SEI Institutional International Trust

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05601

SEI Institutional International Trust

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

CT Corporation

155 Federal Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s

telephone number, including area code: 1-800-342-5734

Date of fiscal year end: September 30, 2015

Date of reporting period: September 30, 2015

| Item 1. |

Reports to Stockholders. |

September 30, 2015

ANNUAL REPORT

SEI Institutional International Trust

➤ International Equity

Fund

➤ Emerging Markets

Equity Fund

➤

International Fixed Income Fund

➤ Emerging Markets Debt Fund

TABLE OF CONTENTS

The Trust files its complete schedule of portfolio

holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Trust’s Form N-Q is available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public

Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to

portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling

1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

SEI INSTITUTIONAL INTERNATIONAL TRUST — SEPTEMBER 30, 2015 (Unaudited)

To Our Shareholders:

This

annual report covers the year ended September 30, 2015. Performance varied significantly across asset classes over the course of the Funds’ fiscal year. A declining global economic outlook and heightened volatility marked the fourth

quarter of 2014, followed by a round of global central-bank easing measures to start the New Year and nearly two full quarters of relative calm that proved hospitable to risk assets. The period concluded with indiscriminate volatility during the

third quarter of 2015, which put downward pressure on a majority of global assets (aside from “safe-haven” developed-market government securities).

Geopolitical events

There were several important geopolitical developments during the Funds’

fiscal year. Worries about an outbreak of Ebola in Africa and the subsequent spread of the virus played a prominent role in news headlines at the beginning of the Funds’ reporting period; although it did not have a significant impact on the

global economy. Severe unrest continued in certain areas of the Middle East, driven by the opposing and overlapping interests of ISIS, the Syrian regime, Syrian nationalists, Kurdish forces, the Iraqi military, Iranian-backed Shiite militias and, at

the end of period, the Russian military. While the conflict that originated in Syria and Iraq appears to have influenced destablizing events elsewhere in the Middle East and Northern Africa, and taken a terrible human toll, it has not had a

significant impact on global markets or the economy. Iran’s agreement with the U.S., U.K., Russia, France, China and Germany regarding the scope of its nuclear program was completed late in the Funds’ fiscal year, paving the way for the

removal of sanctions against Iran.

Economic performance — Global

Global economic growth continued at a diminishing pace for the period, while near-term growth estimates were revised downward, stemming mostly from weakness in emerging economies. Inflation trends diverged,

with an accelerating decline among developed nations as prices reversed higher in developing regions. Continued U.S. dollar strength and a general reliance by emerging economies on commodity exports amid declining prices were primarily responsible

for the desynchronization.

Economic performance — U.S.

In the U.S., economic growth dropped off at the beginning of the period; the fourth quarter of 2014 registered less than half of the preceding quarter’s admittedly stellar expansion, and was followed by

a modest contraction in the first quarter of 2015 that can be attributed partially to seasonal slowdown effects. Second-quarter growth bordered on impressive, due in large part to strong consumer activity; both retail sales and consumer spending

measures registered significant spikes in May. Revolving consumer credit retreated during the first half of the period, before reversing into a string of expansions during the second half, indicating renewed consumer appetite. Personal income growth

was solid and relatively consistent throughout the period, outpacing spending in most months. Consumer prices declined early in the period against the backdrop of a strengthening U.S. dollar, and price increases were muted when measured on a core

basis (with volatile food and energy components removed); negative price pressures were more pronounced at the producer level. The trend subsided through much of the first and second quarters of 2015, before prices began to slide again amid

third-quarter volatility. Home prices joined in the late-period decline, according to Case-Shiller, but actually delivered notable growth in the majority of the Funds’ fiscal year; year-over-year price growth was fairly consistent throughout

the period. Existing-home sales were mixed early in the period, then steadily increased, hitting an eight-year high in the summer of 2015. New-home sales did not follow a clear trend but were strong, reaching a seven-year peak in the first quarter

of 2015 and then again in the summer. The labor market benefited from consistent improvement — jobless claims and the unemployment rate both declined over the Funds’ fiscal year — although the percentage of Americans participating in

the labor force edged down. Industrial production was volatile from month to month, and year-over-year growth trended downward over the period in concert with capacity utilization. Durable goods orders were also unimpressive, with the value of new

orders (excluding volatile transportation-sector components) declining over the period. Motor vehicle sales increased with limited consistency, but registered their highest level in a decade at the end of the Funds’ fiscal year.

|

|

|

|

|

| SEI Institutional International Trust / Annual Report / September 30, 2015 |

|

|

1 |

|

The Federal Reserve (Fed) concluded monthly bond purchases at the beginning of the period as it wound down its

quantitative-easing program. Expectations for an eventual increase in the federal funds rate progressed further along the calendar, remaining to be seen at the end of the Funds’ fiscal year. While the U.S. economy has neared full employment,

the Fed must also consider inflation and price stability when determining the timing of its first rate hike.

Economic performance — Europe

Europe succeeded in cultivating steady, albeit low, economic growth over the course of the Funds’ fiscal year. The fourth quarter of 2014

improved modestly on the prior quarter, which lifted off from flatlining conditions. The first quarter of 2015 also exhibited marginal acceleration before the growth rate held firm during the second quarter. The European Central Bank’s (ECB)

commencement of an asset-purchase program at the start of the Funds’ fiscal year, and sizeable subsequent expansion in the New Year to include sovereign debt, served as the impetus for a chain reaction of central-bank loosening measures around

the globe. An assurance was given by the ECB during the second quarter of 2015 that it would not prematurely conclude its program even if economic conditions improved substantially; third-quarter volatility may have prompted the ECB to go a step

further in suggesting that the program could be expanded if deteriorating conditions warranted. The eurozone also contended with a restructuring of Greece’s public-debt obligations following elections in January 2015 that brought the leftist

Syriza party and prime minister Alexis Tsipras to power. Much of the preoccupation with Europe during the first and second quarters of 2015 centered on the negotiations between Greece, other euro-member states, the ECB and the International Monetary

Fund. The euro’s viability as a common currency among member states with limited fiscal policy coordination came into question, which, along with the ECB’s asset-purchase program, likely contributed to the euro’s slide during the

first half of the Funds’ fiscal year. Despite the euro’s apparent weakness, consumer price pressures were low-to-negative (generally negative at the producer level), with both measures bottoming in the first quarter of 2015. In

labor-market terms, unemployment remained unchanged for the first several months of the Funds’ fiscal year before trending modestly lower through most of the remaining period. The dichotomy between Europe’s core and periphery was stark

throughout the period, with Greece’s unemployment rate remaining more than five times that of Germany.

