10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549-1004

Form 10-K

(Mark One)

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to __________

Commission file number: 0-4408

RESOURCE AMERICA, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 72-0654145 |

(State or other jurisdiction of | | (I.R.S. Employer |

incorporation or organization) | | Identification No.) |

|

| | |

One Crescent Drive, Suite 203, Navy Yard Corporate Center, Philadelphia, PA 19112 |

(Address of principal executive offices) (Zip Code) |

(215) 546-5005 |

(Registrant's telephone number, including area code) |

|

Securities registered pursuant to Section 12(b) of the Act: |

Title of class | | Name of exchange on which registered |

Common stock, par value $.01 per share | | NASDAQ Global Select Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(a) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | |

Large accelerated filer | o | | Accelerated filer | þ |

Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the voting common equity held by non-affiliates of the registrant, based on the closing price of such stock on the last business day of the registrant’s most recently completed second quarter (June 30, 2015) was approximately $146,392,000.

The number of outstanding shares of the registrant’s common stock on March 1, 2016 was 20,758,325 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement filed with the Commission in connection with the 2014 Annual Meeting of Stockholders are incorporated by reference in Part III of this Form 10-K.

RESOURCE AMERICA, INC. AND SUBSIDIARIES

INDEX TO ANNUAL REPORT

ON FORM 10-K |

| | |

| | Page |

PART I | | |

| | |

Item 1: | | |

| | |

Item 1A: | | |

| | |

Item 2: | | |

| | |

Item 3: | | |

| | |

PART II | | |

| | |

Item 5: | | |

| | |

Item 6: | | |

| | |

Item 7: | | |

| | |

Item 7A: | | |

| | |

Item 8: | | |

| | |

Item 9: | | |

| | |

Item 9A: | | |

| | |

PART III | | |

| | |

Item 10: | | |

| | |

Item 11: | | |

| | |

Item 12: | | |

| | |

Item 13: | | |

| | |

Item 14: | | |

| | |

PART IV | | |

| | |

Item 15: | | |

| | |

| |

PART I

This report contains certain forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expects,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “will” and “would” or the negative of these terms or other comparable terminology. Such statements are subject to the risks and uncertainties more particularly described in Item 1A, under the caption “Risk Factors.” These risks and uncertainties could cause our actual results and financial position to differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events or circumstances after the date of this report, except as may be required under applicable law. We make references to the years ended December 31, 2015, 2014 and 2013 as 2015, 2014 and 2013, respectively.

General

We are an asset management company that specializes in real estate and credit investments. We use industry specific expertise to evaluate, originate, service and manage investment opportunities through our real estate, financial fund management and commercial finance subsidiaries as well as our joint ventures. As a specialized asset manager, we seek to develop investment funds for outside investors for which we provide asset management services, typically under long-term management arrangements either through a contract with, or as the manager or general partner of, our sponsored investment funds. We typically maintain an investment in the funds we sponsor. As of December 31, 2015, we had $21.7 billion of assets under management.

We limit our fund development and management services to asset classes where we own existing operating companies or have specific expertise. We believe this strategy enhances the return on investment we can achieve for our funds. In our real estate operations, we concentrate on the ownership, operation and management of multifamily and commercial real estate and real estate mortgage loans including whole mortgage loans, first priority interests in commercial mortgage loans, known as A notes, subordinated interests in first mortgage loans, known as B notes, mezzanine loans, and investments in “value-added” properties, which require substantial improvements to reach their full investment potential. In our financial fund management operations, we concentrate on bank loans, trust preferred securities of banks, bank holding companies, insurance companies and other financial companies, and asset backed securities, or ABS.

In our real estate segment, we focus our efforts primarily on acquiring and managing a portfolio of commercial real estate and real estate related debt as well as value-added multifamily investments. Our principal emphasis in this area has been the sponsorship of non-traded real estate investment trusts, or REITs. In 2013, we completed the public offering for Resource Real Estate Opportunity REIT, Inc., or Opportunity REIT I, which raised total equity of $635.0 million (including proceeds of a private offering). We increased our assets under management during 2014 and 2015 by raising investor funds through our retail broker channel for our investment programs, principally for Resource Real Estate Opportunity REIT II, Inc., or Opportunity REIT II. As of December 31, 2015, Opportunity REIT II had raised $512.7 million; the fundraising closed on February 5, 2016, with total funds raised having increased to $556.0 million. On November 2, 2015, we filed a registration statement with the SEC for Resource Apartment REIT III, Inc., or Apartment REIT III, a $1.0 billion offering that will invest in a portfolio of multifamily properties, which will commence fundraising in 2016.

We anticipate fundraising for Resource Innovation Office REIT, Inc., or Innovation Office REIT, to also commence in 2016. This $1.0 billion offering will focus on acquiring office buildings.

During 2013, we launched Resource Real Estate Diversified Income Fund, or DIF, a publicly-offered, alternative real estate income mutual fund that invests across global securities, credit and unlisted real estate funds. Its focus is to invest at least 80% of its assets in real estate and real estate related industry securities, primarily in income-producing equity and debt securities. As of December 31, 2015, DIF has raised $90.7 million; through February 29, 2016, total funds raised increased to $100.4 million.

During 2014, we launched Resource Credit Income Fund, or CIF, a publicly-offered, alternative mutual fund that will invest in the debt of small- to middle-market companies with a focus on senior and subordinated debt. As of December 31, 2015, we had invested $1.7 million in the fund and expect to commence our fundraising for the CIF in the first half of 2016.

In June 2015, we formed a 50/50 joint venture with the principals of Pearlmark Real Estate Partners, LLC to sponsor and manage private institutional real estate funds. The joint venture, Pearlmark Real Estate, LLC, or Pearlmark, will focus on managing

institutional real estate investments. As of December 31, 2015, we had invested $6.0 million in Pearlmark and on February 17, 2016, we invested an additional $1.0 million.

In our financial fund management segment, we continue to focus primarily on the sponsorship and management of collateralized loan obligation, or CLO, issuers, managed accounts, credit opportunity funds, and the management of legacy collateralized debt obligation, or CDO, issuers. Through our joint venture, CVC Credit Partners L.P., or CVC Credit Partners, we have closed 17 CLOs with a total par value of approximately $8.8 billion since the formation of the joint venture in 2012. In 2016, we expect to continue to focus on managing our existing assets, expanding our CLO issuances and separately managed account activities through our joint venture, and to commence fundraising for Pelium Capital Partners, L.P., or Pelium, a hedge fund we sponsored and manage.

In 2013, we formed Northport Capital, LLC, or Northport, to originate both senior and subordinated, secured and unsecured loans to middle market companies on behalf of Resource Capital Corp., or RSO, a New York Stock Exchange listed REIT that invests in real estate loans, and to a lesser extent, commercial real estate loans, which we manage and in which we have a 2.3% equity interest. At December 31, 2015, Northport held a total of $376.3 million of middle market loans at fair value.

In our commercial finance operations, our lease origination and servicing platform is managed by our joint venture, LEAF Commercial Capital, Inc., or LEAF, in which we currently own a 13.5% interest. As of December 31, 2015, LEAF managed $785 million of commercial leases and notes. In addition, LEAF Financial Corporation, or LEAF Financial, our wholly-owned subsidiary, currently manages one sponsored commercial lease investment partnership. LEAF Financial had previously liquidated a second such partnership in July 2015 and two other such partnerships during 2014.

We expect our capital raising for 2016 to decrease in comparison to 2015 (which reflected the strong closing for Opportunity REIT II) as we commence marketing new funds in 2016 (including the Innovation Office REIT, Apartment REIT II and CIF) and continue to fundraise for the DIF. We will also continue to monitor trends in the industry, including any regulatory changes that could have an impact on our ability to fundraise.

