January 31, 2020, as amended through March 18, 2020

PROSPECTUS

SEI Institutional International Trust

Class F Shares

› International Equity Fund (SEITX)

› Emerging Markets Equity Fund (SIEMX)

› International Fixed Income Fund (SEFIX)

› Emerging Markets Debt Fund (SITEX)

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Not all Funds appearing in this prospectus are available for purchase in all states. You may purchase Fund shares only if they are registered in your state.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds' shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank.

Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can follow the instructions included with this disclosure or contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-DIAL-SEI. Your election to receive reports in paper will apply to all funds held with the SEI Funds or your financial intermediary.

seic.com

SEI / PROSPECTUS

SEI INSTITUTIONAL INTERNATIONAL TRUST

About This Prospectus

|

FUND SUMMARY |

|||||||

|

INTERNATIONAL EQUITY FUND |

1 |

||||||

|

EMERGING MARKETS EQUITY FUND |

7 |

||||||

|

INTERNATIONAL FIXED INCOME FUND |

13 |

||||||

|

EMERGING MARKETS DEBT FUND |

20 |

||||||

|

Purchase and Sale of Fund Shares |

27 |

||||||

|

Tax Information |

27 |

||||||

|

Payments to Broker-Dealers and Other Financial Intermediaries |

27 |

||||||

|

MORE INFORMATION ABOUT INVESTMENTS |

28 |

||||||

|

MORE INFORMATION ABOUT RISKS |

28 |

||||||

|

Risk Information Common to the Funds |

28 |

||||||

|

More Information About Principal Risks |

29 |

||||||

|

GLOBAL ASSET ALLOCATION |

43 |

||||||

|

MORE INFORMATION ABOUT THE FUNDS' BENCHMARK INDEXES |

43 |

||||||

|

INVESTMENT ADVISER |

44 |

||||||

|

SUB-ADVISERS |

46 |

||||||

|

Information About Fee Waivers |

46 |

||||||

|

Sub-Advisers and Portfolio Managers |

47 |

||||||

|

PURCHASING, EXCHANGING AND SELLING FUND SHARES |

58 |

||||||

|

HOW TO PURCHASE FUND SHARES |

58 |

||||||

|

Pricing of Fund Shares |

59 |

||||||

|

Frequent Purchases and Redemptions of Fund Shares |

62 |

||||||

|

Foreign Investors |

63 |

||||||

|

Customer Identification and Verification and Anti-Money Laundering Program |

63 |

||||||

|

HOW TO EXCHANGE YOUR FUND SHARES |

64 |

||||||

|

HOW TO SELL YOUR FUND SHARES |

64 |

||||||

|

Receiving Your Money |

64 |

||||||

|

Methods Used to Meet Redemption Obligations |

64 |

||||||

|

Low Balance Redemptions |

65 |

||||||

|

Suspension of Your Right to Sell Your Shares |

65 |

||||||

|

Large Redemptions |

65 |

||||||

|

Telephone Transactions |

65 |

||||||

|

Unclaimed Property |

65 |

||||||

|

DISTRIBUTION OF FUND SHARES |

66 |

||||||

|

SERVICE OF FUND SHARES |

66 |

||||||

|

DISCLOSURE OF PORTFOLIO HOLDINGS INFORMATION |

66 |

||||||

|

DIVIDENDS, DISTRIBUTIONS AND TAXES |

66 |

||||||

|

Dividends and Distributions |

66 |

||||||

|

Taxes |

67 |

||||||

|

ADDITIONAL INFORMATION |

69 |

||||||

|

FINANCIAL HIGHLIGHTS |

70 |

||||||

|

HOW TO OBTAIN MORE INFORMATION ABOUT SEI INSTITUTIONAL INTERNATIONAL TRUST |

Back Cover |

||||||

SEI / PROSPECTUS

INTERNATIONAL EQUITY FUND

Fund Summary

Investment Goal

Long-term capital appreciation.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold Fund shares.

ANNUAL FUND OPERATING EXPENSES

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class F Shares |

||||||

|

Management Fees |

0.51 |

% |

|||||

|

Distribution (12b-1) Fees |

None |

||||||

|

Other Expenses |

0.59 |

% |

|||||

|

Total Annual Fund Operating Expenses |

1.10 |

% |

|||||

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||

|

International Equity Fund — Class F Shares |

$ |

112 |

$ |

350 |

$ |

606 |

$ |

1,340 |

|||||||||||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 73% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, the International Equity Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities. Equity securities may include common stocks, preferred stocks, warrants, participation notes and depositary receipts. The Fund will invest primarily in equity securities of issuers of all capitalization ranges that are located in at least three countries other than the U.S. It is expected that at least 40% of the Fund's assets will be invested outside the U.S. The Fund will invest primarily in companies located in developed countries,

1

SEI / PROSPECTUS

but may also invest in companies located in emerging markets. Generally, the Fund will invest less than 20% of its assets in emerging markets. Emerging market countries are those countries that: (i) are characterized as developing or emerging by any of the World Bank, the United Nations, the International Finance Corporation, or the European Bank for Reconstruction and Development; (ii) are included in an emerging markets index by a recognized index provider; or (iii) have similar developing or emerging characteristics as countries classified as emerging market countries pursuant to sub-paragraph (i) and (ii) above, in each case determined at the time of purchase.

The Fund uses a multi-manager approach, relying upon a number of sub-advisers (each, a Sub-Adviser and collectively, the Sub-Advisers) with differing investment philosophies to manage portions of the Fund's portfolio under the general supervision of SEI Investments Management Corporation (SIMC), the Fund's adviser.

The Fund may invest in futures contracts, forward contracts and options for hedging purposes, including seeking to manage the Fund's currency exposure to foreign securities and mitigate the Fund's overall risk.

The Fund may purchase futures contracts or shares of exchange-traded funds (ETFs) to gain exposure to a particular portion of the market while awaiting an opportunity to purchase securities or other instruments directly.

Principal Risks

Market Risk — The risk that the market value of a security may move up and down, sometimes rapidly and unpredictably. Market risk may affect a single issuer, an industry, a sector or the equity or bond market as a whole.

Foreign Investment/Emerging Markets Risk — The risk that non-U.S. securities may be subject to additional risks due to, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments. These additional risks may be heightened with respect to emerging market countries because political turmoil and rapid changes in economic conditions are more likely to occur in these countries.

Investment Style Risk — The risk that developed international and emerging markets equity securities may underperform other segments of the equity markets or the equity markets as a whole.

Currency Risk — As a result of the Fund's investments in securities denominated in, and/or receiving revenues in, foreign currencies, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an investment in the Fund would be adversely affected. Currency exchange rates may fluctuate in response to, among other things, changes in interest rates, intervention (or failure to intervene) by U.S. or foreign governments, central banks or supranational entities, or by the imposition of currency controls or other political developments in the United States or abroad.