U.K. economic growth softened, but

then recovered during the period. The fourth quarter of 2014 and first quarter of 2015 each registered slower growth than the preceding quarters, while improvement during the second quarter of 2015 offset the deceleration. The Bank of England (BoE)

made no changes to monetary policy in the Funds’ fiscal year; its latest quarterly inflation report released in August 2015 indicated that consumer-price inflation was not projected to reach levels consistent with an increase in the Bank Rate

for at least several quarters following the fiscal year end. Consumer-price changes oscillated monthly between positive and negative, with the year-ago trend declining steadily in the first half of the period and remaining essentially unchanged

thereafter. Producer-price trends followed a similar first-half/second-half pattern, but were decidedly more negative (especially among input prices). Price trends were due primarily to commodity-price weakness and sterling strength, which both

intensified from late 2014 through the first quarter of 2015, picked up again during the summer, and tapered at the end of the period. The labor trend remained promising throughout most of the period, with both the claimant count and the

unemployment rate declining in most months. Year-over-year average weekly earnings growth doubled over the period as well.

Economic performance

— Asia Pacific

In the Asia-Pacific region, Japan began the period in recession but recovered during the fourth quarter of 2014 and first

quarter of the New Year, following an expansion of the Bank of Japan’s asset-purchase program and a postponed national sales tax increase. The economy fell back into contraction territory during the second quarter. While the yen weakened early

in the Funds’ fiscal year, it remained in a relatively tight range (with the exception of temporary further weakening during the summer of 2015). China’s economy, meanwhile, experienced steadily declining growth throughout the period,

albeit from levels considerably higher than most other economies. The People’s Bank of China loosened its monetary policy stance, reducing benchmark interest rates and bank-reserve requirement ratios at multiple points during the Funds’

fiscal year. However, the government’s decision to let the renminbi float and decline in value against the U.S. dollar during the third quarter of 2015 had more significant global repercussions — especially given its implications for a

potential rebalancing of global trade and the uncertainty about potential future actions.

|

|

|

| 2 |

|

SEI Institutional International Trust / Annual Report / September 30, 2015 |

Market developments — equities

Global equity markets, as reflected by the MSCI All-Country World Index (ACWI), endured a swoon at the beginning of the Funds’ reporting period. Prior to recovering, markets navigated a choppy first

quarter of 2015, trended higher in the second quarter, and fell back to their lows near the end of the period. U.S. large-cap stocks (Russell 1000 Index) followed essentially the same path, while U.S. small-cap stocks (Russell 2000 Index) delivered

stronger performance when equities were in favor (registering a small gain for the full period) over the course of the Funds’ fiscal year.

A

majority of sectors were negative, with a similar order of performance between U.S. (S&P 500 Index) and global (MSCI ACWI Index) sectors; although the U.S. delivered better overall performance. Consumer discretionary, followed by consumer

staples and healthcare, were the top-performing sectors — with positive returns in the U.S. and globally. Information technology and utilities each delivered modestly positive performance in the U.S., while information technology was negative

globally. Financials and industrials were negative everywhere, but by considerably more on a global basis than in the U.S. Telecommunications was the only sector that declined by more in the U.S. than globally. Energy was universally the worst

performer, followed at a significant distance by materials, which also delivered a deeply negative performance.

Although normally sensitive to

the threat of rising interest rates, real estate investment trusts (as measured by the Wilshire Real Estate Securities Index), performed well for the period, outpacing all U.S. sectors despite succumbing to the summer swoon.

Regionally, Europe was well-represented among countries with strong relative performance; although Greece and Russia delivered some of the most severe

overall losses. The U.S. and Japan also performed relatively well, while returns across the broader Asia and Pacific regions ranged from slightly to deeply negative. Latin America, particularly Brazil and Colombia, also struggled with sharp

declines.

Market developments — fixed income

Developed-market government bonds performed well during the Funds’ fiscal year, as yields declined on U.S. Treasuries, U.K. gilts, German bunds and Japanese government bonds (yields and prices move

inversely). The appetite for these high-quality securities led to a relatively consistent decline in yields for much of the first half of the reporting period. However, an uneven reversal followed through the spring, with the market falling again in

the summer as investors sought out the safety of developed-market government securities.

Notably, despite a great deal of central-bank monetary

policy actions during the period, there were no benchmark interest-rate increases, as most adjustments served to loosen central bank postures. Inflation-linked bonds struggled for the most part. U.S. Treasury inflation-protected securities, which

are impacted negatively by both rising interest rates and falling inflation, continued to underperform during the period. They performed well over the first four months of the New Year before selling off — sharply at first, and then steadily

through the Funds’ fiscal year end.

Spread sectors — areas of the market that offer a higher yield than government debt in return for

assuming more credit risk (including corporate, mortgage-backed securities and asset-backed securities) — performed well during the fiscal year, despite varying degrees of volatility among sectors during periods of stress, especially during the

third quarter of 2015.

Investment-grade U.S. corporate debt was positive over the full period, despite early-2015 gains having mostly eroded by

the end of the second quarter. High-yield corporates (which are below investment grade and carry greater credit risk) had a volatile, ultimately unproductive fourth-quarter 2014 before climbing through late-May 2015 — and finally sharply

declining to finish the Funds’ fiscal year with losses.

Globally, emerging-market bonds generally lagged developed markets; but performance

varied within the segment. Local-currency emerging-market bonds had steep losses, while external-currency (foreign-currency denominated) bonds were only slightly negative.

Market developments — commodities

Commodity prices (as measured by the Reuters/Jefferies CRB

Index) began the Funds’ fiscal year with a continuation of declines that began in mid-2014 and proceeded until late January 2015. The slide recommenced in earnest during May, continuing through the end of the period aside from a slight rebound

in late August. Energy prices — especially oil — were clear laggards within the commodity complex, followed at a distance by industrial metals and then by precious metals. Agricultural commodities were mixed, with corn and wheat in

positive territory at the fiscal year end.

|

|

|

|

|

| SEI Institutional International Trust / Annual Report / September 30, 2015 |

|

|

3 |

|

Our view

Economic and market cycles in recent years have been disjointed and out of sync from region to region and country to country. Volatility notwithstanding, it

is our expectation that monetary policies will remain far more expansionary and for longer in Japan, Europe and the rest of the world compared to the U.S. It’s our strong conviction that developed economies will not only avoid recession but

will actually step up the pace of growth in the year ahead. If demand flags in those regions, deflationary pressures will probably intensify.

On

behalf of SEI, I want to thank you for your confidence in the SEI Institutional International Trust. We are dedicated to helping our investors reach their long-term objectives, and we look forward to serving your investment needs in the future.

Sincerely,

William Lawrence, CFA

Managing Director, Portfolio Management Team

|

|

|

| 4 |

|

SEI Institutional International Trust / Annual Report / September 30, 2015 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL INTERNATIONAL TRUST — SEPTEMBER 30, 2015 (Unaudited)

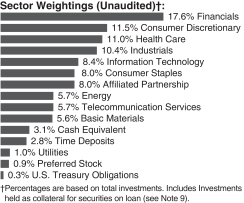

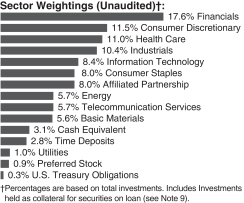

International Equity Fund

I. Objective:

The International Equity Fund (the “Fund”) seeks long-term capital appreciation.

II.

