|

|

September 2012

Free Writing Prospectus Registration Statement No. 333-180289 Dated September 10, 2012 Filed pursuant to Rule 433 |

Currency-Linked Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish USD), Subject to the Credit Risk of HSBC USA Inc.

The Currency-Linked Partial Principal at Risk Securities due October 2, 2014 Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish USD), Subject to the Credit Risk of HSBC USA Inc. (“HSBC”), which we refer to as the “securities”, do not pay interest and provide for a minimum payment of only 90% of principal at maturity. At maturity, if the Chinese renminbi has appreciated relative to the U.S. dollar, an investor will receive for each $1,000 stated principal amount of securities that the investor holds, the $1,000 stated principal amount plus the supplemental redemption amount. If the Chinese renminbi has depreciated relative to the U.S. dollar as of the valuation date, the payment at maturity will be less than the stated principal amount of $1,000 per security by an amount that is proportionate to the percentage depreciation. However, under no circumstances will the payment at maturity be less than the minimum payment amount of $900 per security. The securities are senior unsecured obligations of HSBC. All payments on the securities are subject to the credit risk of HSBC.

| SUMMARY TERMS | |

| Issuer: | HSBC USA Inc. |

| Aggregate principal amount: | $ |

| Issue price: | $1,000 per security |

| Stated principal amount: | $1,000 per security |

| Pricing date: | September 28, 2012 |

| Original issue date: | October 2, 2012 |

| Maturity date: | October 2, 2014 |

| Minimum payment amount: | $900 per security (90% of the stated principal amount) |

| Interest: | None |

| Payment at maturity: |

If the Chinese renminbi appreciates relative to the U.S. dollar:

$1,000 + supplemental redemption amount

If the Chinese renminbi depreciates relative to the U.S. dollar:

$1,000 + ($1,000 x currency performance), subject to the minimum payment amount

If the Chinese renminbi depreciates relative to the U.S. dollar, the currency performance will be negative and the payment at maturity will be less than the stated principal amount of $1,000 per security by an amount that is proportionate to the percentage depreciation of the currency. However, under no circumstances will the payment at maturity be less than the minimum payment amount of $900 per security.

|

|

Supplemental redemption amount: |

$1,000 times the currency performance times the participation rate

|

| Currency performance: |

1 – (final exchange rate / initial exchange rate)

This formula effectively limits the positive currency performance to 100%.

|

| Participation rate: | Expected to be between 200% and 250%. The participation rate will be determined on the pricing date. |

| Initial exchange rate: | The exchange rate as determined by the calculation agent on the pricing date |

| Final exchange rate: | The exchange rate as determined by the calculation agent on the valuation date |

| Exchange rate: | On any business day, the rate for conversion of the Chinese renminbi (“CNY”) into U.S. dollars (expressed as the number of units of CNY per one U.S. dollar), as determined by reference to the rate displayed on the reference source on such business day. |

| Reference source: | Reuters page “SAEC” on Reuters or any successor service, as applicable, opposite the symbol “USDCNY=” at approximately 9:15 a.m., Beijing time, on the applicable date. |

| Valuation date: | September 29, 2014, subject to subject to further adjustment as described under “Market Disruption Events” herein |

| CUSIP/ISIN: | 06738G191/US06738G1913 |

| Listing: | The securities will not be listed on any securities exchange. |

| Agent: | HSBC Securities (USA) Inc., an affiliate of HSBC. See “General Information - Supplemental plan of distribution (conflicts of interest)” herein. |

| Commissions and Issue Price: | Price to Public(1) | Agent’s Commissions(1) | Proceeds to Issuer |

| Per security | $1,000 | $ | $ |

| Total | $ | $ | $ |

| (1) | HSBC Securities (USA) Inc., acting as agent for HSBC, will receive a fee of up to $17.50 per $1,000 stated principal amount and will pay the entire fee to Morgan Stanley Smith Barney LLC (“MSSB”) as a fixed sales commission of up to $17.50 for each security it sells. See “General Information - Supplemental plan of distribution (conflicts of interest).” |

Investment in the securities involves certain risks. See “Risk Factors” beginning on page 6 of this free writing prospectus and page S-3 of the prospectus supplement.

Neither the U.S. Securities and Exchange Commission, or SEC, nor any state securities commission has approved or disapproved the securities, or determined that this free writing prospectus or the accompanying prospectus supplement or prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

HSBC has filed a registration statement (including a prospectus and a prospectus supplement) with the SEC for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents HSBC has filed with the SEC for more complete information about HSBC and this offering. You may get these documents for free by visiting EDGAR on the SEC’s web site at www.sec.gov. Alternatively, HSBC Securities (USA) Inc. or any dealer participating in this offering will arrange to send you the prospectus and prospectus supplement if you request them by calling toll-free 1-866-811-8049.

You should read this document together with the related prospectus supplement and prospectus, each of which can be accessed via the hyperlinks below.

The prospectus supplement at: http://www.sec.gov/Archives/edgar/data/83246/000104746912003151/a2208335z424b2.htm

The prospectus at: http://www.sec.gov/Archives/edgar/data/83246/000104746912003148/a2208395z424b2.htm

The securities are not deposit liabilities or other obligations of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency of the United States or any other jurisdiction, and involve investment risks including possible loss of the stated principal amount invested due to the credit risk of HSBC.

The securities:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

Currency-Linked

Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish

USD),

Subject to the Credit Risk of HSBC USA Inc.

