blfs_10q.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

þ

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended March 31, 2012

OR

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to_______

Commission File Number 0-18170

BIOLIFE SOLUTIONS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

94-3076866

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(IRS Employer

Identification No.)

|

3303 Monte Villa Parkway, Suite 310

Bothell, WA 98021

(Address of Principal Executive Offices, Including Zip Code)

(425) 402-1400

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act):

| Large Accelerated Filer |

o |

Accelerated Filer |

o |

Non-Accelerated Filer |

o |

(Do not check if a smaller reporting company) |

| |

|

|

|

|

|

|

| Smaller reporting company |

þ |

|

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The registrant had 69,679,854 shares of Common Stock, $0.001 par value per share, outstanding as of May 1, 2012.

BIOLIFE SOLUTIONS, INC.

FORM 10-Q

FOR THE QUARTER ENDED MARCH 31, 2012

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

|

Item 1.

|

Financial Statements

|

|

|

|

| |

Balance Sheets as of March 31, 2012 (unaudited) and December 31, 2011

|

|

|

3 |

|

| |

Statements of Operations (unaudited) for the three month periods Ended March 31, 2012 and 2011

|

|

|

4 |

|

| |

Statements of Cash Flows (unaudited) for the three month periods Ended March 31, 2012 and 2011

|

|

|

5 |

|

| |

Notes to Financial Statements (unaudited)

|

|

|

6 |

|

| |

|

|

|

|

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

10 |

|

| |

|

|

|

|

|

|

Item 3.

|

Quantitative and Qualitative Disclosures about Market Risk

|

|

|

14 |

|

| |

|

|

|

|

|

|

Item 4.

|

Controls and Procedures

|

|

|

14 |

|

| |

|

|

|

|

|

| PART II. OTHER INFORMATION |

|

|

|

|

| |

|

|

|

|

|

|

Item 6.

|

Exhibits

|

|

|

15 |

|

| |

|

|

|

|

|

| |

Signatures

|

|

|

16 |

|

| |

|

|

|

|

|

| |

Index to Exhibits

|

|

|

17 |

|

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

BIOLIFE SOLUTIONS, INC.

Balance Sheets

(unaudited)

| |

March 31,

|

|

December 31,

|

|

| |

2012

|

|

2011

|

|

|

Assets

|

|

Current assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

70,524

|

|

|

$

|

16,864

|

|

|

Accounts receivable, trade, net of allowance for doubtful accounts of $1,100 at March 31, 2012 and December 31, 2011

|

|

|

471,816

|

|

|

|

547,143

|

|

|

Inventories

|

|

|

763,967

|

|

|

|

505,956

|

|

|

Prepaid expenses and other current assets

|

|

|

68,299

|

|

|

|

90,444

|

|

|

Total current assets

|

|

|

1,374,606

|

|

|

|

1,160,407

|

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment

|

|

|

|

|

|

|

|

|

|

Leasehold improvements

|

|

|

3,936

|

|

|

|

––

|

|

|

Furniture and computer equipment

|

|

|

187,147

|

|

|

|

177,013

|

|

|

Manufacturing and other equipment

|

|

|

655,098

|

|

|

|

623,782

|

|

|

Subtotal

|

|

|

846,181

|

|

|

|

800,795

|

|

|

Less: Accumulated depreciation

|

|

|

(472,780

|

)

|

|

|

(447,393

|

)

|

|

Net property and equipment

|

|

|

373,401

|

|

|

|

353,402

|

|

|

Long term deposits

|

|

|

36,166

|

|

|

|

36,166

|

|

|

Deferred financing costs

|

|

|

84,997

|

|

|

|

112,042

|

|

|

Total assets

|

|

$

|

1,869,170

|

|

|

$

|

1,662,017

|

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity (Deficiency)

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

534,001

|

|

|

$

|

403,103

|

|

|

Accrued expenses and other current liabilities

|

|

|

58,207

|

|

|

|

69,582

|

|

|

Accrued compensation

|

|

|

75,605

|

|

|

|

86,563

|

|

|

Deferred revenue

|

|

|

20,000

|

|

|

|

20,000

|

|

|

Total current liabilities

|

|

|

687,813

|

|

|

|

579,248

|

|

|

Long term liabilities

|

|

|

|

|

|

|

|

|

|

Promissory notes payable, related parties

|

|

|

10,303,127

|

|

|

|

10,128,127

|

|

|

Accrued interest, related parties

|

|

|

2,204,738

|

|

|

|

2,025,961

|

|

|

Deferred revenue, long term

|

|

|

104,167

|

|

|

|

109,167

|

|

|

Total liabilities

|

|

|

13,299,845

|

|

|

|

12,842,503

|

|

| |

|

|

|

|

|

|

|

|

|

Commitments and Contingencies (Note 9)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Shareholders' equity (deficiency)

