|

Filed Pursuant to Rule 433 Registration No. 333-180289 February 20, 2013 FREE WRITING PROSPECTUS (To Prospectus dated March 22, 2012 and Prospectus Supplement dated March 22, 2012) |

| Structured Investments |

HSBC USA Inc. $ Knock-Out Buffer Notes Linked to the Performance of an Equally Weighted Basket of Three Currencies Relative to the U.S. Dollar due August 29, 2014 |

General

| · | Terms used in this free writing prospectus are described or defined herein, in the prospectus supplement and in the prospectus. The Notes will have the terms described herein and in the prospectus supplement and prospectus. The Notes do not guarantee any return of principal, and you may lose up to 100% of your initial investment. The Notes will not bear interest. |

| · | This free writing prospectus relates to a single note offering. The purchaser of a Note will acquire a security linked to the Basket described below. |

| · | Although the offering relates to a Basket, you should not construe that fact as a recommendation as to the merits of acquiring an investment linked to the Basket or any Basket Currency or as to the suitability of an investment in the Notes. |

| · | Senior unsecured debt obligations of HSBC USA Inc. maturing August 29, 2014. |

| · | Minimum denominations of $10,000 and integral multiples of $1,000 in excess thereof. |

| · | If the terms of the Notes set forth below are inconsistent with those described in the prospectus supplement and prospectus, the terms set forth below will supersede. |

| · | Any payment on the Notes is subject to the Issuer’s credit risk. |

Key Terms

| Issuer: | HSBC USA Inc. |

| Principal Amount: | $1,000 per Note. |

| Basket: | The Notes are linked to an equally weighted basket consisting of three currencies (each a “Basket Currency,” and together, the “Basket Currencies”) that measures the performance of each Basket Currency relative to the U.S. Dollar (the “Reference Currency”). |

| Basket Currency | Fixing Source | Initial Spot Rate | Currency Weighting |

| Brazilian real (“BRL”) | BRL at Reuters Page BRFR | 1/3 | |

| Chilean peso (“CLP”) | CLP at Reuters Page CLPOB= | 1/3 | |

| Mexican peso (“MXN”) | MXN at Reuters Page WMRSPOT01 | 1/3 |

| Knock-Out Event: | A Knock-Out Event occurs if on the Final Valuation Date the Basket has depreciated, compared to the Initial Basket Level, by a percentage that is more than the Knock-Out Buffer Amount. |

| Knock-Out Buffer Amount: | 15% |

| Contingent Minimum Return: | 8.15% |

| Trade Date: | February 22, 2013 |

| Pricing Date: | February 22, 2013 |

| Original Issue Date: | March 1, 2013 |

| Final Valuation Date: | August 22, 2014, subject to adjustment as described herein. |

| Maturity Date: | 5 business days after the Final Valuation Date, and expected to be August 29, 2014. The Maturity Date is subject to further adjustment as described under “Market Disruption Events” herein. |

| Basket Return: | The quotient, expressed as a percentage, calculated as follows: |

| Final Basket Level – Initial Basket Level | |

| Initial Basket Level | |

| Payment at Maturity: | If a Knock-Out Event has occurred, you will receive a cash payment on the Maturity Date that will reflect the performance of the Basket. Under these circumstances, your Payment at Maturity per $1,000 Principal Amount of Notes will be calculated as follows: |

| $1,000 + ($1,000 × Basket Return) | |

| If a Knock-Out Event has occurred, you will lose some or all of your investment. This means that if the Basket Return is -100%, you will lose your entire investment. | |

| If a Knock-Out Event has not occurred, you will receive a cash payment on the Maturity Date that will reflect the performance of the Basket, subject to the Contingent Minimum Return. If a Knock-Out Event has not occurred, your Payment at Maturity per $1,000 Principal Amount of Notes will equal $1,000 plus the product of (a) $1,000 multiplied by (b) the greater of (i) the Basket Return and (ii) the Contingent Minimum Return. For additional clarification, please see “What is the Total Return on the Notes at Maturity Assuming a Range of Performances for the Basket?” herein. | |

| Initial Basket Level: | Set equal to 100 on the Pricing Date. |

| Final Basket Level: | The level of the Basket on the Final Valuation Date, which will be calculated as follows: |

| 100 × (1 + (the sum of the Basket Currency Returns)) | |

| Basket Currency Return: | With respect to each Basket Currency, the product of (a) the Currency Performance of that Basket Currency times (b) its Currency Weighting. |

| Currency Performance: | With respect to each Basket Currency, the performance of that Basket Currency from the Initial Spot Rate to the Final Spot Rate, calculated as follows: |

| Initial Spot Rate – Final Spot Rate | |

| Initial Spot Rate | |

| Spot Rate: | For each Basket Currency, the spot exchange rate for that Basket Currency against the U.S. Dollar, as determined by the calculation agent in the manner set forth in this free writing prospectus under “Spot Rates.” The Spot Rate for each Basket Currency is expressed as units of the respective currency per one U.S. Dollar. The Spot Rates are subject to the provisions set forth under “Market Disruption Events” herein. |

| Initial Spot Rate: | The Spot Rate as determined by the Calculation Agent in its sole discretion on the Pricing Date. |

| Final Spot Rate: | The Spot Rate as determined by the Calculation Agent in its sole discretion on the Final Valuation Date. |

| Calculation Agent: | HSBC or one of its affiliates |

| CUSIP/ISIN: | 40432XBL4/US40432XBL47 |

| Form of Notes: | Book-Entry |

| Listing: | The Notes will not be listed on any U.S. securities exchange or quotation system. |

Investment in the Notes involves certain risks. You should refer to “Selected Risk Considerations” beginning on page 5 of this document and “Risk Factors” beginning on page S-3 of the prospectus supplement.

