UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05601

SEI Institutional International Trust

(Exact name of registrant as specified in charter)

________

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

Timothy D. Barto, Esq.

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area

code: 610-676-1000

Date of fiscal year end: September 30, 2023

Date of reporting period: September 30, 2023

Item 1. Reports to Stockholders.

September 30, 2023

ANNUAL REPORT

SEI Institutional International Trust

|

❯

|

International Equity Fund

|

|

❯

|

Emerging Markets Equity Fund

|

|

❯

|

International Fixed Income Fund

|

|

❯

|

Emerging Markets Debt Fund

|

Paper copies of the Funds’ shareholder reports are no longer sent by mail, unless you specifically request them from the Funds or from your financial intermediary, such as a broker-dealer or bank. Shareholder reports are available online and you will be notified by mail each time a report is posted on the Funds’ website and provided with a link to access the report online.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-DIAL-SEI. Your election to receive reports in paper will apply to all funds held with the SEI Funds or your financial intermediary.

seic.com

TABLE OF CONTENTS

| Letter to Shareholders |

1 |

| Management’s Discussion and Analysis of Fund Performance |

7 |

| Schedules of Investments |

15 |

| Statements of Assets and Liabilities |

85 |

| Statements of Operations |

87 |

| Statements of Changes in Net Assets |

88 |

| Financial Highlights |

90 |

| Notes to Financial Statements |

92 |

| Report of Independent Registered Public Accounting Firm |

112 |

| Trustees and Officers of the Trust |

113 |

| Disclosure of Fund Expenses |

117 |

| Liquidity Risk Management Program |

118 |

| Board of Trustees Considerations in Approving the Advisory Agreement |

119 |

| Notice to Shareholders |

122 |

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Trust’s Form N-PORT reports are available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

LETTER TO SHAREHOLDERS

September 30, 2023 (Unaudited)

To Our Shareholders:

During the one-year reporting period ending September 30, 2023, global financial markets gyrated in response to concerns about central bank monetary policy, the strength of the global economy, a crisis in the U.S. regional banking sector, the politically charged U.S. debt-ceiling standoff, and the implications of a higher-for-longer interest-rate environment.

The U.S. equity market experienced numerous periods of volatility as the Federal Reserve (Fed) maintained its interest rate-hiking cycle for much of the reporting period in an effort to tame rising inflation. Headline inflation, as measured by the U.S. consumer-price index (CPI), decelerated during the reporting period. The Fed raised the federal-funds rate in six increments totaling 225 basis points (2.25%) to a range of 5.25% to 5.50% during the reporting period. These included a 25-basis point increase following the central bank meeting in July 2023, which was sandwiched between pauses in its rate-hiking cycle in June and September.

In a statement announcing the pause in September, the Federal Open Market Committee (FOMC) reiterated its commitment to bringing inflation down to its 2% target rate and cautioned that “tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain.” The Fed members also commented that it “would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.” The Fed’s so-called dot plot of economic projections indicated a median federal-funds rate of 5.6% at the end of 2023, unchanged from its previous estimate issued in June, implying that the central bank could opt for an additional 25-basis point increase at one of its two remaining policy meetings in 2023.

In early March 2023, the financial markets’ focus turned to the banking sector as two U.S.-based regional banks–Silicon Valley Bank (SVB) and Signature Bank–failed after depositors withdrew funds on fears regarding the valuation of the institutions’ bond portfolios. The Federal Deposit Insurance Corporation (FDIC) was appointed as receiver to SVB after the California Department of Financial Protection and Innovation– which oversees the operations of state-licensed financial institutions, including banks and credit unions–closed the bank. Occurring on the heels of the collapse of Silvergate Capital a few days earlier, SVB’s failure prompted investors to reconsider the safety of their positions across the banking industry. SVB is a unique entity, with a client base highly concentrated among startup, venture capital-backed companies. The deposits of the bank increased tremendously over the past few years and poor liquidity management of these assets appears to have been a significant contributor to the collapse. Both Silvergate Capital and Signature Bank, which was shut down by New York state regulators in mid-March, were closely aligned with the highly speculative cryptocurrency industry. In early May, U.S. regulators took control of California-based First Republic Bank. The California Department of Financial Protection and Innovation issued a statement announcing that it had taken over the bank and appointed the FDIC as receiver. The FDIC subsequently announced that it had accepted J.P. Morgan Chase Bank’s bid to “assume all deposits, including all uninsured deposits, and substantially all assets of First Republic Bank."

The administration of President Joe Biden and the Republican Party majority in the U.S. House of Representatives engaged in a heated debate about raising the U.S. government’s $31.4 trillion debt ceiling for much of the first half of 2023. The debt ceiling comprises the total amount of money that the U.S. government is authorized to borrow to meet its existing legal obligations, including Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments. U.S. Treasury Secretary Janet Yellen had warned that the U.S. would no longer be able to meet its financial obligations as of early June. After numerous one-on-one discussions, Biden and Kevin McCarthy, who had been elected Speaker of the House of Representatives after the Republicans secured a majority in the lower house of Congress following the national election in November 2022, reached an agreement on the debt ceiling during the last week of May. Both the U.S. House of Representatives and the Senate passed the legislation–the Fiscal Responsibility Act–by wide margins, with strong support from Republicans and Democrats. The bill suspended the debt ceiling through January 1, 2025; maintains non-military spending close to current levels for the 2024 fiscal year, which was to begin in October; and implements a 1% cap on increases in non-military spending for the 2025 fiscal year. The fast-track approval of the legislation enabled the government to avoid a potential default on its debt.

Despite the budget agreement, credit-rating agency Fitch Ratings downgraded U.S. debt one notch from AAA—the agency’s highest credit rating—to AA+ with a stable outlook. In a news release announcing the downgrade, Fitch

SEI Institutional International Trust

LETTER TO SHAREHOLDERS (Continued)

September 30, 2023 (Unaudited)

cited “expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to 'AA' and 'AAA' rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.” The agency also expressed its view that, despite June’s bipartisan agreement on the government’s debt ceiling, there has been “a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters.”

At the end of the reporting period on September 30, Congress again avoided a shutdown of the federal government, agreeing on a bipartisan stopgap bill to fund the government through mid-November. The House of Representatives voted 335-91 in support of the agreement, while the Senate, where the Democratic Party holds a slim majority, approved the measure by a vote of 88-9. The bill included, among other appropriations, $16 billion for disaster relief, but provided no additional financial aid for Ukraine for its ongoing conflict with Russia. Leaders of both political parties indicated that they would propose separate legislation authorizing more assistance to Ukraine.

Geopolitical Events

The ongoing Russia-Ukraine war dominated the geopolitical news during the reporting period. Ukraine’s president, Volodymyr Zelenskyy, traveled to Washington, D.C., to address a joint session of the U.S. Congress in late December 2022, in an effort to secure additional financial aid from the U.S. and its allies. President Biden reiterated the U.S. government’s support for Ukraine in its conflict with Russia. In late December, the U.S. Congress approved $45 billion in additional financial assistance to Ukraine. In February 2023, nearly a year after the conflict began, President Biden made an unannounced trip to Ukraine to meet with President Volodymyr Zelenskyy and to encourage ongoing support from U.S. allies. The visit occurred as Russian President Vladimir Putin increased military activity in eastern Ukraine. President Biden’s trip was particularly risky as there was no protection from U.S. military personnel on the ground in Ukraine. In March, President Xi Jinping of China met with Russian President Vladimir Putin in Moscow to discuss China’s proposal to end the conflict with Ukraine. The Biden administration criticised the plan as “the ratification of Russian conquest” as it proposed a ceasefire that would recognize Russia’s right to occupy territory in Ukraine and provide Putin with time to bolster the nation’s military forces.

The Wagner Group, a Russian paramilitary organization, began to retreat from the city of Bakhmut, Ukraine, in late May. The mercenaries were scheduled to complete their retreat by the beginning of June, and would be replaced by regular Russian troops. The Wagner Group had been fighting in Bakhmut since the summer of 2022. The withdrawal from the city occurred after the group’s leader, Yevgeny Prigozhin, claimed that Russian Defense Minister Sergei Shoigu and Valery Gerasimov, Chief of the General Staff, had intentionally withheld ammunition from Wagner Group fighters. In late June, the Wagner Group organized a short-lived mutiny against Russian President Vladimir Putin’s regime. The group occupied Rostov-On-Don in southern Russia, a significant command center for the Russian government’s invasion of Ukraine. Prigozhin agreed to be exiled to Belarus, and the mercenaries retreated from Rostov-On-Don. Prigozhin and nine other passengers later died in an airplane crash near Moscow on August 24, raising questions about the circumstances surrounding his death.

