This filing is made pursuant to Rule 424(b)(2) under

the Securities Act of 1933 in connection with Registration No. 333-202281

PROSPECTUS SUPPLEMENT

(To Prospectus dated February 25, 2015)

Medium-Term Notes, Series B

Due Nine Months or More From Date of Issue

Toyota Motor Credit Corporation (“TMCC”) may offer its medium-term notes from time to time. TMCC will provide the specific terms of any notes offered in a pricing supplement. Unless the pricing supplement provides otherwise, the notes offered will have the following terms:

• The notes will mature nine months or more from the date of issue.

• The notes will be unsecured unsubordinated obligations of Toyota Motor Credit Corporation.

• The notes may bear interest at fixed or floating rates or may not bear any interest. Floating rate interest may be based on one or more of the following rates plus or minus one or more fixed amounts or multiplied by one or more leverage factors:

• Eleventh District Cost of Funds Rate

• Federal Funds OIS Compound Rate

|

|

• Any other rate specified in the applicable pricing supplement or any combination of rates specified in the applicable pricing supplement.

• The pricing supplement will specify the interest payment dates.

• Payments on notes issued as indexed notes will be determined by reference to the index specified in the pricing supplement.

• The pricing supplement will specify if the notes can be redeemed before their maturity and if they are subject to mandatory redemption, redemption at TMCC’s option or repayment at the option of the holder of the notes.

• The notes will be denominated in U.S. dollars or any other currency specified in the applicable pricing supplement.

• The notes will be in certificated or book-entry form.

• The notes will be in minimum denominations of $1,000, increased in multiples of $1,000, unless specified otherwise in the applicable pricing supplement. TMCC will specify the minimum denominations for notes denominated in a foreign currency in the applicable pricing supplement.

|

Investing in the notes involves risks. See “Risk Factors” on page S-2 of this prospectus supplement and page 1 of the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities, or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

|

Price to Public

|

Agents’ Discounts and

Commissions

|

Proceeds to

Toyota Motor Credit Corporation

|

| |

|

|

|

|

|

Per note

|

100.000%(1)

|

.050% – .875%(2)

|

99.125% – 99.950%(2)

|

_____________________

|

(1)

|

Unless the pricing supplement provides otherwise, TMCC will issue the notes at 100% of their principal amount.

|

|

(2)

|

Unless the pricing supplement provides otherwise, TMCC will pay an agent a discount commission ranging from 0.050% to 0.875% and the proceeds to Toyota Motor Credit Corporation will be ranging from 99.125% to 99.950%.

|

TMCC is offering the notes on a continuing basis through the agents listed below. These agents will use their reasonable efforts to sell the notes offered. TMCC may also appoint additional agents. TMCC may also sell notes to the agents listed below or others, as principal, for resale to investors and other purchasers. In this prospectus supplement, persons who purchase notes from TMCC as agent or as principal for resale are referred to as “agents.” TMCC may also sell notes without the assistance of an agent.

This prospectus supplement may also be used for offers and sales related to market making transactions in TMCC’s Medium-Term Notes, Series B.

BofA Merrill Lynch

Arranger

|

Barclays

Citigroup

Deutsche Bank Securities

HSBC

J.P. Morgan

Morgan Stanley

RBC Capital Markets

Société Générale Corporate & Investment Banking

Toyota Financial Services Securities USA Corporation

|

The date of this prospectus supplement is February 26, 2015

This prospectus supplement does not contain complete information about the offering of the notes. No one may use this prospectus supplement to offer and sell the notes unless it is accompanied by the prospectus. If the terms of particular notes described in a pricing supplement are different from those described in this prospectus supplement or the prospectus, you should rely on the information in the pricing supplement.

TMCC has not authorized any person to provide you with any information other than the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus, any pricing supplement or any free writing prospectus prepared by or on behalf of TMCC or to which TMCC has referred you. TMCC takes no responsibility for, and can provide no assurance as to, any other information. You should not assume that the information contained in or incorporated by reference in this prospectus supplement, any pricing supplement or any free writing prospectus is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and other information may have changed since those dates. TMCC is not making an offer to sell the notes in any jurisdiction where the offer or sale is not permitted.

TABLE OF CONTENTS

|

|

Page

|

| |

|

|

Prospectus Supplement

|

|

| |

|

|

Forward-Looking Statements

|

S-1

|

|

Risk Factors

|

S-2

|

|

Description of the Notes

|

S-7

|

|

Use of Proceeds

|

S-32

|

|

Ratio of Earnings to Fixed Charges

|

S-32

|

|

United States Federal Taxation

|

S-33

|

|

Plan of Distribution (Conflicts of Interest)

|

S-47

|

|

Validity of the Notes

|

S-52

|

| |

|

|

Prospectus

|

|

| |

|

|

About this Prospectus

|

1

|

|

Risk Factors

|

1

|

|

Where You Can Find More Information

|

1

|

|

Incorporation of Information Filed with the SEC

|

1

|

|

Forward-Looking Statements

|

2

|

|

Toyota Motor Credit Corporation

|

3

|

|

Description of Debt Securities

|

4

|

|

Legal Matters

|

10

|

|

Experts

|

10

|

| |

|

In this prospectus supplement, unless otherwise indicated by the context, “TMCC” refers specifically to Toyota Motor Credit Corporation (excluding its subsidiaries) and “we,” “our” and “us” refer specifically to Toyota Motor Credit Corporation and its consolidated subsidiaries. TMCC is the issuer of all of the notes offered under this prospectus supplement. References to “TMC” are to TMCC’s indirect parent, Toyota Motor Corporation. TMCC’s website is http://www.toyotafinancial.com. The information on the website is not part of, or incorporated by reference into, this prospectus supplement.

Forward-Looking Statements

Certain statements contained in this prospectus supplement or incorporated by reference herein are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on current expectations and currently available information. However, since these statements are based on factors that involve risks and uncertainties, our performance and results may differ materially from those described or implied by such forward-looking statements. Words such as “believe,” “anticipate,” “expect,” “estimate,” “project,” “should,” “intend,” “will,” “may” or words or phrases of similar meaning are intended to identify forward-looking statements. We caution that the forward-looking statements involve known and unknown risks, uncertainties and other important factors such as the following that may cause actual results to differ materially from those stated:

|

|

·

|

changes in general business, economic, and geopolitical conditions, as well as in consumer demand and the competitive environment in the automotive markets in the United States;

|

|

|

·

|

a decline in Toyota Motor Sales, USA, Inc. (“TMS”) sales volume and the level of TMS sponsored subvention programs;

|

|

|

·

|

increased competition from other financial institutions seeking to increase their share of financing Toyota, Scion and Lexus vehicles;

|

|

|

·

|

fluctuations in interest rates and currency exchange rates;

|

|

|

·

|

fluctuations in the value of our investment securities or market prices;

|

|

|

·

|

changes or disruptions in our funding environment or access to the global capital markets;

|

|

|

·

|

failure or changes in commercial soundness of our counterparties and other financial institutions;

|

|

|

·

|

changes in our credit ratings and those of TMC;

|

|

|

·

|

changes in the laws, regulatory requirements and regulatory scrutiny, including as a result of recent financial services legislation, and related costs;

|

|

|

·

|

natural disasters, changes in fuel prices, manufacturing disruptions and production suspensions of Toyota, Lexus and Scion vehicle models and related parts supply;

|

|

|

·

|

operational risks, including security breaches or cyber-attacks;

|

|

|

·

|

challenges related to the relocation of our corporate headquarters to Plano, Texas;

|

|

|

·

|

revisions to the estimates and assumptions for our allowance for credit losses;

|

|

|

·

|

changes in prices of used vehicles and their effect on residual values of our off-lease vehicles and return rates;

|

|

|

·

|

the failure of a customer or dealer to meet the terms of any contract with us, or otherwise fail to perform as agreed;

|

|

|

·

|

recalls announced by TMS and the perceived quality of Toyota, Lexus and Scion vehicles; and

|

|

|

·

|

the factors discussed under “Risk Factors” in our incorporated documents.

|

Forward-looking statements speak only as of the date they are made. TMCC will not update the forward-looking statements to reflect actual results or changes in the factors affecting the forward-looking statements.

