UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

|

For fiscal year ended December 31, 2014 |

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 000-52091

GEOVAX LABS, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware (State or other jurisdiction of incorporation or organization)

1900 Lake Park Drive, Suite 380 Smyrna, GA |

87-0455038 (IRS Employer Identification Number)

30080 |

|

(Address of principal executive offices) |

(Zip Code) |

(678) 384-7220

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock $.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes ☐ No ☑

The aggregate market value of Common Stock held by non-affiliates of the registrant on June 30, 2014, based on the closing price on that date was $4,780,857.

Number of shares of Common Stock outstanding as of March 20, 2015: 31,950,813

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement with respect to its 2015 Annual Meeting of Stockholders are incorporated by reference in Part III

Table of Contents

|

PART I | ||

|

Item 1 |

Business |

1 |

|

Item 1A |

Risk Factors |

16 |

|

Item 1B |

Unresolved Staff Comments |

24 |

|

Item 2 |

Properties |

24 |

|

Item 3 |

Legal Proceedings |

24 |

|

Item 4 |

Mine Safety Disclosures |

24 |

|

PART II | ||

|

Item 5 |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

25 |

|

Item 6 |

Selected Financial Data |

26 |

|

Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

26 |

|

Item 7A |

Quantitative and Qualitative Disclosures about Market Risk |

33 |

|

Item 8 |

Financial Statements and Supplementary Data |

33 |

|

Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

33 |

|

Item 9A |

Controls and Procedures |

33 |

|

Item 9B |

Other Information |

34 |

|

PART III | ||

|

Item 10 |

Directors, Executive Officers and Corporate Governance |

34 |

|

Item 11 |

Executive Compensation |

34 |

|

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and |

|

|

Related Stockholder Matters |

34 | |

|

Item 13 |

Certain Relationships and Related Party Transactions, and Director Independence |

34 |

|

Item 14 |

Principal Accountant Fees and Services |

34 |

|

PART IV | ||

|

Item 15 |

Exhibits and Financial Statement Schedules |

35 |

|

Signatures |

36 | |

|

Exhibit Index |

37 | |

PART I

|

ITEM 1. |

BUSINESS |

This Annual Report (including the following section regarding Management’s Discussion and Analysis of Financial Condition and Results of Operations) contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Annual Report. Additionally, statements concerning future matters, including statements regarding our business, our financial position, the research and development of our products and other statements regarding matters that are not historical are forward-looking statements.

Although forward-looking statements in this Annual Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include without limitation those discussed under the heading “Risk Factors” below, as well as those discussed elsewhere in this Annual Report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report. Readers are urged to carefully review and consider the various disclosures made in this Annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

Overview

GeoVax Labs, Inc. (“GeoVax” or the “Company”) is a clinical-stage biotechnology company developing human vaccines against infectious diseases using our novel vaccine platform. Our platform supports production of non-infectious virus-like particles (VLPs) from the cells of the person receiving the vaccine. Producing non-infectious virus-like particles in the person being vaccinated circumvents the need to purify virus-like particles for inoculation. The production of virus-like particles in the person being vaccinated mimics a natural infection, stimulating both the humoral and cellular arms of the immune system to recognize, prevent and control the target infection should it appear.

Our current development programs are focused on vaccines against Ebola and Marburg viruses, and a vaccine against Human Immunodeficiency Virus (HIV). We believe our technology and vaccine development expertise is well-suited for a wide variety of human infectious diseases for which there is an unmet medical need, and we intend to pursue expansion of our product pipeline as resources permit.

Our Ebola/Marburg vaccine program was initiated during 2014 with the goal of developing monovalent vaccines capable of controlling existing outbreaks as well as a multivalent vaccine for preventing future outbreaks. We plan to conduct preclinical animal immunogenicity and challenge studies during 2015 for both vaccines with human clinical testing to begin in late 2016.

Our most advanced HIV vaccine program is focused on the clade B subtype of HIV prevalent in the Americas and Western Europe. Our preventive clade B HIV vaccine has successfully completed Phase 2a human clinical testing and is targeted to enter a follow-on clinical trial in 2015. It has shown outstanding safety and excellent and highly reproducible immunogenicity (Journal of Infectious Diseases volume 203, pg 610 and volume 210 pg 99). We also are investigating our HIV vaccines for their potential to contribute to combination therapies for therapeutic treatment leading to a cure for HIV infections. We are also extending our HIV vaccine effort to the most common virus subtype affecting the developing world, clade C. For clade C, we have jointly developed and licensed via Emory University one vaccine from the National Institutes of Health (NIH), completed lead discovery for a second vaccine, and initiated early preclinical research using both approaches. Each of our vaccine development programs is discussed in greater detail in the sections that follow below.

Our vaccine development activities have been, and continue to be, financially supported by the U.S. government. This support has been both in the form of research grants awarded directly to us, as well as indirect support for the conduct of our human clinical trials. This is discussed further under “Support from the United States Government” below.

Our HIV vaccine technology was developed in collaboration with researchers at Emory University, the NIH, and the Centers for Disease Control and Prevention (CDC). The technology developed by the collaboration is exclusively licensed to us from Emory University. We also have nonexclusive licenses to certain patents owned by the NIH. Our Ebola/Marburg vaccines have been developed with technology licensed from, and in collaboration with, the NIH.

We are incorporated in Delaware, and our offices and laboratory facilities are located in Smyrna, Georgia (metropolitan Atlanta).

Our Technology

Vaccines typically contain agents (antigens) that resemble disease-causing microorganisms. Traditional vaccines are often made from weakened or killed forms of the virus or from its surface proteins. Many newer vaccines use recombinant DNA (deoxyribonucleic acid) technology to generate vaccine antigens in bacteria or cultured cells from specific portions of the DNA sequence of the target pathogen. The generated antigens are then purified and formulated for use in a vaccine. The most successful of these purified antigens have been non-infectious virus-like particles (VLPs) as exemplified by vaccines for hepatitis B (Merck’s Recombivax® and GSK’s Engerix®) and Papilloma viruses (GSK’s Cervarix®, and Merck’s Gardasil®). Our approach uses recombinant DNA or recombinant viruses to produce VLPs in the person being vaccinated. In human clinical trials of our HIV vaccines, we have demonstrated that our VLPs, expressed in the cells of the person being vaccinated, are safe, yet elicit both strong and durable humoral and cellular immune response.

All of our vaccines are designed to produce self-assembling non-infectious VLPs in the cells of the person being vaccinated. VLPs train the body’s immune system to recognize and kill the authentic virus should it appear. VLPs also train the immune system to recognize and kill infected cells to control infection and reduce the length and severity of disease. One of the biggest challenges with VLP-based vaccines is to design the vaccines in such a way that the VLPs will be recognized by the immune system in the same way as the authentic virus would be. When VLPs for enveloped viruses like HIV, Ebola, and Marburg are produced in vivo, they include not only the protein antigens, but also an envelope consisting of membranes from the vaccinated individual’s cells. In this way, they are highly similar to the virus generated in a person’s body during a natural infection. VLPs produced externally, by contrast, have no envelope; or, envelopes from the cultured cells (typically hamster or insect cells) used to produce them. We believe our technology provides distinct advantages by producing VLPs that more closely resemble the authentic virus, which in turn, allows the body’s immune system to more readily recognize the authentic virus. By producing VLPs in vivo, we avoid potential purification issues associated with in vitro production of VLPs.

