10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________________________________________________________________

FORM 10-K

|

| | |

(Mark One) | | |

ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 25, 2015 |

OR |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(Commission File Number) 333-196049

______________________________________________________________________________________________________

TYCO INTERNATIONAL PLC

(Exact Name of Registrant as Specified in its Charter)

|

| | |

Ireland (Jurisdiction of Incorporation) | | 98-0390500 (I.R.S. Employer Identification Number) |

Mahon, Cork, Ireland

(Address of registrant's principal executive office)

353-21-423-5000

(Registrant's telephone number)

Securities registered pursuant to Section 12 (b) of the Act: |

| | |

Title of each class | | Name of each exchange on which registered |

Ordinary Shares, Par Value $0.01 | | New York Stock Exchange |

Securities registered pursuant to Section 12 (g) of the Act: None

________________________________________________________________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III or this Form 10-K or any amendment to this Form 10-K o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one): |

| | | | | | |

| | | | | | |

Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý The aggregate market value of voting ordinary shares held by non-affiliates of the registrant as of March 27, 2015 was approximately $17,741,657,194.

The number of ordinary shares outstanding as of November 6, 2015 was 422,755,899.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's proxy statement filed within 120 days of the close of the registrant's fiscal year in connection with the registrant's 2016 annual general meeting of shareholders are incorporated by reference into Part III of this Form 10-K.

See page 59 to 61 for the exhibit index.

TABLE OF CONTENTS

|

| | |

| | |

| | Page |

Part I | | |

| | |

| | |

| | |

| | |

| | |

| | |

Part II | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Part III | | |

| | |

| | |

| | |

| | |

| | |

Part IV | | |

| | |

| |

| |

Part I

Item 1. Business

General

Tyco International plc (hereinafter referred to as "we," the "Company" or "Tyco") is a leading global provider of security products and services, fire detection and suppression products and services and life safety products. Our broad portfolio of products and services, sold under well-known brands such as Tyco, SimplexGrinnell, Sensormatic, Wormald, Ansul, Simplex, Scott and ADT (other than the U.S., Canada and Korea) serve security, fire detection and suppression and life safety needs across commercial, industrial, retail, small business, institutional and governmental markets, as well as non-U.S. residential markets. We hold market-leading positions in large, fragmented industries and we believe that we are well positioned to leverage our global footprint, deep industry experience, strong customer relationships and innovative technologies to expand our business in both developed and emerging markets.

During the fourth quarter of fiscal 2015, the Company changed the name of its North America Installation & Services and Rest of World Installation & Services segments to North America Integrated Solutions & Services and Rest of World Integrated Solutions & Services, respectively. The segment reporting structure is consistent with how management reviews the businesses, makes investing and resource decisions and assesses operating performance. The name changes better reflect the Company's focus on providing technology solutions that encompass a mix of products, services and consultation that is tailored to the unique needs of each customer. No changes were made to the current segment structure or underlying financial data that comprise each segment as a result of the name changes and there was no impact to previously disclosed segment information.

We operate and report financial and operating information in the following three operating segments:

| |

• | North America Integrated Solutions & Services ("NA Integrated Solutions & Services") designs, sells, installs, services and monitors integrated electronic security systems and integrated fire detection and suppression systems for commercial, industrial, retail, small business, institutional and governmental customers in North America. |

| |

• | Rest of World ("ROW") Integrated Solutions & Services ("ROW Integrated Solutions & Services") designs, sells, installs, services and monitors integrated electronic security systems and integrated fire detection and suppression systems for commercial, industrial, retail, residential, small business, institutional and governmental customers in the ROW regions. |

| |

• | Global Products designs, manufactures and sells fire protection, security and life safety products, including intrusion security, anti-theft devices, breathing apparatus and access control and video management systems, for commercial, industrial, retail, residential, small business, institutional and governmental customers worldwide, including products installed and serviced by our NA and ROW Integrated Solutions & Services segments. |

We also provide general corporate services to our segments and these costs are reported as Corporate and Other.

Certain prior period amounts have been reclassified to conform with the current period presentation. Specifically, the Company has reclassified the operations of several businesses in the ROW Integrated Solutions & Services segment to (Loss) income from discontinued operations within the Consolidated Statements of Operations and the assets and liabilities as held for sale within the Consolidated Balance Sheets as they satisfied the criteria to be presented as discontinued operations. See Note 3 to the Consolidated Financial Statements.

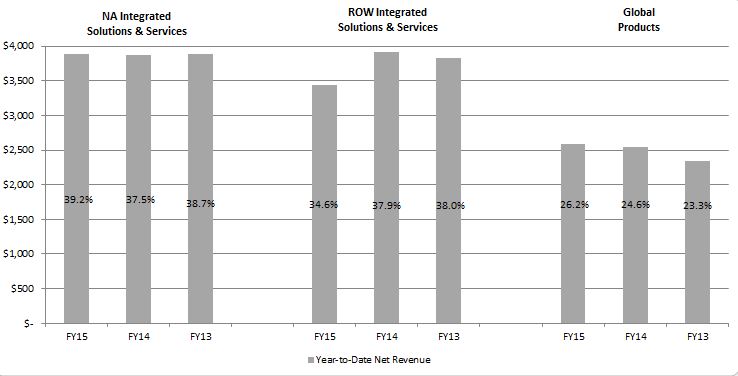

Net revenue by segment for 2015 is as follows ($ in millions):

|

| | | | | | | | |

| Net Revenue | | Percent of Total Net Revenue | | Key Brands |

NA Integrated Solutions & Services | $ | 3,879 |

| | 39 | % | | Tyco Fire & Security, Tyco Integrated Security, SimplexGrinnell, Sensormatic |

ROW Integrated Solutions & Services | 3,432 |

| | 35 | % | | Tyco Fire & Security, Wormald, Sensormatic, ADT |

Global Products | 2,591 |

| | 26 | % | | Tyco, Simplex, Ansul, DSC, Scott, American Dynamics, Software House, Visonic, Chemguard, Exacq |

| $ | 9,902 |

| | 100 | % | | |

Unless otherwise indicated, references in this Annual Report to 2015, 2014 and 2013 are to Tyco's fiscal years ended September 25, 2015, September 26, 2014 and September 27, 2013, respectively. The Company has a 52 or 53-week fiscal year

that ends on the last Friday in September. Fiscal 2015, 2014, and 2013 were 52-week years. Fiscal 2016 will be a 53-week year which will end on September 30, 2016.

For a detailed discussion of revenue, operating income and total assets by segment for fiscal years 2015, 2014 and 2013 see Item 7. Management's Discussion and Analysis and Note 16 to the Consolidated Financial Statements.

