SEI Institutional International Trust

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05601

SEI Institutional International Trust

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

CT Corporation

155 Federal Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s

telephone number, including area code: 1-800-342-5734

Date of fiscal year end: September 30, 2017

Date of reporting period: September 30, 2017

| Item 1. |

Reports to Stockholders. |

September 30, 2017

ANNUAL REPORT

SEI Institutional International Trust

|

|

|

|

|

International Equity Fund |

|

|

|

|

Emerging Markets Equity Fund |

|

|

|

|

International Fixed Income Fund |

|

|

|

|

Emerging Markets Debt Fund |

TABLE OF CONTENTS

The Trust files its complete schedule of portfolio holdings

with the Securities and Exchange Commission for the first and third quarter of each fiscal year on Form N-Q within sixty days after the end of the period. The Trust’s Forms

N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the

Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to

how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

LETTER TO SHAREHOLDERS

September 30, 2017 (Unaudited)

To Our Shareholders:

Looking back, the expectations we shared for the Funds’ most recently completed fiscal year, from the start of October 2016 through the end of September 2017,

largely came to pass. The pace of interest-rate increases by the Federal Reserve (“Fed”) followed the market’s more modest expectations rather than those projected by Federal Open Market Committee members. The European Central

Bank’s (“ECB”) commitment to stimulus efforts entrenched euro weakness relative to the U.S. dollar for part of the period; the same can be said for the Bank of Japan (“BOJ”) and the yen. China continued to guide its currency

lower, hitting a low near the end of the fiscal period. The global oil supply-demand imbalance persisted throughout the year; the Organization of Petroleum Exporting Countries’ (“OPEC”) agreement to curb production in January

temporarily bolstered markets, but prices retraced due to record U.S. inventories and rising U.S. production before rebounding during the final quarter of the period.

Geopolitical events

Geopolitical threats and an assortment of other noneconomic

influences continued in various regions: civil war and domestic struggle in parts of the Middle East and Africa, the suffering of refugees and migrants in bordering countries and Europe, and acts of global terror.

Severe unrest continued in certain areas of the Middle East, driven by the opposing and overlapping regional interests of extremist groups, nationalist fighters and

state actors. Syrian government forces appeared to consolidate military gains in and around Aleppo, with assistance from Russia, while Iraqi forces, supported by U.S. military resources, made notable progress in reversing Islamic State gains. The

U.S. military increased its air support during the period, targeting both Syrian government and extremist positions, while also raising the profile of its involvement in Afghanistan by targeting Islamic State strongholds.

Despite the considerable aforementioned instability in the Middle East, the price of oil remained mostly insulated from regional developments. Oil-price weakness, which began to moderate in 2016, remained primarily attributable to oversupply. Energy-export-dependent Venezuela succumbed to the economically depressive effects of low oil prices during the

period, as food shortages and a breakdown of the rule of law appeared to worsen, despite an eventual rebound in the price of oil. Brazil’s prospects also paled, then recovered partially, as a corruption investigation centering on its lead state-run oil company enveloped a cross-section of political leaders. The OPEC reached an agreement in late 2016 with the cooperation of non-OPEC producers to enact production

cuts in pursuit of a balanced market.

The lasting effect of the Syrian migrant crisis on the European Union (“EU”) remains unknown. Immigration served as

one of the key points of contention leading up to Great Britain’s Brexit vote to leave the European Union prior to the reporting year. Prime Minister May triggered Article 50 during the fiscal period and began the formal withdrawal process.

Immigration-driven uncertainty also took center stage in the months leading up to the U.S. presidential election, which Donald Trump ultimately won in November with

a tough stance on immigration. President Trump’s early actions following his inauguration in January demonstrated a commitment to follow through on tighter U.S. immigration policy.

A raft of political surprises unfolded late in the fiscal period. The U.K. Conservative party relinquished its parliamentary majority and was forced to seek a partner to

form a minority government. Emmanuel Macron’s early-May victory in the French presidential election amounted to a significant win for the establishment. In the U.S., a high-profile special prosecutor was

appointed to investigate the possibility of collusion between Donald Trump’s presidential campaign and Russia. In Brazil, an ongoing top-level corruption scandal was blown wide open in mid-May as potential evidence emerged of a taped conversation featuring President Michel Temer approving a large hush-money bribe.

Toward the end of the fiscal year, political tensions weighed heavily on investor attitudes. President Trump stated that aggression from North Korea would be met with

“fire and fury” while controversy over Trump’s response to violent clashes between protesters in Charlottesville, Virginia drove sentiment after the president dissolved two advisory councils. Setbacks in the Trump

administration’s efforts to repeal and replace Obamacare sparked volatility, as investors assumed that tax and budget resolutions would have to wait until health care legislation was resolved.

|

|

|

| SEI Institutional International Trust /

Annual Report / September 30, 2017 |

|

1 |

LETTER TO SHAREHOLDERS (Continued)

September 30, 2017 (Unaudited)

Economic performance

U.S. economic growth accelerated in the fourth quarter of 2016, slumped early in 2017, and then rebounded solidly in the second quarter as both consumer and government

spending boosted the economy. The labor market remained historically strong throughout the year: the unemployment rate fell, finishing the period at 4.2%, while the labor-force participation rate ended at 63.1%, marginally higher than a year ago.

Average hourly earnings gained, bouncing around a mean of about 0.2% growth per month over the year; although a modest increase in price pressures weighed on real personal income growth as the period progressed. The Fed raised its target interest

rate in mid-December 2016, and again in both March and June 2017, representing two of three projected rate increases in 2017. The Fed also announced that it would start to reduce the size of its balance sheet

and reverse some of the quantitative easing that has been so supportive of bond prices in recent years.

The ECB held its benchmark interest rate unchanged at a

historic low through the fiscal period, while the Bank of England did the same with the hope of stimulating the U.K. economy following the Brexit vote. Quarterly growth in the eurozone expanded at its quickest pace since 2015, emphasizing the

area’s notable economic performance at a time that many thought would be plagued by political uncertainty. Year-on-year growth was 2.3% at the end of the second

quarter of 2017, with France, Italy and Greece all beating expectations. The U.K. economy grew at 1.5% year-on-year through the second quarter of 2017, but slowed

significantly toward the end of the fiscal period as a weakened pound dampened consumer spending to its lowest level in three years.

Japanese GDP grew 1.4% year-on-year at the end of the second quarter of 2017, while the BOJ maintained stimulus to try to rejuvenate the economy. Meanwhile, economic growth in China expanded by 6.9%

year-on-year in the second quarter of 2017 after China’s government provided substantial fiscal stimulus early in the period to support the government’s growth

targets.

Market developments

For the fiscal period ending September 30,

2017, geopolitical events dominated global equity markets. Market movements were driven by periods of risk-on and risk-off rallies. The early part of the fiscal period

was marked by continued, but uninspiring, economic expansion and populist movements surprisingly sweeping political elections in the U.K. and the U.S. The second half saw a synchronized global economic recovery.

Investors positioned defensively into the U.S. presidential elections. Though candidate Trump presented a source of uncertainty to markets, promises of deregulation, corporate-tax reform and fiscally expansionary policies sparked a sharp rally in cyclical assets, and defensive assets that were bid up during prior years sold off. OPEC’s decision to curb output and the

Fed’s rate hike also contributed to the sharp rally for traditional value sectors (financials, industrials and energy).