DNA and MVA as Vaccine Vectors. Our HIV vaccines incorporate two delivery components (or vectors): a recombinant plasmid DNA vaccine, and a recombinant MVA (modified vaccinia Ankara) vaccine. Our Ebola and Marburg vaccines use only the MVA vector. Both our DNA and MVA vaccines express sufficient vaccine genes to support the production of non-infectious VLPs. The VLPs cannot cause disease because they contain mutated or deleted enzymatic functions that are essential for virus replication. The virus-like particles display trimeric membrane bound forms of the viral envelope glycoprotein (Env for HIV or GP for Ebola or Marburg). This is important because the natural form of the envelope glycoprotein elicits multi-target antibody capable of recognizing incoming virus and blocking infections. Expression of multiple proteins by the vaccines is essential for the formation of VLPs. The multiple proteins also provide more targets for immune responses such as cytotoxic T-cells. Elicitation of multi-target humoral and cellular responses limits immune escape, just as multi-drug therapies limit drug escape.

|

|

|

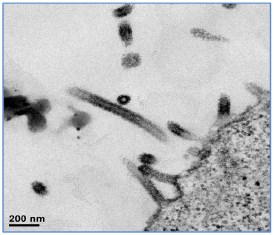

Ebola VLPs |

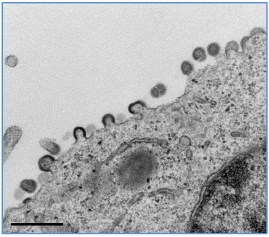

HIV VLPs |

Figure 1. Electron micrographs showing the virus-like particles (VLPs) elicited by GeoVax vaccines from human cells. Note that the Ebola VLPs on the left self-assemble into the rod-like shape of the authentic Ebola virus, while the HIV VLPs shown on the right take on the spherical shape of the authentic HIV virus. While below the resolution of these micrographs, both types of VLPs display what we believe to be the native form of their respective viral envelope glycoproteins which we believe is key to generating an effective immune humoral response.

We selected MVA for use as the live viral component of our vaccines because of its well-established safety record and because of the ability of this vector to carry sufficient viral proteins to produce virus-like particles. MVA was originally developed as a safer smallpox vaccine for use in immune compromised humans. It was developed by attenuating the standard smallpox vaccine by making over 500 passages of the virus in chicken embryos or chick embryo fibroblasts, which resulted in a virus with limited ability to replicate in human cells but did not compromise the ability of MVA to grow on avian cells, which are used for manufacturing the virus. The deletions also resulted in the loss of immune evasion genes which assist the spread of wild type smallpox infections, even in the presence of human immune responses. MVA was safely administered to over 120,000 people in the 1970s as a smallpox vaccine.

Induction of T-cell and Antibody Immune Responses. In both preclinical and clinical trials, our HIV vaccines have been shown to induce both humoral (antibody) and cellular (T-cell) responses against HIV. The induction of both antibodies and T-cells is beneficial because these immune responses work through different mechanisms. Antibodies prevent infection by blocking viruses from infecting cells. In preclinical simian vaccine studies using repeated rectal challenges with moderate doses of virus, the avidity, or tightness, of antibody binding to the surface envelope glycoprotein of HIV correlates with the prevention of infection (The Journal of Infectious Diseases, 204:164 (2011)). In high dose challenges that infect all animals at the first exposure, the avidity of the antibody for envelope glycoprotein correlates with reduced levels of virus replication (Journal of Virology, 83:4102 (2009)). Similarly, antibody responses are believed to be critical for vaccine-elicited protection against Ebola and Marburg infection (Expert Review of Vaccines, 10:63 (2011)). These results likely reflect the tightly binding antibody both blocking infection as well as tagging virus and infected cells for destruction, by white blood cells such as macrophages, neutrophils and natural killer cells. Our vaccines elicit CD8+ T-cells, a type of T-cell that can recognize and kill cells that become infected by virus (without antibody tagging). For HIV, CD8+ T-cells are important for the control of the virus that has established an infection. For Ebola and Marburg, antibodies can stop or slow the progress of infection, but T cells are important for clearing the infection by killing remaining infected cells.

Background – Viruses and Vaccines

What are Viruses? Viruses are microscopic organisms consisting of genetic material comprised of DNA (deoxyribonucleic acid) or RNA (ribonucleic acid), surrounded by a protein, lipid (fat), or glycoprotein coat. Viruses invade healthy, living host cells in order to replicate and spread. In many cases, the body’s immune system can recognize and effectively combat an infection caused by a virus. However, with certain viral infections, the body’s immune system is unable to fully destroy or inhibit the replication of the virus, which results in persistent and ongoing viral replication resulting in disease.

Infections caused by viruses can be chronic or acute. Chronic infections, such as those caused by HIV, do not typically self-resolve with time and can cause chronic disease. Acute infections associated with viruses, such as influenza, generally last for a relatively short period of time, and self-resolve in most immunocompetent individuals. However, certain acute infections, such as those caused by Ebola and Marburg, can overwhelm the immune system, resulting in serious disease and death.

Viruses can also be characterized as either active or latent. An active virus can cause a persistent infection or disease over an extended period of time. A latent virus will remain in the body for very long periods of time after the initial infection and generally will only cause disease when the body’s immune system weakens, fails or is suppressed, allowing the virus to once again replicate. Vaccines have been widely used to prevent active viral infections from occurring. Latent infections are more difficult to address with vaccines. A latent virus does not replicate actively and can “fly below the radar” of the immune system in that it does not provide the immune system with targets for antibody and T-cell responses.

Viruses that develop resistance to antiviral drugs are increasingly becoming a challenge in the treatment of viral infections, particularly those that are chronic in nature. The ability of viruses to mutate spontaneously during replication allows drug-resistant strains to emerge when patients are using drugs that are not potent enough to quickly and completely inhibit viral replication. Drug-resistant mutant viruses, while initially low in number, eventually become the predominant strain in an infected patient as those strains that remain susceptible to the drug are inhibited from replicating. Once this occurs, the treatment benefit of that particular antiviral drug diminishes, resulting in treatment failure and the need for an alternate therapy with different or possibly new drugs, or classes of drugs. In general, viruses that cause chronic infections, such as HIV, are more likely to develop drug resistance due to the long-term and persistent exposure of the virus to the antiviral therapy.

What are Vaccines? Vaccines represent an approach to broaden the ability to prevent serious infectious diseases caused by both viruses and bacteria. A vaccine is a substance introduced into the human body that teaches the immune system to detect and destroy a pathogen (a virus or other pathogen that causes disease). All vaccines contain some harmless form or part of the pathogen they target or of a highly similar pathogen. They exert their effects through the adaptive immune response, an arm of the immune system that learns to recognize and control specific pathogens.

