Document

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

___________________________

FORM 10-K

ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

| |

(Mark One) |

X | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

|

| |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission file number 0-17196

MGP Ingredients, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

| |

Kansas | 45-4082531 |

(State or Other Jurisdiction | (I.R.S. Employer |

of Incorporation or Organization) | Identification No.) |

| |

100 Commercial Street, Box 130, Atchison, Kansas | 66002 |

(Address of Principal Executive Offices) | (Zip Code) |

(913) 367-1480

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Title of Each Class | Name of Each Exchange on Which Registered |

Common Stock, no par value | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes _X_ No __

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes __ No X_

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No ____

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to their Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of "large accelerated filer", "accelerated filer", and "smaller reporting company": in Rule 12b-2 of the Exchange Act. (Check One):

[ ] Large accelerated filer [X] Accelerated filer

[ ] Non-accelerated filer (Do not check if smaller reporting company [ ] Smaller Reporting Company

[ ] Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ___ No X_

The aggregate market value of common equity held by non-affiliates, computed by reference to the last sales price as reported by NASDAQ on June 30, 2017, was $656,675,622.

The number of shares of the registrant’s common stock, no par value ("Common Stock") outstanding as of February 23, 2018 was 16,798,353.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents are incorporated herein by reference:

| |

(1) | Portions of the MGP Ingredients, Inc. Proxy Statement for the Annual Meeting of Stockholders to be held on May 23, 2018 are incorporated by reference into Part III of this report to the extent set forth herein. |

CONTENTS PAGE

|

| | | |

| | |

| | Business | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Consolidated Statements of Income - Years Ended December 31, 2017, 2016, and 2015 | |

| | Consolidated Statements of Comprehensive Income - Years Ended December 31, 2017, 2016, and 2015 | |

| | Consolidated Balance Sheets - December 31, 2017 and 2016 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

| Item 16. | Form 10-K Summary | |

| | |

The calculation of the aggregate market value of the Common Stock held by non-affiliates is based on the assumption that affiliates include directors and executive officers. Such assumption does not constitute an admission by the Company or any director or executive officer that any director or executive officer is an affiliate of the Company.

PART I

ITEM 1. BUSINESS

MGP Ingredients, Inc. was incorporated in 2011 in Kansas, continuing a business originally founded by Cloud L. Cray, Sr. in Atchison, Kansas in 1941. As used herein, the term "MGP," "Company," "we," "our," or "us" refers to MGP Ingredients, Inc. and its subsidiaries unless the context indicates otherwise. In this document, for any references to Note 1 through Note 17 refer to the Notes to Consolidated Financial Statements in Item 8.

AVAILABLE INFORMATION

We make available through our website (www.mgpingredients.com) under "For Investors," free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, special reports and other information, and amendments to those reports as soon as reasonably practicable after we electronically file or furnish such material with the Securities and Exchange Commission.

METHOD OF PRESENTATION

All amounts in this report, except for shares, par values, bushels, gallons, pounds, mmbtu, proof gallons, per share, per bushel, per gallon, per proof gallon, and percentage amounts are shown in thousands, unless otherwise noted.

GENERAL INFORMATION

MGP is a leading producer and supplier of premium distilled spirits and specialty wheat protein and starch food ingredients. Distilled spirits include premium bourbon and rye whiskeys and grain neutral spirits ("GNS"), including vodka and gin. MGP is also a top producer of high quality industrial alcohol for use in both food and non-food applications. Our protein and starch food ingredients provide a host of functional, nutritional, and sensory benefits for a wide range of food products to serve the packaged goods industry. Our distillery products are derived from corn and other grains, and our ingredient products are derived from wheat flour. The majority of our distillery and ingredient product sales are made directly, or through distributors, to manufacturers and processors of finished packaged goods or to bakeries.

We are headquartered in Atchison, Kansas, where distilled alcohol products and food ingredients are produced at our production facility ("Atchison facility"). Premium spirits are distilled and matured at our facility in Lawrenceburg and Greendale, Indiana ("Lawrenceburg facility").

INFORMATION ABOUT SEGMENTS

As of December 31, 2017, we had two reportable segments: distillery products and ingredient solutions. Additional information about our reportable segments can be found in Management’s Discussion & Analysis ("MD&A") and Note 11. Note 11 provides detail of our foreign and domestic net sales revenue and identifiable assets.

Distillery Products Segment - We process corn and other grains (including rye, barley, wheat, barley malt, and milo) into food grade alcohol and distillery co-products, such as distillers feed (commonly called dried distillers grain in the industry), fuel grade alcohol, and corn oil. We also provide warehouse services, including barrel put away, barrel storage, and barrel retrieval services. We have certain contracts with customers to supply distilled products (or "distillate"), as well as certain contracts with customers to provide barreling and warehousing services. Contracts with customers may be monthly, annual, and multi-year with periodic review of pricing. Sales of fuel grade alcohol are made on the spot market. Since 2015, our distillery products segment includes production and sales of our own branded alcohol products under the George Remus®,, TILL American Wheat Vodka®, and Tanner's Creek® Blended Bourbon Whiskey brands. During 2017, our five largest distillery products customers, combined, accounted for 23.5 percent of our consolidated net sales.

Food Grade Alcohol - The majority of our distillery capacities are dedicated to the production of high quality, high purity food grade alcohol for beverage and industrial applications.

Food grade alcohol sold for beverage applications, premium beverage alcohol, consists primarily of premium bourbon and rye whiskeys and GNS, including vodka and gin. Our premium bourbon is created by distilling grains, primarily corn. Our whiskey is made from fermented grain mash, including rye and corn. Our whiskeys are primarily sold as unaged new distillate, which are then aged by our customers from two to four years and are sold at various proof concentrations. Our GNS is sold in bulk quantities at various proof concentrations. Our gin is created by redistilling GNS together with proprietary formulations of botanicals or botanical oils.

Food grade industrial alcohol is used as an ingredient in foods (e.g., vinegar and food flavorings), personal care products (e.g., hair sprays and hand sanitizers), cleaning solutions, pharmaceuticals, and a variety of other products. We sell food grade industrial alcohol in tank truck or rail car quantities direct to a number of industrial processors.

Fuel grade alcohol - Fuel grade alcohol is sold primarily for blending with gasoline to increase the octane and oxygen levels of the gasoline. As an octane enhancer, fuel grade alcohol can serve as a substitute for lead and petroleum-based octane enhancers. As an oxygenate, fuel grade alcohol has been used in gasoline to meet certain environmental regulations and laws relating to air quality by reducing carbon monoxide, hydrocarbon particulates, and other toxic emissions generated from the burning of gasoline.

Distillers Feed and related Co-Products - The bulk alcohol co-products sales include distillers feed, fuel grade alcohol, and corn oil. Distillers feed is principally derived from the mash from alcohol processing operations. The mash is dried and sold primarily to processors of animal feeds as a high protein additive. We produce fuel grade alcohol as a co-product of our food grade alcohol business at our Atchison facility. We produce corn oil as a value added co-product through a corn oil extraction process.

Warehouse Services - Customers who purchase unaged barreled distillate may, and in most cases do, also enter into separate warehouse service agreements with us for the storage of product for aging that include services for barrel put away, barrel storage, and barrel retrieval. Revenue from warehousing services is recognized upon providing the service and/or over the passage of time, as in the case of storage fees.