Investment Overview

Currency-Linked Partial Principal at Risk Securities due October 2, 2014 Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish USD), Subject to the Credit Risk of HSBC USA Inc. (the “securities”) provide investors with an opportunity to gain leveraged upside exposure to the Chinese renminbi relative to the U.S. dollar, while maintaining 1:1 downside exposure to any depreciation of the Chinese renminbi, subject to the minimum payment amount at maturity of $900 per security.

At maturity, if the Chinese renminbi has appreciated relative to the U.S. dollar, the investment will return the stated principal amount plus a supplemental redemption amount. If the Chinese renminbi has depreciated relative to the U.S. dollar, the payment per security will be less than the $1,000 stated principal amount of securities by an amount proportionate to the depreciation of the Chinese renminbi, subject to the minimum payment amount of $900 per security.

The securities are senior unsecured obligations of HSBC, and all payments on the securities are subject to the credit risk of HSBC. There will be no interest payments on the securities.

There are several important factors you should consider in connection with your investment in the securities.

§ The securities do not provide a linear return on the performance of the CNY relative to the U.S. dollar. A linear return is the return that would be achieved by converting a notional amount of U.S. dollars into the CNY at the initial exchange rate and then, on the valuation date, converting the resulting amount of the CNY back into the U.S. dollars at the final exchange rate. Instead, the return on the securities will be determined by reference to the currency performance formula described in this document.

§ Because of the way the currency performance is calculated, the currency performance of the CNY will never exceed 100%.

| Maturity: | Approximately 24 months |

| Participation Rate: | Expected to be between 200% and 250%. The actual participation rate will be determined on the pricing date. |

|

Supplemental redemption amount: |

$1,000 times the currency performance times the participation rate |

| Payment at maturity: |

If the CNY appreciates relative to the U.S. dollar: $1,000 + supplemental redemption amount If the CNY depreciates relative to the U.S. dollar: $1,000 + ($1,000 x currency performance), subject to the minimum payment amount If the CNY depreciates relative to the U.S. dollar, the currency performance will be negative and the payment at maturity will be less than the stated principal amount of $1,000 per security by an amount that is proportionate to the percentage depreciation of the currency. However, under no circumstances will the payment at maturity be less than the minimum payment amount of $900 per security. |

| September 2012 | Page 2 |

Currency-Linked

Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish

USD),

Subject to the Credit Risk of HSBC USA Inc.

How Do Currency Exchange Rates Work?

Exchange rates reflect the amount of one currency that can be exchanged for a unit of another currency.

| § | The exchange rate for the Chinese renminbi is expressed as the number of units of the CNY per U.S. dollar. | |

| Ø | As a result, a decrease in the exchange rate means that the Chinese renminbi has appreciated / strengthened relative to the U.S. dollar. This means that one U.S. dollar may purchase fewer Chinese renminbi on the valuation date than it did on the pricing date. For example, an exchange rate of 4.80 reflects a strengthening of the CNY relative to the U.S. dollar, as compared to an exchange rate of 6.40. | |

| Ø | Conversely, an increase in the exchange rate means that the Chinese renminbi has depreciated / weakened relative to the U.S. dollar. This means that one U.S. dollar may purchase more Chinese renminbi on the valuation date than it did on the pricing date. For example, an exchange rate of 9.60 reflects a weakening of the Chinese renminbi relative to the U.S. dollar, as compared to an exchange rate of 6.40. |

How Does the Currency Performance Formula Work?

The currency performance formula used to calculate the payment at maturity for the securities effectively limits the positive currency performance to 100%.

The currency performance is equal to (1 – final exchange rate / initial exchange rate).

| Ø | In the example below, the Chinese renminbi strengthens from the initial exchange rate of 6.40 to the final exchange rate of 4.80, resulting in the currency performance of 1 – (4.80 / 6.40) = 25%. |

| Initial Exchange Rate (# CNY / 1 USD) | Final Exchange Rate (# CNY / 1 USD) |

| 6.40 | 4.80 |

| Ø | In the example below, the Chinese renminbi weakens from the initial exchange rate of 6.40 to the final exchange rate of 9.60, resulting in the currency performance of 1 – (9.60 / 6.40) = –50%. |

| Initial Exchange Rate (# CNY / 1 USD) | Final Exchange Rate (# CNY / 1 USD) |

| 6.40 | 9.60 |

| Ø | In the example below, the Chinese renminbi strengthens to the fullest extent possible from the initial exchange rate of 6.40 to the final exchange rate of 0.00001, resulting in the currency performance of 1 – (0.00001 / 6.40) = approximately 99.9999%. |

| Initial Exchange Rate (# CNY / 1 USD) | Final Exchange Rate (# CNY / 1 USD) |

| 6.40 | 0.00001 |

This example illustrates that, because the currency performance for the CNY is calculated by subtracting a fraction equal to the final exchange rate divided by the initial exchange rate from 1, the maximum possible currency performance will be no greater than 100%.

Actual exchange rates will vary from those used in the examples above.

| September 2012 | Page 3 |

Currency-Linked

Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish

USD),

Subject to the Credit Risk of HSBC USA Inc.