There are several types of vaccines:

|

● |

Whole-killed/Whole-inactivated vaccines: The active ingredient in these vaccines is an intact virus or bacterium that has been killed or otherwise stripped of its ability to infect humans. Examples include the cholera and injectable polio vaccines. This approach has not been applied to the development of vaccines against HIV due to lack of success in animal experiments and the difficulty of developing an inactivation method capable of ensuring that the product will be entirely free of active virus. Similarly, inactivated Ebola vaccines have not shown great promise in animal models, and any production process starting with live Ebola or Marburg virus would require such extreme containment measures that it would be difficult to operate at industrial scale. |

|

● |

Live attenuated vaccines: These vaccines use a form of the targeted pathogen that is highly unlikely to be harmful—one capable, say, of multiplying, but not causing disease. Examples include the measles vaccine and the oral vaccine against polio, which has been widely deployed in global eradication efforts. Such vaccines can be very effective because they closely mimic the behavior of the targeted pathogen, giving the immune system a truer picture of what it would be up against. Due to the risk that attenuated HIV, Ebola, or Marburg might revert to its disease-causing form, this approach has not been applied to the development of HIV, Ebola, or Marburg vaccines. |

|

● |

Subunit vaccines: Vaccines of this variety are composed of purified pieces of the pathogen (known as antigens) that generate a vigorous, protective immune response. Common subunit vaccines include the seasonal flu and hepatitis B vaccines. This approach was employed to devise the first AIDS vaccine candidate tested in humans, which failed to induce protection from HIV infection. To date, subunit vaccines have failed to protect nonhuman primates against Ebola infection (Human Vaccines, 6:439 (2010)). |

|

● |

Purified VLP vaccines: Purified VLP vaccines consist only of virus-like particles, which are composed of certain viral proteins but do not contain the genetic material of the virus. Unlike subunit vaccines, VLPs typically provide viral antigens in their native form. Due to their structural similarity to actual viruses, VLPs are excellent immunogens capable of raising potent antibody and cellular immune responses. Purified VLPs need to be manufactured and purified in large quantities. They also are difficult to make for relatively fragile viruses with lipid membrane envelopes such as HIV, Ebola, or Marburg vaccines. Examples of successful vaccines using purified VLPs include vaccines for hepatitis B (Merck’s Recombivax® and GSK’s Engerix®) and Papilloma viruses (GSK’s Cervarix®, and Merck’s Gardasil®). |

|

● |

Expressed VLP vaccines: These vaccines are designed to produce self-assembling non-infectious VLPs in the cells of the person being vaccinated. When VLPs for enveloped viruses like HIV, Ebola, and Marburg are produced in vivo, they include not only the protein antigens, but also an envelope consisting of membranes from the vaccinated individual’s cells. In this way, they are highly similar to the virus generated in a person’s body during a natural infection. Purified VLPs produced externally, by contrast, have no envelope; or, envelopes from the cultured cells (typically hamster or insect cells) used to produce them. By producing VLPs in vivo, potential purification issues associated with in vitro production of VLPs are avoided. GeoVax employs this approach in our vaccine design. |

|

● |

DNA vaccines: These vaccine candidates are also designed to train the immune system to recognize a piece of the targeted bacterium or virus. The difference is that the active ingredients are not the purified antigens themselves but circles of DNA, called plasmids, which carry genes encoding those antigens. Human cells passively take up these plasmids and produce the antigens which, in turn, train the immune system to recognize the targeted pathogen. |

|

● |

Recombinant viral vaccines: These vaccines, like DNA vaccines, introduce genes for targeted antigens into the body. But the genes are inserted into a virus that actively infects human cells. The viruses chosen as vectors are safe to use because they do not ordinarily cause disease in humans and/or have been stripped of their ability to proliferate. |

Our Ebola & Marburg Vaccine Program

About Ebola and Marburg. Ebola Hemorrhagic Fever (EHF) and the related disease Marburg Virus Disease (MVD) are highly contagious, extremely deadly diseases that, if not contained by quarantine, are capable of threatening populations worldwide. Since 1976, when Ebola was first discovered, at least 28 outbreaks have occurred. The recent Ebola outbreak in West Africa is significantly larger than any previous epidemic, the first to reach urban areas and the first to lead to person-to-person transmission in the United States. As of February 2015, the current epidemic has resulted in over 22,500 infections with over 9,000 deaths (40% fatality rate). No approved preventive or therapeutic products exist for EHF or MVD.

Ebola and Marburg naturally infect animals including bats, creating reservoirs of Ebola and Marburg that, like rabies, cannot be completely eradicated. The rapid urbanization of many areas of Sub-Saharan Africa and the ease of modern air travel create conditions that facilitate the epidemic spread of EHF and MVD, which previously had been limited to localized outbreaks in villages. EHF is caused by ebolaviruses (Ebola), and MVD is caused by marburgviruses (Marburg). Ebola and Marburg are members of the family Filoviridae. Ebolaviruses are more diverse than marburgviruses and are divided into five subtypes: Zaire, Sudan, Bundibugyo, Tai Forest, and Reston. Zaire is the most lethal of the strains and is responsible for the current epidemic. Sudan and Bundibugyo are also lethal but have caused fewer and less severe outbreaks.

A challenge in Ebola and Marburg vaccine development is the need to create products that are effective both in containing an epidemic (in which rapid responses are critical) and in routine immunization (in which the duration of immunity is important). Ideal countermeasures to Ebola and Marburg would include a single-shot strain-specific epidemic vaccine capable of rapidly producing protective antibodies and T cells, and a routine vaccine capable of eliciting durable immunity to the lethal strains of Ebola (Zaire, Sudan and Bundibugyo) as well as Marburg. An effective vaccine against Ebola and/or Marburg would dramatically reduce the epidemic spread of infections as well as the transmission of Ebola and/or Marburg from natural animal hosts to humans.

Research on Ebola vaccines is progressing rapidly amongst a number of different pharmaceutical companies, with recombinant chimpanzee adenovirus (ChAd3), rare-serotype adenovirus (Ad26) and vesicular stomatitis virus (VSV) candidates already in clinical trials and several other vaccines scheduled to begin clinical trials. However, none of these vaccines has an ideal design, nor are any of them well suited for use in proactive immunization of populations to prevent future epidemics. The adenovirus vaccines require boosting with MVA to raise protective immune responses, and the two-product regimen (adenovirus and MVA) dramatically raises manufacturing costs and the complexity of vaccination. The replication competent VSV recombinants have already shown risk signals in the current trial, necessitating a temporary halt to the trial followed by resumption at a lower vaccine dose. The potential dose-limiting toxicity of the VSV vaccines raises safety concerns for large-scale vaccinations and also could pose threats to immunocompromised people, such as those infected with HIV. None of the competitors’ vaccines produce virus-like particles, a desirable characteristic, which is discussed in detail elsewhere in this document. To the best of our knowledge, no non-GeoVax vaccine candidates share this characteristic. One or more of the current candidates may well show success in stemming the current epidemic. However, the world must be prepared with the optimal vaccine for the next epidemic when it occurs. All of the vaccines currently in clinical trials are designed to protect against one, or at most two, strains of Ebola. To be successful, an optimal vaccine should be safe, effective, and long lasting, all at a reasonable cost. Our analysis suggests that the GeoVax designs are well suited to achieve this aim.

Our Ebola/Marburg Vaccines. To address the unmet need for a product to prevent EHF and MVD, we are developing a series of Ebola and Marburg vaccines, which combine our proven MVA technology with advanced vaccine design. We are developing individual vaccines (monovalent) that will address each of the lethal strains of Ebola virus (Zaire, Sudan and Bundibugyo), as well as Marburg virus. We also plan to develop a multivalent vaccine, which will incorporate multiple monovalent vaccines to protect against the three strains of Ebola and Marburg with a single product.

For testing purposes, our first focus will be the monovalent vaccine for the Zaire strain of Ebola, which we plan to test in the widely used guinea pig challenge model during 2015. This would be followed by testing in the more rigorous non-human primate model, with an expected start date in late 2015. We are planning to begin preclinical testing of our multivalent vaccine several months after the monovalent Zaire vaccine. An initial proof-of-concept study is planned which will allow us to identify which strains and how many strains are needed in the multivalent vaccine; this may be followed (if necessary) by another study to provide additional data on the vaccine, especially with regard to durability of immune responses. We are also planning to initiate IND-enabling toxicology studies in late 2015, with the goal of starting Phase 1 human clinical trials, for both our monovalent and multivalent vaccines, in late 2016.

