January 31, 2019

SUMMARY PROSPECTUS

SIT Emerging Markets Debt Fund (SITEX)

Class F

Before you invest, you may want to review the Fund's prospectus, which contains information about the Fund and its risks. You can find the Fund prospectus and other information about the Fund, including the Fund's Statement of Additional Information, online at seic.com/fundprospectuses. You can also get this information at no cost by dialing 1-800-DIAL-SEI. The Fund's prospectus and Statement of Additional Information, dated January 31, 2019, as may be supplemented from time to time, are incorporated by reference into this Summary Prospectus.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank.

Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can follow the instructions included with this disclosure or contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-DIAL-SEI. Your election to receive reports in paper will apply to all funds held with the SEI Funds or your financial intermediary.

seic.com

SEI / SUMMARY PROSPECTUS

Investment Goal

Maximize total return.

Fees and Expenses

The following tables describe the fees and expenses that you may pay if you buy and hold Fund shares.

ANNUAL FUND OPERATING EXPENSES

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class F Shares |

||||||

|

Management Fees |

0.85 |

% |

|||||

|

Distribution (12b-1) Fees |

None |

||||||

|

Other Expenses |

0.76 |

% |

|||||

|

Total Annual Fund Operating Expenses |

1.61 |

% |

|||||

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||

|

Emerging Markets Debt Fund — Class F Shares |

$ |

164 |

$ |

508 |

$ |

876 |

$ |

1,911 |

|||||||||||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 80% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, the Emerging Markets Debt Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in fixed income securities of emerging market issuers. The Fund will invest in debt securities of government, government-related and corporate issuers in emerging market countries, as well as entities organized to restructure the outstanding debt of such issuers. The Fund may obtain its exposures by investing directly (e.g., in fixed income securities and other instruments) or indirectly/synthetically (e.g., through the use of derivative instruments, principally futures contracts, forward contracts and swaps and structured securities, such as credit-linked and inflation-linked notes). The Fund may invest in swaps based on a single security or an index of securities, including interest rate swaps, credit default swaps, currency swaps and fully-funded total return swaps. Emerging market countries are those countries that are: (i) characterized as developing or emerging by any of the World Bank, the United Nations, the International Finance Corporation, or the European Bank for Reconstruction and Development; (ii) included in an emerging markets index by a recognized index provider; or (iii) countries with similar developing or emerging characteristics as countries classified as emerging market countries pursuant to sub-paragraph (i) and (ii) above, in each case determined at the time of purchase.

The Fund uses a multi-manager approach, relying upon a number of sub-advisers (each, a Sub-Adviser and collectively, the Sub-Advisers) with differing investment philosophies to manage portions of the Fund's portfolio under the general supervision of SEI Investments Management Corporation (SIMC), the Fund's adviser. The Sub-Advisers will spread the Fund's holdings across a number of countries and industries to limit its exposure to any single emerging market economy and may not invest more than 25% of its assets in any single country. There are no restrictions on the Fund's average portfolio maturity or on the maturity of any specific security. There is no minimum rating standard for the Fund's securities, and the Fund's securities will generally be in the lower or lowest rating categories (including those below the fourth highest rating category by a Nationally Recognized Statistical Rating Organization (NRSRO), commonly referred to as junk bonds).

The Sub-Advisers may seek to enhance the Fund's return by actively managing the Fund's foreign currency exposure. In managing the Fund's currency exposure, the Sub-Advisers buy and sell currencies (i.e., take long or short positions) using

2

SEI / SUMMARY PROSPECTUS

derivatives, principally futures, foreign currency forward contracts, options on foreign currencies and currency swaps. The Fund may take long and short positions in foreign currencies in excess of the value of the Fund's assets denominated in a particular currency or when the Fund does not own assets denominated in that currency. The Fund may also engage in currency transactions in an attempt to take advantage of certain inefficiencies in the currency exchange market, to increase its exposure to a foreign currency or to shift exposure to foreign currency fluctuations from one currency to another. In managing the Fund's currency exposure from foreign securities, the Sub-Advisers may buy and sell currencies for hedging or for speculative purposes.