Key Investment Rationale

Investors concerned about the risks associated with investing directly in a single markets currency can use the securities to gain exposure to the CNY while protecting 90% of principal at maturity. If CNY appreciates against the U.S. dollar, investors will receive, in addition to the stated principal amount, a supplemental redemption amount based on the performance of the CNY.

| Scenario 1 | If the CNY appreciates relative to the U.S. dollar as of the valuation date, the payment at maturity will be $1,000 + ($1,000 x currency performance x participation rate). |

| Scenario 2 | If the CNY depreciates relative to the U.S. dollar as of the valuation date, but not by more than 10%, the payment at maturity will reflect a 1:1 downside exposure to any depreciation of the Chinese renminbi, subject to the minimum payment amount at maturity of $900 per security. |

| Scenario 3 | If the CNY depreciates relative to the U.S. dollar as of the valuation date by more than 10%, the payment at maturity will be $900. |

If the CNY depreciates relative to the U.S. dollar, the currency performance will be negative and the payment at maturity will be less than the stated principal amount of $1,000 per security by an amount that is proportionate to the percentage depreciation of the currency. However, under no circumstances will the payment at maturity be less than the minimum payment amount of $900 per security.

Summary of Selected Key Risks (see page 6)

| § | The securities do not pay interest and may pay up to 10% less than the principal amount. |

| § | The currency performance formula will limit the upside potential of the securities. |

| § | The securities are subject to the credit risk of HSBC USA Inc. |

| § | The securities are not insured by any governmental agency of the United States or any other jurisdiction. |

| § | Currency markets may be volatile. |

| § | An investment in the securities is subject to legal and regulatory risks relating to the currency markets. |

| § | The securities are subject to currency exchange risk. |

| § | If the liquidity of the Chinese renminbi is limited, the value of the securities would likely be impaired. |

| § | We have no control over exchange rates between the Chinese renminbi and the U.S. dollar. |

| § | The securities are exposed to a single emerging markets currency and therefore expose you to significant nondiversified currency risk. |

| § | Investing in the securities is not equivalent to investing directly in the Chinese renminbi. |

| § | Historical performance of the Chinese renminbi relative to the U.S. dollar should not be taken as an indication of the performance of the Chinese renminbi relative to the U.S. dollar during the term of the securities. |

| § | The securities will not be listed on any securities exchange and secondary trading may be limited. |

| § | Certain built-in costs are likely to adversely affect the value of the securities prior to maturity. |

| § | Hedging and trading activity by our affiliates could potentially affect the value of the securities. |

| § | The calculation agent, which will be HSBC or one of its affiliates, will make determinations with respect to the securities. |

| § | Potentially inconsistent research, opinions or recommendations by HSBC and MSSB. |

| § | Market disruptions may adversely affect your return. |

| § | Many economic and market factors will impact the value of the securities. |

| § | The payment formula for the securities will not take into account all developments in the exchange rate. |

| September 2012 | Page 4 |

Currency-Linked

Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish

USD),

Subject to the Credit Risk of HSBC USA Inc.

Fact Sheet

The securities offered are senior unsecured obligations of HSBC, will pay no interest, provide for a minimum repayment at maturity of only 90% of principal and have the terms described in the accompanying prospectus supplement and prospectus, as supplemented or modified by this free writing prospectus. At maturity, an investor will receive for each $1,000 stated principal amount of securities that the investor holds, an amount in cash that may be more than, equal to or less than the stated principal amount based on whether the CNY has appreciated relative to the U.S. dollar as of the valuation date, subject to the minimum payment at maturity at $900 per security. All payments on the securities are subject to the credit risk of HSBC.

| Expected Key Dates | ||

| Pricing date: | Original issue date (settlement date): | Maturity date: |

| September 28, 2012 | October 2, 2012 | October 2, 2014 |

| Key Terms | |

| Issuer: | HSBC USA Inc. |

| Aggregate principal amount: | $ |

| Issue price: | $1,000 per security |

| Stated principal amount: | $1,000 per security |

| Denominations: | $1,000 and integral multiples thereof |

| Interest: | None |

| Minimum payment amount: | $900 per security (90% of the stated principal amount) |

| Payment at maturity: |

If the CNY appreciates relative to the U.S. dollar: $1,000 + supplemental redemption amount If the CNY depreciates relative to the U.S. dollar: $1,000 + ($1,000 x currency performance), subject to the minimum payment amount If the CNY depreciates relative to the U.S. dollar, the currency performance will be negative and the payment at maturity will be less than the stated principal amount of $1,000 per security by an amount that is proportionate to the percentage depreciation of the currency. However, under no circumstances will the payment at maturity be less than the minimum payment amount of $900 per security. |

| Supplemental redemption amount: |

$1,000 times the currency performance times the participation rate

|

| Participation rate: | Expected to be between 200% and 250%. The actual participation rate will be determined on the pricing date. |

| Risk factors: | Please see “Risk Factors” beginning on page 6 of this free writing prospectus and page S-3 of the prospectus supplement. |

| Currency performance: |

1 – (final exchange rate / initial exchange rate) This formula effectively limits the positive currency performance to 100%. |

| Initial exchange rate: | The exchange rate as determined by the calculation agent on the pricing date. |

| Final exchange rate: | The exchange rate as determined by the calculation agent on the valuation date. |

| Exchange Rate: | On any business day, the rate for conversion of the CNY into U.S. dollars (expressed as the number of units of CNY per U.S. dollar), as determined by reference to the rate displayed on the reference source on such business day. |

| Valuation date: | September 29, 2014, subject to subject to further adjustment as described under “Market Disruption Events” herein. |

| Reference source: | Reuters page “SAEC” on Reuters or any successor service, as applicable, opposite the symbol “USDCNY=” at approximately 9:15 a.m., Beijing time, on the applicable date. |

| September 2012 | Page 5 |

Currency-Linked

Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish

USD),

Subject to the Credit Risk of HSBC USA Inc.