The turn of the calendar year marked

the beginning of the reversal of the cyclical rally (dubbed the Trump reflation trade). The first few months saw setbacks for the Trump administration after Washington failed to pass a replacement for the Affordable Care Act and controversies

involving Russian election meddling plagued the new administration. There was a realization that the growth expected from promised regulatory changes would take a while to play out, and markets began to unwind the reflation trade. At the same time,

assets such as defensive sectors and technology stocks that sold off during the reflation trade rallied during this period. The risk-on sentiment that pushed equities higher over the quarter was also visible

in fixed income markets, with credit outperforming government bonds. U.S. Treasury yields rose across the curve with short-term yields rising more than long-term yields. Yields for 10-year government bonds

began the fiscal period around 1.6% and ended around 2.3%, reflecting increased optimism around economic growth, but remained below their late-2016 peak.

Stocks

rallied toward the end of the fiscal period amid signs of global economic synchronization, strong earnings and continued central-bank stimulus.

The U.K. stunned

investors prior to the start of the fiscal year with the British vote to leave the EU and joined the list of frustrations for European equities that included Italian banks with oversized debt. The result was a lack of enthusiasm for stocks in the

region despite continued stimulus from the ECB. European stocks experienced a small rally after the Brexit vote as investors looked past the results, and saw an even greater rally after Donald Trump’s surprising victory in the U.S. elections.

President Trump’s promises of deregulation and fiscal stimulus, along with

|

|

|

| 2 |

|

SEI Institutional International Trust / Annual Report / September 30, 2017 |

the Fed’s three rate increases during the period, sparked a cyclical rally in European

stocks, with banks leading the way. At the turn of the year, despite political volatility from French and Dutch elections and the possibility of further fragmentation in the EU, signs of economic recovery emerged in the region, and European equities

rallied on the back of recovering economic growth and victories for pro-EU parties in elections nearer the end of the fiscal period.

Looking back on market performance for the full period, the MSCI ACWI Index, a proxy for global equities in both developed and emerging markets, rose 18.65% in U.S.

dollar terms. U.S. markets marginally lagged, as the S&P 500 Index returned 18.61%.

The U.S. equity market began the fiscal year with investors focused on the

presidential election campaign. Value stocks in general and the financial sector, in particular, rose sharply after the election, while high-dividend-yield segments of the market, such as utilities and real-estate investment trusts

(“REITs”), lagged as they were seen as less attractive in a rising interest-rate environment. One trend that reversed as the fiscal year progressed was the underperformance of growth stocks. Many growth managers outperformed value

managers, as internet-commerce and information-technology stocks were market leaders for the final three quarters of the fiscal year, and information technology became the second best-performing sector (after financials) for the full fiscal year.

The latter group’s rally in the final fiscal quarter provided a boost to growth stocks, propelling the Russell 1000 Growth Index to 21.94% for the period, while the Russell 1000 Value Index returned 15.12%.

Small-cap stocks outperformed as well. U.S. small caps (Russell 2000 Index) outpaced large caps (Russell 1000 Index), delivering

20.74% and 18.54%, respectively.

After hitting lows early in the fiscal period on the heels of deflationary fears caused by low commodity prices and Brexit-related

concerns, rates began to rise. Economic growth exceeded expectations, and Trump’s victory sparked expectations of reflationary fiscal policy. The market began to price in a December 2016 Fed rate hike, causing Treasury yields to rise,

particularly those at the front end of the yield curve. The Fed voted to increase the federal-funds rate target range to 1.00 -1.25% after a third rate hike during the period in June 2017, and increased its

projection for the pace of rate hikes in 2017 from two to three, citing strengthening labor-market conditions and firming inflation as the rationale.

Inflation-sensitive assets, such as commodities and Treasury inflation-protected securities, were mixed. The Bloomberg Commodity Total Return Index (which represents the

broad commodity market) eased 0.29% lower during the period, as the energy and agriculture sectors dragged down the index, while the Bloomberg Barclays 1-10 Year US TIPS Index (USD) ebbed 0.14%.

Global fixed income, as measured by the Bloomberg Barclays Global Aggregate Index, fell 1.26% in U.S. dollar terms during the reporting period, while the high-yield

market was strong, with the BofA Merrill Lynch US High Yield Constrained Index delivering 9.05%.

U.S. investment-grade corporate debt was positive, as the Bloomberg

Barclays Investment Grade US Corporate Index returned 2.21%. U.S. asset-backed and mortgage-backed securities were both marginally positive during the fiscal year, although both faced headwinds late in the period from rising interest-rate

expectations.

Emerging-market debt delivered positive performance. The J.P. Morgan GBI Emerging Markets Global Diversified Index, which tracks

local-currency-denominated emerging-market bonds, gained 7.32% in U.S. dollar terms during the reporting period thanks to an impressive rally in the second half of the period. The J.P. Morgan EMBI Global Diversified Index, which tracks

emerging-market debt denominated in external currencies (such as the U.S. dollar), advanced by 4.61%.

Our view

Neither devastating hurricanes nor all-around political dysfunction have done much to halt the U.S. equity market’s rise.

Even the game of nuclear chess being played between North Korea’s Kim Jong-un and President Donald Trump has failed to elicit much of a response. To be sure, all good things eventually come to an end. Yet

when we consider valuations, the upward momentum of the U.S. economy and earnings, and the likely path of Fed policy and inflation, we reason that the U.S. equity bull market isn’t dead yet.

On the issue of valuations, there is no denying that U.S. equities are trading at elevated levels. But the exceedingly low level of prevailing interest rates is an

important mitigating factor. There has been a strong inverse relationship

|

|

|

| SEI Institutional International Trust /

Annual Report / September 30, 2017 |

|

3 |

LETTER TO SHAREHOLDERS (Concluded)

September 30, 2017 (Unaudited)

between bond yields and valuations over the past four decades, which we believe justifies

structurally elevated valuations.

The overriding question among investors is a simple one: is a recession on the horizon? We contend that the answer is

“no.” Financial stress, a harbinger of recession, is virtually non-existent. Recent economic data also point to the continuation of

slow-but-steady economic growth.

A large portion of the world appears to be growing

at a slightly better-than-trend pace. The breadth of the improvement is particularly impressive; as of July 2017, 72% of the countries that make up the Organization for Economic Cooperation and Development’s (“OECD”) Composite Leading

Indicator index have posted improvement over the past year—and 75% of countries in the index came in above 100. This means above-trend growth will likely continue in the months ahead on a global basis.

According to the OECD’s calculations, Brazil’s economic situation is improving at the fastest rate. The eurozone as a whole looks set to grow above trend, as

does Japan. China’s momentum remains toward the upside, even though recent economic data suggest some deceleration. The U.S. economy, by contrast, is growing somewhat below trend. India also is signaling below-trend growth, but has begun to

rebound. On balance, things are looking up in much of the world.

One of the big surprises of 2017 is the extensive weakness of the U.S. dollar, which has fallen by

about 8% against a trade-weighted basket of foreign currencies since the end of last year. The U.S. dollar can appreciate and depreciate in long cycles. If the peak at the end of 2016 proves to be the top of the current cycle, the most recent

upswing would be shorter in duration than previously experienced—but the magnitude of the trough-to-peak rise would be similar to that of the up-cycle that occurred from April 1995 to March 2002 (about 41%).

