As filed with the Securities and Exchange Commission on January 28, 2014

File No. 033-22821

File No. 811-05601

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933 o

POST-EFFECTIVE AMENDMENT NO. 59 x

and

REGISTRATION STATEMENT UNDER THE

INVESTMENT COMPANY ACT OF 1940 o

AMENDMENT NO. 60 x

SEI INSTITUTIONAL INTERNATIONAL TRUST

(Formerly, "SEI International Trust")

(Exact Name of Registrant as Specified in Charter)

SEI Investments Company

One Freedom Valley Drive

Oaks, Pennsylvania 19456

(Address of Principal Executive Offices) (Zip Code)

Registrant's Telephone Number, including Area Code 610-676-1000

Timothy D. Barto

SEI Investments Company

One Freedom Valley Drive

Oaks, Pennsylvania 19456

(Name and Address of Agent for Service)

Copy to:

Timothy W. Levin, Esquire

Morgan, Lewis & Bockius LLP

1701 Market Street

Philadelphia, PA 19103

Title of Securities Being Registered. . .Units of Beneficial Interest

It is proposed that this filing become effective (check appropriate box)

o immediately upon filing pursuant to paragraph (b)

x on January 31, 2014 pursuant to paragraph (b)

o 60 days after filing pursuant to paragraph (a)(1)

o on [date] pursuant to paragraph (a)(1)

o 75 days after filing pursuant to paragraph (a)(2)

o on [date] pursuant to paragraph (a)(2) of Rule 485.

If appropriate, check the following box:

o This post-effective Amendment designates a new effective

date for a previously filed Post-Effective Amendment.

January 31, 2014

PROSPECTUS

SEI Institutional International Trust

Class A Shares

› International Equity Fund (SEITX)

› Emerging Markets Equity Fund (SIEMX)

› International Fixed Income Fund (SEFIX)

› Emerging Markets Debt Fund (SITEX)

The Securities and Exchange Commission and the Commodity Futures Trading Commission have not approved or disapproved these securities or this pool, or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Not all Funds appearing in this prospectus are available for purchase in all states. You may purchase Fund shares only if they are registered in your state.

seic.com

SEI / PROSPECTUS

SEI INSTITUTIONAL INTERNATIONAL TRUST

About This Prospectus

|

FUND SUMMARY |

|||||||

|

INTERNATIONAL EQUITY FUND |

1 |

||||||

|

EMERGING MARKETS EQUITY FUND |

6 |

||||||

|

INTERNATIONAL FIXED INCOME FUND |

11 |

||||||

|

EMERGING MARKETS DEBT FUND |

17 |

||||||

|

Purchase and Sale of Fund Shares |

23 |

||||||

|

Tax Information |

23 |

||||||

|

Payments to Broker-Dealers and Other Financial Intermediaries |

23 |

||||||

|

MORE INFORMATION ABOUT INVESTMENTS |

23 |

||||||

|

MORE INFORMATION ABOUT RISKS |

24 |

||||||

|

Risk Information Common to the Funds |

24 |

||||||

|

More Information About Principal Risks |

24 |

||||||

|

GLOBAL ASSET ALLOCATION |

33 |

||||||

|

MORE INFORMATION ABOUT THE FUNDS' BENCHMARK INDICES |

33 |

||||||

|

INVESTMENT ADVISER AND SUB-ADVISERS |

34 |

||||||

|

Information About Fee Waivers |

35 |

||||||

|

Sub-Advisers and Portfolio Managers |

35 |

||||||

|

Legal Proceedings |

42 |

||||||

|

PURCHASING, EXCHANGING AND SELLING FUND SHARES |

43 |

||||||

|

HOW TO PURCHASE FUND SHARES |

43 |

||||||

|

Pricing of Fund Shares |

44 |

||||||

|

Frequent Purchases and Redemptions of Fund Shares |

46 |

||||||

|

Foreign Investors |

47 |

||||||

|

Customer Identification and Verification and Anti-Money Laundering Program |

47 |

||||||

|

HOW TO EXCHANGE YOUR FUND SHARES |

48 |

||||||

|

HOW TO SELL YOUR FUND SHARES |

48 |

||||||

|

Receiving Your Money |

48 |

||||||

|

Redemptions in Kind |

48 |

||||||

|

Suspension of Your Right to Sell Your Shares |

49 |

||||||

|

Redemption Fee |

49 |

||||||

|

Telephone Transactions |

49 |

||||||

|

DISTRIBUTION AND SERVICE OF FUND SHARES |

50 |

||||||

|

DISCLOSURE OF PORTFOLIO HOLDINGS INFORMATION |

50 |

||||||

|

DIVIDENDS, DISTRIBUTIONS AND TAXES |

50 |

||||||

|

Dividends and Distributions |

50 |

||||||

|

Taxes |

50 |

||||||

|

FINANCIAL HIGHLIGHTS |

53 |

||||||

|

HOW TO OBTAIN MORE INFORMATION ABOUT SEI INSTITUTIONAL INTERNATIONAL TRUST |

Back Cover |

||||||

SEI / PROSPECTUS

INTERNATIONAL EQUITY FUND

Fund Summary

Investment Goal

Long-term capital appreciation.

Fees and Expenses

The following tables describe the fees and expenses that you may pay if you buy and hold Fund shares.

SHAREHOLDER FEES

|

(fees paid directly from your investment) |

Class A Shares |

||||||

|

Redemption Fee (applies to a redemption, or series of redemptions, from a single identifiable source that, in the aggregate, exceeds $50 million within any thirty (30) day period) |

0.75 |

% |

|||||

ANNUAL FUND OPERATING EXPENSES

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class A Shares |

||||||

|

Management Fees |

0.51 |

% |

|||||

|

Distribution (12b-1) Fees |

None |

||||||

|

Other Expenses |

0.74 |

% |

|||||

|

Total Annual Fund Operating Expenses |

1.25 |

% |

|||||

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||

|

International Equity Fund — Class A Shares |

$ |

127 |

$ |

397 |

$ |

686 |

$ |

1,511 |

|||||||||||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 47% of the average value of its portfolio.

1

SEI / PROSPECTUS

Principal Investment Strategies

Under normal circumstances, the International Equity Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities. Equity securities may include common stocks, preferred stock, warrants, participation notes and depositary receipts. The Fund will invest primarily in equity securities of issuers of all capitalization ranges that are located in at least three countries other than the U.S. It is expected that at least 40% of the Fund's assets will be invested outside the U.S. The Fund will invest primarily in companies located in developed countries, but may also invest in companies located in emerging markets. Generally, the Fund will invest less than 20% of its assets in emerging markets. Emerging market countries are those countries that are: (i) characterized as developing or emerging by any of the World Bank, the United Nations, the International Finance Corporation, or the European Bank for Reconstruction and Development; (ii) included in an emerging markets index by a recognized index provider; or (iii) countries with similar developing or emerging characteristics as countries classified as emerging market countries pursuant to sub-paragraph (i) and (ii) above, in each case determined at the time of purchase.

