0000834365falseFY2023P3Y1111http://fasb.org/us-gaap/2023#AssetImpairmentChargesP3YP1YP1YP4YP1Y.25.25.25.2529038200008343652023-01-012023-12-3100008343652023-06-30iso4217:USD00008343652024-02-22xbrli:shares00008343652021-01-012021-12-3100008343652023-12-3100008343652022-12-31iso4217:USDxbrli:shares0000834365us-gaap:SeriesAPreferredStockMember2022-12-310000834365us-gaap:SeriesAPreferredStockMember2023-12-310000834365us-gaap:ProductMember2023-01-012023-12-310000834365us-gaap:ProductMember2022-01-012022-12-310000834365us-gaap:ProductMember2021-01-012021-12-310000834365us-gaap:ServiceMember2023-01-012023-12-310000834365us-gaap:ServiceMember2022-01-012022-12-310000834365us-gaap:ServiceMember2021-01-012021-12-310000834365blfs:RentalRevenueMember2023-01-012023-12-310000834365blfs:RentalRevenueMember2022-01-012022-12-310000834365blfs:RentalRevenueMember2021-01-012021-12-3100008343652022-01-012022-12-310000834365us-gaap:RetainedEarningsMember2023-01-012023-12-310000834365us-gaap:RetainedEarningsMember2022-01-012022-12-310000834365us-gaap:RetainedEarningsMember2021-01-012021-12-310000834365us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2020-12-310000834365us-gaap:CommonStockMember2020-12-310000834365us-gaap:AdditionalPaidInCapitalMember2020-12-310000834365us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000834365us-gaap:RetainedEarningsMember2020-12-3100008343652020-12-310000834365blfs:GCIAcquisitionMemberus-gaap:CommonStockMember2021-01-012021-12-310000834365blfs:GCIAcquisitionMemberus-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000834365blfs:GCIAcquisitionMember2021-01-012021-12-310000834365us-gaap:CommonStockMemberblfs:SextonAcquisitionMember2021-01-012021-12-310000834365blfs:SextonAcquisitionMemberus-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000834365blfs:SextonAcquisitionMember2021-01-012021-12-310000834365us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000834365us-gaap:CommonStockMember2021-01-012021-12-310000834365us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310000834365us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2021-12-310000834365us-gaap:CommonStockMember2021-12-310000834365us-gaap:AdditionalPaidInCapitalMember2021-12-310000834365us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000834365us-gaap:RetainedEarningsMember2021-12-3100008343652021-12-310000834365us-gaap:CommonStockMember2022-01-012022-12-310000834365us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000834365us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000834365us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2022-12-310000834365us-gaap:CommonStockMember2022-12-310000834365us-gaap:AdditionalPaidInCapitalMember2022-12-310000834365us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000834365us-gaap:RetainedEarningsMember2022-12-310000834365us-gaap:CommonStockMember2023-01-012023-12-310000834365us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000834365us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000834365us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2023-12-310000834365us-gaap:CommonStockMember2023-12-310000834365us-gaap:AdditionalPaidInCapitalMember2023-12-310000834365us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000834365us-gaap:RetainedEarningsMember2023-12-310000834365blfs:GlobalCoolingIncAndSextonBiotechnologiesMember2023-01-012023-12-310000834365blfs:GlobalCoolingIncAndSextonBiotechnologiesMember2022-01-012022-12-310000834365blfs:GlobalCoolingIncAndSextonBiotechnologiesMember2021-01-012021-12-310000834365blfs:SciSafeMember2023-01-012023-12-310000834365blfs:SciSafeMember2022-01-012022-12-310000834365blfs:SciSafeMember2021-01-012021-12-31blfs:reportable_segmentblfs:reporting_unit0000834365blfs:ProductFreezerAndThawMember2023-01-012023-12-310000834365blfs:ProductFreezerAndThawMember2022-01-012022-12-310000834365blfs:ProductFreezerAndThawMember2021-01-012021-12-310000834365blfs:ProductCellProcessingMember2023-01-012023-12-310000834365blfs:ProductCellProcessingMember2022-01-012022-12-310000834365blfs:ProductCellProcessingMember2021-01-012021-12-310000834365blfs:ProductBiostorageServicesMember2023-01-012023-12-310000834365blfs:ProductBiostorageServicesMember2022-01-012022-12-310000834365blfs:ProductBiostorageServicesMember2021-01-012021-12-310000834365blfs:ServiceFreezerAndThawMember2023-01-012023-12-310000834365blfs:ServiceFreezerAndThawMember2022-01-012022-12-310000834365blfs:ServiceFreezerAndThawMember2021-01-012021-12-310000834365blfs:ServiceBiostorageServicesMember2023-01-012023-12-310000834365blfs:ServiceBiostorageServicesMember2022-01-012022-12-310000834365blfs:ServiceBiostorageServicesMember2021-01-012021-12-310000834365blfs:RentalBiostorageServicesMember2023-01-012023-12-310000834365blfs:RentalBiostorageServicesMember2022-01-012022-12-310000834365blfs:RentalBiostorageServicesMember2021-01-012021-12-310000834365blfs:RentalRevenueMember2024-01-012023-12-310000834365blfs:RentalRevenueMember2023-12-310000834365blfs:ServiceRevenueMember2024-01-012023-12-310000834365blfs:ServiceRevenueMember2023-12-310000834365blfs:ShareBasedPaymentArrangementOptionAndRestrictedStockAwardsMember2023-01-012023-12-310000834365blfs:ShareBasedPaymentArrangementOptionAndRestrictedStockAwardsMember2022-01-012022-12-310000834365blfs:ShareBasedPaymentArrangementOptionAndRestrictedStockAwardsMember2021-01-012021-12-310000834365us-gaap:WarrantMember2023-01-012023-12-310000834365us-gaap:WarrantMember2022-01-012022-12-310000834365us-gaap:WarrantMember2021-01-012021-12-310000834365blfs:SeriesA1AndA2PreferredStockMember2022-12-310000834365blfs:SeriesA1AndA2PreferredStockMember2023-12-310000834365us-gaap:SeriesEPreferredStockMember2022-12-310000834365us-gaap:SeriesEPreferredStockMember2023-12-310000834365blfs:SeriesA2PreferredStockMemberus-gaap:ContingentConvertiblePreferredStockMember2020-11-300000834365us-gaap:ConvertibleDebtSecuritiesMember2023-01-012023-12-310000834365us-gaap:ConvertibleDebtSecuritiesMember2022-01-012022-12-310000834365us-gaap:ConvertibleDebtSecuritiesMember2021-01-012021-12-310000834365blfs:PanTHERAheraCryosolutionsMemberus-gaap:ContingentConvertiblePreferredStockMemberblfs:PreferredStockClassEMember2020-11-300000834365us-gaap:ContingentConvertiblePreferredStockMemberblfs:PreferredStockClassEMember2020-11-012020-11-300000834365us-gaap:ContingentConvertiblePreferredStockMemberblfs:PreferredStockClassEMember2021-06-012021-06-300000834365srt:MinimumMember2023-12-310000834365srt:MaximumMember2023-12-310000834365blfs:AssetsHeldForRentMember2023-12-310000834365blfs:AssetsHeldForRentMember2022-01-012022-12-310000834365blfs:AssetsHeldForRentMember2021-01-012021-12-310000834365blfs:AssetsHeldForRentMember2023-01-012023-12-310000834365blfs:TaxAttributesCarriedForwardMember2023-12-310000834365us-gaap:InterestExpenseMember2023-12-310000834365us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberblfs:OneCustomerMember2023-01-012023-12-31xbrli:pure0000834365us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberblfs:OneCustomerMember2022-01-012022-12-310000834365us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberblfs:OneCustomerMember2021-01-012021-12-310000834365blfs:CryoStorProductsMemberus-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMember2023-01-012023-12-310000834365blfs:CryoStorProductsMemberus-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMember2022-01-012022-12-310000834365blfs:CryoStorProductsMemberus-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMember2021-01-012021-12-310000834365us-gaap:SalesRevenueNetMemberblfs:XLEFreezerLineMemberus-gaap:ProductConcentrationRiskMember2023-01-012023-12-310000834365us-gaap:SalesRevenueNetMemberblfs:XLEFreezerLineMemberus-gaap:ProductConcentrationRiskMember2022-01-012022-12-310000834365us-gaap:SalesRevenueNetMemberblfs:XLEFreezerLineMemberus-gaap:ProductConcentrationRiskMember2021-01-012021-12-310000834365us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMembercountry:US2023-01-012023-12-310000834365us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMembercountry:US2022-01-012022-12-310000834365us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMembercountry:US2021-01-012021-12-310000834365us-gaap:GeographicConcentrationRiskMemberus-gaap:EMEAMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310000834365us-gaap:GeographicConcentrationRiskMemberus-gaap:EMEAMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