Product Supplement No. EQUITY INDICES MITTS-1

(To Prospectus dated March 22, 2012

and Prospectus Supplement dated March 22, 2012)

October 1, 2013

Market Index Target-Term Securities® “MITTS®” Linked to One or More Equity Indices

| · | MITTS are senior unsecured debt securities issued by HSBC USA Inc. (“HSBC,” or the “Issuer”). Any payments due on MITTS, including any repayment of principal, will be subject to the credit risk of HSBC. |

| · | MITTS may not guarantee the full return of principal at maturity, and we will not pay interest on MITTS. Instead, the return on the MITTS will be based on the performance of an underlying “Market Measure,” which will be an equity index or a basket of equity indices. |

| · | If the value of the Market Measure increases from its Starting Value to its Ending Value (each as defined below), you will receive at maturity a cash payment per unit (the “Redemption Amount”) that equals the principal amount plus a multiple (the “Participation Rate”) of that increase. The Participation Rate will typically be greater than or equal to 100%. The Redemption Amount may also be subject to a specified cap (the “Capped Value”). |

| · | If the value of the Market Measure does not change or decreases from its Starting Value, you will receive a Redemption Amount that is no less than the minimum redemption amount per unit (the “Minimum Redemption Amount”). The Minimum Redemption Amount may be less than or equal to the principal amount. If the Minimum Redemption Amount is less than the principal amount, you may lose a portion of your investment in MITTS. |

| · | This product supplement describes the general terms of MITTS, the risk factors to consider before investing, the general manner in which they may be offered and sold, and other relevant information. |

| · | For each offering of MITTS, we will provide you with a pricing supplement (which we refer to as a “term sheet”) that will describe the specific terms of that offering, including the specific Market Measure, the Participation Rate, the Minimum Redemption Amount, any applicable Capped Value, and certain risk factors. The term sheet will identify, if applicable, any additions or changes to the terms specified in this product supplement. |

| · | MITTS will be issued in denominations of whole units. Unless otherwise set forth in the applicable term sheet, each unit will have a principal amount of $10. The term sheet may also set forth a minimum number of units that you must purchase. |

| · | Unless otherwise specified in the applicable term sheet, MITTS will not be listed on a securities exchange or quotation system. |

| · | Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”) and one or more of its affiliates may act as our agents to offer MITTS and will act in a principal capacity in such role. |

|

MITTS offered hereunder are not deposit liabilities or other obligations of a bank, are not insured by the Federal Deposit Insurance Corporation (the “FDIC”) or any other governmental agency of the United States, or any other jurisdiction, and carry investment risks, including possible loss of the amount invested due to the credit risk of HSBC. Potential purchasers of MITTS should consider the information in “Risk Factors” beginning on page PS-6 of this product supplement, page S-3 of the accompanying prospectus supplement, and page 1 of the accompanying prospectus.

Neither the U.S. Securities and Exchange Commission (the “SEC”), nor any state securities commission has approved or disapproved of MITTS or passed upon the accuracy or the adequacy of this product supplement, the accompanying prospectus supplement, or prospectus. Any representation to the contrary is a criminal offense.

|

| Merrill Lynch & Co. |

TABLE OF CONTENTS

Page

| SUMMARY | PS-3 |

| RISK FACTORS | PS-6 |

| USE OF PROCEEDS | PS-15 |

| DESCRIPTION OF MITTS | PS-16 |

| SUPPLEMENTAL PLAN OF DISTRIBUTION | PS-23 |

| U.S. FEDERAL INCOME TAX SUMMARY | PS-28 |

| ERISA CONSIDERATIONS | PS-31 |

_______________

MITTS® and “Market Index Target-Term Securities®” are registered service marks of Bank of America Corporation, the parent corporation of MLPF&S.

| PS-2 |

SUMMARY

The information in this “Summary” section is qualified in its entirety by the more detailed explanation set forth elsewhere in this product supplement, the prospectus supplement, and the prospectus, as well as the applicable term sheet. Neither we nor MLPF&S have authorized any other person to provide you with any information different from the information set forth in these documents. If anyone provides you with different or inconsistent information, you should not rely on it.

Key Terms:

| General: |

MITTS are senior debt securities issued by HSBC, and are not guaranteed or insured by the FDIC or secured by collateral, and are not, either directly or indirectly, an obligation of any third party. As further described in the accompanying prospectus supplement and prospectus, MITTS will rank on par equally with all of the other unsecured and unsubordinated debt obligations of HSBC. Any payment to be made on MITTS, including any return of principal, depends on HSBC’s credit risk and the ability of HSBC to satisfy its obligations as they become due.

The return on MITTS will be based on the performance of a Market Measure. Depending upon the terms of your MITTS, if the value of the applicable Market Measure decreases, you will receive at least the Minimum Redemption Amount specified in the applicable term sheet.

Each issue of MITTS will mature on the date set forth in the applicable term sheet. We cannot redeem MITTS at any earlier date. We will not make any payments on MITTS until maturity, and you will not receive interest payments. |

| Market Measure: |

The Market Measure may consist of one or more of the following:

· U.S. broad-based equity indices;

· U.S. sector or style-based equity indices;

· non-U.S. or global equity indices; or

· any combination of the above.

The Market Measure may consist of a group, or “Basket,” of the foregoing. We refer to each equity index included in any Basket as a “Basket Component.” If the Market Measure to which your MITTS are linked is a Basket, the Basket Components will be set forth in the applicable term sheet. |

| Market Measure Performance: |

The performance of the Market Measure will be measured according to the percentage change of the Market Measure from its Starting Value to its Ending Value.

Unless otherwise specified in the applicable term sheet:

The “Starting Value” will equal the closing level of the Market Measure on the date when MITTS are priced for initial sale to the public (the “pricing date”).

If the Market Measure consists of a Basket, the Starting Value will be equal to 100. See “Description of MITTS—Basket Market Measures.”

The “Ending Value” will equal the average of the closing levels of the Market Measure on each calculation day during the Maturity Valuation Period (each as defined below).

If a Market Disruption Event (as defined below) occurs and is continuing on a calculation day, or if certain other events occur, the calculation agent will determine the Ending Value as set forth in the section “Description of MITTS—The Starting Value and the Ending Value—Ending Value.” |

| PS-3 |

| If the Market Measure consists of a Basket, the Ending Value will be determined as described in “Description of MITTS—Basket Market Measures—Ending Value of the Basket.” | |

| Participation Rate: | The rate at which investors participate in the increase in the value of the Market Measure, as calculated below. The Participation Rate will be equal to or greater than 100%, and will be set forth in the term sheet. |

| Capped Value: | The maximum Redemption Amount, if one is applicable to your MITTS. If a Capped Value is applicable to your MITTS, your investment return, if any, is limited to the amount represented by the Capped Value. We will determine the applicable Capped Value on the pricing date. |

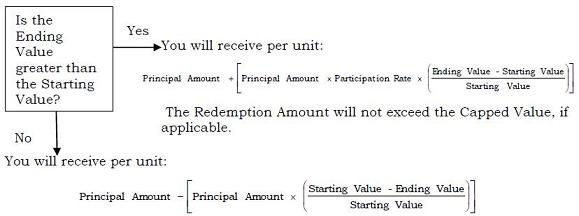

| Redemption Amount at Maturity: |

At maturity, you will receive a Redemption Amount that is greater than the principal amount if the value of the Market Measure increases from the Starting Value to the Ending Value. However, in no event will the Redemption Amount exceed the Capped Value, if applicable. If the value of the Market Measure does not change or decreases from the Starting Value to the Ending Value, you will receive an amount determined as set forth below.