The Fund uses a multi-manager approach, relying upon a number of sub-advisers (each, a Sub-Adviser and collectively, the Sub-Advisers) with differing investment philosophies to manage portions of the Fund's portfolio under the general supervision of SEI Investments Management Corporation (SIMC), the Fund's adviser.

The Fund may invest in futures contracts, forward contracts and options for hedging purposes, including seeking to manage the Fund's currency exposure to foreign securities and mitigate the Fund's overall risk.

The Fund may purchase shares of exchange-traded funds (ETFs) to gain exposure to a particular portion of the market while awaiting an opportunity to purchase securities or other instruments directly.

Principal Risks

Credit Risk — The risk that the issuer of a security or the counterparty to a contract will default or otherwise become unable to honor a financial obligation.

Currency Risk — As a result of the Fund's investments in securities denominated in, and/or receiving revenues in, foreign currencies, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an investment in the Fund would be adversely affected. Currency exchange rates may fluctuate in response to, among other things, changes in interest rates, intervention (or failure to intervene) by U.S. or foreign governments, central banks or supranational entities, or by the imposition of currency controls or other political developments in the United States or abroad.

Depositary Receipts — Depositary receipts, such as American depositary receipts (ADRs), are certificates evidencing ownership of shares of a foreign issuer that are issued by depositary banks and generally trade on an established market. Depositary receipts are subject to many of the risks associated with investing directly in foreign securities, including, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments.

2

SEI / PROSPECTUS

Derivatives Risk — The Fund's use of futures contracts, forward contracts and options is subject to market risk, leverage risk, correlation risk and liquidity risk. Leverage risk and liquidity risk are described below. Market risk is the risk that the market value of an investment may move up and down, sometimes rapidly and unpredictably. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. The Fund's use of over-the-counter forward contracts is also subject to credit risk and valuation risk. Valuation risk is the risk that the derivative may be difficult to value and/or valued incorrectly. Credit risk is described above. Each of the above risks could cause the Fund to lose more than the principal amount invested in a derivative instrument.

Equity Market Risk — The risk that stock prices will fall over short or extended periods of time.

Exchange-Traded Funds (ETFs) Risk — The risks of owning shares of an ETF generally reflect the risks of owning the underlying securities the ETF is designed to track, although lack of liquidity in an ETF could result in its value being more volatile than the underlying portfolio securities. When the Fund invests in an ETF, in addition to directly bearing the expenses associated with its own operations, it will bear a pro rata portion of the ETF's expenses.

Foreign Investment/Emerging Markets Risk — The risk that non-U.S. securities may be subject to additional risks due to, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments. These additional risks may be heightened with respect to emerging market countries since political turmoil and rapid changes in economic conditions are more likely to occur in these countries.

Investment Style Risk — The risk that developed international equity securities may underperform other segments of the equity markets or the equity markets as a whole.

Leverage Risk — The Fund's use of derivatives may result in the Fund's total investment exposure substantially exceeding the value of its portfolio securities and the Fund's investment returns depending substantially on the performance of securities that the Fund may not directly own. The use of leverage can amplify the effects of market volatility on the Fund's share price and may also cause the Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. The Fund's use of leverage may result in a heightened risk of investment loss.

Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to lower the price, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance.

Portfolio Turnover Risk — Due to its investment strategy, the Fund may buy and sell securities frequently. This may result in higher transaction costs and additional capital gains tax liabilities.

Small and Medium Capitalization Risk — The risk that small and medium capitalization companies in which the Fund invests may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, small and medium capitalization companies may have limited product lines, markets and financial resources and may depend upon a relatively small management group. Therefore, small capitalization and medium capitalization stocks may be more volatile than those of larger companies. Small capitalization and medium capitalization stocks may be traded over-the-counter or listed on an exchange.

Loss of money is a risk of investing in the Fund.

3

SEI / PROSPECTUS

Performance Information

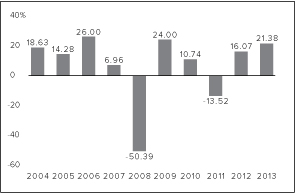

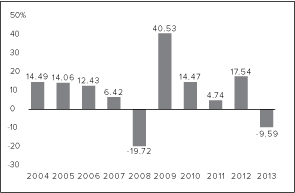

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compare with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

Best Quarter: 22.98% (06/30/2009)

Worst Quarter: -26.13% (09/30/2008)

Average Annual Total Returns (for the periods ended December 31, 2013)

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

International Equity Fund — Class A Shares |

1 Year |

5 Years |

10 Years |

Since Inception* (12/20/1989) |

|||||||||||||||

|

Return Before Taxes |

21.38 |

% |

10.84 |

% |

4.25 |

% |

3.76 |

% |

|||||||||||

|

Return After Taxes on Distributions |

21.13 |

% |

10.72 |

% |

3.61 |

% |

2.91 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

12.50 |

% |

8.80 |

% |

3.58 |

% |

2.93 |

% |

|||||||||||

|

MSCI EAFE Index Return (reflects no deduction for fees, expenses or taxes) |

22.78 |

% |

12.44 |

% |

6.91 |

% |

4.71 |

% |

|||||||||||

* Index returns are shown from December 31, 1989.

4

SEI / PROSPECTUS

Management

Investment Adviser. SEI Investments Management Corporation

Sub-Advisers and Portfolio Managers.

|

Sub-Adviser |

Portfolio Manager |

Experience with the Fund |

Title with Sub-Adviser |

||||||||||||

|

Acadian Asset Management LLC |

John Chisholm Asha Mehta |

Since 2009 Since 2010 |

Executive Vice President, Chief Investment Officer Vice President, Portfolio Manager |

||||||||||||

|

Causeway Capital Management LLC |

Sarah H. Ketterer Harry W. Hartford James A. Doyle Jonathan P. Eng Kevin Durkin Conor Muldoon, CFA Foster Corwith, CFA Alessandro Valentini, CFA |

Since 2010 Since 2010 Since 2010 Since 2010 Since 2010 Since 2010 Since 2013 Since 2013 |

Chief Executive Officer President Director Director Director Director Director Director |

||||||||||||

|

INTECH Investment Management LLC |

Adrian Banner, Ph.D. Joseph Runnels, CFA Vassilios Papathanakos, Ph.D. Phillip Whitman, Ph.D. |

Since 2009 Since 2009 Since 2012 Since 2012 |

Chief Executive Officer and Chief Investment Officer Vice President — Portfolio Management Deputy Chief Investment Officer Director of Research |

||||||||||||

|

Neuberger Berman Management LLC |

Benjamin Segal, CFA |

Since 2010 |

Managing Director |

||||||||||||

|

Schroder Investment Management North America Inc |

Simon Webber |

Since 2010 |

Lead Portfolio Manager, Global and International Equities |

||||||||||||

|

Tradewinds Global Investors, LLC |

Peter L. Boardman |

Since 2010 |

Managing Director, Equity Analyst and Portfolio Manager |

||||||||||||

For important information about Purchase and Sale of Fund Shares, Tax Information and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 23 of this prospectus.

