HSBC USA Inc.

Buffered Accelerated Market Participation SecuritiesTM

Linked to the S&P 500® ESG Index (the “Reference Asset”)

| ► | 200% (2.0x) exposure to any positive return of the S&P 500® ESG Index, subject to a maximum return of at least 13.60% (to be determined on the Pricing Date) |

| ► | Protection from the first 10% of any losses of the Reference Asset |

| ► | Approximately a 2.5-year Maturity |

| ► | All payments on the Notes are subject to the credit risk of HSBC USA Inc. |

http://uswealth.hsbcnet.com/videos/buffered_accelerated_notes.html

The Buffered Accelerated Market Participation SecuritiesTM (each a “Note” and collectively the “Notes") offered hereunder will not be listed on any U.S. securities exchange or automated quotation system. The Notes will not bear interest.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the Notes or passed upon the accuracy or the adequacy of this document, the accompanying prospectus, prospectus supplement or Equity Index Underlying Supplement. Any representation to the contrary is a criminal offense. We have appointed HSBC Securities (USA) Inc., an affiliate of ours, as the agent for the sale of the Notes. HSBC Securities (USA) Inc. will purchase the Notes from us for distribution to other registered broker-dealers or will offer the Notes directly to investors. In addition, HSBC Securities (USA) Inc. or another of its affiliates or agents may use the pricing supplement to which this free writing prospectus relates in market-making transactions in any Notes after their initial sale. Unless we or our agent inform you otherwise in the confirmation of sale, the pricing supplement to which this free writing prospectus relates is being used in a market-making transaction. See “Supplemental Plan of Distribution (Conflicts of Interest)” on page FWP-20 of this document.

Investment in the Notes involves certain risks. You should refer to “Risk Factors” beginning on page FWP-7 of this document, page S-1 of the accompanying prospectus supplement and page S-1 of the accompanying Equity Index Underlying Supplement.

The Estimated Initial Value of the Notes on the Pricing Date is expected to be between $860 and $960 per Note, which will be less than the price to public. The market value of the Notes at any time will reflect many factors and cannot be predicted with accuracy. See “Estimated Initial Value” on page FWP-4 and “Risk Factors” beginning on page FWP-7 of this document for additional information.

| Price to Public | Underwriting Discount(1) | Proceeds to Issuer | |

| Per Note | $1,000.00 | ||

| Total |

(1) ) HSBC USA Inc. or one of our affiliates may pay an underwriting discount of up to 2.25% and referral fees of up to 1.00% per $1,000 Principal Amount in connection with the distribution of the Notes to other registered broker-dealers. In no case will the sum of the underwriting discounts and referral fees exceed 2.75% per $1,000 Principal Amount. See “Supplemental Plan of Distribution (Conflicts of Interest)” on page FWP-20 of this document.

The Securities:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

HSBC pledges to invest the amount raised by this Note into projects that align with the United Nations Sustainable Development Goals. This Note is an obligation of the issuer, HSBC USA Inc, and all payments of principal and interest are obligations of the issuer.

Indicative Terms1

|

|

| Principal

Amount |

$1,000 per Note |

| Term | Approximately 2.5 years |

| Reference Asset |

The S&P 500® ESG Index (Ticker: “SPXESUP”) |

| Upside Participation Rate |

200% (2.0x) exposure to any positive Reference Return |

| Maximum Cap | At least 13.60% (to be determined on the Pricing Date) |

| Buffer Level | -10% |

| Reference Return |

Final Level – Initial Level Initial Level |

Payment

at |

If the Reference Return is greater than zero, you will receive the lesser of: a) $1,000 + ($1,000 × Reference Return × Upside Participation Rate); and b) $1,000 + ($1,000 × Maximum Cap). If the Reference Return is less than or equal to zero but greater than or equal to the Buffer Level: $1,000 (zero return). If the Reference Return is less than the Buffer Level: $1,000 + [$1,000 × (Reference Return + 10%)]. For example, if the Reference Return is -30%, you will suffer a 20% loss and receive 80% of the Principal Amount, subject to the credit risk of HSBC USA, Inc. If the Reference Return is less than the Buffer Level, you will lose some or a significant portion (up to 90%) of your investment. |

| Initial Level | The official Closing Level of the Reference Asset on the Pricing Date |

| Final Level | The official Closing Level of the Reference Asset on the Final Valuation Date |

| Pricing Date | January 26, 2021 |

| Trade Date | January 26, 2021 |

| Original

Issue Date |

January 29, 2021 |

| Final

Valuation Date(2) |

July 26, 2023 |

| Maturity Date(2) | July 31, 2023 |

| CUSIP/ISIN | 40438CM99 / US40438CM997 |

Sustainable Development Goals

| § | HSBC is embracing the catalyzing role its lending activities can play towards the achievement of the United Nations’ Sustainable Development Goals (UNSDGs). The bank has pledged $100 billion in sustainable financing by 2025. These funds will go towards climate change, as well as reducing poverty and inequality. |

| § | The United Nations Sustainable Development Goals are a unified action plan for promoting global sustainability. The amount raised by this Note will fund projects that are closely aligned with several of these goals. |

| § | The range of sustainable development projects supported may include building hospitals, schools, small scale renewable energy power plants, LEED certified buildings, public railway systems, and more. The projects align with these goals: |

The S&P 500® ESG Index

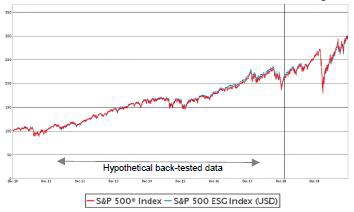

| § | The S&P 500® ESG Index aligns investment objectives with Environmental, Social, and Governance (ESG) values. The index’s broad market exposure and industry diversification result in a return profile similar to that of the S&P 500® Index (see graph on the following page). |

| § | The index uses the new S&P DJI ESG Scores and other comprehensive ESG data to select companies, targeting 75% of the market capitalization of each Global Industry Classification Standard industry group within the S&P 500® Index. |

| § | The S&P 500® ESG Index excludes tobacco, controversial weapons, and companies not in compliance with the UN Global Compact. In addition, those with S&P ESG Scores in the bottom 25% of companies globally within their industry groups are also excluded. |

(1) As more fully described on page FWP-4.

(2) Subject to adjustment as described under “Additional Terms of the Notes” in the accompanying Equity Index Underlying Supplement.

FWP-2

HSBC Sustainable Development Goals Bond – your investment making a difference

HSBC pledges to invest the amount raised by these Notes into projects that align with the United Nations Sustainable Development Goals, specifically:

|

CLIMATE CHANGE - Adaptation projects that contribute to reducing vulnerability to climate change and do not increase carbon emissions |

|

SUSTAINABLE CITIES & COMMUNITIES - Activities that expand or maintain affordable housing and sustainable transport systems |

|

INDUSTRY INNOVATION & INFRASTRUCTURE - Develop sustainable infrastructure that will also benefit economic development and well-being |

|

CLEAN WATER - Expand public access to safe drinking water; provide adequate sanitation; improve water quality; increase water-use efficiency |

|

AFFORDABLE CLEAN ENERGY – Generate clean energy from renewable sources; introduce technology that reduces energy consumption |

|

QUALITY EDUCTION - Expand equal access to education at all levels; women and minority inclusion in education; enhance education infrastructure |

|

GOOD HEALTH & WELL-BEING - Strengthen capacity of all countries’, free or subsidized healthcare, and management of health crises |

ESG investing considers environmental, social, and governance factors as central to the fundamental analysis of a security.

Hypothetical and Historical Comparative Data1

ESG Index tracks the S&P 500® Index with less than 1% tracking error

Source: Bloomberg L.P. The black vertical line shows the inception on January 28, 2019. Past performance is not a prediction of future results.