We are self-funding the early development work on our vaccines, including the guinea pig challenge studies, but the later-stage testing and clinical trials will be dependent upon the availability of sufficient financial resources. We intend to seek funding from U.S. government agencies and/or world health organizations to assist us in this regard.

We believe our Ebola/Marburg vaccines will demonstrate a unique combination of advantages that set them apart from any other products in development for prevention of EHF.

|

● |

VLP immunogens. Our GEO-EM01 vector (the active component of the GOVX-E301 product) has been demonstrated to express noninfectious Ebola VLPs in human cells. VLPs mimic the structure of ebolavirus particles and display the vaccine antigens in conformations that are highly similar to those present in live virions. Our prior experience with VLP-expressing HIV vaccines suggests that VLPs expressed by MVA raise highly durable antibody responses, the best durability seen in the field of HIV vaccines. |

|

● |

Expression of VLPs by a live vector. Unlike purified VLP vaccines, the GeoVax vaccines are intended to produce VLPs in the cells of the vaccinated person. This strategy carries several advantages. The live, VLP-expressing vector provides antigens in three different forms: as VLPs, as proteins on the surface of MVA-infected cells, and as proteins expressed within MVA-infected cells. Each type of antigen is recognized differently by the immune system, contributing to the breadth and potency of the immune response. Also, unlike VLPs produced in cell culture, the VLPs expressed by the GeoVax vaccines bud from the cells of the vaccinated person, just as infectious Ebola or Marburg would do if the person were exposed to the virus rather than the vaccine. In this way, the VLPs produced in the cells of the vaccinated person are structurally more similar to actual Ebola or Marburg virions. This structural similarity focuses the immune response on the actual antigens of interest rather than eliciting responses against antigens in non-native forms or irrelevant proteins from the membranes of cultured cells. |

|

● |

The excellent safety of MVA. Our vaccines use the MVA vector, which is highly attenuated. Originally developed as a safer alternative to vaccinia, MVA has shown excellent safety in over 120,000 human subjects. It is widely recognized as a safe vector for recombinant vaccines and has been shown to be safe in immunocompromised individuals and in SIV (the primate version of HIV) infected macaques. The attenuation of MVA allows it to be used in high doses, potentially enabling a protective single-dose regimen in an epidemic situation. Though two other MVA vectors do not express VLPs and are components of other vaccines in clinical development, these other MVA vectors are used in combination with novel adenovirus vectors, which have only limited safety data in humans. |

|

● |

The ability of MVA to raise antibody and T-cell responses. The field of Ebola immunology is developing rapidly, and researchers have not yet reached a solid consensus on a correlate of protection. Recent studies, including anecdotal results from passive antibody therapy of infected patients, point toward neutralizing antibody as the most important immune response. However, certain animal challenge studies have suggested that binding (rather than neutralizing) antibody correlates best with protection, and other studies have indicated T-cell responses are critical for clearing infections. MVA-vectored vaccines are very efficient at raising both antibody and T-cell responses. |

|

● |

Antigens against the current epidemic. A vaccine will be most effective if it provides antigens as similar as possible to those in circulating strains of the pathogen. For this reason, we have designed our Zaire ebolavirus vaccines against a genetic sequence from the current epidemic. In this way, our product maximizes the probability of delivering a vaccine antigen that is as close as possible to the circulating pathogen. |

|

● |

Rapid induction of responses. The MVA vector is highly effective at raising protective responses quickly. Vaccinia, the parental vector for MVA, was used successfully in immunization of people who had come in contact with smallpox-infected individuals. This fact and results from GeoVax’s HIV trials suggest that the GeoVax Ebola and Marburg vaccines should be well-suited to epidemic situations in which a protective response must be raised quickly. |

|

● |

Homologous prime-boost regimen. Published data indicate that, while a single immunization may be sufficient to provide short-term protection in an epidemic situation, a multiple-dose strategy is often superior for raising the durable responses that are required in routine preventive vaccination campaigns. Our MVAs are designed to be used in homologous prime-boost regimens, in which multiple doses of the same vaccine are given. The homologous prime-boost strategy is simpler and more economical than heterologous prime-boost products such as the adenovirus-MVA combinations currently being tested. Relative to a product that requires a heterologous prime-boost regimen, our MVAs are simpler and less expensive to manufacture, test, distribute, and use. |

|

● |

Experience with the use of MVA in prime-boost regimens. MVAs are highly effective at boosting immune responses, as demonstrated in previous work on Ebola as well as preclinical and clinical trials of HIV vaccines. Our results with MVA prime-boost regimens in HIV trials suggest that MVA alone is highly effective (more effective than DNA and MVA combined) at raising antibody responses. For this reason, we believe that the MVA-MVA prime-boost strategy will be ideal for routine vaccination of populations with our GOVX-E301 product. Also, though we have no current plans to develop our MVAs as boosts for other vaccines, we recognize that any of our MVAs could potentially be used as a heterologous boost to a different (for example, adenovirus) priming vaccine if future data indicate that a heterologous regimen is desirable. |

|

● |

The excellent thermal stability of MVA. To be appropriate for use in remote regions of the world, a vaccine must be stable enough to remain potent despite suboptimal cold chain logistics. In addition, to be suitable for storage in national stockpiles, Ebola vaccines must remain stable over several years of storage. MVA vaccines are highly stable in both liquid and lyophilized dosage forms. An ongoing stability study of our MVA vaccine against HIV has shown excellent stability over more than six years of storage. |

|

● |

Manufacturability of MVA-vectored vaccines. If designed with genetically stable inserts, MVA-vectored vaccines can reliably be manufactured in large quantities. In addition to the established Chick Embryo Fibroblast (CEF) cell substrate, we have also investigated novel continuous cell lines for manufacture of our vaccines against HIV, and believe they could potentially be used for manufacture of our MVA vaccines against Ebola. Continuous cell lines offer virtually unlimited scalability as well as greater process consistency and efficiency. |

Our HIV/AIDS Vaccine Program

About HIV/AIDS. HIV is a retrovirus that carries its genetic code in the form of RNA. Retroviruses use RNA and the reverse transcriptase enzyme to create DNA from the RNA template. The HIV-1 virus enters human cells and copies its viral RNA to produce complementary DNA (cDNA) that is subsequently inserted into the chromosomes, which are the genetic material of a cell. HIV preferentially infects and replicates in T-cells, which are a type of white blood cell. Infection of T-cells alters them from immunity mediating cells to cells that produce and release HIV. This process results in the destruction of the immune defenses of infected individuals and ultimately, the development of AIDS.

There are several AIDS-causing HIV virus subtypes, or clades, that are found in different regions of the world. These clades are identified as clade A, clade B and so on. The predominant clade found in Europe, North America, parts of South America, Japan and Australia is clade B, whereas the predominant clades in Africa are clades A and C. In India, the predominant clade is clade C. Each clade differs by at least 20% with respect to its genetic sequence from other clades. These differences may mean that vaccines or treatments developed against HIV of one clade may only be partially effective or ineffective against HIV of other clades. Thus, there is often a geographical focus to designing and developing HIV vaccines.

HIV, even within clades, has a high rate of mutation that supports a significant level of genetic variation. In drug treatment programs, virus mutation can result in the development of drug resistance, referred to as virus drug escape, thereby rendering drug therapy ineffective. Hence, we believe that multi-drug therapy is very important. If several drugs are active against virus replication, the virus must undergo multiple simultaneous mutations to escape, which is less likely. The same is true for immune responses. HIV can escape single targeted immune responses. However, our scientists believe if an immune response is directed against multiple targets, which are referred to as epitopes, virus escape is much less frequent. Vaccination against more than one of the proteins found in HIV increases the number of targets for the immune response as well as the chance that HIV will not escape the vaccine-stimulated immune response, thus resulting in protection against infection or the development of clinical AIDS if infection occurs.

