SEI Institutional International Trust

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-05601

SEI Institutional International Trust

(Exact name of registrant as specified in charter)

SEI

Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

CT Corporation

155 Federal Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-342-5734

Date of

fiscal year end: September 30, 2012

Date of reporting period: September 30, 2012

| Item 1. |

Reports to Stockholders. |

September 30, 2012

ANNUAL REPORT

SEI Institutional International Trust

International Equity Fund

Emerging Markets Equity Fund

International Fixed Income

Fund

Emerging Markets Debt

Fund

TABLE OF CONTENTS

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and

third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Trust’s Form N-Q is available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s

Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A

description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent

12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL INTERNATIONAL TRUST — SEPTEMBER 30, 2012

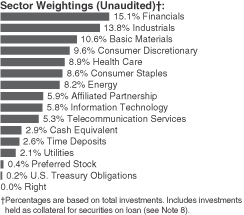

International Equity Fund

I. Objective

The International Equity Fund (the “Fund”) seeks to provide long-term capital appreciation.

II. Multi-Manager Approach Statement

The Fund uses a

multi-manager approach, relying on a number of sub-advisors with differing investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (SIMC). The Fund utilized the

following sub-advisers as of September 30, 2012: Acadian Asset Management LLC, Causeway Capital Management LLC, del Rey Global Investors LLC, INTECH Investment Management LLC, Neuberger Berman Management LLC, Schroder Investment Management North

America, Inc. and Tradewinds Global Investors LLC. For the year ended September 30, 2012, there were no new managers added to the Fund; Quantitative Management Associates LLC was terminated during the period.

III. Market Commentary

For the year ended September

30, 2012, we saw strong equity returns on the heels of relatively positive economic data combined with significant central bank intervention worldwide. The greatest concern continued to be the eurozone sovereign debt saga, with the focus shifting

from Greece and other peripheral countries to questions regarding the financial strength of larger national economies such as Germany and France, which may eventually have to backstop the debts of their weaker neighbors. Entering 2012, eurozone debt

fears waned temporarily, bringing strong equity market results in January and February despite the fact that yield spreads between stronger governments and troubled governments remained quite high (wide spreads may be an indication of stress and

risk aversion in credit markets). While there were releases of improved economic data throughout the period, fears persisted regarding the prospects of a hard landing for China and other emerging markets’ domestic economies, as well as concerns

regarding the potential for a double-dip recession in the U.S. However, global equity markets rallied in the third quarter of 2012, due, we believe, to central banks around the world signaling that they will take the necessary measures to stimulate

economic growth. Performance was strong across developed markets with the exception of Japan, which continues to struggle due largely to the impact of its strong currency on its predominately export-driven economy. Financials also rebounded

significantly during the period in response to increasing central bank intervention aimed at stabilizing financial markets.

IV. Return vs.

Benchmark

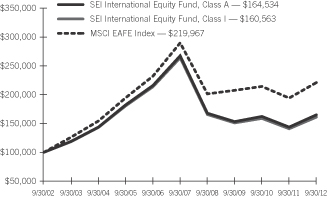

For year ended September 30, 2012, the Fund’s Class A shares outperformed the MSCI EAFE Index (the “Index”), returning

14.76% (Class A) versus the Index return of 13.75%.

V. Fund Attribution

At the sector level, Fund outperformance came mainly from stock selection. Selection in Industrials drove positive results as did selection in Energy and Telecommunications. In contrast, selection in

Consumer Discretionary and Consumer Staples detracted slightly from performance. Regionally, outperformance came mainly through stock selection, while regional allocation had little impact. Stock selection in Europe was the greatest contributor to

Fund outperformance, particularly within Switzerland and the Netherlands. The greatest detractor from performance was Australia, where stock selection and the underweight allocation both dragged on results.

Some of the managers within the Fund used derivatives for currency hedging (futures and forwards) during the period, though these instruments did not have a

meaningful impact on Fund performance.

International Equity Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Class A |

|

|

14.76% |

|

|

|

2.50% |

|

|

|

(9.13)% |

|

|

|

5.11% |

|

|

|

2.84% |

|

| Class I |

|

|

14.37% |

|

|

|

2.22% |

|

|

|

(9.34)% |

|

|

|

4.85% |

|

|

|

2.03% |

|

| MSCI EAFE Index |

|

|

13.75% |

|

|

|

2.12% |

|

|

|

(5.24)% |

|

|

|

8.20% |

|

|

|

3.85% |

|

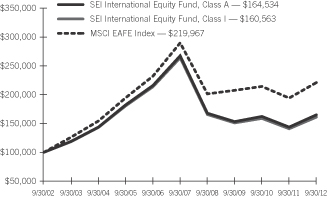

Comparison of Change in the Value of a $100,000 Investment in the International Equity Fund, Class A and Class I, versus

the MSCI EAFE Index

| |

1 |

|

For the year ended September 30, 2012. Past performance is no indication of future performance. Class I Shares were offered beginning on

January 4, 2002. Class A Shares were offered beginning December 20, 1989. Class I Shares performance for the period prior to January 4, 2002 is performance derived from the performance of the Class A Shares. The performance

of Class I Shares may be lower than the performance of Class A Shares because of different distribution fees paid by Class I shareholders. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or

the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower.

|

|

|

|

|

|

| SEI Institutional International Trust / Annual Report / September 30, 2012 |

|

|

1` |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL INTERNATIONAL TRUST — SEPTEMBER 30, 2012

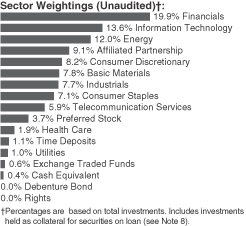

Emerging Markets Equity Fund

I. Objective

The Emerging Markets Equity Fund (the “Fund”) seeks capital appreciation.