Hypothetical Scenarios

The Scenarios below are for purposes of illustration only. They show hypothetical calculations of the Index's Final Return.

Payoff Example

The table at right shows the hypothetical payout profile of an investment in the Notes reflecting the Upside Participation Rate of 200% (2.0x) and the Buffer Level of -10%, and assuming a Maximum Cap of 13.60%.

| Reference Return | Participation

in Reference Return |

Securities Return |

| 30.00% 20.00% |

2.0x

upside exposure, subject to Maximum Cap |

13.60% 13.60% |

| 8.50% 5.00% |

2.0x

upside exposure |

13.60% 10.00% |

| -20.00% -30.00% |

1x

loss beyond buffer |

-10.00% -20.00% |

1 The hypothetical back-tested Index data only reflects the application of that methodology in hindsight, since the Index was not actually calculated and published prior to January 28, 2019. The hypothetical back-tested Index data cannot completely account for the impact of financial risk in actual trading. There are numerous factors related to the equities markets in general that cannot be, and have not been, accounted for in the hypothetical back-tested Index data, all of which can affect actual performance. Consequently, you should not rely on that data as a reflection of what the actual Index performance would have been had the Index been in existence or in forecasting future Index performance. The graph above also reflects the actual Index performance from January 28, 2019 to December 18, 2020 based on information that we obtained from Bloomberg L.P. Any hypothetical or actual historical upward or downward trend in the level of the Index during any period shown is not an indication that the level of the Index is more or less likely to increase or decrease at any time during the term of the Notes.

FWP-3

| HSBC USA Inc. |  |

| Buffered Accelerated Market Participation Securities |

Linked to the S&P 500® ESG Index

This document relates to a single offering of Buffered Accelerated Market Participation SecuritiesTM. The Notes will have the terms described in this document and the accompanying prospectus, prospectus supplement and Equity Index Underlying Supplement. If the terms of the Notes offered hereby are inconsistent with those described in the accompanying prospectus, prospectus supplement or Equity Index Underlying Supplement, the terms described in this document shall control. You should be willing to forgo interest and dividend payments during the term of the Notes and, if the Reference Return is less than the Buffer Level, lose some or a significant portion (up to 90%) of your principal.

This document relates to an offering of Notes linked to the performance of the S&P 500® ESG Index (the “Reference Asset”). The purchaser of a Note will acquire a senior unsecured debt security of HSBC USA Inc. linked to the Reference Asset as described below. The following key terms relate to the offering of Notes:

| Issuer: | HSBC USA Inc. |

| Principal Amount: | $1,000 per Note |

| Reference Asset: | The S&P 500® ESG Index (Ticker: “SPXESUP”) |

| Trade Date: | January 26, 2021 |

| Pricing Date: | January 26, 2021 |

| Original Issue Date: | January 29, 2021 |

| Final Valuation Date: | July 26, 2023, subject to adjustment as described under “Additional Terms of the Notes—Valuation Dates” in the accompanying Equity Index Underlying Supplement. |

| Maturity Date: | 3 business days after the Final Valuation Date, which is expected to be July 31, 2023. The Maturity Date is subject to adjustment as described under “Additional Terms of the Notes—Coupon Payment Dates, Call Payment Dates and Maturity Date” in the accompanying Equity Index Underlying Supplement. |

| Upside Participation Rate: | 200% (2.0x) |

| Payment at Maturity: | On the Maturity Date, for each Note, we will pay you the Final Settlement Value. |

| Reference Return: | The quotient, expressed as a percentage, calculated as follows: |

Final Level – Initial Level Initial Level | |

| Final Settlement Value: | If the Reference Return is greater than zero, you will receive a cash payment on the Maturity Date, per $1,000 Principal Amount, equal to the lesser of: (a) $1,000 + ($1,000 × Reference Return × Upside Participation Rate); and (b) $1,000 + ($1,000 × Maximum Cap). If the Reference Return is less than or equal to zero but greater than or equal to the Buffer Level, you will receive $1,000 per $1,000 Principal Amount (zero return). If the Reference Return is less than the Buffer Level, you will receive a cash payment on the Maturity Date, per $1,000 Principal Amount, calculated as follows: $1,000 + [$1,000 × (Reference Return + 10%)]. Under these circumstances, you will lose 1% of the Principal Amount of your Notes for each percentage point that the Reference Return is below the Buffer Level. For example, if the Reference Return is -30%, you will suffer a 20% loss and receive 80% of the Principal Amount, subject to the credit risk of HSBC. If the Reference Return is less than the Buffer Level, you will lose some or a significant portion (up to 90%) of your investment. |

| Buffer Level: | -10% |

| Maximum Cap: | At least 13.60% (to be determined on the Pricing Date) |

| Initial Level: | The Official Closing Level of the Reference Asset on the Pricing Date. |

| Final Level: | The Official Closing Level of the Reference Asset on the Final Valuation Date. |

| Form of Securities: | Book-Entry |

| Listing: | The Notes will not be listed on any U.S. securities exchange or quotation system. |

| CUSIP/ISIN: | 40438CM99 / US40438CM997 |

| Estimated Initial Value: | The Estimated Initial Value of the Notes is expected to be less than the price you pay to purchase the Notes. The Estimated Initial Value does not represent a minimum price at which we or any of our affiliates would be willing to purchase your Notes in the secondary market, if any, at any time. The Estimated Initial Value will be calculated on the Pricing Date. See “Risk Factors — The Estimated Initial Value of the Notes, which will be determined by us on the Pricing Date, is expected to be less than the price to public and may differ from the market value of the Notes in the secondary market, if any.” |

The Trade Date, the Pricing Date and the other dates set forth above are subject to change, and will be set forth in the pricing supplement relating to the Notes.

FWP-4

GENERAL

This document relates to an offering of Notes linked to the Reference Asset. The purchaser of a Note will acquire a senior unsecured debt security of HSBC USA Inc. We reserve the right to withdraw, cancel or modify this offering and to reject orders in whole or in part. Although the offering of Notes relates to the Reference Asset, you should not construe that fact as a recommendation as to the merits of acquiring an investment linked to the Reference Asset or any component security included in the Reference Asset or as to the suitability of an investment in the Notes.

You should read this document together with the prospectus dated February 26, 2018, the prospectus supplement dated February 26, 2018 and the Equity Index Underlying Supplement dated February 26, 2018. If the terms of the Notes offered hereby are inconsistent with those described in the accompanying prospectus, prospectus supplement or Equity Index Underlying Supplement, the terms described in this document shall control. You should carefully consider, among other things, the matters set forth in “Risk Factors” beginning on page FWP-7 of this document, page S-1 of the prospectus supplement and page S-1 of the Equity Index Underlying Supplement, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes. As used herein, references to the “Issuer”, “HSBC”, “we”, “us” and “our” are to HSBC USA Inc.

HSBC has filed a registration statement (including a prospectus, prospectus supplement and Equity Index Underlying Supplement) with the SEC for the offering to which this document relates. Before you invest, you should read the prospectus, prospectus supplement and Equity Index Underlying Supplement in that registration statement and other documents HSBC has filed with the SEC for more complete information about HSBC and this offering. You may get these documents for free by visiting EDGAR on the SEC’s web site at www.sec.gov. Alternatively, HSBC Securities (USA) Inc. or any dealer participating in this offering will arrange to send you the prospectus, prospectus supplement and Equity Index Underlying Supplement if you request them by calling toll-free 1-866-811-8049.