Late in the reporting period, China, the world’s second-largest economy, experienced relatively weak credit growth, a downturn in exports, and a year-over-year decline in consumer prices. Lower demand for goods and services from Chinese consumers could have a negative impact on other countries’ exports of iron ore, crude oil, factory equipment, and luxury goods into the country. A large property developer filed for protection under Chapter 15 of the U.S. bankruptcy code, which safeguards non-U.S. companies that are undergoing debt restructurings from creditors seeking to sue the firms or to freeze their assets in the U.S. Additionally, in contrast to inflationary worries in most global economies, there were concerns regarding a bout of deflation in China. According to the National Bureau of Statistics of China, the country’s producer-price index (PPI), which tracks the average change over time in selling prices received by domestic producers of manufactured goods, was down 3.0% year-over-year in August— the eleventh consecutive month-over-month decline. Prices for the mining, raw materials, and processing industries fell by 9.0%, 4.0%, and 3.1%, respectively, during the previous 12-month period.

Economic Performance

U.S. inflation cooled during the reporting period. According to the Department of Labor, the U.S. consumer-price index (CPI) fell from an annual rate of 7.7% in September 2022, to 3.7% in August 2023. The most recent inflation data indicated that the CPI increased 0.6% month-over-month in August. However, the 4.3% annual increase in core inflation, as measured by the CPI for all items less food and energy, represented a 0.4- percentage point decline

SEI Institutional International Trust

from the 4.7% year-over-year upturn in July. Core inflation rose 0.3% month-over-month in August, following a 0.2-percentage point uptick in July. The government noted that more than half of the month-over-month increase in the overall CPI was attributable to higher gasoline prices, which climbed 10.6% in August. Housing costs also contributed to the upturn in inflation for the month. Food prices rose 0.2% in August, matching the previous month’s increase.

According to the third estimate from the Department of Commerce, U.S. gross domestic product (GDP) grew at annualized rate of 2.1% in the second quarter of 2023, unchanged from the government’s second estimate released in August, and down 0.1 percentage point from the 2.2% rise in the first three months of the year. The largest increases for the second quarter were in nonresidential fixed investment (purchases of both nonresidential structures and equipment and software), consumer spending, and state and local government spending. These gains offset reductions in exports and residential fixed investment (purchases of private residential structures and residential equipment that property owners use for rentals). The marginal decline in the GDP growth rate for the second quarter compared to the first three months of the year was due to slowdowns in consumer and federal government spending, as well as a decrease in exports.

The Office for National Statistics reported that consumer prices in the U.K. rose 0.4% month-over-month in August (the most recent reporting period)—up sharply from the 0.3% decrease in July. Inflation advanced 6.3% over the previous 12-month period, down marginally from the 6.4% annual upturn in July. Prices for alcohol and tobacco, along with clothing and footwear, were the largest contributors to the rise in inflation in August, while food and alcoholic beverages, and alcohol and tobacco posted the most notable price increases over the previous 12-month period. Core inflation, which excludes volatile food prices, rose at an annual rate of 5.9% in August, down from the 6.4% rise in July.

Eurostat pegged the inflation rate for the eurozone at 4.3% for the 12-month period ending in September 2023, down 0.9% from the 5.2% annual increase in August. Prices for food, alcohol and tobacco rose 8.8% in September, but the pace of acceleration slowed from the 9.7% annual rate for the previous month. Energy prices fell 4.7% year-over-year, following a 3.3% decline in August. Core inflation, which excludes volatile energy and food prices, rose at an annual rate of 4.5% in September, down 0.8% from August.

Market Developments

Global equity markets, as measured by the MSCI All-Country (AC) World Index, garnered positive returns despite periods of volatility over the reporting period. Developed markets significantly outperformed their emerging-market counterparts, though both asset classes posted double-digit gains. The Nordic countries garnered the highest returns among developed markets for the reporting period, attributable mainly to robust performance in Denmark. Despite posting a double-digit gain during the period, the Pacific ex Japan region was the primary underperformer due to weakness in Hong Kong. Eastern Europe was the top-performing region within the emerging markets for the reporting period due to notable strength in Hungary, Greece, and Poland. Conversely, the Gulf Cooperating Council (GCC) countries (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, and Oman) were the most notable laggards among the emerging markets for the period.

Global fixed-income assets ended the reporting period in positive territory, with the Bloomberg Global Aggregate Bond Index returning 2.24% in U.S. dollar terms. High-yield bonds, which posted double-digit returns, and emerging-market debt were the strongest performers. Both asset classes outperformed global corporate and government bonds. Over the reporting period, rates rose significantly across all maturities of the U.S. Treasury yield curve. The yield on the 10-year U.S. Treasury note ended the one-year reporting period up 76 basis points to 4.59%, while the 2-year yield rose 81 basis points to 5.03%. Bond prices fall as interest rates rise. The spread between 10- and 2-year notes widened from -39 to -44 basis points over the reporting period. The yield curve remained inverted, with yields on shorter-term bonds exceeding those on longer-dated securities. In an unusual move, yields on the 1-, 2- and 3-month Treasury bills climbed by corresponding margins of 276, 240 and 222 basis points to 5.55%, 5.60%, and 5.55% during the period. The significant upturn in ultra-short-term bond yields reflected expectations for rates to remain higher for longer; longer-term bond yields showed signs of concerns regarding how monetary tightening might have a negative impact on economic growth.

Global commodity prices, as measured by the Bloomberg Commodity Total Return Index, dipped 1.30% in U.S. dollar terms during the reporting period. However, gold prices rallied and ended the period in positive territory as

SEI Institutional International Trust

LETTER TO SHAREHOLDERS (Continued)

September 30, 2023 (Unaudited)

the U.S. dollar weakened (gold prices move inversely to the U.S. dollar) and the Fed began to slow the pace of its interest-rate hikes. Prices for West Texas Intermediate crude oil and Brent crude oil declined during much of first nine months of the reporting period before rallying sharply in the summer of 2023 on expectations that production output cuts from the Organization of the Petroleum Exporting Countries (OPEC) and Russia would continue through the end of the year. Wheat prices moved lower over the period, hampered by Russia’s shipments of large quantities of cheaply priced grain. The New York Mercantile Exchange (NYMEX) natural gas price tumbled more than 50% over the reporting period. The downturn was attributable mainly to a steep decline in late 2022 and early 2023, as an unusually mild winter in the U.S. continued to weigh on demand during the home-heating season.

Our View

While predictions of a downturn in business activity during 2023 have been widely held since the end of last year, the U.S. economy has mostly surprised to the upside. Recession calls are now in the minority, with the latest plane analogy going from “hard landing” to “soft landing,” and even to “no landing.” Strong July results for retail sales, services consumption, industrial production, and housing starts resulted in the inflation-adjusted gross domestic product reaching an annualized 5.9% rate of gain in August. We do not believe this trend is sustainable. Although the consensus has swung away from this view, there is a reasonable probability of a recession in 2024.

Other major economies outside the U.S. are showing signs of weakness, despite advances during the first half of this year. Germany is already in recession and the U.K. may not be far behind. In these developed economies, businesses and consumers alike are feeling pressure from rising interest rates and persistent core inflation.

Hopes that China’s economy would offset slowing growth elsewhere have proven to be elusive. Although Chinese domestic travel and services consumption experienced a post-COVID-19 bounce, the economic data have been mostly disappointing. Consumer sentiment remains extremely depressed, with the latest quarterly reading showing a partial reversal of the early 2023 post-lockdown bounce. Chinese consumers and financial market participants appear largely unimpressed with the government’s efforts, both fiscal and monetary, to turn the economy around.

Inflation continues to fall as COVID-19-era supply-chain disruptions abate. However, it is SEI’s strong conviction that there has been a regime change when it comes to long-run inflation, and that it will run sustainably higher in the U.S. than the Federal Reserve’s (Fed) 2% target. Structurally tight labor markets, the shifting of global supply chains away from China, higher financing costs, the disruptions caused by the transition to a carbon-neutral regime, and a likely boost in corporate tax rates in the years ahead suggest to us that an inflation rate over 3% is more likely than one under 2%.

The Fed’s rate-hiking cycle is nearing an end, but this does not mean that the federal-funds rate will be moving lower anytime soon. We believe there could be one more interest-rate increase from the Fed, but as labor-market pressures ease, even this appears increasingly unlikely. The latest Federal Open Market Committee projections indicate an intention to keep the federal-funds rate higher for longer. In our view, it is unlikely the central bank will begin cutting rates before the second half of 2024.

