Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-5567

MFS INTERMEDIATE HIGH INCOME FUND

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: November 30

Date of reporting period: May 31, 2012

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

MFS® Intermediate

High Income Fund

SEMIANNUAL REPORT

May 31, 2012

CIH-SEM

Table of Contents

HIGH INCOME FUND

New York Stock Exchange Symbol: CIF

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK GUARANTEE

Table of Contents

LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholders:

World financial markets remain a venue of uncertainty. The focus has shifted most recently to the eurozone, where policymakers are attempting to develop a plan that will help debt-laden countries and prevent their woes from spreading across the region. Volatility is likely to continue as investors test the resolve of European officials to make the tough decisions needed to solve the crisis.

The U.S. economy is experiencing a period of growth. However, markets have been jittery in reaction to events in Europe and ahead of the U.S. presidential election. Voters in the United States are watching the economy closely and waiting to see if Congress agrees to cut the budget and extend the Bush administration tax cuts. Failure to do so could ultimately send the U.S. economy back into recession.

Amid this global uncertainty, managing risk becomes a top priority for investors and their advisors. At MFS® our global research platform is designed to ensure the smooth functioning

of our investment process in all business climates. Through this integrated approach, our investment staff shares ideas and evaluates opportunities across geographies, across both fundamental and quantitative disciplines, and across companies’ entire capital structure. We employ this uniquely collaborative approach to build better insights for our clients.

Additionally, we have a team of quantitative analysts that measures and assesses the risk profiles of our portfolios and securities on an ongoing basis. The chief investment risk officer, who oversees the team, reports directly to the firm’s president and chief investment officer so that the risk associated with each portfolio can be assessed objectively and independently of the portfolio management team.

We, like our investors, are mindful of the many economic challenges faced at the local, national, and international levels. It is in times such as these that we want to emphasize the merits of maintaining a long-term view, adhering to basic investing principles such as asset allocation and diversification, and working closely with investment advisors to research and identify appropriate investment opportunities.

Respectfully,

Robert J. Manning

Chairman and Chief Executive Officer

MFS Investment Management®

July 17, 2012

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

Table of Contents

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change. Not Rated includes fixed income securities, including fixed income futures, which have not been rated by any rating agency. Non-Fixed Income includes equity securities (including convertible bonds and equity derivatives) and commodities. Cash & Other includes cash, other assets less liabilities, offsets to derivative positions, and short-term securities. The fund may not hold all of these instruments. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. |

2

Table of Contents

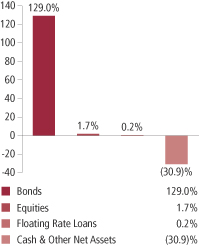

Portfolio Composition – continued

| (i) | For purposes of this presentation, the components include the market value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. The bond component will include any accrued interest amounts. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than market value. Where the fund holds convertible bonds, these are treated as part of the equity portion of the portfolio. |

| (m) | In determining an instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening device (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

From time to time “Cash & Other Net Assets” may be negative due to borrowings for leverage transactions, timing of cash receipts, and/or equivalent exposure from any derivative holdings.

Percentages are based on net assets as of 5/31/12.

The portfolio is actively managed and current holdings may be different.

3

Table of Contents

| William Adams | — | Investment Officer of MFS; employed in the investment management area of MFS since 2009. Portfolio Manager of the fund since May 2011. | ||

| David Cole | — | Investment Officer of MFS; employed in the investment management area of MFS since 2004. Portfolio Manager of the fund since June 2007. | ||

The fund’s shares may trade at a discount or premium to net asset value. Shareholders do not have the right to cause the fund to repurchase their shares at net asset value. When fund shares trade at a premium, buyers pay more than the net asset value underlying fund shares, and shares purchased at a premium would receive less than the amount paid for them in the event of the fund’s liquidation. As a result, the total return that is calculated based on the net asset value and New York Stock Exchange price can be different.

The fund’s monthly distributions may include a return of capital to shareholders to the extent that distributions are in excess of the fund’s net investment income and net capital gains, determined in accordance with federal income tax regulations. Distributions that are treated for federal income tax purposes as a return of capital will reduce each shareholder’s basis in his or her shares and, to the extent the return of capital exceeds such basis, will be treated as gain to the shareholder from a sale of shares. Returns of shareholder capital have the effect of reducing the fund’s assets and increasing the fund’s expense ratio.

In accordance with Section 23(c) of the Investment Company Act of 1940, the fund hereby gives notice that it may from time to time repurchase shares of the fund in the open market at the option of the Board of Trustees and on such terms as the Trustees shall determine.

4

Table of Contents

5/31/12 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Bonds - 126.4% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Aerospace - 2.6% | ||||||||

| BE Aerospace, Inc., 8.5%, 2018 | $ | 315,000 | $ | 343,350 | ||||

| Bombardier, Inc., 7.5%, 2018 (n) | 405,000 | 441,450 | ||||||

| Bombardier, Inc., 7.75%, 2020 (n) | 95,000 | 104,261 | ||||||

| CPI International, Inc., 8%, 2018 | 250,000 | 223,750 | ||||||

| Heckler & Koch GmbH, 9.5%, 2018 (z) | EUR | 115,000 | 98,116 | |||||

| Huntington Ingalls Industries, Inc., 7.125%, 2021 | $ | 195,000 | 202,313 | |||||

| Kratos Defense & Security Solutions, Inc., 10%, 2017 | 160,000 | 169,600 | ||||||

|

|

|

|||||||

| $ | 1,582,840 | |||||||

| Apparel Manufacturers - 1.5% | ||||||||

| Hanesbrands, Inc., 8%, 2016 | $ | 165,000 | $ | 180,881 | ||||

| Hanesbrands, Inc., 6.375%, 2020 | 100,000 | 102,125 | ||||||

| Hanesbrands, Inc., FRN, 4.145%, 2014 | 131,000 | 131,001 | ||||||

| Jones Group, Inc., 6.875%, 2019 | 115,000 | 110,544 | ||||||

| Levi Strauss & Co., 6.875%, 2022 (n) | 40,000 | 39,700 | ||||||

| Phillips-Van Heusen Corp., 7.375%, 2020 | 335,000 | 365,988 | ||||||

|

|

|

|||||||

| $ | 930,239 | |||||||

| Asset-Backed & Securitized - 0.5% | ||||||||

| Banc of America Commercial Mortgage, Inc., FRN, 6.248%, 2051 (z) | $ | 450,000 | $ | 77,864 | ||||

| Citigroup Commercial Mortgage Trust, FRN, 5.699%, 2049 | 275,000 | 68,521 | ||||||

| G-Force LLC, CDO, “A2”, 4.83%, 2036 (z) | 107,324 | 102,494 | ||||||

| JPMorgan Chase Commercial Mortgage Securities Corp., “C”, FRN, 6.052%, 2051 | 155,000 | 43,497 | ||||||

|

|

|

|||||||

| $ | 292,376 | |||||||

| Automotive - 5.6% | ||||||||

| Accuride Corp., 9.5%, 2018 | $ | 445,000 | $ | 465,025 | ||||

| Allison Transmission, Inc., 7.125%, 2019 (n) | 245,000 | 256,025 | ||||||

| Chrysler Group LLC/CG Co-Issuer, Inc., 8.25%, 2021 | 200,000 | 200,500 | ||||||

| Ford Motor Co., 7.45%, 2031 | 165,000 | 214,913 | ||||||

| Ford Motor Credit Co. LLC, 8%, 2014 | 125,000 | 139,103 | ||||||

| Ford Motor Credit Co. LLC, 12%, 2015 | 960,000 | 1,212,000 | ||||||

| General Motors Financial Co., Inc., 6.75%, 2018 | 215,000 | 230,818 | ||||||

| Goodyear Tire & Rubber Co., 7%, 2022 | 85,000 | 83,300 | ||||||

| IDQ Holdings, Inc., 11.5%, 2017 (z) | 90,000 | 94,050 | ||||||

| Jaguar Land Rover PLC, 8.125%, 2021 (n) | 345,000 | 348,450 | ||||||

| Lear Corp., 8.125%, 2020 | 190,000 | 212,800 | ||||||

|

|

|

|||||||

| $ | 3,456,984 | |||||||

5

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Basic Industry - 0.3% | ||||||||

| Trimas Corp., 9.75%, 2017 | $ | 172,000 | $ | 187,910 | ||||

| Broadcasting - 6.9% | ||||||||

| Allbritton Communications Co., 8%, 2018 | $ | 175,000 | $ | 181,125 | ||||

| AMC Networks, Inc., 7.75%, 2021 (n) | 136,000 | 150,960 | ||||||

| Clear Channel Communications, Inc., 9%, 2021 | 223,000 | 191,780 | ||||||

| Clear Channel Worldwide Holdings, Inc., 7.625%, 2020 (n) | 225,000 | 214,875 | ||||||

| Clear Channel Worldwide Holdings, Inc., “A”, 7.625%, 2020 (n) | 10,000 | 9,400 | ||||||