The Fund may also invest in futures contracts, forward contracts and swaps for speculative or hedging purposes. Futures contracts, forward contracts and swaps are used to synthetically obtain exposure to the securities identified above or baskets of such securities and to manage the Fund's interest rate duration and yield curve exposure. These derivatives are also used to mitigate the Fund's overall level of risk and/or the Fund's risk to particular types of securities, currencies or market segments. Interest rate swaps are further used to manage the Fund's yield spread sensitivity. When the Fund seeks to take an active long or short position with respect to the likelihood of an event of default of a security or basket of securities, the Fund may use credit default swaps. The Fund may buy credit default swaps in an attempt to manage credit risk where the Fund has credit exposure to an issuer and the Fund may sell credit default swaps to more efficiently gain credit exposure to such security or basket of securities.

The Fund may purchase shares of exchange-traded funds (ETFs) to gain exposure to a particular portion of the market while awaiting an opportunity to purchase securities or other instruments directly.

Principal Risks

Market Risk — The prices of the Fund's fixed income securities respond to economic developments, particularly interest rate changes, as well as to perceptions about the creditworthiness of individual issuers, including governments and their agencies. Generally, the Fund's fixed income securities will decrease in value if interest rates rise and vice versa. In a low interest rate environment, risks associated with rising rates are heightened. Declines in dealer market-making capacity as a result of structural or regulatory changes could further decrease liquidity and/or increase volatility in the fixed income markets. In the case of foreign securities, price fluctuations will reflect international economic and political events, as well as changes in currency valuations relative to the U.S. dollar. In response to these events, the Fund's value may fluctuate and/or the Fund may experience increased redemptions from shareholders, which may impact the Fund's liquidity or force the Fund to sell securities into a declining or illiquid market.

Foreign Investment/Emerging Markets Risk — The risk that non-U.S. securities may be subject to additional risks due to, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments. These additional risks may be heightened with respect to emerging market countries because political turmoil and rapid changes in economic conditions are more likely to occur in these countries.

Investment Style Risk — The risk that emerging market debt securities may underperform other segments of the fixed income markets or the fixed income markets as a whole.

Non-Diversified Risk — The Fund is non-diversified, which means that it may invest in the securities of relatively few issuers. As a result, the Fund may be more susceptible to a single adverse economic or political occurrence affecting one or more of these issuers and may experience increased volatility due to its investments in those securities.

Currency Risk — As a result of the Fund's investments in securities or other investments denominated in, and/or receiving revenues in, foreign currencies and the Fund's active management of its currency exposures, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an investment in the Fund would be adversely affected. Due to the Fund's active positions in currencies, it will be subject to the risk that currency exchange rates may fluctuate in response to, among other things, changes in interest rates, intervention (or failure to intervene) by U.S. or foreign governments, central banks or supranational entities, or by the imposition of currency controls or other political developments in the United States or abroad.

Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to lower the price of the security, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance.

Foreign Sovereign Debt Securities Risk — The risks that (i) the governmental entity that controls the repayment of sovereign debt may not be willing or able to repay the principal and/or interest when it becomes due because of factors such as debt service burden, political constraints, cash flow problems and other national economic factors; (ii) governments may default on their debt securities, which may require holders of such securities to participate in debt rescheduling or additional

3

SEI / SUMMARY PROSPECTUS

lending to defaulting governments; and (iii) there is no bankruptcy proceeding by which defaulted sovereign debt may be collected in whole or in part.

Below Investment Grade Securities (Junk Bonds) Risk — Fixed income securities rated below investment grade (junk bonds) involve greater risks of default or downgrade and are generally more volatile than investment grade securities because the prospect for repayment of principal and interest of many of these securities is speculative. Because these securities typically offer a higher rate of return to compensate investors for these risks, they are sometimes referred to as "high yield bonds," but there is no guarantee that an investment in these securities will result in a high rate of return.

Duration Risk — The longer-term securities in which the Fund may invest tend to be more volatile than shorter-term securities. A portfolio with a longer average portfolio duration is more sensitive to changes in interest rates than a portfolio with a shorter average portfolio duration.

Interest Rate Risk — The risk that a rise in interest rates will cause a fall in the value of fixed income securities in which the Fund invests. A low interest rate environment may present greater interest rate risk, because there may be a greater likelihood of rates increasing and rates may increase more rapidly.