History and Development

Tyco International plc

Tyco International plc is a Company organized under the laws of Ireland. The Company was created as a result of the July 1997 acquisition of Tyco International Ltd., a Massachusetts corporation, by ADT Limited, a public company organized under the laws of Bermuda, at which time ADT Limited changed its name to Tyco International Ltd. On November 17, 2014, the Company completed its change of jurisdiction of incorporation from Switzerland to Ireland by merging with its subsidiary, Tyco International plc, a public limited company incorporated under the laws of Ireland.

Effective September 28, 2012, the Company completed the spin-offs of The ADT Corporation ("ADT") and Pentair Ltd. (formerly known as Tyco Flow Control International Ltd. ("Tyco Flow Control")), formerly our North American residential security and flow control businesses, respectively, into separate, publicly traded companies in the form of a distribution to Tyco shareholders. Immediately following the spin-off, Pentair, Inc. was merged with a subsidiary of Tyco Flow Control in a tax-free, all-stock merger (the "Merger"), with Pentair Ltd. ("Pentair") succeeding Pentair Inc. as an independent publicly traded company. The distributions, the Merger and related transactions are collectively referred to herein as the "2012 Separation".

Effective June 29, 2007, the Company completed the spin-offs of Covidien (subsequently acquired by Medtronic plc) and TE Connectivity, formerly our Healthcare and Electronics businesses of Tyco, respectively, into separate, public traded companies (the "2007 Separation") in the form of a tax-free distribution to Tyco shareholders.

Tyco's registered and principal office is located at Unit 1202 Building 1000 City Gate, Mahon, Cork Ireland. Its management office in the United States is located at 9 Roszel Road, Princeton, New Jersey 08540.

Segments

Each of our three segments serves a highly diverse customer base and none is dependent upon a single customer or group of customers. For fiscal year 2015, no customer accounted for more than 10% of our revenues, and approximately 44% of our revenues were derived from customers outside of North America.

Our end-use customers, to whom we may sell directly or through wholesalers, distributors, commercial builders or contractors, can generally be grouped in the following categories:

| |

• | Commercial customers, including residential and commercial property developers, financial institutions, food service businesses and commercial enterprises; |

| |

• | Industrial customers, including companies in the oil and gas, power generation, mining, petrochemical and other industries; |

| |

• | Retail and small business customers, including international, regional and local consumer outlets; |

| |

• | Institutional customers, including a broad range of healthcare facilities, academic institutions, museums and foundations; |

| |

• | Governmental customers, including federal, state and local governments, defense installations, mass transportation networks, public utilities and other government-affiliated entities and applications; and |

| |

• | Residential customers outside of North America, including owners of single-family homes and local providers of a wide range of goods and services. |

As discussed under "Competition" below, the markets in which we compete are generally highly fragmented. We therefore compete with many other businesses in markets throughout the world, including other large global businesses, significant regional businesses and many smaller local businesses.

Integrated Solutions & Services

NA Integrated Solutions & Services and ROW Integrated Solutions & Services (collectively, "Integrated Solutions & Services") design, sell, install, service and monitor electronic security and fire detection and suppression systems for retail, small business, commercial, industrial, governmental and institutional customers around the world. Additionally, ROW Integrated Solutions & Services has the right to design, sell, install, service and monitor security systems for residential customers under the ADT brand name in jurisdictions other than the U.S., Canada and Korea.

Security Services

Our Integrated Solutions & Services segments design, sell, install and service security systems to detect intrusion, control access and react to movement, fire, smoke, flooding, environmental conditions, industrial processes and other hazards. These electronic security systems include detection devices that are usually connected to a monitoring center that receives and records alarm signals where security monitoring specialists verify alarm conditions and initiate a range of response scenarios. For most systems, control panels identify the nature of the alarm and the areas where a sensor was triggered. Our other security solutions include access control systems for sensitive areas such as government facilities and banks; video surveillance systems designed to deter theft and fraud and help protect employees and customers; and asset protection and security management systems designed to monitor and protect physical assets as well as proprietary electronic data. Our offerings also include anti-theft systems utilizing acousto-magnetic and radio frequency identification tags and labels in the retail industry as well as store performance solutions to enhance retailer performance. Many of the world's leading retailers use our Sensormatic anti-theft systems to help protect against shoplifting and employee theft. Many of the products that we install for our Integrated Solutions & Services security customers are designed and manufactured by our Global Products segment. Additionally, our deep experience in designing, integrating, deploying and maintaining large-scale security systems—including, for example, centrally managed security systems that span large commercial and institutional campuses—allows us to install and/or service products manufactured by third parties.

Purchasers of our intrusion systems typically contract for ongoing security system monitoring and maintenance at the time of initial equipment installation. These contracts are generally for a term of one to three years. Systems installed at customers' premises may be owned by us or by our customers. Monitoring center personnel may respond to alarms by relaying appropriate information to local fire or police departments, notifying the customer or taking other appropriate action. In certain markets, we directly provide the alarm response services with highly trained and professionally equipped employees. In some instances, alarm systems are connected directly to local fire or police departments.

Our ROW Integrated Solutions & Services segment is a leading provider of monitored residential and small business security systems. In addition to traditional burglar alarm and fire detection systems, installation and monitoring services, ROW Integrated Solutions & Services provides patrol and response services in select geographies, including South Africa. Our ROW Integrated Solutions & Services segment continues to expand its offering of value-added residential services worldwide, such as an interactive services platform. The interactive services platform allows for remote management of the home security system, as well as lifestyle applications, which currently include remote video, lighting control, and energy management.

Our customers are often prompted to purchase security systems by their insurance carriers, which may offer lower insurance premium rates if a security system is installed or require that a system be installed as a condition of coverage.

Fire Protection Services

Our Integrated Solutions & Services segments design, sell, install and service fire detection and fire suppression systems in both new and existing facilities. Commercial construction as well as legislation mandating the installation and service of fire detection and suppression systems are significant drivers of demand for our products. Our Integrated Solutions & Services segments offer a wide range of fire detection and suppression systems, including those designed and manufactured by our Global Products segment and those designed by third parties. These detection systems include fire alarm control panels, advanced fire alarm monitoring systems, smoke and flame detection systems, heat and carbon monoxide detectors and voice evacuation systems. Our Integrated Solutions & Services segments also offer a wide range of standard water-based sprinkler and chemical suppression systems and custom designed special hazard suppression systems, which incorporate specialized extinguishing agents such as foams, dry chemicals and gases in addition to spill control products designed to absorb, neutralize and solidify spills of hazardous materials. These systems are often especially suited to fire suppression in industrial and commercial applications, including oil and gas, power generation, mining, petrochemical, manufacturing, transportation, data processing, telecommunications, commercial food preparation and marine applications. Our Integrated Solutions & Services segments continue to focus on system maintenance and inspection, which have become increasingly important parts of our business.