310000834365us-gaap:GeographicConcentrationRiskMemberus-gaap:EMEAMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310000834365blfs:GeographicOtherMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310000834365blfs:GeographicOtherMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310000834365blfs:GeographicOtherMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310000834365us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310000834365us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310000834365us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310000834365country:US2023-12-310000834365country:US2022-12-310000834365country:NL2023-12-310000834365country:NL2022-12-310000834365us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMemberblfs:OneCustomerMember2023-01-012023-12-310000834365blfs:TwoCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2022-01-012022-12-310000834365us-gaap:SupplierConcentrationRiskMemberus-gaap:AccountsPayableMemberblfs:OneSupplierMember2023-01-012023-12-310000834365us-gaap:SupplierConcentrationRiskMemberus-gaap:AccountsPayableMemberblfs:OneSupplierMember2022-01-012022-12-310000834365blfs:RentalRevenueMember2025-01-012023-12-310000834365blfs:ServiceRevenueMember2025-01-012023-12-310000834365blfs:FreezerBusinessMember2023-07-012023-09-300000834365us-gaap:TechnologyBasedIntangibleAssetsMemberblfs:FreezerBusinessMember2023-07-012023-09-300000834365us-gaap:CustomerRelationshipsMemberblfs:FreezerBusinessMember2023-07-012023-09-300000834365us-gaap:TradeNamesMemberblfs:FreezerBusinessMember2023-07-012023-09-300000834365blfs:GlobalCoolingMember2022-01-012022-12-310000834365blfs:GlobalCoolingMemberus-gaap:TechnologyBasedIntangibleAssetsMember2022-01-012022-12-310000834365blfs:GlobalCoolingMemberus-gaap:CustomerRelationshipsMember2022-01-012022-12-310000834365blfs:GlobalCoolingMemberus-gaap:TradeNamesMember2022-01-012022-12-310000834365blfs:GlobalCoolingMemberus-gaap:NoncompeteAgreementsMember2022-01-012022-12-310000834365us-gaap:MeasurementInputDiscountRateMemberblfs:SciSafeHoldingsIncMember2020-10-010000834365us-gaap:MeasurementInputRiskFreeInterestRateMemberblfs:SciSafeHoldingsIncMember2020-10-010000834365blfs:MeasurementInputAssetVolatilityMemberblfs:SciSafeHoldingsIncMember2020-10-010000834365blfs:MeasurementInputRevenueVolatilityMemberblfs:SciSafeHoldingsIncMember2020-10-010000834365blfs:SciSafeHoldingsIncMember2020-10-010000834365blfs:SciSafeHoldingsIncMember2022-12-310000834365blfs:SciSafeHoldingsIncMember2023-01-012023-12-310000834365blfs:SciSafeHoldingsIncMember2022-01-012022-12-310000834365us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310000834365us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310000834365us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310000834365us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherDebtSecuritiesMember2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherDebtSecuritiesMember2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherDebtSecuritiesMember2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMember2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310000834365us-gaap:FairValueMeasurementsRecurringMember2023-12-310000834365us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310000834365us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310000834365us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310000834365us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherDebtSecuritiesMember2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherDebtSecuritiesMember2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherDebtSecuritiesMember2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMember2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310000834365us-gaap:FairValueMeasurementsRecurringMember2022-12-310000834365blfs:ContingentConsiderationLiabilitiesMember2022-12-310000834365blfs:ContingentConsiderationLiabilitiesMember2021-12-310000834365blfs:ContingentConsiderationLiabilitiesMember2020-12-310000834365blfs:ContingentConsiderationLiabilitiesMember2023-01-012023-12-310000834365blfs:ContingentConsiderationLiabilitiesMember2022-01-012022-12-310000834365blfs:ContingentConsiderationLiabilitiesMember2021-01-012021-12-310000834365blfs:ContingentConsiderationLiabilitiesMember2023-12-310000834365blfs:WarrantLiabilitiesMember2021-12-310000834365blfs:WarrantLiabilitiesMember2022-01-012022-12-310000834365blfs:WarrantLiabilitiesMember2022-12-310000834365us-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310000834365us-gaap:CorporateDebtSecuritiesMember2023-12-310000834365us-gaap:OtherDebtSecuritiesMember2023-12-310000834365blfs:RealEstateLeaseMembersrt:MinimumMember2023-12-310000834365blfs:RealEstateLeaseMembersrt:MaximumMember2023-12-310000834365blfs:VehicleAndOtherEquipmentMembersrt:MinimumMember2023-12-310000834365blfs:VehicleAndOtherEquipmentMembersrt:MaximumMember2023-12-310000834365us-gaap:LeaseholdImprovementsMember2023-12-310000834365us-gaap:LeaseholdImprovementsMember2022-12-310000834365blfs:FurnitureAndComputerEquipmentMember2023-12-310000834365blfs:FurnitureAndComputerEquipmentMember2022-12-310000834365us-gaap:ManufacturingFacilityMember2023-12-310000834365us-gaap:ManufacturingFacilityMember2022-12-310000834365us-gaap:ConstructionInProgressMember2023-12-310000834365us-gaap:ConstructionInProgressMember2022-12-310000834365blfs:GlobalCoolingMember2022-01-012022-12-310000834365blfs:SextonBiotechnologiesIncMember2022-01-012022-12-310000834365us-gaap:CustomerRelationshipsMember2023-12-310000834365srt:WeightedAverageMemberus-gaap:CustomerRelationshipsMember2023-12-310000834365us-gaap:TradeNamesMember2023-12-310000834365srt:WeightedAverageMemberus-gaap:TradeNamesMember2023-12-310000834365us-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310000834365srt:WeightedAverageMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310000834365us-gaap:NoncompeteAgreementsMember2023-12-310000834365us-gaap:NoncompeteAgreementsMembersrt:WeightedAverageMember2023-12-310000834365srt:WeightedAverageMember2023-12-310000834365us-gaap:CustomerRelationshipsMember2022-12-310000834365srt:WeightedAverageMemberus-gaap:CustomerRelationshipsMember2022-12-310000834365us-gaap:TradeNamesMember2022-12-310000834365srt:WeightedAverageMemberus-gaap:TradeNamesMember2022-12-310000834365us-gaap:TechnologyBasedIntangibleAssetsMember2022-12-310000834365srt:WeightedAverageMemberus-gaap:TechnologyBasedIntangibleAssetsMember2022-12-310000834365us-gaap:NoncompeteAgreementsMember2022-12-310000834365us-gaap:NoncompeteAgreementsMembersrt:WeightedAverageMember2022-12-310000834365srt:WeightedAverageMember2022-12-310000834365us-gaap:CustomerRelationshipsMember2022-01-012022-12-310000834365us-gaap:TradeNamesMember2022-01-012022-12-310000834365us-gaap:TechnologyBasedIntangibleAssetsMember2022-01-012022-12-310000834365us-gaap:NoncompeteAgreementsMember2022-01-012022-12-310000834365blfs:GCIEscrowMember2021-05-030000834365blfs:EscrowSharesMemberblfs:GCIEscrowMember2021-05-030000834365blfs:GCIEscrowMemberblfs:GeneralEscrowSharesMember2021-05-030000834365blfs:GCIEscrowMemberus-gaap:SettledLitigationMemberblfs:GeneralEscrowSharesMember2023-06-0500008343652023-04-012023-06-3000008343652021-05-012021-05-31blfs:note0000834365blfs:NotesPayableMember2021-05-310000834365blfs:LondonInterbankOfferedRateLIBOR1Memberblfs:NotesPayableMember2021-05-012021-05-310000834365blfs:NotesPayableMember2021-10-310000834365blfs:AdvantageTermNote1Memberblfs:NotesPayableMember2021-10-310000834365blfs:NotesPayableMemberblfs:AdvantageTermNote2Member2021-10-310000834365blfs:EnhancedTermNoteMemberblfs:NotesPayableMember2021-10-310000834365blfs:The2023TermLoan3Member2022-09-200000834365blfs:The2023TermLoan3Member2022-09-202022-09-200000834365us-gaap:PrimeRateMemberblfs:The2023TermLoan3Member2022-09-202022-09-200000834365blfs:The2023TermLoan3Member2023-12-310000834365blfs:GlobalCoolingTermNotesMember2023-12-310000834365blfs:GlobalCoolingTermNotesMember2022-12-310000834365blfs:TermLoanMember2022-12-310000834365blfs:TermLoanMember2023-12-310000834365blfs:FinancedInsurancePremiumMember2023-12-310000834365blfs:FinancedInsurancePremiumMember2022-12-310000834365blfs:FreezerEquipmentLoanMember2022-12-310000834365blfs:FreezerEquipmentLoanMember2023-12-310000834365blfs:ManufacturingEquipmentLoansMember2022-12-310000834365blfs:ManufacturingEquipmentLoansMember2023-12-310000834365blfs:FreezerInstallationLoanMember2022-12-310000834365blfs:FreezerInstallationLoanMember2023-12-310000834365blfs:OtherLoansMember2023-12-310000834365blfs:OtherLoansMember2022-12-310000834365blfs:TotalDebtMember2023-12-310000834365blfs:TotalDebtMember2022-12-310000834365blfs:WarrantsExercisedMember2021-03-012021-03-310000834365blfs:The2013PerformanceIncentivePlanMember2013-12-310000834365blfs:The2013PerformanceIncentivePlanMember2017-05-310000834365blfs:The2013PerformanceIncentivePlanMember2020-07-310000834365blfs:The2013PerformanceIncentivePlanMember2021-06-300000834365blfs:The2013PerformanceIncentivePlanMember2022-06-300000834365blfs:The2013PerformanceIncentivePlanMember2023-12-310000834365blfs:The2023PerformanceIncentivePlanMember2023-07-210000834365us-gaap:RestrictedStockMemberblfs:The2023PerformanceIncentivePlanMember2023-12-310000834365us-gaap:EmployeeStockOptionMember2022-12-310000834365us-gaap:EmployeeStockOptionMember2021-12-310000834365us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000834365us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000834365us-gaap:EmployeeStockOptionMember2023-12-310000834365us-gaap:EmployeeStockOptionMember2021-01-012021-12-310000834365blfs:PriceRange1Member2023-01-012023-12-310000834365blfs:PriceRange1Member2023-12-310000834365blfs:PriceRange2Member2023-01-012023-12-310000834365blfs:PriceRange2Member2023-12-310000834365blfs:PriceRange3Member2023-01-012023-12-310000834365blfs:PriceRange3Member2023-12-310000834365blfs:PriceRange4Member2023-01-012023-12-310000834365blfs:PriceRange4Member2023-12-310000834365us-gaap:PerformanceSharesMemberblfs:ManagementPerformanceBonusPlan2017Member2023-01-012023-12-310000834365us-gaap:PerformanceSharesMemberblfs:ManagementPerformanceBonusPlan2017Member2021-01-012021-12-310000834365us-gaap:PerformanceSharesMemberblfs:ManagementPerformanceBonusPlan2017Member2022-01-012022-12-310000834365us-gaap:RestrictedStockMember2022-12-310000834365us-gaap:RestrictedStockMember2021-12-310000834365us-gaap:RestrictedStockMember2023-01-012023-12-310000834365us-gaap:RestrictedStockMember2022-01-012022-12-310000834365us-gaap:RestrictedStockMember2023-12-310000834365us-gaap:RestrictedStockMembersrt:ExecutiveOfficerMember2021-01-012021-12-310000834365us-gaap:RestrictedStockMember2021-01-012021-12-310000834365blfs:MichaelRiceMembersrt:ExecutiveOfficerMemberblfs:MarketbasedRestrictedStockMember2023-01-032023-01-030000834365blfs:MichaelRiceMembersrt:ExecutiveOfficerMemberblfs:MarketbasedRestrictedStockMember2022-02-242022-02-240000834365blfs:MarketbasedRestrictedStockMember2023-10-192023-10-190000834365blfs:MarketbasedRestrictedStockMember2023-10-190000834365us-gaap:RestrictedStockMembersrt:ExecutiveOfficerMember2023-08-012023-12-310000834365us-gaap:RestrictedStockMember2023-08-012023-12-310000834365us-gaap:RestrictedStockMembersrt:ExecutiveOfficerMember2022-05-012022-08-300000834365blfs:MarketbasedRestrictedStockMember2022-12-310000834365blfs:MarketbasedRestrictedStockMember2021-12-310000834365blfs:MarketbasedRestrictedStockMember2023-01-012023-12-310000834365blfs:MarketbasedRestrictedStockMember2022-01-012022-12-310000834365blfs:MarketbasedRestrictedStockMember2023-12-310000834365blfs:MarketbasedRestrictedStockMember2020-03-252020-03-250000834365blfs:MarketbasedRestrictedStockMember2022-02-242022-02-2400008343652022-02-242022-02-24blfs:peer0000834365srt:MinimumMemberblfs:MarketbasedRestrictedStockMember2022-02-242022-02-240000834365srt:MaximumMemberblfs:MarketbasedRestrictedStockMember2022-02-242022-02-240000834365blfs:MarketbasedRestrictedStockSecondIssuanceMember2021-01-012021-12-310000834365blfs:MarketbasedRestrictedStockMember2021-02-082021-02-080000834365blfs:MarketbasedRestrictedStockMember2023-01-032023-01-0300008343652023-01-032023-01-030000834365srt:MinimumMemberblfs:MarketbasedRestrictedStockMember2021-02-082021-02-080000834365srt:MaximumMemberblfs:MarketbasedRestrictedStockMember2021-02-082021-02-080000834365srt:ExecutiveOfficerMemberblfs:MarketbasedRestrictedStockMember2022-02-242022-02-240000834365srt:ExecutiveOfficerMemberblfs:MarketbasedRestrictedStockMember2023-01-032023-01-030000834365srt:MinimumMemberblfs:MarketbasedRestrictedStockMember2023-01-032023-01-030000834365srt:MaximumMemberblfs:MarketbasedRestrictedStockMember2023-01-032023-01-030000834365blfs:MarketbasedRestrictedStockMember2021-01-012021-12-310000834365us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310000834365us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310000834365us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310000834365us-gaap:SellingAndMarketingExpenseMember2023-01-012023-12-310000834365us-gaap:SellingAndMarketingExpenseMember2022-01-012022-12-310000834365us-gaap:SellingAndMarketingExpenseMember2021-01-012021-12-310000834365us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310000834365us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310000834365us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310000834365us-gaap:CostOfSalesMember2023-01-012023-12-310000834365us-gaap:CostOfSalesMember2022-01-012022-12-310000834365us-gaap:CostOfSalesMember2021-01-012021-12-310000834365us-gaap:RestrictedStockMembersrt:ExecutiveOfficerMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-012023-12-310000834365us-gaap:RestrictedStockMembersrt:ExecutiveOfficerMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-01-012023-12-310000834365us-gaap:RestrictedStockMemberblfs:ShareBasedPaymentArrangementTrancheFourMembersrt:ExecutiveOfficerMember2023-01-012023-12-310000834365us-gaap:RestrictedStockMembersrt:ExecutiveOfficerMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2023-01-012023-12-310000834365blfs:GCIAcquisitionMember2021-12-310000834365blfs:SextonAcquisitionMember2021-12-310000834365blfs:SextonAcquisitionMember2021-09-012021-09-010000834365blfs:SextonAcquisitionMemberblfs:CommonStockIssuedToAcquireParticipatingHoldersMember2021-09-012021-09-010000834365blfs:CommonStockDepositedIntoEscrowMemberblfs:SextonAcquisitionMember2021-09-012021-09-010000834365blfs:SextonAcquisitionMember2021-09-010000834365blfs:SextonAcquisitionMemberus-gaap:DevelopedTechnologyRightsMember2021-09-010000834365blfs:SextonAcquisitionMemberus-gaap:CustomerRelationshipsMember2021-09-010000834365blfs:SextonAcquisitionMemberus-gaap:TradeNamesMember2021-09-010000834365us-gaap:NoncompeteAgreementsMemberblfs:SextonAcquisitionMember2021-09-010000834365blfs:SextonAcquisitionMember2021-10-012021-12-310000834365blfs:SextonAcquisitionMembersrt:MinimumMemberus-gaap:DevelopedTechnologyRightsMember2021-09-010000834365blfs:SextonAcquisitionMemberus-gaap:DevelopedTechnologyRightsMembersrt:MaximumMember2021-09-010000834365blfs:GCIAcquisitionMember2021-05-032021-05-030000834365blfs:GCIAcquisitionMemberblfs:OneGCIStockholderMember2021-05-032021-05-030000834365blfs:GCIAcquisitionMemberblfs:OneGCIStockholderMember2021-05-030000834365blfs:GCIAcquisitionMember2021-03-190000834365blfs:GCIAcquisitionMember2021-05-030000834365blfs:GCIAcquisitionMemberus-gaap:DevelopedTechnologyRightsMember2021-05-030000834365blfs:GCIAcquisitionMemberus-gaap:CustomerRelationshipsMember2021-05-030000834365blfs:GCIAcquisitionMemberus-gaap:TradeNamesMember2021-05-030000834365blfs:GCIAcquisitionMemberus-gaap:NoncompeteAgreementsMember2021-05-030000834365blfs:GCIAcquisitionMemberblfs:IndefiniteInProcessResearchAndDevelopmentMember2021-05-030000834365blfs:GCIAcquisitionMember2021-10-012021-12-310000834365blfs:SextonAcquisitionMember2021-09-012021-12-310000834365blfs:GCIAcquisitionMember2021-05-032021-12-310000834365blfs:SarahAebersoldMember2023-10-012023-12-310000834365blfs:SarahAebersoldMember2023-12-310000834365blfs:ToddBerardMemberblfs:ToddBerardTradingPlanTwoMember2023-10-012023-12-310000834365blfs:ToddBerardMemberblfs:ToddBerardTradingPlanOneMember2023-10-012023-12-310000834365blfs:ToddBerardMemberblfs:ToddBerardTradingPlanTwoMember2023-12-310000834365blfs:MichaelRiceMember2023-10-012023-12-310000834365blfs:MarcusSchulzMember2023-10-012023-12-310000834365blfs:MarcusSchulzMember2023-12-310000834365blfs:ToddBerardMember2023-10-012023-12-310000834365blfs:ToddBerardMemberblfs:ToddBerardTradingPlanOneMember2023-12-310000834365blfs:MichaelRiceMember2023-12-3100008343652023-10-012023-12-310000834365blfs:SarahAebersoldMember2023-01-012023-12-310000834365blfs:ToddBerardMemberblfs:ToddBerardTradingPlanTwoMember2023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended December 31, 2023