Credit Risk — The risk that the issuer of a security or the counterparty to a contract will default or otherwise become unable to honor a financial obligation.

Corporate Fixed Income Securities Risk — Corporate fixed income securities respond to economic developments, especially changes in interest rates, as well as perceptions of the creditworthiness and business prospects of individual issuers.

Extension Risk — The risk that rising interest rates may extend the duration of a fixed income security, typically reducing the security's value.

Prepayment Risk — The risk that in a declining interest rate environment, fixed income securities with stated interest rates may have the principal paid earlier than expected, requiring the Fund to invest the proceeds at generally lower interest rates.

Derivatives Risk — The Fund's use of futures contracts, forward contracts, options, swaps and credit-linked notes is subject to market risk, leverage risk, correlation risk and liquidity risk. Leverage risk is described below and liquidity risk and market risk are described above. Many over-the-counter (OTC) derivative instruments will not have liquidity beyond the counterparty to the instrument. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. The Fund's use of forward contracts, options, credit-linked notes and swap agreements is also subject to credit risk and valuation risk. Valuation risk is the risk that the derivative may be difficult to value and/or valued incorrectly. Credit risk is described above. Each of the above risks could cause the Fund to lose more than the principal amount invested in a derivative instrument. Some derivatives have the potential for unlimited loss, regardless of the size of the Fund's initial investment. The other parties to certain derivative contracts present the same types of credit risk as issuers of fixed income securities. The Fund's use of derivatives may also increase the amount of taxes payable by shareholders. Both U.S. and non-U.S. regulators are in the process of adopting and implementing regulations governing derivatives markets, the ultimate impact of which remains unclear.

Leverage Risk — The Fund's use of derivatives may result in the Fund's total investment exposure substantially exceeding the value of its portfolio securities and the Fund's investment returns depending substantially on the performance of securities that the Fund may not directly own. The use of leverage can amplify the effects of market volatility on the Fund's share price and may also cause the Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. The Fund's use of leverage may result in a heightened risk of investment loss.

Exchange-Traded Funds (ETFs) Risk — The risks of owning shares of an ETF generally reflect the risks of owning the underlying securities the ETF is designed to track, although lack of liquidity in an ETF could result in its value being more volatile than the underlying portfolio securities. When the Fund invests in an ETF, in addition to directly bearing the expenses associated with its own operations, it will bear a pro rata portion of the ETF's expenses.

Investing in the Fund involves risk, and there is no guarantee that the Fund will achieve its investment goal. You could lose money on your investment in the Fund, just as you could with other investments. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

4

SEI / SUMMARY PROSPECTUS

Performance Information

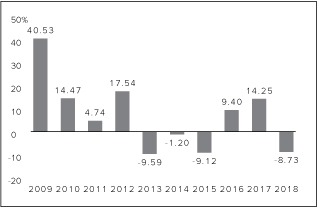

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compare with those of a broad measure of market performance. The performance information shown is based on full calendar years. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

|

|

Best Quarter: 15.11% (06/30/09) Worst Quarter: -8.78% (06/30/18) |

||||||

Average Annual Total Returns (for the periods ended December 31, 2018)

This table compares the Fund's average annual total returns to those of a broad-based index and the Fund's 50/50 Blended Benchmark, which consists of the J.P. Morgan Emerging Markets Bond Index (EMBI) Global Diversified Index (50%) and the J.P. Morgan Government Bond Index-Emerging Markets (GBI-EM) Global Diversified Index (50%). The Fund's Blended Benchmark is designed to provide a useful comparison to the Fund's overall performance and more accurately reflect the Fund's investment strategy than the broad-based index.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In the event of negative performance, the Fund's returns after taxes on distributions and sale of Fund shares are calculated assuming that an investor has sufficient capital gains of the same character from other investments to offset any capital losses from the sale of Fund shares. As a result, the Fund's returns after taxes on distributions and sale of Fund shares may exceed the Fund's returns before taxes and/or returns after taxes on distributions.

|

Emerging Markets Debt Fund — Class F Shares |

1 Year |

5 Years |

10 Years |

Since Inception (6/26/1997) |

|||||||||||||||

|

Return Before Taxes |

-8.73 |

% |

0.48 |

% |

6.25 |

% |

7.33 |

% |

|||||||||||

|

Return After Taxes on Distributions |

-9.48 |

% |

-0.43 |

% |

4.60 |

% |

4.66 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

-5.46 |

% |

-0.08 |

% |

4.43 |

% |

4.75 |

% |

|||||||||||

|

J.P. Morgan EMBI Global Diversified Index Return (reflects no deduction for fees, expenses or taxes) |

-4.26 |

% |

4.80 |

% |

8.20 |

% |

8.06 |

% |

|||||||||||

|

The Fund's Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

-6.21 |

% |

-0.96 |

% |

3.45 |

% |

N/A† |

||||||||||||

† The Blended Benchmark Return for the "Since Inception" period is not provided because returns for the J.P. Morgan GBI-EM Global Diversified Index Return are not available prior to 2003.

5

SEI / SUMMARY PROSPECTUS

Management

Investment Adviser and Portfolio Manager. SEI Investments Management Corporation

|

Portfolio Manager |

Experience with the Fund |

Title with Adviser |

|||||||||

|

William T. Lawrence, CFA |

Since 2015 |

Portfolio Manager |

|||||||||

|

Hardeep Khangura, CFA |

Since 2015 |

Portfolio Manager |

|||||||||

Sub-Advisers and Portfolio Managers.

|

Sub-Adviser |

Portfolio Manager |

Experience with the Fund |

Title with Sub-Adviser |

||||||||||||

|

Colchester Global Investors Ltd |

Ian Sims Keith Lloyd, CFA |

Since 2018 Since 2018 |

Chairman and Chief Investment Officer Chief Executive Officer and Deputy Chief Investment Officer |

||||||||||||

|

Investec Asset Management Ltd. |

Antoon De Klerk Werner Gey van Pittius |

Since 2017 Since 2013 |

Co-Portfolio Manager of Emerging Markets Local Currency Debt Co-Head of Emerging Market Sovereign & FX; Co-Portfolio Manager Emerging Markets Local Currency Debt |

||||||||||||

|

Marathon Asset Management, L.P. |

Lou Hanover Gaby Szpigiel Andrew Szmulewicz |

Since 2018 Since 2018 Since 2018 |

CIO & Co-Managing Partner, Co-Founder of Marathon Partner & Head of Emerging Markets Managing Director, Portfolio Manager & Strategist |

||||||||||||

|

Neuberger Berman Investment Advisers LLC |

Rob Drijkoningen Gorky Urquieta Jennifer Gorgoll, CFA Raoul Luttik Nish Popat Prashant Singh, CFA Bart van der Made, CFA Vera Kartseva |

Since 2013 Since 2013 Since 2013 Since 2013 Since 2013 Since 2013 Since 2013 Since 2013 |

Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Vice President |

||||||||||||

|

Stone Harbor Investment Partners LP |

Peter J. Wilby, CFA Pablo Cisilino James E. Craige, CFA David A. Oliver, CFA Kumaran Damodaran, Ph.D. William Perry Stuart Sclater-Booth |

Since 2006 Since 2006 Since 2006 Since 2008 Since 2015 Since 2012 Since 2018 |

Chief Investment Officer Portfolio Manager Portfolio Manager Portfolio Manager Portfolio Manager Portfolio Manager Portfolio Manager |

||||||||||||

Purchase and Sale of Fund Shares

The minimum initial investment for Class F Shares is $100,000 with minimum subsequent investments of $1,000. Such minimums may be waived at the discretion of SIMC. You may purchase and redeem shares of the Fund on any day that the New York Stock Exchange (NYSE) is open for business (a Business Day). You may sell your Fund shares by contacting your authorized financial institution or intermediary directly. Authorized financial institutions and intermediaries may redeem Fund shares on behalf of their clients by contacting the Fund's transfer agent (the Transfer Agent) or the Fund's authorized agent, using certain SEI Investments Company (SEI) or third party systems or by calling 1-800-858-7233, as applicable.

Tax Information

The distributions made by the Fund generally are taxable and will be taxed as ordinary income or capital gains. If you are investing through a tax-deferred arrangement, such as a 401(k) plan or individual retirement account, you will generally not be subject to federal taxation on Fund distributions until you begin receiving distributions from your tax-deferred arrangement. You should consult your tax advisor regarding the rules governing your tax-deferred arrangement.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

6