RISK FACTORS

Your investment in the notes involves risks. You should consult with your own financial and legal advisers as to the risks involved in an investment in the notes and to determine whether the notes are a suitable investment for you. The notes may not be a suitable investment for you if you are unsophisticated about debt securities. Notes denominated or payable in a foreign currency are not an appropriate investment for investors who are unsophisticated with respect to foreign currency transactions. Indexed notes are not an appropriate investment for investors who are unsophisticated with respect to the type of index or formula used to determine the amount payable. You should carefully consider the risk factors discussed below and the risks described under “Risk Factors” on page 1 of the accompanying prospectus or in the documents incorporated by reference into the accompanying prospectus, as well as the other information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus, before investing in the notes. The pricing supplement for a particular issuance of notes may describe additional information and risks applicable to those notes.

An Investment in Notes Indexed to Interest Rate, Currency or Other Indices or Formulas Entails Special Risks

An investment in notes where the principal, premium or interest is determined by reference to interest rate, currency or other indices or formulas will entail significant risks not associated with an investment in conventional fixed or floating rate notes. Examples of this type of note are notes where any or all of the principal, premium and interest is indexed to one or more:

• interest rates;

• currencies, including exchange rates and swap indices between currencies;

• commodities or stocks; or

• other indices or formulas specified in a particular pricing supplement.

The risks from this type of investment include the possibility that the index or indices may fluctuate significantly and therefore (1) you will receive a lower amount of, or no, principal, premium, or interest and at different times than you expected and (2) the secondary market for indexed notes will be negatively affected by a number of factors, independent of TMCC’s creditworthiness. Such factors include the volatility of the index selected, the time remaining to the maturity of the notes, the amount outstanding of the notes and market interest rates. TMCC has no control over a number of factors affecting this type of note, including economic, financial and political events, that are important in determining the existence, magnitude and longevity of these risks and their results. In addition, if an index or formula used to determine the amount of principal, premium, or interest payable in respect of a note contains a multiple or leverage factor, the effect of any change in the index or formula will be magnified. In recent years, particular interest rates and indices have been highly volatile and this volatility may be expected to continue in the future. However, past experience is not necessarily indicative of what may happen in the future and the historical experience of an index should not be taken as an indication of its future performance. Accordingly, you should consult your own financial and legal advisors as to the risk entailed by an investment in indexed notes.

The Secondary Market Price of Notes Indexed to Interest Rates, Currencies or Other Indices or Formulas Are Likely To Be Adversely Affected Since TMCC’s Cost of Distributing the Notes and Cost of Hedging its Payment Obligations Under the Notes Will Be Included in the Original Offering Price of These Notes

For notes that are linked to interest rates, currencies or other indices or formulas, assuming no change in the level of the applicable linked interest rate, currencies or other index or formula, the price, if any, at which buyers are willing to purchase those notes in secondary market transactions will likely be less than the original offering price of the notes since the original offering price included, and the secondary market price, if any, offered to you will likely exclude, the cost of original distribution and the cost of any hedge of TMCC’s payment obligations under the notes. In addition, any such prices may be lower than the value of the notes determined by

pricing models used by an agent, as a result of dealer discounts, mark-ups or other transaction costs. See also, “—Many Factors Affect the Trading Market and Market Value of Your Notes” for other factors that may affect the trading market and market value of your notes.

An Investment in Notes Denominated or Payable in a Currency Other than U.S. Dollars Entails Special Risks Relating to Exchange Rates and Exchange Controls

An investment in a note denominated or payable in a currency other than U.S. dollars entails significant risks. These risks include the possibility of significant changes in rates of exchange between the U.S. dollar and such currency and the possibility of the imposition or modification of foreign exchange controls by either the United States or foreign governments. These risks generally depend on factors over which TMCC has no control, such as economic and political events and the supply of and demand for the relevant currencies. Moreover, if payments on your notes denominated or payable in a currency other than U.S. dollars are determined by reference to a formula containing a multiple or leverage factor, the effect of any change in exchange rates between the applicable currencies will be magnified. In recent years, rates of exchange between the U.S. dollar and certain currencies have been highly volatile, and you should be aware that volatility may occur in the future. Fluctuations in any particular exchange rate that have occurred in the past, however, are not necessarily indicative of fluctuations in the rate that may occur during the term of any note. Depreciation of the specified currency for a note against the U.S. dollar would result in a decrease in the effective yield of such note (on a U.S. dollar basis) below its coupon rate, in the U.S. dollar equivalent value of payments made on such note and in the U.S. dollar equivalent market value of such note.

Except as set forth below in “—Foreign Currency Judgments Are Subject to Exchange Rate Risks,” and unless specified otherwise in the applicable pricing supplement, if payment in respect of a note is required to be made in a currency other than U.S. dollars and such currency is unavailable to TMCC due to the imposition of exchange controls or other circumstances beyond TMCC’s control or is no longer used by the relevant government or for the settlement of transactions within the international banking community, then all payments in respect of such note will be made in U.S. dollars until such currency is again available to TMCC or so used. The amounts payable on any date in such currency will be converted into U.S. dollars on the basis of the most recently available market exchange rate for such currency or as otherwise indicated in the applicable pricing supplement. Any payment in respect of such note so made in U.S. dollars will not constitute an event of default under the Indenture (as defined below in “Description of the Notes”). However, if TMCC cannot make payment in a specified currency solely because that currency has been replaced by the euro, then, beginning with the date the replacement becomes effective, TMCC will be able to satisfy its obligations under those notes by making payment in euro.

The information set forth in this prospectus supplement with respect to foreign currency risks is general in nature. TMCC disclaims any responsibility to advise prospective purchasers of foreign currency notes with respect to any matters that may affect the purchase, holding or receipt of payments of principal or premium, if any, and interest on such notes. Such persons should consult their own counsel with regard to such matters.

Foreign Currency Judgments Are Subject to Exchange Rate Risks

The notes and the Indenture will be governed by and construed in accordance with the internal laws of the State of New York. New York courts will normally enter judgments or decrees for money damages in the foreign currency in which notes are denominated. These amounts are then converted into U.S. dollars at the rate of exchange in effect on the date the judgment or decree is entered. It is not certain, however, whether a non-New York state court would follow the same rules and procedure, with respect to conversion of foreign currency judgment. Courts in the United States outside New York customarily have not rendered judgments for money damages denominated in any currency other than the U.S. dollar.

Redemption May Adversely Affect Your Return on the Notes

If your notes are redeemable at TMCC’s option or are otherwise subject to mandatory redemption, TMCC may redeem your notes at a time when prevailing interest rates are relatively low. If this happens, you generally

will not be able to reinvest the redemption proceeds in a comparable security at an effective interest rate as high as that of the redeemed notes. For this reason, an optional or mandatory redemption feature can affect the market value of your notes. TMCC’s redemption right also may adversely affect your ability to sell your notes as the redemption date approaches.

