Filed Pursuant to Rule 433

Registration No. 333-223208

June 28, 2019

FREE WRITING PROSPECTUS

(To Prospectus dated February 26, 2018,

Prospectus Supplement dated February 26, 2018 and

Equity Index Underlying Supplement dated February 26, 2018)

Linked to the S&P 500® Index (the “Reference Asset”)

| ► | Digital Upside Return of at least 8.25% (to be determined on the Pricing Date) if the Reference Return of the Reference Asset is greater than or equal to the Buffer Percentage (-10%) |

| ► | Protection from the first 10% of any losses of the Reference Asset |

| ► | Approximately a 2-year maturity |

| ► | All payments on the notes are subject to the credit risk of HSBC USA Inc. |

The Buffered Digital Notes (each a “note” and collectively the “notes") offered hereunder will not be listed on any U.S. securities exchange or automated quotation system. The notes will not bear interest.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this document, the accompanying prospectus, prospectus supplement or Equity Index Underlying Supplement. Any representation to the contrary is a criminal offense. We have appointed HSBC Securities (USA) Inc., an affiliate of ours, as the agent for the sale of the notes. HSBC Securities (USA) Inc. will purchase the notes from us for distribution to other registered broker-dealers or will offer the notes directly to investors. In addition, HSBC Securities (USA) Inc. or another of its affiliates or agents may use the pricing supplement to which this free writing prospectus relates in market-making transactions in any notes after their initial sale. Unless we or our agent inform you otherwise in the confirmation of sale, the pricing supplement to which this free writing prospectus relates is being used in a market-making transaction. See “Supplemental Plan of Distribution (Conflicts of Interest)” on page FWP-12 of this document.

Investment in the notes involves certain risks. You should refer to “Risk Factors” beginning on page FWP-7 of this document, page S-1 of the accompanying prospectus supplement and page S-1 of the accompanying Equity Index Underlying Supplement.

The Estimated Initial Value of the notes on the Pricing Date is expected to be between $940 and $972 per note, which will be less than the price to public. The market value of the notes at any time will reflect many factors and cannot be predicted with accuracy. See “Estimated Initial Value” on page FWP-4 and “Risk Factors” beginning on page FWP-7 of this document for further information.

| Price to Public | Underwriting Discount1 | Proceeds to Issuer | |

| Per security | $1,000 | ||

| Total |

1HSBC USA Inc. or one of its affiliates may pay varying underwriting discounts of up to 2.80% and varying referral fees of up to 0.80% per $1,000 Principal Amount in connection with the distribution of the notes to other registered broker-dealers. In no case will the sum of the underwriting discounts and referral fees exceed 2.80% per $1,000 Principal Amount. See “Supplemental Plan of Distribution (Conflicts of Interest)” on page FWP-12 of this document.

The Notes:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

| Indicative Terms1 | |

| Principal Amount | $1,000 per note |

| Term | Approximately 2 years |

| Reference Asset | The S&P 500® Index (“SPX”) |

| Digital Upside Return | At least 8.25%, to be determined on the Pricing Date |

| Buffer Percentage | -10% |

| Reference Return |

Final Level – Initial Level Initial Level |

|

Payment at Maturity per Note |

If the Reference Return is greater than or equal to the Buffer Percentage, you will receive: $1,000 + ($1,000 × Digital Upside Return).

If the Reference Return is less than the Buffer Percentage: $1,000 + [$1,000 × (Reference Return + 10%)]. For example, if the Reference Return is -40%, you will suffer a 30% loss and receive 70% of the Principal Amount, subject to the credit risk of HSBC. If the Reference Return is less than the Buffer Percentage, you will lose some or a significant portion (up to 90%) of your investment. |

| Initial Level | See page FWP-4 |

| Final Level | See page FWP-4 |

| Pricing Date | July 26, 2019 |

| Trade Date | July 26, 2019 |

| Original Issue Date | July 31, 2019 |

| Final Valuation Date(2) | July 28, 2021 |

| Maturity Date(2) | August 2, 2021 |

| CUSIP/ISIN | 40435URJ5 / US40435URJ50 |

(1) As more fully described on page FWP-4.

(2) Subject to adjustment as described under “Additional Terms of the Notes” in the accompanying Equity Index Underlying Supplement.

The Notes

These Buffered Digital Notes may be suitable for investors who believe that the Reference Asset will increase modestly over the term of the notes.

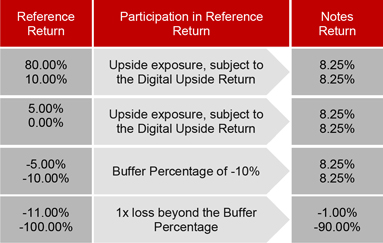

If the Reference Return is greater than or equal to the Buffer Percentage, you will realize the Digital Upside Return at maturity (subject to the credit risk of HSBC). If the Reference Return exceeds the Digital Upside Return, the notes will not provide any additional return aside from the Digital Upside Return. If the Reference Return is less than zero but equal to or greater than -10%, you will still receive the Digital Upside Return. If the Reference Asset declines by more than 10%, you will lose 1% of your investment for every 1% decline of the Reference Asset beyond -10%.

| FWP-2 |

| Payoff Example | ||

|

The table at right shows the hypothetical payout profile of an investment in the notes assuming a hypothetical Digital Upside Return of 8.25%. The actual Digital Upside Return will be determined on the Pricing Date and will be at least 8.25%.

