UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Amendment No. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended June 30, 2012 | |

| or | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _________________ to _________________ |

Commission File Number 000-27083

MAM SOFTWARE GROUP, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 84-1108035 | |

| (State or other jurisdiction of | (I.R.S. employer | |

| incorporation or organization) | identification no.) |

Maple Park, Maple Court, Tankersley, Barnsley, UK S75 3DP

(Address of principal executive offices)(Zip code)

011 44 124 431 1794

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The registrant had 14,018,247 shares of its common stock outstanding as of September 10, 2012.

EXPLANATORY NOTE

We are filing this Amendment No. 1 (the “Amendment”) to our annual report on Form 10-K for the fiscal year ended June 30, 2012, filed on September 13, 2012 to provide the interactive data files required by Item 601(b)(101) of Regulation S-K and Sections 405 and 406T of Regulation S-T and other minor changes.

TABLE OF CONTENTS

| Page | ||

| PART I | 1 | |

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 12 |

| Item 1B. | Unresolved Staff Comments | 17 |

| Item 2. | Properties | 17 |

| Item 3. | Legal Proceedings | 17 |

| Item 4. | Mine Safety Disclosures | 17 |

| PART II | 18 | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 18 |

| Item 6. | Selected Financial Data | 20 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 20 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk. | 32 |

| Item 8. | Financial Statements and Supplementary Data | 32 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 32 |

| Item 9A. | Controls and Procedures | 33 |

| Item 9B. | Other Information | 33 |

| PART III | 34 | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 34 |

| Item 11. | Executive Compensation | 38 |

| Item 12. | Security Ownership Of Certain Beneficial Owners And Management and Related Stockholder Matters | 46 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 49 |

| Item 14. | Principal Accounting Fees and Services | 49 |

| PART IV | 50 | |

| Item 15. | Exhibits, Financial Statement Schedules | 50 |

| SIGNATURES | 51 | |

| INDEX TO EXHIBITS | 52 | |

| i |

PART I

| Item 1. | Business |

Unless the context indicates or requires otherwise, (i) the term “MAM” refers to MAM Software Group, Inc. and its principal operating subsidiaries; (ii) the term “MAM Ltd.” or “MAM Software” refers to MAM Software Limited; (iii) the term “ASNA” refers to Aftersoft Network N.A., Inc. and its operating subsidiaries; (iv)the term MAM U.S. refers to MAM Software, Inc. a wholly owned subsidiary of ASNA, and (v) the terms “we,” “our,” “ours,” “us” and the “Company” refer collectively to MAM Software Group, Inc.

Our Company

MAM Software Group, Inc. provides software, information and related services to businesses engaged in the automotive aftermarket in the U.S., Canada, U.K. and Ireland. The automotive aftermarket consists of businesses associated with the life cycle of a motor vehicle from when the original manufacturer’s warranty expires to when the vehicle is scrapped. Products sold by businesses engaged in this market include the parts, tires and auto services required to maintain and improve the performance or appeal of a vehicle throughout its useful life. The Company aims to meet the business needs of customers who are involved in the maintenance and repair of automobiles and light trucks in three key segments of the automotive aftermarket, namely parts, tires and auto service.

The Company’s business management systems, information products and online services permit our customers to manage their critical day-to-day business operations through automated point-of-sale, information (content) products, inventory management, purchasing, general accounting and customer relationship management.

The Company’s customer base consists of wholesale parts and tire distributors, retailers, franchisees, cooperatives, auto service chains and single location auto service businesses with high customer service expectations and complex commercial relationships.

The Company’s revenues are derived from the following:

| · | The sale of business management systems comprised of proprietary software applications, implementation and training; and |

| · | Providing subscription-based services, including software support and maintenance, information (content) products and online services for a fee. |

| 1 |

CORPORATE BACKGROUND

The Company’s principal executive office is located at Maple Park, Maple Court, Tankersley, Barnsley, U.K. S75 3DP and its phone number is 011-44-124-431-1794

In December 2005, W3 Group, Inc. (“W3”) consummated a reverse acquisition and changed its corporate name to Aftersoft Group, Inc. W3, which was initially incorporated in February 1988 in Colorado, changed its state of incorporation to Delaware in May 2003. On December 21, 2005, an Acquisition Agreement (the “Agreement”) was consummated among W3, a separate Delaware corporation named Aftersoft Group, Inc. (“Oldco”) and Auto Data Network, Inc. (“ADNW”) in which W3 acquired all of the issued and outstanding shares of Oldco in exchange for issuing 3,250,000 shares of Common Stock of W3, par value $0.0001 per share, to ADNW, which was then the sole shareholder of the Company. At the time of the acquisition, W3 had no business operations. Concurrent with the acquisition, W3 changed its name to Aftersoft Group, Inc. and its corporate officers were replaced. The Board of Directors of the Company appointed three additional directors designated by ADNW to serve until the next annual election of directors. As a result of the acquisition, the former W3 shareholders owned, 160,117 or 4.7% of the 3,410,117 total issued and outstanding shares of Common Stock and ADNW owned 3,250,000 or 95.3% of the Company’s Common Stock. On December 22, 2005, Oldco changed its name to Aftersoft Software, Inc. and is currently inactive. On April 21, 2010 shareholders approved the change of the Company’s name to MAM Software Group, Inc.

| 2 |

MAM is a former subsidiary of ADNW, a publicly traded company, the stock of which is currently traded on the pink sheets under the symbol ADNW.PK. ADNW transferred its software aftermarket services operating businesses to MAM and retained its database technology, Orbit. Orbit is a system for supply and collection of data throughout

the automotive industry.

On November 24, 2008, ADNW distributed a dividend of the 7,125,000 shares of MAM common stock that ADNW owned at such time in order to complete the previously announced spin-off of MAM’s businesses. The dividend shares were distributed in the form of a pro rata dividend to the holders of record as of November 17, 2008 (the “Record Date”) of ADNW’s common and convertible preferred stock. Each holder of record of shares of ADNW common and preferred stock as of the close of business on the Record Date was entitled to receive 0.06864782 shares of MAM’s common stock for each share of common stock of ADNW held at such time, and/or for each share of ADNW common stock that such holder would own, assuming the convertible preferred stock owned on the Record Date was converted in full. Prior to the spin-off, ADNW owned approximately 77% of MAM’s issued and outstanding common stock. Subsequent to and as a result of the spin-off, MAM is no longer a subsidiary of ADNW. The Company currently has the following wholly owned direct operating subsidiaries: MAM Software in the U.K., and ASNA in the U.S.

On March 25, 2011, (“the Effective Date”), the Company amended its Certificate of Incorporation to effectuate a one-for-one hundred reverse stock split, followed by a ten-for-one forward stock split. Pursuant to this transaction, every 100 shares of the Company's Common Stock were converted into one share of the Company's Common Stock. Immediately thereafter, a forward stock split was undertaken whereby each share of Common Stock was converted into 10 shares of Common Stock. Stockholders owning fewer than 100 shares of Common Stock whose interests were converted into fewer than 1 share of Common Stock pursuant to the reverse split, were converted into the right to receive an amount equal to the average daily closing price per share of the Common Stock on the OTC Bulletin Board for the five trading days immediately before and including the Effective Date, without interest. Stockholders who held 100 or more shares as of the Effective Date received fractional shares in the reverse split and were not cashed out. Any fractional shares held after the ensuing forward split were rounded up to the nearest whole share. All share numbers and per share amounts reported in this annual report on Form 10-K for the fiscal year ended June 30, 2012 and in the consolidated financial statements and notes to the consolidated financial statements have been retroactively adjusted to give effect to the stock split.

| 3 |

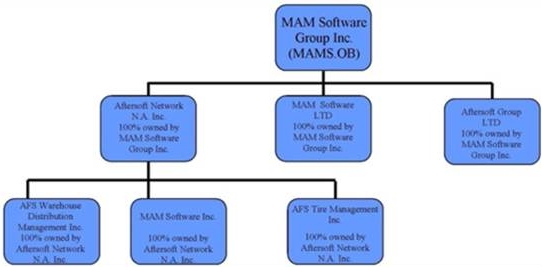

MAM Software Group, Inc. Organization Chart

MAM Software Ltd.