| Hughes Network Systems LLC, 7.625%, 2021 | 215,000 | 222,525 | ||||||

| Inmarsat Finance PLC, 7.375%, 2017 (n) | 165,000 | 175,725 | ||||||

| Intelsat Bermuda Ltd., 11.25%, 2017 | 400,000 | 393,000 | ||||||

| Intelsat Bermuda Ltd., 11.5%, 2017 (p) | 325,000 | 319,313 | ||||||

| Intelsat Jackson Holdings Ltd., 11.25%, 2016 | 163,000 | 170,131 | ||||||

| LBI Media, Inc., 8.5%, 2017 (z) | 150,000 | 30,000 | ||||||

| Liberty Media Corp., 8.5%, 2029 | 215,000 | 218,225 | ||||||

| Liberty Media Corp., 8.25%, 2030 | 45,000 | 45,788 | ||||||

| LIN Television Corp., 8.375%, 2018 | 55,000 | 56,375 | ||||||

| Local TV Finance LLC, 9.25%, 2015 (p)(z) | 268,809 | 273,849 | ||||||

| Newport Television LLC, 13%, 2017 (n)(p) | 173,412 | 178,614 | ||||||

| Nexstar Broadcasting Group, Inc., 8.875%, 2017 | 80,000 | 83,600 | ||||||

| Sinclair Broadcast Group, Inc., 9.25%, 2017 (n) | 125,000 | 137,500 | ||||||

| Sinclair Broadcast Group, Inc., 8.375%, 2018 | 40,000 | 42,900 | ||||||

| SIRIUS XM Radio, Inc., 13%, 2013 (n) | 110,000 | 123,475 | ||||||

| SIRIUS XM Radio, Inc., 8.75%, 2015 (n) | 220,000 | 248,050 | ||||||

| SIRIUS XM Radio, Inc., 7.625%, 2018 (n) | 170,000 | 181,900 | ||||||

| Townsquare Radio LLC, 9%, 2019 (z) | 100,000 | 102,500 | ||||||

| Univision Communications, Inc., 6.875%, 2019 (n) | 240,000 | 234,000 | ||||||

| Univision Communications, Inc., 7.875%, 2020 (n) | 150,000 | 153,375 | ||||||

| Univision Communications, Inc., 8.5%, 2021 (n) | 135,000 | 130,275 | ||||||

|

|

|

|||||||

| $ | 4,269,260 | |||||||

| Brokerage & Asset Managers - 1.1% | ||||||||

| E*TRADE Financial Corp., 7.875%, 2015 | $ | 260,000 | $ | 263,900 | ||||

| E*TRADE Financial Corp., 12.5%, 2017 | 365,000 | 418,838 | ||||||

|

|

|

|||||||

| $ | 682,738 | |||||||

| Building - 2.5% | ||||||||

| Building Materials Holding Corp., 6.875%, 2018 (n) | $ | 165,000 | $ | 170,361 | ||||

| Building Materials Holding Corp., 7%, 2020 (n) | 115,000 | 120,750 | ||||||

| Building Materials Holding Corp., 6.75%, 2021 (n) | 100,000 | 102,250 | ||||||

| CEMEX S.A., 9.25%, 2020 | 375,000 | 296,250 | ||||||

| HD Supply, Inc., 8.125%, 2019 (n) | 80,000 | 83,400 | ||||||

| Masonite International Corp., 8.25%, 2021 (n) | 230,000 | 234,025 | ||||||

6

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Building - continued | ||||||||

| Nortek, Inc., 10%, 2018 | $ | 120,000 | $ | 126,600 | ||||

| Nortek, Inc., 8.5%, 2021 | 245,000 | 237,650 | ||||||

| Roofing Supply Group LLC/Roofing Supply Finance, Inc., 10%, 2020 (z) | 80,000 | 80,800 | ||||||

| USG Corp., 7.875%, 2020 (n) | 110,000 | 112,475 | ||||||

|

|

|

|||||||

| $ | 1,564,561 | |||||||

| Business Services - 1.6% | ||||||||

| Ceridian Corp., 12.25%, 2015 (p) | $ | 120,000 | $ | 109,800 | ||||

| Fidelity National Information Services, Inc., 7.625%, 2017 | 80,000 | 87,100 | ||||||

| Fidelity National Information Services, Inc., 5%, 2022 (n) | 105,000 | 101,981 | ||||||

| iGate Corp., 9%, 2016 | 289,000 | 306,340 | ||||||

| Iron Mountain, Inc., 8.375%, 2021 | 220,000 | 234,850 | ||||||

| SunGard Data Systems, Inc., 10.25%, 2015 | 47,000 | 48,293 | ||||||

| SunGard Data Systems, Inc., 7.375%, 2018 | 100,000 | 101,750 | ||||||

|

|

|

|||||||

| $ | 990,114 | |||||||

| Cable TV - 5.1% | ||||||||

| Bresnan Broadband Holdings LLC, 8%, 2018 (n) | $ | 60,000 | $ | 61,050 | ||||

| CCH II LLC, 13.5%, 2016 | 285,000 | 319,200 | ||||||

| CCO Holdings LLC, 7.875%, 2018 | 355,000 | 380,736 | ||||||

| CCO Holdings LLC, 8.125%, 2020 | 400,000 | 440,000 | ||||||

| Cequel Communications Holdings, 8.625%, 2017 (n) | 120,000 | 126,450 | ||||||

| CSC Holdings LLC, 8.5%, 2014 | 255,000 | 280,819 | ||||||

| DISH DBS Corp., 6.75%, 2021 | 105,000 | 108,413 | ||||||

| EchoStar Corp., 7.125%, 2016 | 160,000 | 171,200 | ||||||

| ONO Finance ll PLC, 10.875%, 2019 (n) | 150,000 | 120,000 | ||||||

| Telenet Finance Luxembourg, 6.375%, 2020 (n) | EUR | 100,000 | 122,414 | |||||

| UPC Holding B.V., 9.875%, 2018 (n) | $ | 100,000 | 108,000 | |||||

| UPCB Finance III Ltd., 6.625%, 2020 (n) | 354,000 | 348,690 | ||||||

| Videotron Ltee, 5%, 2022 (n) | 115,000 | 112,125 | ||||||

| Virgin Media Finance PLC, 9.5%, 2016 | 83,000 | 91,923 | ||||||

| Virgin Media Finance PLC, 5.25%, 2022 | 200,000 | 195,000 | ||||||

| Ziggo Bond Co. B.V., 8%, 2018 (n) | EUR | 135,000 | 178,613 | |||||

|

|

|

|||||||

| $ | 3,164,633 | |||||||

| Chemicals - 4.5% | ||||||||

| Celanese U.S. Holdings LLC, 6.625%, 2018 | $ | 335,000 | $ | 354,260 | ||||

| Hexion U.S. Finance Corp./Hexion Nova Scotia Finance, 8.875%, 2018 | 465,000 | 462,675 | ||||||

| Hexion U.S. Finance Corp./Hexion Nova Scotia Finance, 9%, 2020 | 60,000 | 52,350 | ||||||

| Huntsman International LLC, 8.625%, 2021 | 235,000 | 263,200 | ||||||

| INEOS Finance PLC, 8.375%, 2019 (n) | 200,000 | 205,500 | ||||||

| INEOS Group Holdings PLC, 8.5%, 2016 (n) | 160,000 | 144,400 | ||||||

| LyondellBasell Industries N.V., 6%, 2021 (n) | 275,000 | 294,250 | ||||||

7

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Chemicals - continued | ||||||||

| Momentive Performance Materials, Inc., 12.5%, 2014 | $ | 505,000 | $ | 528,988 | ||||

| Momentive Performance Materials, Inc., 11.5%, 2016 | 260,000 | 195,000 | ||||||

| Polypore International, Inc., 7.5%, 2017 | 255,000 | 266,475 | ||||||

|

|

|

|||||||

| $ | 2,767,098 | |||||||

| Computer Software - 1.3% | ||||||||

| Lawson Software, Inc., 11.5%, 2018 (n) | $ | 300,000 | $ | 329,250 | ||||

| Lawson Software, Inc., 9.375%, 2019 (n) | 30,000 | 30,900 | ||||||

| Syniverse Holdings, Inc., 9.125%, 2019 | 295,000 | 316,388 | ||||||

| TransUnion Holding Co., Inc., 9.625%, 2018 (n)(p) | 85,000 | 89,675 | ||||||

| TransUnion LLC/TransUnion Financing Corp., 11.375%, 2018 | 40,000 | 46,850 | ||||||

|

|

|

|||||||

| $ | 813,063 | |||||||

| Computer Software - Systems - 1.6% | ||||||||

| Audatex North America, Inc., 6.75%, 2018 (n) | $ | 140,000 | $ | 144,200 | ||||

| CDW LLC/CDW Finance Corp., 12.535%, 2017 | 95,000 | 101,650 | ||||||

| CDW LLC/CDW Finance Corp., 8.5%, 2019 (n) | 65,000 | 66,786 | ||||||

| CDW LLC/CDW Finance Corp., 8.5%, 2019 | 305,000 | 313,386 | ||||||

| DuPont Fabros Technology, Inc., REIT, 8.5%, 2017 | 350,000 | 381,500 | ||||||

|

|

|

|||||||

| $ | 1,007,522 | |||||||

| Conglomerates - 2.2% | ||||||||

| Amsted Industries, Inc., 8.125%, 2018 (n) | $ | 375,000 | $ | 397,500 | ||||

| Dynacast International LLC, 9.25%, 2019 (z) | 200,000 | 206,000 | ||||||

| Griffon Corp., 7.125%, 2018 | 365,000 | 366,825 | ||||||

| Tomkins LLC/Tomkins, Inc., 9%, 2018 | 373,000 | 409,834 | ||||||

|

|

|

|||||||

| $ | 1,380,159 | |||||||

| Consumer Products - 1.4% | ||||||||

| ACCO Brands Corp., 6.75%, 2020 | $ | 40,000 | $ | 41,100 | ||||

| Easton-Bell Sports, Inc., 9.75%, 2016 | 145,000 | 158,413 | ||||||

| Elizabeth Arden, Inc., 7.375%, 2021 | 280,000 | 305,550 | ||||||

| FGI Operating Co./FGI Finance, Inc., 7.875%, 2020 (z) | 20,000 | 20,550 | ||||||