Other major central banks are in similar positions. Given Europe’s stubborn inflation and lower policy-rate stance, the European Central Bank may raise its key interest rate once or twice more this cycle. The U.K. is closest to a wage-price spiral, which may force the Bank of England to implement a monetary policy that is tighter than it would prefer. Meanwhile, the Bank of Japan is under increasing pressure to start raising its policy interest rate in order to firm up the yen.

Bond yields have risen despite lower inflation rates. We believe markets are responding to the increase in government debt issuance at a time when central banks are adding to supply pressures via quantitative tightening (i.e., selling bonds out of their portfolios).

SEI expects bond yields to remain elevated as investors adjust their expectations regarding the probability of higher-for-longer central bank interest-rate policy. We also believe that the term premium (the excess yield required to offset the additional risk in longer-dated bonds) will turn positive as investors demand compensation for taking on a greater level of uncertainty around future interest-rate risk.

Equity markets have entered a corrective phase. U.S. large-capitalization stocks are expected to trade in a broad range, with the S&P 500 Index currently closer to the upper end of this range. Growth companies with high price-to-

SEI Institutional International Trust

earnings ratios are vulnerable to rising bond yields, and more cyclical and economically sensitive names within this cohort could face pressure from declining profit margins.

Sincerely,

James Smigiel

Head and Chief Investment Officer of Non-Traditional Asset Management

SEI Institutional International Trust

LETTER TO SHAREHOLDERS (Concluded)

September 30, 2023 (Unaudited)

Index Definitions

The MSCI All Country (AC) World Index is a market capitalization-weighted index that tracks the performance of over 2,000 companies, and is representative of the market structure of 48 developed and emerging-market countries in North and South America, Europe, Africa, and the Pacific Rim. The index is calculated with net dividends reinvested in U.S. dollars.

The MSCI Emerging Markets Index (Net) is a free float-adjusted (i.e., including only shares that are available for public trading) market capitalization-weighted index that tracks the performance of emerging-market equities.

The Bloomberg Global Aggregate Bond Index is a market capitalization-weighted index that tracks the performance of investment-grade (rated BBB- or higher by S&P Global Ratings/Fitch Ratings or Baa3 or higher by Moody’s Investors Service) fixed-income securities denominated in 13 currencies. The index reflects reinvestment of all distributions and changes in market prices.

The Bloomberg Commodity Total Return Index comprises futures contracts and tracks the performance of a fully collateralized investment in the index. This combines the returns of the index with the returns on cash collateral invested in 13-week (three-month) U.S. Treasury bills.

Producer-price indexes (PPI) measure the average change over time in selling prices received by domestic producers of goods and services.

The S&P 500 Index is a market-weighted index that tracks the performance of the 500 largest publicly traded U.S. companies and is considered representative of the broad U.S. stock market.

SEI Institutional International Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

September 30, 2023 (Unaudited)

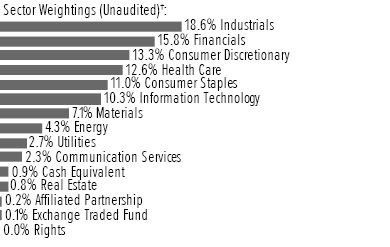

International Equity Fund

I. Objective

The International Equity Fund (the “Fund”) seeks long-term capital appreciation.

II. Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisors with differing investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (SIMC). The Fund utilized the following sub-advisors as of September 30, 2023: Acadian Asset Management LLC (Acadian), Causeway Capital Management LLC (Causeway), Delaware Investments Fund Advisers, a series of Macquarie Investment Management Business Trust (Macquarie), Lazard Asset Management LLC (Lazard), Pzena Investment Management, LLC (Pzena), and WCM Investment Management LLC (WCM).

During the period, Lazard was added to the Fund, while Intech Investment Management LLC and JOHCM (USA) Inc. were removed from the Fund.

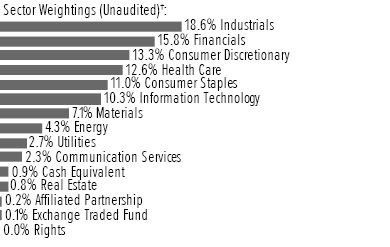

III. Return vs. Benchmark

For the year ended September 30, 2023, the Fund’s Class F shares outperformed the MSCI EAFE Index (Net)—which tracks the performance of developed-market equities outside North America—returning 27.81% versus the Index return of 25.65%.

IV. Fund Attribution

As of the end of the reporting period, global equity markets had recovered sharply from a difficult year in 2022, with the MSCI EAFE Index bottoming in October 2022, and recovering since then. The global economy avoided a recession and it appeared that markets were pricing in an economic downturn in 2022. All of this produced a sharp rebound as risk had been repriced. Economic data remained fairly strong over the period and company earnings moved higher. While inflation remained high and interest rates were elevated, most investors believed that central banks were closer to the end of their monetary policy tightening than the beginning. Oil prices were virtually flat over the reporting period, with natural gas prices down significantly (which was especially helpful for Europe). The U.S. Dollar index declined modestly over the 12- month period. These measures served to ease financial conditions, though this was partly offset by higher interest rates. Ultimately, the “rate of increase” of inflation moderated, which is a

positive environment for corporate earnings and investor risk appetite.

The market backdrop and avoidance of recession caused the cyclical and economically sensitive industries to outperform over the reporting period. Specifically, shares of semiconductor companies, banks, providers of capital goods, energy companies, and auto manufacturers have done well. Relative laggards were defensive areas, including food and beverage, telecommunications, healthcare equipment, and pharmaceutical firms.

Regionally, Europe outperformed, Japan performed in line with the benchmark MSCI EAFE Index, and Pacific ex Japan was a laggard. The Japanese yen was relatively weak over the reporting period, but the U.S. dollar return for the Tokyo Stock Price Index (TOPIX) was in line with that of the MSCI EAFE Index for the period.

The Value factor was, by far, the strongest-performing alpha source (the investment approach taken by an active investment manager in an effort to generate excess returns relative to a benchmark) over the reporting period. With the avoidance of recession, the rise in interest rates, and the outperformance of more economically sensitive sectors, we would expect value to outperform in this environment. The Momentum factor produced flat relative returns during the period. Quality stocks lagged the overall market due primarily to its higher exposure to the consumer staples and healthcare sectors, as we had expected. Low volatility also underperformed amid a sharp upturn in a market where risk was rewarded.

The Fund outperformed its benchmark, the MSCI EAFE Index, due primarily to an overweight allocation to value. The Fund also had a higher volatility bias, which is to be expected given our preference for value. This positioning benefited Fund performance as defensive stocks lagged during the period.

From a sector perspective, an overweight to the consumer discretionary sector and underweight to utilities and communication services had a positive impact on Fund performance for the reporting period. Regional effects were noteworthy, especially in Japan, which was the strongest-performing market in local currency terms over the period. Consequently, the Fund’s underweight in Japan detracted from performance. However, the Japanese yen also depreciated significantly as Japan has been one of the only countries that has kept interest rates low and maintained loose monetary policy. Therefore, the Fund’s

SEI Institutional International Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

September 30, 2023 (Unaudited)

International Equity Fund (Concluded)

underweight allocation to the Japanese yen offset the underweight to the equity market.

The Fund managers’ results bolstered performance over the reporting period. Causeway was the standout performer, as its results exceeded our expectations. In our view, it is not unusual to have a manager performing above expectations while another underperforms. While Causeway’s value bias benefited Fund performance, stock selection also was very strong, particularly its holdings in luxury auto-maker Rolls Royce and Unicredit, a commercial bank. Pzena also performed well during the reporting period, attributable to its value bias. Conversely, the performance of Macquarie and WCM (quality managers) lagged, which was consistent with expectations. Acadian (multi-factor quantitative) also underperformed, as its momentum bias was not able to capture shifting trends given the volatile environment and several changes in leadership at the company. The Fund had a relatively small allocation to Lazard, which was appointed as a sub-advisor for the Fund in February 2023.

Investing is subject to risk, including the possible loss of principal. Past performance is no indication of future results.