Neither the U.S. Securities and Exchange Commission, or SEC, nor any state securities commission has approved or disapproved of the Notes or determined that this free writing prospectus, or the accompanying prospectus supplement and prospectus, is truthful or complete. Any representation to the contrary is a criminal offense.

HSBC Securities (USA) Inc. or another of our affiliates or agents may use the pricing supplement to which this free writing prospectus relates in market-making transactions in any Notes after their initial sale. Unless we or our agent informs you otherwise in the confirmation of sale, the pricing supplement to which this free writing prospectus relates will be used in a market-making transaction. HSBC Securities (USA) Inc., an affiliate of ours, will purchase the Notes from us for distribution to the placement agent. See “Supplemental Plan of Distribution (Conflicts of Interest)” on the last page of this free writing prospectus.

J.P. Morgan Securities LLC and certain of its registered broker-dealer affiliates are purchasing the Notes for resale. JPMorgan Chase Bank N.A. may purchase the Notes on behalf of certain fiduciary accounts. J.P. Morgan Securities LLC, certain of its registered broker-dealer affiliates and JPMorgan Chase Bank N.A. will not receive fees from us for sales to fiduciary accounts.

| Price to Public(1) | Fees and Commissions | Proceeds to Issuer | |

| Per Note | $1,000 | $15 | $985 |

| Total | $ | $ | $ |

| (1) | Certain fiduciary accounts purchasing the Notes will pay a purchase price of $985 per Note, and the placement agents with respect to sales made to such accounts will forgo any fees. |

The Notes:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

JPMorgan

Placement Agent

February [●], 2013

Additional Terms Specific to the Notes

This free writing prospectus relates to a single note offering linked to the Basket identified on the cover page. The purchaser of a Note will acquire a senior unsecured debt security linked to the Basket. We reserve the right to withdraw, cancel or modify this offering and to reject orders in whole or in part. Although the Note offering relates only to the Basket identified on the cover page, you should not construe that fact as a recommendation as to the merits of acquiring an investment linked to the Basket or any Basket Currency, or as to the suitability of an investment in the Notes.

You should read this document together with the prospectus dated March 22, 2012 and the prospectus supplement dated March 22, 2012. If the terms of the Notes offered hereby are inconsistent with those described in the accompanying prospectus supplement or prospectus, the terms described in this free writing prospectus shall control. You should carefully consider, among other things, the matters set forth in “Selected Risk Considerations” beginning on page 5 of this free writing prospectus and “Risk Factors” beginning on page S-3 of the prospectus supplement, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes. As used herein, references to the “Issuer”, “HSBC”, “we”, “us” and “our” are to HSBC USA Inc.

HSBC has filed a registration statement (including a prospectus and a prospectus supplement) with the SEC for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents HSBC has filed with the SEC for more complete information about HSBC and this offering. You may get these documents for free by visiting EDGAR on the SEC’s web site at www.sec.gov. Alternatively, HSBC Securities (USA) Inc. or any dealer participating in this offering will arrange to send you the prospectus and prospectus supplement if you request them by calling toll-free 1-866-811-8049.

You may also obtain:

| • | The Prospectus Supplement at: www.sec.gov/Archives/edgar/data/83246/000104746912003151/a2208335z424b2.htm |

| • | The Prospectus at: www.sec.gov/Archives/edgar/data/83246/000104746912003148/a2208395z424b2.htm |

We are using this free writing prospectus to solicit from you an offer to purchase the Notes. You may revoke your offer to purchase the Notes at any time prior to the time at which we accept your offer by notifying HSBC Securities (USA) Inc. We reserve the right to change the terms of, or reject any offer to purchase, the Notes prior to their issuance. The Trade Date, the Pricing Date and the other terms of the Notes are subject to change, and will be set forth in the final pricing supplement relating to the Notes. In the event of any material changes to the terms of the Notes, we will notify you.

| -2- |

Summary

The four charts below provide a summary of the Notes, including Note characteristics and risk considerations as well as an illustrative diagram and table reflecting hypothetical returns at maturity. These charts should be reviewed together with the disclosure regarding the Notes contained in this free writing prospectus as well as in the accompanying prospectus and prospectus supplement.