| Jarden Corp., 7.5%, 2020 | 195,000 | 211,088 | ||||||

| Libbey Glass, Inc., 10%, 2015 | 14,000 | 14,910 | ||||||

| Libbey Glass, Inc., 6.875%, 2020 (z) | 80,000 | 80,200 | ||||||

| Prestige Brands, Inc., 8.125%, 2020 (z) | 20,000 | 21,600 | ||||||

|

|

|

|||||||

| $ | 853,411 | |||||||

| Consumer Services - 1.7% | ||||||||

| Realogy Corp., 11.5%, 2017 | $ | 170,000 | $ | 150,450 | ||||

| Service Corp. International, 6.75%, 2015 | 25,000 | 27,000 | ||||||

| Service Corp. International, 7%, 2017 | 785,000 | 873,313 | ||||||

|

|

|

|||||||

| $ | 1,050,763 | |||||||

8

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Containers - 3.1% | ||||||||

| Ardagh Packaging Finance PLC, 9.125%, 2020 (n) | $ | 400,000 | $ | 412,000 | ||||

| Ball Corp., 5%, 2022 | 134,000 | 135,340 | ||||||

| Exopack Holding Corp., 10%, 2018 | 155,000 | 157,325 | ||||||

| Greif, Inc., 6.75%, 2017 | 350,000 | 375,375 | ||||||

| Reynolds Group, 7.75%, 2016 (n) | 100,000 | 105,500 | ||||||

| Reynolds Group, 7.125%, 2019 (n) | 225,000 | 231,188 | ||||||

| Reynolds Group, 9.875%, 2019 (n) | 100,000 | 99,750 | ||||||

| Reynolds Group, 8.5%, 2021 (n) | 285,000 | 264,338 | ||||||

| Sealed Air Corp., 8.125%, 2019 (n) | 40,000 | 43,400 | ||||||

| Sealed Air Corp., 8.375%, 2021 (n) | 40,000 | 44,000 | ||||||

| Tekni-Plex, Inc., 9.75%, 2019 (z) | 40,000 | 39,700 | ||||||

|

|

|

|||||||

| $ | 1,907,916 | |||||||

| Defense Electronics - 0.8% | ||||||||

| Ducommun, Inc., 9.75%, 2018 | $ | 166,000 | $ | 175,545 | ||||

| ManTech International Corp., 7.25%, 2018 | 145,000 | 152,975 | ||||||

| MOOG, Inc., 7.25%, 2018 | 135,000 | 141,750 | ||||||

|

|

|

|||||||

| $ | 470,270 | |||||||

| Electrical Equipment - 0.3% | ||||||||

| Avaya, Inc., 9.75%, 2015 | $ | 205,000 | $ | 169,125 | ||||

| Avaya, Inc., 7%, 2019 (z) | 45,000 | 40,275 | ||||||

|

|

|

|||||||

| $ | 209,400 | |||||||

| Electronics - 1.2% | ||||||||

| Freescale Semiconductor, Inc., 9.25%, 2018 (n) | $ | 280,000 | $ | 294,700 | ||||

| Freescale Semiconductor, Inc., 8.05%, 2020 | 85,000 | 80,750 | ||||||

| Nokia Corp., 5.375%, 2019 | 65,000 | 53,051 | ||||||

| Sensata Technologies B.V., 6.5%, 2019 (n) | 305,000 | 305,763 | ||||||

|

|

|

|||||||

| $ | 734,264 | |||||||

| Energy - Independent - 10.4% | ||||||||

| ATP Oil & Gas Corp., 11.875%, 2015 | $ | 245,000 | $ | 130,463 | ||||

| BreitBurn Energy Partners LP, 8.625%, 2020 | 85,000 | 88,186 | ||||||

| BreitBurn Energy Partners LP, 7.875%, 2022 (n) | 135,000 | 132,300 | ||||||

| Carrizo Oil & Gas, Inc., 8.625%, 2018 | 160,000 | 167,200 | ||||||

| Chaparral Energy, Inc., 7.625%, 2022 (n) | 125,000 | 127,810 | ||||||

| Chesapeake Energy Corp., 6.875%, 2020 | 100,000 | 94,750 | ||||||

| Concho Resources, Inc., 8.625%, 2017 | 110,000 | 119,900 | ||||||

| Concho Resources, Inc., 6.5%, 2022 | 225,000 | 235,125 | ||||||

| Continental Resources, Inc., 8.25%, 2019 | 165,000 | 183,150 | ||||||

| Denbury Resources, Inc., 8.25%, 2020 | 225,000 | 243,000 | ||||||

| Energy XXI Gulf Coast, Inc., 9.25%, 2017 | 285,000 | 306,375 | ||||||

9

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Energy - Independent - continued | ||||||||

| Everest Acquisition LLC/Everest Acquisition Finance, Inc., 9.375%, 2020 (n) | $ | 380,000 | $ | 389,500 | ||||

| EXCO Resources, Inc., 7.5%, 2018 | 355,000 | 299,975 | ||||||

| Harvest Operations Corp., 6.875%, 2017 (n) | 345,000 | 361,388 | ||||||

| Hilcorp Energy I/Hilcorp Finance Co., 8%, 2020 (n) | 70,000 | 74,550 | ||||||

| Laredo Petroleum, Inc., 9.5%, 2019 | 170,000 | 188,700 | ||||||

| Laredo Petroleum, Inc., 7.375%, 2022 (n) | 40,000 | 40,900 | ||||||

| LINN Energy LLC, 6.5%, 2019 (n) | 100,000 | 97,000 | ||||||

| LINN Energy LLC, 8.625%, 2020 | 55,000 | 58,300 | ||||||

| LINN Energy LLC, 7.75%, 2021 | 209,000 | 213,703 | ||||||

| Newfield Exploration Co., 6.625%, 2016 | 90,000 | 92,025 | ||||||

| Newfield Exploration Co., 6.875%, 2020 | 215,000 | 227,900 | ||||||

| OGX Petroleo e Gas Participacoes S.A., 8.5%, 2018 (n) | 602,000 | 579,425 | ||||||

| Pioneer Natural Resources Co., 7.5%, 2020 | 200,000 | 247,307 | ||||||

| Plains Exploration & Production Co., 8.625%, 2019 | 130,000 | 141,050 | ||||||

| QEP Resources, Inc., 6.875%, 2021 | 410,000 | 443,825 | ||||||

| Range Resources Corp., 8%, 2019 | 185,000 | 201,650 | ||||||

| SandRidge Energy, Inc., 8%, 2018 (n) | 425,000 | 425,000 | ||||||

| SM Energy Co., 6.5%, 2021 | 170,000 | 173,825 | ||||||

| Swift Energy Co., 7.875%, 2022 | 115,000 | 116,150 | ||||||

| Whiting Petroleum Corp., 6.5%, 2018 | 215,000 | 224,675 | ||||||

|

|

|

|||||||

| $ | 6,425,107 | |||||||

| Energy - Integrated - 0.2% | ||||||||

| Pacific Rubiales Energy Corp., 7.25%, 2021 (n) | $ | 100,000 | $ | 107,000 | ||||

| Engineering - Construction - 0.3% | ||||||||

| B-Corp. Merger Sub, Inc., 8.25%, 2019 (n) | $ | 185,000 | $ | 185,000 | ||||

| Entertainment - 1.8% | ||||||||

| AMC Entertainment, Inc., 8.75%, 2019 | $ | 210,000 | $ | 224,700 | ||||

| AMC Entertainment, Inc., 9.75%, 2020 | 210,000 | 225,750 | ||||||

| Cedar Fair LP, 9.125%, 2018 | 115,000 | 127,361 | ||||||

| Cinemark USA, Inc., 8.625%, 2019 | 380,000 | 413,250 | ||||||

| NAI Entertainment Holdings LLC, 8.25%, 2017 (n) | 90,000 | 98,100 | ||||||

|

|

|

|||||||

| $ | 1,089,161 | |||||||

| Financial Institutions - 7.1% | ||||||||

| Ally Financial, Inc., 5.5%, 2017 | $ | 430,000 | $ | 430,387 | ||||

| CIT Group, Inc., 5.25%, 2014 (n) | 510,000 | 518,925 | ||||||

| CIT Group, Inc., 5.25%, 2018 | 155,000 | 152,675 | ||||||

| CIT Group, Inc., 6.625%, 2018 (n) | 274,000 | 284,275 | ||||||

10

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Financial Institutions - continued | ||||||||

| CIT Group, Inc., 5.5%, 2019 (n) | $ | 280,000 | $ | 272,300 | ||||

| Credit Acceptance Corp., 9.125%, 2017 | 225,000 | 241,875 | ||||||

| GMAC, Inc., 8%, 2031 | 35,000 | 39,375 | ||||||

| Icahn Enterprises LP, 8%, 2018 | 323,000 | 341,976 | ||||||

| International Lease Finance Corp., 4.875%, 2015 | 105,000 | 103,468 | ||||||

| International Lease Finance Corp., 8.625%, 2015 | 80,000 | 87,200 | ||||||

| International Lease Finance Corp., 8.75%, 2017 | 225,000 | 249,750 | ||||||

| International Lease Finance Corp., 7.125%, 2018 (n) | 246,000 | 270,600 | ||||||

| Nationstar Mortgage LLC/Capital Corp., 10.875%, 2015 | 465,000 | 502,200 | ||||||