Investment Approach

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage

portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (“SIMC”). The Fund utilized the following sub-advisers as of September 30, 2015: Acadian Asset Management LLC, Blackcrane

Capital, LLC, Causeway Capital Management LLC, Henderson Global Investors (North America) Inc., INTECH Investment Management LLC, Neuberger Berman Management LLC, Tradewinds Global Investors LLC and WCM Investment Management. For the year ended

September 30, 2015, sub-adviser Schroders Investment Management North America, Inc. was terminated and sub-advisers Blackcrane Capital, LLC and WCM Investment Management were added to the Fund.

III. Returns

For the year ended September 30,

2015, the Fund’s Class A shares outperformed the MSCI EAFE Index (the “Index”), returning -5.98% versus the Index return of -8.66%.

IV. Performance Discussion

At the sector level, the Fund’s outperformance came mainly from stock

selection, while sector selection was also slightly additive. Selection was relatively strong in financials, followed by materials, consumer staples, industrials and consumer discretionary. In financials and materials, the Fund benefited from having

an underweight to some of the troubled banks or materials companies that experienced strong negative performance during the period. Stock selection was poor in energy and utilities, the former due to the oil and gas industry, which was hit heavily

during the reporting period given the decline in commodity prices addressed in the enclosed shareholder letter. The Fund slightly benefited from an overweight to the consumer discretionary, information technology and

telecommunication services sectors. Meanwhile, an underweight to consumer staples detracted as the sector once again performed

relatively well in the risk-averse environment despite rather rich valuations.

Regionally,

the Fund’s outperformance came mainly from stock selection, while sector selection was also slightly additive. Stock selection was positive in most developed regions and countries, led by the U.K., where the Fund benefited from good stock

selection in many sectors, and also by underweighting several of the troubled energy and commodity names. Stock selection in continental Europe was also a positive in both peripheral countries such as Italy and Portugal and in core countries such as

Germany and Belgium. Stock selection was a negative in France while an overweight to Norway, a country with heavy exposure to the beleaguered oil industry, also detracted from performance. Stock selection in Japan was beneficial, but an underweight

to the country, which was a top performer given the ongoing economic reforms by Prime Minister Shinzo Abe, detracted slightly. The Fund was also negatively impacted by exposure to commodity and natural-resources heavy Canada, yet benefited from an

underweight to Australia for the same reason. Emerging markets as an asset class performed very poorly during the reporting period, underperforming its developed-markets peers. As a result, exposure to emerging markets in aggregate was a negative.

The contribution by emerging Asia was more than offset by poor performance in Latin America, as noted in the shareholder letter, given its high correlation to the commodity sector but also some political and economic troubles in Brazil, its largest

economy.

For the year ended September 30, 2015, Fund-manager performance was mixed but mostly positive. Neuberger Berman Management LLC had

strong stock selection in Europe and the U.K. with the strongest contribution from Germany, while France and Sweden detracted. Henderson Global Investors (North America) Inc. also had good stock selection in the U.K., while also benefitting from an

underweight to the Pacific ex-Japan region and good stock selection within the region. Blackcrane Capital, LLC, a manager that was added in October 2014, demonstrated solid stock selection in Japan while also benefitting from exposure to Korea.

Acadian Asset Management LLC’s quantitative model and INTECH Investment Management LLC’s mathematical model produced solid results; the former was helped by stock selection in Europe and Japan, while the latter achieved good results in

Europe, the U.K. and the Pacific ex-Japan region. Causeway

|

|

|

|

|

| SEI Institutional International Trust / Annual Report / September 30, 2015 |

|

|

5 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL INTERNATIONAL TRUST — SEPTEMBER 30, 2015 (Unaudited)

Capital Management LLC’s value strategy lagged during the year with poor stock selection broadly spread

across regions, but most pronounced in Europe and Japan.

International Equity Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception to

Date |

|

| Class A† |

|

|

-5.98% |

|

|

|

5.50% |

|

|

|

3.62% |

|

|

|

0.63% |

|

|

|

3.15% |

|

| Class I† |

|

|

-6.18% |

|

|

|

5.23% |

|

|

|

3.37% |

|

|

|

0.39% |

|

|

|

2.72% |

|

| Class Y |

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

-2.24% |

* |

| MSCI EAFE Index |

|

|

-8.66% |

|

|

|

5.63% |

|

|

|

3.98% |

|

|

|

2.97% |

|

|

|

4.06% |

|

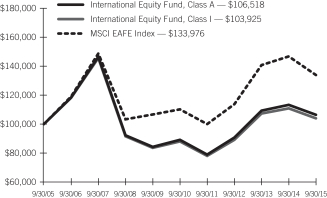

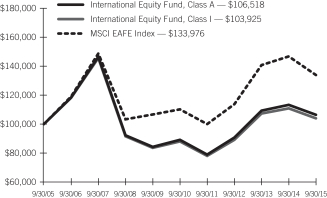

Comparison of Change in the Value of a $100,000 Investment in the International Equity Fund, Class A and Class I, versus the

MSCI EAFE Index

| |

1 |

|

For the year ended September 30, 2015. Past performance is no indication of future performance. Class I Shares were offered beginning on

January 4, 2002. Class A Shares were offered beginning December 20, 1989. The performance of Class I Shares may be lower than the performance of Class A Shares because of different distribution fees paid by Class I shareholders.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee

waivers and reimbursements, performance would have been lower. |

| |

† |

|

The graph is based on only Class A and Class I Shares; performance for Class Y Shares would be different due to differences in fee structures.

|

| |

* |

|

Cumulative inception to date as of December 31, 2014. |

|

|

|

| 6 |

|

SEI Institutional International Trust / Annual Report / September 30, 2015 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL INTERNATIONAL TRUST — SEPTEMBER 30, 2015 (Unaudited)

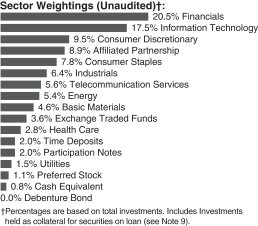

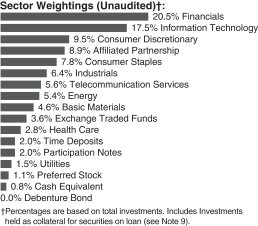

Emerging Markets Equity Fund

I. Objective:

The Emerging Markets Equity Fund (the “Fund”) seeks capital appreciation.

II. Investment

Approach

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage portions of

the Fund’s portfolio, under the general supervision of SEI Investments Management Corp. (“SIMC”). The Fund utilized the following sub-advisers as of September 30, 2015: Delaware Investment Fund Advisers, a series of Delaware

Management Business Trust, JO Hambro Capital Management Limited, Kleinwort Benson Investors International Ltd., Lazard Asset Management LLC, Neuberger Berman Management LLC, PanAgora Asset Management, Inc. and RWC Asset Advisors (US) LLC. During the

year, Everest Capital was added to and then removed from the Fund. The Everest investment team migrated to RWC Asset Advisors (US) LLC, which was then added to the Fund during the year.

III. Returns

For the year ended September 30, 2015, the Fund’s Class A shares

underperformed the MSCI Emerging Markets Index (Gross) (the “Index”), returning -20.78% versus the Index return of -18.98%.

IV.

