|

Filed Pursuant to Rule 433 Registration No. 333-202524 May 19, 2015 FREE WRITING PROSPECTUS (To Prospectus dated March 5, 2015, Prospectus Supplement dated March 5, 2015, and Stock-Linked Underlying Supplement dated March 5, 2015) |

| Structured Investments |

HSBC USA Inc. $ Notes Linked to an Equally Weighted Basket Consisting of Nineteen Common Equity Securities due June 8, 2016 (the “Notes”) |

General

| · | Terms used in this free writing prospectus are described or defined herein and in the accompanying Stock-Linked Underlying Supplement, prospectus supplement and prospectus. The Notes will have the terms described herein and in the accompanying Stock-Linked Underlying Supplement, prospectus supplement and prospectus. The Notes do not guarantee any return of principal, and you may lose some or all of your initial investment. The Notes will not bear interest. |

| · | This free writing prospectus relates to a single note offering. The purchaser of a Note will acquire a security linked to the Reference Asset described below. |

| · | Although the offering relates to a Reference Asset, you should not construe that fact as a recommendation as to the merits of acquiring an investment linked to the Reference Asset or any Basket Component (as defined below) or as to the suitability of an investment in the Notes. |

| · | Senior unsecured debt obligations of HSBC USA Inc. maturing June 8, 2016. |

| · | Minimum denominations of $10,000 and integral multiples of $1,000 in excess thereof. |

| · | If the terms of the Notes set forth below are inconsistent with those described in the accompanying Stock-Linked Underlying Supplement, prospectus supplement and prospectus, the terms set forth below will supersede. |

| · | Any payment on the Notes is subject to the Issuer’s credit risk. |

Key Terms

| Issuer: | HSBC USA Inc. |

| Reference Asset: | The Notes are linked to an equally weighted basket (the “Basket”) consisting of the respective common equity securities of the Reference Asset Issuers (each such equity security, a “Basket Component” and together, the “Basket Components”). |

| Reference Asset Issuers: | The issuers listed on page 2 of this document. |

| Component Weightings: | With respect to each Basket Component, approximately 5.26% (1/19th). |

| Principal Amount: | $1,000 per Note |

| Trade Date: | May 22, 2015 |

| Pricing Date: | May 22, 2015 |

| Original Issue Date: | May 28, 2015 |

| Ending Averaging Dates: | May 27, 2016, May 31, 2016, June 1, 2016, June 2, 2016 and June 3, 2016 (the “Final Valuation Date”), subject to adjustment as described in “Additional Terms of the Notes — Valuation Dates” in the accompanying Stock-Linked Underlying Supplement. |

| Maturity Date: | 3 business days after the Final Valuation Date and expected to be June 8, 2016. The Maturity Date is subject to adjustment as described under “Additional Terms of the Notes — Coupon Payment Dates, Call Payment Dates and Maturity Date” in the accompanying Stock-Linked Underlying Supplement. |

| Payment at Maturity: | For each Note, the Cash Settlement Value. |

| Cash Settlement Value: | For each Note, you will receive a cash payment on the Maturity Date that is based on the Basket Return (as described below) and calculated as follows: |

| 1,000 × (1 + Basket Return) × Adjustment Factor | |

| If the level of the Reference Asset does not increase by at least 0.45%, you will lose a portion of your principal amount, which could be significant. | |

| Adjustment Factor: | 99.55% |

| Basket Return: | The quotient, expressed as a percentage, calculated as follows: |

| Basket Ending Level – Basket Starting Level | |

| Basket Starting Level | |

| Basket Starting Level: | Set equal to 100 on the Pricing Date. |

| Basket Ending Level: | The Basket Closing Level, as determined on the Final Valuation Date. |

| Basket Closing Level: | The Basket Closing Level will be calculated as follows: |

| 100 × [1 + (the sum of the Basket Component return multiplied by the respective component weighting, for each Basket Component)] | |

| Each of the Basket Component returns set forth in the formula above refers to the return for the relevant Basket Component, expressed as the percentage change from the Initial Price of that Basket Component to the Final Price of that Basket Component, calculated as follows: | |

| Final Price – Initial Price | |

| Initial Price | |

| Initial Price: | The official closing price of the respective Basket Component as determined by the Calculation Agent on the Pricing Date, and set forth on the following page. |

| Final Price: | The arithmetic average of the official closing prices of the respective Basket Component as determined by the Calculation Agent on each of the Ending Averaging Dates. |

| Estimated Initial Value: | The Estimated Initial Value of the Notes may be less than the price you pay to purchase the Notes. The Estimated Initial Value does not represent a minimum price at which we or any of our affiliates would be willing to purchase your Notes in the secondary market, if any, at any time. The Estimated Initial Value will be calculated on the Pricing Date and will be set forth in the pricing supplement to which this free writing prospectus relates. See “Selected Risk Considerations — The Estimated Initial Value of the Notes, which will be determined by us on the Pricing Date, may be less than the price to public and may differ from the market value of the Notes in the secondary market, if any.” |

| Calculation Agent: | HSBC USA Inc. or one of its affiliates |

| CUSIP / ISIN: | 40433BW79 / US40433BW791 |

| Form of the Notes: | Book-Entry |

| Listing: | The Notes will not be listed on any securities exchange or quotation system. |

An investment in the Notes involves certain risks. You should refer to “Selected Risk Considerations” beginning on page 5 of this document and “Risk Factors” beginning on page S-1 of the Stock-Linked Underlying Supplement and page S-1 of the prospectus supplement.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the Notes or determined that this free writing prospectus, or the accompanying Stock-Linked Underlying Supplement, prospectus supplement and prospectus, is truthful or complete. Any representation to the contrary is a criminal offense.

HSBC Securities (USA) Inc. or another of our affiliates or agents may use the pricing supplement to which this free writing prospectus relates in market-making transactions in any Notes after their initial sale. Unless we or our agent informs you otherwise in the confirmation of sale, the pricing supplement to which this free writing prospectus relates is being used in a market-making transaction. HSBC Securities (USA) Inc., an affiliate of ours, will purchase the Notes from us for distribution to the placement agent. See “Supplemental Plan of Distribution (Conflicts of Interest)” on the last page of this free writing prospectus.

J.P. Morgan Securities LLC and certain of its registered broker-dealer affiliates are purchasing the Notes for resale. JPMorgan Chase Bank N.A. may purchase the Notes on behalf of certain fiduciary accounts. J.P. Morgan Securities LLC, certain of its registered broker-dealer affiliates and JPMorgan Chase Bank N.A. will not receive fees from us for sales to fiduciary accounts.

The Estimated Initial Value of the Notes on the Pricing Date is expected to be between $980 and $1,000 per Note, which may be less than the price to public. The market value of the Notes at any time will reflect many factors and cannot be predicted with accuracy. See “Estimated Initial Value” above and “Selected Risk Considerations” beginning on page 5 of this document for additional information.

| Price to Public | Fees and Commissions(1) | Proceeds to Issuer | |

| Per Note | $1,000.00 | $1.00 | $999.00 |

| Total | $ | $ | $ |

(1) Certain fiduciary accounts purchasing the Notes will pay a purchase price of $999.00 per Note, and the placement agent with respect to sales made to such accounts will forgo any fees.

The Notes:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

JPMorgan

Placement Agent

May [●], 2015

Reference Asset Issuers

| Reference Asset Issuer | Ticker Symbol | Initial Price | Reference Asset Issuer | Ticker Symbol | Initial Price |

| Actavis plc | ACT | $l | Lions Gate Entertainment Corp. | LFG | $l |

| Akorn, Inc. | AKRX | $l | Pioneer Natural Resources Company | PXD | $l |

| Anadarko Petroleum Corporation | APC | $l | Rite Aid Corporation | RAD | $l |

| BioMarin Pharmaceutical Inc. | BMRN | $l | Tableau Software, Inc. | DATA | $l |

| Endo International plc | ENDP | $l | Time Warner Cable Inc. | TWC | $l |

| FireEye, Inc. | FEYE | $l | Valeant Pharmaceuticals International, Inc. | VRX | $l |

| First Republic Bank | FRC | $l | Viacom Inc. | VIAB | $l |

| Jarden Corporation | JAH | $l | Workday, Inc. | WDAY | $l |

| Jazz Pharmaceuticals Public Limited Company | JAZZ | $l | YUM! Brands, Inc. | YUM | $l |

| Juno Therapeutics, Inc. | JUNO | $l |

Additional Terms Specific to the Notes

This free writing prospectus relates to a single note offering linked to the Reference Asset. The purchaser of a Note will acquire a senior unsecured debt security linked to the Reference Asset. We reserve the right to withdraw, cancel or modify this offering and to reject orders in whole or in part. Although the Note offering relates only to the Reference Asset, you should not construe that fact as a recommendation as to the merits of acquiring an investment linked to the Reference Asset or any Basket Component or as to the suitability of an investment in the Notes.

