Filed Pursuant to Rule 433

Registration No. 333-158385

May 5, 2011

FREE WRITING PROSPECTUS

(To Prospectus dated April 2, 2009 and

Prospectus Supplement dated April 9, 2009)

HSBC USA Inc.

Currency Appreciation Coupon Securities

|

}

|

Currency Appreciation Coupon Securities linked to the performance of the Chinese Renminbi (Yuan) relative to the U.S. dollar.

|

|

}

|

5-year maturity

|

|

}

|

Return of principal at maturity, subject to the credit risk of HSBC USA Inc.

|

|

}

|

Conditional annual coupon payments at a fixed rate of between 4.50% per annum and 5.00% per annum (to be determined on the Pricing Date) if the Chinese Remninbi (Yuan) has appreciated such that the Spot Rate is less than the applicable Trigger Rate on the relevant Coupon Observation Date

|

The Currency Appreciation Coupon Securities (each a “security” and collectively the “securities") offered hereunder are not deposit liabilities or other obligations of a bank and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency of the United States or any other jurisdiction and include investment risks including possible loss of the Principal Amount invested due to the credit risk of HSBC USA Inc.

The securities will not be listed on any U.S. securities exchange or automated quotation system.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities or passed upon the accuracy or the adequacy of this document, the accompanying prospectus or prospectus supplement. Any representation to the contrary is a criminal offense. We have appointed HSBC Securities (USA) Inc., an affiliate of ours, as the agent for the sale of the securities. HSBC Securities (USA) Inc. will purchase the securities from us for distribution to other registered broker dealers or will offer the securities directly to investors. We may use this free writing prospectus in the initial sale of securities. In addition, HSBC Securities (USA) Inc. or another of its affiliates or agents may use the pricing supplement to which this free writing prospectus relates in market-making transactions in any securities after their initial sale. Unless we or our agent informs you otherwise in the confirmation of sale, the pricing supplement to which this free writing prospectus relates is being used in a market-making transaction. See “Supplemental Plan of Distribution (Conflicts of Interest)” on page FWP-15 of this free writing prospectus.

Investment in the securities involves certain risks. You should refer to “Selected Risk Considerations” beginning on page FWP-7 of this free writing prospectus and page S-3 of the accompanying prospectus supplement.

|

Price to Public

|

Fees and Commissions1

|

Proceeds to Issuer

|

|

|

Per security

|

$1,000

|

||

|

Total

|

1HSBC USA Inc. or one of our affiliates may pay varying discounts and commissions of between 2.00% and 2.50% per $1,000 Principal Amount of securities in connection with the distribution of the securities, a portion of which may consist of a combination of selling concessions of up to 2.50% and referral fees of up to 2.50%. See “Supplemental Plan of Distribution (Conflicts of Interest)” on page FWP-15 of this free writing prospectus.

HSBC USA Inc.

Currency Appreciation Coupon Securities

Linked to the Chinese Renminbi (Yuan)

Indicative Terms*

|

Principal Amount

|

$1,000 per security

|

|

|

Term

|

5 Years

|

|

|

Reference Currency:

|

Chinese Renminbi (Yuan) (“CNY”)

|

|

|

Payment at Maturity

|

At maturity, you will be entitled to receive a cash payment per $1,000 Principal Amount of securities equal to the Principal Amount plus the final Conditional Coupon, if any.

|

|

|

Conditional Coupon:

|

Paid annually on each Coupon Payment Date only if the CNY has appreciated such that the Spot Rate is less than the applicable Trigger Rate on the relevant Coupon Observation Date.

|

|

|

Conditional Coupon Rate:

|

Between 4.50% per annum and 5.00% per annum (to be determined on the Pricing Date).

|

|

|

Coupon

Observation Date

|

Trigger Rate

|

|

|

|

May 25, 2012

|

98% of Initial Spot Rate

|

|

Coupon Observation Dates

|

May 28, 2013

|

96% of Initial Spot Rate

|

|

and Trigger Rates:

|

May 27, 2014

|

94% of Initial Spot Rate

|

|

May 26, 2015

|

92% of Initial Spot Rate

|

|

|

May 25, 2016

|

90% of Initial Spot Rate

|

|

|

Coupon Payment Dates:

|

Generally, 3 Business Days following each Coupon Observation Date as described more fully on FWP-4.

|

|

|

Initial Spot Rate:

|

See page FWP-5

|

|

|

Spot Rate:

|

See page FWP-5

|

|

|

Trade Date

|

May 24, 2011

|

|

|

Pricing Date

|

May 25, 2011

|

|

|

Settlement Date

|

May 31, 2011

|

|

|

Maturity Date†

|

May 31, 2016

|

|

|

CUSIP

|

4042K1HE6

|

|

* As more fully described on page FWP-4.

†Subject to adjustment as described herein.

The Currency Appreciation Coupon Securities

For investors who believe the Chinese Renminbi (Yuan) will appreciate over the term of the securities, the Currency Appreciation Coupon Securities provide an opportunity for enhanced income and a return of principal at maturity, subject to the credit risk of HSBC. For each Coupon Observation Date on which the Chinese Renminbi (Yuan) has appreciated such that it is below the applicable Trigger Rate, a Conditional Coupon will be paid. At maturity, the investor will be paid back the full principal, subject to credit risk of HSBC, along with the final Conditional Coupon, if any.

|

The offering period for the securities is through May 24, 2011

|

FWP-2

|

Chinese Renminbi (Yuan)

|

|

|

The Chinese Renminbi (Yuan) is the official currency of The People’s Republic of China. The conventional market quotation is the number of Chinese Renminbi (Yuan) per U.S. dollar.

