UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05567

MFS INTERMEDIATE HIGH INCOME FUND

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: November 30

Date of reporting period: November 30, 2021

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| Item 1(a): | |

Income Fund

Income Fund

|

|

1 |

|

|

2 |

|

|

4 |

|

|

6 |

|

|

8 |

|

|

18 |

|

|

19 |

|

|

20 |

|

|

21 |

|

|

35 |

|

|

36 |

|

|

38 |

|

|

39 |

|

|

40 |

|

|

42 |

|

|

54 |

|

|

56 |

|

|

57 |

|

|

61 |

|

|

65 |

|

|

65 |

|

|

65 |

|

|

65 |

|

|

65 |

|

|

66 |

|

|

back cover |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities and fixed income derivatives that have not been rated by any rating agency. Non-Fixed Income includes equity securities (including convertible bonds and equity derivatives) and/or commodity-linked derivatives. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

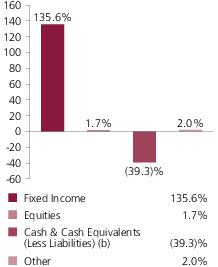

| (b) | Cash & Cash Equivalents (Less Liabilities) includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Liabilities include the value of outstanding borrowings made by the fund for leverage transactions. Cash & Cash Equivalents (Less Liabilities) is negative due to these borrowings. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities. Please see Note 6 in the Notes to Financial Statements for more information on the fund's outstanding borrowings. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (m) | In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening device (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

David Cole and Michael Skatrud

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value. |

| (r) | Securities rated “BBB”, “Baa”, or higher are considered investment grade; securities rated “BB”, “Ba”, or below are considered non-investment grade. Ratings are assigned to underlying securities utilizing ratings from Moody's, Fitch, and Standard & Poor's and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). For securities that are not rated by any of the rating agencies, the security is considered Not Rated. |

| (y) | A yield curve graphically depicts the yields of different maturity bonds of the same credit quality and type; a normal yield curve is upward sloping, with short-term rates lower than long-term rates. |

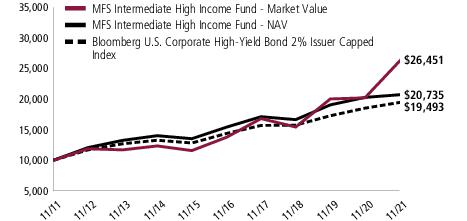

| Inception Date | 1-yr | 5-yr | 10-yr | |

| Market Value (r) | 7/21/88 | 30.89% | 13.98% | 10.22% |

| Net Asset Value (r) | 7/21/88 | 2.25% | 6.11% | 7.56% |

| Bloomberg U.S. Corporate High-Yield Bond 2% Issuer Capped Index (f) | 5.27% | 6.27% | 6.90% |

| (f) | Source: FactSet Research Systems Inc. |

| (r) | Includes reinvestment of all distributions. Market value references New York Stock Exchange Price. |

| (a) | Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith. |

| (1) | borrow money except to the extent not prohibited by the 1940 Act and exemptive orders granted under such Act. |

| (2) | underwrite securities issued by other persons, except that all or any portion of the assets of the Fund may be invested in one or more investment companies, to the extent not prohibited by the 1940 Act and exemptive orders granted under such Act, and except insofar as the Fund may technically be deemed an underwriter under the Securities Act of 1933, as amended, in selling a portfolio security. |

| (3) | issue any senior securities except to the extent not prohibited by the 1940 Act and exemptive orders granted under such Act. For purposes of this restriction, collateral arrangements with respect to any type of swap, option, Forward Contracts and Futures Contracts and collateral arrangements with respect to initial and variation margin are not deemed to be the issuance of a senior security. |

| (4) | make loans except to the extent not prohibited by the 1940 Act and exemptive orders granted under such Act. |

| (5) | purchase or sell real estate (excluding securities secured by real estate or interests therein and securities of companies, such as real estate investment trusts, which deal in real estate or interests therein), interests in oil, gas or mineral leases, commodities or commodity contacts (excluding currencies and any type of option, Futures Contracts and Forward Contracts or other derivative instruments whose value is related to commodities or other commodity contracts) in the ordinary course of its business. The Fund reserves the freedom of action to hold and to sell real estate, mineral leases, commodities or commodity contracts (including currencies and any type of option, Futures Contracts and Forward Contracts) acquired as a result of the ownership of securities. |

| (6) | purchase any securities of an issuer in a particular industry if as a result 25% or more of its total assets (taken at market value at the time of purchase) would be invested in securities of issuers whose principal business activities are in the same industry. |

| Line of Credit Borrowings as a Percentage of Total Assets (Including Assets Attributable to Leverage) | 29.16% | ||||

| Estimated Annual Effective Rate of Interest Expense on Line of Credit Borrowings | 0.70% | ||||

| Annual Return Fund Portfolio Must Experience (net of expenses) to Cover Estimated Annual Effective Interest Expense on Line of Credit Borrowings | 0.20% | ||||

| Assumed Return on Portfolio (Net of Expenses) | -10.00% | -5.00% | 0.00% | 5.00% | 10.00% |

| Corresponding Return to Shareholder | -14.41% | -7.35% | -0.29% | 6.77% | 13.83% |

| Portfolio Manager | Primary Role | Since | Title and Five Year History |

| David Cole | Portfolio Manager | 2007 | Investment Officer of MFS; employed in the investment management area of MFS since 2004. |

| Michael Skatrud | Portfolio Manager | 2018 | Investment Officer of MFS; employed in the investment management area of MFS since 2013. |

| Issuer | Shares/Par | Value ($) | ||

| Bonds – 135.8% | ||||

| Aerospace & Defense – 3.2% | ||||

| Bombardier, Inc., 7.5%, 3/15/2025 (n) | $ | 143,000 | $ 145,747 | |

| Bombardier, Inc., 7.125%, 6/15/2026 (n) | 137,000 | 141,453 | ||

| F-Brasile S.p.A./F-Brasile U.S. LLC, 7.375%, 8/15/2026 (n) | 200,000 | 196,000 | ||

| Moog, Inc., 4.25%, 12/15/2027 (n) | 285,000 | 289,467 | ||

| TransDigm, Inc., 6.25%, 3/15/2026 (n) | 200,000 | 207,500 | ||

| TransDigm, Inc., 6.375%, 6/15/2026 | 185,000 | 190,319 | ||

| TransDigm, Inc., 5.5%, 11/15/2027 | 140,000 | 140,898 | ||

| TransDigm, Inc., 4.625%, 1/15/2029 | 132,000 | 126,460 | ||

| $1,437,844 | ||||

| Automotive – 3.7% | ||||

| Dana, Inc., 5.375%, 11/15/2027 | $ | 143,000 | $ 149,256 | |

| Dana, Inc., 5.625%, 6/15/2028 | 47,000 | 49,468 | ||

| Dana, Inc., 4.25%, 9/01/2030 | 95,000 | 94,406 | ||

| Dornoch Debt Merger Sub Inc., 6.625%, 10/15/2029 (n) | 120,000 | 118,200 | ||

| Ford Motor Co., 5.113%, 5/03/2029 | 210,000 | 232,491 | ||

| Ford Motor Co., 4.75%, 1/15/2043 | 155,000 | 165,850 | ||

| IAA Spinco, Inc., 5.5%, 6/15/2027 (n) | 200,000 | 207,640 | ||

| Panther BR Aggregator 2 LP/Panther Finance Co., Inc., 8.5%, 5/15/2027 (n) | 285,000 | 299,962 | ||

| PM General Purchaser LLC, 9.5%, 10/01/2028 (n) | 90,000 | 92,148 | ||

| Real Hero Merger Sub 2, Inc., 6.25%, 2/01/2029 (n) | 130,000 | 130,398 | ||

| Wheel Pros, Inc., 6.5%, 5/15/2029 (n) | 120,000 | 116,909 | ||

| $1,656,728 | ||||

| Broadcasting – 4.6% | ||||

| Advantage Sales & Marketing, Inc., 6.5%, 11/15/2028 (n) | $ | 185,000 | $ 189,300 | |

| Gray Escrow II, Inc., 5.375%, 11/15/2031 (n) | 305,000 | 305,653 | ||

| iHeartCommunications, Inc., 8.375%, 5/01/2027 | 175,000 | 184,126 | ||

| Nexstar Escrow Corp., 5.625%, 7/15/2027 (n) | 120,000 | 124,500 | ||

| Scripps Escrow II, Inc., 5.875%, 7/15/2027 (n) | 240,000 | 246,228 | ||

| Summer (BC) Bidco B LLC, 5.5%, 10/31/2026 (n) | 200,000 | 201,500 | ||

| Summer (BC) Holdco S.à r.l., “A”, 9.25%, 10/31/2027 | EUR | 90,105 | 109,750 | |

| Univision Communications, Inc., 4.5%, 5/01/2029 (n) | $ | 355,000 | 354,755 | |

| WMG Acquisition Corp., 3.875%, 7/15/2030 (n) | 340,000 | 340,850 | ||

| $2,056,662 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Brokerage & Asset Managers – 1.8% | ||||

| Aretec Escrow Issuer, Inc., 7.5%, 4/01/2029 (n) | $ | 120,000 | $ 123,900 | |

| LPL Holdings, Inc., 4.625%, 11/15/2027 (n) | 265,000 | 271,625 | ||

| LPL Holdings, Inc., 4%, 3/15/2029 (n) | 191,000 | 191,800 | ||

| NFP Corp., 4.875%, 8/15/2028 (n) | 155,000 | 152,675 | ||

| NFP Corp., 6.875%, 8/15/2028 (n) | 65,000 | 64,396 | ||

| $804,396 | ||||

| Building – 4.7% | ||||

| ABC Supply Co., Inc., 4%, 1/15/2028 (n) | $ | 405,000 | $ 408,544 | |

| GYP Holding III Corp., 4.625%, 5/01/2029 (n) | 240,000 | 235,596 | ||

| Interface, Inc., 5.5%, 12/01/2028 (n) | 205,000 | 213,456 | ||

| New Enterprise Stone & Lime Co., Inc., 5.25%, 7/15/2028 (n) | 95,000 | 94,763 | ||

| New Enterprise Stone & Lime Co., Inc., 9.75%, 7/15/2028 (n) | 109,000 | 116,651 | ||