MAM Software is a provider of software to the automotive aftermarket in the U.K. and Ireland. MAM Software specializes in providing reliable and competitive business management solutions to the motor factor (also known as jobber), retailing, and wholesale distribution sectors. It also develops applications for vehicle repair management and provides solutions to the retail and wholesale tire industry. All MAM Software programs are based on the Microsoft Windows family of operating systems. Each program is fully compatible with the other applications in their range, enabling them to be combined to create a fully integrated package. MAM Software is based in Tankersley, U.K.

Aftersoft Network N.A., Inc. (ASNA)

ASNA develops open business management systems, and distribution channel e-commerce systems for the automotive aftermarket supply chain. These systems are used by leading aftermarket outlets, including tier one manufacturers, program groups, warehouse distributors, tire and service chains and independent installers. ASNA products and services enable companies to generate new sales, operate more cost efficiently, accelerate inventory turns and maintain stronger relationships with suppliers and customers. ASNA has one wholly owned operating subsidiary (i) MAM Software, Inc. and two inactive wholly owned subsidiaries, (ii) AFS Warehouse Distribution Management, Inc., and (iii) AFS Tire Management, Inc., which are all based in Allentown, Pennsylvania.

MAM Software, Inc.

MAM Software, Inc. provides software solutions to the North American automotive aftermarket. It targets jobbers and warehouse distributors, supplying a localized version of the UK-developed software.

ASNA specifically focuses on selling systems to the service and tire segment of the market, while MAM Software, Inc. focuses on the warehouse and jobber segment of the market.

| 4 |

Industry Overview

The Company serves the business needs of customers involved in the supply of parts, maintenance and repair of automobiles and light trucks in three key segments of the automotive aftermarket, namely parts, tires and auto service.

The industry is presently experiencing a level of consolidation in the lines that are being sold. The previous distinction of having parts and tires provided by two distinct suppliers is coming to an end, as our customers’ businesses need to offer their clients the widest range of products and services under one roof. As a result, what were previously parts-only stores, jobbers and warehouse, are now taking in tire inventory as well in order to satisfy their clients’ demands, and vice-versa. This in turn is causing owners of these businesses to evaluate their business systems to ensure they can compete over the short, medium and long term. An increase in the “do-it-yourself” market due to the “credit crunch” is requiring these systems, but at the same time a need to compete strongly with other parts stores is cutting margins as businesses attempt to attract new and return business. Longer warranties are still deferring the length of time until newer vehicles are entering the aftermarket, except for running spares and service parts, accident damage, and optional add-ons such as security, entertainment, performance and customization.

Continuing market conditions related to the overall downturn in the consumer market is also directly affecting the confidence and ability of businesses to invest in new systems. The industry’s response to this has been to introduce incentive and discount programs, but to date it is uncertain whether this approach will be successful long term.

The Company believes that growth in the automotive aftermarket will continue to be driven by the following factors:

| · | gradual growth in the aggregate number of vehicles in use; |

| · | an increase in the average age of vehicles in operation; |

| · | fewer new vehicles being purchased due to uncertainty in the economy, especially available credit; |

| · | growth in the total number of miles driven per vehicle per year; and |

| · | increased vehicle complexity. |

Products and Services

Meeting the needs of the automotive aftermarket requires a combination of business management systems, information products and online services that combine to deliver benefits for all parties involved in the timely repair of a vehicle. The Company provides systems and services that meet these needs and help its customers to meet their customers’ expectations. These products and services include:

| 1. | Business Management Systems comprised of the Company’s proprietary software applications, implementation and training and third-party hardware and peripherals; |

| 2. | Information Products such as an accessible catalog database related to parts, tires, labor estimates, scheduled maintenance, repair information, technical service bulletins, pricing and product features and benefits that are used by the different participants in the automotive aftermarket; |

| 5 |

| 3. | Online Services and products that provide online connectivity between manufacturers, warehouse distributors, retailers and automotive service providers. These products enable electronic data interchange throughout the automotive aftermarket supply chain between the different trading partners. They also enable procurement and business services to be projected over the internet to an expanded business audience; and |

| 4. | Customer Support, Consulting and Training that provide phone and online support, implementation and training. |

Business Management Systems

MAM’s business management systems meet the needs of warehouse distributors, part stores and automotive service providers as follows:

Warehouse Distributors

Autopart. This is a U.K.-developed product that is sold and promoted in the U.S. by MAM Software, Inc. This product is designed for and targeted at warehouse distributors that seek to manage multiple locations and inventories on a single system for a regional area and are also suited to managing single location franchisees or buying group members. The product provides point of sale, inventory management, electronic purchasing capabilities and a fully integrated accounting module. It also allows the parts stores to connect with automotive service providers through our OpenWebs™ online services product.

DirectStep. This is our legacy product that was designed for warehouse distributors that seek to manage multiple locations and inventories on a single system. Although still actively supported, DirectStep is no longer promoted.

Parts Stores

Autopart. This is a U.K.-developed product that is sold in both the U.S. and U.K. In the U.S. it is sold by MAM Software, Inc. and in the U.K. by MAM Software Ltd. This product is designed for and targeted at parts store chains that seek to manage multiple locations and inventories on a single system for a regional area. It is also suited to managing single location franchisees or buying group members. The product provides point of sale, inventory management, electronic purchasing capabilities and a fully integrated accounting module. An Autopart PDA module is also available to allow field sales personnel to record sales activity in real time on handheld devices while on the road. The PDA module also allows the sales representative to maintain their stock and synchronize in real time while traveling, or later, locally, with Autopart directly. It also allows parts stores to connect with automotive service providers through the ASNA online services, OpenWebs™.

Automotive Service Providers

VAST. This product is designed for and targeted at large- to medium- sized automotive service and tire chains that seek to manage multiple locations and inventories for a regional area is also suited to managing single location stores that are part of a franchise or a buying group. VAST provides point-of-sale, inventory management, electronic purchasing and customer relationship management capabilities. It also allows the service provider to connect with parts and tires warehouse distributors and parts stores through either ASNA’s online services and products or other industry connectivity solutions.

| 6 |

Autowork Online. This is a U.K.-developed cloud computing solution that is sold by MAM Software Ltd. This product is designed for and targeted at small single location automotive installers. The Autowork Online product provides estimate, job card, parts procurement and invoice capabilities. It also allows the automotive installer to connect with parts distributors to purchase components. Autowork Online is delivered as a service over the internet, allowing customers to purchase the solution on a monthly basis but without the need to manage the system.

Vertical Markets

Trader. This is a U.K.-developed product that is sold by MAM Software Ltd. This product is designed for and targeted at generic wholesalers and distributors. Based on the Autopart codebase, the product provides point of sale, inventory management, electronic purchasing capabilities and a fully integrated accounting module.