Customers

Our Integrated Solutions & Services customers range from Fortune 500 companies with diverse worldwide operations who look to us to provide integrated, global solutions for their fire and security needs, to single location commercial customers and individual homeowners. Our Integrated Solutions & Services customer relationships generally are in the market for new construction or retrofit projects, which represented 47% of Integrated Solutions & Services fiscal 2015 net revenue, and the market for aftermarket products and services, which accounted for the remaining 53% of Integrated Solutions & Services fiscal 2015 net revenue. New construction projects are inherently long-lead in nature and we strive to become involved in the planning process for these projects as early as possible. We believe that by actively participating in the preliminary design stages of a new construction project and by offering our design services that combine our global expertise and knowledge of local codes and standards, we can increase our value to customers relative to many smaller local and regional competitors. With respect to fire detection and suppression installations, we prefer to become involved at the time an architectural or engineering design firm is selected. With respect to security system design and installation, we generally become involved in the later stages of a construction project or as tenants take occupancy.

Our relationships with customers in the aftermarket may include any combination of alarm monitoring, fire and security maintenance and or testing and inspection services. We also provide aftermarket services to many customers whose fire and security systems were manufactured or installed by third parties.

Global Products

Our Global Products segment designs, manufactures and sells fire protection, security and life safety products, including intrusion security, anti-theft devices, breathing apparatus, and access control and video management systems.

Fire Protection Products

Fire Protection Products designs, manufactures, distributes and sells fire alarm and fire detection systems, automatic fire sprinkler systems and special hazard suppression systems, including many of the fire protection products that our Integrated Solutions & Services segments install and service. Fire Protection Products also manufactures and sells grooved products for the rapid joining of piping in both the fire and non-fire markets. Fire Protection Products are marketed under various leading trade names, including Simplex, Wormald, Ansul and Tyco and include fire alarm control panels, advanced fire alarm monitoring systems, smoke, heat and carbon monoxide detectors and voice evacuation systems. Fire Protection Products also offers a wide range of water-based sprinkler systems and custom designed special hazard suppression systems, which incorporate specialized extinguishing agents such as foams, dry chemicals and gases. These systems are often especially suited to fire suppression in industrial and commercial applications, including oil and gas, power generation, mining, petrochemical, manufacturing, transportation, data processing, telecommunications, commercial food preparation and marine applications.

Fire Protection Products' systems often are purchased or specified by facility owners through general and subcontractors in the fire protection field. In recent years, retrofitting of existing buildings has increased as a result of legislation mandating the installation of fire detection and fire suppression systems, especially in hotels, restaurants, healthcare facilities and educational establishments. The 2009 through 2015 editions of the International Residential Code, developed by the International Code Council, a non-profit association that develops model codes that are the predominant building and fire safety regulations followed by state and local jurisdictions in the United States, continue to require sprinkler systems in new one and two-family homes and townhouses since January 2011. This national code is not binding on state and local jurisdictions and must be adopted locally before it becomes mandatory for new homes being built in these areas. Fire Protection Products continues to advocate for the adoption of these requirements to reduce the future loss of life due to residential fires. The timing and extent of adoption, if at all, will vary by jurisdiction. However, we believe that this development may offer opportunities to expand our residential fire suppression business in the United States.

Security Products

Security Products designs and manufactures a wide array of electronic security products, including integrated video surveillance and access control systems to enable businesses to manage their security and enhance business performance. Our global access control solutions include integrated security management systems for enterprise applications, access control solutions applications, alarm management panels, door controllers, readers, keypads and cards. Our global video system solutions include digital video management systems, matrix switchers and controllers, digital multiplexers, programmable cameras, monitors and liquid crystal interactive displays. Our security products for homes and businesses range from basic burglar alarms to comprehensive interactive security systems including alarm control panels, keypads, sensors and central station receiving equipment used in security monitoring centers. Our offerings also include anti-theft systems utilizing acousto magnetic and radio frequency identification tags and labels in the retail industry. Our security products are marketed under various leading trade names, including Software House, DSC, American Dynamics, Sensormatic, Visonic and Exacq. Many of the world's leading retailers use our Sensormatic anti-theft systems to help protect against shoplifting and employee theft.

Security Products manufactures many of the security products that our Integrated Solutions & Services business installs and services.

Life Safety Products

Life Safety Products manufactures life safety products, including self-contained breathing apparatus designed for firefighter, industrial and military use, supplied air respirators, air-purifying respirators, thermal imaging cameras, gas detection equipment, gas masks and personal protection equipment. The Life Safety Products business operates under various leading trade names, including Scott Safety and Protector. Our breathing apparatus are used by the military forces of several countries and many U.S. firefighters rely on the Scott Air-Pak brand of self-contained breathing apparatus.

Customers

Global Products sells products through our Integrated Solutions & Service segments and indirect distribution channels around the world. Some of Global Products' channel business partners act as dealers selling to smaller fire and security contractors that install fire detection and suppression, security and theft protection systems, whereas others act as integrators that install the products themselves. Builders, contractors and developers are customers for our sprinkler products. End customers for our breathing apparatus and related products include fire departments, municipal and state governments and military forces as well as major companies in the industrial sector.

Competition

The markets that we serve are generally highly competitive and fragmented with a small number of large, global firms and thousands of smaller regional and local companies. Competition is based on price, specialized product capacity, breadth of product line, training, support and delivery, with the relative importance of these factors varying depending on the project complexity, product line, the local market and other factors. Rather than compete primarily on price, we emphasize the quality of our products and services, the reputation of our brands and our knowledge of customers' fire and security needs. Among large industrial, commercial, governmental and institutional customers, we believe that our comprehensive global coverage and product and service offerings provide a competitive advantage. We also believe that our systems integration capabilities, which allow us to offer global solutions to customers that fully integrate our security and/or fire offerings into existing information technology networks, business operations and management tools, and process automation and control systems, set us apart from all but a small number of other large, global competitors.

Competitive dynamics in the fire and security industry generally result in more direct competition and lower margins for installation projects compared to aftermarket products and services. We generally face the greatest competitive pricing pressure for the installation of products that have become more commoditized over time, including standard commercial sprinkler systems and closed-circuit television systems.

Backlog

See Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations for information relating to our backlog.

Intellectual Property

Patents, trademarks, copyrights and other proprietary rights are important to our business. We also rely upon trade secrets, manufacturing know-how, continuing technological innovations and licensing opportunities to maintain and improve our competitive position. We review third-party proprietary rights, including trademarks, patents and patent applications, in an effort to develop an effective intellectual property strategy, avoid infringement of third-party proprietary rights, identify licensing opportunities and misappropriation of our proprietary rights, and monitor the intellectual property claims of others.

We own a portfolio of patents that principally relates to: electronic security products and systems for intrusion detection, access control, electronic identification tags & video surveillance; fire protection products and systems, including fire detection and fire suppression with chemical, gas, foam and water agents; personal protective products and systems for fire and other hazards. We also own a portfolio of trademarks and are a licensee of various patents and trademarks. Patents for individual products extend for varying periods according to the date of patent filing or grant and the legal term of patents in the various countries where patent protection is obtained. Trademark rights may potentially extend for longer periods of time and are dependent upon national laws and use of the marks.

