As filed with the Securities and Exchange Commission on February 9, 2024

Registration No. 333-268190

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Corporation Service Company

1900 W. Littleton Boulevard

Littleton, Colorado 80120

Tel: (303) 832 7579

(Name, address, including zip code, and telephone number,

including area code, of agent for service of process)

Copies To:

Vincent J. McGill, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, NY 10105 Telephone: (516) 220-6569 |

Louis A. Bevilacqua, Esq. Bevilacqua PLLC 1050 Connecticut Avenue, NW, Suite 500 Washington, DC 20036 (202) 869-0888 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller

reporting company | |

| Emerging

growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 9, 2024

PRELIMINARY PROSPECTUS

AiXin Life International, Inc.

[$9,500,000]

Shares of Common Stock

This is a public offering of common stock, par value $0.00001 per share (“common stock”), by AiXin Life International, Inc., a Colorado company. Throughout this prospectus, unless the context requires otherwise, all references to “AiXin Colorado” refer to AiXin Life International, Inc., a holding company, and references to “Aixin Life,” we,” “us,” “our,” the “Registrant,” the “Company” or “our Company” are to AiXin Colorado collectively with our PRC Subsidiaries and AiXin BVI. We are offering 2,375,000 shares of common stock on a firm commitment basis. We currently expect the public offering price to be $4.00 per share.

The offering is being made on a “firm commitment” basis by Boustead Securities, LLC. See “Underwriting.”

Our shares of common stock offered in this prospectus are shares of AiXin Colorado which has no material operations of its own. AiXin Colorado conducts substantially all of its operations through operating companies established in the People’s Republic of China, or the PRC, specifically, Chengdu AiXinZhonghong Biological Technology Co., Ltd, (“AiXinZhonghong”), AiXin Shangyan Hotel Management Co. Ltd. (“AiXin Hotel”), Chengdu Aixintang Haichuan Pharmacy (which together with certain affiliated entities is referred to as “Chengdu Aixintang Pharmacies”), and Yunnan Runcangsheng Technology Co., Ltd. (“Runcangsheng,” collectively with AiXinZhonghong, Aixin Hotel and Chengdu Aixintang Pharmacies, the “Chinese Operating Companies”). The Chinese Operating Companies are wholly owned through an intermediary company established in Hong Kong named HK AiXin International Group Co., Limited (“AiXin HK” and collectively with our Chinese Operating Companies our “PRC Subsidiaries”), which is owned by an intermediary company (AiXin (BVI) International Group, Ltd., “AiXin BVI”) established in the British Virgin Islands. We are not a Chinese operating company. We are a holding company and do not directly own any substantive business operations in China. Therefore, you will not directly hold any equity interests in our Chinese Operating Companies, AiXin BVI or AiXin HK. Our holding company structure involves unique risks to investors. Chinese regulatory authorities could disallow our operating structure, which would likely result in a material change in our operations and/or the value of our common stock, including causing the value of our common stock to significantly decline or become worthless. For a detailed description of risks related to our corporate structure, see “Risk Factors—Risks Relating to Our Holding Company Structure” for detailed discussions.

Additionally, as we conduct substantially all of our operations in China, we are subject to legal and operational risks associated with our business operations in China and our holding company in Hong Kong including risks related to the legal, political and economic policies of the PRC government, the relations between China and the United States, or Chinese or United States regulations, which risks could result in a material change in our operations or cause the value of our common stock to significantly decline or become worthless and affect our ability to offer or continue to offer securities to investors. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and we face the risk that changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business. These risks associated with our being based in or conducting substantially all of our operations through operating companies established in China could cause the value of our securities to significantly decline or become worthless. Furthermore, these risks may result in a material change in our business operations or a complete hinderance of our ability to offer or continue to offer our securities to investors. The PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in securities markets, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts to enforce anti-monopoly laws and regulations. As confirmed by our PRC counsel, Beijing Dentons Law Offices, LLP (Chengdu) (“Dentons” or “PRC Counsel”) the business conducted by our subsidiaries until now is not subject to cybersecurity review with the Cyberspace Administration of China, or CAC, given that we are not an operator of critical information infrastructure or an online platform operator as defined by the Measures for Cybersecurity Review (2021 version). In addition, as confirmed by our PRC Counsel, we are not subject to merger control review by China’s anti-monopoly enforcement agency due to the level of revenues reported by us and audited by our auditor KCCW Accountancy Corp, and the fact that we currently do not expect to propose or implement any acquisition of control of, or decisive influence over, any company with revenues within China of more than RMB400 million. To date, the statements and regulatory actions related to cybersecurity and anti-monopoly policies have had no impact on our daily business operations, the ability to accept foreign investments and list our securities on a U.S. or other foreign exchange. As of the date of this prospectus, no effective laws or regulations in the PRC explicitly require us to seek approval from the China Securities Regulatory Commission (the “CSRC”) or any other PRC governmental authorities for our overseas listing, nor has our Company or any of our subsidiaries received any inquiry, notice, warning or sanctions regarding our overseas listing from the CSRC or any other PRC governmental authorities. However, since these statements and regulatory actions are new, it is highly uncertain as to how soon legislative or administrative regulation making bodies will respond to ongoing developments and what existing or new laws or regulations or detailed implementation policies and interpretations will be promulgated or modified and the potential impact such new laws or modified laws and regulations will have on our daily business operations, the ability to accept foreign investments and list our securities on a U.S. or other foreign exchange. The Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”), came into effect March 31, 2023. The Trial Measures apply to overseas securities offerings and/or listings conducted by companies incorporated in the PRC, PRC domestic companies, and companies incorporated overseas with operations primarily in the PRC, indirect offerings. The Trial Measures require (1) the filing of the overseas offering and listing plan by the PRC domestic companies with the CSRC under certain conditions, and (2) the filing by the underwriter with the CSRC under certain conditions and (3) the submission of an annual report to the CSRC within the required timeline. Based on the advice of our PRC Counsel, this offering will be considered an indirect offering. However, our PRC Counsel has advised that because our common stock currently trades in the U.S., we are not required to submit filings to the CSRC before this offering is completed and this offering is not conditioned on CSRC approval. Rather, within three days of the closing of this offering we must submit filings to the CSRC in accordance with the Trial Measures. If we were to fail to comply with the post-offering filing obligations imposed by the Trial Measures or make a misrepresentation, misleading statement or material omission in the materials we submit to the CSRC, the CSRC would have the right to order rectification, issue a warning and impose a fine on us of between RMB1 million and RMB10 million and issuing a warning to the parties responsible for such failure, misrepresentation or material omission and impose a fine on each of such individuals ranging from RMB500,000 to RMB5 million. See “Risk Factors” for a discussion of these legal and operational risks and other information that should be considered before making a decision to purchase our common stock.