Information Products

The Company provides product catalog and vehicle repair information required to enable point-of-sale transactions. These proprietary database products and services generate recurring revenues through monthly or annual subscription fees.

MAM Software Ltd. develops and maintains proprietary information products that differentiate its products from those of the majority of its competitors in the U.K. In the U.S. and Canada, both MAM Software Inc. and ASNA develops and maintains a proprietary workflow capability that integrates information products sourced from its suppliers such as Epicor (formerly Activant), WHI and NAPA for its automotive parts and tire customers, including warehouse distributors, parts stores and automotive service providers.

MAM Software Ltd.’s principal information service is Autocat+, a parts catalog that is distributed via the Internet. Autocat+ provides access to a database of over 19 million automobile vehicle applications for the U.K. market. Business systems software used by the warehouse distributor, parts store and auto service provider enable the user to access information about parts quickly and accurately. MAM Software Ltd. charges a monthly or annual subscription fee for its information products. Customers are provided updates daily via the internet. In the U.K., there are approximately 11,500 end-users who use our information products.

In addition, information products developed or resold by ASNA include Interchange Catalog, a database that provides cross references of original equipment manufacturer part numbers to aftermarket manufacturer part numbers; Price Updating, a service that provides electronic price updates following a price change by the part manufacturer; Labor Guide, a database used by automotive service providers to estimate labor hours for purposes of providing written estimates of repair costs to customers; Scheduled Service Intervals, a database of maintenance intervals; and Tire Sizing, a database that cross-references various tire products and applications.

Online Services

Both ASNA and MAM Software Ltd. offer online e-commerce services in the form of system-to-system and web browser implementations. These online services connect the automotive aftermarket from manufacturers through warehouse distributors and parts stores to automotive service providers for the purpose of purchasing parts and tires, fleet and national account transaction processing and online product price information.

OpenWebs™ e-Commerce Gateway Services

In the U.S. and Canada, ASNA’s e-commerce gateway services use automotive industry standard messaging specifications to deliver online services that connect the automotive aftermarket supply chain for the purpose of purchasing parts and tires, fleet and national account transaction processing, online product and price updating for parts and tires.

| 7 |

OpenWebs™ e-Commerce Browser Services

In the U.S. and Canada, ASNA’s e-commerce browser services enable warehouse distributors and parts stores to provide an online service to automotive service providers for the purpose of purchasing of parts and tires, accessing account information and other browser-based channel management services.

Autonet

In the U.K., MAM Software Ltd.’s Autonet online services connect manufacturers, warehouse distributors, parts stores and automotive service providers for the purpose of purchasing of parts and tires, fleet and national account transaction processing and product information and price distribution.

Customer Support and Consulting and Training

The Company provides support, consulting and training to its customers to ensure the successful use of its products and services. The Company believes this extra level of commitment and service builds customer relationships, enhances customer satisfaction and maximizes customer retention. These services consist of the following:

| · | Phone and online support. Customers can call dedicated support lines to speak with knowledgeable personnel who provide support and perform on-line problem solving as required. |

| · | Implementation, education and training consulting. Our consulting and training teams work together to minimize the disruption to a customer’s business during the implementation process of a new system and to maximize the customer’s benefit from the use of the system through training. |

ASNA and MAM Software Ltd. also provide a customer-only section on their intranet sites that allows customers direct access to tutorials, on-line documentation and information related to products and services. New customers enter into support agreements, and most retain such service agreements for as long as they own the system. Monthly fees vary with the number of locations and the software modules, information products and online services subscribed to. The agreements are generally month-to-month agreements. The Company offers training at both ASNA and MAM Software Ltd.’s facilities, the customer’s facilities and online for product updates or introduce specific new capabilities.

MAM Software Ltd.’s U.K. catalog information product and other information services are delivered by its Autocat team, based in Wareham, England. The Autocat product team sources, standardizes and formats data collected in an electronic format from over 230 automotive parts manufacturers. MAM Software Ltd. provides this data to its customers via the internet.

Distribution

There are two primary vertical distribution channels for aftermarket parts and tire distribution: the traditional wholesale channel and the retail channel.

| 8 |

Automotive Aftermarket Distribution Channels

| · | Traditional Wholesale Channel. The wholesale channel is the predominant distribution channel in the automotive aftermarket. It is characterized by the distribution of parts from the manufacturer to a warehouse distributor, to parts stores and then to automotive service providers. Warehouse distributors sell to automotive service providers through parts stores, which are positioned geographically near the automotive service providers they serve. This distribution method provides for the rapid distribution of parts. The Company has products and services that meet the needs of the warehouse distributors, parts stores and the automotive service providers. |

| · | Retail Channel. The retail channel is comprised of large specialty retailers, small independent parts stores and regional chains that sell to “do-it-yourself” customers. Larger specialty retailers, such as Advance Auto Parts, AutoZone, Inc., and O’Reilly Automotive, Inc. carry a greater number of parts and accessories at more attractive prices than smaller retail outlets and are gaining market share. The business management systems used in this channel are either custom developed by the large specialty retailers or purchased from business systems providers by small to medium-sized businesses. The Company has products and services that support the retail channel. |

In addition to these two primary channels, some aftermarket parts and tires end up being distributed to new car dealers. The business management systems used in this channel have unique functionality specific to new car dealerships. The Company sells a small number of products into the auto service provider side of car dealerships. Aftermarket wholesalers of parts and tires provide online purchasing capabilities to some new car dealerships.

Product Development

The Company’s goal is to add value to its customers’ businesses through products and services designed to create optimal efficiency. To accomplish this goal, the Company’s product development strategy consists of the following three key components:

| · | Integrating all of the Company’s products so that its software solutions work together seamlessly, thereby eliminating the need to switch between applications; |

| · | Enhancing the Company’s current products and services to support its changing customers’ needs; and |

| · | Providing a migration path to the Company’s business management systems, reducing a fear that many customers have that changing systems will disrupt business. |

Sales and Marketing

The Company’s sales and marketing strategy is to acquire customers and retain them by cross-selling and up-selling a range of commercially compelling business management systems, information products and online services.

Within the parts, tire and auto service provider segments, each division sells and markets through a combination of field sales, inside sales, and independent representatives. The Company seeks to partner with large customers or buying groups and leverage their relationships with their customers or members. Incentive pay is a significant portion of the total compensation package for all sales representatives and sales managers. Outside sales representatives focus primarily on identifying and selling to new customers complemented by an inside sales focus on selling upgrades and new software applications to its installed customer base.

The Company’s marketing approach aims to leverage its reputation for customer satisfaction and for delivering systems, information and services that improve a customer’s commercial results. The goal of these initiatives is to maximize customer retention and recurring revenues, to enhance the productivity of the field sales team, and to create the cross-selling and up-selling opportunities for its systems, information products and online services.

| 9 |

Research and Development

The Company spent approximately $3.3 million in fiscal 2012 on research and development, with approximately $0.9 million spent by ASNA, $0.2 million by MAM Software, Inc., and $2.2 million by MAM Software Ltd. The Company spent approximately $3.2 million in fiscal 2011 on research and development, with approximately $0.9 million spent by ASNA, $0.3 million by MAM Software, Inc., and $2.0 million by MAM Software Ltd.

Patent and Trademark

None.