You should read this document together with the prospectus dated March 5, 2015, the prospectus supplement dated March 5, 2015 and the Stock-Linked Underlying Supplement dated March 5, 2015. If the terms of the Notes offered hereby are inconsistent with those described in the accompanying Stock-Linked Underlying Supplement, prospectus supplement or prospectus, the terms described in this free writing prospectus shall control. You should carefully consider, among other things, the matters set forth in “Selected Risk Considerations” beginning on page 5 of this free writing prospectus and “Risk Factors” beginning on page S-1 of the Stock-Linked Underlying Supplement and page S-1 of the prospectus supplement, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes. As used herein, references to the “Issuer,” “HSBC,” “we,” “us” and “our” are to HSBC USA Inc.

HSBC has filed a registration statement (including a prospectus, a prospectus supplement and the Stock-Linked Underlying Supplement) with the SEC for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus, prospectus supplement and Stock-Linked Underlying Supplement in that registration statement and other documents HSBC has filed with the SEC for more complete information about HSBC and this offering. You may get these documents for free by visiting EDGAR on the SEC’s web site at www.sec.gov. Alternatively, HSBC Securities (USA) Inc. or any dealer participating in this offering will arrange to send you the prospectus, prospectus supplement and Stock-Linked Underlying Supplement if you request them by calling toll-free 1-866-811-8049.

You may also obtain:

| • | The Stock-Linked Underlying Supplement: http://www.sec.gov/Archives/edgar/data/83246/000114420415014323/v403651_424b2.htm |

| • | The prospectus supplement: http://www.sec.gov/Archives/edgar/data/83246/000114420415014311/v403645_424b2.htm |

| • | The prospectus: http://www.sec.gov/Archives/edgar/data/83246/000119312515078931/d884345d424b3.htm |

We are using this free writing prospectus to solicit from you an offer to purchase the Notes. You may revoke your offer to purchase the Notes at any time prior to the time at which we accept your offer by notifying HSBC Securities (USA) Inc. We reserve the right to change the terms of, or reject any offer to purchase, the Notes prior to their issuance. The Trade Date, the Pricing Date and the other terms of the Notes are subject to change, and will be set forth in the final pricing supplement relating to the Notes. In the event of any material changes to the terms of the Notes, we will notify you.

| -2- |

Summary

The three charts below provide a summary of the Notes, including Note characteristics and risk considerations as well as a table reflecting hypothetical returns at maturity. These charts should be reviewed together with the other information contained in this free writing prospectus as well as in the accompanying Stock-Linked Underlying Supplement, prospectus and prospectus supplement.

The following charts illustrate the hypothetical total return at maturity on the Notes. The “total return” as used in this free writing prospectus is the number, expressed as a percentage, that results from comparing the Payment at Maturity per $1,000 Principal Amount to $1,000. The hypothetical total returns set forth below reflect the Adjustment Factor of 99.55% and the Basket Starting Level of 100.00. The hypothetical total returns set forth below are for illustrative purposes only and may not be the actual total returns applicable to a purchaser of the Notes. The numbers appearing in the following table and examples have been rounded for ease of analysis.

| -3- |

Selected Purchase Considerations

| · | APPRECIATION POTENTIAL — The Notes provide the opportunity to participate in the appreciation of the Reference Asset at maturity, subject to the Adjustment Factor of 99.55%. Because the Notes are our senior unsecured debt obligations, payment of any amount at maturity is subject to our ability to pay our obligations as they become due. |

| · | THE NOTES DO NOT GUARANTEE THE RETURN OF YOUR PRINCIPAL — If the Basket Ending Level does not increase by at least 0.45% as compared to the Basket Starting Level, you will lose all or a portion of the principal amount of your Notes. |

| · | YOU WILL NOT PARTICIPATE IN 100.00% OF THE APPRECIATION OF THE REFERENCE ASSET— Because the Adjustment Factor is equal to 99.55%, your return on the Notes will reflect only a portion of any increase in the Basket Ending Level of the Reference Asset as compared to the Basket Starting Level. |

| -4- |

Selected Risk Considerations

An investment in the Notes involves significant risks. Investing in the Notes is not equivalent to investing directly in any of the Basket Components. These risks are explained in more detail in the “Risk Factors” sections of the accompanying Stock-Linked Underlying Supplement and prospectus supplement.

| · | YOUR INVESTMENT IN THE NOTES MAY RESULT IN A LOSS — The Notes do not guarantee any

return of principal. The return on the Notes at maturity is linked to the performance of the Reference Asset and will depend on

whether, and the extent to which, the Basket Return is positive or negative. In order for you to receive a payment at maturity

that is not less than the principal amount, the Basket Ending Level must exceed the Basket Starting Level by at least 0.45%. You

may lose all or a significant portion of the principal amount. |

| · | YOU WILL ONLY PARTICIPATE IN 99.55% OF ANY APPRECIATION IN THE REFERENCE ASSET — The Participation Rate is only 99.55%. Accordingly, the return on the Notes will not reflect the full increase, if any, in the level of the Reference Asset. In addition, because the return on the Notes will not reflect any dividends on the Reference Asset, an investment in the securities represented by the Reference Asset could be greater than the return on the Notes. |

| · | THE AMOUNT PAYABLE ON THE NOTES IS NOT LINKED TO THE LEVEL OF THE REFERENCE ASSET AT ANY TIME OTHER THAN ON THE ENDING AVERAGING DATES, INCLUDING THE FINAL VALUATION DATE — The Basket Ending Level will be based on the official closing prices of each Basket Component on each of the Ending Averaging Dates, subject to postponement for non-trading days and certain market disruption events. Even if the level of the Reference Asset appreciates during the term of the Notes other than on the Ending Averaging Dates but then drops on one or more of the Ending Averaging Dates to a level that is less than the Basket Starting Level, the Payment at Maturity may be less, and may be significantly less, than it would have been had the Payment at Maturity been linked to the level of the Reference Asset prior to such decrease. Although the actual level of the Reference Asset on the Maturity Date or at other times during the term of the Notes may be higher than the Basket Ending Level, the Payment at Maturity will be based solely on the official closing prices of each Basket Component on each of the Ending Averaging Dates. |

| · | THE NOTES ARE SUBJECT TO THE CREDIT RISK OF HSBC USA INC. — The Notes are senior unsecured debt obligations of the Issuer, HSBC, and are not, either directly or indirectly, an obligation of any third party. As further described in the accompanying prospectus supplement and prospectus, the Notes will rank on par with all of the other unsecured and unsubordinated debt obligations of HSBC, except such obligations as may be preferred by operation of law. Any payment to be made on the Notes, including any return of principal at maturity, depends on the ability of HSBC to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of HSBC may affect the market value of the Notes and, in the event HSBC were to default on its obligations, you may not receive the amounts owed to you under the terms of the Notes. |

| · | SUITABILITY OF THE NOTES FOR INVESTMENT — You should only reach a decision to invest in the Notes after carefully considering, with your advisors, the suitability of the Notes in light of your investment objectives and the information set out in this free writing prospectus. Neither HSBC nor any dealer participating in the offering makes any recommendation as to the suitability of the Notes for investment. |

| · | THE ESTIMATED INITIAL VALUE OF THE NOTES, WHICH WILL BE DETERMINED BY US ON THE PRICING DATE, MAY BE LESS THAN THE PRICE TO PUBLIC AND MAY DIFFER FROM THE MARKET VALUE OF THE NOTES IN THE SECONDARY MARKET, IF ANY — The Estimated Initial Value of the Notes will be calculated by us on the Pricing Date and may be less than the price to public. The Estimated Initial Value will reflect our internal funding rate, which is the borrowing rate we pay to issue market-linked securities, as well as the mid-market value of the embedded derivatives in the Notes. This internal funding rate is typically lower than the rate we would use when we issue conventional fixed or floating rate debt securities. As a result of the difference between our internal funding rate and the rate we would use when we issue conventional fixed or floating rate debt securities, the Estimated Initial Value of the Notes may be lower if it were based on the levels at which our fixed or floating rate debt securities trade in the secondary market. In addition, if we were to use the rate we use for our conventional fixed or floating rate debt issuances, we would expect the economic terms of the Notes to be more favorable to you. We will determine the value of the embedded derivatives in the Notes by reference to our or our affiliates’ internal pricing models. These pricing models consider certain assumptions and variables, which can include volatility and interest rates. Different pricing models and assumptions could provide valuations for the Notes that are different from our Estimated Initial Value. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. The Estimated Initial Value does not represent a minimum price at which we or any of our affiliates would be willing to purchase your Notes in the secondary market (if any exists) at any time. |

| · | THE PRICE OF YOUR NOTES IN THE SECONDARY MARKET, IF ANY, IMMEDIATELY AFTER THE PRICING DATE WILL BE LESS THAN THE PRICE TO PUBLIC — The price to public takes into account certain costs. These costs will include our affiliates’ projected hedging profits (which may or may not be realized) for assuming risks inherent in hedging our obligations under the Notes, the underwriting discount and the costs associated with structuring and hedging our obligations under the Notes. These costs, except for the underwriting discount, will be |

| -5- |

used or retained by us or one of our affiliates. If you were to sell your Notes in the secondary market, if any, the price you would receive for your Notes may be less than the price you paid for them because secondary market prices will not take into account these costs. The price of your Notes in the secondary market, if any, at any time after issuance will vary based on many factors, including the level of the Reference Asset and changes in market conditions, and cannot be predicted with accuracy. The Notes are not designed to be short-term trading instruments, and you should, therefore, be able and willing to hold the Notes to maturity. Any sale of the Notes prior to maturity could result in a loss to you.