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-36362

BioLife Solutions, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 94-3076866 |

(State or other jurisdiction of

incorporation or organization) | (IRS Employer

Identification No.) |

3303 Monte Villa Parkway, Suite 310, Bothell, Washington, 98021

(Address of registrant’s principal executive offices, Zip Code)

(425) 402-1400

(Telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of exchange on which registered |

Common stock, par value $0.001 per share | BLFS | The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No o

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (S232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such said files). Yes ☑ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☑ Accelerated filer o Non-accelerated filer o Smaller reporting company o Emerging Growth Company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ☑

As of the registrant’s most recently completed second fiscal quarter, the aggregate market value of common equity (based on closing price on June 30, 2023 of $22.10 per share) held by non-affiliates was approximately $774 million.

As of February 22, 2024, 45.3 million shares of the registrant’s common stock were outstanding.

Table of Contents

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Form 10-K” or “Annual Report”) contains forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The forward-looking statements in this Form 10-K do not constitute guarantees of future performance, and actual results could differ materially from those contained in the forward-looking statements. These statements are based on current expectations of future events. Such statements include, but are not limited to, statements about our products, customers, regulatory approvals, the potential utility of and market for our products and services, our ability to implement our business strategy and anticipated business and operations (including with respect to acquired businesses), future financial and operational performance, our anticipated future growth strategy, the expected benefits and other statements relating to our divestitures and acquisitions, capital requirements, intellectual property, suppliers, joint venture partners, future financial and operating results, the impact of macroeconomic developments (including the ongoing effects of the coronavirus (“COVID-19”) pandemic, plans, objectives, expectations and intentions, revenues, costs and expenses, interest rates, outcome of contingencies, business strategies, regulatory filings and requirements, the estimated potential size of markets, the terms of any capital financing agreements and other statements that are not historical facts. You can find many of these statements by looking for words like “believes”, “expects”, “anticipates”, “estimates”, “may”, “should”, “will”, “could”, “plan”, “intend”, or similar expressions in this Form 10-K. We intend that such forward-looking statements be subject to the safe harbors for such statements.

These forward-looking statements are based on the current beliefs and expectations of our management and are subject to significant risks and uncertainties. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results may differ materially from current expectations and projections. Factors that might cause such a difference include those discussed under “Risk Factors”, as well as those discussed elsewhere in the Form 10-K.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Form 10-K or, in the case of documents referred to or incorporated by reference, the date of those documents.

All subsequent written or oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this Form 10-K or to reflect the occurrence of unanticipated events, except as may be required under applicable United States (“U.S.”) securities law. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

References throughout this Form 10-K to “BioLife Solutions, Inc.”, “BioLife”, “we”, “us”, “our”, or the “Company” refer to BioLife Solutions, Inc. and its subsidiaries, taken as a whole, unless the context otherwise indicates.

PART I

ITEM 1. BUSINESS

The following discussion of our business contains forward-looking statements that involve risks and uncertainties (see the section entitled “Forward-Looking Statements” herein). Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those factors set forth under “Risk Factors” and elsewhere in this Form 10-K.

Overview

We are a life sciences company that develops, manufactures, and markets bioproduction tools and services which are designed to improve quality and de-risk biologic manufacturing, storage, distribution, and transportation in the cell and gene therapy (“CGT”) industry and broader biopharma markets. Our products are used in basic and applied research and commercial manufacturing of biologic-based therapies. Customers use our products to maintain the health and function of biologic material during sourcing, manufacturing, storage, and distribution.

We currently operate as one bioproduction tools and services business which supports several steps in the biologic material manufacturing and delivery process. We have a diversified portfolio of tools and services that focuses on biopreservation, cell processing, frozen biologic storage products and services, cold-chain logistics, and thawing of biologic materials. We have in-house expertise in cryobiology and the broader CGT workflow, and continue to evaluate opportunities to maximize the value of our product platforms for our extensive customer base through organic growth innovations, partnerships, and acquisitions.