Assets Under Management

As of December 31, 2015 and 2014, we managed assets in the following classes for the accounts of institutional and individual investors, RSO, and for our own account (in millions):

|

| | | | | | | | | | | | | | | | | | | |

| December 31, 2015 | | December 31, 2014 |

| Institutional and

Individual Investors | | RSO | | Company | | Total | | Total |

Bank loans (1) | $ | 12,217 |

| | $ | 646 |

| | $ | — |

| | $ | 12,863 |

| | $ | 11,642 |

|

Trust preferred securities (1) | 3,065 |

| | — |

| | — |

| | 3,065 |

| | 3,226 |

|

Asset-backed securities (1) | 413 |

| | — |

| | — |

| | 413 |

| | 876 |

|

Mortgage and other real

estate-related loans (2) | 7 |

| | 1,968 |

| | — |

| | 1,975 |

| | 1,717 |

|

Real properties (2) | 1,996 |

| | — |

| | 16 |

| | 2,012 |

| | 1,622 |

|

Commercial finance assets (3) | 785 |

| | — |

| | — |

| | 785 |

| | 674 |

|

Private equity and other assets (1) | 133 |

| | 441 |

| | — |

| | 574 |

| | 415 |

|

| $ | 18,616 |

| | $ | 3,055 |

| | $ | 16 |

| | $ | 21,687 |

| | $ | 20,172 |

|

| | | | | | | | | |

Net assets under management (4) | $ | 6,894 |

| | $ | 2,459 |

| | $ | 16 |

| | $ | 9,369 |

| | $ | 9,666 |

|

| |

(1) | We value these assets at their amortized cost. |

| |

(2) | We value our managed real estate assets as the sum of: (i) the amortized cost of the commercial real estate loans; and (ii) the book value of each of the following: (a) real estate and other assets held by our real estate investment entities, (b) our outstanding legacy loan portfolio, and (c) our interests in real estate. |

| |

(3) | We value our commercial finance assets as the sum of the book value of financed equipment and leases and loans. |

| |

(4) | Net assets under management represents the proportionate share of assets we manage after reflecting joint venture arrangements. |

Our assets under management are primarily managed through the investment entities we sponsor. The following table sets forth the number of entities we manage by operating segment, including tenant in common, or TIC, property interests:

|

| | | | | | | |

| CLO/CDOs | | Limited Partnerships | | TIC Programs | | Other Investment Funds |

As of December 31, 2015 (1) | | | | | | | |

Financial fund management | 48 | | 13 | | — | | 14 |

Real estate | 6 | | 5 | | 4 | | 5 |

Commercial finance | — | | 1 | | — | | 1 |

| 54 | | 19 | | 4 | | 20 |

As of December 31, 2014 (1) | | | | | | | |

Financial fund management | 46 | | 12 | | — | | 11 |

Real estate | 4 | | 8 | | 6 | | 5 |

Commercial finance | — | | 2 | | — | | 2 |

| 50 | | 22 | | 6 | | 18 |

| |

(1) | All of our operating segments manage assets on behalf of RSO. |

Real Estate

Through our real estate segment, we focus on four different activities:

| |

• | the acquisition, ownership and management of portfolios of real estate and real estate related debt, which we have acquired through sponsored real estate investment entities; |

| |

• | the management, principally for RSO, of general investments in commercial real estate debt, including first mortgage debt, whole loans, mortgage participations, B notes, mezzanine debt and related commercial real estate securities; |

| |

• | the development and expansion of our liquid alternative investment product platform for investments that offer higher levels of income, lower volatility, and because they include publicly-traded vehicles, greater liquidity as compared to traditional real estate investments. Our current liquid alternative platform includes the DIF. In the first quarter of 2015, we added six new employees who are dedicated solely to the distribution of the DIF and expanded this platform through the creation of the CIF; and |

| |

• | to a significantly lesser extent, the management and resolution of a portfolio of real estate loans and property interests that we acquired at various times between 1991 and 1999, which we collectively refer to as our legacy portfolio. |

Multifamily Properties. We are the general partner of Opportunity REIT I and, in that capacity, manage its operations. Opportunity REIT I has acquired a diversified portfolio of U.S. commercial real estate and real estate related debt that has been significantly discounted due to the effects of economic events and high levels of leverage, including properties that are often acquired at discounted prices. In December 2013, Opportunity REIT I closed its initial offering having raised an aggregate of $635.0 million through its public and private offerings. As of December 31, 2015, Opportunity REIT I had invested capital of $990.9 million, reflecting 36 multifamily apartment complexes comprised of 11,156 units.

We are also the general partner of Opportunity REIT II, which commenced its public offering in February 2014. As of February 5, 2016, fundraising closed having raised a total of $556.0 million. As of December 31, 2015, Opportunity REIT II had invested capital of $391.2 million, reflecting 10 multifamily apartment complexes comprised of 2,588 units.

We receive a 2% acquisition fee based on the cost of investments acquired on behalf of Opportunity REIT I and Opportunity REIT II, a monthly asset management fee equal to one-twelfth of 1.0% of cash deployed, and a disposition fee in connection with the sale of a property that ranges from 1.0% to 2.75% of the contract sales price. We may also earn a debt financing fee equal to 0.5% of debt financing obtained. Additionally, we record property management fees (4.5% of gross property revenues) and debt servicing fees (2.75% on payments received from loans held for investment).

Liquid Alternatives. During 2013, we launched the DIF, a publicly-offered, alternative real estate income mutual fund that will invest across global securities, credit and unlisted real estate funds. As of December 31, 2015, the DIF has raised $90.7 million; through February 29, 2016, total funds raised increased to $100.4 million. We receive an annual investment management fee of 1.25% based on the average daily value of the net assets in the fund.

Real Estate Investment Entities. Since 2003, we have sponsored and managed 19 real estate investment entities (partnerships and TICs) for which we raised a total of $319.3 million in investor funds. As of December 31, 2015, we had 9 such investment entities holding interests in 22 multifamily apartment complexes comprising 5,364 units at a combined acquisition cost of $324.2 million, including interests owned by third-parties.

We record an annual investment management fee from our investment partnerships equal to 1% of the gross offering proceeds of each partnership for our services. We record an annual asset management fee from our TIC programs equal to 1% to 2% of the gross revenues from the property in connection with our performance of our asset management responsibilities. These investment management fees and asset management fees are recognized monthly when earned and are discounted to the extent that these fees are deferred. In addition, we receive property management fees of 4.5% to 5% of gross revenues.

Resource Capital Corp. As of December 31, 2015, our real estate operations managed approximately $2.0 billion of commercial real estate assets on behalf of RSO. We discuss RSO in more detail in “− Resource Capital Corp.,” below.

Legacy Portfolio of Loan and Property Interests. Between 1991 and 1999, our real estate operations focused on the purchase of commercial real estate loans at a discount to their outstanding loan balances and the appraised value of their underlying properties. Since 1999, management has focused on resolving and disposing of these assets. At December 31, 2015, the remaining legacy portfolio consisted of three property interests, with an aggregate book value of $6.1 million, net of non-recourse debt.

Resource Residential. Our internal property management division, Resource Real Estate Management, Inc., or Resource Residential, has provided us with a source of stable revenues for our real estate operations. Furthermore, we believe that having direct management control over the properties in our investment programs has not only enabled us to enhance their profitability, but also provides us with a competitive edge in marketing our funds by distinguishing us from other sponsors of real estate investment funds. As of December 31, 2015, our property management division manages 64 properties, comprising approximately 17,000 apartment units in 20 states on behalf of our funds.