The drop in the greenback coincides with the improved global

macroeconomic outlook. Economic growth of developed economies around the world is converging with that of the U.S. While U.S. monetary policy is further along the path toward tightening, other central banks have already begun to raise rates (Canada)

or may do so soon (the U.K.). Even the ECB is expected to announce its first steps away from unconventional monetary stimulus by the end of this year.

Political

considerations are coming into play as well. Participants in the currency markets have adopted a far more sanguine view regarding the political stability of the eurozone following a series of national elections this year that enhanced the position

of parties favoring further European integration. While confidence in the eurozone has increased, international confidence in the U.S. has ebbed. The Trump administration’s decision to pull out of the Trans-Pacific Partnership and Paris climate

accord was controversial in the U.S.; it was especially confounding to those outside the U.S., and raised questions of whether it is relinquishing its role as leader of the free world. Confidence in the existing international economic order was also

hurt by the threat of additional U.S. trade discord with Canada, Mexico, South Korea and China. Trump was voted into office partially owing to his populist stance on trade; but we think a trade war could be as dangerous an economic blunder today as

it was during the Great Depression.

We continue to expect a U.S. business-friendly tax package to be enacted and signed by the Trump administration before the end

of the year. However, the absence of such legislation could further dampen investors’ expectations for U.S. economic growth—thereby causing a serious correction in the overall U.S. equity market, especially hurting economically sensitive

small-company and value stocks.

As noted above, the upturn in global economic activity has spurred the world’s major central banks to reassess their policy

stance. The danger is that they could make a policy mistake, either by acting too quickly or not fast enough. The BOE faces the greatest policy challenge, with an accelerating inflation rate at a time when its overall economic growth has been

somewhat below that of the U.S. and eurozone. Although the BOE has signaled its intention to reverse the easing implemented in the aftermath of the Brexit vote, it is unclear whether the correct policy course calls for further tightening moves.

In the run-up to this October’s all-important National Congress of the Communist

Party of China, the country’s economic policy has been geared toward growth. President Xi Jinping’s government has been focused on restraining rampant speculation in the property markets and curtailing growth of the shadow-banking

system—with

|

|

|

| 4 |

|

SEI Institutional International Trust / Annual Report / September 30, 2017 |

mixed success. As soon as China’s economy begins to weaken and financial markets exhibit

signs of stress, its economic planners tend to reengage the accelerator.

It may be time to step on the brake again following the National Congress and the likely

strengthening of President Xi’s political power coming out of that meeting. The current inflation rate for Chinese manufacturing producer prices is near the peak levels recorded in 2004, 2008 and 2011. A cyclical slowdown in China’s

economy would likely be bad news for commodity prices and other emerging economies. Since the overall consumer price index remains at less than a 2% rate, we expect the People’s Bank of China to try a gentle tap on the brake.

While we would not rule out a correction in asset values more notable than others that occurred in the past 18 months, our investment mantra of buying on the dip still

holds.

Our equity strategies remain positioned for further cyclical improvement around the world. They generally have a smaller-company and value bias versus their

benchmarks. We tend to favor momentum-oriented opportunities, and view equity markets outside the U.S. as more attractive than U.S. equity markets. Indeed, our caution toward equities is most pronounced in the U.S., where the outlook for earnings

growth is more modest than elsewhere in the world.

On the fixed-income side, we expect yields will slowly move higher as

global growth becomes more entrenched and central banks begin to remove the extraordinary stimulative measures of quantitative easing and zero (or negative) interest rates. Our underlying managers are generally short duration versus their

benchmarks, favor credit-spread strategies and are positioned for a further narrowing of the yield curve, especially in the U.S.

On behalf of SEI Investments, I

thank you for your continued confidence. We are working every day to maintain that confidence, and look forward to serving your investment needs in the future.

Sincerely,

William T. Lawrence, CFA

Managing Director,

Portfolio Management Team

|

|

|

| SEI Institutional International Trust /

Annual Report / September 30, 2017 |

|

5 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

September 30, 2017 (Unaudited)

International Equity Fund

I. Objective

The International Equity

Fund (the “Fund”) seeks to provide long-term capital appreciation.

II. Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage

portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (“SIMC”). The Fund utilized the following sub-advisers during the year ending

September 30, 2017: Acadian Asset Management LLC, Blackcrane Capital, LLC, Causeway Capital Management LLC, Henderson Global Investors (North America) Inc., INTECH Investment Management LLC, Neuberger Berman Investment Advisers LLC, NWQ

Investment Management Company, LLC and WCM Investment Management. For the year ended September 30, 2017, sub-adviser Henderson Global Investors (North America) Inc. was terminated from the Fund.

III. Return vs. Benchmark

For the year ended September 30, 2017, the

Fund’s Class F shares outperformed the MSCI EAFE Index (the “Index”), returning 19.23% versus the Index return of 19.10%.

IV. Fund Attribution

International developed stocks continued their upward march during the fiscal year, leading U.S. equities but trailing their emerging-market peers. The financial

sector was the top-performing sector, reflecting the emergence of synchronized global growth early in 2017, as noted in the shareholder letter. While technology was the second-best performing sector on the

back of strong growth in semiconductors, the materials and energy sectors trailed close behind, indicating the better position the global economy was in compared to a year earlier. Within the Fund, the technology and healthcare sectors added the

most to performance. Strong security selection within technology and exposure to ex-benchmark names in emerging markets helped. Technology stocks in both emerging markets and the U.S. appreciated on strong

fundamentals and market preference for growth stocks. An underweight to healthcare, as well as strong stock selection in pharmaceuticals and biotechnology stocks, also benefited performance. Auto stocks drove selection within the

consumer-discretionary sector, which contributed to performance. The biggest detractors to performance came from the consumer-staples and industrials sectors. For staples, an overweight and

selection within the lagging sector provided a headwind to performance. Poor stock selection within industrials also drove

the underperformance.

Regionally, Europe was the best-performing region due to a strong rally and passive flows after presidential elections across the continent

resulted in ¬friendly outcomes. An underweight to the Pacific ex-Japan region provided a substantial tailwind to the Fund, as the region lagged thanks to macroeconomic headwinds in the area’s largest

country, Australia. The next best-performing country in the Fund was the U.K. The portfolio added value by avoiding the weak healthcare and utilities sectors, while selection was positive across multiple sectors. The portfolio also benefited from an

underweight to Japan, which faced economic headwinds as well. The economic issues were a drag on Japanese equity performance, and being underweight during the fiscal year helped. Most managers in the Fund were underweight to Japan. Within Europe,

stock selection within the biggest countries lagged but was strong in countries near the periphery and northern Europe.