You may also obtain:

| 4 | The Equity Index Underlying Supplement at: https://www.sec.gov/Archives/edgar/data/83246/000114420418010782/tv486722_424b2.htm |

| 4 | The prospectus supplement at: https://www.sec.gov/Archives/edgar/data/83246/000114420418010762/tv486944_424b2.htm |

| 4 | The prospectus at: https://www.sec.gov/Archives/edgar/data/83246/000114420418010720/tv487083_424b3.htm |

We are using this document to solicit from you an offer to purchase the Notes. You may revoke your offer to purchase the Notes at any time prior to the time at which we accept your offer by notifying HSBC Securities (USA) Inc. We reserve the right to change the terms of, or reject any offer to purchase, the Notes prior to their issuance. In the event of any material changes to the terms of the Notes, we will notify you.

PAYMENT AT MATURITY

On the Maturity Date, for each Note you hold, we will pay you the Final Settlement Value, which is an amount in cash, as described below:

If the Reference Return is greater than zero, you will receive a cash payment on the Maturity Date, per $1,000 Principal Amount, equal to the lesser of:

(a) $1,000 + ($1,000 × Reference Return × Upside Participation Rate); and

(b) $1,000 + ($1,000 × Maximum Cap*).

*At least 13.60% (to be determined on the Pricing Date)

If the Reference Return is less than or equal to zero but greater than or equal to the Buffer Level, you will receive $1,000 per $1,000 Principal Amount (zero return).

If the Reference Return is less than the Buffer Level, you will receive a cash payment on the Maturity Date, per $1,000 Principal Amount, calculated as follows:

$1,000 + [$1,000 × (Reference Return + 10%)].

Under these circumstances, you will lose 1% of the Principal Amount of your Notes for each percentage point that the Reference Return is below the Buffer Level. For example, if the Reference Return is -30%, you will suffer a 20% loss and receive 80% of the Principal Amount, subject to the credit risk of HSBC. You should be aware that if the Reference Return is less than the Buffer Level, you will lose some or a significant portion (up to 90%) of your investment.

FWP-5

Interest

The Notes will not pay interest.

Calculation Agent

We or one of our affiliates will act as calculation agent with respect to the Notes.

Reference Sponsor

S&P Dow Jones Indices LLC, a division of S&P Global, is the reference sponsor.

INVESTOR SUITABILITY

| The Notes may be suitable for you if: | The Notes may not be suitable for you if: |

► You seek an investment with an enhanced return linked to the potential positive performance of the Reference Asset and you believe the level of the Reference Asset will increase over the term of the Notes.

► You are willing to invest in the Notes based on the Maximum Cap of at least 13.60% (to be determined on the Pricing Date), which may limit your return at maturity.

► You are willing to make an investment that is exposed to the negative Reference Return on a 1-to-1 basis for each percentage point that the Reference Return is below the Buffer Level of -10%.

► You are willing to forgo dividends or other distributions paid to holders of the stocks included in the Reference Asset.

► You are willing to accept the risk and return profile of the Notes versus a conventional debt security with a comparable maturity issued by HSBC or another issuer with a similar credit rating.

► You are comfortable with the proceeds of the Notes being used as described in “Use of Proceeds.”

► You do not seek current income from your investment.

► You do not seek an investment for which there is an active secondary market.

► You are willing to hold the Notes to maturity.

► You are comfortable with the creditworthiness of HSBC, as Issuer of the Notes.

|

► You believe the Reference Return will be negative or that the Reference Return will not be sufficiently positive to provide you with your desired return.

► You are unwilling to invest in the Notes based on the Maximum Cap of at least 13.60% (to be determined on the Pricing Date), which may limit your return at maturity.

► You are unwilling to make an investment that is exposed to the negative Reference Return on a 1-to-1 basis for each percentage point that the Reference Return is below the Buffer Level of -10%.

► You seek an investment that provides full return of principal.

► You prefer the lower risk, and therefore accept the potentially lower returns, of conventional debt securities with comparable maturities issued by HSBC or another issuer with a similar credit rating.

► You are not comfortable with the proceeds of the Notes being used as described in “Use of Proceeds.”

► You prefer to receive the dividends or other distributions paid to holders of the stocks included in the Reference Asset.

► You seek current income from your investment.

► You seek an investment for which there will be an active secondary market.

► You are unable or unwilling to hold the Notes to maturity.

► You are not willing or are unable to assume the credit risk associated with HSBC, as Issuer of the Notes.

|

FWP-6

RISK FACTORS

We urge you to read the section “Risk Factors” beginning on page S-1 of the accompanying prospectus supplement and page S-1 of the accompanying Equity Index Underlying Supplement. Investing in the Notes is not equivalent to investing directly in any of the stocks included in the Reference Asset. You should understand the risks of investing in the Notes and should reach an investment decision only after careful consideration, with your advisors, of the suitability of the Notes in light of your particular financial circumstances and the information set forth in this document and the accompanying, prospectus, prospectus supplement and Equity Index Underlying Supplement.

In addition to the risks discussed below, you should review “Risk Factors” in the accompanying prospectus supplement and Equity Index Underlying Supplement including the explanation of risks relating to the Notes described in the following sections:

| 4 | “— Risks Relating to All Note Issuances” in the prospectus supplement; and |

| 4 | “— General Risks Related to Indices” in the Equity Index Underlying Supplement. |

You will be subject to significant risks not associated with conventional fixed-rate or floating-rate debt securities.

Risks Relating to the Structure or Features of the Notes

Your investment in the Notes may result in a loss.

You will be exposed to the decline in the Final Level from the Initial Level beyond the Buffer Level of -10%. Accordingly, if the Reference Return is less than the Buffer Level of -10%, your Payment at Maturity will be less than the Principal Amount of your Notes. You will lose some or a significant portion (up to 90%) of your investment at maturity if the Reference Return is less than the Buffer Level.

The appreciation on the Notes is limited by the Maximum Cap.

You will not participate in any appreciation in the level of the Reference Asset (as multiplied by the Upside Participation Rate) beyond the Maximum Cap of at least 13.60% (to be determined on the Pricing Date). You will not receive a return on the Notes greater than the Maximum Cap.

The amount payable on the Notes is not linked to the level of the Reference Asset at any time other than on the Final Valuation Date.

The Final Level will be based on the Official Closing Level of the Reference Asset on the Final Valuation Date, subject to postponement for non-trading days and certain Market Disruption Events. Even if the level of the Reference Asset appreciates during the term of the Notes other than on the Final Valuation Date but then decreases on the Final Valuation Date to a level that is less than the Initial Level, the Payment at Maturity may be less, and may be significantly less, than it would have been had the Payment at Maturity been linked to the level of the Reference Asset prior to such decrease. Although the actual level of the Reference Asset on the Maturity Date or at other times during the term of the Notes may be higher than the Final Level, the Payment at Maturity will be based solely on the Official Closing Level of the Reference Asset on the Final Valuation Date.

Use of proceeds.

We and/or our affiliates will exercise our judgment and sole discretion in determining the businesses and projects within the Eligible Sectors (as defined below) that will be financed by the proceeds of the Notes. If the use of the proceeds of the Notes is a factor in your decision to invest in the Notes, you should consider our discussion in “Use of Proceeds” and consult with your counsel or other advisors before making an investment in the Notes. There can be no assurance that any of the businesses and projects funded with the proceeds from the Notes will meet our sustainable development goals or your expectations. Furthermore, there is no contractual obligation to allocate the proceeds of the Notes or an amount equal thereto to finance eligible businesses and projects or to provide annual progress reports as described in “Use of Proceeds”. Our or our affiliates’ failure to so allocate, the failure of HSBC Holdings plc to report as further described in “Use of Proceeds”, the failure of any of the businesses and projects funded with the proceeds from the Notes to meet the Framework (as defined herein) or the failure of Sustainalytics or any external assurance provider to opine on the progress report’s conformity with the Framework may affect the value of the Notes and/or have adverse consequences for certain depositors with portfolio mandates to invest in the businesses and projects within the Eligible Sectors (as defined below).

