| SIT EMERGING MARKETS EQUITY FUND | SIT EMERGING MARKETS EQUITY FUND - CLASS A | ||||||||||||||||||||||||||||||||||||||||||

| SIT EMERGING MARKETS EQUITY FUND | ||||||||||||||||||||||||||||||||||||||||||

| Investment Goal | ||||||||||||||||||||||||||||||||||||||||||

Capital appreciation. |

||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses | ||||||||||||||||||||||||||||||||||||||||||

The following tables describe the fees and expenses that you may pay if you buy and hold Fund shares. |

||||||||||||||||||||||||||||||||||||||||||

| SHAREHOLDER FEES (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||

| EXAMPLE | ||||||||||||||||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. |

||||||||||||||||||||||||||||||||||||||||||

| Although your actual costs may be higher or lower, based on these assumptions your costs would be: | ||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||

| PORTFOLIO TURNOVER | ||||||||||||||||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 93% of the average value of its portfolio. |

||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies | ||||||||||||||||||||||||||||||||||||||||||

Under normal circumstances, the Emerging Markets Equity Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities of emerging market issuers. Equity securities may include common stocks, preferred stock, warrants and depositary receipts. The Fund normally maintains investments in at least six emerging market countries and does not invest more than 35% of its total assets in any one emerging market country. Emerging market countries are those countries that are: (i) characterized as developing or emerging by any of the World Bank, the United Nations, the International Finance Corporation, or the European Bank for Reconstruction and Development; (ii) included in an emerging markets index by a recognized index provider; or (iii) countries with similar developing or emerging characteristics as countries classified as emerging market countries pursuant to sub-paragraph (i) and (ii) above, in each case determined at the time of purchase. The Fund uses a multi-manager approach, relying upon a number of sub-advisers (each, a Sub-Adviser and collectively, the Sub-Advisers) with differing investment philosophies to manage portions of the Fund's portfolio under the general supervision of SEI Investments Management Corporation (SIMC), the Fund's adviser. The Fund may invest in futures contracts, forward contracts and options for hedging purposes, including to seek to manage the Fund's currency exposure to foreign securities and mitigate the Fund's overall risk. The Fund may purchase shares of exchange-traded funds (ETFs) to gain exposure to a particular portion of the market while awaiting an opportunity to purchase securities or other instruments directly. |

||||||||||||||||||||||||||||||||||||||||||

| Principal Risks | ||||||||||||||||||||||||||||||||||||||||||

Currency Risk — As a result of the Fund's investments in securities denominated in, and/or receiving revenues in, foreign currencies, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an investment in the Fund would be adversely affected. Depositary Receipts — Depositary receipts are certificates evidencing ownership of shares of a foreign issuer that are issued by depositary banks and generally trade on an established market. Depositary receipts are subject to many of the risks associated with investing directly in foreign securities, including, among other things, political, social and economic developments abroad, currency movements, and different legal, regulatory and tax environments. Derivatives Risk — The Fund's use of futures and forward contracts and options is subject to market risk, leverage risk, correlation risk and liquidity risk. Leverage risk and liquidity risk are described below. Market risk is the risk that the market value of an investment may move up and down, sometimes rapidly and unpredictably. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. The Fund's use of over-the-counter forward contracts is also subject to credit risk and valuation risk. Valuation risk is the risk that the derivative may be difficult to value and/or valued incorrectly. Credit risk is described above. Each of the above risks could cause the Fund to lose more than the principal amount invested in a derivative instrument. Equity Market Risk — The risk that stock prices will fall over short or extended periods of time. Exchange-Traded Funds (ETFs) Risk — The risks of owning shares of an ETF generally reflect the risks of owning the underlying securities the ETF is designed to track, although lack of liquidity in an ETF could result in its value being more volatile than the underlying portfolio securities. Foreign Investment/Emerging Markets Risk — The risk that non-U.S. securities may be subject to additional risks due to, among other things, political, social and economic developments abroad, currency movements and different legal, regulatory and tax environments. These additional risks may be heightened with respect to emerging market countries since political turmoil and rapid changes in economic conditions are more likely to occur in these countries. Investment Style Risk — The risk that emerging market equity securities may underperform other segments of the equity markets or the equity markets as a whole. Leverage Risk — The Fund's use of derivatives may result in the Fund's total investment exposure substantially exceeding the value of its portfolio securities and the Fund's investment returns depending substantially on the performance of securities that the Fund may not directly own. The use of leverage can amplify the effects of market volatility on the Fund's share price and may also cause the Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. The Fund's use of leverage may result in a heightened risk of investment loss. Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to lower the price, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance. Portfolio Turnover Risk — Due to its investment strategy, the Fund may buy and sell securities frequently. This may result in higher transaction costs and additional capital gains tax liabilities. Small and Medium Capitalization Risk — The risk that small and medium capitalization companies in which the Fund invests may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, small and medium capitalization companies may have limited product lines, markets and financial resources and may depend upon a relatively small management group. Therefore, small capitalization and medium capitalization stocks may be more volatile than those of larger companies. Small capitalization and medium capitalization stocks may be traded over the counter or listed on an exchange. Loss of money is a risk of investing in the Fund. |

||||||||||||||||||||||||||||||||||||||||||

| Performance Information | ||||||||||||||||||||||||||||||||||||||||||

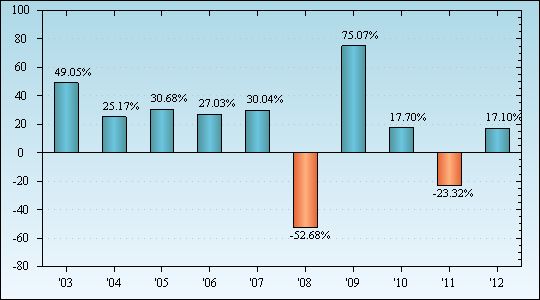

The bar chart and the performance table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year for the past ten calendar years and by showing how the Fund's average annual returns for 1, 5 and 10 years, and since the Fund's inception, compare with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. For current performance information, please call 1-800-DIAL-SEI. |

||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||

Best Quarter: 34.40% (06/30/09) Worst Quarter: -27.79% (12/31/08) |

||||||||||||||||||||||||||||||||||||||||||

| Average Annual Total Returns (for the periods ended December 31, 2012) | ||||||||||||||||||||||||||||||||||||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||