| · | IF HSBC SECURITIES (USA) INC. WERE TO REPURCHASE YOUR NOTES IMMEDIATELY AFTER THE ORIGINAL ISSUE DATE, THE PRICE YOU RECEIVE MAY BE HIGHER THAN THE ESTIMATED INITIAL VALUE OF THE NOTES — Assuming that all relevant factors remain constant after the Original Issue Date, the price at which HSBC Securities (USA) Inc. may initially buy or sell the Notes in the secondary market, if any, and the value that we may initially use for customer account statements, if we provide any customer account statements at all, may exceed the Estimated Initial Value on the Pricing Date for a temporary period expected to be approximately six months after the Original Issue Date. This temporary price difference may exist because, in our discretion, we may elect to effectively reimburse to investors a portion of the estimated cost of hedging our obligations under the Notes and other costs in connection with the Notes that we will no longer expect to incur over the term of the Notes. We will make such discretionary election and determine this temporary reimbursement period on the basis of a number of factors, including the tenor of the Notes and any agreement we may have with the distributors of the Notes. The amount of our estimated costs which we effectively reimburse to investors in this way may not be allocated ratably throughout the reimbursement period, and we may discontinue such reimbursement at any time or revise the duration of the reimbursement period after the Original Issue Date of the Notes based on changes in market conditions and other factors that cannot be predicted. |

| · | NO INTEREST OR DIVIDEND PAYMENTS OR VOTING RIGHTS — As a holder of the Notes, you will not receive interest payments, and you will not have voting rights or rights to receive cash dividends or other distributions or other rights that holders of shares of the Basket Components would have. In addition, the Reference Asset Issuers will not have any obligation to consider your interests as a holder of the Notes in taking any corporate action that might affect the value of the Basket Components and the Notes. |

| · | POTENTIALLY INCONSISTENT RESEARCH, OPINIONS OR RECOMMENDATIONS BY HSBC AND JPMORGAN — HSBC, JPMorgan, or their respective affiliates may publish research, express opinions or provide recommendations that are inconsistent with investing in or holding the Notes and which may be revised at any time. Any such research, opinions or recommendations could affect the level of the Reference Asset, and therefore, the market value of the Notes. |

| · | WE ARE NOT AFFILIATED WITH THE REFERENCE ASSET ISSUERS — We are not affiliated with the Reference Asset Issuers. We have not made any independent investigation regarding the adequacy or completeness of the information about the Basket Components contained in this free writing prospectus. You should make your own investigation into the Basket Components and the Reference Asset Issuers. We are not responsible for the Reference Asset Issuers’ public disclosure of information, whether contained in SEC filings or otherwise. |

| · | THERE IS LIMITED ANTI-DILUTION PROTECTION — The Calculation Agent will adjust the Ending Basket Level, which will affect the Basket Return and, consequently, the Payment at Maturity, for certain events affecting the Basket Components, such as stock splits and corporate actions. The Calculation Agent is not required to make an adjustment for every corporate action which affects the applicable Basket Component. If an event occurs that does not require the Calculation Agent to adjust the price of the Basket Components, the market price of the Notes may be materially and adversely affected. See “Additional Terms of the Notes — Antidilution and Reorganization Adjustments” in the accompanying Stock-Linked Underlying Supplement. |

| · | CHANGES IN THE VALUES OF THE BASKET COMPONENTS MAY OFFSET EACH OTHER — Movements in the prices of the Basket Components may not correlate with each other. At a time when the price of one or more of the Basket Components increases, the price of the other Basket Components may not increase as much or may even decline. Therefore, in calculating the Basket Closing Level and the Basket Return, increases in the price of one or more of the Basket Components may be moderated, or more than offset, by lesser increases or declines in the price of the other Basket Components. |

| · | In some circumstances, the payment you receive on the Notes may be partially based on the EQUITY SECURITY of a company other than the Basket Components initially in the basket — Following certain corporate events relating to the Reference Asset Issuers where such issuer is not the surviving entity, your Payment at Maturity may be based on the common stock of a successor one or more of the Reference Asset Issuers or any cash or any other assets distributed to holders of such Basket Component in such corporate event. The occurrence of these corporate events and the consequent adjustments may materially and adversely affect the value of the Notes. For more information, see the “Additional Terms of the Notes — Antidilution and Reorganization” in the accompanying Stock-Linked Underlying Supplement. |

| -6- |

| · | THE NOTES ARE SUBJECT TO NON-U.S. SECURITIES MARKETS RISK — An investment in securities linked to the value of non-U.S. companies, such as Actavis plc, Endo International plc and Jazz Pharmaceuticals Public Limited Company, which are Irish issuers, and Lions Gate Entertainment Corp. and Valeant Pharmaceuticals International, Inc., which are Canadian issuers, involves risks associated with the home countries of such non-U.S. companies. The prices of such non-U.S. companies’ common equity securities may be affected by political, economic, financial and social factors in the home countries of such non-U.S. companies, including changes in such countries’ governments, economic and fiscal policies, currency exchange laws or other laws or restrictions, which could affect the value of the Notes. |

| · | THE NOTES ARE SUBJECT TO RISKS ASSOCIATED WITH BASKET COMPONENTS WITH LIMITED TRADING HISTORIES — FRC has been publicly traded only since 2010, VIAB has been publicly traded only since 2011, WDAY has been publicly traded only since 2012, DATA and FEYE have been publicly traded only since 2013 and JUNO has been publicly traded only since 2014. Accordingly, there is only a limited trading history available for these Basket Components upon which you can evaluate their prior performances. |

| · | THE NOTES LACK LIQUIDITY — The Notes will not be listed on any securities exchange. HSBC Securities (USA) Inc. may offer to purchase the Notes in the secondary market. However, it is not required to do so and may cease making such offers at any time if at all. Because other dealers are not likely to make a secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at which HSBC Securities (USA) Inc. is willing to buy the Notes. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Notes easily. |

| · | POTENTIAL

CONFLICTS — HSBC and its affiliates play a variety of roles in connection with

the issuance of the Notes, including acting as Calculation Agent and hedging its obligations

under the Notes. In performing these duties, the economic interests of the Calculation

Agent and other affiliates of HSBC are potentially adverse to your interests as an investor

in the Notes. HSBC and the Calculation Agent are under no obligation to consider your

interests as a holder of the Notes in taking any corporate actions or other actions that

might affect the level of the Reference Asset and the value of the Notes. |

| · | The Notes are Not Insured OR GUARANTEED by any Governmental Agency of the United States or any Other Jurisdiction — The Notes are not deposit liabilities or other obligations of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency or program of the United States or any other jurisdiction. An investment in the Notes is subject to the credit risk of HSBC, and in the event that HSBC is unable to pay its obligations as they become due, you may not receive the full Payment at Maturity of the Notes. |

| · | HISTORICAL PERFORMANCE OF THE REFERENCE ASSET SHOULD NOT BE TAKEN AS AN INDICATION OF ITS FUTURE PERFORMANCE DURING THE TERM OF THE NOTES — It is impossible to predict whether the level of the Reference Asset will rise or fall. The Reference Asset will be influenced by complex and interrelated political, economic, financial and other factors. |

| · | MARKET DISRUPTIONS MAY ADVERSELY AFFECT YOUR RETURN — The Calculation Agent may, in its sole discretion, determine that the markets have been affected in a manner that prevents it from determining the level of the Reference Asset in the manner described herein, and calculating the amount that we are required to pay you upon maturity, or from properly hedging its obligations under the Notes. These events may include disruptions or suspensions of trading in the markets as a whole. If the Calculation Agent, in its sole discretion, determines that any of these events prevents us or any of our affiliates from properly hedging our obligations under the Notes or prevents the Calculation Agent from determining the Basket Return or Payment at Maturity in the ordinary manner, the Calculation Agent will determine the Basket Return or Payment at Maturity in good faith and in a commercially reasonable manner, and it is possible that the Ending Averaging Dates and the Maturity Date will be postponed, which may adversely affect the return on your Notes. |

| · | MANY ECONOMIC AND MARKET FACTORS WILL IMPACT THE VALUE OF THE NOTES — In addition to the level of the Reference Asset on any day, the value of the Notes will be affected by a number of economic and market factors that may either offset or magnify each other, including: |

| · | the actual and expected volatility of the Basket Components; |

| · | the time to maturity of the Notes; |

| · | the dividend rate on the Basket Components; |

| · | interest and yield rates in the market generally; |

| · | a variety of economic, financial, political, regulatory or judicial events that affect the Basket Components or the securities markets generally; and |

| · | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

| -7- |

What Is the Total Return on the Notes at Maturity Assuming a Range of Performances for the Reference Asset?

