SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

|

Average Annual Total Returns

|

||||

|

1 Year

|

5 Year

|

10 Year

|

||

|

Reynolds Blue Chip Growth Fund

|

7.37%

|

6.96%

|

13.40%

|

|

|

The Standard & Poor’s 500 Index(2)

|

9.50%

|

10.91%

|

15.92%

|

|

|

(1)

|

Performance data quoted represents past performance; past performance does not guarantee future results. The

investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the

performance quoted. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month-end may be obtained by visiting

www.reynoldsfunds.com or by calling 1-800-773-9665.

|

|

|

(2)

|

The Standard & Poor’s 500 Index (“S&P”) is a capitalization-weighted index, representing the aggregate market

value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The table does not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original

cost.

|

|

(1)

|

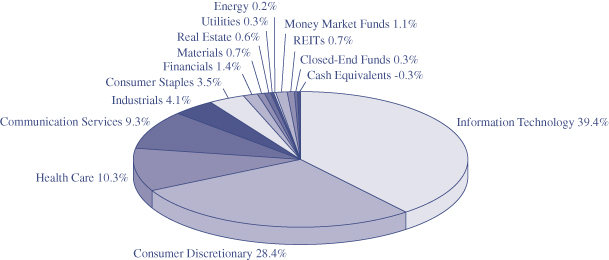

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC. GICS® is a service

mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

|

|

(2)

|

For presentation purposes within the Fund’s shareholder letter, the Fund has grouped some of the industry

categories by sector. For purposes of categorizing securities for compliance with section 8(b)(1) of the Investment Company Act of 1940, as amended, the Fund uses more specific industry classifications for financial reporting within its

Schedule of Investments.

|

|

(1)

|

Long-term borrowing costs of corporations are lower resulting in higher business confidence and profits.

|

|

|

(2)

|

Long-term borrowing costs of individuals are lower which increases consumer confidence and spending.

|

|

|

(3)

|

A company’s stock is usually valued by placing a present value on that company’s future stream of earnings and

dividends. The present value is higher when interest and inflation rates are low.

|

|

Annualized Net

|

Beginning

|

Ending

|

Expenses Paid

|

|

|

Expense Ratio

|

Account Value

|

Account Value

|

During Period

|

|

|

3/31/19

|

10/1/18

|

3/31/19

|

10/1/18-3/31/19(1)

|

|

|

Actual Expenses(2)

|

1.98%

|

$1,000.00

|

$ 919.90

|

$9.48

|

|

Hypothetical Example for Comparison Purposes

|

||||

|

(5% return before expenses)

|

1.98%

|

$1,000.00

|

$1,015.03

|

$9.95

|

|

(1)

|

Expenses are equal to the Fund’s annualized net expense ratio, multiplied by the average account value over the

period, multiplied by 182/365 to reflect the one-half year period.

|

|

(2)

|

Based on the actual returns of -8.01% for the six month-period ended March 31, 2019.

|

|

ASSETS:

|

||||

|

Investments in securities, at value (cost $46,906,076)

|

$

|

65,893,613

|

||

|

Cash

|

38

|

|||

|

Dividends and interest receivable

|

22,807

|

|||

|

Prepaid expenses

|

23,149

|

|||

|

Receivable from shareholders for purchases

|

645

|

|||

|

Other receivables

|

633

|

|||

|

Total assets

|

65,940,885

|

|||

|

LIABILITIES:

|

||||

|

Payable to shareholders for redemptions

|

88,604

|

|||

|

Payable to adviser for management fees

|

56,198

|

|||

|

Other liabilities

|

87,450

|

|||

|

Total Liabilities

|

232,252

|

|||

|

NET ASSETS

|

$

|

65,708,633

|

||

|

NET ASSETS CONSIST OF:

|

||||

|

Capital Stock, $0.01 par value; 40,000,000 shares authorized; 1,268,387 shares outstanding

|

$

|

50,926,655

|

||

|

Distributable earnings

|

14,781,978

|

|||

|

Net assets

|

$

|

65,708,633

|

||

|

CALCULATION OF NET ASSET VALUE PER SHARE:

|

||||

|

Net asset value, offering and redemption price per share ($65,708,633 ÷ 1,268,387 shares outstanding)

|

$

|

51.80

|

||

SCHEDULE OF INVESTMENTS

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS — 99.0% (a)

|

||||||||

|

Aerospace & Defense — 0.0%

|

||||||||

|

Hexcel Corporation

|

400

|

$

|

27,664

|

|||||

|

Air Freight & Logistics — 0.0%

|

||||||||

|

United Parcel Service, Inc., Class B

|

200

|

22,348

|

||||||

|

Airlines — 0.1%

|

||||||||

|

Delta Air Lines, Inc.

|

700

|

36,155

|

||||||

|

Automobiles — 0.2%

|

||||||||

|

Tesla, Inc.*

|

400

|

111,944

|

||||||

|

Beverages — 0.2%

|

||||||||

|

Coca-Cola Bottling Company Consolidated

|

200

|

57,566

|

||||||

|

Diageo plc — SP-ADR

|

300

|

49,083

|

||||||

|

106,649

|

||||||||

|

Biotechnology — 2.5%

|

||||||||

|

AbbVie, Inc.

|

600

|

48,354

|

||||||

|

ACADIA Pharmaceuticals, Inc.*

|

3,900

|

104,715

|

||||||

|

Alexion Pharmaceuticals, Inc.*

|

1,000

|

135,180

|

||||||

|

Amgen, Inc.

|

100

|

18,998

|

||||||

|

BeiGene, Ltd.*

|

100

|

13,200

|

||||||

|

Biogen, Inc.*

|

200

|

47,276

|

||||||

|

Celgene Corporation*

|

400

|

37,736

|

||||||

|

China Biologic Products Holdings, Inc.*#

|

800

|

73,000

|

||||||

|

Clovis Oncology, Inc.*

|

2,700

|

67,014

|

||||||

|

Esperion Therapeutics, Inc.*

|

400

|

16,060

|

||||||

|

Exact Sciences Corporation*

|

800

|

69,296

|

||||||

|

Immunomedics, Inc.*

|

500

|

9,605

|

||||||

|

Intercept Pharmaceuticals, Inc.*

|

2,700

|

302,022

|

||||||

|

Ionis Pharmaceuticals, Inc.*

|

3,600

|

292,212

|

||||||

|

Ligand Pharmaceuticals, Inc.*

|

1,700

|

213,707

|

||||||

|

Neurocrine Biosciences, Inc.*

|

500

|

44,050

|

||||||

|

Regeneron Pharmaceuticals, Inc.*

|

100

|

41,062

|

||||||

|

Repligen Corporation*

|

700

|

41,356

|

||||||

|

Seattle Genetics, Inc.*

|

500

|

36,620

|

||||||

|

1,611,463

|

||||||||

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS — 99.0% (a) (Continued)

|

||||||||

|

Capital Markets — 0.8%

|

||||||||

|

Ameriprise Financial, Inc.