Ingredient Solutions Segment - Our ingredient solutions segment consists primarily of specialty wheat starches, specialty wheat proteins, commodity wheat starches, and commodity wheat proteins. Contracts with ingredients customers are generally price, volume, and term agreements, which are fixed for three or six month periods, with very few agreements of 12 months duration or longer. During 2017, our five largest ingredient solutions customers, combined, accounted for 10.2 percent of our consolidated net sales.

Specialty Wheat Starches - Wheat starch is derived from the carbohydrate-bearing portion of wheat flour. We produce a premium wheat starch powder by extracting the starch from the starch slurry, substantially free of all impurities and fibers, and then dry the starch in spray, flash, or drum dryers.

A substantial portion of our premium wheat starch is altered during processing to produce certain unique specialty wheat starches designed for special applications. We sell our specialty wheat starches on a global basis, primarily to food processors and distributors.

We market our specialty wheat starches under the trademarks Fibersym® Resistant Starch series, FiberRite® RW Resistant Starch, Pregel® Instant Starch series, and Midsol® Cook-up Starch series. They are used primarily for food applications as an ingredient in a variety of food products to affect their nutritional profile, appearance, texture, tenderness, taste, palatability, cooking temperature, stability, viscosity, binding, and freeze-thaw characteristics. Important physical properties contributed by wheat starch include whiteness, clean flavor, viscosity, and texture. For example, our starches are used to improve the taste and texture of cream puffs, éclairs, puddings, pie fillings, breading, and batters; to improve the size, symmetry, and taste of angel food cakes; to alter the viscosity of soups, sauces, and gravies; to improve the freeze-thaw stability and shelf life of fruit pies and other frozen foods; to improve moisture retention in microwavable foods; and to add stability and to improve spreadability in frostings, mixes, glazes, and sugar coatings.

Our wheat starches, as a whole, generally compete primarily with corn starch, which dominates the United States starch market. However, the unique characteristics of our specialty wheat starches provide a number of advantages over corn and other starches for certain baking and other end uses.

Specialty Wheat Proteins - We have developed a number of specialty wheat proteins for food applications. Specialty wheat proteins are derived from vital wheat gluten through a variety of proprietary processes which change its molecular structure. Specialty wheat proteins for food applications include the products Arise® and Trutex®.

In June 2017, we announced the addition of new clean label ingredients to our Arise® line of wheat protein isolates. Along with Arise® 8000, this new series includes Arise® 8100 and Arise® 8200. Each of these ingredients is also Non-GMO Project Verified. In September 2017, we announced additions to our extensive Non-GMO Project Verified food ingredients portfolio of TruTex® 751, TruTex® 1501, TruTex® 2240, and TruTex® Redishred 65 textured wheat proteins.

Our specialty wheat proteins generally compete with other ingredients and modified proteins having similar characteristics, primarily soy proteins and other wheat proteins, with differentiation being based on factors such as functionality, price, and, in the case of food applications, flavor.

Commodity Wheat Starches - As is the case with value added wheat starches, our commodity wheat starches have both food and non-food applications, but such applications are more limited than those of value added wheat starches and typically sell for a lower price in the marketplace. Commodity wheat starches compete primarily with corn starches, which dominate the marketplace and prices generally track the fluctuations in the corn starch market.

Commodity Wheat Proteins - Commodity wheat protein, or vital wheat gluten, is a free-flowing light tan powder which contains approximately 70 to 80 percent protein. When we process wheat flour to derive starch, we also derive vital wheat gluten. Vital wheat gluten is added by bakeries and food processors to baked goods, such as breads, and to pet foods, cereals, processed meats, and fish and poultry to improve the nutritional content, texture, strength, shape, and volume of the product. The neutral flavor and color of vital wheat gluten also enhances the flavor and color of certain foods. The cohesiveness and elasticity of the gluten enables the dough in wheat and other high protein breads to rise and to support added ingredients, such as whole cracked grains, raisins and fibers. This allows bakers to make an array of different breads by varying the gluten content of the dough. Vital wheat gluten is also added to white breads, hot dog buns, and hamburger buns to improve the strength and cohesiveness of the product.

COMPETITIVE CONDITION

While we believe that the overall market environment offers considerable growth opportunities for us in 2018 and beyond, the markets in which our products are sold are competitive. Our products compete against similar products of many large and small companies. In our distillery products segment, competition is based primarily on product innovation, product characteristics, functionality, price, service, and quality factors, such as flavor. In our ingredient solutions segment, competition is based primarily on product innovation, product characteristics, price, name, color, flavor, or other properties that affect how the ingredient is being used.

PATENTS, TRADEMARKS, AND LICENSES

We are involved in a number of patent-related activities, primarily within our ingredient solutions segment. We have filed patent applications to protect a range of inventions made in our research and development efforts, including inventions relating to applications for our products. Some of these patents or licenses cover significant product formulation and processes used to manufacture our products.

SEASONALITY

Our sales are generally not seasonal.

TRANSPORTATION

Historically, our output has been transported to customers by truck and rail, most of which is provided by common carriers. We use third party transportation companies to help us manage truck and rail carriers who deliver our products to our North American customers. As of December 31, 2017, we leased 223 rail cars under operating leases.

RAW MATERIALS AND PACKAGING MATERIALS

Our principal distillery products segment raw materials, or input costs, are corn and other grains (including rye, barley, wheat, barley malt, and milo), which are processed into food grade alcohol and distillery co-products consisting of distillers feed, fuel grade alcohol, and corn oil. Our principal ingredient solutions segment raw material is wheat flour, which is processed into starches and proteins. The cost of grain has, at times, been subject to substantial fluctuation.

In 2017, we purchased most of our grain requirements from two suppliers, Bunge Milling, Inc. ("Bunge") and Consolidated Grain and Barge Co. ("CGB"). Our current grain supply contracts with Bunge and CGB expire on December 31, 2021 and December 31, 2020, respectively. Through these contracts, we purchase grain for delivery into the future at negotiated prices based on several factors. We also order wheat flour for delivery into the future at negotiated prices based on several factors. We provide for our wheat flour requirements through a supply contract with Ardent Mills, which expires July 10, 2019. We typically enter contracts for future delivery only to protect margins on contracted alcohol sales, expected ingredient sales, and general usage.

Our principal packaging material for our distillery products segment is oak barrels. Both new and used barrels are utilized for the aging of premium bourbon and rye whiskeys. We purchase oak barrels from multiple suppliers and some customers supply their own barrels.

We also source food grade alcohol from Pacific Ethanol Central, LLC ("Pacific Ethanol"), formerly Illinois Corn Processing, LLC ("ICP"), which was our 30 percent-owned joint venture until July 3, 2017 when it was divested and sold to Pacific Ethanol. Additional information related to ICP and the divestiture is in "Equity Method Investments" below, the MD&A, and Note 3.

ENERGY

Natural gas is an input cost used to operate boilers to make steam heat. We procure natural gas for our facilities in the open market from various suppliers. We have a risk management program whereby we may purchase contracts for the delivery of natural gas for delivery into the future at negotiated prices based on several factors, or we can purchase futures contracts on the exchange. Depending on existing market conditions, in Atchison we use our ability to transport gas through a gas pipeline owned by a wholly-owned subsidiary. Historically, prices of natural gas have been higher in the late fall and winter months than during other periods.

EMPLOYEES

As of December 31, 2017, we had a total of 317 employees. A collective bargaining agreement covering 99 employees at the Atchison facility expires on August 31, 2019. A collective bargaining agreement covering 62 employees at the Lawrenceburg facility expires on December 31, 2022. We consider our relations with our personnel generally to be good.

