Filed Pursuant to Rule 433

Registration No. 333-223208

HSBC USA Inc. |

|

|

Market Linked Securities–Autocallable Securities with Contingent Coupon and Contingent Downside

$1,267,000 Principal at Risk Securities Linked to the Lowest Performing of the S&P 500® Index, the Russell 2000® Index and the EURO STOXX 50® Index

Term Sheet to Pricing Supplement dated November 25, 2019 |

Summary of Terms

| Issuer | HSBC USA Inc. (“HSBC”) |

| Term | Approximately 7 years |

| Reference Asset | The S&P 500® Index, the Russell 2000® Index and the EURO STOXX 50® Index (each, an “Underlying”) |

| Principal Amount | $1,000 per security |

| Pricing Date | November 25, 2019 |

| Original Issue Date | November 29, 2019 |

| Observation Dates | Quarterly, on the 24th of each February, May, August and November, commencing on February 24, 2020 and ending on November 24, 2026 (the “Final Valuation Date”) |

| Call Observation Dates | The Observation Dates commencing on November 24, 2020 and ending on August 24, 2026 |

| Maturity Date | November 30, 2026 |

| Contingent Coupon | See “How to Determine If a Contingent Coupon Is Payable” on page 2 |

| Contingent Coupon Rate | 6.50% per annum |

| Automatic Call | See “How to Determine If the Securities Will Be Automatically Called” on page 2 |

| Payment at Maturity per Security | See “How the Payment at Maturity Is Calculated” on page 2 |

| Lowest Performing Underlying | The Underlying with the lowest Final Return |

| Final Return |

With respect to each Underlying, Initial Level |

| Initial Level | 3,133.64 for the SPX, 1,621.904 for the RTY and 3,707.68 for the SX5E, each of which was its Official Closing Level on the Pricing Date |

| Final Level | With respect to each Underlying, its Official Closing Level on the Final Valuation Date |

| Coupon Trigger | 2,193.548 for the SPX, 1,135.3328 for the RTY and 2,595.376 for the SX5E, each of which is 70% of its Initial Level |

| Barrier Level | 1,880.184 for the SPX, 973.1424 for the RTY and 2,224.608 for the SX5E, each of which is 60% of its Initial Level |

| Calculation Agent | HSBC USA Inc., or one of its affiliates |

| Denominations | $1,000 and any integral multiple of $1,000 |

| Agent Discount | 2.925%, of which dealers, including those using the trade name Wells Fargo Advisors (“WFA”), may receive a selling concession of up to 2.00%, and WFA will receive a distribution expense fee of 0.075% |

| CUSIP | 40435UJ47/US40435UJ470 |

Investment Description

| · | Linked to the Lowest Performing of the S&P 500® Index, the Russell 2000® Index and the EURO STOXX 50® Index |

| · | Unlike ordinary debt securities, the securities do not provide for fixed payments of interest, do not repay a fixed amount of principal at maturity and are subject to potential automatic call prior to maturity upon the terms described below. Whether the securities pay a Contingent Coupon, whether the securities are automatically called prior to maturity and, if they are not automatically called, the amount of the Payment at Maturity will depend in each case on the Official Closing Level of each Underlying or the Lowest Performing Underlying, as applicable, on the relevant Observation Date. The Lowest Performing Underlying is the Underlying with the lowest Final Return. |

| · | Contingent Coupon: If the Official Closing Level of each Underlying is greater than or equal to its Coupon Trigger on the relevant Observation Date, you will receive the Contingent Coupon applicable to that Observation Date. However, If the Official Closing Level of any Underlying is less than its Coupon Trigger on the relevant Observation Date, the Contingent Coupon applicable to that Observation Date will not be payable. You may not receive any Contingent Coupons over the term of the securities. |

| · | Automatic Call: If the Official Closing Level of each Underlying on any of the quarterly Call Observation Date is greater than or equal to its Initial Level, the securities will be automatically called for the Principal Amount plus the applicable Contingent Coupon. No further payments will be made on the securities once they have been called. |

| · | Potential Loss of Principal: If the securities are not automatically called prior to maturity and the Final Level of the Lowest Performing Underlying is greater than or equal to its Barrier Level, you will receive the Principal Amount, plus the final Contingent Coupon if applicable. However, if the Final Level of the Lowest Performing Underlying is less than its Barrier Level, you will lose more than 40%, and possibly all, of the Principal Amount. |

| · | All payments on the securities are subject to the credit risk of HSBC, and you will have no ability to pursue any securities included in any Underlying for payment; if HSBC defaults on its obligations, you could lose some or all of your investment |

The Estimated Initial Value of the securities on the Pricing Date is $947.10 per security, which is less than the price to public. The market value of the securities at any time will reflect many factors and cannot be predicted with accuracy. The Estimated Initial Value does not represent a minimum price at which we or any of our affiliates would be willing to purchase your securities in the secondary market, if any, at any time. See “Risk Factors — The Estimated Initial Value of the securities, which was determined by us on the Pricing Date, is less than the price to public and may differ from the market value of the securities in the secondary market, if any” in the accompanying pricing supplement.

