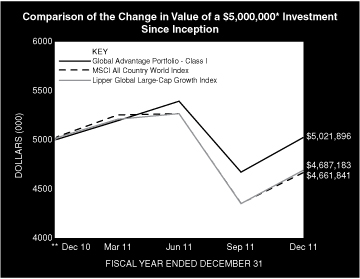

| Global Advantage | 12/28/10 | 12/28/10 | 12/28/10 | 12/28/10 | 0.34 | 0.07 | 0.08 | –0.44 | –7.35 | (4 | ) | — | — | — | — | — | (4 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Global Discovery | 12/28/10 | 12/28/10 | 12/28/10 | 12/28/10 | –7.72 | –7.98 | –7.96 | –8.41 | –7.35 | (4 | ) | — | — | — | — | — | (4 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Global Franchise | 11/28/01 | 11/28/01 | — | — | 9.38 | 8.98 | — | — | –5.54 | (5 | ) | 4.74 | 4.46 | — | — | –2.37 | (5 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Global Insight | 12/28/11 | — | 12/28/11 | 12/28/11 | — | — | — | — | — | (4 | ) | — | — | — | — | — | (4 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Global Opportunity | 5/30/08 | 5/21/10 | 5/30/08 | 5/30/08 | –4.90 | –5.16 | –5.18 | –5.19 | –7.35 | (4 | ) | — | — | — | — | — | (4 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Global Real Estate | 8/30/06 | 8/30/06 | 1/2/08 | 6/16/08 | –9.67 | –9.91 | –9.90 | –10.33 | –6.00 | (6 | ) | –4.94 | –5.21 | — | — | –5.46 | (6 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| International Advantage | 12/28/10 | 12/28/10 | 12/28/10 | 12/28/10 | –1.31 | –1.57 | –1.57 | –2.09 | –13.71 | (7 | ) | — | — | — | — | — | (7 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| International Equity | 8/4/89 | 1/2/96 | — | — | –7.63 | –7.83 | — | — | –12.14 | (1 | ) | –2.63 | –2.88 | — | — | –4.72 | (1 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

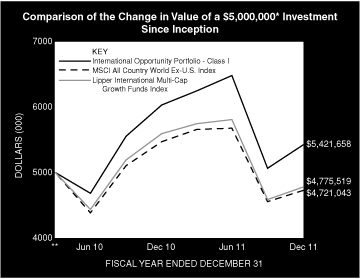

| International Opportunity | 3/31/10 | 3/31/10 | 3/31/10 | 3/31/10 | –10.16 | –10.33 | –10.30 | –10.81 | –13.71 | (7 | ) | — | — | — | — | — | (7 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

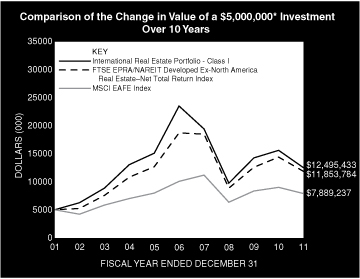

| International Real Estate | 10/1/97 | 10/1/97 | — | — | –19.92 | –20.16 | — | — | –17.81 | (8 | ) | –11.92 | –12.14 | — | — | –8.75 | (8 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| International Small Cap | 12/15/92 | 10/21/08 | — | — | –18.33 | –18.56 | — | — | –15.94 | (9 | ) | –6.39 | — | — | — | –4.14 | (9 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Select Global Infrastructure | 9/20/10 | 9/20/10 | 9/20/10 | 9/20/10 | 15.95 | 15.67 | 15.67 | 15.12 | 13.75 | (10 | ) | — | — | — | — | — | (10 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Equity Portfolios: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Advantage | 6/30/08 | 5/21/10 | 6/30/08 | 6/30/08 | 5.33 | 5.07 | 5.06 | 5.19 | 2.64 | (11 | ) | — | — | — | — | — | (11 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Focus Growth | 3/8/95 | 1/2/96 | — | — | –7.30 | –7.53 | — | — | 2.64 | (11 | ) | 3.76 | 3.49 | — | — | 2.50 | (11 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Growth | 4/2/91 | 1/2/96 | — | — | –3.01 | –3.27 | — | — | 2.64 | (11 | ) | 3.34 | 3.09 | — | — | 2.50 | (11 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Insight | 12/28/11 | — | 12/28/11 | 12/28/11 | — | — | — | — | — | (12 | ) | — | — | — | — | — | (12 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Opportunity | 8/12/05 | 5/21/10 | 5/28/98 | 5/28/98 | –0.46 | –0.72 | –0.73 | –1.17 | 2.64 | (11 | ) | 5.16 | — | 4.86 | 4.18 | 2.50 | (11 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Small Company Growth | 11/1/89 | 1/2/96 | 11/11/11 | 11/11/11 | –9.12 | –9.28 | — | — | –2.91 | (13 | ) | 0.49 | 0.24 | — | — | 2.09 | (13 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Real Estate | 2/24/95 | 1/2/96 | 11/11/11 | 11/11/11 | 5.57 | 5.26 | — | — | 8.29 | (14 | ) | –1.70 | –1.97 | — | — | –1.42 | (14 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed Income Portfolio: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Emerging Markets Debt | 2/1/94 | 1/2/96 | 1/2/08 | 6/16/08 | –3.66 | –3.90 | –3.88 | –4.34 | –1.75 | (15 | ) | 5.15 | 4.86 | — | — | 7.02 | (15 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

6

2011 Annual Report

December 31, 2011

Performance Summary (unaudited) (cont'd)

|

Ten Years Average Annual Total Return |

Since Inception Average Annual Total Return* |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class I | Class P | Class H | Class L | Index | Class I | Index | Class P | Index | Class H | Index | Class L | Index | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Global and International Equity Portfolios: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Active International Allocation | 4.84 | % | 4.57 | % | — | % | — | % | 4.67 | % | (1 | ) | 5.36 | % | 4.82 | % | 4.35 | % | 3.55 | % | — | % | — | % | —% | —%(1) | |||||||||||||||||||||||||||||||||||||

| Asian Equity | — | — | — | — | — | (2 | ) | –15.19 | –15.45 | –15.38 | –15.45 | –15.38 | –15.45 | –15.88 | –15.45 | (2 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Emerging Markets | 12.98 | 12.69 | — | — | 13.86 | (3 | ) | 8.70 | 8.46 | 7.48 | 6.79 | — | — | — | — | (3 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Global Advantage | — | — | — | — | — | (4 | ) | 0.43 | –6.71 | 0.17 | –6.71 | 0.18 | –6.71 | –0.34 | –6.71 | (4 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Global Discovery | — | — | — | — | — | (4 | ) | –7.93 | –6.71 | –8.19 | –6.71 | –8.17 | –6.71 | –8.62 | –6.71 | (4 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Global Franchise | 10.44 | 10.15 | — | — | 3.62 | (5 | ) | 10.85 | 3.76 | 10.55 | 3.76 | — | — | — | — | (5 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Global Insight | — | — | — | — | — | (4 | ) | 0.70 | 1.15 | — | — | 0.70 | 1.15 | 0.70 | 1.15 | (4 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Global Opportunity | — | — | — | — | — | (4 | ) | 2.83 | –4.90 | 16.07 | 7.82 | 2.60 | –4.90 | 2.51 | –4.90 | (4 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Global Real Estate | — | — | — | — | — | (6 | ) | –1.76 | –2.29 | –2.03 | –2.29 | –4.34 | –4.99 | –4.13 | –3.76 | (6 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| International Advantage | — | — | — | — | — | (7 | ) | –1.40 | –12.66 | –1.66 | –12.66 | –1.65 | –12.66 | –2.17 | –12.66 | (7 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| International Equity | 5.72 | 5.47 | — | — | 4.67 | (1 | ) | 8.53 | 3.63 | 7.34 | 3.55 | — | — | — | — | (1 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| International Opportunity | — | — | — | — | — | (7 | ) | 4.73 | –3.22 | 4.47 | –3.22 | 4.49 | –3.22 | 3.95 | –3.22 | (7 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| International Real Estate | 9.59 | 9.31 | — | — | 9.02 | (8 | ) | 6.87 | 4.45 | 6.61 | 4.45 | — | — | — | — | (8 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| International Small Cap | 6.45 | — | — | — | 9.01 | (9 | ) | 8.29 | 4.93 | 6.25 | 12.11 | — | — | — | — | (9 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Select Global Infrastructure | — | — | — | — | — | (10 | ) | 16.57 | 15.80 | 16.29 | 15.80 | 16.29 | 15.80 | 15.73 | 15.80 | (10 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Equity Portfolios: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Advantage | — | — | — | — | — | (11 | ) | 4.73 | 3.09 | 16.05 | 13.66 | 4.49 | 3.09 | 4.53 | 3.09 | (11 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Focus Growth | 3.79 | 3.53 | — | — | 2.60 | (11 | ) | 9.87 | 6.88 | 7.73 | 5.48 | — | — | — | — | (11 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Growth | 3.42 | 3.17 | — | — | 2.60 | (11 | ) | 8.73 | 7.20 | 6.83 | 5.48 | — | — | — | — | (11 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Insight | — | — | — | — | — | (12 | ) | 0.60 | 0.72 | — | — | 0.60 | 0.72 | 0.60 | 0.72 | (12 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Opportunity | — | — | 3.85 | 3.17 | 2.60 | (11 | ) | 6.58 | 3.79 | 14.44 | 13.66 | 3.68 | 1.89 | 2.97 | 1.89 | (11 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Small Company Growth | 5.68 | 5.42 | — | — | 4.48 | (13 | ) | 10.39 | 6.40 | 8.99 | 4.38 | –3.46 | –1.26 | –3.54 | –1.26 | (13 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Real Estate | 10.99 | 10.70 | — | — | 10.20 | (14 | ) | 12.69 | 10.77 | 11.71 | 10.40 | 1.24 | 2.25 | 1.17 | 2.25 | (14 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Fixed Income Portfolio: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Emerging Markets Debt | 9.74 | 9.46 | — | — | 10.49 | (15 | ) | 9.58 | 9.82 | 9.78 | 10.81 | 5.03 | 6.96 | 4.84 | 7.67 | (15 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

Performance data quoted assumes that all dividends and distributions, if any, were reinvested and represents past performance, which is no guarantee of future results. Returns do not reflect the deduction of any applicable sales charges for Class H shares. Such costs would lower performance. Current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.morganstanley.com/im or call 1-800-548-7786. Investment returns and principal value will fluctuate and fund shares, when redeemed, may be worth more or less than their original cost.