|

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 100,000,000 shares authorized, 69,679,854 shares issued and outstanding at March 31, 2012 and December 31, 2011

|

|

|

69,680

|

|

|

|

69,680

|

|

|

Additional paid-in capital

|

|

|

42,948,013

|

|

|

|

42,901,325

|

|

|

Accumulated deficit

|

|

|

(54,448,368

|

)

|

|

|

(54,151,491

|

)

|

|

Total shareholders' equity (deficiency)

|

|

|

(11,430,675

|

)

|

|

|

(11,180,486

|

)

|

|

Total liabilities and shareholders' equity (deficiency)

|

|

$

|

1,869,170

|

|

|

$

|

1,662,017

|

|

The accompanying Notes to Financial Statements are an integral part of these financial statements

BIOLIFE SOLUTIONS, INC.

Statements of Operations

(unaudited)

| |

|

Three Month Period Ended March 31,

|

|

| |

|

2012

|

|

|

2011

|

|

|

Revenue

|

|

|

|

|

|

|

|

Product sales

|

|

$

|

830,880

|

|

|

$

|

605,799

|

|

|

Licensing revenue

|

|

|

5,000

|

|

|

|

5,000

|

|

|

Total revenue

|

|

|

835,880

|

|

|

|

610,799

|

|

|

Cost of product sales

|

|

|

346,129

|

|

|

|

368,600

|

|

|

Gross profit

|

|

|

489,751

|

|

|

|

242,199

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

116,521

|

|

|

|

158,793

|

|

|

Sales and marketing

|

|

|

73,381

|

|

|

|

83,308

|

|

|

General and administrative

|

|

|

479,113

|

|

|

|

454,375

|

|

|

Total operating expenses

|

|

|

669,015

|

|

|

|

696,476

|

|

| |

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

(179,264

|

)

|

|

|

(454,277

|

)

|

| |

|

|

|

|

|

|

|

|

|

Other income (expenses)

|

|

|

|

|

|

|

|

|

|

Other income

|

|

|

88,272

|

|

|

|

21

|

|

|

Interest expense

|

|

|

(178,777

|

)

|

|

|

(160,542

|

)

|

|

Amortization of deferred financing costs

|

|

|

(27,045

|

)

|

|

|

(15,324

|

)

|

|

Loss on disposal of property and equipment

|

|

|

(63

|

)

|

|

|

––

|

|

|

Total other income (expenses)

|

|

|

(117,613

|

)

|

|

|

(175,845

|

)

|

| |

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$

|

(296,877

|

)

|

|

$

|

(630,122

|

)

|

| |

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per common share

|

|

$

|

(0.00

|

)

|

|

$

|

(0.01

|

)

|

| |

|

|

|

|

|

|

|

|

|

Basic and diluted weighted average common shares used to calculate net loss per common share

|

|

|

69,679,854

|

|

|

|

69,679,854

|

|

The accompanying Notes to Financial Statements are an integral part of these financial statements

BIOLIFE SOLUTIONS, INC.

Statements of Cash Flows

(unaudited)

| |

|

Three Month Period Ended March 31,

|

|

| |

|

2012

|

|

|

2011

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(296,877

|

)

|

|

$

|

(630,122

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

26,455

|

|

|

|

22,872

|

|

|

Loss on disposal of property and equipment

|

|

|

63

|

|

|

|

––

|

|

|

Stock-based compensation expense

|

|

|

46,688

|

|

|

|

78,628

|

|

|

Amortization of deferred financing costs

|

|

|

27,045

|

|

|

|

15,324

|

|

|

Change in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

(Increase) Decrease in

|

|

|

|

|

|

|

|

|

|

Accounts receivable, trade

|

|

|

75,327

|

|

|

|

(17,802

|

)

|

|

Inventories

|

|

|

(258,011

|

)

|

|

|

(36,820

|

)

|

|

Prepaid expenses and other current assets

|

|

|

22,145

|

|

|

|

(15,405

|

)

|

|

Increase (Decrease) in

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

130,898

|

|

|

|

159,447

|

|

|

Accrued compensation and other expenses and other current liabilities

|

|

|

(22,333

|

)

|

|

|

(36,303

|

)

|

|

Accrued interest, related parties

|

|

|

178,777

|

|

|

|

160,542

|

|

|

Deferred revenue

|

|

|

(5,000

|

)

|

|

|

(5,000

|

)

|

|

Net cash used in operating activities

|

|

|

(74,823

|

)

|

|

|

(304,639

|

)

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

|

|

Cash received from sale of property and equipment

|

|

|

700

|

|

|

|

––

|

|

|

Purchase of property and equipment

|

|

|

(47,217

|

)

|

|

|

(13,475

|

)

|

|

Net cash used in investing activities

|

|

|

(46,517

|

)

|

|

|

(13,475

|

)

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activity

|

|

|

|

|

|

|

|

|

|

Proceeds from notes payable

|

|

|

175,000

|

|

|

|

350,000

|

|

|

Net cash provided by financing activity

|

|

|

175,000

|

|

|

|

350,000

|

|

| |

|

|

|

|

|

|

|

|

|

Net increase in cash and cash equivalents

|

|

|

53,660

|

|

|

|

31,886

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents - beginning of period

|

|

|

16,864

|

|

|

|

3,211

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents - end of period

|

|

$

|

70,524

|

|

|

$

|

35,097

|

|

The accompanying Notes to Financial Statements are an integral part of these financial statements

BIOLIFE SOLUTIONS, INC.