Any payments due on the MITTS, including repayment of principal, are subject to our credit risk as Issuer of MITTS.

The Redemption Amount, denominated in U.S. dollars, will be calculated as follows:

The Redemption Amount will not be less than the Minimum Redemption Amount per unit. |

| Minimum Redemption Amount |

The Minimum Redemption Amount may be less than or equal to the principal amount, as specified in the applicable term sheet. |

| Principal at Risk: | If the Minimum Redemption Amount for your MITTS is less than the principal amount, you may lose a portion of the principal amount of the MITTS. Further, if you sell your MITTS prior to maturity, the price you may receive may be less than the price that you paid for the MITTS, and could be less than the Minimum Redemption Amount. |

| Calculation Agent: | The calculation agent will make all determinations associated with MITTS. Unless otherwise set forth in the applicable term sheet, we or one or more of our affiliates, acting independently or jointly with MLPF&S, will act as the calculation agent, or we may appoint MLPF&S or one of its affiliates to act as calculation agent for MITTS. See the section entitled “Description of MITTS—Role of the Calculation Agent.” |

| PS-4 |

| Agents: | MLPF&S and one or more of its affiliates will act as our agents in connection with each offering of MITTS and will receive an underwriting discount based on the number of units of MITTS sold. None of the agents is your fiduciary or advisor solely as a result of the making of any offering of MITTS, and you should not rely upon this product supplement, the term sheet, or the accompanying prospectus or prospectus supplement, as investment advice or a recommendation to purchase MITTS. |

| Listing: | Unless otherwise specified in the applicable term sheet, MITTS will not be listed on a securities exchange or quotation system. |

| U.S. Federal Income Tax Consequences: | MITTS will be subject to federal income tax, even though no payments on the MITTS will be made until the maturity date. You are urged to review the section entitled “U.S. Federal Income Tax Summary” and to consult your own tax advisor. |

This product supplement relates only to MITTS and does not relate to any equity index that comprises the Market Measure described in any term sheet. You should read carefully the entire prospectus, prospectus supplement, and product supplement, together with the applicable term sheet, to understand fully the terms of your MITTS, as well as the tax and other considerations important to you in making a decision about whether to invest in any MITTS. In particular, you should review carefully the sections in this product supplement and the accompanying prospectus supplement entitled “Risk Factors,” which highlight a number of risks of an investment in MITTS, to determine whether an investment in MITTS is appropriate for you. If information in this product supplement is inconsistent with the prospectus or prospectus supplement, this product supplement will supersede those documents. However, if information in any term sheet is inconsistent with this product supplement, that term sheet will supersede this product supplement.

None of us, the agents, or our respective affiliates is making an offer to sell MITTS in any jurisdiction where the offer or sale is not permitted.

Certain capitalized terms used and not defined in this product supplement have the meanings ascribed to them in the prospectus supplement and prospectus. Unless otherwise indicated or unless the context requires otherwise, all references in this product supplement to “we,” “us,” “our,” or similar references are to HSBC USA Inc.

You are urged to consult with your own attorneys and business and tax advisors before making a decision to purchase any MITTS.

| PS-5 |

RISK FACTORS

You will be subject to significant risks not associated with conventional fixed-rate or floating-rate debt securities. You should understand the risks of investing in MITTS and should reach an investment decision only after careful consideration with your advisors with respect to MITTS in light of your particular financial and other circumstances and the information set forth in the relevant term sheet, this product supplement and the accompanying prospectus supplement and prospectus.

General Risks Relating to MITTS

You may not earn a return on your investment and, if the Minimum Redemption Amount is less than the principal amount, then your investment may result in a loss. The payment you will receive on the maturity date on your MITTS will depend on the direction of and percentage change in the value of the Market Measure to which your MITTS are linked. If the value of the Market Measure decreases from the Starting Value to the Ending Value, you will not receive any positive return on your MITTS, and if the Minimum Redemption Amount is less than the principal amount, your investment will result in a loss.

Your return on the MITTS may be less than the yield on a conventional fixed or floating rate debt security of comparable maturity. There will be no periodic interest payments on MITTS as there would be on a conventional fixed-rate or floating-rate debt security having the same maturity. Any return that you receive on MITTS may be less than the return you would earn if you purchased a conventional debt security with the same maturity date. As a result, your investment in MITTS may not reflect the full opportunity cost to you when you consider factors, such as inflation, that affect the time value of money.

Your investment return, if any, will be limited to the return represented by the Capped Value, if applicable, and may be less than a comparable investment directly in the Market Measure. If specified in the applicable term sheet, the appreciation potential of MITTS will be limited to the Capped Value. In such a case, you will not receive a Redemption Amount greater than the Capped Value, regardless of the appreciation of the Market Measure. In contrast, a direct investment in the Market Measure (or the securities included in the Market Measure) would allow you to receive the full benefit of any appreciation in the value of the Market Measure (or those underlying securities).

In addition, unless otherwise set forth in the applicable term sheet, the Ending Value will not reflect the value of dividends paid, or distributions made, on the securities included in the Market Measure or any other rights associated with those securities. Thus, any return on MITTS will not reflect the return you would realize if you actually owned the securities underlying the Market Measure.

Additionally, the Market Measure may consist of one or more equity indices that include components traded in a non-U.S. currency. If the value of that currency strengthens against the U.S. dollar during the term of your MITTS, you may not obtain the benefit of that increase, which you would have received if you had owned the securities included in the index or indices.

Payments on MITTS are subject to our credit risk, and actual or perceived changes in our creditworthiness are expected to affect the value of MITTS. MITTS are senior unsecured debt obligations of the Issuer, and are not, either directly or indirectly, an obligation of any third party. As further described in the accompanying prospectus supplement and prospectus, MITTS will rank on par with all of the other unsecured and

| PS-6 |

unsubordinated debt obligations of HSBC. Any payment to be made on MITTS, including any return of principal at maturity, depends on the ability of HSBC to satisfy its obligations as they become due. As a result, the actual and perceived creditworthiness of HSBC may affect the market value of MITTS and, in the event HSBC were to default on its obligations, you may not receive the amounts owed to you under the terms of MITTS. Because your return on MITTS depends upon factors in addition to HSBC’s ability to pay its obligations, such as the value of the applicable Market Measure, an improvement in HSBC’s credit ratings will not reduce the other investment risks related to MITTS.

The estimated initial value of the MITTS will be less than the public offering price and may differ from the market value of the MITTS in the secondary market, if any. We will determine the estimated initial value of the MITTS, which will be set forth in the applicable term sheet, by reference to our or our affiliates’ internal pricing models. These pricing models consider certain assumptions and variables, which can include volatility and interest rates. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. Different pricing models and assumptions could provide valuations for the MITTS that are different from our estimated initial value. The estimated initial value will reflect the implied borrowing rate we use to issue market-linked notes, as well as the mid-market value of the hedging arrangements related to the MITTS (which may include call options, put options or other derivatives).

Our implied borrowing rate for the issuance of these MITTS is lower than the rate we would use when we issue conventional fixed or floating rate debt securities. This is one of the factors that may result in the market value of the MITTS being less than their estimated initial value. As a result of the difference between our implied borrowing rate and the rate we would use when we issue conventional fixed or floating rate debt securities, the estimated initial value of the MITTS may be lower if it were based on the levels at which our fixed or floating rate debt securities trade in the secondary market. In addition, if we were to use the rate we use for our conventional fixed or floating rate debt issuances, we would expect the economic terms of the MITTS to be more favorable to you.