* Returns for periods less than one year are not annualized.

Indices:

(1) MSCI EAFE (Europe, Australasia, Far East) Index

(2) MSCI All Country Asia Ex-Japan Index

(3) MSCI Emerging Markets Net Index

(4) MSCI All Country World Index

(5) MSCI World Index

(6) FTSE EPRA/NAREIT Developed Real Estate (Net) Index

(7) MSCI All Country World Index Ex-U.S. Index

(8) FTSE EPRA/NAREIT Developed ex-North America Real Estate Index

(9) MSCI EAFE Small Cap Total Return Index

(10) Dow Jones Brookfield Global Infrastructure IndexSM

(11) Russell 1000® Growth Index

(12) Russell 3000® Value Index

(13) Russell 2000® Growth Index

(14) FTSE NAREIT Equity REITs Index

(15) JP Morgan EMBI Global Bond Index/JP Morgan GBI-EM Global Diversified Bond Index

7

2011 Annual Report

December 31, 2011

Expense Examples (unaudited)

As a shareholder of a Portfolio, you may incur two types of costs: (1) transactional costs, including redemptions fees, and (2) ongoing costs, including management fees, shareholder servicing and distribution fees (in the case of Class P, Class H and Class L) and other Portfolio expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

These examples are based on an investment of $1,000 invested at the beginning of the six-month period ended December 31, 2011 and held for the entire six-month period.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled "Actual Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Please note that "Actual Expenses Paid During Period" are grossed up to reflect Portfolio expenses prior to the effect of Expense Offset (See Note F in the Notes to Financial Statements). Therefore, the annualized net expense ratios may differ from the ratio of expenses to average net assets shown in the Financial Highlights.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

2011 Annual Report

December 31, 2011

Expense Examples (unaudited) (cont'd)

| Portfolio |

Beginning Account Value 7/1/11 |

Actual Ending Account Value 12/31/11 |

Hypothetical Ending Account Value |

Actual Expenses Paid During Period* |

Hypothetical Expenses Paid During Period* |

Net Expense Ratio During Period** |

|||||||||||||||||||||

| Active International Allocation Portfolio Class I | $ | 1,000.00 | $ | 815.80 | $ | 1,020.72 | $ | 4.07 | $ | 4.53 | 0.89 | % | |||||||||||||||

| Active International Allocation Portfolio Class P | 1,000.00 | 814.70 | 1,019.46 | 5.21 | 5.80 | 1.14 | |||||||||||||||||||||

| Asian Equity Portfolio Class I | 1,000.00 | 819.10 | 1,017.95 | 6.60 | 7.32 | 1.44 | |||||||||||||||||||||

| Asian Equity Portfolio Class P | 1,000.00 | 818.00 | 1,016.69 | 7.74 | 8.59 | 1.69 | |||||||||||||||||||||

| Asian Equity Portfolio Class H | 1,000.00 | 818.00 | 1,016.69 | 7.74 | 8.59 | 1.69 | |||||||||||||||||||||

| Asian Equity Portfolio Class L | 1,000.00 | 815.50 | 1,014.17 | 10.02 | 11.12 | 2.19 | |||||||||||||||||||||

| Emerging Markets Portfolio Class I | 1,000.00 | 823.40 | 1,017.69 | 6.85 | 7.58 | 1.49 | |||||||||||||||||||||

| Emerging Markets Portfolio Class P | 1,000.00 | 822.40 | 1,016.43 | 7.99 | 8.84 | 1.74 | |||||||||||||||||||||

| Global Advantage Portfolio Class I | 1,000.00 | 930.80 | 1,018.65 | 6.33 | 6.61 | 1.30 | |||||||||||||||||||||

| Global Advantage Portfolio Class P | 1,000.00 | 930.10 | 1,017.39 | 7.54 | 7.88 | 1.55 | |||||||||||||||||||||

| Global Advantage Portfolio Class H | 1,000.00 | 930.20 | 1,017.39 | 7.54 | 7.88 | 1.55 | |||||||||||||||||||||

| Global Advantage Portfolio Class L | 1,000.00 | 927.90 | 1,014.87 | 9.96 | 10.41 | 2.05 | |||||||||||||||||||||

| Global Discovery Portfolio Class I | 1,000.00 | 828.10 | 1,018.40 | 6.22 | 6.87 | 1.35 | |||||||||||||||||||||

| Global Discovery Portfolio Class P | 1,000.00 | 827.20 | 1,017.14 | 7.37 | 8.13 | 1.60 | |||||||||||||||||||||

| Global Discovery Portfolio Class H | 1,000.00 | 826.70 | 1,017.14 | 7.37 | 8.13 | 1.60 | |||||||||||||||||||||

| Global Discovery Portfolio Class L | 1,000.00 | 824.90 | 1,014.62 | 9.66 | 10.66 | 2.10 | |||||||||||||||||||||

| Global Franchise Portfolio Class I | 1,000.00 | 974.60 | 1,020.16 | 4.98 | 5.09 | 1.00 | |||||||||||||||||||||

| Global Franchise Portfolio Class P | 1,000.00 | 972.60 | 1,018.90 | 6.22 | 6.36 | 1.25 | |||||||||||||||||||||

| Global Insight Portfolio Class I | 1,000.00 | 1,007.00 | 1,000.30 | 0.11 | + | 0.11 | 1.35 | ||||||||||||||||||||

| Global Insight Portfolio Class H | 1,000.00 | 1,007.00 | 1,000.28 | 0.13 | + | 0.13 | 1.60 | ||||||||||||||||||||

| Global Insight Portfolio Class L | 1,000.00 | 1,007.00 | 1,000.24 | 0.17 | + | 0.17 | 2.10 | ||||||||||||||||||||

| Global Opportunity Portfolio Class I | 1,000.00 | 869.20 | 1,018.95 | 5.84 | 6.31 | 1.24 | |||||||||||||||||||||

| Global Opportunity Portfolio Class P | 1,000.00 | 868.00 | 1,017.69 | 7.02 | 7.58 | 1.49 | |||||||||||||||||||||

| Global Opportunity Portfolio Class H | 1,000.00 | 868.40 | 1,017.69 | 7.02 | 7.58 | 1.49 | |||||||||||||||||||||

| Global Opportunity Portfolio Class L | 1,000.00 | 868.10 | 1,017.44 | 7.25 | 7.83 | 1.54 | |||||||||||||||||||||

| Global Real Estate Portfolio Class I | 1,000.00 | 857.40 | 1,019.81 | 5.01 | 5.45 | 1.07 | |||||||||||||||||||||

| Global Real Estate Portfolio Class P | 1,000.00 | 855.90 | 1,018.55 | 6.17 | 6.72 | 1.32 | |||||||||||||||||||||

| Global Real Estate Portfolio Class H | 1,000.00 | 856.80 | 1,018.55 | 6.18 | 6.72 | 1.32 | |||||||||||||||||||||

| Global Real Estate Portfolio Class L | 1,000.00 | 854.10 | 1,016.03 | 8.51 | 9.25 | 1.82 | |||||||||||||||||||||

| International Advantage Portfolio Class I | 1,000.00 | 915.40 | 1,018.90 | 6.03 | 6.36 | 1.25 | |||||||||||||||||||||

| International Advantage Portfolio Class P | 1,000.00 | 913.80 | 1,017.64 | 7.24 | 7.63 | 1.50 | |||||||||||||||||||||

| International Advantage Portfolio Class H | 1,000.00 | 913.90 | 1,017.64 | 7.24 | 7.63 | 1.50 | |||||||||||||||||||||

| International Advantage Portfolio Class L | 1,000.00 | 911.50 | 1,015.12 | 9.64 | 10.16 | 2.00 | |||||||||||||||||||||

| International Equity Portfolio Class I | 1,000.00 | 871.20 | 1,020.42 | 4.48 | 4.84 | 0.95 | |||||||||||||||||||||

| International Equity Portfolio Class P | 1,000.00 | 870.00 | 1,019.16 | 5.66 | 6.11 | 1.20 | |||||||||||||||||||||

| International Opportunity Portfolio Class I | 1,000.00 | 836.00 | 1,019.46 | 5.28 | 5.80 | 1.14 | |||||||||||||||||||||