Financial Fund Management

General. We conduct our financial fund management operations primarily through seven separate operating entities:

| |

• | CVC Credit Partners L.P, or CVC Credit Partners, a joint venture between the Company and an unrelated third-party, finances, structures and manages investments in bank loans, high yield bonds and equity investments through collateralized loan obligation issuers, or CLOs, managed accounts and two credit opportunity funds; |

| |

• | Resource Capital Manager, Inc., or RCM, an indirect wholly-owned subsidiary, provides investment management and administrative services to RSO under a management agreement between the Company, RCM and RSO, or the RCM Agreement; |

| |

• | Resource Capital Markets, Inc., or Resource Capital Markets, through the Company's registered broker-dealer subsidiary, Resource Securities, Inc., acts as an agent in the primary and secondary markets for structured finance securities and transactions; |

| |

• | Northport Capital, LLC, or Northport, provides middle market loan management and monitoring services to RSO under the RCM Agreement: |

| |

• | Trapeza Capital Management, LLC, or TCM, a joint venture between us and an unrelated third-party, manages investments in trust preferred securities and senior debt securities of banks, bank holding companies, insurance companies and other financial companies through CDO issuers. TCM, together with the Trapeza CDO issuers, are collectively referred to as Trapeza; |

| |

• | Ischus Capital Management, LLC, or Ischus, manages legacy CDOs it sponsored, which hold investments in asset backed securities ("ABS"), including residential mortgage-backed securities ("RMBS") and commercial mortgage-backed securities ("CMBS"); and |

| |

• | Resource Financial Institutions Group, Inc., or RFIG, serves as the general partner for seven company-sponsored affiliated partnerships which invest in financial institutions. |

We derive revenues from our existing financial fund management operations through management fees, structuring and placement fees, trading activities and through our equity investments. We are entitled to receive distributions on amounts we have invested in CLOs, limited partnerships we formed that invest in financial institutions, and our CVC joint venture.

For the CLO issuers sponsored and managed through our joint venture, CVC Credit Partners, we earn average fees of 0.15% (senior) and 0.32% (subordinate) of the aggregate principal balance of eligible collateral. Subordinate management fees are subordinate to debt service payments on the CLOs. Incentive management fees, which depend on performance, are also subordinate to payments on debt. In accordance with our 2012 sale agreement with CVC, we retained our interests in 75% of the

incentive management fees generated by the legacy Apidos CLOs sold to CVC and contributed to our joint venture, CVC Credit Partners. During 2015, we received incentive fees generated by six of the legacy Apidos CLOs, one of which liquidated during the year. We also record our 24% equity interest in the operations of CVC Credit Partners.

For separately managed accounts, we earn approximately 0.85% on the average balance of assets managed.

Resource Capital Markets generates fees through a variety of services for third parties, including acting as introductory agent on structured transactions, assistance in CDO and CLO auction procedures and transaction structuring and placement of debt and equity investors in CLO transactions. In addition, Resource Capital Markets manages a trading portfolio for our own account, an investment portfolio for RCM Global, LLC, or RCM Global, and Pelium. As a result of adopting the latest Financial Accounting Standards Board consolidation guidance in the fourth quarter of 2015, we determined that Pelium should be consolidated with us and, accordingly, have revised our financial statements for 2014 and 2015. RCM Global and Pelium both include investments by us, RSO and certain related parties. With respect to Pelium, interests not held by us are reflected as non-controlling interests.

Northport earns loan origination fees of up to 2%, which are paid by the borrower on RSO middle market loans. During 2015, Northport assisted RSO in growing assets under management from $250.6 million to $376.3 million across 32 loans and, as a result, a larger portion of the RSO management fee was allocated to the Northport group in 2015.

For the CDO issuers sponsored and managed through our Trapeza and Ischus operations, fees primarily consist of base management fees, which range from 0.10% to 0.25% of the aggregate principal balance. For the Trapeza CDO issuers we sponsored and manage, we share these base management fees with our co-sponsors.

RFIG currently manages seven affiliated partnerships for individual and institutional investors, which have a combined asset value of $67.4 million ($49.8 million cost basis) of investments in financial institutions at December 31, 2015. We derive revenues from these operations through annual management fees, based on an average of 1.89% of equity. In addition, we may receive a carried interest of up to 20% upon meeting specific investor return rates. In connection with our sponsorship, management and general partnership interests in these entities, we also hold limited partnership interests in five of these partnerships.

As of December 31, 2015, our financial fund management operations and our joint venture partner have sponsored and/or manage 48 CLO and CDO issuers (including five CLOs we manage on behalf of RSO) holding $13.7 billion in assets, as set forth in the following table:

|

| | | | | | | | | |

Sponsor/Manager | | Asset Class | | Number of

CLO/CDO Issuers | | Assets Under Management (1) |

| | | | | | (in millions) |

CVC Credit Partners | | Bank loans | | 28 |

| | $ | 10,260 |

|

Trapeza | | Trust preferred securities | | 13 |

| | 3,065 |

|

Ischus | | RMBS/CMBS/ABS | | 7 |

| | 413 |

|

| | | | 48 |

| | $ | 13,738 |

|

| | | | | | |

Net assets under management (2) | | | | | | $ | 4,209 |

|

| |

(1) | Calculated as set forth in “Assets Under Management,” above. |

| |

(2) | Net assets under management represents the proportionate share of assets we manage after reflecting joint venture arrangements. |

Resource Capital Corp. As of December 31, 2015, our financial fund management operations managed $646.0 million of bank loans on behalf of RSO that are in CLOs managed by CVC Credit Partners (RSO holds the equity interests in two of these CLOs). We discuss RSO in more detail in “− Resource Capital Corp.” below.

Resource Capital Corp.

RSO, a publicly-traded REIT that we sponsored and manage, invests in a diversified portfolio of whole loans, B notes, CMBS and other real estate-related loans and commercial finance assets. At December 31, 2015, we owned 715,396 shares of RSO common stock, or approximately 2.3% of its common stock outstanding.

We manage RSO through RCM. At December 31, 2015, we managed a total of $3.1 billion of assets on behalf of RSO. Under our management agreement with RSO, RCM receives a base management fee, incentive compensation, property management fees and a reimbursement for out-of-pocket expenses. The base management fee is 1/12th of 1.50% of RSO's equity per month. The management agreement defines “equity” as essentially shareholders' equity (including preferred equity as of March 2012), subject to adjustment for non-cash equity-based compensation expense and non-recurring charges to which the

parties agree. The incentive compensation is 25% of (i) the amount by which RSO's adjusted operating earnings (as defined in the agreement) of RSO (before incentive compensation but after the base management fee) for such quarter per common share (based on the weighted average number of common shares outstanding for such quarter) exceeds (ii) an amount equal to (a) the weighted average of the price per share of RSO's common shares in the initial offering by RSO and the prices per share of the common shares in any subsequent offerings of RSO, in each case at the time of issuance thereof, multiplied by (b) the greater of (1) 2.00% and (2) 0.50% plus one-fourth of the ten year treasury rate (as defined in the agreement) for such quarter, multiplied by the weighted average number of common shares outstanding during such quarter; provided, that the foregoing calculation of incentive compensation will be adjusted (i) to exclude events pursuant to changes in accounting principles generally accepted in the United States, or U.S. GAAP, or the application of U.S. GAAP, as well as non-recurring or unusual transactions or events, after discussion between us, RSO and the approval of a majority of RSO's directors in the case of non-recurring or unusual transactions or events and (ii) by deducting any fees paid directly by RSO to our employees, agents and/or affiliates with respect to profits earned by a taxable REIT subsidiary of RSO (calculated as if such fees were payable quarterly) not previously used to offset incentive compensation. RCM receives at least 25% of its incentive compensation in additional shares of RSO common stock and has the option to receive more of its incentive compensation in stock under the management agreement.