REGULATION

We are subject to a broad range of federal, state, local, and foreign laws and regulations intended to protect public health and the environment. Our operations are also subject to regulation by various federal agencies, including the Alcohol and Tobacco Tax Trade Bureau ("TTB"), the Occupational Safety and Health Administration ("OSHA"), the Food and Drug Administration ("FDA") the United States Environmental Protection Agency ("EPA"), and by various state and local authorities. Such laws and regulations cover virtually every aspect of our operations, including production and storage facilities, distillation and maturation requirements, importing ingredients, distribution of beverage alcohol products, marketing, pricing, labeling, packaging, advertising, water usage, waste water discharge, disposal of hazardous wastes and emissions, and other matters. In addition, beverage alcohol products are subject to customs duties or excise taxation in many countries, including taxation at the federal, state, and local level in the United States.

EQUITY METHOD INVESTMENTS

Illinois Corn Processing, LLC ("ICP"). In November 2009, we completed a series of transactions to form ICP, which produced high quality food grade alcohol, chemical intermediates, and fuel. In connection with these transactions, we entered into agreements with ICP and ICP Holdings, an affiliate of SEACOR Holdings, Inc. One of the agreements was the LLC Interest Purchase Agreement under which we sold ICP Holdings 50 percent of the membership interest in ICP. This agreement also gave ICP Holdings the option to purchase up to an additional 20 percent of the membership interest in ICP, and on February 1, 2012, ICP Holdings exercised its option and purchased an additional 20 percent from us, reducing our ownership from 50 percent to 30 percent.

On July 3, 2017, we sold our 30 percent equity ownership interest in ICP to Pacific Ethanol pursuant to an Agreement and Plan of Merger ("Merger Agreement") entered into on June 26, 2017. Illinois Corn Processing Holdings, Inc., an affiliate of SEACOR Holdings, Inc., held the remaining equity in ICP that was also sold pursuant to the Merger Agreement (Note 3).

D.M. Ingredients GmbH ("DMI"). In 2007, we acquired a 50 percent interest in DMI, a German joint venture company that produced certain of our specialty ingredients products through a toller for distribution in the European Union ("E.U.") and elsewhere.

On December 29, 2014, we gave notice to DMI and to our partner in DMI, Crespel and Dieters GmbH & Co. KG ("C&D"), to terminate our joint venture effective June 30, 2015. On June 30, 2015, normal operations for DMI ceased and, under German law, a one year winding down process began once the registration of resolutions, appointment of liquidators, inventory count, and publication of the notice to potential creditors was complete, which occurred on October 29, 2015. On December 23, 2016, we received our portion of the remaining DMI liquidation proceeds as a return of our investment (Note 3).

EXECUTIVE OFFICERS OF THE REGISTRANT

Our officers as of December 31, 2017 and their ages as of March 1, 2018:

|

| | |

Name | Age | Principal Occupation and Business Experience |

Augustus C. Griffin | 58 | President and Chief Executive Officer for the Company since July 2014 and member of the Board of Directors for the Company since August 2014. Executive Vice President of Marketing for Next Level Spirits from April 2013 to January 2014. Brand and Business Consultant for Nelson's Green Brier Distillery from November 2011 to March 2013. Senior Vice President, Global Managing Director for Brown Forman Corporation's flagship Jack Daniels business from January 2008 to April 2011. |

Thomas K. Pigott | 53 | Vice President, Finance and Chief Financial Officer for the Company since September 2015. Vice President of Finance for the Kraft Foods Group Meal Solutions Division from March 2015 to August 2015. Vice President of Finance for the Kraft Foods Group Meals and Desserts Business Unit from May 2014 to March 2015. Vice President of Finance and Chief Audit Executive for the Kraft Foods Group from October 2012 to April 2014. Vice President of Finance for the Pizza Division at Nestle, U.S.A. from April 2010 to October 2012. |

Stephen J. Glaser | 57 | Vice President, Production and Engineering for the Company since October 2015. Corporate Director of Operations for the Company from January 2014 to October 2015. Plant Manager for the Company of the Atchison facility from May 2011 to December 2013. |

David E. Dykstra | 54 | Vice President, Alcohol Sales and Marketing for the Company since 2009. |

Michael R. Buttshaw | 55 | Vice President, Ingredient Sales and Marketing for the Company since December 2014. Vice President of Sales for the ingredient group at Southeastern Mills, Inc. from October 2010 to November 2014. |

David E. Rindom | 62 | Vice President and Chief Administrative Officer for the Company since December 2015. Vice President, Human Resources for the Company from June 2000 to December 2015. |

Andrew P. Mansinne | 58 | Vice President, Brands for the Company since November 2016. Managing director at Intercontinental Beverage Capital and President of Tattico Strategies from March 2015 to October 2016. President of Aveniu Brands from May 2010 to April 2014. |

ITEM 1A. RISK FACTORS

Our business is subject to certain risks and uncertainties that could cause actual results and events to differ materially from forward looking statements. The following discussion identifies those which we consider to be most important. The following discussion of risks is not all inclusive. Additional risks not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, financial condition, or results of operations.

RISKS THAT AFFECT OUR BUSINESS AS A WHOLE

An interruption of operations, a catastrophic event at our facilities, or a disruption of transportation services could negatively affect our business.

Although we maintain insurance coverage for various property damage and loss events, an interruption in or loss of operations at either of our production facilities could reduce or postpone production of our products, which could have a material adverse effect on our business, results of operations, or financial condition. To the extent that our value added products rely on unique or proprietary processes or techniques, replacing lost production by purchasing from outside suppliers would be difficult.

Our customers store a substantial amount of barreled inventory of aged premium bourbon and rye whiskeys at our Lawrenceburg facility. If there was a catastrophic event at our Lawrenceburg facility, our customers' business could be adversely affected. The loss of a significant amount of aged inventory through fire, natural disaster, or otherwise could result in a significant reduction in supply of the affected product or products and could result in customer claims against us.

We also store a substantial amount of our own inventory of aged premium bourbon and rye whiskeys at our Lawrenceburg facility. If there was a catastrophic event at our Lawrenceburg facility, our business, financial condition, or results of operations could be adversely affected. The loss of a significant amount of our aged inventory through fire, natural disaster, or otherwise, could result in a reduction in supply of the affected product or products and could affect our long-term growth.

A disruption in transportation services could result in difficulties supplying materials to our facilities and impact our ability to deliver products to our customers in a timely manner, and our business, financial condition, or results of operations could be adversely affected.

Our profitability is affected by the costs of grain, wheat flour, and natural gas, or input costs, that we use in our business, the availability and costs of which are subject to weather and other factors beyond our control. We may not be able to recover the costs of commodities and energy by increasing our selling prices.

Grain and wheat flour costs are a significant portion of our costs of goods sold. Historically, the cost of such raw materials has, at times, been subject to substantial fluctuation, depending upon a number of factors which affect commodity prices in general and over which we have no control. These include crop conditions, weather, disease, plantings, government programs and policies, competition for acquisition of inputs such as agricultural commodities, purchases by foreign governments, and changes in demand resulting from population growth and customer preferences. The price of natural gas also fluctuates based on anticipated changes in supply and demand, weather, and the prices of alternative fuels. Fluctuations in the price of commodities and natural gas can be sudden and volatile at times and have had, from time to time, significant adverse effects on the results of our operations. Higher energy costs could result in higher transportation costs and other operating costs.