While we consider our patents to be valuable assets that help prevent or delay the commoditization of our products and thus extend their life cycles, we do not believe that our overall operations are dependent upon any single patent or group of related patents. We share the ADT® trademark with ADT and operate under a brand governance agreement between the two companies.

Research and Development

We are engaged in research and development in an effort to introduce new products, to enhance the effectiveness, ease of use, safety and reliability of our existing products and to expand the applications for which the uses of our products are appropriate. For example, in order to position ourselves to participate in and lead the development of residential interactive platforms, enterprise-wide integrated access control platforms and transition IP video platforms, we have made significant investments in our security products portfolio. In addition, we continually evaluate developing technologies in areas that we believe will enhance our business for possible investment. Our research and development expense was $212 million in 2015, $193 million in 2014 and $172 million in 2013 related to new product development.

Raw and Other Purchased Materials

We are a large buyer of metals and other commodities, including fuel for our vehicle fleet. We purchase materials from a large number of independent sources around the world and have experienced no shortages that have had a material adverse effect on our businesses. We enter into long-term supply contracts, using fixed or variable pricing to manage our exposure to potential supply disruptions. Significant changes in certain raw material, including steel, brass and certain flurochemicals used in our fire suppression agents, may have an adverse impact on costs and operating margins.

Governmental Regulation and Supervision

Our operations are subject to numerous federal, state and local laws and regulations, both within and outside the United States, in areas such as: consumer protection, government contracts, international trade, environmental protection, labor and employment, tax, licensing and others. For example, most U.S. states and non-U.S. jurisdictions in which we operate have licensing laws directed specifically toward the alarm and fire suppression industries. Our security businesses currently rely extensively upon the use of wireline and wireless telephone service to communicate signals. Wireline and wireless telephone companies in the United States are regulated by the federal and state governments. In addition, government regulation of fire safety codes can impact our fire businesses. These and other laws and regulations impact the manner in which we conduct our business, and changes in legislation or government policies can affect our worldwide operations, both favorably and unfavorably. For a more detailed description of the various laws and regulations that affect our business, see Item 1A. Risk Factors—Risks Related to Legal, Regulatory and Compliance Matters.

Environmental Matters

We are involved in various stages of investigation and cleanup related to environmental remediation matters at a number of sites. The ultimate cost of site cleanup is difficult to predict given the uncertainties regarding the extent of the required cleanup, the interpretation of applicable laws and regulations and alternative cleanup methods. As of September 25, 2015, we concluded that it was probable that we would incur remedial costs in the range of approximately $23 million to $72 million. As of September 25, 2015, Tyco concluded that the best estimate within this range is approximately $33 million, of which $11 million is included in Accrued and other current liabilities and $22 million is included in Other liabilities in the Company's Consolidated Balance Sheet.

The majority of the liabilities described above relate to ongoing remediation efforts at a facility in the Company's Global Products segment located in Marinette, Wisconsin, which the Company acquired in 1990 in connection with its acquisition of, among other things, the Ansul product line. Prior to Tyco's acquisition, Ansul manufactured arsenic-based agricultural herbicides at the Marinette facility, which resulted in significant arsenic contamination of soil and groundwater on the Marinette site and in parts of the adjoining Menominee River. Ansul has been engaged in ongoing remediation efforts at the Marinette site since 1990, and in February 2009 entered into an Administrative Consent Order (the "Consent Order") with the U.S. Environmental Protection Agency to address the presence of arsenic at the Marinette site. Under this agreement, Ansul's principal obligations are to contain the arsenic contamination on the site, pump and treat on-site groundwater, dredge, treat and properly dispose of contaminated sediments in the adjoining river areas, and monitor contamination levels on an ongoing basis. Activities completed under the Consent Order since 2009 include the installation of a subsurface barrier wall around the facility to contain contaminated groundwater, the installation of a groundwater extraction and treatment system and the dredging and offsite disposal of treated river sediment. As of September 25, 2015, the Company concluded that its remaining remediation and monitoring costs related to the Marinette facility were in the range of approximately $14 million to $46 million. The Company's best estimate within that range is approximately $23 million, of which $9 million is included in Accrued and other current liabilities and $14 million is included in Other liabilities in the Company's Consolidated Balance Sheet. During the years ended September 25, 2015, September 26, 2014, and September 27, 2013, the Company recorded charges of nil, nil, and $100 million, respectively, in Selling, general and administrative expenses within the Consolidated Statement of Operations. Although the Company has recorded its best estimate of the costs that it will incur to remediate and monitor the arsenic contamination at the Marinette facility, it is possible that technological, regulatory or enforcement developments, the results of

environmental studies or other factors could change the Company's expectations with respect to future charges and cash outlays, and such changes could be material to the Company's future results of operations, financial condition or cash flows.

Employees

As of September 25, 2015, we employed approximately 57,000 people worldwide, of which approximately 19,000 were employed in the United States and approximately 38,000 were outside the United States. Approximately 9,000 employees are covered by collective bargaining agreements or works councils and we believe that our relations with the labor unions are generally good.

Available Information

Tyco is required to file annual, quarterly and special reports, proxy statements and other information with the U.S. Securities and Exchange Commission ("SEC"). Investors may read and copy any document that Tyco files, including this Annual Report on Form 10-K, at the SEC's Public Reference Room at 100 F Street, N.E., Room 1580, Washington, DC 20549. Investors may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site at http://www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC, from which investors can electronically access Tyco's SEC filings.

Our Internet website is www.tyco.com. We make available free of charge on or through our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, reports filed pursuant to Section 16 and any amendments to those reports filed or furnished pursuant to section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file or furnish such materials to the SEC. In addition, we have posted the charters for our Audit Committee, Compensation and Human Resources Committee, and Nominating and Governance Committee, as well as our Board Governance Principles and Guide to Ethical Conduct, on our website under the "About" heading. The annual report to shareholders, charters and principles are not incorporated in this report by reference. We will also provide a copy of these documents free of charge to shareholders upon request.

Item 1A. Risk Factors

You should carefully consider the risks described below before investing in our publicly traded securities. The risks described below are not the only ones facing us. Our business is also subject to the risks that affect many other companies, such as technological obsolescence, labor relations, geopolitical events, climate change and international operations.

Risks Relating to Our Businesses

General economic and cyclical industry conditions may adversely affect our financial condition, results of operations or cash flows.

Our operating results have been and may in the future be adversely affected by general economic conditions and the cyclical pattern of certain markets that we serve. Demand for our services and products is significantly affected by the level of commercial and residential construction, capital expenditures for expansions and maintenance of industrial facilities, and the amount of discretionary business and consumer spending, each of which historically has displayed significant cyclicality. Even if demand for our products is not negatively affected, the liquidity and financial position of our customers could impact their ability to pay in full and/or on a timely basis.