Notes to Financial Statements

(unaudited)

BioLife Solutions, Inc. ("BioLife,” “us,” “we,” “our,” or the “Company”) develops, manufactures and markets patented hypothermic storage and cryopreservation solutions for cells and tissues. The Company’s proprietary HypoThermosol® and CryoStor® platform of solutions are marketed to academic and commercial organizations involved in cell therapy, tissue engineering, cord blood banking, drug discovery, and toxicology testing. BioLife’s products are serum-free and protein-free, fully defined, and are formulated to reduce preservation-induced, delayed-onset cell damage and death. BioLife’s enabling technology provides academic and clinical researchers significant improvements in post-thaw cell, tissue, and organ viability and function. Additionally, for our direct, distributor, and contract customers, we perform custom formulation, fill, and finish services.

2. Financial Condition and Going Concern

We have been unable to generate sufficient income from operations in order to meet our operating needs and have an accumulated deficit of approximately $54 million at March 31, 2012. This raises substantial doubt about our ability to continue as a going concern.

We believe that cash generated from customer collections in combination with continued access to funds from investors, will provide sufficient funds through December 31, 2012. Factors that would negatively impact our ability to finance our operations include (a) significant reductions in revenue from our internal projections, (b) increased capital expenditures, (c) significant increases in cost of goods and operating expenses, or; (d) an adverse outcome resulting from current litigation. If we are unable to collect adequate cash from customer collections and our investors were to become unwilling to provide access to additional funds, we would need to find immediate additional sources of capital. There can be no assurance that such capital would be available, or, if available, that the terms of such financing would not be dilutive to stockholders. If we are unable to secure additional capital as circumstances require, we may not be able to continue our operations.

These financial statements assume that we will continue as a going concern. If we are unable to continue as a going concern, we may be unable to realize our assets and discharge our liabilities in the normal course of business. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts nor to amounts and classification of liabilities that may be necessary should we be unable to continue as a going concern.

3. Summary of Significant Accounting Policies

Basis of Presentation

We have prepared the accompanying unaudited financial statements pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Pursuant to these rules and regulations, we have condensed or omitted certain information and footnote disclosures we normally include in our annual financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). In management’s opinion, we have made all adjustments (consisting only of normal, recurring adjustments) necessary to fairly present our financial position, results of operations and cash flows. Our interim period operating results do not necessarily indicate the results that may be expected for any other interim period or for the full year. These financial statements and accompanying notes should be read in conjunction with the financial statements and notes thereto in our Annual Report on Form 10-K for the year ended December 31, 2011 on file with the SEC.

There have been no material changes to our significant accounting policies as compared to the significant accounting policies described in the financial statements in our Annual Report on Form 10-K for the year ended December 31, 2011.

Fair value of financial instruments

We generally have the following financial instruments: cash and cash equivalents, accounts receivable, accounts payable, accrued expenses and notes payable. The carrying value of cash and cash equivalents, accounts receivable, accounts payable and accrued expenses approximate their fair value based on the short-term nature of these financial instruments. The carrying values of notes payable approximate their fair value because interest rates of notes payable approximate market interest rates.

Recent Accounting Pronouncements

There have been no new accounting pronouncements during the three month period ended March 31, 2012, as compared to our Annual Report on Form 10-K for the year ended December 31, 2011, that are of significance, or potential significance, to us.

4. Inventory

Inventories consist of the following at March 31, 2012 and December 31, 2011:

| |

|

March 31, 2012

|

|

|

December 31, 2011

|

|

|

Raw materials

|

|

$

|

328,913

|

|

|

$

|

173,510

|

|

|

Work in progress

|

|

|

3,869

|

|

|

|

11,768

|

|

|

Finished goods

|

|

|

431,185

|

|

|

|

320,678

|

|

|

Total

|

|

$

|

763,967

|

|

|

$

|

505,956

|

|

During the period ended March 31, 2012, the Company recorded a nonreciprocal, non-monetary receipt of inventory in the amount of $87,215. This amount was also recorded as Other Income in the Statement of Operations during the three month period ended March 31, 2012. The transaction was accounted for at fair value on the date the inventory was received.