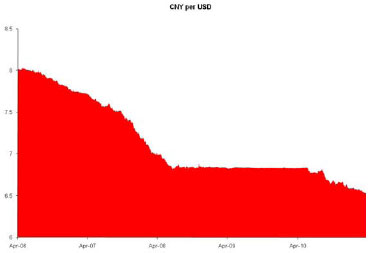

The graph to the right shows the 5 year historical Spot Rates from April 28, 2006 through April 27, 2011 as reported on Bloomberg Financial Markets.

|

|

Payoff Example

The table below shows the hypothetical coupon payments of an investment in the securities reflecting a Conditional Coupon Rate of 4.50% per annum and assuming an Initial Spot Rate of 6.500. The actual Conditional Coupon Rate and Initial Spot Rate will be determined on the Pricing Date. By convention, the Chinese Renminbi (Yuan)is expressed as the number of Renminbi per US Dollar. Accordingly a lower Spot Rate corresponds to an appreciation in the Chinese Renminbi (Yuan) versus the U.S. dollar.

|

Coupon Observation Dates

|

|||||

|

May 25, 2012

|

May 28, 2013

|

May 27, 2014

|

May 26, 2015

|

May 25, 2016

|

|

|

Trigger Rate

|

6.370

(98% of Initial Spot Rate) |

6.240

(96% of Initial Spot Rate) |

6.110

(94% of Initial Spot Rate) |

5.980

(92% of Initial Spot Rate) |

5.850

(90% of Initial Spot Rate) |

| Conditional Coupon Rate if the Spot Rate is below the Trigger Rate |

4.50%

|

4.50%

|

4.50%

|

4.50%

|

4.50%

|

| Conditional Coupon Rate if the Spot Rate is equal to or above the Trigger Rate |

0.00%

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

The graph above illustrates the 5-yr historical Spot Rates of the Reference Currency from April 28, 2006 through April 27, 2011. The Spot Rates in the graph above were obtained from Bloomberg Professional® Service. Past performance is not necessarily an indication of future results. We have derived all disclosure regarding the Reference Currency from publicly available information. Neither HSBC USA Inc. or any of its affiliates assumes any responsibilities for the adequacy or accuracy of information about the Reference Currency.

FWP-3

|

HSBC USA Inc.

Currency Appreciation Coupon Securities

Linked to the Chinese Renminbi (Yuan)

|

|

The offering of Currency Appreciation Coupon Securities due May 31, 2016 will have the terms described in this free writing prospectus and the accompanying prospectus supplement and prospectus. If the terms of the securities offered hereby are inconsistent with those described in the accompanying prospectus supplement or prospectus, the terms described in this free writing prospectus shall control. In reviewing the accompanying prospectus supplement, all references to “Reference Asset” therein shall refer to the Reference Currency (as defined below).

This free writing prospectus relates to a single offering of securities. The purchaser of a security will acquire a senior unsecured debt security of HSBC USA Inc. linked to the performance of the Reference Currency relative to the U.S. dollar as described below. The following key terms relate to the offering of these securities:

|

Issuer:

|

HSBC USA Inc.

|

|

|

Issuer Rating:

|

AA- (S&P), A1 (Moody’s), AA (Fitch)†

|

|

|

Principal Amount:

|

$1,000 per security

|

|

|

Reference Currency:

|

Chinese Renminbi (Yuan) (“CNY”)

|

|

|

Fixing Source:

|

CNY SAEC at Reuters Page SAEC

|

|

|

Base Currency:

|

U.S. Dollar (“USD”)

|

|

|

Payment at Maturity:

|

At maturity, you will be entitled to receive a cash payment per $1,000 Principal Amount of securities equal to the Principal Amount plus the final Conditional Coupon, if any.

|

|

|

Conditional Coupon (paid annually):

|

The Conditional Coupon will be paid annually on each Coupon Payment Date only if the CNY has appreciated such that the Spot Rate is less than the applicable Trigger Rate on the relevant Coupon Observation Date.

If the Spot Rate on the relevant Coupon Observation Date is less than the applicable Trigger Rate, the Coupon will equal:

$1,000 x Conditional Coupon Rate

If the Spot Rate is greater than or equal to the applicable Trigger Rate on the relevant Coupon Observation Date, no Conditional Coupon will be paid on such Coupon Payment Date.

|

|

|

Conditional Coupon Rate:

|

Between 4.50% and 5.00% per annum (to be determined on the Pricing Date).

|

|

|

Coupon Observation Dates

|

Coupon Observation Date

|

Coupon Payment Date

|

|

and Coupon Payment Dates:

|

May 25, 2012

|

May 31, 2012

|

|

May 28, 2013

|

May 31, 2013

|

|

|

May 27, 2014

|

May 30, 2014

|

|

|

May 26, 2015

|

May 29, 2015

|

|

|

May 25, 2016

|

May 31, 2016

|

|

|

If a Coupon Observation Date is not a Currency Business Day, then the Coupon Observation Date will be the next day that is a Currency Business Day. If a Coupon Observation Date is postponed, then the Maturity Date or corresponding Coupon Payment Date, as applicable, will also be postponed until the third Business Day following the latest of such postponed Coupon Observation Dates. The Coupon Observation Dates are also subject to postponement as specified below under “Market Disruption Events.”

For each Coupon Payment Date, if any such day is not a Business Day, the relevant Coupon Payment Date shall be the next succeeding Business Day. If the Maturity Date falls on a date that is not a Business Day, payment of the Conditional Coupon, if any, and principal will be made on the next succeeding Business Day, and no interest will accrue for the period from and after the originally scheduled Maturity Date.

|

||

FWP-4

|

Trigger Rate:

|

The Trigger Rate corresponding to each Coupon Observation Date is as follows:

|

||

|

Coupon Observation Date

|

Trigger Rate

|

Value

|

|

|

May 25, 2012

|

98% of the Initial Spot Rate

|

||

|

May 28, 2013

|

96% of the Initial Spot Rate

|

||

|

May 27, 2014

|

94% of the Initial Spot Rate

|

||

|

May 26, 2015

|

92% of the Initial Spot Rate

|

||

|

May 25, 2016

|

90% of the Initial Spot Rate

|

||

|

Spot Rate:

|

The Spot Rate, as determined by the Calculation Agent by reference to the Spot Rate definitions set forth in this free writing prospectus under “Spot Rate,” will be the U.S. Dollar/CNY spot rate at 9:15 a.m. Beijing time for the CNY, expressed as the amount of foreign currency per one U.S. Dollar, which appears on the relevant Reuters page or any successor page. The Spot Rate is subject to the provisions set forth under “Market Disruption Events” in this free writing prospectus.

|

||

|

Initial Spot Rate:

|

The Spot Rate on the Pricing Date.

|

||

|

Trade Date:

|

May 24, 2011

|

||

|

Pricing Date:

|

May 25, 2011

|

||

|

Original Issue Date:

|

May 31, 2011

|

||

|

Maturity Date:

|

Expected to be May 31, 2016. The Maturity Date is subject to postponement in the event of a market disruption event as described below under “Market Disruption Events.”