II. Multi-Manager

Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisors with differing investment approaches to manage

portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (SIMC). The Fund utilized the following sub-advisers as of September 30, 2012: Delaware Management Company, JO Hambro Capital Management

Limited, Kleinwort Benson Investors International, Lazard Asset Management LLC, Neuberger Berman Management LLC, PanAgora Asset Management, Inc., and The Boston Company Asset Management LLC. For the year ended September 30, 2012, Kleinwort Benson

Investors International was added to the Fund; Artisan Partners Limited Partnership was terminated during the period.

III. Market Commentary

For the year ended September 30, 2012, emerging markets outperformed developed markets driven largely by a renewed appetite for risk that was

interspersed throughout the period. The greatest concern worldwide continued to be the eurozone sovereign debt saga, with the focus shifting from the fate of Greece and other peripheral nations, to questions regarding the financial strength of the

larger nations such as Germany and France, as it was assumed that they would ultimately have to step in and finance the debts of their weaker neighbors. Entering 2012, the euro debt fears waned temporarily, bringing strong results in January and

February, despite the fact that spreads on European sovereign debt remained extremely high. While there were releases of improved economic data throughout the period, fears persisted regarding the prospects of a hard landing for China’s and

other emerging markets’ economies, along with the worldwide concern regarding the potential for a double-dip recession in the U.S. However, equity markets around the world rallied in the third quarter of 2012, as central banks around the globe

continued to signal that they would take whatever measures they deem necessary to stimulate economic growth. Of these measures, the one that created the most positive market reaction was the European Central Bank’s (ECB) announcement to provide

liquidity to the market through unlimited purchases of short-duration bonds, and the ECB president’s pledge to “do whatever it takes” to preserve the euro currency union. Within emerging markets, the larger economies of Brazil and

India struggled, as the sustainability of growth in those nations came into question. In contrast, Mexico and Korea delivered strong performance through the choppy market environment.

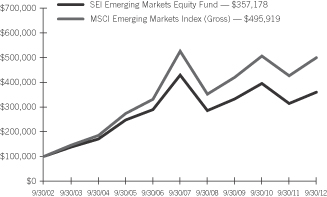

IV. Return vs. Benchmark

For year ended September 30, 2012, the Fund underperformed the MSCI Emerging Markets Index (Gross) (the “Index”), returning 14.21% versus the Index return of 17.33%.

V. Fund Attribution

Stock selection in Information

Technology and Financials detracted most from performance. In contrast, an underweight to Materials contributed positively, as did stock selection in Industrials. From a regional standpoint, both stock selection and portfolio allocation detracted

from performance. Stock selection in Brazil was strong during the period, but weak selection in China and South Africa detracted from results.

Emerging Markets Equity Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Class A |

|

|

14.21% |

|

|

|

2.64% |

|

|

|

(3.44)% |

|

|

|

13.58% |

|

|

|

4.99% |

|

MSCI Emerging Markets Index

(Gross) |

|

|

17.33% |

|

|

|

5.96% |

|

|

|

(0.98)% |

|

|

|

17.37% |

|

|

|

7.08% |

|

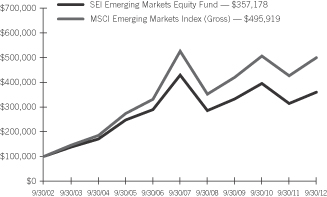

Comparison of Change in the Value of a $100,000 Investment in the

Emerging Markets Equity Fund, Class A, versus the MSCI Emerging Markets Index (Gross)

| |

1 |

|

For the year ended September 30, 2012. Past performance is no indication of future performance. Class A Shares were offered beginning

January 17, 1995. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for

that period; absent fee waivers and reimbursements, performance would have been lower. |

|

|

|

| 2 |

|

SEI Institutional International Trust / Annual Report / September 30, 2012 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL INTERNATIONAL TRUST — SEPTEMBER 30, 2012

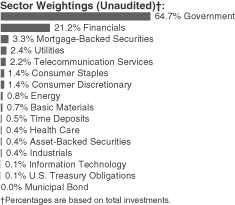

International Fixed Income Fund

I. Objective

The International Fixed Income Fund (the “Fund”) seeks to provide capital appreciation and current income.

II. Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of

sub-advisors with differing investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (SIMC). The Fund utilized the following sub-advisers as of September 30,

2012: AllianceBernstein L.P., Wellington Management Company, LLP and Fidelity International Investment Advisors (UK) Limited. For the year ended September 30, 2012, no manager changes were made.

Market Commentary

For the year ended

September 30, 2012, markets experienced another roller coaster ride, flipping from “risk-on” to “risk-off” quite frequently. The new European Central Bank (ECB) President Mario Draghi has been extremely active all

year-round. At the beginning of his mandate the ECB cut rates in December 2011 and followed suit with two rounds of long term refinancing operations (LTRO). The LTROs have been perceived as a game changer in Europe in terms of: 1) backstopping bank

funding for long periods; 2) pushing all short-end rates and spreads lower; and 3) reviving demand for government bonds. The broader collateral eligibility that came along the second LTRO gave the opportunity to small financial entities to access

the operation: a total of 800 banks borrowed 530 billion euro. The ECB’s efforts were reinforced by the Euro area finance ministers with an extension of EFSF/ ESM firewalls. The deal ensures

€500 billion of lending capacity beyond the funds already committed will be available from the middle of 2012. On the Greek subject

the new government took some measures including public and private sector wage cuts, reduction in the number of civil service employees, tax reform, pension reform and a host of other reforms in order to achieve a consolidation of 1.5% of gross

domestic product (GDP) in 2012 and an additional 5% of GDP through 2015. By the end of the first quarter a second-round bailout was agreed with even more structural reforms in order to pay the March 20th bond maturity. In addition the PSI

negotiations went throughout: EU172bn of bonds tenders in swap

with consents from 85% of holders. The International Swaps and Derivatives Association (ISDA) voted that a Greek credit event occurred which triggered CDS contracts.