| International Opportunity Portfolio Class P | 1,000.00 | 835.00 | 1,018.20 | 6.43 | 7.07 | 1.39 | |||||||||||||||||||||

| International Opportunity Portfolio Class H | 1,000.00 | 835.30 | 1,018.20 | 6.43 | 7.07 | 1.39 | |||||||||||||||||||||

| International Opportunity Portfolio Class L | 1,000.00 | 832.90 | 1,015.68 | 8.73 | 9.60 | 1.89 | |||||||||||||||||||||

| International Real Estate Portfolio Class I | 1,000.00 | 780.90 | 1,020.16 | 4.49 | 5.09 | 1.00 | |||||||||||||||||||||

| International Real Estate Portfolio Class P | 1,000.00 | 779.30 | 1,018.90 | 5.61 | 6.36 | 1.25 | |||||||||||||||||||||

| International Small Cap Portfolio Class I | 1,000.00 | 788.10 | 1,019.41 | 5.18 | 5.85 | 1.15 | |||||||||||||||||||||

| International Small Cap Portfolio Class P | 1,000.00 | 786.40 | 1,018.15 | 6.30 | 7.12 | 1.40 | |||||||||||||||||||||

| Select Global Infrastructure Portfolio Class I | 1,000.00 | 1,038.80 | 1,019.41 | 5.91 | 5.85 | 1.15 | |||||||||||||||||||||

| Select Global Infrastructure Portfolio Class P | 1,000.00 | 1,037.20 | 1,018.15 | 7.19 | 7.12 | 1.40 | |||||||||||||||||||||

| Select Global Infrastructure Portfolio Class H | 1,000.00 | 1,037.20 | 1,018.15 | 7.19 | 7.12 | 1.40 | |||||||||||||||||||||

| Select Global Infrastructure Portfolio Class L | 1,000.00 | 1,034.90 | 1,015.63 | 9.75 | 9.65 | 1.90 | |||||||||||||||||||||

| Advantage Portfolio Class I | 1,000.00 | 974.40 | 1,019.91 | 5.23 | 5.35 | 1.05 | |||||||||||||||||||||

| Advantage Portfolio Class P | 1,000.00 | 973.60 | 1,018.65 | 6.47 | 6.61 | 1.30 | |||||||||||||||||||||

| Advantage Portfolio Class H | 1,000.00 | 973.50 | 1,018.65 | 6.47 | 6.61 | 1.30 | |||||||||||||||||||||

| Advantage Portfolio Class L | 1,000.00 | 974.10 | 1,019.71 | 5.42 | 5.55 | 1.09 | |||||||||||||||||||||

| Focus Growth Portfolio Class I | 1,000.00 | 860.20 | 1,020.21 | 4.64 | 5.04 | 0.99 | |||||||||||||||||||||

| Focus Growth Portfolio Class P | 1,000.00 | 859.20 | 1,018.95 | 5.81 | 6.31 | 1.24 | |||||||||||||||||||||

| Growth Portfolio Class I | 1,000.00 | 886.50 | 1,021.53 | 3.47 | 3.72 | 0.73 | |||||||||||||||||||||

9

2011 Annual Report

December 31, 2011

Expense Examples (unaudited) (cont'd)

| Portfolio |

Beginning Account Value 7/1/11 |

Actual Ending Account Value 12/31/11 |

Hypothetical Ending Account Value |

Actual Expenses Paid During Period* |

Hypothetical Expenses Paid During Period* |

Net Expense Ratio During Period** |

|||||||||||||||||||||

| Growth Portfolio Class P | $ | 1,000.00 | $ | 885.50 | $ | 1,020.27 | $ | 4.66 | $ | 4.99 | 0.98 | % | |||||||||||||||

| Insight Portfolio Class I | 1,000.00 | 1,006.00 | 1,000.32 | 0.09 | + | 0.09 | 1.05 | ||||||||||||||||||||

| Insight Portfolio Class H | 1,000.00 | 1,006.00 | 1,000.30 | 0.11 | + | 0.11 | 1.30 | ||||||||||||||||||||

| Insight Portfolio Class L | 1,000.00 | 1,006.00 | 1,000.26 | 0.15 | + | 0.15 | 1.80 | ||||||||||||||||||||

| Opportunity Portfolio Class I | 1,000.00 | 926.70 | 1,020.77 | 4.27 | 4.48 | 0.88 | |||||||||||||||||||||

| Opportunity Portfolio Class P | 1,000.00 | 925.20 | 1,019.51 | 5.48 | 5.75 | 1.13 | |||||||||||||||||||||

| Opportunity Portfolio Class H | 1,000.00 | 924.90 | 1,019.51 | 5.48 | 5.75 | 1.13 | |||||||||||||||||||||

| Opportunity Portfolio Class L | 1,000.00 | 923.10 | 1,016.99 | 7.90 | 8.29 | 1.63 | |||||||||||||||||||||

| Small Company Growth Portfolio Class I | 1,000.00 | 889.40 | 1,019.91 | 5.00 | 5.35 | 1.05 | |||||||||||||||||||||

| Small Company Growth Portfolio Class P | 1,000.00 | 888.40 | 1,018.65 | 6.19 | 6.61 | 1.30 | |||||||||||||||||||||

| Small Company Growth Portfolio Class H | 1,000.00 | 965.40 | 1,004.87 | 1.68 | ++ | 1.71 | 1.30 | ||||||||||||||||||||

| Small Company Growth Portfolio Class L | 1,000.00 | 964.60 | 1,004.21 | 2.33 | ++ | 2.37 | 1.80 | ||||||||||||||||||||

| U.S. Real Estate Portfolio Class I | 1,000.00 | 964.40 | 1,020.06 | 5.05 | 5.19 | 1.02 | |||||||||||||||||||||

| U.S. Real Estate Portfolio Class P | 1,000.00 | 962.50 | 1,018.80 | 6.28 | 6.46 | 1.27 | |||||||||||||||||||||

| U.S. Real Estate Portfolio Class H | 1,000.00 | 1,012.40 | 1,004.93 | 1.65 | ++ | 1.65 | 1.25 | ||||||||||||||||||||

| U.S. Real Estate Portfolio Class L | 1,000.00 | 1,011.70 | 1,004.27 | 2.31 | ++ | 2.31 | 1.75 | ||||||||||||||||||||

| Emerging Markets Debt Portfolio Class I | 1,000.00 | 914.50 | 1,021.02 | 4.01 | 4.23 | 0.83 | |||||||||||||||||||||

| Emerging Markets Debt Portfolio Class P | 1,000.00 | 913.20 | 1,019.76 | 5.21 | 5.50 | 1.08 | |||||||||||||||||||||

| Emerging Markets Debt Portfolio Class H | 1,000.00 | 913.50 | 1,019.76 | 5.21 | 5.50 | 1.08 | |||||||||||||||||||||

| Emerging Markets Debt Portfolio Class L | 1,000.00 | 911.50 | 1,017.24 | 7.61 | 8.03 | 1.58 | |||||||||||||||||||||

* Expenses are calculated using each Portfolio Class' annualized net expense ratio (as disclosed), multiplied by the average account value over the period, and multiplied by 184/365 (to reflect the most recent one-half year period).

** Annualized.

+ Expenses are calculated using each Portfolio Class' annualized net expense ratio (as disclosed), multiplied by the average account value over the period, and multiplied by 3/365 (to reflect the actual days in the period).

++Expenses are calculated using each Portfolio Class' annualized net expense ratio (as disclosed), multiplied by the average account value over the period, and multiplied by 48/365 (to reflect the actual days in the period).

10

2011 Annual Report

December 31, 2011

Investment Overview (unaudited)

Active International Allocation Portfolio

The Active International Allocation Portfolio (the "Portfolio") seeks long-term capital appreciation by investing primarily, in accordance with country and sector weightings determined by the Adviser, in equity securities of non-U.S. issuers which, in the aggregate, replicate broad market indices.

Performance

For the year ended December 31, 2011, the Portfolio had a total return based on net asset value and reinvestment of distributions per share of -14.56%, net of fees, for Class I shares. The Portfolio's Class I shares underperformed against its benchmark, the MSCI EAFE Index (the "Index"), which returned -12.14%.

Factors Affecting Performance

• For 2011, international equities, as represented by the MSCI EAFE Index (the Index), lost 12%. On a regional basis, U.S. equities (+1%) led the developed markets, followed by the equity markets of Europe (-11%), Asia Ex-Japan (-13%), and Japan (-14%). Emerging markets (-18%) lagged developed markets. Within the Index, health care (+6%), consumer staples (+4%), energy (+1%) were the best-performing sectors, while utilities (-19%), financials (-22%), and materials (-23%) lagged the most. (The country and regional returns shown are based on their respective MSCI indexes and are quoted in U.S. dollars.) Versus the U.S. dollar, the Japanese yen was up 5%, the Swiss franc was flat, the British pound declined 1%, and the euro fell 3%.

• The overweight to the materials and industrials sectors and underweights to Europe and the U.K. were the main detractors from relative performance. Conversely, the most significant contributors were the above-benchmark weight in energy and the underweight positions in Asia Ex-Japan, financials, and utilities.