Much of the demand for installation of security products and fire detection and suppression solutions is driven by commercial and residential construction and industrial facility expansion and maintenance projects. Commercial and residential construction projects are heavily dependent on general economic conditions, localized demand for commercial and residential real estate and availability of credit. Commercial and residential real estate markets are prone to significant fluctuations in supply and demand. In addition, most commercial and residential real estate developers rely heavily on project financing in order to initiate and complete projects. Declines in real estate values could lead to significant reductions in the availability of project financing, even in markets where demand may otherwise be sufficient to support new construction. These factors could in turn hamper demand for new fire detection and suppression and security installations.

Levels of industrial capital expenditures for facility expansions and maintenance turn on general economic conditions, economic conditions within specific industries we serve, expectations of future market behavior and available financing. Additionally, volatility in commodity prices can negatively affect the level of these activities and can result in postponement of capital spending decisions or the delay or cancellation of existing orders.

The businesses of many of our industrial customers, particularly oil and gas companies, chemical and petrochemical companies, mining and general industrial companies, are to varying degrees cyclical and have experienced periodic downturns. During such economic downturns, customers in these industries historically have tended to delay major capital projects, including greenfield construction, expensive maintenance projects and upgrades. Additionally, demand for our products and services may be affected by volatility in energy and commodity prices and fluctuating demand forecasts, as our customers may be more conservative in their capital planning, which may reduce demand for our products and services. Although our industrial customers tend to be less dependent on project financing than real estate developers, disruptions in financial markets and banking systems could make credit and capital markets difficult for our customers to access, and could raise the cost of new debt for our customers to prohibitive levels. Any difficulty in accessing these markets and the increased associated costs can have a negative effect on investment in large capital projects, including necessary maintenance and upgrades, even during periods of favorable end-market conditions.

Many of our customers outside of the industrial and commercial sectors, including governmental and institutional customers, have experienced budgetary constraints as sources of revenue have been negatively impacted by adverse economic conditions. These budgetary constraints have in the past and may in the future reduce demand for our products and services among governmental and institutional customers.

Reduced demand for our products and services could result in the delay or cancellation of existing orders or lead to excess capacity, which unfavorably impacts our absorption of fixed costs. This reduced demand may also erode average selling prices in the industries we serve. Any of these results could materially and adversely affect our business, financial condition, results of operations and cash flows.

We face competition in each of our businesses, which results in pressure on our profit margins and limits our ability to maintain or increase the market share of our products and services. If we cannot successfully compete in an increasingly global market-place, our operating results may be adversely affected.

We operate in competitive local and international markets and compete with many highly competitive manufacturers and service providers, both locally and on a global basis. Our manufacturing businesses face competition from lower cost manufacturers in Asia and elsewhere and our service businesses face competition from alternative service providers around the world. Currently, key components of our competitive position are our ability to bring to market industry-leading products and services, to adapt to changing competitive environments and to manage expenses successfully. These factors require continuous management focus on maintaining our competitive position through technological innovation, cost reduction, productivity improvement and a regular appraisal of our asset portfolio. If we are unable to maintain our position as a market leader, or to achieve appropriate levels of scalability or cost-effectiveness, or if we are otherwise unable to manage and react to changes in the global marketplace, our business, financial condition, results of operations and cash flows could be materially and adversely affected.

Our future growth is dependent upon our ability to continue to adapt our products, services and organization to meet the demands of local markets in both developed and emerging economies.

Our businesses operate in global markets that are characterized by evolving industry standards. Although many of our largest competitors are also global industrial companies, we compete with thousands of smaller regional and local companies that may be positioned to offer products and services at lower cost than ours, particularly in emerging markets, or to capitalize on highly localized relationships and knowledge that are difficult for us to replicate in a cost effective manner. We have found that in several emerging markets potential customers prefer local suppliers, in some cases because of existing relationships and in other cases because of local legal restrictions or incentives that favor local businesses.

Accordingly, our future success depends upon a number of factors, including our ability to adapt our products, services, organization, workforce and sales strategies to fit localities throughout the world, particularly in high growth emerging markets and to identify emerging technological and other trends in our target end-markets. Adapting our businesses to serve more local markets will require us to invest considerable resources in building our distribution channels and engineering and manufacturing capabilities in those markets to ensure that we can address local customer demand. Even when we invest in growing our business in local markets, we may not be successful for any number of reasons, including competitive pressure from regional and local businesses that may have superior local capabilities or products that are produced more locally at lower cost. As a result, the failure to effectively adapt our products and services to the needs of local markets could significantly reduce our revenues, increase our operating costs or otherwise materially and adversely affect our business, financial condition, results of operations and cash flows.

Our future growth is dependent upon our ability to develop or acquire new technologies that achieve market acceptance with acceptable margins.

Our future success depends on our ability to develop or acquire, manufacture and bring competitive, and increasingly complex, products and services to market quickly and cost-effectively. Our ability to develop or acquire new products and services requires the investment of significant resources. These acquisitions and development efforts divert resources from other potential investments in our businesses, and they may not lead to the development of new technologies, products or services on a timely basis. Moreover, as we introduce new products, we may be unable to detect and correct defects in the design of a product or in its application to a specified use, which could result in loss of sales or delays in market acceptance. Even after introduction, new or enhanced products may not satisfy consumer preferences and product failures may cause consumers to reject our products. As a result, these products may not achieve market acceptance and our brand image could suffer. In addition, the markets for our products and services may not develop or grow as we anticipate. As a result, the failure of our technology, products or services to gain market acceptance, the potential for product defects, product quality issues, or the obsolescence of our products and services could significantly reduce our revenues, increase our operating costs or otherwise materially and adversely affect our business, financial condition, results of operations and cash flows.

We rely on our global direct installation channel for a significant portion of our revenue. Failure to maintain and grow the installed base resulting from direct channel sales could adversely affect our business.

Unlike many of our competitors, we rely on a direct sales channel for a substantial portion of our revenue. The direct channel provides for the installation of fire and security solutions, often using products manufactured by our global products segment. This represents a significant distribution channel for our global products segment, creates a large installed base of Tyco fire and security solutions, and creates opportunities for longer term service and monitoring revenue. If we are unable to maintain or grow this installation business, whether due to changes in economic conditions, a failure to anticipate changing customer needs, a failure to introduce innovative or technologically advanced solutions, or for any other reason, our installation revenue could decline, which could in turn adversely impact our global product pull through and our ability to grow service and monitoring revenue.

We are exposed to greater risks of liability for employee acts or omissions, or system failure, than may be inherent in other businesses.