Our products

Our bioproduction tools and services are comprised of three revenue lines that contain seven main offerings:

•Cell processing

◦Biopreservation media

◦Human platelet lysate media (“hPL”), cryogenic vials, and automated cell-processing fill machines

•Freezers and thaw systems

◦Ultra-low temperature freezers

◦Cryogenic freezers and accessories

◦Automated thawing devices

•Biostorage services

◦Biological and pharmaceutical material storage and transport

◦Cloud-connected “smart” shipping containers

Subsequent to the second quarter of 2023, we began to seek divestment of our Global Cooling, Inc. (“GCI”) and Custom Biogenic Systems (“CBS”) freezer product lines (the “Freezer Business”) from our current product portfolio. For additional information regarding our ongoing initiative to divest the Freezer Business, see “Item 1A. Risk Factors” of this Annual Report for additional details.

Cell processing

Biopreservation media

Our proprietary biopreservation media products, HypoThermosol® FRS and CryoStor® Freeze Media, are formulated to mitigate preservation-induced, delayed-onset cell damage and death which result when cells and tissues are subjected to reduced temperatures. Our technology can provide our CGT customers with significant shelf-life extension of biologic source material and final cell products, and can also greatly improve post-preservation cell and tissue viability and function. Our biopreservation media are serum-free, protein-free, fully defined, and manufactured under current Good Manufacturing Practices ("cGMP"). We strive to source wherever possible the highest available grade, Multi-compendial raw materials. Our US FDA Type II Master File applicable to our biopreservation products has been cross referenced over 690 times by our customers, and we believe our cell processing products are utilized in several hundred active clinical trials worldwide.

Stability (i.e. shelf-life) and functional recovery are crucial aspects of academic research and clinical practice in the biopreservation of biologic-based source material, intermediate derivatives, and isolated/derived/expanded cellular products and therapies. Limited stability is especially critical in the CGT field, where harvested cells and tissues will lose viability over time if not maintained appropriately at normothermic body temperature (37ºC) or stored in a hypothermic or cryogenic state in an effective preservation medium.

Chilling (hypothermia) is used to reduce metabolism and delay degradation of harvested cells and tissues. However, subjecting biologic material to hypothermic or cryogenic environments and subsequently rewarming them may also induce damaging molecular stress and structural changes. Although cooling successfully reduces metabolism (i.e., lowers demand for energy), various levels of cellular damage and death occur when using suboptimal methods. Biopreservation media can mitigate the damage from exposure to hypothermic or cryogenic temperatures and subsequent rewarming.

Traditional biopreservation media range from simple “balanced salt” (electrolyte) formulations to complex mixtures of electrolytes, energy substrates such as sugars, osmotic buffering agents, and antibiotics. The resulting limited stability from the use of these traditional biopreservation media formulations is a significant shortcoming that our optimized proprietary products address with great success.

Our scientific research activities over the last 20+ years enabled a detailed understanding of the molecular basis for the hypothermic and cryogenic (low-temperature induced) damage/destruction of cells through apoptosis and necrosis. This research led directly to the development of our HypoThermosol FRS and CryoStor technologies. Our proprietary biopreservation media products are specifically formulated to:

•Minimize cell and tissue swelling

•Reduce free radical levels upon formation

•Maintain appropriate low temperature ionic balances

•Provide regenerative, high-energy substrates to stimulate recovery upon warming

•Avoid the creation of an acidic state (acidosis)

•Inhibit the onset of apoptosis and necrosis

A key feature of our biopreservation media products is their “fully-defined” profile. All of our cGMP products are serum-free, protein-free and are formulated and filled using aseptic processing. We strive to use USP/Multi-compendial grade or the highest quality available synthetic components. All of these features benefit prospective customers by facilitating the qualification process required to incorporate our products into their regulatory filings.

Competing biopreservation media products are often formulated with isotonic media cocktails, animal serum, and potentially a single sugar or human protein. A key differentiator of our proprietary HypoThermosol FRS and CryoStor formulations is the engineered optimization of the key ionic component concentrations for low-temperature environments. This is in contrast to media optimized for normothermic body temperature (around 37°C), as found in culture media or saline-based isotonic formulas. While competing cryopreservation freeze media is often comprised of a single permeating cryoprotectant such as dimethyl sulfoxide (“DMSO”), our CryoStor formulations incorporate multiple permeating and non-permeating cryoprotectant agents, which allows for multiple mechanisms of protection and reduces the dependence on a single cryoprotectant. We believe that our products offer significant advantages over in-house ("home brew") formulations or commercial “generic” biopreservation media. These advantages include time savings, more consistent and higher quality of components, more rigorous quality control release testing, cost effectiveness, and improved preservation efficacy.

The results of independent testing demonstrate that our biopreservation media products significantly extend shelf-life and improve cell and tissue post-thaw viability and function. Our products have demonstrated improved biopreservation outcomes, including greatly extended shelf-life and post-thaw viability and yield across a broad array of cell and tissue types.

We estimate that annual revenue from each customer commercial application in which our products are used could range from $0.5 million to $2.0 million if such application is approved and our customer commences large scale commercial manufacturing of the biologic-based therapy.

Human platelet lysate media, cryogenic vials and automated cell-processing fill machines

In September 2021, we acquired Sexton Biotechnologies, Inc. (“Sexton”), a producer of bioproduction tools. Sexton's bioproduction tools portfolio includes human platelet lysates for cell expansion, which reduces risk and improves

downstream performance over fetal bovine serum, human serum, and other chemically defined media, CellSeal® closed system vials that are purpose-built rigid containers used in CGT that can be filled manually or with high throughput systems, and automated cell processing machines that bring multiple processes traditionally performed by manual techniques under a higher level of control to protect therapies from loss or contamination.

For our Sexton vials and media, we estimate that annual revenue from each customer commercial application in which these products are used could also range from $0.5 million to $2.0 million, if such application is approved and our customer commences large scale commercial manufacturing of the biologic-based therapy.

Biostorage services

Biological and pharmaceutical storage and transport

We are a premier provider of biological and pharmaceutical storage and cold chain logistics. These services ensure that materials are kept at controlled, target temperatures from the moment they leave the customer’s premises to their ultimate return. Our state-of-the-art monitoring systems allow customers real time tracking of the storage temperatures of their materials throughout the logistics process.

We operate five storage facilities in the USA and one facility in the Netherlands.

Cloud connected “smart” shipping containers

We are a leading developer and supplier of next generation cold chain management tools for cell and gene therapies. Our cloud-connected shipping containers and evo.is cloud app allows biologic products to be traced and tracked in real time. Our evo platform consists of rentable cloud-connected shippers that include technologies enabling tracking software to provide customizable, real-time information on geolocation, payload temperature, ambient temperature, tilt of shipper, humidity, altitude, and alerts when a shipper has been opened. The evo Dry Vapor Shipper (“DVS”) is specifically marketed for use with cell and gene therapies. The evo DVS has several design improvements over traditional competing shipping containers, providing benefits such as extended thermal performance, reduced liquid nitrogen recharge time, improved payload extractors, and the ability to maintain temperature for longer periods if the shipper is tilted on its side.

We partner with couriers with established logistic channels and distribution centers. This strategy greatly reduces the time and resource requirements associated with establishing our own logistics services, such as acquiring and maintaining fleets of delivery vehicles and building specialized facilities around the world. Partnerships with multiple white glove couriers allow us to scale our sales and marketing efforts by leveraging couriers' existing channel relationships, as well as the ongoing efforts of their sales and service teams. Courier partners provide promotional efforts by marketing our evo platform to their existing cell and gene therapy customers as a cost-effective and innovative solution.