Management Strategies

• 2011 was an agonizing year. After beginning the year with decent positive momentum, the global markets and economy battled the after-effects of Japan's tragic March earthquake and tsunami, a jarring increase in European bond yields and tightening of bank funding, the U.S. Treasury downgrade and political dysfunction over the debt ceiling, and a sharp fall in Chinese property transactions and in the purchasing managers index (PMI). Rolling Arab revolutions, Libya's civil war, and the growing anti-business-as-usual overtones of the global Occupy Wall Street movements further dampened confidence. Market volatility shot up sharply in August and remained elevated through year-end. Under a fragile world economy and an extremely heated and highly fractioned political backdrop, investors were whipsawed on the global equity market roller coaster, with violent movements to the upside and downside on the back of political indecision and rapid shifts in sentiment.

• We believe that the Great Financial Crisis of 2008-2009 marked the end of both the debt super cycle and the extra-long, central bank-managed economic cycles. Many feared both in the summer of 2010 and the summer of 2011 that the U.S. and Europe were on the verge of double-dip recessions. While positive credit and labor market data in the fourth quarter suggests that the U.S. has skirted a recession, "peripheral" European and Chinese growth indicators have lagged. Developments in both regions present significant hurdles to global growth. Europe has just begun a recession that is likely to intensify in coming quarters, as banks de-leverage and sovereigns implement significant fiscal tightening (estimated at 2% of GDP growth). In China, declining residential real estate demand and falling property prices as a result of restrictive property sector regulations may have a serious impact on growth. If the recent weakness in the property demand and prices of major cities spreads to the smaller, but more numerous, lower tier cities, China could have difficulty managing a soft landing. As optimists, we highlight the U.S. economic resilience, the continued growth potential of China, and the tendency of policymakers to do the right thing when all else has failed. However, there is a non-trivial chance of an economic and financial unwinding, apocalyptic scenario.

• We imagine that the apocalyptic scenario would entail the following events. In the months ahead, the Europeans still do not implement a plausible game plan to resolve their sovereign crisis, potentially resulting in Greece having a disorderly default, French debt being downgraded (Standard & Poor's did cut France's credit rating by one notch after the close of the reporting period), Italy and Spain being unable to rollover their maturing debt, and the euro as we know it

11

2011 Annual Report

December 31, 2011

Investment Overview (unaudited) (cont'd)

Active International Allocation Portfolio

disappearing. The resulting disruption and bank freeze would severely deepen the recession already underway in Europe and would drag the U.S. and Chinese economies into sharp double-dip recessions. In a quasi-depressed and highly charged political environment, global capital would retreat within national borders, trade and corporate spending would dry up, and equity markets would once again test the lows of early 2009. While we do not put high odds on such a disorderly scenario (below 25%), other highly regarded investors, whose opinions we take into consideration, think the chances of such a scenario are more like 50-50.

• As we begin 2012, U.S. equities are as cheap versus Treasuries as they have been since the 1930s. Global equity valuations appear to be relatively inexpensive for a stable economic environment, in our view, but not discounted enough to withstand disappointment in global growth or policy. As this letter went to print, the fourth quarter 2011 earnings season was underway. Investors are listening to corporate expectations for 2012 very carefully and subsequently readjusting market multiples.

• On balance, we are wary, but not immediately bearish. The "gloom-and-doom" scenario we outlined above is well known and equity allocations in portfolios ranging from giant pension and sovereign wealth funds to hedge funds are relatively low. Progress in Europe, an easing of the tax/entitlement stalemate in the U.S., signs of a renewal in emerging markets, and improving data points suggest a moderate economic recovery could cause a major shift from current risk adverse sentiment.

• The current cash position in the Portfolio is roughly 4%, which seems prudent to us as political and economic event risk in Europe remains heightened during the first quarter. While we do not neglect the potential for market rallies on the back of reasonable valuations and marginally better economic news, we do note that under the current environment of high levels of debt, skittish investors, limited policy options, as well as a very political year ahead, poor economic and financial market outcomes are quite possible.

* Minimum Investment

In accordance with SEC regulations, Portfolio's performance shown assumes that all recurring fees (including management fees) were deducted and all dividends and distributions were reinvested. The performance of Class P shares will vary from the Class I shares based upon its different inception date and will be negatively impacted by additional fees assessed to that class.

Performance Compared to the Morgan Stanley Capital International (MSCI) EAFE Index(1) and the Lipper International Large-Cap Core Funds Index(2)

| Period Ended December 31, 2011 | |||||||||||||||||||

| Total Returns(3) | |||||||||||||||||||

| Average Annual | |||||||||||||||||||

|

One Year |

Five Years |

Ten Years |

Since Inception(6) |

||||||||||||||||

|

Portfolio — Class I Shares w/o sales charges(4) |

–14.56 | % | –3.66 | % | 4.84 | % | 5.36 | % | |||||||||||

| MSCI EAFE Index | –12.14 | –4.72 | 4.67 | 4.82 | |||||||||||||||

|

Lipper International Large-Cap Core Funds Index |

–13.56 | –4.96 | 3.91 | 5.92 | |||||||||||||||

|

Portfolio — Class P Shares w/o sales charges(5) |

–14.75 | –3.90 | 4.57 | 4.35 | |||||||||||||||

| MSCI EAFE Index | –12.14 | –4.72 | 4.67 | 3.55 | |||||||||||||||

|

Lipper International Large-Cap Core Funds Index |

–13.56 | –4.96 | 3.91 | 4.65 | |||||||||||||||

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. Performance assumes that all dividends and distributions, if any, were reinvested. For the most recent month-end performance figures, please visit www.morganstanley.com/im. Investment return and principal value will fluctuate so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance of share classes will vary due to difference in expenses.

12

2011 Annual Report

December 31, 2011

Investment Overview (unaudited) (cont'd)

Active International Allocation Portfolio

(1) The Morgan Stanley Capital International (MSCI) EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the international equity market performance of developed markets, excluding the US & Canada. The term "free float" represents the portion of shares outstanding that are deemed to be available for purchase in the public equity markets by investors. The MSCI EAFE Index currently consists of 22 developed market country indices. The performance of the Index is listed in U.S. dollars and assumes reinvestment of net dividends. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(2) The Lipper International Large-Cap Core Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper International Large-Cap Core Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. As of the date of this report, the Portfolio was in the Lipper International Large-Cap Core Funds classification.

(3) Total returns for the Portfolio reflect fees waived and expenses reimbursed, if applicable, by the Adviser. Without such waivers and reimbursements, total returns would have been lower. The fee waivers and/or expense reimbursements will continue for one year or until such time as the Fund's Board of Directors acts to discontinue all or a portion of such waivers and/or expense reimbursements when it deems that such action is appropriate.

(4) Commenced operations on January 17, 1992.

(5) Commenced offering on January 2, 1996.

(6) For comparative purposes, average annual since inception returns listed for the Indexes refer to the inception date or initial offering of the respective share class of the Portfolio, not the inception of the Index.

Portfolio Composition*

| Classification |

Percentage of Total Investments |

||||||

| Other** | 61.5 | % | |||||

| Investment Company | 9.7 | ||||||

| Pharmaceuticals | 8.5 | ||||||

| Metals & Mining | 7.3 | ||||||

| Oil, Gas & Consumable Fuels | 7.1 | ||||||

| Commercial Banks | 5.9 | ||||||

| Total Investments | 100.0 | %*** | |||||

* Percentages indicated are based upon total investments (excluding Securities held as Collateral on Loaned Securities) as of December 31, 2011.

** Industries representing less than 5% of total investments.

*** Does not include open long/short futures contracts with an underlying face amount of approximately $26,968,000 and net unrealized depreciation of approximately $144,000. Also does not include open foreign currency exchange contracts with net unrealized depreciation of approximately $265,000.