Small and Medium Capitalization Risk — The risk that small and medium capitalization companies in which the Fund may invest may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, small and medium capitalization companies may have limited product lines, markets and financial resources and may depend upon a relatively small management

2

SEI / PROSPECTUS

group. Therefore, small capitalization and medium capitalization stocks may be more volatile than those of larger companies. Small capitalization and medium capitalization stocks may be traded over-the-counter (OTC). OTC stocks may trade less frequently and in smaller volume than exchange listed stocks and may have more price volatility than that of exchange-listed stocks.

Depositary Receipts Risk — Depositary receipts, such as American Depositary Receipts (ADRs), are certificates evidencing ownership of shares of a foreign issuer that are issued by depositary banks and generally trade on an established market. Depositary receipts are subject to many of the risks associated with investing directly in foreign securities, including, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments.

Preferred Stock Risk — Preferred stock represents an equity or ownership interest in an issuer that pays dividends at a specified rate and that has precedence over common stock in the payment of dividends. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of bonds take precedence over the claims of those who own preferred and common stock.

Participation Notes (P-Notes) Risk — P-Notes are participation interest notes that are issued by banks or broker-dealers and are designed to offer a return linked to a particular underlying equity, debt, currency or market. Investments in P-Notes involve the same risks associated with a direct investment in the underlying foreign companies or foreign securities markets that they seek to replicate. However, there can be no assurance that the trading price of P-Notes will equal the underlying value of the foreign companies or foreign securities markets that they seek to replicate.

Warrants Risk — Warrants are instruments that entitle the holder to buy an equity security at a specific price for a specific period of time. Warrants may be more speculative than other types of investments. The price of a warrant may be more volatile than the price of its underlying security, and a warrant may offer greater potential for capital appreciation as well as capital loss. A warrant ceases to have value if it is not exercised prior to its expiration date.

Derivatives Risk — The Fund's use of futures contracts, forward contracts and options is subject to market risk, leverage risk, correlation risk and liquidity risk. Market risk is described above, and leverage risk and liquidity risk are described below. Many over-the-counter (OTC) derivative instruments will not have liquidity beyond the counterparty to the instrument. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. The Fund's use of forward contracts is also subject to credit risk and valuation risk. Credit risk is described below. Valuation risk is the risk that the derivative may be difficult to value and/or valued incorrectly. Each of the above risks could cause the Fund to lose more than the principal amount invested in a derivative instrument. Some derivatives have the potential for unlimited loss, regardless of the size of the Fund's initial investment. The other parties to certain derivative contracts present the same types of credit risk as issuers of fixed income securities. The Fund's use of derivatives may also increase the amount of taxes payable by shareholders. Both U.S. and non-U.S. regulators are in the process of adopting and implementing regulations governing derivatives markets, the ultimate impact of which remains unclear.

Credit Risk — The risk that the issuer of a security or the counterparty to a contract will default or otherwise become unable to honor a financial obligation.

Leverage Risk — The Fund's use of derivatives may result in the Fund's total investment exposure substantially exceeding the value of its portfolio securities and the Fund's investment returns depending

3

SEI / PROSPECTUS

substantially on the performance of securities that the Fund may not directly own. The use of leverage can amplify the effects of market volatility on the Fund's share price and may also cause the Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. The Fund's use of leverage may result in a heightened risk of investment loss.

Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to lower the price of the security, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance.

LIBOR Replacement Risk — The elimination of the London Inter-Bank Offered Rate (LIBOR) may adversely affect the interest rates on, and value of, certain Fund investments for which the value is tied to LIBOR. It remains unclear if LIBOR will continue to exist in its current form or will be modified after 2021, or whether the market will adopt one or more alternative rates. It will be difficult to predict the full impact of the transition away from LIBOR on the Fund until new reference rates and market practices have been commercially accepted.

Exchange-Traded Funds (ETFs) Risk — The risks of owning shares of an ETF generally reflect the risks of owning the underlying securities the ETF is designed to track, although lack of liquidity in an ETF could result in its value being more volatile than the underlying portfolio securities. When the Fund invests in an ETF, in addition to directly bearing the expenses associated with its own operations, it will bear a pro rata portion of the ETF's expenses.

Investing in the Fund involves risk, and there is no guarantee that the Fund will achieve its investment goal. You could lose money on your investment in the Fund, just as you could with other investments. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

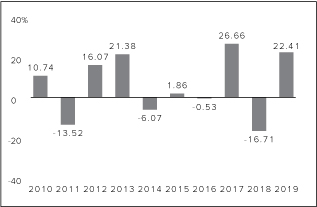

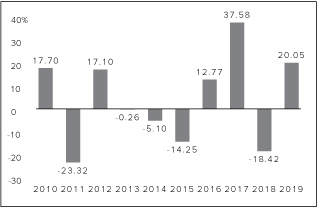

Performance Information

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compare with those of a broad measure of market performance. The performance information shown is based on full calendar years. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

4

SEI / PROSPECTUS

|

|

Best Quarter: 17.63% (09/30/10) Worst Quarter: -20.67% (09/30/11) |

||||||

Average Annual Total Returns (for the periods ended December 31, 2019)

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

International Equity Fund — Class F Shares |

1 Year |

5 Years |

10 Years |

Since Inception (12/20/1989) |

|||||||||||||||

|

Return Before Taxes |

22.41 |

% |

5.52 |

% |

5.19 |

% |

3.70 |

% |

|||||||||||

|

Return After Taxes on Distributions |

22.09 |

% |

5.27 |

% |

4.96 |

% |

2.97 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

13.79 |

% |

4.37 |

% |

4.24 |

% |

2.90 |

% |

|||||||||||

|

MSCI EAFE Index Return (net) (reflects no deduction for fees or expenses) |

22.01 |

% |

5.67 |

% |

5.50 |

% |

4.61 |

% |

|||||||||||

Management

Investment Adviser and Portfolio Manager. SEI Investments Management Corporation

|

Portfolio Manager |

Experience with the Fund |

Title with Adviser |

|||||||||

|

Jason Collins |

Since 2019 |

Portfolio Manager |

|||||||||

Sub-Advisers and Portfolio Managers.