5

SEI / PROSPECTUS

EMERGING MARKETS EQUITY FUND

Fund Summary

Investment Goal

Capital appreciation.

Fees and Expenses

The following tables describe the fees and expenses that you may pay if you buy and hold Fund shares.

SHAREHOLDER FEES

|

(fees paid directly from your investment) |

Class A Shares |

||||||

|

Redemption Fee (applies to a redemption, or series of redemptions, from a single identifiable source that, in the aggregate, exceeds $25 million within any thirty (30) day period) |

1.25 |

% |

|||||

ANNUAL FUND OPERATING EXPENSES

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class A Shares |

||||||

|

Management Fees |

1.05 |

% |

|||||

|

Distribution (12b-1) Fees |

None |

||||||

|

Other Expenses |

0.99 |

% |

|||||

|

Acquired Fund Fees and Expenses (AFFE) |

0.02 |

% |

|||||

|

Total Annual Fund Operating Expenses |

2.06 |

%† |

|||||

† The Fund incurred AFFE during the most recent fiscal year, and therefore the operating expenses in this fee table will not correlate to the expense ratio in the Fund's financial statements (or the "Financial Highlights" section in the prospectus). The financial statements include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in underlying funds.

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||

|

Emerging Markets Equity Fund — Class A Shares |

$ |

209 |

$ |

646 |

$ |

1,108 |

$ |

2,390 |

|||||||||||

6

SEI / PROSPECTUS

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 78% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, the Emerging Markets Equity Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities of emerging market issuers. Equity securities may include common stocks, preferred stock, warrants, participation notes and depositary receipts. The Fund normally maintains investments in at least six emerging market countries and does not invest more than 35% of its total assets in any one emerging market country. Emerging market countries are those countries that are: (i) characterized as developing or emerging by any of the World Bank, the United Nations, the International Finance Corporation, or the European Bank for Reconstruction and Development; (ii) included in an emerging markets index by a recognized index provider; or (iii) countries with similar developing or emerging characteristics as countries classified as emerging market countries pursuant to sub-paragraph (i) and (ii) above, in each case determined at the time of purchase.

The Fund uses a multi-manager approach, relying upon a number of sub-advisers (each, a Sub-Adviser and collectively, the Sub-Advisers) with differing investment philosophies to manage portions of the Fund's portfolio under the general supervision of SEI Investments Management Corporation (SIMC), the Fund's adviser.

The Fund may invest in futures contracts, forward contracts and options for hedging purposes, including seeking to manage the Fund's currency exposure to foreign securities and mitigate the Fund's overall risk.

The Fund may purchase shares of exchange-traded funds (ETFs) to gain exposure to a particular portion of the market while awaiting an opportunity to purchase securities or other instruments directly. The Fund may also invest a portion of its assets in securities of companies located in developed foreign countries and securities of small capitalization companies.

Principal Risks

Credit Risk — The risk that the issuer of a security or the counterparty to a contract will default or otherwise become unable to honor a financial obligation.

Currency Risk — As a result of the Fund's investments in securities denominated in, and/or receiving revenues in, foreign currencies, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an investment in the Fund would be adversely affected. Currency exchange rates may fluctuate in response to, among other things, changes in interest rates, intervention (or failure to intervene) by U.S. or foreign governments, central banks or supranational entities, or by the imposition of currency controls or other political developments in the United States or abroad.

7

SEI / PROSPECTUS

Depositary Receipts — Depositary receipts, such as American depositary receipts (ADRs), are certificates evidencing ownership of shares of a foreign issuer that are issued by depositary banks and generally trade on an established market. Depositary receipts are subject to many of the risks associated with investing directly in foreign securities, including, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments.

Derivatives Risk — The Fund's use of futures and forward contracts and options is subject to market risk, leverage risk, correlation risk and liquidity risk. Leverage risk and liquidity risk are described below. Market risk is the risk that the market value of an investment may move up and down, sometimes rapidly and unpredictably. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. The Fund's use of over-the-counter forward contracts is also subject to credit risk and valuation risk. Valuation risk is the risk that the derivative may be difficult to value and/or valued incorrectly. Credit risk is described above. Each of the above risks could cause the Fund to lose more than the principal amount invested in a derivative instrument.

Equity Market Risk — The risk that stock prices will fall over short or extended periods of time.

Exchange-Traded Funds (ETFs) Risk — The risks of owning shares of an ETF generally reflect the risks of owning the underlying securities the ETF is designed to track, although lack of liquidity in an ETF could result in its value being more volatile than the underlying portfolio securities. When the Fund invests in an ETF, in addition to directly bearing the expenses associated with its own operations, it will bear a pro rata portion of the ETF's expenses.

Foreign Investment/Emerging Markets Risk — The risk that non-U.S. securities may be subject to additional risks due to, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments. These additional risks may be heightened with respect to emerging market countries since political turmoil and rapid changes in economic conditions are more likely to occur in these countries.

Investment Style Risk — The risk that emerging market equity securities may underperform other segments of the equity markets or the equity markets as a whole.

Leverage Risk — The Fund's use of derivatives may result in the Fund's total investment exposure substantially exceeding the value of its portfolio securities and the Fund's investment returns depending substantially on the performance of securities that the Fund may not directly own. The use of leverage can amplify the effects of market volatility on the Fund's share price and may also cause the Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. The Fund's use of leverage may result in a heightened risk of investment loss.

Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to lower the price, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance.

Portfolio Turnover Risk — Due to its investment strategy, the Fund may buy and sell securities frequently. This may result in higher transaction costs and additional capital gains tax liabilities.

Small and Medium Capitalization Risk — The risk that small and medium capitalization companies in which the Fund invests may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, small and medium capitalization companies may have limited

8

SEI / PROSPECTUS

product lines, markets and financial resources and may depend upon a relatively small management group. Therefore, small capitalization and medium capitalization stocks may be more volatile than those of larger companies. Small capitalization and medium capitalization stocks may be traded over the counter or listed on an exchange.

Loss of money is a risk of investing in the Fund.