The following table illustrates the hypothetical total return at maturity on the Notes. The “total return” as used in this free writing prospectus is the number, expressed as a percentage, that results from comparing the Payment at Maturity per $1,000 Principal Amount to $1,000. The hypothetical total returns set forth below reflect the Adjustment Factor of 99.55% and the Basket Starting Level of 100.00. The hypothetical total returns set forth below are for illustrative purposes only and may not be the actual total returns applicable to a purchaser of the Notes. The numbers appearing in the following table and examples have been rounded for ease of analysis.

| Hypothetical Basket Ending Level | Hypothetical Return | Hypothetical Total Return |

| 200.00 | 100.00% | 99.100% |

| 190.00 | 90.00% | 89.145% |

| 180.00 | 80.00% | 79.190% |

| 170.00 | 70.00% | 69.235% |

| 160.00 | 60.00% | 59.280% |

| 150.00 | 50.00% | 49.325% |

| 140.00 | 40.00% | 39.370% |

| 130.00 | 30.00% | 29.415% |

| 120.00 | 20.00% | 19.460% |

| 110.00 | 10.00% | 9.505% |

| 105.00 | 5.00% | 4.528% |

| 101.00 | 1.00% | 0.545% |

| 100.45 | 0.45% | 0.000% |

| 100.00 | 0.00% | -0.450% |

| 99.00 | -1.00% | -1.446% |

| 95.00 | -5.00% | -5.428% |

| 90.00 | -10.00% | -10.405% |

| 80.00 | -20.00% | -20.360% |

| 70.00 | -30.00% | -30.315% |

| 60.00 | -40.00% | -40.270% |

| 50.00 | -50.00% | -50.225% |

| 40.00 | -60.00% | -60.180% |

| 30.00 | -70.00% | -70.135% |

| 20.00 | -80.00% | -80.090% |

| 10.00 | -90.00% | -90.045% |

| 0.00 | -100.00% | -100.000% |

Hypothetical Examples of Amounts Payable at Maturity

The following examples illustrate how the total returns set forth in the table above are calculated.

Example 1: The level of the Reference Asset increases from the Basket Starting Level of 100.00 to a hypothetical Basket Ending Level of 105.00. Because the hypothetical Basket Ending Level of 105.00 is greater than the Basket Starting Level of 100.00 by more than 0.45%, the investor receives a Payment at Maturity of $1,045.28 per $1,000 Principal Amount of Notes, calculated as follows:

$1,000 × (1 + 5.00%) × 99.55% = $1,045.28

Example 2: The level of the Reference Asset increases from the Basket Starting Level of 100.00 to a hypothetical Basket Ending Level of 100.30. Because the hypothetical Basket Ending Level of 100.30 is greater than the Basket Starting Level of 100.00, but not by more than 0.45%, the investor receives a Payment at Maturity of $998.49 per $1,000 Principal Amount of Notes, calculated as follows:

$1,000 × (1 + 0.30%) × 99.55% = $998.49

Even though the level of the Reference Asset has increased, the Payment at Maturity is still less than the principal amount.

Example 3: The level of the Reference Asset decreases from the Basket Starting Level of 100.00 to a hypothetical Basket Ending Level of 90.00. Because the hypothetical Basket Ending Level of 90.00 is less than the Basket Starting Level of 100.00, the investor receives a Payment at Maturity of $895.95 per $1,000 Principal Amount of Notes, calculated as follows:

$1,000 × (1 + -10.00%) × 99.55% = $895.95

| -8- |

Description of the Reference Asset

This free writing prospectus is not an offer to sell and it is not an offer to buy shares in any Basket Component. All disclosures contained in this free writing prospectus regarding the Basket Components are derived from publicly available information. Neither HSBC nor any of our affiliates has made any independent investigation as to the adequacy or accuracy of the information about the Basket Components that is contained in this free writing prospectus. You should make your own investigation into each Basket Component.

ACTAVIS PLC

Description of Actavis plc

Actavis plc manufactures specialty pharmaceuticals. The company develops, manufactures and distributes generic, brand and over-the-counter products. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-13305 or its CIK Code: 884629. The company’s common stock is listed on the New York Stock Exchange (the “NYSE”) under the ticker symbol “ACT.”

Historical Performance of Actavis plc

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from January 1, 2008 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |

| March 31, 2008 | $29.56 | $24.50 | $29.32 |

| June 30, 2008 | $32.68 | $26.00 | $27.17 |

| September 30, 2008 | $31.37 | $26.66 | $28.50 |

| December 31, 2008 | $29.65 | $20.17 | $26.57 |

| March 31, 2009 | $32.91 | $23.05 | $31.11 |

| June 30, 2009 | $33.93 | $28.30 | $33.69 |

| September 30, 2009 | $37.20 | $32.61 | $36.64 |

| December 31, 2009 | $40.25 | $33.92 | $39.61 |

| March 31, 2010 | $42.49 | $37.26 | $41.77 |

| June 30, 2010 | $44.97 | $40.51 | $40.57 |

| September 30, 2010 | $45.14 | $39.35 | $42.31 |

| December 31, 2010 | $52.19 | $42.17 | $51.65 |

| March 31, 2011 | $57.52 | $50.47 | $56.01 |

| June 30, 2011 | $69.04 | $56.13 | $68.73 |

| September 30, 2011 | $73.30 | $58.87 | $68.25 |

| December 31, 2011 | $71.96 | $59.50 | $60.34 |

| March 31, 2012 | $67.50 | $55.00 | $67.06 |

| June 30, 2012 | $77.69 | $65.70 | $73.99 |

| September 30, 2012 | $86.04 | $73.64 | $85.16 |

| December 31, 2012 | $91.27 | $81.73 | $86.00 |

| March 31, 2013 | $92.36 | $82.02 | $92.11 |

| June 30, 2013 | $132.94 | $91.88 | $126.22 |

| September 30, 2013 | $145.50 | $121.13 | $144.00 |

| December 31, 2013 | $168.35 | $136.54 | $168.00 |

| March 31, 2014 | $230.57 | $166.46 | $205.85 |

| June 30, 2014 | $226.23 | $184.94 | $223.05 |

| September 30, 2014 | $249.73 | $202.00 | $241.28 |

| December 31, 2014 | $272.75 | $208.86 | $257.41 |

| March 31, 2015 | $317.72 | $253.00 | $297.62 |

| May 15, 2015* | $305.11 | $279.80 | $296.60 |

* This free writing prospectus includes, for the second calendar quarter of 2015, data for the period from April 1, 2015 through May 15, 2015. Accordingly, the “Quarter High,” “Quarter Low” and “Quarter Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

| -9- |

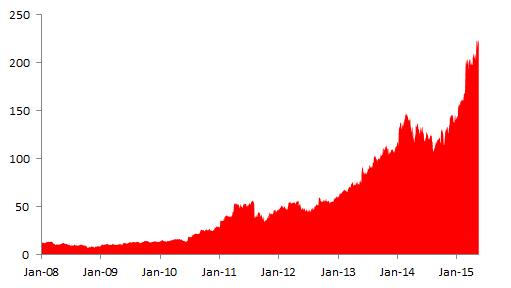

The graph below illustrates the performance of the Basket Component’s common stock from January 1, 2008 through May 15, 2015, based on information from the Bloomberg Professional® service. Past performance of the Basket Component is not indicative of its future performance.

Source: Bloomberg Professional® service

| -10- |

AKORN, INC.

Description of Akorn, Inc.

Akorn, Inc. develops, manufactures, and markets ophthalmic and injectable pharmaceutical products. The company sells various diagnostic and therapeutic pharmaceutical products focused primarily on ophthalmology, anesthesia, antidotes, and rheumatology. The company also markets ophthalmic surgical instruments and other supplies, and provides contract manufacturing for third parties. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-32360 or its CIK Code: 3116. The company’s common stock is listed on the Nasdaq Global Select Market (“NASDAQ”) under the ticker symbol “AKRX.”

Historical Performance of Akorn, Inc.

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from January 1, 2008 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |

| March 31, 2008 | $8.18 | $4.38 | $4.73 |

| June 30, 2008 | $5.21 | $3.26 | $3.31 |

| September 30, 2008 | $5.63 | $3.14 | $5.13 |

| December 31, 2008 | $5.21 | $1.11 | $2.30 |

| March 31, 2009 | $2.67 | $0.86 | $0.86 |

| June 30, 2009 | $1.29 | $0.73 | $1.20 |

| September 30, 2009 | $1.65 | $0.92 | $1.37 |

| December 31, 2009 | $2.00 | $1.22 | $1.79 |

| March 31, 2010 | $1.88 | $1.28 | $1.53 |

| June 30, 2010 | $3.30 | $1.37 | $2.97 |

| September 30, 2010 | $4.07 | $2.80 | $4.04 |

| December 31, 2010 | $6.50 | $3.86 | $6.07 |

| March 31, 2011 | $6.19 | $4.87 | $5.77 |

| June 30, 2011 | $7.15 | $5.66 | $7.00 |

| September 30, 2011 | $9.49 | $6.66 | $7.81 |

| December 31, 2011 | $11.77 | $7.10 | $11.12 |

| March 31, 2012 | $13.09 | $10.53 | $11.70 |

| June 30, 2012 | $16.09 | $10.54 | $15.77 |

| September 30, 2012 | $16.87 | $12.00 | $13.22 |

| December 31, 2012 | $13.77 | $11.74 | $13.36 |

| March 31, 2013 | $14.69 | $12.44 | $13.83 |

| June 30, 2013 | $15.48 | $12.86 | $13.52 |

| September 30, 2013 | $20.21 | $13.35 | $19.68 |

| December 31, 2013 | $26.13 | $19.03 | $24.63 |

| March 31, 2014 | $27.99 | $20.63 | $22.00 |

| June 30, 2014 | $33.30 | $20.52 | $33.25 |

| September 30, 2014 | $39.48 | $31.34 | $36.27 |

| December 31, 2014 | $45.22 | $33.17 | $36.20 |

| March 31, 2015 | $55.84 | $35.47 | $47.51 |

| May 15, 2015* | $57.09 | $38.63 | $41.50 |

* This free writing prospectus includes, for the second calendar quarter of 2015, data for the period from April 1, 2015 through May 15, 2015. Accordingly, the “Quarter High,” “Quarter Low” and “Quarter Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