|

||

|

Calculation Agent:

|

HSBC USA Inc.

|

||

|

Currency Business Day:

|

A day on which (a) dealings in foreign currency in accordance with the practice of the foreign exchange market occur in the City of New York and Beijing, China and (b) banking institutions in The City of New York and Beijing, China are not otherwise authorized or required by law, regulation or executive order to close.

|

||

|

Business Day:

|

Any day, other than a Saturday or Sunday, that is neither a legal holiday nor a day on which banking institutions are authorized or required by law or regulation to close in the City of New York.

|

||

|

Listing:

|

The securities will not be listed on any U.S. securities exchange or quotation system.

|

||

|

CUSIP / ISIN:

|

4042K1HE6 /

|

||

|

Form of Securities:

|

Book-Entry

|

||

† A credit rating reflects the creditworthiness of HSBC USA Inc. and is not a recommendation to buy, sell or hold securities, and it may be subject to revision or withdrawal at any time by the assigning rating organization. The securities themselves have not been independently rated. Each rating should be evaluated independently of any other rating.

FWP-5

GENERAL

This free writing prospectus relates to a single security offering linked to the performance of the Reference Currency relative to the U.S. dollar. The purchaser of a security will acquire a senior unsecured debt security linked to the performance of the Reference Currency relative to the U.S. dollar with annual coupon payments if the Spot Rate is less than the applicable Trigger Rate on the relevant Coupon Observation Date. We reserve the right to withdraw, cancel or modify any offering and to reject orders in whole or in part. Although the security offering relates only to the performance of the Reference Currency relative to the U.S. dollar identified on the cover page, you should not construe that fact as a recommendation as to the merits of acquiring an investment linked to the performance of the Reference Currency relative to the U.S. dollar or as to the suitability of an investment in the securities.

You should read this document together with the prospectus dated April 2, 2009 and the prospectus supplement dated April 9, 2009. If the terms of the securities offered hereby are inconsistent with those described in the accompanying prospectus supplement or prospectus, the terms described in this free writing prospectus shall control. You should carefully consider, among other things, the matters set forth in “Selected Risk Considerations” beginning on page FWP-7 of this free writing prospectus and “Risk Factors” on page S-3 of the prospectus supplement, as the securities involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the securities. As used herein, references to the “Issuer”, “HSBC”, “we”, “us” and “our” are to HSBC USA Inc.

HSBC has filed a registration statement (including a prospectus and a prospectus supplement) with the SEC for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents HSBC has filed with the SEC for more complete information about HSBC and this offering. You may get these documents for free by visiting EDGAR on the SEC’s web site at www.sec.gov. Alternatively, HSBC Securities (USA) Inc. or any dealer participating in this offering will arrange to send you the prospectus and prospectus supplement if you request them by calling toll-free 1-866-811-8049.

You may also obtain:

|

•

|

the prospectus supplement at www.sec.gov/Archives/edgar/data/83246/000114420409019785/v145824_424b2.htm

|

|

•

|

We are using this free writing prospectus to solicit from you an offer to purchase the securities. You may revoke your offer to purchase the securities at any time prior to the time at which we accept your offer by notifying HSBC Securities (USA) Inc. We reserve the right to change the terms of, or reject any offer to purchase, the securities prior to their issuance. In the event of any material changes to the terms of the securities, we will notify you.

TRUSTEE

Notwithstanding anything contained in the accompanying prospectus supplement to the contrary, the securities will be issued under the senior indenture dated March 31, 2009, between HSBC USA Inc., as Issuer, and Wells Fargo Bank, National Association, as trustee. Such indenture has substantially the same terms as the indenture described in the accompanying prospectus supplement.

PAYING AGENT

Notwithstanding anything contained in the accompanying prospectus supplement to the contrary, HSBC Bank USA, N.A. will act as paying agent with respect to the securities pursuant to a Paying Agent and Securities Registrar Agreement dated June 1, 2009, between HSBC USA Inc. and HSBC Bank USA, N.A.

CONDITIONAL COUPON

The Conditional Coupon, if any, is paid annually. The Coupon Payment Dates are expected to be May 31, 2012, May 31, 2013, May 30, 2014, May 29, 2015 and May 31, 2016 (the “Maturity Date”), provided that if any such day is not a Business Day, the relevant Coupon Payment Date shall be the next succeeding Business Day. If the final Coupon Payment Date (which is also the Maturity Date) is postponed as described below, such final Coupon Payment Date will be postponed until the postponed Maturity Date. In no event, however, will any additional interest accrue on the securities as a result of any the foregoing postponements. For information regarding the record dates applicable to the Conditional Coupons paid on the

FWP-6

securities, please see the section entitled “Recipients of Interest Payments” on page S-18 in the accompanying prospectus supplement.

The Conditional Coupon Rate will be between 4.50% and 5.00% per annum (to be determined on the Pricing Date).

CALCULATION AGENT

We or one of our affiliates will act as calculation agent with respect to the securities.

SELECTED PURCHASE CONSIDERATIONS

Preservation of capital at maturity.

You will receive at least the Principal Amount of your securities, subject to the credit risk of HSBC, if you hold the securities to maturity, regardless of whether the Spot rate is less than the applicable Trigger Rate on any Coupon Observation Date. In order to receive the Conditional Coupon on each Coupon Payment Date, the Reference Currency will need to appreciate, as compared to the Initial Spot Rate, by more than 2.00% on the first Coupon Observation Date, more than 4.00% on the second Coupon Observation Date, more than 6.00% on the third Coupon Observation Date, more than 8.00% on the fourth Coupon Observation Date and more than 10.00% on the final Coupon observation Date in order for you to receive a Conditional Coupon on a Coupon Payment Date and therefore a return in excess of your initial investment. Because the securities are our senior unsecured debt obligations, payment of any Conditional Coupon or at maturity is subject to our ability to pay our obligations as they become due.

SELECTED RISK CONSIDERATIONS

An investment in the securities involves significant risks. Investing in the securities is not equivalent to investing directly in the Reference Currency. You should understand the risks of investing in the securities and should reach an investment decision only after careful consideration, with your advisors, of the suitability of the securities in light of your particular financial circumstances and the information set forth in this free writing prospectus and the accompanying prospectus and prospectus supplement.