The second quarter saw the reversal of the first quarter in the form of renewed markets skepticism about two main worried: the stability of the euro area and

the momentum in global growth / demand. Market anxiety about Spain flared up again. At the beginning of the period Spain was in the spotlight as confidence disappeared due to the large fiscal slippage in 2011 (2.5% of GDP). The Spanish government

announced its fiscal consolidation plan for 2012, with measures worth EUR27.3bn for the central government budget. But the weak banking system came into light with the Bankia bailout which was much larger than estimated just two weeks prior and was

placed on the country’s balance sheet despite the country moving back into recession in the first quarter. By the end of the quarter the decision to provide funds for Spanish bank recapitalization failed to stabilize markets.

At the beginning of the third quarter the ECB cut its main refinancing rate by 25bp to 0.75% as well as marginal deposit and lending rates. The deposit rate

is now at zero. During the last ECB meeting of the quarter President Draghi introduced a new policy approach that seeks to navigate the current difficult path in a judicious manner and is called Outright Monetary Transactions (OMT). More precisely,

any country requesting ECB action will first be required to have signed up for either a full EFSF/ESM program (such as Greece, Ireland, Portugal) or at minimum to have set up a precautionary program. Precautionary programs are akin to the IMF’s

precautionary credit line. The market reaction was strong and positive as investors realized that it was a step towards fiscal union.

The

substantially stimulating monetary policy applied in Europe was used throughout the world: the US, Japan, the UK and China all loosened their monetary policy to fight the economic slowdown and the lack of political leadership.

On the market front the major treasury markets (U.S., Europe and UK) are lower than a year ago. Spreads on government debt within the eurozone tightened

significantly, especially since the LTRO announcement. On the corporate-bond side, spreads tightened, especially in the US, as companies deleveraged their balance sheets and are still sitting on a pile of cash to stomach a potentially global

downturn.

|

|

|

|

|

| SEI Institutional International Trust / Annual Report / September 30, 2012 |

|

|

3 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL INTERNATIONAL TRUST — SEPTEMBER 30, 2012

International Fixed Income Fund (Concluded)

III. Return vs. Benchmark

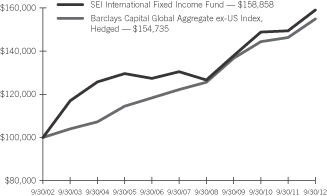

For year ended September 30, 2012, the Fund outperformed the Barclays Capital Global Aggregate ex-USD Index, Hedged (the “Index”) returning 6.34% versus the Index return of 5.86%.

IV. Fund Attribution

The fund kept a short duration

positioning throughout the year which overall was marginally positive. The main contributor to performance was the asset allocation call through an overweight stance to the corporate, especially financials, and securitized sectors and an underweight

stance to the sovereign sector. Another positive driver of performance was the security selection within the corporate and securitized sub-sectors. The country selection was positive as the fund successfully managed to adjust the exposure of the

so-called peripheral countries according to the market environment. Treasury futures, currency forwards, options and swaps were used to efficiently assist in managing the Fund’s duration, currency and yield-curve exposures.

International Fixed Income Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Class A |

|

|

6.34% |

|

|

|

4.85% |

|

|

|

4.03% |

|

|

|

4.74% |

|

|

|

4.63% |

|

| Barclays Capital Global Aggregate ex-US Index, Hedged |

|

|

5.86% |

|

|

|

4.22% |

|

|

|

4.84% |

|

|

|

4.46% |

|

|

|

6.17% |

|

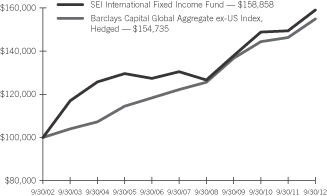

Comparison of Change in the Value of a $100,000 Investment in the International Fixed Income Fund, Class A, versus the

Barclays Capital Global Aggregate ex-US Index, Hedged

| |

1 |

|

For the year ended September 30, 2012. Past performance is no indication of future performance. Class A Shares were offered beginning

September 1, 1993. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for

that period; absent fee waivers and reimbursements, performance would have been lower. |

|

|

|

| 4 |

|

SEI Institutional International Trust / Annual Report / September 30, 2012 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL INTERNATIONAL TRUST — SEPTEMBER 30, 2012

Emerging Markets Debt Fund

I. Objective

The Emerging Markets Debt Fund (the “Fund”) seeks to maximize total return.

II.

Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisors with differing investment approaches

to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corp. (SIMC). The Fund utilized the following sub-advisers as of September 30, 2012: Ashmore Investment Management Limited, ING Investment

Management Advisors, B.V. and Stone Harbor Investment Partners LP. For the year ended September 30, 2012, no manager changes were made.

III.

Market Commentary

For the year ended September 30, 2012, emerging markets debt (EMD) posted a return of 18.52% (as measured by a blended

benchmark) during a roller-coaster market that saw increasing asset prices despite persistent volatility. EMD began the period with a stretch of volatility caused by resolution of the U.S. debt ceiling crisis and deepening concerns over financial

stresses in Europe. Investor risk appetite returned on news of an improving outlook in Europe, positive developments in China, a temporary respite from the U.S. government’s fiscal challenges, and relatively attractive valuations that resulted

from a mid-2011 selloff across global markets.

Emerging markets local-currency debt posted positive absolute returns, but failed to keep pace

with the strong dollar market during the period. Local currency assets were severely impaired in September 2011, coming off another period of volatility, causing investors to return to external-debt sectors. After additional volatility in the second

quarter of 2012, the European Central Bank and U.S. Federal Reserve provided more support to financial markets, enacting measures designed to minimize the likelihood of extremely severe market events in the short term. Central bank policies in

emerging markets also began to ease as inflation risks took a backseat to fears of a global slowdown.

The accommodative tone from policymakers caused a surge in appetite for external emerging market debt assets.