Under a fee agreement, in connection with the April 2012 sale of Apidos to CVC and the formation of CVC Credit Partners, we must pay a portion of the base management fee we receive from RSO to CVC Credit Partners based on the equity owned by RSO in legacy Apidos CLOs (one CLO as of December 31, 2015) multiplied by 1.5% and approximately 6% of any incentive compensation we receive from RSO, excluding non-recurring items unrelated to those CLOs. In October 2013, Apidos CLO VIII was refinanced into Apidos CLO XV, resulting in a $15.0 million reduction of RSO equity in Apidos CLOs. In 2014 and 2015, two more Apidos CLOs were liquidated, further reducing the amount of RSO equity in Apidos CLOs by $51.5 million. We are currently paying CVC on $28.0 million of the equity managed by RSO.

Commercial Finance

Our lease origination and servicing operations are held by LEAF Commercial Capital, Inc., or LEAF, a joint venture between us, RSO, Eos Partners, L.P. (a private investment firm), and Guggenheim Securities LLC. As of December 31, 2015, our equity interest in LEAF was 13.5% on a fully diluted basis.

Our subsidiary, LEAF Financial Corporation, or LEAF Financial, is the manager of our one commercial finance investment partnership (another such partnership was liquidated in July 2015 and two others were liquidated during 2014). The portfolios held by these partnerships have been sub-serviced by LEAF. We have recorded provisions for credit losses of $368,000, $3.1 million and $6.6 million during the years ended December 31, 2015, 2014 and 2013, respectively, on our receivables due from three of the funds based on reductions in their projected cash flows as of the measurement date. At December 31, 2015, there was no reserve outstanding.

As of December 31, 2015, LEAF managed a total of $785.0 million in commercial finance assets, of which $1.0 million was on behalf of the one remaining investment partnership.

Credit Facilities and Notes

As of December 31, 2015, we had two corporate credit facilities.

TD Bank. In March 2011, we entered into a line of credit loan agreement with TD Bank that, as of December 31, 2015, had no outstanding borrowings and availability of $11.5 million before reduction for an outstanding letter of credit. In April 2014, we amended the TD Bank facility to (i) extend the maturity date to the earlier of (a) the expiration of our management agreement with RSO or (b) December 31, 2017, (ii) increase the maximum borrowing amount to $11.5 million provided that we maintain an aggregate value of pledged securities of $6.0 million and (iii) have no cash advances outstanding for 30 consecutive days during each 1-year period beginning on April 25, 2014. The facility bears interest at either (a) the prime rate plus 2.25% or (b) London Interbank Offered Rate, or LIBOR, plus 3%. We are charged an annual fee of 0.5% on the unused facility amount as well as a 5.25% fee on the $503,000 outstanding letter of credit.

Borrowings on the credit facility are secured by a first priority security interest in specified assets and subsidiary guarantees, including (i) the present and future fees and investment income earned in connection with the management of, and investments in, sponsored CDO issuers, (ii) a pledge of 18,972 shares of The Bancorp, Inc., or TBBK (NASDAQ: TBBK), common stock, and (iii) a pledge of 540,168 shares of RSO common stock. Availability under the facility is limited to the lesser of (a) 75.00% of the net present value of future RSO management fees to be earned or (b) the maximum revolving credit facility amount. As of December 31, 2015 and December 31, 2014, there were no borrowings outstanding. Availability on the TD Bank facility was $11.5 million as of December 31, 2015, before reduction for an outstanding letter of credit. In 2016, due to a market decline in the value of the pledged securities, availability under the line of credit was reduced to $7.5 million.

Republic First Bank (or Republic Bank). In February 2011, we entered into a $3.5 million revolving credit facility with Republic Bank. The facility bears interest at the prime rate of interest plus 1% (with a floor of 4.5%). The loan is secured by a pledge of 175,000 shares of RSO common stock and a first priority security interest in an office building located in Philadelphia, Pennsylvania. Availability under this facility is limited to the lesser of (a) the sum of (i) 25% of the appraised value of the real estate, based upon the most recent appraisal delivered to the bank and (ii) 100% of the cash and 75% of the market value of the pledged RSO shares held in the pledged account; or (b) 100% of the cash and 100% of the market value of the pledged RSO shares held in the pledged account. In November 2013, we amended this facility to extend the maturity date to December 28, 2016 and to increase the unused annual facility fee to 0.50%. As of December 31, 2015, there were no outstanding borrowings and availability under this facility was $2.2 million.

Senior Notes. In September and October 2009, we completed a private offering to certain senior executives and shareholders of $18.8 million principal amount of 12% senior notes due in September and October 2012, or the Senior Notes, with 5-year detachable warrants to purchase 3,690,195 shares with an exercise price of $5.10 per share. The warrants were all exercised as of December 31, 2015. The Senior Notes, which require quarterly payments of interest in arrears, are unsecured, senior obligations and are junior to our secured indebtedness. In November 2011, we redeemed $8.8 million of the existing notes for cash and modified the terms of the remaining $10.0 million of notes to provide for a 9% interest rate and extended the maturity to October 2013. In August 2014, we further modified the Senior Notes to extend the maturity date to March 31, 2018 and to include an early redemption feature. We may redeem all or any part of the Senior Notes upon notification to the noteholders at the redemption price plus any accrued and unpaid interest through to the date of such redemption. The redemption prices are at a premium to par, as follows: prior to March 31, 2016 at 102%, between March 31, 2016 and March 31, 2017 at 101% and thereafter at 100%.

Asset Sourcing

Real Estate. We maintain relationships with asset owners, institutions, existing partners and borrowers, who often source investment opportunities directly to us. We maintain offices in Philadelphia (Pennsylvania), New York (New York), Denver (Colorado) and El Segundo (California) as well as outside the United States in London, England and Singapore that provide us with a platform of acquisition and loan origination specialists that source deals from key intermediaries such as commercial real estate brokers, mortgage brokers and specialists in selling discounted and foreclosed assets. We systematically work to exchange market data and asset knowledge across the platform to provide instant market feedback on potential investments that is based on empirical data as well as on data generated by our $4.1 billion portfolio of real estate assets under management.

Employees

As of December 31, 2015, we had 704 full-time employees, a decrease of 33 (4%), from 737 employees at December 31, 2014, principally reflecting the decrease in property management staff in conjunction with the sale of properties held by three of our real estate investment partnerships which were or are in the process of being liquidated. The following table summarizes our employees by operating segment:

|

| | | | | | | |

| Total | | Real Estate | | Financial Fund Management | | Corporate/ Other |

December 31, 2015 | | | | | | | |

Investment professionals | 101 | | 76 | | 19 | | 6 |

Other | 118 | | 46 | | 22 | | 50 |

| 219 | | 122 | | 41 | | 56 |

Property management | 485 | | 485 | | — | | — |

Total | 704 | | 607 | | 41 | | 56 |

| | | | | | | |

December 31, 2014 | | | | | | | |

Investment professionals | 82 | | 65 | | 14 | | 3 |

Other | 103 | | 39 | | 13 | | 51 |

| 185 | | 104 | | 27 | | 54 |

Property management | 552 | | 552 | | — | | — |

Total | 737 | | 656 | | 27 | | 54 |

Operating Segments

We provide operating segment information in Note 21 of the notes to our consolidated financial statements included in Item 8, “Financial Statements and Supplementary Data.” We provide additional narrative discussion of our operating segments in Item 7, “Management's Discussion and Analysis of Financial Condition and Results of Operations.”