|

Sub-Adviser |

Portfolio Manager |

Experience with the Fund |

Title with Sub-Adviser |

||||||||||||

|

Acadian Asset Management LLC |

Brendan O. Bradley Ryan D. Taliaferro |

Since 2009 Since 2011 |

Executive Vice President, Chief Investment Officer Senior Vice President, Director, Equity Strategies |

||||||||||||

|

Blackcrane Capital, LLC |

Daniel Y. Kim, CFA Aaron J. Bower, CFA |

Since 2014 Since 2014 |

Chief Executive Officer, Chief Investment Officer Director, Associate Portfolio Manager |

||||||||||||

5

SEI / PROSPECTUS

|

Sub-Adviser |

Portfolio Manager |

Experience with the Fund |

Title with Sub-Adviser |

||||||||||||

|

Causeway Capital Management LLC |

Sarah H. Ketterer Harry W. Hartford James A. Doyle Jonathan P. Eng Conor Muldoon, CFA Alessandro Valentini, CFA Ellen Lee Steven Nguyen, CFA |

Since 2010 Since 2010 Since 2010 Since 2010 Since 2010 Since 2013 Since 2015 Since 2019 |

Chief Executive Officer President Director Director Director Director Director Director |

||||||||||||

|

Intech Investment Management LLC |

Adrian Banner, Ph.D. Joseph Runnels, CFA Vassilios Papathanakos, Ph.D. |

Since 2009 Since 2009 Since 2012 |

Chief Executive Officer and Chief Investment Officer Vice President — Quantitative Trader Deputy Chief Investment Officer |

||||||||||||

|

Lazard Asset Management LLC |

Mark Rooney, CFA Erik Van Der Sande, CFA |

Since 2019 Since 2019 |

Director, Portfolio Manager/Analyst Director, Portfolio Manager/Analyst |

||||||||||||

|

Neuberger Berman Investment Advisers LLC |

Benjamin Segal, CFA Elias Cohen, CFA |

Since 2010 Since 2016 |

Managing Director Managing Director |

||||||||||||

|

NWQ Investment Management Company, LLC |

Peter Boardman James T. Stephenson, CFA |

Since 2010 Since 2018 |

Managing Director, Portfolio Manager and Equity Analyst Managing Director, Portfolio Manager, Associate Director of Research and Equity Analyst |

||||||||||||

|

WCM Investment Management, LLC |

Paul R. Black Peter J. Hunkel Michael B. Trigg Kurt R. Winrich |

Since 2015 Since 2015 Since 2015 Since 2015 |

Portfolio Manager, Co-CEO Portfolio Manager & Business Analyst Portfolio Manager & Business Analyst Portfolio Manager, Co-CEO |

||||||||||||

For important information about the Purchase and Sale of Fund Shares, Tax Information and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 27 of this prospectus.

6

SEI / PROSPECTUS

EMERGING MARKETS EQUITY FUND

Fund Summary

Investment Goal

Capital appreciation.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold Fund shares.

ANNUAL FUND OPERATING EXPENSES

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class F Shares |

||||||

|

Management Fees |

1.05 |

% |

|||||

|

Distribution (12b-1) Fees |

None |

||||||

|

Other Expenses |

0.75 |

% |

|||||

|

Total Annual Fund Operating Expenses |

1.80 |

% |

|||||

|

Fee Waivers and Expense Reimbursements |

(0.10 |

)%* |

|||||

|

Total Annual Fund Operating Expenses Less Fee Waivers and Expense Reimbursements |

1.70 |

% |

|||||

* Renewed as of January 31, 2020, SIMC, the Fund's investment adviser, has contractually agreed to waive its management fee as necessary to keep the management fee paid by the Fund during its fiscal year from exceeding 0.95%. This fee waiver agreement shall remain in effect until January 31, 2021 and, unless earlier terminated, shall be automatically renewed for successive one-year periods thereafter. The agreement may be amended or terminated only with the consent of the Board of Trustees.

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||

|

Emerging Markets Equity Fund — Class F Shares |

$ |

173 |

$ |

557 |

$ |

966 |

$ |

2,108 |

|||||||||||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 89% of the average value of its portfolio.

7

SEI / PROSPECTUS

Principal Investment Strategies

Under normal circumstances, the Emerging Markets Equity Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities of emerging market issuers. Equity securities include common stocks, preferred stock, warrants, participation notes and depositary receipts. The Fund normally maintains investments in at least six emerging market countries and does not invest more than 35% of its total assets in any one emerging market country. Emerging market countries are those countries that: (i) are characterized as developing or emerging by any of the World Bank, the United Nations, the International Finance Corporation, or the European Bank for Reconstruction and Development; (ii) are included in an emerging markets index by a recognized index provider; or (iii) have similar developing or emerging characteristics as countries classified as emerging market countries pursuant to sub-paragraph (i) and (ii) above, in each case determined at the time of purchase.

The Fund uses a multi-manager approach, relying upon a number of sub-advisers (each, a Sub-Adviser and collectively, the Sub-Advisers) with differing investment philosophies to manage portions of the Fund's portfolio under the general supervision of SEI Investments Management Corporation (SIMC), the Fund's adviser.

The Fund may invest in swaps based on a single security or an index of securities, futures contracts, forward contracts and options to synthetically obtain exposure to securities or baskets of securities or for hedging purposes, including seeking to manage the Fund's currency exposure to foreign securities and mitigate the Fund's overall risk. Swaps may be used to obtain exposure to different foreign equity markets.

The Fund may purchase futures contracts or shares of exchange-traded funds (ETFs) to gain exposure to a particular portion of the market while awaiting an opportunity to purchase securities or other instruments directly. The Fund may also invest a portion of its assets in securities of companies located in developed foreign countries and securities of small capitalization companies.

Principal Risks

Market Risk — The risk that the market value of a security may move up and down, sometimes rapidly and unpredictably. Market risk may affect a single issuer, an industry, a sector or the equity or bond market as a whole.

Foreign Investment/Emerging Markets Risk — The risk that non-U.S. securities may be subject to additional risks due to, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments. These additional risks may be heightened with respect to emerging market countries because political turmoil and rapid changes in economic conditions are more likely to occur in these countries.

Investment Style Risk — The risk that emerging market equity securities may underperform other segments of the equity markets or the equity markets as a whole.

Currency Risk — As a result of the Fund's investments in securities denominated in, and/or receiving revenues in, foreign currencies, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an

8

SEI / PROSPECTUS

investment in the Fund would be adversely affected. Currency exchange rates may fluctuate in response to, among other things, changes in interest rates, intervention (or failure to intervene) by U.S. or foreign governments, central banks or supranational entities, or by the imposition of currency controls or other political developments in the United States or abroad.

Small and Medium Capitalization Risk — The risk that small and medium capitalization companies in which the Fund may invest may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, small and medium capitalization companies may have limited product lines, markets and financial resources and may depend upon a relatively small management group. Therefore, small capitalization and medium capitalization stocks may be more volatile than those of larger companies. Small capitalization and medium capitalization stocks may be traded over-the-counter (OTC). OTC stocks may trade less frequently and in smaller volume than exchange listed stocks and may have more price volatility than that of exchange-listed stocks.