|

|

| Information about the Reference Asset | ||

|

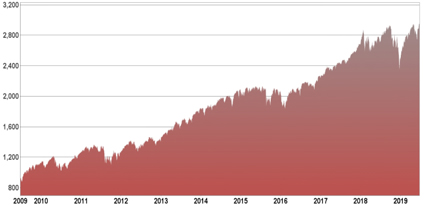

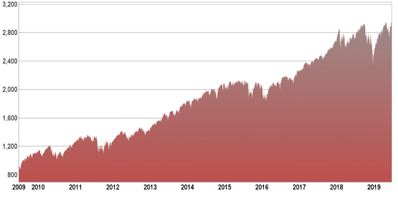

The SPX is a capitalization-weighted index of 500 U.S. stocks. It is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The top 5 industry groups by market capitalization as of May 31, 2019 were: Information Technology, Health Care, Financials, Communication Services and Consumer Discretionary. |

|

The graph above illustrates the performance of the Reference Asset from June 25, 2009 through June 25, 2019. The closing levels in the graph above were obtained from the Bloomberg Professional® Service. Past performance is not necessarily an indication of future results. For further information on the Reference Asset, please see “The S&P 500® Index” on page FWP-11 of this document. We have derived all disclosure regarding the Reference Asset from publicly available information. Neither HSBC USA Inc. nor any of its affiliates have undertaken any independent review of, or made any due diligence inquiry with respect to, the publicly available information about the Reference Asset.

| FWP-3 |

| HSBC USA Inc. |  |

| Buffered Digital Notes |

Linked to the S&P 500® Index

This document relates to a single offering of Buffered Digital Notes. The notes will have the terms described in this document and the accompanying prospectus supplement, prospectus and Equity Index Underlying Supplement. If the terms of the notes offered hereby are inconsistent with those described in the accompanying prospectus supplement, prospectus or Equity Index Underlying Supplement, the terms described in this document shall control. You should be willing to forgo interest and dividend payments during the term of the notes and, if the Reference Return is less than -10%, lose up to 90% of your principal.

This document relates to an offering of notes linked to the performance of the S&P 500® Index (the “Reference Asset”). The purchaser of a note will acquire a senior unsecured debt security of HSBC USA Inc. linked to the Reference Asset as described below. The following key terms relate to the offering of notes:

| Issuer: | HSBC USA Inc. |

| Principal Amount: | $1,000 per note |

| Reference Asset: | The S&P 500® Index (Ticker: “SPX”) |

| Trade Date: | July 26, 2019 |

| Pricing Date: | July 26, 2019 |

| Original Issue Date: | July 31, 2019 |

| Final Valuation Date | July 28, 2021, subject to adjustment as described under “Additional Terms of the Notes—Valuation Dates” in the accompanying Equity Index Underlying Supplement. |

| Maturity Date: | 3 business days after the Final Valuation Date, and expected to be August 2, 2021. The Maturity Date is subject to adjustment as described under “Additional Terms of the Notes—Coupon Payment Dates, Call Payment Dates and Maturity Date” in the accompanying Equity Index Underlying Supplement. |

| Digital Upside Return: | At least 8.25% (to be determined on the Pricing Date) |

| Payment at Maturity: | On the Maturity Date, for each note, we will pay you the Final Settlement Value. |

| Final Settlement Value: |

If the Reference Return is greater than or equal to the Buffer Percentage, you will receive a cash payment on the Maturity Date, per $1,000 Principal Amount of notes, equal to: $1,000 + ($1,000 × Digital Upside Return). If the Reference Return is less than the Buffer Percentage, you will receive a cash payment on the Maturity Date, per $1,000 Principal Amount, calculated as follows: $1,000 + [$1,000 × (Reference Return + 10%)]. Under these circumstances, you will lose 1% of the Principal Amount for each percentage point that the Reference Return is less than the Buffer Percentage. For example, if the Reference Return is -40%, you will suffer a 30% loss and receive 70% of the Principal Amount, subject to the credit risk of HSBC. If the Reference Return is less than the Buffer Percentage, you will lose some or a significant portion (up to 90%) of your investment. |

| Reference Return: | The quotient, expressed as a percentage, calculated as follows: |

|

Final Level – Initial Level Initial Level | |

| Buffer Percentage: | -10% |

| Initial Level: | The Official Closing Level of the Reference Asset on the Pricing Date. |

| Final Level: | The Official Closing Level of the Reference Asset on the Final Valuation Date. |

| Form of Notes: | Book-Entry |

| Listing: | The notes will not be listed on any U.S. securities exchange or quotation system. |

| CUSIP/ISIN: | 40435URJ5 / US40435URJ50 |

| Estimated Initial Value: | The Estimated Initial Value of the notes will be less than the price you pay to purchase the notes. The Estimated Initial Value does not represent a minimum price at which we or any of our affiliates would be willing to purchase your notes in the secondary market, if any, at any time. The Estimated Initial Value will be calculated on the Pricing Date. See “Risk Factors — The Estimated Initial Value of the notes, which will be determined by us on the Pricing Date, will be less than the price to public and may differ from the market value of the notes in the secondary market, if any.” |

The Trade Date, the Pricing Date and the other dates set forth above are subject to change, and will be set forth in the pricing supplement relating to the notes.

| FWP-4 |

GENERAL

This document relates to an offering of notes linked to the Reference Asset. The purchaser of a note will acquire a senior unsecured debt security of HSBC USA Inc. We reserve the right to withdraw, cancel or modify the offering and to reject orders in whole or in part. Although the offering of notes relates to the Reference Asset, you should not construe that fact as a recommendation as to the merits of acquiring an investment linked to the Reference Asset or any component security included in the Reference Asset or as to the suitability of an investment in the notes.