Risk Factors

We urge you to read the section “Risk Factors” on page S-3 in the accompanying prospectus supplement. Investing in the securities is not equivalent to investing directly in the Chinese renminbi. You should understand the risks of investing in the securities and should reach an investment decision only after careful consideration, with your advisors, of the suitability of the securities in light of your particular financial circumstances and the information set forth in this free writing prospectus and the accompanying prospectus supplement and prospectus.

In addition to the risks discussed below, you should review “Risk Factors” in the accompanying prospectus supplement, including the explanation of risks relating to the securities described in the section “— Risks Relating to All Security Issuances”.

You will be subject to significant risks not associated with conventional fixed-rate or floating-rate debt securities.

| § | The securities do not pay interest and may pay up to 10% less than the principal amount. The terms of the securities differ from those of ordinary debt securities in that the securities do not pay interest and provide for a minimum payment amount of only 90% of the principal at maturity. If the Chinese renminbi has depreciated relative to the U.S. dollar, the payout at maturity will be an amount in cash that is less than the $1,000 stated principal amount of each security by an amount proportionate to the negative currency performance, subject to the minimum payment amount of $900 per security (90% of the stated principal amount). See “Hypothetical Payouts on the Securities at Maturity” beginning on page 12 below. |

| § | The currency performance formula will limit the upside potential of the securities. The currency performance measures the extent to which the exchange rate of the Chinese renminbi relative to the USD increases or decreases from the pricing date to the valuation date, expressed as (1 – final exchange rate / initial exchange rate). Because of the way the currency performance is calculated, the maximum currency performance is effectively 100%. |

| § | The securities are subject to the Credit risk of HSBC USA Inc. The securities are senior unsecured debt obligations of the Issuer, HSBC, and are not, either directly or indirectly, an obligation of any third party. As further described in the accompanying prospectus supplement and prospectus, the securities will rank on par with all of the other unsecured and unsubordinated debt obligations of HSBC, except such obligations as may be preferred by operation of law. Any payment to be made on the securities depends on the ability of HSBC to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of HSBC may affect the market value of the securities and, in the event HSBC were to default on its obligations, you may not receive the amounts owed to you under the terms of the securities. |

| § | The securities are not insured by any governmental agency of the United States or any other jurisdiction. The securities are not deposit liabilities or other obligations of a bank and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency or program of the United States or any other jurisdiction. An investment in the securities is subject to the credit risk of HSBC, and in the event that HSBC is unable to pay its obligations as they become due, you may not receive the full amount due on the securities. |

| § | CURRENCY MARKETS MAY BE VOLATILE. Currency markets may be highly volatile. Significant changes, including changes in liquidity and prices, can occur in such markets within very short periods of time. Foreign currency rate risks include, but are not limited to, convertibility risk and market volatility and potential interference by foreign governments through regulation of local markets, foreign investment or particular transactions in foreign currency. These factors may affect the value of the currency on the pricing date or the valuation date, and therefore, the value of your securities. |

| § | An investment in the securities is subject to legal and regulatory risks relating to the currency markets. Legal and regulatory changes could adversely affect exchange rates. In addition, many governmental agencies and regulatory organizations are authorized to take extraordinary actions in the event of market emergencies. It is not possible to predict the effect of any future legal or regulatory action relating to exchange rates, but any such action could cause unexpected volatility and instability in currency |

| September 2012 | Page 6 |

Currency-Linked

Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish

USD),

Subject to the Credit Risk of HSBC USA Inc.

| markets with a substantial and adverse effect on the performance of CNY and, consequently, the value of the securities. | |

| § | THE SECURITIES ARE SUBJECT TO CURRENCY EXCHANGE RISK. Foreign currency exchange rates vary over time, and may vary considerably during the term of the securities. The exchange rate between the Chinese renminbi and the U.S. dollar is volatile and is the result of numerous factors specific to China and the United States including the supply of, and the demand for, the Chinese renminbi, as well as government policy, intervention or actions, but are also influenced significantly from time to time by political or economic developments, and by macroeconomic factors and speculative actions related to different regions. Of particular importance to currency exchange risk are: |

| o | existing and expected rates of inflation; | |

| o | existing and expected interest rate levels; | |

| o | the balance of payments; and | |

| o | the extent of governmental surpluses or deficits in China and the United States. | |

Each of these factors, among others, are sensitive to the monetary, fiscal and trade policies pursued by the governments of China and the United States and other countries important to international trade and finance.

| § | IF THE LIQUIDITY OF THE Chinese renminbi IS LIMITED, THE VALUE OF THE SECURITIES WOULD LIKELY BE IMPAIRED. Currencies and derivatives contracts on currencies may be difficult to buy or sell, particularly during adverse market conditions. Reduced liquidity on the valuation date would likely have an adverse effect on the final exchange rate, and therefore, on the return on your securities. Limited liquidity relating to the CNY may also result in HSBC USA Inc. or one of its affiliates, as calculation agent, being unable to determine the currency performance using its normal means. The resulting discretion by the calculation agent in determining the currency performance could, in turn, result in potential conflicts of interest. |

| § | WE HAVE NO CONTROL OVER EXCHANGE RATES BETWEEN THE Chinese renminbi AND THE U.S. DOLLAR. Foreign exchange rates can either float or be fixed by sovereign governments. Exchange rates of the currencies used by most nations are permitted to fluctuate in value relative to the U.S. dollar and to each other. However, from time to time governments may use a variety of techniques, such as intervention by a central bank, the imposition of regulatory controls or taxes or changes in interest rates to influence the exchange rates of their currencies. Governments may also issue a new currency to replace an existing currency or alter the exchange rate or relative exchange characteristics by a devaluation or revaluation of a currency. These governmental actions could change or interfere with currency valuations and currency fluctuations that would otherwise occur in response to economic forces, as well as in response to the movement of currencies across borders. As a consequence, these government actions could adversely affect an investment in the securities. |