HIV infects and gradually destroys T-cells and macrophages, which are white blood cells that play key roles in protecting humans against infectious disease caused by viruses, bacteria, fungi and other micro-organisms. Opportunistic infections by organisms, normally posing no problem for control by a healthy immune system, can ravage persons with immune systems damaged by HIV infections. Destruction of the immune system occurs over years. The average onset of the clinical disease recognized as AIDS occurs after three to ten years of HIV infection if the virus is not treated effectively with drugs, but the time to developing AIDS is highly variable.

AIDS is considered by many in the scientific and medical community to be the most lethal infectious disease in the world. According to the report published by UNAIDS/WHO, at the end of 2012, an estimated 36 million people were living with HIV worldwide, with approximately 2.5 million newly infected in 2012 alone. Approximately 25 million people infected with HIV have died since the 1981 start of the HIV pandemic. The United States currently has an estimated 1.1 million HIV-infected individuals, with approximately 55,000 new infections per year.

At present, the standard approach to treating HIV infection is to inhibit viral replication through the use of combinations of drugs. Available drugs include reverse transcriptase inhibitors, protease inhibitors, integration inhibitors and inhibitors of cell entry to block multiple essential steps in virus replication. However, HIV is prone to genetic changes that can produce strains that are resistant to currently approved drugs. When HIV acquires resistance to one drug within a class, it can often become resistant to the entire class, meaning that it may be impossible to re-establish control of a genetically altered strain by substituting different drugs in the same class. Furthermore, these treatments continue to have significant limitations which include toxicity, patient non-adherence to the treatment regimens and cost. As a result, over time, viruses acquire drug-resistant mutations, and many patients develop intolerance to the medications or simply give up taking the medications due to the side effects.

According to the International AIDS Vaccine Initiative (IAVI), the cost and complexity of new treatment advances for AIDS puts them out of reach for most people in the countries where treatment is most needed. As noted above, in industrialized nations, where drugs are more readily available, side effects and increased rates of viral resistance have raised concerns about their long term use. AIDS vaccines, therefore, are seen by many as the most promising way to end the HIV/AIDS pandemic. It is expected that vaccines for HIV/AIDS, once developed, will be used universally and administered worldwide by organizations that provide health care services, including hospitals, medical clinics, the military, prisons and schools.

Our Preventive HIV Vaccine Program

Prevention of HIV infection remains a worldwide unmet medical need, even in the United States and other first world countries where effective antiretroviral therapies are available. Current antiretroviral therapies do not eliminate HIV infection, requiring individuals to remain on antiretroviral drugs for their entire lives. In the United States, it is estimated that of the 1.1 million infected individuals, for various reasons (lack of diagnosis, linkage to care, patient compliance, etc.) only 25% ultimately remain in HIV care with their viral load sufficiently suppressed to prevent spread of HIV. As a result, the annual incidence of new HIV infections has remained virtually unchanged for the past 20 years. Furthermore, the annual financial burden to the U.S. taxpayer for HIV education, prevention, and treatment costs borne through Medicaid, Medicare, and the Ryan White Act is more than $16 billion annually, and the estimated lifetime medical costs for an individual infected with HIV is $500,000.

Work on our HIV vaccines began during the 1990s at Emory University in Atlanta, Georgia, under the direction of Dr. Harriet L. Robinson, who is now our Chief Scientific Officer. The vaccine technology was developed in collaboration with researchers at the NIH and the CDC.

Our most clinically advanced vaccine development program is a DNA/MVA vaccine regimen designed to protect against the clade B subtype of the HIV virus. Clade B is prevalent in the Americas and Western Europe. An estimated 3.3 million people are infected with clade B HIV virus worldwide, with 187,000 new infections in 2012.

We have two HIV vaccine components under development: a recombinant DNA vaccine, and a recombinant MVA vaccine. Both the DNA and MVA vaccines contain sufficient HIV genes to support the production of non-infectious virus-like particles. These VLPs display the native trimeric membrane-bound form of the HIV envelope glycoprotein (Env) that mediates entry into cells and is the target for protective antibody. When used together, the recombinant DNA component primes immune responses, which are boosted by administration of the recombinant MVA component. This prime-boost strategy elicits high avidity antibodies (tightly binding antibodies) and cytotoxic T cells. The antibodies can block infections and initiate the killing of virus and infected cells by bound antibody signaling destruction by virion capture, antibody-dependent cellular cytotoxicity, phagocytosis and complement mediated lysis. We may also pursue development of our MVA vaccine component as a standalone HIV vaccine, or in combination with other vaccine components.

Clinical trials of our preventive HIV vaccine have been conducted by the HIV Vaccine Trials Network (HVTN). The HVTN is the largest worldwide clinical trials network dedicated to the development and testing of HIV/AIDS vaccines. Support for the HVTN comes from the National Institute of Allergy and Infectious Diseases (NIAID), part of the NIH. The HVTN’s HIV Vaccine Trial Units are located at leading research institutions in 27 cities on four continents.

We have completed multiple Phase 1 trials and a Phase 2a trial (HVTN 205) of various dosing regimens and formulations of our vaccines. These vaccines have been evaluated in nearly 500 humans. All of the clinical trials of our preventive vaccines have been conducted by the HVTN, and fully funded by the NIH.

We are actively engaged in discussions with the HVTN and NIAID regarding the design of our next clinical study and various trial designs are being considered. Our vaccine is currently the only vaccine being contemplated for efficacy trials for prevention of clade B HIV infection. However, the HVTN believes the best path forward will be to test our vaccines in combination with a protein boost. Protein boosts may augment antibody responses that can block virus infections (neutralizing antibody) and cause antibody dependent cellular cytotoxicity (ADCC antibody). Proteins added to HIV vaccines have shown some success in other trials. The HVTN believes this “dual-action” approach will be a prudent and cost-effective path forward for supporting large clinical trials. Our current expectation is that the next clinical trial will begin in late 2015 and will be a follow-on study to the HVTN 205 trial, in which those trial participants are given a protein boost to evaluate their immune responses. Information from this trial would then inform the design of future, larger clinical trials.

The HVTN is continuing to consider future efficacy studies, and members are working to develop collaborative clinical development plans, as well as initiating regulatory planning. The plans for large-scale clinical trials may change as researchers continue to gather information from our earlier studies and are influenced by results from other vaccine trials. Trial start dates are dependent on many factors and are likely to change.

Preventive HIV Vaccine Program – Clade C. Subject to the availability of funding support from governmental or nongovernmental organizations, we also plan to develop vaccines designed for use to combat the subtypes of HIV that predominate in the developing countries. We have licensed from the U.S. National Institutes of Health (NIH) the modified vaccine Ankara (MVA) construct for the clade C subtype of HIV prevalent in South Africa and India, and we have completed lead discovery using a novel approach to vaccination against clade C. We have performed initial process development studies for the NIH-developed vaccine and initiated early development work on the other, newer clade C vaccine. Depending on the results of animal studies and the focus of government support, we may advance either or both of the clade C vaccines into the clinic.

Preclinical Studies. We conducted preclinical efficacy trials of our preventive HIV vaccines by vaccinating non-human primates with simian immunodeficiency virus prototypes of our HIV vaccines and then testing them for resistance to simian immunodeficiency virus infection. The experimental data produced by these trials documented the ability of the simian prototypes of our vaccines to induce immune responses that can prevent infection as well as reduce the levels of viral replication in those animals that become infected.