Depositary Receipts Risk — Depositary receipts, such as American Depositary Receipts (ADRs), are certificates evidencing ownership of shares of a foreign issuer that are issued by depositary banks and generally trade on an established market. Depositary receipts are subject to many of the risks associated with investing directly in foreign securities, including, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments.

Preferred Stock Risk — Preferred stock represents an equity or ownership interest in an issuer that pays dividends at a specified rate and that has precedence over common stock in the payment of dividends. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of bonds take precedence over the claims of those who own preferred and common stock.

Participation Notes (P-Notes) Risk — P-Notes are participation interest notes that are issued by banks or broker-dealers and are designed to offer a return linked to a particular underlying equity, debt, currency or market. Investments in P-Notes involve the same risks associated with a direct investment in the underlying foreign companies or foreign securities markets that they seek to replicate. However, there can be no assurance that the trading price of P-Notes will equal the underlying value of the foreign companies or foreign securities markets that they seek to replicate.

Warrants Risk — Warrants are instruments that entitle the holder to buy an equity security at a specific price for a specific period of time. Warrants may be more speculative than other types of investments. The price of a warrant may be more volatile than the price of its underlying security, and a warrant may offer greater potential for capital appreciation as well as capital loss. A warrant ceases to have value if it is not exercised prior to its expiration date.

Derivatives Risk — The Fund's use of futures contracts, forward contracts, options and swaps is subject to market risk, leverage risk, correlation risk and liquidity risk. Market risk is described above, and leverage risk and liquidity risk are described below. Many over-the-counter (OTC) derivative instruments will not have liquidity beyond the counterparty to the instrument. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. The Fund's use of forward contracts and swap agreements is also subject to credit risk and valuation risk. Credit risk is described below. Valuation risk is the risk that the derivative may be difficult to value and/or valued incorrectly. Each of the above risks could cause the Fund to lose more than the principal amount invested in a derivative instrument. Some derivatives have the potential for unlimited loss,

9

SEI / PROSPECTUS

regardless of the size of the Fund's initial investment. The other parties to certain derivative contracts present the same types of credit risk as issuers of fixed income securities. The Fund's use of derivatives may also increase the amount of taxes payable by shareholders. Both U.S. and non-U.S. regulators are in the process of adopting and implementing regulations governing derivatives markets, the ultimate impact of which remains unclear.

Credit Risk — The risk that the issuer of a security or the counterparty to a contract will default or otherwise become unable to honor a financial obligation.

Leverage Risk — The Fund's use of derivatives may result in the Fund's total investment exposure substantially exceeding the value of its portfolio securities and the Fund's investment returns depending substantially on the performance of securities that the Fund may not directly own. The use of leverage can amplify the effects of market volatility on the Fund's share price and may also cause the Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. The Fund's use of leverage may result in a heightened risk of investment loss

Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to lower the price of the security, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance.

LIBOR Replacement Risk — The elimination of the London Inter-Bank Offered Rate (LIBOR) may adversely affect the interest rates on, and value of, certain Fund investments for which the value is tied to LIBOR. It remains unclear if LIBOR will continue to exist in its current form or will be modified after 2021, or whether the market will adopt one or more alternative rates. It will be difficult to predict the full impact of the transition away from LIBOR on the Fund until new reference rates and market practices have been commercially accepted.

Exchange-Traded Funds (ETFs) Risk — The risks of owning shares of an ETF generally reflect the risks of owning the underlying securities the ETF is designed to track, although lack of liquidity in an ETF could result in its value being more volatile than the underlying portfolio securities. When the Fund invests in an ETF, in addition to directly bearing the expenses associated with its own operations, it will bear a pro rata portion of the ETF's expenses.

Investing in the Fund involves risk, and there is no guarantee that the Fund will achieve its investment goal. You could lose money on your investment in the Fund, just as you could with other investments. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

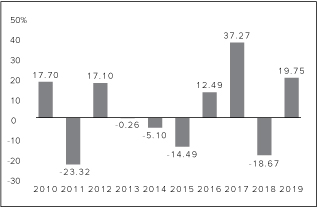

Performance Information

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compare with those of a broad measure of market performance. The performance information shown is based on full calendar years. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

10

SEI / PROSPECTUS

|

|

Best Quarter: 18.01% (09/30/10) Worst Quarter: -24.81% (09/30/11) |

||||||

Average Annual Total Returns (for the periods ended December 31, 2019)

This table compares the Fund's average annual total return to those of a broad-based index and the MSCI Emerging Markets Index Return. As of January 31, 2020, the Fund's benchmark changed to the MSCI Emerging Markets Index Return (net) because it provides a more appropriate basis for performance comparison.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the Fund's return after taxes may exceed the Fund's return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

|

Emerging Markets Equity Fund — Class F Shares |

1 Year |

5 Years |

10 Years |

Since Inception (1/17/1995) |

|||||||||||||||

|

Return Before Taxes |

19.75 |

% |

5.16 |

% |

2.55 |

% |

4.58 |

% |

|||||||||||

|

Return After Taxes on Distributions |

19.74 |

% |

5.15 |

% |

2.58 |

% |

4.14 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

12.20 |

% |

4.22 |

% |

2.19 |

% |

4.00 |

% |

|||||||||||

|

MSCI Emerging Markets Index Return (net) (reflects no deduction for fees or expenses) |

18.42 |

% |

5.61 |

% |

3.68 |

% |

N/A† |

||||||||||||

|

MSCI Emerging Markets Index Return (reflects no deduction for fees, expenses or taxes) |

18.88 |

% |

6.01 |

% |

4.04 |

% |

6.26 |

% |

|||||||||||

† The MSCI Emerging Markets Index Return (net) for the "Since Inception" period is not provided because returns for the MSCI Emerging Markets Index Return (net) are not available prior to 1999.