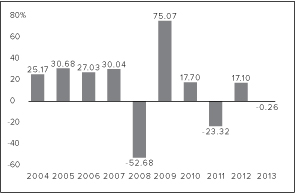

Performance Information

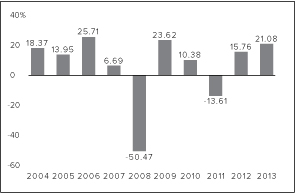

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compare with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

Best Quarter: 34.40% (06/30/2009)

Worst Quarter: -27.79% (12/31/2008)

Average Annual Total Returns (for the periods ended December 31, 2013)

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

Emerging Markets Equity Fund — Class A Shares |

1 Year |

5 Years |

10 Years |

Since Inception* (1/17/1995) |

|||||||||||||||

|

Return Before Taxes |

-0.26 |

% |

13.04 |

% |

8.96 |

% |

4.97 |

% |

|||||||||||

|

Return After Taxes on Distributions |

-0.22 |

% |

13.14 |

% |

7.82 |

% |

4.39 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

0.10 |

% |

10.73 |

% |

7.85 |

% |

4.38 |

% |

|||||||||||

|

MSCI Emerging Markets Index Return (reflects no deduction for fees, expenses or taxes) |

-2.27 |

% |

15.15 |

% |

11.52 |

% |

7.10 |

% |

|||||||||||

* Index returns are shown from January 31, 1995.

9

SEI / PROSPECTUS

Management

Investment Adviser. SEI Investments Management Corporation

Sub-Advisers and Portfolio Managers.

|

Sub-Adviser |

Portfolio Manager |

Experience with the Fund |

Title with Sub-Adviser |

||||||||||||

|

Delaware Investments Fund Advisers, a series of Delaware Management Business Trust |

Liu-Er Chen, CFA |

Since 2011 |

Senior Vice President, Chief Investment Officer — Emerging Markets and Healthcare |

||||||||||||

|

JO Hambro Capital Management Limited |

Emery Brewer Dr. Ivo Kovachev |

Since 2010 Since 2010 |

Senior Fund Manager Senior Fund Manager |

||||||||||||

|

Kleinwort Benson Investors International Ltd |

Gareth Maher David Hogarty Ian Madden James Collery |

Since 2012 Since 2012 Since 2012 Since 2012 |

Head of Portfolio Management Head of Strategy Development Portfolio Manager Portfolio Manager |

||||||||||||

|

Lazard Asset Management LLC |

Kevin O'Hare, CFA Peter Gillespie, CFA James Donald, CFA John R. Reinsberg |

Since 2010 Since 2010 Since 2010 Since 2010 |

Managing Director, Portfolio Manager/Analyst Director, Portfolio Manager/Analyst Managing Director, Portfolio Manager/Analyst Deputy Chairman, Portfolio Manager/Analyst |

||||||||||||

|

Neuberger Berman Management LLC |

Conrad A. Saldanha, CFA |

Since 2010 |

Managing Director |

||||||||||||

|

PanAgora Asset Management Inc |

Jane Zhao, Ph.D. Dmitri Kantsyrev, Ph.D., CFA |

Since 2007 Since 2007 |

Director on the Dynamic Equity Management Team Director on the Dynamic Modeling Team |

||||||||||||

For important information about Purchase and Sale of Fund Shares, Tax Information and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 23 of this prospectus.

10

SEI / PROSPECTUS

INTERNATIONAL FIXED INCOME FUND

Fund Summary

Investment Goal

Capital appreciation and current income.

Fees and Expenses

The following tables describe the fees and expenses that you may pay if you buy and hold Fund shares.

SHAREHOLDER FEES

|

(fees paid directly from your investment) |

Class A Shares |

||||||

|

Redemption Fee (applies to a redemption, or series of redemptions, from a single identifiable source that, in the aggregate, exceeds $25 million within any thirty (30) day period) |

1.00 |

% |

|||||

ANNUAL FUND OPERATING EXPENSES

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class A Shares |

||||||

|

Management Fees |

0.30 |

% |

|||||

|

Distribution (12b-1) Fees |

None |

||||||

|

Other Expenses |

0.90 |

% |

|||||

|

Total Annual Fund Operating Expenses |

1.20 |

% |

|||||

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||

|

International Fixed Income Fund — Class A Shares |

$ |

122 |

$ |

381 |

$ |

660 |

$ |

1,455 |

|||||||||||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 86% of the average value of its portfolio.

11

SEI / PROSPECTUS

Principal Investment Strategies

Under normal circumstances, the International Fixed Income Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in fixed income securities. The Fund will invest primarily in investment grade foreign government and corporate fixed income securities, as well as foreign mortgage-backed and/or asset-backed fixed income securities, of issuers located in at least three countries other than the U.S. It is expected that at least 40% of the Fund's assets will be invested in non-U.S. securities. Other fixed income securities in which the Fund may invest include: (i) securities issued or guaranteed by the U.S. Government and its agencies and instrumentalities and obligations of U.S. commercial banks, such as certificates of deposit, time deposits, bankers' acceptances and bank notes; and (ii) U.S. corporate debt securities and mortgage-backed and asset-backed securities. The Fund uses a multi-manager approach, relying upon a number of sub-advisers (each, a Sub-Adviser and collectively, the Sub-Advisers) with differing investment philosophies to manage portions of the Fund's portfolio under the general supervision of SEI Investments Management Corporation (SIMC), the Fund's adviser. In selecting investments for the Fund, the Sub-Advisers choose securities issued by corporations and governments located in various countries, looking for opportunities to achieve capital appreciation and gain, as well as current income. There are no restrictions on the Fund's average portfolio maturity or on the maturity of any specific security.

The Sub-Advisers may seek to enhance the Fund's return by actively managing the Fund's foreign currency exposure. In managing the Fund's currency exposure, the Sub-Advisers buy and sell currencies (i.e., take long or short positions) using derivatives, principally futures, foreign currency forward contracts and currency swaps. The Fund may take long and short positions in foreign currencies in excess of the value of the Fund's assets denominated in a particular currency or when the Fund does not own assets denominated in that currency. The Fund may also engage in currency transactions in an attempt to take advantage of certain inefficiencies in the currency exchange market, to increase its exposure to a foreign currency or to shift exposure to foreign currency fluctuations from one currency to another. In managing the Fund's currency exposure for foreign securities, the Sub-Advisers may buy and sell currencies for hedging or for speculative purposes.

The Fund may also invest in futures contracts, forward contracts and swaps for speculative or hedging purposes. Futures contracts, forward contracts and swaps are used to synthetically obtain exposure to the securities identified above or baskets of such securities and to manage the Fund's interest rate duration and yield curve exposure. These derivatives are also used to mitigate the Fund's overall level of risk and/or the Fund's risk to particular types of securities, currencies or market segments. Interest rate swaps are further used to manage the Fund's yield spread sensitivity. When the Fund seeks to take an active long or short position with respect to the likelihood of an event of default of a security or basket of securities, the Fund may use credit default swaps. The Fund may buy credit default swaps in an attempt to manage credit risk where the Fund has credit exposure to an issuer and the Fund may sell credit default swaps to more efficiently gain credit exposure to such security or basket of securities.