Completed Human Clinical Trials -- Preventive HIV Vaccine

Phase 1 Human Clinical Trials. All of our preventive vaccination trials in humans have been conducted by the HVTN, a network that is funded and supported by the NIH. The HVTN is the largest worldwide clinical trials network focused on the development and testing of HIV/AIDS vaccines. The results of a two group, 30 participant, Phase 1 trial (designated HVTN 045) are published in AIDS RESEARCH AND HUMAN RETROVIRUSES 22:678 (2006) and of a four group 120 participant trial (HVTN 065) in The Journal of Infectious Diseases 203:610 (2011). Our Phase 1 trials have tested both safety and dosing regimens.

In our first Phase 1 clinical trial, HVTN 045, our DNA vaccine was tested without MVA boosting to document the safety of the DNA. Our second Phase 1 clinical trial, HVTN 065, was designed to test the combined use of DNA and MVA and consisted of a dose escalation as well as regimen studies. The low dose consisted of 0.3 mg of DNA and 1x107 tissue culture infectious doses (TCID50) of MVA. Once safety was demonstrated for the low dose in 10 participants, the full dose (3 mg of DNA and 1x108 TCID50 of MVA) was administered to 30 participants. A single dose of DNA at time 0 followed by MVA at weeks 8 and 24, a DMM regimen, and three doses of MVA administered at weeks 0, 8 and 24, an MMM regimen, were also tested in 30 participants each. Participants were followed for 12 months to assess vaccine safety and to measure vaccine-induced immune responses.

Data from the HVTN 065 trial again documented the safety of the vaccine products but also showed that the DDMM and MMM regimens induced different patterns of immune responses. The full dose DDMM regimen induced higher response rates of CD4++ T-cells (77%) and CD8++ T-cells (42%) compared to the MMM regimen (43% CD4+ and 17% CD8+ response rates). In contrast, the highest response rates and highest titers of antibodies to the HIV Env protein were induced in the group that received only the MVA using the MMM regimen. Antibody response rates were documented to be higher for the MMM group using three different assays designed to measure total binding antibody levels for an immune dominant portion of the Env protein (27% for DDMM and 75% for MMM), binding of antibodies to the gp120 subunit of the envelope glycoprotein (81% for DDMM and 86% for MMM) and neutralizing antibodies (7% for DDMM and 30% for MMM). The 1/10th dose DDMM regimen induced overall similar T-cell responses but reduced antibody responses while the response rates were intermediate in the DMM group.

The HVTN also sponsored and conducted a Phase 1 clinical trial in humans (HVTN 094) of the adjuvanted form of our vaccine that co-expresses GM-CSF in the DNA priming vaccine. We have designated the GM-CSF-adjuvanted version of our DNA/MVA vaccine regimen as GOVX-B21, and the unadjuvanted version as GOVX-B11. During December 2013, we reviewed preliminary results from HVTN 094. Based on excellent preclinical non-human primate data, this trial was originally initiated with the expectation that GOVX-B21 would be carried forward into Phase 2 testing by the HVTN, with support by the NIH. However, comparison of data between HVTN 094 and the Phase 2a trial, HVTN 205 (see below) did not show a significant benefit from adding the adjuvant to the vaccine for preventive use; therefore GOVX-B21 was not advanced in further clinical testing (results to be published).

Phase 2 Human Clinical Trials. Based on the safety and the immunogenicity results in the HVTN 045 and HVTN 065 trials, the full dose DNA/MVA and MVA-only regimens were selected for testing by the HVTN in a Phase 2a trial (designated HVTN 205) which was completed in 2012 and the subject of an oral presentation at the AIDS Vaccine 2012 Conference in September 2012, with further analysis presented at the AIDS Vaccine Meeting in Barcelona, Spain, in October 2013 and a publication in the Journal of Infectious Diseases (volume 210, pg 99) in 2014. HVTN 205 was designed to evaluate the safety and immunogenicity of our vaccines in healthy, HIV-uninfected adults. In HVTN 205, 299 participants were randomly assigned to three study arms: 149 participants received two injections of our DNA vaccine followed by two injections of our MVA vaccine (DDMM arm), 75 participants received three MVA injections and one placebo injection (MMPM arm), and 75 participants received four injections of placebo. After the final vaccination, antibody responses against the HIV Envelope protein (Env), the target for protective antibody, were detected in 93.2% of the DDMM arm (the vaccination regimen selected for further clinical study). At six months after final vaccination (the latest time point tested), gp140 IgG antibody response titers in the DDMM arm had declined by less than 3-fold, with response rates only declining from 100% to 84%, indicating significant durability of the antibody response. Additionally, HVTN 205 also showed that the antibody responses after vaccination had high affinity binding, a characteristic which has been associated with prevention of HIV infection in preclinical models. The study also showed low response rates for serum IgA, a desirable characteristic because serum IgA competed with serum IgG for reducing the risk of infection in the one partially protective (31%) AIDS vaccine trial in Thailand. Response rates for serum IgG3, an isotype associated with activating innate methods of protection such as complement (C’)-mediated lysis and antibody-dependent cellular cytotoxicity were excellent (91%).

HIV Immunotherapy Program

Current antiretroviral therapies, though highly effective at suppressing HIV viral load, are unable to eliminate HIV infection entirely. A major challenge in the development of HIV therapeutics is the ability of HIV to persist in host cells in a latent proviral form, invisible to the immune system and inaccessible to antiretroviral drugs. In response to this problem, the NIH and other leaders in the HIV field have developed a new concept: the “shock and kill” strategy, in which patients remain on standard-of-care anti-retroviral drug therapy while a second drug (“shock agent”) is used to activate latent HIV and a third drug (“kill agent”) is used to recognize and eliminate cells that harbor the latent HIV reservoir. A shock and kill therapy could potentially contribute to a cure for HIV.

Observations from a pilot Phase 1 clinical trial of our HIV vaccines (GV-TH-01 – discussed below) have led us to postulate that our DNA vaccines may be effective as a shock agent and that a subsequent, precisely timed MVA inoculation may reduce viral reservoirs. The Company is currently considering the best course of action for advancing its HIV immunotherapy program. Future therapeutic studies of GeoVax’s vaccine may investigate vaccine’s ability to act as a “shock agent” in a shock and kill therapy in combination with standard of care antiretroviral drug therapy to seek a cure. The timetable and specific clinical plans will be dependent upon the Company’s ability to secure external funding for the program, and on the nature of any potential collaborations GeoVax may establish.

Preclinical Studies – Therapeutic Vaccine. In 2007-2008, data were generated in three pilot studies on therapeutic vaccination in simian immunodeficiency virus-infected non-human primates. The vaccine used in these pilot studies was specific for simian immunodeficiency virus but with the design features of our HIV/AIDS vaccine. In these pilot studies, conducted at Yerkes National Primate Research Center of Emory University, non-human primates were infected, drug-treated, vaccinated and then drug-interrupted. Following treatment interruption, median levels of virus in blood, measured as viral RNA, were 10 to 1000-times lower than those measured prior to drug and vaccine treatment. The therapeutic reductions in virus levels were best for animals placed on drugs within 12 weeks of infection with lower levels of protection being achieved in animals that were placed on drugs at 3 months or later after infection.

