January 31, 2017

SUMMARY PROSPECTUS

SIT Emerging Markets Equity Fund (SEQFX)

Class Y

Before you invest, you may want to review the Fund's prospectus, which contains information about the Fund and its risks. You can find the Fund prospectus and other information about the Fund, including the Fund's Statement of Additional Information, online at seic.com/fundprospectuses. You can also get this information at no cost by dialing 1-800-DIAL-SEI. The Fund's prospectus and Statement of Additional Information, dated January 31, 2017, as may be supplemented from time to time, are incorporated by reference into this Summary Prospectus.

Investment Goal

Capital appreciation.

Fees and Expenses

The following tables describe the fees and expenses that you may pay if you buy and hold Fund shares.

ANNUAL FUND OPERATING EXPENSES

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class Y Shares |

||||||

|

Management Fees |

1.05 |

% |

|||||

|

Distribution (12b-1) Fees |

None |

||||||

|

Other Expenses^ |

0.55 |

% |

|||||

|

Acquired Fund Fees and Expenses (AFFE) |

0.02 |

% |

|||||

|

Total Annual Fund Operating Expenses |

1.62 |

%† |

|||||

|

Fee Waivers and Expense Reimbursements |

0.10 |

% |

|||||

|

Total Annual Fund Operating Expenses Less Fee Waivers and Expense Reimbursements |

1.52 |

%* |

|||||

^ Other Expenses have been restated to reflect estimated fees and expenses for the upcoming fiscal year.

† The Fund incurred AFFE during the most recent fiscal year, and therefore the operating expenses in this fee table will not correlate to the expense ratio in the Fund's financial statements (or the "Financial Highlights" section in the prospectus). The financial statements include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in underlying funds.

* Renewed as of January 31, 2017, SIMC, the Fund's investment adviser, has contractually agreed to waive its management fee as necessary to keep the management fee paid by the Fund during its fiscal year from exceeding 0.95%. This fee waiver agreement shall remain in effect until January 31, 2018 and, unless earlier terminated, shall be automatically renewed for successive one-year periods thereafter. The agreement may be amended or terminated only with the consent of the Board of Trustees.

seic.com

SEI / SUMMARY PROSPECTUS

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||

|

Emerging Markets Equity Fund — Class Y Shares |

$ |

155 |

$ |

501 |

$ |

872 |

$ |

1,914 |

|||||||||||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 79% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, the Emerging Markets Equity Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities of emerging market issuers. Equity securities may include common stocks, preferred stock, warrants, participation notes and depositary receipts. The Fund normally maintains investments in at least six emerging market countries and does not invest more than 35% of its total assets in any one emerging market country. Emerging market countries are those countries that are: (i) characterized as developing or emerging by any of the World Bank, the United Nations, the International Finance Corporation, or the European Bank for Reconstruction and Development; (ii) included in an emerging markets index by a recognized index provider; or (iii) countries with similar developing or emerging characteristics as countries classified as emerging market countries pursuant to sub-paragraph (i) and (ii) above, in each case determined at the time of purchase.

The Fund uses a multi-manager approach, relying upon a number of sub-advisers (each, a Sub-Adviser and collectively, the Sub-Advisers) with differing investment philosophies to manage portions of the Fund's portfolio under the general supervision of SEI Investments Management Corporation (SIMC), the Fund's adviser.

The Fund may invest in swaps based on a single security or an index of securities, futures contracts, forward contracts and options to synthetically obtain exposure to securities or baskets of securities or for hedging purposes, including seeking to manage the Fund's currency exposure to foreign securities and mitigate the Fund's overall risk. Swaps may be used to obtain exposure to different foreign equity markets.

The Fund may purchase futures contracts or shares of exchange-traded funds (ETFs) to gain exposure to a particular portion of the market while awaiting an opportunity to purchase securities or other instruments directly. The Fund may also invest a portion of its assets in securities of companies located in developed foreign countries and securities of small capitalization companies.

Principal Risks

Credit Risk — The risk that the issuer of a security or the counterparty to a contract will default or otherwise become unable to honor a financial obligation.

Currency Risk — As a result of the Fund's investments in securities denominated in, and/or receiving revenues in, foreign currencies, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an investment in the Fund would be adversely affected. Currency exchange rates may fluctuate in response to, among other things, changes in interest rates, intervention (or failure to intervene) by U.S. or foreign governments, central banks or supranational entities, or by the imposition of currency controls or other political developments in the United States or abroad.

Depositary Receipts Risk — Depositary receipts, such as American Depositary Receipts (ADRs), are certificates evidencing ownership of shares of a foreign issuer that are issued by depositary banks and generally trade on an established market. Depositary receipts are subject to many of the risks associated with investing directly in foreign securities, including, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments.