In addition to the following risks, you should review “Risk Factors” beginning on page S-3 in the accompanying prospectus supplement including the explanation of risks relating to the securities described in the following section:

|

|

·

|

“— Risks Relating to All Note Issuances”; and

|

|

|

·

|

“— Additional Risks Relating to Notes That Are Denominated In or Indexed to a Foreign Currency or With a Reference Asset That Is a Foreign Currency or a Contract or Index Relating Thereto.”

|

You may not receive the Conditional Coupon even if the Chinese Renminbi (Yuan) appreciates relative to the U.S. Dollar.

On each Coupon Payment Date, the Conditional Coupon is payable only if the Spot Rate is less than the applicable Trigger Rate on the relevant Coupon Observation Date. The Conditional Coupon will not be paid if the Spot Rate is greater than or equal to the applicable Trigger Rate on the relevant Coupon Observation Date, meaning the Reference Currency either depreciated or did not sufficiently appreciate relative to the U.S. Dollar. Therefore, even if the Reference Currency appreciates relative to the U.S. dollar but the Spot Rate is not less than the applicable Trigger Rate on the relevant Coupon Observation Date, you will not receive the Conditional Coupon on the relevant Coupon Payment Date. If the Spot Rate is never less than the applicable Trigger Rate, you will receive no Conditional Coupon payments over the term of the securities and you will not be compensated for any loss in value due to inflation and other factors relating to the value of money over time. You should consider, among other things, the overall potential annual Conditional Coupon Rate to maturity of the securities as compared to other investment alternatives.

The securities are not ordinary debt securities and the Conditional Coupon payment is not fixed for any Coupon Payment Date.

The Conditional Coupon payment will be paid on a Coupon Payment Date, only if the Spot Rate is less than the applicable Trigger Rate on the relevant Coupon Observation Date. If the Spot Rate is not less than the applicable Trigger Rate on the

FWP-7

relevant Coupon Observation Date you will not receive a Conditional Coupon payment. We have no control over any fluctuation in the Spot Rate.

The securities are subject to the credit risk of HSBC USA Inc.

The securities are senior unsecured debt obligations of the issuer, HSBC, and are not, either directly or indirectly, an obligation of any third party. As further described in the accompanying prospectus supplement and prospectus, the securities will rank on par with all of the other unsecured and unsubordinated debt obligations of HSBC, except such obligations as may be preferred by operation of law. Any payment to be made on the securities, including any Conditional Coupon payment or return of principal at maturity, depends on the ability of HSBC to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of HSBC may affect the market value of the securities and, in the event HSBC were to default on its obligations, you may not receive the amounts owed to you under the terms of the securities.

The exchange rate of the Chinese Renminbi (Yuan) is currently managed by the Chinese government.

The U.S. Dollar/Chinese Renminbi (Yuan) exchange rate is managed by the Chinese government to float within a narrow band with reference to a basket of currencies and is based on a daily poll of onshore market dealers and other undisclosed factors. The People’s Bank of China, the monetary authority in China, may also use a variety of techniques, such as imposition of regulatory controls or taxes, to affect the U.S. Dollar/Chinese Renminbi (Yuan) exchange rate. The People’s Bank has stated that it will make adjustments of the Chinese Renminbi (Yuan) exchange rate band when necessary according to market developments as well as the economic and financial situation. In the future, the Chinese government may also issue a new currency to replace its existing currency or alter the exchange rate or relative exchange characteristics by devaluation or revaluation of the Chinese Renminbi (Yuan) in ways that may be adverse to your interests.

The Chinese government continues to manage the valuation of the Chinese Renminbi (Yuan), and, as currently managed, its price movements may not contribute significantly to either an increase or decrease in the Spot Rate. If the exchange rate of the Chinese Renminbi (Yuan) remains static you will not receive any Conditional Coupon payments during the term of the securities. However, changes in the Chinese government’s management of the Chinese Renminbi (Yuan) could result in movements in the U.S. Dollar/Chinese Renminbi (Yuan) exchange rate. A decrease in the value of the Chinese Renminbi (Yuan), whether as a result of a change in the government’s management of the currency or for other reasons, could result in a change in the Spot Rate.

Investing in the securities is not equivalent to investing directly in the Reference Currency.

You may receive a lower return than you would have received if you had invested directly in the Reference Currency. In addition, your return is based on the Conditional Coupon, which is in turn based upon the Spot Rate on each Coupon Observation Date as compared to the applicable Trigger Rate. The Conditional Coupon is dependent solely on the Spot Rate as compared to the applicable Trigger Rate and not on any other formula that could be used for calculating currency performances. As such, the Conditional Coupon may be materially different from the return on a direct investment in the Reference Currency.

The securities are not insured or guaranteed by any governmental agency of the United States or any other jurisdiction.

The securities are not deposit liabilities or other obligations of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency or program of the United States or any other jurisdiction. An investment in the securities is subject to the credit risk of HSBC, and in the event that HSBC is unable to pay its obligations as they become due, you may not receive the full Payment at Maturity of the securities.

Certain built-in costs are likely to adversely affect the value of the securities prior to maturity.

While the Payment at Maturity described in this free writing prospectus is based on the full Principal Amount of your securities, the original issue price of the securities includes the placement agent’s commission and the estimated cost of hedging our obligations under the securities through one or more of our affiliates. As a result, the price, if any, at which HSBC Securities (USA) Inc. will be willing to purchase securities from you in secondary market transactions, if at all, will likely be lower than the original issue price, and any sale of securities by you prior to the maturity date could result in a substantial loss to you.

FWP-8

The securities are not designed to be short-term trading instruments.

The securities are not designed to be short-term trading instruments. Accordingly, you should be willing and able to hold your securities to maturity.

Currency markets may be volatile.

Currency markets may be highly volatile, particularly in relation to emerging or developing nations’ currencies, and, in certain market conditions, also in relation to developed nations’ currencies. Significant changes, including changes in liquidity and prices, can occur in such markets within very short periods of time. Foreign currency rate risks include, but are not limited to, convertibility risk and market volatility and potential interference by foreign governments through regulation of local markets, foreign investment or particular transactions in foreign currency. These factors may affect the Reference Currency and the value of your securities in varying ways, and different factors may cause the Reference Currency and the volatility of its price to move in inconsistent directions at inconsistent rates.

Legal and regulatory risks.