Furthermore, it should be noted that there is currently no clearly-defined definition (legal, regulatory or otherwise) of, nor market consensus as to what constitutes, a “green” or an equivalently-labelled project or as to what precise attributes are required for a particular project to be defined as “green” or “sustainable” or such other equivalent label, nor can any assurance be given that such a clear definition or consensus will develop over time. Accordingly, no assurance is or can be given to depositors that any projects or uses that are the subject of, or related to, any of the businesses and projects funded with the proceeds from the Notes will meet any or all depositors expectations regarding such “green” or other equivalently-labelled performance objectives or that any adverse environmental and/or other impacts will not occur during the implementation of any projects or uses that are the subject of, or related to, any of the businesses and projects funded with the proceeds from the Notes.

The Notes will not bear interest.

As a holder of the Notes, you will not receive interest payments.

FWP-7

Risks Relating to the Reference Asset

Changes that affect the Reference Asset will affect the market value of the Notes and the amount you will receive at maturity.

The policies of the reference sponsor of the Reference Asset concerning additions, deletions and substitutions of the constituents comprising the Reference Asset and the manner in which the reference sponsor takes account of certain changes affecting those constituents included in the Reference Asset may affect the level of the Reference Asset. The policies of the reference sponsor with respect to the calculation of the Reference Asset could also affect the level of the Reference Asset. The reference sponsor may discontinue or suspend calculation or dissemination of the Reference Asset. Any such actions could affect the value of the Notes and the return on the Notes.

We make no representation or assurance as to the environmental and social impact of the companies included in the Reference Asset.

We make no representation or assurance that the composition of the Reference Asset satisfies, whether in whole or in part, any present or future depositor expectations or requirements as regards any direct or indirect environmental and social impact of the businesses or products of companies included in the Reference Asset. If the environmental and social impact of the companies included in the Reference Asset is a factor in an investor’s decision to invest in Notes linked to such Reference Asset, investors should consult with their legal or other advisers before making an investment in the Notes.

The Reference Asset may not be successful and may underperform alternative investment strategies.

There can be no assurance that the Reference Asset will achieve positive returns over any period. The components of the Reference Asset are selected from the constituents of the S&P 500® Index according to the methodology described below. The Reference Asset may underperform relative to the S&P 500® Index or equity markets generally, and the performance of the Reference Asset may be less favorable than alternative investment strategies that could have been implemented.

The Reference Asset follows a particular methodology, which may differ significantly from alternative approaches and investor expectations.

As described in “Description of the Reference Asset,” the Reference Asset follows a specific methodology developed by its sponsor, with determinations made by the sponsor as to which constituents of the S&P 500® Index will be selected as components of the Reference Asset. These determinations are also based on information provided by third-parties and scoring methodologies developed by the sponsor and third-parties. The Reference Asset methodology and the underlying score methodologies and may differ substantially from alternative strategies with similar objectives. Decisions to include or exclude components of the Reference Asset will be made solely by the sponsor, and such decisions will affect the performance of the Reference Asset on an ongoing basis. Additionally, the sponsor will make decisions regarding the stocks included in the Reference Asset at its own discretion, without regard to investor expectations. For example, the sponsor can exercise discretion in evaluating the severity of a controversy and determining whether to exclude a company after the publication of a Media and Stakeholder Analysis report. Similarly, any determinations made with respect to the underlying scores or data referenced by the sponsor, will be made without regard to investors. Neither we nor you will have any ability to affect decisions made regarding the Reference Asset or any underlying data, scores or methodologies. The Reference Asset may include components that differ significantly from alternative investments strategies with similar objectives and may underperform such alternative investment strategies, perhaps significantly.

The Reference Asset has a very limited operating history and may perform in unanticipated ways.

The Reference Asset was established on January 28, 2019 and therefore has little to no operating history. Because the Reference Asset is of recent origin and limited actual historical performance data exists with respect to it, your investment in the Notes may involve a greater risk than investing in securities linked to an index with a more established record of performance. Hypothetical back-tested performance prior to the launch of the Index provided in this document refers to simulated performance data created by applying the Index's calculation methodology to historical prices of the equities that comprise the Reference Asset. Such simulated performance data has been produced by the retroactive application of a back-tested methodology in hindsight, and may give more preference towards equities that have performed well in the past. Hypothetical back-tested results are neither an indicator or a guarantor of future results.

General Risk Factors

Credit risk of HSBC USA Inc.

The Notes are senior unsecured debt obligations of the Issuer, HSBC, and are not, either directly or indirectly, an obligation of any third party. As further described in the accompanying prospectus supplement and prospectus, the Notes will rank on par with all of the other unsecured and unsubordinated debt obligations of HSBC, except such obligations as may be preferred by operation of law. Any payment to be made on the Notes, including any return of principal at maturity, depends on the ability of HSBC to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of HSBC may affect the market value of the Notes and, in the event HSBC were to default on its obligations, you may not receive the amounts owed to you under the terms of the Notes.

FWP-8

The Notes are not insured or guaranteed by any governmental agency of the United States or any other jurisdiction.

The Notes are not deposit liabilities or other obligations of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency or program of the United States or any other jurisdiction. An investment in the Notes is subject to the credit risk of HSBC, and in the event that HSBC is unable to pay its obligations as they become due, you may not receive the full Payment at Maturity of the Notes.

The Estimated Initial Value of the Notes, which will be determined by us on the Pricing Date, is expected to be less than the price to public and may differ from the market value of the Notes in the secondary market, if any.

The Estimated Initial Value of the Notes will be calculated by us on the Pricing Date and is expected to be less than the price to public. The Estimated Initial Value will reflect our internal funding rate, which is the borrowing rate we pay to issue market-linked securities, as well as the mid-market value of the embedded derivatives in the Notes. This internal funding rate is typically lower than the rate we would use when we issue conventional fixed or floating rate debt securities. As a result of the difference between our internal funding rate and the rate we would use when we issue conventional fixed or floating rate debt securities, the Estimated Initial Value of the Notes may be lower if it were based on the prices at which our fixed or floating rate debt securities trade in the secondary market. In addition, if we were to use the rate we use for our conventional fixed or floating rate debt issuances, we would expect the economic terms of the Notes to be more favorable to you. We will determine the value of the embedded derivatives in the Notes by reference to our or our affiliates’ internal pricing models. These pricing models consider certain assumptions and variables, which can include volatility and interest rates. Different pricing models and assumptions could provide valuations for the Notes that are different from our Estimated Initial Value. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. The Estimated Initial Value does not represent a minimum price at which we or any of our affiliates would be willing to purchase your Notes in the secondary market (if any exists) at any time.

The price of your Notes in the secondary market, if any, immediately after the Pricing Date is expected to be less than the price to public.

The price to public takes into account certain costs. These costs, which will be used or retained by us or one of our affiliates, include the underwriting discount, our affiliates’ projected hedging profits (which may or may not be realized) for assuming risks inherent in hedging our obligations under the Notes and the costs associated with structuring and hedging our obligations under the Notes. If you were to sell your Notes in the secondary market, if any, the price you would receive for your Notes may be less than the price you paid for them because secondary market prices will not take into account these costs. The price of your Notes in the secondary market, if any, at any time after issuance will vary based on many factors, including the level of the Reference Asset and changes in market conditions, and cannot be predicted with accuracy. The Notes are not designed to be short-term trading instruments, and you should, therefore, be able and willing to hold the Notes to maturity. Any sale of the Notes prior to maturity could result in a loss to you.

If we were to repurchase your Notes immediately after the Original Issue Date, the price you receive may be higher than the Estimated Initial Value of the Notes.