|

400

|

$

|

51,240

|

|||||

|

The Blackstone Group L.P.

|

900

|

31,473

|

||||||

|

The Charles Schwab Corporation

|

1,500

|

64,140

|

||||||

|

FactSet Research Systems, Inc.

|

200

|

49,654

|

||||||

|

Interactive Brokers Group, Inc., Class A

|

2,900

|

150,452

|

||||||

|

Intercontinental Exchange, Inc.

|

600

|

45,684

|

||||||

|

T. Rowe Price Group, Inc.

|

1,400

|

140,168

|

||||||

|

532,811

|

||||||||

|

Chemicals — 0.6%

|

||||||||

|

Air Products & Chemicals, Inc.

|

300

|

57,288

|

||||||

|

Albemarle Corporation

|

900

|

73,782

|

||||||

|

DowDuPont, Inc.

|

1,600

|

85,296

|

||||||

|

Ecolab, Inc.

|

1,100

|

194,194

|

||||||

|

410,560

|

||||||||

|

Commercial Services & Supplies — 0.9%

|

||||||||

|

Cintas Corporation

|

300

|

60,633

|

||||||

|

Copart, Inc.*

|

2,800

|

169,652

|

||||||

|

Stericycle, Inc.*

|

900

|

48,978

|

||||||

|

Waste Connections, Inc.#

|

2,800

|

248,052

|

||||||

|

Waste Management, Inc.

|

900

|

93,519

|

||||||

|

620,834

|

||||||||

|

Communications Equipment — 4.7%

|

||||||||

|

Cisco Systems, Inc.

|

8,800

|

475,112

|

||||||

|

F5 Networks, Inc.*

|

3,800

|

596,334

|

||||||

|

Finisar Corporation*

|

4,300

|

99,631

|

||||||

|

Lumentum Holdings, Inc.*

|

2,400

|

135,696

|

||||||

|

Motorola Solutions, Inc.

|

2,000

|

280,840

|

||||||

|

NETGEAR, Inc.*

|

1,400

|

46,368

|

||||||

|

Palo Alto Networks, Inc.*

|

2,300

|

558,624

|

||||||

|

Ubiquiti Networks, Inc.

|

5,200

|

778,492

|

||||||

|

ViaSat, Inc.*

|

1,800

|

139,500

|

||||||

|

3,110,597

|

||||||||

|

Consumer Services — Diversified — 0.1%

|

||||||||

|

TAL Education Group — ADR*

|

1,200

|

43,296

|

||||||

|

Containers & Packaging — 0.1%

|

||||||||

|

Avery Dennison Corporation

|

400

|

45,200

|

||||||

|

Diversified Financial Services — 0.3%

|

||||||||

|

Berkshire Hathaway, Inc., Class B*

|

1,000

|

200,890

|

||||||

|

Electric Utilities — 0.0%

|

||||||||

|

Edison International

|

300

|

18,576

|

||||||

|

Electrical Equipment — 0.1%

|

||||||||

|

Acuity Brands, Inc.

|

400

|

48,004

|

||||||

|

Emerson Electric Company

|

600

|

41,082

|

||||||

|

89,086

|

||||||||

|

Electronic Equipment,

|

||||||||

|

Instruments & Components — 1.4%

|

||||||||

|

Cognex Corporation

|

2,600

|

132,236

|

||||||

|

IPG Photonics Corporation*

|

300

|

45,534

|

||||||

|

Tech Data Corporation*

|

500

|

51,205

|

||||||

|

Zebra Technologies Corporation, Class A*

|

3,200

|

670,496

|

||||||

|

899,471

|

||||||||

|

Entertainment — 1.7%

|

||||||||

|

Live Nation Entertainment, Inc.*

|

800

|

50,832

|

||||||

|

NetEase, Inc. — ADR

|

200

|

48,290

|

||||||

|

Netflix, Inc.*

|

2,400

|

855,744

|

||||||

|

Spotify Technology SA*#

|

500

|

69,400

|

||||||

|

Take-Two Interactive Software, Inc.*

|

300

|

28,311

|

||||||

|

Tencent Music Entertainment Group*#

|

3,800

|

68,780

|

||||||

|

1,121,357

|

||||||||

|

Food & Staples Retailing — 3.0%

|

||||||||

|

Costco Wholesale Corporation

|

6,800

|

1,646,552

|

||||||

|

CVS Health Corporation

|

1,067

|

57,543

|

||||||

|

The Kroger Company

|

1,600

|

39,360

|

||||||

|

Walmart, Inc.

|

2,500

|

243,825

|

||||||

|

1,987,280

|

||||||||

|

Health Care Equipment & Supplies — 3.9%

|

||||||||

|

Abbott Laboratories

|

600

|

47,964

|

||||||

|

Align Technology, Inc.*

|

200

|

56,866

|

||||||

|

Becton, Dickinson and Company

|

200

|

49,946

|

||||||

|

Boston Scientific Corporation*

|

1,200

|

46,056

|

||||||

|

Danaher Corporation

|

3,000

|

396,060

|

||||||

|

Dentsply Sirona, Inc.

|

900

|

44,631

|

||||||

|

DexCom, Inc.*

|

1,400

|

166,740

|

||||||

|

Edwards Lifesciences Corporation*

|

1,700

|

325,261

|

||||||

|

Hologic, Inc.*

|

800

|

38,720

|

||||||

|

Integra LifeSciences Holdings Corporation*

|

900

|

50,148

|

||||||

|

Intuitive Surgical, Inc.*

|

900

|

513,522

|

||||||

|

Novocure Ltd.*#

|

1,600

|

77,072

|

||||||

|

ResMed, Inc.

|

900

|

93,573

|

||||||

|

Stryker Corporation

|

300

|

59,256

|

||||||

|

Tandem Diabetes Care, Inc.*

|

1,200

|

76,200

|

||||||

|

Varian Medical Systems, Inc.*

|

2,700

|

382,644

|

||||||

|

Zimmer Biomet Holdings, Inc.