13

2011 Annual Report

December 31, 2011

Portfolio of Investments

Active International Allocation Portfolio

| Shares |

Value (000) |

||||||||||

| Common Stocks (88.6%) | |||||||||||

| Australia (3.9%) | |||||||||||

| AGL Energy Ltd. | 4,864 | $ | 71 | ||||||||

| Alumina Ltd. | 61,436 | 70 | |||||||||

| Amcor Ltd. | 32,344 | 239 | |||||||||

| AMP Ltd. | 20,428 | 85 | |||||||||

| ASX Ltd. | 896 | 28 | |||||||||

| Australia & New Zealand Banking Group Ltd. | 24,702 | 519 | |||||||||

| BHP Billiton Ltd. (a) | 128,952 | 4,540 | |||||||||

| Boral Ltd. (a) | 23,491 | 86 | |||||||||

| Brambles Ltd. | 12,583 | 92 | |||||||||

| Caltex Australia Ltd. | 3,825 | 46 | |||||||||

| Coca-Cola Amatil Ltd. | 5,977 | 70 | |||||||||

| Cochlear Ltd. (a) | 319 | 20 | |||||||||

| Commonwealth Bank of Australia (a) | 3,975 | 200 | |||||||||

| Computershare Ltd. | 2,767 | 23 | |||||||||

| CSL Ltd. | 4,636 | 152 | |||||||||

| CSR Ltd. (a) | 5,902 | 12 | |||||||||

| DuluxGroup Ltd. (a) | 14,641 | 43 | |||||||||

| Echo Entertainment Group Ltd. (b) | 4,938 | 18 | |||||||||

| Fortescue Metals Group Ltd. | 52,090 | 227 | |||||||||

| GPT Group REIT (Stapled Securities) (c) | 4,988 | 16 | |||||||||

| Incitec Pivot Ltd. | 65,003 | 207 | |||||||||

| Insurance Australia Group Ltd. | 16,506 | 50 | |||||||||

| James Hardie Industries SE CDI | 16,816 | 117 | |||||||||

| Leighton Holdings Ltd. (a) | 1,886 | 37 | |||||||||

| Macquarie Group Ltd. (a) | 2,367 | 58 | |||||||||

| Mirvac Group REIT (Stapled Securities) (a)(c)(d) | 8,147 | 10 | |||||||||

| National Australia Bank Ltd. (a) | 5,099 | 122 | |||||||||

| Newcrest Mining Ltd. | 61,509 | 1,862 | |||||||||

| OneSteel Ltd. | 32,592 | 23 | |||||||||

| Orica Ltd. | 14,276 | 354 | |||||||||

| Origin Energy Ltd. | 10,576 | 144 | |||||||||

| OZ Minerals Ltd. | 11,364 | 116 | |||||||||

| Perpetual Ltd. (a) | 315 | 7 | |||||||||

| Qantas Airways Ltd. (b) | 5,339 | 8 | |||||||||

| QBE Insurance Group Ltd. | 7,459 | 99 | |||||||||

| Rio Tinto Ltd. (a) | 10,857 | 670 | |||||||||

| Santos Ltd. | 6,289 | 79 | |||||||||

| Sims Metal Management Ltd. (a) | 6,190 | 80 | |||||||||

| Sonic Healthcare Ltd. | 2,599 | 30 | |||||||||

| Stockland REIT (Stapled Securities) (c)(d) | 8,391 | 27 | |||||||||

| Suncorp Group Ltd. (a) | 8,001 | 69 | |||||||||

| TABCORP Holdings Ltd. | 4,933 | 14 | |||||||||

| Telstra Corp, Ltd. | 34,266 | 117 | |||||||||

| Toll Holdings Ltd. (a) | 5,604 | 24 | |||||||||

| Transurban Group (Stapled Securities) (c) | 10,994 | 63 | |||||||||

| Treasury Wine Estates Ltd. | 6,561 | 25 | |||||||||

| Wesfarmers Ltd. | 8,383 | 253 | |||||||||

| Westfield Group REIT (Stapled Securities) (c)(d) | 10,520 | 84 | |||||||||

| Westfield Retail Trust REIT | 10,501 | 27 | |||||||||

| Westpac Banking Corp. (a) | 7,742 | 158 | |||||||||

| Shares |

Value (000) |

||||||||||

| Woodside Petroleum Ltd. | 6,199 | $ | 194 | ||||||||

| Woolworths Ltd. | 11,881 | 305 | |||||||||

| WorleyParsons Ltd. | 926 | 24 | |||||||||

| 12,014 | |||||||||||

| Austria (0.5%) | |||||||||||

| Erste Group Bank AG | 11,823 | 208 | |||||||||

| OMV AG | 6,528 | 198 | |||||||||

| Raiffeisen Bank International AG (a) | 3,341 | 87 | |||||||||

| Telekom Austria AG | 32,532 | 390 | |||||||||

| Verbund AG (a) | 4,525 | 122 | |||||||||

|

Vienna Insurance Group AG Wiener Versicherung Gruppe |

2,934 | 116 | |||||||||

| Voestalpine AG | 9,872 | 278 | |||||||||

| 1,399 | |||||||||||

| Belgium (0.9%) | |||||||||||

| Ageas | 12,628 | 20 | |||||||||

| Anheuser-Busch InBev N.V. | 26,825 | 1,642 | |||||||||

| Anheuser-Busch InBev N.V. VVPR (b) | 17,784 | — | @ | ||||||||

| Belgacom SA | 6,959 | 218 | |||||||||

| Delhaize Group SA | 164 | 9 | |||||||||

| Groupe Bruxelles Lambert SA | 3,704 | 247 | |||||||||

| Mobistar SA | 96 | 5 | |||||||||

| Solvay SA, Class A | 2,263 | 186 | |||||||||

| UCB SA | 4,789 | 202 | |||||||||

| Umicore SA | 4,728 | 195 | |||||||||

| 2,724 | |||||||||||

| Brazil (0.1%) | |||||||||||

| All America Latina Logistica SA (Units) (d) | 10,200 | 51 | |||||||||

| Banco do Brasil SA | 8,100 | 103 | |||||||||

| BRF - Brasil Foods SA | 14,848 | 290 | |||||||||

| Cia Energetica de Minas Gerais (Preference) | 1 | — | @ | ||||||||

| 444 | |||||||||||

| Canada (1.3%) | |||||||||||

| Agnico-Eagle Mines Ltd. (a) | 4,900 | 178 | |||||||||

| Barrick Gold Corp. | 28,100 | 1,273 | |||||||||

| Centerra Gold, Inc. | 5,000 | 88 | |||||||||

| Eldorado Gold Corp. | 15,700 | 216 | |||||||||

| Franco-Nevada Corp. | 3,800 | 145 | |||||||||

| Goldcorp, Inc. | 22,400 | 994 | |||||||||

| IAMGOLD Corp. | 10,600 | 169 | |||||||||

| Kinross Gold Corp. | 32,000 | 365 | |||||||||

| New Gold, Inc. (b) | 12,700 | 128 | |||||||||

| Osisko Mining Corp. (b) | 9,900 | 96 | |||||||||

| Yamana Gold, Inc. (a) | 21,700 | 320 | |||||||||

| 3,972 | |||||||||||

| China (0.0%) | |||||||||||

| China Merchants Holdings International Co., Ltd. (e) | 29 | — | @ | ||||||||

| Skyworth Digital Holdings Ltd. (a)(e) | 114 | — | @ | ||||||||

| — | @ | ||||||||||

The accompanying notes are an integral part of the financial statements.

14

2011 Annual Report

December 31, 2011

Portfolio of Investments (cont'd)