AVERAGE ANNUAL TOTAL RETURN1 |

| |

1 Year

Return |

Annualized

3 Year

Return |

Annualized

5 Year

Return |

Annualized

10 Year

Return |

Annualized

Inception

to Date |

International Equity Fund, Class F |

27.81% |

5.67% |

3.09% |

3.85% |

3.62% |

International Equity Fund, Class I |

27.63% |

5.44% |

2.84% |

3.59% |

3.37% |

International Equity Fund, Class Y |

28.26% |

5.96% |

3.35% |

4.08% |

3.69% |

MSCI EAFE Index (Net) |

25.65% |

5.75% |

3.24% |

3.82% |

4.38% |

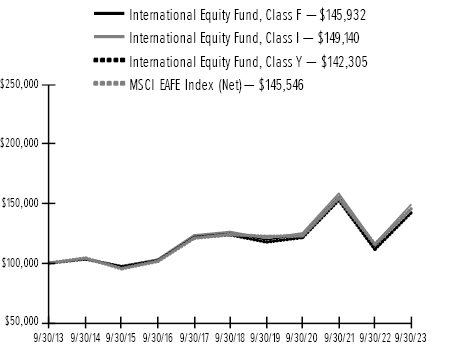

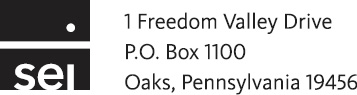

Comparison of Change in the Value of a $100,000 Investment in the International Equity Fund, Class F, Class I and Class Y, versus the MSCI EAFE Index (Net)

|

1

|

For the year ended September 30, 2023. Past performance is no indication of future performance. Class F shares were offered beginning December 20, 1989. Class I shares were offered beginning January 4, 2002. The performance of Class I shares prior to January 4, 2002 is calculated using the performance of Class F shares adjusted for the higher expenses of the Class I shares. Returns for Class I shares are substantially similar to those of Class F shares and differ only to the extent that Class I shares have higher total annual fund operating expenses than Class F shares. The Fund’s Class Y shares commenced operations on December 31, 2014. For periods prior to December 31, 2014, the performance of the Fund’s Class F Shares has been used. Returns for Class Y Shares would have been substantially similar to those of Class F shares and would have differed only to the extent that Class Y shares have lower total annual fund operating expenses than Class F shares. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for the period reflect fee waivers and/or reimbursements in effect for the period; absent fee waivers and reimbursements, performance would have been lower.

|

SEI Institutional International Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

September 30, 2023 (Unaudited)

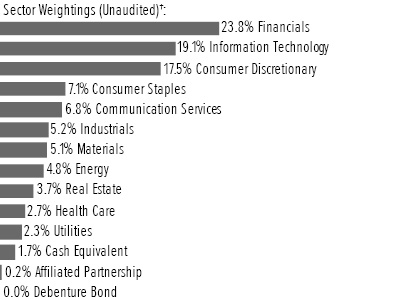

Emerging Markets Equity Fund

I. Objective

The Emerging Markets Equity Fund (the “Fund”) seeks capital appreciation.

II. Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisors with differing investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (SIMC). The Fund utilized the following sub-advisors as of September 30, 2023: Aikya Investment Management Limited (Aikya), JOHCM (USA) Inc. (JO Hambro), KBI Global Investors (North America) Ltd. (KBI), Qtron Investments LLC (Qtron), and Robeco Institutional Asset Management US Inc. (Robeco).

During the Fund’s fiscal year, Aikya was added to the Fund, while RWC Asset Advisors (US) LLC (RWC) and Neuberger Berman Investment Advisers LLC (Neuberger Berman) were terminated from the Fund.

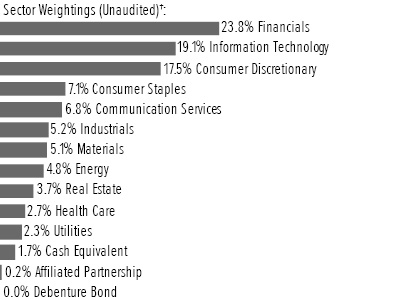

III. Return vs. Benchmark

For the year ended September 30, 2023, the Fund’s Class F shares outperformed the MSCI Emerging Markets Index (Net)—which tracks the performance of global emerging market equities—returning 12.32% versus the Index return of 11.70%.

IV. Fund Attribution

Emerging-market equities garnered positive returns during the 12-month reporting period. The majority of gains were registered in the first four months of the period, when Chinese equities rallied following the sudden removal of COVID lockdowns, as discussed in the shareholder letter. The rally faded, however, as consumer sentiment and economic growth in China stalled, and China ended the reporting period underperforming the benchmark MSCI Emerging Markets Index. India was a strong performer due to robust domestic growth in the second half of the reporting period. Taiwan and Korea also performed well, led by strong gains in the information technology (IT) hardware sector and consumer companies, respectively. Latin America underperformed the benchmark index, hampered by Brazilian equities following weak returns in the IT and consumer-related sectors. However, Mexico outperformed the benchmark index as the country benefited from positive impact of nearshoring (the process of transferring a business operation to a nearby country, especially in preference to a more distant one). The Europe, Middle East and Africa (EMEA) region

underperformed the index as well, primarily due to weak performance in South Africa as the country struggled with economic and political turmoil. The Eastern Europe market rallied, however, as the region rebounded from the selloff following Russia’s invasion of Ukraine.

From a sector standpoint, IT was the strongest performer sector, as demand for artificial intelligence (AI) fueled gains. The energy sector also performed well, rallying on higher oil prices in the summer of 2023. Utilities and real estate were among the weakest-performing sectors, as utilities underperformed in China and India, while the Chinese real estate sector continued to grapple with weak growth and demand.

The Value factor was the strongest-performing alpha source (the investment approach taken by an active investment manager in an effort to generate excess returns relative to a benchmark) as cheap markets such as Korea outperformed. Chinese state-owned banks, which are cheap relative to the benchmark index, also outperformed as investors perceived these stocks as defensive relative to the broader Chinese economy. The Quality factor was the next-strongest performer among alpha sources due to notable gains in IT hardware stocks in Taiwan and Korea, fueled by the AI craze. The Momentum factor was the weakest performer, but performed in line with the index. This was attributable to rotation in market leadership, from India to China and back to India, and from the underperformance and then resurgence in IT.

Robeco was the Fund’s top-performing manager during the reporting period due to the strong performance from value stocks. This resulted in significant gains from banks and consumer discretionary companies, especially banks in Greece and auto stocks in Korea. Qtron was another contributor due to strong multi-factor model-driven results in the IT, utilities, and consumer discretionary sectors. Qtron had positive exposure to all three alpha sources. KBI was another contributor to Fund performance as well due to strong performance of value, resulting in gains in financials and energy stocks. Momentum was not a meaningful tailwind for JO Hambro, which slightly lagged the benchmark index due to weak results in the industrials and communication services sectors. Neuberger Berman saw bottom-up-driven gains in the health care and consumer staples sectors, and losses in financials and industrials. Specifically, the manager’s lack of exposure to Chinese banks in particular weighed on performance. Aikya detracted from Fund performance for the period due to bottom-updriven losses in the consumer staples and financials.

SEI Institutional International Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

September 30, 2023 (Unaudited)

Emerging Markets Equity Fund (Concluded)

From a regional standpoint, Taiwan was the biggest contributor to Fund performance due to exposure to IT stocks that benefited from the AI theme. India was another major contributor due to positive bottom-up results in the IT sector and by the lack of exposure to underperforming Indian utilities. The United Arab Emirates (UAE) was another strong contributor due to positive real estate stock results that capitalized on strong demographic trends in the country. Brazil was the biggest detractor due to losses in the consumer sectors. Vietnam was another detractor from performance as the country faced a difficult economic backdrop.

Regarding sector performance, financials was the biggest contributor due to positive results in Greek and Korean banks on which the Fund’s value managers capitalized. IT was another contributor due to strong results in IT hardware and software stocks that benefited from AI demand. Utilities also contributed to performance as the Fund was underweight to the underperforming Indian utilities sector. Industrials was the largest detractor from Fund performance due to weak bottom-up results in Asia. Consumer staples was another notable detractor attributable primarily to bottom-up losses in the food and beverages sector.

Investing is subject to risk, including the possible loss of principal. Past performance is no indication of future results.