Many Factors Affect the Trading Market and Market Value of Your Notes

TMCC cannot assure you that a trading market for your notes will ever develop or be maintained. Many factors independent of the creditworthiness of TMCC may affect the trading market or market value of your notes. Some of these factors, which are mentioned below, are interrelated. As a result, the effect of any one factor may be offset or magnified by the effect of another factor. These factors include, without limitation:

|

|

•

|

the complexity and volatility of any index or formula applicable to the notes;

|

|

|

•

|

the method of calculating any principal, premium or interest to be paid on the notes;

|

|

|

•

|

the time remaining to the maturity of the notes;

|

|

|

•

|

the outstanding amount of the notes;

|

|

|

•

|

any redemption or repayment features of the notes;

|

|

|

•

|

the amount of other securities linked to any index or formula applicable to the notes;

|

|

|

•

|

the level, direction and volatility of market interest rates generally and other conditions in the credit markets, including the degree of liquidity in the credit markets generally;

|

|

|

•

|

the credit ratings assigned to TMCC, TMC or the notes; and

|

|

|

•

|

TMCC’s or TMC’s perceived creditworthiness, which may be impacted by our or TMC’s financial condition, cash flow or results of operations.

|

In addition, because some notes may be designed for specific investment objectives or strategies, those notes may (1) have a more limited trading market and (2) experience more price volatility than conventional debt securities.

Because of these limitations, you may not be able to sell notes readily or at prices that enable you to realize the yield you expect. In this regard, notes issued at a substantial discount from their principal amount payable at maturity trade at prices that tend to fluctuate more in relation to general changes in interest rates than the prices for conventional interest-bearing notes with comparable maturities. You should not purchase notes unless you understand and are able to bear the risk that particular notes may not be easy to sell and that the value of the notes will fluctuate over time, perhaps significantly.

In addition, if your investment activities are subject to legal investment laws and regulations, you may not be able to invest in certain types of notes or your investment in them may be limited. You should review and consider any applicable restrictions before investing in the notes.

Your Notes May Not Have an Established Trading Market; Secondary Trading in the Notes

TMCC does not anticipate any note will have an established trading market when issued. The notes will not be listed on any securities exchange unless otherwise provided in the applicable pricing supplement. Agents may from time to time purchase and sell notes in the secondary market, but no agent is obligated to do so. From time to time, agents may make a market in the notes, but any market making may be discontinued at any time. For these reasons, you should not assume that there will be any secondary market for your notes or, if there is a

market, that it will be liquid. In addition, even if a secondary market develops for any notes, the spread between bid and asked prices for notes may be substantial.

TMCC’s Credit Ratings Do Not Reflect The True Risks of an Investment in the Notes

The credit ratings assigned to TMCC represent the rating agencies’ opinion regarding its credit quality and are not a guarantee of quality. Credit ratings are not recommendations to buy, sell or hold securities and are subject to revision or withdrawal at any time by the assigning rating agency. The credit ratings on this Medium-Term Note program are an assessment of TMCC’s ability to make payments on the notes when such payments are due. Consequently, real or anticipated changes in the program’s credit ratings will generally affect the market value of your notes. The credit ratings on the program, however, do not take into account fluctuations in the structure or market value of the notes or the possibility that payments on indexed notes may be less than anticipated because of changes in the specified index or indices. Therefore, the ratings assigned to TMCC may not fully reflect the true risks of an investment in the notes.

Hedging and Trading Activities By TMCC, the Agents and Their Affiliates May Adversely Affect Your Return on the Notes and the Value of Notes

TMCC, the agents, and their affiliates may carry out activities to mitigate their risks related to notes that are linked to an interest rate, currency or other index or formula. In particular, on or prior to the date of the applicable pricing supplement, TMCC, the agents, and/or any of their affiliates may have hedged their anticipated exposure in connection with some of the notes by taking positions in the underlying assets (or options or futures contracts on the underlying assets) that relate to a linked interest rate, currency or other index or formula or in other instruments that they deem appropriate in connection with such hedging. These trading activities, however, could potentially alter the level of a linked interest rate, linked currency or other linked index or linked formula and/or the underlying asset(s) comprising such linked interest rate, linked currency or other linked index or linked formula and, therefore, the value of the notes.

The agents and their affiliates are likely to modify any hedge position they may enter into in respect of the notes throughout the term of the notes by purchasing and selling underlying asset(s) (or options or futures contracts on the underlying asset(s)) that relate to a linked interest rate, linked currency or other linked index or linked formula, or other instruments that they deem appropriate. Neither TMCC, the agents, nor any of their affiliates can give any assurance that their hedging or trading activities will not affect the level of a linked interest rate, linked currency or other linked index or linked formula or the underlying asset(s) comprising such linked interest rate, linked currency or other linked index or linked formula. It is also possible that TMCC, the agents, and any of their affiliates could receive substantial returns from these hedging activities while the value of the notes may decline.

TMCC, the agents, and/or any of their affiliates may also engage in trading the underlying asset(s) (or options or futures contracts on the underlying asset(s)) that relate to a linked interest rate, linked currency or other linked index or linked formula or options or futures on such linked interest rate, linked currency or other linked index or linked formula on a regular basis as part of their general broker-dealer activities and other businesses, for proprietary accounts, for other accounts under management or to facilitate transactions for customers, including through block transactions. Any of these activities could adversely affect the level of a linked interest rate, linked currency or other linked index or linked formula, the underlying asset(s) comprising a linked interest rate, linked currency or other linked index or linked formula and, therefore, the value of the notes linked to such interest rate, currency or other index or formula.

TMCC, the agents, and/or any of their affiliates may also issue or underwrite other notes or financial or derivative instruments with returns linked or related to changes in the value of a linked interest rate, linked currency or other linked index or linked formula or the underlying asset(s) comprising a linked interest rate, linked currency or other linked index or linked formula. By introducing competing products into the marketplace in this manner, TMCC, the agents, and any of their affiliates could adversely affect the value of the notes.

The Agents and Their Affiliates May Publish Reports, Express Opinions Or Provide Recommendations That Are Inconsistent With Investing In or Holding the Notes. Any Such Reports, Opinions or Recommendations Could Directly Affect the Value of the Notes and Could Affect the Level of a Linked Interest Rate, Linked Currency or Other Linked Index or Linked Formula and Therefore the Value of the Notes

The agents and their affiliates may publish reports from time to time on financial markets and other matters that may influence the value of the notes or express opinions or provide recommendations that are inconsistent with investing in or holding the notes. The agents and their affiliates may have published or may publish reports or other opinions that call into question the investment view implicit in an investment in the notes. Any reports, opinions or recommendations expressed by the agents and/or any of their affiliates may not be consistent with each other and may be modified from time to time without notice. Investors should make their own independent investigation of the merits of investing in the notes and the rate or market measure to which the notes may be linked.

Tax Consequences of Holding the Notes

The tax consequences to you of owning and disposing of the notes may vary depending on the terms of the notes and your particular status and circumstances. You should consult with your own tax adviser about the U.S. federal, state, local and foreign tax consequences to you of owning and disposing of the notes.

Floating Rate Notes Have Risks That Conventional Fixed Rate Notes Do Not

Because the interest rate of floating rate notes may be based upon the CD Rate, the CMS Rate, the CMT Rate, the Commercial Paper Rate, the Eleventh District Cost of Funds Rate, the Federal Funds Rate, the Federal Funds OIS Compound Rate, LIBOR, the Prime Rate or the Treasury Rate or other such interest rate basis or interest rate formula or combination of rates as specified in the applicable pricing supplement, there will be significant risks not associated with conventional fixed rate notes. These risks include fluctuation of the interest rates and the possibility that you will receive a lower amount of interest in the future as a result of such fluctuations. TMCC has no control over various matters that are important in determining the existence, magnitude and longevity of these risks, including economic, financial and political events.