If a customer or third party believes that he or she has suffered harm to person or property due to an actual or alleged act or omission of one of our employees or a security or fire system failure, he or she may pursue legal action against us, and the cost of defending the legal action and of any judgment could be substantial. In particular, because our products and services are intended to protect lives and real and personal property, we may have greater exposure to litigation risks than businesses that provide other products and services. We could face liability for failure to respond adequately to alarm activations or failure of our fire protection systems to operate as expected. The nature of the services we provide exposes us to the risks that we may be held liable for employee acts or omissions or system failures. In an attempt to reduce this risk, our installation, service and monitoring agreements and other contracts contain provisions limiting our liability in such circumstances, and we typically maintain product liability insurance to mitigate the risk that our products and services fail to operate as expected. However, in the event of litigation, it is possible that contract limitations may be deemed not applicable or unenforceable, that our insurance coverage is not adequate, or that insurance carriers deny coverage of our claims. As a result, such employee acts or omissions or system failures could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We face risks relating to doing business internationally that could adversely affect our business.

Our business operates and serves consumers worldwide. There are certain risks inherent in doing business internationally, including:

| |

• | economic volatility and the impact of economic conditions in various regions; |

| |

• | the difficulty of enforcing agreements, collecting receivables and protecting assets, especially our intellectual property rights, through non-U.S. legal systems; |

| |

• | possibility of unfavorable circumstances from local country laws, regulations or licensing requirements; |

| |

• | fluctuations in revenues, operating margins and other financial measures due to currency exchange rate fluctuations and restrictions on currency and earnings repatriation; |

| |

• | trade protection measures, import or export restrictions, licensing requirements and differing local fire and security codes and standards; |

| |

• | increased costs and risks of developing, staffing and simultaneously managing a number of global operations as a result of distance as well as language and cultural differences; |

| |

• | issues related to occupational safety and adherence to local labor laws and regulations; |

| |

• | potentially adverse tax developments; |

| |

• | changes in the general political, social and economic conditions in the countries where we operate, particularly in emerging markets; |

| |

• | the threat of nationalization and expropriation, as well as new or changed restrictions regarding foreign ownership of assets - in particular with respect to security products or services that may be viewed by certain governments as sovereign security interests; |

| |

• | the presence of corruption in certain countries; and |

| |

• | fluctuations in available municipal funding in those instances where a project is government financed. |

One or more of these factors could adversely affect our business and financial condition.

In order to manage our day-to-day operations, we must overcome cultural and language barriers and assimilate different business practices. In addition, we are required to create compensation programs, employment policies and other administrative programs that comply with laws of multiple countries. We also must communicate and monitor standards and directives across our global network. Our failure to successfully manage our geographically diverse operations could impair our ability to react quickly to changing business and market conditions and to enforce compliance with standards and procedures, any of which could adversely impact our financial condition, results of operations and cash flows.

Volatility in currency exchange rates, commodity prices and interest rates may adversely affect our financial condition, results of operations or cash flows.

A significant portion of our revenue and certain of our costs, assets and liabilities, are denominated in currencies other than the U.S. dollar. Foreign currencies to which we have exposure regularly fluctuate in value relative to the U.S. dollar, which can have the effect of reducing the value of local monetary assets, reduce the U.S. dollar value of local cash flows and potentially reduce the U.S. dollar value of future local net income. Although we routinely enter into forward exchange contracts to economically hedge some of the risks associated with transactions denominated in certain foreign currencies, no assurances can be made that exchange rate fluctuations will not adversely affect our financial condition, results of operations and cash flows.

In addition, we are a large buyer of metals and other non-metal commodities, including fossil fuels for our manufacturing operations and our vehicle fleet, the prices of which have fluctuated significantly in recent years. Increases in the prices of some of these commodities could increase the costs of manufacturing our products and providing our services. We may not be able to pass on these costs to our customers or otherwise effectively manage price volatility and this could have a material adverse effect on our financial condition, results of operations or cash flows. Further, in a declining price environment, our operating margins may contract because we account for inventory primarily using the first-in, first-out method.

We monitor these exposures as an integral part of our overall risk management program. In some cases, we may enter into hedge contracts to insulate our results of operations from these fluctuations. These hedges are subject to the risk that our counterparty may not perform. As a result, changes in currency exchange rates, commodity prices and interest rates could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our business strategy includes acquiring companies and making investments that complement our existing business. These acquisitions and investments could be unsuccessful or consume significant resources, which could adversely affect our operating results.

We will continue to analyze and evaluate the acquisition of strategic businesses, product lines or technologies with the potential to strengthen our industry position or enhance our existing set of product and services offerings. These acquisitions are likely to include businesses in emerging markets, which are often riskier than acquisitions in developed markets. We cannot assure you that we will identify or successfully complete transactions with suitable acquisition candidates in the future. Nor can we assure you that completed acquisitions will be successful.

Acquisitions and investments may involve significant cash expenditures, debt incurrence, operating losses and expenses that could have a material adverse effect on our business, financial condition, results of operations and cash flows. Acquisitions involve numerous other risks, including:

| |

• | diversion of management time and attention from daily operations; |

| |

• | difficulties integrating acquired businesses, technologies and personnel into our business; |

| |

• | inability to obtain required regulatory approvals and/or required financing on favorable terms; |

| |

• | potential loss of key employees, key contractual relationships, or key customers of acquired companies or from our existing businesses; |

| |

• | assumption of the liabilities and exposure to unforeseen liabilities of acquired companies; and |

| |

• | dilution of interests of holders of our common shares through the issuance of equity securities or equity-linked securities. |

It may be difficult for us to complete transactions quickly and to integrate acquired operations efficiently into our current business operations. Moreover, we may be unable to obtain strategic or operational benefits that are expected from our acquisitions. Any acquisitions or investments may ultimately harm our business or financial condition, as such acquisitions may not be successful and may ultimately result in impairment charges.

A significant percentage of our future growth is anticipated to come from emerging markets, and if we are unable to expand our operations in emerging markets, our growth rate could be negatively affected.

One aspect of our growth strategy is to seek significant growth in emerging markets, including China, India, Latin America and the Middle East, through both organic investments and through acquisitions. Emerging markets generally involve greater financial and operational risks than more mature markets, where legal systems are more developed and familiar to us. In some cases, emerging markets have greater political and economic volatility, greater vulnerability to infrastructure and labor disruptions, are more susceptible to corruption, and are locations where it may be more difficult to impose corporate standards and procedures and the extraterritorial laws of the United States. Negative or uncertain political climates and military disruptions in developing and emerging markets could also adversely affect us.

We cannot guarantee that our growth strategy will be successful. If we are unable to manage the risks inherent in our growth strategy in emerging markets, including civil unrest, international hostilities, natural disasters, security breaches and failure to maintain compliance with multiple legal and regulatory systems, our results of operations and ability to grow could be materially adversely affected.

Failure to maintain and upgrade the security of our information and technology networks, including personally identifiable and other information; non-compliance with our contractual or other legal obligations regarding such information; or a violation of the Company's privacy and security policies with respect to such information, could adversely affect us.