| Park River Holdings, Inc., 5.625%, 2/01/2029 (n) | 135,000 | 127,912 | ||

| Patrick Industries, Inc., 7.5%, 10/15/2027 (n) | 200,000 | 212,000 | ||

| SRM Escrow Issuer LLC, 6%, 11/01/2028 (n) | 190,000 | 196,616 | ||

| SRS Distribution, Inc., 6.125%, 7/01/2029 (n) | 140,000 | 140,350 | ||

| Standard Industries, Inc., 4.375%, 7/15/2030 (n) | 206,000 | 202,652 | ||

| Standard Industries, Inc., 3.375%, 1/15/2031 (n) | 40,000 | 36,850 | ||

| White Cap Buyer LLC, 6.875%, 10/15/2028 (n) | 140,000 | 142,800 | ||

| $2,128,190 | ||||

| Business Services – 3.7% | ||||

| Ascend Learning LLC, 6.875%, 8/01/2025 (n) | $ | 130,000 | $ 132,344 | |

| Austin BidCo, Inc., 7.125%, 12/15/2028 (n) | 115,000 | 118,050 | ||

| HealthEquity, Inc., 4.5%, 10/01/2029 (n) | 185,000 | 182,687 | ||

| Iron Mountain, Inc., 5.25%, 3/15/2028 (n) | 100,000 | 102,750 | ||

| Iron Mountain, Inc., 5.25%, 7/15/2030 (n) | 130,000 | 132,495 | ||

| Iron Mountain, Inc., REIT, 4.875%, 9/15/2027 (n) | 175,000 | 177,496 | ||

| Nielsen Finance LLC, 4.5%, 7/15/2029 (n) | 205,000 | 198,243 | ||

| Paysafe Finance PLC, 4%, 6/15/2029 (z) | 185,000 | 170,663 | ||

| Switch Ltd., 3.75%, 9/15/2028 (n) | 235,000 | 232,650 | ||

| Switch Ltd., 4.125%, 6/15/2029 (n) | 70,000 | 70,317 | ||

| Verscend Escrow Corp., 9.75%, 8/15/2026 (n) | 150,000 | 157,529 | ||

| $1,675,224 | ||||

| Cable TV – 11.4% | ||||

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.75%, 3/01/2030 (n) | $ | 575,000 | $ 589,162 | |

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.5%, 8/15/2030 (n) | 150,000 | 151,192 | ||

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.25%, 2/01/2031 (n) | 240,000 | 236,422 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Cable TV – continued | ||||

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.25%, 1/15/2034 (n) | $ | 155,000 | $ 149,110 | |

| CSC Holdings LLC, 5.375%, 2/01/2028 (n) | 200,000 | 204,250 | ||

| CSC Holdings LLC, 5.75%, 1/15/2030 (n) | 400,000 | 391,752 | ||

| CSC Holdings LLC, 4.125%, 12/01/2030 (n) | 200,000 | 191,394 | ||

| DISH DBS Corp., 7.75%, 7/01/2026 | 80,000 | 82,200 | ||

| DISH DBS Corp., 5.25%, 12/01/2026 (n) | 150,000 | 148,561 | ||

| DISH DBS Corp., 5.125%, 6/01/2029 | 135,000 | 118,550 | ||

| Intelsat Jackson Holdings S.A., 5.5%, 8/01/2023 (a)(d) | 130,000 | 63,050 | ||

| Intelsat Jackson Holdings S.A., 9.75%, 7/15/2025 (a)(d)(z) | 90,000 | 44,100 | ||

| LCPR Senior Secured Financing DAC, 6.75%, 10/15/2027 (n) | 200,000 | 207,348 | ||

| Sirius XM Holdings, Inc., 3.875%, 9/01/2031 (n) | 230,000 | 217,925 | ||

| Sirius XM Radio, Inc., 4%, 7/15/2028 (n) | 228,000 | 225,435 | ||

| Sirius XM Radio, Inc., 5.5%, 7/01/2029 (n) | 390,000 | 413,689 | ||

| Telenet Finance Luxembourg S.A., 5.5%, 3/01/2028 (n) | 400,000 | 412,200 | ||

| Videotron Ltd., 5.375%, 6/15/2024 (n) | 20,000 | 21,381 | ||

| Videotron Ltd., 5.125%, 4/15/2027 (n) | 400,000 | 410,476 | ||

| Virgin Media Finance PLC, 5%, 7/15/2030 (n) | 225,000 | 218,250 | ||

| Virgin Media Vendor Financing Notes IV DAC, 5%, 7/15/2028 (n) | 225,000 | 221,733 | ||

| Ziggo Bond Finance B.V., 5.125%, 2/28/2030 (n) | 400,000 | 399,542 | ||

| $5,117,722 | ||||

| Chemicals – 3.2% | ||||

| Axalta Coating Systems Ltd., 4.75%, 6/15/2027 (n) | $ | 150,000 | $ 155,017 | |

| Axalta Coating Systems Ltd., 3.375%, 2/15/2029 (n) | 170,000 | 161,526 | ||

| Consolidated Energy Finiance S.A., 5.625%, 10/15/2028 (n) | 188,000 | 179,181 | ||

| Element Solutions, Inc., 3.875%, 9/01/2028 (n) | 213,000 | 210,870 | ||

| Herens Holdco S.à r.l., 4.75%, 5/15/2028 (n) | 200,000 | 194,500 | ||

| Ingevity Corp., 3.875%, 11/01/2028 (n) | 230,000 | 220,292 | ||

| LSF11 A5 HoldCo LLC, 6.625%, 10/15/2029 (n) | 120,000 | 116,850 | ||

| S.P.C.M. S.A., 3.125%, 3/15/2027 (n) | 200,000 | 195,500 | ||

| $1,433,736 | ||||

| Computer Software – 1.4% | ||||

| Camelot Finance S.A., 4.5%, 11/01/2026 (n) | $ | 165,000 | $ 171,187 | |

| Clarivate Science Holdings Corp., 4.875%, 7/01/2029 (n) | 215,000 | 210,539 | ||

| PTC, Inc., 3.625%, 2/15/2025 (n) | 160,000 | 160,800 | ||

| PTC, Inc., 4%, 2/15/2028 (n) | 95,000 | 95,475 | ||

| $638,001 | ||||

| Computer Software - Systems – 2.1% | ||||

| Fair Isaac Corp., 5.25%, 5/15/2026 (n) | $ | 385,000 | $ 423,019 | |

| Fair Isaac Corp., 4%, 6/15/2028 (n) | 36,000 | 35,910 | ||

| SS&C Technologies Holdings, Inc., 5.5%, 9/30/2027 (n) | 250,000 | 259,844 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Computer Software - Systems – continued | ||||

| Viavi Solutions, Inc., 3.75%, 10/01/2029 (n) | $ | 235,000 | $ 229,712 | |

| $948,485 | ||||

| Conglomerates – 4.5% | ||||

| Amsted Industries Co., 5.625%, 7/01/2027 (n) | $ | 255,000 | $ 263,288 | |

| BWX Technologies, Inc., 4.125%, 6/30/2028 (n) | 58,000 | 58,000 | ||

| BWX Technologies, Inc., 4.125%, 4/15/2029 (n) | 300,000 | 299,899 | ||

| EnerSys, 4.375%, 12/15/2027 (n) | 55,000 | 56,650 | ||

| Gates Global LLC, 6.25%, 1/15/2026 (n) | 165,000 | 169,125 | ||

| Granite Holdings U.S. Acquisition Co., 11%, 10/01/2027 (n) | 135,000 | 146,745 | ||

| Griffon Corp., 5.75%, 3/01/2028 | 223,000 | 229,829 | ||

| Madison IAQ LLC, 5.875%, 6/30/2029 (n) | 160,000 | 153,928 | ||

| Stevens Holding Co., Inc., 6.125%, 10/01/2026 (n) | 200,000 | 214,000 | ||

| TriMas Corp., 4.125%, 4/15/2029 (n) | 432,000 | 432,000 | ||

| $2,023,464 | ||||

| Construction – 2.3% | ||||

| Empire Communities Corp., 7%, 12/15/2025 (n) | $ | 145,000 | $ 148,550 | |

| Mattamy Group Corp., 5.25%, 12/15/2027 (n) | 95,000 | 98,646 | ||

| Mattamy Group Corp., 4.625%, 3/01/2030 (n) | 155,000 | 153,653 | ||

| Shea Homes LP/Shea Homes Funding Corp., 4.75%, 2/15/2028 (n) | 235,000 | 234,412 | ||

| Taylor Morrison Communities, Inc., 5.75%, 1/15/2028 (n) | 110,000 | 120,619 | ||

| Taylor Morrison Communities, Inc., 5.125%, 8/01/2030 (n) | 100,000 | 107,250 | ||

| Weekley Homes LLC/Weekley Finance Corp., 4.875%, 9/15/2028 (n) | 181,000 | 186,309 | ||

| $1,049,439 | ||||

| Consumer Products – 1.6% | ||||

| Mattel, Inc., 3.375%, 4/01/2026 (n) | $ | 147,000 | $ 149,211 | |

| Mattel, Inc., 5.875%, 12/15/2027 (n) | 109,000 | 116,085 | ||

| Mattel, Inc., 5.45%, 11/01/2041 | 55,000 | 64,824 | ||

| Prestige Consumer Healthcare, Inc., 5.125%, 1/15/2028 (n) | 175,000 | 181,563 | ||

| Prestige Consumer Healthcare, Inc., 3.75%, 4/01/2031 (n) | 80,000 | 76,650 | ||

| SWF Escrow Issuer Corp., 6.5%, 10/01/2029 (n) | 155,000 | 148,800 | ||

| $737,133 | ||||

| Consumer Services – 5.1% | ||||

| Allied Universal Holdco LLC, 6.625%, 7/15/2026 (n) | $ | 59,000 | $ 60,634 | |

| Allied Universal Holdco LLC, 9.75%, 7/15/2027 (n) | 180,000 | 188,550 | ||

| ANGI Group LLC, 3.875%, 8/15/2028 (n) | 210,000 | 199,466 | ||

| Arches Buyer, Inc., 6.125%, 12/01/2028 (n) | 175,000 | 176,698 | ||

| Garda World Security Corp., 4.625%, 2/15/2027 (n) | 75,000 | 73,313 | ||

| GoDaddy, Inc., 3.5%, 3/01/2029 (n) | 328,000 | 311,954 | ||

| GW B-CR Security Corp., 9.5%, 11/01/2027 (n) | 131,000 | 136,533 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Consumer Services – continued | ||||