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the United States Securities and Exchange Commission, or SEC. Our Internet address is http://www.resourceamerica.com. We make our SEC filings available free of charge on or through our Internet website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We are not incorporating by reference in this report any material from our website.

ITEM 1A. RISK FACTORS.

You should carefully consider the following risks together with all of the other information contained in this report in evaluating our company. If any of these risks develop into actual events, our business, financial condition and results of operations could be materially adversely affected and the trading price of our common stock could decline.

Risks Related to Our Business Generally

Our business depends upon our ability to sponsor, and raise debt and equity capital for, our investment funds.

Our business as a specialized asset manager depends upon our ability to sponsor investment funds, raise sufficient equity capital and debt financing for these funds and to generate management fees by managing these funds and the assets they hold. If we are unable to raise capital or obtain financing through these funds, we will not be able to increase our assets under management and, accordingly, increase our revenues from management fees. Moreover, because many of our investment funds have limited terms, an inability to sponsor new investment funds could result in reduced assets under management and, accordingly, reduce our management fee revenues over time. Our ability to raise capital and obtain financing through these funds depends upon numerous factors, many of which are beyond our control, including:

| |

• | existing capital markets conditions which may affect: interest rates, the availability of acquisition financing as well as the amount and cost of such financing, and the returns we are able to achieve on our investments; asset valuation and pricing; and our ability to refinance or exit and realize value from investments made for the funds; |

| |

• | market acceptance of the types of funds we sponsor and market perceptions about the types of assets which we seek to acquire for our funds; |

| |

• | the willingness or ability of investors to invest in long-term, relatively illiquid investments of the type we sponsor; |

| |

• | the performance of our existing funds relative to market performance generally and to the performance of similar types of funds; |

| |

• | the availability of qualified personnel to manage our funds; and |

| |

• | the availability of suitable investments on acceptable terms of the type we seek to acquire for our funds. |

There are few economic barriers to entry in the asset management business.

Our investment funds compete against an ever-increasing number of investment and asset management products and services sponsored by investment banks, banks, insurance companies, financial services companies and others. There are few economic barriers to entry into the investment or asset management industries and, as a result, we expect that competition for access to distribution channels and appropriate assets to acquire will increase.

Non-traded companies have been the subject of increased scrutiny by regulators and media outlets resulting from inquires and investigations initiated by the Financial Industry Regulatory Authority, or FINRA, and the SEC. These inquiries, and any subsequent inquiries or proceedings could significantly affect our sponsorship and management of non-traded companies and, accordingly, our ability to generate management and related fees.

A significant portion of our operations consists of the sponsorship and management of non-traded companies, particularly non-traded REITs. Public, non-traded companies have been receiving increased regulatory scrutiny from the SEC, the Financial Industry Regulatory Authority, or FINRA, and state regulators. Furthermore, amendments to FINRA rules regarding customer account statements have been approved by the SEC and will be effective on April 11, 2016, which may significantly affect the manner in which, and the ability of, non-traded companies to raise capital.

As a result of this increased scrutiny and accompanying negative publicity and coverage by media outlets, FINRA may in the future seek to impose additional restrictions on sales practices in the independent broker-dealer channel for non-traded companies and, accordingly, the non-traded companies we are sponsoring now, and non-traded companies we may seek to sponsor in the future, may face increased difficulties in raising capital and commencing operations. Should these companies be unable to raise substantial funds in their offerings, the number and type of investments they may make will be curtailed, all of which could materially reduce the fee income we can generate from these entities as well as our ability to grow our business. If we or the non-

traded companies we manage become the subject of scrutiny, even if we have complied with all applicable laws and regulations, responding to such scrutiny could be expensive, harmful to our reputation and distracting to our management.

Because there are numerous companies seeking to raise capital through non-traded companies, it may be more difficult for us to do so.

Our ability to sponsor investment funds depends upon our access to various distribution systems of national, regional and local securities firms, and our ability to locate and acquire appropriate assets for our investment funds. We are subject to substantial competition in each area, and in some cases, competition has caused price increases, which has reduced the discount at which many properties sell, making them less attractive from an investment standpoint. In the distribution area, our investment funds compete with those sponsored by other asset managers, which are being distributed through the same networks, as well as investments sponsored by the securities firms themselves; none of the distribution systems which we access has any obligation to sell any of the interests in our investment funds. While we have been successful in maintaining access to these distribution systems, we cannot assure you that we will continue to do so. If access to one or more of our distribution channels is limited or terminated, the number of funds we sponsor and assets we manage could be reduced, thereby impeding and possibly impairing our revenues and revenue growth.

In acquiring appropriate assets for our investment funds, we compete with numerous public and private investment entities, commercial banks, investment banks and other financial institutions, as well as industry participants, in each of our separate asset management areas. Many of our competitors are substantially larger and have considerably greater financial, technical and marketing resources than we do. Competition for desirable investments may result in higher costs and lower investment returns, and may reduce our ability to sponsor investment funds.

Market changes, including changes in interest rates, may reduce the value of our assets and those of our investment funds’ and our returns on these assets and our ability to generate and increase our management fee revenues.

Market changes, including changes in interest rates, will affect the market value of assets we hold for our own account and our returns from such assets. In general, as interest rates rise, the value of fixed-rate investments will decrease, while as interest rates fall, the return on variable rate assets will fall. Changes in interest rates will also affect the value and return on assets we manage for our investment funds, thereby affecting both our management fees from those funds as well as our ability to sponsor additional investment funds, which, in turn, may affect our ability to generate and increase our management fee revenues and achieve growth in our business.

If we cannot generate sufficient cash to fund our participations in our investment funds, our ability to maintain and increase our revenues may be impaired.

We typically participate in our investment funds along with our investors, and believe that our participation enhances our ability to raise capital from investors. We typically fund our participations through cash derived from operations or from financing. If our cash from operations is insufficient to fund our participation in future investment funds we sponsor or if we are unable to obtain financing on acceptable terms, we may be limited in our ability, or unable, to participate in our funds, which would impede our ability to raise funds from investors and, thus, our ability to maintain and increase the revenues we receive from fund management.

Termination of management arrangements with one or more of our investment funds could harm our business.

We provide management services to our investment funds through management agreements, through our position as the sole or managing general partner of partnership funds, through our position as the operating manager of other fund entities, or combinations thereof. Our arrangements are long-term, and frequently have no specified termination dates. However, our management arrangements with, or our position as general partner or operating manager of, an investment fund typically may be terminated by action taken by the investors. Upon any such termination, our management fees, after payment of any termination payments required, would cease, thereby reducing our expected future revenues.

Many of our assets are illiquid, and we may not be able to divest them in response to changing economic, financial and investment conditions. In addition, significant portions of our assets are subject to transfer constraints.

Many of our assets do not have ready markets, or there are restrictions on our ability to divest our investment. As a result, many of our portfolio assets are relatively illiquid investments. We may be unable to vary our portfolio in response to changing economic, financial and investment conditions or to sell our investments on acceptable terms should we desire or need to do so.

We may not realize the anticipated benefits of our joint ventures.

We have and may continue to enter into joint ventures to support growth in our business segments. We may not realize any of the anticipated benefits of our joint ventures, which subject us to risks that may not be present with other methods of investment, including:

| |

• | our joint venture partner could become insolvent or bankrupt; |

| |

• | fraud or misconduct by our joint venture partner; |

| |

• | shared or, where we are a minority partner, significantly limited decision-making authority which may prevent us from taking actions that would be in our interest or allow our joint venture partner to take actions with which we may disagree; |

| |

• | conflicts of interest between us and our joint venture partner that could lead to the implementation of policies or objectives that are not in our interest; and |

| |

• | restrictions on our ability to sell or liquidate our investment in the joint venture, or requirements for additional investment, which could reduce our liquidity. |

Occurrence of any of the foregoing could subject us to unanticipated costs (including litigation costs) or reduction or elimination of our expected return or investment.