Customers

During the year ended June 30, 2012 no one customer accounted for 10% of the Company’s total revenues. During the year ended June 30, 2011 no one customer accounted for 10% of the Company’s total revenues. The Company’s top ten customers collectively accounted for 17% of total revenues during fiscal 2012 and 18% of total revenues during 2011. Some of ASNA’s top customers in North America include Autopart International, AutoZone, Monro Muffler Brake, and U.S. AutoForce. In the U.K. and Irish markets, MAM Software’s top customers include Unipart Automotive, Dingbro Ltd, Allparts Automotive and General Traffic Service.

Competition

In the U.S. and Canada, MAM Software Inc. competes primarily with Epicor Inc. (formerly Activant, Inc.) and several smaller software companies, including Autologue, DST and DMS. ASNA competes primarily with Maddenco, ASA and RO Writer who all provide similar products and services to the U.S. automotive aftermarket. Additionally, an ongoing competitive threat to the Company is custom developed in-house systems, information products and online services. For example, AutoZone, Inc. and Genuine Parts Company’s NAPA Parts Group both developed their own business management systems and electronic automotive parts catalogs for their stores and members, although the Company currently has a partnership agreement with each of these companies to supply their information products through the Company’s solutions.

In the U.S. and Canada, the Company expects to compete successfully against its competitors using two separate and complimentary strategies. First, the Company will continue to focus on selling and promoting the Company’s complete supply chain solutions that provide businesses with easy integration of the Company’s business management information systems into their existing supply chain structures. Second, the Company will continue its strategy of working with those businesses that already manage their own supply chains and information products (catalogs), such as Autozone, helping to improve and compliment their systems with the Company’s products.

ASNA, in the U.S. and Canada, competes with multiple products across different market segments, so its competitors vary by segment.

Within the warehouse distribution segment, the Company will continue to support its legacy system, Direct Step, a product which the Company developed many years ago which enables large warehouses with millions of parts to locate, manage, pack and deliver the parts with ease and efficiency. DirectStep is not a Microsoft Windows-based technology. The Company’s existing and prospective customers are moving towards modern solutions which integrate easily with Internet-based transactions and interactions, and the Company believes that its Autopart product provides that solution. The Company has been selling Autopart successfully in the U.K. and Ireland since 2000, and feels that the success this product in the U.K. and the successful installation of this product within the U.S. will enable the Company to promote and benefit quickly from this product.

| 10 |

The tire segment is comprised of three distinct elements: retail, wholesale and commercial. Within the tire segment and the auto service segment, the Company focuses on client and market requirements, which the Company believes will enable it to offer its clients the best solution, regardless of the size of a client’s business. By continually integrating and extending the functionality of its solutions across the entire supply chain, the Company believes that it will be able to offer existing and potential clients products that suit their present and future needs. Management believes that its products will present existing and potential clients the opportunity to move away from their older existing systems, which may restrict their market opportunities, and will permit integration into additional sales channels and reduce the costly maintenance of older systems.

The auto parts segment within the auto service space has many competitors who have developed applications for single location auto service shops. Many of these have been developed by parts distributors like NAPA and AutoZone. While these applications do well in a small single location store, they are not widely distributed in the multi-store location segment of the auto parts business. The Company’s goal is not to pursue single store locations. Rather, it will focus on multi-store locations for which its product VAST is highly suited. The Company believes that this multi-store ability offers strong opportunities to beat the competition in this area and quickly increase the Company’s customer base.

The last area that the Company plans to compete in is the e-commerce space, providing new tools and solutions for this expanding Internet marketplace. The goal of the Company’s OpenWebs™ product is to connect both parts and tire partners together in a real-time environment so they can perform electronic ordering, gauge inventory levels as well as disseminate information. Within the tire segment, the Company feels that it has a competitive advantage. The Company’s observation has led it to believe that most tire distributors either do not have a business-to-business solution or have developed solutions from independent sources. While the parts segment of this market is largely tied to Epicor, Inc. (formerly Activant, Inc.) at this time, the Company believes that customers are looking for solutions that simply integrate their supply chain, completely and without further restrictions. The Company’s OpenWebs™ solution will allow its customers to achieve these goals.

In the U.K., MAM Software continues to compete primarily with Epicor, Inc., (formerly Activant, Inc.) in the component sector of automotive aftermarket. In the tyre sector, MAM Software competes primarily with CAM Systems, Tyreman and Team Systems. In the vertical markets now being targeted by MAM Software in the UK, the company competes with Kerridge, Chatsworth, EDP, Blue Rock, OGL and Ramtac, The Company feels that it provides a range of solutions that combine proven concepts with cutting-edge technology that are functional, effective and reliable. The Company feels that its focus towards continuing to provide solutions that enable business to find new efficiencies and increase existing efficiencies, as the Company develops its own products, will provide it an advantage over the competition. These efforts, together with strong post-sales support and ongoing in depth product and market support, will assist the Company in generating and maintaining its position within the market.

Several large enterprise resource planning and software companies, including Microsoft Corporation, Oracle Corporation and SAP AG, continue to supply Enterprise Resource Planning (“ERP”) and Supply Chain Management (“SCM”) products to medium sized original equipment manufacturers and suppliers within the automotive market, but to date have not focused strongly on the aftermarket. The solutions that they have developed are mainly focused on the efficient management of the supply chain and to date do not appear to be looking to supply systems and solutions into the jobber and service segments of the aftermarket. However there can be no assurance that those companies will not develop or acquire a competitive product or service in the future.

Employees

The Company has 181 full-time employees: 2 at MAM Software Group, Inc., 31 at ASNA, 17 at MAM Software, Inc., and 131 at MAM Software Ltd. MAM Software Group, Inc.’s., 2 employees include 1 senior executive and 1 accountant. ASNA has 31 employees in the U.S. comprised of 1 in management, 4 in sales and marketing, 8 in research and development, 16 in professional services and support and 2 in general and administration. MAM Software, Inc. has 17 employees, 1 in senior management, 5 in sales and marketing, and 11 in research and development. MAM Software has 131 employees in the U.K. comprised of 5 in management, 17 in sales and marketing, 61 in research and development, 41 in professional services and support and 7 in general and administration.

| 11 |

All of the Company’s employees have executed customary confidentiality and restrictive covenant agreements. The Company believes it has a good relationship with its employees and is currently unaware of any key management or other personnel looking to either retire or leave the employment of the Company. During 2008, the Company adopted a 2007 Long Term Stock Incentive Plan, which was approved by the Company’s Board of Directors and stockholders.

| Item 1A. | Risk Factors |

Our business, financial condition and operating results are subject to a number of risk factors, both those that are known to U.S. and identified below and others that may arise from time to time. These risk factors could cause our actual results to differ materially from those suggested by forward-looking statements in this report and elsewhere, and may adversely affect our business, financial condition or operating results. If any of those risk factors should occur, moreover, the trading price of our securities could decline, and investors in our securities could lose all or part of their investment in our securities. These risk factors should be carefully considered in evaluating our prospects.

WE MAY FAIL TO ADDRESS RISKS WE FACE AS A DEVELOPING BUSINESS WHICH COULD ADVERSELY AFFECT THE IMPLEMENTATION OF OUR BUSINESS PLAN.

We are prone to all of the risks inherent in the establishment of any new business venture. You should consider the likelihood of our future success to be highly speculative in light of our limited operating history, as well as the limited resources, problems, expenses, risks and complications frequently encountered by entities at our current stage of development.