| Match Group Holdings II LLC, 3.625%, 10/01/2031 (n) | $ | 15,000 | $ 14,141 | |

| Match Group, Inc., 5%, 12/15/2027 (n) | 185,000 | 192,863 | ||

| Match Group, Inc., 4.625%, 6/01/2028 (n) | 235,000 | 238,527 | ||

| Match Group, Inc., 4.125%, 8/01/2030 (n) | 65,000 | 64,431 | ||

| Realogy Group LLC, 9.375%, 4/01/2027 (n) | 145,000 | 156,536 | ||

| Realogy Group LLC, 5.75%, 1/15/2029 (n) | 90,000 | 91,013 | ||

| TriNet Group, Inc., 3.5%, 3/01/2029 (n) | 278,000 | 274,664 | ||

| WASH Multifamily Acquisition, Inc., 5.75%, 4/15/2026 (n) | 120,000 | 123,600 | ||

| $2,302,923 | ||||

| Containers – 2.7% | ||||

| Ardagh Metal Packaging, 4%, 9/01/2029 (n) | $ | 200,000 | $ 193,930 | |

| Ardagh Packaging Finance PLC/Ardagh MP Holdings USA, Inc., 5.25%, 8/15/2027 (n) | 255,000 | 249,900 | ||

| Can-Pack S.A., 3.875%, 11/15/2029 (n) | 275,000 | 267,437 | ||

| Crown Americas LLC/Crown Americas Capital Corp. V, 4.25%, 9/30/2026 | 250,000 | 263,125 | ||

| Crown Americas LLC/Crown Americas Capital Corp. VI, 4.75%, 2/01/2026 | 45,000 | 46,208 | ||

| Greif, Inc., 6.5%, 3/01/2027 (n) | 165,000 | 171,386 | ||

| $1,191,986 | ||||

| Electrical Equipment – 0.6% | ||||

| CommScope Technologies LLC, 5%, 3/15/2027 (n) | $ | 285,000 | $ 255,904 | |

| Electronics – 2.7% | ||||

| Diebold Nixdorf, Inc., 8.5%, 4/15/2024 | $ | 65,000 | $ 64,160 | |

| Diebold Nixdorf, Inc., 9.375%, 7/15/2025 (n) | 106,000 | 112,508 | ||

| Entegris, Inc., 4.375%, 4/15/2028 (n) | 75,000 | 76,406 | ||

| Entegris, Inc., 3.625%, 5/01/2029 (n) | 160,000 | 158,800 | ||

| Sensata Technologies B.V., 5.625%, 11/01/2024 (n) | 140,000 | 152,600 | ||

| Sensata Technologies B.V., 5%, 10/01/2025 (n) | 285,000 | 308,461 | ||

| Sensata Technologies, Inc., 4.375%, 2/15/2030 (n) | 125,000 | 129,650 | ||

| Synaptics, Inc., 4%, 6/15/2029 (n) | 215,000 | 217,150 | ||

| $1,219,735 | ||||

| Energy - Independent – 5.5% | ||||

| Apache Corp., 5.35%, 7/01/2049 | $ | 65,000 | $ 74,110 | |

| Ascent Resources Utica Holdings LLC/ARU Finance Corp., 7%, 11/01/2026 (n) | 65,000 | 65,975 | ||

| Callon Petroleum Co., 6.125%, 10/01/2024 | 90,000 | 86,625 | ||

| Callon Petroleum Co., 8%, 8/01/2028 (n) | 80,000 | 78,322 | ||

| CNX Resources Corp., 6%, 1/15/2029 (n) | 215,000 | 220,003 | ||

| Comstock Resources, Inc., 6.75%, 3/01/2029 (n) | 155,000 | 161,200 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Energy - Independent – continued | ||||

| Encino Acquisition Partners Holdings LLC, 8.5%, 5/01/2028 (n) | $ | 100,000 | $ 100,750 | |

| EQT Corp., 3.125%, 5/15/2026 (n) | 30,000 | 29,981 | ||

| EQT Corp., 5%, 1/15/2029 | 158,000 | 173,010 | ||

| Murphy Oil Corp., 5.875%, 12/01/2027 | 65,000 | 66,163 | ||

| Occidental Petroleum Corp., 5.875%, 9/01/2025 | 165,000 | 177,375 | ||

| Occidental Petroleum Corp., 5.5%, 12/01/2025 | 160,000 | 171,074 | ||

| Occidental Petroleum Corp., 6.625%, 9/01/2030 | 160,000 | 191,947 | ||

| Occidental Petroleum Corp., 6.45%, 9/15/2036 | 80,000 | 99,339 | ||

| Occidental Petroleum Corp., 6.6%, 3/15/2046 | 115,000 | 146,378 | ||

| Ovintiv, Inc., 6.5%, 2/01/2038 | 40,000 | 50,959 | ||

| Range Resources Corp., 8.25%, 1/15/2029 (n) | 120,000 | 132,283 | ||

| SM Energy Co., 5.625%, 6/01/2025 | 95,000 | 94,050 | ||

| SM Energy Co., 6.5%, 7/15/2028 | 70,000 | 70,700 | ||

| Southwestern Energy Co., 6.45%, 1/23/2025 | 53,300 | 57,833 | ||

| Southwestern Energy Co., 8.375%, 9/15/2028 | 90,000 | 99,154 | ||

| Southwestern Energy Co., 5.375%, 3/15/2030 | 125,000 | 130,156 | ||

| $2,477,387 | ||||

| Entertainment – 4.9% | ||||

| AMC Entertainment Holdings, Inc., 12%, (10% cash or 12% PIK) 6/15/2026 (n)(p) | $ | 65,000 | $ 66,056 | |

| Boyne USA, Inc., 4.75%, 5/15/2029 (n) | 220,000 | 221,650 | ||

| Carnival Corp. PLC, 7.625%, 3/01/2026 (n) | 355,000 | 364,049 | ||

| Carnival Corp. PLC, 5.75%, 3/01/2027 (n) | 150,000 | 146,603 | ||

| Carnival Corp. PLC, 6%, 5/01/2029 (n) | 45,000 | 43,733 | ||

| Cedar Fair LP/Canada's Wonderland Co./Magnum Management Corp./Millennium Operations LLC, 5.375%, 4/15/2027 | 105,000 | 106,838 | ||

| Live Nation Entertainment, Inc., 5.625%, 3/15/2026 (n) | 218,000 | 223,995 | ||

| Live Nation Entertainment, Inc., 3.75%, 1/15/2028 (n) | 100,000 | 96,050 | ||

| Motion Bondco DAC, 6.625%, 11/15/2027 (n) | 200,000 | 199,500 | ||

| NCL Corp. Ltd., 3.625%, 12/15/2024 (n) | 100,000 | 91,788 | ||

| NCL Corp. Ltd., 5.875%, 3/15/2026 (n) | 115,000 | 112,081 | ||

| Royal Caribbean Cruises Ltd., 5.5%, 4/01/2028 (n) | 225,000 | 218,812 | ||

| SeaWorld Parks & Entertainment, 5.25%, 8/15/2029 (n) | 240,000 | 239,160 | ||

| Viking Cruises Ltd. Co., 5.875%, 9/15/2027 (n) | 95,000 | 88,139 | ||

| $2,218,454 | ||||

| Financial Institutions – 4.2% | ||||

| Avation Capital S.A., 8.25%, (8.25% cash or 9% PIK) 10/31/2026 (n)(p) | $ | 203,202 | $ 168,658 | |

| Credit Acceptance Corp., 5.125%, 12/31/2024 (n) | 220,000 | 224,400 | ||

| Freedom Mortgage Corp., 7.625%, 5/01/2026 (n) | 185,000 | 178,573 | ||

| Global Aircraft Leasing Co. Ltd., 6.5%,(6.5% cash or 7.25% PIK) 9/15/2024 (n)(p) | 448,020 | 434,212 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Financial Institutions – continued | ||||

| Howard Hughes Corp., 4.125%, 2/01/2029 (n) | $ | 264,000 | $ 260,196 | |

| Nationstar Mortgage Holdings, Inc., 6%, 1/15/2027 (n) | 200,000 | 206,506 | ||

| OneMain Finance Corp., 6.875%, 3/15/2025 | 95,000 | 104,500 | ||

| OneMain Finance Corp., 8.875%, 6/01/2025 | 99,000 | 106,178 | ||

| OneMain Finance Corp., 7.125%, 3/15/2026 | 100,000 | 112,396 | ||

| PennyMac Financial Services, Inc., 5.75%, 9/15/2031 (n) | 105,000 | 102,039 | ||

| $1,897,658 | ||||

| Food & Beverages – 5.2% | ||||

| Aramark Services, Inc., 6.375%, 5/01/2025 (n) | $ | 270,000 | $ 281,610 | |

| JBS USA Lux S.A./JBS USA Finance, Inc., 6.75%, 2/15/2028 (n) | 295,000 | 318,158 | ||

| JBS USA Lux S.A./JBS USA Finance, Inc., 5.5%, 1/15/2030 (n) | 115,000 | 123,359 | ||

| Kraft Heinz Co., 4.25%, 3/01/2031 | 315,000 | 360,354 | ||

| Lamb Weston Holdings, Inc., 4.125%, 1/31/2030 (n) | 360,000 | 358,990 | ||

| Performance Food Group Co., 5.5%, 10/15/2027 (n) | 210,000 | 216,300 | ||

| Post Holdings, Inc., 5.625%, 1/15/2028 (n) | 150,000 | 154,397 | ||

| Post Holdings, Inc., 4.625%, 4/15/2030 (n) | 150,000 | 148,125 | ||

| Primo Water Holding, Inc., 4.375%, 4/30/2029 (n) | 145,000 | 143,509 | ||

| U.S. Foods Holding Corp., 4.75%, 2/15/2029 (n) | 230,000 | 232,852 | ||

| $2,337,654 | ||||

| Gaming & Lodging – 9.3% | ||||

| Boyd Gaming Corp., 4.75%, 12/01/2027 | $ | 190,000 | $ 192,850 | |

| Boyd Gaming Corp., 4.75%, 6/15/2031 (n) | 75,000 | 74,588 | ||

| Caesars Entertainment, Inc., 4.625%, 10/15/2029 (n) | 150,000 | 146,250 | ||

| CCM Merger, Inc., 6.375%, 5/01/2026 (n) | 165,000 | 171,600 | ||

| Colt Merger Sub, Inc., 5.75%, 7/01/2025 (n) | 131,000 | 136,068 | ||

| Colt Merger Sub, Inc., 8.125%, 7/01/2027 (n) | 162,000 | 177,738 | ||

| Hilton Domestic Operating Co., Inc., 3.75%, 5/01/2029 (n) | 238,000 | 235,794 | ||