The following charts illustrate the hypothetical total return at maturity on the Notes. The “total return” as used in this free writing prospectus is the number, expressed as a percentage, that results from comparing the Payment at Maturity per $1,000 Principal Amount of Notes to $1,000. The hypothetical total returns set forth below reflect the Initial Basket Level of 100, the Knock-Out Buffer Amount of 15% and the Contingent Minimum Return on the Notes of 8.15%. The hypothetical total returns set forth below are for illustrative purposes only and may not be the actual total returns applicable to a purchaser of the Notes. The numbers appearing in the following table and examples have been rounded for ease of analysis.

| -3- |

Selected Purchase Considerations

| · | APPRECIATION POTENTIAL — The Notes provide the opportunity to participate in the appreciation of the Basket at maturity. If a Knock-Out Event has not occurred, in addition to the Principal Amount, you will receive at maturity at least the Contingent Minimum Return of 8.15% on the Notes, or a minimum Payment at Maturity of $1,081.50 for every $1,000 Principal Amount of Notes. Because the Notes are our senior unsecured debt obligations, payment of any amount at maturity is subject to our ability to pay our obligations as they become due. | |

| · | THE CONTINGENT MINIMUM RETURN APPLIES ONLY IF A KNOCK-OUT EVENT HAS NOT OCCURRED — If a Knock-Out Event has not occurred, you will receive at least the Principal Amount and the Contingent Minimum Return at maturity even if the Basket has depreciated compared to the Initial Basket Level. If a Knock-Out Event has occurred, you will lose 1% of your Principal Amount for every 1% that the Basket has depreciated as compared to the Initial Basket Level. If the Basket Return is -100%, you will lose your entire investment. | |

| · | DIVERSIFICATION AMONG THE BASKET CURRENCIES — The return on the Notes is linked to the performance of an equally weighted basket of three currencies, which we refer to as the Basket Currencies, relative to the U.S. Dollar, from the Pricing Date to the Final Valuation Date. Accordingly, the level of the Basket increases if the Basket Currencies strengthen in value relative to the U.S. Dollar. The Basket derives its value from an equally weighted group of currencies consisting of the Brazilian real, the Chilean peso and the Mexican peso. | |

| · | TAX TREATMENT — There is no direct legal authority as to the proper tax treatment of the Notes, and therefore significant aspects of the tax treatment of the Notes are uncertain as to both the timing and character of any inclusion in income in respect of the Notes. Under one approach, a Note should be treated as a pre-paid executory contract with respect to the Basket. We intend to treat the Notes consistent with this approach. Pursuant to the terms of the Notes, you agree to treat the Notes under this approach for all U.S. federal income tax purposes. Subject to the limitations described therein, and based on certain factual representations received from us, in the opinion of our special U.S. tax counsel, Morrison & Foerster LLP, it is reasonable to treat a Note as a pre-paid executory contract with respect to the Basket. Assuming this characterization is respected, upon a sale or exchange of a Note, you should recognize gain or loss equal to the difference between the amount realized on the sale or exchange and your tax basis in the Note, which should equal the amount you paid to acquire the Note. Your gain or loss should generally be exchange gain or loss that is taxable as ordinary income or loss for U.S. federal income tax purposes, unless an election under Section 988 of the Internal Revenue Code of 1986, as amended (the “Code”) is available and made to treat such gain or loss as capital gain or loss (“Section 988 election”). The Section 988 election is generally available for a forward contract, a futures contract, or option on foreign currencies as described in Section 988 of the Code. Although not clear, a U.S. Holder (as defined in the accompanying prospectus supplement) may be entitled to make a Section 988 election with respect to the Notes. If a Section 988 election is available in respect of the Notes, in order for the election to be valid, a U.S. Holder must: (A) make the Section 988 election by clearly identifying the investment in the Notes on its books and records on the date the holder acquires the Notes as being subject to the Section 988 election (although no specific language or account is necessary for identifying a transaction on the holder’s books and records, the method of identification must be consistently applied and must clearly identify the pertinent transaction as subject to the Section 988 election); and (B) verify the election by attaching a statement to the holder’s income tax return, which must include (i) a description and the date of the Section 988 election, (ii) a statement that the Section 988 election was made before the close of the date that the Notes were acquired, (iii) a description of the Notes and the maturity date of the Notes or, alternatively, the date on which the Notes were sold or exchanged, (iv) a statement that the Notes were never part of a “straddle” as defined in Section 1092 of the Code, and (v) a statement that all transactions subject to the Section 988 election are included on the statement attached to the holder’s income tax return. If a Section 988 election is available and validly made in respect of the Notes, gain or loss recognized upon the sale or exchange of the Notes should be treated as capital gain or loss. Capital gain recognized by an individual U.S. Holder is generally taxed at preferential rates where the property is held for more than one year and is generally taxed at ordinary income rates where the property is held for one year or less. The deductibility of capital losses is subject to limitations. Prospective investors should consult their tax advisors regarding the availability, applicable procedures and requirements, and consequences of making a Section 988 election in respect of the Notes. |

Due to the absence of authorities that directly address the proper characterization of the Notes, no assurance can be given that the Internal Revenue Service (the “IRS”) will accept, or that a court will uphold, this characterization and tax treatment of the Notes, in which case the timing and character of any income or loss on the Notes could be significantly and adversely affected. For example, the Notes could be treated either as ”foreign currency contracts” within the meaning of Section 1256 of the Code or as “contingent payment debt instruments”, as discussed in the section entitled “U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement.