We do not enter into futures and options contracts ourselves because we can purchase grain and wheat flour for delivery into the future under our grain and wheat flour supply agreements. We intend to contract for the future delivery of grain and wheat flour only to protect margins on expected sales. On the portion of volume not contracted, we attempt to recover higher commodity costs through higher selling prices, but market considerations may not always permit this result. Even where prices can be adjusted, there is likely a lag between when we experience higher commodity or natural gas costs and when we might be able to increase prices. To the extent we are unable to timely pass increases in the cost of raw materials to our customers under sales contracts, market fluctuations in the cost of grain, natural gas, and ethanol may have a material adverse effect on our business, financial condition, or results of operations.

We have a high concentration of certain raw material and finished goods purchases from a limited number of suppliers which exposes us to risk.

We have signed supply agreements with Bunge and CGB for our grain supply (primarily corn) and with Ardent Mills for our wheat flour. The Company also procures some textured wheat proteins through a third-party toll manufacturer in the United States. If any of these companies encounters an operational or financial issue, or otherwise cannot meet our supply demands, it could lead to an interruption in supply to us and/or higher prices than those we have negotiated or than are available in the market at the time, and in turn, have a material adverse effect on our business, financial condition, or results of operations.

The markets for our products are very competitive, and our business could be negatively affected if we do not compete effectively.

The markets for products in which we participate are very competitive. Our principal competitors in these markets have substantial financial, marketing, and other resources, and several are much larger enterprises than us.

We are dependent on being able to generate net sales and other operating income in excess of the costs of products sold in order to obtain margins, profits, and cash flows to meet or exceed our targeted financial performance measures. Competition is based on such factors as product innovation, product characteristics, product quality, pricing, color, and name. Pricing of our products is partly dependent upon industry capacity, which is impacted by competitor actions to bring online idled capacity or to build new production capacity. If market conditions make our products too expensive for use in consumer goods, our revenues could be affected. If our principal competitors were to decrease their pricing, we could choose to do the same, which could adversely affect our margins and profitability. If we did not do the same, our revenues could be adversely affected due to the potential loss of sales or market share. Our revenue growth could also be adversely affected if we are not successful in developing new products for our customers or as a result of new product introductions by our competitors. In addition, more stringent new customer demands may require us to make internal investments to achieve or sustain competitive advantage and meet customer expectations.

Unsuccessful research activities or product launches could affect our business.

Research activities and product launch activities are inherently uncertain. The failure to launch a new product successfully could give rise to inventory write-offs and other costs and could affect consumer perception of an existing brand. Any significant changes in consumer preferences and failure to anticipate and react to such changes could result in reduced demand for our products. If we were to have unsuccessful research activities or product launches, our business, financial condition, or results of operations could be adversely affected.

Work disruptions or stoppages by our unionized workforce could cause interruptions in our operations.

As of December 31, 2017, approximately 161 of our 317 employees were members of a union. Although our relations with our two unions are stable and our labor contracts do not expire until August 2019 and December 2022, there is no assurance that we will not experience work disruptions or stoppages in the future, which could have a material adverse effect on our business, financial condition, or results of operations and could adversely affect our relationships with our customers.

If we were to lose any of our key management personnel, we may not be able to fully implement our strategic plan, our system of internal controls could be impacted.

We rely on the continued services of key personnel involved in management, finance, product development, sales, manufacturing and distribution, and, in particular, upon the efforts and abilities of our executive management team. The loss of service of any of our key personnel could have a material adverse effect on our business, financial condition, results of operations, and on our system of internal controls.

If we cannot attract and retain key management personnel, or if our search for qualified personnel is prolonged, our system of internal controls may be affected, which could lead to an adverse effect on our business, financial condition, or results of operations. In addition, it could be difficult, time consuming, and expensive to replace any key management member or other critical personnel, and no guarantee exists that we will be able to recruit suitable replacements or assimilate new key management personnel into our organization.

Covenants and other provisions in our credit arrangements could hinder our ability to operate. Our failure to comply with covenants in our credit arrangements could result in the acceleration of the debt extended under such agreements, limit our liquidity, and trigger other rights of our lenders.

Our credit arrangements (Item 5 and Note 5) contain a number of financial and other covenants that include provisions which require us, in certain circumstances, to meet certain financial tests. These covenants could hinder our ability to operate and could reduce our profitability. The lender may also terminate or accelerate our obligations under our credit arrangements upon the occurrence of various events in addition to payment defaults and other breaches. Any acceleration of our debt or termination of our credit arrangements would negatively impact our overall liquidity and might require us to take other actions to preserve any remaining liquidity. Although we anticipate that we will be able to meet the covenants in our credit arrangements, there can be no assurance that we will do so, as there are a number of external factors that affect our operations over which we have little or no control, that could have a material adverse effect on our business, financial condition, or results of operations.

Product recalls or other product liability claims could materially and negatively affect our business.

Selling products for human consumption involves inherent legal and other risks, including product contamination, spoilage, product tampering, allergens, or other adulteration. We could decide to, or be required to, recall products due to suspected or confirmed product contamination, adulteration, misbranding, tampering, or other deficiencies. Although we maintain product recall insurance, product recalls or market withdrawals could result in significant losses due to their costs, the destruction of product inventory, and lost sales due to the unavailability of the product for a period of time. We could be adversely affected if our customers lose confidence in the safety and quality of certain of our products, or if consumers lose confidence in the food and beverage safety system generally. Negative attention about these types of concerns, whether or not valid, may damage our reputation, discourage consumers from buying our products, or cause production and delivery disruptions.

We may also suffer losses if our products or operations cause injury, illness, or death. In addition, we could face claims of false or deceptive advertising or other criticism. A significant product liability or other legal judgment or a related regulatory enforcement action against us, or a significant product recall, may materially and adversely affect our reputation and profitability. Moreover, even if a product liability or other legal or regulatory claim is unsuccessful, has no merit, or is not pursued, the negative publicity surrounding assertions against our products or processes could have a material adverse effect our business, financial condition, or results of operations.

We are subject to extensive regulation and taxation, as well as compliance with existing or future laws and regulations, which may require us to incur substantial expenditures.

We are subject to a broad range of federal, state, local, and foreign laws and regulations intended to protect public health and the environment. Our operations are also subject to regulation by various federal agencies, including the TTB, OSHA, the FDA, the EPA, and by various state and local authorities. Such laws and regulations cover virtually every aspect of our operations, including production and storage facilities, distillation and maturation requirements, importing ingredients, distribution of beverage alcohol products, marketing, pricing, labeling, packaging, advertising, water usage, waste water discharge, disposal of hazardous wastes and emissions, and other matters. In addition, beverage alcohol products are subject to customs, duties, or excise taxation in many countries, including taxation at the federal, state, and local level in the United States.

Violations of any of these laws and regulations may result in administrative, civil, or criminal fines or penalties being levied against us, including temporary or prolonged cessation of production, revocation or modification of permits, performance of environmental investigatory or remedial activities, voluntary or involuntary product recalls, or a cease and desist order against operations that are not in compliance with applicable laws. These laws and regulations may change in the future and we may incur material costs in our efforts to comply with current or future laws and regulations. These matters may have a material adverse effect on our business, financial condition, or results of operations.

A failure of one or more of our key information technology systems, networks, processes, associated sites, or service providers could have a negative impact on our business.