The price of your MITTS in the secondary market, if any, immediately after the pricing date will be less than the public offering price. The public offering price takes into account certain costs, principally the underwriting discount, the expected hedging costs described in the applicable term sheet, and the costs associated with issuing the MITTS. The costs associated with issuing the MITTS will be used or retained by us or one of our affiliates. If you were to sell your MITTS in the secondary market, if any, the price you would receive for your MITTS may be less than the price you paid for them.

The estimated initial value does not represent a minimum price at which we, MLPF&S or any of our respective affiliates would be willing to purchase your MITTS in the secondary market (if any exists) at any time. The price of your MITTS in the secondary market, if any, at any time after issuance will vary based on many factors, including the value of the Market Measure and changes in market conditions, and cannot be predicted with accuracy. The MITTS are not designed to be short-term trading instruments, and you should, therefore, be able and willing to hold the MITTS to maturity. Any sale of the MITTS prior to maturity could result in a loss to you.

We cannot assure you that there will

be a trading market for your MITTS. If a secondary market exists, we cannot predict how the MITTS will trade, or whether that

market will be liquid or illiquid. The development of a trading market for MITTS will depend on various factors, including our

financial performance and changes in the value of the Market Measure. The number of potential buyers of your MITTS in any secondary

market may be limited. There

| PS-7 |

is no assurance that any party will be willing to purchase your MITTS at any price in any secondary market.

We anticipate that one or more of the agents will act as a market-maker for MITTS that it offers, but none of them is required to do so and may cease to do so at any time. Any price at which an agent may bid for, offer, purchase, or sell any MITTS may be higher or lower than the applicable public offering price, and that price may differ from the values determined by pricing models that it may use, whether as a result of dealer discounts, mark-ups, or other transaction costs. These bids, offers, or transactions may affect the prices, if any, at which those MITTS might otherwise trade in the market. In addition, if at any time any agent were to cease acting as a market-maker for any issue of MITTS, it is likely that there would be significantly less liquidity in that secondary market. In such a case, the price at which those MITTS could be sold likely would be lower than if an active market existed.

Unless otherwise stated in the term sheet, we will not list MITTS on any securities exchange. Even if an application were made to list your MITTS, we cannot assure you that the application will be approved or that your MITTS will be listed and, if listed, that they will remain listed for their entire term. The listing of MITTS on any securities exchange will not necessarily ensure that a trading market will develop, and if a trading market does develop, that there will be liquidity in the trading market.

The Redemption Amount will not reflect changes in the value of the Market Measure that occur prior to the Maturity Valuation Period. Changes in the value of the Market Measure during the term of MITTS before the Maturity Valuation Period will not be reflected in the calculation of the Redemption Amount. To calculate the Redemption Amount, the calculation agent will compare only the Ending Value to the Starting Value. No other values of the Market Measure will be taken into account. As a result, even if the value of the Market Measure has increased at certain times during the term of the MITTS, you may receive a Redemption Amount that, depending on the Minimum Redemption Amount, is less than the principal amount if the Ending Value is less than the Starting Value.

If your MITTS are linked to a Basket, changes in the levels of one or more of the Basket Components may be offset by changes in the levels of one or more of the other Basket Components. The Market Measure of your MITTS may be a Basket. In such a case, changes in the levels of one or more of the Basket Components may not correlate with changes in the levels of one or more of the other Basket Components. The levels of one or more Basket Components may increase, while the levels of one or more of the other Basket Components may decrease or not increase as much. Therefore, in calculating the value of the Market Measure at any time, increases in the level of one Basket Component may be moderated or wholly offset by decreases or lesser increases in the levels of one or more of the other Basket Components. If the weightings of the applicable Basket Components are not equal, adverse changes in the levels of the Basket Components which are more heavily weighted could have a greater impact upon your MITTS.

The respective publishers of the applicable

indices may adjust those indices in a way that affects their levels, and these publishers have no obligation to consider your interests.

The publisher of each index to which your MITTS are linked (each, an “Index Publisher”)

can add, delete, or substitute the components included in that index or make other methodological changes that could change its

level. A new security included in an index may perform significantly better or worse than the replaced security, and the performance

will impact the level of the applicable index. Additionally, an Index Publisher may alter, discontinue, or suspend calculation

or dissemination of an index. Any of these actions could

| PS-8 |

adversely affect the value of your MITTS. The Index Publishers will have

no obligation to consider your interests in calculating or revising any index.

Exchange rate movements may impact the value of MITTS. If any security included in a Market Measure is traded in a currency other than U.S. dollars and, for purposes of the applicable index, is converted into U.S. dollars, then the Redemption Amount may depend in part on the relevant exchange rates. If the value of the U.S. dollar increases against the currencies of that index, the level of the applicable index may be adversely affected and the Redemption Amount may be reduced. Exchange rate movements may be particularly impacted by existing and expected rates of inflation and interest rate levels, the balance of payments, and the extent of governmental surpluses or deficits in the countries relevant to the applicable index and the United States. All of these factors are in turn sensitive to the monetary, fiscal, and trade policies pursued by the governments of those countries and the United States and other countries important to international trade and finance.

If you attempt to sell MITTS prior to maturity, their market value, if any, will be affected by various factors that interrelate in complex ways, and their market value may be less than the principal amount, and the Minimum Redemption Amount. The limited protection against the risk of losses provided by the Minimum Redemption Amount will only apply if you hold MITTS to maturity. You have no right to have your MITTS redeemed prior to maturity. If you wish to liquidate your investment in MITTS prior to maturity, your only option would be to sell them. At that time, there may be an illiquid market for your MITTS or no market at all. Even if you were able to sell your MITTS, there are many factors outside of our control that may affect their market value, some of which, but not all, are stated below. The impact of any one factor may be offset or magnified by the effect of another factor. The following paragraphs describe a specific factor’s expected impact on the market value of MITTS, assuming all other conditions remain constant.

| · | Value of the Market Measure. We anticipate that the market value of MITTS prior to maturity generally will depend to a significant extent on the applicable Market Measure. In general, it is expected that the market value of MITTS will decrease as the value of the Market Measure decreases, and increase as the value of the Market Measure increases. However, as the value of the Market Measure increases or decreases, the market value of MITTS is not expected to increase or decrease at the same rate. If you sell your MITTS when the value of the Market Measure is less than, or not sufficiently above the applicable Starting Value, then you may receive less than the principal amount and the Minimum Redemption Amount of your MITTS. |

In addition, if a Capped Value is specified in the applicable term sheet, because the Redemption Amount will not exceed that Capped Value, we do not expect that the MITTS will trade in any secondary market at a price that is greater than the Capped Value.