We are dependent on information technology networks and systems, including the Internet, to process, transmit and store electronic information. In the normal course of our business, we collect and retain significant volumes of certain types of personally identifiable and other information pertaining to our customers, stockholders and employees, including video and other customer data obtained in connection with monitoring and analytical services. The legal, regulatory and contractual environment surrounding information security and privacy is constantly evolving and companies that collect and retain such information are under increasing attack by cyber-criminals around the world. A significant actual or potential theft, loss, fraudulent use or misuse of customer, stockholder, employee or our data, whether by third parties or as a result of employee malfeasance or otherwise, non-compliance with our contractual or other legal obligations regarding such data or a violation of our privacy and security policies with respect to such data could adversely impact our reputation and could result in significant costs, fines, litigation or regulatory action against us. In addition, we depend on our information technology infrastructure for business-to-business and business-to-consumer electronic commerce. Security breaches of this infrastructure can create system disruptions and shutdowns that could result in disruptions to our operations. Increasingly, our products and services make use of wireless technologies and are accessed through the Internet, and security breaches in connection with the delivery of our services wirelessly or via the Internet may affect us and could be detrimental to our reputation, business, operating results and financial condition. We cannot be certain that advances in criminal capabilities, new discoveries in the field of cryptography or other developments will not compromise or breach the technology protecting the networks that access our products and services.

Failure to maintain, upgrade and consolidate our information and technology networks could adversely affect us.

We are continuously upgrading and consolidating our systems, including making changes to legacy systems, replacing legacy systems with successor systems with new functionality, acquiring new systems with new functionality and moving to cloud-based technology solutions. These types of activities subject us to inherent costs and risks associated with replacing and changing these systems, including impairment of our ability to fulfill customer orders, potential disruption of our internal control structure, substantial capital expenditures, additional administration and operating expenses, retention of sufficiently skilled personnel to implement and operate the new systems, demands on management time, and other risks and costs of delays or difficulties in transitioning to new systems or of integrating new systems into our current systems. Our system implementations may not result in productivity improvements at a level that outweighs the costs of implementation, or at all. In addition, the implementation of new technology systems may cause disruptions in our business operations and have an adverse effect on our business and operations, if not anticipated and appropriately mitigated.

If we cannot obtain sufficient quantities of materials, components and equipment required for our manufacturing activities at competitive prices and quality and on a timely basis, or if our manufacturing capacity does not meet demand, our financial condition, results of operations and cash flows may suffer.

We purchase materials, components and equipment from unrelated parties for use in our manufacturing operations. If we cannot obtain sufficient quantities of these items at competitive prices and quality and on a timely basis, we may not be able to produce sufficient quantities of product to satisfy market demand, product shipments may be delayed or our material or manufacturing costs may increase. In addition, because we cannot always immediately adapt our cost structures to changing market conditions, our manufacturing capacity may at times exceed or fall short of our production requirements. Any of these problems could result in the loss of customers, provide an opportunity for competing products to gain market acceptance and otherwise materially and adversely affect our business, financial condition, results of operations and cash flows.

Failure to attract, motivate, train and retain qualified personnel could adversely affect our business.

Our culture and guiding principles focus on continuously training, motivating and developing employees, and in particular we strive to attract, motivate, train and retain qualified engineers and managers to handle the day-to-day operations of a highly diversified organization. Many of our manufacturing processes, and many of the integrated solutions we offer, are highly technical in nature. Our ability to expand or maintain our business depends on our ability to hire, train and retain engineers and other technical professionals with the skills necessary to understand and adapt to the continuously developing needs of our customers. This includes developing talent and leadership capabilities in emerging markets, where the depth of skilled employees is often limited and competition for resources is intense. Our geographic expansion strategy in emerging markets depends on our ability to attract, retain and integrate qualified managers and engineers. If we fail to attract, motivate, train and retain qualified personnel, or if we experience excessive turnover, we may experience declining sales, manufacturing delays or other inefficiencies, increased recruiting, training and relocation costs and other difficulties, and our business, financial condition, results of operations and cash flows could be materially and adversely affected.

We may be required to recognize substantial impairment charges in the future.

Pursuant to accounting principles generally accepted in the United States, we are required to assess our goodwill, intangibles and other long-lived assets periodically to determine whether they are impaired. Disruptions to our business, unfavorable end-market conditions and protracted economic weakness, unexpected significant declines in operating results of reporting units, divestitures and market capitalization declines may result in material charges for goodwill and other asset impairments. We maintain significant goodwill and intangible assets on our balance sheet, and we believe these balances are recoverable. However, fair value determinations require considerable judgment and are sensitive to change. Impairments to one or more of our reporting units could occur in future periods whether or not connected with the annual impairment analysis. Future impairment charges could materially affect our reported earnings in the periods of such charges and could adversely affect our financial condition and results of operations.

Our residential and commercial security businesses may experience higher rates of customer attrition, which may reduce our future revenue and cause us to change the estimated useful lives of assets related to our security monitoring customers, increasing our depreciation and amortization expense.

If our residential or commercial security customers are dissatisfied with our products or services and switch to competitive products or services, or disconnect for other reasons, our recurring revenue and results of operations may be materially adversely affected. The risk is more pronounced in times of economic uncertainty, as customers may reduce amounts spent on the products and services we provide. We amortize the costs of acquired monitoring contracts and related customer relationships based on the estimated life of the customer relationships. Internally generated residential and commercial pools are similarly depreciated. If customer disconnect rates were to rise significantly, we may be required to accelerate the depreciation and amortization of subscriber system assets and intangible assets, which could cause a material adverse effect on our financial condition or results of operations.

Divestitures of some of our businesses or product lines may materially adversely affect our financial condition, results of operations or cash flows.

We continually evaluate the performance of all of our businesses and may sell businesses or product lines. Divestitures involve risks, including difficulties in the separation of operations, services, products and personnel, the diversion of management's attention from other business concerns, the disruption of our business, the potential loss of key employees and the retention of uncertain environmental or other contingent liabilities related to the divested business. In addition, divestitures may result in significant asset impairment charges, including those related to goodwill and other intangible assets, which could have a material adverse effect on our financial condition and results of operations. We cannot assure you that we will be successful in managing these or any other significant risks that we encounter in divesting a business or product line, and any

divestiture we undertake could materially and adversely affect our business, financial condition, results of operations and cash flows.

Our business may be adversely affected by work stoppages, union negotiations, labor disputes and other matters associated with our labor force.

We employ approximately 57,000 people worldwide. Approximately 16% of these employees are covered by collective bargaining agreements or works council. Although we believe that our relations with the labor unions and works councils that represent our employees are generally good and we have experienced no material strikes or work stoppages recently, no assurances can be made that we will not experience in the future these and other types of conflicts with labor unions, works council, other groups representing employees or our employees generally, or that any future negotiations with our labor unions will not result in significant increases in our cost of labor. Additionally, a work stoppage at one of our suppliers could materially and adversely affect our operations if an alternative source of supply were not readily available. Stoppages by employees of our customers could also result in reduced demand for our products.