Management

Investment Adviser and Portfolio Manager. SEI Investments Management Corporation

|

Portfolio Manager |

Experience with the Fund |

Title with Adviser |

|||||||||

|

John Lau |

Since 2019 |

Portfolio Manager |

|||||||||

11

SEI / PROSPECTUS

Sub-Advisers and Portfolio Managers.

|

Sub-Adviser |

Portfolio Manager |

Experience with the Fund |

Title with Sub-Adviser |

||||||||||||

|

Delaware Investments Fund Advisers, a series of Macquarie Investment Management Business Trust |

Liu-Er Chen, CFA |

Since 2011 |

Senior Vice President, Chief Investment Officer — Emerging Markets and Healthcare |

||||||||||||

|

J O Hambro Capital Management Limited |

Emery Brewer Dr. Ivo Kovachev |

Since 2010 Since 2010 |

Lead Senior Manager Senior Fund Manager |

||||||||||||

|

KBI Global Investors (North America) Ltd |

Gareth Maher David Hogarty Ian Madden James Collery John Looby Massimiliano Tondi, CFA, FRM |

Since 2012 Since 2012 Since 2012 Since 2012 Since 2014 Since 2014 |

Head of Portfolio Management Head of Strategy Development Senior Portfolio Manager Senior Portfolio Manager Senior Portfolio Manager Senior Portfolio Manager |

||||||||||||

|

Lazard Asset Management LLC |

Kevin O'Hare, CFA Peter Gillespie, CFA James Donald, CFA John R. Reinsberg |

Since 2010 Since 2010 Since 2010 Since 2010 |

Managing Director, Portfolio Manager/Analyst Managing Director, Portfolio Manager/Analyst Managing Director, Portfolio Manager/Analyst Deputy Chairman, Portfolio Manager/Analyst |

||||||||||||

|

Neuberger Berman Investment Advisers LLC |

Conrad A. Saldanha, CFA |

Since 2010 |

Managing Director |

||||||||||||

|

Qtron Investments LLC |

Dmitri Kantsyrev, Ph.D., CFA Ronald Hua, CFA |

Since 2018 Since 2018 |

Partner, Portfolio Manager Partner, Portfolio Manager |

||||||||||||

|

RWC Asset Advisors (US) LLC |

James Johnstone John Malloy |

Since 2015 Since 2015 |

Portfolio Manager Portfolio Manager |

||||||||||||

For important information about the Purchase and Sale of Fund Shares, Tax Information and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 27 of this prospectus.

12

SEI / PROSPECTUS

INTERNATIONAL FIXED INCOME FUND

Fund Summary

Investment Goal

Capital appreciation and current income.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold Fund shares.

ANNUAL FUND OPERATING EXPENSES

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class F Shares |

||||||

|

Management Fees |

0.30 |

% |

|||||

|

Distribution (12b-1) Fees |

None |

||||||

|

Other Expenses |

0.77 |

% |

|||||

|

Total Annual Fund Operating Expenses |

1.07 |

% |

|||||

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||

|

International Fixed Income Fund — Class F Shares |

$ |

109 |

$ |

340 |

$ |

590 |

$ |

1,306 |

|||||||||||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 58% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, the International Fixed Income Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in fixed income securities. The Fund will invest primarily in investment grade foreign government and corporate fixed income securities, as well as foreign mortgage-backed and/or asset-backed fixed income securities, of issuers located in at least three countries other than the U.S. (including, to a lesser extent, emerging market countries). It is expected that at least 40% of the Fund's assets will be invested in non-U.S. securities. Other fixed

13

SEI / PROSPECTUS

income securities in which the Fund may invest include: (i) securities issued or guaranteed by the U.S. Government and its agencies and instrumentalities and obligations of U.S. commercial banks, such as certificates of deposit, time deposits, bankers' acceptances and bank notes; (ii) U.S. corporate debt securities and mortgage-backed and asset-backed securities; and (iii) obligations of supranational entities.

The Fund uses a multi-manager approach, relying upon a number of sub-advisers (each, a Sub-Adviser and collectively, the Sub-Advisers) with differing investment philosophies to manage portions of the Fund's portfolio under the general supervision of SEI Investments Management Corporation (SIMC), the Fund's adviser. In selecting investments for the Fund, the Sub-Advisers choose securities issued by corporations and governments located in various countries, looking for opportunities to achieve capital appreciation and gain, as well as current income. There are no restrictions on the Fund's average portfolio maturity or on the maturity of any specific security.

The Sub-Advisers may seek to enhance the Fund's return by actively managing the Fund's foreign currency exposure. In managing the Fund's currency exposure, the Sub-Advisers buy and sell currencies (i.e., take long or short positions) using derivatives, principally futures, foreign currency forward contracts and currency swaps. The Fund may take long and short positions in foreign currencies in excess of the value of the Fund's assets denominated in a particular currency or when the Fund does not own assets denominated in that currency. The Fund may also engage in currency transactions in an attempt to take advantage of certain inefficiencies in the currency exchange market, to increase its exposure to a foreign currency or to shift exposure to foreign currency fluctuations from one currency to another. In managing the Fund's currency exposure from foreign securities, the Sub-Advisers may buy and sell currencies for hedging or for speculative purposes.

The Fund may also invest in futures contracts, forward contracts and swaps for speculative or hedging purposes. Futures contracts, forward contracts and swaps are used to synthetically obtain exposure to the securities identified above or baskets of such securities and to manage the Fund's interest rate duration and yield curve exposure. These derivatives are also used to mitigate the Fund's overall level of risk and/or the Fund's risk to particular types of securities, currencies or market segments. Interest rate swaps are further used to manage the Fund's yield spread sensitivity. When the Fund seeks to take an active long or short position with respect to the likelihood of an event of default of a security or basket of securities, the Fund may use credit default swaps. The Fund may buy credit default swaps in an attempt to manage credit risk where the Fund has credit exposure to an issuer and the Fund may sell credit default swaps to more efficiently gain credit exposure to such security or basket of securities.

The Fund will also invest in securities rated below investment grade (junk bonds). However, in general, the Fund will purchase bonds with a rating of CCC or above. The Fund also invests a portion of its assets in bank loans, which are generally non-investment grade floating rate instruments. The Fund may invest in bank loans in the form of participations in the loans or assignments of all or a portion of the loans from third parties.

The Fund may purchase shares of exchange-traded funds (ETFs) to gain exposure to a particular portion of the market while awaiting an opportunity to purchase securities or other instruments directly.

14

SEI / PROSPECTUS

Principal Risks

Market Risk — The prices of the Fund's fixed income securities respond to economic developments, particularly interest rate changes, as well as to perceptions about the creditworthiness of individual issuers, including governments and their agencies. Generally, the Fund's fixed income securities will decrease in value if interest rates rise and vice versa. In a low interest rate environment, risks associated with rising rates are heightened. Declines in dealer market-making capacity as a result of structural or regulatory changes could further decrease liquidity and/or increase volatility in the fixed income markets. In the case of foreign securities, price fluctuations will reflect international economic and political events, as well as changes in currency valuations relative to the U.S. dollar. In response to these events, the Fund's value may fluctuate and/or the Fund may experience increased redemptions from shareholders, which may impact the Fund's liquidity or force the Fund to sell securities into a declining or illiquid market.

Foreign Investment/Emerging Markets Risk — The risk that non-U.S. securities may be subject to additional risks due to, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments. These additional risks may be heightened with respect to emerging market countries because political turmoil and rapid changes in economic conditions are more likely to occur in these countries.

Investment Style Risk — The risk that developed international fixed income securities may underperform other segments of the fixed income markets or the fixed income markets as a whole.