Freezers and thaw systems

Ultra-low temperature freezers

Our portfolio of ultra-low temperature freezers range in size from portable units to stationary upright freezers, accommodating a wide variety of use cases. Users can configure these freezers to achieve temperatures between -20°C and -86°C. The portfolio was designed to be environmentally friendly and energy efficient, using as little as 2.8 kWh/day at temperatures of -80°C. The freezers do not use compressor-based or cascade refrigeration systems. Instead, they use patented free-piston Stirling engine technology that uses fewer moving parts.

Cryogenic freezers and accessories

Our line of cryogenic freezers offer leading design and manufacture of state-of-the-art liquid nitrogen laboratory freezers, cryogenic equipment and accessories. Our Isothermal LN2 freezers are constructed with a patented system which stores liquid nitrogen in a jacketed space in the walls of the freezer. This dry storage method eliminates liquid nitrogen contact with stored specimens, reducing the risk of cross-contamination and providing increased user safety in a laboratory setting by limiting liquid nitrogen contact injuries. To accommodate customer requirements, we offer customizable features, including wide bodied and extended height models. Our high-capacity controlled rate freezers (“HCFR”) are designed for large volume storage with customizable freezing programs and the ability to monitor conditions in real time.

To accompany the offerings of cryogenic freezer equipment, we supply equipment for storing critically important biological materials. This storage equipment includes upright freezer racks, chest freezer racks, liquid nitrogen freezer racks, canisters/cassettes and frames, as well as laboratory boxes and dividers. Due to our onsite design and manufacturing capabilities, racks and canisters can be customized to address customers’ varying requirements.

Automated thawing devices

The ThawSTAR® line includes thawing products that control the temperature and timing of the thawing process of biologic material. Our customizable, automated, water-free thawing products use algorithmic programmed heating plates to consistently bring biologic material from a frozen state to a liquid state in a controlled and consistent manner, helping reduce damage during the temperature transition while delivering critical process consistency across cell batches. Use of ThawSTAR products can also reduce risk of contamination versus using a traditional water bath.

Our market opportunity

The CGT market has been rapidly expanding, treating diseases once thought incurable. According to the Alliance for Regenerative Medicine (“ARM”), “2024 State of the Industry Briefing” there were approximately 1,900 ongoing clinical trials utilizing regenerative medicine at year-end 2023, with continued growth in CGT development companies throughout 2023. ARM also reported there was approximately $12 billion invested in the regenerative medicine market in 2023. In addition, ARM predicts up to 17 US and EU cell and gene therapy regulatory approvals may be granted during 2024.

The technologies developed within the CGT market change the ways physicians treat patients. The manufacturing, distribution and the delivery process of these therapies is significantly different from many other types of treatments. We believe we are well positioned to address many of the unique manufacturing challenges in the process of delivering cell and gene therapies.

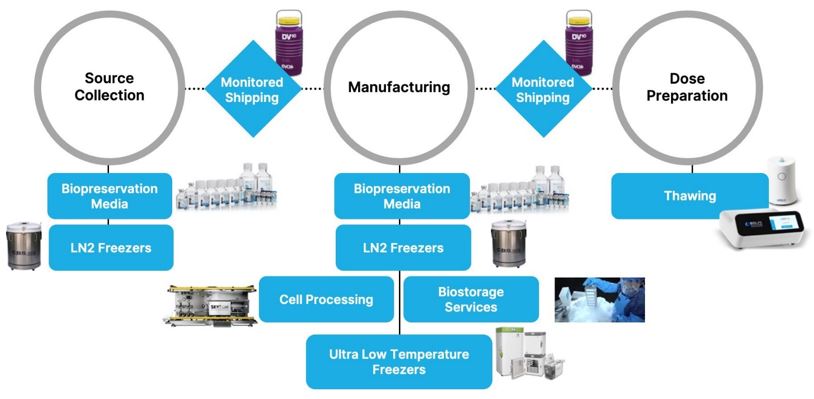

The bioproduction process

Our various products and services currently integrate into several steps in our customers’ bioproduction workflow process for cell and gene therapies. See the diagram below for an illustration of this process and our product roles. We now offer products that integrate into the critical steps of preservation, thawing, and both fixed and transportable storage under controlled conditions.

Complementary products portfolio

Expanding Participation in Customers’ Workflow

Our strategy

We are focused on the development, production, and commercialization of differentiated, best-in-class products and services that facilitate the manufacturing, delivery, and storage of cell and gene therapies and biologic materials. Our products are designed to increase our customers’ product yield and we are committed to supporting our customers with strong customer service and applications expertise.

We leverage our numerous relationships with leading cell and gene therapy companies that use our expanded offering of bioproduction tools and services to cross-sell other parts of the portfolio. Over the last several years, we have built a strong reputation as a trusted supplier of critical tools used in cell and gene therapy and biopharma manufacturing. We believe that our relationships and reputation could enable us to drive further incremental revenue growth through the sale of additional products to a captive customer base. Our products are designed to increase our customers’ product yield and functionality while reducing their risk, and we are committed to supporting our customers with strong service in addition to scientific and technical expertise in the applications of our products.

Business Operations

Research and development

Our research and development activities are focused on evaluating new, potentially disruptive technologies which may add value throughout the cell and gene therapy manufacturing and delivery workflow. We routinely assess and analyze the strengths and weaknesses of competitive and adjacent products, and are engaged in business development discussions on an ongoing basis. We strive to continue to anticipate customer needs in providing enabling technologies in the CGT space.

Sales and marketing

We market and sell our products through direct sales and third-party distribution. We have expanded our global commercial organization over time to continue building relationships within the broader CGT market.

We have experienced field-based sales employees who market our growing product portfolio on a direct basis. Our technical applications engineers and customer care support teams have extensive experience providing support both prior and subsequent to the sale of products.

Our products are also marketed and distributed by STEMCELL Technologies, MilliporeSigma, VWR, Avantor, Thermo Fisher, and several other regional distributors under non-exclusive agreements. In 2023, 2022, and 2021, sales to third-party distributors accounted for 49%, 50%, and 46% of our revenue, respectively.

During the years ended December 31, 2023, 2022, and 2021, we derived approximately 16%, 18%, and 17% of our revenue from the same customer, respectively.

The following table represents the Company’s total revenue by geographic area (based on the location of the customer):

| | | | | | | | | | | | | | | | | |

| Years Ended December 31, |

Revenue by customers’ geographic locations(1) | 2023 | | 2022 | | 2021 |

United States(2) | 80 | % | | 79 | % | | 85 | % |

| Europe, Middle East, Africa (EMEA) | 16 | % | | 16 | % | | 11 | % |

| Other | 4 | % | | 5 | % | | 4 | % |

| Total revenue | 100 | % | | 100 | % | | 100 | % |

(1) During the year ended December 31, 2023, the Company updated its methodology for determining the country of origin for its sales. Sales are now recorded by shipping country rather than billing country. The Company updated the methodology retrospectively, adjusting the prior year presentation for all regions presented.

(2) The line item presented above previously bifurcated sales between the United States and Canada. Due to the updated methodology for determining the country of origin for sales, it was noted that Canada no longer was a material location to

separately disclose. Canada sales have been included within the "Other" line item in the table above and United States sales has been retained as its own line item to more accurately reflect origin of sales for material regions.

Manufacturing

Cell processing – We maintain and operate two independent cGMP clean room production suites for manufacturing sterile biopreservation media products in Bothell, Washington. Our quality management system (“QMS”) in Bothell is certified to the ISO 13485:2016 standard. Our QMS takes guidance from applicable sections of 21 CFR Part 820 – Quality System Regulation for Good Manufacturing Practice of medical devices, 21 CFR Parts 210 and 211 – cGMP for Finished Pharmaceuticals, FDA Guidance – Sterile Drug Products, Volume 4, EU Guidelines Annex 1 – Manufacture of Sterile Medicinal Products, ISO 13408 – Aseptic Processing of Healthcare Products, and ISO 14644 – Clean Rooms and Associated Controlled Environments.