|

900

|

114,930

|

||||||

|

2,539,589

|

||||||||

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS — 99.0% (a) (Continued)

|

||||||||

|

Health Care Providers & Services — 1.2%

|

||||||||

|

Acadia Healthcare Company, Inc.*

|

1,400

|

$

|

41,034

|

|||||

|

Amedisys, Inc.*

|

900

|

110,934

|

||||||

|

Centene Corporation*

|

1,946

|

103,333

|

||||||

|

Cigna Corporation

|

243

|

39,079

|

||||||

|

Encompass Health Corporation

|

600

|

35,040

|

||||||

|

HCA Holdings, Inc.

|

800

|

104,304

|

||||||

|

Laboratory Corporation of America Holdings*

|

300

|

45,894

|

||||||

|

Molina Healthcare, Inc.*

|

600

|

85,176

|

||||||

|

UnitedHealth Group, Inc.

|

1,000

|

247,260

|

||||||

|

812,054

|

||||||||

|

Health Care Technology — 1.0%

|

||||||||

|

Cerner Corporation*

|

900

|

51,489

|

||||||

|

Teladoc Health, Inc.*

|

4,000

|

222,400

|

||||||

|

Veeva Systems, Inc.*

|

2,800

|

355,208

|

||||||

|

629,097

|

||||||||

|

Hotels, Restaurants & Leisure — 4.1%

|

||||||||

|

Carnival Corporation#

|

3,300

|

167,376

|

||||||

|

Chipotle Mexican Grill, Inc.*

|

300

|

213,093

|

||||||

|

Dine Brands Global, Inc.

|

600

|

54,774

|

||||||

|

Dunkin’ Brands Group, Inc.

|

2,100

|

157,710

|

||||||

|

Hilton Worldwide Holdings, Inc.

|

1,900

|

157,909

|

||||||

|

Las Vegas Sands Corporation

|

1,500

|

91,440

|

||||||

|

Marriott International, Inc., Class A

|

1,880

|

235,169

|

||||||

|

Norwegian Cruise Line Holdings, Ltd.*#

|

800

|

43,968

|

||||||

|

Papa John’s International, Inc.

|

1,200

|

63,540

|

||||||

|

Planet Fitness, Inc., Class A*

|

3,400

|

233,648

|

||||||

|

Royal Caribbean Cruises, Ltd.#

|

400

|

45,848

|

||||||

|

Shake Shack, Inc., Class A*

|

1,000

|

59,150

|

||||||

|

Starbucks Corporation

|

10,100

|

750,834

|

||||||

|

Yum! Brands, Inc.

|

4,500

|

449,145

|

||||||

|

2,723,604

|

||||||||

|

Household Durables — 0.5%

|

||||||||

|

iRobot Corporation*

|

1,100

|

129,459

|

||||||

|

Roku, Inc.*

|

2,600

|

167,726

|

||||||

|

297,185

|

||||||||

|

Household Products — 0.1%

|

||||||||

|

Kimberly-Clark Corporation

|

400

|

49,560

|

||||||

|

The Procter & Gamble Company

|

400

|

41,620

|

||||||

|

91,180

|

||||||||

|

Independent Power Producers

|

||||||||

|

& Energy Traders — 0.1%

|

||||||||

|

Pattern Energy Group, Inc.

|

1,500

|

33,000

|

||||||

|

Industrial Conglomerates — 0.2%

|

||||||||

|

Honeywell International, Inc.

|

900

|

143,028

|

||||||

|

Insurance — 0.4%

|

||||||||

|

eHealth, Inc.*

|

300

|

18,702

|

||||||

|

Willis Towers Watson plc#

|

1,300

|

228,345

|

||||||

|

247,047

|

||||||||

|

Interactive Media & Services — 7.4%

|

||||||||

|

Alphabet, Inc., Class A*

|

1,500

|

1,765,335

|

||||||

|

Alphabet, Inc., Class C*

|

1,800

|

2,111,958

|

||||||

|

Facebook, Inc., Class A*

|

2,000

|

333,380

|

||||||

|

IAC/InterActiveCorp*

|

200

|

42,022

|

||||||

|

Match Group, Inc.

|

1,900

|

107,559

|

||||||

|

SINA Corporation*#

|

600

|

35,544

|

||||||

|

TripAdvisor, Inc.*

|

7,900

|

406,455

|

||||||

|

Zillow Group, Inc., Class C*

|

2,200

|

76,428

|

||||||

|

4,878,681

|

||||||||

|

Internet & Direct Marketing Retail — 18.2%

|

||||||||

|

Amazon.com, Inc.*

|

5,600

|

9,972,200

|

||||||

|

Booking Holdings, Inc.*

|

300

|

523,473

|

||||||

|

Ctrip.com International, Ltd. — ADR*

|

900

|

39,321

|

||||||

|

Etsy, Inc.*

|

5,500

|

369,710

|

||||||

|

Expedia Group, Inc.

|

1,205

|

143,395

|

||||||

|

GrubHub, Inc.*

|

600

|

41,682

|

||||||

|

JD.com, Inc. — ADR*

|

3,100

|

93,465

|

||||||

|

Stitch Fix, Inc., Class A*

|

5,200

|

146,796

|

||||||

|

Wayfair, Inc., Class A*

|

4,300

|

638,335

|

||||||

|

11,968,377

|

||||||||

|

Internet Software & Services — 1.9%

|

||||||||

|

Akamai Technologies, Inc.*

|

1,500

|

107,565

|

||||||

|

Alibaba Group Holding, Ltd. — SP-ADR*

|

3,300

|

602,085

|

||||||

|

Baidu, Inc. — SP-ADR*

|

2,200

|

362,670

|

||||||

|

Cimpress N.V.*#

|

500

|

40,065

|

||||||

|

eBay, Inc.

|

1,900

|

70,566

|

||||||

|

Yandex N.V., Class A*#

|

1,200

|

41,208

|

||||||

|

1,224,159

|

||||||||

|

IT Services — 9.5%

|

||||||||

|

Accenture plc, Class A#

|

300

|

52,806

|

||||||

|

Automatic Data Processing, Inc.

|

1,400

|

223,636

|

||||||

|

DXC Technology Company

|

900

|

57,879

|

||||||

|

EPAM Systems, Inc.*

|

1,100

|

186,043

|

||||||

|

Euronet Worldwide, Inc.*

|

2,400

|

342,216

|

||||||

|

Fiserv, Inc.*

|

2,300

|

203,044

|

||||||

|

FleetCor Technologies, Inc.*

|

500

|

123,295

|

||||||

|

Global Payments, Inc.