AVERAGE ANNUAL TOTAL RETURN1 |

| |

1 Year

Return |

Annualized

3 Year

Return |

Annualized

5 Year

Return |

Annualized

10 Year

Return |

Annualized

Inception

to Date |

Emerging Markets Equity Fund, Class F |

12.32% |

-1.95% |

0.16% |

1.39% |

3.66% |

Emerging Markets Equity Fund, Class Y |

12.63% |

-1.70% |

0.40% |

1.62% |

3.74% |

MSCI Emerging Markets Index (Net) |

11.70% |

-1.73% |

0.55% |

2.07% |

2.42% |

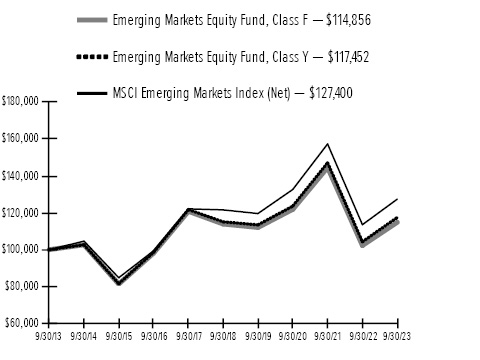

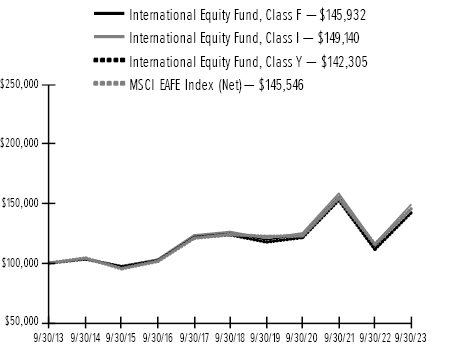

Comparison of Change in the Value of a $100,000 Investment in the Emerging Markets Equity Fund, Class F and Class Y, versus the MSCI Emerging Markets Index (Net)

|

1

|

For the year ended September 30, 2023. Past performance is no indication of future performance. Class F shares were offered beginning January 17, 1995. The Fund’s Class Y shares commenced operations on December 31, 2014. For periods prior to December 31, 2014, the performance of the Fund’s Class F Shares has been used. Returns for Class Y Shares would have been substantially similar to those of Class F shares and would have differed only to the extent that Class Y shares have lower total annual fund operating expenses than Class F shares. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for the period reflect fee waivers and/or reimbursements in effect for the period; absent fee waivers and reimbursements, performance would have been lower.

|

SEI Institutional International Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

September 30, 2023 (Unaudited)

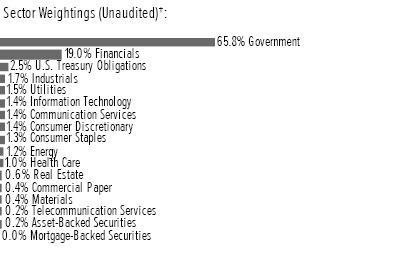

International Fixed Income Fund

I. Objective

The International Fixed Income Fund (the “Fund”) seeks capital appreciation and current income.

II. Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisors with differing investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (SIMC). The Fund utilized the following sub-advisors as of September 30, 2023: AllianceBernstein L.P. (AllianceBernstein), Colchester Global Investors Limited (Colchester), and Wellington Management Company LLP (Wellington).

No manager changes were made during the Fund’s fiscal year.

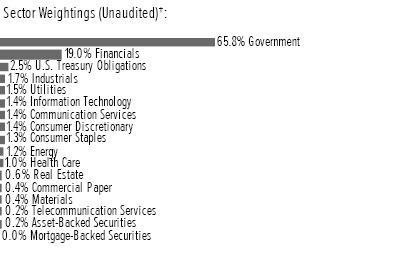

III. Return vs. Benchmark

For the year ended September 30, 2023, the Fund’s Class F shares underperformed the Bloomberg Global Aggregate ex-USD Index, Hedged (the index)–which tracks the performance of the global investment-grade fixed-rate debt markets outside of the U.S.–returning 1.88% versus the Index return of 2.99%.

IV. Fund Attribution

Global bond yields rose over the reporting period as the market reassessed the likely path of central bank monetary policy against a backdrop of sticky inflation, tight labor markets and a surprisingly resilient U.S. economy. However, the performance of fixed-income securities was protected to an extent by the additional yield cushion that had been built into bond markets throughout 2022. At the regional level, China was the strongest-performing bond market amid investors’ concerns about economic growth and disinflation. Japan, meanwhile, was the worst performing G7 market as the Bank of Japan tries to carefully engineer a route back to policy normalization. Credit spreads tightened over the reporting period despite concerns earlier in the year regarding the banking sector. In the currency space, the U.S. dollar weakened against all other G10 currencies, with the exception of the Japanese yen (JPY).

The Fund underperformed the benchmark index for the reporting period. Fund performance was hampered by an overweight duration position in New Zealand and an underweight in China. Currency detractors included a long position in the JPY and short positions in the Swiss franc (CHF) euro (EUR), and New Zealand dollar (NZD). Positive contributors to Fund performance included

an overweight to corporate credit, an underweight to European rates, off-index exposure to U.S. bonds, and overweight allocations to Mexican, Colombian and Polish local-currency bonds. Long currency positions in the British pound sterling (GBP) and Korean won (KRW) also enhanced the Fund’s relative performance. Among the Fund’s managers, Wellington performed roughly in line with its customized index, while Colchester outperformed its customized index. Colchester benefited from duration underweight positions in Europe and Japan, overweights in local-currency emerging market bonds, and long currency positions in the GBP, KRW and Czech koruna (CZK).

AllianceBernstein underperformed its customized index despite the positive impact of an overweight allocation to corporate credit. The main detractors included overweight duration positions in the UK and New Zealand, as well as an underweight to China. Long currency positions in the JPY and Norwegian krone (NOK) also weighed on performance.

Regarding derivatives, the Fund used FX forwards, financial futures, interest-rate swaps, and over-the-counter options during the reporting period to hedge existing exposures and gain exposure to particular areas of the market.

Investing is subject to risk, including the possible loss of principal. Past performance is no indication of future results.

AVERAGE ANNUAL TOTAL RETURN1 |

| |

1 Year

Return |

Annualized

3 Year

Return |

Annualized

5 Year

Return |

Annualized

10 Year

Return |

Annualized

Inception

to Date |

International Fixed Income Fund, Class F |

1.88% |

-3.17% |

-0.02% |

1.52% |

3.45% |

International Fixed Income Fund, Class Y |

2.30% |

-2.89% |

0.24% |

1.73% |

3.52% |

Bloomberg Global Aggregate ex-USD Index, Hedged |

2.99% |

-2.62% |

0.83% |

2.30% |

4.73% |

SEI Institutional International Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

September 30, 2023 (Unaudited)

International Fixed Income Fund (Concluded)

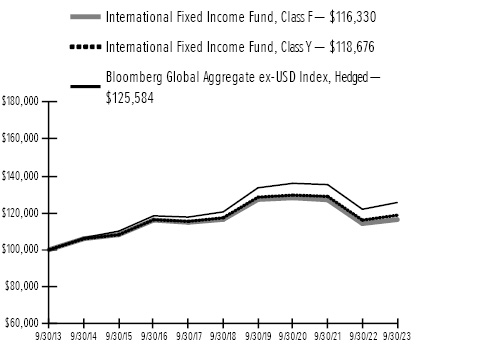

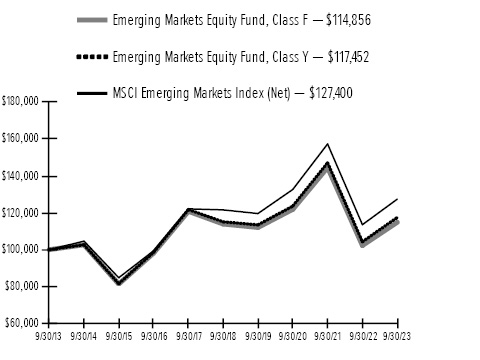

Comparison of Change in the Value of a $100,000 Investment in the International Fixed Income Fund, Class F and Class Y, versus the Bloomberg Global Aggregate ex-USD Index, Hedged

|

1

|

For the year ended September 30, 2023. Past performance is no indication of future performance. Class F shares were offered beginning September 1, 1993. The Fund’s Class Y shares commenced operations on October 30, 2015. For periods prior to October 30, 2015, the performance of the Fund’s Class F Shares has been used. Returns for Class Y Shares would have been substantially similar to those of Class F shares and would have differed only to the extent that Class Y shares have lower total annual fund operating expenses than Class F shares. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for the period reflect fee waivers and/or reimbursements in effect for the period; absent fee waivers and reimbursements, performance would have been lower.

|

SEI Institutional International Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

September 30, 2023 (Unaudited)

Emerging Markets Debt Fund

I. Objective

The Emerging Markets Debt Fund (the “Fund”) seeks to maximize total return.