Phase 1 Trial (Treatment Interruption). In early 2014, we completed a Phase 1 clinical trial (GV-TH-01) investigating the therapeutic use of our vaccines in HIV-infected patients. GV-TH-01 is an open label Phase 1 treatment interruption trial investigating the safety and immunogenicity of our DNA/MVA vaccine regimen in 9 HIV-infected patients who initiated drug treatment within 18 months of seroconversion and had stably controlled virus for at least 6 months. Patients were vaccinated with two DNA inoculations followed by two MVA inoculations at intervals of two months. Eight weeks following the last inoculation, patients suspended drug therapy for a 12-week period. Vaccinated patients’ ability to control the time and temporal height of re-emergent virus in the absence of drugs was then observed. Drug treatment was re-instituted after 12 weeks, and trial participants were observed for an additional 6 months. The primary endpoint of this study was to evaluate the safety of our vaccine in HIV-positive patients with well-controlled infections who are being treated with oral HIV medications. An exploratory objective of the study was to evaluate the ability of the vaccinated patient to control re-emergent virus during the drug treatment interruption period.

Analysis of GV-TH-01 data indicates that, during the vaccination phase of the trial, enhanced CD8++ T cells were elicited in 8 of 9 participants and enhanced CD4++ T cell in 5 of 9 participants. Antibody responses were boosted in 4 of 9 participants. Analyses during the treatment interruption phase of the trial suggested that individuals with the best immune responses had lower levels of re-emergent virus. These levels however were not sufficiently low to prevent immune escape and the reinstitution of progression towards AIDS. Excellent safety was observed throughout the trial, with none of the participants needing to reinstate antiretroviral drugs during the treatment interruption phase of the trial (data being compiled for publication).

Support from the United States Government

With the exception of the GV-TH-01 Phase 1 therapeutic trial (treatment interruption protocol), all of our human clinical trials to date have been conducted by the HVTN and funded by NIH. This financial support has been provided by the NIH directly to the HVTN, so has not been recognized in our financial statements. Our responsibility for these clinical trials has been to provide sufficient supplies of vaccine materials and technical expertise when necessary.

In addition to clinical trial support from the NIH, our operations are partially funded by NIH research grants. In September 2007, the NIH awarded us an Integrated Preclinical/Clinical AIDS Vaccine Development (IPCAVD) grant to support our HIV/AIDS vaccine program. We utilized this funding to further our HIV/AIDS vaccine development, optimization and production. The aggregate award (including subsequent amendments) totaled approximately $20.4 million, and there was approximately $75,000 remaining and available for use as of December 31, 2014. In September 2012, the NIH awarded us an additional grant of approximately $1.9 million to support development of versions of our HIV/AIDS vaccines to address the clade C subtype of the HIV virus prevalent in the developing world. All funding pursuant to this grant has been utilized. In July 2013, the NIH awarded us a Small Business Innovative Research (SBIR) grant for approximately $277,000 to support preclinical studies evaluating the ability of protein boosts to augment antibody responses. The initial grant award was approximately $277,000 for the first year of a two-year project period beginning August 1, 2013. In July 2014, the NIH awarded us approximately $290,000 for the second year of the project period. We recorded grant revenues of $258,267, $154,563, and $-0- for the years ended December 31, 2014, 2013 and 2012, respectively, related to this grant, and there was approximately $154,000 of unrecognized grant funds remaining and available for use pursuant to this grant as of December 31, 2014.

Please refer to our Financial Statements beginning on page F-1 of this Form 10-K, and to “Management's Discussion and Analysis of Financial Condition and Results of Operations”, for additional information regarding revenue and funds availability.

Regulations

Regulation by governmental authorities in the United States and other countries is a significant factor in our ongoing research and development activities and in the manufacture of our products under development. Complying with these regulations involves considerable time and expense.

In the United States, drugs are subject to rigorous federal and state regulation. Our products are regulated under the Federal Food, Drug and Cosmetic Act, as amended (FD&C Act), and the regulations promulgated thereunder, and other federal and state statutes and regulations. These laws govern, among other things, the testing, manufacture, safety, efficacy, labeling, storage, record keeping, approval, advertising and promotion of medications and medical devices. Product development and approval within this regulatory framework is difficult to predict, takes a number of years and involves great expense. The steps required before a human vaccine may be marketed in the United States include:

|

● |

pre-clinical laboratory tests, in vivo pre-clinical studies and formulation studies; | |

|

● |

manufacturing and testing of the product under strict compliance with current Good Manufacturing Practice (cGMP) regulations; | |

|

● |

the submission to the FDA of an Investigational New Drug (IND) application for human clinical testing which must become effective before human clinical trials can commence; | |

|

● |

adequate and well-controlled human clinical trials to establish the safety and efficacy of the product; | |

|

● |

the submission of a Biologics License Application to the FDA, along with the required user fees; | |

|

● |

FDA approval of the Biologics License Application prior to any commercial sale or shipment of the product; and | |

|

● |

postmarketing requirements imposed by FDA. |

Each of these steps is described further below. Before marketing any drug or biologic for human use, the product sponsor must obtain FDA approval. In addition, each manufacturing establishment must be registered with the FDA and must pass a Pre-Approval Inspection (PAI) before introducing any new drug or biological product into commercial distribution. Because GeoVax does not manufacture vaccines for human use within our own facilities, we must ensure compliance both in our own operations and in the outsourced manufacturing operations. All FDA-regulated manufacturing establishments (both domestic establishments and foreign establishments that export products to the United States) are subject to inspections by the FDA and must comply with the FDA’s Good Manufacturing Practices for products, drugs and devices.

FDA determines compliance with applicable statutes and regulations through documentation review, investigations, and inspections. Several enforcement mechanisms are available to FDA, ranging from a simple demand to correct a minor deficiency to mandatory recalls, closure of facilities, and even criminal charges for the most serious violations.

Preclinical Testing. Preclinical testing includes laboratory evaluation of chemistry and formulation, as well as cell culture and animal studies to assess the safety and potential efficacy of the product. Preclinical safety tests and certain other pivotal preclinical studies must be conducted by laboratories that comply with the FDA’s Good Laboratory Practices, or GLP. The results of pre-clinical testing are submitted to the FDA as part of the IND application and are reviewed by the FDA prior to the commencement of human clinical trials. Unless the FDA objects to an IND, the IND becomes effective 30 days following its receipt by the FDA.

cGMP-Compliant Manufacturing and Testing. FDA has issued, and frequently updates, extensive regulations on current Good Manufacturing Practice (cGMP). Any drug, biologic, or device for human use, whether commercial or investigational, must be manufactured under these regulations. cGMP regulations include a wide variety of requirements covering personnel, documentation, facilities, equipment, testing procedures, and many other aspects of manufacturing and testing.

Clinical Trials. Clinical trials involve the administration of investigational drugs to volunteers or to patients under the supervision of a qualified, medically trained clinical investigator. Clinical trials are conducted in accordance with Good Clinical Practices under protocols that detail the objectives of the trial, the parameters to be used to monitor safety and the efficacy criteria to be evaluated. Each protocol and the qualifications of the investigators who plan to carry it out must be submitted to the FDA as part of the IND. Further, each clinical trial must be conducted under the auspices of an independent institutional review board at the institution where the trial will be conducted. The institutional review board will consider, among other things, ethical factors, the safety of human subjects and the possible liability of the institution.

Clinical trials are typically conducted in three sequential phases, but the phases may overlap. In the Phase 1 clinical trial, the initial introduction of the product into healthy human subjects, the vaccine is tested for safety (including adverse side effects) and dosage tolerance. The Phase 2 clinical trial is the proof of principal stage and involves trials in a limited patient population to determine whether the product induces the desired effect (for our vaccines this means immune responses) and to better determine optimal dosage. The continued identification of possible safety risks is also a focus. When there is evidence that the product may be effective and has an acceptable safety profile in Phase 2 clinical trials, Phase 3 clinical trials are undertaken to evaluate clinical efficacy and to test for safety within an expanded patient population. Phase 3 trials are completed using multiple clinical study sites which are geographically dispersed. The manufacturer or the FDA may suspend clinical trials at any time if either believes that the individuals participating in the trials are being exposed to unacceptable health risks.