As a holding company, our ability to pay dividends to our shareholders and to service any debt we may incur at the holding company level may depend upon dividends or interest paid by our Chinese Operating Companies and AiXin HK (collectively, our “PRC Subsidiaries”). Current PRC regulations permit our PRC Subsidiaries to pay dividends to us only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, each of our PRC Subsidiaries is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. As of the date hereof, we have had no transactions that involved the transfer of cash or assets throughout our corporate structure. In order for us to pay dividends to our shareholders we will rely on the distribution of dividends through AiXin HK from our Chinese Operating Companies. As of the date hereof, none of our Chinese Operating Companies has distributed any cash or other assets to AiXin HK, including by way of dividends or interest payments, AiXin HK has not distributed any cash or other assets to AiXin BVI, and AiXin Colorado and Aixin BVI have not transferred any cash or other assets to any of our PRC Subsidiaries. AiXin Colorado does not currently plan or anticipate transferring cash or other assets from our operations in China to any non-Chinese entity. As of the date hereof, no transfers, dividends or distributions have been made to our investors. To the extent our cash or other assets is in one of our Chinese Operating Companies or AiXin HK, the funds or assets may not be available to fund operations or for use outside of mainland China or Hong Kong including for the payment of dividends to the shareholders of AiXin Colorado, due to interventions by the governments of PRC or Hong Kong, or the imposition of restrictions and limitations on the ability of the PRC Subsidiaries to use such cash or assets imposed by the government of mainland China or Hong Kong. See “Prospectus Summary – Summary of Risk Factors – Risks Relating to Our Holding Company Structure,” and “Risk Factors – Risks Relating to Our Holding Company Structure - We may rely on dividends and other distributions on equity paid by our PRC Subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC Subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business.” For a detailed description of limitations on the Company’s ability to transfer cash through our corporate structure, see “Prospectus Summary - Transfers of Cash to and from our Subsidiaries.”

Except for such limitations on our Company’s ability to transfer cash and other assets among our entities currently or hereafter imposed by the governments of the PRC and Hong Kong, there are no limitations on our Company’s ability to transfer cash and other assets through our corporate structure. Our Company does not have any cash management policies with respect to the transfer of cash among our entities other than requirements for the approval of management for transfers in excess of specified amounts and none of our entities is currently party to any debenture, loan or other agreement which imposes restrictions or otherwise limits our Company’s ability to transfer our cash and other assets. We have not adopted any policies that dictate how funds are transferred among our entities other than as necessary to comply with applicable laws. See “Prospectus Summary - Transfers of Cash to and from our Subsidiaries.”

Pursuant to the Holding Foreign Companies Accountable Act (“HFCAA”), the Public Company Accounting Oversight Board (United States) (the “PCAOB”) issued a Determination Report on December 16, 2021 which found that the PCAOB was then unable to inspect or investigate completely registered public accounting firms headquartered in mainland China of the PRC and Hong Kong, a Special Administrative Region and dependency of the PRC. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. Our registered public accounting firm, KCCW Accountancy Corp. is not headquartered in mainland China or Hong Kong and was not identified in this report as a firm subject to the PCAOB’s determinations. KCCW Accountancy Corp. is registered with the PCAOB and is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess KCCW Accountancy Corp.’s compliance with applicable professional standards. KCCW Accountancy Corp. has been inspected by the PCAOB on a regular basis, with the last inspection in 2022. On December 15, 2022, the PCAOB determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB will consider the need to issue a new determination. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”) was enacted, which amended the HFCA Act by decreasing the number of non-inspection years from three years to two, thus reducing the time period before our common stock may be prohibited from trading or delisted if the PCAOB was unable to inspect our auditor. Notwithstanding the foregoing, if the PCAOB is not able to inspect and investigate completely our auditor’s work papers in China, you may be deprived of the benefits of such inspection which could result in a limitation on or a restriction to our access to the U.S. capital markets. Further, trading of our securities may be prohibited under the HFCAA and Nasdaq may determine to delist our securities if the PCAOB determines that it cannot inspect or investigate completely our auditor under the HFCAA. For more details, see “Risk Factors – Risk Associated with Our Company -A recent joint statement by the SEC and the Public Company Accounting Oversight Board (United States), or the “PCAOB,” proposed rule changes submitted by Nasdaq, and the newly enacted “Holding Foreign Companies Accountable Act” all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering.”

We are a reporting company under Section 12(g) of the Securities Exchange Act of 1934, as amended. Our common stock is currently quoted on the OTCQB (the “OTCQB”) under the symbol “AIXN.” The last reported closing price for our common stock on February 8, 2024, was $0.50 per share. There is a limited public trading market for our common stock. We have applied to list our common stock on the Nasdaq Capital Market under the symbol “AIXN.” There can be no assurance that our application will be approved. The closing of this offering is contingent upon the successful listing of our common stock on the Nasdaq Capital Market.

Investing in our securities involves a significant degree of risks. You should carefully consider the risk factors beginning on page 15 of this prospectus and set forth in the documents incorporated by reference herein before making any decision to invest in our securities.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this registration statement. Any representation to the contrary is a criminal offense.

| Per share | Total | |||||||

| Public offering price | $ | 4.00 | $ | 9,500,000 | ||||

| Underwriting discounts and commissions (1) | $ | 0.32 | $ | 760,000 | ||||

| Offering proceeds to us, before expenses | $ | 3.68 | $ | 8,740,000 | ||||

| (1) | Does not include additional items of compensation payable to Boustead Securities, LLC, the underwriter, which includes warrants to purchase 5% of the aggregate number of shares issued in this offering, with an exercise price equal to 125% of the price per share sold in this offering. We have also agreed to reimburse the underwriter for certain accountable expenses incurred by them. See “Underwriting.” |

We have also granted a 45-day option to the underwriter to purchase up to additional [356,250] shares of common stock solely to cover over-allotments, if any.

The underwriter expects to deliver our shares of common stock to purchasers in this offering on or about [●], 2024.

The date of this prospectus is [●], 2024

TABLE OF CONTENTS

| i |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC” or the “Commission”). You should rely only on the information contained in this prospectus or any supplement or amendment hereto. Neither we, nor the underwriter have authorized any person to provide you with different information. Neither we, nor the underwriter are offering to sell, or seeking an offer to buy, our common stock in any jurisdiction where such offer or sale is not permitted. You should assume that the information contained in this prospectus and any supplement or amendment hereto is accurate only as of their respective dates, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

On October 27, 2020, we effected a 1-for-4 reverse split of our shares of common stock. Concurrently with the reverse split we reduced the number of our authorized shares of common stock from 900,000,000 shares to 500,000,000 shares. On February 17, 2023, we effected a 1-for-2 reverse split of our shares of common stock. At such time the number of our authorized shares of common stock remained 500,000,000 shares. On March 1, 2023, Quanzhong Lin entered into a Contribution Agreement wherein he agreed to contribute to the capital of AiXin Colorado seven million shares of common stock of AiXin Colorado effective upon effectiveness of the Registration Statement of which this prospectus is a part. Except as otherwise indicated, all share and per share numbers contained herein other than those set forth in the financial statements beginning on page F-1, have been adjusted to give effect to the 1-for-4 and 1-for-2 reverse stock splits and the reduction in the number of our shares of our common stock outstanding to occur as result of a contribution to our capital of 7 million shares of our common stock to be made by Mr. Quanzhong Lin, our Chairman, President, Chief Executive Officer and principal shareholder.

You should read this prospectus, together with additional information described under “Where You Can Find More Information”, beginning on page 81, before making an investment decision.

The market data and certain other statistical information used throughout this prospectus is based on independent industry publications, reports by market research firms or other independent sources that we believe to be reliable sources. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We are responsible for all of the disclosure contained in this prospectus, and we believe these industry publications and third-party research, surveys and studies are reliable. While we are not aware of any misstatements regarding any third-party information presented in this prospectus, their estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors. Some market and other data included herein, as well as the data of competitors as they relate to Aixin, is also based on our good faith estimates.