| Hilton Domestic Operating Co., Inc., 3.625%, 2/15/2032 (n) | 191,000 | 185,398 | ||

| International Game Technology PLC, 4.125%, 4/15/2026 (n) | 200,000 | 203,500 | ||

| International Game Technology PLC, 6.25%, 1/15/2027 (n) | 200,000 | 220,000 | ||

| Marriott Ownership Resorts, Inc., 4.5%, 6/15/2029 (n) | 185,000 | 181,619 | ||

| MGM China Holdings Ltd., 5.875%, 5/15/2026 (n) | 200,000 | 201,242 | ||

| MGM Growth Properties LLC, 4.625%, 6/15/2025 (n) | 185,000 | 197,025 | ||

| MGM Growth Properties LLC, 5.75%, 2/01/2027 | 75,000 | 84,937 | ||

| MGM Growth Properties LLC, 3.875%, 2/15/2029 (n) | 145,000 | 152,250 | ||

| Penn National Gaming, Inc., 4.125%, 7/01/2029 (n) | 150,000 | 141,555 | ||

| Scientific Games Corp., 8.625%, 7/01/2025 (n) | 45,000 | 47,908 | ||

| Scientific Games Corp., 8.25%, 3/15/2026 (n) | 120,000 | 126,316 | ||

| Scientific Games International, Inc., 7%, 5/15/2028 (n) | 115,000 | 122,209 | ||

| VICI Properties LP, REIT, 4.25%, 12/01/2026 (n) | 135,000 | 139,387 | ||

| VICI Properties LP, REIT, 3.75%, 2/15/2027 (n) | 200,000 | 205,000 | ||

| Wyndham Hotels & Resorts, Inc., 4.375%, 8/15/2028 (n) | 284,000 | 286,941 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Gaming & Lodging – continued | ||||

| Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp., 5.25%, 5/15/2027 (n) | $ | 120,000 | $ 117,634 | |

| Wynn Macau Ltd., 5.5%, 1/15/2026 (n) | 105,000 | 98,175 | ||

| Wynn Macau Ltd., 5.625%, 8/26/2028 (n) | 200,000 | 183,952 | ||

| Wynn Resorts Finance LLC/Wynn Resorts Capital Corp., 5.125%, 10/01/2029 (n) | 150,000 | 146,625 | ||

| $4,176,561 | ||||

| Industrial – 1.4% | ||||

| APi Escrow Corp., 4.75%, 10/15/2029 (n) | $ | 170,000 | $ 172,125 | |

| Dycom Industries, Inc., 4.5%, 4/15/2029 (n) | 215,000 | 216,464 | ||

| Williams Scotsman International, Inc., 4.625%, 8/15/2028 (n) | 222,000 | 225,885 | ||

| $614,474 | ||||

| Insurance - Property & Casualty – 1.5% | ||||

| Alliant Holdings Intermediate LLC, 6.75%, 10/15/2027 (n) | $ | 285,000 | $ 287,961 | |

| AssuredPartners, Inc., 5.625%, 1/15/2029 (n) | 120,000 | 115,200 | ||

| GTCR (AP) Finance, Inc., 8%, 5/15/2027 (n) | 65,000 | 66,500 | ||

| Hub International Ltd., 5.625%, 12/01/2029 (n) | 180,000 | 179,618 | ||

| $649,279 | ||||

| Machinery & Tools – 0.4% | ||||

| Terex Corp., 5%, 5/15/2029 (n) | $ | 185,000 | $ 188,469 | |

| Medical & Health Technology & Services – 8.8% | ||||

| 180 Medical, Inc., 3.875%, 10/15/2029 (n) | $ | 200,000 | $ 196,392 | |

| Avantor Funding, Inc., 4.625%, 7/15/2028 (n) | 279,000 | 288,123 | ||

| BCPE Cycle Merger Sub II, Inc., 10.625%, 7/15/2027 (n) | 135,000 | 138,038 | ||

| Catalent, Inc., 3.125%, 2/15/2029 (n) | 363,000 | 346,102 | ||

| Charles River Laboratories International, Inc., 3.75%, 3/15/2029 (n) | 414,000 | 409,342 | ||

| CHS/Community Health Systems, Inc., 8%, 12/15/2027 (n) | 105,000 | 112,301 | ||

| CHS/Community Health Systems, Inc., 6.125%, 4/01/2030 (n) | 265,000 | 253,738 | ||

| DaVita, Inc., 4.625%, 6/01/2030 (n) | 140,000 | 138,250 | ||

| DaVita, Inc., 3.75%, 2/15/2031 (n) | 122,000 | 113,121 | ||

| Encompass Health Corp., 5.75%, 9/15/2025 | 30,000 | 30,488 | ||

| HCA, Inc., 5.875%, 2/15/2026 | 275,000 | 308,151 | ||

| HCA, Inc., 3.5%, 9/01/2030 | 260,000 | 270,654 | ||

| HealthSouth Corp., 5.125%, 3/15/2023 | 88,000 | 88,000 | ||

| IQVIA Holdings, Inc., 5%, 5/15/2027 (n) | 400,000 | 412,000 | ||

| LifePoint Health, Inc., 4.375%, 2/15/2027 (n) | 30,000 | 29,534 | ||

| MPH Acquisition Holdings LLC, 5.5%, 9/01/2028 (n) | 115,000 | 111,390 | ||

| Regional Care/LifePoint Health, Inc., 9.75%, 12/01/2026 (n) | 130,000 | 136,338 | ||

| Syneos Health, Inc., 3.625%, 1/15/2029 (n) | 275,000 | 270,927 | ||

| Tenet Healthcare Corp., 6.125%, 10/01/2028 (n) | 150,000 | 153,210 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Medical & Health Technology & Services – continued | ||||

| US Acute Care Solutions LLC, 6.375%, 3/01/2026 (n) | $ | 135,000 | $ 138,206 | |

| $3,944,305 | ||||

| Medical Equipment – 0.9% | ||||

| Mozart Debt Merger Sub, Inc., 5.25%, 10/01/2029 (n) | $ | 150,000 | $ 149,813 | |

| Teleflex, Inc., 4.625%, 11/15/2027 | 240,000 | 246,900 | ||

| $396,713 | ||||

| Metals & Mining – 5.5% | ||||

| Baffinland Iron Mines Corp./Baffinland Iron Mines LP, 8.75%, 7/15/2026 (n) | $ | 220,000 | $ 229,350 | |

| Coeur Mining, Inc., 5.125%, 2/15/2029 (n) | 215,000 | 205,368 | ||

| Compass Minerals International, Inc., 6.75%, 12/01/2027 (n) | 185,000 | 188,931 | ||

| Eldorado Gold Corp., 6.25%, 9/01/2029 (n) | 175,000 | 176,115 | ||

| First Quantum Minerals Ltd., 6.875%, 10/15/2027 (n) | 200,000 | 211,400 | ||

| FMG Resources Ltd., 4.375%, 4/01/2031 (n) | 225,000 | 227,984 | ||

| Freeport-McMoRan, Inc., 4.375%, 8/01/2028 | 100,000 | 104,273 | ||

| Freeport-McMoRan, Inc., 5.25%, 9/01/2029 | 165,000 | 178,200 | ||

| GrafTech Finance, Inc., 4.625%, 12/15/2028 (n) | 145,000 | 146,769 | ||

| Kaiser Aluminum Corp., 4.625%, 3/01/2028 (n) | 282,000 | 276,199 | ||

| Kaiser Aluminum Corp., 4.5%, 6/01/2031 (n) | 125,000 | 121,406 | ||

| Novelis Corp., 3.25%, 11/15/2026 (n) | 78,000 | 77,932 | ||

| Novelis Corp., 4.75%, 1/30/2030 (n) | 180,000 | 181,742 | ||

| Novelis Corp., 3.875%, 8/15/2031 (n) | 93,000 | 89,745 | ||

| Petra Diamonds US$ Treasury PLC, 10.5%, (0% cash or 10.5% PIK) 3/08/2026 (n)(p) | 67,105 | 69,118 | ||

| $2,484,532 | ||||

| Midstream – 6.3% | ||||

| Cheniere Energy Partners LP, 4.5%, 10/01/2029 | $ | 90,000 | $ 94,601 | |

| Cheniere Energy, Inc., 4%, 3/01/2031 (n) | 230,000 | 234,600 | ||

| DT Midstream, Inc., 4.125%, 6/15/2029 (n) | 144,000 | 143,100 | ||

| DT Midstream, Inc., 4.375%, 6/15/2031 (n) | 244,000 | 242,475 | ||

| EnLink Midstream Partners LP, 5.625%, 1/15/2028 (n) | 135,000 | 138,375 | ||

| EQM Midstream Partners LP, 6%, 7/01/2025 (n) | 48,000 | 51,017 | ||

| EQM Midstream Partners LP, 6.5%, 7/01/2027 (n) | 32,000 | 34,560 | ||

| EQM Midstream Partners LP, 5.5%, 7/15/2028 | 365,000 | 386,900 | ||

| EQM Midstream Partners LP, 4.5%, 1/15/2029 (n) | 90,000 | 89,325 | ||

| Genesis Energy LP/Genesis Energy Finance Corp., 6.25%, 5/15/2026 | 82,500 | 79,459 | ||

| Northriver Midstream Finance LP, 5.625%, 2/15/2026 (n) | 235,000 | 242,320 | ||

| Targa Resources Partners LP/Targa Resources Finance Corp., 6.875%, 1/15/2029 | 260,000 | 287,997 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Midstream – continued | ||||