The securities are exposed to a single emerging markets currency and therefore expose you to significant nondiversified currency risk. An investment in the securities is subject to risk of significant adverse fluctuations in the performance of a single emerging market currency, the Chinese renminbi, relative to the U.S. dollar. As an emerging markets currency, the Chinese renminbi is subject to an increased risk of significant adverse fluctuations in value. Currencies of emerging economies are often subject to more frequent and larger central bank interventions than the currencies of developed countries and are also more likely to be affected by drastic changes in monetary or exchange rate policies of the issuing countries, which may negatively affect the value of the securities. The exchange rate between the Chinese renminbi and the U.S. dollar is managed by the Chinese government, and may also be influenced by political or economic developments in the People’s Republic of China or elsewhere and by macroeconomic factors and speculative actions. From 1994 to 2005, the Chinese government used a managed floating exchange rate system, under which the People’s Bank of China (the “People’s Bank”) allowed the renminbi to float against the U.S. dollar within a very narrow band around the central exchange rate published daily by the People’s Bank. In July 2005, the People’s Bank revalued the renminbi by 2% and announced that in the future it would set the value of the renminbi with reference to a basket of currencies rather than solely with reference to the U.S. dollar. In addition, the People’s Bank announced that the reference basket of currencies used to set the value of the renminbi would be based on a daily poll of onshore market dealers and other undisclosed factors. Movements in the exchange rate between the Chinese renminbi and the U.S. dollar within the narrow band established by the

| September 2012 | Page 7 |

Currency-Linked

Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish

USD),

Subject to the Credit Risk of HSBC USA Inc.

People’s Bank result from the supply of, and the demand for, those two currencies and fluctuations in the reference basket of currencies. The inflow and outflow of renminbi in China has historically been tightly controlled by the People’s Bank, but there have been signs in recent years of a nascent but fast growing offshore renminbi market, with foreign exchange reforms implemented in 2010 serving as the catalyst. These reforms allow the renminbi to move to Hong Kong from mainland China without restriction if it is for the purpose of international trade settlement (e.g., import payments). Once moved offshore, this renminbi is reclassified from “CNY” renminbi to so-called “CNH” renminbi, which has no mainland restriction as to its end-use if it remains offshore. However, the growth of the CNH market may be impeded as China still tightly regulates the “back flow” of CNH into the onshore mainland market, in part to protect domestic markets. This creates a separate currency market for onshore versus offshore renminbi with different levels of exchange rates driven by capital control measures, supply and demand and arbitrage opportunities. No assurance can be given with respect to any future changes in the policy of the People’s Republic of China dealing with offshore renminbi trading. To the extent that management of the renminbi by the People’s Bank has resulted in and currently results in trading levels that do not fully reflect market forces, any further changes in the government’s management of the Chinese renminbi could result in significant movement in the value of the renminbi. Changes in the exchange rate result over time from the interaction of many factors directly or indirectly affecting economic and political conditions in the People’s Republic of China and the United States, including capital control measures and economic and political developments in other countries.

| § | Investing in the securities is not equivalent to investing directly in the Chinese renminbi. You may receive a lower payment at maturity than you would have received if you had invested directly in the Chinese renminbi. The currency performance is dependent solely on the formula stated above and not on any other formula that could be used for calculating currency performances. |

| § | HISTORICAL PERFORMANCE OF THE Chinese renminbi relative to the U.S. dollar SHOULD NOT BE TAKEN AS AN INDICATION OF THE FUTURE PERFORMANCE OF THE Chinese renminbi relative to the U.S. dollar DURING THE TERM OF THE SECURITIES. It is impossible to predict whether the exchange rate of the Chinese renminbi relative to the U.S. dollar will rise or fall. The exchange rate will be influenced by complex and interrelated political, economic, financial and other factors. |

| § | The securities will not be listed on any securities exchange and secondary trading may be limited. The securities will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the securities. HSBC Securities (USA) Inc. may, but is not obligated to, make a market in the securities. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the securities easily. Because we do not expect that other broker-dealers will participate significantly in the secondary market for the securities, the price at which you may be able to trade your securities is likely to depend on the price, if any, at which HSBC Securities (USA) Inc. is willing to transact. If, at any time, HSBC Securities (USA) Inc. were to cease making a market in the securities, it is likely that there would be no secondary market for the securities. Accordingly, you should be willing to hold your securities to maturity. |

| § | Certain built-in costs are likely to adversely affect the value of the securities prior to maturity. The original issue price of the securities includes the agent’s fees and commissions and the estimated cost of HSBC hedging its obligations under the securities. As a result, the price, if any, at which HSBC Securities (USA) Inc. will be willing to purchase securities from you in secondary market transactions, if at all, will likely be lower than the original issue price, and any sale prior to the stated maturity date could result in a substantial loss to you. The securities are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your securities to maturity. |