| -11- |

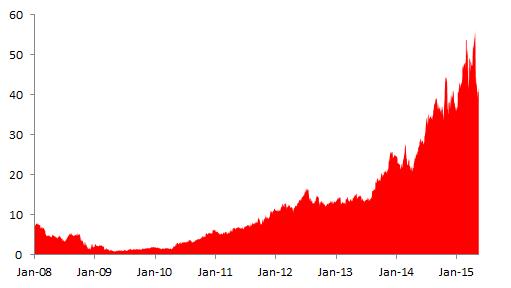

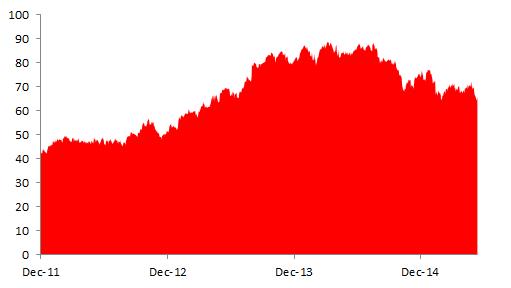

The graph below illustrates the performance of the Basket Component’s common stock from January 1, 2008 through May 15, 2015, based on information from the Bloomberg Professional® service. Past performance of the Basket Component is not indicative of its future performance.

Source: Bloomberg Professional® service

| -12- |

ANADARKO PETROLEUM CORPORATION

Description of Anadarko Petroleum Corporation

Anadarko Petroleum Corporation is an independent oil and gas exploration and production company with international operations. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-08968 or its CIK Code: 773910. The company’s common stock is listed on the NYSE under the ticker symbol “APC.”

Historical Performance of Anadarko Petroleum Corporation

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from January 1, 2008 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |

| March 31, 2008 | $67.63 | $50.92 | $63.03 |

| June 30, 2008 | $81.36 | $61.35 | $74.84 |

| September 30, 2008 | $75.90 | $43.27 | $48.51 |

| December 31, 2008 | $49.64 | $24.57 | $38.55 |

| March 31, 2009 | $44.00 | $30.89 | $38.89 |

| June 30, 2009 | $52.37 | $37.85 | $45.39 |

| September 30, 2009 | $66.21 | $40.28 | $62.73 |

| December 31, 2009 | $69.37 | $55.88 | $62.42 |

| March 31, 2010 | $73.89 | $60.75 | $72.83 |

| June 30, 2010 | $75.07 | $34.54 | $36.09 |

| September 30, 2010 | $58.42 | $36.06 | $57.05 |

| December 31, 2010 | $78.98 | $55.65 | $76.16 |

| March 31, 2011 | $83.98 | $73.06 | $81.92 |

| June 30, 2011 | $85.50 | $68.67 | $76.76 |

| September 30, 2011 | $85.25 | $63.03 | $63.05 |

| December 31, 2011 | $84.42 | $57.12 | $76.33 |

| March 31, 2012 | $88.68 | $75.91 | $78.34 |

| June 30, 2012 | $79.85 | $56.42 | $66.20 |

| September 30, 2012 | $76.63 | $64.19 | $69.92 |

| December 31, 2012 | $76.95 | $65.82 | $74.31 |

| March 31, 2013 | $89.19 | $74.74 | $87.45 |

| June 30, 2013 | $92.17 | $78.30 | $85.93 |

| September 30, 2013 | $96.75 | $86.13 | $92.99 |

| December 31, 2013 | $98.47 | $73.66 | $79.32 |

| March 31, 2014 | $86.83 | $77.81 | $84.76 |

| June 30, 2014 | $112.00 | $84.86 | $109.47 |

| September 30, 2014 | $113.51 | $100.42 | $101.44 |

| December 31, 2014 | $102.68 | $71.00 | $82.50 |

| March 31, 2015 | $90.09 | $73.82 | $82.81 |

| May 15, 2015* | $95.92 | $82.55 | $84.67 |

* This free writing prospectus includes, for the second calendar quarter of 2015, data for the period from April 1, 2015 through May 15, 2015. Accordingly, the “Quarter High,” “Quarter Low” and “Quarter Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

| -13- |

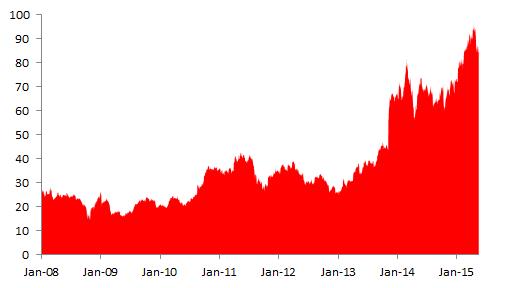

The graph below illustrates the performance of the Basket Component’s common stock from January 1, 2008 through May 15, 2015, based on information from the Bloomberg Professional® service. Past performance of the Basket Component is not indicative of its future performance.

Source: Bloomberg Professional® service

| -14- |

BIOMARIN PHARMACEUTICAL INC.

Description of BioMarin Pharmaceutical Inc.

BioMarin Pharmaceutical Inc. develops and commercializes therapeutic enzyme products. The company has applied its proprietary enzyme technology to develop products for lysosomal storage diseases and for the treatment of serious burns. The company’s subsidiary provides analytical and diagnostic products and services in the area of carbohydrate biology. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-26727 or its CIK Code: 1048477. The company’s common stock is listed on the NASDAQ under the ticker symbol “BMRN.”

Historical Performance of BioMarin Pharmaceutical Inc.

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from January 1, 2008 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |

| March 31, 2008 | $41.00 | $31.25 | $35.37 |

| June 30, 2008 | $40.00 | $28.35 | $28.98 |

| September 30, 2008 | $33.49 | $25.36 | $26.49 |

| December 31, 2008 | $26.49 | $13.27 | $17.80 |

| March 31, 2009 | $21.20 | $9.93 | $12.35 |

| June 30, 2009 | $15.97 | $11.41 | $15.61 |

| September 30, 2009 | $18.58 | $13.72 | $18.08 |

| December 31, 2009 | $19.02 | $15.22 | $18.81 |

| March 31, 2010 | $24.98 | $18.35 | $23.37 |

| June 30, 2010 | $24.90 | $17.70 | $18.96 |

| September 30, 2010 | $23.28 | $18.04 | $22.35 |

| December 31, 2010 | $28.35 | $21.62 | $26.93 |

| March 31, 2011 | $28.42 | $23.10 | $25.13 |

| June 30, 2011 | $28.64 | $24.77 | $27.21 |

| September 30, 2011 | $33.45 | $23.74 | $31.87 |

| December 31, 2011 | $35.56 | $29.54 | $34.38 |

| March 31, 2012 | $38.94 | $33.62 | $34.25 |

| June 30, 2012 | $39.64 | $31.92 | $39.58 |

| September 30, 2012 | $44.18 | $36.51 | $40.27 |

| December 31, 2012 | $51.50 | $36.30 | $49.25 |

| March 31, 2013 | $62.95 | $49.83 | $62.26 |

| June 30, 2013 | $71.56 | $53.53 | $55.79 |

| September 30, 2013 | $80.63 | $56.70 | $72.22 |

| December 31, 2013 | $75.96 | $58.65 | $70.27 |

| March 31, 2014 | $84.19 | $64.62 | $68.21 |

| June 30, 2014 | $70.42 | $55.08 | $62.21 |

| September 30, 2014 | $73.34 | $55.36 | $72.16 |

| December 31, 2014 | $96.32 | $65.91 | $90.40 |

| March 31, 2015 | $133.54 | $88.52 | $124.62 |

| May 15, 2015* | $129.33 | $110.58 | $122.78 |

* This free writing prospectus includes, for the second calendar quarter of 2015, data for the period from April 1, 2015 through May 15, 2015. Accordingly, the “Quarter High,” “Quarter Low” and “Quarter Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

| -15- |

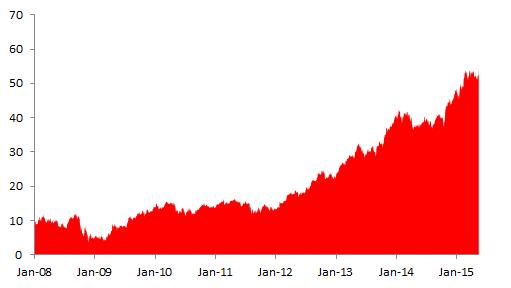

The graph below illustrates the performance of the Basket Component’s common stock from January 1, 2008 through May 15, 2015, based on information from the Bloomberg Professional® service. Past performance of the Basket Component is not indicative of its future performance.