2

SEI / SUMMARY PROSPECTUS

Derivatives Risk — The Fund's use of futures contracts, forward contracts, options and swaps is subject to market risk, leverage risk, correlation risk and liquidity risk. Leverage risk, liquidity risk and market risk are described below. Many over-the-counter (OTC) derivative instruments will not have liquidity beyond the counterparty to the instrument. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. The Fund's use of OTC forward contracts and swap agreements is also subject to credit risk and valuation risk. Valuation risk is the risk that the derivative may be difficult to value and/or valued incorrectly. Credit risk is described above. Each of the above risks could cause the Fund to lose more than the principal amount invested in a derivative instrument. Some derivatives have the potential for unlimited loss, regardless of the size of the Fund's initial investment. The other parties to certain derivative contracts present the same types of credit risk as issuers of fixed income securities. The Fund's use of derivatives may also increase the amount of taxes payable by shareholders. Both U.S. and non-U.S. regulators are in the process of adopting and implementing regulations governing derivatives markets, the ultimate impact of which remains unclear.

Equity Market Risk — The risk that stock prices will fall over short or extended periods of time.

Exchange-Traded Funds (ETFs) Risk — The risks of owning shares of an ETF generally reflect the risks of owning the underlying securities the ETF is designed to track, although lack of liquidity in an ETF could result in its value being more volatile than the underlying portfolio securities. When the Fund invests in an ETF, in addition to directly bearing the expenses associated with its own operations, it will bear a pro rata portion of the ETF's expenses.

Foreign Investment/Emerging Markets Risk — The risk that non-U.S. securities may be subject to additional risks due to, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments. These additional risks may be heightened with respect to emerging market countries because political turmoil and rapid changes in economic conditions are more likely to occur in these countries.

Investment Style Risk — The risk that emerging market equity securities may underperform other segments of the equity markets or the equity markets as a whole.

Leverage Risk — The Fund's use of derivatives may result in the Fund's total investment exposure substantially exceeding the value of its portfolio securities and the Fund's investment returns depending substantially on the performance of securities that the Fund may not directly own. The use of leverage can amplify the effects of market volatility on the Fund's share price and may also cause the Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. The Fund's use of leverage may result in a heightened risk of investment loss.

Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to lower the price, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance.

Market Risk — The risk that the market value of a security may move up and down, sometimes rapidly and unpredictably. Market risk may affect a single issuer, an industry, a sector or the equity or bond market as a whole.

Opportunity Risk — The risk of missing out on an investment opportunity because the assets necessary to take advantage of it are tied up in other investments.

Participation Notes (P-Notes) Risk — P-Notes are participation interest notes that are issued by banks or broker-dealers and are designed to offer a return linked to a particular underlying equity, debt, currency or market. Investments in P-Notes involve the same risks associated with a direct investment in the underlying foreign companies of foreign securities markets that they seek to replicate. However, there can be no assurance that the trading price of P-Notes will equal the underlying value of the foreign companies or foreign securities markets that they seek to replicate.

Small and Medium Capitalization Risk — The risk that small and medium capitalization companies in which the Fund may invest may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, small and medium capitalization companies may have limited product lines, markets and financial resources and may depend upon a relatively small management group. Therefore, small capitalization and medium capitalization stocks may be more volatile than those of larger companies. Small capitalization and medium capitalization stocks may be traded over the counter or listed on an exchange.

Warrants Risk — Warrants are instruments that entitle the holder to buy an equity security at a specific price for a specific period of time. Warrants may be more speculative than other types of investments. The price of a warrant may be more volatile than the price of its underlying security, and a warrant may offer greater potential for capital appreciation as well as capital loss. A warrant ceases to have value if it is not exercised prior to its expiration date.

Investing in the Fund involves risk, and there is no guarantee that the Fund will achieve its investment goal. You could lose money on your investment in the Fund, just as you could with other investments.

3

SEI / SUMMARY PROSPECTUS

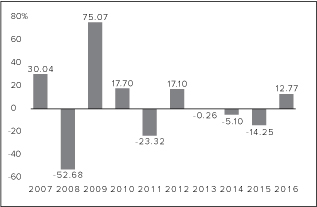

Performance Information

The bar chart and the performance table below provide some indication of the risks of investing in the Class Y Shares of the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compare with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

Best Quarter: 34.40% (06/30/09)

Worst Quarter: -27.79% (12/31/08)

The Fund's Class Y Shares commenced operations on December 31, 2014. For full calendar years through December 31, 2014, the performance of the Fund's Class F Shares is shown. The Fund's Class F Shares are offered in a separate prospectus. Because Class Y Shares are invested in the same portfolio of securities, returns for Class Y Shares would have been substantially similar to those of Class F Shares, shown here, and would have differed only to the extent that Class Y Shares have lower total annual fund operating expenses than Class F Shares.