A material disruption of our operations, particularly at our monitoring and/or manufacturing facilities, could adversely affect our business.

If our operations, particularly at our monitoring facilities and/or manufacturing facilities, were to be disrupted as a result of significant equipment failures, natural disasters, power outages, fires, explosions, terrorism, sabotage, adverse weather conditions, public health crises, labor disputes or other reasons, we may be unable to effectively respond to alarm signals, fill customer orders and otherwise meet obligations to or demand from our customers, which could adversely affect our financial performance.

Interruptions in production could increase our costs and reduce our sales. Any interruption in production capability could require us to make substantial capital expenditures or purchase alternative material at higher costs to fill customer orders, which could negatively affect our profitability and financial condition. We maintain property damage insurance that we believe to be adequate to provide for reconstruction of facilities and equipment, as well as business interruption insurance to mitigate losses resulting from any production interruption or shutdown caused by an insured loss. However, any recovery under our insurance policies may not offset the lost sales or increased costs that may be experienced during the disruption of operations, which could adversely affect our business, financial condition, results of operations and cash flow.

We may be unable to execute on our strategic priorities.

Following the spin-offs of our former North American residential and small business security business and flow control businesses in September 2012, we began implementing a multi-year strategy focused on transitioning the Company from a holding company to an operating company emphasizing growth through innovation. In connection with this strategic shift, we anticipated certain financial, operational, managerial and other benefits to Tyco, including certain productivity and other strategic initiatives intended to reduce complexity, restructure operations and leverage Tyco’s scale in certain areas such as sourcing. We may not be able to achieve the anticipated results of these actions on the scale that we expected, and the anticipated benefits of the productivity and other strategic initiatives may not be fully realized.

We do not own the right to use the ADT® brand name in the United States and Canada.

As a result of the 2012 Separation, we own the ADT® brand name in jurisdictions outside of the United States and Canada, and The ADT Corporation owns the brand name in the United States and Canada. Although we have entered agreements with ADT designed to protect the value of the ADT® brand, we cannot assure you that actions taken by ADT will not negatively impact the value of the brand outside of the United States and Canada. These factors expose us to the risk that the ADT® brand name could suffer reputational damage or devaluation for reasons outside of our control, including ADT's business conduct in the United States and Canada. Any of these factors may materially and adversely affect our business, financial condition, results of operations and cash flows.

Risks Related to Legal, Regulatory and Compliance Matters

We are subject to a variety of claims and litigation that could cause a material adverse effect on our financial condition, results of operations and cash flows.

In the normal course of our business, we are subject to claims and lawsuits, including from time to time claims for damages related to product liability and warranties, litigation alleging the infringement of intellectual property rights, litigation alleging anti-competitive behavior, and litigation related to employee matters, wages and commercial disputes. In certain circumstances, patent infringement and anti-trust laws permit successful plaintiffs to recover treble damages. Furthermore, we face exposure to product liability claims in the event that any of our products results in personal injury or property damage.

The defense of these lawsuits may involve significant expense and diversion of our management's attention. In addition, we may be required to pay damage awards or settlements, become subject to injunctions or other equitable remedies or suffer from adverse publicity that could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We are subject to product liability claims relating to products we manufacture or install. These claims could result in significant costs and liabilities and reduce our profitability.

We face exposure to product liability claims in the event that any of our products results in personal injury or property damage. In addition, if any of our products prove to be defective, we may be required to recall or redesign such products, which could result in significant unexpected costs. Any insurance we maintain may not be available on terms acceptable to us, such coverage may not be adequate for liabilities actually incurred, and our insurance carriers may deny coverage for claims made by us. Any claim or product recall could result in adverse publicity against us, which could adversely affect our financial condition, results of operations or cash flows.

In addition, we could face liability for failure to respond adequately to alarm activations or failure of our fire protection systems to operate as expected. The nature of the services we provide exposes us to the risks that we may be held liable for employee acts or omissions or system failures. In an attempt to reduce this risk, our alarm monitoring agreements and other contracts contain provisions limiting our liability in such circumstances. We cannot provide assurance, however, that these limitations will be enforced. Losses from such litigation could be material to our financial condition, results of operations or cash flows.

Our businesses operate in regulated industries and are subject to a variety of complex and continually changing laws and regulations.

Our operations and employees are subject to various U.S. federal, state and local licensing laws, fire and security codes and standards and other laws and regulations. In certain jurisdictions, we are required to obtain licenses or permits to comply with standards governing employee selection and training and to meet certain standards in the conduct of our business. The loss of such licenses, or the imposition of conditions to the granting or retention of such licenses, could have a material adverse effect on us. Furthermore, our systems generally must meet fire and building codes in order to be installed, and it is possible that our current or future products will fail to meet such codes, which could require us to make costly modifications to our products or to forgo marketing in certain jurisdictions.

Changes in laws or regulations could require us to change the way we operate or to utilize resources to maintain compliance, which could increase costs or otherwise disrupt operations. In addition, failure to comply with any applicable laws or regulations could result in substantial fines or revocation of our operating permits and licenses. If laws and regulations were to change or if we or our products failed to comply, our business, financial condition and results of operations could be materially and adversely affected.

Due to the international scope of our operations, the system of laws and regulations to which we are subject is complex and includes regulations issued by the U.S. Customs and Border Protection, the U.S. Department of Commerce's Bureau of Industry and Security, the U.S. Treasury Department's Office of Foreign Assets Control and various non U.S. governmental agencies, including applicable export controls, customs, currency exchange control and transfer pricing regulations, and laws regulating the foreign ownership of assets. No assurances can be made that we will continue to be found to be operating in compliance with, or be able to detect violations of, any such laws or regulations. In addition, we cannot predict the nature, scope or effect of future regulatory requirements to which our international operations might be subject or the manner in which existing laws might be administered or interpreted.

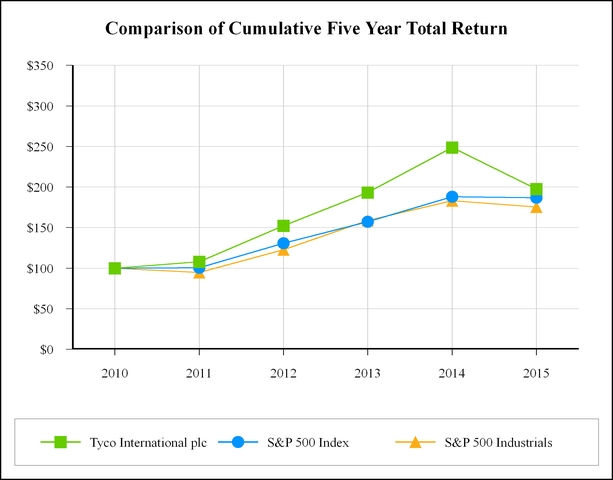

We could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act and similar anti-bribery laws outside the United States.