We may determine to grow our business through the acquisition of asset management contracts or companies, which entails substantial risk.

We may determine to grow our business through the acquisition of asset management contracts or companies which subjects us to the risk that, during our due diligence examination of such acquisitions, we may not uncover all relevant liabilities and we may have limited, if any, recourse against the sellers. We may overpay to acquire asset management contracts or companies which could result a return on our investment that is less than anticipated or in losses. We also may not successfully integrate the asset management contracts or companies that we acquire into our business and operations, which could result in substantial costs.

The development of new products and services may expose as to additional costs or operational risk.

Our financial performance depends, in part, on our ability to develop, market and manage new investment funds, which may require significant time and resources, as well as ongoing support and investment. Substantial risk and uncertainties are associated with the introduction of new products and services, including shifting client and market preferences, the introduction of competing products or services and compliance with regulatory requirements. Failure to successfully manage these risks may cause our revenues and costs to fluctuate and limit our ability to achieve growth.

Significant legal proceedings may adversely affect our results of operations or financial condition.

We may in the future be involved in litigation matters arising in the ordinary course of business and may potentially be involved in other legal proceedings, including securities class actions and regulatory and governmental investigations related to the offering of securities in our investment funds. Even if we successfully defend actions brought against us, the cost, both in terms of fees incurred and the diversion of management time, could be substantial, thereby adversely affecting our ability to operate profitably. Moreover, an adverse result in any legal proceedings could result in our having to pay substantial amounts as fines and/or damages, which could be in excess of our ability to pay and remain a viable business.

The Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, may be detrimental to our business.

The Dodd-Frank Act has had a significant impact on us and the financial services industry due to increased compliance costs, hedging activities regulation, and broker-dealer compliance. Because much of the Dodd-Frank Act creates a framework through which regulatory reform will be promulgated, rather than providing regulatory reform itself, some of the impacts of the act are not yet fully known.

Failure to maintain adequate infrastructure could impede our productivity and growth.

Our infrastructure, including our technological capacity and office space, is important to our ability to conduct our operations. Failure to maintain an adequate infrastructure commensurate with the size and scope of our business could impede our productivity and growth, which could cause our earnings or stock price to decline.

Furthermore, we are highly dependent on various software applications, technologies and other systems for our business to function properly and to safeguard confidential information; any significant limitation, failure or security breach of these systems could constrain our operations. We utilize software and related technologies throughout our business to, among other things, obtain asset pricing information, process client transactions, and provide reports and other customer services to the clients of the funds we manage. Although we take protective measures, including measures to effectively secure information through system security technology and established and tested business continuity plans, we may experience system delays and interruptions as a result of natural disasters, power failures, acts of war and third-party failures. We cannot predict with certainty all of the adverse effects

that could result from our failure, or the failure of a third-party, to efficiently address and resolve these delays and interruptions. These adverse effects could include the inability to perform critical business functions or failure to comply with financial reporting and other regulatory requirements, which could lead to loss of client confidence, harm to our reputation, exposure to disciplinary action and liability to our clients. Accordingly, potential system failures and the cost necessary to correct those failures could have a material adverse effect on our results of operations and business prospects.

In addition, we could be subject to losses if we fail to properly safeguard sensitive and confidential information. As part of our normal operations, we maintain and transmit confidential information about our clients as well as proprietary information relating to our business operations. Although we take protective measures, our systems could still be vulnerable to unauthorized access, computer viruses or other events that have a security impact, such as an authorized employee or vendor inadvertently or intentionally causing us to release confidential or proprietary information. Such disclosure could, among other things, allow competitors access to our proprietary business information and require significant time and expense to investigate and remediate the breach. Moreover, loss of confidential client information could harm our reputation and subject us to liability under laws that protect confidential personal data, resulting in increased costs or loss of revenues.

Declines in the market values of our investments may reduce our earnings and the availability of credit.

We classify a portion of our assets for accounting purposes as “available-for-sale.” As a result, changes in the market values of those assets are directly charged or credited to stockholders' equity. A decline in these values will reduce the book value of our assets. Moreover, if the decline in value of an available-for-sale asset is other-than-temporary, such decline will reduce earnings. We cannot assure you that there will not be declines in the value of our assets, or that the declines will not be material, or that they will not be other-than-temporary.

A decline in the market value of our assets may also adversely affect us in instances where we have borrowed money based on the market value of those assets or seek new borrowings. If the market value of assets securing an existing loan declines, the lender may reduce availability (if the loan is a line of credit), require us to post additional collateral or require us to pay down the loan so that it meets specified loan to collateral value ratios. If we were unable to post the additional collateral, we could have to sell the assets under adverse market conditions which could result in losses and which could result in us failing our debt covenants. Moreover, a decline in asset values could limit our ability to obtain financing in the amounts we seek or require us to provide more collateral to secure proposed financing.

Increases in interest rates increase our operating costs.

As of December 31, 2015, we had two corporate credit facilities that were subject to variable interest rates. We may seek to obtain other credit facilities depending upon capital markets conditions. Any facilities that we may be able to obtain may also be at variable rates. To the extent we use these facilities, increases in interest rates will increase our interest costs, which would reduce our net income or cause us to sustain losses.

Our ability to realize our deferred tax asset may be reduced, which may adversely impact results of operations.

Realization of a deferred tax asset requires us to exercise significant judgment and is inherently uncertain because it requires the prediction of future occurrences. We may reduce our deferred tax asset in the future if estimates of projected income or our tax planning strategies do not support the amount of the deferred tax asset or if there are unanticipated changes in future tax rates. If we determine that a valuation allowance with respect to our deferred tax asset is necessary, we may incur a charge to earnings.

Risks Relating to Particular Aspects of Our Real Estate, Financial Fund Management and Commercial Finance Operations

The performance of our investment funds is subject to risks relating to the asset classes in which they invest.

Our investment funds invest in various classes of assets. They are, accordingly, subject to the risks typically associated with such asset classes, such as, with respect to real estate, the ability to attract tenants, local economic conditions, the availability of mortgage financing, environmental and other regulatory problems, and with respect to loans, economic factors affecting the borrower’s ability to pay debt service. The occurrence of any of these risks could cause one or more investment funds to fail to perform adequately, or at all, which could limit our ability to generate fee income from those funds and our ability to grow through the sponsorship of new investment funds.

We typically have retained some portion or all of the equity in the CDOs or CLOs we sponsored. CDO equity receives distributions from the CDO only if the CDO generates enough income to first pay the holders of the debt securities and the CDO's expenses.

We typically have retained some portion or all of the equity interest in CDOs and CLOs we sponsored either directly or through other entities. The equity is usually entitled to all of the income generated by the CDO or CLO after the CDO or CLO pays all of the interest due on the debt securities and its other expenses, and is entitled to a return on capital only when the principal amount and accrued interest of all of the debt securities has been paid. However, there will be little or no income available to the CDO or CLO equity if covenants regarding the operations of the CDO or CLO (primarily relating to the value of collateral and interest coverage) are not met, or if there are excessive payment defaults, payment deferrals or rating agency downgrades with respect to the issuers of the underlying collateral, and there may be little or no amounts available to return our capital. In that event, our revenues from and the value of our direct or indirect investment in the CDO's or CLO's equity, which for all CDOs and CLOs was $3.6 million at December 31, 2015, could decrease substantially or be eliminated. In addition, the equity securities of CDOs and CLOs are generally illiquid and, because they represent a leveraged investment in the CDO's or CLO's assets, the value of the equity securities will generally have greater fluctuations than the value of the underlying collateral.