To address these risks, we must, among other things,

| · | implement and successfully execute our business and marketing strategy; |

| · | continue to develop new products and upgrade our existing products; |

| · | respond to industry and competitive developments; |

| · | attract, retain, and motivate qualified personnel; and |

| · | obtain equity and debt financing on satisfactory terms and in timely fashion in amounts adequate to implement our business plan and meet our obligations. |

We may not be successful in addressing these risks. If we are unable to do so, our business prospects, financial condition and results of operations would be materially adversely affected.

GLOBAL MARKET DISRUPTIONS MAY ADVERSELY AFFECT OUR BUSINESS AND RESULTS OF OPERATIONS.

Recent disruptions in the current global credit and financial markets have included diminished liquidity and credit availability, a decline in economic growth and uncertainty about economic stability. There can be no assurance that there will not be further deterioration in credit and financial markets and confidence in economic conditions. These economic uncertainties affect businesses such as ours in a number of ways, making it difficult to accurately forecast and plan our future business activities. We believe that the recent global economic slowdown and the resulting slow recovery have caused certain customers to reduce or delay capital spending plans, which, if prolonged, could impact our growth expectations as potential and existing customers continue to delay decisions to purchase or upgrade their systems. We are unable to predict the likely duration and severity of the current disruptions in the credit and financial markets and adverse global economic conditions and its potential impact on our business. If the current uncertain economic conditions continue or further deteriorate, our business and results of operations could be materially and adversely affected.

| 12 |

WE MAY FAIL TO SUCCESSFULLY DEVELOP, MARKET AND SELL OUR PRODUCTS.

To achieve profitable operations, we, along with our subsidiaries, must continue successfully to improve market and sell existing products and develop, market and sell new products. Our product development efforts may not be successful. The development of new software products is highly uncertain and subject to a number of significant risks. The development cycle-from inception to installing the software for customers - can be lengthy and uncertain. The ability to market the product is unpredictable and may cause delays. Potential products may appear promising at early stages of development, and yet may not reach the market for a number of reasons.

ADDITIONAL ISSUANCES OF SECURITIES WILL DILUTE YOUR STOCK OWNERSHIP AND COULD AFFECT OUR STOCK PRICE.

As of September 7, 2012, there were 13,980,115 shares of our Common Stock issued and outstanding. Our Articles of Incorporation authorize the issuance of an aggregate of 18,000,000 shares of Common Stock and 2,000,000 shares of Preferred Stock, on such terms and at such prices as our Board of Directors may determine. These shares are intended to provide U.S. with the necessary flexibility to undertake and complete plans to raise funds if and when needed. In addition, we may pursue acquisitions that could include issuing equity, although we have no current arrangements to do so. Any such issuances of securities would have a dilutive effect on current ownership of MAM stock. The market price of our Common Stock could fall in response to the sale or issuance of a large number of shares, or the perception that sales of a large number of shares could occur.

WE MAY ENCOUNTER SIGNIFICANT FINANCIAL AND OPERATING RISKS IF WE GROW OUR BUSINESS THROUGH ACQUISITIONS.

As part of our growth strategy, we may seek to acquire or invest in complementary or competitive businesses, products or technologies. The process of integrating acquired assets into our operations may result in unforeseen operating difficulties and expenditures and may absorb significant management attention that would otherwise be available for the ongoing development of our business. We may allocate a significant portion of our available working capital to finance all or a portion of the purchase price relating to possible acquisitions although we have no immediate plans to do so. Any future acquisition or investment opportunity may require U.S. to obtain additional financing to complete the transaction. The anticipated benefits of any acquisitions may not be realized. In addition, future acquisitions by U.S. could result in potentially dilutive issuances of equity securities, the incurrence of debt and contingent liabilities and amortization expenses related to goodwill and other intangible assets, any of which could materially adversely affect our operating results and financial position. Acquisitions also involve other risks, including entering markets in which we have no or limited prior experience.

AN INCREASE IN COMPETITION FROM OTHER SOFTWARE MANUFACTURERS COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR ABILITY TO GENERATE REVENUE AND CASH FLOW.

Competition in our industry is intense. Potential competitors in the U.S. and Europe are numerous. Most competitors have substantially greater capital resources, marketing experience, research and development staffs and facilities than we have. Our competitors may be able to develop products before U.S. or develop more effective products or market them more effectively which would limit our ability to generate revenue and cash flow.

THE PRICES WE CHARGE FOR OUR PRODUCTS MAY DECREASE AS A RESULT OF COMPETITION AND OUR REVENUES COULD DECREASE AS A RESULT.

We face potential competition from very large software companies, including Microsoft Corporation, Oracle Corporation and SAP AG which supply ERP and SCM products to our target market of small to medium-sized businesses servicing the automotive aftermarket. To date we have directly competed with one of these larger software and service companies. There can be no assurance that these companies will not develop or acquire a competitive product or service in the future. Our business would be dramatically affected by price pressure if these larger software companies attempted to gain market share through the use of highly discounted sales and extensive marketing campaigns.

| 13 |

IF WE FAIL TO KEEP UP WITH RAPID TECHNOLOGICAL CHANGE, OUR TECHNOLOGIES AND PRODUCTS COULD BECOME LESS COMPETITIVE OR OBSOLETE.

The software industry is characterized by rapid and significant technological change. We expect that the software needs associated with the automotive technology will continue to develop rapidly, and our future success will depend on our ability to develop and maintain a competitive position through technological development.

WE DEPEND ON PATENT AND PROPRIETARY RIGHTS TO DEVELOP AND PROTECT OUR TECHNOLOGIES AND PRODUCTS, WHICH RIGHTS MAY NOT OFFER US SUFFICIENT PROTECTION.

The software industry places considerable importance on obtaining patent and trade secret protection for new technologies, products and processes. Our success will depend on our ability to obtain and enforce protection for products that we develop under U.S. and foreign patent laws and other intellectual property laws, preserve the confidentiality of our trade secrets and operate without infringing the proprietary rights of third parties. Currently, only one of our products is patented.

We also rely upon trade secret protection for our confidential and proprietary information. Others may independently develop substantially equivalent proprietary information and techniques or gain access to our trade secrets or disclose our technology. We may not be able to meaningfully protect our trade secrets which could limit our ability to exclusively produce products.

We require our employees, consultants, and parties to collaborative agreements to execute confidentiality agreements upon the commencement of employment or consulting relationships or collaboration with U.S. These agreements may not provide meaningful protection of our trade secrets or adequate remedies in the event of unauthorized use or disclosure of confidential and proprietary information.

IF WE BECOME SUBJECT TO ADVERSE CLAIMS ALLEGING INFRINGEMENT OF THIRD-PARTY PROPRIETARY RIGHTS, WE MAY INCUR UNANTICIPATED COSTS AND OUR COMPETITIVE POSITION MAY SUFFER.

We are subject to the risk that we are infringing on the proprietary rights of third parties. Although we are not aware of any infringement by our technology on the proprietary rights of others and are not currently subject to any legal proceedings involving claimed infringements, we cannot assure you that we will not be subject to such third-party claims, litigation or indemnity demands and that these claims will not be successful. If a claim or indemnity demand were to be brought against U.S., it could result in costly litigation or product shipment delays or force U.S. to stop selling such product or providing such services or to enter into royalty or license agreements.

OUR SOFTWARE AND INFORMATION SERVICES COULD CONTAIN DESIGN DEFECTS OR ERRORS WHICH COULD AFFECT OUR REPUTATION, RESULT IN SIGNIFICANT COSTS TO US AND IMPAIR OUR ABILITY TO SELL OUR PRODUCTS.