The Fund will also invest in securities rated below investment grade (junk bonds). However, in general, the Fund will purchase bonds with a rating of CCC or above. The Fund also invests a portion of its assets in bank loans, which are generally non-investment grade floating rate instruments. The Fund may invest in bank loans in the form of participations in the loans (participations) and assignments of all or a portion of the loans from third parties (assignments).

12

SEI / PROSPECTUS

The Fund may purchase shares of exchange-traded funds (ETFs) to gain exposure to a particular portion of the market while awaiting an opportunity to purchase securities or other instruments directly.

Principal Risks

Asset-Backed Securities Risk — Payment of principal and interest on asset-backed securities is dependent largely on the cash flows generated by the assets backing the securities, and asset-backed securities may not have the benefit of any security interest in the related assets.

Bank Loans Risk — With respect to bank loans, the Fund will assume the credit risk of both the borrower and the lender that is selling the participation. The Fund may also have difficulty disposing of bank loans because, in certain cases, the market for such instruments is not highly liquid.

Below Investment Grade Securities (Junk Bonds) Risk — Fixed income securities rated below investment grade (junk bonds) involve greater risks of default or downgrade and are more volatile than investment grade securities because the prospect for repayment of principal and interest of many of these securities is speculative. Because these securities typically offer a higher rate of return to compensate investors for these risks, they are sometimes referred to as "high yield bonds," but there is no guarantee that an investment in these securities will result in a high rate of return.

Corporate Fixed Income Securities Risk — Corporate fixed income securities respond to economic developments, especially changes in interest rates, as well as perceptions of the creditworthiness and business prospects of individual issuers.

Credit Risk — The risk that the issuer of a security or the counterparty to a contract will default or otherwise become unable to honor a financial obligation.

Currency Risk — As a result of the Fund's investments in securities or other investments denominated in, and/or receiving revenues in, foreign currencies and the Fund's active management of its currency exposures, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an investment in the Fund would be adversely affected. Due to the Fund's active positions in currencies, it will be subject to the risk that currency exchange rates may fluctuate in response to, among other things, changes in interest rates, intervention (or failure to intervene) by U.S. or foreign governments, central banks or supranational entities, or by the imposition of currency controls or other political developments in the United States or abroad.

Derivatives Risk — The Fund's use of swaps, futures and forward contracts is subject to market risk, leverage risk, correlation risk and liquidity risk. Leverage risk and liquidity risk are described below. Market risk is the risk that the market value of an investment may move up and down, sometimes rapidly and unpredictably. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. The Fund's use of swaps and over-the-counter forward contracts is also subject to credit risk and valuation risk. Valuation risk is the risk that the derivative may be difficult to value and/or valued incorrectly. Credit risk is described above. Each of the above risks could cause the Fund to lose more than the principal amount invested in a derivative instrument.

13

SEI / PROSPECTUS

Exchange-Traded Funds (ETFs) Risk — The risks of owning shares of an ETF generally reflect the risks of owning the underlying securities the ETF is designed to track, although lack of liquidity in an ETF could result in its value being more volatile than the underlying portfolio securities. When the Fund invests in an ETF, in addition to directly bearing the expenses associated with its own operations, it will bear a pro rata portion of the ETF's expenses.

Extension Risk — The risk that rising interest rates may extend the duration of a fixed income security, typically reducing the security's value.

Fixed Income Market Risk — The prices of the Fund's fixed income securities respond to economic developments, particularly interest rate changes, as well as to perceptions about the creditworthiness of individual issuers, including governments and their agencies. Generally, the Fund's fixed income securities will decrease in value if interest rates rise and vice versa. Declines in dealer market-making capacity as a result of structural or regulatory changes could decrease liquidity and/or increase volatility in the fixed income markets. In the case of foreign securities, price fluctuations will reflect international economic and political events, as well as changes in currency valuations relative to the U.S. dollar. In response to these events, the Fund's value may fluctuate and/or the Fund may experience increased redemptions from shareholders, which may impact the fund's liquidity or force the fund to sell securities into a declining or illiquid market.

Foreign Investment/Emerging Markets Risk — The risk that non-U.S. securities may be subject to additional risks due to, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments. These additional risks may be heightened with respect to emerging market countries since political turmoil and rapid changes in economic conditions are more likely to occur in these countries.

Interest Rate Risk — The risk that a rise in interest rates will cause a fall in the value of fixed income securities, including U.S. Government securities, in which a Fund invests. Although U.S. Government securities are considered to be among the safest investments, they are not guaranteed against price movements due to changing interest rates. A low interest rate environment may present greater interest rate risk, because there may be a greater likelihood of rates increasing and rates may increase more rapidly.

Investment Style Risk — The risk that developed international fixed income securities may underperform other segments of the fixed income markets or the fixed income markets as a whole.

Leverage Risk — The Fund's use of derivatives may result in the Fund's total investment exposure substantially exceeding the value of its portfolio securities and the Fund's investment returns depending substantially on the performance of securities that the Fund may not directly own. The use of leverage can amplify the effects of market volatility on the Fund's share price and may also cause the Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. The Fund's use of leverage may result in a heightened risk of investment loss.

Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to lower the price, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance.

14

SEI / PROSPECTUS

Mortgage-Backed Securities Risk — Mortgage-backed securities are affected by, among other things, interest rate changes and the possibility of prepayment of the underlying mortgage loans. Mortgage-backed securities are also subject to the risk that underlying borrowers will be unable to meet their obligations.

Non-Diversified Risk — The Fund is non-diversified, which means that it may invest in the securities of relatively few issuers. As a result, the Fund may be more susceptible to a single adverse economic or political occurrence affecting one or more of these issuers and may experience increased volatility due to its investments in those securities.

Portfolio Turnover Risk — Due to its investment strategy, the Fund may buy and sell securities frequently. This may result in higher transaction costs and additional capital gains tax liabilities.

Prepayment Risk — The risk that with declining interest rates, fixed income securities with stated interest rates may have the principal paid earlier than expected, requiring the Fund to invest the proceeds at generally lower interest rates.

Loss of money is a risk of investing in the Fund.