Source: Bloomberg Professional® service

| -16- |

ENDO INTERNATIONAL PLC

Description of Endo International plc

Endo International plc provides specialty healthcare solutions. The company develops, manufactures, markets and distributes pharmaceutical products and generic drugs. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-59365 or its CIK Code: 1100962. The company’s ordinary shares are listed on the NASDAQ under the ticker symbol “ENDP.”

Historical Performance of Endo International plc

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from January 1, 2008 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |

| March 31, 2008 | $28.47 | $22.62 | $23.94 |

| June 30, 2008 | $26.56 | $23.60 | $24.19 |

| September 30, 2008 | $25.47 | $19.46 | $20.00 |

| December 31, 2008 | $25.98 | $13.87 | $25.88 |

| March 31, 2009 | $26.14 | $16.29 | $17.68 |

| June 30, 2009 | $18.55 | $15.75 | $17.92 |

| September 30, 2009 | $23.35 | $16.84 | $22.63 |

| December 31, 2009 | $24.04 | $19.11 | $20.51 |

| March 31, 2010 | $24.85 | $19.19 | $23.69 |

| June 30, 2010 | $24.29 | $19.58 | $21.82 |

| September 30, 2010 | $34.25 | $21.30 | $33.24 |

| December 31, 2010 | $38.19 | $32.80 | $35.71 |

| March 31, 2011 | $38.51 | $32.14 | $38.16 |

| June 30, 2011 | $44.50 | $36.66 | $40.17 |

| September 30, 2011 | $42.09 | $26.78 | $27.99 |

| December 31, 2011 | $36.38 | $26.07 | $34.53 |

| March 31, 2012 | $39.28 | $32.82 | $38.73 |

| June 30, 2012 | $38.96 | $28.83 | $30.98 |

| September 30, 2012 | $33.85 | $28.89 | $31.72 |

| December 31, 2012 | $33.01 | $25.50 | $26.27 |

| March 31, 2013 | $33.32 | $25.01 | $30.76 |

| June 30, 2013 | $39.82 | $30.41 | $36.79 |

| September 30, 2013 | $46.08 | $36.18 | $45.44 |

| December 31, 2013 | $67.62 | $43.13 | $67.46 |

| March 31, 2014 | $82.00 | $63.65 | $68.65 |

| June 30, 2014 | $75.55 | $53.62 | $70.02 |

| September 30, 2014 | $71.48 | $61.14 | $68.34 |

| December 31, 2014 | $75.00 | $57.14 | $72.12 |

| March 31, 2015 | $93.01 | $70.62 | $89.70 |

| May 15, 2015* | $96.40 | $83.52 | $85.35 |

* This free writing prospectus includes, for the second calendar quarter of 2015, data for the period from April 1, 2015 through May 15, 2015. Accordingly, the “Quarter High,” “Quarter Low” and “Quarter Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

| -17- |

The graph below illustrates the performance of the Basket Component’s ordinary shares from January 1, 2008 through May 15, 2015, based on information from the Bloomberg Professional® service. Past performance of the Basket Component is not indicative of its future performance.

Source: Bloomberg Professional® service

| -18- |

FIREEYE, INC.

Description of FireEye, Inc.

FireEye, Inc. provides malware protection systems and network threat prevention solutions. The company offers web, email and file security, as well as malware analysis. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-36067 or its CIK Code: 1370880. The company’s common stock is listed on the NASDAQ under the ticker symbol “FEYE.”

Historical Performance of FireEye, Inc.

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from September 20, 2013 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |

| September 30, 2013* | $44.85 | $20.00 | $41.53 |

| December 31, 2013 | $44.50 | $33.30 | $43.61 |

| March 31, 2014 | $97.35 | $40.41 | $61.57 |

| June 30, 2014 | $65.65 | $25.59 | $40.55 |

| September 30, 2014 | $41.81 | $27.07 | $30.56 |

| December 31, 2014 | $34.55 | $24.82 | $31.58 |

| March 31, 2015 | $46.41 | $29.27 | $39.25 |

| May 15, 2015** | $44.89 | $37.67 | $41.37 |

* FireEye, Inc. commenced trading on September 20, 2013 and therefore has a limited historical performance.

** This free writing prospectus includes, for the second calendar quarter of 2015, data for the period from April 1, 2015 through May 15, 2015. Accordingly, the “Quarter High,” “Quarter Low” and “Quarter Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

| -19- |

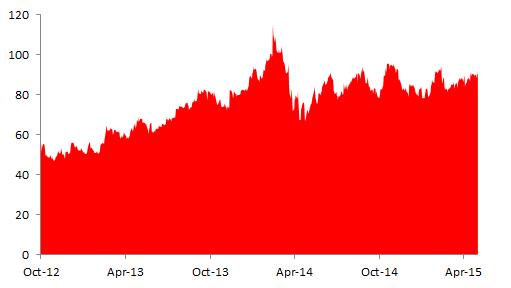

The graph below illustrates the performance of the Basket Component’s common stock from September 20, 2013 through May 15, 2015, based on information from the Bloomberg Professional® service. Past performance of the Basket Component is not indicative of its future performance.

Source: Bloomberg Professional® service

| -20- |

FIRST REPUBLIC BANK

Description of First Republic Bank

First Republic Bank and its subsidiaries provide private banking, private business banking and private wealth management in urban, coastal markets in the U.S. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-79573 or its CIK Code: 1132979. The company’s common stock is listed on the NYSE under the ticker symbol “FRC.”

Historical Performance of First Republic Bank

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from December 10, 2010 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |

| December 31, 2010* | $30.51 | $27.00 | $29.12 |

| March 31, 2011 | $31.47 | $27.60 | $30.91 |

| June 30, 2011 | $34.75 | $29.15 | $32.28 |

| September 30, 2011 | $31.75 | $22.80 | $23.16 |

| December 31, 2011 | $31.49 | $21.93 | $30.61 |

| March 31, 2012 | $33.68 | $29.48 | $32.94 |

| June 30, 2012 | $34.10 | $29.21 | $33.60 |

| September 30, 2012 | $34.87 | $31.82 | $34.46 |

| December 31, 2012 | $35.14 | $31.51 | $32.78 |

| March 31, 2013 | $38.74 | $32.87 | $38.62 |

| June 30, 2013 | $40.31 | $36.44 | $38.48 |

| September 30, 2013 | $47.47 | $38.08 | $46.63 |

| December 31, 2013 | $52.82 | $45.59 | $52.35 |

| March 31, 2014 | $56.18 | $47.49 | $53.99 |

| June 30, 2014 | $55.50 | $49.27 | $54.99 |

| September 30, 2014 | $55.84 | $45.64 | $49.38 |

| December 31, 2014 | $53.06 | $45.67 | $52.12 |

| March 31, 2015 | $59.77 | $46.71 | $57.09 |

| May 15, 2015** | $61.22 | $56.22 | $60.07 |

* First Republic Bank commenced trading on December 10, 2010 and therefore has a limited historical performance.

** This free writing prospectus includes, for the second calendar quarter of 2015, data for the period from April 1, 2015 through May 15, 2015. Accordingly, the “Quarter High,” “Quarter Low” and “Quarter Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

| -21- |

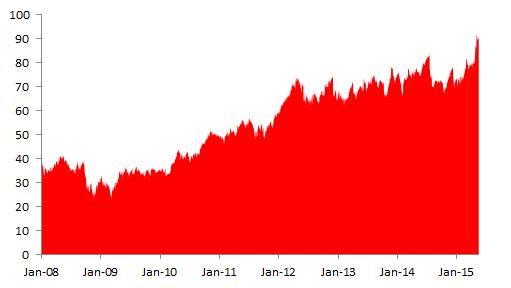

The graph below illustrates the performance of the Basket Component’s common stock from December 10, 2010 through May 15, 2015, based on information from the Bloomberg Professional® service. Past performance of the Basket Component is not indicative of its future performance.

Source: Bloomberg Professional® service

| -22- |

JARDEN CORPORATION

Description of Jarden Corporation

Jarden Corporation provides a broad range of consumer products. The company's product segments include Outdoor Solutions, Consumer Solutions and Branded Consumables. The company sells branded products through a variety of distribution channels, including club, department store, drug, grocery, mass merchant, sporting goods and specialty retailers, as well as direct to consumers. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-13665 or its CIK Code: 895655. The company’s common stock is listed on the NYSE under the ticker symbol “JAH.”