DESCRIPTION OF THE NOTES

The following description of the terms of the notes is in addition to, and if and to the extent inconsistent, replaces, the description and general terms of the notes under “Description of Debt Securities” in the accompanying prospectus. The following description of the terms of the notes sets forth certain general terms and provisions of the notes. The particular terms of notes offered by TMCC and the extent to which these general provisions may apply to the notes will be described in a pricing supplement relating to the notes. If the terms of particular notes described in a pricing supplement are different from those described in this prospectus supplement or in the prospectus, you should rely on the information in the pricing supplement.

General

TMCC will issue the notes as a series of debt securities (designated Medium-Term Notes, Series B) under an indenture, dated as of August 1, 1991, as amended by a first supplemental indenture, dated as of October 1, 1991, a second supplemental indenture, dated as of March 31, 2004, and a third supplemental indenture, dated as of March 8, 2011 (together, the “Indenture”), by and among TMCC, The Bank of New York Mellon Trust Company, N.A. and Deutsche Bank Trust Company Americas (formerly known as Bankers Trust Company) (“DBTCA”). DBTCA will act as trustee for the notes (the “Trustee”). The following is a summary of certain provisions of the notes and of the Indenture and does not contain all of the information which may be important to you. You should read all provisions of the Indenture carefully, including the definitions of certain terms, before you decide to invest in the notes. References to particular sections or defined terms of the Indenture are meant to incorporate by reference those sections or defined terms of the Indenture. A copy of the Indenture is an exhibit to the registration statement relating to the debt securities which includes the prospectus. See “Where You Can Find More Information” in the accompanying prospectus. Capitalized terms used but not defined in this prospectus supplement have the meanings given to them in the Indenture or the notes, as the case may be. The term “debt securities,” as used under this caption refers to all securities that may be issued under the Indenture, including the notes.

All debt securities, including the notes, issued and to be issued under the Indenture will be unsecured general obligations of TMCC and will rank equally with its other unsecured and unsubordinated indebtedness from time to time outstanding. The Indenture does not limit the total principal amount of debt securities that TMCC may issue.

The notes offered by this prospectus supplement will be part of the same series of debt securities as TMCC’s previously issued Medium-Term Notes, Series B. TMCC may issue an unlimited principal amount of its Medium-Term Notes, Series B.

The notes offered by this prospectus supplement will be offered on a continuing basis and will mature on a day that is nine months or more from the date of issue, as selected by the purchaser and agreed to by TMCC. The notes may bear interest at fixed or floating rates or may not bear any interest. Notes may be issued at a premium, or at significant discounts from their principal amount payable at the stated maturity date or on any prior date on which the principal or an installment of principal of a note becomes due and payable, whether by the declaration of acceleration, call for redemption at the option of TMCC, repayment at the option of the holder or otherwise (each date, a “Maturity”).

TMCC may change, from time to time, interest rates, interest rate and/or principal formulae and other variable terms of the notes, but no change will affect any note already issued or as to which TMCC has accepted an offer to purchase.

Terms May Vary Among Investors

Interest rates offered by TMCC for different notes may differ depending upon, among other things, the aggregate principal amount of notes purchased in any single transaction. TMCC may also offer notes with similar variable terms but different interest rates concurrently at any time. TMCC may also concurrently offer notes having different variable terms to different investors.

Reopenings

TMCC may reopen a prior issuance of its Medium-Term Notes, Series B by issuing additional notes with the same terms as the notes that it previously issued. However, any additional notes of this kind may have a different original offering price or first interest payment date. Unless otherwise specified in the applicable pricing supplement, the additional notes will be considered part of the same issuance of notes for all purposes.

Redemption

The notes will not be subject to any sinking fund. Unless otherwise specified in the applicable pricing supplement, a note will not be redeemable prior to its stated maturity date. If provided in an applicable pricing supplement, TMCC may redeem notes, in whole or in part, before their stated maturity at TMCC’s option on notice given not more than 15 nor less than 10 days (or on other notice described in the applicable pricing supplement) before the date of redemption, or through operation of a mandatory or optional sinking fund or analogous provisions. The pricing supplement will set forth the detailed terms of any redemption, including the date after or on which and the price or prices including premium, if any, at which the notes may be redeemed. Unless otherwise specified in the applicable pricing supplement, the notes will not be subject to repayment at the option of the holders.

Listing

Unless otherwise specified in the applicable pricing supplement, the notes will not be listed on, or admitted to trading on or by, any stock exchanges, and/or markets within or outside the United States. No note will have an established trading market when issued. A market for any particular issue of notes may not develop.

Interest and Interest Rates

General

Each note will not bear any interest or will bear interest from and including the date of issue (the “Original Issue Date”) at the rate per annum or, in the case of a floating rate note, pursuant to the interest rate formula stated in the applicable note and in the applicable pricing supplement until the principal of the note is paid or made available for payment. Interest will be payable in arrears on each interest payment date specified in the applicable pricing supplement on which an installment of interest is due and payable (an “Interest Payment Date”) and at Maturity. The first payment of interest on any note originally issued between a Regular Record Date, as defined below, and the related Interest Payment Date will be made on the Interest Payment Date immediately following the next succeeding Regular Record Date to the registered holder on the next succeeding Regular Record Date.

“Regular Record Date” will be the fifteenth calendar day, whether or not a Business Day, immediately preceding the related Interest Payment Date.

“Business Day” as used in this prospectus supplement means, unless otherwise specified in the applicable pricing supplement:

|

|

•

|

for CMS Rate Notes and CMT Rate Notes, any day except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities; and

|

with respect to all other notes:

|

|

•

|

for U.S. dollar denominated notes for which LIBOR is not an applicable Interest Rate Basis:

|

|

|

•

|

any day other than a Saturday or Sunday, that is neither a legal holiday nor a day on which commercial banks are authorized or required by law, regulation or executive order to close in The City of New York (a “New York Business Day”);

|

|

|

•

|

for U.S. dollar denominated notes for which LIBOR is an applicable Interest Rate Basis:

|

|

|

•

|

a day that is both (1) a day on which commercial banks are open for business, including dealings in the designated Index Currency (as defined below) in London (a “London Banking Day”) and (2) a New York Business Day;

|

|

|

•

|

for non-U.S. dollar denominated notes (other than notes denominated in euro) for which LIBOR is not an applicable Interest Rate Basis:

|

|

|

•

|

a day that is both (1) a day other than a day on which commercial banks are authorized or required by law, regulation or executive order to close in the Principal Financial Center (as defined below) of the country issuing the Specified Currency (a “Principal Financial Center Business Day”) and (2) a New York Business Day;

|

|

|

•

|

for non-U.S. dollar denominated notes (other than notes denominated in euro) for which LIBOR is an applicable Interest Rate Basis:

|

|

|

•

|

a day that is all of: (1) a Principal Financial Center Business Day; (2) a New York Business Day; and (3) a London Banking Day;

|

|

|

•

|

for euro denominated notes for which LIBOR is not an applicable Interest Rate Basis:

|

|

|

•

|

a day that is both (1) a day on which the Trans-European Automated Real-time Gross Settlement Express Transfer (TARGET) System is open (a “TARGET Business Day”) and (2) a New York Business Day; and

|

|

|

•

|

for euro denominated notes for which LIBOR is an applicable Interest Rate Basis:

|

|

|

•

|

a day that is all of: (1) a TARGET Business Day; (2) a New York Business Day; and (3) a London Banking Day.

|

“Principal Financial Center” means, unless otherwise specified in the applicable pricing supplement:

|

|

•

|

the capital city of the country issuing the Specified Currency except that with respect to U.S. dollars, Australian dollars, Canadian dollars, South African rand and Swiss francs, the Principal Financial Center will be the City of New York, Sydney, Toronto, Johannesburg and Zurich, respectively; or

|

|

|

•

|

the capital city of the country to which the Index Currency relates, except that with respect to U.S. dollars, Australian dollars, Canadian dollars, euro, South African rand and Swiss francs, the Principal Financial Center will be the City of New York, Sydney, Toronto, London, Johannesburg and Zurich, respectively.

|

“Index Currency” means the currency specified in the applicable pricing supplement as the currency for which LIBOR will be calculated. If no currency is specified in the applicable pricing supplement, the Index Currency will be U.S. dollars.