Performance Discussion

While all equities sectors reported negative absolute performance during the Fund’s fiscal year, the Fund’s

underperformance was primarily due to stock selection, as sector selection provided some benefit.

Stock selection was negative in information

technology (IT), consumer discretionary and energy and materials. While selection in financials and consumer staples was beneficial, it could not offset the poor performance elsewhere. Within IT, the Fund was primarily and adversely impacted by

several of its Chinese software and services holdings, which experienced strong sell offs. The Fund’s IT holdings detracted due to underweights to particular companies (e.g. an Indian IT consulting & services firm as well as a Chinese

Internet firm) that performed well. In absolute terms, the healthcare sector

underperformed the least, and the Fund benefited from an overweight as well as selection within the sector. As addressed in the enclosed shareholder letter, energy and materials performed very

poorly in absolute terms, as markets experienced a sharp sell off in commodities given the slowdown of the Chinese economy. In both energy and materials, the Fund’s holdings underperformed their respective benchmark holdings and hence detracted

from overall results. However underweights to both sectors were positive.

Regionally, the Fund’s underperformance came mainly from

allocation, while stock selection had a minor negative impact. Latin America was the worst performing region given the adverse impact of the sharp sell off in commodities. As the shareholder letter noted, Brazil and Colombia were hit harder than

other Latin American countries. Stock selection in Brazil detracted from overall results. EMEA was a tale of two stories; Greece, a small country within the region, saw deeply negative absolute performance as the country defaulted on its

International Monetary Fund debt after a month of negotiations with its Eurozone creditors. The Fund’s underweight to Greece, however, contributed. Beneficial regions for the Fund included some of the smaller Eastern European countries.

Emerging Asia was a contributor to overall results. Despite the negative news about a Chinese economic-growth slowdown, as well as the volatility of the Chinese stock market, it was one of the better performing countries within the equities asset

class, followed by India and the Philippines. The Fund benefited from an overweight and stock selection in India, as well as good stock selection in Korea and an underweight to Malaysia.

Fund manager results were mixed during the year. Delaware Investment Fund Advisers detracted most, attributable to poor stock selection in emerging Asia as well as selection in and overweight to Latin

America. In Emerging Asia, the Fund’s holdings in China and India underperformed the respective benchmark components. Within Latin America the biggest detractor was Brazil, while holdings in Mexico did not perform well. Both JO Hambro

Capital Management Limited and Neuberger Berman Management LLC outperformed the respective benchmark with positive performance bolstered by their exposure in Emerging Asia. JO Hambro Capital Management Limited also benefited from good stock

selection in China and Taiwan, while

|

|

|

|

|

| SEI Institutional International Trust / Annual Report / September 30, 2015 |

|

|

7 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL INTERNATIONAL TRUST — SEPTEMBER 30, 2015 (Unaudited)

Neuberger Berman Management LLC produced solid results in China, Indonesia and India. Meanwhile PanAgora Asset

Management Inc.’s model added value in EMEA and the manager’s underweight to Latin America was also beneficial. Lazard Asset Management LLC’s strategy slightly lagged the benchmark and while stock selection in emerging Asia was

strong; the strategy was negatively impacted by stock selection in Latin America, primarily Brazil, as well as through emerging-markets holdings that are listed on exchanges in North America. Kleinwort Benson Investors International Ltd. performed

slightly ahead of the benchmark, with results in EMEA slightly ahead of emerging Asia.

Emerging Markets Equity Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception to

Date |

|

| Class A† |

|

|

-20.78% |

|

|

|

-5.64% |

|

|

|

-5.24% |

|

|

|

1.99% |

|

|

|

3.38% |

|

| Class Y |

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

-16.17% |

* |

| MSCI Emerging Markets Index (Gross) |

|

|

-18.98% |

|

|

|

-4.93% |

|

|

|

-3.25% |

|

|

|

4.60% |

|

|

|

5.25% |

|

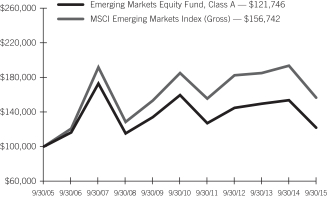

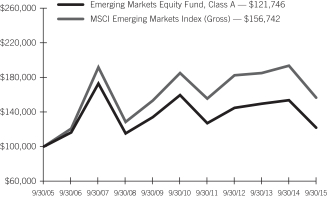

Comparison of Change in the Value of a $100,000 Investment in the

Emerging Markets Equity Fund, Class A, versus the MSCI Emerging Markets Index (Gross)

| |

1 |

|

For the year ended September 30, 2015. Past performance is no indication of future performance. Class A Shares were offered beginning

January 17, 1995. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for

that period; absent fee waivers and reimbursements, performance would have been lower. |

| |

† |

|

The graph is based on only Class A Shares; performance for Class Y Shares would be different due to differences in fee structures.

|

| |

* |

|

Cumulative inception to date as of December 31, 2014. |

|

|

|

| 8 |

|

SEI Institutional International Trust / Annual Report / September 30, 2015 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL INTERNATIONAL TRUST — SEPTEMBER 30, 2015 (Unaudited)

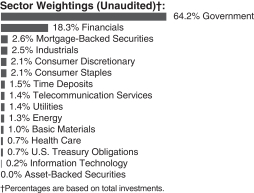

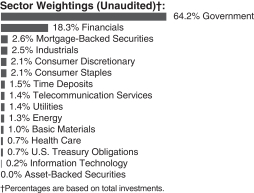

International Fixed Income Fund

I. Objective:

The International Fixed-Income Fund (the “Fund”) seeks capital appreciation and current income.

II. Investment Approach

The Fund uses a multi-manager approach, relying on a number of sub-advisers

with differing investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (“SIMC”). The Fund utilized the following sub-advisers as of September 30,

2015: AllianceBernstein, L.P., FIL Investment Advisors and Wellington Management Company, LLP. For the year ended September 30, 2015, no manager changes were made.

III. Returns

For the year ended September 30, 2015, the Fund’s Class A shares

underperformed the Barclays Global Aggregate ex-US Index, Hedged (the “Index”), returning 2.02% versus the Index return of 3.37%.

Performance Discussion

During the Fund’s fiscal

year, persistent worries over the global economic outlook, anxiety over an economic slowdown in China, declining commodity prices, the end of U.S. quantitative easing (QE), expectations about the U.S. Federal Reserve raising interest rates, and the

beginning of the European Central Bank’s QE program, were dominant market themes. As noted in the enclosed shareholder letter, both European and Japanese bonds rallied, supported by QE and investor panic during this risk-off period.

From a performance perspective, the Fund’s short-duration stance in the European and Japanese markets was detrimental. However, overweight exposures to

Europe partially mitigated the negative impact. Performance also suffered from exposure to credit risk, predominantly in the investment-grade and high-yield subsectors across the U.S., U.K. and Europe. As the shareholder letter addressed, widening

spreads, especially during the third quarter of 2015, were the result of shaken sentiment due to the correction in emerging markets and downgraded global-growth outlook. As a result, the Fund’s overweight to credit detracted.