|

400

|

54,608

|

||||||

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS — 99.0% (a) (Continued)

|

||||||||

|

IT Services — 9.5% (Continued)

|

||||||||

|

GoDaddy, Inc., Class A*

|

600

|

$

|

45,114

|

|||||

|

MasterCard, Inc., Class A

|

3,900

|

918,255

|

||||||

|

Paychex, Inc.

|

5,400

|

433,080

|

||||||

|

PayPal Holdings, Inc.*

|

10,200

|

1,059,168

|

||||||

|

Perspecta, Inc.

|

450

|

9,099

|

||||||

|

Shopify, Inc., Class A*#

|

800

|

165,296

|

||||||

|

Square, Inc., Class A*

|

4,800

|

359,616

|

||||||

|

Twilio, Inc., Class A*

|

3,600

|

465,048

|

||||||

|

VeriSign, Inc.*

|

2,400

|

435,744

|

||||||

|

Virtusa Corporation*

|

500

|

26,725

|

||||||

|

Visa, Inc., Class A

|

5,400

|

843,426

|

||||||

|

WEX, Inc.*

|

700

|

134,393

|

||||||

|

Wix.com, Ltd.*#

|

600

|

72,498

|

||||||

|

Worldpay, Inc., Class A*

|

500

|

56,750

|

||||||

|

6,267,739

|

||||||||

|

Life Sciences Tools & Services — 1.5%

|

||||||||

|

Agilent Technologies, Inc.

|

4,900

|

393,862

|

||||||

|

Bio-Techne Corporation

|

500

|

99,275

|

||||||

|

ICON plc*#

|

500

|

68,290

|

||||||

|

PRA Health Sciences, Inc.*

|

400

|

44,116

|

||||||

|

Thermo Fisher Scientific, Inc.

|

500

|

136,860

|

||||||

|

Waters Corporation*

|

1,000

|

251,710

|

||||||

|

994,113

|

||||||||

|

Machinery — 0.6%

|

||||||||

|

Caterpillar, Inc.

|

300

|

40,647

|

||||||

|

IDEX Corporation

|

300

|

45,522

|

||||||

|

Illinois Tool Works, Inc.

|

300

|

43,059

|

||||||

|

The Middleby Corporation*

|

700

|

91,021

|

||||||

|

Nordson Corporation

|

300

|

39,756

|

||||||

|

The Toro Company

|

1,800

|

123,912

|

||||||

|

383,917

|

||||||||

|

Media — 0.3%

|

||||||||

|

Comcast Corporation, Class A

|

900

|

35,982

|

||||||

|

DISH Network Corporation, Class A*

|

900

|

28,521

|

||||||

|

IMAX Corporation*#

|

1,200

|

27,216

|

||||||

|

The New York Times Company, Class A

|

1,500

|

49,275

|

||||||

|

Sirius XM Holdings, Inc.

|

13,100

|

74,277

|

||||||

|

215,271

|

||||||||

|

Multiline Retail — 1.1%

|

||||||||

|

Dillard’s, Inc., Class A

|

1,200

|

86,424

|

||||||

|

Dollar General Corporation

|

2,000

|

238,600

|

||||||

|

Dollar Tree, Inc.*

|

400

|

42,016

|

||||||

|

Kohl’s Corporation

|

500

|

34,385

|

||||||

|

Target Corporation

|

3,600

|

288,936

|

||||||

|

690,361

|

||||||||

|

Oil, Gas & Consumable Fuels — 0.3%

|

||||||||

|

EOG Resources, Inc.

|

500

|

47,590

|

||||||

|

Hess Corporation

|

700

|

42,161

|

||||||

|

ONEOK, Inc.

|

500

|

34,920

|

||||||

|

Pioneer Natural Resources Company

|

300

|

45,684

|

||||||

|

170,355

|

||||||||

|

Personal Products — 0.2%

|

||||||||

|

The Estee Lauder Companies, Inc.

|

800

|

132,440

|

||||||

|

Pharmaceuticals — 0.9%

|

||||||||

|

Allergan plc#

|

300

|

43,923

|

||||||

|

Aurora Cannabis, Inc.*#

|

6,000

|

54,360

|

||||||

|

GW Pharmaceuticals plc — ADR*

|

600

|

101,142

|

||||||

|

Jazz Pharmaceuticals plc*#

|

400

|

57,180

|

||||||

|

Johnson & Johnson

|

400

|

55,916

|

||||||

|

Merck & Company, Inc.

|

1,600

|

133,072

|

||||||

|

Pacira Pharmaceuticals, Inc.*

|

500

|

19,030

|

||||||

|

Perrigo Company plc#

|

600

|

28,896

|

||||||

|

Pfizer, Inc.

|

1,900

|

80,693

|

||||||

|

574,212

|

||||||||

|

Professional Services — 1.3%

|

||||||||

|

Equifax, Inc.

|

1,500

|

177,750

|

||||||

|

Verisk Analytics, Inc.

|

5,000

|

665,000

|

||||||

|

842,750

|

||||||||

|

REITs — 1.3%

|

||||||||

|

American Tower Corporation

|

1,200

|

236,472

|

||||||

|

Boston Properties, Inc.

|

400

|

53,552

|

||||||

|

Crown Castle International Corporation

|

800

|

102,400

|

||||||

|

SBA Communications Corporation

|

700

|

139,762

|

||||||

|

STORE Capital Corporation

|

9,300

|

311,550

|

||||||

|

843,736

|

||||||||

|

Road & Rail — 0.1%

|

||||||||

|

Union Pacific Corporation

|

300

|

50,160

|

||||||

|

Semiconductors & Semiconductor

|

||||||||

|

Equipment — 3.1%

|

||||||||

|

Advanced Micro Devices, Inc.*

|

8,800

|

224,576

|

||||||

|

Analog Devices, Inc.

|

400

|

42,108

|

||||||

|

Applied Materials, Inc.

|

1,800

|

71,388

|

||||||

|

Broadcom, Inc.

|

1,100

|

330,781

|

||||||

|

Intel Corporation

|

2,100

|

112,770

|

||||||

|

KLA-Tencor Corporation

|

700

|

83,587

|

||||||

|

Maxim Integrated Products, Inc.

|

400

|

21,268

|

||||||

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS — 99.0% (a) (Continued)

|

||||||||

|

Semiconductors & Semiconductor

|

||||||||

|

Equipment — 3.1% (Continued)

|

||||||||

|

Monolithic Power Systems, Inc.