| § | Hedging and trading activity by our affiliates could potentially affect the value of the securities. One or more of our affiliates expect to carry out hedging activities related to the securities (and possibly to other instruments linked to the Chinese renminbi and/or the U.S. dollar), including trading in futures, forwards and options contracts on the Chinese renminbi. Some of our subsidiaries also trade the Chinese renminbi and other financial instruments related to the Chinese renminbi on a regular basis as part of their general broker-dealer, proprietary trading and other businesses. Any of these hedging or trading activities on or prior to the pricing date could have increased the value of the Chinese renminbi relative to the U.S. dollar on the pricing date and, as a result, could have increased the value relative to the U.S. dollar that the Chinese renminbi must attain on the valuation date before you would receive a payment at maturity that exceeds |

| September 2012 | Page 8 |

Currency-Linked

Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish

USD),

Subject to the Credit Risk of HSBC USA Inc.

| the $1,000 stated principal amount of the securities. Additionally, such hedging or trading activities during the term of the securities could potentially affect the exchange rate of the Chinese renminbi on the valuation date and, accordingly, the amount of cash you will receive at maturity. |

| § | The calculation agent, which is HSBC or one of its affiliates, will make determinations with respect to the securities. As calculation agent, HSBC or one of its affiliates will determine the initial exchange rate, the final exchange rate and the currency performance, and will calculate the amount you will receive at maturity. Determinations made by HSBC or one of its affiliates in its capacity as calculation agent, including with respect to the calculation of any rate in the event of a discontinuance of reporting of the Chinese renminbi exchange rate, may adversely affect the payout to you at maturity. |

| § | POTENTIALLY INCONSISTENT RESARCH, OPINIONS OR RECOMMENDATIONS BY HSBC AND MSSB. HSBC, MSSB or their affiliates may publish research, express opinions or provide recommendations that are inconsistent with investing in or holding the securities and which may be revised at any time. Any such research, opinions or recommendations could affect the exchange rate between CNY and the U.S. dollar, and therefore, the market value of the securities. |

| § | MARKET DISRUPTIONS MAY ADVERSELY AFFECT YOUR RETURN. The calculation agent may, in its sole discretion, determine that the markets have been affected in a manner that prevents it from determining the currency performance in the manner described herein, and calculating the amount that we are required to pay you upon maturity, or from properly hedging its obligations under the securities. These events may include disruptions or suspensions of trading in the markets as a whole or general inconvertibility or non-transferability of one or more currencies. If the calculation agent, in its sole discretion, determines that any of these events prevents us or any of our affiliates from properly hedging our obligations under the securities or prevents the calculation agent from determining the currency performance or payment at maturity in the ordinary manner, the calculation agent will determine the currency performance or payment at maturity in good faith and in a commercially reasonable manner, and it is possible that the valuation date and the maturity date will be postponed, which may adversely affect the return on your securities. For example, if the source for an exchange rate is not available on the valuation date, the calculation agent may determine the exchange rate for such date, and such determination may adversely affect the return on your securities. |

| § | MANY ECONOMIC AND MARKET FACTORS WILL IMPACT THE VALUE OF THE SECURITIES. In addition to the level of the Chinese renminbi and the U.S. dollar on any day, the value of the securities will be affected by a number of economic and market factors that may either offset or magnify each other, including: |

| o | the expected volatility of the Chinese renminbi and the U.S. dollar; | |

| o | the time to maturity of the securities; | |

| o | interest and yield rates in the market generally and in the markets of the Chinese renminbi and the U.S. dollar; | |

| o | a variety of economic, financial, political, regulatory or judicial events; | |

| o | the exchange rates and volatility of the exchange rates between the Chinese renminbi and the U.S. dollar; and | |

| o | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

| § | THE PAYMENT FORMULA FOR THE SECURITIES WILL NOT TAKE INTO ACCOUNT ALL DEVELOPMENTS IN THE EXCHANGE RATE. Changes in the exchange rate during the term of the securities before the valuation date may be not be reflected in the calculation of the payment at maturity. The currency performance will be calculated only as of the valuation date. As a result, the currency return may be less than zero even if CNY appreciates at certain times during the term of the securities before moving to an unfavorable level on the valuation date. |

| September 2012 | Page 9 |

Currency-Linked

Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish

USD),

Subject to the Credit Risk of HSBC USA Inc.

| General Information | |

| Listing: | The securities will not be listed on any securities exchange. |

| CUSIP: | 06738G191 |

| ISIN: | US06738G1913 |

| Minimum ticketing size: | $1,000 / 1 security |

| Tax considerations: |

You should carefully consider, among other things, the matters set forth in the section “U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement. The following discussion summarizes certain of the U.S. federal income tax consequences of the purchase, beneficial ownership, and disposition of each of the securities. This summary supplements the section “U.S. Federal Income Tax Considerations” in the prospectus supplement and supersedes it to the extent inconsistent therewith.

There are no statutory provisions, regulations, published rulings or judicial decisions addressing the characterization for U.S. federal income tax purposes of securities with terms that are substantially the same as those of the Securities. We intend to take the position that the “denomination currency” (as defined in the applicable Treasury regulations) of the Securities is the U.S. dollar and, accordingly, we intend to treat the Securities as contingent payment debt instruments for U.S. federal income tax purposes. Pursuant to the terms of the Securities, you agree to treat the Securities as contingent payment debt instruments for all U.S. federal income tax purposes and, in the opinion of Morrison & Foerster LLP, special U.S. tax counsel to us, it is reasonable to treat the Securities as contingent payment debt instruments. Assuming the Securities are treated as contingent payment debt instruments, a U.S. holder will be required to include original issue discount (“OID”) in gross income each year, even though no payments will be made on the Securities until maturity.