| Targa Resources Partners LP/Targa Resources Finance Corp., 4.875%, 2/01/2031 | $ | 135,000 | $ 144,787 | |

| Targa Resources Partners LP/Targa Resources Finance Corp., 4%, 1/15/2032 (n) | 80,000 | 82,642 | ||

| Venture Global Calcasieu Pass LLC, 3.875%, 8/15/2029 (n) | 135,000 | 135,560 | ||

| Venture Global Calcasieu Pass LLC, 4.125%, 8/15/2031 (n) | 135,000 | 138,059 | ||

| Western Midstream Operating LP, 5.3%, 2/01/2030 | 160,000 | 172,208 | ||

| Western Midstream Operation LP, 4.65%, 7/01/2026 | 65,000 | 69,388 | ||

| Western Midstream Operation LP, 5.5%, 8/15/2048 | 45,000 | 51,975 | ||

| $2,819,348 | ||||

| Municipals – 0.1% | ||||

| Puerto Rico Industrial, Tourist, Educational, Medical & Environmental Control Facilities Financing Authority Rev. (Cogeneration Facilities - AES Puerto Rico Project), 9.12%, 6/01/2022 | $ | 35,000 | $ 35,875 | |

| Network & Telecom – 0.8% | ||||

| Front Range BidCo, Inc., 6.125%, 3/01/2028 (n) | $ | 140,000 | $ 131,775 | |

| Iliad Holding S.A.S., 7%, 10/15/2028 (n) | 200,000 | 204,404 | ||

| $336,179 | ||||

| Oil Services – 0.2% | ||||

| Solaris Midstream Holding LLC, 7.625%, 4/01/2026 (n) | $ | 100,000 | $ 104,522 | |

| Oils – 0.9% | ||||

| Parkland Corp., 4.625%, 5/01/2030 (n) | $ | 245,000 | $ 241,489 | |

| PBF Holding Co. LLC/PBF Finance Corp., 7.25%, 6/15/2025 | 120,000 | 80,250 | ||

| PBF Holding Co. LLC/PBF Finance Corp., 6%, 2/15/2028 | 130,000 | 77,545 | ||

| $399,284 | ||||

| Personal Computers & Peripherals – 0.8% | ||||

| NCR Corp., 5%, 10/01/2028 (n) | $ | 220,000 | $ 222,200 | |

| NCR Corp., 5.125%, 4/15/2029 (n) | 115,000 | 116,213 | ||

| $338,413 | ||||

| Pharmaceuticals – 3.1% | ||||

| Bausch Health Companies, Inc., 6.125%, 4/15/2025 (n) | $ | 371,000 | $ 374,710 | |

| Bausch Health Companies, Inc., 5%, 1/30/2028 (n) | 350,000 | 311,248 | ||

| Bausch Health Companies, Inc., 5%, 2/15/2029 (n) | 95,000 | 81,463 | ||

| Endo Luxembourg Finance Co I S.à r.l., 6.125%, 4/01/2029 (n) | 105,000 | 102,853 | ||

| Jazz Securities DAC, 4.375%, 1/15/2029 (n) | 200,000 | 203,764 | ||

| Organon Finance 1 LLC, 5.125%, 4/30/2031 (n) | 200,000 | 204,250 | ||

| Par Pharmaceutical, Inc., 7.5%, 4/01/2027 (n) | 105,000 | 105,857 | ||

| $1,384,145 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Pollution Control – 1.2% | ||||

| GFL Environmental, Inc., 4%, 8/01/2028 (n) | $ | 180,000 | $ 174,615 | |

| GFL Environmental, Inc., 4.75%, 6/15/2029 (n) | 60,000 | 59,992 | ||

| GFL Environmental, Inc., 4.375%, 8/15/2029 (n) | 80,000 | 77,827 | ||

| Stericycle, Inc., 3.875%, 1/15/2029 (n) | 210,000 | 204,750 | ||

| $517,184 | ||||

| Precious Metals & Minerals – 0.6% | ||||

| IAMGOLD Corp., 5.75%, 10/15/2028 (n) | $ | 155,000 | $ 150,297 | |

| Taseko Mines Ltd., 7%, 2/15/2026 (n) | 120,000 | 121,800 | ||

| $272,097 | ||||

| Printing & Publishing – 0.7% | ||||

| Cimpress N.V., 7%, 6/15/2026 (n) | $ | 300,000 | $ 310,125 | |

| Railroad & Shipping – 0.4% | ||||

| Watco Cos. LLC/Watco Finance Corp., 6.5%, 6/15/2027 (n) | $ | 187,000 | $ 195,950 | |

| Real Estate - Other – 0.9% | ||||

| InterMed Holdings Ltd., 5.875%, 10/01/2028 (n) | $ | 235,000 | $ 242,284 | |

| XHR LP, REIT, 4.875%, 6/01/2029 (n) | 180,000 | 181,350 | ||

| $423,634 | ||||

| Retailers – 1.6% | ||||

| Asbury Automotive Group, Inc., 4.625%, 11/15/2029 (n) | $ | 101,000 | $ 101,638 | |

| Bath & Body Works, Inc., 5.25%, 2/01/2028 | 410,000 | 439,725 | ||

| Victoria's Secret & Co., 4.625%, 7/15/2029 (n) | 170,000 | 167,834 | ||

| $709,197 | ||||

| Specialty Chemicals – 0.4% | ||||

| Univar Solutions USA, Inc., 5.125%, 12/01/2027 (n) | $ | 186,000 | $ 194,370 | |

| Specialty Stores – 2.5% | ||||

| Group 1 Automotive, Inc., 4%, 8/15/2028 (n) | $ | 161,000 | $ 159,271 | |

| Magic Mergeco, Inc., 5.25%, 5/01/2028 (n) | 100,000 | 98,938 | ||

| Magic Mergeco, Inc., 7.875%, 5/01/2029 (n) | 125,000 | 124,063 | ||

| Penske Automotive Group Co., 3.75%, 6/15/2029 | 243,000 | 236,943 | ||

| PetSmart, Inc./PetSmart Finance Corp., 4.75%, 2/15/2028 (n) | 250,000 | 253,026 | ||

| PetSmart, Inc./PetSmart Finance Corp., 7.75%, 2/15/2029 (n) | 250,000 | 267,187 | ||

| $1,139,428 | ||||

| Supermarkets – 0.8% | ||||

| Albertsons Cos. LLC/Safeway, Inc., 4.625%, 1/15/2027 (n) | $ | 215,000 | $ 222,880 | |

| Albertsons Cos. LLC/Safeway, Inc., 3.5%, 3/15/2029 (n) | 150,000 | 148,657 | ||

| $371,537 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Telecommunications - Wireless – 3.3% | ||||

| Altice France S.A., 6%, 2/15/2028 (n) | $ | 200,000 | $ 186,750 | |

| SBA Communications Corp., 3.875%, 2/15/2027 | 161,000 | 164,796 | ||

| SBA Communications Corp., 3.125%, 2/01/2029 (n) | 305,000 | 289,750 | ||

| Sprint Capital Corp., 6.875%, 11/15/2028 | 265,000 | 327,161 | ||

| Sprint Corp., 7.125%, 6/15/2024 | 75,000 | 84,040 | ||

| Sprint Corp., 7.625%, 3/01/2026 | 360,000 | 425,250 | ||

| $1,477,747 | ||||

| Tobacco – 0.5% | ||||

| Vector Group Ltd., 10.5%, 11/01/2026 (n) | $ | 105,000 | $ 108,114 | |

| Vector Group Ltd., 5.75%, 2/01/2029 (n) | 105,000 | 99,881 | ||

| $207,995 | ||||

| Utilities - Electric Power – 3.8% | ||||

| Calpine Corp., 4.5%, 2/15/2028 (n) | $ | 185,000 | $ 183,993 | |

| Calpine Corp., 5.125%, 3/15/2028 (n) | 240,000 | 237,590 | ||

| Clearway Energy Operating LLC, 4.75%, 3/15/2028 (n) | 90,000 | 94,500 | ||

| Clearway Energy Operating LLC, 3.75%, 2/15/2031 (n) | 355,000 | 350,889 | ||

| NextEra Energy, Inc., 4.25%, 7/15/2024 (n) | 130,000 | 132,989 | ||

| NextEra Energy, Inc., 4.25%, 9/15/2024 (n) | 29,000 | 30,284 | ||

| NextEra Energy, Inc., 4.5%, 9/15/2027 (n) | 150,000 | 158,719 | ||

| TerraForm Global Operating LLC, 6.125%, 3/01/2026 (n) | 120,000 | 122,400 | ||

| TerraForm Power Operating LLC, 5%, 1/31/2028 (n) | 275,000 | 286,000 | ||

| TerraForm Power Operating LLC, 4.75%, 1/15/2030 (n) | 110,000 | 111,623 | ||

| $1,708,987 | ||||

| Total Bonds (Identified Cost, $61,108,583) | $ 61,009,075 | |||

| Common Stocks – 1.7% | ||||

| Construction – 0.0% | ||||

| ICA Tenedora, S.A. de C.V. (a)(u) | 11,385 | $ 9,026 | ||

| Oil Services – 0.2% | ||||

| LTRI Holdings LP (a)(u) | 200 | $ 57,518 | ||

| Special Products & Services – 1.5% | ||||

| iShares iBoxx $ High Yield Corporate Bond ETF | 8,000 | $ 685,120 | ||

| Total Common Stocks (Identified Cost, $714,438) | $ 751,664 | |||

| Issuer | Strike

Price |

First

Exercise |

Shares/Par | Value ($) |

| Warrants – 0.0% | ||||

| Forest & Paper Products – 0.0% | ||||

| Appvion Holdings Corp. - Tranche A (1 share for 1 warrant, Expiration 6/13/23) (a) | $11.50 | 8/24/18 | 84 | $ 1 |

| Appvion Holdings Corp. - Tranche B (1 share for 1 warrant, Expiration 6/13/23) (a) | 13.23 | 8/24/18 | 84 | 1 |

| $2 | ||||

| Other Banks & Diversified Financials – 0.0% | ||||

| Avation Capital S.A. (1 share for 1 warrant, Expiration 10/31/26) (a)(u) | GBP 1.14 | 3/16/21 | 3,500 | $ 461 |