| · | Volatility of the Market Measure. Volatility is the term used to describe the size and frequency of market fluctuations. Increases or decreases in the volatility of the Market Measure may have an adverse impact on the market value of MITTS. Even if the value of the Market Measure increases after the applicable pricing date, if you are able to sell your MITTS before their maturity date, you may receive substantially less than the amount that would be payable at maturity based on that value because of the anticipation that the value of the Market Measure will continue to fluctuate until the Ending Value is determined. |

| · | Economic and Other Conditions Generally. The general economic conditions of the capital markets in the United States, as well as geopolitical conditions and other |

| PS-9 |

| financial, political, regulatory, and judicial events and related uncertainties that affect stock markets generally, may affect the value of the Market Measure and the market value of MITTS. If the Market Measure includes one or more indices that have returns that are calculated based upon securities prices in one or more non-U.S. markets (a “non-U.S. Market Measure”), the value of your MITTS may also be affected by similar events in the markets of the relevant foreign countries. |

| · | Interest Rates. We expect that changes in interest rates will affect the market value of MITTS. In general, if U.S. interest rates increase, we expect that the market value of MITTS will decrease, and conversely, if U.S. interest rates decrease, we expect that the market value of MITTS will increase. In general, we expect that the longer the amount of time that remains until maturity, the more significant the impact of these changes will be on the value of the MITTS. In the case of non-U.S. Market Measures, the level of interest rates in the relevant foreign countries may also affect their economies and in turn the value of the non-U.S. Market Measure, and, thus, the market value of the MITTS may be adversely affected. |

| · | Dividend Yields. In general, if cumulative dividend yields on the securities included in the Market Measure increase, we anticipate that the market value of MITTS will decrease; conversely, if those dividend yields decrease, we anticipate that the market value of your MITTS will increase. |

| · | Exchange Rate Movements and Volatility. If the Market Measure of your MITTS includes any non-U.S. Market Measures, changes in, and the volatility of, the exchange rates between the U.S. dollar and the relevant non-U.S. currency or currencies could have a negative impact on the value of your MITTS, and the Redemption Amount may depend in part on the relevant exchange rates. In addition, the correlation between the relevant exchange rate and any applicable non-U.S. Market Measure reflects the extent to which a percentage change in that exchange rate corresponds to a percentage change in the applicable non-U.S. Market Measure, and changes in these correlations may have a negative impact on the value of your MITTS. |

| · | Our Financial Condition and Creditworthiness. Our perceived creditworthiness, including any increases in the spread between the yield on our securities and the yield on U.S. Treasury securities (the “credit spread”) and any actual or anticipated decreases in our credit ratings, may adversely affect the market value of the MITTS. In general, we expect the longer the amount of time that remains until maturity, the more significant the impact will be on the value of the MITTS. However, a decrease in our credit spreads or an improvement in our credit ratings will not necessarily increase the market value of MITTS. |

| · | Time to Maturity. There may be a disparity between the market value of the MITTS prior to maturity and their value at maturity. This disparity is often called a time “value,” “premium,” or “discount,” and reflects expectations concerning the value of the Market Measure prior to the maturity date. As the time to maturity decreases, this disparity will likely decrease, such that the value of the MITTS will approach the expected Redemption Amount to be paid at maturity. |

Trading

and hedging activities by us, the agents, and our respective affiliates may affect your return on

the MITTS and their market value. We, the agents, and our respective affiliates may buy or sell the securities included in

the Market Measure, or futures or options contracts on the Market Measure or its component securities. We may execute such purchases

or sales for our own or their own accounts, for business reasons, or in connection

| PS-10 |

with hedging our obligations under MITTS. These transactions could affect the value of these securities

and, in turn, the value of a Market Measure in a manner that could be adverse to your investment in MITTS. On or before the applicable

pricing date, any purchases or sales by us, the agents, and our respective affiliates, or others on our or their behalf may increase

the value of a Market Measure or its component securities. Consequently, the values of that Market Measure or the securities included

in that Market Measure may decrease subsequent to the pricing date of an issue of MITTS, adversely affecting the market value

of MITTS.

We, the agents, or one or more of our respective affiliates may also engage in hedging activities that could increase the value of the Market Measure on the applicable pricing date. In addition, these activities may decrease the market value of your MITTS prior to maturity, including during the Maturity Valuation Period, and may affect the Redemption Amount. We, the agents, or one or more of our respective affiliates may purchase or otherwise acquire a long or short position in MITTS, and may hold or resell MITTS. For example, the agents may enter into these transactions in connection with any market making activities in which they engage. We cannot assure you that these activities will not adversely affect the value of the Market Measure or the market value of your MITTS prior to maturity or the Redemption Amount.

Our trading, hedging and other business activities, and those of the agents, may create conflicts of interest with you. We, the agents, or one or more of our respective affiliates may engage in trading activities related to the Market Measure and to securities included in the Market Measure that are not for your account or on your behalf. We, the agents, or one or more of our respective affiliates also may issue or underwrite other financial instruments with returns based upon the applicable Market Measure. These trading and other business activities may present a conflict of interest between your interest in MITS and the interests we, the agents, and our respective affiliates may have in our proprietary accounts, in facilitating transactions, including block trades, for our or their other customers, and in accounts under our or their management. These trading and other business activities, if they influence the value of the Market Measure or secondary trading in your MITTS, could be adverse to your interests as a beneficial owner of the MITTS.

We, the agents, and our respective affiliates expect to enter into arrangements or adjust or close out existing transactions to hedge our obligations under the MITTS. We, the agents, or our respective affiliates also may enter into hedging transactions relating to other notes or instruments that we or they issue, some of which may have returns calculated in a manner related to that of a particular issue of MITTS. We may enter into such hedging arrangements with one or more of our subsidiaries or affiliates, or with one or more of the agents or their affiliates. Such a party may enter into additional hedging transactions with other parties relating to MITTS and the applicable Market Measure. This hedging activity is expected to result in a profit to those engaging in the hedging activity, which could be more or less than initially expected, or the hedging activity could also result in a loss. We, the agents, and our respective affiliates will price these hedging transactions with the intent to realize a profit, regardless of whether the value of MITTS increases or decreases.

There may be potential conflicts of interest

involving the calculation agent. We may appoint and remove the calculation agent. We or one of our affiliates may be the calculation

agent or act as joint calculation agent for MITTS and, as such, will determine the Starting Value, the Ending Value, and the Redemption

Amount. Under some circumstances, these duties could result in a conflict of interest between our status as Issuer and our responsibilities

as calculation agent. These conflicts could occur, for instance, in connection with the calculation agent’s determination

as to whether a Market Disruption Event has occurred, or in connection with judgments that the calculation agent would be required

to make if the publication of an index is discontinued. See the sections entitled “Description of

| PS-11 |

MITTS—Market Disruption

Events,” “—Adjustments to an Index,” and “—Discontinuance of an Index.” The calculation

agent will be required to carry out its duties in good faith and use its reasonable judgment. However, because we may serve as

the calculation agent, potential conflicts of interest could arise.

In addition, we may appoint MLPF&S or one of its affiliates to act as the calculation agent or as joint calculation agent for MITTS. As the calculation agent or joint calculation agent, MLPF&S or one of its affiliates will have discretion in making various determinations that affect your MITTS. The exercise of this discretion by the calculation agent could adversely affect the value of your MITTS and may present the calculation agent with a conflict of interest of the kind described under “—Trading and hedging activities by us, the agents, and our respective affiliates may affect your return on the MITTS and their market value” and “—Our trading, hedging and other business activities, and those of the agents, may create conflicts of interest with you” above.

MITTS are not insured or guaranteed by any governmental agency of the United States or any other jurisdiction. MITTS are not deposit liabilities or other obligations of a bank and are not insured or guaranteed by the FDIC or any other governmental agency or program of the United States or any other jurisdiction. An investment in MITTS is subject to the credit risk of HSBC, and in the event that HSBC is unable to pay its obligations as they become due, you may not receive the full payments due on the MITTS.