Unless the context otherwise requires, all references in this prospectus to:

| ● | “AiXin Colorado” refers to AiXin Life International, Inc., a Colorado corporation; | |

| ● | “AiXin BVI” refers to AiXin (BVI) International Group, Ltd., a British Virgin Islands corporation; | |

| ● | “AiXin HK” refers to HK AiXin International Group Co., Limited, a Hong Kong limited company; | |

| ● | “AiXinZhonghong” refers to Chengdu AiXinZhonghong Biological Technology Co., Ltd, a Chinese limited company and each of the affiliated Chinese limited companies owned by AiXinZhonghong which operates a pharmacy; | |

| ● | “AiXin Hotel” refers to Chengdu AiXin Shangyan Hotel Management Co., Ltd., a Chinese limited company; | |

| ● | “Aixintang Pharmacy” refers to Chengdu Aixintang Haichuan Pharmacy, a Chinese limited Company; | |

| ● | “Chengdu Aixintang Pharmacies” refers to Aixintang Pharmacy and each of the affiliated Chinese limited companies owned by Aixintang Pharmacy which operates a pharmacy; | |

| ● | “Runcangsheng” refers to Yunnan Runcangsheng Technology Co., Ltd. a Chinese limited company; | |

| ● | “Chinese Operating Companies” refers to, collectively, AiXinZhonghong, AiXin Hotel, Chengdu Aixintang Pharmacies and Runcangsheng; | |

| ● | “PRC Subsidiaries refers to, collectively, AiXin HK and the Chinese Operating Companies; | |

| ● | “Aixin Life,” “we,” “us,” “our,” the “Registrant”, the “Company,” or “our Company” refer to AiXin Colorado and our PRC Subsidiaries and Chinese Operating Companies, as appropriate; | |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; | |

| ● | “SEC” or the “Commission” refers to the United States Securities and Exchange Commission; | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; | |

| ● | “China,” “Chinese” or the “PRC” refers to the People’s Republic of China, including Hong Kong and Macau and excluding Taiwan; | |

| ● | all references to “RMB” or “Chinese Yuan” is to the legal currency of the People’s Republic of China; and | |

| ● | all references to “U.S. dollars,” “dollars,” “USD” or “$” are to the legal currency of the United States; |

AiXin Colorado’s reporting currency is the U.S. dollar. The functional currency of AiXin Colorado is the U.S. dollar and the functional currency of the Chinese Subsidiaries is the Chinese Renminbi (“RMB”). For the subsidiaries whose functional currencies are the RMB, all assets and liabilities are translated at exchange rates at the balance sheet date, which are 7.2960 and 6.8972 as of September 30, 2023 and December 31, 2022, respectively. Revenue and expenses are translated at the average yearly exchange rates, which are 7.0467, 6.7290 and 6.4508 for the three years ended December 31, 2023, 2022 and 2021, respectively, and 7.0343 for the nine months ended September 30, 2023. The equity is translated at historical exchange rates. Any translation adjustments resulting are not included in determining net income but are included in foreign exchange adjustments to other comprehensive loss, a component of equity.

| 1 |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, especially the risks of investing in our securities as discussed under “Risk Factors” and the financial statements and notes thereto herein. The following summary is qualified in its entirety by the detailed information appearing elsewhere in this prospectus.

Overview

Our Business

We, AiXin Life International, Inc. (“AiXin Colorado,” together with our Chinese Operating Companies and PRC Subsidiaries, as appropriate, referred to as “AiXin Life,” the “Company”, “we”, “us” and “our” unless specified otherwise) are a Colorado holding company with no material operations of our own. We conduct substantially all of our operations through our wholly-owned operating companies in the PRC. This is an offering of common stock of our Colorado holding company. Therefore, you will not directly own any equity interests in our operating companies.