Assuming that all relevant factors remain constant after the Original Issue Date, the price at which HSBC Securities (USA) Inc. may initially buy or sell the Notes in the secondary market, if any, and the value that may initially be used for customer account statements, if any, may exceed the Estimated Initial Value on the Pricing Date for a temporary period expected to be approximately 3 months after the Original Issue Date. This temporary price difference may exist because, in our discretion, we may elect to effectively reimburse to investors a portion of the estimated cost of hedging our obligations under the Notes and other costs in connection with the Notes that we will no longer expect to incur over the term of the Notes. We will make such discretionary election and determine this temporary reimbursement period on the basis of a number of factors, including the tenor of the Notes and any agreement we may have with the distributors of the Notes. The amount of our estimated costs which we effectively reimburse to investors in this way may not be allocated ratably throughout the reimbursement period, and we may discontinue such reimbursement at any time or revise the duration of the reimbursement period after the Original Issue Date of the Notes based on changes in market conditions and other factors that cannot be predicted.

The Notes lack liquidity.

The Notes will not be listed on any securities exchange or automated quotation system. HSBC Securities (USA) Inc. is not required to offer to purchase the Notes in the secondary market, if any exists. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Notes easily. Because other dealers are not likely to make a secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at which HSBC Securities (USA) Inc. is willing to buy the Notes.

Potential conflicts of interest may exist.

An affiliate of HSBC has a minority equity interest in the owner of an electronic platform, through which we may make available certain structured investments offering materials. HSBC and its affiliates play a variety of roles in connection with the issuance of the Notes, including acting as calculation agent and hedging our obligations under the Notes. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the Notes. We will not have any obligation to consider your interests as a holder of the Notes in taking any action that might affect the value of your Notes.

FWP-9

Uncertain tax treatment.

For a discussion of the U.S. federal income tax consequences of your investment in a Note, please see the discussion under “U.S. Federal Income Tax Considerations” herein and the discussion under “U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement.

FWP-10

USE OF PROCEEDS

An amount equal to the net proceeds of the Notes will be used by the Issuer and/or its affiliates to finance, in whole or in part, new and/or existing businesses and projects in the Eligible Sectors (as defined below) in accordance with the Sustainable Development Goal Framework dated November 2017 (the “Framework”) (as described below) adopted by our indirect parent, HSBC Holdings plc (“HSBC plc”), which HSBC plc furnished under cover of Form 6-K to the SEC on November 14, 2017 and which HSBC plc has made available on their website. You can find the Framework on the HSBC plc’s website under “Green and sustainability bonds — HSBC’s Green Bond Framework”. Nothing in the HSBC plc’s website is incorporated into, or made a part of, this document. We expect HSBC plc to furnish any future versions of the Framework with the SEC under cover of Form 6-K, as well as to make it available on their website.

The term of funding to any eligible business or project under the Framework may be shorter or longer than the term of the Notes and may mature or be sold before or after the Maturity Date of the Notes. In the case of any investment that matures or is sold before the Maturity Date of the Notes, we expect to reallocate funds with respect to that eligible business or project back to our account either until maturity of the Notes or allocation of such amounts to new eligible businesses or projects. If funding for any eligible business or project remains outstanding after the Maturity Date of the Notes, neither we nor any of our consolidated subsidiaries will be required to terminate the financing of such project on the Maturity Date of the Notes.

Payment of principal and interest on the Notes will be made from our general funds and will not be directly linked to the performance of any eligible business or project.

The disclosure in this section regarding the use of proceeds of the Notes supersedes the disclosure about the use of proceeds in the accompanying prospectus supplement and prospectus, to the extent this disclosure is inconsistent with the disclosure in those underlying documents.

Framework

Since HSBC plc’s adoption in 2003 of the Equator Principles, establishing an environmental risk management framework for banks, HSBC plc has been at the forefront in supporting growth and innovation in the market for sustainable finance. HSBC plc was one of the first banks to support the International Capital Market Association’s Green Bond Principles in 2014, working with others to establish clear and consistent rules for green investing, and HSBC plc also promoted the 17 Sustainable Development Goals formally established by United Nations General Assembly in September 2015, which implemented a common framework for public and private stakeholders to set their agendas and define their policies and strategies over the following 15 years (the “SDG”). The Framework was a further step towards contributing capital towards the accomplishment of the SDG.

HSBC plc believes that the Framework remains consistent with the current International Capital Market Association’s Green Bond Principles, Social Bond Principles and Sustainability Bond Guidelines and in reaching such conclusion, HSBC plc relied in part on a second party opinion dated 6 November 2017 from Sustainalytics, an external assurance provider, confirming the alignment of the Framework with the International Capital Market Association’s 2017 Sustainability Bond Guidelines. That opinion is available on HSBC plc’s website.

Eligible Sectors

In accordance with the Framework, the “Eligible Sectors” comprise:

Good Health and Well-being (SDG 3)—activities that strengthen the capacity of all countries, in particular developing countries, for provision of free or subsidized healthcare, and early warning, risk reduction and management of health crises.

Quality Education (SDG 4)—activities that (i) expand access to primary, secondary, adult and vocational education, (ii) target women and minority inclusion in education or (iii) improve educational infrastructure.

Clean Water and Sanitation (SDG 6)—activities that (i) expand public access to safe and affordable drinking water, (ii) provide access to adequate sanitation facilities, (iii) improve water quality or (iv) increase water-use efficiency through water recycling, treatment and reuse (including treatment of wastewater).

Affordable and Clean Energy (SDG 7)—activities that involve (i) generation of energy from renewable sources, (ii) construction, maintenance and/or expansion of associated distribution networks, (iii) manufacturing of components of renewable energy technology, (iv) development of products or technology and their implementation that reduces energy consumption of underlying asset, technology, product or system(s), (v) improved efficiency in the delivery of bulk energy services or (vi) manufacturing of components to enable energy efficiency.

Industry Innovation and Infrastructure (SDG 9)—activities that (i) develop quality, reliable, sustainable infrastructure (including regional and trans-border) to support affordable and equitable access for all in a manner that also benefits economic development and human well-being or (ii) upgrade and retrofit infrastructure to make it sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies and industrial processes.

Sustainable Cities and Communities (SDG 11)—activities that expand or maintain the supply of affordable housing or access to sustainable transport systems.

Climate Change (SDG 13)—activities that demonstrably contribute to reducing vulnerability to climate change identified in the project area and do not increase carbon emissions.

FWP-11

Eligibility Criteria of Businesses and Projects

The net proceeds will be used to finance, in whole or in part, future and/or re-finance existing businesses and projects, including our own operations, that promote any of the Eligible Sectors in accordance with the Framework.

We will determine the eligibility of businesses and projects based on whether they apply their funds to Eligible Sectors and whether a significant net positive sustainability impact is achieved by them. If a business or project derives at least 90% its revenue from activities within the Eligible Sectors, it would be considered for financing with the net proceeds. In these instances, the net proceeds can be used for general purposes, so long as this financing does not fund expansion into activities falling outside of the Eligible Sectors.

There is no contractual obligation to allocate the proceeds of the Notes or an amount equal thereto to finance eligible businesses and projects or to provide annual progress reports as further described below. Our failure to so allocate, the failure of HSBC plc to report, the failure of any of the businesses and projects funded with the proceeds from the Notes to meet the Framework or the failure of Sustainalytics or any external assurance provider to opine on the progress report’s conformity with the Framework will not constitute an Event of Default with respect to the Notes and may affect the value of the Notes and/or have adverse consequences for certain investors with portfolio mandates to invest in green assets.

We recognize that businesses and projects may benefit the environment in important ways while also degrading it in others. Accordingly, our assessment of environmental and societal benefits will consider the balance of impact in determining the overall net benefit. We will exercise our professional judgment, discretion and sustainability knowledge in determining eligibility of businesses and projects for the use of the net proceeds.

Businesses and projects that are involved in the following operations will be ineligible: (i) nuclear power generation; (ii) weapons; (iii) alcohol; (iv) gambling / adult entertainment; and (v) palm oil. Moreover, the businesses and projects will not include any coal-fired power plants, the extraction and refining of coal, thermal coal mines or mountaintop removal.