Non-Diversified Risk — The Fund is non-diversified, which means that it may invest in the securities of relatively few issuers. As a result, the Fund may be more susceptible to a single adverse economic or political occurrence affecting one or more of these issuers and may experience increased volatility due to its investments in those securities. However, the Fund intends to satisfy the asset diversification requirements under the Internal Revenue Code of 1986, as amended (the Code) for classification as a regulated investment company (RIC).

Interest Rate Risk — The risk that a rise in interest rates will cause a fall in the value of fixed income securities, including U.S. Government securities, in which the Fund invests. A low interest rate environment may present greater interest rate risk, because there may be a greater likelihood of rates increasing and rates may increase more rapidly.

Duration Risk — The longer-term securities in which the Fund may invest tend to be more volatile than shorter-term securities. A portfolio with a longer average portfolio duration is more sensitive to changes in interest rates than a portfolio with a shorter average portfolio duration.

Corporate Fixed Income Securities Risk — Corporate fixed income securities respond to economic developments, especially changes in interest rates, as well as perceptions of the creditworthiness and business prospects of individual issuers.

Credit Risk — The risk that the issuer of a security or the counterparty to a contract will default or otherwise become unable to honor a financial obligation.

Foreign Sovereign Debt Securities Risk — The risks that: (i) the governmental entity that controls the repayment of sovereign debt may not be willing or able to repay the principal and/or interest when it becomes due because of factors such as debt service burden, political constraints, cash flow problems

15

SEI / PROSPECTUS

and other national economic factors; (ii) governments may default on their debt securities, which may require holders of such securities to participate in debt rescheduling or additional lending to defaulting governments; and (iii) there is no bankruptcy proceeding by which defaulted sovereign debt may be collected in whole or in part.

Derivatives Risk — The Fund's use of swaps, futures and forward contracts is subject to market risk, leverage risk, correlation risk and liquidity risk. Market risk is described above, and leverage risk and liquidity risk are described below. Many over-the-counter (OTC) derivative instruments will not have liquidity beyond the counterparty to the instrument. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. The Fund's use of swaps and forward contracts is also subject to credit risk and valuation risk. Credit risk is described above. Valuation risk is the risk that the derivative may be difficult to value and/or valued incorrectly. Each of the above risks could cause the Fund to lose more than the principal amount invested in a derivative instrument. Some derivatives have the potential for unlimited loss, regardless of the size of the Fund's initial investment. The other parties to certain derivative contracts present the same types of credit risk as issuers of fixed income securities. The Fund's use of derivatives may also increase the amount of taxes payable by shareholders. Both U.S. and non-U.S. regulators are in the process of adopting and implementing regulations governing derivatives markets, the ultimate impact of which remains unclear.

Currency Risk — As a result of the Fund's investments in securities or other investments denominated in, and/or receiving revenues in, foreign currencies and the Fund's active management of its currency exposures, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an investment in the Fund would be adversely affected. Due to the Fund's active positions in currencies, it will be subject to the risk that currency exchange rates may fluctuate in response to, among other things, changes in interest rates, intervention (or failure to intervene) by U.S. or foreign governments, central banks or supranational entities, or by the imposition of currency controls or other political developments in the United States or abroad.

Asset-Backed Securities Risk — Payment of principal and interest on asset-backed securities is dependent largely on the cash flows generated by the assets backing the securities. Securitization trusts generally do not have any assets or sources of funds other than the receivables and related property they own, and asset-backed securities are generally not insured or guaranteed by the related sponsor or any other entity. Asset-backed securities may be more illiquid than more conventional types of fixed-income securities that the Fund acquires.

Below Investment Grade Securities (Junk Bonds) Risk — Fixed income securities rated below investment grade (junk bonds) involve greater risks of default or downgrade and are generally more volatile than investment grade securities because the prospect for repayment of principal and interest of many of these securities is speculative. Because these securities typically offer a higher rate of return to compensate investors for these risks, they are sometimes referred to as "high yield bonds," but there is no guarantee that an investment in these securities will result in a high rate of return.

Leverage Risk — The Fund's use of derivatives may result in the Fund's total investment exposure substantially exceeding the value of its portfolio securities and the Fund's investment returns depending substantially on the performance of securities that the Fund may not directly own. The use of leverage

16

SEI / PROSPECTUS

can amplify the effects of market volatility on the Fund's share price and may also cause the Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. The Fund's use of leverage may result in a heightened risk of investment loss.

Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to lower the price of the security, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance.

U.S. Government Securities Risk — Although U.S. Government securities are considered to be among the safest investments, they are not guaranteed against price movements due to changing interest rates. Obligations issued by some U.S. Government agencies are backed by the U.S. Treasury, while others are backed solely by the ability of the agency to borrow from the U.S. Treasury or by the agency's own resources.

Bank Loans Risk — With respect to bank loans, the Fund will assume the credit risk of both the borrower and the lender that is selling the participation. The Fund may also have difficulty disposing of bank loans because, in certain cases, the market for such instruments is not highly liquid.

Mortgage-Backed Securities Risk — Mortgage-backed securities are affected significantly by the rate of prepayments and modifications of the mortgage loans backing those securities, as well as by other factors such as borrower defaults, delinquencies, realized or liquidation losses and other shortfalls. Mortgage-backed securities are particularly sensitive to prepayment risk, which is described below, given that the term to maturity for mortgage loans is generally substantially longer than the expected lives of those securities; however, the timing and amount of prepayments cannot be accurately predicted. The timing of changes in the rate of prepayments of the mortgage loans may significantly affect the Fund's actual yield to maturity on any mortgage-backed securities, even if the average rate of principal payments is consistent with the Fund's expectation. Along with prepayment risk, mortgage-backed securities are significantly affected by interest rate risk, which is described above. In a low interest rate environment, mortgage loan prepayments would generally be expected to increase due to factors such as refinancing and loan modifications at lower interest rates. In contrast, if prevailing interest rates rise, prepayments of mortgage loans would generally be expected to decline and therefore extend the weighted average lives of mortgage-backed securities held or acquired by the Fund.

Extension Risk — The risk that rising interest rates may extend the duration of a fixed income security, typically reducing the security's value.

Prepayment Risk — The risk that in a declining interest rate environment, fixed income securities with stated interest rates may have the principal paid earlier than expected, requiring the Fund to invest the proceeds at generally lower interest rates.

LIBOR Replacement Risk — The elimination of the London Inter-Bank Offered Rate (LIBOR) may adversely affect the interest rates on, and value of, certain Fund investments for which the value is tied to LIBOR. It remains unclear if LIBOR will continue to exist in its current form or will be modified after 2021, or whether the market will adopt one or more alternative rates. It will be difficult to predict the full impact of the transition away from LIBOR on the Fund until new reference rates and market practices have been commercially accepted.