Manager performance was mixed. Acadian Asset

Management LLC was the best-performing manager due to strong stock selection in European airlines and pharmaceutical companies. Ex-benchmark positions in emerging markets also helped. Causeway Capital

Management LLC was the next best-performing manager due to strong stock selection in European banks and U.K. stocks in general. Blackcrane Capital, LLC was slightly positive due to strong stock selection in auto sectors. Neuberger Berman also

outperformed due to its tilt towards Europe. The manager also benefited from ex-benchmark positions. WCM Investment Management nearly matched the benchmark, as an underweight to cyclical parts of the benchmark

detracted from the strong stock selection in consumer and technology sectors. INTECH Investment Management LLC’s mathematical model produced benchmark-like results as well, with poor stock selection in Europe. Henderson Global Investors (North

America) Inc. detracted from performance with poor stock selection. NWQ Investment Management Company, LLC was the worst-performing manager due to poor stock selection in the consumer sectors and French and Israeli stocks.

|

|

|

| 6 |

|

SEI Institutional International Trust / Annual Report / September 30, 2017 |

|

| AVERAGE ANNUAL TOTAL RETURN1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| International Equity

Fund, Class F |

|

|

19.23% |

|

|

|

5.80% |

|

|

|

8.14% |

|

|

|

-0.87% |

|

|

|

3.78% |

|

| International Equity Fund,

Class I |

|

|

19.00% |

|

|

|

5.53% |

|

|

|

7.86% |

|

|

|

-1.12% |

|

|

|

3.84% |

|

| International Equity

Fund, Class Y |

|

|

19.59% |

|

|

|

6.02% |

|

|

|

8.28% |

|

|

|

-0.81% |

|

|

|

3.80% |

|

| MSCI EAFE Index |

|

|

19.10% |

|

|

|

5.04% |

|

|

|

8.38% |

|

|

|

1.34% |

|

|

|

4.65% |

|

Comparison of Change in the Value of a $100,000

Investment in the International Equity Fund, Class F,

Class I and

Class Y, versus the MSCI EAFE Index

| 1 |

For the year ended September 30, 2017. Past performance is no indication of future performance. Class F shares (formerly Class A shares) were offered

beginning December 20, 1989. Class I shares were offered beginning January 4, 2002. The performance of Class I shares prior to January 4, 2002 is calculated using the performance of Class F shares adjusted for the

higher expenses of the Class I shares. Returns for Class I shares are substantially similar to those of Class F shares and differ only to the extent that Class I shares have higher total annual fund operating expenses than

Class F shares. Class Y shares were offered beginning December 31, 2014. Class Y shares performance for the period prior to December 31, 2014 derived from the performance of Class F shares. Returns for Class Y

shares are substantially similar to those of Class F shares and differ only to the extent that Class Y shares have lower total annual fund operating expenses than Class F shares. Returns shown do not reflect the deduction of taxes

that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for the period reflect fee waivers and/or reimbursements in effect for the period; absent fee waivers and reimbursements, performance would have been

lower. |

|

|

|

| SEI Institutional International Trust /

Annual Report / September 30, 2017 |

|

7 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

September 30, 2017 (Unaudited)

Emerging Market Equity Fund

I. Objective

The Emerging Markets

Equity Fund (the “Fund”) seeks to provide capital appreciation.

II. Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage

portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corp. (“SIMC”). The Fund utilized the following sub-advisers during the year ending

September 30, 2017: J O Hambro Capital Management Limited, KBI Global Investors (North America) Ltd., Lazard Asset Management LLC, Macquarie Investment Management (formerly Delaware Investment Fund Advisers, a series of Delaware Management

Business Trust), Neuberger Berman Investment Advisers LLC, PanAgora Asset Management Inc. and RWC Asset Advisors (US) LLC. For the year ended September 30, 2017, no manager changes were made.

III. Return vs. Benchmark

For the year ended September 30, 2017, the

Fund’s Class F shares outperformed the MSCI Emerging Markets Index (the “Index”), returning 23.10% versus the Index return of 22.91%.

IV. Fund

Attribution

Emerging markets outpaced both the U.S. and developed international markets, as measured by the S&P 500 Index and the MSCI EAFE Index, during the

fiscal year. All sectors had positive absolute returns during the period. Information technology delivered the strongest performance, followed by the real-estate sector and cyclicals, particularly energy and materials, while defensive sectors such

as consumer staples and healthcare lagged. The technology sector was one of the strongest-performing sectors due to strong fundamental data. The concentration of technology stocks at the top of the benchmark also benefited from healthy passive

inflows throughout the fiscal year. Cyclical sectors fared well due to strong synchronized global growth that served as a tailwind, as noted in the shareholder letter. The financials sector also benefited Fund performance. A recovering Russian

economy helped Russian bank stocks outperform, and bank holdings in other countries rallied, driven by macroeconomic improvements. Within technology, the Fund benefited from an overweight to the strong-performing sector, and stock selection in

Russian technology stocks helped. Healthy passive inflows, which benefit technology stocks the most,

rewarded an overweight position in technology. Stock selection and a slight overweight in materials also helped.

Regionally, the best-performing countries were China, Taiwan and India. With strong passive inflows, the biggest countries in the benchmark (East Asian countries due to

the large technology companies in those countries) were rewarded the most. The inclusion of Chinese ‘A’ shares in the benchmark also boosted Chinese equities. Stock selection was especially strong in China. Solid fundamental data in

technology and consumer stocks were rewarded during the fiscal year and contributed to positive portfolio results. Indian banks were a boost to performance as investors favored private banks with strong management and competitive models over the

inefficient state-run banks in India. An underweight to Malaysia helped, as Malaysia experienced a headwind from falling oil prices. Within the Europe, Middle East and Africa region, the overweight to Russia

paid off due to a recovering economy. The improving economy was a boost to Russian cyclicals, and the Fund’s exposure to Russian cyclicals, as well as Russian retailing and technology companies, helped. Fund holdings in Latin America

contributed to performance as well, although not by as much as holdings in other regions. Brazilian holdings helped, as the Fund owned stocks with the smallest exposure to the political scandal that plagued Brazil during the first half of 2017.

Fund manager results were generally positive. All managers except KBI Global Investors (North America) Ltd outperformed the benchmark. Macquarie Investment Management

had the best performance, driven by strong stock selection within Asia. The manager’s selection in technology stocks was especially helpful. The same can be said for Neuberger Berman Investment Advisers LLC, which had strong selection in the

technology sector as well. Both managers also had strong stock selection in banks. For Neuberger Berman Investment Advisers LLC, the manager’s focus on quality companies at reasonable prices was in favor during the period. RWC Asset Advisors

(US) LLC and Lazard Asset Management LLC also outperformed through strong stock selection. RWC Asset Advisors (US) LLC benefited from materials stocks in South Africa that had strong results which provided a tailwind, while Lazard Asset Management

LLC’s investments in Chinese educational stocks were rewarded by strong market growth and demand. PanAgora Asset Management Inc. outperformed through strong stock selection in financials and the consumer-discretionary sector despite areas of

weakness in

|

|

|

| 8 |

|

SEI Institutional International Trust / Annual Report / September 30, 2017 |

technology stocks. J O Hambro Capital Management Limited added value and outperformed partially due to a momentum-style

tailwind. KBI Global Investors (North America) Ltd suffered a style headwind, as dividend stocks moved out of favor with the rise in global interest rates, which detracted.