In 2007, the IRS released a revenue ruling holding that a financial instrument with some arguable similarity to the Notes is properly treated as a debt instrument denominated in a foreign currency. The Notes are distinguishable in meaningful respects from the instruments described in the revenue ruling. If, however, the reach of the revenue ruling were to be extended, it could materially and adversely affect the tax consequences of an investment in the Notes for U.S. Holders, possibly with retroactive effect.

| -4- |

Withholding and reporting requirements under the legislation enacted on March 18, 2010 (as discussed beginning on page S-48 of the prospectus supplement) will generally apply to payments made after December 31, 2013. However, this withholding tax will not be imposed on payments pursuant to obligations outstanding on January 1, 2014. Holders are urged to consult with their own tax advisors regarding the possible implications of this recently enacted legislation on their investment in the Notes.

For a discussion of the U.S. federal income tax consequences of your investment in a Note, please see the discussion under “U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement.

Selected Risk Considerations

An investment in the Notes involves significant risks. Investing in the Notes is not equivalent to investing directly in the Basket or any Basket Currency. These risks are explained in more detail in the “Risk Factors” section of the accompanying prospectus supplement.

| · | SUITABILITY OF THE NOTES FOR INVESTMENT — You should only reach a decision to invest in the Notes after carefully considering, with your advisors, the suitability of the Notes in light of your investment objectives and the information set out in this free writing prospectus. Neither HSBC nor any dealer participating in the offering makes any recommendation as to the suitability of the Notes for investment. | |

| · | YOUR INVESTMENT IN THE NOTES MAY RESULT IN A LOSS — The Notes do not guarantee any return of principal. The return on the Notes at maturity is linked to the performance of the Basket and will depend on whether, and the extent to which, the Basket appreciates or depreciates. If the Basket has depreciated, compared to the Initial Basket Level, by more than the Knock-Out Buffer Amount of 15%, a Knock-Out Event has occurred, and the benefit provided by the Knock-Out Buffer Amount will terminate. In such a case, you will lose 1% of the Principal Amount of the Notes for every 1% depreciation of the Basket as compared to the Initial Basket Level. IF A KNOCK-OUT EVENT OCCURS, YOU MAY LOSE UP TO 100% OF YOUR INVESTMENT. | |

| · | THE NOTES ARE SUBJECT TO THE CREDIT RISK OF HSBC USA INC. — The Notes are senior unsecured debt obligations of the Issuer, HSBC, and are not, either directly or indirectly, an obligation of any third party. As further described in the accompanying prospectus supplement and prospectus, the Notes will rank on par with all of the other unsecured and unsubordinated debt obligations of HSBC, except such obligations as may be preferred by operation of law. Any payment to be made on the Notes, including any return of principal at maturity, depends on the ability of HSBC to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of HSBC may affect the market value of the Notes and, in the event HSBC were to default on its obligations, you may not receive the amounts owed to you under the terms of the Notes. | |

| · | CHANGES IN THE VALUES OF THE BASKET CURRENCIES MAY OFFSET EACH OTHER — Movements in the value of each of the Basket Currencies, with respect to the U.S. Dollar, may not correlate with each other. At a time when one or more of the Basket Currencies appreciates in value relative to the U.S. Dollar, the other Basket Currencies may not appreciate as much or may even depreciate. Therefore, in calculating the Basket Return, appreciation in one or more of the Basket Currencies may be moderated, or more than offset, by lesser appreciation or depreciation in the other Basket Currencies. | |

| · | INVESTING IN THE NOTES IS NOT EQUIVALENT TO INVESTING DIRECTLY IN THE BASKET CURRENCIES — You may receive a lower return than you would have received if you had invested directly in the Basket Currencies. The Basket Return is dependent solely on the formula set forth above and not on any other formula that could be used for calculating currency performances. As such, the Basket Return may be materially different from the return on a direct investment in the respective Basket Currencies. | |

| · | CURRENCY MARKETS MAY BE VOLATILE — Currency markets may be highly volatile. Significant changes, including changes in liquidity and prices, can occur in such markets within very short periods of time. Foreign currency rate risks include, but are not limited to, convertibility risk and market volatility and potential interference by foreign governments through regulation of local markets, foreign investment or particular transactions in foreign currency. These factors may affect the value of the Basket on the Final Valuation Date, and therefore, the value of your Notes. | |

| · | LEGAL AND REGULATORY RISKS — Legal and regulatory changes could adversely affect exchange rates. In addition, many governmental agencies and regulatory organizations are authorized to take extraordinary actions in the event of market emergencies. It is not possible to predict the effect of any future legal or regulatory action relating to exchange rates, but any such action could cause unexpected volatility and instability in currency markets with a substantial and adverse effect on the performance of the Basket Currencies and, consequently, the value of the Notes. | |