You may be required to include income on MITTS over their term for tax purposes, even though you will not receive any payments until maturity. MITTS are considered to be issued with original issue discount. You will be required to include income on MITTS over their term based upon a comparable yield, even though you will not receive any payments until maturity. You are urged to review the section entitled “U.S. Federal Income Tax Summary” and consult your own tax advisor.

The U.S. federal income tax consequences of an investment in MITTS are uncertain, and may be adverse to a holder of MITTS. No statutory, judicial, or administrative authority directly addresses the characterization of MITTS or securities similar to MITTS for U.S. federal income tax purposes. As a result, significant aspects of the U.S. federal income tax consequences of an investment in MITTS are not certain. We intend to treat MITTS as debt instruments for U.S. federal income tax purposes. Accordingly, you should consider the tax consequences of investing in MITTS, aspects of which are uncertain. See the section entitled “U.S. Federal Income Tax Summary.”

You are urged to consult with your own tax advisor regarding all aspects of the U.S. federal income tax consequences of investing in MITTS.

Risks Relating to the Market Measures

You must rely on your own evaluation of the merits of an investment linked to the applicable Market Measure. In the ordinary course of their businesses, we, the agents, and our respective affiliates may have expressed views on expected movements in a Market Measure or the securities included in the Market Measure, and may do so in the future. These views or reports may be communicated to our clients and clients of these entities. However, these views are subject to change from time to time. Moreover, other professionals who deal in markets relating to a Market Measure may at any time have significantly different views from our views and the views of these entities. For these reasons, you are encouraged to derive information concerning a Market Measure and its component securities from multiple sources, and you should not rely on our views or the views expressed by these entities.

| PS-12 |

You will have no rights as a security holder, you will have no rights to receive any of the securities represented by the Market Measure, and you will not be entitled to dividends or other distributions by the issuers of these securities. MITTS are our debt securities. They are not equity instruments, shares of stock, or securities of any other issuer. Investing in MITTS will not make you a holder of any of the securities represented by the Market Measure. You will not have any voting rights, any rights to receive dividends or other distributions, or any other rights with respect to those securities. As a result, the return on your MITTS may not reflect the return you would realize if you actually owned those securities and received the dividends paid or other distributions made in connection with them. Additionally, the levels of certain indices reflect only the prices of the securities included in that index and do not take into consideration the value of dividends paid on those securities. Your MITTS will be paid in cash and you have no right to receive delivery of any of these securities.

If the Market Measure to which your MITTS are linked includes equity securities traded on foreign exchanges, your return may be affected by factors affecting international securities markets. The value of securities traded outside of the U.S. may be adversely affected by a variety of factors relating to the relevant securities markets. Factors which could affect those markets, and therefore the return on your MITTS, include:

| · | Market Volatility. The relevant foreign securities markets may be more volatile than U.S. or other securities markets and may be affected by market developments in different ways than U.S. or other securities markets. |

| · | Political, Economic, and Other Factors. The prices and performance of securities of companies in foreign countries may be affected by political, economic, financial, and social factors in those regions. Direct or indirect government intervention to stabilize a particular securities market and cross-shareholdings in companies in the relevant foreign markets may affect prices and the volume of trading in those markets. In addition, recent or future changes in government, economic, and fiscal policies in the relevant jurisdictions, the possible imposition of, or changes in, currency exchange laws, or other laws or restrictions, and possible fluctuations in the rate of exchange between currencies, are factors that could negatively affect the relevant securities markets. The relevant foreign economies may differ favorably or unfavorably from the U.S. economy in economic factors such as growth of gross national product, rate of inflation, capital reinvestment, resources, and self-sufficiency. |

In particular, many emerging nations are undergoing rapid change, involving the restructuring of economic, political, financial and legal systems. Regulatory and tax environments may be subject to change without review or appeal, and many emerging markets suffer from underdevelopment of capital markets and tax systems. In addition, in some of these nations, issuers of the relevant securities face the threat of expropriation of their assets, and/or nationalization of their businesses. The economic and financial data about some of these countries may be unreliable.

| · | Publicly Available Information. There is generally less publicly available information about foreign companies than about U.S. companies that are subject to the reporting requirements of the SEC. In addition, accounting, auditing, and financial reporting standards and requirements in foreign countries differ from those applicable to U.S. reporting companies. |

Unless otherwise set forth in the applicable

term sheet, we and the agents do not control any company included in any Market Measure and are not responsible for any disclosure

made by any other company. We, the agents, or our respective affiliates

| PS-13 |

currently, or in the future, may engage in business

with companies included in a Market Measure, and we, the agents, or our respective affiliates may from time to time own securities

of companies included in a Market Measure. However, none of us, the agents, or any of our respective affiliates have the ability

to control the actions of any of these companies or have undertaken any independent review of, or made any due diligence inquiry

with respect to, any of these companies, unless (and only to the extent that) the securities of us, the agents, or our respective

affiliates are represented by that Market Measure. In addition, unless otherwise set forth in the applicable term sheet, none

of us, the agents, or any of our respective affiliates are responsible for the calculation of any index represented by a Market

Measure. You should make your own investigation into the Market Measure.

Unless otherwise set forth in the applicable term sheet, none of the Index Publishers, their affiliates, or any companies included in the Market Measure will be involved in any offering of MITTS or will have any obligation of any sort with respect to MITTS. As a result, none of those companies will have any obligation to take your interests as holders of MITTS into consideration for any reason, including taking any corporate actions that might affect the value of the securities represented by the Market Measure or the value of MITTS.

Our business activities and those of the agents relating to the companies represented by a Market Measure may create conflicts of interest with you. We, the agents, and our respective affiliates, at the time of any offering of MITTS or in the future, may engage in business with the companies represented by the Market Measure, including making loans to, equity investments in, or providing investment banking, asset management, or other services to those companies, their affiliates, and their competitors.

In connection with these activities, any of these entities may receive information about those companies that we will not divulge to you or other third parties. We, the agents, and our respective affiliates have published, and in the future may publish, research reports on one or more of these companies. This research is modified from time to time without notice and may express opinions or provide recommendations that are inconsistent with purchasing or holding your MITTS. Any of these activities may affect the value of the Market Measure and, consequently, the market value of your MITTS. None of us, the agents, or our respective affiliates makes any representation to any purchasers of the MITTS regarding any matters whatsoever relating to the issuers of the securities included in a Market Measure. Any prospective purchaser of the MITTS should undertake an independent investigation of the companies included in the Market Measure to a level that, in its judgment, is appropriate to make an informed decision regarding an investment in the MITTS. The composition of the Market Measure does not reflect any investment recommendations from us, the agents, or our respective affiliates.

Other Risk Factors Relating to the Applicable Market Measure

The applicable term sheet may set forth additional risk factors as to the Market Measure that you should review prior to purchasing MITTS.

| PS-14 |

USE OF PROCEEDS

We will use the net proceeds we receive from each sale of MITTS for the purposes described in the accompanying prospectus supplement under “Use of Proceeds and Hedging.” In addition, we expect that we or our affiliates may use a portion of the net proceeds to hedge our obligations under MITTS.

| PS-15 |

DESCRIPTION OF MITTS

General

Each issue of MITTS will be part of a series of notes entitled “Notes, Series 1” that will be issued under the Senior Indenture, as amended and supplemented from time to time. The Senior Indenture is described more fully in the prospectus and prospectus supplement. The following description of MITTS supplements and, to the extent it is inconsistent with, supersedes the description of the general terms and provisions of the notes and debt securities set forth under the headings “Description of Notes” in the prospectus supplement and “Description of Debt Securities” in the prospectus. These documents should be read in connection with the applicable term sheet.