II. Multi-Manager Approach

The Fund uses a multi-manager approach, relying on a number of sub-advisors with differing investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corp. (SIMC). The Fund utilized the following sub-advisors as of September 30, 2023: Colchester Global Investors Limited (Colchester), Marathon Asset Management, L.P. (Marathon), Neuberger Berman Investment Advisers LLC (Neuberger Berman), Ninety One UK Ltd. (Ninety One), and Stone Harbor Investment Partners LP, a division of Virtus Fixed Income Advisers, LLC (Stone Harbor).

No manager changes were made during the Fund’s fiscal year.

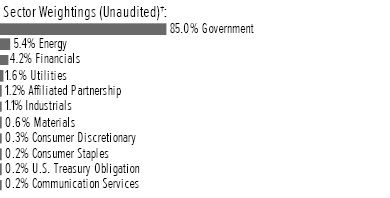

III. Return vs. Benchmark

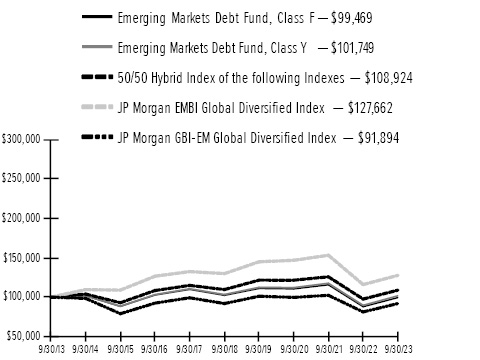

For the year ending September 30, 2023, the Fund’s Class F shares outperformed a hybrid of 50% J.P. Morgan EMBI Global Diversified Index (JPM EMBI GD)–which tracks the performance of external debt instruments in the emerging markets–and 50% J.P. Morgan GBI Emerging Markets Global Diversified Index (JPM GBI-EM GD)–which tracks the performance of debt instruments issued in domestic currencies by emerging-market governments–returning 13.13%, versus the Index return of 11.58%.

IV. Fund Attribution

For the 12-month period ending September 30, 2023, the hard-currency and local-currency markets returned 10.01% and 13.10%, respectively. Hard currency spreads tightened from 560 basis points (bps) (5.60%) to 430 bps over the reporting period, generating a significant positive return. High yield hard currency spreads moved from 993 to 789 bps and investment-grade spreads moved from 191 to 128 bps. The Fund’s overweight allocation to high-yield issues benefited from the sector’s outperformance relative to investment-grade bonds. A wedge of 661 bps remains between investment-grade and high-yield spreads, comparatively to a long-term average of 388 bps, supporting the Fund’s overweight to high yield.

The local-currency market benefited from both lower local yields and stronger emerging markets foreign exchange (EM FX) for the reporting period. Local rates

generated positive returns over the period as central banks in emerging markets begun tightening monetary policy into signs of disinflation. EM FX generated positive returns in the initial part of the reporting period before weakening against a strong U.S. dollar in the last few months of the period.

The Fund outperformed its blended benchmark during the reporting period. An overweight to high-yield hard-currency exposure such as Romania in euro exposure, state-owned oil company Pemex in Mexico, and El Salvador enhanced Fund performance. Underweight positions in high-investment-grade countries such as Bahrain and Oman detracted from Fund performance. Regarding currency exposure, overweight allocations to Hungary, Brazil and Columbia, and underweight to Turkey, bolstered Fund performance, while overweight exposure to South Africa and the Chinese renminbi had a negative impact. The Fund had a small short position in the U.S. dollar, which contributed to performance for the 12 month period. Among the Fund’s managers, Colchester and Ninety One outperformed the Fund’s blended benchmark. Colchester was positioned with a bias toward currencies such as Brazil and Mexico with relatively higher real yields, while being underweight to Asia, and outperformed as a result. Ninety One outperformed due to an inflation position in Mexico, as well as overweight positions in the Hungarian forint and Columbian peso.

Stone Harbor, Marathon and Neuberger Berman outperformed the blended benchmark as spreads tightened over the reporting period. The performance of Stone Harbor and Neuberger benefited from overweight allocations to high-yield hard-currency exposures, including Argentina, El Salvador and Angola. Marathon benefited from its quasi-sovereign exposure to Pemex and trades in high-quality Gulf Cooperation Council (GCC) credits, which saw spread-tightening over the period.

Regarding derivatives, the Fund employed currency forwards and swap contracts over the reporting period in an effort to either hedge particular positions or gain exposure to additional areas of the market. Currency forwards had a material impact on Fund performance during the period, as 50% of the benchmark index is directly affected by foreign currencies. Positive and negative effects differed on a country-to-country basis, depending on whether the forward increased or decreased currency exposure, and whether the currency strengthened or weakened relative to the U.S. dollar.

SEI Institutional International Trust

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

September 30, 2023 (Unaudited)

Emerging Markets Debt Fund (Concluded)

Investing is subject to risk, including the possible loss of principal. Past performance is no indication of future results.

AVERAGE ANNUAL TOTAL RETURN1 |

| |

1 Year

Return |

Annualized

3 Year

Return |

Annualized

5 Year

Return |

Annualized

10 Year

Return |

Annualized

Inception

to Date |

Emerging Markets Debt Fund, Class F |

13.13% |

-3.46% |

-0.58% |

-0.05% |

5.89% |

Emerging Markets Debt Fund, Class Y |

13.50% |

-3.20% |

-0.32% |

0.17% |

5.98% |

JP Morgan EMBI Global Diversified Index |

10.01% |

-4.56% |

-0.35% |

2.47% |

6.54% |

JP Morgan GBI-EM Global Diversified Index |

13.10% |

-2.70% |

-0.00% |

-0.84% |

X.XX% |

50/50 Hybrid of the JP Morgan EMBI Global Diversified Index and the JP Morgan GBI-EM Global Diversified Index |

11.58% |

-3.61% |

-0.14% |

0.86% |

X.XX% |

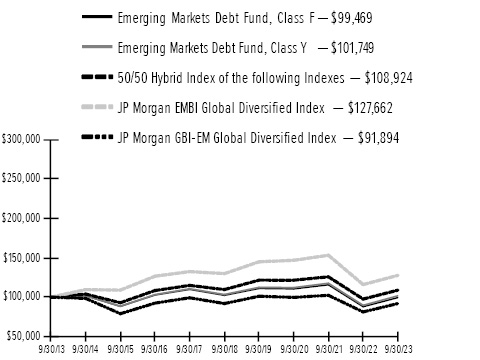

Comparison of Change in the Value of a $100,000 Investment in the Emerging Markets Debt Fund, Class F and Class Y, versus a 50/50 Hybrid of the Following Indexes: the JP Morgan EMBI Global Diversified Index and the JP Morgan GBI-EM Global Diversified Index

|

1

|

For the year ended September 30, 2023. Past performance is no indication of future performance. Class F shares were offered beginning June 26, 1997. The Fund’s Class Y shares commenced operations on December 31, 2014. For periods prior to December 31, 2014, the performance of the Fund’s Class F Shares has been used. Returns for Class Y Shares would have been substantially similar to those of Class F shares and would have differed only to the extent that Class Y shares have lower total annual fund operating expenses than Class F shares. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns

|

|

|

for the period reflect fee waivers and/or reimbursements in effect for the period; absent fee waivers and reimbursements, performance would have been lower.