From the sub-adviser (manager) perspective, all of the Fund’s managers underperformed. In the case of FIL

Investment Advisors, exposure to credit risk severely impaired performance, alongside an underweight to U.S., U.K. and Canadian and Japanese interest-rate risk. However, exposure to German Bunds slightly mitigated underperformance. Additionally, FIL

Investment Advisors overweight to securitized bonds was a negative. AllianceBernstein’s performance was also detrimental due to its high exposure to credit risk amid widening spreads, as well as its short-duration stance. Wellington

underperformed for the same reasons, and due to its exposure to the securitized sector.

International Fixed Income Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Class A |

|

|

2.02% |

|

|

|

2.90% |

|

|

|

3.07% |

|

|

|

2.94% |

|

|

|

4.39% |

|

| Barclays Global Aggregate ex-US Index, Hedged |

|

|

3.37% |

|

|

|

3.95% |

|

|

|

3.80% |

|

|

|

4.26% |

|

|

|

5.86% |

|

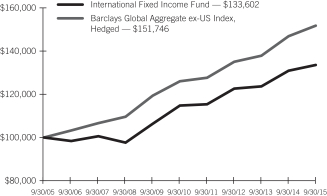

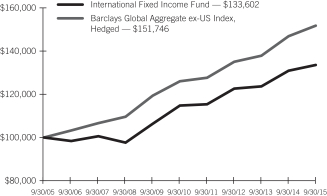

Comparison of Change in the Value of a $100,000 Investment in the International Fixed Income Fund, Class A, versus the

Barclays Global Aggregate ex-US Index, Hedged

| |

1 |

|

For the year ended September 30, 2015. Past performance is no indication of future performance. Class A Shares were offered beginning

September 1, 1993. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for

that period; absent fee waivers and reimbursements, performance would have been lower. |

|

|

|

|

|

| SEI Institutional International Trust / Annual Report / September 30, 2015 |

|

|

9 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL INTERNATIONAL TRUST — SEPTEMBER 30, 2015 (Unaudited)

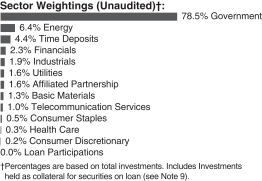

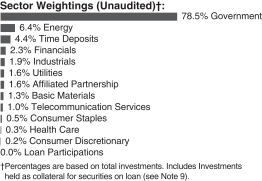

Emerging Markets Debt Fund

I. Objective:

The Emerging Markets Debt Fund (the “Fund”) seeks to maximize total return.

II. Investment

Approach

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage portions of

the Fund’s portfolio, under the general supervision of SEI Investments Management Corp. (“SIMC”). The Fund utilized the following sub-advisers as of September 30, 2015: Investec Asset Management Ltd., Neuberger Berman Fixed

Income LLC and Stone Harbor Investment Partners LP. For the year ended September 30, 2015, no manager changes were made.

III. Returns

For the year ended September 30, 2015, the Fund’s Class A shares underperformed a hybrid of 50% J.P. Morgan EMBI Global

Diversified Index and 50% J.P. Morgan GBI-EM Global Diversified (the “Index”), returning -13.35% versus the Index return of -10.62%.

IV. Performance Discussion

For the year ended

September 30, 2015, emerging markets were adversely affected by several broad factors: low commodity prices — most significantly the drop in oil prices noted in the enclosed shareholder letter — as large index constituents Russia,

Mexico, Brazil, Malaysia and Venezuela are all oil exporters; the slowing Chinese economy, which has hurt emerging markets overall, but Asian countries like Malaysia, Indonesia and Philippines even more so; and the U.S. economy, which performed

relatively well, serving as a flight to safety for many investors while also causing the U.S. dollar to strengthen relative to every emerging country’s local currency. Along with these broader themes, there were some non-financial market risks

that affected countries with large weights in the index. The conflict between Russia and the Ukraine seems more benign now than it did a year ago; as a consequence of this improving landscape, Ukraine’s external debt returned over 50% in the

third quarter of 2015, making it the market’s top performer. The other country gaining investor attention is Brazil, where a corruption probe into state-run oil company Petrobras has affected the oil giant as well as Brazil’s

government. Brazil’s credit rating was cut twice in the third quarter of 2015, ending the Fund’s fiscal year with a junk-status rating by Standard & Poor.

The majority of the blended-index underperformance comes from the local currency (GBI-EM Global Diversified) portion, which declined 19.77% over the last

twelve months. The poor performance of local currencies stemmed from the appreciation of the U.S. dollar, as addressed in the shareholder letter, versus every local-EM currency in the index: the Mexican peso, the Malaysian ringgit, the Russian

rouble, the Brazilian real, and the Colombian peso, each of which has weakened more than 20% to the U.S. dollar. The best performing currency — and only currency in the GBI-EM index that hasn’t weakened more than 10% to the U.S. dollar

— was the Philippine peso, which weakened only 3.8% to the U.S. dollar. Therefore, while the Fund benefited from a consistent underweight to local debt over the period, it was unfortunately more than offset by local-debt selection, which was

one of the primary drivers of underperformance for the year.

The external index (EMBI Global Diversified) was down 0.62% over the past twelve

months, which, when compared to the local-index performance addressed in the paragraph above, is relatively flat. The external index spread increased significantly over the year, reflecting uncertainty over low commodity prices, a weak Chinese

economy and expectations that the U.S. Federal Reserve will raise interest rates in the near future. The Fund was hurt by an average underweight to external debt during the Fund’s fiscal year, but the primary driver of underperformance came

from selection in external debt.

Within local debt, selection in Brazil was the strongest driver of underperformance. A combination of

overweights and selection in Mexico, Russia and Indonesia were the other main detractors in local debt. These four countries have all been affected by low energy prices and a strong U.S. dollar. An underweight combined with good security selection

led to Polish local debt being the largest contributor in the Fund.

Within external debt, an underweight to Ukraine was the strongest detractor

over the period. The Fund increased its Ukraine underweight in the beginning of 2015 only to see the country’s external debt rally during the third quarter of 2015. Another major

|

|

|

| 10 |

|

SEI Institutional International Trust / Annual Report / September 30, 2015 |

detractor was an underweight to the Philippines. The position is justified by the country’s tight valuations and relatively low spread compared to most others in the index, but an

investment-grade market rally and a lack of headline news from the Philippines led to solid performance. Off-benchmark holdings in Slovenia were the largest contributor in external debt, as the country generated strong positive returns over the

period.

Positioning in pure emerging-market corporate debt also contributed to returns. The Fund’s benchmark includes only sovereign and

quasi-sovereign (majority owned by the government) debt, so the Fund’s exposure is off-benchmark, with positions concentrated in high-yielding Brazilian, Russian, Chinese and Mexican credits.

Use of Derivatives

Currency forwards and swap

contracts were used in the Fund for the one-year period ending September 30, 2015 as a way to either hedge particular positions or gain exposure to additional areas of the market. Foreign-exchange (FX) hedges on local currency bonds

generally contributed to performance, particularly those used to reduce FX exposure in countries like Brazil, Russia and Malaysia.