Active International Allocation Portfolio

| Shares |

Value (000) |

||||||||||

| Denmark (1.2%) | |||||||||||

| AP Moller - Maersk A/S Series B | 80 | $ | 528 | ||||||||

| DSV A/S | 13,027 | 234 | |||||||||

| Novo Nordisk A/S Series B | 21,308 | 2,449 | |||||||||

| Novozymes A/S Series B | 13,415 | 414 | |||||||||

| TDC A/S | 1,320 | 11 | |||||||||

| Vestas Wind Systems A/S (b) | 9,396 | 101 | |||||||||

| 3,737 | |||||||||||

| Finland (0.8%) | |||||||||||

| Elisa Oyj (a) | 268 | 6 | |||||||||

| Fortum Oyj | 18,201 | 388 | |||||||||

| Kesko Oyj, Class B | 10,179 | 342 | |||||||||

| Kone Oyj, Class B | 5,707 | 296 | |||||||||

| Metso Oyj | 6,139 | 228 | |||||||||

| Neste Oil Oyj | 3,925 | 40 | |||||||||

| Nokia Oyj | 72,648 | 355 | |||||||||

| Sampo Oyj, Class A | 10,536 | 261 | |||||||||

| Stora Enso Oyj, Class R | 27,433 | 164 | |||||||||

| UPM-Kymmene Oyj | 23,485 | 259 | |||||||||

| Wartsila Oyj | 5,505 | 159 | |||||||||

| 2,498 | |||||||||||

| France (4.3%) | |||||||||||

| Accor SA | 3,759 | 95 | |||||||||

| Air Liquide SA | 4,261 | 527 | |||||||||

| Alcatel-Lucent (a)(b) | 10,323 | 16 | |||||||||

| Alstom SA | 11,339 | 344 | |||||||||

| ArcelorMittal | 13,431 | 246 | |||||||||

| AtoS | 497 | 22 | |||||||||

| AXA SA | 19,570 | 254 | |||||||||

| BNP Paribas SA | 9,067 | 356 | |||||||||

| Bouygues SA (a) | 10,509 | 331 | |||||||||

| Cap Gemini SA | 3,035 | 95 | |||||||||

| Carrefour SA | 19,578 | 446 | |||||||||

| Casino Guichard Perrachon SA | 2,469 | 208 | |||||||||

| Cie de St-Gobain | 4,086 | 157 | |||||||||

| Cie Generale d'Optique Essilor International SA | 5,321 | 376 | |||||||||

| Cie Generale de Geophysique-Veritas (b) | 10,908 | 256 | |||||||||

| Cie Generale des Etablissements Michelin Series B | 995 | 59 | |||||||||

| CNP Assurances | 3,726 | 46 | |||||||||

| Credit Agricole SA | 5,762 | 33 | |||||||||

| Danone | 13,703 | 861 | |||||||||

| Dassault Systemes SA | 1,201 | 96 | |||||||||

| Edenred | 3,759 | 93 | |||||||||

| EDF SA | 109 | 3 | |||||||||

| Eurazeo | 539 | 19 | |||||||||

| European Aeronautic Defence and Space Co. N.V. | 2,580 | 81 | |||||||||

| Fonciere Des Regions REIT | 487 | 31 | |||||||||

| France Telecom SA | 29,891 | 469 | |||||||||

| GDF Suez | 6,735 | 184 | |||||||||

| Gecina SA REIT | 392 | 33 | |||||||||

| Hermes International (a) | 307 | 92 | |||||||||

| ICADE REIT (a) | 411 | 32 | |||||||||

| Shares |

Value (000) |

||||||||||

| Imerys SA | 465 | $ | 21 | ||||||||

| Klepierre REIT | 1,814 | 52 | |||||||||

| L'Oreal SA | 1,106 | 116 | |||||||||

| Lafarge SA (a) | 7,873 | 277 | |||||||||

| Lagardere SCA | 3,184 | 84 | |||||||||

| Legrand SA | 424 | 14 | |||||||||

| LVMH Moet Hennessy Louis Vuitton SA | 1,187 | 168 | |||||||||

| Neopost SA (a) | 251 | 17 | |||||||||

| Pernod-Ricard SA | 671 | 62 | |||||||||

| Peugeot SA | 1,160 | 18 | |||||||||

| PPR | 907 | 130 | |||||||||

| Publicis Groupe SA | 1,545 | 71 | |||||||||

| Renault SA | 1,136 | 39 | |||||||||

| Safran SA | 1,108 | 33 | |||||||||

| Sanofi | 21,970 | 1,614 | |||||||||

| Schneider Electric SA | 8,728 | 460 | |||||||||

| SCOR SE | 2,725 | 64 | |||||||||

| Societe BIC SA | 586 | 52 | |||||||||

| Societe Generale SA | 5,183 | 115 | |||||||||

| Societe Television Francaise 1 | 3,828 | 37 | |||||||||

| Sodexo | 1,806 | 130 | |||||||||

| STMicroelectronics N.V. | 13,202 | 78 | |||||||||

| Suez Environnement Co. | 817 | 9 | |||||||||

| Technip SA | 4,733 | 445 | |||||||||

| Thales SA (a) | 1,159 | 37 | |||||||||

| Total SA | 45,255 | 2,314 | |||||||||

| Unibail-Rodamco SE REIT | 1,726 | 310 | |||||||||

| Vallourec SA | 1,220 | 79 | |||||||||

| Veolia Environnement SA | 6,388 | 70 | |||||||||

| Vinci SA | 7,207 | 315 | |||||||||

| Vivendi SA | 16,686 | 365 | |||||||||

| 13,457 | |||||||||||

| Germany (6.5%) | |||||||||||

| Adidas AG | 1,929 | 125 | |||||||||

| Allianz SE (Registered) | 9,957 | 952 | |||||||||

| Axel Springer AG (a) | 200 | 9 | |||||||||

| BASF SE | 25,309 | 1,765 | |||||||||

| Bayer AG (Registered) | 26,024 | 1,664 | |||||||||

| Bayerische Motoren Werke AG | 276 | 19 | |||||||||

| Beiersdorf AG | 2,162 | 123 | |||||||||

| Celesio AG | 3,968 | 63 | |||||||||

| Commerzbank AG (a)(b) | 10,234 | 17 | |||||||||

| Continental AG (b) | 731 | 46 | |||||||||

| Daimler AG (Registered) | 18,430 | 809 | |||||||||

| Deutsche Bank AG (Registered) | 16,744 | 638 | |||||||||

| Deutsche Boerse AG (b) | 1,776 | 93 | |||||||||

| Deutsche Lufthansa AG (Registered) | 9,297 | 111 | |||||||||

| Deutsche Post AG (Registered) | 31,565 | 485 | |||||||||

| Deutsche Telekom AG (Registered) | 110,382 | 1,266 | |||||||||

| E.ON AG | 74,947 | 1,617 | |||||||||

| Fresenius Medical Care AG & Co. KGaA | 9,132 | 621 | |||||||||

| GEA Group AG | 4,471 | 126 | |||||||||

The accompanying notes are an integral part of the financial statements.

15

2011 Annual Report

December 31, 2011

Portfolio of Investments (cont'd)