“Specified Currency” means the currency in which a particular note is denominated or payable (or, if the currency is no longer legal tender for the payment of public and private debts, any other currency of the relevant country or entity which is then legal tender for the payment of such debts).

Fixed Rate Notes

Fixed rate notes will bear interest at the rate per annum specified in the fixed rate note and applicable pricing supplement. Interest payments on fixed rate notes will equal the amount of interest accrued from and including the immediately preceding interest payment date in respect of which interest has been paid or from and including the date of issue, if no interest has been paid with respect to the notes to, but excluding, the related interest payment date or Maturity, as the case may be. Unless otherwise specified in the applicable pricing supplement, interest on fixed rate notes will be paid on the basis of a 360-day year of twelve 30-day months.

Unless otherwise provided in the applicable pricing supplement, interest on fixed rate notes will be payable semiannually on May 15 and November 15 of each year and at Maturity. Unless otherwise provided in the applicable pricing supplement, if any Interest Payment Date or the Maturity of a fixed rate note falls on a day that is not a Business Day, any principal, premium, or interest payments will be made on the next succeeding Business Day as if made on the date the payment was due, and no interest will accrue on the amount payable for the period from and after the Interest Payment Date or Maturity, as the case may be.

Floating Rate Notes

Interest Rate Basis. Interest on floating rate notes will be determined by reference to the applicable Interest Rate Basis or Interest Rate Bases, which may be one or more of:

|

|

•

|

the Commercial Paper Rate,

|

|

|

•

|

the Eleventh District Cost of Funds Rate,

|

|

|

•

|

the Federal Funds Rate,

|

|

|

•

|

the Federal Funds OIS Compound Rate,

|

|

|

•

|

any other Interest Rate Basis or interest rate formula that is specified in the applicable pricing supplement.

|

A floating rate note may bear interest with respect to two or more Interest Rate Bases.

Terms. Each applicable pricing supplement will specify the terms of a floating rate note, which may include:

|

|

•

|

whether the floating rate note is:

|

|

|

•

|

a “Regular Floating Rate Note,”

|

|

|

•

|

an “Inverse Floating Rate Note,” or

|

|

|

•

|

a “Floating Rate/Fixed Rate Note,”

|

|

|

•

|

the Interest Rate Basis or Bases,

|

|

|

•

|

the Initial Interest Rate,

|

|

|

•

|

the Interest Reset Dates,

|

|

|

•

|

the Interest Reset Period,

|

|

|

•

|

the Interest Payment Dates,

|

|

|

•

|

the period to maturity of the instrument or obligation with respect to which the Interest Rate Basis or Bases will be calculated (“Index Maturity”),

|

|

|

•

|

Maximum Interest Rate and Minimum Interest Rate, if any,

|

|

|

•

|

the number of basis points to be added to or subtracted from the related Interest Rate Basis or Bases (the “Spread”),

|

|

|

•

|

the percentage of the related Interest Rate Basis or Bases by which the Interest Rate Basis or Bases will be multiplied to determine the applicable interest rate (the “Spread Multiplier”),

|

|

|

•

|

if one or more of the specified Interest Rate Bases is LIBOR, the Index Currency, the Index Maturity and the Designated LIBOR Page,

|

|

|

•

|

if one or more of the specified Interest Rate Bases is the CMS Rate, the Designated CMS Index Maturity, and

|

|

|

•

|

if one or more of the specified Interest Rate Bases is the CMT Rate, the Designated CMT Reuters Page and the Designated CMT Maturity Index.

|

The interest rate borne by floating rate notes will be determined, in general, as described below. However, if a floating rate note is designated as having an addendum, and the addendum specifies different or additional interest payment terms, the floating rate note will bear interest at the rate in accordance with the terms described in the addendum and the applicable pricing supplement.

Regular Floating Rate Notes. Unless a floating rate note is designated as a Floating Rate/Fixed Rate Note, an Inverse Floating Rate Note or as having an addendum attached which specifies different or additional interest payment terms, it will be a Regular Floating Rate Note and, except as described below or in an applicable pricing supplement, will bear interest at the rate determined by reference to the applicable Interest Rate Basis or Bases:

|

|

•

|

plus or minus the applicable Spread, if any; and/or

|

|

|

•

|

multiplied by the applicable Spread Multiplier, if any.

|

The interest rate in effect for the period from the date of issue to the first Interest Reset Date will be the Initial Interest Rate specified in the applicable pricing supplement. Beginning on the first Interest Reset Date, the rate at which interest on a Regular Floating Rate Note will be payable will be reset as of each Interest Reset Date.

TMCC may change the Spread, Spread Multiplier, Index Maturity, Designated CMS Index Maturity, Designated CMT Reuters Page and other variable terms of floating rate notes from time to time, but no change will affect any floating rate note previously issued or as to which TMCC has accepted an offer to purchase.

Floating Rate/Fixed Rate Notes. If a floating rate note is designated as a “Floating Rate/Fixed Rate Note,” then, except as described below or in an applicable pricing supplement, it will bear interest at the rate determined by reference to the applicable Interest Rate Basis or Bases:

|

|

•

|

plus or minus the applicable Spread, if any; and/or

|

|

|

•

|

multiplied by the applicable Spread Multiplier, if any.

|

The interest rate in effect for the period from the date of issue to the first Interest Reset Date will be the Initial Interest Rate specified in the applicable pricing supplement. Beginning on the first Interest Reset Date, the rate at which interest on a Floating Rate/Fixed Rate Note will be payable will be reset as of each Interest Reset Date until the date on which interest begins to accrue on a fixed rate basis (the “Fixed Rate Commencement Date”). Unless otherwise specified in the applicable pricing supplement, the interest rate in effect beginning on, and including, the Fixed Rate Commencement Date to Maturity will be the Fixed Interest Rate, if that rate is specified in the applicable pricing supplement. If no Fixed Interest Rate is specified, the interest rate will be the rate in effect on the day immediately preceding the Fixed Rate Commencement Date.

Inverse Floating Rate Notes. If a floating rate note is designated as an “Inverse Floating Rate Note,” then, except as described below or in the applicable pricing supplement, it will bear interest at the rate equal to the Fixed Interest Rate specified in the related pricing supplement minus the rate determined by reference to the Interest Rate Basis or Bases:

|

|

•

|

plus or minus the applicable Spread, if any; and/or

|

|

|

•

|

multiplied by the applicable Spread Multiplier, if any.

|

The interest rate on an Inverse Floating Rate Note will not be less than zero unless specified otherwise in the applicable pricing supplement. The interest rate in effect for the period from the date of issue to the first Interest Reset Date will be the Initial Interest Rate specified in the pricing supplement. Beginning on the first Interest Reset Date, the rate at which interest on an Inverse Floating Rate Note is payable will be reset as of each Interest Reset Date.