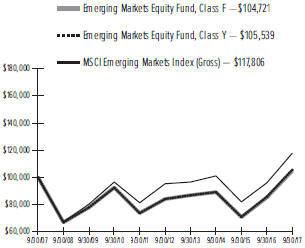

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception to Date |

|

| Emerging Markets Equity

Fund, Class F |

|

|

23.10% |

|

|

|

5.57% |

|

|

|

4.53% |

|

|

|

0.46% |

|

|

|

4.89% |

|

| Emerging Markets Equity

Fund, Class Y |

|

|

23.46% |

|

|

|

5.84% |

|

|

|

4.69% |

|

|

|

0.54% |

|

|

|

4.93% |

|

| MSCI Emerging Markets Index

(Gross) |

|

|

22.91% |

|

|

|

5.28% |

|

|

|

4.36% |

|

|

|

1.65% |

|

|

|

6.47% |

|

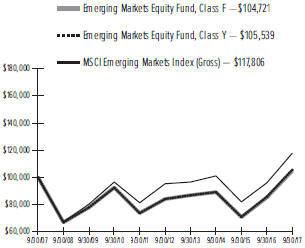

Comparison of Change in the Value of a $100,000 Investment in the Emerging Markets Equity Fund, Class F and Class Y, versus

the S&P 500 Index and the MSCI Emerging Markets Index (Gross)

| 1 |

For the year ended September 30, 2017. Past performance is no indication of future performance. Class F shares (formerly Class A shares) were offered

beginning January 17, 1995. Class Y shares were offered beginning December 31, 2014. Class Y shares performance for the period prior to December 31, 2014 derived from the performance of Class F shares. Returns for

Class Y shares are substantially similar to those of Class F shares and differ only to the extent that Class Y shares have lower total annual fund operating expenses than Class F shares. Returns shown do not reflect the deduction

of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for the period reflect fee waivers and/or reimbursements in effect for the period; absent fee waivers and reimbursements, performance would

have been lower. |

|

|

|

| SEI Institutional International Trust /

Annual Report / September 30, 2017 |

|

9 |

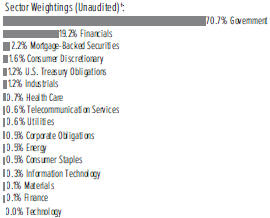

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

September 30, 2017 (Unaudited)

International Fixed Income Fund

I. Objective

The International Fixed

Income Fund (the “Fund”) seeks to provide capital appreciation and current income.

II. Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage

portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (“SIMC”). The Fund utilized the following sub-advisers during the year ending

September 30, 2017: AllianceBernstein, L.P., FIL Investment Advisors and Wellington Management Company LLP. For the year ended September 30, 2017, sub-adviser FIL Investment Advisors was terminated

from the Fund.

III. Return vs. Benchmark

For the year ended September 30,

2017, the Fund’s Class F shares outperformed the Bloomberg Barclays Global Aggregate ex-USD Index (the “Index”), returning -1.03% versus the Index

return of -0.55%.

IV. Fund Attribution

Investor appetite for risk was generally strong through the fiscal year, as credit-sensitive sectors outperformed interest rate-sensitive assets, as noted in the

shareholder letter. Government-bond yields rose sharply early in the reporting period in response to Trump’s election victory, although 2017 saw a degree of desynchronization across the core markets. Bond yields drifted higher as the eurozone

economy surprised to the upside, while the U.S. reflation trade stalled after the Trump administration’s economic agenda struggled to gain traction. U.K. gilt yields also tracked slightly lower through much of 2017 on fears over Brexit.

Japanese government-bond yields, meanwhile, remained tightly range-bound, consistent with the Bank of Japan’s yield-curve control policy. Overall, government yields finished the period higher.

Spread sectors outperformed duration-matched sovereigns, as lower-quality fared particularly well. Investors’ risk appetites extended to emerging markets, with U.S.

dollar weakness in 2017 providing an additional boost to local-currency debt. Risk assets, in general, benefited from a combination of synchronized global growth, benign inflation and continued accommodative central-bank policy.

The benchmark Bloomberg Barclays Global Aggregate ex-USD Index returned -0.55% during the

period. Some

of the capital loss attributable to rising government yields was offset by coupon income as well as spread compression in

the credit sectors.

The Fund’s outperformance was driven primarily by its pro-cyclical positioning; the overweight to

corporate credit was beneficial in the spread-tightening environment, as was the underweight duration stance in G3 markets (Colombia, Mexico and Venezuela) as yields rose across core sovereign markets. Our overweight to local-currency

emerging-market debt also added to excess performance thanks to yield convergence across developed markets and appreciating currencies against the U.S. dollar. Finally, our off-index exposure to Treasury

inflation-protected securities added alpha as implied inflation rose during the period.

At the sub-adviser level,

AllianceBernstein LP. was the best-performing manager, thanks to its relatively aggressive credit-beta stance. FIL Investment Advisors was terminated in March and posted flat performance against the benchmark up until termination. Wellington

Management Company LLP’s performance was also relatively flat to benchmark. Its credit strategies contributed, although its macro and quant strategies both detracted.

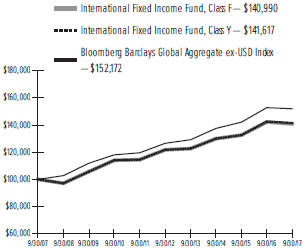

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| International Fixed Income

Fund, Class F† |

|

|

-1.03% |

|

|

|

2.71% |

|

|

|

2.96% |

|

|

|

3.49% |

|

|

|

4.28% |

|

| International Fixed Income

Fund, Class Y† |

|

|

-0.76% |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

3.07%* |

|

| Bloomberg Barclays Global

Aggregate ex-USD Index |

|

|

-0.55% |

|

|

|

3.40% |

|

|

|

3.74% |

|

|

|

4.29% |

|

|

|

5.66% |

|

|

|

|

| 10 |

|

SEI Institutional International Trust / Annual Report / September 30, 2017 |

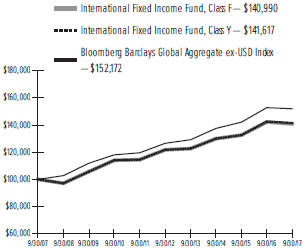

Comparison of Change in the Value of a $100,000 Investment in the International Fixed Income Fund, Class F versus the

Bloomberg Barclays Global Aggregate ex-USD Index

| 1 |

For the year ended September 30, 2017. Past performance is no indication of future performance. Class F shares (formerly Class A shares) were offered

beginning September 1, 1993. Class Y shares were offered beginning October 30, 2015. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The

returns for the period reflect fee waivers and/or reimbursements in effect for the period; absent fee waivers and reimbursements, performance would have been lower. |

| † |

Returns for Class Y shares are substantially similar to those of Class F shares and differ only to the extent that Class Y shares have lower total

annual fund operating expenses than Class F shares. |

| * |

Cumulative inception to date as of October 30, 2015. |

N/A — Not Available

|

|

|

| SEI Institutional International Trust /

Annual Report / September 30, 2017 |

|

11 |

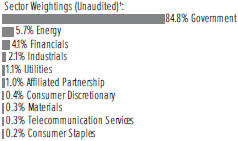

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

September 30, 2017 (Unaudited)

Emerging Markets Debt Fund

I. Objective

The Emerging Markets

Debt Fund (the “Fund”) seeks to maximize total return.

II. Multi-Manager Approach

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage

portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corp. (“SIMC”). The Fund utilized the following sub-advisers during the year ending

September 30, 2017: Investec Asset Management Ltd., Neuberger Berman Investment Advisers LLC and Stone Harbor Investment Partners LP. For the year ended September 30, 2017, no manager changes were made.

III. Return vs. Benchmark

For the year ended September 30, 2017, the

Fund’s Class F shares outperformed a hybrid of 50% J.P. Morgan EMBI Global Diversified Index and 50% J.P. Morgan GBI-EM Global Diversified (the “Index”), returning 6.93% versus the Index

return of 5.98%.