This resulted in asset-class inflows of approximately $60 billion — $25 billion more than projected at the start of 2012 — with another quarter left in calendar year 2012. These positive technicals put upward pressure on EMD asset prices

and boosted returns, despite liquidity challenges and supply imbalances. New issuance, which usually helps absorb investor inflows, was largely completed at the start of 2012 and thus unavailable to offset a sharp decline in yields. Though sovereign

financing remained quiet, very strong issuance in new corporate deals helped pick up the slack. Investors are still becoming acquainted with the growing EMD corporate sector.

Growth expectations in emerging markets declined during the period, yet remain significantly higher than in the developed world. Economic fundamentals continued to improve despite fiscal pressures in a few

countries, giving way to more credit-rating upgrades—a trend that is expected to continue. The strong technical environment has clearly supported asset prices, but we believe it is ultimately the positive underlying long-term fundamentals that

are supporting investors’ increasing comfort with the emerging markets debt asset class.

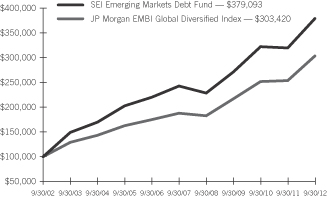

IV. Return vs. Benchmark

From September 30, 2011 through June 30, 2012, the Fund’s benchmark was the JP Morgan EMBI Global Diversified Index. During that period, the Fund

outperformed the benchmark, returning 13.11% versus 12.11%.

From June 30, 2012 through September 30, 2012, the Fund’s benchmark was 50% JP

Morgan EMBI Global Diversified Index and 50% JP Morgan GBI-EM Global Diversified Index. During that period, the Fund outperformed the benchmark, returning 6.16% versus 5.72%.

For the year ended September 30, 2012, the Fund returned 18.48% versus a linked return of 18.52% for the two benchmarks used during the period.

|

|

|

|

|

| SEI Institutional International Trust / Annual Report / September 30, 2012 |

|

|

5 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL INTERNATIONAL TRUST — SEPTEMBER 30, 2012

Emerging Markets Debt Fund (Concluded)

V. Fund Attribution

Adding to the Fund’s relative return for the period was an overweight to local-currency debt (particularly in Mexico and Brazil), security selection in quasi-sovereign debt, an underweight to Lebanon

and security selection in Venezuela.

At the country level, security selection in Mexico was the largest contributor to relative return as the

country’s debt benefited from a high correlation to U.S. Treasuries, which rallied. Mexico’s currency, the peso, also rallied on favorable economic growth expectations for continued reforms under the new administration. Local-currency debt

in Brazil was also a strong contributor to performance, with the majority of returns derived from local rates rather than changes in the exchange rate (the Brazilian government currently manages the U.S. dollar-exchange rate of its currency, the

real). Bond yields fell and prices rose as Brazil’s central bank slashed interest rates after it became apparent that global growth was slowing. An underweight in Lebanon, one of the benchmark’s worst performers, was beneficial.

Demographics and high levels of debt resulted in unattractive fundamentals there. Security selection in Venezuela’s Energy sector helped returns thanks to supportive oil prices. Bonds in Venezuela also posted a rally during the year on

expectations of a potential regime change which would have been viewed as market friendly.

Detracting from relative returns was a broader

allocation to corporate debt, which performed well but lagged dollar debt during the year. An overweight to Argentina detracted in the Fund’s fiscal year but benefited returns in the third quarter of 2012. An underweight to Peru and an

overweight to local-currency debt in India also detracted from returns. Currency forwards and swap contracts were used in the Fund for the year ended September 30, 2012 as a way to either hedge particular positions or gain exposure to additional

areas of the market. These tools, which allow for more efficient portfolio management, had a marginally positive impact on Fund performance.

Emerging Markets Debt Fund

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Class A |

|

|

18.48% |

|

|

|

11.80% |

|

|

|

9.34% |

|

|

|

14.25% |

|

|

|

10.77% |

|

| JP Morgan EMBI Global Diversified Index |

|

|

19.55% |

|

|

|

11.83% |

|

|

|

10.07% |

|

|

|

11.74% |

|

|

|

10.04% |

|

| 50/50 Blended Benchmark consisting of the J.P. Morgan EMBI Global Diversified Index and the J.P. Morgan GBI-EM Global Diversified

Index |

|

|

16.18% |

|

|

|

10.72% |

|

|

|

9.50% |

|

|

|

N/A |

|

|

|

N/A |

|

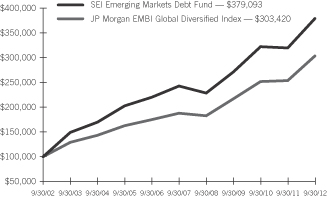

Comparison of Change in the Value of a $100,000 Investment in the Emerging Markets Debt Fund, Class A, versus the JP Morgan

EMBI Global Diversified Index

| |

1 |

|

For the year ended September 30, 2012. Past performance is no indication of future performance. Class A Shares were offered beginning

June 26, 1997. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that

period; absent fee waivers and reimbursements, performance would have been lower. |

|

|

|

| 6 |

|

SEI Institutional International Trust / Annual Report / September 30, 2012 |

SUMMARY SCHEDULE OF INVESTMENTS

International Equity Fund

September 30, 2012

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMMON STOCK — 93.8% |

|

|

|

|

|

|

|

| Argentina — 0.0% |

|

|

|

|

|

| Other Securities |

|

|

0.0 |

% |

|

|

|

|

|

$ |

42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Australia — 3.1% |

|

|

|

|

|

| Australia & New Zealand Banking Group |

|

|

0.6 |

|

|

|

407,583 |

|

|

|

10,490 |

|

| Newcrest Mining |

|

|

0.5 |

|

|

|

330,170 |

|

|

|

10,005 |

|

| Other Securities |

|

|

2.0 |

|

|

|

|

|

|

|

35,728 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

56,223 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Austria — 0.0% |

|

|

|

|

|

| Other Securities |

|

|

0.0 |

|

|

|

|

|

|

|

651 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Belgium — 1.7% |

|

|

|

|

|

| Anheuser-Busch InBev |

|

|

0.9 |

|

|

|

197,567 |

|

|

|

16,819 |

|

| Other Securities |

|

|

0.8 |

|

|

|

|

|

|

|

15,226 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32,045 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bosnia and Herzegovina — 0.1% |