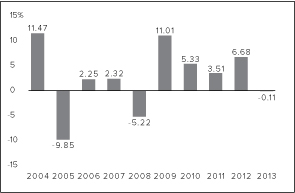

Performance Information

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compare with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

Best Quarter: 10.83% (12/31/2004)

Worst Quarter: -3.03% (06/30/2005)

15

SEI / PROSPECTUS

Average Annual Total Returns (for the periods ended December 31, 2013)

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

International Fixed Income Fund — Class A Shares |

1 Year |

5 Years |

10 Years |

Since Inception* (9/1/1993) |

|||||||||||||||

|

Return Before Taxes |

-0.11 |

% |

5.22 |

% |

2.54 |

% |

4.40 |

% |

|||||||||||

|

Return After Taxes on Distributions |

-0.35 |

% |

4.23 |

% |

1.15 |

% |

2.88 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

-0.06 |

% |

3.71 |

% |

1.46 |

% |

2.87 |

% |

|||||||||||

|

Barclays Global Aggregate ex-US Index, Hedged Return (reflects no deduction for fees, expenses or taxes) |

1.18 |

% |

3.85 |

% |

4.31 |

% |

5.91 |

% |

|||||||||||

* Index returns are shown from September 30, 1993.

Management

Investment Adviser. SEI Investments Management Corporation

Sub-Advisers and Portfolio Managers.

|

Sub-Adviser |

Portfolio Manager |

Experience with the Fund |

Title with Sub-Adviser |

||||||||||||

|

AllianceBernstein L.P. |

Douglas J. Peebles Scott DiMaggio John Taylor Jorgen Kjaersgaard Daniel Loughney |

Since 2006 Since 2006 Since 2012 Since 2013 Since 2013 |

Executive Vice President, Chief Investment Officer of Fixed Income and Director of Global Fixed Income Vice President, Director of Global and Canada Fixed Income Vice President Portfolio Manager — European Credit Portfolio Manager — UK Multi-Sector |

||||||||||||

|

FIL Investment Advisors |

Andrew Weir |

Since 2007 |

Portfolio Manager |

||||||||||||

|

Wellington Management Company, LLP |

Robert L. Evans |

Since 2009 |

Director and Fixed Income Portfolio Manager affiliated with Wellington Management Company, LLP and located outside the U.S. |

||||||||||||

For important information about Purchase and Sale of Fund Shares, Tax Information and Payments to Broker-Dealers and Other Financial Intermediaries, please page 23 of this prospectus.

16

SEI / PROSPECTUS

EMERGING MARKETS DEBT FUND

Fund Summary

Investment Goal

Maximize total return.

Fees and Expenses

The following tables describe the fees and expenses that you may pay if you buy and hold Fund shares.

SHAREHOLDER FEES

|

(fees paid directly from your investment) |

Class A Shares |

||||||

|

Redemption Fee (applies to a redemption, or series of redemptions, from a single identifiable source that, in the aggregate, exceeds $25 million within any thirty (30) day period) |

1.00 |

% |

|||||

ANNUAL FUND OPERATING EXPENSES

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class A Shares |

||||||

|

Management Fees |

0.85 |

% |

|||||

|

Distribution (12b-1) Fees |

None |

||||||

|

Other Expenses |

0.96 |

% |

|||||

|

Total Annual Fund Operating Expenses |

1.81 |

% |

|||||

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||

|

Emerging Markets Debt Fund — Class A Shares |

$ |

184 |

$ |

569 |

$ |

980 |

$ |

2,127 |

|||||||||||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 90% of the average value of its portfolio.

17

SEI / PROSPECTUS

Principal Investment Strategies

Under normal circumstances, the Emerging Markets Debt Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in fixed income securities of emerging market issuers. The Fund will invest in debt securities of government, government-related and corporate issuers in emerging market countries, as well as entities organized to restructure the outstanding debt of such issuers. The Fund may obtain its exposures by investing directly (e.g., in fixed income securities and other instruments) or indirectly/synthetically (e.g., through the use of derivative instruments, principally futures contracts, forward contracts, swaps, including fully funded total return swaps and interest rate swaps, and structured securities, such as credit-linked notes). Emerging market countries are those countries that are: (i) characterized as developing or emerging by any of the World Bank, the United Nations, the International Finance Corporation, or the European Bank for Reconstruction and Development; (ii) included in an emerging markets index by a recognized index provider; or (iii) countries with similar developing or emerging characteristics as countries classified as emerging market countries pursuant to sub-paragraph (i) and (ii) above, in each case determined at the time of purchase.

The Fund uses a multi-manager approach, relying upon a number of sub-advisers (each, a Sub-Adviser and collectively, the Sub-Advisers) with differing investment philosophies to manage portions of the Fund's portfolio under the general supervision of SEI Investments Management Corporation (SIMC), the Fund's adviser. The Sub-Advisers will spread the Fund's holdings across a number of countries and industries to limit its exposure to a single emerging market economy and may not invest more than 25% of its assets in any single country. There are no restrictions on the Fund's average portfolio maturity or on the maturity of any specific security. There is no minimum rating standard for the Fund's securities, and the Fund's securities will generally be in the lower or lowest rating categories (including those below the fourth highest rating category by a Nationally Recognized Statistical Rating Organization (NRSRO), commonly referred to as junk bonds).

The Sub-Advisers may seek to enhance the Fund's return by actively managing the Fund's foreign currency exposure. In managing the Fund's currency exposure, the Sub-Advisers buy and sell currencies (i.e., take long or short positions) using derivatives, principally futures, foreign currency forward contracts and currency swaps. The Fund may take long and short positions in foreign currencies in excess of the value of the Fund's assets denominated in a particular currency or when the Fund does not own assets denominated in that currency. The Fund may also engage in currency transactions in an attempt to take advantage of certain inefficiencies in the currency exchange market, to increase its exposure to a foreign currency or to shift exposure to foreign currency fluctuations from one currency to another. In managing the Fund's currency exposure for foreign securities, the Sub-Advisers may buy and sell currencies for hedging or for speculative purposes.

The Fund may purchase shares of exchange-traded funds (ETFs) to gain exposure to a particular portion of the market while awaiting an opportunity to purchase securities or other instruments directly.

Principal Risks

Below Investment Grade Securities (Junk Bonds) Risk — Fixed income securities rated below investment grade (junk bonds) involve greater risks of default or downgrade and are more volatile than investment grade securities because the prospect for repayment of principal and interest of many of these securities is speculative. Because these securities typically offer a higher rate of return to compensate

18

SEI / PROSPECTUS

investors for these risks, they are sometimes referred to as "high yield bonds," but there is no guarantee that an investment in these securities will result in a high rate of return.

Corporate Fixed Income Securities Risk — Corporate fixed income securities respond to economic developments, especially changes in interest rates, as well as perceptions of the creditworthiness and business prospects of individual issuers.

Credit Risk — The risk that the issuer of a security or the counterparty to a contract will default or otherwise become unable to honor a financial obligation.