You should read this document together with the prospectus dated February 26, 2018, the prospectus supplement dated February 26, 2018, and the Equity Index Underlying Supplement dated February 26, 2018. If the terms of the notes offered hereby are inconsistent with those described in the accompanying prospectus supplement, prospectus or Equity Index Underlying Supplement, the terms described in this document shall control. You should carefully consider, among other things, the matters set forth in “Risk Factors” beginning on page FWP-7 of this document, page S-1 of the prospectus supplement and page S-1 of the Equity Index Underlying Supplement, as the notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the notes. As used herein, references to the “Issuer”, “HSBC”, “we”, “us” and “our” are to HSBC USA Inc.

HSBC has filed a registration statement (including a prospectus, a prospectus supplement and Equity Index Underlying Supplement) with the SEC for the offering to which this document relates. Before you invest, you should read the prospectus, prospectus supplement and Equity Index Underlying Supplement in that registration statement and other documents HSBC has filed with the SEC for more complete information about HSBC and this offering. You may get these documents for free by visiting EDGAR on the SEC’s web site at www.sec.gov. Alternatively, HSBC Securities (USA) Inc. or any dealer participating in this offering will arrange to send you the prospectus, prospectus supplement and Equity Index Underlying Supplement if you request them by calling toll-free 1-866-811-8049.

You may also obtain:

The Equity Index Underlying Supplement at: https://www.sec.gov/Archives/edgar/data/83246/000114420418010782/tv486722_424b2.htm

The prospectus supplement at: https://www.sec.gov/Archives/edgar/data/83246/000114420418010762/tv486944_424b2.htm

The prospectus at: https://www.sec.gov/Archives/edgar/data/83246/000114420418010720/tv487083_424b3.htm

We are using this document to solicit from you an offer to purchase the notes. You may revoke your offer to purchase the notes at any time prior to the time at which we accept your offer by notifying HSBC Securities (USA) Inc. We reserve the right to change the terms of, or reject any offer to purchase, the notes prior to their issuance. In the event of any material changes to the terms of the notes, we will notify you.

PAYMENT AT MATURITY

On the Maturity Date, for each note you hold, we will pay you the Final Settlement Value, which is an amount in cash, as described below:

If the Reference Return is greater than or equal to the Buffer Percentage, you will receive a cash payment on the Maturity Date, per $1,000 Principal Amount of notes, equal to:

$1,000 + ($1,000 × Digital Upside Return).

If the Reference Return is less than the Buffer Percentage, you will receive a cash payment on the Maturity Date, per $1,000 Principal Amount, calculated as follows:

$1,000 + [$1,000 × (Reference Return + 10%)].

Under these circumstances, you will lose 1% of the Principal Amount for each percentage point that the Reference Return is less than the Buffer Percentage. For example, if the Reference Return is -40%, you will suffer a 30% loss and receive 70% of the Principal Amount, subject to the credit risk of HSBC. You should be aware that if the Reference Return is less than the Buffer Percentage, you will lose some or a significant portion (up to 90%) of your investment.

Interest

The notes will not pay interest.

Calculation Agent

We or one of our affiliates will act as calculation agent with respect to the notes.

Reference Sponsor

The reference sponsor is S&P Dow Jones Indices LLC.

| FWP-5 |

INVESTOR SUITABILITY

The notes may be suitable for you if:

| 4 | You seek an investment with a return linked to the potential performance of the Reference Asset and you believe the level of the Reference Asset will not be less than the Buffer Percentage. |

| 4 | You are willing to make an investment that is exposed to the negative Reference Return on a 1-to-1 basis for each percentage point that the Reference Return is less than the Buffer Percentage. |

| 4 | You are willing to invest in the notes based on the fact that your maximum potential return is the Digital Upside Return. |

| 4 | You are willing to accept the risk and return profile of the notes versus a conventional debt security with a comparable maturity issued by HSBC or another issuer with a similar credit rating. |

| 4 | You are willing to forgo dividends or other distributions paid to holders of the stocks included in the Reference Asset. |

| 4 | You do not seek current income from your investment. |

| 4 | You do not seek an investment for which there is an active secondary market. |

| 4 | You are willing to hold the notes to maturity. |

| 4 | You are comfortable with the creditworthiness of HSBC, as Issuer of the notes. |