| PHH Corp., 9.25%, 2016 | 265,000 | 275,600 | ||||||

| SLM Corp., 8.45%, 2018 | 80,000 | 84,400 | ||||||

| SLM Corp., 8%, 2020 | 460,000 | 470,821 | ||||||

| SLM Corp., 7.25%, 2022 | 55,000 | 53,833 | ||||||

|

|

|

|||||||

| $ | 4,379,660 | |||||||

| Food & Beverages - 2.9% | ||||||||

| ARAMARK Corp., 8.5%, 2015 | $ | 430,000 | $ | 440,217 | ||||

| B&G Foods, Inc., 7.625%, 2018 | 295,000 | 315,650 | ||||||

| Constellation Brands, Inc., 7.25%, 2016 | 180,000 | 203,061 | ||||||

| Del Monte Foods Co., 7.625%, 2019 | 30,000 | 29,100 | ||||||

| JBS USA LLC/JBS USA Finance, 8.25%, 2020 (n) | 225,000 | 214,875 | ||||||

| Pinnacle Foods Finance LLC, 9.25%, 2015 | 330,000 | 336,600 | ||||||

| Pinnacle Foods Finance LLC, 8.25%, 2017 | 50,000 | 52,250 | ||||||

| TreeHouse Foods, Inc., 7.75%, 2018 | 215,000 | 232,200 | ||||||

|

|

|

|||||||

| $ | 1,823,953 | |||||||

| Forest & Paper Products - 2.0% | ||||||||

| Boise, Inc., 8%, 2020 | $ | 225,000 | $ | 246,375 | ||||

| Cascades, Inc., 7.75%, 2017 | 205,000 | 203,975 | ||||||

| Georgia-Pacific Corp., 8%, 2024 | 115,000 | 152,815 | ||||||

| Graphic Packaging Holding Co., 7.875%, 2018 | 125,000 | 137,813 | ||||||

| Millar Western Forest Products Ltd., 8.5%, 2021 | 40,000 | 33,200 | ||||||

| Smurfit Kappa Group PLC, 7.75%, 2019 (n) | EUR | 120,000 | 155,799 | |||||

| Tembec Industries, Inc., 11.25%, 2018 (n) | $ | 15,000 | 14,888 | |||||

| Tembec Industries, Inc., 11.25%, 2018 | 135,000 | 133,988 | ||||||

| Xerium Technologies, Inc., 8.875%, 2018 | 215,000 | 162,325 | ||||||

|

|

|

|||||||

| $ | 1,241,178 | |||||||

| Gaming & Lodging - 5.2% | ||||||||

| Boyd Gaming Corp., 7.125%, 2016 | $ | 165,000 | $ | 157,575 | ||||

| Caesars Operating Escrow LLC, 8.5%, 2020 (n) | 60,000 | 59,775 | ||||||

| Fontainebleau Las Vegas Holdings LLC, 10.25%, 2015 (a)(d)(n) | 695,000 | 434 | ||||||

| GWR Operating Partnership LLP, 10.875%, 2017 | 135,000 | 152,550 | ||||||

11

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Gaming & Lodging - continued | ||||||||

| Harrah’s Operating Co., Inc., 11.25%, 2017 | $ | 365,000 | $ | 387,813 | ||||

| Harrah’s Operating Co., Inc., 10%, 2018 | 164,000 | 108,240 | ||||||

| Harrah’s Operating Co., Inc., 10%, 2018 | 270,000 | 182,250 | ||||||

| MGM Mirage, 10.375%, 2014 | 40,000 | 45,000 | ||||||

| MGM Mirage, 6.625%, 2015 | 70,000 | 71,881 | ||||||

| MGM Mirage, 7.5%, 2016 | 35,000 | 35,788 | ||||||

| MGM Resorts International, 11.375%, 2018 | 405,000 | 466,763 | ||||||

| MGM Resorts International, 9%, 2020 | 170,000 | 186,150 | ||||||

| Penn National Gaming, Inc., 8.75%, 2019 | 357,000 | 393,593 | ||||||

| Pinnacle Entertainment, Inc., 8.75%, 2020 | 130,000 | 141,375 | ||||||

| Pinnacle Entertainment, Inc., 7.75%, 2022 | 70,000 | 73,850 | ||||||

| Rivers Pittsburgh Borrower LP/Rivers Pittsburgh Finance Corp., 9.5%, 2019 (z) |

40,000 | 40,900 | ||||||

| Seven Seas Cruises S. de R.L., 9.125%, 2019 (n) | 265,000 | 272,950 | ||||||

| Wyndham Worldwide Corp., 6%, 2016 | 1,000 | 1,126 | ||||||

| Wyndham Worldwide Corp., 7.375%, 2020 | 105,000 | 127,675 | ||||||

| Wynn Las Vegas LLC, 7.75%, 2020 | 315,000 | 342,169 | ||||||

|

|

|

|||||||

| $ | 3,247,857 | |||||||

| Industrial - 1.7% | ||||||||

| Altra Holdings, Inc., 8.125%, 2016 | $ | 115,000 | $ | 122,762 | ||||

| Dematic S.A., 8.75%, 2016 (z) | 200,000 | 207,000 | ||||||

| Hillman Group, Inc., 10.875%, 2018 | 210,000 | 218,925 | ||||||

| Hyva Global B.V., 8.625%, 2016 (n) | 200,000 | 170,500 | ||||||

| Mueller Water Products, Inc., 8.75%, 2020 | 142,000 | 156,910 | ||||||

| Rexel S.A., 6.125%, 2019 (n) | 200,000 | 199,000 | ||||||

|

|

|

|||||||

| $ | 1,075,097 | |||||||

| Insurance - 2.3% | ||||||||

| American International Group, Inc., 8.25%, 2018 | $ | 170,000 | $ | 204,419 | ||||

| American International Group, Inc., 8.175% to 2038, FRN to 2068 | 505,000 | 524,569 | ||||||

| MetLife, Inc., 9.25% to 2038, FRN to 2068 (n) | 600,000 | 714,000 | ||||||

|

|

|

|||||||

| $ | 1,442,988 | |||||||

| Insurance - Health - 0.3% | ||||||||

| AMERIGROUP Corp., 7.5%, 2019 | $ | 155,000 | $ | 165,850 | ||||

| Insurance - Property & Casualty - 1.3% | ||||||||

| Liberty Mutual Group, Inc., 10.75% to 2038, FRN to 2088 (n) | $ | 330,000 | $ | 455,400 | ||||

| XL Group PLC, 6.5% to 2017, FRN to 2049 | 475,000 | 365,750 | ||||||

|

|

|

|||||||

| $ | 821,150 | |||||||

12

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Machinery & Tools - 2.2% | ||||||||

| Case Corp., 7.25%, 2016 | $ | 90,000 | $ | 98,325 | ||||

| Case New Holland, Inc., 7.875%, 2017 | 525,000 | 598,500 | ||||||

| CNH Capital LLC, 6.25%, 2016 (n) | 65,000 | 67,761 | ||||||

| NESCO LLC/NESCO Holdings Corp., 11.75%, 2017 (z) | 120,000 | 121,200 | ||||||

| RSC Equipment Rental, Inc., 8.25%, 2021 | 240,000 | 253,800 | ||||||

| UR Financing Escrow Corp., 5.75%, 2018 (n) | 115,000 | 117,013 | ||||||

| UR Financing Escrow Corp., 7.625%, 2022 (n) | 117,000 | 119,633 | ||||||

|

|

|

|||||||

| $ | 1,376,232 | |||||||

| Major Banks - 0.9% | ||||||||

| Bank of America Corp., 5.65%, 2018 | $ | 175,000 | $ | 182,288 | ||||

| Royal Bank of Scotland Group PLC, 6.99% to 2017, FRN to 2049 (a)(d)(n) | 100,000 | 76,000 | ||||||

| Royal Bank of Scotland Group PLC, 7.648% to 2031, FRN to 2049 | 365,000 | 278,313 | ||||||

|

|

|

|||||||

| $ | 536,601 | |||||||

| Medical & Health Technology & Services - 6.9% | ||||||||

| Biomet, Inc., 10.375%, 2017 (p) | $ | 85,000 | $ | 90,472 | ||||

| Biomet, Inc., 11.625%, 2017 | 435,000 | 461,100 | ||||||

| Davita, Inc., 6.375%, 2018 | 505,000 | 511,313 | ||||||

| Davita, Inc., 6.625%, 2020 | 145,000 | 146,813 | ||||||

| Fresenius Medical Care AG & Co. KGaA, 9%, 2015 (n) | 165,000 | 188,513 | ||||||

| Fresenius Medical Care Capital Trust III, 5.625%, 2019 (n) | 85,000 | 84,363 | ||||||

| HCA, Inc., 8.5%, 2019 | 665,000 | 733,994 | ||||||

| HCA, Inc., 7.5%, 2022 | 185,000 | 193,903 | ||||||

| HCA, Inc., 5.875%, 2022 | 85,000 | 84,363 | ||||||

| HealthSouth Corp., 8.125%, 2020 | 390,000 | 416,325 | ||||||

| IASIS Healthcare LLC/IASIS Capital Corp., 8.375%, 2019 | 130,000 | 122,200 | ||||||

| Physio-Control International, Inc., 9.875%, 2019 (z) | 135,000 | 143,100 | ||||||