|

SEI Institutional International Trust

SCHEDULE OF INVESTMENTS

September 30, 2023

International Equity Fund

†Percentages based on total investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| |

|

|

|

|

|

|

Description |

|

Shares |

|

|

Market Value

($ Thousands) |

|

COMMON STOCK — 95.9% |

Australia — 2.7% |

Adbri Ltd * |

|

|

36,642 |

|

|

$ |

48 |

|

Ampol |

|

|

54,892 |

|

|

|

1,197 |

|

ANZ Group Holdings Ltd |

|

|

59,877 |

|

|

|

992 |

|

Aristocrat Leisure Ltd |

|

|

113,995 |

|

|

|

3,005 |

|

Audinate Group * |

|

|

6,506 |

|

|

|

57 |

|

Base Resources Ltd |

|

|

271,387 |

|

|

|

30 |

|

Bellevue Gold * |

|

|

646,979 |

|

|

|

578 |

|

BHP Group Ltd |

|

|

116,778 |

|

|

|

3,335 |

|

BlueScope Steel Ltd |

|

|

933,040 |

|

|

|

11,706 |

|

Brambles Ltd |

|

|

608,925 |

|

|

|

5,628 |

|

Cochlear Ltd |

|

|

14,298 |

|

|

|

2,356 |

|

CSR Ltd ‡ |

|

|

669,497 |

|

|

|

2,441 |

|

Fortescue Metals Group Ltd |

|

|

131,251 |

|

|

|

1,772 |

|

GPT Group ‡ |

|

|

250,000 |

|

|

|

629 |

|

Helia Group Ltd |

|

|

156,150 |

|

|

|

352 |

|

Iluka Resources Ltd |

|

|

579,958 |

|

|

|

2,875 |

|

Inghams Group |

|

|

53,436 |

|

|

|

115 |

|

Insurance Australia Group Ltd |

|

|

310,959 |

|

|

|

1,140 |

|

Medibank Pvt |

|

|

586,831 |

|

|

|

1,303 |

|

Neuren Pharmaceuticals * |

|

|

74,700 |

|

|

|

533 |

|

New Hope |

|

|

232,041 |

|

|

|

951 |

|

Northern Star Resources Ltd |

|

|

70,236 |

|

|

|

474 |

|

Nufarm Ltd |

|

|

30,265 |

|

|

|

93 |

|

Orica Ltd |

|

|

130,606 |

|

|

|

1,314 |

|

Orora Ltd |

|

|

2,269,436 |

|

|

|

4,028 |

|

Premier Investments Ltd |

|

|

30,909 |

|

|

|

499 |

|

Pro Medicus Ltd |

|

|

35,250 |

|

|

|

1,897 |

|

Qantas Airways Ltd * |

|

|

2,534,336 |

|

|

|

8,473 |

|

Rio Tinto PLC |

|

|

207,468 |

|

|

|

13,102 |

|

Rio Tinto PLC ADR |

|

|

130,750 |

|

|

|

8,321 |

|

Santos Ltd |

|

|

188,573 |

|

|

|

961 |

|

Seven Group Holdings Ltd |

|

|

44,940 |

|

|

|

904 |

|

Sonic Healthcare Ltd |

|

|

132,573 |

|

|

|

2,550 |

|

South32 Ltd |

|

|

1,211,425 |

|

|

|

2,651 |

|

| |

|

|

|

|

|

|

Description |

|

Shares |

|

|

Market Value

($ Thousands) |

|

COMMON STOCK (continued) |

Super Retail Group Ltd |

|

|

92,810 |

|

|

$ |

718 |

|

Technology One Ltd |

|

|

123,506 |

|

|

|

1,236 |

|

Telstra Group Ltd |

|

|

175,223 |

|

|

|

435 |

|

Vicinity Centres ‡ |

|

|

550,000 |

|

|

|

602 |

|

Washington H Soul Pattinson |

|

|

86,065 |

|

|

|

1,810 |

|

Whitehaven Coal Ltd |

|

|

1,479,952 |

|

|

|

6,791 |

|

Woolworths Group Ltd |

|

|

124,649 |

|

|

|

3,002 |

|

| |

|

|

|

|

|

|

100,904 |

|

| |

|

|

|

|

|

|

|

|

Austria — 0.4% |

ANDRITZ AG |

|

|

44,869 |

|

|

|

2,272 |

|

Erste Group Bank AG |

|

|

98,710 |

|

|

|

3,430 |

|

OMV AG |

|

|

166,029 |

|

|

|

7,966 |

|

Raiffeisen Bank International AG |

|

|

39,393 |

|

|

|

576 |

|

Vienna Insurance Group AG Wiener Versicherung Gruppe |

|

|

5,873 |

|

|

|

164 |

|

Wienerberger AG |

|

|

2,047 |

|

|

|

52 |

|

| |

|

|

|

|

|

|

14,460 |

|

| |

|

|

|

|

|

|

|

|

Belgium — 0.3% |

Anheuser-Busch InBev SA/NV |

|

|

203,432 |

|

|

|

11,310 |

|

Lotus Bakeries |

|

|

94 |

|

|

|

765 |

|

| |

|

|

|

|

|

|

12,075 |

|

| |

|

|

|

|

|

|

|

|

Bermuda — 0.0% |

Conduit Holdings Ltd |

|

|

958 |

|

|

|

5 |

|

| |

|

|

|

|

|

|

|

|

Brazil — 1.1% |

Ambev SA * |

|

|

9,464,400 |

|

|

|

24,809 |

|

Banco Bradesco SA ADR * |

|

|

1,667,850 |

|

|

|

4,753 |

|

Banco do Brasil SA |

|

|

948,200 |

|

|

|

8,951 |

|

MercadoLibre Inc * |

|

|

3,310 |

|

|

|

4,197 |

|

| |

|

|

|

|

|

|

42,710 |

|

| |

|

|

|

|

|

|

|

|

Canada — 1.6% |

AGF Management, Cl B |

|

|

20,400 |

|

|

|

108 |

|

Alimentation Couche-Tard Inc |

|

|

189,842 |

|

|

|

9,686 |

|

Black Diamond Group Ltd |

|

|

4,100 |

|

|

|

22 |

|

Canadian Pacific Kansas City |

|

|

258,199 |

|

|

|

19,240 |

|

Canfor Corp * |

|

|

87,567 |

|

|

|

1,093 |

|

Cascades Inc |

|

|

4,484 |

|

|

|

41 |

|

Celestica Inc * |

|

|

119,384 |

|

|

|

2,935 |

|

Coveo Solutions Inc * |

|

|

4,242 |

|

|

|

32 |

|

Dexterra Group Inc |

|

|

104 |

|

|

|

– |

|

Ensign Energy Services Inc * |

|

|

37,800 |

|

|

|

91 |

|

Exco Technologies Ltd |

|

|

9,200 |

|

|

|

51 |

|

iA Financial Corp Inc |

|

|

64,397 |

|

|

|

4,058 |

|

Magna International Inc, Cl A |

|

|

291,942 |

|

|

|

15,706 |

|

Martinrea International Inc |

|

|

88,935 |

|

|

|

823 |

|

MEG Energy Corp * |

|

|

104,300 |

|

|

|

2,039 |

|

Mullen Group Ltd |

|

|

53,775 |

|

|

|

534 |

|

Pason Systems Inc |

|

|

17,325 |

|

|

|

173 |

|

Thomson Reuters |

|

|

35,406 |

|

|

|

4,351 |

|

SEI Institutional International Trust

SCHEDULE OF INVESTMENTS

September 30, 2023

International Equity Fund (Continued)