| · | IF THE LIQUIDITY OF ANY BASKET CURRENCY IS LIMITED, THE VALUE OF THE NOTES WOULD LIKELY BE IMPAIRED — Currencies and derivatives contracts on currencies may be difficult to buy or sell, particularly during adverse market conditions. Reduced liquidity of a Basket Currency on the Final Valuation Date would likely have an adverse effect on the Final Basket Level for that Basket, and therefore, on the return of your Notes. Limited liquidity relating to the a Basket Currency may also result in HSBC USA Inc. or one of its affiliates, as Calculation Agent, being unable to determine the Currency Performance for that Basket Currency using its normal means. The resulting discretion by the Calculation Agent in determining the Currency Performance for that Basket Currency could, in turn, result in potential conflicts of interest. | |

| · | WE HAVE NO CONTROL OVER THE EXCHANGE RATE BETWEEN EACH OF THE BASKET CURRENCIES AND THE U.S. DOLLAR — Foreign exchange rates can either float or be fixed by sovereign governments. Exchange rates of the currencies used by most economically developed nations are permitted to fluctuate in value relative to the U.S. Dollar and to each other. However, from time to time governments may use a variety of techniques, such as intervention by a central bank, the imposition of regulatory controls or taxes or changes in interest rates to influence the exchange rates of their currencies. Governments may also issue a new currency to replace an existing currency or alter the exchange rate or relative exchange characteristics by a devaluation or revaluation of a currency. These |

| -5- |

| governmental actions could change or interfere with currency valuations and currency fluctuations that would otherwise occur in response to economic forces, as well as in response to the movement of currencies across borders. As a consequence, these government actions could adversely affect an investment in the Notes, which are affected by the exchange rate between each of the Basket Currencies and the U.S. Dollar. |

| · | THE PAYMENT FORMULA FOR THE NOTES WILL NOT TAKE INTO ACCOUNT ALL DEVELOPMENTS IN THE BASKET CURRENCIES — Changes in the Basket Currencies during the term of the Notes before the Final Valuation Date may not be reflected in the calculation of the Payment at Maturity. The Basket Return will be calculated only as of the Final Valuation Date. As a result, the Basket Return may be less than zero even if the Basket Currencies had moved favorably at certain times during the term of the Notes before moving to an unfavorable level on the Final Valuation Date. | |

| · | THE NOTES ARE SUBJECT TO EMERGING MARKETS’ POLITICAL AND ECONOMIC RISKS — All the Basket Currencies are the currencies of emerging market countries. Emerging market countries are more exposed to the risk of swift political change and economic downturns than their industrialized counterparts. In recent years, emerging markets have undergone significant political, economic and social change. Such far-reaching political changes have resulted in constitutional and social tensions, and, in some cases, instability and reaction against market reforms have occurred. With respect to any emerging or developing nation, there is the possibility of nationalization, expropriation or confiscation, political changes, government regulation and social instability. There can be no assurance that future political changes will not adversely affect the economic conditions of an emerging or developing-market nation. Political or economic instability is likely to have an adverse effect on the performance of these Basket Currencies, and, consequently, the return on the Notes. | |

| · | THE NOTES ARE SUBJECT TO CURRENCY EXCHANGE RISK — Foreign currency exchange rates vary over time, and may vary considerably during the term of the Notes. The relative values of the U.S. Dollar and the Basket Currencies are at any moment a result of the supply and demand for such currencies. Changes in foreign currency exchange rates result over time from the interaction of many factors directly or indirectly affecting economic and political developments in other relevant countries. Of particular importance to currency exchange risk are: | |

| · | existing and expected rates of inflation; | |

| · | existing and expected interest rate levels; | |

| · | the balance of payments in Brazil, Chile, Mexico and the United States, between each country and its major trading partners; and | |

| · | the extent of governmental surplus or deficit in Brazil, Chile, Mexico and the United States. |

Each of these factors, among others, are sensitive to the monetary, fiscal and trade policies pursued by Brazil, Chile, Mexico and the United States, and those of other countries important to international trade and finance.

| · | NO INTEREST PAYMENTS — As a holder of the Notes, you will not receive interest payments. | |

| · | Potentially Inconsistent Research, Opinions or Recommendations by HSBC and JPMorgan — HSBC, JPMorgan, or their respective affiliates may publish research, express opinions or provide recommendations that are inconsistent with investing in or holding the Notes and which may be revised at any time. Any such research, opinions or recommendations could affect the value of the Basket Currencies, and therefore, the market value of the Notes. | |

| · | CERTAIN BUILT-IN COSTS ARE LIKELY TO ADVERSELY AFFECT THE VALUE OF THE NOTES PRIOR TO MATURITY — While the Payment at Maturity described in this free writing prospectus is based on the full Principal Amount of your Notes, the original issue price of the Notes includes the placement agent’s commission and the estimated cost of hedging our obligations under the Notes through one or more of our affiliates. As a result, the price, if any, at which HSBC Securities (USA) Inc. will be willing to purchase Notes from you in secondary market transactions, if at all, will likely be lower than the original issue price, and any sale of Notes by you prior to the Maturity Date could result in a substantial loss to you. The Notes are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your Notes to maturity. | |

| · | THE NOTES LACK LIQUIDITY — The Notes will not be listed on any securities exchange. HSBC Securities (USA) Inc. may offer to purchase the Notes in the secondary market. However, it is not required to do so and may cease making such offers at any time if at all. Because other dealers are not likely to make a secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at which HSBC Securities (USA) Inc. is willing to buy the Notes. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Notes easily. | |