17

SEI / PROSPECTUS

Exchange-Traded Funds (ETFs) Risk — The risks of owning shares of an ETF generally reflect the risks of owning the underlying securities the ETF is designed to track, although lack of liquidity in an ETF could result in its value being more volatile than the underlying portfolio securities. When the Fund invests in an ETF, in addition to directly bearing the expenses associated with its own operations, it will bear a pro rata portion of the ETF's expenses.

Investing in the Fund involves risk, and there is no guarantee that the Fund will achieve its investment goal. You could lose money on your investment in the Fund, just as you could with other investments. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

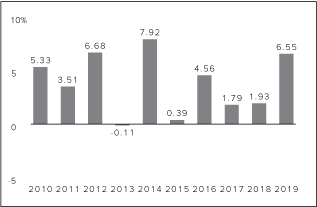

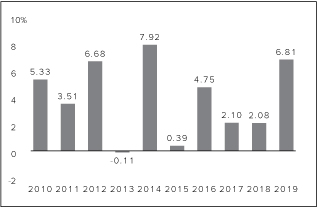

Performance Information

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compare with those of a broad measure of market performance. The performance information shown is based on full calendar years. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 3.51% (09/30/10) Worst Quarter: -3.02% (06/30/15) |

||||||

Average Annual Total Returns (for the periods ended December 31, 2019)

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your

18

SEI / PROSPECTUS

tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

International Fixed Income Fund — Class F Shares |

1 Year |

5 Years |

10 Years |

Since Inception (9/1/1993) |

|||||||||||||||

|

Return Before Taxes |

6.55 |

% |

3.02 |

% |

3.82 |

% |

4.27 |

% |

|||||||||||

|

Return After Taxes on Distributions |

5.17 |

% |

1.67 |

% |

2.35 |

% |

2.71 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

3.90 |

% |

1.72 |

% |

2.33 |

% |

2.71 |

% |

|||||||||||

|

Bloomberg Barclays Global Aggregate ex-US Index, Hedged Return (reflects no deduction for fees, expenses or taxes) |

7.57 |

% |

3.87 |

% |

4.29 |

% |

5.62 |

% |

|||||||||||

Management

Investment Adviser and Portfolio Manager. SEI Investments Management Corporation

|

Portfolio Manager |

Experience with the Fund |

Title with Adviser |

|||||||||

|

James Mashiter, CFA |

Since 2016 |

Portfolio Manager |

|||||||||

Sub-Advisers and Portfolio Managers.

|

Sub-Adviser |

Portfolio Manager |

Experience with the Fund |

Title with Sub-Adviser |

||||||||||||

|

AllianceBernstein L.P. |

Douglas J. Peebles Scott DiMaggio, CFA John Taylor Jorgen Kjaersgaard Nicholas Sanders, CFA Eamonn Buckley |

Since 2006 Since 2006 Since 2012 Since 2013 Since 2016 Since 2018 |

Chief Investment Officer Fixed Income Director — Global Fixed Income Portfolio Manager — European Multi-Sector Portfolio Manager — European Credit Portfolio Manager — European and UK Multi-Sector Portfolio Manager — Fixed Income |

||||||||||||

|

Colchester Global Investors Ltd |

Ian Sims Keith Lloyd, CFA |

Since 2017 Since 2017 |

Chairman and Chief Investment Officer Chief Executive Officer and Deputy Chief Investment Officer |

||||||||||||

|

Wellington Management Company LLP |

Mark H. Sullivan, CFA |

Since 2017 |

Senior Managing Director and Fixed Income Portfolio Manager |

||||||||||||

For important information about the Purchase and Sale of Fund Shares, Tax Information and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 27 of this prospectus.

19

SEI / PROSPECTUS

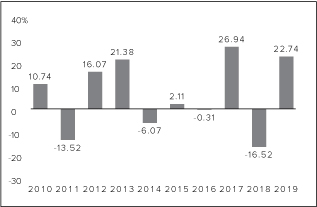

EMERGING MARKETS DEBT FUND

Fund Summary

Investment Goal

Maximize total return.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold Fund shares.

ANNUAL FUND OPERATING EXPENSES

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class F Shares |

||||||

|

Management Fees |

0.85 |

% |

|||||

|

Distribution (12b-1) Fees |

None |

||||||

|

Other Expenses |

0.77 |

% |

|||||

|

Total Annual Fund Operating Expenses |

1.62 |

% |

|||||

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||

|

Emerging Markets Debt Fund — Class F Shares |

$ |

165 |

$ |

511 |

$ |

881 |

$ |

1,922 |

|||||||||||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 114% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, the Emerging Markets Debt Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in fixed income securities of emerging market issuers. The Fund will invest in debt securities of government, government-related and corporate issuers in emerging market countries, as well as entities organized to restructure the outstanding debt of such issuers. The Fund may obtain its exposures by investing directly (e.g., in fixed income securities and other instruments) or indirectly/synthetically (e.g., through the use of derivative instruments,

20

SEI / PROSPECTUS

principally futures contracts, forward contracts and swaps and structured securities, such as credit-linked and inflation-linked notes). The Fund may invest in swaps based on a single security or an index of securities, including interest rate swaps, credit default swaps, currency swaps and fully-funded total return swaps. Emerging market countries are those countries that: (i) are characterized as developing or emerging by any of the World Bank, the United Nations, the International Finance Corporation, or the European Bank for Reconstruction and Development; (ii) are included in an emerging markets index by a recognized index provider; or (iii) have similar developing or emerging characteristics as countries classified as emerging market countries pursuant to sub-paragraph (i) and (ii) above, in each case determined at the time of purchase.

The Fund uses a multi-manager approach, relying upon a number of sub-advisers (each, a Sub-Adviser and collectively, the Sub-Advisers) with differing investment philosophies to manage portions of the Fund's portfolio under the general supervision of SEI Investments Management Corporation (SIMC), the Fund's adviser. The Sub-Advisers will spread the Fund's holdings across a number of countries and industries to limit its exposure to any single emerging market economy and may not invest more than 25% of its assets in any single country. There are no restrictions on the Fund's average portfolio maturity or on the maturity of any specific security. There is no minimum rating standard for the Fund's securities, and the Fund's securities will generally be in the lower or lowest rating categories (including those below the fourth highest rating category by a Nationally Recognized Statistical Rating Organization (NRSRO), commonly referred to as junk bonds).