The maturity date of the MITTS and the aggregate principal amount of each issue of MITTS will be stated in the term sheet.

We will not pay interest on MITTS. Depending on the terms of the MITTS, they may not guarantee the full return of principal at maturity. MITTS will be payable only in U.S. dollars.

Prior to the maturity date, MITTS are not redeemable by us or repayable at the option of any holder. MITTS are not subject to any sinking fund.

We will issue MITTS in denominations of whole units. Unless otherwise set forth in the applicable term sheet, each unit will have a principal amount of $10. The CUSIP number for each issue of MITTS will be set forth in the applicable term sheet. You may transfer MITTS only in whole units.

Payment at Maturity

At maturity, subject to our credit risk as Issuer of MITTS, you will receive a Redemption Amount, denominated in U.S. dollars. The “Redemption Amount” will be calculated as follows:

| · | If the Ending Value is greater than the Starting Value, then the Redemption Amount will equal: |

If so specified in the applicable term sheet, the Redemption Amount will not exceed a “Capped Value” set forth in the term sheet.

| · | If the Ending Value is equal to or less than the Starting Value, then the Redemption Amount will equal: |

The Redemption Amount will not be less than the Minimum Redemption Amount per unit.

| PS-16 |

The “Participation Rate” will be equal to or greater than 100%, unless otherwise set forth in the applicable term sheet.

The “Minimum Redemption Amount” may be less than or equal to the principal amount, as specified in the applicable term sheet. If the Minimum Redemption Amount is less than the principal amount and the Ending Value is less than the Starting Value, you will lose a portion of your investment in MITTS.

Each term sheet will provide examples of Redemption Amounts based on hypothetical Ending Values, and, if applicable, Capped Values.

The term sheet will set forth information as to the specific Market Measure, including information as to the historical values of the Market Measure. However, historical values of the Market Measure are not indicative of its future performance, or the performance of your MITTS.

An investment in MITTS does not entitle you to any ownership interest, including any voting rights, dividends paid, interest payments, or other distributions, in the securities of any of the companies included in a Market Measure.

The Starting Value and the Ending Value

Starting Value

Unless otherwise specified in the term sheet, the “Starting Value” will equal the closing level of the Market Measure on the pricing date.

Ending Value

Unless otherwise specified in the term sheet, the “Ending Value” will equal the average of the closing levels of the Market Measure determined on each calculation day during the Maturity Valuation Period.

The “Maturity Valuation Period” means the period consisting of one or more calculation days shortly before the maturity date. The timing and length of the period will be set forth in the term sheet.

A “calculation day” means any Market Measure Business Day during the Maturity Valuation Period on which a Market Disruption Event has not occurred.

Unless otherwise specified in the applicable term sheet, a “Market Measure Business Day” means a day on which (1) the New York Stock Exchange (the “NYSE”) and The NASDAQ Stock Market (“NASDAQ”), or their successors, are open for trading and (2) the Market Measure or any successor is calculated and published.

If (i) a Market Disruption Event occurs

on a scheduled calculation day during the Maturity Valuation Period or (ii) any scheduled calculation day is determined by the

calculation agent not to be a Market Measure Business Day by reason of an extraordinary event, occurrence, declaration, or otherwise

(any such day in either (i) or (ii) being a “non-calculation day”), the closing level of the Market Measure

for the applicable non-calculation day will be the closing level of the Market Measure on the next calculation day that occurs

during the Maturity Valuation Period. For example, if the first and second scheduled calculation days during the Maturity Valuation

Period are non-calculation days, then the closing level of the Market Measure on the next calculation day will also be the closing

level for the Market Measure on

| PS-17 |

the first and second scheduled calculation days during the Maturity Valuation Period. If no further

calculation days occur after a non-calculation day, or if every scheduled calculation day during the Maturity Valuation Period

is a non-calculation day, then the closing level of the Market Measure for each following non-calculation day (or for all the scheduled

calculation days during the Maturity Valuation Period, if applicable) will be determined (or, if not determinable, estimated) by

the calculation agent in a commercially reasonable manner on the last scheduled calculation day during the Maturity Valuation Period,

regardless of the occurrence of a Market Disruption Event on that last scheduled calculation day.

If the Market Measure consists of a Basket, the Starting Value and the Ending Value of the Basket will be determined as described in “—Basket Market Measures.”

Market Disruption Events

For an index, a “Market Disruption Event” means any of the following events, as determined by the calculation agent in its sole discretion:

| (A) | the suspension of or material limitation on trading, in each case, for more than two consecutive hours of trading, or during the one-half hour period preceding the close of trading, on the primary exchange where the securities included in an index trade (without taking into account any extended or after-hours trading session), in 20% or more of the securities which then comprise the index or any successor index; and | |

|

(B) |

the suspension of or material limitation on trading, in each case, for more than two consecutive hours of trading, or during the one-half hour period preceding the close of trading, on the primary exchange that trades options contracts or futures contracts related to the index (without taking into account any extended or after-hours trading session), whether by reason of movements in price otherwise exceeding levels permitted by the relevant exchange or otherwise, in options contracts or futures contracts related to the index, or any successor index. |

For the purpose of determining whether a Market Disruption Event has occurred:

| (1) | a limitation on the hours in a trading day and/or number of days of trading will not constitute a Market Disruption Event if it results from an announced change in the regular business hours of the relevant exchange; | |

| (2) | a decision to permanently discontinue trading in the relevant futures or options contracts related to the index, or any successor index, will not constitute a Market Disruption Event; | |

| (3) | a suspension in trading in a futures or options contract on the index, or any successor index, by a major securities market by reason of (a) a price change violating limits set by that securities market, (b) an imbalance of orders relating to those contracts, or (c) a disparity in bid and ask quotes relating to those contracts will constitute a suspension of or material limitation on trading in futures or options contracts related to the index; | |

| (4) | a suspension of or material limitation on trading on the relevant exchange will not include any time when that exchange is closed for trading under ordinary circumstances; and | |

| (5) | if applicable to indices with component securities listed on the NYSE, for the purpose of clause (A) above, any limitations on trading during significant market |

| PS-18 |

| fluctuations under NYSE Rule 80B, or any applicable rule or regulation enacted or promulgated by the NYSE or any other self-regulatory organization or the SEC of similar scope as determined by the calculation agent, will be considered “material.” |

Adjustments to an Index

After the applicable pricing date, an Index Publisher may make a material change in the method of calculating an index or in another way that changes the index such that it does not, in the opinion of the calculation agent, fairly represent the level of the index had those changes or modifications not been made. In this case, the calculation agent will, at the close of business in New York, New York, on each date that the closing level is to be calculated, make adjustments to the index. Those adjustments will be made in good faith as necessary to arrive at a calculation of a level of the index as if those changes or modifications had not been made, and calculate the closing level of the index, as so adjusted.

Discontinuance of an Index

After the pricing date, an Index Publisher may discontinue publication of an index to which an issue of MITTS is linked. The Index Publisher or another entity may then publish a substitute index that the calculation agent determines, in its sole discretion, to be comparable to the original index (a “successor index”). If this occurs, the calculation agent will substitute the successor index as calculated by the relevant Index Publisher or any other entity and calculate the Ending Value as described under “—The Starting Value and the Ending Value” or “—Basket Market Measure,” as applicable. If the calculation agent selects a successor index, the calculation agent will give written notice of the selection to the trustee, to us, and to the holders of the MITTS.