5. Share-based Compensation

The fair value of share-based payments made to employees and non-employee directors was estimated on the measurement date using the Black-Scholes model using the following weighted average assumptions:

| |

|

Three Month Period Ended

|

|

| |

|

March 31,

|

|

| |

|

2012

|

|

|

2011

|

|

|

Risk free interest rate

|

|

|

0.83%

|

|

|

|

2.25%

|

|

|

Dividend yield

|

|

|

0.0%

|

|

|

|

0.0%

|

|

|

Expected term (in years)

|

|

|

6.0

|

|

|

|

6.0

|

|

|

Volatility

|

|

|

101%

|

|

|

|

93%

|

|

| |

|

|

|

|

|

|

|

|

Management applies an estimated forfeiture rate that is derived from historical employee termination data. The estimated forfeiture rate applied for the three month periods ended March 31, 2012 and 2011 was 7.85% and 6.47%, respectively.

The following is a summary of stock option activity for the three month period ended March 31, 2012, and the status of stock options outstanding at March 31, 2012:

| |

|

Three Month Period Ended

|

|

| |

|

March 31, 2012

|

|

| |

|

|

|

|

Wtd. Avg.

|

|

| |

|

|

|

|

Exercise

|

|

| |

|

Shares

|

|

|

Price

|

|

|

Outstanding at beginning of year

|

|

|

17,873,227

|

|

|

$

|

0.08

|

|

|

Granted

|

|

|

1,100,000

|

|

|

|

0.10

|

|

|

Exercised

|

|

|

––

|

|

|

|

––

|

|

|

Forfeited

|

|

|

(206,250

|

)

|

|

|

(0.08

|

)

|

|

Outstanding at March 31, 2012

|

|

|

18,766,977

|

|

|

$

|

0.09

|

|

| |

|

|

|

|

|

|

|

|

|

Stock options exercisable at March 31, 2012

|

|

|

11,722,906

|

|

|

$

|

0.09

|

|

Weighted average fair value of options granted was $0.08 and $0.06 per share for the three month periods ended March 31, 2012 and 2011, respectively.

As of March 31, 2012, there was $299,363 of aggregate intrinsic value of outstanding stock options, including $195,359 of aggregate intrinsic value of exercisable stock options. Intrinsic value is the total pretax intrinsic value for all “in-the-money” options (i.e., the difference between the Company’s closing stock price on the last trading day of the quarter and the exercise price, multiplied by the number of shares) that would have been received by the option holders had all option holders exercised their options on March 31, 2012. This amount will change based on the fair market value of the Company’s stock.

We recorded stock compensation expense of $46,688 and $78,628 for the three month periods ended March 31, 2012 and 2011, respectively, as follows:

| |

|

Three Month Period Ended

|

|

| |

|

March 31,

|

|

| |

|

2012

|

|

|

2011

|

|

|

Research and development costs

|

|

$

|

6,368

|

|

|

$

|

10,433

|

|

|

Sales and marketing costs

|

|

|

––

|

|

|

|

862

|

|

|

General and administrative costs

|

|

|

37,299

|

|

|

|

60,693

|

|

|

Cost of product sales

|

|

|

3,021

|

|

|

|

6,640

|

|

|

Total

|

|

$

|

46,688

|

|

|

$

|

78,628

|

|

As of March 31, 2012, we had approximately $354,092 of unrecognized compensation expense related to unvested stock options. We expect to recognize this compensation expense over a weighted average period of approximately 2.40 years.

At March 31, 2012, we had 6,218,750 warrants outstanding and exercisable with a weighted average exercise price of $0.08. There were no warrants issued, exercised or forfeited in the three month period ended March 31, 2012. The outstanding warrants have expiration dates between May 2012 and August 2016.

During the three month period ended March 31, 2012, we recorded $27,045 and $15,324, respectively, in amortization of deferred financing costs related to warrants granted in 2010 and 2011 in conjunction with the restructuring of outstanding notes.

7. Net Loss per Common Share

Basic net loss per common share is calculated by dividing the net loss by the weighted average number of common shares outstanding during the period. Diluted earnings per share is calculated using the weighted average number of common shares outstanding plus dilutive common stock equivalents outstanding during the period. Common stock equivalents are excluded for the three month periods ended March 31. 2012 and 2011, respectively, since the effect is anti-dilutive due to the Company’s net losses. Common stock equivalents include stock options and warrants.