Biologics License Application and FDA Approval Process. The results and details of the pre-clinical studies and clinical trials are submitted to the FDA in the form of a Biologics License Application (BLA), which is equivalent to the New Drug Application (NDA) submitted by companies seeking to market new drugs. If the BLA is approved, the manufacturer may market the product in the United States. Under the Prescription Drug User Fee Act (PDUFA), FDA charges user fees to applicants to offset the costs of its operations. The PDUFA user fee for a new vaccine is over $2 million, unless the applicant obtains a waiver or reduction through certain programs designed to encourage development of certain types of products.

Postmarketing Requirements. FDA frequently imposes postmarketing requirements as a condition of NDA or BLA approval. Common postmarketing requirements include additional clinical trials (Phase 4 trials) or observational studies. Postmarketing requirements are especially relevant to our Ebola and Marburg vaccines. We intend to pursue approval of these vaccines using the accelerated approval process, in which FDA grants approval based on performance against a criterion other than actual protection against the disease but requires the manufacturer to monitor and submit data on efficacy of the approved product. Unlike pathogens such as human papillomavirus, Ebola and Marburg are not constantly in circulation; instead, they occur in sporadic but extremely deadly outbreaks. For this reason, it would be impractical and potentially unethical to attempt to perform a traditional Phase 3 trial in which vaccinated participants are compared against unvaccinated participants to determine the efficacy of the vaccine in preventing infection with Ebola or Marburg. The accelerated approval process allows FDA to approve a new medicine based on its performance against a surrogate endpoint (in the case of Ebola or Marburg, its performance in raising immune responses). We anticipate that, as a condition of receiving accelerated approval, GeoVax would agree to monitor the real-world performance of our Ebola and Marburg vaccines.

International Approval. Whether or not the FDA has approved the drug, approval of a product by regulatory authorities in foreign countries must be obtained prior to the commencement of commercial sales of the drug in such countries. The requirements governing the conduct of clinical trials and drug approvals vary widely from country to country, and the time required for approval may be longer or shorter than that required for FDA approval.

Other Regulations. In addition to FDA regulations, our business activities may also be regulated by the Occupational Safety and Health Act, the Environmental Protection Act, the Toxic Substances Control Act, the Resource Conservation and Recovery Act and other present and potential future federal, state or local regulations. Violations of regulatory requirements at any stage may result in various adverse consequences, including regulatory delay in approving or refusal to approve a product, enforcement actions, including withdrawal of approval, labeling restrictions, seizure of products, fines, injunctions and/or civil or criminal penalties. Any product that we develop must receive all relevant regulatory approvals or clearances before it may be marketed.

Manufacturing

We do not have the facilities or expertise to manufacture any of the clinical or commercial supplies of any of our products. To be successful, our products must be manufactured in commercial quantities in compliance with regulatory requirements and at an acceptable cost. To date, we have not commercialized any products, nor have we demonstrated that we can manufacture commercial quantities of our product candidates in accordance with regulatory requirements. If we cannot manufacture products in suitable quantities and in accordance with regulatory standards, either on our own or through contracts with third parties, it may delay clinical trials, regulatory approvals and marketing efforts for such products. Such delays could adversely affect our competitive position and our chances of achieving profitability. We cannot be sure that we can manufacture, either on our own or through contracts with third parties, such products at a cost or in quantities that are commercially viable.

We currently rely and intend to continue to rely on third-party contract manufacturers to produce vaccines needed for research and clinical trials. We have entered into arrangements with third party manufacturers for the supply of our DNA and MVA vaccines for use in our planned clinical trials. These suppliers operate under the FDA’s Good Manufacturing Practices and (in the case of European manufacturers) similar regulations of the European Medicines Agency. We anticipate that these suppliers will be able to provide sufficient vaccine supplies to complete our currently planned clinical trials. Various contractors are generally available in the United States and Europe for manufacture of vaccines for clinical trial evaluation, however, it may be difficult to replace existing contractors for certain manufacturing and testing activities and costs for contracted services may increase substantially if we switch to other contractors.

Development of Improved Manufacturing Techniques for MVA – The MVA component of our vaccine is currently manufactured in cells that are cultured from embryonated chicken eggs, which is a reliable method to manufacture large quantities of vaccine. In an attempt to find a means to reduce costs for large-scale manufacturing, we have explored a number of approaches to producing MVA in continuous cell lines that can be grown in bioreactors. In this process we have identified a duck stem-cell-derived line (termed EB66), that is proprietary to Valneva S.E., France. We are currently working with Valneva on the use of EB66 cells for the growth of our MVA vaccines. We are hopeful that upon completion of process development we will be producing vaccine at significantly higher titers in a much more advanced and scalable process, allowing for quality improvements over the current process as well as meaningful cost reductions.

Competition

The biopharmaceutical industry and the vaccine market is competitive and subject to rapid and substantial technological change. Developments by others may render our proposed vaccination technologies noncompetitive or obsolete, or we may be unable to keep pace with technological developments or other market factors. Technological competition in the industry from pharmaceutical and biotechnology companies, universities, governmental entities and others diversifying into the field is intense and is expected to increase. Many of the pharmaceutical companies that compete with us have significantly greater research and development capabilities than we have, as well as substantially more marketing, manufacturing, and financial resources. In addition, acquisitions of, or investments in, small pharmaceutical or biotechnology companies by such large corporations could increase their research, financial, marketing, manufacturing and other resources. Competitive technologies may ultimately prove to be safer, more effective or less costly than any vaccine that we develop.

There are currently no FDA licensed and commercialized Ebola vaccines, Marburg vaccines, or HIV vaccines available in the world market. We are aware of several development-stage and established enterprises, including major pharmaceutical and biotechnology firms, which are actively engaged in vaccine research and development in these areas. For Ebola, these include Johnson & Johnson, GlaxoSmithKline, and Merck. For HIV, these include Novartis, Sanofi-Aventis and GlaxoSmithKline. Other HIV vaccines are in varying stages of research, testing and clinical trials including those supported by the NIH Vaccine Research Center, the U.S. Military, IAVI, the European Vaccine Initiative, and the South African AIDS Vaccine Initiative. We may also experience competition from companies that have acquired or may acquire technologies from companies, universities and other research institutions. As these companies develop their technologies, they may develop proprietary technologies which may materially and adversely affect our business.

If any of our competitors develop products with efficacy or safety profiles significantly better than our products, we may not be able to commercialize our products, and sales of any of our commercialized products could be harmed. Some of our competitors and potential competitors have substantially greater product development capabilities and financial, scientific, marketing and human resources than we do. Competitors may develop products earlier, obtain FDA approvals for products more rapidly, or develop products that are more effective than those under development by us. We will seek to expand our technological capabilities to remain competitive; however, research and development by others may render our technologies or products obsolete or noncompetitive, or result in treatments or cures superior to ours.

Our competitive position will be affected by the disease indications addressed by our product candidates and those of our competitors, the timing of market introduction for these products and the stage of development of other technologies to address these disease indications. For us and our competitors, proprietary technologies, the ability to complete clinical trials on a timely basis and with the desired results, and the ability to obtain timely regulatory approvals to market these product candidates are likely to be significant competitive factors. Other important competitive factors will include the efficacy, safety, ease of use, reliability, availability and price of products and the ability to fund operations during the period between technological conception and commercial sales.

Our Intellectual Property