Our software and information services are highly complex and sophisticated and could, from time to time, contain design defects or errors. We cannot assure you that these defects or errors will not delay the release or shipment of our products or, if the defect or error is discovered only after customers have received the products, that these defects or errors will not result in increased costs, litigation, customer attrition, reduced market acceptance of our systems and services or damage to our reputation.

IF WE LOSE KEY MANAGEMENT OR OTHER PERSONNEL OUR BUSINESS WILL SUFFER.

We are highly dependent on the principal members of our management staff. We also rely on consultants and advisors to assist us in formulating our development strategy. Our success also depends upon retaining key management and technical personnel, as well as our ability to continue to attract and retain additional highly qualified personnel. We may not be successful in retaining our current personnel or hiring and retaining qualified personnel in the future. If we lose the services of any of our management staff or key technical personnel, or if we fail to continue to attract qualified personnel, our ability to acquire, develop or sell products would be adversely affected.

| 14 |

IT MAY BE DIFFICULT FOR SHAREHOLDERS TO RECOVER AGAINST THOSE OF OUR DIRECTORS AND OFFICERS THAT ARE NOT RESIDENTS OF THE U.S.

Two of our directors, of whom one is also an executive officer, are residents of the U.K. In addition, our significant operating subsidiary, MAM Software is located in the U.K. Were one or more shareholders to bring an action against us in the U.S. and succeed, either through default or on the merits, and obtain a financial award against an officer or director of the Company, that shareholder may be required to enforce and collect on his or her judgment in the U.K., unless the officer or director owned assets which were located in the U.S. Further, shareholder efforts to bring an action in the U.K. against its citizens for any alleged breach of a duty in a foreign jurisdiction may be difficult, as prosecution of a claim in a foreign jurisdiction, and in particular a foreign nation, is fraught with difficulty and may be effectively, if not financially, unfeasible.

OUR MANAGEMENT AND INTERNAL SYSTEMS MIGHT BE INADEQUATE TO HANDLE OUR POTENTIAL GROWTH.

Our success will depend in significant part on the expansion of our operations and the effective management of growth. This growth will place a significant strain on our management and information systems and resources and operational and financial systems and resources. To manage future growth, our management must continue to improve our operational and financial systems and expand, train, retain and manage our employee base. Our management may not be able to manage our growth effectively. If our systems, procedures, controls, and resources are inadequate to support our operations, our expansion would be halted and we could lose our opportunity to gain significant market share. Any inability to manage growth effectively may harm our ability to institute our business plan.

THE MARKET FOR OUR COMMON STOCK IS LIMITED AND YOU MAY NOT BE ABLE TO SELL YOUR COMMON STOCK.

Our Common Stock is currently quoted on the Over-The-Counter Bulletin Board, and is not traded on a national securities exchange. The market for purchases and sales of the Company’s Common Stock is limited and therefore the sale of a relatively small number of shares could cause the price to fall sharply. Accordingly, it may be difficult to sell shares quickly without significantly depressing the value of the stock. Unless we are successful in developing continued investor interest in our stock, sales of our stock could continue to result in major fluctuations in the price of the stock.

THE PRICE OF OUR COMMON STOCK IS LIKELY TO BE VOLATILE AND SUBJECT TO WIDE FLUCTUATIONS.

The market price of the securities of software companies has been especially volatile. Thus, the market price of our Common Stock is likely to be subject to wide fluctuations. If our revenues do not grow or grow more slowly than we anticipate, or, if operating or capital expenditures exceed our expectations and cannot be adjusted accordingly, or if some other event adversely affects U.S., the market price of our Common Stock could decline. If the stock market in general experiences a loss in investor confidence or otherwise fails, the market price of our Common Stock could fall for reasons unrelated to our business, results of operations and financial condition. The market price of our stock also might decline in reaction to events that affect other companies in our industry even if these events do not directly affect U.S.

| 15 |

SINCE OUR STOCK IS CLASSIFIED AS A “PENNY STOCK,” THE RESTRICTIONS OF THE SEC’S PENNY STOCK REGULATIONS MAY RESULT IN LESS LIQUIDITY FOR OUR STOCK.

The U.S. Securities and Exchange Commission (“SEC”) has adopted regulations which define a “Penny Stock” to be any equity security that has a market price (as therein defined) of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. For any transactions involving a penny stock, unless exempt, the rules require the delivery, prior to any transaction involving a penny stock by a retail customer, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about commissions payable to both the broker/dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Because the market price for our shares of common stock is less than $5.00, our securities are classified as penny stock. As a result of the penny stock restrictions, brokers or potential investors may be reluctant to trade in our securities, which may result in less liquidity for our stock.

WE HAVE INSURANCE COVERAGE FOR THE SERVICES WE OFFER. HOWEVER, A CLAIM FOR DAMAGES MAY BE MADE AGAINST US REGARDLESS OF OUR RESPONSIBILITY FOR THE FAILURE, WHICH COULD EXPOSE US TO LIABILITY.

We provide business management solutions that we believe are critical to the operations of our customers’ businesses and provide benefits that may be difficult to quantify. Any failure of a customer’s system installed or of the services offered by us could result in a claim for substantial damages against us, regardless of our responsibility for the failure. Although we attempt to limit our contractual liability for damages resulting from negligent acts, errors, mistakes or omissions in rendering our services, we cannot assure you that the limitations on liability we include in our agreements will be enforceable in all cases, or that those limitations on liability will otherwise protect U.S. fromliabilityfordamages.Intheeventthattheterms and conditions of our contracts which limit our liability are not sufficient, we have insurance coverage. This coverage of approximately $5,000,000 in the aggregate in the U.K. and in the U.S. insures the business for negligent acts, error or omission, failure of the technology services to perform as intended, and breach of warranties or representations. It also insures the services that we supply including, web services, consulting, analysis, design, installation, training, support, system integration, the manufacture, sale, licensing, distribution or marketing of software, the design and development of code, software and programming and the provision of software applications as a service, rental or lease. However, there can be no assurance that our insurance coverage will be adequate or that coverage will remain available at acceptable costs. Successful claims brought against U.S. in excess of our insurance coverage could seriously harm our business, prospects, financial condition and results of operations. Even if not successful, large claims against U.S. could result in significant legal and other costs and may be a distraction to our senior management.

BECAUSE WE HAVE INTERNATIONAL OPERATIONS, WE WILL BE SUBJECT TO RISKS OF CONDUCTING BUSINESS IN FOREIGN COUNTRIES.

International operations constitute a significant part of our business, and we are subject to the risks of conducting business in foreign countries, including:

| • | difficulty in establishing or managing distribution relationships; |

| • | different standards for the development, use, packaging and marketing of our products and technologies; |

| • | our ability to locate qualified local employees, partners, distributors and suppliers; |

| • | the potential burden of complying with a variety of foreign laws and trade standards; and |

| • | general geopolitical risks, such as political and economic instability, changes in diplomatic and trade relations, and foreign currency risks and fluctuations. |

No assurance can be given that we will be able to positively manage the risks inherent in the conduct of our international operations or that such operations will not have a negative impact on our overall financial operations.

| 16 |

WE DO NOT INTEND TO DECLARE DIVIDENDS ON OUR COMMON STOCK.