|

300

|

$

|

40,647

|

|||||

|

NVIDIA Corporation

|

2,300

|

412,988

|

||||||

|

NXP Semiconductors N.V.#

|

400

|

35,356

|

||||||

|

ON Semiconductor Corporation*

|

1,600

|

32,912

|

||||||

|

Qorvo, Inc.*

|

600

|

43,038

|

||||||

|

QUALCOMM, Inc.

|

2,400

|

136,872

|

||||||

|

SolarEdge Technologies, Inc.*

|

1,200

|

45,216

|

||||||

|

Texas Instruments, Inc.

|

400

|

42,428

|

||||||

|

Universal Display Corporation

|

1,000

|

152,850

|

||||||

|

Xilinx, Inc.

|

1,900

|

240,901

|

||||||

|

2,069,686

|

||||||||

|

Software — 15.9%

|

||||||||

|

Adobe Systems, Inc.*

|

3,000

|

799,470

|

||||||

|

ANSYS, Inc.*

|

300

|

54,813

|

||||||

|

Aspen Technology, Inc.*

|

400

|

41,704

|

||||||

|

Autodesk, Inc.*

|

3,200

|

498,624

|

||||||

|

Bottomline Technologies DE, Inc.*

|

800

|

40,072

|

||||||

|

Box, Inc., Class A*

|

2,200

|

42,482

|

||||||

|

Cadence Design Systems, Inc.*

|

1,700

|

107,967

|

||||||

|

Check Point Software Technologies, Ltd.*#

|

2,000

|

252,980

|

||||||

|

Citrix Systems, Inc.

|

4,800

|

478,368

|

||||||

|

Coupa Software, Inc.*

|

400

|

36,392

|

||||||

|

CyberArk Software, Ltd.*#

|

1,900

|

226,195

|

||||||

|

DocuSign, Inc.*

|

800

|

41,472

|

||||||

|

Fair Isaac Corporation*

|

400

|

108,652

|

||||||

|

Fortinet, Inc.*

|

5,000

|

419,850

|

||||||

|

HubSpot, Inc.*

|

200

|

33,242

|

||||||

|

Intuit, Inc.

|

1,400

|

365,974

|

||||||

|

Microsoft Corporation

|

5,500

|

648,670

|

||||||

|

NICE, Ltd. — SP-ADR*

|

300

|

36,753

|

||||||

|

Nuance Communications, Inc.*

|

1,500

|

25,395

|

||||||

|

Oracle Corporation

|

800

|

42,968

|

||||||

|

Paycom Software, Inc.*

|

500

|

94,565

|

||||||

|

Paylocity Holding Corporation*

|

500

|

44,595

|

||||||

|

Pegasystems, Inc.

|

1,400

|

91,000

|

||||||

|

Proofpoint, Inc.*

|

1,200

|

145,716

|

||||||

|

PTC, Inc.*

|

1,400

|

129,052

|

||||||

|

Salesforce.com, Inc.*

|

12,400

|

1,963,788

|

||||||

|

ServiceNow, Inc.*

|

300

|

73,947

|

||||||

|

Splunk, Inc.*

|

2,600

|

323,960

|

||||||

|

Synopsys, Inc.*

|

1,600

|

184,240

|

||||||

|

Tableau Software, Inc., Class A*

|

400

|

50,912

|

||||||

|

The Trade Desk, Inc., Class A*

|

2,000

|

395,900

|

||||||

|

Tyler Technologies, Inc.*

|

300

|

61,320

|

||||||

|

Varonis Systems, Inc.*

|

1,500

|

89,445

|

||||||

|

Virnetx Holding Corporation*

|

2,800

|

17,724

|

||||||

|

VMware, Inc., Class A

|

6,500

|

1,173,315

|

||||||

|

Workday, Inc., Class A*

|

4,000

|

771,400

|

||||||

|

Zscaler, Inc.*

|

5,700

|

404,301

|

||||||

|

Zynga, Inc., Class A*

|

20,500

|

109,265

|

||||||

|

10,426,488

|

||||||||

|

Specialty Retail — 3.2%

|

||||||||

|

Advance Auto Parts, Inc.

|

300

|

51,159

|

||||||

|

AutoZone, Inc.*

|

250

|

256,030

|

||||||

|

Best Buy Company, Inc.

|

2,900

|

206,074

|

||||||

|

Hibbett Sports Inc.*

|

600

|

13,686

|

||||||

|

The Home Depot, Inc.

|

1,100

|

211,079

|

||||||

|

Lowe’s Companies, Inc.

|

1,800

|

197,046

|

||||||

|

RH*

|

500

|

51,475

|

||||||

|

Ross Stores, Inc.

|

9,500

|

884,450

|

||||||

|

Tiffany & Company

|

500

|

52,775

|

||||||

|

The TJX Companies, Inc.

|

1,300

|

69,173

|

||||||

|

Ulta Beauty, Inc.*

|

400

|

139,492

|

||||||

|

2,132,439

|

||||||||

|

Technology Hardware,

|

||||||||

|

Storage & Peripherals — 2.8%

|

||||||||

|

Apple, Inc.

|

7,200

|

1,367,640

|

||||||

|

Dell Technologies, Inc., Class C*

|

4,500

|

264,105

|

||||||

|

NetApp, Inc.

|

1,800

|

124,812

|

||||||

|

Seagate Technology plc#

|

1,500

|

71,835

|

||||||

|

Western Digital Corporation

|

700

|

33,642

|

||||||

|

1,862,034

|

||||||||

|

Textiles, Apparel & Luxury Goods — 0.9%

|

||||||||

|

Canada Goose Holdings, Inc.*#

|

300

|

14,406

|

||||||

|

Deckers Outdoor Corporation*

|

800

|

117,592

|

||||||

|

lululemon athletica, Inc.*

|

300

|

49,161

|

||||||

|

NIKE, Inc., Class B

|

2,600

|

218,946

|

||||||

|

PVH Corporation

|

400

|

48,780

|

||||||

|

Ralph Lauren Corporation

|

900

|

116,712

|

||||||

|

565,597

|

||||||||

|

Trading Companies & Distributors — 0.1%

|

||||||||

|

Fastenal Company

|

1,500

|

96,465

|

||||||

|

Water Utilities — 0.2%

|

||||||||

|

American Water Works Company, Inc.