| Total Warrants (Identified Cost, $0) | $ 463 | |||

| Investment Companies (h) – 1.8% | ||||

| Money Market Funds – 1.8% | ||||

| MFS Institutional Money Market Portfolio, 0.05% (v) (Identified Cost, $828,311) | 828,333 | $ 828,333 | ||

| Other Assets, Less Liabilities – (39.3)% | (17,646,349) | |||

| Net Assets – 100.0% | $44,943,186 | |||

| (a) | Non-income producing security. |

| (d) | In default. |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund's investments in affiliated issuers and in unaffiliated issuers were $828,333 and $61,761,202, respectively. |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $51,276,850, representing 114.1% of net assets. |

| (p) | Payment-in-kind (PIK) security for which interest income may be received in additional securities and/or cash. |

| (u) | The security was valued using significant unobservable inputs and is considered level 3 under the fair value hierarchy. For further information about the fund’s level 3 holdings, please see Note 2 in the Notes to Financial Statements. |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

| (z) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered. Disposal of these securities may involve time-consuming negotiations and prompt sale at an acceptable price may be difficult. The fund holds the following restricted securities: |

| Restricted Securities | Acquisition

Date |

Cost | Value |

| Intelsat Jackson Holdings S.A., 9.75%, 7/15/2025 | 2/12/20 | $86,384 | $44,100 |

| Paysafe Finance PLC, 4%, 6/15/2029 | 6/10/21-9/09/21 | 184,137 | 170,663 |

| Total Restricted Securities | $214,763 | ||

| % of Net assets | 0.5% |

| The following abbreviations are used in this report and are defined: | |

| ETF | Exchange-Traded Fund |

| REIT | Real Estate Investment Trust |

| Abbreviations indicate amounts shown in currencies other than the U.S. dollar. All amounts are stated in U.S. dollars unless otherwise indicated. A list of abbreviations is shown below: | |

| EUR | Euro |

| GBP | British Pound |

| Forward Foreign Currency Exchange Contracts | ||||||

| Currency

Purchased |

Currency

Sold |

Counterparty | Settlement

Date |

Unrealized

Appreciation (Depreciation) | ||

| Asset Derivatives | ||||||

| USD | 115,475 | EUR | 99,766 | JPMorgan Chase Bank N.A. | 1/14/2022 | $2,139 |

| Futures Contracts | ||||||

| Description | Long/

Short |

Currency | Contracts | Notional

Amount |

Expiration

Date |

Value/Unrealized

Appreciation (Depreciation) |

| Asset Derivatives | ||||||

| Interest Rate Futures | ||||||

| U.S. Treasury Bond | Long | USD | 6 | $972,750 | March – 2022 | $24,254 |

| U.S. Treasury Ultra Bond | Long | USD | 1 | 200,562 | March – 2022 | 8,434 |

| $32,688 | ||||||

| Liability Derivatives | ||||||

| Interest Rate Futures | ||||||

| U.S. Treasury Note 10 yr | Short | USD | 16 | $2,093,000 | March – 2022 | $(28,683) |

| Assets | |

| Investments in unaffiliated issuers, at value (identified cost, $61,823,021) | $61,761,202 |

| Investments in affiliated issuers, at value (identified cost, $828,311) | 828,333 |

| Cash | 2,508 |

| Deposits with brokers for | |

| Futures contracts | 11,900 |

| Receivables for | |

| Forward foreign currency exchange contracts | 2,139 |

| Net daily variation margin on open futures contracts | 5,064 |

| Investments sold | 92,953 |

| Interest | 854,561 |

| Other assets | 2,018 |

| Total assets | $63,560,678 |

| Liabilities | |

| Notes payable | $18,500,000 |

| Payable to affiliates | |

| Investment adviser | 8,146 |

| Administrative services fee | 94 |

| Transfer agent and dividend disbursing costs | 253 |

| Payable for independent Trustees' compensation | 2 |

| Accrued interest expense | 10,760 |

| Accrued expenses and other liabilities | 98,237 |

| Total liabilities | $18,617,492 |

| Net assets | $44,943,186 |

| Net assets consist of | |

| Paid-in capital | $50,156,230 |

| Total distributable earnings (loss) | (5,213,044) |

| Net assets | $44,943,186 |

| Shares of beneficial interest outstanding | 19,342,135 |

| Net asset value per share (net assets of $44,943,186 / 19,342,135 shares of beneficial interest outstanding) | $2.32 |

| Net investment income (loss) | |

| Income | |

| Interest | $3,217,810 |

| Dividends | 36,786 |

| Other | 4,270 |

| Dividends from affiliated issuers | 759 |

| Foreign taxes withheld | (782) |

| Total investment income | $3,258,843 |

| Expenses | |

| Management fee | $468,058 |

| Transfer agent and dividend disbursing costs | 15,183 |

| Administrative services fee | 17,500 |

| Independent Trustees' compensation | 5,153 |

| Stock exchange fee | 23,741 |

| Custodian fee | 3,127 |

| Shareholder communications | 57,193 |

| Audit and tax fees | 87,898 |

| Legal fees | 2,786 |

| Interest expense and fees | 146,058 |

| Miscellaneous | 42,140 |

| Total expenses | $868,837 |

| Reduction of expenses by investment adviser | (91,645) |

| Net expenses | $777,192 |

| Net investment income (loss) | $2,481,651 |

| Realized and unrealized gain (loss) | |

| Realized gain (loss) (identified cost basis) | |

| Unaffiliated issuers | $1,526,539 |

| Affiliated issuers | 38 |

| Futures contracts | (1,663) |

| Forward foreign currency exchange contracts | 3,390 |

| Foreign currency | (15) |

| Net realized gain (loss) | $1,528,289 |

| Change in unrealized appreciation or depreciation | |

| Unaffiliated issuers | $(2,376,388) |

| Affiliated issuers | (39) |

| Futures contracts | 4,005 |

| Forward foreign currency exchange contracts | 2,139 |

| Translation of assets and liabilities in foreign currencies | (5) |

| Net unrealized gain (loss) | $(2,370,288) |

| Net realized and unrealized gain (loss) | $(841,999) |

| Change in net assets from operations | $1,639,652 |

| Year ended | ||

| 11/30/21 | 11/30/20 | |

| Change in net assets | ||

| From operations | ||

| Net investment income (loss) | $2,481,651 | $2,694,648 |

| Net realized gain (loss) | 1,528,289 | (698,521) |

| Net unrealized gain (loss) | (2,370,288) | 435,652 |

| Change in net assets from operations | $1,639,652 | $2,431,779 |

| Distributions to shareholders | $(2,704,910) | $(2,905,561) |

| Tax return of capital distributions to shareholders | $(1,782,784) | $(1,563,056) |

| Change in net assets from fund share transactions | $206,540 | $(765,301) |

| Total change in net assets | $(2,641,502) | $(2,802,139) |

| Net assets | ||

| At beginning of period | 47,584,688 | 50,386,827 |

| At end of period | $44,943,186 | $47,584,688 |

| Cash flows from operating activities: | |

| Change in net assets from operations | $1,639,652 |

| Adjustments to reconcile change in net assets from operations to net cash provided by operating activities: | |

| Purchase of investment securities | (42,881,023) |

| Proceeds from disposition of investment securities | 43,546,559 |

| Proceeds from disposition of short-term investments, net | 1,039,591 |

| Realized gain/loss on investments | (1,526,539) |

| Unrealized appreciation/depreciation on investments | 2,376,427 |

| Unrealized appreciation/depreciation on foreign currency contracts | (2,139) |

| Net amortization/accretion of income | 116,935 |

| Decrease in interest receivable | 5,663 |

| Decrease in accrued expenses and other liabilities | (13,695) |

| Increase in receivable for net daily variation margin on open futures contracts | (5,064) |

| Increase in other assets | (57) |

| Decrease in interest payable | (1,452) |

| Net cash provided by operating activities | $4,294,858 |

| Cash flows from financing activities: | |

| Distributions paid in cash | $(4,281,154) |

| Net increase in cash and restricted cash | $13,704 |

| Cash and restricted cash: | |

| Beginning of period | $704 |

| End of period | $14,408 |

| Year ended | |||||

| 11/30/21 | 11/30/20 | 11/30/19 | 11/30/18 | 11/30/17 | |

| Net asset value, beginning of period | $2.47 | $2.56 | $2.46 | $2.79 | $2.77 |

| Income (loss) from investment operations | |||||

| Net investment income (loss) (d) | $0.13 | $0.14 | $0.14 | $0.14(c) | $0.16 |

| Net realized and unrealized gain (loss) | (0.05) | (0.00)(w) | 0.20 | (0.22) | 0.12 |

| Total from investment operations | $0.08 | $0.14 | $0.34 | $(0.08) | $0.28 |

| Less distributions declared to shareholders | |||||

| From net investment income | $(0.14) | $(0.15) | $(0.14) | $(0.15) | $(0.17) |

| From tax return of capital | (0.09) | (0.08) | (0.10) | (0.10) | (0.10) |

| Total distributions declared to shareholders | $(0.23) | $(0.23) | $(0.24) | $(0.25) | $(0.27) |

| Net increase from repurchase of capital shares | $— | $0.00(w) | $0.00(w) | $— | $0.01 |

| Net asset value, end of period (x) | $2.32 | $2.47 | $2.56 | $2.46 | $2.79 |

| Market value, end of period | $2.97 | $2.47 | $2.70 | $2.29 | $2.75 |

| Total return at market value (%) | 30.89 | 0.89 | 29.74 | (8.21) | 22.30 |

| Total return at net asset value (%) (j)(r)(s)(x) | 2.25 | 6.40 | 14.52 | (2.81)(c) | 11.09 |

| Ratios

(%) (to average net assets) and Supplemental data: | |||||

| Expenses before expense reductions (f) | 1.84 | 2.05 | 2.56 | 2.50(c) | 2.15 |

| Expenses after expense reductions (f) | 1.65 | 1.82 | 2.49 | 2.41(c) | 2.05 |

| Net investment income (loss) | 5.27 | 5.75 | 5.43 | 5.50(c) | 5.75 |

| Portfolio turnover | 65 | 57 | 56 | 45 | 49 |

| Net assets at end of period (000 omitted) | $44,943 | $47,585 | $50,387 | $48,508 | $54,950 |