| · | POTENTIAL CONFLICTS — HSBC and its affiliates play a variety of roles in connection with the issuance of the Notes, including acting as Calculation Agent and hedging its obligations under the Notes. In performing these duties, the economic interests of the Calculation Agent and other affiliates of HSBC are potentially adverse to your interests as an investor in the Notes. HSBC will not have any obligation to consider your interests as a holder of the Notes in taking any corporate action that might affect the value of the Basket Currencies and the value of the Notes. | |

| · | The Notes are Not Insured OR GUARANTEED by any Governmental Agency of the United States or any Other Jurisdiction — The Notes are not deposit liabilities or other obligations of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency or program of the United States or any other jurisdiction. An investment in the Notes is subject to the credit risk of HSBC, and in the event that HSBC is unable to pay its obligations as they become due, you may not receive the full Payment at Maturity of the Notes. |

| -6- |

| · | HISTORICAL PERFORMANCE OF THE BASKET CURRENCIES SHOULD NOT BE TAKEN AS AN INDICATION OF THE FUTURE PERFORMANCE OF THE BASKET CURRENCIES DURING THE TERM OF THE NOTES — It is impossible to predict whether any of the Spot Rates for the Basket Currencies will rise or fall. The Basket Currencies will be influenced by complex and interrelated political, economic, financial and other factors. | |

| · | MARKET DISRUPTIONS MAY ADVERSELY AFFECT YOUR RETURN — The Calculation Agent may, in its sole discretion, determine that the markets have been affected in a manner that prevents it from valuing the Basket Currencies or determining the Basket Return in the manner described herein, and calculating the amount that we are required to pay you at maturity, or from properly hedging its obligations under the Notes. These events may include disruptions or suspensions of trading in the markets as a whole or general inconvertibility or non-transferability of one or more Basket Currencies. If the Calculation Agent, in its sole discretion, determines that any of these events occurs, the Calculation Agent will determine the Spot Rates of the Basket Currencies and the Basket Return in good faith and in a commercially reasonable manner, which may adversely affect the return on your Notes. For example, if the source for an exchange rate of a Basket Currency is not available on the Final Valuation Date, the Calculation Agent may determine the exchange rate for that Basket Currency for such date, and such determination may adversely affect the return on your Notes. | |

| · | MANY ECONOMIC AND MARKET FACTORS WILL IMPACT THE VALUE OF THE NOTES — In addition to the Spot Rates of the Basket Currencies on any day, the value of the Notes will be affected by a number of economic and market factors that may either offset or magnify each other, including: | |

| · | the actual and expected exchange rates and volatility of the exchange rates between each Basket Currency and the U.S. Dollar; | |

| · | the interaction of the movements in each Basket Currency which may offset one another; | |

| · | the time to maturity of the Notes; | |

| · | interest and yield rates in the market generally and in the markets of Brazil, Chile, Mexico and the United States; | |

| · | a variety of economic, financial, political, regulatory or judicial events; and | |

| · | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

| -7- |

What Is the Total Return on the Notes at Maturity Assuming a Range of Performances for the Basket?

The following table illustrates the hypothetical total return at maturity on the Notes. The “total return,” as used in this free writing prospectus, is the number, expressed as a percentage, that results from comparing the Payment at Maturity per $1,000 Principal Amount of Notes to $1,000. The hypothetical total returns set forth below reflect the Knock-Out Buffer Amount of 15%, the Initial Basket Level of 100, and the Contingent Minimum Return on the Notes of 8.15%. The hypothetical total returns set forth below are for illustrative purposes only, and may not be the actual total returns applicable to a purchaser of the Notes. The numbers appearing in the following table and examples have been rounded for ease of analysis.

| Hypothetical Final Basket Level | Hypothetical Basket Return | Hypothetical Total Return on the Notes |

| 200.00 | 100.00% | 100.00% |

| 180.00 | 80.00% | 80.00% |

| 160.00 | 60.00% | 60.00% |

| 150.00 | 50.00% | 50.00% |

| 140.00 | 40.00% | 40.00% |

| 130.00 | 30.00% | 30.00% |

| 120.00 | 20.00% | 20.00% |

| 115.00 | 15.00% | 15.00% |

| 108.15 | 8.15% | 8.15% |

| 105.00 | 5.00% | 8.15% |

| 100.00 | 0.00% | 8.15% |

| 98.00 | -2.00% | 8.15% |

| 95.00 | -5.00% | 8.15% |

| 90.00 | -10.00% | 8.15% |

| 85.00 | -15.00% | 8.15% |

| 80.00 | -20.00% | -20.00% |

| 70.00 | -30.00% | -30.00% |

| 60.00 | -40.00% | -40.00% |

| 50.00 | -50.00% | -50.00% |

| 40.00 | -60.00% | -60.00% |

| 20.00 | -80.00% | -80.00% |

| 0.00 | -100.00% | -100.00% |

Hypothetical Examples of Amounts Payable at Maturity

The following examples illustrate how the total returns set forth in the table above are calculated.