Interest Reset Dates. Each applicable pricing supplement will specify whether the rate of interest on the floating rate note will be reset daily, weekly, monthly, quarterly, semiannually, annually or any other specified period (each, an “Interest Reset Period”) and the dates on which the interest rate will be reset (each, an “Interest Reset Date”). Unless specified otherwise in the applicable pricing supplement, the Interest Reset Date will be in the case of floating rate notes which reset:

|

|

•

|

daily — each Business Day;

|

|

|

•

|

weekly — the Wednesday of each week, with the exception of weekly reset floating rate notes as to which the Treasury Rate is an applicable Interest Rate Basis, which will reset the Tuesday of each week;

|

|

|

•

|

monthly — the third Wednesday of each month, with the exception of monthly reset floating rate notes as to which the Eleventh District Cost of Funds Rate Notes is an applicable Interest Rate Basis, which will reset on the first calendar day of the month;

|

|

|

•

|

quarterly — the third Wednesday of March, June, September and December of each year;

|

|

|

•

|

semiannually — the third Wednesday of the two months specified in the applicable pricing supplement; and

|

|

|

•

|

annually — the third Wednesday of the month specified in the applicable pricing supplement;

|

provided however, that, for Floating Rate/Fixed Rate Notes, the interest rate will not reset after the Fixed Rate Commencement Date.

Unless specified otherwise in the applicable pricing supplement, if any Interest Reset Date for a floating rate note would otherwise be a day that is not a Business Day, the applicable Interest Reset Date will be postponed to the next succeeding day that is a Business Day (the “Following Business Day Convention”), except that in the case of a floating rate note as to which LIBOR is an applicable Interest Rate Basis, if the Business Day falls in the next succeeding calendar month, the applicable Interest Reset Date will be the immediately preceding Business Day (the “Modified Following Business Day Convention”).

Except as set forth above or in the applicable pricing supplement, the interest rate in effect on each day will be:

|

|

•

|

if the day is an Interest Reset Date, the interest rate determined on the related Interest Determination Date, as defined below, immediately preceding such Interest Reset Date; or

|

|

|

•

|

if the day is not an Interest Reset Date, the interest rate determined on the related Interest Determination Date immediately preceding the most recent Interest Reset Date.

|

Interest Rate Reset Cutoff Date. A pricing supplement may also specify a date (an “Interest Rate Reset Cutoff Date”) prior to an Interest Reset Date on which the interest rate for a floating rate note will no longer be subject to adjustment. Beginning on the Interest Rate Reset Cutoff Date, the interest rate applicable from and including the Interest Rate Reset Cutoff Date to but excluding the next Interest Payment Date shall be determined based on the Interest Rate Basis in effect on the Interest Rate Reset Cutoff Date.

Maximum and Minimum Interest Rates. A floating rate note may also have either or both of the following:

|

|

•

|

a maximum numerical limitation, or ceiling, on the annual rate at which interest may accrue during any interest period (“Maximum Interest Rate”); and

|

|

|

•

|

a minimum numerical limitation, or floor, on the annual rate at which interest may accrue during any interest period (“Minimum Interest Rate”).

|

In addition to any Maximum Interest Rate that may be applicable to a floating rate note under the above provisions, the interest rate on floating rate notes will in no event be higher than the maximum rate permitted by New York law, as the same may be modified by United States laws of general application.

Interest Payments. The interest payment dates applicable to a floating rate note will be specified in the related pricing supplement. Each floating rate note will bear interest from the date of issue at the rates specified in the note until the principal is paid or otherwise made available for payment. Except as provided below or in an applicable pricing supplement, the interest payment dates for floating rate notes will be, in the case of floating rate notes which reset:

|

|

•

|

daily, weekly or monthly — the third Wednesday of each month or the third Wednesday of March, June, September and December of each year, as specified in the applicable pricing supplement;

|

|

|

•

|

quarterly — the third Wednesday of March, June, September and December of each year;

|

|

|

•

|

semiannually — the third Wednesday of the two months of each year specified in the applicable pricing supplement;

|

|

|

•

|

annually — the third Wednesday of the month of each year specified in the applicable pricing supplement; and

|

|

|

•

|

in each case, at Maturity (each, an “Interest Payment Date”).

|

Unless specified otherwise in the applicable pricing supplement, if any Interest Payment Date for a floating rate note other than an Interest Payment Date at Maturity would otherwise be a day that is not a Business Day, the Interest Payment Date will follow the Following Business Day Convention except that in the case of a floating rate note as to which LIBOR is an applicable Interest Rate Basis, unless specified in the applicable pricing supplement, if the Business Day falls in the next succeeding calendar month, the Interest Payment Date will follow the Modified Following Business Day Convention. If the Maturity of a floating rate note falls on a day that is not a Business Day, the payment of principal, premium and interest, if any, will be made on the next succeeding Business Day, and no interest on the payment will accrue for the period from and after Maturity.

Unless specified otherwise in the applicable pricing supplement, all percentages resulting from any calculation on floating rate notes will be rounded to the nearest one hundred-thousandth of a percentage point, with five one millionths of a percentage point rounded upwards. For example, 9.876545% (or .09876545) would be rounded to 9.87655% (or .0987655), and all dollar amounts used in or resulting from the calculation on floating rate notes will be rounded to the nearest cent with one-half cent being rounded upward.

Interest payments on floating rate notes will equal the amount of interest accrued from and including the immediately preceding Interest Payment Date in respect of which interest has been paid (or from and including the date of issue, if no interest has been paid), to but excluding the related Interest Payment Date. Interest payments on floating rate notes made at Maturity will include interest accrued to but excluding the date of Maturity.

Except as specified otherwise in the applicable pricing supplement, each floating rate note will accrue interest on an “Actual/360” basis, an “Actual/Actual” basis, or a “30/360” basis, in each case from the period from the Original Issue Date to the date of Maturity, unless otherwise specified in the applicable pricing supplement. If no day count convention is specified in the applicable pricing supplement, interest on floating rate notes will be paid on an “Actual/360” basis. For floating rate notes calculated on an Actual/360 basis and Actual/Actual basis, accrued interest for each Interest Calculation Period, as defined below, will be calculated by multiplying:

|

|

(1)

|

the face amount of the floating rate note;

|

|

|

(2)

|

the applicable interest rate; and

|

|

|

(3)

|

the actual number of days in the related Interest Calculation Period

|

and dividing the resulting product by 360 or 365, as applicable; or with respect to an Actual/Actual basis floating rate note, if any portion of the related Interest Calculation Period falls in a leap year, the product of (1) and (2) above will be multiplied by the sum of:

|

|

•

|

the actual number of days in that portion of the related Interest Calculation Period falling in a leap year divided by 366, and

|

|

|

•

|

the actual number of days in that portion of the related Interest Calculation Period falling in a non-leap year divided by 365.

|

For floating rate notes calculated on a 30/360 basis, accrued interest for an Interest Calculation Period will be computed on the basis of a 360-day year of twelve 30-day months, irrespective of how many days are actually in the Interest Calculation Period. Unless specified otherwise in the applicable pricing supplement, for floating rate notes that accrue interest on a 30/360 basis, if any Interest Payment Date or the Maturity falls on a day that is not a Business Day, the related payment of principal or interest will be made on the next succeeding Business Day as if made on the date such payment was due, and no interest will accrue on the amount payable for the period from and after the Interest Payment Date or Maturity, as the case may be.