Active International Allocation Portfolio

| Shares |

Value (000) |

||||||||||

| Germany (cont'd) | |||||||||||

| Hannover Rueckversicherung AG | 194 | $ | 10 | ||||||||

| Henkel AG & Co. KGaA (Preference) | 3,203 | 185 | |||||||||

| Hochtief AG | 2,409 | 139 | |||||||||

| K&S AG (Registered) | 2,249 | 102 | |||||||||

| Lanxess AG | 1,805 | 93 | |||||||||

| Linde AG | 3,164 | 471 | |||||||||

| MAN SE | 236 | 21 | |||||||||

| Merck KGaA | 1,765 | 176 | |||||||||

| Metro AG | 12,088 | 441 | |||||||||

| Muenchener Rueckversicherungs AG (Registered) | 4,325 | 531 | |||||||||

| Porsche Automobil Holding SE (Preference) | 2,748 | 147 | |||||||||

| ProSiebenSat.1 Media AG | 355 | 6 | |||||||||

| Puma SE (a) | 90 | 26 | |||||||||

| RWE AG | 11,421 | 401 | |||||||||

| RWE AG (Preference) | 877 | 29 | |||||||||

| SAP AG | 40,422 | 2,137 | |||||||||

| Siemens AG (Registered) | 40,781 | 3,903 | |||||||||

| ThyssenKrupp AG | 7,875 | 181 | |||||||||

| Volkswagen AG | 2,553 | 342 | |||||||||

| Volkswagen AG (Preference) | 2,295 | 344 | |||||||||

| 20,234 | |||||||||||

| Hong Kong (0.0%) | |||||||||||

| Henderson Land Development Co., Ltd. (a) | 164 | 1 | |||||||||

| Hong Kong Exchanges and Clearing Ltd. (a) | 187 | 3 | |||||||||

| 4 | |||||||||||

| Indonesia (0.3%) | |||||||||||

| Adaro Energy Tbk PT | 98,000 | 19 | |||||||||

| Astra International Tbk PT | 18,500 | 151 | |||||||||

| Bank Central Asia Tbk PT | 112,500 | 99 | |||||||||

| Bank Danamon Indonesia Tbk PT | 28,500 | 13 | |||||||||

| Bank Mandiri Tbk PT | 86,000 | 64 | |||||||||

| Bank Negara Indonesia Persero Tbk PT | 73,500 | 31 | |||||||||

| Bank Rakyat Indonesia Persero Tbk PT | 103,500 | 77 | |||||||||

| Bumi Resources Tbk PT | 170,000 | 41 | |||||||||

| Charoen Pokphand Indonesia Tbk PT | 79,000 | 19 | |||||||||

| Golden Agri-Resources Ltd. | 184,315 | 102 | |||||||||

| Gudang Garam Tbk PT | 5,500 | 38 | |||||||||

| Indo Tambangraya Megah PT | 4,100 | 18 | |||||||||

| Indocement Tunggal Prakarsa Tbk PT | 13,500 | 25 | |||||||||

| Indofood Sukses Makmur Tbk PT | 42,500 | 22 | |||||||||

| Kalbe Farma Tbk PT | 48,500 | 18 | |||||||||

| Perusahaan Gas Negara PT | 100,500 | 35 | |||||||||

| Semen Gresik Persero Tbk PT | 33,500 | 42 | |||||||||

| Tambang Batubara Bukit Asam Tbk PT | 8,000 | 15 | |||||||||

| Telekomunikasi Indonesia Tbk PT | 90,500 | 70 | |||||||||

| Unilever Indonesia Tbk PT | 13,000 | 27 | |||||||||

| United Tractors Tbk PT | 15,984 | 46 | |||||||||

| 972 | |||||||||||

| Ireland (0.0%) | |||||||||||

| CRH PLC | 1,158 | 23 | |||||||||

| Italy (0.2%) | |||||||||||

| Enel SpA | 15,011 | 61 | |||||||||

| Shares |

Value (000) |

||||||||||

| Eni SpA | 6,448 | $ | 134 | ||||||||

| Exor SpA | 3,550 | 71 | |||||||||

| Saipem SpA | 9,857 | 419 | |||||||||

| 685 | |||||||||||

| Japan (23.9%) | |||||||||||

| Advantest Corp. | 8,290 | 79 | |||||||||

| Aeon Credit Service Co., Ltd. (a) | 2,300 | 36 | |||||||||

| Aeon Mall Co., Ltd. | 14,900 | 316 | |||||||||

| Aisin Seiki Co., Ltd. | 10,300 | 294 | |||||||||

| Amada Co., Ltd. | 9,000 | 57 | |||||||||

| Asahi Glass Co., Ltd. (a) | 37,800 | 317 | |||||||||

| Asahi Group Holdings Ltd. (a) | 17,200 | 378 | |||||||||

| Asahi Kasei Corp. | 50,000 | 301 | |||||||||

| Astellas Pharma, Inc. | 19,100 | 777 | |||||||||

| Bank of Kyoto Ltd. (The) (a) | 7,000 | 60 | |||||||||

| Bank of Yokohama Ltd. (The) | 46,000 | 218 | |||||||||

| Benesse Holdings, Inc. | 2,400 | 116 | |||||||||

| Bridgestone Corp. (a) | 56,700 | 1,285 | |||||||||

| Canon, Inc. (a) | 35,100 | 1,555 | |||||||||

| Casio Computer Co., Ltd. (a) | 14,600 | 89 | |||||||||

| Central Japan Railway Co. | 55 | 464 | |||||||||

| Chiba Bank Ltd. (The) (a) | 18,000 | 116 | |||||||||

| Chubu Electric Power Co., Inc. | 10,300 | 192 | |||||||||

| Chugai Pharmaceutical Co., Ltd. (a) | 9,500 | 157 | |||||||||

| Citizen Holdings Co., Ltd. | 16,800 | 98 | |||||||||

| Credit Saison Co., Ltd. | 3,100 | 62 | |||||||||

| Dai Nippon Printing Co., Ltd. (a) | 16,600 | 160 | |||||||||

| Daicel Corp | 8,000 | 49 | |||||||||

| Daiichi Sankyo Co., Ltd. | 51,100 | 1,013 | |||||||||

| Daikin Industries Ltd. | 13,300 | 364 | |||||||||

| Daito Trust Construction Co., Ltd. | 4,200 | 360 | |||||||||

| Daiwa House Industry Co., Ltd. | 26,600 | 317 | |||||||||

| Daiwa Securities Group, Inc. | 61,000 | 190 | |||||||||

| Denki Kagaku Kogyo KK | 21,000 | 78 | |||||||||

| Denso Corp. | 47,850 | 1,322 | |||||||||

| East Japan Railway Co. | 13,700 | 872 | |||||||||

| Eisai Co., Ltd. (a) | 9,100 | 377 | |||||||||

| FamilyMart Co., Ltd. | 7,096 | 287 | |||||||||

| Fanuc Corp. | 10,100 | 1,546 | |||||||||

| Fast Retailing Co., Ltd. | 6,400 | 1,164 | |||||||||

| Fuji Electric Co., Ltd. (a) | 8,000 | 22 | |||||||||

| FUJIFILM Holdings Corp. | 38,100 | 902 | |||||||||

| Fujitsu Ltd. | 147,200 | 765 | |||||||||

| Fukuoka Financial Group, Inc. | 26,000 | 109 | |||||||||

| Furukawa Electric Co., Ltd. | 18,800 | 43 | |||||||||

| GS Yuasa Corp. (a) | 28,000 | 151 | |||||||||

| Hirose Electric Co., Ltd. (a) | 1,200 | 105 | |||||||||

| Hisamitsu Pharmaceutical Co., Inc. (a) | 2,600 | 110 | |||||||||

| Hitachi Construction Machinery Co., Ltd. (a) | 13,600 | 229 | |||||||||

| Hitachi Ltd. | 142,000 | 745 | |||||||||

| Hokkaido Electric Power Co., Inc. | 2,200 | 31 | |||||||||

| Hokuhoku Financial Group, Inc. | 48,000 | 94 | |||||||||

The accompanying notes are an integral part of the financial statements.

16

2011 Annual Report

December 31, 2011

Portfolio of Investments (cont'd)

Active International Allocation Portfolio

| Shares |

Value (000) |

||||||||||

| Japan (cont'd) | |||||||||||

| Honda Motor Co., Ltd. (a) | 76,104 | $ | 2,322 | ||||||||

| Hoya Corp. | 17,500 | 377 | |||||||||

| Ibiden Co., Ltd. | 11,500 | 227 | |||||||||

| IHI Corp. (a) | 36,000 | 87 | |||||||||

| Inpex Corp. | 95 | 599 | |||||||||

| ITOCHU Corp. | 67,500 | 686 | |||||||||

| Itochu Techno-Solutions Corp. (a) | 1,800 | 81 | |||||||||

| Japan Real Estate Investment Corp. REIT | 26 | 203 | |||||||||

| Japan Retail Fund Investment Corp. REIT | 81 | 120 | |||||||||

| Japan Tobacco, Inc. | 171 | 804 | |||||||||

| JFE Holdings, Inc. | 24,300 | 440 | |||||||||

| JGC Corp. | 28,000 | 672 | |||||||||

| Joyo Bank Ltd. (The) (a) | 35,000 | 155 | |||||||||

| JS Group Corp. | 7,500 | 144 | |||||||||

| JSR Corp. | 6,200 | 114 | |||||||||

| JX Holdings, Inc. | 90,546 | 547 | |||||||||

| Kajima Corp. (a) | 39,400 | 121 | |||||||||

| Kaneka Corp. (a) | 10,000 | 53 | |||||||||

| Kansai Electric Power Co., Inc. (The) | 14,700 | 226 | |||||||||

| Kawasaki Heavy Industries Ltd. (a) | 34,000 | 85 | |||||||||

| Kawasaki Kisen Kaisha Ltd. (a) | 143,000 | 258 | |||||||||

| Keikyu Corp. (a) | 15,000 | 135 | |||||||||

| Keio Corp. (a) | 9,000 | 63 | |||||||||

| Keyence Corp. | 3,430 | 827 | |||||||||

| Kintetsu Corp. (a) | 64,200 | 251 | |||||||||

| Kirin Holdings Co., Ltd. (a) | 34,000 | 413 | |||||||||

| Kobe Steel Ltd. | 80,000 | 124 | |||||||||

| Komatsu Ltd. | 55,500 | 1,297 | |||||||||

| Konami Corp. (a) | 4,800 | 144 | |||||||||

| Konica Minolta Holdings, Inc. | 19,500 | 145 | |||||||||

| Kubota Corp. (a) | 77,000 | 645 | |||||||||

| Kuraray Co., Ltd. | 14,000 | 199 | |||||||||

| Kurita Water Industries Ltd. (a) | 2,200 | 57 | |||||||||

| Kyocera Corp. | 12,700 | 1,021 | |||||||||

| Kyushu Electric Power Co., Inc. | 6,400 | 92 | |||||||||

| Mabuchi Motor Co., Ltd. (a) | 5,100 | 212 | |||||||||

| Makita Corp. | 4,000 | 129 | |||||||||

| Marubeni Corp. | 63,000 | 384 | |||||||||

| Mitsubishi Chemical Holdings Corp. (a) | 54,000 | 297 | |||||||||

| Mitsubishi Corp. | 66,900 | 1,352 | |||||||||

| Mitsubishi Electric Corp. | 115,800 | 1,110 | |||||||||

| Mitsubishi Estate Co., Ltd. | 60,000 | 896 | |||||||||

| Mitsubishi Heavy Industries Ltd. | 109,000 | 464 | |||||||||

| Mitsubishi Logistics Corp. | 4,000 | 44 | |||||||||

| Mitsubishi Materials Corp. | 77,000 | 209 | |||||||||

| Mitsubishi Tanabe Pharma Corp. | 9,900 | 157 | |||||||||

| Mitsubishi UFJ Financial Group, Inc. (See Note G-2) | 239,546 | 1,018 | |||||||||