The notes may not be suitable for you if:

| 4 | You believe the Reference Return will be less than the Buffer Percentage. |

| 4 | You are unwilling to make an investment that is exposed to the negative Reference Return on a 1-to-1 basis for each percentage point that the Reference Return is less than the Buffer Percentage. |

| 4 | You are unwilling to invest in the notes based on the fact that your maximum potential return is the Digital Upside Return. |

| 4 | You seek an investment that provides full return of principal. |

| 4 | You prefer the lower risk, and therefore accept the potentially lower returns, of conventional debt securities with comparable maturities issued by HSBC or another issuer with a similar credit rating. |

| 4 | You prefer to receive the dividends or other distributions paid on the stocks included in the Reference Asset. |

| 4 | You seek current income from your investment. |

| 4 | You seek an investment for which there will be an active secondary market. |

| 4 | You are unable or unwilling to hold the notes to maturity. |

| 4 | You are not willing or are unable to assume the credit risk associated with HSBC, as Issuer of the notes. |

| FWP-6 |

RISK FACTORS

We urge you to read the section “Risk Factors” beginning on page S-1 in the accompanying prospectus supplement and on page S-1 of the accompanying Equity Index Underlying Supplement. Investing in the notes is not equivalent to investing directly in any of the stocks included in the Reference Asset. You should understand the risks of investing in the notes and should reach an investment decision only after careful consideration, with your advisors, of the suitability of the notes in light of your particular financial circumstances and the information set forth in this document and the accompanying Equity Index Underlying Supplement, prospectus supplement and prospectus.

In addition to the risks discussed below, you should review “Risk Factors” in the accompanying prospectus supplement and Equity Index Underlying Supplement including the explanation of risks relating to the notes described in the following sections:

| 4 | “— Risks Relating to All Note Issuances” in the prospectus supplement; and |

| 4 | “— General Risks Related to Indices” in the Equity Index Underlying Supplement; |

You will be subject to significant risks not associated with conventional fixed-rate or floating-rate debt securities.

Your investment in the notes may result in a loss.

You will be exposed on a 1-to-1 basis to any decrease in the level of the Reference Asset beyond the Buffer Percentage of -10%. Accordingly, if the Reference Return is less than -10%, you will lose up to 90% of your investment at maturity.

You will not participate in any appreciation in the level of the Reference Asset and your return on the notes is limited to the Digital Upside Return.

The notes will not pay a return more than the Digital Upside Return. Even if the level of the Reference Asset appreciates over the term of the notes, you will not participate in that appreciation. Assuming the notes are held to maturity, the maximum return on the notes will not exceed the Digital Upside Return. Under no circumstances, regardless of the extent to which the level of the Reference Asset increases, will your return exceed the Digital Upside Return. In some cases, you may earn significantly less by investing in the notes than you would have earned by investing in an instrument directly linked to the performance of the Reference Asset, or by investing directly in the stocks included in the Reference Asset.

The amount payable on the notes is not linked to the level of the Reference Asset at any time other than the Final Valuation Date.

The Final Level will be based on the Official Closing Level of the Reference Asset on the Final Valuation Date, subject to postponement for non-trading days and certain market disruption events. Even if the level of the Reference Asset appreciates during the term of the notes other than on the Final Valuation Date but then decreases on the Final Valuation Date to a level that is less than 90% of the Initial Level, the Payment at Maturity may be less, and may be significantly less, than it would have been had the Payment at Maturity been linked to the level of the Reference Asset prior to such decrease. Although the actual level of the Reference Asset on the Maturity Date or at other times during the term of the notes may be higher than the Final Level, the Payment at Maturity will be based solely on the Official Closing Level of the Reference Asset on the Final Valuation Date.

Credit risk of HSBC USA Inc.

The notes are senior unsecured debt obligations of the Issuer, HSBC, and are not, either directly or indirectly, an obligation of any third party. As further described in the accompanying prospectus supplement and prospectus, the notes will rank on par with all of the other unsecured and unsubordinated debt obligations of HSBC, except such obligations as may be preferred by operation of law. Any payment to be made on the notes, including any return of principal at maturity, depends on the ability of HSBC to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of HSBC may affect the market value of the notes and, in the event HSBC were to default on its obligations, you may not receive the amounts owed to you under the terms of the notes.

The notes will not bear interest.

As a holder of the notes, you will not receive interest payments.

Changes that affect the Reference Asset may affect the market value of the notes and the amount you will receive at maturity.

The policies of the reference sponsor concerning additions, deletions and substitutions of the stocks included in the Reference Asset and the manner in which the reference sponsor takes account of certain changes affecting those stocks may affect the level of the Reference Asset. The policies of the reference sponsor with respect to the calculation of the Reference Asset could also affect the level of the Reference Asset. The reference sponsor may discontinue or suspend calculation or dissemination of the Reference Asset. Any such actions could affect the value of the notes and their return.

The notes are not insured or guaranteed by any governmental agency of the United States or any other jurisdiction.

The notes are not deposit liabilities or other obligations of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency or program of the United States or any other jurisdiction. An investment in the notes is subject to the credit risk of HSBC, and in the event that HSBC is unable to pay its obligations as they become due, you may not receive the full Payment at Maturity of the notes.

| FWP-7 |

The Estimated Initial Value of the notes, which will be determined by us on the Pricing Date, will be less than the price to public and may differ from the market value of the notes in the secondary market, if any.