“Interest Calculation Period” means with respect to any period, the period from and including the most recent Interest Reset Date (or from and including the date of issue in the case of the first Interest Reset Date) to but excluding the next succeeding Interest Reset Date for which accrued interest is being calculated.

Unless specified otherwise in the applicable pricing supplement, interest with respect to notes for which the interest rate is calculated with reference to two or more Interest Rate Bases will be calculated in the same manner as if only one of the applicable Interest Rate Bases applied.

Interest Determination Dates. The interest rate applicable to each Interest Reset Period beginning on the Interest Reset Date with respect to that Interest Reset Period will be the rate determined on the applicable “Interest Determination Date,” as follows unless otherwise specified in the applicable pricing supplement:

|

|

•

|

the Interest Determination Date for the CD Rate, the CMS Rate, the CMT Rate, the Commercial Paper Rate and the Prime Rate will be the second Business Day preceding each Interest Reset Date for the related note;

|

|

|

•

|

the Interest Determination Date for the Federal Funds Rate will be the same day as the Interest Reset Date or the first Business Day preceding each Interest Reset Date, as specified in the pricing supplement for the related note;

|

|

|

•

|

the Interest Determination Date for the Federal Funds OIS Compound Rate will be the same day as each Interest Reset Date for the related note;

|

|

|

•

|

the Interest Determination Date for the Eleventh District Cost of Funds Rate will be the last working day of the month immediately preceding each Interest Reset Date on which the Federal Home Loan Bank of San Francisco publishes the Index, as defined below under “Eleventh District Cost of Funds Rate Notes”;

|

|

|

•

|

the Interest Determination Date for LIBOR will be the second London Banking Day preceding each Interest Reset Date;

|

|

|

•

|

the Interest Determination Date for the Treasury Rate will be the day in the week in which the related Interest Reset Date falls on which day Treasury Bills, as defined below, are normally auctioned. Treasury Bills are normally sold at auction on Monday of each week, unless that day is a legal holiday, in which case the auction is normally held on the following Tuesday, except that the auction may be held on the preceding Friday; provided, however, that if an auction is held on the Friday of the week preceding the related Interest Reset Date, the related Interest Determination Date will be that preceding Friday;

|

|

|

•

|

the Interest Determination Date for a floating rate note whose interest rate is determined with reference to two or more Interest Rate Bases, will be the most recent Business Day which is at least two Business Days prior to the Interest Reset Date for the floating rate note on which each Interest Rate Basis is determinable. Each Interest Rate Basis will be determined and compared on that date, and the applicable interest rate will take effect on the related Interest Reset Date.

|

Calculation Agent and Calculation Date. Unless otherwise provided in the applicable pricing supplement, DBTCA will be the calculation agent. Upon request of the holder of any floating rate note, the calculation agent will provide the interest rate then in effect and, if determined, the interest rate that will become effective as a result of a determination made for the next Interest Reset Date with respect to such floating rate note. Unless specified otherwise in the applicable pricing supplement, the “Calculation Date,” if applicable, pertaining to any Interest Determination Date, will be the earlier of:

|

|

•

|

the tenth calendar day after the applicable Interest Determination Date, or, if that day is not a Business Day, the next succeeding Business Day, or

|

|

|

•

|

the Business Day preceding the applicable Interest Payment Date or Maturity, as the case may be.

|

CD Rate Notes. CD Rate notes (“CD Rate Notes”) will bear interest at the rates (calculated with reference to the CD Rate and the Spread and/or Spread Multiplier, if any) specified in the CD Rate Notes and the applicable pricing supplement.

Unless specified otherwise in the applicable pricing supplement, “CD Rate” means the rate on the applicable Interest Determination Date for negotiable U.S. dollar certificates of deposit having the Index Maturity specified in the applicable pricing supplement as published in H.15(519), as defined below, under the heading “CDs (secondary market)”.

The following procedures will be followed if the CD Rate cannot be determined as described above:

(1) If the rate referred to above is no longer published or if not published by 3:00 P.M., New York City time, on the related Calculation Date, then the CD Rate on the applicable Interest Determination Date will be the rate for negotiable U.S. dollar certificates of deposit of the Index Maturity specified in the applicable pricing supplement as published in H.15 Daily Update (as defined below), or other recognized electronic source used for the purpose of displaying the applicable rate, for the Interest Determination Date, under the caption “CDs (secondary market)”.

(2) If the rate referred to in clause (1) above is no longer published or is not published by 3:00 P.M., New York City time, on the related Calculation Date, then the CD Rate on the applicable Interest Determination Date will be the rate calculated by the calculation agent as the arithmetic mean of the secondary market offered rates as of 10:00 A.M., New York City time, on the applicable Interest Determination Date of three leading nonbank dealers in negotiable U.S. dollar certificates of deposit in the City of New York selected by the calculation agent (after consultation with TMCC) for negotiable U.S. dollar certificates of deposit of major United States money market banks for negotiable certificates of deposit with a remaining maturity closest to the Index Maturity specified in the applicable pricing supplement in an amount that is representative for a single transaction in that market at the time.

(3) If the dealers selected by the calculation agent are not quoting as referred to in clause (2) above, the CD Rate on the applicable Interest Determination Date will be the rate in effect on the applicable Interest Determination Date.

“H.15(519)” means the weekly statistical release designated as such published by the Federal Reserve System Board of Governors, or its successor, available through the website of the Board of Governors of the Federal Reserve System at http://www.federalreserve.gov/releases/h15/current/default.htm, or any Successor Source.

“H.15 Daily Update” means the daily update of H.15(519), available through the website of the Board of Governors of the Federal Reserve System at http://www.federalreserve.gov/releases/h15/update/default.htm, or any Successor Source.

“Successor Source” means, in relation to any display page, other published source, information vendor or provider: (i) the successor display page, other published source, information vendor or provider that has been officially designated by the sponsor of the original page or source; or (ii) if the sponsor has not officially designated a successor display page, other published source, information vendor or provider (as the case may be), the successor display page, other published source, information vendor or provider, if any, designated by the relevant information vendor or provider (if different from the sponsor).

CMS Rate Notes. CMS Rate notes (“CMS Rate Notes”) will bear interest at the rates (calculated with reference to the CMS Rate and the Spread and/or Spread Multiplier, if any) specified in the CMS Rate Notes and the applicable pricing supplement.

Unless specified otherwise in the applicable pricing supplement, “CMS Rate” means the rate on the applicable Interest Determination Date for U.S. dollar swaps having the Designated CMS Maturity Index specified in the applicable pricing supplement, expressed as a percentage, which appears on the Reuters Screen ISDAFIX1 Page as of 11:00 A.M., New York City time.

The following procedures will be followed if the CMS Rate cannot be determined as described above:

(1) If the rate referred to above is no longer published on the relevant page, or if not published by 3:00 P.M., New York City time, on the related Calculation Date, then the CMS Rate on the applicable Interest Determination Date will be a percentage determined on the basis of the mid-market semi-annual swap rate quotations provided by five leading swap dealers in the New York City interbank market selected by the calculation agent (after consultation with TMCC) as of approximately 11:00 A.M., New York City time on the related Interest Determination Date. For this purpose, the semi-annual swap rate means the mean of the bid and offered rates for the semi-annual fixed leg, calculated on a 30/360 day count basis, of a fixed-for-floating U.S. Dollar interest rate swap transaction having the Designated CMS Maturity Index specified in the applicable pricing supplement in an amount that is representative for a single transaction in that market at the time with an acknowledged dealer of good credit in the swap market, where the floating leg, calculated on an Actual/360 day count basis, is equivalent to USD-LIBOR-ICE with a designated maturity of three months. The calculation agent will request the principal New York City office of each of the swap dealers to provide a quotation of this rate. If at least three quotations are provided, the rate will be the arithmetic mean of the quotations, eliminating the highest quotation (or, in the event of equality, one of the highest) and the lowest quotation (or, in the event of equality, one of the lowest).