| Teleflex, Inc., 6.875%, 2019 | 275,000 | 291,500 | ||||||

| Tenet Healthcare Corp., 9.25%, 2015 | 140,000 | 154,525 | ||||||

| Truven Health Analytics, Inc., 10.625%, 2020 (z) | 50,000 | 50,250 | ||||||

| Universal Health Services, Inc., 7%, 2018 | 130,000 | 139,100 | ||||||

| Universal Hospital Services, Inc., 8.5%, 2015 (p) | 280,000 | 285,250 | ||||||

| USPI Finance Corp., 9%, 2020 (n) | 70,000 | 72,625 | ||||||

| Vanguard Health Systems, Inc., 0%, 2016 | 2,000 | 1,385 | ||||||

| Vanguard Health Systems, Inc., 8%, 2018 | 105,000 | 102,900 | ||||||

|

|

|

|||||||

| $ | 4,273,994 | |||||||

| Metals & Mining - 3.1% | ||||||||

| Arch Coal, Inc., 7.25%, 2020 | $ | 110,000 | $ | 94,050 | ||||

| Cloud Peak Energy, Inc., 8.25%, 2017 | 445,000 | 455,011 | ||||||

| Cloud Peak Energy, Inc., 8.5%, 2019 | 225,000 | 231,750 | ||||||

| Consol Energy, Inc., 8%, 2017 | 170,000 | 170,425 | ||||||

13

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Metals & Mining - continued | ||||||||

| Consol Energy, Inc., 8.25%, 2020 | $ | 110,000 | $ | 110,000 | ||||

| Fortescue Metals Group Ltd., 8.25%, 2019 (n) | 245,000 | 252,963 | ||||||

| Peabody Energy Corp., 7.375%, 2016 | 350,000 | 387,625 | ||||||

| Peabody Energy Corp., 6%, 2018 (n) | 110,000 | 109,725 | ||||||

| Peabody Energy Corp., 6.25%, 2021 (n) | 110,000 | 109,725 | ||||||

|

|

|

|||||||

| $ | 1,921,274 | |||||||

| Natural Gas - Distribution - 0.3% | ||||||||

| AmeriGas Finance LLC, 6.75%, 2020 | $ | 80,000 | $ | 78,800 | ||||

| Ferrellgas LP/Ferrellgas Finance Corp., 6.5%, 2021 | 105,000 | 93,975 | ||||||

|

|

|

|||||||

| $ | 172,775 | |||||||

| Natural Gas - Pipeline - 3.3% | ||||||||

| Atlas Pipeline Partners LP, 8.75%, 2018 | $ | 280,000 | $ | 296,800 | ||||

| Colorado Interstate Gas Co., 6.8%, 2015 | 91,000 | 105,794 | ||||||

| Crosstex Energy, Inc., 8.875%, 2018 | 270,000 | 283,500 | ||||||

| El Paso Corp., 7%, 2017 | 185,000 | 207,633 | ||||||

| El Paso Corp., 7.75%, 2032 | 395,000 | 450,830 | ||||||

| Energy Transfer Equity LP, 7.5%, 2020 | 290,000 | 313,200 | ||||||

| Enterprise Products Partners LP, 8.375% to 2016, FRN to 2066 | 249,000 | 268,920 | ||||||

| Enterprise Products Partners LP, 7.034% to 2018, FRN to 2068 | 67,000 | 71,355 | ||||||

| Rockies Express Pipeline LLC, 5.625%, 2020 (n) | 88,000 | 77,880 | ||||||

|

|

|

|||||||

| $ | 2,075,912 | |||||||

| Network & Telecom - 2.5% | ||||||||

| Citizens Communications Co., 9%, 2031 | $ | 110,000 | $ | 100,650 | ||||

| Eileme 2 AB, 11.625%, 2020 (n) | 200,000 | 196,000 | ||||||

| Frontier Communications Corp., 8.125%, 2018 | 225,000 | 228,938 | ||||||

| Qwest Communications International, Inc., 7.125%, 2018 (n) | 315,000 | 332,777 | ||||||

| Qwest Corp., 7.5%, 2014 | 145,000 | 162,418 | ||||||

| Windstream Corp., 8.125%, 2018 | 45,000 | 46,688 | ||||||

| Windstream Corp., 7.75%, 2020 | 375,000 | 375,000 | ||||||

| Windstream Corp., 7.75%, 2021 | 100,000 | 100,250 | ||||||

|

|

|

|||||||

| $ | 1,542,721 | |||||||

| Oil Services - 1.2% | ||||||||

| Chesapeake Energy Corp., 6.625%, 2019 (n) | $ | 85,000 | $ | 73,525 | ||||

| Dresser-Rand Group, Inc., 6.5%, 2021 | 80,000 | 81,600 | ||||||

| Edgen Murray Corp., 12.25%, 2015 | 165,000 | 168,713 | ||||||

| Pioneer Drilling Co., 9.875%, 2018 (n) | 35,000 | 36,750 | ||||||

| Pioneer Drilling Co., 9.875%, 2018 | 230,000 | 241,500 | ||||||

| Unit Corp., 6.625%, 2021 | 135,000 | 134,325 | ||||||

|

|

|

|||||||

| $ | 736,413 | |||||||

14

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Other Banks & Diversified Financials - 1.7% | ||||||||

| Capital One Financial Corp., 10.25%, 2039 | $ | 305,000 | $ | 315,675 | ||||

| Groupe BPCE S.A., 12.5% to 2019, FRN to 2049 (n) | 125,000 | 121,254 | ||||||

| LBG Capital No. 1 PLC, 7.875%, 2020 (n) | 210,000 | 183,341 | ||||||

| Santander UK PLC, 8.963% to 2030, FRN to 2049 | 478,000 | 463,660 | ||||||

|

|

|

|||||||

| $ | 1,083,930 | |||||||

| Pharmaceuticals - 1.1% | ||||||||

| Capsugel FinanceCo. SCA, 9.875%, 2019 (n) | EUR | 200,000 | $ | 259,665 | ||||

| Endo Health Solutions, Inc., 7%, 2019 | $ | 205,000 | 214,225 | |||||

| Valeant Pharmaceuticals International, Inc., 6.5%, 2016 (n) | 65,000 | 66,300 | ||||||

| Valeant Pharmaceuticals International, Inc., 7%, 2020 (n) | 125,000 | 120,938 | ||||||

|

|

|

|||||||

| $ | 661,128 | |||||||

| Pollution Control - 0.2% | ||||||||

| Heckmann Corp., 9.875%, 2018 (z) | $ | 110,000 | $ | 104,500 | ||||

| Printing & Publishing - 0.6% | ||||||||

| American Media, Inc., 13.5%, 2018 (z) | $ | 28,207 | $ | 24,258 | ||||

| Morris Publishing Group LLC, 10%, 2014 | 66,908 | 66,072 | ||||||

| Nielsen Finance LLC, 11.5%, 2016 | 97,000 | 109,610 | ||||||

| Nielsen Finance LLC, 7.75%, 2018 | 165,000 | 177,375 | ||||||

|

|

|

|||||||

| $ | 377,315 | |||||||

| Railroad & Shipping - 0.2% | ||||||||

| Kansas City Southern de Mexico S.A. de C.V., 6.125%, 2021 | $ | 90,000 | $ | 97,425 | ||||

| Real Estate - 1.3% | ||||||||

| CB Richard Ellis Group, Inc., 11.625%, 2017 | $ | 180,000 | $ | 203,400 | ||||

| CNL Lifestyle Properties, Inc., REIT, 7.25%, 2019 | 80,000 | 71,600 | ||||||

| Entertainment Properties Trust, REIT, 7.75%, 2020 | 200,000 | 218,443 | ||||||

| Kennedy Wilson, Inc., 8.75%, 2019 | 75,000 | 77,250 | ||||||

| MPT Operating Partnership LP, REIT, 6.875%, 2021 | 150,000 | 154,500 | ||||||

| MPT Operating Partnership LP, REIT, 6.375%, 2022 | 70,000 | 69,650 | ||||||

|

|

|

|||||||

| $ | 794,843 | |||||||

| Retailers - 3.5% | ||||||||

| Academy Ltd., 9.25%, 2019 (n) | $ | 160,000 | $ | 168,800 | ||||

| Burlington Coat Factory Warehouse Corp., 10%, 2019 | 210,000 | 216,825 | ||||||

| J. Crew Group, Inc., 8.125%, 2019 | 145,000 | 145,544 | ||||||

| Limited Brands, Inc., 6.9%, 2017 | 125,000 | 139,063 | ||||||

| Limited Brands, Inc., 6.95%, 2033 | 175,000 | 168,000 | ||||||

| Neiman Marcus Group, Inc., 10.375%, 2015 | 255,000 | 266,796 | ||||||

| QVC, Inc., 7.375%, 2020 (n) | 125,000 | 136,250 | ||||||

| Rite Aid Corp., 9.25%, 2020 (z) | 95,000 | 90,963 | ||||||

15

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Retailers - continued | ||||||||

| Sally Beauty Holdings, Inc., 6.875%, 2019 (n) | $ | 110,000 | $ | 117,150 | ||||

| Toys “R” Us Property Co. II LLC, 8.5%, 2017 | 330,000 | 339,488 | ||||||

| Toys “R” Us, Inc., 10.75%, 2017 | 280,000 | 304,500 | ||||||

| Yankee Acquisition Corp., 8.5%, 2015 | 2,000 | 2,050 | ||||||

| YCC Holdings LLC/Yankee Finance, Inc., 10.25%, 2016 (p) | 90,000 | 90,225 | ||||||