Historical Performance of Jarden Corporation

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from January 1, 2008 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |

| March 31, 2008 | $11.84 | $8.59 | $9.66 |

| June 30, 2008 | $10.72 | $7.77 | $8.11 |

| September 30, 2008 | $12.30 | $7.50 | $10.42 |

| December 31, 2008 | $10.61 | $3.21 | $5.11 |

| March 31, 2009 | $6.50 | $3.90 | $5.63 |

| June 30, 2009 | $9.31 | $5.45 | $8.33 |

| September 30, 2009 | $12.81 | $7.76 | $12.48 |

| December 31, 2009 | $14.20 | $10.92 | $13.74 |

| March 31, 2010 | $15.60 | $13.05 | $14.80 |

| June 30, 2010 | $15.39 | $11.33 | $11.94 |

| September 30, 2010 | $13.99 | $11.36 | $13.84 |

| December 31, 2010 | $15.34 | $13.48 | $13.72 |

| March 31, 2011 | $16.67 | $13.73 | $15.81 |

| June 30, 2011 | $16.67 | $13.86 | $15.34 |

| September 30, 2011 | $15.63 | $11.39 | $12.56 |

| December 31, 2011 | $15.53 | $11.79 | $13.28 |

| March 31, 2012 | $18.09 | $13.12 | $17.88 |

| June 30, 2012 | $19.20 | $16.64 | $18.68 |

| September 30, 2012 | $24.11 | $18.45 | $23.48 |

| December 31, 2012 | $24.78 | $21.62 | $22.98 |

| March 31, 2013 | $29.47 | $23.42 | $28.57 |

| June 30, 2013 | $32.85 | $27.84 | $29.17 |

| September 30, 2013 | $33.40 | $28.59 | $32.27 |

| December 31, 2013 | $40.94 | $30.90 | $40.90 |

| March 31, 2014 | $42.67 | $38.12 | $39.89 |

| June 30, 2014 | $40.55 | $36.17 | $39.57 |

| September 30, 2014 | $41.37 | $36.73 | $40.07 |

| December 31, 2014 | $48.70 | $36.27 | $47.88 |

| March 31, 2015 | $54.26 | $44.78 | $52.90 |

| May 15, 2015* | $54.52 | $50.77 | $53.98 |

* This free writing prospectus includes, for the second calendar quarter of 2015, data for the period from April 1, 2015 through May 15, 2015. Accordingly, the “Quarter High,” “Quarter Low” and “Quarter Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

| -23- |

The graph below illustrates the performance of the Basket Component’s common stock from January 1, 2008 through May 15, 2015, based on information from the Bloomberg Professional® service. Past performance of the Basket Component is not indicative of its future performance.

Source: Bloomberg Professional® service

| -24- |

JAZZ PHARMACEUTICALS PUBLIC LIMITED COMPANY

Description of Jazz Pharmaceuticals Public Limited Company

Jazz Pharmaceuticals Public Limited Company is a specialty biopharmaceutical company focused on identifying, developing and commercializing innovative products that address unmet medical needs. The company has a portfolio of products in the areas of narcolepsy, oncology, pain and psychiatry. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-33500 or its CIK Code: 1232524. The company’s ordinary shares are listed on the NASDAQ under the ticker symbol “JAZZ.”

Historical Performance of Jazz Pharmaceuticals Public Limited Company

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from January 1, 2008 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |

| March 31, 2008 | $15.58 | $8.82 | $9.02 |

| June 30, 2008 | $9.63 | $5.13 | $7.41 |

| September 30, 2008 | $8.85 | $3.40 | $4.94 |

| December 31, 2008 | $5.20 | $0.91 | $1.93 |

| March 31, 2009 | $2.09 | $0.58 | $0.89 |

| June 30, 2009 | $5.25 | $0.52 | $3.73 |

| September 30, 2009 | $11.88 | $3.60 | $8.02 |

| December 31, 2009 | $9.28 | $6.02 | $7.88 |

| March 31, 2010 | $13.95 | $8.02 | $10.90 |

| June 30, 2010 | $12.17 | $6.38 | $7.83 |

| September 30, 2010 | $11.90 | $7.52 | $10.73 |

| December 31, 2010 | $20.26 | $9.61 | $19.68 |

| March 31, 2011 | $33.83 | $18.85 | $31.85 |

| June 30, 2011 | $34.96 | $23.51 | $33.35 |

| September 30, 2011 | $47.88 | $31.87 | $41.52 |

| December 31, 2011 | $45.81 | $34.02 | $38.63 |

| March 31, 2012 | $53.10 | $37.90 | $48.47 |

| June 30, 2012 | $54.16 | $40.40 | $45.01 |

| September 30, 2012 | $58.93 | $43.39 | $57.01 |

| December 31, 2012 | $59.96 | $47.51 | $53.20 |

| March 31, 2013 | $60.79 | $53.71 | $55.91 |

| June 30, 2013 | $72.00 | $50.76 | $68.73 |

| September 30, 2013 | $93.84 | $69.01 | $91.97 |

| December 31, 2013 | $128.49 | $80.40 | $126.56 |

| March 31, 2014 | $176.58 | $123.55 | $138.68 |

| June 30, 2014 | $156.21 | $120.38 | $147.01 |

| September 30, 2014 | $176.15 | $131.95 | $160.56 |

| December 31, 2014 | $183.84 | $137.54 | $163.73 |

| March 31, 2015 | $190.00 | $155.27 | $172.79 |

| May 15, 2015* | $191.01 | $165.00 | $178.01 |

* This free writing prospectus includes, for the second calendar quarter of 2015, data for the period from April 1, 2015 through May 15, 2015. Accordingly, the “Quarter High,” “Quarter Low” and “Quarter Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

| -25- |

The graph below illustrates the performance of the Basket Component’s ordinary shares from January 1, 2008 through May 15, 2015, based on information from the Bloomberg Professional® service. Past performance of the Basket Component is not indicative of its future performance.

Source: Bloomberg Professional® service

| -26- |

JUNO THERAPEUTICS, INC.

Description of Juno Therapeutics, Inc.

Juno Therapeutics, Inc. operates as a clinical-stage biotechnology company. The company focuses on developing immunotherapies for cancer and other research services. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-35144 or its CIK Code: 732888. The company’s common stock is listed on the NASDAQ under the ticker symbol “JUNO.”

Historical Performance of Juno Therapeutics, Inc.

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from December 22, 2014 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |

| December 31, 2014* | $56.50 | $34.71 | $52.22 |

| March 31, 2015 | $64.54 | $38.00 | $60.66 |

| May 15, 2015** | $66.00 | $42.03 | $43.37 |

* June Therapeutics, Inc. commenced trading on December 22, 2014 and therefore has a limited historical performance.

** This free writing prospectus includes, for the second calendar quarter of 2015, data for the period from December 22, 2014 through May 15, 2015. Accordingly, the “Quarter High,” “Quarter Low” and “Quarter Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

| -27- |

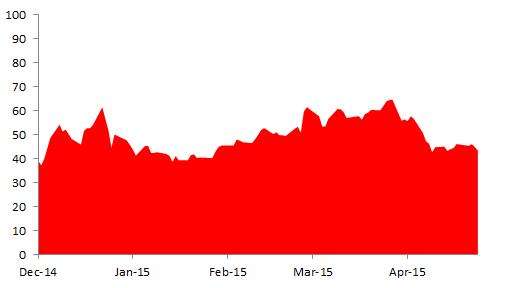

The graph below illustrates the performance of the Basket Component’s common stock from December 22, 2014 through May 15, 2015, based on information from the Bloomberg Professional® service. Past performance of the Basket Component is not indicative of its future performance.

Source: Bloomberg Professional® service

| -28- |

LIONS GATE ENTERTAINMENT CORP.

Description of Lions Gate Entertainment Corp.

Lions Gate Entertainment Corp. develops and distributes film entertainment contents. The company produces motion pictures, television programming, animation, and digital media. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-14880 or its CIK Code: 929351. The company’s common shares are listed on the NYSE under the ticker symbol “LGF.”

Historical Performance of Lions Gate Entertainment Corp.

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from January 1, 2008 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |

| March 31, 2008 | $9.89 | $8.43 | $9.75 |

| June 30, 2008 | $10.76 | $9.53 | $10.36 |

| September 30, 2008 | $10.97 | $8.54 | $9.10 |

| December 31, 2008 | $9.19 | $5.15 | $5.50 |

| March 31, 2009 | $6.50 | $3.65 | $5.05 |

| June 30, 2009 | $6.29 | $4.41 | $5.60 |

| September 30, 2009 | $7.17 | $5.29 | $6.16 |

| December 31, 2009 | $6.16 | $4.86 | $5.81 |

| March 31, 2010 | $6.62 | $4.82 | $6.24 |

| June 30, 2010 | $7.38 | $5.64 | $6.98 |

| September 30, 2010 | $7.42 | $5.90 | $7.35 |

| December 31, 2010 | $7.83 | $6.41 | $6.51 |

| March 31, 2011 | $6.87 | $5.70 | $6.25 |

| June 30, 2011 | $6.75 | $5.76 | $6.62 |

| September 30, 2011 | $7.58 | $6.17 | $6.90 |

| December 31, 2011 | $8.86 | $6.73 | $8.32 |

| March 31, 2012 | $16.17 | $8.14 | $13.92 |

| June 30, 2012 | $15.04 | $11.27 | $14.74 |

| September 30, 2012 | $15.97 | $12.75 | $15.27 |

| December 31, 2012 | $17.02 | $14.59 | $16.40 |

| March 31, 2013 | $24.15 | $16.76 | $23.77 |

| June 30, 2013 | $30.57 | $22.25 | $27.47 |

| September 30, 2013 | $37.80 | $27.68 | $35.05 |

| December 31, 2013 | $37.75 | $27.94 | $31.66 |

| March 31, 2014 | $33.79 | $24.55 | $26.73 |

| June 30, 2014 | $29.81 | $24.81 | $28.58 |

| September 30, 2014 | $34.15 | $27.46 | $32.97 |

| December 31, 2014 | $35.74 | $29.01 | $32.02 |

| March 31, 2015 | $34.87 | $27.55 | $33.92 |

| May 15, 2015* | $34.36 | $30.28 | $31.48 |

* This free writing prospectus includes, for the second calendar quarter of 2015, data for the period from April 1, 2015 through May 15, 2015. Accordingly, the “Quarter High,” “Quarter Low” and “Quarter Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

| -29- |

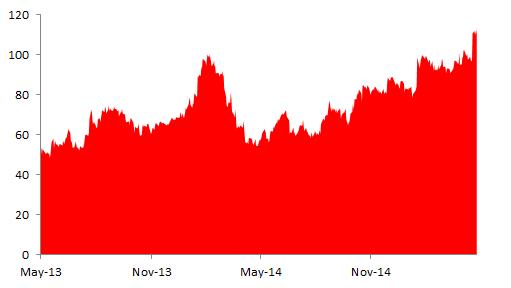

The graph below illustrates the performance of the Basket Component’s common shares from January 1, 2008 through May 15, 2015, based on information from the Bloomberg Professional® service. Past performance of the Basket Component is not indicative of its future performance.