Management and Tracking of the Proceeds

HSBC plc’s Green Bond Committee has responsibility for governing the Framework and for the ratification of eligible businesses and projects by applying the guidelines in the Framework. The Green Bond Committee also will track the use of proceeds of the Notes using its internal information system, as described in the Framework. If any portion of the net proceeds has not been applied to Eligible Sectors, we may invest such unused proceeds according to our local liquidity management guidelines.

Reporting

HSBC plc expects to provide a progress report on an annual basis until all proceeds have been fully allocated including:

| ► | aggregate amounts of funds allocated to each of the Eligible Sectors, together with a description of the types of business and projects financed; |

| ► | the remaining balance of unallocated net proceeds at the reporting period end; and |

| ► | confirmation that the use of proceeds of the Notes issued conforms with the Framework. |

Moreover, Sustainalytics will act as the external assurance provider that will independently review the progress report, on an annual basis, and opine on its conformity with the Framework. We expect HSBC plc to make the annual progress reports and related opinions available on its website.

FWP-12

ILLUSTRATIVE EXAMPLES

The following table and examples are provided for illustrative purposes only and are hypothetical. They do not purport to be representative of every possible scenario concerning increases or decreases in the level of the Reference Asset relative to its Initial Level. We cannot predict the Final Level. The assumptions we have made in connection with the illustrations set forth below may not reflect actual events, and the hypothetical Initial Level used in the table and examples below is not expected to be the actual Initial Level of the Reference Asset. You should not take this illustration or these examples as an indication or assurance of the expected performance of the Reference Asset or the return on your Notes. The Final Settlement Value may be less than the amount that you would have received from a conventional debt security with the same stated maturity, including such a security issued by HSBC. The numbers appearing in the table below and following examples have been rounded for ease of analysis.

The table below illustrates the Payment at Maturity on a $1,000 investment in the Notes for a hypothetical range of Reference Returns from -100% to +100%. The following results are based solely on the assumptions outlined below. The “Hypothetical Return on the Notes” as used below is the number, expressed as a percentage, that results from comparing the Final Settlement Value per $1,000 Principal Amount to $1,000. The potential returns described here assume that your Notes are held to maturity. You should consider carefully whether the Notes are suitable to your investment goals. The following table and examples assume the following:

| ► | Principal Amount: | $1,000 |

| ► | Hypothetical Initial Level: | 1,000 |

| ► | Upside Participation Rate: | 200% |

| ► | Hypothetical Maximum Cap: | 13.60% |

| ► | Buffer Level: | -10% |

*The actual Initial Level and Maximum Cap will be determined on the Pricing Date.

Hypothetical |

Hypothetical Reference Return |

Hypothetical |

Hypothetical |

| 2,000.00 | 100.00% | $1,136.00 | 13.60% |

| 1,800.00 | 80.00% | $1,136.00 | 13.60% |

| 1,600.00 | 60.00% | $1,136.00 | 13.60% |

| 1,400.00 | 40.00% | $1,136.00 | 13.60% |

| 1,300.00 | 30.00% | $1,136.00 | 13.60% |

| 1,200.00 | 20.00% | $1,136.00 | 13.60% |

| 1,068.00 | 6.80% | $1,136.00 | 13.60% |

| 1,050.00 | 5.00% | $1,100.00 | 10.00% |

| 1,020.00 | 2.00% | $1,040.00 | 4.00% |

| 1,010.00 | 1.00% | $1,020.00 | 2.00% |

| 1,000.00 | 0.00% | $1,000.00 | 0.00% |

| 990.00 | -1.00% | $1,000.00 | 0.00% |

| 980.00 | -2.00% | $1,000.00 | 0.00% |

| 950.00 | -5.00% | $1,000.00 | 0.00% |

| 900.00 | -10.00% | $1,000.00 | 0.00% |

| 800.00 | -20.00% | $900.00 | -10.00% |

| 700.00 | -30.00% | $800.00 | -20.00% |

| 600.00 | -40.00% | $700.00 | -30.00% |

| 200.00 | -80.00% | $300.00 | -70.00% |

| 0.00 | -100.00% | $100.00 | -90.00% |

FWP-13

The following examples indicate how the Final Settlement Value would be calculated with respect to a hypothetical $1,000 investment in the Notes.

Example 1: The level of the Reference Asset increases from the Initial Level of 1,000.00 to a Final Level of 1,050.00.

| Reference Return: | 5.00% |

| Final Settlement Value: | $1,100.00 |

Because the Reference Return is positive, and the Reference Return multiplied by the Upside Participation Rate is less than the hypothetical Maximum Cap, the Final Settlement Value would be $1,100.00 per $1,000 Principal Amount, calculated as follows:

$1,000 + ($1,000 × Reference Return × Upside Participation Rate)

= $1,000 + ($1,000 × 5.00% × 200%)

= $1,100.00

Example 1 shows that you will receive the return of your principal investment plus a return equal to the Reference Return multiplied by the Upside Participation Rate when the Reference Asset appreciates and such Reference Return multiplied by the Upside Participation Rate does not exceed the hypothetical Maximum Cap.

Example 2: The level of the Reference Asset increases from the Initial Level of 1,000.00 to a Final Level of 1,300.00.

| Reference Return: | 30.00% |

| Final Settlement Value: | $1,136.00 |

Because the Reference Return is positive, and the Reference Return multiplied by the Upside Participation Rate is greater than the hypothetical Maximum Cap, the Final Settlement Value would be $1,136.00 per $1,000 Principal Amount, calculated as follows:

$1,000 + ($1,000 × Maximum Cap)

= $1,000 + ($1,000 × 13.60%)

= $1,136.00

Example 2 shows that you will receive the return of your principal investment plus a return equal to the hypothetical Maximum Cap when the Reference Return is positive and such Reference Return multiplied by the Upside Participation Rate exceeds the hypothetical Maximum Cap.

Example 3: The level of the Reference Asset decreases from the Initial Level of 1,000.00 to a Final Level of 920.00.

| Reference Return: | -8.00 % |

| Final Settlement Value: | $1,000.00 |

Because the Reference Return is less than zero but greater than the Buffer Level of -10%, the Final Settlement Value would be $1,000.00 per $1,000 Principal Amount (a zero return).

Example 4: The level of the Reference Asset decreases from the Initial Level of 1,000.00 to a Final Level of 700.00.

| Reference Return: | -30.00% |

| Final Settlement Value: | $800.00 |

Because the Reference Return is less than the Buffer Level of -10%, the Final Settlement Value would be $800.00 per $1,000 Principal Amount, calculated as follows:

$1,000 + [$1,000 × (Reference Return + 10%)]

= $1,000 + [$1,000 × (-30.00% + 10%)]

= $800.00

Example 4 shows that you are exposed on a 1-to-1 basis to declines in the level of the Reference Asset beyond the Buffer Level of -10%. You will lose some or a significant portion (up to 90%) of your investment.

FWP-14

DESCRIPTION OF THE REFERENCE ASSET

General

Below is a brief description of the Index and its performance from January 28, 2019. This information is from the Bloomberg Professional® service without independent verification by us. In addition, information regarding the Index sponsor may have been obtained from other sources, including, but not limited to, press releases, newspaper articles and other publicly disseminated documents. The information contained herein is furnished as a matter of information only. Fluctuations in or levels of the Index that have occurred in the past should not be taken as indicative of fluctuations in or levels of the Index that may occur over the term of the Notes. Neither we nor any of our affiliates makes any representation as to the performance of the Index.