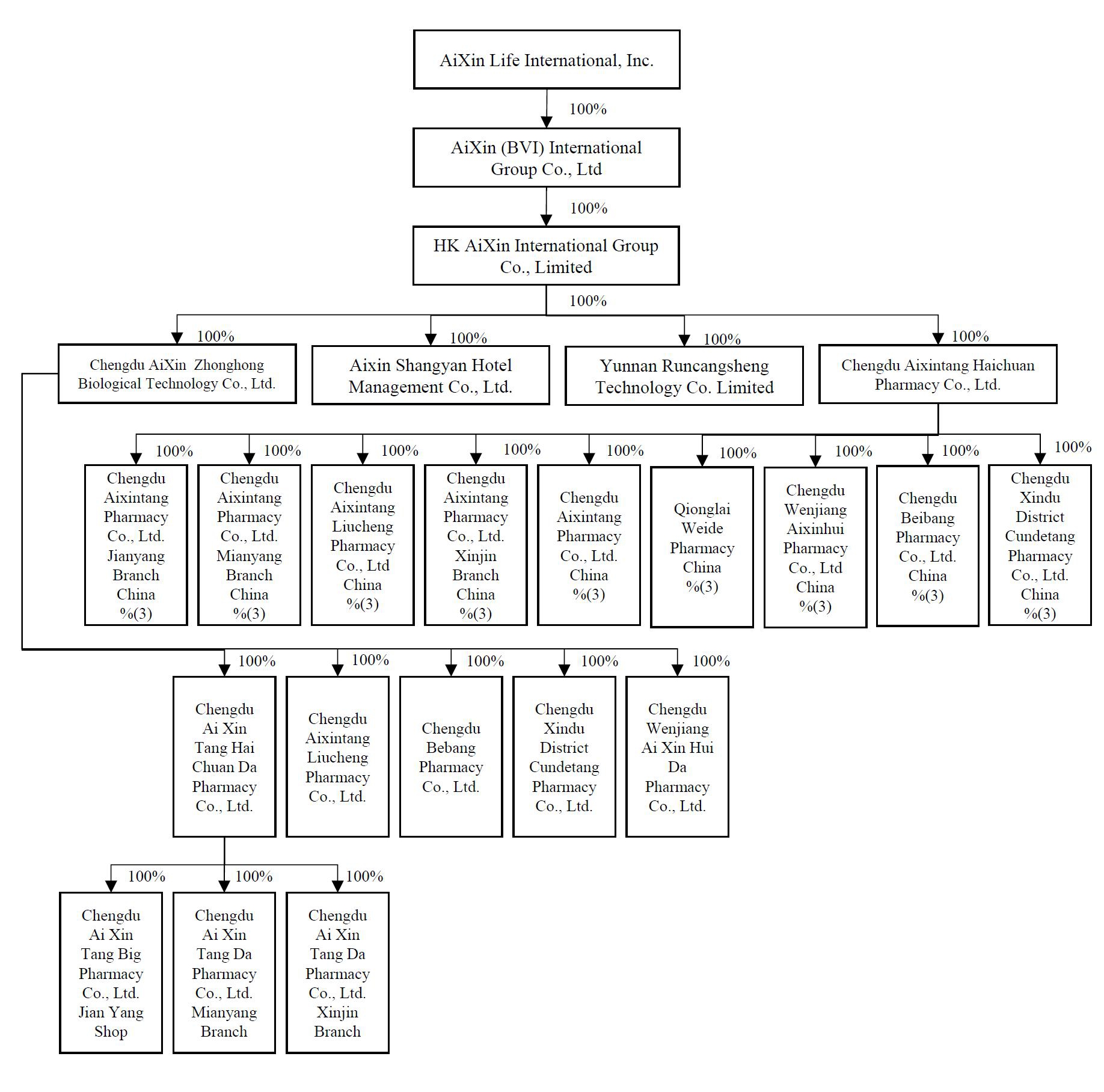

Our subsidiaries are (i) AiXin (BVI) International Group Co., Ltd. (“AiXin BVI”), 100% owned by AiXin Colorado, (ii) HK AiXin International Group Co., Limited, a Hong Kong limited company (“AiXin HK”), 100% owned by AiXin BVI, and the following entities, each of which was organized in the PRC, is wholly-owned by AiXin HK and which are collectively referred to as our “Chinese Operating Companies” (iii) Chengdu AiXinZhonghong Biological Technology Co., Ltd. and its wholly-owned subsidiaries, each of which operates a pharmacy (“AiXinZhonghong”), (iv) Yunnan Runcangsheng Technology Co., Ltd (“Yunnan Runcangsheng”), (v) Chengdu Aixintang Haichuan Pharmacy Co., Ltd. and its wholly-owned subsidiaries, each of which operates a pharmacy (“Chengdu Aixintang Pharmacies”) and (vi) AiXin Shangyan Hotel Management Co., Ltd. Our Chinese Operating Companies and AiXin HK are collectively referred to as our “PRC Subsidiaries.”

Our holding company structure involves unique risks to investors. Chinese regulatory authorities could disallow our operating structure, which would likely result in a material change in our operations and/or the value of our common stock, including causing the value of our common stock to significantly decline or become worthless. AiXin Colorado is listed on the OTCQB under the symbol “AIXN”.

| 2 |

We are focused on providing health and wellness products to the growing middle class in China. We currently develop, manufacture, market and sell premium-quality healthcare, nutritional products and wellness supplements, including herbs and greens, traditional Chinese remedies, functional products, such as weight management tools, probiotics, foods and drinks. We also offer products purchased from third parties. In addition, we have provided advertising and marketing services to clients which engaged us to market and distribute their products, though we have decreased this activity as we focus on distributing our products. We offer our products and those of clients for which we provide marketing services, through a diversified, omni-channel business model which generates revenues through retail and wholesale product sales, through company-owned pharmacies, direct marketing and on-line activities. Our marketing approach emphasizes proactively approaching customers such as by hosting marketing events for clients, which we believe is ideally suited to marketing the products we offer because sales of healthcare, nutritional products and supplements are strengthened by ongoing personal contact and support, coaching and education among the Company and our clients towards how to achieve a healthy and active lifestyle.

In December 2017, when we acquired AiXin BVI, it indirectly owned all of the capital stock of AiXinZhonghong, which began distributing nutritional products in 2013.

In September 2021, we completed the acquisition of nine retail pharmacies in Chengdu. Since that time we have added additional pharmacies and currently operate 25 pharmacies. We utilize these pharmacies to distribute health and wellness products and serve as learning centers for our clients. We intend to seek to continue to expand our chain of pharmacies and to use these outlets as part of our overall marketing strategy.

In September 2022, we acquired Yunnan Runcangsheng based in Yunnan Province which engages in the research, development, manufacture and wholesale distribution of health foods. Yunnan Runcangsheng operates a 13,000 square meter production facility, which houses R&D centers, extraction facilities, preparation workshops and a warehouse. Yunnan Runcangsheng has more than 30 sub brands and operates planting facilities where it grows some of the key ingredients used in its products. Many of the products it has developed are specifically targeted to disorders associated with changing eating habits and the presence of environmental toxins that are becoming more widespread through the use of western style pesticides and fertilizers.

In addition to our acquisitions in the health and nutritional sector, in July 2021, we acquired a hotel located in the Jinniu District, Chengdu City. The hotel covers more than 8,000 square meters and has a large restaurant that can accommodate 600 people, six luxury dining rooms, a 200 square meter music tea house, 13 private tea rooms, 108 guest rooms and other supporting facilities. We envision utilizing the hotel to conduct marketing events and seminars for our customers, and training sessions for our personnel at which we introduce new products and services intended to promote healthy living.

Business Objectives

Key elements of our business strategy are detailed below:

Leading brand of nutritional supplements. Our primary goal is to develop recognized brand names with a reputation as a provider of quality health and wellness products which deliver demonstrable benefits to our customers. Our objective is to provide potential customers with the information necessary to maintain a healthy lifestyle and to offer a variety of products whether the customer is looking to treat a specific health-related issue, maintain their overall wellness or improve their performance. Our premium, value-added offerings will include both proprietary branded products and other branded products provided by third parties to meet needs not met by our in-house products.

We believe that by offering a variety of branded exclusive products and a wide range of merchandise, and close customer support and services, we will be able to differentiate our Company from competitors and effectively compete against other food, drug and mass channel players, specialty stores, independent vitamin, supplement and natural food shops and online retailers.

| 3 |

Product development and innovation. With the acquisition of Yunnan Runcangsheng, we have the facilities and, more importantly, knowledgeable, experienced personnel to develop high-quality, innovative health foods and nutritional supplements that will be offered by our direct marketing team and available through our Company-owned pharmacies, our website and, as demand grows other select marketplaces and wholesale partners. To the extent desirable we will grow our own key ingredients. When we choose to use ingredients of third parties, they will be rigorously tested before they are added to our products, undergoing multiple quality checks to ensure that they meet our high standards for purity, composition and absence of contaminants.

We believe our ability to innovate and respond to customer needs by designing new products gives us a significant competitive advantage. At Yunnan Runcangsheng we directly employ scientists, nutritionists, formulators, and quality control experts who work at our research and manufacturing facilities.

A differentiated customer experience. We believe one of the key differentiators to our marketing strategy is the continued development of well-trained team members first used at AiXinZhonghong that work closely with customers. We will provide our team members with regular training and education focused on the benefits of a healthy lifestyle, the advantages of our products and solution-based selling. With their knowledge of the available products, our team members can engage customers in conversation, access the customer’s purchasing history through our data base, share product information and testimonials, and recommend solutions and help customers add complimentary products and build wellness regimens. We operate in a highly personalized, aspirational sector and believe that health food and nutritional supplement consumers often desire and seek out product expertise and knowledgeable customer service.

Our loyalty programs used early on by AiXinZhonghong will allow us to develop and maintain a large and loyal customer base, provide targeted offers and information, and connect with our customers on a regular basis. We routinely harness data generated by these programs to better understand customers’ buying behaviors and needs, so we can deliver a stronger experience, bring like-minded consumers into the channel and make well-informed decisions about our business.

As we grow and develop our customer base, we can use our hotel as a site for educational seminars, conferences and marketing events featuring well known experts in the wellness sector. These events can be used to increase customer loyalty and to educate our team members as to the benefits of a healthy lifestyle and our products so they can better serve our customers by guiding them to products that meet their needs.