Basic weighted average common shares outstanding, and the potentially dilutive securities excluded from loss per share computations because they are anti-dilutive, are as follows as of March 31, 2012 and 2011, respectively:

| |

|

Three Month Period Ended

March 31,

|

|

| |

|

2012

|

|

|

2011

|

|

|

Basic and diluted weighted average common stock shares outstanding

|

|

|

69,679,854 |

|

|

|

69,679,854 |

|

|

Potentially dilutive securities excluded from loss per share computations:

|

|

|

|

|

|

|

|

|

|

Common stock options

|

|

|

18,766,977 |

|

|

|

19,101,545 |

|

|

Common stock purchase warrants

|

|

|

6,218,750 |

|

|

|

4,218,750 |

|

8. Related Party Transactions

We incurred $7,201 and $11,983 in legal fees during the three month periods ended March 31, 2012 and 2011, respectively, for services provided by Breslow & Walker, LLP in which Howard S. Breslow, a director and stockholder of the Company, is a partner. At March 31, 2012 and December 31, 2011, accounts payable included $19,266 and $22,631, respectively, due to Breslow & Walker, LLP for services rendered.

We incurred $24,000 in consulting fees for services provided pursuant to a consulting agreement during the three month period ended March 31, 2011 to Roderick de Greef, a director of the Company. The agreement with Mr. De Greef was terminated in August of 2011.

9. Commitments & Contingencies

Legal Proceedings

We are a party in a number of legal matters filed in the state of New York by the Company or John G. Baust, the Company’s former Chief Executive Officer, and members of his extended family, that are described more fully in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011. During the three months ended March 31, 2012, there were no significant developments related to these complaints. We have not made any accrual related to future litigation outcomes as of March 31, 2012 and December 31, 2011.

Leases

In July 2007, we signed a four-year lease, commencing August 1, 2007, for 4,366 square feet of office and laboratory space in Bothell, Washington at an initial rental rate of $6,367 per month. We are also responsible for paying a proportionate share of property taxes and other operating expenses as defined in the lease.

In November 2008, we signed an amended five-year lease to gain 5,798 square feet of additional clean room space for manufacturing in a facility adjacent to our corporate office facility leased in Bothell, Washington at an initial rental rate of $14,495 per month. Included in this amendment is the exercise of the renewal option for our current office and laboratory space to make the lease for such space coterminous with the new facility five-year lease period.

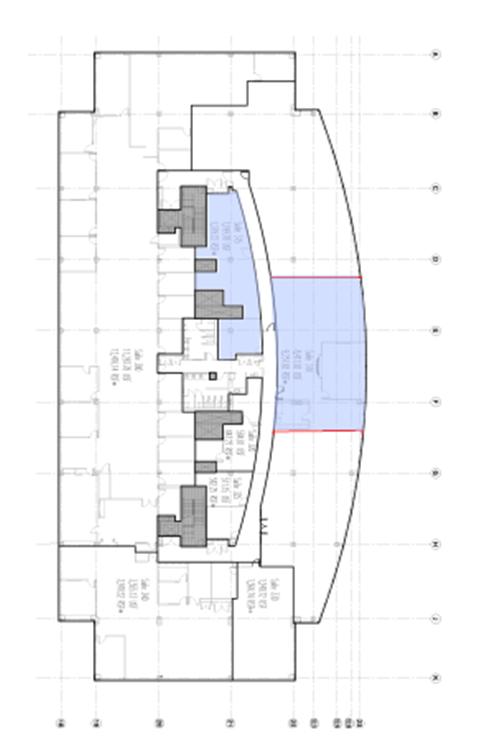

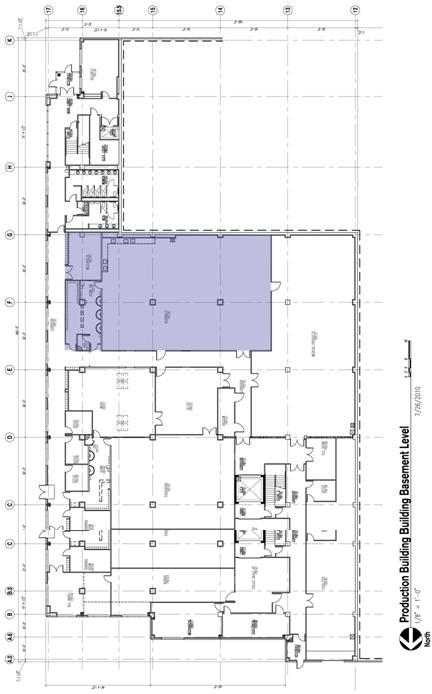

In March of 2012, we signed an amended lease agreement which expanded the premises leased by the Company from the landlord to approximately 21,000 rentable square feet. The term of the lease was extended for nine (9) years commencing on July 1, 2012 and expiring on June 30, 2021. The amendment includes two (2) options to extend the term of the lease, each option is for an additional period of five (5) years, with the first extension term commencing, if at all, on July 1, 2021, and the second extension term commencing, if at all, immediately following the expiration of the first extension term. In accordance with the amended lease agreement, the Company’s monthly base rent will increase to approximately $35,000. The Company will be required to pay an amount equal to the Company’s proportionate share of certain taxes and operating expenses.