IV. Fund Attribution

The fiscal year ended September 30,

2017 began with a surprise outcome in the U.S. presidential election and a subsequent selloff across emerging-markets debt, followed by the recovery and outperformance of those assets through the remainder of the reporting period in 2017.

The beginning of the period saw a Hillary Clinton victory in the U.S. presidential election priced into the markets. A Clinton victory was seen as potentially beneficial

for emerging markets, especially for local-currency debt. Donald Trump ran a campaign based on isolationist policies that could be detrimental for many emerging-market countries, with the promise to put “America First” by, among other

things, killing trade deals like the North American Free Trade Agreement (“NAFTA”) and the threat to impose new tariffs on imports through a Border Adjustment Tax (“BAT”). In addition, Trump campaigned on tax reform, a commitment

to infrastructure spending and replacing the healthcare system. After the surprise victory, markets that had anticipated a Clinton presidency priced in Donald Trump and his policies, which were expected to increase inflation and strengthen the U.S.

dollar. This occurred in conjunction with markets anticipating what would be the first of three U.S. Federal Reserve interest-rate hikes during the fiscal

year, as noted in the shareholder letter, which put further pressure on emerging-market rates.

However, the fear was short-lived. Emerging-market assets sold off in the fourth quarter of 2016 and began their recovery by the first quarter of 2017. This happened, in

part, because the Trump trade—a reaction to inflation and U.S. dollar expectations linked to Trump’s campaign promises—quickly began to fade. By the time Donald Trump took office in January 2017, the tough trade rhetoric he had pushed

for the entire election had softened, while he backed away from the threat of BAT implementation and talking about a “renegotiation” of NAFTA rather than simply “killing” the trade deal. It also became clear that his agenda to

repeal healthcare and reform the tax code would be much more difficult to push through Congress than originally anticipated. This unwinding of expectations helped spur a rally in emerging-market rates and currencies.

Another important driver to the strong performance of emerging-market debt since Trump’s election was the improved fundamentals across the emerging-markets debt

asset class. Helped in part by the stabilization of commodity prices, emerging markets saw their current-account balances improve in 2017. Additionally, inflation in many emerging-market economies fell, allowing certain central banks to cut rates at

a time when developed markets were either raising rates or keeping them on hold. While the surprise U.S. election result and subsequent rally drove emerging-market performance for the first part of the year, continued fundamental improvement

throughout the period drove strong performance of the asset class over the fiscal year.

While emerging-market debt is an asset class that can be affected by macro

events like the U.S. election, it is also driven by idiosyncratic happenings in each of the emerging-market debt universe countries. Argentina experienced a large rally after the market-friendly Mauricio Macri was elected and began to implement

economic reform. Implementation of reforms has gone smoothly and the country’s economic indicators have improved. However, sentiment was hurt early in the summer by polls showing increased support for former president Cristina Fernandez de

Kirchner; a good performance by the former president’s party in October’s mid-term legislative election could constrict Macri’s ability to continue implementing economic reform. However, a

surprisingly strong showing by Macri’s party in the August primary led to a rally.

Mexico was affected more than most other countries during the first months

after Trump’s surprise win. The

|

|

|

| 12 |

|

SEI Institutional International Trust / Annual Report / September 30, 2017 |

peso, seen as a proxy for emerging-market sentiment, sold off to an all-time low

against the U.S. dollar in January 2017. Around the same time the peso was hitting its historic low, several key members of the Trump administration began to take a softer tone when discussing the future of U.S.-Mexico trade relations, which helped

stop the currency from sliding further and led to modest recovery. Mexico’s central bank took the additional step of issuing foreign-exchange hedges, a move that would support Mexico’s currency. Eventually the peso began to trade more in

line with its underlying fundamentals and passed through its pre-U.S. election level.

Turkey experienced a failed coup

d’état attempt in the summer of 2016. The failed attempt to overthrow President Erdogan strengthened his seemingly authoritarian control over the country. In the months following the attempt, Erdogan jailed thousands of opponents and

declared martial law. Turkey’s political strife coincided with an already-weak economy, which drove the weak performance of the Turkish lira against the U.S. dollar during the 12-month period.

A relatively low-yielding currency with seemingly little upside benefited from the outcome of France’s presidential

election. Markets feared that a victory by Marine Le Pen could have led to France’s exit from the European Union. Emmanuel Macron’s victory was received positively by markets and led to a rally in emerging-European economies like Hungary.

Finally, Venezuela, long reliant on income from oil sales, was crippled by low energy prices. The weak fundamentals underlying Venezuela’s economy were

exacerbated when the U.S. implemented sanctions in August to restrict U.S. institutions from buying new debt issued by the Venezuelan government and the state-owned oil company PDVSA. Although the sanctions had no immediate economic impact, they

essentially choked off Venezuelan president Nicolas Maduro’s access to new cash, an important source of funding for the government to provide services and service existing debt in a time of

persistently-low oil prices. Although the sanctions did not directly affect most bonds that were already issued and, more importantly, do not directly affect any bonds that the Fund holds, the sanctions have

the potential to affect liquidity for both sovereign and PDVSA bonds going forward.

The top contributors to Fund performance over the fiscal year were hard-currency

securities within Argentina, an overweight to, and security selection within, Mexico and an underweight to the Turkish lira.

The top detractors to the Fund during the reporting period were cash positioning (cash holdings in the Fund are U.S.

dollar-denominated, while emerging-market currencies strengthened meaningfully against the U.S. dollar over the period), an underweight to local-currency debt in Hungary and a small overweight to Venezuelan debt.

All managers contributed to relative performance during the fiscal year. Neuberger Berman Investment Advisers LLC was the

top-performing manager, due primarily to positioning within Mexico and external Argentinian and Indonesian debt, as well as underweights to Hungary and South Korea. Cash positioning was a detractor. Investec

Asset Management Ltd. also contributed on the merits of positioning in Mexico and Turkey, an overweight to local Russian debt and underweights to local Brazil debt, as well as external Malaysian debt. Holdings in cash detracted. Stone Harbor

Investment Partners LP benefited due to strong selection within Argentina and overweights to Brazil and Ukraine, while an underweight to local Hungary debt, an overweight to Venezuela and cash positioning detracted.

Currency forwards and swap contracts were used in the Fund for the one-year period ending September 30, 2017 as a way to

either hedge particular positions or gain exposure to additional areas of the market. Foreign-exchange hedges on local-currency bonds generally contributed to performance.

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Emerging Markets Debt Fund,

Class F |

|

|

6.93% |

|

|

|

2.55% |

|

|

|

0.83% |

|

|

|

5.00% |

|

|

|

8.23% |

|

| Emerging Markets Debt

Fund, Class Y |

|

|

7.18% |

|

|

|

2.79% |

|

|

|

0.97% |

|

|

|

5.07% |

|

|

|

8.27% |

|

| J.P. Morgan EMBI Global

Diversified Index |

|

|

4.61% |

|

|

|

6.50% |

|

|

|

4.91% |

|

|

|

7.46% |

|

|

|

8.75% |

|

| J.P. Morgan GBI-EM Global

Diversified Index |

|

|

7.32% |

|

|

|

0.26% |

|

|

|

-0.91% |

|

|

|

3.80% |

|

|

|

N/A |

|

| 50/50 Hybrid of the J.P.