|

1,200

|

125,112

|

||||||

|

TOTAL COMMON STOCKS

|

||||||||

|

(cost $46,064,060)

|

65,026,057

|

|||||||

|

Shares

|

Value

|

|||||||

|

CLOSED-END FUND — 0.2% (a)

|

||||||||

|

Altaba, Inc.*

|

2,300

|

$

|

170,476

|

|||||

|

TOTAL CLOSED-END FUND

|

||||||||

|

(cost $144,936)

|

170,476

|

|||||||

|

MONEY MARKET FUND — 1.1% (a)

|

||||||||

|

First American Government Obligations

|

||||||||

|

Fund, Class X Shares, 2.33%^

|

697,080

|

697,080

|

||||||

|

TOTAL MONEY MARKET FUND

|

||||||||

|

(cost $697,080)

|

697,080

|

|||||||

|

TOTAL INVESTMENTS — 100.3%

|

||||||||

|

(cost $46,906,076)

|

65,893,613

|

|||||||

|

Cash and receivables, less liabilities — (0.3)% (a)

|

(184,980 | ) |

||||||

|

TOTAL NET ASSETS — 100.0%

|

$

|

65,708,633

|

||||||

|

^

|

Rate shown in the 7-day effective yield March 31, 2019.

|

|

|

*

|

Non-income producing security.

|

|

|

#

|

Foreign issued security.

|

|

|

(a)

|

Percentages for the various classifications relate to net assets.

|

|

INVESTMENT INCOME:

|

||||

|

Dividends (net of foreign withholding tax of $421)

|

$

|

281,822

|

||

|

Interest

|

57,218

|

|||

|

Total investment income

|

339,040

|

|||

|

EXPENSES:

|

||||

|

Management fees

|

327,974

|

|||

|

Transfer agent fees

|

49,798

|

|||

|

Custodian fees

|

38,633

|

|||

|

Administrative services

|

38,479

|

|||

|

Professional fees

|

28,912

|

|||

|

Distribution fees

|

28,202

|

|||

|

Insurance expense

|

27,369

|

|||

|

Shareholder servicing fees

|

25,088

|

|||

|

Accounting services

|

25,036

|

|||

|

Registration fees

|

14,714

|

|||

|

Board of Directors fees

|

13,961

|

|||

|

Chief Compliance Officer fees

|

12,716

|

|||

|

Printing and postage expense

|

7,800

|

|||

|

Other expenses

|

10,649

|

|||

|

Total expenses

|

649,331

|

|||

|

NET INVESTMENT LOSS

|

(310,291

|

)

|

||

|

NET REALIZED LOSS ON INVESTMENTS

|

(2,561,316

|

)

|

||

|

NET CHANGE IN UNREALIZED DEPRECIATION ON INVESTMENTS

|

(4,029,660

|

)

|

||

|

NET LOSS ON INVESTMENTS

|

(6,590,976

|

)

|

||

|

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

(6,901,267

|

)

|

|

STATEMENTS OF CHANGES IN NET ASSETS

|

2019

|

2018

|

|||||||

|

OPERATIONS:

|

||||||||

|

Net investment loss

|

$

|

(310,291

|

)

|

$

|

(1,004,911

|

)

|

||

|

Net realized gain (loss) on investments

|

(2,561,316

|

)

|

12,873,152

|

|||||

|

Net change in unrealized appreciation (depreciation) on investments

|

(4,029,660

|

)

|

6,803,634

|

|||||

|

Net increase (decrease) in net assets resulting from operations

|

(6,901,267

|

)

|

18,671,875

|

|||||

|

DISTRIBUTIONS TO SHAREHOLDERS:

|

||||||||

|

Distributions from net capital gains ($9.42907 per share and $4.59816 per share, respectively)

|

(10,525,703

|

)

|

(5,374,980

|

)

|

||||

|

FUND SHARE ACTIVITIES:

|

||||||||

|

Proceeds from shares issued (17,605 and 61,094 shares, respectively)

|

987,715

|

3,747,615

|

||||||

|

Net asset value of shares issued in distributions reinvested (231,149 and 92,258 shares,

respectively)

|

10,193,707

|

5,236,557

|

||||||

|

Cost of shares redeemed (139,084 and 206,881 shares, respectively)

|

(7,239,887

|

)

|

(12,581,269

|

)

|

||||

|

Net increase (decrease) in net assets derived from Fund share activities

|

3,941,535

|

(3,597,097

|

)

|

|||||

|

TOTAL INCREASE IN NET ASSETS

|

(13,485,435

|

)

|

9,699,798

|

|||||

|

NET ASSETS AT THE BEGINNING OF THE PERIOD

|

79,194,068

|

69,494,270

|

||||||

|

NET ASSETS AT THE END OF THE PERIOD

|

$

|

65,708,633

|

$

|

79,194,068

|

||||

|

For the Six

|

||||||||||||||||||||||||

|

Months Ended

|

||||||||||||||||||||||||

|

March 31, 2019

|

Year Ended September 30,

|

|||||||||||||||||||||||

|

(Unaudited)

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||||||

|

PER SHARE OPERATING PERFORMANCE:

|

||||||||||||||||||||||||

|

Net asset value, beginning of period

|

$

|

68.35

|

$

|

57.33

|

$

|

53.65

|

$

|

56.84

|

$

|

75.86

|

$

|

71.45

|

||||||||||||

|

Income from investment operations:

|

||||||||||||||||||||||||

|

Net investment loss(1)

|

(0.25

|

)

|

(0.84

|

)

|

(0.46

|

)

|

(0.49

|

)

|

(0.49

|

)

|

(0.49

|

)

|

||||||||||||

|

Net realized and unrealized

gains (losses) on investments

|

(6.87

|

)

|

16.46

|

8.57

|

0.94

|

0.40

|

8.28

|

|||||||||||||||||

|

Total from investment operations

|

(7.12

|

)

|

15.62

|

8.11

|

0.45

|

(0.09

|

)

|

7.79

|

||||||||||||||||

|

Less distributions:

|

||||||||||||||||||||||||

|

Distributions from net capital gains

|

(9.43

|

)

|

(4.60

|

)

|

(4.43

|

)

|

(3.64

|

)

|

(18.93

|

)

|

(3.38

|

)

|

||||||||||||

|

Total from distributions

|

(9.43

|

)

|

(4.60

|

)

|

(4.43

|

)

|

(3.64

|

)

|

(18.93

|

)

|

(3.38

|

)