The Estimated Initial Value of the notes will be calculated by us on the Pricing Date and will be less than the price to public. The Estimated Initial Value will reflect our internal funding rate, which is the borrowing rate we pay to issue market-linked securities, as well as the mid-market value of the embedded derivatives in the notes. This internal funding rate is typically lower than the rate we would use when we issue conventional fixed or floating rate debt securities. As a result of the difference between our internal funding rate and the rate we would use when we issue conventional fixed or floating rate debt securities, the Estimated Initial Value of the notes may be lower if it were based on the prices at which our fixed or floating rate debt securities trade in the secondary market. In addition, if we were to use the rate we use for our conventional fixed or floating rate debt issuances, we would expect the economic terms of the notes to be more favorable to you. We will determine the value of the embedded derivatives in the notes by reference to our or our affiliates’ internal pricing models. These pricing models consider certain assumptions and variables, which can include volatility and interest rates. Different pricing models and assumptions could provide valuations for the notes that are different from our Estimated Initial Value. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. The Estimated Initial Value does not represent a minimum price at which we or any of our affiliates would be willing to purchase your notes in the secondary market (if any exists) at any time.

The price of your notes in the secondary market, if any, immediately after the Pricing Date will be less than the price to public.

The price to public takes into account certain costs. These costs, which will be used or retained by us or one of our affiliates, include the underwriting discount, our affiliates’ projected hedging profits (which may or may not be realized) for assuming risks inherent in hedging our obligations under the notes and the costs associated with structuring and hedging our obligations under the notes. If you were to sell your notes in the secondary market, if any, the price you would receive for your notes may be less than the price you paid for them because secondary market prices will not take into account these costs. The price of your notes in the secondary market, if any, at any time after issuance will vary based on many factors, including the level of the Reference Asset and changes in market conditions, and cannot be predicted with accuracy. The notes are not designed to be short-term trading instruments, and you should, therefore, be able and willing to hold the notes to maturity. Any sale of the notes prior to maturity could result in a loss to you.

If we were to repurchase your notes immediately after the Original Issue Date, the price you receive may be higher than the Estimated Initial Value of the notes.

Assuming that all relevant factors remain constant after the Original Issue Date, the price at which HSBC Securities (USA) Inc. may initially buy or sell the notes in the secondary market, if any, and the value that may be initially used for customer account statements, if any, may exceed the Estimated Initial Value on the Pricing Date for a temporary period expected to be approximately 6 months after the Original Issue Date. This temporary price difference may exist because, in our discretion, we may elect to effectively reimburse to investors a portion of the estimated cost of hedging our obligations under the notes and other costs in connection with the notes that we will no longer expect to incur over the term of the notes. We will make such discretionary election and determine this temporary reimbursement period on the basis of a number of factors, including the tenor of the notes and any agreement we may have with the distributors of the notes. The amount of our estimated costs which we effectively reimburse to investors in this way may not be allocated ratably throughout the reimbursement period, and we may discontinue such reimbursement at any time or revise the duration of the reimbursement period after the Original Issue Date of the notes based on changes in market conditions and other factors that cannot be predicted.

The notes lack liquidity.

The notes will not be listed on any securities exchange. HSBC Securities (USA) Inc. is not required to offer to purchase the notes in the secondary market, if any exists. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the notes easily. Because other dealers are not likely to make a secondary market for the notes, the price at which you may be able to trade your notes is likely to depend on the price, if any, at which HSBC Securities (USA) Inc. is willing to buy the notes.

Potential conflicts of interest may exist.

An affiliate of HSBC has a minority equity interest in the owner of an electronic platform, through which we may make available certain structured investments offering materials. HSBC and its affiliates play a variety of roles in connection with the issuance of the notes, including acting as calculation agent and hedging our obligations under the notes. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the notes. We will not have any obligation to consider your interests as a holder of the notes in taking any action that might affect the value of your notes.

Uncertain tax treatment.

For a discussion of the U.S. federal income tax consequences of your investment in the notes, please see the discussion under “U.S. Federal Income Tax Considerations” herein and the discussion under “U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement.

| FWP-8 |

ILLUSTRATIVE EXAMPLES

The following table and examples are provided for illustrative purposes only and are hypothetical. They do not purport to be representative of every possible scenario concerning increases or decreases in the level of the Reference Asset relative to its Initial Level. We cannot predict the actual Final Level. The assumptions we have made in connection with the illustrations set forth below may not reflect actual events, and the hypothetical Initial Level used in the table and examples below is not expected to be the actual Initial Level. You should not take this illustration or these examples as an indication or assurance of the expected performance of the Reference Asset or the return on your notes. The Final Settlement Value may be less than the amount that you would have received from a conventional debt security with the same stated maturity, including such a security issued by HSBC. The numbers appearing in the table below and following examples have been rounded for ease of analysis.

The table below illustrates the Final Settlement Value on a $1,000 investment in the notes for a hypothetical range of Reference Returns from -100% to +100%. The following results are based solely on the assumptions outlined below. The “Hypothetical Return on the Notes” as used below is the number, expressed as a percentage, that results from comparing the Final Settlement Value per $1,000 Principal Amount to $1,000. The potential returns described here assume that your notes are held to maturity. You should consider carefully whether the notes are suitable to your investment goals. The following table and examples assume the following:

| Principal Amount: | $1,000 |

| Hypothetical Initial Level*: | 1,000.00 |

| Hypothetical Digital Upside Return: | 8.25% (The actual Digital Upside Return will be determined on the Pricing Date and will be at least 8.25%.) |

| Buffer Percentage: | -10% |

*The actual Initial Level will be determined on the Pricing Date.