|

|

|

|||||||

| $ | 2,185,654 | |||||||

| Specialty Chemicals - 0.1% | ||||||||

| Koppers, Inc., 7.875%, 2019 | $ | 70,000 | $ | 74,725 | ||||

| Specialty Stores - 0.4% | ||||||||

| Michaels Stores, Inc., 11.375%, 2016 | $ | 125,000 | $ | 132,814 | ||||

| Michaels Stores, Inc., 7.75%, 2018 | 125,000 | 130,313 | ||||||

|

|

|

|||||||

| $ | 263,127 | |||||||

| Telecommunications - Wireless - 4.7% | ||||||||

| Clearwire Corp., 12%, 2015 (n) | $ | 335,000 | $ | 292,286 | ||||

| Cricket Communications, Inc., 7.75%, 2016 | 135,000 | 142,425 | ||||||

| Cricket Communications, Inc., 7.75%, 2020 | 220,000 | 201,300 | ||||||

| Crown Castle International Corp., 9%, 2015 | 215,000 | 233,811 | ||||||

| Crown Castle International Corp., 7.125%, 2019 | 345,000 | 370,444 | ||||||

| Digicel Group Ltd., 8.25%, 2017 (n) | 235,000 | 236,175 | ||||||

| Digicel Group Ltd., 10.5%, 2018 (n) | 100,000 | 102,000 | ||||||

| MetroPCS Wireless, Inc., 7.875%, 2018 | 90,000 | 90,900 | ||||||

| Sprint Capital Corp., 6.875%, 2028 | 140,000 | 103,950 | ||||||

| Sprint Nextel Corp., 6%, 2016 | 205,000 | 187,575 | ||||||

| Sprint Nextel Corp., 8.375%, 2017 | 310,000 | 297,600 | ||||||

| Sprint Nextel Corp., 9%, 2018 (n) | 100,000 | 108,250 | ||||||

| Wind Acquisition Finance S.A., 11.75%, 2017 (n) | 250,000 | 212,500 | ||||||

| Wind Acquisition Finance S.A., 7.25%, 2018 (n) | 410,000 | 350,550 | ||||||

|

|

|

|||||||

| $ | 2,929,766 | |||||||

| Telephone Services - 0.6% | ||||||||

| Cogent Communications Group, Inc., 8.375%, 2018 (n) | $ | 100,000 | $ | 107,250 | ||||

| Level 3 Financing, Inc., 9.375%, 2019 | 155,000 | 164,688 | ||||||

| Level 3 Financing, Inc., 8.625%, 2020 (n) | 80,000 | 81,600 | ||||||

|

|

|

|||||||

| $ | 353,538 | |||||||

| Transportation - 0.2% | ||||||||

| Navios South American Logistics, Inc., 9.25%, 2019 | $ | 146,000 | $ | 134,320 | ||||

| Transportation - Services - 3.9% | ||||||||

| ACL I Corp., 10.625%, 2016 (n)(p) | $ | 188,684 | $ | 180,239 | ||||

| Aguila American Resources Ltd., 7.875%, 2018 (n) | 300,000 | 306,000 | ||||||

16

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Transportation - Services - continued | ||||||||

| Atlas Airlines, Inc. Pass-Through Certificates, “B”, 7.68%, 2014 | $ | 83,993 | $ | 79,794 | ||||

| Avis Budget Car Rental LLC, 8.25%, 2019 (n) | 50,000 | 51,750 | ||||||

| Avis Budget Car Rental LLC, 8.25%, 2019 | 80,000 | 82,800 | ||||||

| Avis Budget Car Rental LLC, 9.75%, 2020 | 95,000 | 104,025 | ||||||

| CEVA Group PLC, 8.375%, 2017 (n) | 290,000 | 282,025 | ||||||

| Commercial Barge Line Co., 12.5%, 2017 | 355,000 | 402,036 | ||||||

| Hertz Corp., 7.5%, 2018 | 62,000 | 64,558 | ||||||

| Navios Maritime Acquisition Corp., 8.625%, 2017 | 260,000 | 244,400 | ||||||

| Navios Maritime Holdings, Inc., 8.875%, 2017 | 125,000 | 128,125 | ||||||

| Swift Services Holdings, Inc., 10%, 2018 | 470,000 | 505,250 | ||||||

|

|

|

|||||||

| $ | 2,431,002 | |||||||

| Utilities - Electric Power - 6.2% | ||||||||

| AES Corp., 8%, 2017 | $ | 390,000 | $ | 432,900 | ||||

| Atlantic Power Corp., 9%, 2018 (z) | 130,000 | 131,950 | ||||||

| Calpine Corp., 8%, 2016 (n) | 415,000 | 445,086 | ||||||

| Calpine Corp., 7.875%, 2020 (n) | 215,000 | 227,900 | ||||||

| Covanta Holding Corp., 7.25%, 2020 | 220,000 | 238,817 | ||||||

| Covanta Holding Corp., 6.375%, 2022 | 70,000 | 72,582 | ||||||

| Dolphin Subsidiary ll, Inc., 7.25%, 2021 (n) | 135,000 | 146,813 | ||||||

| Edison Mission Energy, 7%, 2017 | 155,000 | 82,925 | ||||||

| EDP Finance B.V., 6%, 2018 (n) | 315,000 | 277,320 | ||||||

| Energy Future Holdings Corp., 10%, 2020 | 270,000 | 286,875 | ||||||

| Energy Future Holdings Corp., 10%, 2020 | 515,000 | 554,913 | ||||||

| Energy Future Holdings Corp., 11.75%, 2022 (n) | 125,000 | 127,500 | ||||||

| GenOn Energy, Inc., 9.875%, 2020 | 475,000 | 439,375 | ||||||

| NRG Energy, Inc., 7.375%, 2017 | 105,000 | 108,413 | ||||||

| NRG Energy, Inc., 8.25%, 2020 | 200,000 | 197,000 | ||||||

| Texas Competitive Electric Holdings Co. LLC, 11.5%, 2020 (n) | 125,000 | 83,750 | ||||||

|

|

|

|||||||

| $ | 3,854,119 | |||||||

| Total Bonds (Identified Cost, $78,208,928) | $ | 78,300,836 | ||||||

| Preferred Stocks - 0.7% | ||||||||

| Other Banks & Diversified Financials - 0.7% | ||||||||

| Ally Financial, Inc., 7% (z) | 100 | $ | 85,744 | |||||

| Ally Financial, Inc., “A”, 8.5% | 8,010 | 174,618 | ||||||

| GMAC Capital Trust I, 8.125% | 5,675 | 130,071 | ||||||

| Total Preferred Stocks (Identified Cost, $443,217) | $ | 390,433 | ||||||

| Convertible Bonds - 0.4% | ||||||||

| Network & Telecom - 0.4% | ||||||||

| Nortel Networks Corp., 2.125%, 2014 (Identified Cost, $256,638) (a)(d) | $ | 260,000 | $ | 257,400 | ||||

17

Table of Contents

Portfolio of Investments (unaudited) – continued

| Common Stocks - 0.3% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Automotive - 0.0% | ||||||||

| Accuride Corp. (a) | 4,099 | $ | 24,266 | |||||

| Broadcasting - 0.1% | ||||||||

| New Young Broadcasting Holding Co., Inc. (a) | 30 | $ | 87,750 | |||||

| Printing & Publishing - 0.1% | ||||||||

| American Media Operations, Inc. (a) | 7,229 | $ | 40,121 | |||||

| Special Products & Services - 0.1% | ||||||||

| Mark IV Industries LLC, Common Units, “A” (a) | 790 | $ | 27,650 | |||||

| Total Common Stocks (Identified Cost, $410,061) | $ | 179,787 | ||||||

| Floating Rate Loans (g)(r) - 0.2% | ||||||||

| Financial Institutions - 0.1% | ||||||||

| Springleaf Finance Corp., Term Loan, 5.5%, 2017 | $ | 80,705 | $ | 74,081 | ||||

| Utilities - Electric Power - 0.1% | ||||||||

| Dynegy Midwest Generation LLC, Term Loan, 9.25%, 2016 | $ | 23,014 | $ | 23,283 | ||||

| Dynegy Power LLC, Term Loan, 9.25%, 2016 | 34,521 | 35,499 | ||||||

|

|

|

|||||||

| $ | 58,782 | |||||||

| Total Floating Rate Loans (Identified Cost, $136,906) | $ | 132,863 | ||||||

| Convertible Preferred Stocks - 0.2% | ||||||||

| Automotive - 0.2% | ||||||||

| General Motors Co., 4.75% (Identified Cost, $145,500) | 2,910 | $ | 106,855 | |||||

| Warrants - 0.1% | ||||||||||||||||

| Strike Price | First Exercise | |||||||||||||||

| Broadcasting - 0.1% | ||||||||||||||||

| New Young Broadcasting Holding Co., Inc. (1 share for 1 warrant) (Identified Cost, $51,567) (a) | $ | 0.01 | 12/24/24 | 27 | $ |

78,975 |

| |||||||||

| Money Market Funds - 4.3% | ||||||||||||||||

| MFS Institutional Money Market Portfolio, 0.13%, at Cost and Net Asset Value (v) |