Average Annual Total Returns (for the periods ended December 31, 2016)

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In the event of negative performance, the Fund's returns after taxes on distributions and sale of Fund shares are calculated assuming that an investor has sufficient capital gains of the same character from other investments to offset any capital losses from the sale of Fund shares. As a result, the Fund's returns after taxes on distributions and sale of Fund shares may exceed the Fund's returns before taxes and/or returns after taxes on distributions.

|

Emerging Markets Equity Fund* |

1 Year |

5 Years |

10 Years |

Since Inception** (1/17/1995) |

|||||||||||||||

|

Return Before Taxes |

12.77 |

% |

1.40 |

% |

0.41 |

% |

3.87 |

% |

|||||||||||

|

Return After Taxes on Distributions |

12.53 |

% |

1.27 |

% |

-0.46 |

% |

3.28 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

7.50 |

% |

1.15 |

% |

0.60 |

% |

3.40 |

% |

|||||||||||

|

MSCI Emerging Markets Index Return (reflects no deduction for fees, expenses or taxes) |

11.60 |

% |

1.64 |

% |

2.17 |

% |

5.78 |

% |

|||||||||||

* The Fund's Class Y Shares commenced operations on December 31, 2014. For periods prior to December 31, 2014, the performance of the Fund's Class F Shares has been used. Returns for Class Y Shares would have been substantially similar to those of Class F Shares and would have differed only to the extent that Class Y Shares have lower total annual fund operating expenses than Class F Shares.

** Index returns are shown from January 31, 1995.

Management

Investment Adviser and Portfolio Manager. SEI Investments Management Corporation

|

Portfolio Manager |

Experience with the Fund |

Title with Adviser |

|||||||||

|

Sandra M. Ackermann-Schaufler, CFA |

Since 2009 |

Portfolio Manager |

|||||||||

4

SEI / SUMMARY PROSPECTUS

Sub-Advisers and Portfolio Managers.

|

Sub-Adviser |

Portfolio Manager |

Experience with the Fund |

Title with Sub-Adviser |

||||||||||||

|

Delaware Investments Fund Advisers, a series of Delaware Management Business Trust |

Liu-Er Chen, CFA |

Since 2011 |

Senior Vice President, Chief Investment Officer — Emerging Markets and Healthcare |

||||||||||||

|

J O Hambro Capital Management Limited |

Emery Brewer Dr. Ivo Kovachev |

Since 2010 Since 2010 |

Senior Fund Manager Senior Fund Manager |

||||||||||||

|

KBI Global Investors (North America) Ltd |

Gareth Maher David Hogarty Ian Madden James Collery John Looby Massimiliano Tondi |

Since 2012 Since 2012 Since 2012 Since 2012 Since 2014 Since 2014 |

Head of Portfolio Management Head of Strategy Development Senior Portfolio Manager Senior Portfolio Manager Senior Portfolio Manager Senior Portfolio Manager |

||||||||||||

|

Lazard Asset Management LLC |

Kevin O'Hare, CFA Peter Gillespie, CFA James Donald, CFA John R. Reinsberg |

Since 2010 Since 2010 Since 2010 Since 2010 |

Managing Director, Portfolio Manager/Analyst Director, Portfolio Manager/Analyst Managing Director, Portfolio Manager/Analyst Deputy Chairman, Portfolio Manager/Analyst |

||||||||||||

|

Neuberger Berman Investment Advisers LLC |

Conrad A. Saldanha, CFA |

Since 2010 |

Managing Director |

||||||||||||

|

PanAgora Asset Management Inc. |

Jamie Lee, Ph.D. Oleg Nuzinson, CFA |

Since 2015 Since 2015 |

Director — Dynamic Equity Team Director — Dynamic Equity Team |

||||||||||||

|

RWC Asset Advisors (US) LLC |

James Johnstone John Malloy |

Since 2015 Since 2015 |

Portfolio Manager Portfolio Manager |

||||||||||||

Purchase and Sale of Fund Shares

The minimum initial investment for Class Y Shares is $100,000 with minimum subsequent investments of $1,000. Such minimums may be waived at the discretion of SIMC. Notwithstanding the foregoing, a higher minimum investment amount may be required for certain types of investors to be eligible to invest in Class Y shares. You may purchase and redeem shares of the Fund on any day that the New York Stock Exchange (NYSE) is open for business (a Business Day). You may sell your Fund shares by contacting your authorized financial institution or intermediary directly. Authorized financial institutions and intermediaries may redeem Fund shares on behalf of their clients by contacting the Fund's transfer agent (the Transfer Agent) or the Fund's authorized agent, using certain SEI Investments Company (SEI) or third party systems or by calling 1-800-858-7233, as applicable.

Tax Information

The distributions made by the Fund generally are taxable and will be taxed as ordinary income or capital gains. If you are investing through a tax-deferred arrangement, such as a 401(k) plan or individual retirement account, you will generally not be subject to federal taxation on Fund distributions until you begin receiving distributions from your tax-deferred arrangement. You should consult your tax advisor regarding the rules governing your tax-deferred arrangement.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

5