The S&P 500® ESG Index

We have derived all information relating to the S&P 500® ESG Index (the “SPXESUP” or the “Index”), including, without limitation, its make-up, method of calculation and changes in its components, from publicly available information. Such information reflects the policies of, and is subject to change by, S&P Dow Jones Indices LLC (“S&P”), a division of S&P Global (the “sponsor”). Neither we nor any of our affiliates has undertaken any independent review or due diligence of such information. S&P has no obligation to continue to publish, and may discontinue or suspend the publication of the SPXESUP at any time.

General

The SPXESUP (reported on the Bloomberg Professional® service under the symbol “SPXESUP”) is designed to measure the performance of securities meeting sustainability criteria, while maintaining similar overall industry group weights as the S&P 500® Index. Publication of the SPXESUP began on January 28, 2019, with a base value of 100 on April 30, 2010.

The SPXESUP is constructed from an eligible universe of stocks consisting of the stocks included in the S&P 500® Index. Eligible constituents are then excluded based on the four screens described below:

| · | Tobacco. Based on data provided by Sustainalytics (a company that rates the sustainability of companies based on their environmental, social and corporate governance performance), constituents are excluded if they either directly or via an ownership interest of 25% or more of another company: (i) produce tobacco, (ii) have tobacco sales accounting for greater than 10% of their revenue, or (iii) have tobacco-related products & services accounting for greater than 10% of their revenue. |

| · | Controversial Weapons. Based on data provided by Sustainalytics, constituents are excluded if they either directly or via an ownership interest of 25% or more of another company are involved in: (i) cluster weapons, (ii) landmines (anti-personnel mines), (iii) biological or chemical weapons, (iv) depleted uranium weapons, (v) white phosphorus weapons, or (vi) nuclear weapons. |

| · | UNGC Score. The Arabesque S-Ray® Service provided by Arabesque (Deutschland) GMBH (an asset manager that, along with its affiliates based in other countries, focuses on environmental, social and governance data and quantitative models) rates companies based on the normative principles of the United Nations Global Compact (such rating, a “UNGC Score” and all companies with an assigned UNGC Score, collectively, the “UNGC Score Universe”). Any company with a UNGC Score at or below the bottom 5% of the UNGC Score Universe is excluded. |

| · | ESG Score. ESG Scores are determined as described below. Any company with an ESG Score that falls within the worst 25% of ESG Scores for its Global Industry Classification Standard (“GICS”) industry group is excluded. GICS entails four levels of classification: (i) sector; (ii) industry group; (iii) industries; and (iv) sub-industries. Under GICS, each company is assigned to one sub-industry according to its principal business activity. Therefore, a company can belong to only one industry grouping at each of the four levels of GICS. |

Companies without Sustainalytics coverage, an assigned UNGC Score or an assigned ESG Score are ineligible for inclusion in the SPXESUP until they receive Sustainalytics coverage, a UNGC Score and an ESG Score. In addition to the exclusions described above, if SAM (the trade name for a business unit of RobecoSAM AG that specializes in environmental, social and governance data, rating services and benchmarking) releases a Media and Stakeholder Analysis (an “MSA”), the applicable constituent will be reviewed and may be removed from the SPXESUP. Any constituent removed based on an MSA will not be eligible for reentry in the SPXESUP for one full calendar year. MSAs are released by SAM to highlight issues including economic crime and corruption, fraud, illegal commercial practices, human rights issues, labor disputes, workplace safety, catastrophic accidents and environmental disasters.

FWP-15

The SPXESUP is then constructed from the remaining eligible stocks through the following process:

| · | First, for each GICS industry group, companies are selected in decreasing order of ESG Score until 65% of the float-adjusted market capitalization for such GICS industry group is reached. |

| · | Second, constituents ranked between 65% and 85% for each GICS industry group are selected to get as close as possible to the target of 75% of the float-adjusted market capitalization. |

| · | Finally, if the combined float-adjusted market capitalization is not above the 75% target, additional eligible companies may be added in decreasing order of ESG Score to get as close as possible to the 75% target. This will continue until the addition of the next eligible component would result in the total float-adjusted market capitalization of the GICS industry group to move further away from the 75% target. |

ESG Scores. S&P and SAM together provide environmental, social and governance scores (“ESG Scores”) that seek to measure companies’ financially material ESG factors based on SAM’s Corporate Sustainability Assessment (“CSA”). For purposes of assessing ESG Scores, companies are assigned to industry groups defined by SAM. These industry group assignments are based on GICS industry group classifications, but some non-standards aggregations are made by SAM.

SAM seeks to perform a CSA on each company included in the S&P Global LargeMidCap Index and the S&P Global 1200 Index (which includes all companies included in the S&P 500® Index as the S&P 500® Index is one of the constituent indices of the S&P Global 1200 Index) as of a designated date in September.

CSA requests, including industry-specific questionnaires, are sent to companies each year in March. ESG scores are calculated based on the responses to the CSA and other available data. If a company does not respond to the CSA, SAM assigns a score based on available data.

A company’s ESG Score is equal to the weighted sum of its ESG indicators. ESG indicators are assigned to different sustainability topics and questions, and the assigned weights of ESG indicators for each industry group are included in the CSAs that are distributed to companies in that industry group. The assigned weight for each ESG indicator may vary between industry groups and may be zero if SAM determines that a particular ESG indicator is not relevant for an industry group. ESG indicator weightings are reviewed each year.

The ESG Score methodology attempts to account for information bias inherent in both the self-provided answers and the discrepancies between provided answers and available information for different companies. Two sorting screens are applied to the questions in each CSA. First, all questions are assigned to one of the three dimensions: environmental, social and governance. The questions within each dimension are then designated as either “mandatory” or “non-mandatory” with a minimum number of mandatory questions required in each dimension. Questions are generally, but not always, deemed mandatory if: (i) information is provided or available for greater than 50% of companies, (ii) if the question is deemed fundamentally important by SAM, or (iii) questions involving public disclosure.

If a question is deemed mandatory but no relevant information is provided or found, a score of zero is assigned and will be included in the calculation of the company’s ESG Score. If no information is found for a non-mandatory question, the question will be disregarded and not included in the company’s ESG Score calculation. The score that is assigned to each question based on a company’s response or other available information is an ESG indicator. When no information is provided for a non-mandatory question and the question is disregarded, the weight allocated to that ESG indicator is redistributed amongst the other ESG indicators.

The ESG Score also attempts to mitigate some of the inherent data biases by normalizing the ESG indicators within each industry group based on a standardized z-score. It is the normalized ESG indicators that are used to calculate the ESG Score for each company.

The ESG Score methodology is under the supervision of the S&P DJI ESG Score Committee (the “ESG Committee”), which included committee members from S&P and SAM. The ESG Committee meets regularly. At each meeting, the ESG Committee reviews the methodology, and the ESG Committee may revise the methodology process if the ESG Committee determines a change is needed to better implement the intent of the scoring process. The ESG Committee may also make exceptions when applying the methodology.

FWP-16

Index Maintenance

The SPXESUP is rebalanced once a year effective after the market close on the last business day of April. The reference date for the data used in the review is the last trading day of March. In addition to the annual rebalancing, there are quarterly updates to the underlying shares and their respective weights within the SPXESUP which are effective after the close on the third Friday in March, June, September and December. Generally, no companies are added between rebalancings, but a company can be deleted between rebalancings due to corporate events such as mergers, takeovers or delistings. In addition, at the discretion of the Committee (as defined below), a deletion may occur if an MSA is raised.

The S&P Dow Jones Indices’ Europe (EMEA) Index Committee (the “Committee”) maintains the SPXESUP and other S&P ESG Indices, meeting regularly. At each meeting, the Committee reviews pending corporate actions that may affect SPXESUP constituents, statistics comparing the composition of the indices to the market, companies that are being considered as candidates for addition to the SPXESUP and any significant market events. In addition, the Committee may revise the index policy covering rules for selecting companies, treatment of dividends, share counts or other matters. S&P considers information about changes to its indices and related matters to be potentially market-moving and material. Therefore, all Committee discussions are confidential.