Morgan EMBI Global Diversified Index and the

J.P. Morgan GBI-EM Global Diversified

Index |

|

|

5.98% |

|

|

|

3.41% |

|

|

|

2.02% |

|

|

|

5.70% |

|

|

|

N/A |

|

|

|

|

| SEI Institutional International Trust /

Annual Report / September 30, 2017 |

|

13 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

September 30, 2017 (Unaudited)

Emerging Markets Debt Fund (Concluded)

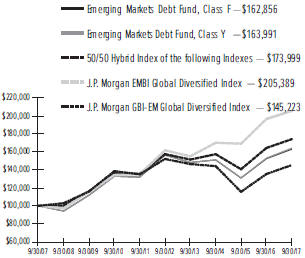

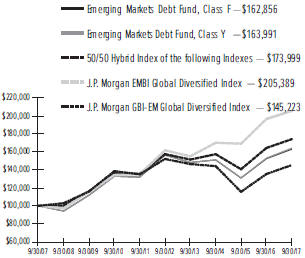

Comparison of Change in the Value of a $100,000

Investment in the Emerging Markets Debt Fund, Class F and Class Y, versus a 50/50 Hybrid of the Following Indexes: the J.P. Morgan EMBI Global Diversified Index and the J.P. Morgan GBI-EM Global

Diversified Index

| 1 |

For the year ended September 30, 2017. Past performance is no indication of future performance. Class F shares (formerly Class A shares) were offered

beginning June 26, 1997. Class Y shares were offered beginning December 31, 2014. Class Y shares performance for the period prior to December 31, 2014 derived from the performance of Class F shares. Returns for

Class Y shares are substantially similar to those of Class F shares and differ only to the extent that Class Y shares have lower total annual fund operating expenses than Class F shares. Returns shown do not reflect the deduction

of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for the period reflect fee waivers and/or reimbursements in effect for the period; absent fee waivers and reimbursements, performance would

have been lower. |

N/A — Not Available.

|

|

|

| 14 |

|

SEI Institutional International Trust / Annual Report / September 30, 2017 |

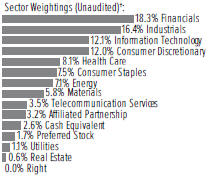

SCHEDULE OF INVESTMENTS

September 30, 2017

International Equity Fund

†Percentages based on

total investments. Includes investments held as collateral for securities on loan (see Note 9).

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

| COMMON STOCK — 93.2% |

|

|

|

|

|

|

|

|

| Argentina — 0.0% |

|

|

|

|

|

|

|

|

| Ternium ADR |

|

|

27,562 |

|

|

$ |

853 |

|

|

|

|

| Australia — 2.1% |

|

|

|

|

|

|

|

|

| AGL Energy |

|

|

114,498 |

|

|

|

2,100 |

|

| Aristocrat Leisure |

|

|

764,014 |

|

|

|

12,589 |

|

| Australia & New Zealand Banking Group |

|

|

14,066 |

|

|

|

327 |

|

| Australian Stock Exchange |

|

|

31,909 |

|

|

|

1,313 |

|

| Bank of Queensland |

|

|

63,761 |

|

|

|

649 |

|

| Bendigo & Adelaide Bank |

|

|

66,422 |

|

|

|

605 |

|

| BlueScope Steel |

|

|

359,284 |

|

|

|

3,093 |

|

| Brambles |

|

|

268,377 |

|

|

|

1,895 |

|

| Challenger |

|

|

94,687 |

|

|

|

925 |

|

| CIMIC Group |

|

|

20,454 |

|

|

|

709 |

|

| Cochlear |

|

|

47,663 |

|

|

|

5,954 |

|

| Computershare |

|

|

85,319 |

|

|

|

969 |

|

| CSL |

|

|

162,152 |

|

|

|

17,044 |

|

| CSR |

|

|

178,014 |

|

|

|

661 |

|

| Dexus ‡ |

|

|

155,424 |

|

|

|

1,159 |

|

| Downer EDI |

|

|

147,742 |

|

|

|

785 |

|

| Fortescue Metals Group |

|

|

433,449 |

|

|

|

1,748 |

|

| Goodman Group

‡ |

|

|

40,040 |

|

|

|

259 |

|

| Insurance Australia Group |

|

|

1,857,176 |

|

|

|

9,283 |

|

| LendLease Group |

|

|

97,759 |

|

|

|

1,375 |

|

| Mineral Resources |

|

|

61,149 |

|

|

|

780 |

|

| National Australia Bank |

|

|

22,476 |

|

|

|

555 |

|

| Orica |

|

|

40,754 |

|

|

|

632 |

|

| OZ Minerals |

|

|

504,373 |

|

|

|

2,936 |

|

| Qantas Airways |

|

|

2,343,806 |

|

|

|

10,722 |

|

| Rio Tinto |

|

|

7,207 |

|

|

|

376 |

|

| Seek |

|

|

13,392 |

|

|

|

174 |

|

| South32 |

|

|

3,048,099 |

|

|

|

7,821 |

|

| Treasury Wine Estates |

|

|

58,461 |

|

|

|

628 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

88,066 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Austria — 0.6% |

|

|

|

|

|

|

|

|

| ANDRITZ |

|

|

117,300 |

|

|

|

6,782 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

| COMMON STOCK (continued) |

|

|

|

|

|

|

|

|

| Erste Group Bank * |

|

|

14,715 |

|

|

$ |

636 |

|

| Immobilien Anlagen |

|

|

32,000 |

|

|

|

919 |

|

| Lenzing |

|

|

20,778 |

|

|

|

3,014 |

|

| OMV |

|

|

170,296 |

|

|

|

9,923 |

|

| Raiffeisen International Bank Holding * |

|

|

28,151 |

|

|

|

944 |

|

| S IMMO |

|

|

10,145 |

|

|

|

179 |

|

| Vienna Insurance Group |

|

|

5,476 |

|

|

|

162 |

|

| voestalpine |

|

|

18,117 |

|

|

|

924 |

|

| Wienerberger |

|

|

19,669 |

|

|

|

481 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,964 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Belgium — 1.1% |

|

|

|

|

|

|

|

|

| Ageas |

|

|

424,064 |

|

|

|

19,933 |

|

| AGFA-Gevaert * |

|

|

70,231 |

|

|

|

335 |

|

| Groupe Bruxelles Lambert |

|

|

123,200 |

|

|

|

12,963 |

|

| KBC Group |

|

|

50,068 |

|

|

|

4,244 |

|

| Solvay (A) |

|

|

7,302 |

|

|

|

1,091 |

|

| Telenet Group Holding * |

|

|

9,700 |

|

|

|

642 |

|

| UCB |

|

|

51,333 |

|

|

|

3,655 |

|

| Umicore |

|

|

1,468 |

|

|

|

121 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42,984 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Brazil — 0.4% |

|

|

|

|

|

|

|

|

| Embraer |

|

|

2,148,200 |

|

|

|

12,177 |

|

| Raia Drogasil * |

|

|

238,200 |

|

|

|

5,645 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17,822 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Canada — 3.2% |