(2) If fewer than three swap dealers selected by the calculation agent are quoting as referred to in clause (1) above, the CMS Rate will be the rate in effect on the applicable Interest Determination Date.

CMT Rate Notes. CMT Rate notes (“CMT Rate Notes”) will bear interest at the rates (calculated with reference to the CMT Rate and the Spread and/or Spread Multiplier, if any) specified in the CMT Rate Notes and the applicable pricing supplement.

Unless specified otherwise in the applicable prospectus supplement, “CMT Rate” means:

|

|

•

|

if “CMT-T7051” is specified in the applicable pricing supplement as the Designated CMT Reuters Page, a percentage equal to the yield for United States Treasury securities at “constant maturity” having the Designated CMT Maturity Index specified in the applicable pricing supplement for the applicable Interest Determination Date as such yield is displayed on the Reuters Screen FRBCMT Page; or

|

|

|

•

|

if “CMT-T7052” is specified in the applicable pricing supplement as the Designated CMT Reuters Page, or neither “CMT-T7051” nor “CMT-T7052” is specified in the applicable pricing supplement as the Designated CMT Reuters Page, a percentage equal to the one-week average yield for United States Treasury securities at “constant maturity” having the Designated CMT Maturity Index specified in the applicable pricing supplement for the week preceding the applicable Interest Determination Date as set forth in H.15(519) under the caption “Week Ending” and opposite the caption “Treasury constant maturities,” as such yield is displayed on the Reuters Screen FEDCMT Page for the week preceding such Interest Determination Date.

|

The following procedures will be followed if the CMT Rate cannot be determined as described above:

(1) If the rate referred to above is no longer published on the relevant page, or if not published by 3:00 P.M., New York City time, on the related Calculation Date, then the CMT Rate for the applicable Interest Determination Date shall be determined as follows:

|

|

•

|

if “CMT-T7051” is specified in the applicable pricing supplement as the Designated CMT Reuters Page, then the CMT Rate for the applicable Interest Determination Date will be the percentage equal to the yield for United States Treasury securities at “constant maturity” for the Designated CMT Maturity Index

|

|

|

|

specified in the applicable pricing supplement as published in the relevant H.15(519) under the caption “Treasury constant maturities”; or

|

|

|

•

|

if “CMT-T7052” is specified in the applicable pricing supplement as the Designated CMT Reuters Page, or neither “CMT-T7051” nor “CMT-T7052” is specified in the applicable pricing supplement as the Designated CMT Reuters Page, then the CMT Rate for the applicable Interest Determination Date will be the percentage equal to the one week average yield for United States Treasury securities at “constant maturity” for the Designated CMT Maturity Index specified in the applicable pricing supplement as published in the relevant H.15(519) under the caption “Week Ending” and opposite the caption “Treasury constant maturities.”

|

(2) If the rate referred to in clause (1) above is no longer published or is not published by 3:00 P.M., New York City time, on the related Calculation Date, then the CMT Rate for the applicable Interest Determination Date shall be determined as follows:

|

|

•

|

if “CMT-T7051” is specified in the applicable pricing supplement as the Designated CMT Reuters Page, then the CMT Rate for the applicable Interest Determination Date will be the rate for the Designated CMT Maturity Index specified in the applicable pricing supplement as may then be published by either the Federal Reserve System Board of Governors or the United States Department of the Treasury that the calculation agent determines to be comparable to the rate which would otherwise have been published in H.15(519); or

|

|

|

•

|

if “CMT-T7052” is specified in the applicable pricing supplement as the Designated CMT Reuters Page, or neither “CMT-T7051” nor “CMT-T7052” is specified in the applicable pricing supplement as the Designated CMT Reuters Page, then the CMT Rate for the applicable Interest Determination Date will be the one-week average yield for the Designated CMT Maturity Index specified in the applicable pricing supplement as otherwise announced by the Federal Reserve Bank of New York for the week preceding that Interest Determination Date.

|

(3) If the rate referred to in clause (2) above is not so published by 3:00 P.M., New York City time, on the related Calculation Date, then the CMT Rate for the applicable Interest Determination Date will be calculated by the calculation agent as a yield to maturity, based on the arithmetic mean of the secondary market bid prices as of approximately 3:30 P.M., New York City time, on the applicable Interest Determination Date, of three leading primary United States government securities dealers in New York City selected by the calculation agent (after consultation with TMCC) (each, a “Reference Dealer”) from five such dealers and eliminating the highest quotation (or, in the event of equality, one of the highest) and the lowest quotation (or, in the event of equality, one of the lowest) for United States Treasury securities with an original maturity equal to the Designated CMT Maturity Index specified in the applicable pricing supplement, a remaining term to maturity no more than one year shorter than the Designated CMT Maturity Index and in a principal amount that is representative for a single transaction in that market at that time.

(4) If fewer than five but more than two such prices referred to in clause (3) are provided as requested, the CMT Rate for the applicable Interest Determination Date will be based on the arithmetic mean of the bid prices obtained and neither the highest nor lowest of such quotations will be eliminated.

(5) If fewer than three prices referred to in clause (4) are provided as requested, the CMT Rate for the applicable Interest Determination Date will be calculated by the calculation agent and will be a yield-to-maturity based on the arithmetic mean of the secondary market bid prices as of approximately 3:30 P.M., New York City time, on the applicable Interest Determination Date of three Reference Dealers in The City of New York selected by the calculation agent from five Reference Dealers selected by the calculation agent (after consultation with TMCC) after eliminating the highest quotation (or, in the event of equality, one of the highest) and the lowest quotation (or, in the event of equality, one of the lowest) for United States Treasury securities with an original maturity greater than the Designated CMT Maturity Index, a remaining term to maturity closest to the Designated CMT Maturity Index, and in a principal amount that is representative for a single transaction in that market at that time.

(6) If fewer than five but more than two such prices referred to in clause (5) are provided, then the CMT Rate for the applicable Interest Determination Date will be calculated by the calculation agent as the arithmetic mean of the bid prices obtained and neither the highest nor lowest of the quotes will be eliminated.

(7) If fewer than three Reference Dealers selected by the calculation agent are quoting as mentioned in clause (6) above, the CMT Rate will be the rate in effect on the applicable Interest Determination Date.

If two United States Treasury securities with an original maturity greater than the Designated CMT Maturity Index have remaining terms to maturity equally close to the Designated CMT Maturity Index, the calculation agent will obtain quotations for the United States Treasury security with the shorter original term to maturity.

“Designated CMT Maturity Index” means the original period to maturity of the U.S. Treasury securities, either 1, 2, 3, 5, 7, 10, 20 or 30 years, specified in the applicable pricing supplement with respect to which the CMT Rate will be calculated.

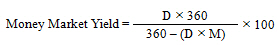

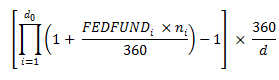

Commercial Paper Rate Notes. Commercial Paper Rate notes (“Commercial Paper Rate Notes”) will bear interest at the rates (calculated with reference to the Commercial Paper Rate and the Spread and/or Spread Multiplier, if any) specified in the Commercial Paper Rate Notes and the applicable pricing supplement.