We rely on information technology ("IT") systems, networks, and services, including internet sites, data hosting and processing facilities and tools, hardware (including laptops and mobile devices), software and technical applications and platforms, some of which are managed and hosted by third party vendors to assist us in the management of our business. The various uses of these IT systems, networks, and services include, but are not limited to: hosting our internal network and communication systems; enterprise resource planning; processing transactions; summarizing and reporting results of operations; business plans, and financial information; complying with regulatory, legal, or tax requirements; providing data security; and handling other processes necessary to manage our business. Although we have some offsite backup systems and a disaster recovery plan, any failure of our information systems could adversely impact our ability to operate. Routine maintenance or development of new information systems may result in systems failures, which may have a material adverse effect on our business, financial condition, or results of operations.

Increased IT security threats and more sophisticated cyber crime pose a potential risk to the security of our IT systems, networks, and services, as well as the confidentiality, availability, and integrity of our data. This can lead to outside parties having access to our privileged data or strategic information, our employees, or our customers. Any breach of our data security systems or failure of our information systems may have a material adverse impact on our business operations and financial results. If the IT systems, networks, or service providers we rely upon fail to function properly, or if we suffer a loss or disclosure of business or other sensitive information due to any number of causes, ranging from catastrophic events to power outages to security breaches, and our disaster recovery plans do not effectively address these failures on a timely basis, we may suffer interruptions in our ability to manage operations and reputational, competitive, or business harm, which may have a material adverse effect on our business, financial condition, or results of operations. In addition, such events could result in unauthorized disclosure of material confidential information, and we may suffer financial and reputational damage because of lost or misappropriated confidential information belonging to us or to our partners, our employees, customers, and suppliers. Although we maintain insurance coverage for various cybersecurity risks, in any of these events, we could also be required to spend significant financial and other resources to remedy the damage caused by a security breach or to repair or replace networks and IT systems.

Damage to our reputation, or that of any of our key customers or their brands, could affect our business performance.

The success of our products depends in part upon the positive image that consumers have of the third party brands that use our products. Contamination, whether arising accidentally or through deliberate third party action, or other events that harm the integrity or consumer support for our and/or our customers' products could affect the demand for our and/or our customers' products. Unfavorable media, whether accurate or not, related to our industry, to us, our products, or to the brands that use our products, marketing, personnel, operations, business performance, or prospects could negatively affect our corporate reputation, stock price, ability to attract high quality talent, or the performance of our business. Negative publicity or commentary on social media outlets could cause consumers to react rapidly by avoiding our brands or by choosing brands offered by our competitors, which could have a material adverse effect on our business, financial condition, or results of operations.

We may not be able to adequately protect our intellectual property rights or may be accused of infringing intellectual property rights of third parties.

We regard our trademarks, service marks, copyrights, patents, trade dress, trade secrets, proprietary technology, and similar intellectual property as critical to our success, and we rely on trademark, copyright, and patent law, trade secret protection, and confidentiality and/or license agreements with our employees, customers, and others to protect our proprietary rights. We may not be able to discover or determine the extent of any unauthorized use of our proprietary rights. Third parties that license our proprietary rights also may take actions that diminish the value of our proprietary rights or reputation. The protection of our intellectual property may require the expenditure of significant financial and managerial resources. Moreover, the steps we take to protect our intellectual property may not adequately protect our rights or prevent third parties from infringing or misappropriating our proprietary rights.

Our intellectual property rights may not be upheld if challenged. Such claims, if they are proved, could materially and adversely affect our business and may lead to the impairment of the amounts recorded for goodwill and other intangible assets. If we are unable to maintain the proprietary nature of our technologies, we may lose any competitive advantage provided by our intellectual property. We and our customers and other users of our products may be subject to allegations that we or they or certain uses of our products infringe the intellectual property rights of third parties. The outcome of any litigation is inherently uncertain. Any intellectual property claims, with or without merit, could be time-consuming and expensive to resolve, could divert management attention from executing our business plan, and could require us or our customers or other users of our products to change business practices, pay monetary damages, or enter into licensing or similar arrangements. Any adverse determination related to intellectual property claims or litigation could be material to our business, financial condition, or results of operations.

Climate change, or legal, regulatory or market measures to address climate change, may negatively affect our business or operations, and water scarcity or quality could negatively impact our production costs and capacity.

Increasing concentrations of carbon dioxide and other greenhouse gases in the atmosphere may have an adverse effect on global temperatures, weather patterns, and the frequency and severity of extreme weather events and natural disasters. In the event that climate change, or legal, regulatory, or market measures enacted to address climate change, has a negative effect on agricultural productivity in the regions from which we procure agricultural products such as corn and wheat, we could be subject to decreased availability or increased prices for a such agricultural products, which could have a material adverse effect on our business, financial condition, or results of operations.

Water is the main ingredient in substantially all of our distillery products and is necessary for the production of our food ingredients. It is also a limited resource, facing unprecedented changes from climate change, increasing pollution, and poor management. As demand for water continues to increase, water becomes more scarce and the quality of available water deteriorates, we may be affected by increasing production costs or capacity constraints, which could have a material adverse effect on our business, financial condition, or results of operations.

RISKS SPECIFIC TO OUR DISTILLERY PRODUCTS SEGMENT

The relationship between the price we pay for grain and the sales prices of our distillery co-products can fluctuate significantly and negatively impact our business.

Distillers feed, fuel grade alcohol, and corn oil are the principal co-products of our alcohol production process and can contribute in varying degrees to the profitability of our distillery products segment. Distillers feed and corn oil are sold for prices which historically have tracked the price of corn, but certain of our co-products compete with similar products made from other plant feedstocks, the cost of which may not have risen in unison with corn prices. We sell fuel grade alcohol, the prices for which typically, but not always, have tracked price fluctuations in gasoline prices. As a result, the profitability of these products could be adversely affected, which could be material to our business, financial condition, or results of operations.

Our strategic plan involves significant investment in the aging of barreled distillate. Decisions concerning the quantity of maturing stock of our aged distillate could materially affect our future profitability.

There is an inherent risk in determining the quantity of maturing stock of aged distillate to lay down in a given year for future sales as a result of changes in consumer demand, pricing, new brand launches, changes in product cycles, and other factors. Demand for products can change significantly between the time of production and the date of sale. It may be more difficult to make accurate predictions regarding new products and brands. Inaccurate decisions and/or estimations could lead to an inability to supply future demand or lead to a future surplus of inventory and consequent write-down in the value of maturing stocks of aged distillate. As a result, our business, financial condition, or results of operations could be materially adversely affected.

If the brands we develop or acquire do not achieve consumer acceptance, our growth may be limited, which could have a material adverse impact on our business, financial condition, or results of operations.

A component of our strategic plan is to develop our own brands, particularly whiskeys. Risks related to this strategy include:

| |

• | Because our brands, internally developed and acquired, are early in their growth cycle or have not yet been developed, they have not achieved extensive brand recognition. Accordingly, if consumers do not accept our brands, we will not be able to penetrate our markets and our growth may be limited. |

| |

• | We depend, in part, on the marketing initiatives and efforts of our independent distributors in promoting our products and creating consumer demand, and we have limited, or no, control regarding their promotional initiatives or the success of their efforts. |

| |

• | We depend on our independent distributors to distribute our products. The failure or inability of even a few of our independent distributors to adequately distribute our products within their territories could harm our sales and result in a decline in our results of operations. |

| |

• | We compete for shelf space in retail stores and for marketing focus by our independent distributors, most of whom carry extensive product portfolios. |

| |

• | The laws and regulations of several states prohibit changes of independent distributors, except under certain limited circumstances, making it difficult to terminate an independent distributor for poor performance without reasonable cause, as defined by applicable statutes. Any difficulty or inability to replace independent distributors, poor performance of our major independent distributors or our inability to collect accounts receivable from our major independent distributors could harm our business. There can be no assurance that the independent distributors and retailers we use will continue to purchase our products or provide our products with adequate levels of promotional support. |

| |

• | Our brands compete with the brands of our bulk alcohol customers. |

Warehouse expansion issues could negatively impact our operations and our business.