The table below describes some of the index maintenance adjustments applicable to the SPXESUP and indicates whether or not an index divisor adjustment is required.

| Type of Corporate Action | Comments | Divisor Adjustment | ||

| Spin-off | In general, a spin-off security is added to the index at a zero price at the market close of the day before the ex-date (with no divisor adjustment). The spin-off security will remain in the index if it meets all necessary criteria. If a spin-off security is determined to be ineligible to remain in the index, it will be removed after at least one day of regular way trading (with a divisor adjustment). | No | ||

| Rights offering | The price is adjusted to the price of the parent company minus (the price of the rights offering/rights ratio). Index shares change so that the company's weight remains the same as its weight before the rights offering. | No | ||

| Stock dividend, stock split, reverse stock split | Index shares are multiplied by and price is divided by the split factor. | No | ||

| Share Issuance, Share Repurchase, Equity Offering or Warrant Conversion | None. | No | ||

| Special dividend | Price of the stock making the special dividend payment is reduced by the per-share special dividend amount after the close of trading on the day before the dividend ex-date. | Yes |

The graph below sets forth the hypothetical back-tested performance of the Index from April 30, 2010 through January 27, 2019 and the historical performance of the Index from January 28, 2019 to December 18, 2020. The Index has been calculated by S&P Dow Jones Indices LLC only since January 28, 2019. The hypothetical back-tested performance of the Index set forth in the graph below was calculated using the selection criteria and methodology employed to calculate the Index since its inception on January 28, 2019. The black vertical line shows the inception on January 28, 2019.

FWP-17

Hypothetical and Historical Comparative Data

The hypothetical back-tested Index data only reflects the application of that methodology in hindsight, since the Index was not actually calculated and published prior to January 28, 2019. The hypothetical back-tested Index data cannot completely account for the impact of financial risk in actual trading. There are numerous factors related to the equities markets in general that cannot be, and have not been, accounted for in the hypothetical back-tested Index data, all of which can affect actual performance. Consequently, you should not rely on that data as a reflection of what the actual Index performance would have been had the Index been in existence or in forecasting future Index performance. The graph above also reflects the actual Index performance from January 28, 2019 to December 18, 2020 based on information that we obtained from Bloomberg L.P. Any hypothetical or actual historical upward or downward trend in the level of the Index during any period shown is not an indication that the level of the Index is more or less likely to increase or decrease at any time during the term of the Notes.

License Agreement

We or one of our affiliates has entered into a nonexclusive license agreement providing for the license to it, in exchange for a fee, of the right to use indices owned and published by S&P in connection with some products, including the Notes.

Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“Standard & Poor’s”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by S&P. “Standard & Poor’s®” and “S&P®” are trademarks of S&P and have been licensed for use by S&P and its affiliates and sublicensed for certain purposes by the Issuer. The SPXESUP is a product of S&P, and has been licensed for use by the Issuer.

The Notes are not sponsored, endorsed, sold or promoted by S&P, Dow Jones, Standard & Poor’s or any of their respective affiliates (collectively, “S&P Dow Jones Indices”). S&P Dow Jones Indices makes no representation or warranty, express or implied, to the depositors of the Notes or any member of the public regarding the advisability of investing in certificates of deposit generally or in the Notes particularly or the ability of the SPXESUP to track general market performance. S&P Dow Jones Indices’ only relationship to the Issuer with respect to the SPXESUP is the licensing of the SPXESUP and certain trademarks, service marks and/or trade names of S&P Dow Jones Indices. The SPXESUP is determined, composed and calculated by S&P Dow Jones Indices without regard to the Issuer or the Notes. S&P Dow Jones Indices has no obligation to take the needs of the Issuer or the holders of the Notes into consideration in determining, composing or calculating the SPXESUP. S&P Dow Jones Indices is not responsible for and has not participated in the determination of the prices and amount of the Notes or the timing of the issuance or sale of the Notes or in the determination or calculation of the equation by which the Notes are to be converted into cash. S&P Dow Jones Indices has no obligation or liability in connection with the administration, marketing or trading of the Notes. There is no assurance that investment products based on the SPXESUP will accurately track index performance or provide positive investment returns. S&P is not an investment advisor. Inclusion of a security within the SPXESUP is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold such security, nor is it considered to be investment advice. Notwithstanding the foregoing, CME Group Inc. and its affiliates may independently issue and/or sponsor financial products unrelated to the Notes currently being issued by the Issuer, but which may be similar to and competitive with the Notes. In addition, CME Group Inc. and its affiliates may trade financial products which are linked to the performance of the SPXESUP. It is possible that this trading activity will affect the value of the SPXESUP and the Notes.

FWP-18

S&P DOW JONES INDICES DOES NOT GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE SPXESUP OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY THE ISSUER, HOLDINGS OF THE NOTES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE SPXESUP OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING, BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND THE ISSUER, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

FWP-19

EVENTS OF DEFAULT AND ACCELERATION

If the Notes have become immediately due and payable following an Event of Default (as defined in the accompanying prospectus) with respect to the Notes, the calculation agent will determine the accelerated payment due and payable at maturity in the same general manner as described in “Payment at Maturity” in this document. In that case, the scheduled trading day immediately preceding the date of acceleration will be used as the Final Valuation Date for purposes of determining the Reference Return, and the accelerated maturity date will be three business days after the accelerated Final Valuation Date. If a Market Disruption Event exists with respect to the Reference Asset on that scheduled trading day, then the accelerated Final Valuation Date for the Reference Asset will be postponed for up to five scheduled trading days (in the same manner used for postponing the originally scheduled Final Valuation Date). The accelerated maturity date will also be postponed by an equal number of business days.

If the Notes have become immediately due and payable following an Event of Default, you will not be entitled to any additional payments with respect to the Notes. For more information, see “Description of Debt Securities — Senior Debt Securities — Events of Default” in the accompanying prospectus.

SUPPLEMENTAL PLAN OF DISTRIBUTION (CONFLICTS OF INTEREST)

We have appointed HSBC Securities (USA) Inc., an affiliate of HSBC, as the agent for the sale of the Notes. Pursuant to the terms of a distribution agreement, HSBC Securities (USA) Inc. will purchase the Notes from HSBC at the price to public set forth on the cover page of the pricing supplement to which this free writing prospectus relates, for distribution to other registered broker-dealers, or will offer the Notes directly to investors. HSBC Securities (USA) Inc. proposes to offer the Notes at the price to public set forth on the cover page of this document. HSBC USA Inc. or one of our affiliates may pay an underwriting discount up to 2.25% and referral fees of up to 1.00% per $1,000 Principal Amount in connection with the distribution of the Notes to other registered broker-dealers. In no case will the sum of the underwriting discounts and referral fees exceed 2.75% per $1,000 Principal Amount.

An affiliate of HSBC has paid or may pay in the future an amount to broker-dealers in connection with the costs of the continuing implementation of systems to support the Notes.

In addition, HSBC Securities (USA) Inc. or another of its affiliates or agents may use the pricing supplement to which this free writing prospectus relates in market-making transactions after the initial sale of the Notes, but is under no obligation to make a market in the Notes and may discontinue any market-making activities at any time without notice.

We expect that delivery of the Notes will be made against payment for the Notes on or about the Original Issue Date set forth on the inside cover page of this document, which is more than two business days following the Trade Date. Under Rule 15c6-1 under the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in two business days, unless the parties to that trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes more than two business days prior to the Original Issue Date will be required to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement, and should consult their own advisors.

See “Supplemental Plan of Distribution (Conflicts of Interest)” on page S-61 in the prospectus supplement.

U.S. FEDERAL INCOME TAX CONSIDERATIONS