Legal and regulatory changes could adversely affect currency rates. In addition, many governmental agencies and regulatory organizations are authorized to take extraordinary actions in the event of market emergencies. It is not possible to predict the effect of any future legal or regulatory action relating to currency rates, but any such action could cause unexpected volatility and instability in currency markets with a substantial and adverse effect on the performance of the Reference Currency and, consequently, the value of the securities.

The securities are subject to emerging markets’ political and economic risks.

The Reference Currency is the currency of an emerging market country. Emerging market countries are more exposed to the risk of swift political change and economic downturns than their industrialized counterparts. In recent years, emerging markets have undergone significant political, economic and social change. Such far-reaching political changes have resulted in constitutional and social tensions, and, in some cases, instability and reaction against market reforms have occurred. With respect to any emerging or developing nation, there is the possibility of nationalization, expropriation or confiscation, political changes, government regulation and social instability. There can be no assurance that future political changes will not adversely affect the economic conditions of an emerging or developing-market nation. Political or economic instability is likely to have an adverse effect on the performance of the Reference Currency, and, consequently, the return on the securities.

If the liquidity of the Reference Currency is limited, the value of the securities would likely be impaired.

Currencies and derivatives contracts on currencies may be difficult to buy or sell, particularly during adverse market conditions. Reduced liquidity on any Coupon Observation Date would likely have an adverse effect on the Spot Rate for the Reference Currency, and therefore, on any Conditional Coupon payment. Limited liquidity relating to the Reference Currency may also result in HSBC USA Inc., as Calculation Agent, being unable to determine the Spot Rate, and therefore any Conditional Coupon payment using its normal means. The resulting discretion by the Calculation Agent in determining the return could, in turn, result in potential conflicts of interest.

Potential conflicts.

We and our affiliates play a variety of roles in connection with the issuance of the securities, including acting as Calculation Agent and hedging our obligations under the securities. In performing these duties, the economic interests of the Calculation Agent and other affiliates of ours are potentially adverse to your interests as an investor in the securities. We will not have any obligation to consider your interests as a holder of the securities in taking any corporate action that might affect the Reference Currency and the value of the securities.

The securities lack liquidity.

The securities will not be listed on any securities exchange. HSBC Securities (USA) Inc. may offer to purchase the securities in the secondary market but is not required to do so and may cease making such offers at any time. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the securities easily. Because other dealers are not likely to make a secondary market for the securities, the price at which you may be able to trade your securities is likely to depend on the price, if any, at which HSBC Securities (USA) Inc. is willing to buy the securities.

FWP-9

We have no control over exchange rates.

Foreign exchange rates can either float or be fixed by sovereign governments. Exchange rates of the currencies used by most economically developed nations are permitted to fluctuate in value relative to the U.S. Dollar and to each other. However, from time to time governments may use a variety of techniques, such as intervention by a central bank, the imposition of regulatory controls or taxes or changes in interest rates to influence the exchange rates of their currencies. Governments may also issue a new currency to replace an existing currency or alter the exchange rate or relative exchange characteristics by a devaluation or revaluation of a currency. These governmental actions could change or interfere with currency valuations and currency fluctuations that would otherwise occur in response to economic forces, as well as in response to the movement of currencies across borders. As a consequence, these government actions could adversely affect an investment in a security that is linked to an exchange rate.

Potentially inconsistent research, opinions, or recommendations by HSBC.

We, our affiliates and agents publish research from time to time on financial markets and other matters that may influence the value of the securities, or express opinions or provide recommendations that may be inconsistent with purchasing or holding the securities. We, our affiliates and agents may publish research or other opinions that are inconsistent with the investment view implicit in the securities. Any research, opinions or recommendations expressed by us, our affiliates or agents may not be consistent with each other and may be modified from time to time without notice. Investors should make their own independent investigation of the merits of investing in the securities and the Reference Currency to which the securities are linked.

Economic and market factors will impact the value of the securities.

We expect that, generally, the exchange rate for the Reference Currency on any day will affect the value of the securities more than any other single factor. However, you should not expect the value of the securities in the secondary market to vary in proportion to the appreciation or depreciation of the Reference Currency relative to the U.S. Dollar. The value of the securities will be affected by a number of other factors that may either offset or magnify each other, including:

|

·

|

the expected volatility of the Reference Currency and the U.S. Dollar;

|

|

·

|

the time to maturity of the securities;

|

|

·

|

the volatility of the exchange rate of the Reference Currency and the U.S. Dollar;

|

|

·

|

interest and yield rates in the market generally and in the market of the Reference Currency and the U.S. Dollar;

|

|

·

|

a variety of economic, financial, political, regulatory or judicial events;

|

|

·

|

supply and demand for the securities; and

|

|

·

|

our creditworthiness, including actual or anticipated downgrades in our credit ratings.

|

Historical performance of the Reference Currency should not be taken as an indication of the future performance of the Reference Currency during the term of the securities.

It is impossible to predict whether the Spot Rate for the Reference Currency will rise or fall. The Reference Currency will be influenced by complex and interrelated political, economic, financial and other factors.

Market disruptions may adversely affect your return.

The Calculation Agent may, in its sole discretion, determine that the markets have been affected in a manner that prevents it from determining the Spot Rate in the manner described herein, and calculating the amount that we are required to pay you on a Coupon Payment Date or upon maturity, or from properly hedging its obligations under the securities. These events may include disruptions or suspensions of trading in the markets as a whole or general inconvertibility or non-transferability of one or more currencies. If the Calculation Agent, in its sole discretion, determines that any of these events prevents us or any of our affiliates from properly hedging our obligations under the securities or prevents the Calculation Agent from determining the Conditional Coupon or Payment at Maturity in the ordinary manner, the Calculation Agent will determine the Conditional Coupon or Payment at Maturity in good faith and in a commercially reasonable manner, and it is possible that the Coupon Payment Dates will be postponed, which may adversely affect the return on your securities. For example, if the source for the Spot Rate is not available on the Coupon Observation Date, the Calculation Agent may determine the Spot Rate for such date, and such determination may adversely affect the return on your securities.

FWP-10

WHAT IS THE PAYMENT AT MATURITY ON THE SECURITIES ASSUMING A RANGE OF PERFORMANCES FOR THE REFERENCE CURRENCY?