On October 21, 2015, we announced a major expansion in warehousing capacity. The program includes both the refurbishment of existing warehouse buildings and the construction of new warehouses. The first projects included in this program were completed in late 2015, with additional projects completed in 2016 and 2017. This program is expected to be continued into the future. There is the potential risk of completion delays, including risk of delay associated with required permits and cost overruns, which could have a material adverse effect our business, financial condition, or results of operations.

We may be subject to litigation directed at the beverage alcohol industry.

Companies in the beverage alcohol industry are, from time to time, exposed to class action or other litigation relating to alcohol advertising, product liability, alcohol abuse problems or health consequences from the misuse of alcohol. Such litigation may result in damages, penalties or fines as well as damage to our reputation, which could have a material adverse effect on our business, financial condition, or results of operations.

A change in public opinion about alcohol could reduce demand for our products.

For many years, there has been a high level of social and political attention directed at the beverage alcohol industry. The attention has focused largely on public health concerns related to alcohol abuse, including drunk driving, underage drinking, and the negative health impacts of the abuse and misuse of beverage alcohol. Anti-alcohol groups have, in the past, advocated successfully for more stringent labeling requirements, higher taxes, and other regulations designed to discourage alcohol consumption. More restrictive regulations, higher taxes, negative publicity regarding alcohol consumption and/or changes in consumer perceptions of the relative healthfulness or safety of beverage alcohol could decrease sales and consumption of alcohol, and thus, the demand for our products. This could, in turn, significantly decrease both our revenues and our revenue growth and have a material adverse effect on our business, financial condition, or results of operations.

Changes in consumer preferences and purchases, and our ability to anticipate or react to them, could negatively affect our business results.

We compete in highly competitive markets, and our success depends on our continued ability to offer our customers and consumers appealing, high-quality products. In recent years there has been increased demand for the products we produce, including, in particular, increased demand for bourbons and rye whiskeys. Customer and consumer preferences and purchases may shift due to a host of factors, many of which are difficult to predict, including:

| |

• | demographic and social trends; |

| |

• | public health policies and initiatives; |

| |

• | changes in government regulation and taxation of beverage alcohol products; |

| |

• | the potential expansion of legalization of, and increased acceptance or use of, marijuana; and |

| |

• | changes in travel, leisure, dining, entertaining, and beverage consumption trends. |

If our customers and consumers shift away from spirits (particularly brown spirits, such as our premium bourbon and rye whiskeys), our business, financial condition, or results of operations could be adversely affected.

RISKS SPECIFIC TO OUR INGREDIENT SOLUTIONS SEGMENT

Our focus on higher margin specialty ingredients may make us more reliant on fewer, more profitable customer relationships.

Our strategic plan for our ingredient solutions segment includes focusing our efforts on the sale of specialty proteins and starches to targeted domestic consumer packaged goods customers. Our major focus is directed at food ingredients, which are primarily used in foods that are developed to address consumers’ desire for healthier and more convenient products; these consist of dietary fiber, wheat protein isolates and concentrates, and textured wheat proteins. The bulk of our applications technology and research and development efforts are dedicated to providing customers with specialty ingredient solutions that deliver nutritional benefits, as well as desired functional and sensory qualities to their products. Our business, financial condition, and results of operations could be materially adversely affected if our customers were to reduce their new product development ("NPD") activities or cease using our unique dietary fibers, starches, and proteins in their NPD efforts.

Products competing with our Fibersym® resistant starch could lead to a decrease in sales volume or pricing, a decrease in margins and lower profitability.

Our patent rights to Fibersym® expired on June 6, 2017. We face competition with our Fibersym® resistant starch. The competition could lead to diminished returns and lower our margins. This factor could result in significant costs and could have a material adverse effect on our business, financial condition, and results of operations.

In November 2016, we announced that we filed a citizen petition with the FDA asking the agency to further confirm the status of our patented Fibersym® RW and FiberRite® RW resistant wheat starches as dietary fiber. A list of dietary fibers is currently being developed by the FDA under new food labeling rules, which were published on May 27, 2016 and had a scheduled compliance date of July 26, 2018. While our citizen petition is undergoing review, the current status of Fibersym® RW, along with FiberRite® RW, as accepted dietary fiber and a recognized fiber fortifying ingredient remains in place. A delay in confirmation by the FDA of our patented Fibersym® RW and FiberRite® RW resistant wheat starches as dietary fiber under the new food labeling rules in a timely manner could have a material adverse impact on ingredient solutions segment operating results.

Adverse public opinion about any of our specialty ingredients could reduce demand for our products.

Consumer preferences with respect to our specialty ingredients might change. In fact, in recent years, we have noticed shifting consumer preferences and media attention directed to gluten, gluten intolerance, and "clean label" products. Shifting consumer preferences could decrease demand for our specialty ingredients. This could, in turn, significantly decrease our revenues and revenue growth, which could have a material adverse affect on our business, financial condition, and results of operations.

RISKS RELATED TO OUR COMMON STOCK

Common Stockholders have limited rights under our Articles of Incorporation.

Under our Articles of Incorporation, holders of our Preferred Stock are entitled to elect five of our nine directors and only holders of our Preferred Stock are entitled to vote with respect to a merger, dissolution, lease, exchange or sale of substantially all of our assets, or on an amendment to the Articles of Incorporation, unless such action would increase or decrease the authorized shares or par value of the Common or Preferred Stock, or change the powers, preferences or special rights of the Common or Preferred Stock so as to affect the holders of Common Stock adversely. Generally, the Common Stock and Preferred Stock vote as separate classes on all other matters requiring stockholder approval.

The majority of the outstanding shares of our Preferred Stock is beneficially owned by one individual, who is effectively in control of the election of five of our nine directors under our Articles of Incorporation.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

MGP has three primary locations, one in Kansas, one in Indiana, and one in Kentucky. Grain processing, distillery, warehousing, research and quality control laboratories, principal executive offices, and a technical innovation center are located in Atchison, Kansas on a 28.5 acre campus. A distillery, warehousing, tank farm, quality control laboratory, and research and development facility are located on a 78 acre campus that spans portions of both Lawrenceburg and Greendale, Indiana. A warehousing facility is located on 33 acres in Williamstown, Kentucky, and is not yet in service.

These facilities are generally in good operating condition and are generally suitable for the business activity conducted therein. We have existing manufacturing capacity to grow our ingredient solutions business at our Atchison facility, as needed. All of our production facilities, executive office building, and technical innovation center are owned, and all of our owned properties are subject to mortgages in favor of one or more of our lenders. We also own or lease transportation equipment and facilities and a gas pipeline as described under Item 1. Business - Transportation and Item 1. Business - Energy.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDERS MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

Equity compensation plan information is incorporated by reference from Part III, Item 12, "Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters," of this document, should be considered an integral part of Item 5. Our Common Stock is traded on the NASDAQ Global Select Market under the ticker symbol MGPI. As of February 23, 2018, there were approximately 415 holders of record of our Common Stock. According to reports received from NASDAQ, the average daily trading volume of our Common Stock (excluding block trades) ranged from 44,900 to 918,300 shares during the year ended December 31, 2017.