| Hypothetical Final Level |

Hypothetical Reference Return |

Hypothetical Final Settlement Value |

Hypothetical Return on the Notes |

| 2,000.00 | 100.00% | $1,082.50 | 8.25% |

| 1,800.00 | 80.00% | $1,082.50 | 8.25% |

| 1,600.00 | 60.00% | $1,082.50 | 8.25% |

| 1,300.00 | 30.00% | $1,082.50 | 8.25% |

| 1,250.00 | 25.00% | $1,082.50 | 8.25% |

| 1,100.00 | 10.00% | $1,082.50 | 8.25% |

| 1,082.50 | 8.25% | $1,082.50 | 8.25% |

| 1,050.00 | 5.00% | $1,082.50 | 8.25% |

| 1,020.00 | 2.00% | $1,082.50 | 8.25% |

| 1,010.00 | 1.00% | $1,082.50 | 8.25% |

| 1,000.00 | 0.00% | $1,082.50 | 8.25% |

| 990.00 | -1.00% | $1,082.50 | 8.25% |

| 980.00 | -2.00% | $1,082.50 | 8.25% |

| 950.00 | -5.00% | $1,082.50 | 8.25% |

| 900.00 | -10.00% | $1,082.50 | 8.25% |

| 850.00 | -15.00% | $950.00 | -5.00% |

| 800.00 | -20.00% | $900.00 | -10.00% |

| 700.00 | -30.00% | $800.00 | -20.00% |

| 600.00 | -40.00% | $700.00 | -30.00% |

| 500.00 | -50.00% | $600.00 | -40.00% |

| 100.00 | -90.00% | $200.00 | -80.00% |

| 0.00 | -100.00% | $100.00 | -90.00% |

| FWP-9 |

The following examples indicate how the Final Settlement Value would be calculated with respect to a hypothetical $1,000 investment in the notes.

Example 1: The level of the Reference Asset increases from the Initial Level of 1,000.00 to a Final Level of 1,050.00.

| Reference Return: | 5.00% |

| Final Settlement Value: | $1,082.50 |

Because the Reference Return is positive, the investor receives the Digital Upside Return, and the Final Settlement Value would be $1,082.50 per $1,000 Principal Amount, calculated as follows:

$1,000 + ($1,000 × Digital Upside Return)

= $1,000 + ($1,000 × 8.25%)

= $1,082.50

Example 1 shows that you will benefit from the Digital Upside Return at maturity when the Reference Return is positive.

Example 2: The level of the Reference Asset increases from the Initial Level of 1,000.00 to a Final Level of 1,600.00.

| Reference Return: | 60.00% |

| Final Settlement Value: | $1,082.50 |

Even if the Reference Return is positive, and greater than the Digital Upside Return, the Final Settlement Value would still be $1,082.50 per $1,000 Principal Amount of notes, calculated as follows:

$1,000 + ($1,000 × Digital Upside Return)

= $1,000 + ($1,000 × 8.25%)

= $1,082.50

Example 2 shows that you will not receive any return of your principal investment in addition to the Digital Upside Return at maturity when the Reference Return is greater than the Digital Upside Return.

Example 3: The level of the Reference Asset decreases from the Initial Level of 1,000.00 to a Final Level of 950.00.

| Reference Return: | -5.00% |

| Final Settlement Value: | $1,082.50 |

Because the Reference Return is greater than the Buffer Percentage of -10%, the Final Settlement Value would be $1,082.50 per $1,000 Principal Amount of notes, calculated as follows:

$1,000 + ($1,000 × Digital Upside Return)

= $1,000 + ($1,000 × 8.25%)

= $1,082.50

Example 3 shows that you will receive the Digital Upside Return at maturity when the Reference Return is equal to or greater than the Buffer Percentage.

Example 4: The level of the Reference Asset decreases from the Initial Level of 1,000.00 to a Final Level of 250.00.

| Reference Return: | -75.00% |

| Final Settlement Value: | $350.00 |

Because the Reference Return is less than the Buffer Percentage of -10%, the Final Settlement Value would be $350.00 per $1,000 Principal Amount, calculated as follows:

$1,000 + [$1,000 × (Reference Return + 10%)]

= $1,000 + [$1,000 × (-75.00% + 10%)]

= $350.00

Example 4 shows that you are exposed on a 1-to-1 basis to declines in the level of the Reference Asset beyond the Buffer Percentage of -10%. YOU MAY LOSE UP TO 90% OF THE PRINCIPAL AMOUNT OF YOUR NOTES.

| FWP-10 |

| THE S&P 500® index | ||

|

Description of the SPX

The SPX is a capitalization-weighted index of 500 U.S. stocks. It is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The top 5 industry groups by market capitalization as of May 31, 2019 were: Information Technology, Health Care, Financials, Communication Services and Consumer Discretionary.

For more information about the SPX, see “The S&P 500® Index” on page S-43 of the accompanying Equity Index Underlying Supplement. |

Historical Performance of the SPX

The following graph sets forth the historical performance of the SPX based on the daily historical closing levels from June 25, 2009 through June 25, 2019. We obtained the closing levels below from the Bloomberg Professional® service. We have not undertaken any independent review of, or made any due diligence inquiry with respect to, the information obtained from the Bloomberg Professional® service.

|

The historical levels of the SPX should not be taken as an indication of future performance, and no assurance can be given as to the Official Closing Level of the SPX on the Final Valuation Date.

| FWP-11 |

EVENTS OF DEFAULT AND ACCELERATION

If the notes have become immediately due and payable following an Event of Default (as defined in the accompanying prospectus) with respect to the notes, the calculation agent will determine the accelerated payment due and payable at maturity in the same general manner as described in “Payment at Maturity” in this document. In that case, the scheduled trading day immediately preceding the date of acceleration will be used as the Final Valuation Date for purposes of determining the Reference Return, and the accelerated Maturity Date will be three business days after the accelerated Final Valuation Date. If a Market Disruption Event exists with respect to the Reference Asset on that scheduled trading day, then the accelerated Final Valuation Date for the Reference Asset will be postponed for up to five scheduled trading days (in the same manner used for postponing the originally scheduled Final Valuation Date). The accelerated Maturity Date will also be postponed by an equal number of business days.

