January 31, 2020, as amended through January 22, 2021

SUMMARY PROSPECTUS

SIT International Equity Fund (SEEIX)

Class I

Before you invest, you may want to review the Fund's prospectus, which contains information about the Fund and its risks. You can find the Fund prospectus and other information about the Fund, including the Fund's Statement of Additional Information, online at seic.com/fundprospectuses. You can also get this information at no cost by dialing 1-800-DIAL-SEI. The Fund's prospectus and Statement of Additional Information, dated January 31, 2020, as may be supplemented from time to time, are incorporated by reference into this Summary Prospectus.

Paper copies of the Fund's shareholder reports are no longer sent by mail, unless you specifically request them from the Fund or from your financial intermediary, such as a broker-dealer or bank. Shareholder reports are available online and you will be notified by mail each time a report is posted on the Fund's website and provided with a link to access the report online.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-DIAL-SEI. Your election to receive reports in paper will apply to all funds held with the SEI Funds or your financial intermediary.

seic.com

SEI / SUMMARY PROSPECTUS

Investment Goal

Long-term capital appreciation.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold Fund shares.

ANNUAL FUND OPERATING EXPENSES

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class I Shares |

||||||

|

Management Fees |

0.51 |

% |

|||||

|

Distribution (12b-1) Fees |

None |

||||||

|

Other Expenses |

0.84 |

% |

|||||

|

Total Annual Fund Operating Expenses |

1.35 |

% |

|||||

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||

|

International Equity Fund — Class I Shares |

$ |

137 |

$ |

428 |

$ |

739 |

$ |

1,624 |

|||||||||||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 73% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, the International Equity Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities. Equity securities may include common stocks, preferred stocks, warrants, participation notes and depositary receipts. The Fund will invest primarily in equity securities of issuers of all capitalization ranges that are located in at least three countries other than the U.S. It is expected that at least 40% of the Fund's assets will be invested outside the U.S. The Fund will invest primarily in companies located in developed countries, but may also invest in companies located in emerging markets. Generally, the Fund will invest less than 20% of its assets in emerging markets. Emerging market countries are those countries that: (i) are characterized as developing or emerging by any of the World Bank, the United Nations, the International Finance Corporation, or the European Bank for Reconstruction and Development; (ii) are included in an emerging markets index by a recognized index provider; or (iii) have similar developing or emerging characteristics as countries classified as emerging market countries pursuant to sub-paragraph (i) and (ii) above, in each case determined at the time of purchase.

The Fund uses a multi-manager approach, relying upon a number of sub-advisers (each, a Sub-Adviser and collectively, the Sub-Advisers) with differing investment philosophies to manage portions of the Fund's portfolio under the general supervision of SEI Investments Management Corporation (SIMC), the Fund's adviser.

The Fund may invest in futures contracts, forward contracts and options for hedging purposes, including seeking to manage the Fund's currency exposure to foreign securities and mitigate the Fund's overall risk.

The Fund may purchase futures contracts or shares of exchange-traded funds (ETFs) to gain exposure to a particular portion of the market while awaiting an opportunity to purchase securities or other instruments directly.

2

SEI / SUMMARY PROSPECTUS

Principal Risks

Market Risk — The risk that the market value of a security may move up and down, sometimes rapidly and unpredictably. Market risk may affect a single issuer, an industry, a sector or the equity or bond market as a whole.

Foreign Investment/Emerging Markets Risk — The risk that non-U.S. securities may be subject to additional risks due to, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments. These additional risks may be heightened with respect to emerging market countries because political turmoil and rapid changes in economic conditions are more likely to occur in these countries.

Investment Style Risk — The risk that developed international and emerging markets equity securities may underperform other segments of the equity markets or the equity markets as a whole.

Currency Risk — As a result of the Fund's investments in securities denominated in, and/or receiving revenues in, foreign currencies, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an investment in the Fund would be adversely affected. Currency exchange rates may fluctuate in response to, among other things, changes in interest rates, intervention (or failure to intervene) by U.S. or foreign governments, central banks or supranational entities, or by the imposition of currency controls or other political developments in the United States or abroad.

Small and Medium Capitalization Risk — The risk that small and medium capitalization companies in which the Fund may invest may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, small and medium capitalization companies may have limited product lines, markets and financial resources and may depend upon a relatively small management group. Therefore, small capitalization and medium capitalization stocks may be more volatile than those of larger companies. Small capitalization and medium capitalization stocks may be traded over-the-counter (OTC). OTC stocks may trade less frequently and in smaller volume than exchange listed stocks and may have more price volatility than that of exchange-listed stocks.