The examples below set forth a sampling of hypothetical Final Spot Rate for the securities based on the following assumptions:

|

}

|

Principal Amount of securities:

|

$1,000

|

|

}

|

Trigger Rates:

|

For each Coupon Observation Date, 98.00%, 96.00%, 94.00%, 92.00% and 90.00%, respectively, of the Hypothetical Initial Spot Rate.

|

|

}

|

Hypothetical Conditional Coupon Rate:

|

4.50% per annum (the actual Conditional Coupon Rate will not be less than 4.50% or greater than 5.00% and will be determined on the Pricing Date).

|

|

}

|

Hypothetical Initial Spot Rate:

|

6.500. The actual Initial Spot Rate will be determined on the Pricing Date.

|

The following examples illustrate how hypothetical Conditional Coupon payments on the securities are calculated. The examples provided herein are for illustration purposes only. The actual Conditional Coupon payments, if any, will depend on whether the Spot Rate is below the applicable Trigger Rate on the corresponding Coupon Observation Date. You should not take these examples as an indication of potential payments. It is not possible to predict whether you will receive any Conditional Coupon payments over the term of the securities.

Example 1: The Reference Currency appreciates relative to the U.S. dollar and the Spot Rate is less than the relevant Trigger Rate on each Coupon Observation Date.

|

Coupon Observation Dates

|

|||||

|

5/25/2012

|

5/28/2013

|

5/27/2014

|

5/26/2015

|

5/25/2016

|

|

|

Trigger Rate

|

6.370

(98% of Initial

Spot Rate) |

6.240

(96% of Initial

Spot Rate) |

6.110

(94% of Initial

Spot Rate) |

5.980

(92% of Initial

Spot Rate) |

5.850

(90% of Initial

Spot Rate) |

|

Currency Appreciation

(Depreciation) |

3%

|

5%

|

8%

|

10%

|

11%

|

|

Spot Rate

|

6.305

|

6.175

|

5.980

|

5.850

|

5.785

|

|

Conditional Coupon

Rate |

4.50%

|

4.50%

|

4.50%

|

4.50%

|

4.50%

|

Because the Spot Rate of the Reference Currency is less than the relevant Trigger Rate on each Coupon Observation Date, you will receive a Conditional Coupon of $45.00 per $1,000 Principal Amount of securities on the respective Coupon Payment Dates. Therefore, you will receive total Conditional Coupon payments of $225.00 over the term of the securities and your principal back at maturity.

Example 2: The Reference Currency either depreciates or does not appreciate sufficiently relative to the U.S. dollar, and the Spot Rate is greater than or equal to the relevant Trigger Rate on each Coupon Observation Date.

|

Coupon Observation Dates

|

|||||

|

5/25/2012

|

5/28/2013

|

5/27/2014

|

5/26/2015

|

5/25/2016

|

|

|

Trigger Rate

|

6.370

(98% of Initial

Spot Rate) |

6.240

(96% of Initial

Spot Rate) |

6.110

(94% of Initial

Spot Rate) |

5.980

(92% of Initial

Spot Rate) |

5.850

(90% of Initial

Spot Rate) |

|

Currency Appreciation

(Depreciation) |

(-5%)

|

(-2%)

|

5%

|

7%

|

10%

|

|

Spot Rate

|

6.825

|

6.630

|

6.175

|

6.046

|

5.850

|

|

Conditional Coupon

Rate |

0.00%

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

Because the Spot Rate of the Reference Currency is greater than the relevant Trigger Rate on each Coupon Observation Date, you will receive only your principal back at maturity and no Conditional Coupon payments over the term of the securities.

FWP-11

Example 3: The Reference Currency appreciates relative to the U.S. dollar and the Spot Rate is less than the relevant Trigger Rate on the second and final Coupon Observation Dates.

|

Coupon Observation Dates

|

|||||

|

5/25/2012

|

5/28/2013

|

5/27/2014

|

5/26/2015

|

5/25/2016

|

|

|

Trigger Rate

|

6.370

(98% of Initial Spot Rate)

|

6.240

(96% of Initial Spot Rate)

|

6.110

(94% of Initial Spot Rate)

|

5.980

(92% of Initial Spot Rate)

|

5.850

(90% of Initial Spot Rate)

|

|

Currency Appreciation (Depreciation)

|

1%

|

5%

|

3%

|

8%

|

11%

|

|

Spot Rate

|

6.435

|

6.175

|

6.305

|

5.980

|

5.785

|

|

Conditional Coupon Rate

|

0.00%

|

4.50%

|

0.00%

|

0.00%

|

4.50%

|

Because the Spot Rate of the Reference Currency is less than the relevant Trigger Rate on the second and final Coupon Observation Dates, you will receive a Conditional Coupon of $45.00 per $1,000 Principal Amount of securities on the respective Coupon Payment Dates. Therefore, you will receive total Conditional Coupon payments of $90.00 over the term of the securities and your principal back at maturity.

FWP-12

USE OF PROCEEDS AND HEDGING

Part of the net proceeds we receive from the sale of the securities will be used in connection with hedging our obligations under the securities through one or more of our affiliates. The hedging or trading activities of our affiliates on or prior to the Trade Date and during the term of the securities could adversely affect the amount you may receive on the securities at maturity.

SPOT RATE

The Spot Rate for the Chinese Renminbi (Yuan) on each date of calculation will be the U.S. Dollar/Chinese Renminbi (Yuan) official fixing rate, expressed as the amount of Chinese Renminbi (Yuan) per one U.S. Dollar, for settlement in two business days, as reported by the People’s Bank of China, Beijing, People’s Republic of China, which appears on Reuters Screen SAEC Page opposite the symbol “USDCNY=” or any successor page, at approximately 9:15 a.m., Beijing time, on such date of calculation. Four decimal figures shall be used for the determination of such USDCNY exchange rate.

If the Spot Rate is unavailable (including being published in error, as determined by the Calculation Agent in its sole discretion), the Spot Rate for the Reference Currency shall be selected by the Calculation Agent in good faith and in a commercially reasonable manner or the Coupon Observation Dates may be postponed by the Calculation Agent as described below in “Market Disruption Events.”