Omni-channel development. We believe our diversified, omni-channel model, which includes company-owned pharmacies, direct marketing by our team members, individually and at large scale company sponsored marketing events, wholesale locations and on-line promotional activities, can differentiate us from many of our competitors, particularly those that rely exclusively on online marketing efforts. Our strategy is to give consumers a seamless, integrated experience across digital, mobile and in-store channels and in every interaction with us and our products. Through our website and in conversations with our well-trained team members, customers can research our products and purchase them online or at one of our local pharmacies or sales offices. We believe our physical store base provides a competitive advantage, allowing customers to experience our products and get expert advice from our team members.

Vertical Integration. We believe that our multi-channel distribution model, combined with our research, development and manufacturing capabilities offers us a unique advantage over our competitors. The daily feedback received from interactions between our team members and customers will be monitored to recognize what our customers want and rapidly develop products to meet their desires. Instead of simply responding to trends in the market, we will seek to bring new topical products to the market before they are generally available in the market.

| 4 |

Our Corporate Structure

We, AiXin Life International, Inc. (“AiXin Life” or “AiXin Colorado”), are a corporation organized under the laws of Colorado. We are a holding company with no material operations of our own. We conduct all of our operations through our wholly owned subsidiaries which are operating companies established in the PRC. Our operating companies in the PRC are wholly owned by HK AiXin International Group Co., Limited (“AiXin HK”), our wholly owned subsidiary organized in Hong Kong which, in turn is wholly owned by AiXin (BVI) International Group Co., Ltd. (“AiXin BVI”), an entity organized in the British Virgin Islands which is wholly owned by us.

Our subsidiaries are (i) AiXin BVI, (ii) AiXin HK, and the following entities, each of which was organized in the PRC and which are collectively referred to as our “Chinese Operating Companies” (iii) Chengdu AiXinZhonghong Biological Technology Co., Ltd., a Chinese limited company and its subsidiaries, each of which operates a pharmacy (“AiXinZhonghong”), (iv) Yunnan Runcangsheng Technology Co., Ltd (“Yunnan Runcangsheng”), (v) Chengdu Aixintang Haichuan Pharmacy Co., Ltd. and its subsidiaries, each of which operates a pharmacy and (“Chengdu Aixintang Pharmacies”) (vi) AiXin Shangyan Hotel Management Co., Ltd. Our Chinese Operating Companies and AiXin HK are collectively referred to as our “PRC Subsidiaries.” Unless the context otherwise requires, all references in this prospectus to “AiXin Colorado” refer to AiXin Life International, Inc., and references to “AiXin Life,” “we,” “us,” “our,” the “Registrant”, the “Company,” or “our Company” refer collectively to AiXin Colorado and its consolidated subsidiaries.

You will be purchasing shares of AiXin Colorado and will not hold a direct interest in any of its subsidiaries. For the avoidance of doubt, Chengdu Aixintang Haichuan Pharmacy Co., Ltd. owns 100% of the equity interests in each of the nine remaining pharmacy companies.

Summary of Risk Factors

Investing in our common stock involves a high degree of risk. Below is a summary of material factors that make an investment in our common stock speculative or risky. This summary does not address all of the risks that we face. Please refer to the information contained in and incorporated by reference under the heading “Risk Factors” on page 15 of this prospectus.

| 5 |

Risks Associated with Our Company

| ● | The health and wellness industry is highly competitive and we face fierce competition from numerous industry participants, including many larger, well capitalized nationally and internationally recognized companies, see “Risk Factors — Risks Associated with Our Company — We operate in a highly competitive industry and our failure to compete effectively could adversely affect our market share, revenues and growth prospects. |

| ● | We first entered the health and wellness business in 2017 when we acquired AiXin BVI. Consequently, we have a limited operating history on which to evaluate our prospects, see “Risk Factors — Risks Associated with Our Company — We have a limited operating history on which to judge our performance and assess our prospects for success.” |

| ● | We recently completed a significant acquisition and intend to seek to expand through future acquisitions. Our future expansion plans are subject to uncertainties and risks. For more details, see “Risk Factors – Risks Associated with Our Company – Our recently completed acquisition is subject to uncertainties and risks” and – “Our future expansion plans are subject to uncertainties and risks.” |

| ● | Our success depends upon our ability to anticipate and timely react to changes in consumers demands, see “Risk Factors – Risks Associated with Our Company - Failure to effectively anticipate consumer preferences could negatively impact the demand for our products and our ability to generate revenues and the market price of our common stock.” |

| ● | We may not succeed in our efforts to develop new products which could cause us to devote our resources to projects that do not succeed, see “Risk Factors – Risks Associated with Our Company—Resources devoted to product innovation may not yield new products that achieve commercial success.” |

| ● | Our success depends on our ability to attract and retain customers through a coordinated omni channel distribution network which includes pharmacies, direct marketing and online activities. If we do not succeed in these efforts we may fail to grow our customer base. For more details, see “Risk Factors – Risks Associated with Our Company – If we do not successfully develop and maintain a robust omni-channel experience for our customers, our business and results of operations could be materially and adversely affected.” |

| ● | If we fail to succeed in developing and protecting our brand names we could fail in our efforts to grow our customer base, see “Risk Factors – Risks Associated with Our Company —If we fail to develop and protect our brand names and reputation, we may not attract and retain new customers which could adversely affect our revenues and financial performance.” |

| ● | We are highly dependent upon consumer perception of our products and unfavorable publicity about us or our business may materially and adversely affect our reputation, business, results of operations and financial condition. For more details, see “Risk Factors – Risks Associated with Our Company –Unfavorable publicity about us or consumer perception of our products, the ingredients they contain and any similar products distributed by other companies could cause fluctuations in our operating results and could have a material adverse effect on our reputation, the demand for our products and our ability to generate revenues and the market price of our common stock.” |

● |

We face risks related to our ability to effectively source raw materials and any adverse change in the supply or cost of raw materials may adversely affect our business. See “Risk Factors – Risks Associated with Our Company -A significant disruption to our timely receipt of raw materials and inventory could adversely impact sales and operations or increase our transportation costs, which would decrease our profits. |

| ● | We are highly dependent upon the services of Quanzhong Lin, our President, Chief Executive Officer and principal shareholder. The loss of his services could have a Material adverse impact on our business. See, Risk Factors – Risks Associated with Our Company - Our business depends on the continued contributions made by Mr. Quanzhong Lin, our key executive officer. The loss of his services may result in a severe impediment to our business.” |

| 6 |

General Risks Associated with Business Operations in China

| ● | The Chinese government may intervene or influence our operations at any time or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in material changes in our operations and/or the value of your common stock. For more details, see “Risk Factors – General Risks Associated with Business Operation in China - The PRC government has significant oversight and discretion over the conduct of a PRC company’s business operations or to exert control over any offering of securities conducted overseas and/or foreign investment in China-based issuers, and may intervene with or influence our operations, may limit or completely hinder our ability to offer or continue to offer securities to investors, and may cause the value of such securities to significantly decline or become worthless, as the government deems appropriate to further regulatory, political and societal goals.” |

| ● | On February 17, 2023, the CSRC released the Trial Measures, which came into effect March 31, 2023. The Trial Measures apply to overseas securities offerings and/or listings conducted by companies incorporated in the PRC, PRC domestic companies, directly and companies incorporated overseas with operations primarily in the PRC, indirect offerings. The Trial Measures require (1) the filings of the overseas offering and listing plan by the PRC domestic companies with the CSRC under certain conditions, (2) filings by the underwriter with the CSRC under certain conditions and (3) the submission of an annual report to the CSRC within the required timeline.