Based on the factors described in the section, “U.S. Federal Income Tax Considerations — U.S. Federal Income Tax Treatment of the Securities as Indebtedness for U.S. Federal Income Tax Purposes — Contingent Payment Debt Instruments”, in order to illustrate the application of the noncontingent bond method to the Securities, we have estimated that the comparable yield of the Securities, solely for U.S. federal income tax purposes, will be 1.12% per annum (compounded annually). Further, based upon the method described in the section, “U.S. Federal Income Tax Considerations — U.S. Federal Income Tax Treatment of the Securities as Indebtedness for U.S. Federal Income Tax Purposes — Contingent Payment Debt Instruments” and based upon the estimate of the comparable yield, we have estimated that the projected payment schedule for Securities that have a Principal Amount of $1,000 and an issue price of $1,000 consists of a single payment of $1,022.55 at maturity.

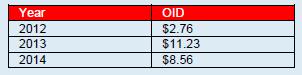

Based upon the estimate of the comparable yield, a U.S. holder that pays taxes on a calendar year basis, buys a Security for $1,000, and holds the Security until maturity will be required to pay taxes on the following amounts of ordinary income in respect of the Securities in each year:

However, the ordinary income reported in the taxable year the Securities mature will be adjusted to reflect the actual payment received at maturity. U.S. holders should also note that the actual comparable yield and projected payment schedule may be different than as provided in this summary depending upon market conditions on the date the Securities are issued. U.S. holders may obtain the actual comparable yield and projected payment schedule as determined by us by submitting a written request to: Structured Equity Derivatives – Structuring HSBC Bank USA, National Association, 452 Fifth Avenue, 3rd Floor, New York, NY 10018. A U.S. holder is generally bound by the comparable yield and the projected payment schedule established by us for the Securities. However, if a U.S. holder believes that the projected payment schedule is unreasonable, a U.S. holder must determine its own projected payment schedule and explicitly disclose the use of such schedule and the reason the holder believes the projected payment schedule is unreasonable on its timely filed U.S. federal income tax return for the taxable year in which it acquires the Securities.

The comparable yield and projected payment schedule are not provided for any purpose other than the determination of a U.S. holder’s interest accruals for U.S. federal income tax purposes and do not constitute a projection or representation by us regarding the actual yield on a Security. We do not make any representation as to what such actual yield will be.

Because there are no statutory provisions, regulations, published rulings or judicial decisions addressing the characterization for U.S. federal income tax purposes of Securities with terms that are substantially the same as those of the Securities, other characterizations and treatments are possible. As a result, the timing and character of income in respect of the Securities might differ from the treatment described above. You should carefully consider the discussion of all potential tax consequences as set forth in “U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement. |

| September 2012 | Page 10 |

Currency-Linked

Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish

USD),

Subject to the Credit Risk of HSBC USA Inc.

|

PROSPECTIVE PURCHASERS OF THE SECURITIES SHOULD CONSULT THEIR TAX ADVISORS AS TO THE FEDERAL, STATE, LOCAL, AND OTHER TAX CONSEQUENCES TO THEM OF THE PURCHASE, OWNERSHIP AND DISPOSITION OF THE SECURITIES.

| |

| Calculation agent: | HSBC USA Inc., or one of its affiliates. |

| Payment currency: | U.S. dollars |

| Supplemental plan of distribution (conflicts of interest): |

Pursuant to the terms of a distribution agreement, HSBC Securities (USA) Inc., an affiliate of HSBC, will purchase the securities from HSBC for distribution to MSSB. HSBC Securities (USA) Inc. will act as agent for the securities and will receive a fee of up to $17.50 per $1,000 stated principal amount and will pay the entire fee to MSSB as a fixed sales commission of up to $17.50 for each security they sell.

In addition, HSBC Securities (USA) Inc. or another of its affiliates or agents may use the pricing supplement to which this free writing prospectus relates in market-making transactions after the initial sale of the securities, but is under no obligation to do so and may discontinue any market-making activities at any time without notice.

See “Supplemental Plan of Distribution (Conflicts of Interest)” on page S-49 in the prospectus supplement. |

This is a summary of the terms and conditions of the securities. We encourage you to read the accompanying prospectus supplement and prospectus for this offering, which can be accessed via the hyperlinks on the front page of this document.

| September 2012 | Page 11 |

Currency-Linked

Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish

USD),

Subject to the Credit Risk of HSBC USA Inc.

Hypothetical Payouts on the Securities at Maturity

Below are two examples of how to calculate the currency performance and the payment at maturity based on a hypothetical initial exchange rate of 6.40, the hypothetical final exchange rates set out below and a hypothetical participation rate of 225%. The following hypothetical examples are provided for illustrative purposes only. Actual results will vary. The actual initial exchange rate and participation rate will be determined on the pricing date and the final exchange rate will be determined on the valuation date. All payments on the securities, including the repayment of principal, are subject to the credit risk of HSBC.

For the CNY, a decrease in the exchange rate means that the currency has appreciated/strengthened relative to the U.S. dollar, and an increase in the exchange rate means that the currency has depreciated/weakened relative to the U.S. dollar. The numbers appearing in the examples below have been rounded for ease of analysis.