If the notes have become immediately due and payable following an Event of Default, you will not be entitled to any additional payments with respect to the notes. For more information, see “Description of Debt Securities — Senior Debt Securities — Events of Default” in the accompanying prospectus.

SUPPLEMENTAL PLAN OF DISTRIBUTION (CONFLICTS OF INTEREST)

We have appointed HSBC Securities (USA) Inc., an affiliate of HSBC, as the agent for the sale of the notes. Pursuant to the terms of a distribution agreement, HSBC Securities (USA) Inc. will purchase the notes from HSBC at the price to public less the underwriting discount set forth on the cover page of the pricing supplement to which this free writing prospectus relates, for distribution to other registered broker-dealers, or will offer the notes directly to investors. HSBC Securities (USA) Inc. proposes to offer the notes at the price to public set forth on the cover page of this free writing prospectus. HSBC USA Inc. or one of its affiliates may pay varying underwriting discounts of up to 2.80% and varying referral fees of up to 0.80% per $1,000 Principal Amount in connection with the distribution of the notes to other registered broker-dealers. In no case will the sum of the underwriting discounts and referral fees exceed 2.80% per $1,000 Principal Amount.

An affiliate of HSBC has paid or may pay in the future an amount to broker-dealers in connection with the costs of the continuing implementation of systems to support the notes.

In addition, HSBC Securities (USA) Inc. or another of its affiliates or agents may use the pricing supplement to which this free writing prospectus relates in market-making transactions after the initial sale of the notes, but is under no obligation to make a market in the notes and may discontinue any market-making activities at any time without notice.

We expect that delivery of the notes will be made against payment for the notes on or about the Original Issue Date set forth on the inside cover page of this document, which is more than two business days following the Trade Date. Under Rule 15c6-1 under the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in two business days, unless the parties to that trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes more than two business days prior to the Original Issue Date will be required to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement, and should consult their own advisors.

See “Supplemental Plan of Distribution (Conflicts of Interest)” on page S-61 in the prospectus supplement.

U.S. FEDERAL INCOME TAX CONSIDERATIONS

There is no direct legal authority as to the proper tax treatment of the notes, and therefore significant aspects of the tax treatment of the notes are uncertain as to both the timing and character of any inclusion in income in respect of the notes. Under one approach, a note should be treated as a pre-paid executory contract with respect to the Reference Asset. We intend to treat the notes consistent with this approach. Pursuant to the terms of the notes, you agree to treat the notes under this approach for all U.S. federal income tax purposes. Subject to the limitations described therein, and based on certain factual representations received from us, in the opinion of our special U.S. tax counsel, Mayer Brown LLP, it is reasonable to treat a note as a pre-paid executory contract with respect to the Reference Asset. Pursuant to this approach, we do not intend to report any income or gain with respect to the notes prior to their maturity or an earlier sale or exchange and we intend to treat any gain or loss upon maturity or an earlier sale or exchange as long-term capital gain or loss, provided that you have held the note for more than one year at such time for U.S. federal income tax purposes.

We will not attempt to ascertain whether any of the entities whose stock is included in the Reference Asset would be treated as a passive foreign investment company (“PFIC”) or United States real property holding corporation (“USRPHC”), both as defined for U.S. federal income tax purposes. If one or more of the entities whose stock is included in the Reference Asset were so treated, certain adverse U.S. federal income tax consequences might apply. You should refer to information filed with the SEC and other authorities by the entities whose stock is included in the Reference Asset and consult your tax advisor regarding the possible consequences to you if one or more of the entities whose stock is included in the Reference Asset is or becomes a PFIC or a USRPHC.

Under current law, while the matter is not entirely clear, individual non-U.S. holders, and entities whose property is potentially includible in those individuals’ gross estates for U.S. federal estate tax purposes (for example, a trust funded by such an individual and with respect to which the individual has retained certain interests or powers), should note that, absent an applicable treaty benefit, the notes are likely to

| FWP-12 |

be treated as U.S. situs property, subject to U.S. federal estate tax. These individuals and entities should consult their own tax advisors regarding the U.S. federal estate tax consequences of investing in the notes.