We also maintain and operate one cGMP clean room production suite for manufacturing hPL media in Indianapolis, Indiana. Our quality management system (“QMS”) in Indianapolis is certified to the ISO 9001:2015 standard. Our QMS takes guidance from applicable sections of 21 CFR Part 820 – Quality System Regulation for Good Manufacturing Practice of medical devices, 21 CFR Parts 210 and 211 – cGMP for Finished Pharmaceuticals, Volume 4, EU Guidelines Annex 2 – Manufacture of Biological active substances and Medicinal Products for Human Use and ISO 14644 – Clean Rooms and Associated Controlled Environments.

We seek to manage single-source supplier risk by regularly assessing the quality and capacity of our suppliers, implementing supply and quality agreements where appropriate, and actively managing lead times and inventory levels of sourced components. Pursuant to our supply agreements, we are required to notify customers of any changes to our raw materials. For certain components without a secondary supplier, we estimate that it would take up to six months to find and qualify a second source. Order quantities and lead times for externally sourced components are based on our forecasts, which are derived from historical demand and anticipated future demand. Lead times for components may vary depending on the size of the order, specific supplier requirements, and current market demand for the materials and parts.

We practice continuous improvement based on routine internal audits through our own monitoring of process outputs, external feedback, and audits performed by our partners and customers. In addition, we maintain a business continuity management system that focuses on key areas such as contingency planning, safety stocks and off-site storage of raw materials and finished goods to ensure continuous supply of our products.

Freezers and thaw systems – Ultra-low temperature (“ULT”) freezers are produced in our facilities in Athens, Ohio. As of the second quarter in 2023, we fully transitioned two freezer product lines under our ULT manufacturing operations from a contract manufacturing organization ("CMO") in Ohio to in-house production within the Athens, Ohio facility.

The majority of our isothermal LN2 freezers and related accessories are manufactured in our facility in Bruce Township, Michigan. We are reliant on certain critical suppliers for some components. To date, we have not experienced significant difficulties in obtaining raw materials for the manufacture of our LN2 freezers and related accessories.

Our ThawSTAR automated, water-free thawing products are produced by a CMO based in the United States. We believe this CMO has the skills, experience and capacity needed to meet our quality standards and demand expectations for the product line. We estimate that it would take up to six months to find and qualify an alternative CMO. To date, we have not experienced significant difficulties in obtaining our automated thaw products from our CMO.

Biostorage services – Production of our evo cold chain management hardware products is performed by external CMOs and by personnel in our Bruce Township, Michigan facility. As of the year-ended December 31, 2023, we fully transitioned our manufacturing operations from Albuquerque, New Mexico to our facility in Bruce Township, Michigan. We leased a new, smaller facility in Albuquerque, New Mexico to retain engineering and administrative operations personnel. Our QMS is certified to the ISO 9001:2015 standard.

SciSafe operates five cGMP compliant storage facilities in the United States and one facility in the Netherlands, which is registered with the European Regulatory body in Netherlands (IGJ) for Good Distribution of Active Pharmaceutical Ingredients. One facility in the United States is certified to the ISO 20387:2018 standard, and all facilities, both in the United States and the Netherlands, are certified to the ISO 9001:2015 standard. We rely on outside suppliers for the build-out of our cold-storage chambers and stand-alone freezers.

Supply chain constraints - Our domestic and international supply chain operations were affected during the years ended December 31, 2021 and 2022 by the global COVID-19 pandemic and the resulting volatility and uncertainty it caused in the U.S. and international markets. The onset of the COVID-19 pandemic caused supply chains globally to become constrained, and these constraints historically impacted our business through both increased difficulty in obtaining semiconductor chips and increased pricing on available parts across our product lines during the years ended December 31, 2021 and 2022. However, during the year ended December 31, 2023, both availability and pricing of semiconductor chips have improved and no longer pose constraints on our supply chain. We currently have sufficient supply for electrical component parts within our operations and do not foresee constraints to return over our supply chain.

Product regulatory status

Our products are not subject to any specific United States Food and Drug Administration (“FDA”) or other international marketing regulations for drugs, devices, or biologics. We are not required to sponsor formal prospective, controlled clinical trials in order to establish safety and efficacy. However, to support our current and prospective clinical customers, we manufacture and release our products in compliance with cGMP and other relevant quality standards.

To assist customers with their regulatory applications, we maintain Type II Master Files at the FDA for CryoStor, HypoThermosol FRS, BloodStor 27, Stemulate, nLiven PR, T-Liven PR, CellSeal Closed System Cryogenic Vials, and our Cell Thawing Media products, which provide the FDA with information regarding our manufacturing facility and process, our quality system, stability and safety, and any additional testing that has been performed. Customers engaged in clinical and commercial applications may notify the FDA of their intention to use our products in their product development and manufacturing process by requesting a cross-reference to our master files.

A group of isothermal, standard, and carousel LN2 freezers in our freezers and thaw systems product line is currently regulated as Class 2 medical devices in the EU.

Intellectual property

The following table lists our granted and pending patents. We have also obtained certain trademarks and tradenames for our products to distinguish our genuine products from our competitors’ products and we maintain certain details about our processes, products, and strategies as trade secrets. While we believe that the protection of patents and trademarks is important to our business, we also rely on a combination of trade secrets, nondisclosure and confidentiality agreements, scientific expertise, and continuing technological innovation to maintain our competitive position. Despite these precautions, it may be possible for unauthorized third parties to copy certain aspects of our products and/or to obtain and use information that we regard as proprietary (see “Item 1A. Risk Factors” of this Annual Report for additional details). The laws of some foreign countries in which we sell our products do not protect our proprietary rights to the same extent as do the laws of the United States.

| | | | | | | | | | | | | | | | | |

| Issued Patents | | Patents Applied For | | Registered Trademarks |

| Cell processing | 56 | | | 16 | | | 41 | |

| Freezers and thaw systems | 85 | | | 71 | | | 25 | |

| Biostorage services | 13 | | | 33 | | | 6 | |

| Total | 154 | | | 120 | | | 72 | |

Competition

Our bioproduction products and services compete on the basis of value proposition, performance, quality, cost effectiveness, and application suitability with numerous established technologies. Additional products using new technologies that may be competitive with our products may also be introduced. Many of the companies selling or developing competitive products have greater financial and human resources, R&D, manufacturing and marketing experience than we do. They may undertake their own development of products that are substantially similar to or compete with our products, and they may succeed in developing products that are more effective or less costly than any that we may develop. These competitors may also prove to be more successful in their production, marketing and commercialization activities. We cannot be certain that the research, development and commercialization efforts of our competitors will not render any of our existing or potential products obsolete.

Human capital

We view our employees and our culture as key to our success. As of December 31, 2023, we had 409 full time employees and 5 part-time employees. Our employees are not covered by any collective bargaining agreement. We consider relations with our employees to be good.

Since March 2020, we have operated with a flexible work environment in which positions not essential to being on-site may embrace hybrid ways of working. Overall, we aim to preserve the flexibility offered by hybrid work arrangements while offering our employees a healthy, supportive, and inclusive environment that supports their development, provides connection, and propels team and individual performance.

Corporate history

We were incorporated in Delaware in 1987 under the name Trans Time Medical Products, Inc. In 2002, the Company, then known as Cryomedical Sciences, Inc. was engaged in manufacturing and marketing cryosurgical products. The entity was merged with our wholly owned subsidiary, BioLife Solutions, Inc., which was engaged as a developer and marketer of biopreservation media products for cells and tissues. Following the merger, we changed our name to BioLife Solutions, Inc.