HISTORICAL STOCK PRICES AND DIVIDENDS

The table below reflects the high and low sales prices of our Common Stock and the details of dividends and dividend equivalents per share for each quarter of 2017 and 2016:

|

| | | | | | | | | | | | | | | |

| Stock Sales Price | | Dividend and Dividend Equivalent Information (per Share and Unit) |

| High | | Low | | Declared | | Paid |

2017 | | | | | | | |

First Quarter | $ | 56.17 |

| | $ | 41.16 |

| | $ | 0.04 |

| | $ | 0.04 |

|

Second Quarter | 58.00 |

| | 47.64 |

| | 0.04 |

| | 0.04 |

|

Third Quarter | 62.00 |

| | 49.58 |

| | 0.89 |

| | 0.89 |

|

Fourth Quarter | 80.75 |

| | 60.30 |

| | 0.04 |

| | 0.04 |

|

| |

| | |

| | $ | 1.01 |

| | $ | 1.01 |

|

2016 | | | | | | | |

First Quarter | $ | 26.52 |

| | $ | 19.91 |

| | $ | 0.08 |

| | $ | — |

|

Second Quarter | 39.50 |

| | 22.11 |

| | — |

| | 0.08 |

|

Third Quarter | 44.25 |

| | 33.38 |

| | 0.02 |

| | 0.02 |

|

Fourth Quarter | 53.22 |

| | 31.93 |

| | 0.02 |

| | 0.02 |

|

| | | | | $ | 0.12 |

| | $ | 0.12 |

|

Our credit agreement with Wells Fargo Bank, National Association ("N.A.") (the "Credit Agreement") and our Note Purchase and Private Shelf Agreement (the "Note Purchase Agreement") with PGIM, Inc. ("Prudential Capital Group") (Note 5) allow for the payment of cash dividends as defined in Restricted Payments of the Credit Agreement and the Note Purchase Agreement. Restricted Payments are allowed as long as no Default exists, or will exist, after giving effect thereto on the date thereof, and on a Pro Forma Basis as if the Restricted Payment occurred on the last day of the most recently ended four-fiscal quarter period (with the terms Default and Pro Forma Basis as defined in the Credit Agreement and the Note Purchase Agreement) (Note 5).

On February 21, 2018, the Board of Directors declared a quarterly dividend payable to stockholders of record as of March 9, 2018, of our Common Stock and a dividend equivalent payable to holders of restricted stock units ("RSUs") as of March 9, 2018, of $0.08 per share and per unit. The dividend payment and dividend equivalent payment will occur on March 23, 2018.

We expect to continue our policy of paying quarterly cash dividends, although there is no assurance as to the declaration or amount of any future dividends because they are dependent on future earnings, capital requirements, and debt service obligations.

STOCK PERFORMANCE GRAPH

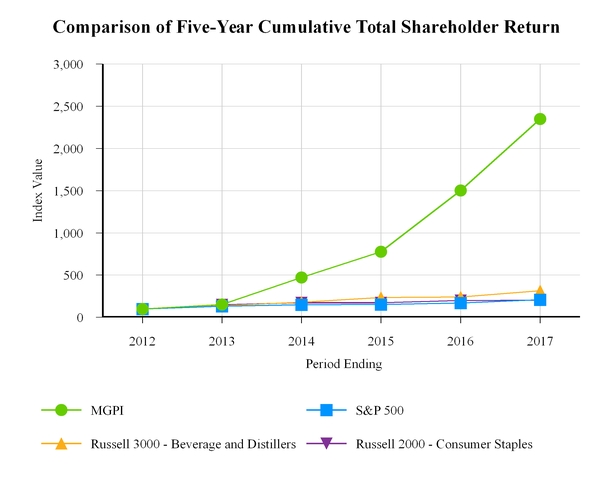

The following graph compares the cumulative total return of our Common Stock for the five year period ended December 31, 2017, against the cumulative total return of the S&P 500 Stock Index (broad market comparison), Russell 3000 - Beverage and Distillers (line of business comparison), and Russell 2000 - Consumer Staples (line of business comparison). The graph assumes $100 (one hundred dollars) was invested on December 31, 2012, and that all dividends were reinvested.

PURCHASES OF EQUITY SECURITIES BY ISSUER

We did not sell equity securities during the quarter ended December 31, 2017.

Issuer Purchases of Equity Securities

|

| | | | | | | | | | | | | | | |

| | (a) Total Number of Shares (or Units) Purchased | | | (b) Average Price Paid per Share (or Unit) | | | (c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs | | (d) Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs |

October 1, 2017 through October 31, 2017 | | — |

| | | — |

| | | — |

| | — |

|

November 1, 2017 through November 30, 2017 | | 42,663 |

| (a) | | $ | 74.21 |

| | | — |

| | — |

|

December 1, 2017 through December 31, 2017 | | 1,653 |

| (a) | | 72.96 |

| | | — |

| | — |

|

Total | | 44,316 |

| | | | | | — |

| | |

| |

(a) | Vested RSU awards under the 2004 Plan that were purchased to cover employee withholding taxes. |

ITEM 6. SELECTED FINANCIAL DATA AND SUPPLEMENTARY FINANCIAL INFORMATION |

| | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2017(a)(e)(g)(h) | | 2016(a)(e)(f) | | 2015(a) | | 2014(a)(b) | | 2013(c) |

Consolidated Statements of Income (Loss) Data: | | | | | | | | | |

Net sales | $ | 347,448 |

| | $ | 318,263 |

| | $ | 327,604 |

| | $ | 313,403 |

| | $ | 323,264 |

|

Income (loss) before income taxes(d) | $ | 52,758 |

| | $ | 44,717 |

| | $ | 38,418 |

| | $ | 25,940 |

| | $ | (6,521 | ) |

Net income (loss) | $ | 41,823 |

| | $ | 31,184 |

| | $ | 26,191 |

| | $ | 23,675 |

| | $ | (4,929 | ) |

| | | | | | | | | |

Basic and Diluted Earnings (Loss) Per Share ("EPS") | | | | | | | | | |

Income (loss) from continuing operations | $ | 2.44 |

| | $ | 1.82 |

| | $ | 1.48 |

| | $ | 1.32 |

| | $ | (0.34 | ) |

Income from discontinued operations | — |

| | — |

| | — |

| | — |

| | 0.05 |

|

Net income (loss) | $ | 2.44 |

| | $ | 1.82 |

| | $ | 1.48 |

| | $ | 1.32 |

| | $ | (0.29 | ) |

| | | | | | | | | |

Dividends and Dividend Equivalents Per Common Share | $ | 1.01 |

| | $ | 0.12 |

| | $ | 0.06 |

| | $ | 0.05 |

| | $ | 0.05 |

|

Consolidated Balance Sheet Data: | | | | | | | | | |

Total assets | $ | 240,328 |

| | $ | 225,336 |

| | $ | 194,310 |

| | $ | 160,215 |

| | $ | 151,329 |

|

Long-term debt, less current maturities | $ | 24,182 |

| | $ | 31,642 |

| | $ | 30,115 |

| | $ | 7,286 |

| | $ | 21,611 |

|

| |

(a) | During 2017, 2016, 2015, and 2014, we determined that we would more likely than not realize a portion of our deferred tax asset and reduced the valuation allowance by $578, $718, $2,385, and $7,446, respectively. |