Currency Risk — As a result of the Fund's investments in securities or other investments denominated in, and/or receiving revenues in, foreign currencies and the Fund's active management of its currency exposures, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an investment in the Fund would be adversely affected. Due to the Fund's active positions in currencies, it will be subject to the risk that currency exchange rates may fluctuate in response to, among other things, changes in interest rates, intervention (or failure to intervene) by U.S. or foreign governments, central banks or supranational entities, or by the imposition of currency controls or other political developments in the United States or abroad.

Derivatives Risk — The Fund's use of futures contracts, forward contracts, swaps and credit-linked notes is subject to market risk, leverage risk, correlation risk and liquidity risk. Leverage risk and liquidity risk are described below. Market risk is the risk that the market value of an investment may move up and down, sometimes rapidly and unpredictably. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. The Fund's use of over-the-counter forward contracts, credit-linked notes and swap agreements is also subject to credit risk and valuation risk. Valuation risk is the risk that the derivative may be difficult to value and/or valued incorrectly. Credit risk is described above. Each of the above risks could cause the Fund to lose more than the principal amount invested in a derivative instrument.

Exchange-Traded Funds (ETFs) Risk — The risks of owning shares of an ETF generally reflect the risks of owning the underlying securities the ETF is designed to track, although lack of liquidity in an ETF could result in its value being more volatile than the underlying portfolio securities. When the Fund invests in an ETF, in addition to directly bearing the expenses associated with its own operations, it will bear a pro rata portion of the ETF's expenses.

Extension Risk — The risk that rising interest rates may extend the duration of a fixed income security, typically reducing the security's value.

Fixed Income Market Risk — The prices of the Fund's fixed income securities respond to economic developments, particularly interest rate changes, as well as to perceptions about the creditworthiness of individual issuers, including governments and their agencies. Generally, the Fund's fixed income securities will decrease in value if interest rates rise and vice versa. Declines in dealer market-making capacity as a result of structural or regulatory changes could decrease liquidity and/or increase volatility in the fixed income markets. In the case of foreign securities, price fluctuations will reflect international economic and political events, as well as changes in currency valuations relative to the U.S. dollar. In response to these events, the Fund's value may fluctuate and/or the Fund may experience increased redemptions from shareholders, which may impact the fund's liquidity or force the fund to sell securities into a declining or illiquid market.

19

SEI / PROSPECTUS

Foreign Investment/Emerging Markets Risk — The risk that non-U.S. securities may be subject to additional risks due to, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments. These additional risks may be heightened with respect to emerging market countries since political turmoil and rapid changes in economic conditions are more likely to occur in these countries.

Foreign Sovereign Debt Securities Risk — The risks that (i) the governmental entity that controls the repayment of sovereign debt may not be willing or able to repay the principal and/or interest when it becomes due, due to factors such as debt service burden, political constraints, cash flow problems and other national economic factors; (ii) governments may default on their debt securities, which may require holders of such securities to participate in debt rescheduling or additional lending to defaulting governments; and (iii) there is no bankruptcy proceeding by which defaulted sovereign debt may be collected in whole or in part.

Interest Rate Risk — The risk that a rise in interest rates will cause a fall in the value of fixed income securities, including U.S. Government securities, in which a Fund invests. Although U.S. Government securities are considered to be among the safest investments, they are not guaranteed against price movements due to changing interest rates. A low interest rate environment may present greater interest rate risk, because there may be a greater likelihood of rates increasing and rates may increase more rapidly.

Investment Style Risk — The risk that emerging market debt securities may underperform other segments of the fixed income markets or the fixed income markets as a whole.

Leverage Risk — The Fund's use of derivatives may result in the Fund's total investment exposure substantially exceeding the value of its portfolio securities and the Fund's investment returns depending substantially on the performance of securities that the Fund may not directly own. The use of leverage can amplify the effects of market volatility on the Fund's share price and may also cause the Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. The Fund's use of leverage may result in a heightened risk of investment loss.

Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to lower the price, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance.

Non-Diversified Risk — The Fund is non-diversified, which means that it may invest in the securities of relatively few issuers. As a result, the Fund may be more susceptible to a single adverse economic or political occurrence affecting one or more of these issuers and may experience increased volatility due to its investments in those securities.

Portfolio Turnover Risk — Due to its investment strategy, the Fund may buy and sell securities frequently. This may result in higher transaction costs and additional capital gains tax liabilities.

Prepayment Risk — The risk that with declining interest rates, fixed income securities with stated interest rates may have the principal paid earlier than expected, requiring the Fund to invest the proceeds at generally lower interest rates.

Loss of money is a risk of investing in the Fund.

20

SEI / PROSPECTUS

Performance Information

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compare with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI.

Best Quarter: 15.11% (06/30/2009)

Worst Quarter: -13.19% (12/31/2008)

Average Annual Total Returns (for the periods ended December 31, 2013)

This table compares the Fund's average annual total returns to those of a broad-based index and the Fund's 50/50 Blended Benchmark, which consists of the J.P. Morgan Emerging Markets Bond Index (EMBI) Global Diversified Index (50%) and the J.P. Morgan Government Bond Index-Emerging Markets (GBI-EM) Global Diversified Index (50%). The Fund's Blended Benchmark is designed to provide a useful comparison to the Fund's overall performance and more accurately reflects the Fund's investment strategy than the broad-based index.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

21

SEI / PROSPECTUS

|

Emerging Markets Debt Fund — Class A Shares |

1 Year |

5 Years |

10 Years |

Since Inception* (6/26/1997) |

|||||||||||||||

|

Return Before Taxes |

-9.59 |

% |

12.36 |

% |

8.43 |

% |

9.49 |

% |

|||||||||||

|

Return After Taxes on Distributions |

-11.14 |

% |

9.89 |

% |

5.72 |

% |

6.25 |

% |

|||||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

-5.29 |

% |

9.01 |

% |

5.79 |

% |

6.25 |

% |

|||||||||||

|

J.P. Morgan EMBI Global Diversified Index Return (reflects no deduction for fees, expenses or taxes) |

-5.25 |

% |

11.72 |

% |

8.19 |

% |

9.08 |

% |

|||||||||||

|

J.P. Morgan GBI-EM Global Diversified Index (reflects no deduction for fees, expenses or taxes) |

-8.98 |

% |

8.06 |

% |

9.52 |

% |

N/A† |

||||||||||||

|

The Fund's Blended Benchmark Return (reflects no deduction for fees, expenses or taxes) |

-7.10 |

% |

9.96 |

% |

8.93 |

% |

N/A†† |

||||||||||||

* Index returns are shown from June 30, 1997.

† The J.P. Morgan GBI-EM Global Diversified Index Return for the "Since Inception" period is not provided since returns for the index are not available prior to 2003.

†† The Blended Benchmark Return for the "Since Inception" period is not provided since returns for the J.P. Morgan GBI-EM Global Diversified Index Return are not available prior to 2003.