On the day it released the Trial Measures, the CSRC held a press conference and issued the Notice on Administration for the Filing of Overseas Offering and Listing by Domestic Companies (“Notice on Overseas Filing”), which, among others, clarified that: (i) PRC domestic companies that have submitted applications for an overseas offering and listing on or prior to the effective date of the Trial Measures but have not obtained approval from overseas regulatory authorities or stock exchanges may reasonably arrange the timing for submitting their filing applications with the CSRC, and should complete the filing before the completion of their overseas offering and listing; (ii) a six-month transition period will be granted to PRC companies in which they can complete an overseas offering and listing provided they obtained the approval for the offering from an overseas regulatory authority or stock exchange (such as the effectiveness of a registration statement in the United States) prior to March 31, 2023 and (iii) companies subject to the Trial Measures which have securities which trade in an overseas market prior to the effectiveness of the Trial Measures will need to file with the CSRC within three days of the completion of a follow-on offering.

Based on the advice of our PRC Counsel, this offering will be considered an indirect offering and we will need to fulfill filing obligations pursuant to the Trial Measures within three days of the completion of this offering. If we fail to comply with the post-offering filing obligations imposed by the Trial Measures or make a misrepresentation, misleading statement or material omission in the materials we submit to the CSRC, the CSRC would have the right to order rectification, issue a warning and impose a fine on us of between RMB1 million and RMB10 million and issuing a warning to the parties responsible for such failure, misrepresentation or material omission and impose a fine on each of such individuals ranging from RMB500,000 to RMB5 million.

The Trial Measures may subject us to additional compliance requirement in the future. Any failure to fully comply with new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our shares, cause significant disruption to our business operations, and severely damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause our common stock to significantly decline in value or become worthless. See “Risk Factors – General Risks Associated with Business Operations in China — The CSRC has released the Trial Measures requiring Chinese domestic companies to complete filings with the CSRC if they complete an overseas offering and listing of their securities.” |

| ● | The Provisions on Strengthening the Confidentiality and Archives Administration Related to the Overseas Securities Offering and Listing by Domestic Enterprises (the “Confidentiality and Archives Provisions”), went into effect March 31, 2023. The Confidentiality and Archives Provisions require, among other items, that PRC domestic enterprises seeking to offer and list securities in overseas markets, establish an archival system which will maintain the confidentiality of information in accordance with applicable laws and regulations. Further, if a PRC domestic enterprise plans, directly or indirectly, to release documents or provide material that contain state secrets or government work secrets, or that will jeopardize national security or the public interest, it must strictly comply with all relevant governmental procedures and obtain approval of the appropriate regulatory before doing so. Although our PR Counsel has advised us that although we are subject to the Confidentiality and Archives Provisions, we believe that none of the documents or materials we intend to provide to parties outside of the PRC contains materials that would require us to make any filing or obtain any approval of a Chinese regulatory authority. Nevertheless, the determination of whether information contains state secrets, government work secrets or jeopardizes national security or the public interest is subjective and any failure or perceived failure by us or our subsidiaries to comply with the confidentiality and archive administration requirements under the Confidentiality and Archives Provisions could cause us to be referred for criminal investigation and held liable for such violations by the authorities in China. Further, PRC regulatory authorities could use these regulations to limit our disclosures or interfere with our operations. Any determination that we have violated the Confidentiality and Archives Provisions or use of these provisions to limit our disclosures could cause the value of our common stock to significantly decline in value or become worthless. See “Risk Factors – General Risks Associated with Business Operations in China — The CSRC has released rules for China-based companies seeking to conduct initial public offerings in foreign markets. The Chinese government may exert more oversight and control over offerings that are conducted overseas and foreign investment in China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer our common stock to investors and could cause the value of our common stock to significantly decline or become worthless.” |

| ● | Article 26 of the Trial Measures came into effect on March 31, 2023. Article 26 provides, among other things, that any domestic entity or individual intending to provide documents and materials requested by an overseas securities regulatory agency in connection with an investigation may not provide such information without prior approval from the CSRC and competent authorities under the State Council. In addition, Article 11 of the Provisions on Strengthening Confidentiality and Archives Administration in Respect of Overseas Issuance and Listing of Securities by Domestic Enterprises, or Article 11 came into effect on March 31, 2023. Article 11 provides among other things, that any domestic company, securities firm and securities service agency shall obtain the consent of the CSRC or the relevant administrative authorities prior to cooperating in an inspection or investigation carried out by an overseas securities regulator or relevant administrative authorities or providing documents and materials for cooperating in the inspection or investigation.

If the Company were to provide information to any securities regulatory agency in violation of Article 26 or Article 11, it would be subject to fines and, if the information were deemed a state secret, government work secret or might jeopardize the national security of China or the public interest, as provided in the Confidentiality and Archives Provisions, it could cause the Company or the individuals responsible for the disclosure to be subject to criminal investigation. Likewise, if the Company refuses to provide information requested by any U.S. securities regulatory agency in circumstances that the Company believes would have caused it to violate Article 26 or Article 11, it will be subject in the United States to fines, penalties or delisting from Nasdaq. While detailed interpretation of or implementation rules of Article 26 and Article 11 have yet to be promulgated, the inability of an overseas securities regulator to directly conduct an investigation or evidence collection activities within China may further increase difficulties that you may face in protecting your interests, see “We could be subject to conflicting demands placed upon us by regulatory authorities in the United States and the PRC which could result in disciplinary actions if not resolved.” |

| ● | You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against us or our management named in the prospectus based on foreign laws, including U. S. court judgements based on violations of the civil liability provisions of the U. S. federal securities laws. For more details, see “Risk Factors – General Risks Associated with Business Operations in China - You may have difficulty enforcing judgments against us.” |

| 7 |

| ● | Changes in the policies, regulations, rules and the enforcement of laws of the PRC government may be quick with little advance notice and could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business. For more details, see “Risk Factors - General Risks Associated with Business Operations in China - Changes in the policies, regulations, rules and the enforcement of laws of the PRC government may be quick with little advance notice and could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business.” |

| ● | Inflation could pose a risk to our business. For more details, see “Risk Factors - General Risks Associated with Business Operations in China - Inflation could pose a risk to our business.” |

| ● | There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations. For more details, see “Risk Factors – General Risks Associated with Business Operation in China - There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations.”. |

| ● | PRC regulations regarding acquisitions impose significant regulatory approval and review requirements, which could make it more difficult for us to pursue growth through acquisitions. For more details, see “Risk Factors – General Risks Associated with Business Operation in China - PRC regulations regarding acquisitions impose significant regulatory approval and review requirements, which could make it more difficult for us to pursue growth through acquisitions.” |

| ● | While the approval of the China Securities Regulatory Commission is not currently required for this offering, it may be required in the future in connection with this offering under the M&A Rules and, if required, we cannot predict whether we will be able to obtain such approval. For more details, see “Risk Factors – General Risks Associated with Business Operation in China - While the approval of the China Securities Regulatory Commission is not currently required for this offering, it may be required in the future in connection with this offering under the M&A Rules and, if required, we cannot predict whether we will be able to obtain such approval.” |