You should carefully consider, among other things, the matters set forth in “Risk Factors” in this term sheet, beginning on page PS-7 of the pricing supplement, page S-1 of the prospectus supplement and page S-1 of the Equity Index Underlying Supplement, as the securities involve risks not associated with conventional debt securities.

Investors should carefully review the accompanying pricing supplement, Equity Index Underlying Supplement, prospectus supplement and prospectus. Terms used herein without definition will have the meanings ascribed to them in the accompanying pricing supplement.

NOT A BANK DEPOSIT AND NOT INSURED OR GUARANTEED BY THE FDIC OR ANY OTHER GOVERNMENTAL AGENCY.

How to Determine If a Contingent Coupon Is Payable

If the Official Closing Level of each Underlying is greater than or equal to its Coupon Trigger on the relevant Observation Date, you will receive the Contingent Coupon applicable to that Observation Date on the applicable Coupon Payment Date.

If the Official Closing Level of any Underlying is less than its Coupon Trigger on the relevant Observation Date, the Contingent Coupon applicable to that Observation Date will not be payable.

You may not receive any Contingent Coupons over the term of the securities.

Each quarterly Contingent Coupon payment, if payable, will be calculated per security as follows:

$1,000 x Contingent Coupon Rate x (90 / 360)

The Contingent Coupon Rate is 6.50% per annum. Any Contingent Coupon payments will be rounded to the nearest cent, with one-half cent rounded upward.

How to Determine If the Securities Will Be Automatically Called

We will automatically call the securities if the Official Closing Level of each Underlying is at or above its Initial Level on any Call Observation Date. If the securities are automatically called, you will receive the Principal Amount plus the applicable Contingent Coupon on the corresponding Call Payment Date. No further payments will be made on the securities once they have been called.

How the Payment at Maturity Is Calculated

Unless the securities are automatically called, for each $1,000 Principal Amount, you will receive a cash payment on the Maturity Date, calculated as follows:

n If the Final Level of the Lowest Performing Underlying is greater than or equal to its Coupon Trigger:

$1,000 + final Contingent Coupon.

n If the Final Level of the Lowest Performing Underlying is less than its Coupon Trigger but greater than or equal to its Barrier Level: $1,000.

n If the Final Level of the Lowest Performing Underlying is less than its Barrier Level:

$1,000 + ($1,000 × Final Return of the Lowest Performing Underlying).

If the securities are not automatically called prior to maturity and the Final Level of the Lowest Performing Underlying is less than its Barrier Level, you will lose more than 40%, and possibly all, of the Principal Amount. Even with any Contingent Coupons, your return on the securities may be negative.

The return on the securities will be limited to the Contingent Coupons, if any, paid during the term of the securities. You will not participate in any appreciation of any Underlying, but you will have full downside exposure to the Lowest Performing Underlying on the Final Valuation Date if the securities are not automatically called prior to maturity and the Final Level of the Lowest Performing Underlying is less than its Barrier Level.

| 2 |

|

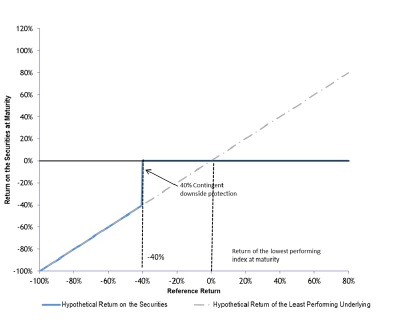

Hypothetical Payout Profile

The profile to the right illustrates the hypothetical Payment at Maturity on the securities (excluding the final Contingent Coupon payment, if payable) for a range of hypothetical Final Returns of the Lowest Performing Underlying, assuming the securities have not been automatically called prior to the maturity.

This graph has been prepared for purposes of illustration only. Your actual Payment at Maturity will depend on the actual Final Return of the Lowest Performing Underlying, whether the securities are automatically called prior to maturity and whether you hold the securities to maturity. The performance of the better performing Underlyings is not relevant to the Payment at Maturity on the securities.

|

|

Hypothetical Returns

If the securities are automatically called: If the securities are automatically called prior to maturity, you will receive the Principal Amount plus the relevant Contingent Coupon on the relevant Call Payment Date. In the event the securities are automatically called, your total return on the securities will equal the return represented by the Contingent Coupons received on or prior to the Call Payment Date.