Management

Investment Adviser. SEI Investments Management Corporation

Sub-Advisers and Portfolio Managers.

|

Sub-Adviser |

Portfolio Manager |

Experience with the Fund |

Title with Sub-Adviser |

||||||||||||

|

Investec Asset Management US Ltd. |

Peter Eerdmans Grant Webster |

Since 2013 Since 2013 |

Co-Head of the Emerging Market Fixed Income Co-Head of the Emerging Markets Blended Debt Strategy and Investment Specialist |

||||||||||||

|

Neuberger Berman Fixed Income LLC |

Rob Drijkoningen Gorky Urquieta Jennifer Gorgoll, CFA Raoul Luttik, Nish Popat Prashant Singh, CFA Bart van der Made, CFA Vera Kartseva |

Since 2013 Since 2013 Since 2013 Since 2013 Since 2013 Since 2013 Since 2013 Since 2013 |

Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Vice President |

||||||||||||

|

Stone Harbor Investment Partners LP |

Peter J. Wilby, CFA Pablo Cisilino James E. Craige, CFA David A. Oliver, CFA Angus Halkett, Ph.D., CFA William Perry |

Since 2006 Since 2006 Since 2006 Since 2008 Since 2011 Since 2012 |

Chief Investment Officer Portfolio Manager Portfolio Manager Portfolio Manager Portfolio Manager Portfolio Manager |

||||||||||||

For important information about Purchase and Sale of Fund Shares, Tax Information and Payments to Broker-Dealers and Other Financial Intermediaries, please see below.

22

SEI / PROSPECTUS

Purchase and Sale of Fund Shares

The minimum initial investment for Class A Shares is $100,000 with minimum subsequent investments of $1,000, which may be waived at the discretion of SIMC. You may purchase and redeem shares of a Fund on any day that the New York Stock Exchange (NYSE) is open for business (a Business Day). You may sell your Fund shares by contacting your financial institution or intermediary directly. Financial institutions and intermediaries may redeem Fund shares on behalf of their clients by contacting the Fund's transfer agent (the Transfer Agent) or the Fund's authorized agent, using certain SEI Investments Company (SEI) proprietary systems or calling 1-800-858-7233, as applicable.

Tax Information

The distributions made by the Funds are taxable and will be taxed as ordinary income or capital gains. If you are investing through a tax-deferred arrangement, such as a 401(k) plan or individual retirement account, you will generally not be subject to federal taxation on Fund distributions until you begin receiving distributions from your tax-deferred arrangement. You should consult your tax advisor regarding the rules governing your tax-deferred arrangement.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

MORE INFORMATION ABOUT INVESTMENTS

Each Fund is a mutual fund. A mutual fund pools shareholders' money and, using professional investment managers, invests it in securities.

Each Fund has its own investment goal and strategies for reaching that goal. Each Fund's assets are managed under the direction of SIMC and one or more Sub-Advisers who manage portions of a Fund's assets in a way that they believe will help the Fund achieve its goals. SIMC acts as "manager of managers" for the Funds and attempts to ensure that the Sub-Advisers comply with the Funds' investment policies and guidelines. SIMC also recommends the appointment of additional or replacement sub-advisers to the Funds' Board of Trustees.

The investments and strategies described in this prospectus are those that SIMC and the Sub-Advisers use under normal conditions. During unusual economic or market conditions, or for temporary defensive or liquidity purposes, each Fund may invest up to 100% of its assets in cash, money market instruments, repurchase agreements and other short-term obligations that would not ordinarily be consistent with a Fund's objectives. A Fund will do so only if SIMC or the Sub-Advisers believe that the risk of loss outweighs the opportunity for capital gains and higher income. Of course, there is no guarantee that any Fund will achieve its investment goal. Each Fund may lend its securities to certain financial institutions in an attempt to earn additional income.

This prospectus describes the Funds' primary investment strategies. However, each Fund may also invest in other securities, use other strategies or engage in other investment practices. These investments and strategies, as well as those described in this prospectus, are described in more detail in the Funds' Statement of Additional Information (SAI).

23

SEI / PROSPECTUS

MORE INFORMATION ABOUT RISKS

Risk Information Common to the Funds

Investing in the Funds involves risk, and there is no guarantee that a Fund will achieve its goal. SIMC and the Sub-Advisers make judgments about the securities markets, the economy and companies, but these judgments may not anticipate actual market movements or the impact of economic conditions on company performance. In fact, no matter how good a job SIMC and the Sub-Advisers do, you could lose money on your investment in a Fund, just as you could with other investments. A Fund is not a bank deposit, and its shares are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The value of your investment in a Fund is based on the market prices of the securities the Fund holds. These prices change daily due to economic and other events that affect securities markets generally, as well as those that affect particular companies and other issuers. These price movements, sometimes called volatility, may be greater or lesser depending on the types of securities a Fund owns and the markets in which those securities trade. The effect on a Fund's share price of a change in the value of a single security will depend on how widely the Fund diversifies its holdings.

Investing in issuers located in foreign countries poses distinct risks since political and economic events unique to a country or region will affect those markets and their issuers. These events will not necessarily affect the U.S. economy or similar issuers located in the U.S. In addition, investments in foreign countries are generally denominated in a foreign currency. As a result, changes in the value of those currencies compared to the U.S. dollar may affect (positively or negatively) the value of a Fund's investments. These currency movements may happen in response to events that do not otherwise affect the value of the security in the issuer's home country. These various risks will be even greater for investments in emerging market countries where political turmoil and rapid changes in economic conditions are more likely to occur.

More Information About Principal Risks

The following descriptions provide additional information about some of the risks of investing in the Funds:

Asset-Backed Securities — The International Fixed Income Fund may invest in asset-backed securities. Asset-backed securities are securities backed by non-mortgage assets such as company receivables, truck and auto loans, leases and credit card receivables. Asset-backed securities are generally issued as pass-through certificates, which represent undivided fractional ownership interests in the underlying pools of assets. Therefore, repayment depends largely on the cash flows generated by the assets backing the securities. Asset-backed securities entail prepayment risk, which may vary depending on the type of asset, but is generally less than the prepayment risk associated with mortgage-backed securities, which is discussed below. Asset-backed securities present credit risks that are not presented by mortgage-backed securities. This is because asset-backed securities generally do not have the benefit of a security interest in collateral that is comparable in quality to mortgage assets. If the issuer of an asset-backed security defaults on its payment obligations, there is the possibility that, in some cases, the Fund will be unable to possess and sell the underlying collateral and that the Fund's recoveries on repossessed collateral may not be available to support payments on the security. In the event of a default, the Fund may suffer a loss if it cannot sell collateral quickly and receive the amount it is owed.

24

SEI / PROSPECTUS