Example 1: A Knock-Out Event has not occurred and the Basket depreciates from the Initial Basket Level of 100 to a hypothetical Final Basket Level of 95. Because a Knock-Out Event has not occurred and the Basket Return of -5.00% is less than the Contingent Minimum Return of 8.15%, the investor benefits from the Contingent Minimum Return and receives a Payment at Maturity of $1,081.50 per $1,000 Principal Amount of Notes.

$1,000 + ($1,000 × 8.15%) = $1,081.50

Example 2: A Knock-Out Event has not occurred and the Basket appreciates from the Initial Basket Level of 100 to a hypothetical Final Basket Level of 120. Because a Knock-Out Event has not occurred and the Basket Return of 20.00% is greater than the Contingent Minimum Return of 8.15%, the investor receives a Payment at Maturity of $1,200 per $1,000 Principal Amount of Notes, calculated as follows:

$1,000 + ($1,000 × 20.00%) = $1,200

Example 3: A Knock-Out Event has occurred and the Basket depreciates from the Initial Basket Level of 100 to a hypothetical Final Basket Level of 60. Because a Knock-Out Event has occurred, the investor is exposed to the negative performance of the Basket and receives a Payment at Maturity of $600 per $1,000 Principal Amount of Notes, calculated as follows:

$1,000 + ($1,000 × -40.00%) = $600

| -8- |

Historical Performance of the Basket Currencies

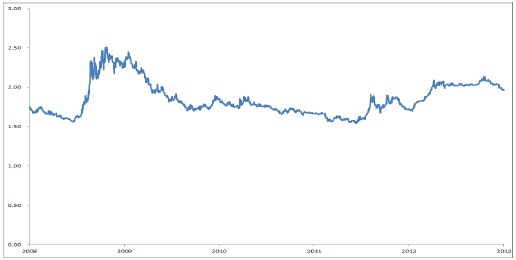

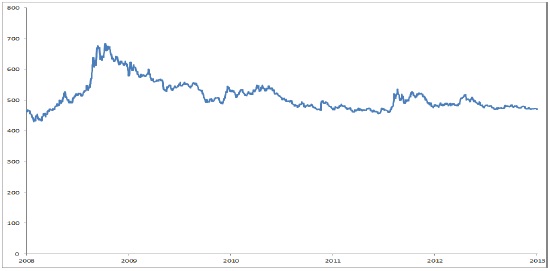

The following first three graphs set forth the historical performance of each Basket Currency based on exchange rates of the Basket Currency relative to the U.S. Dollar from February 15, 2008 through February 15, 2013. The exchange rate of the BRL relative to the USD on February 15, 2013 was 1.9688 Brazilian reais per one U.S. Dollar. The exchange rate of the CLP relative to the USD on February 15, 2013 was 471.2000 Chilean pesos per one U.S. Dollar. The exchange rate of the MXN relative to the USD on February 15, 2013 was 12.6899 Mexican pesos per one U.S. Dollar. We calculated the exchange rates below based on the exchange rates of each Basket Currency relative to the U.S. dollar provided on the Bloomberg Professional® service. We have not made any independent investigation as to the accuracy or completeness of the information obtained from the Bloomberg Professional® service. The exchange rates displayed in the graphs below are for illustrative purposes only and do not form part of the calculation of the Basket Return.

The last graph below shows the hypothetical daily performance of the Basket from February 15, 2008 through February 15, 2013, assuming that the Basket level on February 15, 2008 was 100, that each Basket Currency had a 1/3 weight in the Basket on that date, and that the historical exchange rates of each Basket Currency on the relevant dates were the Spot Rates on such dates.

The historical exchange rates should not be taken as an indication of future performance, and no assurance can be given as to the Spot Rate of any Basket Currency relative to the U.S. Dollar on the Pricing Date or the Final Valuation Date. We cannot give you assurance that the performance of the Basket will result in the return of any of your initial investment. The closing exchange rates in the graph below were the rates reported by the Bloomberg Professional® service and may not be indicative of the Basket performance using the Spot Rates of the Basket Currencies that will be derived from the applicable Reuters page.

Historical Performance of the BRL Relative to the USD

Source: Bloomberg Professional® service

| -9- |

Historical Performance of the CLP Relative to the USD

Source: Bloomberg Professional® service

Historical Performance of the MXN Relative to the USD

Source: Bloomberg Professional® service

| -10- |

Hypothetical Historical Performance of the Basket

Source: Bloomberg Professional® service

| -11- |

Spot Rates

The Spot Rate for the Brazilian real relative to the U.S. dollar (the “USDBRL”) on each date of calculation will be the U.S. dollar/Brazilian real exchange rate, expressed as the amount of Brazilian reals per one U.S. dollar, for settlement on the same day, as reported by Banco Central do Brasil on SISBACEN Data System under transaction code PTAX-800 (“Consulta de Cambio” or Exchange Rate Inquiry), Option 5 (“Cotacoes para Cotabilidade” or Rates for Accounting Purposes) at approximately 1:15 p.m., Sao Paulo time, which appears on Reuters page “BRFR” to the right of the caption “Dollar PTTAX”, or any successor page. The USDBRL shall be calculated to the fourth decimal place.