We will not distribute dividends to our stockholders until and unless we can develop sufficient funds from operations to meet our ongoing needs and implement our business plan. The time frame for that is inherently unpredictable, and you should not plan on it occurring in the near future, if at all.

| Item 1B. | Unresolved Staff Comments. |

Not applicable.

| Item 2. | Properties. |

Our corporate offices are located at Maple Park, Maple Court, Tankersley, Barnsley, U.K. S75 3DP.

The main telephone number is 0-11-44-1244-31-1794. MAM leases approximately 400 square feet at its corporate offices and pays rent of $2,685 per quarter.

ASNA has an office at 3435 Winchester Rd, Ste. 100, Allentown PA, 18104 and the phone number at that office is 610-336-9045. The Allentown, Pennsylvania office is approximately 7,105 square feet in size and is leased for a monthly cost of $11,161.

MAM Software Inc. shares office space with ASNA and the telephone number is 610-351-2928.

MAM Software Ltd. has three offices. It has headquarters at Maple Park, Maple Court, Tankersley, S75 3DP, U.K. The phone number is 0-11-44-122-635-2900. It also has a regional office at 15 Duncan Close, Red House Square, Moulton Park, Northampton, NN3 6WL, U.K. The phone number is 44-160-449-4001. It has second regional office at Leanne Business Centre, Sandford Lane, Wareham, Dorset, BH20 4DY, U.K. The phone number is 44-192-955-0922. MAM Software leases approximately 11,000 square feet at its company headquarters at a monthly cost of approximately $17,036. It leases approximately 1,223 square feet at its Northampton office at a monthly cost of $1,664 and approximately 717 square feet at its Wareham office at a monthly cost of $904.

| Item 3. | Legal Proceedings |

Although there are no pending legal proceedings against the Company, from time to time, the Company may become involved legal proceedings, lawsuits, claims and regulations in the ordinary course of its business.

| Item 4. | Mine Safety Disclosures |

Not applicable.

| 17 |

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Our Common Stock is traded on the Over-The-Counter Bulletin Board under the symbol “MAMS.OB.” As of June 30, 2012, there were approximately 333 shareholders of record and 14,296,105 shares of Common Stock issued and outstanding. As of September 10, 2012, there were approximately 330 shareholders of record and 14,020,863 shares of Common Stock issued and outstanding.

On September 10, 2012, the bid and ask prices of our Common Stock were $2.14 and $2.20 per share, respectively, as reported by the Over-the-Counter Bulletin Board. The following table shows the range of high and low bids per share of our Common Stock as reported by the Over-the-Counter Bulletin Board for the fiscal year periods indicated. Such over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, markdown or commission, and may not necessarily represent actual transactions.

On March 25, 2011, (“the Effective Date”), the Company amended its Certificate of Incorporation to effectuate a one-for-one hundred reverse stock split, followed by a ten-for-one forward stock split. Pursuant to this transaction, every 100 shares of the Company's Common Stock were converted into one share of the Company's Common Stock. Immediately thereafter, a forward stock split was undertaken whereby each share of Common Stock was converted into 10 shares of Common Stock. Stockholders owning fewer than 100 shares of Common Stock whose interests were converted into fewer than 1 share of Common Stock pursuant to the reverse split, were converted into the right to receive an amount equal to the average daily closing price per share of the Common Stock on the OTC Bulletin Board for the five trading days immediately before and including the Effective Date, without interest. Stockholders who held 100 or more shares as of the Effective Date received fractional shares in the reverse split and were not cashed out. Any fractional shares held after the ensuing forward split were rounded up to the nearest whole share. All share numbers and per share amounts reported in this annual report on Form 10-K for the fiscal year ended June 30, 2011 and in the consolidated financial statements and notes to the consolidated financial statements have been retroactively adjusted to give effect to the stock split.

| 2011 | ||||||||

Share price is reflective of the 1:10 March 25, 2011 | High | Low | ||||||

| 1st Quarter ended September 30 | $ | 1.00 | $ | 0.60 | ||||

| 2nd Quarter ended December 31 | $ | 1.70 | $ | 0.80 | ||||

| 3rd Quarter ended March 31 | $ | 1.80 | $ | 1.30 | ||||

| 4th Quarter ended June 30 | $ | 1.88 | $ | 1.49 | ||||

| 2012 | ||||||||

| High | Low | |||||||

| 1st Quarter ended September 30 | $ | 1.90 | 1.60 | |||||

| 2nd Quarter ended December 31 | $ | 1.89 | 1.60 | |||||

| 3rd Quarter ended March 31 | $ | 2.23 | 1.61 | |||||

| 4th Quarter ended June 30 | $ | 2.31 | 1.79 | |||||

| 18 |

Dividends

We have never declared or paid dividends on our Common Stock, and our board of directors does not intend to declare or pay any dividends on the Common Stock in the foreseeable future. Our earnings are expected to be retained for use in expanding our business. The declaration and payment in the future of any cash or stock dividends on the Common Stock will be at the discretion of the board of directors and will depend upon a variety of factors, including our future earnings, capital requirements, financial condition and such other factors as our board of directors may consider to be relevant from time to time.

Securities Authorized For Issuance under Equity Compensation Plans

Equity Compensation Plan Information as of June 30, 2012

| Plan Category | Number of Securities to Be Issued upon Exercise of Outstanding Options | Weighted Average Exercise Price of Outstanding Options | Number of Securities Remaining Available for Future Issuance under the Plan (2) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders (1) | 171,190 | $ | 0.91 | 1,973,226 | ||||||||

| Equity compensation plans not approved by security holders | - | - | - | |||||||||

| Total | 171,190 | $ | 0.91 | 1,973,226 | ||||||||

| (1) | Represents the shares authorized for issuance under the Aftersoft Group, Inc. 2007 Long-Term Incentive Plan, which was approved by the Company’s shareholders at the Annual Meeting held on June 12, 2008. The maximum aggregate number of shares of Common Stock that may be issued under the Plan, including Stock Options, Stock Awards, and Stock Appreciation Rights is limited to 15% of the shares of Common Stock outstanding on the first trading day of any fiscal year, or 2,144,416 for fiscal 2013. |

| (2) | As of July 1, 2012. |

Recent Sales of Unregistered Securities

On April 3, 2012, the Company issued 3,171 shares of common stock to certain directors in lieu of quarterly cash compensation, which were valued at approximately $6,000 based on the closing market price of the Company’s common stock, April 1, 2012.

On April 16, 2012, the Company issued 25,348 shares of common stock to certain directors as part of their routine quarterly compensation, which were valued at $30,000, based on the closing market price of the Company’s common stock on the date of the grant.

On July 3, 2012, the Company issued 21,000 shares of common stock to officers of the Company, which were valued at approximately $17,000 based on the closing market price of the Company’s common stock on the date of the grant.

| 19 |

On July 11, 2012, the Company issued 27,296 shares of common stock to certain directors, which were valued at approximately $32,000 based on the closing market price of the Company’s common stock on the date of the grant.

These transactions were not registered under the Securities Act in reliance on an exemption from registration set forth in Section 4(a)(2) of the Securities Act in a transaction by the Company not involving a public offering as the shares were granted as compensation for services and the recipients had access to adequate current public information concerning the Company.

| Item 6. | Selected Financial Data. |

Not applicable.

| Item 7. | Management Discussion and Analysis of Financial Condition and Results of Operations. |

Some of the statements contained in this Annual Report on Form 10-K, which are not purely historical, are forward-looking statements, including, but not limited to, statements regarding the Company’s objectives, expectations, hopes, beliefs, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by the use of the words “may,” “will,” “should,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of those terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, our actual results could differ materially from those disclosed in these statements due to various risk factors and uncertainties affecting our business. We caution you not to place undue reliance on these forward-looking statements. We do not assume responsibility for the accuracy and completeness of the forward-looking statements and we do not intend to update any of the forward-looking statements after the date of this report to conform them to actual results. You should read the following discussion in conjunction with our financial statements and related notes included elsewhere in this report.