|

||||||||||||

|

Net asset value, end of period

|

$

|

51.80

|

$

|

68.35

|

$

|

57.33

|

$

|

53.65

|

$

|

56.84

|

$

|

75.86

|

||||||||||||

|

TOTAL RETURN

|

(8.01

|

%)

|

28.88

|

%

|

16.44

|

%

|

0.48

|

%

|

(1.00

|

%)

|

11.01

|

%

|

||||||||||||

|

RATIOS/SUPPLEMENTAL DATA:

|

||||||||||||||||||||||||

|

Net assets, end of period (in 000’s)

|

$

|

65,709

|

$

|

79,194

|

$

|

69,494

|

$

|

80,461

|

$

|

114,340

|

$

|

162,930

|

||||||||||||

|

Ratio of expenses to average net assets

|

1.98

|

%

|

1.96

|

%

|

1.97

|

%

|

1.86

|

%

|

1.71

|

%

|

1.59

|

%

|

||||||||||||

|

Ratio of net investment loss to average net assets

|

(0.95

|

%)

|

(1.36

|

%)

|

(0.87

|

%)

|

(0.90

|

%)

|

(0.77

|

%)

|

(0.65

|

%)

|

||||||||||||

|

Portfolio turnover rate

|

220

|

%

|

476

|

%

|

343

|

%

|

491

|

%

|

272

|

%

|

102

|

%

|

||||||||||||

|

(1)

|

Amount calculated based on average shares outstanding throughout the period.

|

NOTES TO FINANCIAL STATEMENTS

|

(1)

|

Summary of Significant Accounting Policies —

|

|

The following is a summary of significant accounting policies of the Reynolds Funds, Inc. (the “Company”), which is

registered as a diversified, open-end management investment company under the Investment Company Act of 1940 (the “Act”), as amended. This Company consists of one fund: the Reynolds Blue Chip Growth Fund (the “Fund”). The Company was

incorporated under the laws of Maryland on April 28, 1988. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting

Standards Codification Topic 946 Financial Services – Investment Companies.

|

|

|

The investment objective of the Fund is to produce long-term growth of capital by investing in a diversified

portfolio of common stocks issued by well-established growth companies commonly referred to as “blue chip” companies, as defined in the prospectus.

|

|

|

(a) The following is a summary of the Fund’s pricing procedures. It is intended to be a general discussion and may

not necessarily reflect all pricing procedures followed by the Fund.

|

|

|

Each security, excluding short-term investments and closed-end funds, is valued at the last sale price reported by

the principal security exchange on which the issue is traded (other than The Nasdaq OMX Group, Inc., referred to as “Nasdaq”), or if no sale is reported, the latest bid price. Securities which are traded on Nasdaq (including closed-end

funds) under one of its three listing tiers, Nasdaq Global Market, Nasdaq Global Select Market and Nasdaq Capital Market, are valued at

|

|

(1)

|

Summary of Significant Accounting Policies — (Continued)

|

|

the Nasdaq Official Closing Price, or if no sale is reported, the latest bid price. Short-term investments with

maturities of 60 days or less may be valued on an amortized cost basis to the extent it is equivalent to fair value, which involves valuing an instrument at its cost and thereafter assuming a constant amortization to maturity of any

discount or premium, regardless of the impact of fluctuating rates on the fair value of the instrument. Amortized cost will not be used if its use would be inappropriate due to credit or other impairments of the issuer. Money market funds

are valued at their net asset value per share. Securities for which quotations are not readily available are valued at fair value as determined by the investment adviser under the supervision of the Board of Directors. The fair value of a

security is the amount which the Fund might receive upon a current sale. The fair value of a security may differ from the last quoted price and the Fund may not be able to sell a security at the fair value. Market quotations may not be

available, for example, if trading in particular securities was halted during the day and not resumed prior to the close of trading on the New York Stock Exchange.

|

|

|

Under accounting principles generally accepted in the United States of America (“GAAP”), fair value is defined as the

price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants at the measurement date.

|

|

|

In determining fair value, the Fund uses various valuation approaches. GAAP establishes a fair value hierarchy for

inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by generally requiring that the most observable inputs be used when available. Observable inputs are those that

market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s assumptions about the inputs market participants would use in pricing

the asset or liability developed based on the best information available in the circumstances. The inputs or methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those

securities.

|

|

The fair value hierarchy is categorized into three levels based on the inputs as follows:

|

|

Level 1—

|

Valuations based on unadjusted quoted prices in active markets for identical assets that the Fund has the ability to

access.

|

|

|

Level 2—

|

Valuations based on quoted prices for similar securities or in markets that are not active or for which all

significant inputs are observable, either directly or indirectly.

|

|

|

Level 3—

|

Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

|

|

The following table summarizes the Fund’s investments as of March 31, 2019, based on the inputs used to value them:

|

|

Valuation Inputs

|

Investments in Securities

|

|||||||

|

Level 1—

|

Common Stock*

|

$

|

65,026,057

|

|||||

|

Closed-End Funds

|

170,476

|

|||||||

|

Money Market Funds

|

697,080

|

|||||||

|

Total Level 1

|

65,893,613

|

|||||||

|

Level 2—

|

None

|

—

|

||||||

|

Level 3—

|

None

|

—

|

||||||

| |

Total

|

$

|

65,893,613

|

|||||

|

* Please refer to the Schedule of Investments to view common stocks segregated by industry type.

|

|

|

For the six months ended March 31, 2019, the Fund did not hold any Level 3 securities, nor were there any transfers

into or out of Level 3.

|

|

|

(b) Investment transactions are accounted for on a trade date basis for financial reporting purposes. Net realized

gains and losses on sales of securities are computed on the highest amortized cost basis.

|

|

(1)

|

Summary of Significant Accounting Policies — (Continued)

|

|

(c) The Fund records dividend income on the ex-dividend date and interest income on an accrual basis. Withholding

taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations.

|

|

|

(d) GAAP requires that certain components of net assets relating to permanent differences be reclassified between

financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. The primary reason for this adjustment is because of equalization. For the year ended September 30, 2018, the following table

shows the reclassifications made:

|

|

Distributable Earnings

|

Capital Stock

|

||

|

$(742,588)

|

$742,588

|

|

(e) The preparation of financial statements in conformity with GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting

period. Actual results could differ from these estimates.

|

|

|

(f) No provision has been made for Federal income taxes since the Fund has elected to be taxed as a “regulated

investment company” and intends to distribute substantially all net investment company taxable income and net capital gains to shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated

investment companies. The Fund may utilize earnings and profits distributed to shareholders on redemption of shares as part of the dividends paid deduction.