|

|

|

|

|

| Other Securities |

|

|

0.1 |

|

|

|

|

|

|

|

2,288 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Brazil — 0.4% |

|

|

|

|

|

| Other Securities |

|

|

0.4 |

|

|

|

|

|

|

|

6,729 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Canada — 3.5% |

|

|

|

|

|

| Barrick Gold |

|

|

0.5 |

|

|

|

225,222 |

|

|

|

9,405 |

|

| Other Securities |

|

|

3.0 |

|

|

|

|

|

|

|

54,514 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

63,919 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chile — 0.2% |

|

|

|

|

|

| Other Securities |

|

|

0.2 |

|

|

|

|

|

|

|

4,407 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| China — 0.4% |

|

|

|

|

|

| Other Securities |

|

|

0.4 |

|

|

|

|

|

|

|

7,249 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Colombia — 0.1% |

|

|

|

|

|

| Other Securities |

|

|

0.1 |

% |

|

|

|

|

|

$ |

2,622 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Czech Republic — 0.1% |

|

|

|

|

|

| Other Securities |

|

|

0.1 |

|

|

|

|

|

|

|

2,161 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Denmark — 1.2% |

|

|

|

|

|

| Novo Nordisk, Cl B |

|

|

0.6 |

|

|

|

62,554 |

|

|

|

9,894 |

|

| Other Securities |

|

|

0.6 |

|

|

|

|

|

|

|

12,013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21,907 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Finland — 0.3% |

|

|

|

|

|

| Other Securities |

|

|

0.3 |

|

|

|

|

|

|

|

6,212 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| France — 8.8% |

|

|

|

|

|

| BNP Paribas (A) |

|

|

0.6 |

|

|

|

207,576 |

|

|

|

9,875 |

|

| Sanofi |

|

|

1.6 |

|

|

|

353,602 |

|

|

|

30,183 |

|

| Schneider Electric |

|

|

0.8 |

|

|

|

238,540 |

|

|

|

14,134 |

|

| Total |

|

|

0.5 |

|

|

|

194,192 |

|

|

|

9,643 |

|

| Other Securities |

|

|

5.3 |

|

|

|

|

|

|

|

98,741 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

162,576 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Germany — 8.4% |

|

|

|

|

|

| Bayer |

|

|

0.5 |

|

|

|

108,656 |

|

|

|

9,342 |

|

| Daimler |

|

|

0.5 |

|

|

|

189,074 |

|

|

|

9,162 |

|

| Deutsche Boerse (A) |

|

|

0.6 |

|

|

|

205,895 |

|

|

|

11,407 |

|

| Linde (A) |

|

|

0.8 |

|

|

|

88,407 |

|

|

|

15,241 |

|

| Muenchener Rueckversicherungs |

|

|

0.5 |

|

|

|

55,307 |

|

|

|

8,645 |

|

| Siemens |

|

|

0.9 |

|

|

|

158,522 |

|

|

|

15,828 |

|

| Other Securities |

|

|

4.6 |

|

|

|

|

|

|

|

85,837 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

155,462 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Hong Kong — 3.0% |

|

|

|

|

|

| Other Securities |

|

|

3.0 |

|

|

|

|

|

|

|

55,811 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| India — 0.3% |

|

|

|

|

|

| Other Securities |

|

|

0.3 |

|

|

|

|

|

|

|

6,238 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Indonesia — 0.1% |

|

|

|

|

|

|

|

|

|

|

|

|

| Other Securities |

|

|

0.1 |

|

|

|

|

|

|

|

2,052 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ireland — 1.1% |

|

|

|

|

|

| Experian |

|

|

0.5 |

|

|

|

541,123 |

|

|

|

8,992 |

|

| Other Securities |

|

|

0.6 |

|

|

|

|

|

|

|

11,933 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,925 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Israel — 0.8% |

|

|

|

|

|

| Check Point Software Technologies* |

|

|

0.5 |

|

|

|

185,968 |

|

|

|

8,956 |

|

| Other Securities |

|

|

0.3 |

|

|

|

|

|

|

|

6,075 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,031 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SEI Institutional International Trust / Annual Report / September 30, 2012 |

|

|

7 |

|

SUMMARY SCHEDULE OF INVESTMENTS

International Equity Fund (Continued)