| Supplemental Ratios (%): | |||||

| Ratios of expenses to average net assets after expense reductions and excluding interest expense and fees (f) | 1.34 | 1.34 | 1.34 | 1.33(c) | 1.34 |

| Senior Securities: | |||||

| Total notes payable outstanding (000 omitted) | $18,500 | $18,500 | $20,000 | $20,000 | $22,000 |

| Asset coverage per $1,000 of indebtedness (k) | $3,429 | $3,572 | $3,519 | $3,425 | $3,498 |

| (c) | Amount reflects a one-time reimbursement of expenses by the custodian (or former custodian) without which net investment income and performance would be lower and expenses would be higher. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (j) | Total return at net asset value is calculated using the net asset value of the fund, not the publicly traded price and therefore may be different than the total return at market value. |

| (k) | Calculated by subtracting the fund's total liabilities (not including notes payable) from the fund's total assets and dividing this number by the notes payable outstanding and then multiplying by 1,000. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (w) | Per share amount was less than $0.01. |

| (x) | The net asset values and total returns at net asset value have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

| Financial Instruments | Level 1 | Level 2 | Level 3 | Total |

| Equity Securities: | ||||

| United States | $685,120 | $2 | $57,518 | $742,640 |

| Mexico | — | — | 9,026 | 9,026 |

| United Kingdom | — | — | 461 | 461 |

| Municipal Bonds | — | 35,875 | — | 35,875 |

| U.S. Corporate Bonds | — | 52,710,579 | — | 52,710,579 |

| Foreign Bonds | — | 8,262,621 | — | 8,262,621 |

| Mutual Funds | 828,333 | — | — | 828,333 |

| Total | $1,513,453 | $61,009,077 | $67,005 | $62,589,535 |

| Other Financial Instruments | ||||

| Futures Contracts – Assets | $32,688 | $— | $— | $32,688 |

| Futures Contracts – Liabilities | (28,683) | — | — | (28,683) |

| Forward Foreign Currency Exchange Contracts – Assets | — | 2,139 | — | 2,139 |

| Equity

Securities | |

| Balance as of 11/30/20 | $56,504 |

| Change in unrealized appreciation or depreciation | 1,014 |

| Transfers into level 3 | 9,026 |

| Received as part of a corporate action | 461 |

| Balance as of 11/30/21 | $67,005 |

| Fair Value (a) | |||

| Risk | Derivative Contracts | Asset Derivatives | Liability Derivatives |

| Interest Rate | Futures Contracts | $32,688 | $(28,683) |

| Foreign Exchange | Forward Foreign Currency Exchange Contracts | 2,139 | — |

| Total | $34,827 | $(28,683) | |

| (a) | Values presented in this table for futures contracts correspond to the values reported in the Portfolio of Investments. Only the current day net variation margin for futures contracts is separately reported within the Statement of Assets and Liabilities. |

| Risk | Futures

Contracts |

Forward

Foreign Currency Exchange Contracts |

| Interest Rate | $(1,663) | $— |

| Foreign Exchange | — | 3,390 |

| Total | $(1,663) | $3,390 |

| Risk | Futures

Contracts |

Forward

Foreign Currency Exchange Contracts |

| Interest Rate | $4,005 | $— |

| Foreign Exchange | — | 2,139 |

| Total | $4,005 | $2,139 |

| 11/30/21 | |

| Cash | $2,508 |

| Restricted cash | — |

| Restricted cash included in deposits with brokers | 11,900 |

| Total cash and restricted cash in the Statement of Cash Flows | $14,408 |

| Year

ended 11/30/21 |

Year

ended 11/30/20 | |

| Ordinary income (including any short-term capital gains) | $2,704,910 | $2,905,561 |

| Tax return of capital (b) | 1,782,784 | 1,563,056 |

| Total distributions | $4,487,694 | $4,468,617 |

| (b) | Distributions in excess of tax basis earnings and profits are reported in the financial statements as a tax return of capital. |

| As of 11/30/21 | |

| Cost of investments | $62,787,845 |

| Gross appreciation | 1,045,225 |

| Gross depreciation | (1,237,391) |

| Net unrealized appreciation (depreciation) | $ (192,166) |

| Capital loss carryforwards | (5,020,873) |

| Other temporary differences | (5) |

| Total distributable earnings (loss) | $ (5,213,044) |

| Short-Term | $(155,706) |

| Long-Term | (4,865,167) |

| Total | $(5,020,873) |

| Year

ended 11/30/21 |

Year

ended 11/30/20 | ||||

| Shares | Amount | Shares | Amount | ||

| Shares issued to shareholders in reinvestment of distributions | 75,458 | $206,540 | 23,422 | $61,008 | |

| Capital shares repurchased | — | — | (410,292) | (826,309) | |

| Net change | 75,458 | $206,540 | (386,870) | $(765,301) | |

| Affiliated Issuers | Beginning

Value |

Purchases | Sales

Proceeds |

Realized

Gain (Loss) |

Change

in Unrealized Appreciation or Depreciation |

Ending

Value |

| MFS Institutional Money Market Portfolio | $1,867,963 | $19,011,970 | $20,051,599 | $38 | $(39) | $828,333 |

| Affiliated Issuers | Dividend

Income |

Capital

Gain Distributions |

| MFS Institutional Money Market Portfolio | $759 | $— |

January 14, 2022

| Number of Shares | ||||

| Nominee | For | Withheld Authority | ||

| John A. Caroselli | 12,337,706.602 | 333,367.000 | ||

| James W. Kilman, Jr. | 12,346,417.602 | 324,656.000 | ||

| Clarence Otis, Jr. | 12,322,066.602 | 349,007.000 | ||

| Name, Age | Position(s) Held with Fund | Trustee/Officer Since(h) | Term

Expiring |

Number

of MFS Funds overseen by the Trustee |

Principal

Occupations During the Past Five Years |

Other

Directorships During the Past Five Years (j) | ||||||

| INTERESTED TRUSTEES | ||||||||||||

| Michael

W. Roberge (k) (age 55) |

Trustee | January 2021 | 2023 | 135 | Massachusetts Financial Services Company, Chairman (since January 2021); Chief Executive Officer (since January 2017); Director; Chairman of the Board (since January 2022); President (until December 2018); Chief Investment Officer (until December 2018) | N/A | ||||||

| INDEPENDENT TRUSTEES | ||||||||||||

| John

P. Kavanaugh (age 67) |

Trustee and Chair of Trustees | January 2009 | 2023 | 135 | Private investor | N/A | ||||||

| Steven

E. Buller (age 70) |

Trustee | February 2014 | 2023 | 135 | Private investor | N/A | ||||||

| John

A. Caroselli (age 67) |

Trustee | March 2017 | 2024 | 135 | Private investor; JC Global Advisors, LLC (management consulting), President (since 2015) | N/A | ||||||

| Maureen

R. Goldfarb (age 66) |

Trustee | January 2009 | 2022 | 135 | Private investor | N/A | ||||||

| Peter

D. Jones (age 66) |

Trustee | January 2019 | 2023 | 135 | Private investor | N/A | ||||||

| James

W. Kilman, Jr. (age 60) |

Trustee | January 2019 | 2024 | 135 | Burford Capital Limited (finance and investment management), Senior Advisor (since May 3, 2021), Chief Financial Officer (2019 - May 2, 2021); KielStrand Capital LLC (family office), Chief Executive Officer (since 2016) | Alpha-En Corporation, Director (2016-2019) |

| Name, Age | Position(s) Held with Fund | Trustee/Officer Since(h) | Term

Expiring |

Number

of MFS Funds overseen by the Trustee |

Principal

Occupations During the Past Five Years |

Other

Directorships During the Past Five Years (j) | ||||||

| Clarence

Otis, Jr. (age 65) |

Trustee | March 2017 | 2024 | 135 | Private investor | VF Corporation, Director; Verizon Communications, Inc., Director; The Travelers Companies, Director | ||||||

| Maryanne

L. Roepke (age 65) |

Trustee | May 2014 | 2022 | 135 | Private investor | N/A | ||||||

| Laurie

J. Thomsen (age 64) |

Trustee | March 2005 | 2022 | 135 | Private investor | The Travelers Companies, Director; Dycom Industries, Inc., Director |

| Name, Age | Position(s)

Held with Fund |

Trustee/Officer Since(h) | Term Expiring | Number

of MFS Funds overseen by the Trustee |

Principal

Occupations During the Past Five Years | |||||

| OFFICERS | ||||||||||

| Christopher

R. Bohane (k) (age 47) |

Assistant Secretary and Assistant Clerk | July 2005 | N/A | 135 | Massachusetts Financial Services Company, Senior Vice President and Associate General Counsel | |||||

| Kino

Clark (k) (age 53) |

Assistant Treasurer | January 2012 | N/A | 135 | Massachusetts Financial Services Company, Vice President | |||||

| John

W. Clark, Jr. (k) (age 54) |

Assistant Treasurer | April 2017 | N/A | 135 | Massachusetts Financial Services Company, Vice President (since March 2017); Deutsche Bank (financial services), Department Head - Treasurer's Office (until February 2017) | |||||

| Thomas

H. Connors (k) (age 62) |

Assistant Secretary and Assistant Clerk | September 2012 | N/A | 135 | Massachusetts Financial Services Company, Vice President and Senior Counsel | |||||

| David

L. DiLorenzo (k) (age 53) |

President | July 2005 | N/A | 135 | Massachusetts Financial Services Company, Senior Vice President | |||||

| Name, Age | Position(s)