|

|

|

(g) The Fund has reviewed all open tax years and major jurisdictions, which include Federal and the state of

Maryland, and concluded that there are no significant uncertain tax positions that would require recognition in the financial statements as of and for the year ended September 30, 2018. Open tax years are those that are open for exam by

taxing authorities and, as of March 31, 2019, open Federal tax years include the tax years ended September 30, 2016 through 2018. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense

in the Fund’s Statement of Operations. During the six months ended March 31, 2019, the Fund did not incur any interest or penalties. The Fund has no examinations in progress and is also not aware of any tax positions for which it is

reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

|

|

|

(h) The Fund’s cash is held in accounts with balances which may exceed the amount of related federal insurance. The

Fund has not experienced any loss in such accounts and believes it is not exposed to significant credit risk.

|

|

|

(2)

|

Investment Advisory Agreement and Transactions With Related Parties —

|

|

The Fund has an advisory agreement with Reynolds Capital Management, LLC (“RCM”), to serve as investment adviser. The

sole owner of RCM is Mr. Frederick L. Reynolds. Mr. Reynolds is also an officer and interested director of the Fund. Under the terms of the agreement, the Fund will pay RCM a monthly management fee at the annual rate of 1.00% of the daily

net assets.

|

|

|

The agreement further stipulates that RCM will reimburse the Fund for all expenses exceeding 2.00% of its daily

average net assets (excluding interest, taxes, brokerage commissions and extraordinary items). The Fund is not obligated to reimburse RCM for any expenses reimbursed in previous fiscal years. No such reimbursements were required for the six

months ended March 31, 2019.

|

|

|

The Fund has adopted a Service and Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Act. The Plan

provides that the Fund may incur certain costs which may not exceed a maximum amount equal to 0.25% per annum of the Fund’s average daily net assets. Payments made pursuant to the Plan may only be used to pay distribution expenses incurred

in the current year, and may be less than the maximum amount allowed by the Plan.

|

|

(2)

|

Investment Advisory Agreement and Transactions With Related Parties — (Continued)

|

|

Under the Fund’s organizational documents, each director, officer, employee or other agent of the Fund (including the

Fund’s investment manager) is indemnified, to the extent permitted by the Act, against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into

contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund

has not had prior claims or losses pursuant to these contracts and believes the risk of loss to be remote.

|

|

|

(3)

|

Distributions to Shareholders —

|

|

Net investment income and net realized gains, if any, for the Fund are distributed to shareholders at least annually

and are recorded on the ex-dividend date. Please see Note 5 for more information.

|

|

|

(4)

|

Investment Transactions —

|

|

For the six months ended March 31, 2019, purchases and proceeds of sales of investment securities (excluding

short-term securities) were $134,524,334 and $139,203,635, respectively. There were no purchases or sales of U.S. Government securities.

|

|

|

(5)

|

Income Tax Information —

|

|

The following information for the Fund is presented on an income tax basis as of September 30, 2018:

|

|

Tax cost of investments

|

$

|

56,008,993

|

||||

|

Gross tax unrealized appreciation

|

$

|

23,407,745

|

||||

|

Gross tax unrealized depreciation

|

(1,725,439

|

)

|

||||

|

Net unrealized appreciation

|

21,682,306

|

|||||

|

Distributable ordinary income

|

4,352,817

|

|||||

|

Distributable long term capital gains

|

6,173,825

|

|||||

|

Other accumulated gain

|

—

|

|||||

|

Total distributable earnings

|

$

|

32,208,948

|

|

The difference between the cost amount for financial statement and federal income tax purposes is due primarily to

timing differences in recognizing certain gains and losses in security transactions.

|

|

|

The tax components of dividends paid during the six months ended March 31, 2019 and the year ended September 30,

2018:

|

|

Six Months Ended March 31, 2019

|

September 30, 2018

|

|||

|

Ordinary Income

|

Long-Term Capital

|

Ordinary Income

|

Long-Term Capital

|

|

|

Distributions

|

Gains Distributions

|

Distributions

|

Gains Distributions

|

|

|

$4,352,828

|

$6,172,875

|

$1,755,353

|

$3,619,627

|

|

|

The Fund designated as long-term capital gain dividend, pursuant to Internal Revenue Code Section 852(b)(3), the

amount necessary to reduce the earnings and profits of the Fund related to net capital gain to zero for the tax year ended September 30, 2018.

|

|

|

As of September 30, 2018, the Fund did not have a post-October capital loss, late year ordinary loss or a capital

loss carryforward.

|

|

(6)

|

Subsequent Events —

|

|

Management has evaluated events and transactions after March 31, 2019 through the date that the financial statements

were issued, and has determined that no additional disclosure in the financial statements is required.

|

|

•

|

The nature and quality of the investment advisory services provided by the Adviser.

|

|

•

|

A comparison of the fees and expenses of the Fund to other similar funds.

|

|

•

|

A comparison of the fee structures of other accounts managed by the Adviser.

|

|

•

|

Whether economies of scale are recognized by the Fund.

|

|

•

|

The costs and profitability of the Fund to the Adviser.

|

|

•

|

The performance of the Fund.

|

|

•

|

The other benefits to the Adviser from serving as investment adviser to the Fund (in addition to the advisory fee).

|

|

•

|

The Adviser provides tailored investment advisory services to the Fund in order to accommodate the cash flow

volatility presented by the purchases and redemptions of shareholders.

|

|

•

|

The Adviser coordinates with the Fund’s Chief Compliance Officer and other service providers to insure compliance

with regulatory regimens imposed on the Fund by Federal law and the Internal Revenue Code.

|

|

•

|

Separate accounts do not require the same level of services and oversight, nor do they present the same compliance

risk.

|

HOUSEHOLDING

AVAILABILITY OF PROXY VOTING INFORMATION/QUARTERLY PORTFOLIO SCHEDULE

|

(a)

|

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

|

|

(b)

|

Not Applicable

|

|

(a)

|

The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in

Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d‑15(b) under the Securities Exchange Act

of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed,

summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider.

|

|

(b)

|

There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that

occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

|

|

(a)

|

(1) Any code of ethics or

amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable

|

|

(b)

|

Change in the registrant’s

independent public accountant. There was no change in the registrant’s independent public accountant for the period covered by this report.

|

|

(c)

|

Certifications pursuant to

Section 906 of the Sarbanes‑Oxley Act of 2002. Furnished herewith.

|