In some of our investment funds, a portion of our management fees may depend upon the performance of the fund and, as a result, our management fee income may be volatile.

As of December 31, 2015, with respect to RSO and nine of our investment entities, we receive incentive or subordinated compensation in addition to our base management fee depending upon whether RSO or those partnerships achieve returns above specified levels. In addition, a portion of our management fees is subordinated to the investors' receipt of specified returns in one of the CLOs we manage. During 2015 and 2014, we earned incentive and subordinated management fees from RSO and from nine and seven CLOs, respectively, which constituted 9% and 9%, respectively, of our aggregate management fee income for both periods. Low growth or recessionary conditions in the national economy may result in the amount of incentive or subordinated management fee income we receive being reduced or possibly eliminated, and may cause these fees to be subject to high volatility.

Our real estate investment funds hold loans in their portfolios that are subject to a higher risk of loss than conventional mortgage loans.

The real estate investment funds that we have sponsored and manage, which we refer to as our RRE Funds, and from which we derive management and other fees, hold loans secured by real estate. In many instances, the loans in their portfolios have terms that differ significantly from conventional mortgage loans. In particular, these loans may:

| |

• | be junior mortgage loans; |

| |

• | involve payment structures other than equal periodic payments that retire a loan over its term; |

| |

• | require the borrower to pay a large lump sum at loan maturity (which will depend upon the borrower's ability to obtain financing or otherwise raise a substantial amount of cash at maturity); and |

| |

• | be secured by properties that, while producing income, do not generate sufficient revenues to pay the full amount of debt service on the loan as originally structured. |

As a result, these real estate loans may have a higher risk of default and loss than conventional mortgage loans, and may require the RRE Funds to become involved in expensive and time-consuming workouts, or bankruptcy, reorganization or foreclosure proceedings.

Both the RRE Funds' real estate held and the real estate securing their loans is typically the principal or sole source of recovery for these real estate loans, and thus the value and performance of the RRE Funds will depend upon local, regional and national economic conditions, and conditions affecting the property specifically, including the cost of compliance with, and liability under environmental, health and safety laws, changes in interest rates and the availability of financing, casualty losses, the attractiveness of the property, the availability of tenants, the ability of tenants to pay rent, competition from similar properties in the area and neighborhood values. Operating and other expenses of real properties, particularly significant expenses such as real estate taxes, insurance and maintenance costs, generally do not decrease when revenues decrease and, even if revenues increase, operating and other expenses may increase faster than revenues.

We may be unable to continue to attract, motivate and retain key personnel, and the cost to retain key personnel could put pressure on our operating margin.

Our business depends on our ability to attract, motivate and retain highly skilled, and often highly specialized, technical, managerial and executive personnel; there is no assurance that we will be able to do so. If our revenues decline during future periods, it will place significant added pressure on our ability to pay our employees at competitive levels. Our operating margin may decline if we increase compensation to retain key personnel without a commensurate increase in revenues.

Failure to comply with the Securities Exchange Act, Investment Advisers Act and related regulations could result in substantial harm to our reputation and results of operations.

Certain of our subsidiaries, including our broker-dealer, are registered with the SEC under the Securities Exchange Act or the Investment Advisers Act. The Investment Advisers Act and the Securities Exchange Act impose numerous obligations and duties, respectively, on registered broker-dealers and registered investment advisers, including record-keeping, operating and marketing requirements, disclosure obligations and prohibitions on fraudulent activities, as well as additional detailed operational and compliance requirements. The failure of any of the relevant subsidiaries to comply with the requirements of either such act could cause the SEC to institute proceedings and impose sanctions for violations, including censure, fines or termination of registration, and could lead to harm to our reputation, any of which could cause our earnings or stock price to decline. Moreover, if the registration of our broker-dealer subsidiary was to be terminated for any reason, our ability to sponsor and raise capital for our investment funds could be severely limited, thereby impairing our ability to grow business and fee income.

If we are deemed an investment company under the Investment Company Act, our business would be subject to applicable restrictions thereunder, which could make it impracticable for us to continue our business as contemplated and would have a material adverse impact on the market price of our common stock.

We do not believe that we are an “investment company” under the Investment Company Act because the nature of our assets excludes us from the definition of an investment company under the Investment Company Act. In addition, we believe our company is not an investment company pursuant to Rule 3a-1 of the Investment Company Act because we have no more than 45% of our assets invested in and derive no more than 45% of our income from investment securities. We intend to conduct our operations so that we will not be deemed an investment company. If we were to be deemed an investment company, however, restrictions imposed by the Investment Company Act, including limitations on our capital structure and our ability to transact with affiliates, could make it impractical for us to continue our business as now contemplated.

Risks Relating to the Market for Our Common Stock

The percentage of ownership of any of our common stockholders may be diluted if we issue new shares of common stock.

Stockholders have no rights to buy additional shares of stock if we issue new shares of stock. We may issue common stock, convertible debt or preferred stock pursuant to a public offering or a private placement. Because our decision to issue securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings. Any of our common stockholders who do not participate in any future stock issuances will experience dilution in the percentage of the issued and outstanding stock they own.

Sales of our common stock, or the perception that such sales will occur, may have adverse effects on our share price.

We cannot predict the effect, if any, of future sales of common stock, or the availability of shares for future sales, on the market price of our common stock. Sales of substantial amounts of common stock by us, the sale of shares of common stock held by our current stockholders, and the sale of any shares we may issue under a long-term incentive plan, or the perception that these sales could occur, may adversely affect prevailing market prices for our common stock.

An increase in market interest rates may have an adverse effect on the market price of our common stock.

One of the factors that investors may consider in deciding whether to buy or sell our common stock is our dividend yield, which is our dividend rate as a percentage of our share price, relative to market interest rates. If market interest rates increase, prospective investors may desire a higher dividend yield on our common stock or may seek securities paying higher dividends or interest. As a result, interest rate fluctuations and capital market conditions are likely to affect the market price of our common stock, and such effects could be significant.

Future issuances of debt securities, which would rank senior to our common stock upon liquidation, or future issuances of preferred stock, may adversely affect the trading price of our common stock.

In the future, we may issue debt or equity securities or incur other borrowings. Upon our liquidation, holders of our debt securities, other loans and preferred stock will receive a distribution of our available assets before common stockholders. Any preferred stock, if issued, likely will also have a preference on periodic distribution payments, which could eliminate or otherwise limit our ability to make distributions to common stockholders. Common stockholders bear the risk that our future issuances of debt or equity securities or our incurrence of other borrowings may negatively affect the trading price of our common stock.

The market prices for our common stock may be volatile.

The prices at which our common stock may sell in the public market may be volatile. Fluctuations in the market prices of our common stock may not be correlated in a predictable way to our performance or operating results. The prices at which our common stock trade may fluctuate as a result of factors that are beyond our control or unrelated to our performance or operating results.

We have not established a minimum dividend payment level and we cannot assure you of our ability to pay dividends in the future or the amount of any dividends.

Our board of directors will determine the amount and timing of dividends on our common stock. In making this determination, our directors will consider all relevant factors, including, restrictions under Delaware law, capital expenditures and reserve requirements and general operational requirements. We cannot assure you that we will be able to pay dividends in the future or in amounts similar to our past distributions. If we do not the market price of our common stock could be reduced.

ITEM 2. PROPERTIES.

Philadelphia, Pennsylvania:

We maintain our executive and corporate offices at One Crescent Drive in the Philadelphia Navy Yard under a lease for 20,234 square feet that expires in May 2019.