| Mitsui & Co., Ltd. | 54,500 | 848 | |||||||||

| Mitsui Chemicals, Inc. (a) | 21,000 | 64 | |||||||||

| Mitsui Fudosan Co., Ltd. | 42,400 | 618 | |||||||||

| Mitsui OSK Lines Ltd. | 55,000 | 213 | |||||||||

| Mizuho Financial Group, Inc. | 579,900 | 784 | |||||||||

| MS&AD Insurance Group Holdings | 12,160 | 225 | |||||||||

| Murata Manufacturing Co., Ltd. (a) | 8,500 | 437 | |||||||||

| Shares |

Value (000) |

||||||||||

| Nabtesco Corp. (a) | 7,500 | $ | 137 | ||||||||

| NEC Corp. (b) | 100,400 | 203 | |||||||||

| NGK Insulators Ltd. | 22,600 | 268 | |||||||||

| NGK Spark Plug Co., Ltd. | 8,000 | 99 | |||||||||

| Nidec Corp. | 3,400 | 296 | |||||||||

| Nikon Corp. | 11,600 | 258 | |||||||||

| Nintendo Co., Ltd. | 5,200 | 716 | |||||||||

| Nippon Building Fund, Inc. REIT | 29 | 237 | |||||||||

| Nippon Electric Glass Co., Ltd. | 31,500 | 312 | |||||||||

| Nippon Express Co., Ltd. | 33,800 | 132 | |||||||||

| Nippon Paper Group, Inc. (a) | 3,700 | 81 | |||||||||

| Nippon Sheet Glass Co., Ltd. | 16,000 | 30 | |||||||||

| Nippon Steel Corp. (a) | 355,000 | 886 | |||||||||

| Nippon Telegraph & Telephone Corp. | 10,600 | 542 | |||||||||

| Nippon Yusen KK (a) | 43,000 | 110 | |||||||||

| Nishi-Nippon City Bank Ltd. (The) | 18,000 | 52 | |||||||||

| Nissan Motor Co., Ltd. (a) | 103,600 | 931 | |||||||||

| Nitto Denko Corp. (a) | 8,300 | 297 | |||||||||

| NKSJ Holdings, Inc. | 7,700 | 151 | |||||||||

| Nomura Holdings, Inc. | 86,400 | 262 | |||||||||

| Nomura Research Institute Ltd. | 5,900 | 133 | |||||||||

| NSK Ltd. | 22,000 | 143 | |||||||||

| NTN Corp. | 16,000 | 64 | |||||||||

| NTT Data Corp. | 64 | 204 | |||||||||

| NTT DoCoMo, Inc. | 144 | 265 | |||||||||

| Obayashi Corp. | 26,000 | 116 | |||||||||

| OJI Paper Co., Ltd. (a) | 102,400 | 525 | |||||||||

| Omron Corp. (a) | 19,000 | 382 | |||||||||

| Ono Pharmaceutical Co., Ltd. | 3,300 | 185 | |||||||||

| Oracle Corp. Japan | 1,900 | 63 | |||||||||

| Oriental Land Co., Ltd. (a) | 2,500 | 264 | |||||||||

| ORIX Corp. (a) | 470 | 39 | |||||||||

| Osaka Gas Co., Ltd. | 38,600 | 152 | |||||||||

| Otsuka Holdings Co. Ltd. | 10,000 | 281 | |||||||||

| Panasonic Corp. (a) | 118,800 | 1,009 | |||||||||

| Resona Holdings, Inc. | 12,400 | 55 | |||||||||

| Rohm Co., Ltd. | 6,000 | 280 | |||||||||

| Santen Pharmaceutical Co. Ltd. | 3,200 | 132 | |||||||||

| SBI Holdings, Inc. | 383 | 28 | |||||||||

| Secom Co., Ltd. | 6,400 | 295 | |||||||||

| Seiko Epson Corp. (a) | 19,400 | 258 | |||||||||

| Sekisui Chemical Co., Ltd. | 18,000 | 148 | |||||||||

| Sekisui House Ltd. | 38,600 | 343 | |||||||||

| Seven & I Holdings Co., Ltd. | 21,500 | 599 | |||||||||

| Sharp Corp. (a) | 31,200 | 273 | |||||||||

| Shimamura Co., Ltd. | 900 | 92 | |||||||||

| Shimano, Inc. (a) | 7,800 | 379 | |||||||||

| Shimizu Corp. (a) | 27,600 | 116 | |||||||||

| Shin-Etsu Chemical Co., Ltd. | 25,496 | 1,255 | |||||||||

| Shinsei Bank Ltd. | 43,000 | 45 | |||||||||

| Shionogi & Co., Ltd. | 12,300 | 158 | |||||||||

| Shiseido Co., Ltd. (a) | 15,600 | 287 | |||||||||

| Shizuoka Bank Ltd. (The) (a) | 16,000 | 169 | |||||||||

| Showa Denko KK (a) | 31,000 | 63 | |||||||||

The accompanying notes are an integral part of the financial statements.

17

2011 Annual Report

December 31, 2011

Portfolio of Investments (cont'd)

Active International Allocation Portfolio

| Shares |

Value (000) |

||||||||||

| Japan (cont'd) | |||||||||||

| Showa Shell Sekiyu KK (a) | 7,500 | $ | 51 | ||||||||

| SMC Corp. | 3,800 | 613 | |||||||||

| Softbank Corp. | 51,800 | 1,526 | |||||||||

| Sony Corp. | 40,497 | 727 | |||||||||

| Stanley Electric Co., Ltd. | 17,900 | 263 | |||||||||

| Sumitomo Chemical Co., Ltd. (a) | 55,600 | 203 | |||||||||

| Sumitomo Corp. | 32,700 | 443 | |||||||||

| Sumitomo Electric Industries Ltd. | 20,500 | 223 | |||||||||

| Sumitomo Heavy Industries Ltd. | 16,000 | 93 | |||||||||

| Sumitomo Metal Industries Ltd. | 284,000 | 517 | |||||||||

| Sumitomo Metal Mining Co., Ltd. | 62,800 | 807 | |||||||||

| Sumitomo Mitsui Financial Group, Inc. | 27,100 | 755 | |||||||||

| Sumitomo Mitsui Trust Holdings, Inc. | 148,544 | 436 | |||||||||

| Sumitomo Realty & Development Co., Ltd. | 18,000 | 315 | |||||||||

| Suzuki Motor Corp. | 17,500 | 362 | |||||||||

| Sysmex Corp. | 7,400 | 241 | |||||||||

| T&D Holdings, Inc. | 14,100 | 131 | |||||||||

| Taisei Corp. | 39,000 | 99 | |||||||||

| Takeda Pharmaceutical Co., Ltd. | 40,300 | 1,770 | |||||||||

| TDK Corp. | 5,200 | 230 | |||||||||

| Teijin Ltd. | 36,400 | 112 | |||||||||

| Terumo Corp. | 13,200 | 622 | |||||||||

| THK Co., Ltd. (a) | 1,600 | 32 | |||||||||

| Tobu Railway Co., Ltd. (a) | 33,400 | 171 | |||||||||

| Tohoku Electric Power Co., Inc. (a) | 8,700 | 84 | |||||||||

| Tokio Marine Holdings, Inc. | 32,252 | 714 | |||||||||

| Tokyo Electron Ltd. | 13,400 | 682 | |||||||||

| Tokyo Gas Co., Ltd. | 44,600 | 205 | |||||||||

| Tokyu Corp. (a) | 40,400 | 199 | |||||||||

| Tokyu Land Corp. | 31,000 | 117 | |||||||||

| TonenGeneral Sekiyu KK (a) | 14,000 | 153 | |||||||||

| Toppan Printing Co., Ltd. (a) | 16,600 | 122 | |||||||||

| Toray Industries, Inc. (a) | 49,100 | 351 | |||||||||

| Toshiba Corp. (a) | 170,000 | 696 | |||||||||

| Tosoh Corp. | 23,000 | 62 | |||||||||

| TOTO Ltd. | 15,600 | 120 | |||||||||

| Toyo Seikan Kaisha Ltd. | 8,000 | 109 | |||||||||

| Toyota Boshoku Corp. (a) | 9,700 | 101 | |||||||||

| Toyota Industries Corp. | 3,250 | 88 | |||||||||

| Toyota Motor Corp. | 52,800 | 1,760 | |||||||||

| Trend Micro, Inc. (a) | 4,800 | 143 | |||||||||

| Unicharm Corp. | 10,100 | 498 | |||||||||

| Ushio, Inc. | 1,600 | 23 | |||||||||

| USS Co., Ltd. | 1,250 | 113 | |||||||||

| West Japan Railway Co. | 1,900 | 83 | |||||||||

| Yahoo! Japan Corp. (a) | 763 | 246 | |||||||||

| Yakult Honsha Co., Ltd. (a) | 9,199 | 290 | |||||||||

| Yamada Denki Co., Ltd. (a) | 4,190 | 285 | |||||||||

| Yamaha Corp. | 5,100 | 47 | |||||||||

| Yamaha Motor Co., Ltd. | 1,800 | 23 | |||||||||

| Yamato Holdings Co., Ltd. | 10,600 | 179 | |||||||||

| Yokogawa Electric Corp. (a)(b) | 11,000 | 99 | |||||||||

| 74,701 | |||||||||||

| Shares |

Value (000) |

||||||||||

| Korea, Republic of (1.2%) | |||||||||||

| Amorepacific Corp. | 22 | $ | 20 | ||||||||

| Cheil Industries, Inc. | 481 | 42 | |||||||||

| Daewoo Securities Co., Ltd. | 1,230 | 11 | |||||||||

|

Doosan Heavy Industries and Construction Co., Ltd. |

646 | 37 | |||||||||

| E-Mart Co., Ltd. | 159 | 38 | |||||||||

| GS Engineering & Construction Corp. | 417 | 34 | |||||||||

| Hana Financial Group, Inc. | 1,290 | 40 | |||||||||

| Hynix Semiconductor, Inc. (b) | 3,060 | 59 | |||||||||

| Hyundai Engineering & Construction Co., Ltd. (b) | 500 | 31 | |||||||||

| Hyundai Heavy Industries Co., Ltd. | 284 | 64 | |||||||||

| Hyundai Mobis (b) | 397 | 101 | |||||||||

| Hyundai Motor Co. | 949 | 176 | |||||||||

| Hyundai Steel Co. (b) | 507 | 42 | |||||||||

| Industrial Bank of Korea (b) | 2,060 | 22 | |||||||||

| KB Financial Group, Inc. | 2,410 | 76 | |||||||||

| Kia Motors Corp. | 1,430 | 83 | |||||||||

| Korea Electric Power Corp. (b) | 1,710 | 38 | |||||||||

| Korea Exchange Bank | 3,450 | 22 | |||||||||

| Korean Air Lines Co., Ltd. (b) | 248 | 9 | |||||||||

| KT Corp. | 1,430 | 44 | |||||||||

| KT&G Corp. | 749 | 53 | |||||||||

| LG Chem Ltd. | 298 | 83 | |||||||||

| LG Corp. | 1,151 | 62 | |||||||||

| LG Display Co., Ltd. (b) | 1,520 | 32 | |||||||||

| LG Electronics, Inc. | 675 | 44 | |||||||||

| LG Household & Health Care Ltd. | 62 | 26 | |||||||||

| Lotte Shopping Co., Ltd. | 87 | 26 | |||||||||

| NCSoft Corp. | 104 | 28 | |||||||||

| NHN Corp. | 282 | 52 | |||||||||

| OCI Co., Ltd. (b) | 119 | 23 | |||||||||

| POSCO | 400 | 132 | |||||||||

| S-Oil Corp. | 490 | 43 | |||||||||

| Samsung C&T Corp. | 985 | 59 | |||||||||

| Samsung Electro-Mechanics Co., Ltd. | 391 | 27 | |||||||||

| Samsung Electronics Co., Ltd. | 1,696 | 1,561 | |||||||||

| Samsung Electronics Co., Ltd. (Preference) | 124 | 72 | |||||||||

| Samsung Engineering Co., Ltd. | 238 | 42 | |||||||||

| Samsung Fire & Marine Insurance Co., Ltd. | 256 | 47 | |||||||||

| Samsung Heavy Industries Co., Ltd. | 1,520 | 37 | |||||||||

| Samsung SDI Co., Ltd. | 244 | 29 | |||||||||

| Samsung Securities Co., Ltd. | 482 | 21 | |||||||||

| Samsung Techwin Co., Ltd. | 263 | 12 | |||||||||

| Shinhan Financial Group Co., Ltd. | 2,670 | 93 | |||||||||