The following is a schedule of future minimum lease payments required under the facility leases as of March 31, 2012:

|

Year Ending

|

|

|

|

|

December 31

|

|

|

|

|

2012

|

|

$

|

215,314

|

|

|

2013

|

|

|

426,086

|

|

|

2014

|

|

|

436,738

|

|

|

2015

|

|

|

447,656

|

|

|

2016

|

|

|

458,848

|

|

|

Thereafter

|

|

|

2,209,374

|

|

|

Total

|

|

$

|

4,194,016

|

|

Additional Proceeds on Outstanding Notes Payable

Subsequent to March 31, 2012, the Company received an additional $300,000 in total pursuant to the amended notes payable.

Extension of Maturity Date of Notes Payable

Subsequent to March 31, 2012, the Investors agreed to extend the maturity date of the Notes Payable for at least twelve months, and we have therefore, classified the Notes Payable as long-term liabilities as of March 31, 2012.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The statements contained in this Quarterly Report on Form 10-Q, including under the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements regarding the Company management’s expectations, hopes, beliefs, intentions or strategies regarding the future. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “plan” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements contained in this Quarterly Report on Form 10-Q are based on the Company’s current expectations and beliefs concerning future developments and their potential effects on the Company. There can be no assurance that future developments affecting the Company will be those that it has anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include those factors described in greater detail in the risk factors disclosed in our Form 10-K for the fiscal year ended December 31, 2011 filed with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those anticipated in these forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Overview

Management’s discussion and analysis provides additional insight into the Company and is provided as a supplement to, and should be read in conjunction with, our annual report on Form 10-K for the fiscal year ended December 31, 2011 filed with the Securities and Exchange Commission.

Our proprietary HypoThermosol®, CryoStor®, and generic BloodStor® biopreservation media products are marketed to cell therapy companies, pharmaceutical companies, cord blood banks, hair transplant surgeons, and suppliers of cells to the toxicology testing and diagnostic markets. All of our products are serum-free and protein-free, fully defined, and are manufactured under current Good Manufacturing Practices using United States Pharmacopeia (“USP”) or the highest available grade components.

Our products are formulated to reduce preservation-induced, delayed-onset cell damage and death. This platform enabling technology provides academic and clinical researchers significant extension in biologic source material shelf life and also improved post-preservation cell, tissue, and organ viability and function.

The discoveries made by our scientists and consultants relate to how cells, tissues, and organs respond to the stress of hypothermic storage, cryopreservation, and the thawing process, and enabled the formulation of truly innovative biopreservation media products that protect biologic material from preservation related cellular injury, much of which is not apparent immediately post-thaw. Our enabling technology provides significant improvement in post-preservation viability and function of biologic material. This yield improvement can reduce research, development, and commercialization costs of new cell and tissue based clinical therapies.

Critical Accounting Policies and Significant Judgments and Estimates

Management’s discussion and analysis of our financial condition and results of operations is based on our financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles for interim financial reporting. The preparation of financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and reported revenues and expenses during the reporting periods presented. On an ongoing basis, we evaluate estimates, including those related to share-based compensation and expense accruals. We base our estimates on historical experience and on other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ materially from these estimates under different assumptions or conditions. Our critical accounting policies and estimates have not changed significantly from those policies and estimates disclosed under the heading “Critical Accounting Policies and Significant Judgments and Estimates” under Item 7 in our Form 10-K for the fiscal year ended December 31, 2011, filed with the Securities and Exchange Commission.

Results of Operations

Summary of Achievements for the First Quarter of 2012

|

·

|

The Company recorded its seventh sequential record revenue quarter.

|

|

·

|

Revenue from direct customers was up 15% over the fourth quarter of 2011 and 84% over the first quarter of 2011, with significant increases in revenue from drug discovery and regenerative medicine market segments.

|

|

·

|

The Company recorded a record gross margin of 58.6% of revenue.

|

|

·

|

The Company signed a lease amendment to increase the size of the corporate headquarters and manufacturing facility by approximately 100%.

|

Comparison of Results of Operations for the Three Month Periods Ended March 31, 2012 and 2011

Percentage comparisons have been omitted within the following table where they are not considered meaningful.

Revenue and Gross Margin

| |

|

Three Month Period Ended

|

|

|

|

|

| |

|

March 31,

|

|

|

|

|

| |

|

2012

|

|

|

2011

|

|

|

Change

|

|

|

% Change

|

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct

|

|

$

|

738,167

|

|

|

$

|

401,929

|

|

|

$

|

336,238

|

|

|

|

84%

|

|

|

Indirect

|

|

|

92,713

|

|

|

|

127,184

|

|

|

|

(34,471

|

)

|

|

|

(27%

|

)

|

|

Contract manufacturing

|

|

|

––

|

|

|

|

76,686

|

|

|

|

(76,686

|

)

|

|

|

(100%

|

)