Held with Fund |

Trustee/Officer Since(h) | Term Expiring | Number

of MFS Funds overseen by the Trustee |

Principal

Occupations During the Past Five Years | |||||

| Heidi

W. Hardin (k) (age 54) |

Secretary and Clerk | April 2017 | N/A | 135 | Massachusetts Financial Services Company, Executive Vice President and General Counsel (since March 2017); Harris Associates (investment management), General Counsel (until January 2017) | |||||

| Brian

E. Langenfeld (k) (age 48) |

Assistant Secretary and Assistant Clerk | June 2006 | N/A | 135 | Massachusetts Financial Services Company, Vice President and Senior Counsel | |||||

| Amanda

S. Mooradian (k) (age 42) |

Assistant Secretary and Assistant Clerk | September 2018 | N/A | 135 | Massachusetts Financial Services Company, Assistant Vice President and Senior Counsel | |||||

| Susan

A. Pereira (k) (age 51) |

Assistant Secretary and Assistant Clerk | July 2005 | N/A | 135 | Massachusetts Financial Services Company, Vice President and Assistant General Counsel | |||||

| Kasey

L. Phillips (k) (age 51) |

Assistant Treasurer | September 2012 | N/A | 135 | Massachusetts Financial Services Company, Vice President | |||||

| Matthew

A. Stowe (k) (age 47) |

Assistant Secretary and Assistant Clerk | October 2014 | N/A | 135 | Massachusetts Financial Services Company, Vice President and Assistant General Counsel | |||||

| Martin

J. Wolin (k) (age 54) |

Chief Compliance Officer | July 2015 | N/A | 135 | Massachusetts Financial Services Company, Senior Vice President and Chief Compliance Officer | |||||

| James

O. Yost (k) (age 61) |

Treasurer | September 1990 | N/A | 135 | Massachusetts Financial Services Company, Senior Vice President |

| (h) | Date first appointed to serve as Trustee/Officer of an MFS Fund. Each Trustee has served continuously since appointment unless indicated otherwise. From January 2012 through December 2016, Messrs. DiLorenzo and Yost served as Treasurer and Deputy Treasurer of the Funds, respectively. |

| (j) | Directorships or trusteeships of companies required to report to the Securities and Exchange Commission (i.e., “public companies”). |

| (k) | “Interested person” of the Trust within the meaning of the Investment Company Act of 1940 (referred to as the 1940 Act), which is the principal federal law governing investment companies like the fund, as a result of a position with MFS. The address of MFS is 111 Huntington Avenue, Boston, Massachusetts 02199-7618. |

| Investment Adviser | Custodian |

| Massachusetts

Financial Services Company 111 Huntington Avenue Boston, MA 02199-7618 |

State

Street Bank and Trust Company 1 Lincoln Street Boston, MA 02111-2900 |

| Portfolio Manager(s) | Independent Registered Public Accounting Firm |

| David

Cole Michael Skatrud |

Ernst &

Young LLP 200 Clarendon Street Boston, MA 02116 |

| FACTS | WHAT DOES MFS DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: |

| • Social Security number and account balances | |

| • Account transactions and transaction history | |

| • Checking account information and wire transfer instructions | |

| When you are no longer our customer, we continue to share your information as described in this notice. |

| How? | All financial companies need to share customers' personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers' personal information; the reasons MFS chooses to share; and whether you can limit this sharing. |

| Reasons

we can share your personal information |

Does MFS share? | Can

you limit this sharing? |

| For

our everyday business purposes – such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus |

Yes | No |

| For

our marketing purposes – to offer our products and services to you |

No | We don't share |

| For

joint marketing with other financial companies |

No | We don't share |

| For

our affiliates' everyday business purposes – information about your transactions and experiences |

No | We don't share |

| For

our affiliates' everyday business purposes – information about your creditworthiness |

No | We don't share |

| For nonaffiliates to market to you | No | We don't share |

| Questions? | Call 800-225-2606 or go to mfs.com. |

| Who we are | |

| Who is providing this notice? | MFS Funds, MFS Investment Management, MFS Institutional Advisors, Inc., and MFS Heritage Trust Company. |

| What we do | |

| How

does MFS protect my personal information? |

To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include procedural, electronic, and physical safeguards for the protection of the personal information we collect about you. |

| How

does MFS collect my personal information? |

We collect your personal information, for example, when you |

| • open an account or provide account information | |

| • direct us to buy securities or direct us to sell your securities | |

| • make a wire transfer | |

| We also collect your personal information from others, such as credit bureaus, affiliates, or other companies. | |

| Why can't I limit all sharing? | Federal law gives you the right to limit only |

| • sharing for affiliates' everyday business purposes – information about your creditworthiness | |

| • affiliates from using your information to market to you | |

| • sharing for nonaffiliates to market to you | |

| State laws and individual companies may give you additional rights to limit sharing. | |

| Definitions | |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. |

| • MFS does not share personal information with affiliates, except for everyday business purposes as described on page one of this notice. | |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. |

| • MFS does not share with nonaffiliates so they can market to you. | |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. |

| • MFS doesn't jointly market. | |

| Other important information |

| If you own an MFS product or receive an MFS service in the name of a third party such as a bank or broker-dealer, their privacy policy may apply to you instead of ours. |

DIVIDEND DISBURSING AGENT

| Item 1(b): | |

A copy of the notice transmitted to the Registrant’s shareholders in reliance on Rule 30e-3 of the Investment Company Act of 1940, as amended that contains disclosure specified by paragraph (c)(3) of Rule 30e-3 is attached hereto as EX-99.30e-3Notice.

| ITEM 2. | CODE OF ETHICS. |

The Registrant has adopted a Code of Ethics (the “Code”) pursuant to Section 406 of the Sarbanes-Oxley Act and as defined in Form N-CSR that applies to the Registrant’s principal executive officer and principal financial and accounting officer. During the period covered by this report, the Registrant has not amended any provision in the Code that relates to an element of the Code’s definition enumerated in paragraph (b) of Item 2 of this Form N-CSR. During the period covered by this report, the Registrant did not grant a waiver, including an implicit waiver, from any provision of the Code.

A copy of the Code is filed as an exhibit to this Form N-CSR.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Messrs. Steven E. Buller, James Kilman, and Clarence Otis, Jr. and Ms. Maryanne L. Roepke, members of the Audit Committee, have been determined by the Board of Trustees in their reasonable business judgment to meet the definition of “audit committee financial expert” as such term is defined in Form N-CSR. In addition, Messrs. Buller, Kilman, and Otis and Ms. Roepke are “independent” members of the Audit Committee (as such term has been defined by the Securities and Exchange Commission in regulations implementing Section 407 of the Sarbanes-Oxley Act of 2002). The Securities and Exchange Commission has stated that the designation of a person as an audit committee financial expert pursuant to this Item 3 on the Form N-CSR does not impose on such a person any duties, obligations or liability that are greater than the duties, obligations or liability imposed on such person as a member of the Audit Committee and the Board of Trustees in the absence of such designation or identification.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Items 4(a) through 4(d) and 4(g):

The Board of Trustees has appointed Ernst & Young LLP (“E&Y”) to serve as independent accountants to the Registrant (hereinafter the “Registrant” or the “Fund”). The tables below set forth the audit fees billed to the Fund as well as fees for non-audit services provided to the Fund and/or to the Fund’s investment adviser, Massachusetts Financial Services Company (“MFS”), and to various entities either controlling, controlled by, or under common control with MFS that provide ongoing services to the Fund (“MFS Related Entities”).

For the fiscal years ended November 30, 2021 and 2020, audit fees billed to the Fund by E&Y were as follows:

| Audit Fees | ||||||||

| 2021 | 2020 | |||||||

| Fees billed by E&Y: |

||||||||

| MFS Intermediate High Income Fund |

63,082 | 62,222 | ||||||

For the fiscal years ended November 30, 2021 and 2020, fees billed by E&Y for audit-related, tax and other services provided to the Fund and for audit-related, tax and other services provided to MFS and MFS Related Entities were as follows:

| Audit-Related Fees1 | Tax Fees2 | All Other Fees3 | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||

| Fees billed by E&Y: |

||||||||||||||||||||||||

| To MFS Intermediate High Income Fund |

12,246 | 12,077 | 11,159 | 11,009 | 1,001 | 1,473 | ||||||||||||||||||

| Audit-Related Fees1 | Tax Fees2 | All Other Fees3 | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||

| Fees billed by E&Y: |

||||||||||||||||||||||||

| To MFS and MFS Related Entities of MFS Intermediate High Income Fund* |

1,275,054 | 2,321,898 | 0 | 0 | 110,620 | 104,750 | ||||||||||||||||||

| Aggregate Fees for Non-audit Services |

||||||||

| 2021 | 2020 | |||||||

| Fees Billed by E&Y: |

||||||||

| To MFS Intermediate High Income Fund, MFS and MFS Related Entities# |

1,576,780 | 2,711,937 | ||||||

| * | This amount reflects the fees billed to MFS and MFS Related Entities for non-audit services relating directly to the operations and financial reporting of the Fund (portions of which services also related to the operations and financial reporting of other funds within the MFS Funds complex). |

| # | This amount reflects the aggregate fees billed by E&Y for non-audit services rendered to the Fund and for non-audit services rendered to MFS and the MFS Related Entities. |

| 1 | The fees included under “Audit-Related Fees” are fees related to assurance and related services that are reasonably related to the performance of the audit or review of financial statements, but not reported under ‘‘Audit Fees,’’ including accounting consultations, agreed-upon procedure reports, attestation reports, comfort letters and internal control reviews. |

| 2 | The fees included under “Tax Fees” are fees associated with tax compliance, tax advice and tax planning, including services relating to the filing or amendment of federal, state or local income tax returns, regulated investment company qualification reviews and tax distribution and analysis. |

| 3 | The fees included under “All Other Fees” are fees for products and services provided by E&Y other than those reported under “Audit Fees,” “Audit-Related Fees” and “Tax Fees,” including fees for services related to review of internal controls and review of Rule 38a-1 compliance program. |

| Item 4(e)(1): | |

Set forth below are the policies and procedures established by the Audit Committee of the Board of Trustees relating to the pre-approval of audit and non-audit related services:

To the extent required by applicable law, pre-approval by the Audit Committee of the Board is needed for all audit and permissible non-audit services rendered to the Fund and all permissible non-audit services rendered to MFS or MFS Related Entities if the services relate directly to the operations and financial reporting of the Registrant. Pre-approval is

currently on an engagement-by-engagement basis. In the event pre-approval of such services is necessary between regular meetings of the Audit Committee and it is not practical to wait to seek pre-approval at the next regular meeting of the Audit Committee, pre-approval of such services may be referred to the Chair of the Audit Committee for approval; provided that the Chair may not pre-approve any individual engagement for such services exceeding $50,000 or multiple engagements for such services in the aggregate exceeding $100,000 between such regular meetings of the Audit Committee. Any engagement pre-approved by the Chair between regular meetings of the Audit Committee shall be presented for ratification by the entire Audit Committee at its next regularly scheduled meeting.

| Item 4(e)(2): | |