2,679,442 | $ | 2,679,442 | |||||||||||||

| Total Investments (Identified Cost, $82,332,259) | $ | 82,126,591 | ||||||||||||||

| Other Assets, Less Liabilities - (32.6)% | (20,168,205 | ) | ||||||||||||||

| Net Assets - 100.0% | $ | 61,958,386 | ||||||||||||||

18

Table of Contents

Portfolio of Investments (unaudited) – continued

| (a) | Non-income producing security. |

| (d) | In default. Interest and/or scheduled principal payment(s) have been missed. |

| (g) | The rate shown represents a weighted average coupon rate on settled positions at period end, unless otherwise indicated. |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $21,663,358 representing 35.0% of net assets. |

| (p) | Payment-in-kind security. |

| (r) | Remaining maturities of floating rate loans may be less than stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. These loans may be subject to restrictions on resale. Floating rate loans generally have rates of interest which are determined periodically by reference to a base lending rate plus a premium. |

| (v) | Underlying affiliated fund that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

| (z) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered. Disposal of these securities may involve time-consuming negotiations and prompt sale at an acceptable price may be difficult. The fund holds the following restricted securities: |

| Restricted Securities | Acquisition Date |

Cost | Value | |||||||

| Ally Financial, Inc., 7% (Preferred Stock) | 4/13/11-4/14/11 | $93,750 | $85,744 | |||||||

| American Media, Inc., 13.5%, 2018 | 12/22/10 | 28,601 | 24,258 | |||||||

| Atlantic Power Corp., 9%, 2018 | 10/26/11-3/02/12 | 128,694 | 131,950 | |||||||

| Avaya, Inc., 7%, 2019 | 5/24/12 | 41,177 | 40,275 | |||||||

| Banc of America Commercial Mortgage, Inc., FRN, 6.248%, 2051 |

6/19/08 | 329,384 | 77,864 | |||||||

| Dematic S.A., 8.75%, 2016 | 4/19/11 | 202,446 | 207,000 | |||||||

| Dynacast International LLC, 9.25%, 2019 | 7/12/11-7/15/11 | 202,361 | 206,000 | |||||||

| FGI Operating Co./FGI Finance, Inc., 7.875%, 2020 | 4/12/12 | 20,000 | 20,550 | |||||||

| G-Force LLC, CDO, “A2”, 4.83%, 2036 | 1/20/11 | 104,232 | 102,494 | |||||||

| Heckler & Koch GmbH, 9.5%, 2018 | 5/10/11 | 162,813 | 98,116 | |||||||

| Heckmann Corp., 9.875%, 2018 | 4/04/12 | 109,397 | 104,500 | |||||||

| IDQ Holdings, Inc., 11.5%, 2017 | 3/20/12 | 88,249 | 94,050 | |||||||

| LBI Media, Inc., 8.5%, 2017 | 7/18/07 | 148,465 | 30,000 | |||||||

| Libbey Glass, Inc., 6.875%, 2020 | 5/11/12 | 80,000 | 80,200 | |||||||

| Local TV Finance LLC, 9.25%, 2015 | 5/02/07-2/16/11 | 269,734 | 273,849 | |||||||

| NESCO LLC/NESCO Holdings Corp., 11.75%, 2017 | 4/05/12 | 117,843 | 121,200 | |||||||

| Physio-Control International, Inc., 9.875%, 2019 | 1/13/12-1/30/12 | 136,813 | 143,100 | |||||||

| Prestige Brands, Inc., 8.125%, 2020 | 1/24/12 | 20,000 | 21,600 | |||||||

| Rite Aid Corp., 9.25%, 2020 | 5/03/12-5/21/12 | 94,524 | 90,963 | |||||||

| Rivers Pittsburgh Borrower LP/Rivers Pittsburgh Finance Corp., 9.5%, 2019 | 5/30/12 | 40,000 | 40,900 | |||||||

19

Table of Contents

Portfolio of Investments (unaudited) – continued

| Restricted Securities - continued | Acquisition Date |

Cost | Value | |||||||||

| Roofing Supply Group LLC/Roofing Supply Finance, Inc., 10%, 2020 |

5/24/12 | $80,000 | $80,800 | |||||||||

| Tekni-Plex, Inc., 9.75%, 2019 | 5/10/12 | 39,504 | 39,700 | |||||||||

| Townsquare Radio LLC, 9%, 2019 | 3/30/12 | 99,017 | 102,500 | |||||||||

| Truven Health Analytics, Inc., 10.625%, 2020 | 5/24/12-5/25/12 | 49,904 | 50,250 | |||||||||

| Total Restricted Securities | $2,267,863 | |||||||||||

| % of Net assets | 3.7% | |||||||||||

The following abbreviations are used in this report and are defined:

| CDO | Collateralized Debt Obligation |

| FRN | Floating Rate Note. Interest rate resets periodically and may not be the rate reported at period end. |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

Abbreviations indicate amounts shown in currencies other than the U.S. dollar. All amounts are stated in U.S. dollars unless otherwise indicated. A list of abbreviations is shown below:

| EUR | Euro |

Derivative Contracts at 5/31/12

Forward Foreign Currency Exchange Contracts at 5/31/12

| Type | Currency | Counterparty | Contracts to Deliver/ Receive |

Settlement Date Range |

In Exchange For |

Contracts at Value |

Net Unrealized Appreciation (Depreciation) |

|||||||||||||||

| Asset Derivatives | ||||||||||||||||||||||

| SELL | EUR | JPMorgan Chase Bank N.A. | 676,541 | 7/13/12 | $ | 884,564 | $ | 836,719 | $ | 47,845 | ||||||||||||

|

|

|

|||||||||||||||||||||

See Notes to Financial Statements

20

Table of Contents

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 5/31/12 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| Assets | ||||

| Investments- |

||||

| Non-affiliated issuers, at value (identified cost, $79,652,817) |

$79,447,149 | |||

| Underlying affiliated funds, at cost and value |

2,679,442 | |||

| Total investments, at value (identified cost, $82,332,259) |

$82,126,591 | |||

| Cash |

14 | |||

| Receivables for |

||||

| Forward foreign currency exchange contracts |

47,845 | |||

| Investments sold |

286,615 | |||

| Interest and dividends |

1,660,829 | |||

| Other assets |

16,003 | |||

| Total assets |

$84,137,897 | |||

| Liabilities | ||||

| Notes payable |

$22,000,000 | |||

| Payables for |

||||

| Investments purchased |

89,904 | |||

| Payable to affiliates |

||||

| Investment adviser |

13,710 | |||

| Transfer agent and dividend disbursing costs |

472 | |||

| Payable for independent Trustees’ compensation |

1,619 | |||

| Accrued interest expense |

39,831 | |||

| Accrued expenses and other liabilities |

33,975 | |||

| Total liabilities |

$22,179,511 | |||

| Net assets |

$61,958,386 | |||

| Net assets consist of | ||||

| Paid-in capital |

$78,944,502 | |||

| Unrealized appreciation (depreciation) on investments and translation of assets and liabilities in foreign currencies |

(158,364 | ) | ||

| Accumulated net realized gain (loss) on investments and foreign currency |

(16,591,809 | ) | ||

| Accumulated distributions in excess of net investment income |

(235,943 | ) | ||

| Net assets |

$61,958,386 | |||

| Shares of beneficial interest outstanding |

20,993,341 | |||

| Net asset value per share (net assets of $61,958,386 / 20,993,341 shares of beneficial interest outstanding) |

$2.95 |

See Notes to Financial Statements

21

Table of Contents

Financial Statements

Six months ended 5/31/12 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses.

It also describes any gains and/or losses generated by fund operations.

| Net investment income | ||||

| Income |

||||

| Interest |

$3,302,455 | |||

| Dividends |

27,826 | |||

| Dividends from underlying affiliated funds |

1,241 | |||

| Total investment income |

$3,331,522 | |||

| Expenses |

||||

| Management fee |

$356,166 | |||

| Transfer agent and dividend disbursing costs |

10,984 | |||

| Administrative services fee |

9,683 | |||

| Independent Trustees’ compensation |

7,154 | |||

| Stock exchange fee |

11,881 | |||

| Custodian fee |

5,780 | |||

| Interest expense |

120,619 | |||

| Shareholder communications |

17,099 | |||

| Audit and tax fees |

35,905 | |||

| Legal fees |

2,400 | |||

| Miscellaneous |

15,299 | |||

| Total expenses |

$592,970 | |||

| Fees paid indirectly |

(23 | ) | ||

| Reduction of expenses by investment adviser |

(51,995 | ) | ||

| Net expenses |

$540,952 | |||

| Net investment income |

$2,790,570 | |||

| Realized and unrealized gain (loss) on investments and foreign currency |

||||

| Realized gain (loss) (identified cost basis) |

||||

| Investments |

$(735,325 | ) | ||

| Foreign currency |

31,903 | |||

| Net realized gain (loss) on investments |

$(703,422 | ) | ||

| Change in unrealized appreciation (depreciation) |

||||

| Investments |

$3,533,329 | |||

| Translation of assets and liabilities in foreign currencies |

38,305 | |||

| Net unrealized gain (loss) on investments |

$3,571,634 | |||

| Net realized and unrealized gain (loss) on investments |

$2,868,212 | |||

| Change in net assets from operations |

$5,658,782 |

See Notes to Financial Statements

22

Table of Contents

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| Change in net assets | Six months ended 5/31/12 (unaudited) |

Year ended 11/30/11 |

||||||

| From operations | ||||||||

| Net investment income |

$2,790,570 | $5,569,128 | ||||||

| Net realized gain (loss) on investments and |

(703,422 | ) | 586,229 | |||||

| Net unrealized gain (loss) on investments and |

3,571,634 | (3,567,034 | ) | |||||

| Change in net assets from operations |

$5,658,782 | $2,588,323 | ||||||

| Distributions declared to shareholders | ||||||||

| From net investment income |

$(3,333,073 | ) | $(6,390,463 | ) | ||||

| Change in net assets from fund share transactions |

$221,552 | $121,235 | ||||||

| Total change in net assets |

$2,547,261 | $(3,680,905 | ) | |||||

| Net assets | ||||||||

| At beginning of period |

59,411,125 | 63,092,030 | ||||||

| At end of period (including accumulated distributions in excess of net investment income of $235,943 and undistributed net investment income of $306,560, respectively) |

$61,958,386 | $59,411,125 | ||||||

See Notes to Financial Statements

23

Table of Contents

Financial Statements

Six months ended 5/31/12 (unaudited)

This statement provides a summary of cash flows from investment activity for the fund.

| Cash flows from operating activities: | ||||

| Net increase in net assets from operations |

$5,658,782 | |||

| Adjustments to reconcile change in net assets from operations to net cash provided by operating activities: | ||||

| Purchase of investment securities |

(20,249,035 | ) | ||

| Proceeds from disposition of investment securities |

21,729,871 | |||

| Purchases of short-term investments, net |

(1,718,128 | ) | ||

| Realized gain/loss on investments |

735,325 | |||

| Unrealized appreciation/depreciation on investments |

(3,533,329 | ) | ||

| Unrealized appreciation/depreciation on foreign currency contracts |

(38,578 | ) | ||

| Net amortization/accretion of income |

63,927 | |||

| Decrease in dividends and interest receivable |

117,233 | |||

| Decrease in accrued expenses and other liabilities |

(44,348 | ) | ||

| Increase in other assets |

(11,335 | ) | ||

| Net cash provided by operating activities |

$2,710,385 | |||

| Cash flows from financing activities: | ||||

| Distributions paid in cash |

(3,111,521 | ) | ||

| Decrease in interest payable |

(3,442 | ) | ||

| Net cash used by financing activities |

$(3,114,963 | ) | ||

| Net decrease in cash |

$(404,578 | ) | ||

| Cash: | ||||

| Beginning of period |

$404,592 | |||

| End of period |

$14 |

Supplementary disclosure of cash flow information: cash paid during the year for interest $124,061.