|

|

Total product sales

|

|

|

830,880

|

|

|

|

605,799

|

|

|

|

225,081

|

|

|

|

37%

|

|

|

Licensing revenue

|

|

|

5,000

|

|

|

|

5,000

|

|

|

|

––

|

|

|

|

––

|

|

|

Total revenue

|

|

|

835,880

|

|

|

|

610,799

|

|

|

|

225,081

|

|

|

|

37%

|

|

|

Cost of sales

|

|

|

346,129

|

|

|

|

368,600

|

|

|

|

(22,471

|

)

|

|

|

(6%

|

)

|

|

Gross profit

|

|

$

|

489,751

|

|

|

$

|

242,199

|

|

|

$

|

247,552

|

|

|

|

102%

|

|

|

Gross margin %

|

|

|

58.6%

|

|

|

|

39.7%

|

|

|

|

|

|

|

|

|

|

Product Sales and Cost of Sales. Our products are sold through both direct and indirect channels. Product sales in the first quarter of 2012 increased compared to the first quarter of 2011 primarily due to higher sales to our customers in the drug discovery and regenerative medicine market segments, which were both up significantly over 2011. Sales to our direct customers in the first quarter of 2012 increased 84% compared to the first quarter of 2011due primarily to higher selling prices to existing customers. Sales to distributors in the first quarter of 2012 decreased 27% compared to the first quarter of 2011.

Cost of product sales consists of raw materials, labor and overhead expenses. Cost of sales in the first quarter of 2012 decreased compared to 2011 and gross margin as a percentage of revenue increased in the first quarter of 2012 compared to 2011 which was due primarily to improved utilization of our manufacturing facility. This increased utilization resulted in lower overhead costs per unit manufactured being included in cost of sales.

Licensing Revenue. We have entered into license agreements with one customer that provides this customer with limited access to our intellectual property under certain conditions. This customer paid upfront fees for the specific rights and we recognize license revenue ratably over the term of the agreements.

Operating Expenses

Our operating expenses for the three month periods ended March 31, 2012 and 2011 were:

| |

|

Three Month Period Ended

|

|

| |

|

March 31,

|

|

| |

|

2012

|

|

|

2011

|

|

|

Research and development

|

|

$

|

116,521

|

|

|

$

|

158,793

|

|

|

% of revenue

|

|

|

14%

|

|

|

|

26%

|

|

|

Sales and marketing

|

|

$

|

73,381

|

|

|

$

|

83,308

|

|

|

% of revenue

|

|

|

9%

|

|

|

|

14%

|

|

|

General and administrative

|

|

$

|

479,113

|

|

|

$

|

454,375

|

|

|

% of revenue

|

|

|

57%

|

|

|

|

74%

|

|

Research and Development. Research and Development expenses consist primarily of salaries and other personnel expenses, consulting and other outside services, laboratory supplies, and other costs. We expense all R&D costs as incurred. R&D expenses for the quarter ended March 31, 2012 decreased compared to the first quarter of 2011 primarily as a result of reduced spending on legal fees associated with patents and lower spending on other consulting expenses.

Sales and Marketing. Sales and marketing expenses consist primarily of salaries and other personnel-related expenses, consulting, trade shows and advertising. The decrease in the first quarter of 2012 compared to the first quarter of 2011 was due primarily to reduced spending on advertising and trade shows.

General and Administrative Expenses. General and administrative expenses consist primarily of salaries and other personnel-related expenses, non-cash stock-based compensation for administrative personnel and non-employee members of the board of directors, professional fees, such as accounting and legal, corporate insurance and facilities costs. The 5% increase in general and administrative expenses in the first quarter of 2012 compared to the first quarter of 2011 was due to higher personnel costs in 2012, offset somewhat by a reduction in consulting expenses due to the termination of one consulting agreement in the third quarter of 2011.

Other Income (Expenses)

Interest and Other Income. Interest and other income includes other revenue of $87,215 related to inventory received in a non-monetary transaction during the first quarter of 2012.

Interest Expense. Interest expense increased to $178,777 for the three months ended March 31, 2012 compared to $160,542 for the same period in 2011. The increase is due to a higher debt balance related to additional borrowings of $175,000 in the first quarter of 2012 and other draws in 2011 after March 31, 2011.

Amortization of Deferred Financing Costs. Amortization of deferred financing costs represents the cost of warrants issued in the fourth quarter of 2010 and the third quarter of 2011 which are being amortized over the life of the debt.

Outlook

We expect revenue to continue to increase to approximately $4.1 million in 2012. We expect sales to our contract manufacturing customers to increase significantly with the commencement of deliveries to the previously announced new customer.. We also expect steady increases in revenue shipments to existing and new direct customers, specifically in the regenerative medicine market segment, as our customers continue to move their cell and tissue based therapies and products through the clinical trial and regulatory approval processes.

We expect slightly lower gross margin as a percentage of revenue in 2012 as a result of increased contract manufacturing, in addition to increased operating expenses associated with selling and product development activity.