September 30, 2012

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Italy — 0.9% |

|

|

|

|

|

| Other Securities |

|

|

0.9 |

% |

|

|

|

|

|

$ |

16,753 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Japan — 16.0% |

|

|

|

|

|

| Chugai Pharmaceutical |

|

|

0.0 |

|

|

|

10,400 |

|

|

|

219 |

|

| Fanuc |

|

|

0.8 |

|

|

|

85,700 |

|

|

|

13,857 |

|

| Honda Motor (A) |

|

|

0.7 |

|

|

|

387,000 |

|

|

|

11,923 |

|

| JGC |

|

|

0.6 |

|

|

|

309,200 |

|

|

|

10,353 |

|

| Jupiter Telecommunications |

|

|

0.5 |

|

|

|

8,833 |

|

|

|

8,992 |

|

| KDDI |

|

|

0.5 |

|

|

|

110,600 |

|

|

|

8,615 |

|

| Mabuchi Motor (A) |

|

|

0.5 |

|

|

|

178,500 |

|

|

|

8,191 |

|

| Nippon Telegraph & Telephone |

|

|

0.6 |

|

|

|

222,200 |

|

|

|

10,624 |

|

| Seven & I Holdings |

|

|

0.8 |

|

|

|

444,200 |

|

|

|

13,686 |

|

| Toyota Motor |

|

|

0.7 |

|

|

|

331,200 |

|

|

|

12,941 |

|

| Other Securities |

|

|

10.6 |

|

|

|

|

|

|

|

195,952 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

295,353 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Malta — 0.0% |

|

|

|

|

|

| Other Securities |

|

|

0.0 |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mexico — 0.3% |

|

|

|

|

|

| Other Securities |

|

|

0.3 |

|

|

|

|

|

|

|

5,204 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Netherlands — 4.7% |

|

|

|

|

|

| Akzo Nobel |

|

|

0.8 |

|

|

|

267,747 |

|

|

|

15,153 |

|

| Reed Elsevier |

|

|

0.6 |

|

|

|

869,613 |

|

|

|

11,641 |

|

| Other Securities |

|

|

3.3 |

|

|

|

|

|

|

|

59,079 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

85,873 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| New Zealand — 0.1% |

|

|

|

|

|

| Other Securities |

|

|

0.1 |

|

|

|

|

|

|

|

2,584 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Norway — 1.3% |

|

|

|

|

|

| DNB |

|

|

0.6 |

|

|

|

920,593 |

|

|

|

11,297 |

|

| Other Securities |

|

|

0.7 |

|

|

|

|

|

|

|

11,887 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,184 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Poland — 0.1% |

|

|

|

|

|

| Other Securities |

|

|

0.1 |

|

|

|

|

|

|

|

1,791 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Portugal — 0.0% |

|

|

|

|

|

| Other Securities |

|

|

0.0 |

|

|

|

|

|

|

|

179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Russia — 0.8% |

|

|

|

|

|

| Sberbank of Russia ADR |

|

|

0.5 |

|

|

|

752,179 |

|

|

|

8,763 |

|

| Other Securities |

|

|

0.3 |

|

|

|

|

|

|

|

4,973 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,736 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Singapore — 1.4% |

|

|

|

|

|

| Other Securities |

|

|

1.4 |

|

|

|

|

|

|

|

25,906 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| South Africa — 0.6% |

|

|

|

|

|

| Other Securities |

|

|

0.6 |

|

|

|

|

|

|

|

11,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| South Korea — 2.8% |

|

|

|

|

|

| KT&G |

|

|

0.6 |

% |

|

|

137,854 |

|

|

$ |

10,506 |

|

| Samsung Electronics |

|

|

0.9 |

|

|

|

13,366 |

|

|

|

16,187 |

|

| Other Securities |

|

|

1.3 |

|

|

|

|

|

|

|

24,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51,233 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Spain — 1.0% |

|

|

|

|

|

| Other Securities |

|

|

1.0 |

|

|

|

|

|

|

|

19,119 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sweden — 2.1% |

|

|

|

|

|

|

|

|

|

|

|

|

| Other Securities |

|

|

2.1 |

|

|

|

|

|

|

|

39,292 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Switzerland — 8.5% |

|

|

|

|

|

| Givaudan |

|

|

0.7 |

|

|

|

14,019 |

|

|

|

13,314 |

|

| Nestle |

|

|

1.2 |

|

|

|

337,630 |

|

|

|

21,304 |

|

| Novartis |

|

|

1.1 |

|

|

|

341,225 |

|

|

|

20,895 |

|

| Roche Holding |

|

|

1.8 |

|

|

|

175,867 |

|

|

|

32,879 |

|

| SGS |

|

|

0.5 |

|

|

|

4,654 |

|

|

|

9,568 |

|

| Sulzer |

|

|

0.4 |

|

|

|

56,389 |

|

|

|

8,220 |

|

| Zurich Insurance Group |

|

|

0.6 |

|

|

|

47,073 |

|

|

|

11,731 |

|

| Other Securities |

|

|

2.2 |

|

|

|

|

|

|

|

38,248 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

156,159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taiwan — 0.1% |

|

|

|

|

|

| Other Securities |

|

|

0.1 |

|

|

|

|

|

|

|

1,418 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Thailand — 0.1% |

|

|

|

|

|

| Other Securities |

|

|

0.1 |

|

|

|

|

|

|

|

1,630 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United Kingdom — 18.4% |

|

|

|

|

|

| BG Group |

|

|

0.9 |

|

|

|

779,002 |

|

|

|

15,724 |

|

| BHP Billiton |

|

|

0.7 |

|

|

|

405,901 |

|

|

|

12,617 |

|

| British American Tobacco |

|

|

0.6 |

|

|

|

229,719 |

|

|

|

11,794 |

|

| Diageo |

|

|

0.4 |

|

|

|

291,195 |

|

|

|

8,180 |

|

| HSBC Holdings |

|

|

0.4 |

|

|

|

874,000 |

|

|

|

8,223 |

|

| Petrofac |

|

|

0.6 |

|

|

|

394,859 |

|

|

|

10,170 |

|

| Rolls-Royce Holdings |

|

|

0.5 |

|

|

|

606,526 |

|

|

|

8,257 |

|

| Shire |

|

|

0.5 |

|

|

|

305,490 |

|

|

|

8,949 |

|

| Tesco |

|

|

0.9 |

|

|

|

3,215,538 |

|

|

|

17,239 |

|

| Vodafone Group |

|

|

1.0 |

|

|

|

6,631,151 |

|

|

|

18,819 |

|

| Other Securities |

|

|

11.9 |

|

|

|

|

|

|

|

219,738 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

339,710 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States — 1.0% |

|

|

|

|

|

| Other Securities |

|

|

1.0 |

|

|

|

|

|

|

|

17,419 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Common Stock (Cost $1,711,127) ($ Thousands) |

|

|

|

1,732,394 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 8 |

|

SEI Institutional International Trust / Annual Report / September 30, 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PREFERRED STOCK — 0.4% |

|

|

| Brazil — 0.1% |

|

| Other Securities |

|

|

0.1 |

% |

|

|

|

|

|

$ |

1,383 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Germany — 0.3% |

|

| Other Securities |

|

|

0.3 |

|

|

|

|

|

|

|

6,421 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Preferred Stock

(Cost $7,335) ($ Thousands) |

|

|

|

7,804 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. TREASURY OBLIGATIONS — 0.3% |

|

| Other Securities |

|

|

0.3 |

|

|

|

|

|

|

|

4,399 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total U.S. Treasury Obligations