The Spot Rate for the Chilean peso relative to the U.S. dollar (“USDCLP”) on each date of calculation will be the U.S. dollar/Chilean peso “observado” rate, expressed as the amount of Chilean pesos per one U.S. dollar, for settlement on the same day, provided by the Banco Central de Chile (www.bcentral.cl) as the “Dolar Observado” (Dollar Observado) rate and reported on Reuters page “CLPOB=”, or any successor page, by not later than 6:00 p.m. (Santiago time) on such date of calculation. The USDCLP shall be calculated to the fourth decimal place.

The Spot Rate for the Mexican peso relative to the U.S. dollar (“USDMXN”) on each date of calculation will be the U.S. dollar/Mexican peso exchange rate, expressed as the amount of Mexican pesos per one U.S. dollar, for settlement on the same day, as reported on Reuters page “WMRSPOT01”, or any successor page, at 4:00 p.m., London time, on the date of calculation. The USDMXN shall be calculated to the fourth or fifth decimal place, as reported on the applicable Reuters page.

As a result of the forgoing, the value of each Basket Currency relative to the U.S. dollar will increase if the applicable Spot Rate decreases, and the value of each Basket Currency relative to the U.S. dollar will decrease if the applicable Spot Rate increases.

If the Spot Rate for any Basket Currency or the Reference Currency is unavailable (including being published in error, as determined by the Calculation Agent in its sole discretion), the Spot Rate shall be selected by the Calculation Agent in good faith and in a commercially reasonable manner, or the Final Valuation Date may be postponed by the Calculation Agent, as described below in “Market Disruption Events.”

Market Disruption Events

The Calculation Agent may, in its sole discretion, determine that an event has occurred that prevents it from valuing any Basket Currency or the Payment at Maturity in the manner initially provided for herein. These events may include disruptions or suspensions of trading in the markets as a whole or general inconvertibility or non-transferability of one or more of the Basket Currencies. If the Calculation Agent, in its sole discretion, determines that any of these events prevents us or our affiliates from properly hedging our obligations under the Notes or prevents the Calculation Agent from determining such value or amount in the ordinary manner on any date of calculation, the Calculation Agent may determine such value or amount in good faith and in a commercially reasonable manner on such date or, in the discretion of the Calculation Agent, the Final Valuation Date and Maturity Date may be postponed for up to five scheduled trading days, each of which may adversely affect the return on your Notes. If the Final Valuation Date has been postponed for five consecutive scheduled trading days, then that fifth scheduled trading day will be the Final Valuation Date and the Calculation Agent will determine the value of that Basket Currency on such date using the formula for and method of determining such value which applied just prior to the market disruption event (or in good faith and in a commercially reasonable manner) on such date.

If the Maturity Date is not a business day, the amounts payable on the Notes will be paid on the next following business day and no interest will be paid in respect of such postponement.

A “business day” means any day, other than a Saturday or Sunday, that is neither a legal holiday nor a day on which banking institutions are authorized or required by law or regulation to close in the City of New York.

| -12- |

Events of Default and Acceleration

If the Notes have become immediately due and payable following an event of default (as defined in the accompanying prospectus) with respect to the Notes, the Calculation Agent will determine the accelerated Payment at Maturity due and payable in the same general manner as described in “Key Terms” in this free writing prospectus. In that case, the business day preceding the date of acceleration will be used as the Final Valuation Date for purposes of determining the accelerated Basket Return (including the Final Basket Level). The accelerated Maturity Date will be the fifth business day following the accelerated Final Valuation Date.

If the Notes have become immediately due and payable following an event of default, you will not be entitled to any additional payments with respect to the Notes. For more information, see “Description of Debt Securities — Senior Debt Securities — Events of Default” in the accompanying prospectus.

Supplemental Plan of Distribution (Conflicts of Interest)

Pursuant to the terms of a distribution agreement, HSBC Securities (USA) Inc., an affiliate of HSBC, will purchase the Notes from HSBC for distribution to J.P. Morgan Securities LLC and certain of its registered broker-dealer affiliates, acting as placement agent, at the price indicated on the cover of the pricing supplement, the document that will be filed pursuant to Rule 424(b)(2) containing the final pricing terms of the Notes. The placement agents for the Notes will receive a fee that will not exceed $15 per $1,000 Principal Amount of Notes. Certain fiduciary accounts purchasing the Notes will pay a purchase price of $985 per Note, and the placement agents with respect to sales made to such accounts will forgo any fees.

In addition, HSBC Securities (USA) Inc. or another of its affiliates or agents may use the pricing supplement to which this free writing prospectus relates in market-making transactions after the initial sale of the Notes, but is under no obligation to make a market in the Notes and may discontinue any market-making activities at any time without notice.

See “Supplemental Plan of Distribution (Conflicts of Interest)” on page S-49 in the prospectus supplement.

We expect that delivery of the Notes will be made against payment for the Notes on or about the Original Issue Date set forth on the cover page of this document, which is expected to be the fifth business day following the Trade Date of the Notes. Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in three business days, unless the parties to that trade expressly agree otherwise. Accordingly, purchasers who wish to trade Notes on the Trade Date and the following business day thereafter will be required to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement, and should consult their own advisors.

| -13- |