Depositary Receipts Risk — Depositary receipts, such as American Depositary Receipts (ADRs), are certificates evidencing ownership of shares of a foreign issuer that are issued by depositary banks and generally trade on an established market. Depositary receipts are subject to many of the risks associated with investing directly in foreign securities, including, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments.

Preferred Stock Risk — Preferred stock represents an equity or ownership interest in an issuer that pays dividends at a specified rate and that has precedence over common stock in the payment of dividends. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of bonds take precedence over the claims of those who own preferred and common stock.

Participation Notes (P-Notes) Risk — P-Notes are participation interest notes that are issued by banks or broker-dealers and are designed to offer a return linked to a particular underlying equity, debt, currency or market. Investments in P-Notes involve the same risks associated with a direct investment in the underlying foreign companies or foreign securities markets that they seek to replicate. However, there can be no assurance that the trading price of P-Notes will equal the underlying value of the foreign companies or foreign securities markets that they seek to replicate.

Warrants Risk — Warrants are instruments that entitle the holder to buy an equity security at a specific price for a specific period of time. Warrants may be more speculative than other types of investments. The price of a warrant may be more volatile than the price of its underlying security, and a warrant may offer greater potential for capital appreciation as well as capital loss. A warrant ceases to have value if it is not exercised prior to its expiration date.

Derivatives Risk — The Fund's use of futures contracts, forward contracts and options is subject to market risk, leverage risk, correlation risk and liquidity risk. Market risk is described above, and leverage risk and liquidity risk are described below. Many over-the-counter (OTC) derivative instruments will not have liquidity beyond the counterparty to the instrument. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. The Fund's use of forward contracts is also subject to credit risk and valuation risk. Credit risk is described below. Valuation risk is the risk that the derivative may be difficult to value and/or valued incorrectly. Each of the above risks could cause the Fund to lose more than the principal amount invested in a derivative instrument. Some derivatives have the potential for unlimited loss, regardless of the size of the Fund's initial investment. The other parties to certain derivative contracts present the same types of credit risk as issuers of fixed income securities. The Fund's use of derivatives may also

3

SEI / SUMMARY PROSPECTUS

increase the amount of taxes payable by shareholders. Both U.S. and non-U.S. regulators are in the process of adopting and implementing regulations governing derivatives markets, the ultimate impact of which remains unclear.

Credit Risk — The risk that the issuer of a security or the counterparty to a contract will default or otherwise become unable to honor a financial obligation.

Leverage Risk — The Fund's use of derivatives may result in the Fund's total investment exposure substantially exceeding the value of its portfolio securities and the Fund's investment returns depending substantially on the performance of securities that the Fund may not directly own. The use of leverage can amplify the effects of market volatility on the Fund's share price and may also cause the Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. The Fund's use of leverage may result in a heightened risk of investment loss.

Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to lower the price of the security, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance.

LIBOR Replacement Risk — The elimination of the London Inter-Bank Offered Rate (LIBOR) may adversely affect the interest rates on, and value of, certain Fund investments for which the value is tied to LIBOR. It remains unclear if LIBOR will continue to exist in its current form or will be modified after 2021, or whether the market will adopt one or more alternative rates. It will be difficult to predict the full impact of the transition away from LIBOR on the Fund until new reference rates and market practices have been commercially accepted.

Exchange-Traded Funds (ETFs) Risk — The risks of owning shares of an ETF generally reflect the risks of owning the underlying securities the ETF is designed to track, although lack of liquidity in an ETF could result in its value being more volatile than the underlying portfolio securities. When the Fund invests in an ETF, in addition to directly bearing the expenses associated with its own operations, it will bear a pro rata portion of the ETF's expenses.

Investing in the Fund involves risk, and there is no guarantee that the Fund will achieve its investment goal. You could lose money on your investment in the Fund, just as you could with other investments. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Performance Information

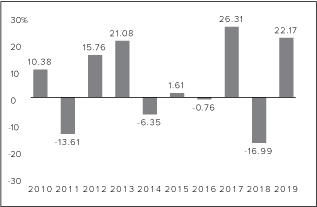

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compare with those of a broad measure of market performance. The performance information shown is based on full calendar years. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 17.51% (09/30/10) Worst Quarter: -20.61% (09/30/11) |

||||||

Average Annual Total Returns (for the periods ended December 31, 2019)

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those

4

SEI / SUMMARY PROSPECTUS

shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

International Equity Fund — Class I Shares* |

1 Year |

5 Years |

10 Years |

Since Inception (12/20/1989) |

|||||||||||||||

|

Return Before Taxes |

22.17 |

% |

5.25 |

% |

4.92 |

% |

3.45 |

% |

|||||||||||

|

Return After Taxes on Distributions |

21.95 |

% |

5.09 |

% |

4.77 |

% |

2.69 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

13.59 |

% |

4.17 |

% |

4.02 |

% |

2.63 |

% |

|||||||||||

|

MSCI EAFE Index Return (net) (reflects no deduction for fees or expenses) |

22.01 |

% |

5.67 |

% |

5.50 |

% |

4.61 |

% |

|||||||||||

* The Fund's Class I Shares commenced operations on January 4, 2002. Therefore, the Fund's average annual total returns for the periods prior to that time are based on the average annual total returns of the Class F Shares, adjusted for the higher expenses of the Class I Shares.