Principal offices; available information

Our principal executive offices are located at 3303 Monte Villa Parkway, Suite 310, Bothell, Washington 98021 and the telephone number is (425) 402-1400. We maintain a website at www.biolifesolutions.com. The information contained on or accessible through our website is not part of this Annual Report on Form 10-K and is not incorporated in any manner into this Annual Report. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”), are available free of charge on our website as soon as reasonably practicable after we electronically file such reports with, or furnish those reports to, the Securities and Exchange Commission (the “SEC”). The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

ITEM 1A. RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information contained in this Annual Report, before deciding to invest in our common stock. If any of the following risks materialize, our business, financial condition, results of operation and prospects will likely be materially and adversely affected. In that event, the market price of our common stock could decline and you could lose all or part of your investment.

Risks related to our financial condition

Despite our increasingly diversified customer base, we depend on a limited number of customers and products in a limited number of market sectors. If we lose any of these large customers or if there are disruptions in the sales of these products, our net product revenue and operating results could decline significantly.

During the years ended December 31, 2023, 2022, and 2021, we derived approximately 16%, 18%, and 17% of our revenue from the same customer, respectively. No other customer accounted for more than 10% of revenue in the years ended December 31, 2023, 2022 and 2021. In the years ended December 31, 2023, 2022, and 2021, we derived approximately 39%, 36%, and 33% of our revenue from CryoStor products, respectively. Additionally, during the years ended December 31, 2023, 2022 and 2021, we derived approximately 19%, 22% and 22% of our revenues from our 780XLE freezers, respectively. Our principal customers may vary from period to period and such customers may not continue to purchase products from us at current levels or at all. Further, the inability of some of our customers to consummate anticipated purchases of our products due to changes in end-user demand, and other unpredictable factors that may affect customer ordering patterns could lead to significant reductions in net product revenue which could harm our business.

We expect our operating results to fluctuate significantly from period to period.

Our revenue, operating margins and other operating results have varied significantly in the past and may continue to fluctuate from period to period in the future due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include changes in customer demand, pricing pressures applicable to our products, the length of our sales cycles, supply chain and inventory management, changes in competitive conditions, including the introduction of new products and enhancements by our competitors, among other factors described elsewhere in this Annual Report. In addition, following our acquisitions from 2019 through 2021, we have increased our fixed costs and now sell products having higher costs of product revenue than our biopreservation media products. We expect that the result of these acquisitions and subsequent operational decisions regarding the businesses acquired will make it more difficult to predict our revenue and operating results from period-to-period and that, as a result, comparisons of our results of operations are not currently and will not be for the foreseeable future a good indicator of our future performance. For example, if revenue declines in a quarter, whether due to a delay in recognizing expected revenue, adverse economic conditions, supply chain issues or otherwise, our results of operations in such period will be harmed because many of our expenses are now relatively fixed. In particular, a large portion of our manufacturing costs, research and development expenses, sales and marketing expenses and general and administrative expenses are not significantly affected by variations in revenue. Further, a shift in product revenue concentration away from our CryoStor products and towards other developing products with higher costs of product revenue will adversely affect our operating margin. If our quarterly operating results fail to meet expectations of investors or research analysts, the price of our common stock may decline.

We have announced that we intend to divest our Freezer Business. The failure to complete such divestiture on favorable terms or at all, or the pursuit of such divestiture, could adversely affect our businesses, results of operations and financial condition.

Subsequent to the second quarter of 2023, we began to actively seek divestment of our Freezer Business to optimize the performance of our product portfolio. Although we are diligently pursuing a sale of the Freezer Business, no potential buyer has yet committed to purchasing the business and we have not yet entered into any agreement for the sale of such business. We may not be successful in selling our Freezer Business in a timely manner, if at all, or may do so on terms that are less favorable than we currently anticipate. If the Freezer Business is not sold as an ongoing business, we may have to liquidate those assets and incur substantial costs to shut down those operations. In addition, we have already recorded impairment charges over the property and equipment and definitive-lived intangible assets of the Freezer Business, as reflected in our consolidated financial statements. See Note 2: Impairment of property and equipment and definite-lived intangible assets, to our consolidated financial statements included in this Annual Report on Form 10-K for more information. If the Freezer Business is sold, it is possible that the net proceeds from the sale could be less than its current

carrying value on our books, which would require us to take an additional impairment charge against our earnings in the amount of the difference, which could be significant. Moreover, the announcement and conduct of the divestiture process could cause disruptions in, and create uncertainty surrounding, our Freezer Business, including affecting relationships with its existing and future customers, suppliers and employees, which could have an adverse effect on the Freezer Business’s operations and financial condition, potentially making it more difficult to successfully complete a transaction on favorable terms. The divestiture process may also divert our management’s attention from overseeing and exploring opportunities that may be beneficial to our other businesses and operations. If we are unable to complete a divestiture of our Freezer Business on favorable terms or at all, we may suffer negative publicity, and our business, results of operations, and financial condition may be adversely affected and the price of our common stock may decline.

Risks related to our acquisition strategy

If intangible assets and goodwill that we recorded in connection with our acquisitions become impaired, we may have to take significant charges against earnings.

In connection with the accounting for our completed acquisitions in recent years, we recorded a significant amount of intangible assets, including developed technology, in-process research and development, and customer relationships relating to the acquired product lines, and goodwill. As of December 31, 2023, the net carrying value of our goodwill and other intangible assets totaled $245.9 million. Under generally accepted accounting principles in the United States, we must assess, at least annually and potentially more frequently, whether the value of indefinite-lived intangible assets and goodwill have been impaired. Intangible assets and goodwill are assessed for impairment in the event of an impairment indicator, as was the case in the third quarter of 2023 when we began to actively seek divestment of our GCI and CBS freezer product lines (the “Freezer Business”). The announcement, coupled with broader economic uncertainty leading to reductions in spending across the biopharma industry and our customer base constituted interim triggering events that required further analysis with respect to potential impairment to goodwill, indefinite-lived intangibles, and our long-lived asset groups. As a result of the interim quantitative impairment analysis performed, we recorded a $5.8 million non-cash impairment charge over definite-lived intangible assets reflected in our consolidated statements of operations. Any future reduction or impairment of the value of intangible assets and goodwill will result in a charge against earnings, which could materially adversely affect our results of operations and shareholders’ equity in future periods.

Our acquisitions expose us to risks that could adversely affect our business, and we may not achieve the anticipated benefits of acquisitions of businesses or technologies.

As a part of our growth strategy, we have made, and may continue to make, selected acquisitions of complementary products and/or businesses. Any acquisition involves numerous risks and operational, financial, and managerial challenges, including the following, any of which could adversely affect our business, financial condition, or results of operations:

•difficulties in integrating new operations, technologies, products, and personnel;

•problems maintaining uniform procedures, controls, and policies with respect to our financial accounting systems;

•lack of synergies or the inability to realize expected synergies and cost-savings;

•difficulties in managing geographically dispersed operations, including risks associated with entering foreign markets in which we have no or limited prior experience;

•underperformance of any acquired technology, product, or business relative to our expectations and the price we paid;

•negative near-term impacts on financial results after an acquisition, including acquisition-related earnings charges;

•the potential loss of key employees, customers, and strategic partners of acquired companies;

•claims by terminated employees and shareholders of acquired companies or other third parties related to the transaction;

•the assumption or incurrence of additional debt obligations or expenses, or use of substantial portions of our cash;

•diversion of management’s attention and company resources from existing operations of the business;

•inconsistencies in standards, controls, procedures, and policies;

•cash expenses and non-cash accounting charges incurred in connection with acquisitions, including unanticipated costs associated with the amortization of intangible assets;

•the impairment of intangible assets as a result of technological advancements, or worse-than-expected performance of acquired companies;

•assumption of, or exposure to, historical liabilities of the acquired business, including unknown contingent or similar liabilities, including product liability, that are difficult to identify or accurately quantify; and

•risks associated with acquiring intellectual property, including potential disputes regarding acquired companies’ intellectual property.