The Sub-Advisers may seek to enhance the Fund's return by actively managing the Fund's foreign currency exposure. In managing the Fund's currency exposure, the Sub-Advisers buy and sell currencies (i.e., take long or short positions) using derivatives, principally futures, foreign currency forward contracts, options on foreign currencies and currency swaps. The Fund may take long and short positions in foreign currencies in excess of the value of the Fund's assets denominated in a particular currency or when the Fund does not own assets denominated in that currency. The Fund may also engage in currency transactions in an attempt to take advantage of certain inefficiencies in the currency exchange market, to increase its exposure to a foreign currency or to shift exposure to foreign currency fluctuations from one currency to another. In managing the Fund's currency exposure from foreign securities, the Sub-Advisers may buy and sell currencies for hedging or for speculative purposes.

The Fund may also invest in futures contracts, forward contracts and swaps for speculative or hedging purposes. Futures contracts, forward contracts and swaps are used to synthetically obtain exposure to the securities identified above or baskets of such securities and to manage the Fund's interest rate duration and yield curve exposure. These derivatives are also used to mitigate the Fund's overall level of risk and/or the Fund's risk to particular types of securities, currencies or market segments. Interest rate swaps are further used to manage the Fund's yield spread sensitivity. When the Fund seeks to take an active long or short position with respect to the likelihood of an event of default of a security or basket of securities, the Fund may use credit default swaps. The Fund may buy credit default swaps in an attempt to manage credit risk where the Fund has credit exposure to an issuer and the Fund may sell credit default swaps to more efficiently gain credit exposure to such security or basket of securities.

The Fund may purchase shares of exchange-traded funds (ETFs) to gain exposure to a particular portion of the market while awaiting an opportunity to purchase securities or other instruments directly. Due to its investment strategy, the Fund may buy and sell securities and other instruments frequently.

21

SEI / PROSPECTUS

Principal Risks

Market Risk — The prices of the Fund's fixed income securities respond to economic developments, particularly interest rate changes, as well as to perceptions about the creditworthiness of individual issuers, including governments and their agencies. Generally, the Fund's fixed income securities will decrease in value if interest rates rise and vice versa. In a low interest rate environment, risks associated with rising rates are heightened. Declines in dealer market-making capacity as a result of structural or regulatory changes could further decrease liquidity and/or increase volatility in the fixed income markets. In the case of foreign securities, price fluctuations will reflect international economic and political events, as well as changes in currency valuations relative to the U.S. dollar. In response to these events, the Fund's value may fluctuate and/or the Fund may experience increased redemptions from shareholders, which may impact the Fund's liquidity or force the Fund to sell securities into a declining or illiquid market.

Foreign Investment/Emerging Markets Risk — The risk that non-U.S. securities may be subject to additional risks due to, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments. These additional risks may be heightened with respect to emerging market countries because political turmoil and rapid changes in economic conditions are more likely to occur in these countries.

Investment Style Risk — The risk that emerging market debt securities may underperform other segments of the fixed income markets or the fixed income markets as a whole.

Non-Diversified Risk — The Fund is non-diversified, which means that it may invest in the securities of relatively few issuers. As a result, the Fund may be more susceptible to a single adverse economic or political occurrence affecting one or more of these issuers and may experience increased volatility due to its investments in those securities. However, the Fund intends to satisfy the asset diversification requirements under the Internal Revenue Code of 1986, as amended (the Code) for classification as a regulated investment company (RIC).

Currency Risk — As a result of the Fund's investments in securities or other investments denominated in, and/or receiving revenues in, foreign currencies and the Fund's active management of its currency exposures, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an investment in the Fund would be adversely affected. Due to the Fund's active positions in currencies, it will be subject to the risk that currency exchange rates may fluctuate in response to, among other things, changes in interest rates, intervention (or failure to intervene) by U.S. or foreign governments, central banks or supranational entities, or by the imposition of currency controls or other political developments in the United States or abroad.

Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to lower the price of the security, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance.

Foreign Sovereign Debt Securities Risk — The risks that (i) the governmental entity that controls the repayment of sovereign debt may not be willing or able to repay the principal and/or interest when it

22

SEI / PROSPECTUS

becomes due because of factors such as debt service burden, political constraints, cash flow problems and other national economic factors; (ii) governments may default on their debt securities, which may require holders of such securities to participate in debt rescheduling or additional lending to defaulting governments; and (iii) there is no bankruptcy proceeding by which defaulted sovereign debt may be collected in whole or in part.

Below Investment Grade Securities (Junk Bonds) Risk — Fixed income securities rated below investment grade (junk bonds) involve greater risks of default or downgrade and are generally more volatile than investment grade securities because the prospect for repayment of principal and interest of many of these securities is speculative. Because these securities typically offer a higher rate of return to compensate investors for these risks, they are sometimes referred to as "high yield bonds," but there is no guarantee that an investment in these securities will result in a high rate of return.

Duration Risk — The longer-term securities in which the Fund may invest tend to be more volatile than shorter-term securities. A portfolio with a longer average portfolio duration is more sensitive to changes in interest rates than a portfolio with a shorter average portfolio duration.

Interest Rate Risk — The risk that a rise in interest rates will cause a fall in the value of fixed income securities in which the Fund invests. A low interest rate environment may present greater interest rate risk, because there may be a greater likelihood of rates increasing and rates may increase more rapidly.

Credit Risk — The risk that the issuer of a security or the counterparty to a contract will default or otherwise become unable to honor a financial obligation.

Corporate Fixed Income Securities Risk — Corporate fixed income securities respond to economic developments, especially changes in interest rates, as well as perceptions of the creditworthiness and business prospects of individual issuers.

Extension Risk — The risk that rising interest rates may extend the duration of a fixed income security, typically reducing the security's value.

Prepayment Risk — The risk that in a declining interest rate environment, fixed income securities with stated interest rates may have the principal paid earlier than expected, requiring the Fund to invest the proceeds at generally lower interest rates.

Derivatives Risk — The Fund's use of futures contracts, forward contracts, options, swaps and credit-linked notes is subject to market risk, leverage risk, correlation risk and liquidity risk. Market risk and liquidity risk are described above, and leverage risk is described below. Many over-the-counter (OTC) derivative instruments will not have liquidity beyond the counterparty to the instrument. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. The Fund's use of forward contracts, options, credit-linked notes and swap agreements is also subject to credit risk and valuation risk. Credit risk is described above. Valuation risk is the risk that the derivative may be difficult to value and/or valued incorrectly. Each of the above risks could cause the Fund to lose more than the principal amount invested in a derivative instrument. Some derivatives have the potential for unlimited loss, regardless of the size of the Fund's initial investment. The other parties to certain derivative contracts present the same types of credit risk as issuers of fixed income securities. The Fund's use of derivatives may also increase the amount of taxes payable by shareholders. Both U.S. and non-U.S. regulators are in the process of adopting and implementing regulations governing derivatives markets, the ultimate impact of which remains unclear.

23

SEI / PROSPECTUS