Emerging

Markets Debt Fund

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Class A† |

|

|

-13.35% |

|

|

|

-5.75% |

|

|

|

-0.30% |

|

|

|

4.58% |

|

|

|

7.87% |

|

| Class Y |

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

-9.48% |

* |

| J.P. Morgan EMBI Global Diversified Index |

|

|

0.62% |

|

|

|

1.50% |

|

|

|

4.73% |

|

|

|

6.89% |

|

|

|

8.59% |

|

| J.P. Morgan GBI-EM Global Diversified Index |

|

|

-19.77% |

|

|

|

-8.72% |

|

|

|

-3.56% |

|

|

|

4.45% |

|

|

|

N/A |

|

| 50/50 Hybrid consisting of the J.P. Morgan EMBI Global Diversified Index and the J.P. Morgan GBI-EM Global Diversified Index |

|

|

-10.62% |

|

|

|

-3.69% |

|

|

|

0.58% |

|

|

|

5.74% |

|

|

|

N/A |

|

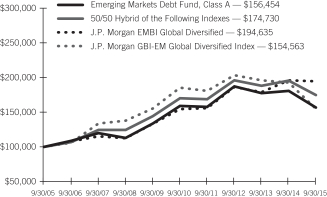

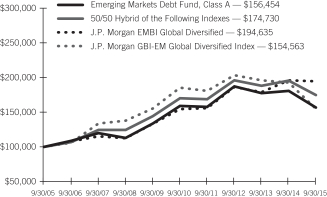

Comparison of Change in the Value of a $100,000 Investment in the Emerging Markets Debt Fund, Class A, versus

a 50/50 Hybrid of the Following Indexes: the J.P. Morgan EMBI Global Diversified Index, and the J.P. Morgan GBI-EM Global Diversified Index

| 1 |

|

For the year ended September 30, 2015. Past performance is no indication of future performance. Class A Shares were offered beginning

June 26, 1997. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that

period; absent fee waivers and reimbursements, performance would have been lower. |

| † |

|

The graph is based on only Class A Shares; performance for Class Y Shares would be different due to differences in fee structures.

|

| * |

|

Cumulative inception to date as of December 31, 2014. |

|

|

|

|

|

| SEI Institutional International Trust / Annual Report / September 30, 2015 |

|

|

11 |

|

SCHEDULE OF INVESTMENTS

International Equity Fund

September 30, 2015

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

|

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMMON STOCK — 92.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Australia — 1.9% |

|

|

|

|

|

|

|

|

|

|

| Amcor |

|

|

|

|

488,828 |

|

|

$ |

4,555 |

|

| AMP |

|

|

|

|

98,120 |

|

|

|

385 |

|

| APA Group |

|

|

|

|

49,445 |

|

|

|

299 |

|

| Australia & New Zealand Banking Group |

|

|

|

|

165,280 |

|

|

|

3,160 |

|

| Australian Stock Exchange |

|

|

|

|

43,316 |

|

|

|

1,156 |

|

| Brambles |

|

|

|

|

411,955 |

|

|

|

2,833 |

|

| Caltex Australia |

|

|

|

|

216,849 |

|

|

|

4,800 |

|

| Cochlear |

|

|

|

|

10,440 |

|

|

|

615 |

|

| Commonwealth Bank of Australia |

|

|

|

|

113,672 |

|

|

|

5,837 |

|

| CSL |

|

|

|

|

140,523 |

|

|

|

8,853 |

|

| CSR |

|

|

|

|

633,976 |

|

|

|

1,297 |

|

| Downer EDI |

|

|

|

|

121,970 |

|

|

|

288 |

|

| Echo Entertainment Group |

|

|

|

|

154,008 |

|

|

|

527 |

|

| Insurance Australia Group |

|

|

|

|

1,219,170 |

|

|

|

4,180 |

|

| Lend Lease |

|

|

|

|

42,894 |

|

|

|

381 |

|

| Macquarie Group |

|

|

|

|

20,809 |

|

|

|

1,130 |

|

| Newcrest Mining* |

|

|

|

|

140,488 |

|

|

|

1,266 |

|

| Qantas Airways* |

|

|

|

|

1,363,154 |

|

|

|

3,572 |

|

| Ramsay Health Care |

|

|

|

|

13,363 |

|

|

|

553 |

|

| Scentre Group (A) |

|

|

|

|

183,993 |

|

|

|

506 |

|

| Sirtex Medical |

|

|

|

|

15,474 |

|

|

|

359 |

|

| SMS Management & Technology |

|

|

|

|

42,238 |

|

|

|

155 |

|

| Stockland (A) |

|

|

|

|

199,487 |

|

|

|

542 |

|

| Tatts Group |

|

|

|

|

98 |

|

|

|

— |

|

| Telstra |

|

|

|

|

265,264 |

|

|

|

1,050 |

|

| Transurban Group |

|

|

|

|

182,287 |

|

|

|

1,283 |

|

| Westfield (A) |

|

|

|

|

147,434 |

|

|

|

1,037 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50,619 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Austria — 0.1% |

|

|

|

|

|

|

|

|

|

|

| ANDRITZ |

|

|

|

|

67,795 |

|

|

|

3,049 |

|

| OMV |

|

|

|

|

33,055 |

|

|

|

803 |

|

| Wienerberger |

|

|

|

|

7,964 |

|

|

|

140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,992 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

|

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Belgium — 1.7% |

|

|

|

|

|

|

|

|

|

|

| Ageas |

|

|

|

|

279,056 |

|

|

$ |

11,452 |

|

| AGFA-Gevaert* |

|

|

|

|

70,231 |

|

|

|

252 |

|

| Anheuser-Busch InBev |

|

|

|

|

22,206 |

|

|

|

2,354 |

|

| Colruyt (B) |

|

|

|

|

79,486 |

|

|

|

3,814 |

|

| Delhaize Group |

|

|

|

|

65,551 |

|

|

|

5,792 |

|

| Groupe Bruxelles Lambert |

|

|

|

|

83,482 |

|

|

|

6,285 |

|

| KBC Groep |

|

|

|

|

252,939 |

|

|

|

15,951 |

|

| Proximus |

|

|

|

|

1,679 |

|

|

|

58 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45,958 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Brazil — 0.0% |