Finally, we believe the Company will achieve positive cash flow from operations in 2012 and that cash generated from customer collections will provide sufficient funds to operate our business.

Liquidity

At March 31, 2012, we had cash and cash equivalents of $70,524 compared to cash and cash equivalents of $16,864 at December 31, 2011. At March 31, 2012, we had working capital of $686,793, compared to working capital of $581,159 at December 31, 2011. We have been unable to generate sufficient income from operations in order to meet our operating needs and have an accumulated deficit of approximately $54 million at March 31, 2012. This raises substantial doubt about our ability to continue as a going concern.

Net Cash Used in Operating Activities

During the quarter ended March 31, 2012, net cash used in operating activities was $74,823 compared to net cash used by operating activities of $304,639 for the quarter ended March 31, 2011. Cash used in operating activities relates primarily to funding net losses and changes in operating assets and liabilities, offset by non-cash compensation related to stock options and depreciation.

Net Cash Used in Investing Activities

Net cash used in investing activities totaled $46,517 and $13,475 during the quarters ended March 31, 2012 and 2011, respectively. Cash used in investing activities was due to purchase of property and equipment, offset slightly by cash received from the sale of certain assets.

Net Cash Provided by Financing Activities

Net cash provided by financing activities was $175,000 and $350,000 during the quarters ended March 31, 2012 and 2011, respectively. Cash provided by financing activities resulted from funding from two shareholders, Thomas Girschweiler, a director and stockholder of the Company, and Walter Villiger, an affiliate of the Company (the “Investors”).

Off-Balance Sheet Arrangements

As of March 31, 2012, we did not have any off-balance sheet financing arrangements.

Contractual Obligations

In March of 2012, we signed an amended lease agreement which expanded the premises leased by the Company from the Landlord to approximately 21,000 rentable square feet. The term of the lease was extended for nine (9) years commencing on July 1, 2012 and expiring on June 30, 2021. The amendment includes two (2) options to extend the term of the lease, each option is for an additional period of five (5) years, with the first extension term commencing, if at all, on July 1, 2021, and the second extension term commencing, if at all, immediately following the expiration of the first extension term. In accordance with the amended lease agreement, the Company’s monthly base rent will increase, as of July 1, 2012, to approximately $35,000. The Company will be required to pay an amount equal to the Company’s proportionate share of certain taxes and operating expenses.

We did not have any off-balance sheet arrangements as defined in S-K 303(a)(4)(ii).

Going Concern

If we are unable to continue as a going concern, we may be unable to realize our assets and discharge our liabilities in the normal course of business. Factors that would negatively impact our ability to finance our operations include (a) significant reductions in revenue from our internal projections, (b) increased capital expenditures, (c) significant increases in cost of goods and operating expenses, or; (d) an adverse outcome resulting from current litigation. If we are unable to collect adequate cash from customer collections and the Investors were to become unwilling to provide access to additional funds through the amended Facilities, we would need to find immediate additional sources of capital. There can be no assurance that such capital would be available, or, if available, that the terms of such financing would not be dilutive to stockholders. If we are unable to secure additional capital as circumstances require, we may not be able to continue our operations.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures. Under the supervision and with the participation of our senior management, including our chief executive officer and chief financial officer, we conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as of the end of the period covered by this quarterly report. Based on this evaluation, our chief executive officer and chief financial officer concluded as of March 31, 2012, that our disclosure controls and procedures were effective such that the information required to be disclosed in our SEC reports (i) is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and (ii) is accumulated and communicated to our management, including our chief executive officer and chief financial officer, as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Control over Financial Reporting. There have been no changes in our internal control over financial reporting that occurred during the quarter ended March 31, 2012 that have materially affected or are reasonably likely to materially affect our internal control over financial reporting.

Limitations on Effectiveness of Control. Our management, including our chief executive officer and chief financial officer, does not expect that our disclosure controls and procedures or our internal controls over financial reporting will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within our Company have been detected.

PART II: Other Information

See accompanying Index to Exhibits included after the signature page of this report for a list of exhibits filed or furnished with this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

|

| |

|

BIOLIFE SOLUTIONS, INC.

|

|

| |

|

|

|

|

Dated: May 14, 2012

|

|

|

|

| |

|

Daphne Taylor

|

|

| |

|

Chief Financial Officer

|

|

| |

|

(Duly authorized officer and principal financial officer) |

|

BIOLIFE SOLUTIONS, INC.

INDEX TO EXHIBITS

|

Exhibit No.

|

|

Description

|

| |

|

|

|

|

|

Second Amendment to the Lease, dated the March 2, 2012, between the Company and Monte Villa Farms, LLC

|

| |

|

|

|

|

|

Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

| |

|

|

|

|

|

Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

| |

|

|

|

|

|

Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

| |

|

|

|

|

|

Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

| |

|

|

| |

|

*Filed herewith

|