Example 1: The CNY has appreciated relative to the U.S. dollar

Hypothetical final exchange rate: 5.76

The currency performance will equal: 1 - (final exchange rate / initial exchange rate)

Using the above hypothetical initial and final exchange rates, the currency performance is calculated as follows:

Currency performance = 1 - (5.76 / 6.40) = 0.10

In this example, the CNY has strengthened 10% relative to the dollar.

| Payment at maturity | = | $1,000 + supplemental redemption amount |

| = | $1,000 + ($1,000 x currency performance x participation rate) | |

| = | $1,000 + ($1,000 x 10% x 225%) | |

| = | $1,225 |

Because the Chinese renminbi has appreciated relative to the U.S. dollar, the payment at maturity will equal $1,000 plus the supplemental redemption amount. In this example, the payment at maturity per security will be $1,225, or the stated principal amount of $1,000 plus the supplemental redemption amount of $225.

Example 2: The CNY has depreciated 5% relative to the U.S. dollar

Hypothetical final exchange rate: 6.72

Currency performance = 1 - (6.72 / 6.40) = -0.50

In this example, the CNY has depreciated by 5% relative to the U.S. dollar.

| Payment at maturity | = | $1,000 + ($1,000 x currency performance) |

| = | $1,000 + ($1,000 x -0.50%) | |

| = | $950 |

In this example, since $950 is more than the minimum payment amount of $900, the payment at maturity will equal $950, a 1:1 downside exposure to the depreciation of the Chinese renminbi as of the valuation date.

| September 2012 | Page 12 |

Currency-Linked

Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish

USD),

Subject to the Credit Risk of HSBC USA Inc.

Example 3: The CNY has depreciated 20% relative to the U.S. dollar, and the investor receives the minimum payment amount

Hypothetical final exchange rate: 7.68

Currency performance = 1 - (7.68 / 6.40) = -0.20

In this example, the CNY has depreciated by 20% relative to the dollar.

| Payment at maturity | = | $1,000 + ($1,000 x currency performance), subject to the minimum payment amount |

| = | $1,000 + ($1,000 x -0.20) | |

| = | $800 |

In this example, since $800 is less than the minimum payment amount of $900, the payment at maturity will equal the minimum payment amount of $900.

| September 2012 | Page 13 |

Currency-Linked

Partial Principal at Risk Securities due October 2, 2014

Based on the Performance of the Chinese Renminbi Relative to the U.S. Dollar (Bullish CNY/Bearish

USD),

Subject to the Credit Risk of HSBC USA Inc.

Historical Information

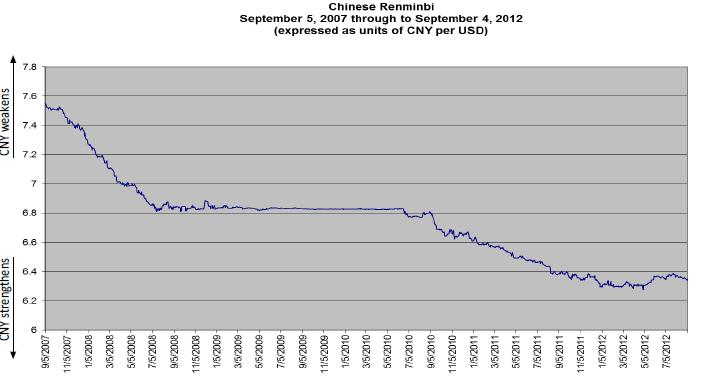

The following graph sets forth the CNY/USD exchange rates (expressed as units of CNY per one U.S. dollar) from September 5, 2007 to September 4, 2012. We obtained the information in the graph from Bloomberg Financial Markets, without independent verification. In addition, the daily exchange rates published by Bloomberg Financial Markets may differ from the exchange rates as determined on the applicable reference source as described above. You cannot predict the future performance of the exchange rate based on its historical performance.

Market Disruption Events

The calculation agent may, in its sole discretion, determine that an event has occurred that prevents it from valuing the exchange rate or the payment at maturity in the manner initially provided for herein. These events may include disruptions or suspensions of trading in the markets as a whole or general inconvertibility or non-transferability of one or more currencies. If the calculation agent, in its sole discretion, determines that any of these events prevents us or our affiliates from properly hedging our obligations under the securities or prevents the calculation agent from determining such value or amount in the ordinary manner on such date, the calculation agent may determine such value or amount in good faith and in a commercially reasonable manner on such date or, in the discretion of the calculation agent, the valuation date and maturity date may be postponed for up to five scheduled business days, each of which may adversely affect the return on your securities. If the valuation date has been postponed for five consecutive scheduled trading days, then that fifth scheduled business day will be the valuation date and the calculation agent will determine the value of the currency in good faith and in a commercially reasonable manner on such date.

Events of Default and Acceleration

If the securities have become immediately due and payable following an event of default (as defined in the accompanying prospectus) with respect to the securities, the calculation agent will determine the accelerated payment at maturity due and payable in the same general manner as described in “Fact Sheet” in this free writing prospectus. In that case, the business day preceding the date of acceleration will be used as the valuation date for purposes of determining the accelerated performance (including the final exchange rate). The accelerated maturity date will be the fifth business day following the accelerated valuation date (including the final exchange rate).

If the securities have become immediately due and payable following an event of default, you will not be entitled to any additional payments with respect to the securities. For more information, see “Description of Debt Securities — Events of Default” and “— Events of Default; Defaults” in the accompanying prospectus.

| September 2012 | Page 14 |