|

|

|

|

|

|

|

|

|

|

| Cia Energetica de Minas Gerais ADR |

|

|

|

|

237,782 |

|

|

|

423 |

|

| JBS |

|

|

|

|

42,700 |

|

|

|

180 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

603 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Canada — 2.9% |

|

|

|

|

|

|

|

|

|

|

| Agrium (B) |

|

|

|

|

68,477 |

|

|

|

6,129 |

|

| Alimentation Couche-Tard, Cl B |

|

|

|

|

148,800 |

|

|

|

6,811 |

|

| Baytex Energy (B) |

|

|

|

|

470,869 |

|

|

|

1,500 |

|

| Cameco (B) |

|

|

|

|

434,899 |

|

|

|

5,293 |

|

| Canadian Imperial Bank of Commerce (B) |

|

|

|

|

61,100 |

|

|

|

4,370 |

|

| Canadian Natural Resources |

|

|

|

|

152,800 |

|

|

|

2,972 |

|

| Canadian Pacific Railway |

|

|

|

|

49,480 |

|

|

|

7,104 |

|

| CGI Group, Cl A* |

|

|

|

|

29,700 |

|

|

|

1,071 |

|

| Cogeco Cable |

|

|

|

|

27,200 |

|

|

|

1,309 |

|

| Constellation Software |

|

|

|

|

17,800 |

|

|

|

7,426 |

|

| Dominion Diamond |

|

|

|

|

50,500 |

|

|

|

537 |

|

| Entertainment One |

|

|

|

|

106,941 |

|

|

|

402 |

|

| George Weston |

|

|

|

|

4,200 |

|

|

|

338 |

|

| Gildan Activewear (B) |

|

|

|

|

363,346 |

|

|

|

10,916 |

|

| Home Capital Group, Cl B (B) |

|

|

|

|

119,900 |

|

|

|

2,864 |

|

| Imperial Oil |

|

|

|

|

238,920 |

|

|

|

7,534 |

|

| Linamar |

|

|

|

|

21,100 |

|

|

|

1,101 |

|

| Magna International, Cl A |

|

|

|

|

81,500 |

|

|

|

3,891 |

|

| Power Corp of Canada |

|

|

|

|

38,900 |

|

|

|

803 |

|

| Quebecor, Cl B |

|

|

|

|

16,000 |

|

|

|

349 |

|

| Royal Bank of Canada |

|

|

|

|

37,400 |

|

|

|

2,058 |

|

| Sun Life Financial |

|

|

|

|

31,700 |

|

|

|

1,018 |

|

| Suncor Energy |

|

|

|

|

60,300 |

|

|

|

1,605 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

77,401 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| China — 0.4% |

|

|

|

|

|

|

|

|

|

|

| Alibaba Group Holding ADR* |

|

|

|

|

29,800 |

|

|

|

1,757 |

|

| STMicroelectronics (B) |

|

|

|

|

111,352 |

|

|

|

755 |

|

| Tencent Holdings |

|

|

|

|

416,900 |

|

|

|

7,040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,552 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Denmark — 2.4% |

|

|

|

|

|

|

|

|

|

|

| Bavarian Nordic* |

|

|

|

|

11,467 |

|

|

|

455 |

|

| Carlsberg, Cl B |

|

|

|

|

5,937 |

|

|

|

455 |

|

| Chr Hansen Holding |

|

|

|

|

175,592 |

|

|

|

9,823 |

|

| Coloplast, Cl B |

|

|

|

|

101,405 |

|

|

|

7,183 |

|

|

|

|

| 12 |

|

SEI Institutional International Trust / Annual Report / September 30, 2015 |

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

|

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

| Danske Bank |

|

|

|

|

9,265 |

|

|

$ |

279 |

|

| H Lundbeck |

|

|

|

|

222,080 |

|

|

|

5,915 |

|

| ISS |

|

|

|

|

351,633 |

|

|

|

11,664 |

|

| Jyske Bank* |

|

|

|

|

76,481 |

|

|

|

4,212 |

|

| Novo Nordisk, Cl B |

|

|

|

|

50,889 |

|

|

|

2,745 |

|

| Novo Nordisk ADR |

|

|

|

|

210,318 |

|

|

|

11,408 |

|

| Novozymes, Cl B |

|

|

|

|

157,252 |

|

|

|

6,852 |

|

| Pandora |

|

|

|

|

38,213 |

|

|

|

4,443 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

65,434 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Finland — 0.5% |

|

|

|

|

|

|

|

|

|

|

| Aktia Bank |

|

|

|

|

5,931 |

|

|

|

72 |

|

| Amer Sports, Cl A |

|

|

|

|

27,087 |

|

|

|

685 |

|

| Elisa, Cl A |

|

|

|

|

29,937 |

|

|

|

1,008 |

|

| Kone, Cl B |

|

|

|

|

15,350 |

|

|

|

584 |

|

| Neste |

|

|

|

|

114,696 |

|

|

|

2,635 |

|

| Nokia |

|

|

|

|

88,505 |

|

|

|

606 |

|

| Orion, Cl B |

|

|

|

|

61,183 |

|

|

|

2,310 |

|

| Sampo, Cl A |

|

|

|

|

15,811 |

|

|

|

763 |

|

| Stora Enso, Cl R |

|

|

|

|

359,778 |

|

|

|

2,713 |

|

| Tieto |

|

|

|

|

15,404 |

|

|

|

388 |

|

| UPM-Kymmene |

|

|

|

|

189,206 |

|

|

|

2,825 |

|

| Valmet |

|

|

|

|

24,475 |

|

|

|

237 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14,826 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| France — 8.6% |