A “dividend equivalent” payment is treated as a dividend from sources within the United States and such payments generally would be subject to a 30% U.S. withholding tax if paid to a non-U.S. holder. Under U.S. Treasury Department regulations, payments (including deemed payments) with respect to equity-linked instruments (“ELIs”) that are “specified ELIs” may be treated as dividend equivalents if such specified ELIs reference an interest in an “underlying security,” which is generally any interest in an entity taxable as a corporation for U.S. federal income tax purposes if a payment with respect to such interest could give rise to a U.S. source dividend. However, Internal Revenue Service guidance provides that withholding on dividend equivalent payments will not apply to specified ELIs that are not delta-one instruments and that are issued before January 1, 2021. Based on the Issuer’s determination that the notes are not “delta-one” instruments, non-U.S. holders should not be subject to withholding on dividend equivalent payments, if any, under the notes. However, it is possible that the notes could be treated as deemed reissued for U.S. federal income tax purposes upon the occurrence of certain events affecting the Reference Asset or the notes, and following such occurrence the notes could be treated as subject to withholding on dividend equivalent payments. Non-U.S. holders that enter, or have entered, into other transactions in respect of the Reference Asset or the notes should consult their tax advisors as to the application of the dividend equivalent withholding tax in the context of the notes and their other transactions. If any payments are treated as dividend equivalents subject to withholding, we (or the applicable paying agent) would be entitled to withhold taxes without being required to pay any additional amounts with respect to amounts so withheld.

For a discussion of the U.S. federal income tax consequences of your investment in a note, please see the discussion under “U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement.

PROSPECTIVE PURCHASERS OF NOTES SHOULD CONSULT THEIR TAX ADVISORS AS TO THE FEDERAL, STATE, LOCAL, AND OTHER TAX CONSEQUENCES TO THEM OF THE PURCHASE, OWNERSHIP AND DISPOSITION OF NOTES.

| FWP-13 |

| TABLE OF CONTENTS | You should only rely on the information contained in this free writing prospectus, the accompanying Equity Index Underlying Supplement, prospectus supplement and prospectus. We have not authorized anyone to provide you with information or to make any representation to you that is not contained in this free writing prospectus, the accompanying Equity Index Underlying Supplement, prospectus supplement and prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This free writing prospectus, the accompanying Equity Index Underlying Supplement, prospectus supplement and prospectus are not an offer to sell these notes, and these documents are not soliciting an offer to buy these notes, in any jurisdiction where the offer or sale is not permitted. You should not, under any circumstances, assume that the information in this free writing prospectus, the accompanying Equity Index Underlying Supplement, prospectus supplement and prospectus is correct on any date after their respective dates.

HSBC USA Inc.

$

Buffered

Digital Notes Linked to the

June 28, 2019

FREE WRITING PROSPECTUS | ||

| Free Writing Prospectus | |||

| General | FWP-5 | ||

| Payment at Maturity | FWP-5 | ||

| Investor Suitability | FWP-6 | ||

| Risk Factors | FWP-7 | ||

| Illustrative Examples | FWP-9 | ||

| The S&P 500® Index | FWP-11 | ||

| Events of Default and Acceleration | FWP-12 | ||

| Supplemental Plan of Distribution (Conflicts of Interest) | FWP-12 | ||

| U.S. Federal Income Tax Considerations | FWP-12 | ||

| Equity Index Underlying Supplement | |||

| Disclaimer | ii | ||

| Risk Factors | S-1 | ||

| The DAX® Index | S-8 | ||

| The Dow Jones Industrial Average® | S-10 | ||

| The EURO STOXX 50® Index | S-12 | ||

| The FTSETM 100 Index | S-14 | ||

| The Hang Seng® Index | S-15 | ||

| The Hang Seng China Enterprises Index® | S-17 | ||

| The KOSPI 200 Index | S-20 | ||

| The MSCI Indices | S-23 | ||

| The NASDAQ-100 Index® | S-27 | ||

| The Nikkei 225 Index | S-31 | ||

| The PHLX Housing SectorSM Index | S-33 | ||

| The Russell 2000® Index | S-37 | ||

| The S&P 100® Index | S-40 | ||

| The S&P 500® Index | S-43 | ||

| The S&P 500® Low Volatility Index | S-46 | ||

| The S&P BRIC 40 Index | S-49 | ||

| The S&P MidCap 400® Index | S-51 | ||

| The TOPIX® Index | S-54 | ||

| Additional Terms of the Notes | S-56 | ||

| Prospectus Supplement | |||

| Risk Factors | S-1 | ||

| Pricing Supplement | S-10 | ||

| Description of Notes | S-12 | ||

| Use of Proceeds and Hedging | S-36 | ||

| Certain ERISA Considerations | S-37 | ||

| U.S. Federal Income Tax Considerations | S-39 | ||

| Supplemental Plan of Distribution (Conflicts of Interest) | S-61 | ||

| Prospectus | |||

| About this Prospectus | 1 | ||

| Risk Factors | 2 | ||

| Where You Can Find More Information | 3 | ||

| Special Note Regarding Forward-Looking Statements | 4 | ||

| HSBC USA Inc. | 7 | ||

| Use of Proceeds | 8 | ||

| Description of Debt Securities | 9 | ||

| Description of Preferred Stock | 20 | ||

| Description of Warrants | 25 | ||

| Description of Purchase Contracts | 30 | ||

| Description of Units | 33 | ||

| Book-Entry Procedures | 36 | ||

| Limitations on Issuances in Bearer Form | 40 | ||

| U.S. Federal Income Tax Considerations Relating to Debt Securities | 41 | ||

| Plan of Distribution (Conflicts of Interest) | 49 | ||

| Notice to Canadian Investors | 52 | ||

| Notice to EEA Investors | 53 | ||

| Notice to UK Investors | 54 | ||

| UK Financial Promotion | 54 | ||

| Certain ERISA Matters | 55 | ||

| Legal Opinions | 57 | ||

| Experts | 58 |