| |

|

|

|

|

|

|

Description |

|

Shares |

|

|

Market Value

($ Thousands) |

|

COMMON STOCK (continued) |

Torex Gold Resources Inc * |

|

|

7,008 |

|

|

$ |

73 |

|

| |

|

|

|

|

|

|

61,056 |

|

| |

|

|

|

|

|

|

|

|

China — 1.9% |

Agricultural Bank of China Ltd, Cl H |

|

|

746,000 |

|

|

|

277 |

|

Alibaba Group Holding Ltd * |

|

|

2,199,500 |

|

|

|

23,845 |

|

Autohome Inc ADR |

|

|

1,788 |

|

|

|

54 |

|

Beijing Capital International Airport Co Ltd, Cl H * |

|

|

4,888,000 |

|

|

|

2,260 |

|

China CITIC Bank Corp Ltd, Cl H |

|

|

1,518,126 |

|

|

|

704 |

|

China Construction Bank Corp, Cl H |

|

|

20,432,000 |

|

|

|

11,485 |

|

China Minsheng Banking, Cl H |

|

|

207,000 |

|

|

|

71 |

|

China Overseas Land & Investment Ltd |

|

|

3,361,000 |

|

|

|

6,944 |

|

China Pacific Insurance Group Co Ltd, Cl H |

|

|

528,000 |

|

|

|

1,314 |

|

Haier Smart Home Co Ltd, Cl H |

|

|

2,274,800 |

|

|

|

7,109 |

|

Lenovo Group Ltd |

|

|

24,000 |

|

|

|

25 |

|

MINISO Group Holding ADR |

|

|

10,995 |

|

|

|

285 |

|

New China Life Insurance Co Ltd, Cl H |

|

|

260,300 |

|

|

|

624 |

|

PetroChina Co Ltd, Cl H |

|

|

9,954,000 |

|

|

|

7,459 |

|

SITC International Holdings Co Ltd |

|

|

1,358,000 |

|

|

|

2,278 |

|

Tencent Holdings Ltd |

|

|

167,400 |

|

|

|

6,488 |

|

Vipshop Holdings Ltd ADR * |

|

|

80,091 |

|

|

|

1,282 |

|

Yangzijiang Shipbuilding Holdings Ltd |

|

|

183,700 |

|

|

|

224 |

|

| |

|

|

|

|

|

|

72,728 |

|

| |

|

|

|

|

|

|

|

|

Denmark — 3.2% |

AP Moller - Maersk A/S, Cl B |

|

|

5,853 |

|

|

|

10,583 |

|

Danske Bank A/S |

|

|

599,587 |

|

|

|

13,991 |

|

Demant A/S * |

|

|

41,884 |

|

|

|

1,740 |

|

DSV A/S |

|

|

73,996 |

|

|

|

13,857 |

|

Genmab A/S * |

|

|

22,224 |

|

|

|

7,914 |

|

Novo Nordisk, Cl B |

|

|

724,850 |

|

|

|

66,267 |

|

Pandora A/S |

|

|

43,488 |

|

|

|

4,517 |

|

ROCKWOOL A/S, Cl B |

|

|

1,480 |

|

|

|

360 |

|

Zealand Pharma, Cl A * |

|

|

18,921 |

|

|

|

822 |

|

| |

|

|

|

|

|

|

120,051 |

|

| |

|

|

|

|

|

|

|

|

Finland — 0.9% |

Kone Oyj, Cl B |

|

|

148,624 |

|

|

|

6,282 |

|

Nokia Oyj |

|

|

6,761,254 |

|

|

|

25,541 |

|

Nordea Bank Abp |

|

|

113,937 |

|

|

|

1,258 |

|

Orion Oyj, Cl B |

|

|

43,560 |

|

|

|

1,717 |

|

Puuilo |

|

|

4,370 |

|

|

|

37 |

|

Vaisala Oyj, Cl A |

|

|

564 |

|

|

|

20 |

|

Wartsila OYJ Abp, Cl B |

|

|

85,387 |

|

|

|

972 |

|

| |

|

|

|

|

|

|

35,827 |

|

| |

|

|

|

|

|

|

|

|

France — 9.6% |

Accor SA |

|

|

654,436 |

|

|

|

22,131 |

|

Air Liquide SA |

|

|

151,301 |

|

|

|

25,605 |

|

Alstom SA (A) |

|

|

676,617 |

|

|

|

16,190 |

|

Amundi SA |

|

|

453,454 |

|

|

|

25,613 |

|

AXA SA |

|

|

492,003 |

|

|

|

14,679 |

|

Beneteau SA |

|

|

30,414 |

|

|

|

369 |

|

| |

|

|

|

|

|

|

Description |

|

Shares |

|

|

Market Value

($ Thousands) |

|

COMMON STOCK (continued) |

BNP Paribas SA |

|

|

81,465 |

|

|

$ |

5,212 |

|

Bouygues SA |

|

|

313,483 |

|

|

|

10,999 |

|

Carrefour SA |

|

|

466,507 |

|

|

|

8,043 |

|

Christian Dior SE |

|

|

448 |

|

|

|

331 |

|

Cie de Saint-Gobain |

|

|

99,309 |

|

|

|

5,981 |

|

Cie Generale des Etablissements Michelin SCA |

|

|

994,527 |

|

|

|

30,609 |

|

Danone SA |

|

|

701,315 |

|

|

|

38,804 |

|

Dassault Aviation SA |

|

|

39,312 |

|

|

|

7,425 |

|

Hermes International |

|

|

12,610 |

|

|

|

23,094 |

|

Ipsen SA |

|

|

62,682 |

|

|

|

8,243 |

|

Jacquet Metals SACA |

|

|

5,998 |

|

|

|

102 |

|

Kering SA |

|

|

37,842 |

|

|

|

17,304 |

|

LVMH Moet Hennessy Louis Vuitton SE |

|

|

7,745 |

|

|

|

5,875 |

|

Orange SA |

|

|

884,670 |

|

|

|

10,172 |

|

Publicis Groupe SA |

|

|

213,792 |

|

|

|

16,243 |

|

Rexel SA |

|

|

1,652,809 |

|

|

|

37,273 |

|

Safran SA |

|

|

4,705 |

|

|

|

740 |

|

Savencia SA |

|

|

510 |

|

|

|

29 |

|

Sodexo SA |

|

|

152,841 |

|

|

|

15,781 |

|

Sopra Steria Group SACA |

|

|

537 |

|

|

|

111 |

|

Stef SA |

|

|

602 |

|

|

|

68 |

|

Technip Energies NV |

|

|

58,227 |

|

|

|

1,453 |

|

Thales SA |

|

|

11,269 |

|

|

|

1,588 |

|

Valeo |

|

|

325,577 |

|

|

|

5,629 |

|

Vinci SA |

|

|

76,225 |

|

|

|

8,476 |

|

Wendel SE |

|

|

3,315 |

|

|

|

263 |

|

| |

|

|

|

|

|

|

364,435 |

|

| |

|

|

|

|

|

|

|

|

Germany — 9.4% |

adidas AG |

|

|

80,076 |

|

|

|

14,126 |

|

Allianz SE |

|

|

65,145 |

|

|

|

15,567 |

|

BASF SE |

|

|

643,728 |

|

|

|

29,272 |

|

Bayer AG |

|

|

478,630 |

|

|

|

23,032 |

|

Bayerische Motoren Werke AG |

|

|

19,371 |

|

|

|

1,977 |

|

Beiersdorf AG |

|

|

10,382 |

|

|

|

1,343 |

|

Carl Zeiss Meditec AG |

|

|

8,200 |

|

|

|

719 |

|

Cewe Stiftung & Co KGAA |

|

|

1,443 |

|

|

|

135 |

|

Commerzbank AG |

|

|

42,027 |

|

|

|

480 |

|

Covestro AG * |

|

|

432,561 |

|

|

|

23,384 |

|

CTS Eventim AG & Co KGaA |

|

|

20,863 |

|

|

|

1,189 |

|

Daimler Truck Holding AG |

|

|

1,268,069 |

|

|

|

44,063 |

|

Deutsche Boerse AG |

|

|

37,537 |

|

|

|

6,506 |

|

Deutsche Lufthansa AG * |

|

|

719,264 |

|

|

|

5,716 |

|

Deutsche Telekom AG |

|

|

833,556 |

|

|

|

17,534 |

|

Deutz AG |

|

|

21,725 |

|

|

|

96 |

|

Duerr AG |

|

|

24,234 |

|

|

|

659 |

|

E.ON SE |

|

|

780,525 |

|

|

|

9,255 |

|

Evonik Industries AG |

|

|

625,315 |

|

|

|

11,470 |

|

Fresenius Medical Care AG & Co KGaA |

|

|

411,229 |

|

|

|

17,781 |

|

GEA Group AG |

|

|

1,749 |

|

|

|

65 |

|

Gerresheimer AG |

|

|

12,543 |

|

|

|

1,321 |

|

HeidelbergCement AG |

|

|

155,597 |

|

|

|

12,112 |

|

SEI Institutional International Trust

| |

|

|

|

|

|

|

Description |

|

Shares |

|

|

Market Value

($ Thousands) |

|

COMMON STOCK (continued) |

HOCHTIEF AG |

|

|

28,929 |

|

|

$ |

2,933 |

|

HUGO BOSS AG |

|

|

30,746 |

|

|

|

1,951 |

|

Infineon Technologies AG |

|

|

111,630 |

|

|

|

3,706 |

|

Kloeckner & Co SE |

|

|

9,107 |

|

|

|

66 |

|

Knorr-Bremse AG |

|

|

170,915 |

|

|

|

10,890 |

|

Krones AG |

|

|

5,055 |

|

|

|

522 |

|

LANXESS AG |

|

|

204,775 |

|

|

|

5,214 |

|

Mercedes-Benz Group AG |

|

|

28,574 |

|

|

|

1,993 |

|

Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen |

|

|

17,760 |

|

|

|

6,940 |

|

Nemetschek SE |

|

|

907 |

|

|

|

56 |

|

PSI Software AG |

|

|

31 |

|

|

|

1 |

|

Rational AG |

|

|

945 |

|

|

|

600 |

|

RWE AG |

|

|

296,137 |

|

|

|

11,021 |

|

SAP SE |

|

|

474,343 |

|

|

|

61,682 |

|

Scout24 AG |

|

|

15,476 |

|

|

|

1,076 |

|

Siemens AG |

|

|

37,305 |

|

|

|

5,358 |

|

SMA Solar Technology AG * |

|

|

14,908 |

|

|

|