| ● | Our business may be subject to a variety of PRC laws and other obligations regarding cybersecurity and data protection. For more details, see “Risk Factors – General Risks Associated with Business Operation in China - Our business may be subject to a variety of PRC laws and other obligations regarding cybersecurity and data protection.” |

| ● | PRC regulations relating to investments in offshore companies by PRC residents may subject our PRC-resident beneficial owners or our PRC Subsidiaries to liability or penalties, limit our ability to inject capital into our PRC Subsidiaries or limit our PRC Subsidiaries’ ability to increase their registered capital or distribute profits. For more details, see “Risk Factors – General Risks Associated with Business Operation in China - PRC regulations relating to investments in offshore companies by PRC residents may subject our PRC-resident beneficial owners or our PRC Subsidiaries to liability or penalties, limit our ability to inject capital into our PRC Subsidiaries or limit our PRC Subsidiaries’ ability to increase their registered capital or distribute profits.” |

| 8 |

| ● | We may be treated as a resident enterprise for PRC tax purposes under the PRC Enterprise Income Tax Law, and we may therefore be subject to PRC income tax on our global income. For more details, see “Risk Factors – General Risks Associated with Business Operation in China - We may be treated as a resident enterprise for PRC tax purposes under the PRC Enterprise Income Tax Law, and we may therefore be subject to PRC income tax on our global income.” |

| ● | Restrictions on currency exchange may limit our ability to utilize our PRC revenue effectively. For more details, see “Risk Factors – General Risks Associated with Business Operation in China - Restrictions on currency exchange may limit our ability to utilize our PRC revenue effectively.” |

| ● | Introduction of new laws or regulations or changes to existing laws or regulations by the PRC government may adversely affect our business. For more details, see “Risk Factors – General Risks Associated with Business Operation in China - Introduction of new laws or changes to existing laws by the PRC government may adversely affect our business.” |

Risks Relating to Our Holding Company Structure

| ● | Substantial uncertainties exist with respect to the interpretation and implementation of the newly enacted Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations. For more details, see “Risk Factors – Risks Relating to Our Holding Company Structure - Substantial uncertainties exist with respect to the interpretation and implementation of the newly enacted Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations.” |

| ● |

We may rely on dividends and other distributions on equity paid by our PRC Subsidiaries and loans between us and our PRC Subsidiaries to fund any cash and financing requirements we or any of our PRC Subsidiaries may have, and any limitation on the ability of our PRC Subsidiaries to make payments to or transfer funds to us or our other PRC Subsidiaries could have a material and adverse effect on our ability to conduct our business and the ability of our PRC Subsidiaries to conduct their respective businesses. Current PRC regulations permit our PRC Subsidiaries to pay dividends to us only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, each of our PRC Subsidiaries is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. As of the date hereof, we have had no transactions that involved the transfer of cash or assets throughout our corporate structure. The PRC Subsidiaries have not transferred cash or other assets to AiXin BVI or AiXin Colorado, including by way of dividends or interest payments and AiXin BVI and AiXin Colorado have not transferred cash or other assets to any of our PRC Subsidiaries. AiXin Colorado does not currently plan or anticipate transferring cash or other assets from our operations in China to any non-Chinese entity. As of the date hereof, no transfers, dividends or distributions have been made to our investors. To the extent our cash or other assets is in one of our Chinese Operating Companies or AiXin HK, the funds or assets may not be available to fund operations or for use outside of mainland China or Hong Kong due to interventions by the governments of PRC or Hong Kong, or the imposition of restrictions and limitations on the ability of the PRC Subsidiaries to use such cash or assets imposed by the government of mainland China or Hong Kong. Except for such limitations on our Company’s ability to transfer cash and other assets among our entities currently or hereafter imposed by the governments of the PRC and Hong Kong, there are no limitations on our Company’s ability to transfer cash and other assets through our corporate structure. Our Company does not have any cash management policies with respect to the transfer of cash among our entities other than requirements for the approval of management for transfers in excess of specified amounts and none of our entities is currently party to any debenture, loan or other agreement which imposes restrictions or otherwise limits our Company’s ability to transfer our cash and other assets. We have not adopted any policies that dictate how funds are transferred among our entities other than as necessary to comply with applicable laws. For more details, see “Risk Factors – Risks Relating to Our Holding Company Structure - We may rely on dividends and other distributions on equity paid by our PRC Subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC Subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business.” and “Prospectus Summary - Transfers of Cash to and from our Subsidiaries.” |

| ● | PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds of this offering to make loans or additional capital contributions to our PRC Subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business. For more details, see “Risk Factors – Risks Relating to Our Holding Company Structure - PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds of this offering to make loans or additional capital contributions to our PRC Subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business.” |

Risks Relating to this Offering and Our Common Stock

| ● | Prior to this offering, we had a limited public market for our common stock and you may not be able to resell our shares at or above the price you paid, or at all. For more details, see “Risk Factors – Risks Relating to this Offering and Our Common Stock - Prior to this offering, we had a limited public market for our common stock and you may not be able to resell our shares at or above the price you paid, or at all.” |

| ● | Future sales of substantial amounts of our common stock by existing shareholders, including sales resulting from a foreclosure of shares pledged by holders of a substantial number of shares of our common stock, could adversely affect the price of our common stock. For more details, see “Risk Factors – Risks Relating to this Offering and Our Common Stock - The sale or availability for sale of substantial amounts of our common stock could adversely affect its market price.” |

| 9 |

| ● | The market price of our shares is likely to be highly volatile and subject to wide fluctuations in response to various factors. For more details, see “Risk Factors – Risks Relating to this Offering and Our Common Stock - The market price of our shares is likely to be highly volatile, which could result in substantial losses to investors.” |

| ● | We may never be able to pay dividends and are unlikely to do so. For more details, see “Risk Factors – Risks Relating to this Offering and Our Common Stock - Because we do not expect to pay dividends in the foreseeable future after this offering, you must rely on price appreciation of our common stock for return on your investment.” |

PRC Limitation on Overseas Listing and Share Issuances

As confirmed by our PRC Counsel, neither we nor our subsidiaries are currently required to obtain approval from Chinese authorities, including the China Securities Regulatory Commission, or CSRC, or Cybersecurity Administration Committee, or CAC, to list on U.S. exchanges or issue securities to foreign investors. We are, however, required by the Trial Measures to submit a filing with the CSRC within three days after the completion of this offering. If we were to fail to comply with the post-offering filing obligations imposed by the Trial Measures or make a misrepresentation, misleading statement or material omission in the materials we submit to the CSRC, the CSRC would have the right to order rectification, issue a warning and impose a fine on us of between RMB1 million and RMB10 million and issuing a warning to the parties responsible for such failure, misrepresentation or material omission and impose a fine on each of such individuals ranging from RMB500,000 to RMB5 million.