If an Index Publisher discontinues publication of the index before the end of the Maturity Valuation Period and the calculation agent does not select a successor index, then on each day that would have been a calculation day, until the earlier to occur of:

| • | the determination of the Ending Value; and | ||

| • | a determination by the calculation agent that a successor index is available, |

the calculation agent will compute a substitute level for the index in accordance with the procedures last used to calculate the index before any discontinuance as if that day were a calculation day. The calculation agent will make available to holders of the MITTS information regarding those levels by means of Bloomberg L.P., Thomson Reuters, a website, or any other means selected by the calculation agent in its reasonable discretion.

If a successor index is selected or the calculation agent calculates a level as a substitute for an index, the successor index or level will be used as a substitute for all purposes, including for the purpose of determining whether a Market Disruption Event exists.

Notwithstanding these alternative arrangements, any modification or discontinuance of the publication of any index to which your MITTS are linked may adversely affect trading in the MITTS.

Basket Market Measures

If the Market Measure to which your MITTS are linked is a Basket, the Basket Components will be set forth in the term sheet. We will assign each Basket Component a weighting (the “Initial Component Weight”) so that each Basket Component represents a

| PS-19 |

percentage of the Starting Value

of the Basket on the pricing date. We may assign the Basket Components equal Initial Component Weights, or we may assign the Basket

Components unequal Initial Component Weights. The Initial Component Weight for each Basket Component will be stated in the term

sheet.

Determination of the Component Ratio for Each Basket Component

The “Starting Value” of the Basket will be equal to 100. We will set a fixed factor (the “Component Ratio”) for each Basket Component on the pricing date, based upon the weighting of that Basket Component. The Component Ratio for each Basket Component will be calculated on the pricing date and will equal:

| · | the Initial Component Weight (expressed as a percentage) for that Basket Component, multiplied by 100; divided by |

| · | the closing level of that Basket Component on the pricing date. |

Each Component Ratio will be rounded to eight decimal places.

The Component Ratios will be calculated in this way so that the Starting Value of the Basket will equal 100 on the pricing date. The Component Ratios will not be revised subsequent to their determination on the pricing date, except that the calculation agent may in its good faith judgment adjust the Component Ratio of any Basket Component in the event that Basket Component is materially changed or modified in a manner that does not, in the opinion of the calculation agent, fairly represent the value of that Basket Component had those material changes or modifications not been made.

The following table is for illustration purposes only, and does not reflect the actual composition, Initial Component Weights, or Component Ratios, which will be set forth in the term sheet.

Example: The hypothetical Basket Components are Index ABC, Index XYZ, and Index RST, with their Initial Component Weights being 50.00%, 25.00% and 25.00%, respectively, on a hypothetical pricing date:

|

Basket Component |

Initial

Component |

Hypothetical

Closing |

Hypothetical |

Initial Basket |

| Index ABC | 50.00% | 500.00 | 0.10000000 | 50.00 |

| Index XYZ | 25.00% | 2,420.00 | 0.01033058 | 25.00 |

| Index RST | 25.00% | 1,014.00 | 0.02465483 | 25.00 |

| Starting Value | 100.00 | |||

| (1) | This column sets forth the hypothetical closing level of each Basket Component on the hypothetical pricing date. |

| (2) | The hypothetical Component Ratio equals the Initial Component Weight (expressed as a percentage) of each Basket Component multiplied by 100, and then divided by the closing |

| PS-20 |

| level of that Basket Component on the hypothetical pricing date, with the result rounded to eight decimal places. |

Unless otherwise stated in the term sheet, if a Market Disruption Event occurs on the pricing date as to any Basket Component, the calculation agent will establish the closing level of that Basket Component (the “Basket Component Closing Level”), and thus its Component Ratio, based on the closing level of that Basket Component on the first Market Measure Business Day following the pricing date on which no Market Disruption Event occurs for that Basket Component. In the event that a Market Disruption Event occurs for that Basket Component on the pricing date and on each day to and including the second scheduled Market Measure Business Day following the pricing date, the calculation agent (not later than the close of business in New York, New York on the second scheduled Market Measure Business Day following the pricing date) will estimate the Basket Component Closing Level, and thus the applicable Component Ratio, in a manner that the calculation agent considers commercially reasonable. The final term sheet will provide the Basket Component Closing Level, a brief statement of the facts relating to the establishment of the Basket Component Closing Level (including the applicable Market Disruption Event(s)), and the applicable Component Ratio.

For purposes of determining whether a Market Disruption Event has occurred as to any Basket Component, “Market Disruption Event” will have the meaning stated above in “—Market Disruption Events.”

Ending Value of the Basket

The calculation agent will calculate the value of the Basket by summing the products of the Basket Component Closing Level on a calculation day and the Component Ratio for each Basket Component. The value of the Basket will vary based on the increase or decrease in the level of each Basket Component. Any increase in the level of a Basket Component (assuming no change in the level of the other Basket Component or Basket Components) will result in an increase in the value of the Basket. Conversely, any decrease in the level of a Basket Component (assuming no change in the level of the other Basket Component or Basket Components) will result in a decrease in the value of the Basket.

The “Ending Value” of the Basket will be the average value of the Basket on each calculation day during the Maturity Valuation Period.

Unless otherwise specified in the term sheet, if, for any Basket Component (an “Affected Basket Component”), (i) a Market Disruption Event occurs on a scheduled calculation day during the Maturity Valuation Period or (ii) any scheduled calculation day is determined by the calculation agent not to be a Market Measure Business Day by reason of an extraordinary event, occurrence, declaration, or otherwise (any such day in either (i) or (ii) being a “non-calculation day”), the calculation agent will determine the value of the Basket Components for such non-calculation day, and as a result, the Ending Value, as follows:

| · | The closing level of each Basket Component that is not an Affected Basket Component will be its closing level on such non-calculation day. |

| · | The closing level of each Basket Component that is an Affected Basket Component for the applicable non-calculation day will be determined in the same manner as described in the fifth paragraph of subsection “—Ending Value,” provided that references to “Market Measure” will be references to “Basket Component.” |

| PS-21 |

Role of the Calculation Agent

The calculation agent has the sole discretion to make all determinations regarding MITTS as described in this product supplement, including determinations regarding the Starting Value, the Ending Value, the Market Measure, the Redemption Amount, any Market Disruption Events, a successor index, Market Measure Business Days, business days, calculation days, non-calculation days, and calculations related to the discontinuance of any index. Absent manifest error, all determinations of the calculation agent will be conclusive for all purposes and final and binding on you and us, without any liability on the part of the calculation agent.

We or one of our affiliates may act as the calculation agent, or we may appoint MLPF&S or one of its affiliates to act as the calculation agent for MITTS. Alternatively, we and MLPF&S or one of its affiliates may act as joint calculation agents for MITTS. When we refer to a “calculation agent” in this product supplement or in any term sheet, we are referring to the applicable calculation agent or joint calculation agents, as the case may be. We may change the calculation agent at any time without notifying you. The identity of the calculation agent will be set forth in the applicable term sheet.

Same-Day Settlement and Payment

MITTS will be delivered in book-entry form only through The Depository Trust Company against payment by purchasers of MITTS in immediately available funds. We will pay the Redemption Amount in immediately available funds so long as the MITTS are maintained in book-entry form.