|

|

|

|

|

|

|

|

|

|

| Accor |

|

|

|

|

13,075 |

|

|

|

609 |

|

| Alcatel-Lucent* |

|

|

|

|

3,275,460 |

|

|

|

11,980 |

|

| Arkema |

|

|

|

|

43,236 |

|

|

|

2,794 |

|

| Atos |

|

|

|

|

29,616 |

|

|

|

2,269 |

|

| AXA |

|

|

|

|

118,335 |

|

|

|

2,860 |

|

| BNP Paribas |

|

|

|

|

331,339 |

|

|

|

19,406 |

|

| Boiron |

|

|

|

|

1,900 |

|

|

|

183 |

|

| Bonduelle S.C.A. |

|

|

|

|

2,303 |

|

|

|

59 |

|

| Cap Gemini |

|

|

|

|

6,275 |

|

|

|

558 |

|

| Carrefour |

|

|

|

|

358,155 |

|

|

|

10,567 |

|

| Christian Dior |

|

|

|

|

12,412 |

|

|

|

2,310 |

|

| Cie des Alpes |

|

|

|

|

3,261 |

|

|

|

64 |

|

| CNP Assurances |

|

|

|

|

19,539 |

|

|

|

271 |

|

| Dassault Systemes |

|

|

|

|

1,948 |

|

|

|

144 |

|

| Electricite de France |

|

|

|

|

277,248 |

|

|

|

4,891 |

|

| Engie |

|

|

|

|

762,129 |

|

|

|

12,315 |

|

| Essilor International |

|

|

|

|

7,247 |

|

|

|

881 |

|

| Eurofins Scientific |

|

|

|

|

3,986 |

|

|

|

1,222 |

|

| Eutelsat Communications |

|

|

|

|

5,952 |

|

|

|

182 |

|

| Groupe Eurotunnel |

|

|

|

|

33,212 |

|

|

|

451 |

|

| Ipsen |

|

|

|

|

30,854 |

|

|

|

1,910 |

|

| Legrand |

|

|

|

|

191,515 |

|

|

|

10,144 |

|

| L’Oreal |

|

|

|

|

5,483 |

|

|

|

949 |

|

| LVMH Moet Hennessy Louis Vuitton |

|

|

|

|

43,066 |

|

|

|

7,320 |

|

| Metropole Television |

|

|

|

|

37,494 |

|

|

|

715 |

|

| Natixis |

|

|

|

|

12,049 |

|

|

|

66 |

|

| Numericable-SFR SAS* |

|

|

|

|

16,776 |

|

|

|

773 |

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

|

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

| Orange |

|

|

|

|

912,632 |

|

|

$ |

13,767 |

|

| Pernod Ricard |

|

|

|

|

28,450 |

|

|

|

2,867 |

|

| Peugeot* |

|

|

|

|

72,859 |

|

|

|

1,095 |

|

| Publicis Groupe |

|

|

|

|

53,826 |

|

|

|

3,670 |

|

| Renault |

|

|

|

|

12,643 |

|

|

|

903 |

|

| Rexel |

|

|

|

|

1,013,170 |

|

|

|

12,432 |

|

| Safran |

|

|

|

|

12,181 |

|

|

|

915 |

|

| Sanofi |

|

|

|

|

344,287 |

|

|

|

32,585 |

|

| Schneider Electric |

|

|

|

|

239,031 |

|

|

|

13,358 |

|

| SCOR |

|

|

|

|

17,328 |

|

|

|

620 |

|

| SEB |

|

|

|

|

5,886 |

|

|

|

541 |

|

| SES |

|

|

|

|

16,793 |

|

|

|

528 |

|

| Societe BIC |

|

|

|

|

4,474 |

|

|

|

693 |

|

| Sodexo |

|

|

|

|

57,919 |

|

|

|

4,783 |

|

| SPIE* |

|

|

|

|

129,920 |

|

|

|

2,156 |

|

| Technicolor |

|

|

|

|

209,719 |

|

|

|

1,444 |

|

| Technip |

|

|

|

|

160,392 |

|

|

|

7,566 |

|

| Teleperformance |

|

|

|

|

4,248 |

|

|

|

321 |

|

| Thales |

|

|

|

|

93,116 |

|

|

|

6,465 |

|

| Total |

|

|

|

|

524,313 |

|

|

|

23,536 |

|

| Unibail-Rodamco (A) |

|

|

|

|

2,525 |

|

|

|

653 |

|

| Valeo |

|

|

|

|

37,408 |

|

|

|

5,047 |

|

| Vetoquinol |

|

|

|

|

569 |

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

231,863 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Germany — 5.9% |

|

|

|

|

|

|

|

|

|

|

| Bayer |

|

|

|

|

209,349 |

|

|

|

26,783 |

|

| Bayerische Motoren Werke |

|

|

|

|

121,082 |

|

|

|

10,731 |

|

| Brenntag |

|

|

|

|

93,083 |

|

|

|

5,016 |

|

| Continental |

|

|

|

|

25,793 |

|

|

|

5,481 |

|

| Daimler |

|

|

|

|

102,292 |

|

|

|

7,421 |

|

| Daimler ADR |

|

|

|

|

4,915 |

|

|

|

358 |

|

| DCC |

|

|

|

|

46,740 |

|

|

|

3,535 |

|

| Deutsche Bank* (B) |

|

|

|

|

151,693 |

|

|

|

4,096 |

|

| Deutsche Boerse |

|

|

|

|

103,694 |

|

|

|

8,920 |

|

| Deutsche EuroShop |

|

|

|

|

29,331 |

|

|

|

1,319 |

|

| Deutsche Lufthansa |

|

|

|

|

303,231 |

|

|

|

4,221 |

|

| Deutsche Post |

|

|

|

|

7,442 |

|

|

|

206 |

|

| Deutsche Telekom |

|

|

|

|

86,682 |

|

|

|

1,537 |

|

| Deutsche Wohnen |

|

|

|

|

24,203 |

|

|

|

646 |

|

| Duerr |

|

|

|

|

8,895 |

|

|

|

625 |

|

| Evonik Industries |

|

|

|

|

68,616 |

|

|

|

2,293 |

|

| Fresenius |

|

|

|

|

49,420 |

|

|

|

3,313 |

|

| Fresenius Medical Care |

|

|

|

|

11,933 |

|

|

|

930 |

|

| Gerresheimer |

|

|

|

|

20,399 |

|

|

|

1,486 |

|

| Hannover Rueck |

|

|

|

|

31,057 |

|

|

|

3,174 |

|

| Henkel |

|

|

|

|

912 |

|

|

|

80 |

|

| Hochtief |

|

|

|

|

60,368 |

|

|

|

5,020 |

|

| Infineon Technologies |

|

|

|

|

62,293 |

|

|

|

701 |

|

| Krones |

|

|

|

|

6,828 |

|

|

|

717 |

|

| KUKA (B) |

|

|

|

|

3,781 |

|

|

|

290 |

|

| Linde |

|

|

|

|

90,024 |

|

|

|

14,576 |

|

| Merck |

|

|

|

|

67,121 |

|

|

|

5,935 |

|

| Muenchener Rueckversicherungs |

|

|

|

|

1,900 |

|

|

|

354 |

|

|

|

|

|

|

| SEI Institutional International Trust / Annual Report / September 30, 2015 |

|

|

13 |

|

SCHEDULE OF INVESTMENTS

International Equity Fund (Continued)

September 30, 2015

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

|

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

| Nordex* |

|

|

|

|

68,932 |

|

|

$ |

1,881 |

|

| Pfeiffer Vacuum Technology |

|

|

|

|

17,950 |

|

|

|

2,072 |

|

| ProSiebenSat.1 Media |

|

|

|

|

54,569 |

|

|

|

2,674 |

|

| QIAGEN* |

|

|

|

|

5,099 |

|

|

|

131 |

|

| Rhoen Klinikum (B) |

|

|

|

|

41,757 |

|

|

|

1,180 |

|

| SAP |

|

|

|

|

213,498 |

|

|

|

13,811 |

|

| SAP ADR (B) |

|

|

|

|

63,400 |

|

|

|

4,108 |

|

| Siemens |

|

|

|

|

82,175 |

|

|

|

7,335 |

|

| STADA Arzneimittel |

|

|

|

|

7,027 |

|

|

|

251 |

|

| Symrise |

|

|

|

|

14,365 |

|

|

|

864 |

|

| Talanx |

|

|

|

|

13,993 |

|

|

|

419 |

|

| ThyssenKrupp |

|

|

|

|

5,661 |

|

|

|

99 |

|

| TUI |

|

|

|

|

156,224 |

|

|

|

2,851 |

|

| Volkswagen |

|

|

|

|

3,131 |

|

|

|

369 |

|

| Vonovia |

|

|

|

|

27,335 |

|

|

|

879 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

158,688 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Hong Kong — 2.6% |

|

|

|

|

|

|

|

|

|

|

| AIA Group |

|

|

|

|

2,280,669 |

|

|

|

11,927 |

|

| BOC Hong Kong Holdings |

|

|

|

|

432,000 |

|

|

|

1,278 |

|

| Chaoda Modern Agriculture |

|

|

|

|

2,440,000 |

|

|

|

75 |

|

| Cheung Kong Infrastructure Holdings (B) |

|

|

|

|

107,000 |

|

|

|

960 |

|

| Cheung Kong Property Holdings |

|

|

|

|

69,326 |

|

|

|

504 |

|

| China Merchants Holdings International |

|

|

|

|

1,389,779 |

|

|

|

4,103 |