MARKET DISRUPTION EVENTS

The Calculation Agent may, in its sole discretion, determine that an event has occurred that prevents it from valuing the Reference Currency in the manner initially provided for herein. These events may include disruptions or suspensions of trading in the markets as a whole or general inconvertibility or non-transferability of the Reference Currency. If the Calculation Agent, in its sole discretion, determines that any of these events prevents us or our affiliates from properly hedging our obligations under the securities or prevents the Calculation Agent from determining such value in the ordinary manner on such Coupon Observation Date, the Calculation Agent may determine such value in good faith and in a commercially reasonable manner on such date or, in the discretion of the Calculation Agent, the Coupon Observation Dates may be postponed for up to five scheduled trading days, each of which may adversely affect the return on your securities. If a Coupon Observation Date has been postponed for five consecutive scheduled trading days, then that fifth scheduled trading day will be the Coupon Observation Date and the Calculation Agent will determine the level of such Reference Currency using the formula for and method of determining such level which applied just prior to the market disruption event (or in good faith and in a commercially reasonable manner) on such date. If a Coupon Observation Date is postponed, then the Maturity Date or corresponding Coupon Payment Date, as applicable, will also be postponed to the third Business Day following the latest of such postponed Coupon Observation Dates.

EVENTS OF DEFAULT AND ACCELERATION

If the securities have become immediately due and payable following an Event of Default (as defined in the accompanying prospectus) with respect to the securities, the calculation agent will determine (i) the accelerated Payment at Maturity due and payable in the same general manner as described in Payment at Maturity in this free writing prospectus and (ii) any accrued but unpaid interest payable. In such a case, the Business Day immediately preceding the date of acceleration will be used as the Coupon Observation Date for purposes of determining the Conditional Coupon payable, if any, on the securities on the accelerated Maturity Date. The accelerated Maturity Date will be the third Business Day following the accelerated final Coupon Observation Date.

If the securities have become immediately due and payable following an event of default, you will not be entitled to any additional payments with respect to the securities. For more information, see “Description of Debt Securities — Events of Default” and “— Events of Default; Defaults” in the accompanying prospectus.

FWP-13

HISTORICAL INFORMATION

|

Description of the CNY

The exchange rate displayed in the graph below are for illustrative purposes only and do not form part of the calculation of the Conditional Coupon or Payment at Maturity. The value of the Coupon increases when the Reference Currency appreciates in value against the U.S. Dollar.

The closing exchange rate and the historical daily Reference Currency performance data in the graph below was the rate reported by Bloomberg Financial Markets and may not be indicative of the Reference Currency performance using the Spot Rates of the Reference Currency that would be derived from the applicable Reuters page.

|

Historical Performance of the CNY

The following graph below shows the historical weekly performance of the Reference Currency expressed in terms of the conventional market quotation, as shown on Bloomberg Financial Markets, for the Reference Currency (the amount of the Reference Currency that can be exchanged for one U.S. Dollar, which we refer to in this term sheet as the exchange rate) from April 28, 2006 through April 27, 2011. The exchange rate of the Chinese Renminbi (Yuan), relative to the U.S. Dollar on April 27, 2011, was 6.512.

Chinese Renminbi (Yuan)

|

FWP-14

SUPPLEMENTAL PLAN OF DISTRIBUTION (CONFLICTS OF INTEREST)

We have appointed HSBC Securities (USA) Inc., an affiliate of HSBC, as the agent for the sale of the securities. Pursuant to the terms of a distribution agreement, HSBC Securities (USA) Inc. will purchase the securities from HSBC for distribution to other registered broker dealers or will offer the securities directly to investors. HSBC Securities (USA) Inc. proposes to offer the securities at the offering price set forth on the cover page of this free writing prospectus and will receive underwriting discounts and commissions of between 2.00% and 2.50%, or between $20.00 and $25.00, per $1,000 Principal Amount of securities. HSBC Securities (USA) Inc. may allow selling concession on sales of such securities by other brokers or dealers of up to 2.50%, or $25.00, and may pay referral fees to other broker-dealers of up to 2.50%, or $25.00, per $1,000 Principal Amount of securities.

In addition, HSBC Securities (USA) Inc. or another of its affiliates or agents may use the pricing supplement to which this free writing prospectus relates in market-making transactions after the initial sale of the securities, but is under no obligation to do so and may discontinue any market-making activities at any time without notice.

See “Supplemental Plan of Distribution” on page S-52 in the prospectus supplement. All references to NASD Rule 2720 in the prospectus supplement shall be to FINRA Rule 5121.

We expect that delivery of the securities will be made against payment for the securities on or about the Original Issue Date set forth on page FWP-2 of this document, which is expected to be the fourth business day following the Trade Date of the securities. Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in three business days, unless the parties to that trade expressly agree otherwise. Accordingly, purchasers who wish to trade securities on the Trade Date, will be required to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement and should consult their own advisers.

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS

You should carefully consider the matters set forth in “Certain U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement. The following discussion summarizes certain of the material U.S. federal income tax consequences of the purchase, beneficial ownership, and disposition of the securities. This summary supplements the section “Certain U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement and supersedes it to the extent inconsistent therewith.

There are no statutory provisions, regulations, published rulings or judicial decisions addressing the characterization for U.S. federal income tax purposes of securities with terms that are substantially the same as those of the securities. We intend to treat the securities as contingent payment debt instruments for U.S. federal income tax purposes. Pursuant to the terms of the securities, you agree to treat the securities as contingent payment debt instruments for all U.S. federal income tax purposes and, in the opinion of Sidley Austin llp, special U.S. tax counsel to us, it is reasonable to treat the securities as contingent payment debt instruments. Assuming the securities are treated as contingent payment debt instruments, a U.S. holder will be required to include original issue discount (“OID”) in gross income each year, even though the actual coupon payment made with respect to the securities during a taxable year, if any, may differ from the amount of OID that must be accrued during that taxable year.

Based on the factors described in the section, “Certain U.S. Federal Income Tax Considerations — U.S. Federal Income Tax Treatment of the Notes as Indebtedness for U.S. Federal Income Tax Purposes — Contingent Payment Debt Instruments” in the accompanying prospectus supplement, in order to illustrate the application of the noncontingent bond method to the securities, we have estimated that the comparable yield of the securities, solely for U.S. federal income tax purposes, will be 3.03% per annum (compounded annually). In addition, we have computed a “projected payment schedule” that produces the comparable yield and includes the projected amount of the coupon payments.