Management

Investment Adviser and Portfolio Manager. SEI Investments Management Corporation

|

Portfolio Manager |

Experience with the Fund |

Title with Adviser |

|||||||||

|

Jason Collins |

Since 2019 |

Portfolio Manager |

|||||||||

Sub-Advisers and Portfolio Managers.

|

Sub-Adviser |

Portfolio Manager |

Experience with the Fund |

Title with Sub-Adviser |

||||||||||||

|

Acadian Asset Management LLC |

Brendan O. Bradley Ryan D. Taliaferro |

Since 2009 Since 2011 |

Executive Vice President, Chief Investment Officer Senior Vice President, Director, Equity Strategies |

||||||||||||

|

Causeway Capital Management LLC |

Sarah H. Ketterer Harry W. Hartford James A. Doyle Jonathan P. Eng Conor Muldoon, CFA Alessandro Valentini, CFA Ellen Lee Steven Nguyen, CFA |

Since 2010 Since 2010 Since 2010 Since 2010 Since 2010 Since 2013 Since 2015 Since 2019 |

Chief Executive Officer President Director Director Director Director Director Director |

||||||||||||

|

Delaware Investments Fund Advisers, a series of Macquarie Investment Management Business Trust |

Jens Hansen Klaus Petersen Claus Juul Åsa Annerstedt Allan Jensens, CFA Chris Gowlland, CFA |

Since 2021 Since 2021 Since 2021 Since 2021 Since 2021 Since 2021 |

Managing Director, Chief Investment Officer — Global Equity Team Managing Director, Senior Portfolio Manager Vice President, Portfolio Manager Vice President, Portfolio Manager Vice President, Portfolio Manager Senior Vice President, Head of Equity Quantitative Research |

||||||||||||

|

Intech Investment Management LLC |

Adrian Banner, Ph.D. Joseph Runnels, CFA Vassilios Papathanakos, Ph.D. |

Since 2009 Since 2009 Since 2012 |

Chief Executive Officer and Chief Investment Officer Vice President — Quantitative Trader Deputy Chief Investment Officer |

||||||||||||

|

J O Hambro Capital Management Limited |

Christopher Lees, CFA Nudgem Richyal, CFA |

Since 2020 Since 2020 |

Senior Fund Manager Senior Fund Manager |

||||||||||||

|

Lazard Asset Management LLC |

Mark Rooney, CFA Erik Van Der Sande, CFA |

Since 2019 Since 2019 |

Director, Portfolio Manager/Analyst Director, Portfolio Manager/Analyst |

||||||||||||

|

WCM Investment Management, LLC |

Paul R. Black Peter J. Hunkel Michael B. Trigg Kurt R. Winrich |

Since 2015 Since 2015 Since 2015 Since 2015 |

Portfolio Manager, Co-CEO Portfolio Manager & Business Analyst Portfolio Manager & Business Analyst Portfolio Manager, Co-CEO |

||||||||||||

5

SEI / SUMMARY PROSPECTUS

Purchase and Sale of Fund Shares

The minimum initial investment for Class I Shares is $100,000 with minimum subsequent investments of $1,000. Such minimums may be waived at the discretion of SIMC. You may purchase and redeem shares of the Fund on any day that the New York Stock Exchange (NYSE) is open for business (a Business Day). You may sell your Fund shares by contacting your authorized financial institution or intermediary directly. Authorized financial institutions and intermediaries may redeem Fund shares on behalf of their clients by contacting the Fund's transfer agent (the Transfer Agent) or the Fund's authorized agent, using certain SEI Investments Company (SEI) or third party systems or by calling 1-800-858-7233, as applicable.

Tax Information

The distributions made by the Fund generally are taxable and will be taxed as ordinary income or capital gains. If you are investing through a tax-deferred arrangement, such as a 401(k) plan or individual retirement account, you will generally not be subject to federal taxation on Fund distributions until you begin receiving distributions from your tax-deferred arrangement. You should consult your tax advisor regarding the rules governing your tax-deferred arrangement.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

6