Source: Bloomberg Professional® service

| -30- |

PIONEER NATURAL RESOURCES COMPANY

Description of Pioneer Natural Resources Company

Pioneer Natural Resources Company is an independent oil and gas exploration and production company. The company engages in onshore oil and gas drilling, exploration and production in the United States. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-13245 or its CIK Code: 1038357. The company’s common stock is listed on the NYSE under the ticker symbol “PXD.”

Historical Performance of Pioneer Natural Resources Company

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from January 1, 2008 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |

| March 31, 2008 | $50.00 | $36.43 | $49.12 |

| June 30, 2008 | $81.26 | $48.50 | $78.28 |

| September 30, 2008 | $82.21 | $46.25 | $52.28 |

| December 31, 2008 | $52.26 | $14.03 | $16.18 |

| March 31, 2009 | $20.44 | $11.89 | $16.47 |

| June 30, 2009 | $30.56 | $15.67 | $25.50 |

| September 30, 2009 | $36.74 | $21.78 | $36.29 |

| December 31, 2009 | $49.98 | $33.50 | $48.17 |

| March 31, 2010 | $56.88 | $41.88 | $56.32 |

| June 30, 2010 | $73.99 | $54.89 | $59.45 |

| September 30, 2010 | $67.77 | $55.50 | $65.03 |

| December 31, 2010 | $88.00 | $64.99 | $86.82 |

| March 31, 2011 | $104.22 | $85.93 | $101.92 |

| June 30, 2011 | $106.07 | $82.41 | $89.57 |

| September 30, 2011 | $99.64 | $65.76 | $65.77 |

| December 31, 2011 | $97.10 | $58.71 | $89.48 |

| March 31, 2012 | $119.19 | $90.30 | $111.59 |

| June 30, 2012 | $117.63 | $77.44 | $88.21 |

| September 30, 2012 | $115.67 | $82.19 | $104.40 |

| December 31, 2012 | $110.67 | $99.75 | $106.59 |

| March 31, 2013 | $133.67 | $107.30 | $124.25 |

| June 30, 2013 | $157.80 | $109.25 | $144.75 |

| September 30, 2013 | $190.15 | $146.19 | $188.80 |

| December 31, 2013 | $227.02 | $172.62 | $184.07 |

| March 31, 2014 | $205.84 | $164.10 | $187.14 |

| June 30, 2014 | $234.20 | $177.62 | $229.81 |

| September 30, 2014 | $234.60 | $193.08 | $196.97 |

| December 31, 2014 | $199.49 | $127.39 | $148.85 |

| March 31, 2015 | $167.25 | $133.97 | $163.51 |

| May 15, 2015* | $181.82 | $150.06 | $154.67 |

* This free writing prospectus includes, for the second calendar quarter of 2015, data for the period from April 1, 2015 through May 15, 2015. Accordingly, the “Quarter High,” “Quarter Low” and “Quarter Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

| -31- |

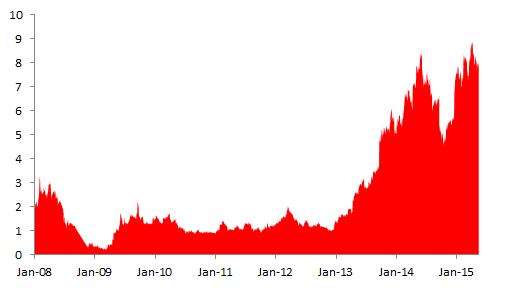

The graph below illustrates the performance of the Basket Component’s common stock from January 1, 2008 through May 15, 2015, based on information from the Bloomberg Professional® service. Past performance of the Basket Component is not indicative of its future performance.

Source: Bloomberg Professional® service

| -32- |

RITE AID CORPORATION

Description of Rite Aid Corporation

Rite Aid Corporation operates a retail drugstore chain in various states and the District of Columbia. The company's stores sell prescription drugs, as well as other products such as nonprescription medications, health and beauty aids, and cosmetics. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-13305 or its CIK Code: 84129. The company’s common stock is listed on the NYSE under the ticker symbol “RAD.”

Historical Performance of Rite Aid Corporation

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from January 1, 2008 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |

| March 31, 2008 | $3.25 | $1.91 | $2.94 |

| June 30, 2008 | $3.03 | $1.35 | $1.59 |

| September 30, 2008 | $1.62 | $1.05 | $1.06 |

| December 31, 2008 | $0.52 | $0.30 | $0.31 |

| March 31, 2009 | $0.43 | $0.20 | $0.36 |

| June 30, 2009 | $1.97 | $0.32 | $1.51 |

| September 30, 2009 | $2.35 | $1.22 | $1.64 |

| December 31, 2009 | $1.63 | $1.21 | $1.51 |

| March 31, 2010 | $1.77 | $1.27 | $1.50 |

| June 30, 2010 | $1.58 | $0.95 | $0.98 |

| September 30, 2010 | $1.12 | $0.86 | $0.94 |

| December 31, 2010 | $0.98 | $0.87 | $0.88 |

| March 31, 2011 | $1.47 | $0.88 | $1.06 |

| June 30, 2011 | $1.33 | $1.01 | $1.33 |

| September 30, 2011 | $1.38 | $0.95 | $0.98 |

| December 31, 2011 | $1.37 | $0.85 | $1.26 |

| March 31, 2012 | $2.12 | $1.23 | $1.74 |

| June 30, 2012 | $1.81 | $1.14 | $1.40 |

| September 30, 2012 | $1.46 | $1.05 | $1.17 |

| December 31, 2012 | $1.45 | $0.95 | $1.36 |

| March 31, 2013 | $1.95 | $1.26 | $1.90 |

| June 30, 2013 | $3.21 | $1.65 | $2.86 |

| September 30, 2013 | $5.07 | $2.67 | $4.76 |

| December 31, 2013 | $6.15 | $4.73 | $5.06 |

| March 31, 2014 | $7.05 | $5.01 | $6.27 |

| June 30, 2014 | $8.61 | $5.83 | $7.17 |

| September 30, 2014 | $7.75 | $4.81 | $4.84 |

| December 31, 2014 | $7.61 | $4.42 | $7.52 |

| March 31, 2015 | $8.86 | $6.69 | $8.69 |

| May 15, 2015* | $9.07 | $7.65 | $8.29 |

* This free writing prospectus includes, for the second calendar quarter of 2015, data for the period from April 1, 2015 through May 15, 2015. Accordingly, the “Quarter High,” “Quarter Low” and “Quarter Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

| -33- |

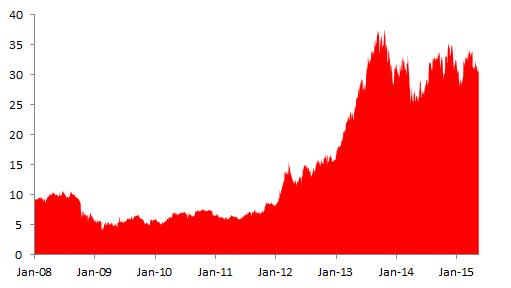

The graph below illustrates the performance of the Basket Component’s common stock from January 1, 2008 through May 15, 2015, based on information from the Bloomberg Professional® service. Past performance of the Basket Component is not indicative of its future performance.

Source: Bloomberg Professional® service

| -34- |

TABLEAU SOFTWARE, INC.

Description of Tableau Software, Inc.

Tableau Software, Inc. offers analytics software. The company helps its customers analyze, visualize, and share information, allowing them to share data on their blogs and websites. Information filed by the company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-35925 or its CIK Code: 1303652. The company’s common stock is listed on the NYSE under the ticker symbol “DATA.”

Historical Performance of Tableau Software, Inc.

The following table sets forth (to the extent available) the quarterly high and low intraday prices, as well as end-of-quarter closing prices on the relevant exchange, of the Basket Component for each quarter in the period from May 20, 2013 through May 15, 2015. We obtained the data in these tables from the Bloomberg Professional® service, without independent verification by us. Historical prices of the Basket Component should not be taken as an indication of its future performance.

| Quarter Ending | Quarter High | Quarter Low | Quarter Close |