Critical Accounting Policies

Our consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis of making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

We believe the following critical accounting policies, among others, affect our more significant judgments and estimates used in the preparation of our consolidated financial statements:

Fair Value of Financial Instruments

The Company’s financial instruments consist principally of cash and cash equivalents, accounts receivable, accounts payable, accrued expenses, derivative liabilities, and debt instruments.

Financial assets and liabilities that are remeasured and reported at fair value at each reporting period are classified and disclosed in one of the following three categories:

| · | Level 1 – Fair value based on quoted prices in active markets for identical assets or liabilities. |

| · | Level 2 – Fair value based on significant directly observable data (other than Level 1 quoted prices) or significant indirectly observable data through corroboration with observable market data. Inputs would normally be (i) quoted prices in active markets for similar assets or liabilities, (ii) quoted prices in inactive markets for identical or similar assets or liabilities or (iii) information derived from or corroborated by observable market data. |

| 20 |

| · | Level 3 – Fair value based on prices or valuation techniques that require significant unobservable data inputs. Inputs would normally be a reporting entity’s own data and judgments about assumptions that market participants would use in pricing the asset or liability. |

Derivative Liabilities

For purposes of determining whether certain instruments are derivatives for accounting treatment, the Company follows the accounting standard that provides guidance for determining whether an equity-linked financial instrument, or embedded feature, is indexed to an entity’s own stock. The standard applies to any freestanding financial instruments or embedded features that have the characteristics of a derivative, and to any freestanding financial instruments that are potentially settled in an entity’s own common stock.

The Company has certain common stock purchase warrants that are accounted for as derivative liabilities as they do not meet the requirements to be treated as equity instruments.

The fair value of these common stock purchase warrants was $442,000 on June 30, 2012. The fair value of these common stock purchase warrants was $672,000 on June 30, 2011. The total value of these derivative liabilities decreased for the year ended June 30, 2012, and as a result, the Company recognized a gain of approximately $230,000 from the change in fair value of these warrants for the year ended June 30, 2012 and recognized a loss of approximately $381,000 from the change in fair value of these warrants for the year ended June 30, 2011.

On December 2, 2010 the Company accounted for all unexercised stock purchase warrants as derivative liabilities because if all outstanding options and warrants were exercised there would be insufficient authorized shares to fulfill the request. As of that date, additional paid-in capital was reduced by $338,000 and derivative liabilities were increased by $338,000.

On January 21, 2011, 3,563 warrants exercisable at $0.80 were exercised using the cashless exercise provision of the warrant agreement. The average closing price for the prior five days was $1.60 and 1,782 shares of common stock were issued. As a result of this exercise, $4,994 was reclassified to additional paid-in capital from derivative liabilities.

On February 11, 2011, 3,563 warrants were exercised for $2,850 and $5,318 was reclassified to additional paid-in capital from derivative liabilities. The fair value of the remaining unexercised warrants was $262,000 as of March 25, 2011, and the Company recorded a gain of $65,000 for the year ended June 30, 2011 in connection with the change in fair value of these warrants.

Effective March 25, 2011, the Company completed a reverse/forward stock split and reduced the number of shares outstanding from approximately 139,150,000 to 13,915,000 and no longer accounted for unexercised stock purchase warrants as derivative liabilities. The Company had sufficient authorized shares available for the exercise of all outstanding options and stock purchase warrants. As of March 25, 2011, additional paid-in capital was increased by $262,000 and derivative liabilities were reduced by $262,000.

All future changes in the fair value of the Company’s warrants that are still accounted for as derivatives and will be recognized in earnings until such time as the warrants are exercised or expire. These common stock purchase warrants do not trade in an active securities market, and as such, the Company estimates the fair value of these warrants using Black-Scholes and the following assumptions:

| June 30, | June 30, | |||||||

| 2012 | 2011 | |||||||

| Annual dividend yield | 0.0% | 0.0% | ||||||

| Expected life (years) | 1.5 -2.25 | 0.17 -4.00 | ||||||

| Risk-free interest rate | 0.25%– 0.33% | 0.16%– 1.79% | ||||||

| Expected volatility | 28% - 91% | 87% - 151% | ||||||

Expected volatility is based primarily on historical volatility. Historical volatility was computed using weekly pricing observations for recent periods. The Company believes this method produces an estimate that is representative of the Company’s expectations of future volatility over the expected term of these warrants. The Company currently has no reason to believe future volatility over the expected remaining life of these warrants is likely to differ materially from historical volatility. The expected life is based on the remaining contractual term of the warrants. The risk-free rate is based on the U.S. Treasury rate that corresponds to the expected term of the warrants.

| 21 |

Liabilities measured at fair value on a recurring basis are summarized as follows:

| June 30, 2012 | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Derivative liability related to fair value of warrants | $ | - | $ | - | $ | 442,000 | $ | 442,000 | ||||||||

| June 30, 2011 | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Derivative liability related to fair value of warrants | $ | - | $ | - | $ | 672,000 | $ | 672,000 | ||||||||

The following table details the approximate fair value measurements within the fair value hierarchy of the Company’s derivative liabilities using Level 3 Inputs:

| Balance as of July 1, 2010 | $ | 291,000 | ||

| Warrants reclassified from additional paid-in capital to derivative liabilities | 338,000 | |||

| Warrants reclassified from derivative liabilities to additional paid-in capital | (272,000 | ) | ||

| Change in fair value of derivative liabilities | 315,000 | |||

| Balance as of June 30, 2011 | 672,000 | |||

| Change in fair value of derivative liabilities | (230,000 | ) | ||

| Balance as of June 30, 2012 | $ | 442,000 |

The Company has no assets that are measured at fair value on a recurring basis. There were no assets or liabilities measured at fair value on a non-recurring basis during the years ended June 30, 2012 and 2011, respectively.

The Company has no assets that are measured at fair value on a recurring basis. There were no assets or liabilities measured at fair value on a non-recurring basis during the years ended June 30, 2012 and 2011, respectfully.

All future changes in the fair value of these warrants will be recognized in earnings until such time as the warrants are exercised or expire. These common stock purchase warrants do not trade in an active securities market, and as such, the Company estimates the fair value of these warrants using the Black-Scholes option pricing model.

Allowance for Doubtful Accounts

We maintain allowances for doubtful accounts for estimated losses resulting from the inability of our customers to make required payments. The allowance for doubtful accounts is based on specific identification of customer accounts and our best estimate of the likelihood of potential loss, taking into account such factors as the financial condition and payment history of major customers. We evaluate the collectibility of our receivables at least quarterly. The allowance for doubtful accounts is subject to estimates based on the historical actual costs of bad debt experienced, total accounts receivable amounts, age of accounts receivable and any knowledge of the customers’ ability or inability to pay outstanding balances. If the financial condition of our customers were to deteriorate, resulting in impairment of their ability to make payments, additional allowances may be required. The differences could be material and could significantly impact cash flows from operating activities.

Software Development Costs