See Notes to Financial Statements

24

Table of Contents

Financial Statements

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| Six months (unaudited) |

Years ended 11/30 | |||||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||||||

| Net asset value, beginning of period |

$2.84 | $3.02 | $2.72 | $1.72 | $3.47 | $3.64 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (d) |

$0.13 | $0.27 | $0.29 | $0.28 | $0.33 | $0.29 | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

0.14 | (0.14 | ) | 0.28 | 1.01 | (1.76 | ) | (0.18 | ) | |||||||||||||||

| Total from investment operations |

$0.27 | $0.13 | $0.57 | $1.29 | $(1.43 | ) | $0.11 | |||||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

| From net investment income |

$(0.16 | ) | $(0.31 | ) | $(0.27 | ) | $(0.29 | ) | $(0.32 | ) | $(0.28 | ) | ||||||||||||

| Net increase from repurchase of |

$— | $— | $— | $0.00 | (w) | $0.00 | (w) | $— | ||||||||||||||||

| Net asset value, end of period (x) |

$2.95 | $2.84 | $3.02 | $2.72 | $1.72 | $3.47 | ||||||||||||||||||

| Market value, end of period |

$3.03 | $2.85 | $3.01 | $2.42 | $1.35 | $2.97 | ||||||||||||||||||

| Total return at market value (%) |

12.13 | (n) | 4.90 | 36.61 | 107.88 | (48.49 | ) | (6.95 | ) | |||||||||||||||

| Total return at net asset value (%) (j)(r)(s)(x) |

9.56 | (n) | 4.19 | 21.94 | 83.39 | (43.83 | ) | 3.34 | ||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||||||||||||||

| Expenses before expense reductions (f) |

1.90 | (a) | 1.92 | 2.31 | 2.85 | 3.55 | 3.35 | |||||||||||||||||

| Expenses after expense reductions (f) |

1.74 | (a) | 1.81 | 1.88 | 2.16 | 2.81 | 3.24 | |||||||||||||||||

| Net investment income |

8.96 | (a) | 8.83 | 9.85 | 12.69 | 10.80 | 7.97 | |||||||||||||||||

| Portfolio turnover |

20 | 60 | 57 | 45 | 62 | 90 | ||||||||||||||||||

| Net assets at end of period (000 omitted) |

$61,958 | $59,411 | $63,092 | $56,684 | $35,926 | $72,833 | ||||||||||||||||||

25

Table of Contents

Financial Highlights – continued

| Six months (unaudited) |

Years ended 11/30 | |||||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||||||

| Supplemental Ratios (%): | ||||||||||||||||||||||||

| Ratio of expenses to average net assets |

1.35 | (a) | 1.35 | 1.03 | 1.08 | 1.01 | 1.04 | |||||||||||||||||

| Senior Securities: | ||||||||||||||||||||||||

| Total notes payable outstanding |

$22,000 | $22,000 | $22,000 | $21,000 | $17,000 | $28,500 | ||||||||||||||||||

| Asset coverage per $1,000 of |

$3,816 | $3,701 | $3,868 | $3,699 | $3,113 | $3,556 | ||||||||||||||||||

| (a) | Annualized. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (j) | Total return at net asset value is calculated using the net asset value of the fund, not the publicly traded price and therefore may be different than the total return at market value. |

| (k) | Calculated by subtracting the fund’s total liabilities (not including notes payable) from the trust’s total assets and dividing this number by the notes payable outstanding and then multiplying by 1,000. |

| (n) | Not annualized. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (w) | Per share amount was less than $0.01. |

| (x) | The net asset values per share and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

26

Table of Contents

(unaudited)

| (1) | Business and Organization |

MFS Intermediate High Income Fund (the fund) is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as a closed-end management investment company.

| (2) | Significant Accounting Policies |

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued. The fund invests in high-yield securities rated below investment grade. Investments in high-yield securities involve greater degrees of credit and market risk than investments in higher-rated securities and tend to be more sensitive to economic conditions. The fund invests in foreign securities. Investments in foreign securities are vulnerable to the effects of changes in the relative values of the local currency and the U.S. dollar and to the effects of changes in each country’s legal, political, and economic environment.

In December 2011, the Financial Accounting Standards Board issued Accounting Standards Update 2011-11, Balance Sheet (Topic 210) – Disclosures about Offsetting Assets and Liabilities (“ASU 2011-11”). Effective for annual reporting periods beginning on or after January 1, 2013 and interim periods within those annual periods, ASU 2011-11 is intended to enhance disclosure requirements on the offsetting of financial assets and liabilities. Although still evaluating the potential impacts of ASU 2011-11 to the fund, management expects that the impact of the fund’s adoption will be limited to additional financial statement disclosures.

Investment Valuations – Debt instruments and floating rate loans (other than short-term instruments), including restricted debt instruments, are generally valued at an evaluated or composite bid as provided by a third-party pricing service. Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price as provided by a third-party pricing service on the market or exchange on which they are primarily traded. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation as provided by a third-party pricing service on the market or exchange on which such securities are

27

Table of Contents

Notes to Financial Statements (unaudited) – continued

primarily traded. Short-term instruments with a maturity at issuance of 60 days or less generally are valued at amortized cost, which approximates market value. Exchange-traded options are generally valued at the last sale or official closing price as provided by a third-party pricing service on the exchange on which such options are primarily traded. Exchange-traded options for which there were no sales reported that day are generally valued at the last daily bid quotation as provided by a third-party pricing service on the exchange on which such options are primarily traded. Options not traded on an exchange are generally valued at a broker/dealer bid quotation. Foreign currency options are generally valued at valuations provided by a third-party pricing service. Forward foreign currency exchange contracts are generally valued at the mean of bid and asked prices for the time period interpolated from rates provided by a third-party pricing service for proximate time periods. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. Values obtained from third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment

28

Table of Contents

Notes to Financial Statements (unaudited) – continued

characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. Other financial instruments are derivative instruments not reflected in total investments, such as forward foreign currency exchange contracts. The following is a summary of the levels used as of May 31, 2012 in valuing the fund’s assets or liabilities:

| Investments at Value | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Equity Securities | $435,810 | $280,119 | $40,121 | $756,050 | ||||||||||||

| Corporate Bonds | — | 66,929,903 | — | 66,929,903 | ||||||||||||

| Commercial Mortgage-Backed Securities | — | 189,882 | — | 189,882 | ||||||||||||

| Asset-Backed Securities (including CDOs) | — | 102,494 | — | 102,494 | ||||||||||||

| Foreign Bonds | — | 11,335,957 | — | 11,335,957 | ||||||||||||

| Floating Rate Loans | — | 132,863 | — | 132,863 | ||||||||||||

| Mutual Funds | 2,679,442 | — | — | 2,679,442 | ||||||||||||

| Total Investments | $3,115,252 | $78,971,218 | $40,121 | $82,126,591 | ||||||||||||

| Other Financial Instruments | ||||||||||||||||

| Forward Foreign Currency Exchange Contracts | $— | $47,845 | $— | $47,845 | ||||||||||||

29

Table of Contents

Notes to Financial Statements (unaudited) – continued

For further information regarding security characteristics, see the Portfolio of Investments.

The following is a reconciliation of level 3 assets for which significant unobservable inputs were used to determine fair value. The fund’s policy is to recognize transfers between the levels as of the end of the period. The table presents the activity of level 3 securities held at the beginning and the end of the period.

| Equity Securities |

||||

| Balance as of 11/30/11 | $85,953 | |||

| Change in unrealized appreciation (depreciation) |

(45,832 | ) | ||

| Balance as of 5/31/12 | $40,121 | |||

The net change in unrealized appreciation (depreciation) from investments still held as level 3 at May 31, 2012 is $(45,832).

Foreign Currency Translation – Purchases and sales of foreign investments, income, and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions or on the reporting date for foreign denominated receivables and payables. Gains and losses attributable to foreign currency exchange rates on sales of securities are recorded for financial statement purposes as net realized gains and losses on investments. Gains and losses attributable to foreign exchange rate movements on receivables, payables, income and expenses are recorded for financial statement purposes as foreign currency transaction gains and losses. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

Derivatives – The fund uses derivatives for different purposes, primarily to increase or decrease exposure to a particular market or segment of the market, or security, to increase or decrease interest rate or currency exposure, or as alternatives to direct investments. Derivatives are used for hedging or non-hedging purposes. While hedging can reduce or eliminate losses, it can also reduce or eliminate gains. When the fund uses derivatives as an investment to increase market exposure, or for hedging purposes, gains and losses from derivative instruments may be substantially greater than the derivative’s original cost.