If our PRC Subsidiaries or AiXin Colorado were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we would not be able to continue listing on any U.S. exchange, which would materially affect the interests of investors in our securities. It is uncertain when and whether we will be required to obtain permission from the PRC government to list on U.S. exchanges in the future, and even if such permission is obtained, whether it will be rescinded. Although we currently are not required to obtain permission from any of the PRC central or local government agencies and have not been denied the right to list on a U.S. exchange by any Chinese governmental authority, our operations could be adversely affected, directly or indirectly, by existing or future laws and regulations denying us the right to list on any U.S. exchange. If we inadvertently conclude that such approvals are not required when they are, or applicable laws, regulations, or interpretations change and we are required to obtain approval in the future, our operations and the interests of our shareholders could be adversely affected. For more detailed information, see “Risk Factors – General Risks Associated with Business Operations in China – While the approval of the China Securities Regulatory Commission is not currently required for this offering, it may be required in the future in connection with this offering under the M&A Rules and, if required, we cannot predict whether we will be able to obtain such approval.”

On February 17, 2023, the CSRC released regulations for the filing-based administration of direct and indirect overseas securities offerings and listings by domestic companies incorporated in Mainland China. The regulations became effective March 31, 2023. The regulations are comprised of the Trial Administrative Measures of Overseas Securities Offering and Listing by China-based Companies (the “Trial Measures”) and five supporting guidelines. The Trial Measures lay out the filing regulations for both direct and indirect overseas listings and clarify the criteria for determining whether a listing constitutes an indirect overseas listing in an overseas market.

An offering and listing by an overseas company will be deemed an indirect offering by a China-based company: if (i) more than 50% of the overseas company’s consolidated revenues, profit, total assets or net assets as indicated by its audited consolidated financial statements for the most recently completed fiscal year are attributable to PRC domestic companies, and (ii) one of (a) key components of its operations are carried out in Mainland China; (b) its principal places of business are located in Mainland China; or (c) the majority of the senior management members in charge of operations are Mainland China citizens or residents, is true. The determination is made on the basis of a “substance over form” review.

If a China-based company seeks to indirectly offer and list securities in an overseas market, it is required to designate a major Chinese operating entity to be responsible for processing all filings with the CSRC. With respect to an initial offering and listing overseas, the initial filing with the CSRC is to be made within three business days of the date on which the overseas application is submitted. In the case of a follow-on offering in the same overseas market where a Chinese based company has previously offered and listed securities, the issuer shall submit filings with the CSRC within three business days after the follow-on offering is completed.

In addition, an overseas offering and listing is prohibited if: (1) the intended securities offering and listing is specifically prohibited by PRC law, regulations or relevant national provisions; (2) the State Council determines that the intended securities offering and listing endanger the national security of the PRC; (3) in the past three years, the issuer or its controlling shareholders or the actual parties controlling the issuer have been convicted of committing corruption, bribery, embezzlement, misappropriation of property, or other criminal offenses disruptive to the order of the Chinese socialist market economy, or are under judicial investigation for suspicion of criminal offenses or major violations; (4) the issuer is suspected of committing any crimes or serious violations of laws and regulations and is under an investigation which has not been concluded; (5) there are material disputes with regard to the ownership of the securities of the relevant Chinese entity by its controlling shareholders or shareholders or by the parties actually in control of the issuer. The Trial Measures provide that in the event of an issuer’s breach of the Trial Measures, such as a failure to comply with the filing obligations, conducting an overseas securities offering and listing in violation of the Trial Measures or making a misrepresentation, misleading statement or material omission in the materials submitted to the CSRC by the issuer, the CSRC shall order rectification, issue warnings to the issuer, and, impose a fine between RMB1 million and RMB10 million on the issuer, and further, that the parties responsible for such breach, failure, misrepresentation or material omission shall be warned and each shall be subject to a fine ranging from RMB500,000 to RMB5 million.

On the date of the release of the Trial Measures, the CSRC held a press conference and issued the Notice on Administration for the Filing of Overseas Offering and Listing by China-based Companies, which clarified that: (i) China-based companies that have submitted applications for an overseas offering and listing on or prior to the effective date of the Trial Measures, but have not obtained approval from overseas regulatory authorities or stock exchanges may reasonably arrange the timing for submitting their filing applications with the CSRC and should complete the filing before the completion of their overseas offering and listing; (ii) a six-month transition period will be granted to China-based companies in which they can complete an overseas offering and listing provided that they have obtained approval from an overseas regulatory authority or stock exchange (such as effectiveness of a registration statement in the market of the United States) prior to March 31, 2023 and (iii) companies which have securities which trade in an overseas market prior to the effective date of the Trial Measures will need to file with the CSRC pursuant to the Trial Measures within three days of completion of a follow-on offering.

Because our PRC Subsidiaries have accounted for more than 50% of our consolidated revenues, profit, total assets and net assets from inception of our Company to date and key components of our operations are carried out in Mainland China, the offering by us pursuant to this registration statement is deemed by the CSRC to be an indirect offering and we will need to fulfill filing obligations pursuant to the Trial Measures after we have completed this offering. “Risk Factors – General Risks Associated with Business Operations in China — The CSRC has released the Trial Measures requiring Chinese domestic companies to complete filings with the CSRC if they complete an overseas offering and listing of their securities.”

The Provisions on Strengthening the Confidentiality and Archives Administration Related to the Overseas Securities Offering and Listing by Domestic Enterprises (the “Confidentiality and Archives Provisions”), came into effect March 31, 2023. The Confidentiality and Archives Provisions require, among other items, that PRC domestic enterprises seeking to offer and list securities in overseas markets, shall establish an archival system which will maintain the confidentiality of information in accordance with applicable laws and regulations. Further, if a PRC domestic enterprise plans, directly or indirectly, to release documents or provide material that contain state secrets or government work secrets, or that will jeopardize national security or the public interest, it must strictly comply with all relevant governmental procedures and obtain approval of the appropriate regulatory before doing so. Although our PRC Counsel has advised us that we are subject to the Confidentiality and Archives Provisions, we believe that none of the documents or materials we intend to provide to parties outside of the PRC contains materials that would require us to make any filing or obtain any approval of a Chinese regulatory authority. Nevertheless, the determination of whether information contains state secrets, government work secrets or jeopardizes national security or the public interest is subjective and any failure or perceived failure by us or our subsidiaries to comply with the confidentiality and archive administration requirements under the Confidentiality and Archives Provisions could cause us to be referred for criminal investigation and held liable for such violations by the authorities in China. Further, PRC regulatory authorities could use these regulations to limit our disclosures or interfere with our operations. Any determination that we have violated the Confidentiality and Archives Provisions or use of these provisions to limit our disclosures could cause the value of our common stock to significantly decline in value or become worthless. See “Risk Factors – General Risks Associated with Business Operations in China — The CSRC has released rules for China-based companies seeking to conduct initial public offerings in foreign markets. The Chinese government may exert more oversight and control over offerings that are conducted overseas and foreign investment in China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer our common stock to investors and could cause the value of our common stock to significantly decline or become worthless.”

We also reviewed our operations with our PRC Counsel as to the applicability of the Measures for Cybersecurity review administered by the CAC. During this review we and our PRC Counsel determined that we are not a “critical information infrastructure operator” as we do not operate or maintain any infrastructure used by the public to communicate or transmit information. We further determined that we possess only limited personal information with respect to any individual, currently have personal information pertaining to fewer than 1 million individuals and the data we process in our business does not have a bearing on national security and thus may not be classified as core or important data by the authorities and, consequently, we and our PRC Counsel concluded that we are not subject to cybersecurity review by the CAC. See “Risk Factors - Our business may be subject to a variety of PRC laws and obligations regarding cybersecurity and date protection.”