|

|

|

|

|

|

|

|

| Alimentation Couche-Tard, Cl B |

|

|

205,725 |

|

|

|

9,360 |

|

| Bank of Montreal |

|

|

61,400 |

|

|

|

4,636 |

|

| Canadian Imperial Bank of Commerce (A) |

|

|

131,834 |

|

|

|

11,508 |

|

| Canadian Natural Resources |

|

|

322,116 |

|

|

|

10,788 |

|

| Canadian Pacific Railway (A) |

|

|

105,325 |

|

|

|

17,650 |

|

| Cogeco Communications |

|

|

10,970 |

|

|

|

807 |

|

| Encana |

|

|

1,919,849 |

|

|

|

22,550 |

|

| Entertainment One |

|

|

106,941 |

|

|

|

370 |

|

| Gildan Activewear |

|

|

363,528 |

|

|

|

11,333 |

|

| High Liner Foods |

|

|

9,000 |

|

|

|

101 |

|

| Manulife Financial |

|

|

671,300 |

|

|

|

13,586 |

|

| Royal Bank of Canada |

|

|

141,893 |

|

|

|

10,953 |

|

| Suncor Energy |

|

|

221,650 |

|

|

|

7,750 |

|

| Toronto-Dominion Bank |

|

|

173,386 |

|

|

|

9,739 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

131,131 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| China — 1.9% |

|

|

|

|

|

|

|

|

| Alibaba Group Holding ADR * |

|

|

96,900 |

|

|

|

16,736 |

|

| Baidu ADR * |

|

|

127,300 |

|

|

|

31,531 |

|

| Ctrip.com International ADR * |

|

|

148,413 |

|

|

|

7,827 |

|

| STMicroelectronics |

|

|

520,327 |

|

|

|

10,070 |

|

| Tencent Holdings |

|

|

269,200 |

|

|

|

11,587 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

77,751 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Denmark — 2.1% |

|

|

|

|

|

|

|

|

| AP Moller – Maersk, Cl A |

|

|

456 |

|

|

|

838 |

|

| AP Moller – Maersk, Cl B |

|

|

180 |

|

|

|

342 |

|

|

|

|

| SEI Institutional International Trust /

Annual Report / September 30, 2017 |

|

15 |

SCHEDULE OF INVESTMENTS

September 30, 2017

International Equity Fund (Continued)

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

| COMMON STOCK (continued) |

|

|

|

|

|

|

|

|

| Bavarian Nordic *(A) |

|

|

35,887 |

|

|

$ |

1,605 |

|

| Chr Hansen Holding |

|

|

120,221 |

|

|

|

10,313 |

|

| Coloplast, Cl B |

|

|

119,218 |

|

|

|

9,678 |

|

| Danske Bank |

|

|

42,246 |

|

|

|

1,690 |

|

| Dfds |

|

|

24,291 |

|

|

|

1,388 |

|

| H Lundbeck |

|

|

173,189 |

|

|

|

9,996 |

|

| ISS |

|

|

507,538 |

|

|

|

20,415 |

|

| Novozymes, Cl B |

|

|

184,593 |

|

|

|

9,475 |

|

| Scandinavian Tobacco Group (B) |

|

|

783,114 |

|

|

|

13,896 |

|

| Schouw |

|

|

5,421 |

|

|

|

589 |

|

| Vestas Wind Systems |

|

|

42,843 |

|

|

|

3,845 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

84,070 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Finland — 0.7% |

|

|

|

|

|

|

|

|

| Cargotec, Cl B |

|

|

31,119 |

|

|

|

1,955 |

|

| Neste |

|

|

178,680 |

|

|

|

7,805 |

|

| Orion, Cl B |

|

|

100,058 |

|

|

|

4,644 |

|

| Stora Enso, Cl R |

|

|

484,560 |

|

|

|

6,846 |

|

| UPM-Kymmene |

|

|

247,924 |

|

|

|

6,721 |

|

| Wartsila, Cl B |

|

|

13,603 |

|

|

|

963 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28,934 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| France — 7.8% |

|

|

|

|

|

|

|

|

| Aeroports de Paris |

|

|

4,735 |

|

|

|

766 |

|

| Air France-KLM * |

|

|

493,305 |

|

|

|

7,780 |

|

| Air Liquide |

|

|

48,302 |

|

|

|

6,444 |

|

| Airbus |

|

|

18,966 |

|

|

|

1,803 |

|

| Arkema |

|

|

99,014 |

|

|

|

12,144 |

|

| Aroundtown |

|

|

52,528 |

|

|

|

376 |

|

| Atos |

|

|

55,766 |

|

|

|

8,653 |

|

| BNP Paribas |

|

|

137,217 |

|

|

|

11,071 |

|

| Boiron |

|

|

1,900 |

|

|

|

170 |

|

| Bouygues |

|

|

11,160 |

|

|

|

530 |

|

| Carrefour |

|

|

692,722 |

|

|

|

14,000 |

|

| Cie Generale des Etablissements Michelin, Cl B |

|

|

6,812 |

|

|

|

995 |

|

| CNP Assurances |

|

|

106,230 |

|

|

|

2,490 |

|

| Credit Agricole |

|

|

166,975 |

|

|

|

3,036 |

|

| Dassault Systemes |

|

|

3,978 |

|

|

|

402 |

|

| Derichebourg |

|

|

85,621 |

|

|

|

898 |

|

| Elior Group (A)(B) |

|

|

185,190 |

|

|

|

4,904 |

|

| Engie |

|

|

968,080 |

|

|

|

16,446 |

|

| Essilor International |

|

|

64,582 |

|

|

|

7,998 |

|

| Eurazeo |

|

|

6,620 |

|

|

|

592 |

|

| Erofins Scientific |

|

|

15,427 |

|

|

|

9,750 |

|

| Eutelsat Communications |

|

|

18,184 |

|

|

|

539 |

|

| Gaztransport Et Technigaz |

|

|

3,902 |

|

|

|

212 |

|

| Hermes International |

|

|

22,424 |

|

|

|

11,308 |

|

| Ipsen |

|

|

59,104 |

|

|

|

7,857 |

|

| IPSOS |

|

|

18,645 |

|

|

|

645 |

|

| Kering |

|

|

10,505 |

|

|

|

4,186 |

|

| Lagardere |

|

|

6,748 |

|

|

|

226 |

|

| Les Nouveaux Constructeurs |

|

|

1,043 |

|

|

|

66 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

| COMMON STOCK (continued) |

|

|

|

|

|

|

|

|

| L’Oreal |

|

|

34,312 |

|

|

$ |

7,297 |

|

| LVMH Moet Hennessy Louis Vuitton |

|

|

45,288 |

|

|

|

12,499 |

|

| Natixis |

|

|

131,149 |

|

|

|

1,050 |

|

| Nexity |

|

|

18,692 |

|

|

|

1,142 |

|

| Pernod Ricard |

|

|

57,615 |

|

|

|

7,973 |

|

| Peugeot |

|

|

488,541 |

|

|

|

11,638 |

|

| Publicis Groupe |

|

|

187,879 |

|

|

|

13,125 |

|

| Remy Cointreau |

|

|

486 |

|

|

|

58 |

|

| Safran |

|

|

30,650 |

|

|

|

3,132 |

|

| Sanofi |

|

|

167,842 |

|

|

|

16,669 |

|

| Schneider Electric * |

|

|

436,592 |

|

|

|

38,003 |

|

| SCOR |

|

|

28,161 |

|

|

|