| |

(b) | In January 2014 and October 2014, we experienced a fire at one of our facilities. Insurance recoveries totaled $8,290 for 2014. |

| |

(c) | In connection with the proxy contest related to our 2013 Annual Meeting of stockholders, we were involved in various proceedings with respect to MGP Ingredients, Inc. Voting Trust, the 2013 Annual Meeting, and the Special Committee of the Board of Directors and incurred $5,465 of expenses in 2013. |

| |

(d) | In 2013 we reported discontinued operations. Accordingly, the caption for 2013 was Loss from continuing operations before income taxes. |

| |

(e) | In March 2016, the FASB issued ASU No. 2016-09, Compensation—Stock Compensation (Topic 718) Improvements to Employee Share-Based Payment Accounting. We elected to early adopt the ASU and, for 2017 and 2016, respectively, received a combined federal and state tax effected excess tax benefit of $4,625 and $1,571 from windfalls related to employee share-based compensation recognized as a reduction to income tax expense. Retrospective application to 2015, 2014, and 2013 was not required. |

| |

(f) | Net income for 2016 included a legal settlement agreement and a gain on sale of long-lived assets of $3,385 before tax. |

| |

(g) | On July 3, 2017, we completed the sale of our 30 percent equity ownership interest in ICP to Pacific Ethanol, consistent with a Merger Agreement entered into on June 26, 2017, and, as a result, recorded a gain on sale of equity method investment of $11,381 before tax, which is included in Net income for 2017 (Note 3). |

| |

(h) | On December 22, 2017, the United States enacted tax reform legislation commonly known as the Tax Cuts and Jobs Act (the "Tax Act"), resulting in significant modifications to existing law. Following the guidance in SEC Staff Bulletin 118 ("SAB 118"), we recorded a provisional discrete net tax benefit in our Consolidated Statements of Income through net income of $3,343 in 2017. The ultimate impact may differ from the provisional amount, possibly materially, due to, among other things, additional analysis, changes in interpretations and assumptions we made, additional regulatory guidance that may be issued, and action we may take as a result of the Tax Act (Note 6). |

Selected Financial Information

Selected quarterly financial information is detailed in Note 15.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

CAUTIONARY NOTE CONCERNING FACTORS THAT MAY AFFECT FUTURE RESULTS

This Report on Form 10-K contains forward looking statements as well as historical information. All statements, other than statements of historical facts, regarding the prospects of our industry and our prospects, plans, financial position, and strategic plan may constitute forward looking statements. In addition, forward looking statements are usually identified by or are associated with such words as "intend," "plan," "believe," "estimate," "expect," "anticipate," "hopeful," "should," "may," "will," "could," "encouraged," "opportunities," "potential," and/or the negatives or variations of these terms or similar terminology. Forward looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from those expressed or implied in the forward looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward looking statements is included in the section titled "Risk Factors" (Item 1A of this Form 10-K). Forward looking statements are made as of the date of this report, and we undertake no obligation to update or revise publicly any forward looking statements, whether because of new information, future events or otherwise.

Management’s Discussion and Analysis ("MD&A") of Financial Condition and Results of Operations is designed to provide a reader of MGP’s consolidated financial statements with a narrative from the perspective of management. MGP’s MD&A is presented in eight sections:

| |

• | Distillery Products Segment |

| |

• | Ingredient Solutions Segment |

| |

• | Cash Flow, Financial Condition and Liquidity |

| |

• | Off Balance Sheet Obligations |

| |

• | New Accounting Pronouncements |

OVERVIEW

MGP is a leading producer and supplier of premium distilled spirits and specialty wheat protein and starch food ingredients. Distilled spirits include premium bourbon and rye whiskeys and GNS, including vodka and gin. We are also a top producer of high quality industrial alcohol for use in both food and non-food applications. Our protein and starch food ingredients provide a host of functional, nutritional and sensory benefits for a wide range of food products to serve the packaged goods industry. We have two reportable segments: our distillery products segment and our ingredient solutions segment.

Our Mission

Secure our future by consistently delivering superior financial results by more fully participating in all levels of the alcohol and food ingredients segments for the betterment of our shareholders, employees, partners, consumers, and communities.

Our Strategic Plan

Our strategic plan is designed to leverage our history and strengths. We have a long history in the distilling industry. Our Lawrenceburg facility, which we purchased in 2011, was founded in 1847 and our Atchison facility was opened in 1941. Through these two distilleries, we are involved in producing some of the finest whiskeys, vodkas, and gins in the world. Likewise, our history in the food ingredient business stretches back more than 60 years.

Our strategic plan seeks to leverage the positive macro trends we see in the industries where we compete while providing better insulation from outside factors, including swings in commodity pricing. We believe the successful execution of our strategy will deliver strong operating income growth in 2018 and beyond. Specifically, our strategic plan is built on five key growth strategies: Maximize Value, Capture Value Share, Invest for Growth, Risk Management, and Build the MGP Brand. Each of these strategies, along with related 2017 accomplishments, is discussed below.

Maximize Value - We focus on maximizing the value of our current production volumes, particularly taking advantage of favorable macro trends in our distillery products segment, such as the growth of the American whiskey category that has continued to expand over the past several years. This includes shifting sales mix to higher margin products, such as premium bourbon and rye whiskeys, as well as extending the product range of our grain neutral spirits, including vodkas and gins. In our ingredient solutions segment, the macro trends include growth in high fiber, high protein, plant-based proteins, and non-GMO products.

Although these macro trends are currently favorable, we have seen competition intensify as industry participants in both of our segments seek to capitalize on consumers' interest in these categories. While we believe we are well-positioned to benefit from these favorable trends, we may also be negatively affected by the increase in competition in one or both of our segments. We intend to continue to focus on opportunities that will allow us to achieve the highest value from our production facilities.

Accomplishments

| |

• | In March 2017, we announced the introduction of Non-GMO Project Verified GNS in our portfolio of premium distilled spirits, which consists of vodkas, gins, bourbons, and whiskeys. Our Non-GMO Project Verified GNS is produced in compliance with the Non-GMO Project Standard. Achieving this verification assures customers who require non-GMO products that we follow stringent best practices for GMO avoidance. The Non-GMO Project, a non-profit organization, offers North America’s only third party verification and labeling for non-GMO products. |

| |

• | In June 2017, we announced the addition of new clean label ingredients to our Arise® line of wheat protein isolates, and by fall 2017, our portfolio of Non-GMO Project Verified food ingredients included Arise® wheat protein isolates, HWG™ 2009 lightly hydrolyzed wheat protein, as well as TruTex® textured wheat proteins. In addition to providing protein enrichment, the Arise® protein isolates deliver a multitude of functional benefits across a wide range of bakery products and other food applications. Produced principally for use in vegetarian food applications, TruTex® develops a fibrous structure when hydrated and can be customized to take on the appearance beef, pork, poultry, and seafood. |

| |

• | Our shift in sales mix to higher margin products has contributed to a 17.6 percent increase in gross profit within the distillery products segment in 2017 over the prior year. |

| |

• | Our shift in sales mix to higher margin products has contributed to a 8.9 percent increase in gross profit within the ingredient solutions segment in 2017 over the prior year. |

See the "Distillery Products Segment" and "Ingredient Solutions Segment" discussions.

Capture Value Share - We will work to develop partnerships to support brand creation, long-term growth, and to combine our innovation capabilities and industry expertise to provide unique solutions and offerings to the marketplace. In that way, we believe we will be able to realize full value for our operational capacity, quality, and commitment.

Accomplishments

| |