(Cost $4,399) ($ Thousands) |

|

|

|

4,399 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| RIGHTS — 0.0% |

|

|

| France — 0.0% |

|

| Other Securities |

|

|

0.0 |

|

|

|

|

|

|

|

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Rights

(Cost $—) ($ Thousands) |

|

|

|

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AFFILIATED PARTNERSHIP — 6.3% |

|

| SEI Liquidity Fund, L.P. 0.150%**† (B) |

|

|

6.3 |

|

|

|

118,692,866 |

|

|

|

116,607 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Affiliated Partnership

(Cost $118,693) ($ Thousands) |

|

|

|

116,607 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH EQUIVALENT — 3.1% |

|

| SEI Daily Income Trust, Prime Obligation Fund, CI A 0.070%**† |

|

|

3.1 |

|

|

|

57,461,405 |

|

|

|

57,461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Cash Equivalent

(Cost $57,461) ($ Thousands) |

|

|

|

57,461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

Face Amount (1)

(thousands) |

|

|

Market Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TIME DEPOSITS — 2.7% |

|

|

|

|

|

|

|

| United States — 2.7% |

|

|

|

|

|

| Brown Brothers Harriman |

|

|

|

|

|

|

|

|

|

|

|

|

| 4.150%, 10/01/2012 |

|

|

|

|

ZAR |

|

|

|

14 |

|

|

$ |

2 |

|

| 2.580%, 10/01/2012 |

|

|

|

|

AUD |

|

|

|

309 |

|

|

|

321 |

|

| 1.550%, 10/01/2012 |

|

|

|

|

NZD |

|

|

|

137 |

|

|

|

114 |

|

| 0.550%, 10/01/2012 |

|

|

|

|

NOK |

|

|

|

715 |

|

|

|

125 |

|

| 0.400%, 10/01/2012 |

|

|

|

|

SEK |

|

|

|

10 |

|

|

|

2 |

|

| 0.185%, 10/01/2012 |

|

|

|

|

CAD |

|

|

|

6 |

|

|

|

6 |

|

| 0.054%, 10/01/2012 |

|

|

|

|

GBP |

|

|

|

598 |

|

|

|

965 |

|

| 0.030%, 10/01/2012 |

|

|

|

|

|

|

|

|

46,735 |

|

|

|

46,735 |

|

| 0.010%, 10/01/2012 |

|

|

|

|

JPY |

|

|

|

30,165 |

|

|

|

388 |

|

| 0.010%, 10/01/2012 |

|

|

|

|

SGD |

|

|

|

140 |

|

|

|

114 |

|

| 0.005%, 10/01/2012 |

|

|

|

|

HKD |

|

|

|

1,747 |

|

|

|

225 |

|

| 0.005%, 10/01/2012 |

|

|

|

|

CHF |

|

|

|

1,060 |

|

|

|

1,128 |

|

| (0.014)%, 10/01/2012 |

|

|

|

|

EUR |

|

|

|

288 |

|

|

|

370 |

|

| (0.200)%, 10/01/2012 |

|

|

|

|

DKK |

|

|

|

852 |

|

|

|

147 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Time Deposits

(Cost $50,642) ($ Thousands) |

|

|

|

50,642 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments — 106.6%

(Cost $1,949,657) ($ Thousands)†† |

|

|

$ |

1,969,348 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A list of the open futures contracts held by the Fund at September 30, 2012, is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Type of

Contract |

|

Number of

Contracts

Long |

|

|

Expiration

Date |

|

|

Unrealized

Appreciation

(Depreciation)

($ Thousands) |

|

| DJ Euro Stoxx 50 Index |

|

|

585 |

|

|

|

Dec-2012 |

|

|

$ |

(930 |

) |

| FTSE 100 Index |

|

|

198 |

|

|

|

Dec-2012 |

|

|

|

(327 |

) |

| Hang Seng Index |

|

|

25 |

|

|

|

Oct-2012 |

|

|

|

30 |

|

| SPI 200 Index |

|

|

57 |

|

|

|

Dec-2012 |

|

|

|

(28 |

) |

| Topix Index |

|

|

155 |

|

|

|

Dec-2012 |

|

|

|

235 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(1,020 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the year ended September 30, 2012, the total amount of all open futures contracts, as presented in the table above,

are representative of the volume of activity for this derivative type during the year.

A list of the open forward foreign currency contracts held

by the Fund at September 30, 2012, is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Settlement

Date |

|

Currency

to

Deliver

(Thousands) |

|

|

Currency

to

Receive (Thousands) |

|

|

Unrealized

Depreciation

($ Thousands) |

|

| 11/02/2012 |

|

|

EUR |

|

|

|

11,621 |

|

|

|

USD |

|

|

|

14,562 |

|

|

$ |

(391 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SEI Institutional International Trust / Annual Report / September 30, 2012 |

|

|

9 |

|

SUMMARY SCHEDULE OF INVESTMENTS

International Equity Fund (Concluded)

September 30, 2012

A list of the counterparties for the open forward foreign currency contracts held by the Fund at

September 30, 2012, is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Counterparty |

|

Settlement

Date |

|

|

Currency

to Deliver ($ Thousands) |

|

|

Currency

to Receive ($ Thousands) |

|

|

Unrealized

Appreciation

(Depreciation)

($ Thousands) |

|

| State Street |

|

|

11/02/2012 |

|

|

|

(14,953 |

) |

|

|

14,562 |

|

|

$ |

(391 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the year ended September 30, 2012, the total amount of all open forward foreign currency contracts, as presented in

the table above, are representative of the volume of activity for this derivative type during the year.