Events of Default and Acceleration

Events of default are defined in the prospectus. If such event occurs and is continuing, unless otherwise stated in the term sheet, the amount payable to a holder of MITTS upon any acceleration permitted under the Senior Indenture will be equal to the Redemption Amount described under the caption “—Payment at Maturity,” determined as if the MITTS matured on the date of acceleration. If the MITTS have become immediately due and payable following an event of default, you will not be entitled to any additional payments with respect to MITTS. For more information, see “Description of Debt Securities — Senior Debt Securities — Events of Default” in the prospectus.

Listing

Unless otherwise specified in the applicable term sheet, the MITTS will not be listed on a securities exchange or quotation system.

| PS-22 |

SUPPLEMENTAL PLAN OF DISTRIBUTION

MLPF&S and one or more of its affiliates may act as our agents for any offering of the MITTS. The agents may act on either a principal basis or an agency basis, as set forth in the applicable term sheet. Each agent will be a party to a distribution agreement with us.

Each agent will receive an underwriting discount that is a percentage of the aggregate principal amount of MITTS sold through its efforts, which will be set forth in the applicable term sheet. You must have an account with the applicable agent in order to purchase MITTS.

None of the agents is acting as your fiduciary or advisor solely as a result of the making of any offering of the MITTS, and you should not rely upon this product supplement, the term sheet, or the accompanying prospectus or prospectus supplement as investment advice or a recommendation to purchase any MITTS. You should make your own investment decision regarding MITTS after consulting with your legal, tax, and other advisors.

We have agreed to indemnify the agents against certain liabilities, including liabilities under the Securities Act of 1933, or to contribute to payments made in respect of those liabilities. We have also agreed to reimburse the agents for specified expenses.

MLPF&S and its affiliates may use this product supplement, the prospectus supplement, and the prospectus, together with the applicable term sheet, in market-making transactions for any MITTS after their initial sale solely for the purpose of providing investors with the description of the terms of the MITTS that were made available to investors in connection with the initial distribution of the MITTS. Secondary market investors should not, and will not be authorized to rely on these documents for information regarding HSBC or for any purpose other than that described in the immediately preceding sentence.

Selling Restrictions

European Economic Area

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”), MLPF&S has represented and agreed that with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the “Relevant Implementation Date”) it has not made and will not make an offer of MITTS to the public in that Relevant Member State except that it may, with effect from and including the Relevant Implementation Date, make an offer of such MITTS to the public in that Relevant Member State:

| (a) | if an offer of those MITTS may be made other than pursuant to Article 3(2) of the Prospectus Directive in that Relevant Member State (a “Non-exempt Offer”), following the date of publication of a prospectus in relation to such MITTS which has been approved by the competent authority in that Relevant Member State or, where appropriate, approved in another Relevant Member State and notified to the competent authority in that Relevant Member State, provided that any such prospectus has subsequently been completed by the final offering document contemplating such Non-exempt Offer, in accordance with the Prospectus Directive, in the period beginning and ending on the dates specified in such prospectus or final offering document, as applicable, and the issuer has consented in writing to its use for the purpose of that Non-exempt Offer; |

| PS-23 |

| (b) | at any time to any legal entity which is a qualified investor as defined in the Prospectus Directive; |

| (c) | at any time to fewer than 100 or, if the Relevant Member State has implemented the relevant provision of the 2010 PD Amending Directive, 150, natural or legal persons (other than qualified investors as defined in the Prospectus Directive), subject to obtaining the prior consent of the relevant dealer or dealers nominated by the issuer for any such offer; or |

| (d) | at any time in any other circumstances falling within Article 3(2) of the Prospectus Directive, |

| (i) | provided that no such offer of MITTS referred to in (b) to (d) above shall require the issuer or any dealer to publish a prospectus pursuant to Article 3 of the Prospectus Directive or supplement a prospectus pursuant to Article 16 of the Prospectus Directive. |

For the purposes of this provision, the expression an “offer of MITTS to the public”, in relation to any MITTS in any Relevant Member State, means the communication in any form and by any means of sufficient information on the terms of the offer and the MITTS to be offered so as to enable an investor to decide to purchase or subscribe for the MITTS, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State, the expression “Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant implementing measure in the Relevant Member State, and the expression “2010 PD Amending Directive” means Directive 2010/73/EU.

United Kingdom

MLPF&S has represented and agreed that:

| (a) | in relation to any MITTS which have a maturity of less than one year, (i) it is a person whose ordinary activities involve it in acquiring, holding, managing, or disposing of investments (as principal or as agent) for the purposes of its business and (ii) it has not offered or sold and will not offer or sell any MITTS other than to persons whose ordinary activities involve them in acquiring, holding, managing, or disposing of investments (as principal or as agent) for the purposes of their businesses or who it is reasonable to expect will acquire, hold, manage, or dispose of investments (as principal or as agent) for the purposes of their businesses where the issue of MITTS would otherwise constitute a contravention of section 19 of the Financial Services and Markets Act 2000 (the “FSMA”) by the issuer; |

| (b) | it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of section 21 of the FSMA) received by it in connection with the issue or sale of any MITTS in circumstances in which section 21(1) of the FSMA does not apply to the issuer; and |

| (c) | it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to MITTS in, from or otherwise involving the United Kingdom. |

| PS-24 |

Argentina

MITTS are not and will not be marketed in Argentina by means of a public offer of securities, as such term is defined under Section 16 of Argentine Law No. 17, 811, as amended, as securities. No application has been or will be made with the Argentine Comision Nacional de Valores, the Argentine securities governmental authority, to offer MITTS in Argentina.

Brazil

The information contained in this product supplement and in the accompanying prospectus supplement and prospectus does not constitute a public offering or distribution of securities in Brazil and no registration or filing with respect to any securities or financial products described in these documents has been made with the Comissão de Valores Mobiliários (the “CVM”). No public offer of securities or financial products described in this product supplement or in the accompanying prospectus supplement and prospectus should be made in Brazil without the applicable registration at the CVM.

The People’s Republic of China

These offering documents have not been filed with or approved by the People’s Republic of China (for such purposes, not including Hong Kong and Macau Special Administrative Regions or Taiwan) authorities, and is not an offer of securities (whether public offering or private placement) within the meaning of the Securities Law or other pertinent laws and regulations of the People’s Republic of China. These offering documents shall not be offered to the general public if used within the People’s Republic of China, and MITTS so offered cannot be sold to anyone that is not a qualified purchaser of the People’s Republic of China. MLPF&S has represented, warranted and agreed that MITTS are not being offered or sold and may not be offered or sold, directly or indirectly, in the People’s Republic of China, except under circumstances that will result in compliance with applicable laws and regulations.

France

The offering documents have not been approved by the Autorité des marchés financiers (“AMF”).

Offers of MITTS (a) have only been made and will only be made to the public (offre au public) in France or an admission of MITTS to trading on a regulated market in France in the period beginning (i) when a prospectus in relation to those MITTS has been approved by the AMF, on the date of such publication or, (ii) when a prospectus in relation to those MITTS has been approved by the competent authority of another Member State of the European Economic Area which has implemented the EU Prospectus Directive 2003/71/EC, on the date of notification of such approval to the AMF and, in either case, when the formalities required by French laws and regulations have been carried out, and ending at the latest on the date which is 12 months after the date of the approval of the prospectus, all in accordance with articles L.412-1 and L.621-8 to L.621-8-3 of the French Code monétaire et financier and the Règlement général of the AMF, or (b) have only been made and will only be made to the public in France or an admission of MITTS to trading on a regulated market in France in circumstances which do not require the publication by the offeror of a prospectus pursuant to the French Code monétaire et financier and the Règlement général of the Autorité des marchés financiers.

| PS-25 |