Under this method and based upon the estimate of the comparable yield, HSBC has estimated that the projected payment schedule for the securities that have a Principal Amount of $1,000 and an issue price of $1,000, consists of the following projected payments, and a U.S. holder that pays taxes on a calendar year basis, buys a security for $1,000 and holds the security until maturity, will, subject to the adjustments described below, be required to pay taxes on the following amounts of ordinary income in respect of the securities in each year:

FWP-15

|

Year

|

Projected Payments

|

OID Income

|

|

2010

|

N/A

|

$17.76

|

|

2011

|

$30.38

|

$30.38

|

|

2012

|

$30.30

|

$30.30

|

|

2013

|

$30.30

|

$30.30

|

|

2014

|

$30.30

|

$30.30

|

|

2015

|

$1,030.38

|

$12.62

|

However, if the actual amount of a coupon payment in a taxable year is different from the amount reflected in the projected payment schedule, a U.S. holder is required to make an adjustment to its original issue discount accrual when such amount is paid. Adjustments arising from coupon payments that are greater than the projected amounts of those payments are referred to as “positive adjustments”; adjustments arising from coupon payments that are less than the projected amounts are referred to as “negative adjustments.” Any positive adjustment for a taxable year is treated as additional original issue discount income of the U.S. holder. Any negative adjustment reduces any original issue discount on the security for the taxable year that would otherwise accrue. Any excess is then treated as a current-year ordinary loss to the U.S. holder to the extent of original issue discount accrued in prior years. The balance, if any, is treated as a negative adjustment in subsequent taxable years. To the extent that it has not previously been taken into account, an excess negative adjustment reduces the amount realized upon a sale, exchange, or retirement of the security.

U.S. holders should also note that the actual comparable yield may be different than as provided in this summary depending upon market conditions on the date the securities are issued. U.S. holders may obtain the actual comparable yield and projected payment schedule, as determined by us, by submitting a written request to: Structured Equity Derivatives – Structuring HSBC Bank USA, National Association, 452 Fifth Avenue, 3rd Floor, New York, NY 10018. A U.S. holder is generally bound by the comparable yield and the projected payment schedule established by us for the securities. However, if a U.S. holder believes that the projected payment schedule is unreasonable, a U.S. holder must determine its own projected payment schedule and explicitly disclose the use of such schedule and the reason the holder believes the projected payment schedule is unreasonable on its timely filed U.S. federal income tax return for the taxable year in which it acquires the securities.

The comparable yield and projected payment schedule are not provided for any purpose other than the determination of a U.S. holder’s interest accruals for U.S. federal income tax purposes and do not constitute a projection or representation by us regarding the actual yield on a security. We do not make any representation as to what such actual yield will be.

Because there are no statutory provisions, regulations, published rulings or judicial decisions addressing the characterization for U.S. federal income tax purposes of securities with terms that are substantially the same as those of the securities, other characterizations and treatments are possible. As a result, the timing and character of income in respect of the securities might differ from the treatment described above. You should carefully consider the discussion of all potential tax consequences as set forth in “Certain U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement.

PROSPECTIVE PURCHASERS OF SECURITIES SHOULD CONSULT THEIR TAX ADVISORS AS TO THE FEDERAL, STATE, LOCAL, AND OTHER TAX CONSEQUENCES TO THEM OF THE PURCHASE, OWNERSHIP AND DISPOSITION OF SECURITIES.

FWP-16

|

TABLE OF CONTENTS

|

You should only rely on the information contained in this free writing prospectus, any accompanying prospectus supplement and prospectus. We have not authorized anyone to provide you with information or to make any representation to you that is not contained in this free writing prospectus, any accompanying prospectus supplement and prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This free writing prospectus, any accompanying prospectus supplement and prospectus are not an offer to sell these securities, and these documents are not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted. You should not, under any circumstances, assume that the information in this free writing prospectus, any accompanying prospectus supplement and prospectus is correct on any date after their respective dates.

HSBC USA Inc.

$ Currency Appreciation Coupon

Securities due May 31, 2016 May 5, 2011

FREE WRITING PROSPECTUS

|

||

|

Free Writing Prospectus

|

|||

|

General

|

FWP-6

|

||

|

Trustee

|

FWP-6

|

||

|

Paying Agent

|

FWP-6

|

||

|

Conditional Coupon

|

FWP-6

|

||

|

Calculation Agent

|

FWP-7

|

||

|

Selected Purchase Considerations

|

FWP-7

|

||

|

Selected Risk Considerations

|

FWP-7

|

||

|

What is the Payment at Maturity on the Securities

|

|||

| Assuming a Range of Performances for the | |||

|

Reference Currency?

|

FWP-11

|

||

|

Use of Proceeds and Hedging

|

FWP-13

|

||

|

Spot Rates

|

FWP-13

|

||

|

Market Disruption Events

|

FWP-13

|

||

|

Events of Default and Acceleration

|

FWP-13

|

||

|

Historical Information

|

FWP-14

|

||

|

Supplemental Plan of Distribution (Conflicts of Interest)

|

FWP-15

|

||

|

Certain U.S. Ferderal Income Tax Considerations

|

FWP-15

|

||

|

Prospectus Supplement

|

|||

|

Risk Factors

|

S-3

|

||

|

Pricing Supplement

|

S-16

|

||

|

Description of Notes

|

S-16

|

||

|

Sponsors or Issuers and Reference Asset

|

S-37

|

||

|

Use of Proceeds and Hedging

|

S-37

|

||

|

Certain ERISA

|

S-38

|

||

|

Certain U.S. Federal Income Tax Considerations

|

S-39

|

||

|

Supplemental Plan of Distribution

|

S-52

|

||

|

Prospectus

|

|||

|

About this Prospectus

|

2

|

||

|

Special Note Regarding Forward-Looking Statements

|

2

|

||

|

HSBC USA Inc.

|

3

|

||

|

Use of Proceeds

|

3

|

||

|

Description of Debt Securities

|

4

|

||

|

Description of Preferred Stock

|

16

|

||

|

Description of Warrants

|

22

|

||

|

Description of Purchase Contracts

|

26

|

||

|

Description of Units

|

29

|

||

|

Book-Entry Procedures

|

32

|

||

|

Limitations on Issuances in Bearer Form

|

36

|

||

|

Certain U.S. Federal Income Tax Considerations Relating to

Debt Securities |

37

|

||

|

Plan of Distribution

|

52

|

||

|

Notice to Canadian Investors

|

54

|

||

|

Certain ERISA Matters

|

58

|

||

|

Where You Can Find More Information

|

59

|

||

|

Legal Opinions

|

59

|

||

|

Experts

|

59

|

||

FWP-17