Percentages are based on a Net Assets of

$1,848,122 ($ Thousands).

| * |

|

Non-income producing security |

| ** |

|

Rate shown is the 7-day effective yield as of September 30, 2012. |

| † |

|

Investment in Affiliated security (See Note 4). |

| (1) |

|

In U.S. Dollars unless otherwise indicated. |

| (A) |

|

This security or a partial position of this security is on loan at September 30, 2012. The total market value of such securities at September 30, 2012 was

$111,744 ($ Thousands) (See Note 8). |

| (B) |

|

This security was purchased with cash collateral held from securities on loan (see Note 8). The total value of such securities on loan at September 30, 2012 was

$116,607 ($ Thousands). |

| †† |

|

The Summary Schedule of Investments does not reflect the complete portfolio holdings. It includes the Fund’s 50 largest holdings and each investment of any issuer

that exceeds 1% of the Fund’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). In certain instances, securities

for which footnotes listed above may otherwise apply are included in the Other Securities caption. The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 342-5734; and (ii) on the

SEC’s website at http://www.sec.gov. |

AUD — Australian Dollar

CAD — Canadian Dollar

CHF — Swiss Franc

Cl — Class

DJ — Dow Jones

DKK — Danish Krone

EUR — Euro

FTSE — Financial Times and the London Stock Exchange

GBP — British Pound Sterling

HKD — Hong Kong Dollar

JPY — Japanese Yen

L.P. — Limited

Partnership

NOK — Norwegian Krone

NZD — New Zealand Dollar

SEK — Swedish

Krone

SGD — Singapore Dollar

SPI

— Share Price Index

USD — U.S. Dollar

ZAR — South African Rand

The following is a summary of the inputs used as of September 30, 2012, in valuing the Fund’s

investments and other financial instruments carried at value ($ Thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investments in Securities |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3(1) |

|

|

Total |

|

| Common Stock |

|

$ |

1,726,328 |

|

|

$ |

5,712 |

|

|

$ |

354 |

|

|

$ |

1,732,394 |

|

| Preferred Stock |

|

|

7,804 |

|

|

|

— |

|

|

|

— |

|

|

|

7,804 |

|

| U.S. Treasury Obligations |

|

|

— |

|

|

|

4,399 |

|

|

|

— |

|

|

|

4,399 |

|

| Rights |

|

|

41 |

|

|

|

— |

|

|

|

— |

|

|

|

41 |

|

| Affiliated Partnership |

|

|

— |

|

|

|

116,607 |

|

|

|

— |

|

|

|

116,607 |

|

| Cash Equivalent |

|

|

57,461 |

|

|

|

— |

|

|

|

— |

|

|

|

57,461 |

|

| Time Deposits |

|

|

— |

|

|

|

50,642 |

|

|

|

— |

|

|

|

50,642 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments in Securities |

|

$ |

1,791,634 |

|

|

$ |

177,360 |

|

|

$ |

354 |

|

|

$ |

1,969,348 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Financial Instruments |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Futures Contracts* |

|

$ |

(1,020 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(1,020 |

) |

| Forwards Contracts* |

|

|

— |

|

|

|

(391 |

) |

|

|

— |

|

|

|

(391 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Other Financial Instruments |

|

$ |

(1,020 |

) |

|

$ |

(391 |

) |

|

$ |

— |

|

|

$ |

(1,411 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

|

A reconciliation of Level 3 instruments is presented when the Fund has a significant amount of Level 3 investments at the beginning and/or end of the

period in relation to net assets. |

| * |

|

Futures and forwards contracts are valued at the unrealized depreciation on the instrument. |

For the year ended September 30, 2012, there were transfers between Level 1 and Level 2 assets and liabilities. The primary reason for changes in the classifications between Levels 1 and 2 occurs

when foreign equity securities are fair valued using other observable market-based inputs in place of the closing exchange price due to events occurring after the close of the exchange or market on which the investment is principally traded (see

Note 2).

For the year ended September 30, 2012, there were transfers from Level 2 into Level 3 assets and liabilities for certain

securities. The primary reason for changes in the classifications between Level 2 and Level 3 occurs when trading of securities are halted on the primary exchange on which they are traded.

Amounts designated as “—” are $O or have been rounded to $O.

The accompanying notes are

an integral part of the financial statements.

|

|

|

| 10 |

|

SEI Institutional International Trust / Annual Report / September 30, 2012 |

SUMMARY SCHEDULE OF INVESTMENTS

Emerging Markets Equity Fund

September 30, 2012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMMON STOCK — 93.6% |

|

|

|

|

|

|

|

| Argentina — 0.2% |

|

|

|

|

|

| Other Securities |

|

|

0.2 |

% |

|

|

|

|

|

|

|

$ |

2,067 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Austria — 0.2% |

|

|

|

|

|

| Other Securities |

|

|

0.2 |

|

|

|

|

|

|

|

|

|

1,546 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Brazil — 9.3% |

|

|

|

|

|

| Gerdau ADR (A) |

|

|

0.6 |

|

|

|

|

|

550,665 |

|

|

|

5,237 |

|

| Petroleo Brasileiro ADR |

|

|

1.1 |

|

|

|

|

|

413,765 |

|

|

|

9,492 |

|

| Petroleo Brasileiro |

|

|

0.1 |

|

|

|

|

|

80,722 |

|

|

|

923 |

|

| Totvs |

|

|

0.5 |

|

|

|

|

|

215,292 |

|

|

|

4,456 |

|

| Vale |

|

|

0.1 |

|

|

|

|

|

58,092 |

|

|

|

1,038 |

|

| Vale ADR, Cl B |

|

|

0.6 |

|

|

|

|

|

300,325 |

|

|

|

5,376 |

|

| Other Securities |

|

|

6.3 |

|

|

|

|

|

|