In addition, we lease 34,476 square feet of office space at 1845 Walnut Street, Philadelphia, Pennsylvania, primarily for use by our real estate operations, which expires in September 2023. We manage this office building and own a 7% equity interest in the entity that owns the building and parking garage.

New York, New York:

We maintain additional executive offices in a 12,930 square foot location at 712 5th Avenue, New York, New York under a lease agreement that expires in July 2020.

Other Locations:

In addition, we lease various offices in the following cities: Omaha (Nebraska), El Segundo (California) and Denver (Colorado) as well as outside the United States in London (England) and Singapore.

As of December 31, 2015, we believe that the properties we lease are suitable for our operations and adequate for our needs.

ITEM 3. LEGAL PROCEEDINGS.

We are a party to various routine legal proceedings arising out of the ordinary course of our business. Management believes that none of these actions, individually or in the aggregate, will have a material adverse effect on our financial condition or operations.

PART II

| |

ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our common stock is quoted on the NASDAQ Global Select Market under the symbol "REXI." The following table sets forth the high and low closing sale prices per share of our common stock as reported by NASDAQ and the cash dividend declared per share of our common stock on a quarterly basis for the last two years:

|

| | | | | | | | | | | |

| Closing Market Prices | | Dividends |

| High | | Low | | Declared |

2015 | | | | | |

Fourth Quarter | $ | 7.87 |

| | $ | 3.60 |

| | $ | 0.06 |

|

Third Quarter | $ | 8.42 |

| | $ | 6.60 |

| | $ | 0.06 |

|

Second Quarter | $ | 9.08 |

| | $ | 7.98 |

| | $ | 0.06 |

|

First Quarter | $ | 9.43 |

| | $ | 8.52 |

| | $ | 0.06 |

|

| | | | | |

2014 | |

| | |

| | |

Fourth Quarter | $ | 9.60 |

| | $ | 8.75 |

| | $ | 0.05 |

|

Third Quarter | $ | 9.87 |

| | $ | 9.10 |

| | $ | 0.04 |

|

Second Quarter | $ | 9.51 |

| | $ | 8.20 |

| | $ | 0.03 |

|

First Quarter | $ | 9.51 |

| | $ | 8.43 |

| | $ | 0.03 |

|

As of March 1, 2016, our outstanding shares of common stock were held by 264 holders of record.

There are no restrictions imposed on the declaration of dividends under our credit facilities or Senior Notes. The determination of the amount of future cash dividends, if any, is at the discretion of our board of directors and will depend on various factors affecting our financial condition and other matters that the directors deem relevant.

Issuer Purchases of Equity Securities

The following table provides information about purchases by us of our common stock during the quarter ended December 31, 2015:

Issuer Purchases of Equity Securities

|

| | | | | | | | | | | | | | | | |

Period | | Total Number of Shares Purchased | | Average Price Paid per Share (1) | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Number of Shares that May Yet be Purchased Under the Plans or Programs (2) | | |

October 1 - 31, 2015 | | 219,808 |

| | $ | 7.43 |

| | 219,808 |

| | $ | 14,589,584 |

| | |

November 1 - 30, 2015 | | 310,580 |

| | $ | 5.72 |

| | 310,580 |

| | $ | 12,812,690 |

| | |

December 1 - 31, 2015 | | 336,001 |

| | $ | 4.48 |

| | 336,001 |

| | $ | 11,308,927 |

| | |

| | 866,389 |

| | $ | 5.67 |

| |

|

| | |

| | |

| |

(1) | The average price per share, as reflected above, includes broker fees and commissions. |

| |

(2) | In August 2015, our Board of Directors authorized a program to repurchase up to $25.0 million of our common stock. |

Share repurchases may be made from time to time through open market purchases or privately negotiated transactions at our discretion and in accordance with the rules of the Securities and Exchange Commission, as applicable. The amount and timing of any repurchases will depend on market conditions and other factors.

Performance Graph

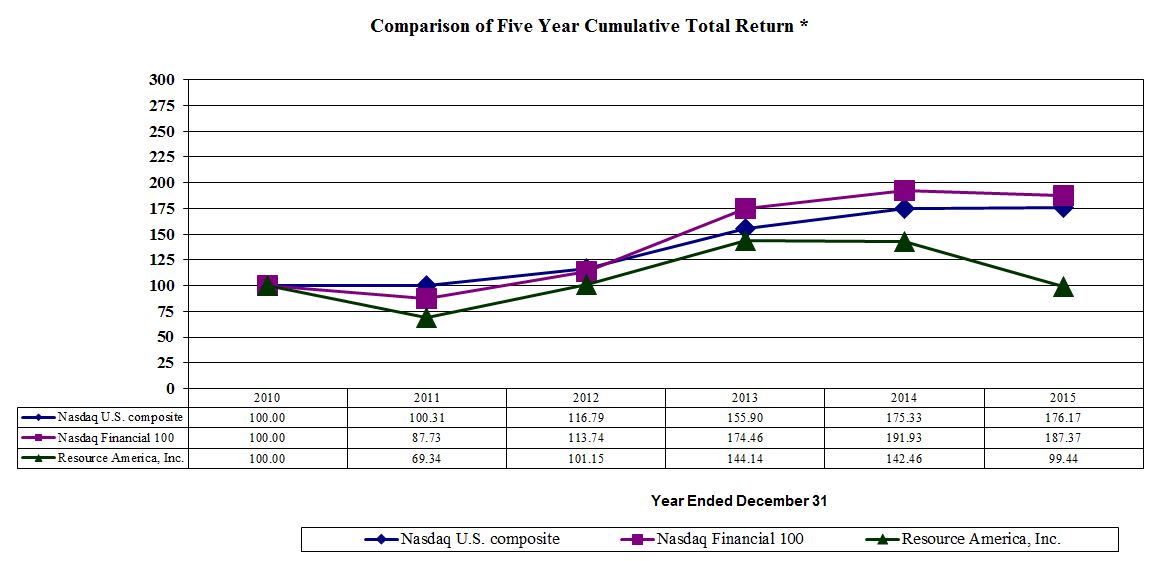

The following graph assumes that $100 was invested on January 1, 2010 in our common stock, or in the indicated index, and that all cash dividends were reinvested as received. The cumulative total stockholder return on our common stock is then compared with the cumulative total return of two other stock market indices, the NASDAQ United States Composite and the NASDAQ Financial 100.

ITEM 6. SELECTED FINANCIAL DATA.

The following selected financial data should be read together with our "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 of this report and our consolidated financial statements, the notes to our consolidated financial statements, including the notes, found elsewhere herein.

The following table sets forth selected operating and balance sheet data (in thousands, except per share data):

|

| | | | | | | | | | | | | | | | | | | |

| As of and for the Years Ended December 31, |

| 2015 | | 2014 | | 2013 | | 2012 | | 2010 |

| | | | | | | | | |

Statement of operations data: | | | | | | | | | |

Revenues: | | | | | | | | | |

Real estate | $ | 79,130 |

| | $ | 54,861 |

| | $ | 57,143 |

| | $ | 45,083 |

| | $ | 40,172 |

|

Financial fund management | 20,411 |

| | 29,118 |

| | 19,773 |

| | 18,053 |

| | 24,090 |

|

Commercial finance | 314 |

| | (164 | ) | | (341 | ) | | (1,659 | ) | | 23,738 |

|

Total revenues | $ | 99,855 |

| | $ | 83,815 |

| | $ | 76,575 |

| | $ | 61,477 |

| | $ | 88,000 |

|

| | | | | | | | | |

Income (loss) from continuing operations | $ | 8,232 |

| | $ | 9,747 |

| | $ | 8,192 |

| | $ | 24,883 |

| | $ | (10,353 | ) |