If the securities are not automatically called: If the securities are not automatically called prior to maturity, the following table illustrates, for a range of hypothetical Final Returns of the Lowest Performing Underlying, the hypothetical Payment at Maturity per security.

| Hypothetical Final Return of the Lowest Performing Underlying |

Hypothetical Payment at Maturity (Excluding Any Contingent Coupons Payable on the Securities) |

| 100.00% | $1,000.00 |

| 80.00% | $1,000.00 |

| 60.00% | $1,000.00 |

| 40.00% | $1,000.00 |

| 20.00% | $1,000.00 |

| 0.00% | $1,000.00 |

| -10.00% | $1,000.00 |

| -20.00% | $1,000.00 |

| -25.00% | $1,000.00 |

| -30.00% | $1,000.00 |

| -40.00% | $1,000.00 |

| -50.00% | $500.00 |

| -60.00% | $400.00 |

| -70.00% | $300.00 |

| -80.00% | $200.00 |

| -100.00% | $0.00 |

The above figures do not take into account any Contingent Coupons received on the securities. As noted above, any positive return on the securities will be limited to any Contingent Coupons received during the term of the securities.

The above figures are for purposes of illustration only and may have been rounded for ease of analysis. If the securities are not automatically called prior to maturity, the actual amount you will receive at maturity will depend on the actual Final Return of the Lowest Performing Underlying on the Final Valuation Date. The performance of the better performing Underlyings is not relevant to the Payment at Maturity on the securities.

| 3 |

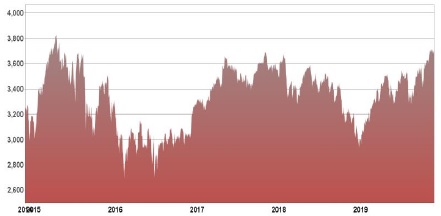

S&P 500® Index Daily Closing Levels*

Russell 2000® Index Daily Closing Levels*

EURO STOXX 50® Index Daily Closing Levels*

*The graphs above are based on the daily Official Closing Levels of the Underlyings for the period from November 25, 2014 to November 25, 2019. The historical performance of any Underlying is not an indication of its future performance during the term of the securities.

| 4 |

Risk Factors

The risks set forth below are discussed in detail in the “Risk Factors” section in the accompanying pricing supplement and the accompanying Equity Index Underlying Supplement and prospectus supplement. Please review those risk disclosures carefully.

| · | The securities do not guarantee any return of principal and you may lose all of your Principal Amount at maturity. |

| · | You may not receive any Contingent Coupons. |

| · | Your return on the securities is limited to the Principal Amount plus the Contingent Coupons, if any, regardless of any appreciation in the level of any Underlying. |

| · | The securities are subject to the credit risk of HSBC USA Inc. |

| · | Changes that affect an Underlying may affect its level and the market value of the securities and the amount you will receive on the securities. |

| · | If the securities are not called, your return will be based on the Final Return of the Lowest Performing Underlying. |

| · | Since the securities are linked to the performance of more than one Underlying, you will be fully exposed to the risk of fluctuations in the level of each Underlying and correlation or lack thereof between the Underliers. |

| · | Higher Contingent Coupon Rates Are Generally Associated With Underlyings with Greater Expected Volatility and Therefore Can Indicate a Greater Risk of Loss. |

| · | The securities may be automatically called prior to the Maturity Date. |

| · | The securities are not insured or guaranteed by any governmental agency of the United States or any other jurisdiction. |

| · | The Estimated Initial Value of the securities, which was determined by us on the Pricing Date, is less than the price to public and may differ from the market value of the securities in the secondary market, if any. |

| · | The price of your securities in the secondary market, if any, immediately after the Pricing Date may be less than the price to public. |

| · | If an agent were to repurchase your securities immediately after the Original Issue Date, the price you receive may be higher than the Estimated Initial Value of the securities. |

| · | The amount payable on the securities is not linked to the levels of the Underlyings at any time other than the Observation Dates, including the Final Valuation Date. |

| · | The securities lack liquidity. |

| · | Potential conflicts of interest may exist. |

| · | The securities are subject to small-capitalization risk. |

| · | Risks associated with non-U.S. companies. |

| · | The securities will not be adjusted for changes in exchange rates. |

| · | Historical levels of an Underlying should not be taken as an indication of its future performance during the term of the securities. |

| · | The amount you will receive on the securities will depend upon the performance of the Underlyings. Therefore, the securities are subject to the following risks, as set forth in the accompanying prospectus supplement or the Equity Index Underlying Supplement: |

| o | You must rely on your own evaluation of the merits of an investment in the securities; |

| o | The price at which you will be able to sell your securities prior to maturity will depend on a number of factors, and may be substantially less than the amount you had originally invested; |

| o | The securities are not insured against loss by any third parties; you can depend only on our earnings and assets for payment and interest, if any, on the securities; |

| o | Trading and other transactions by us or our affiliates could affect the trading level or price and/or level of the Reference Asset, the trading value of the securities or the amount you may receive at maturity; |

| o | Research reports and other transactions may create conflicts of interest between you and us; |

| o | Our trading, hedging and other business activities, and those of the agents, may create conflicts of interest with you; |

| o | Equity market risks may affect the trading value of the securities and the amount due on the securities; |

| o | As a holder of the securities, you will not have any ownership interest or rights in the stocks or other securities tracked by an Index; |

| o | We or our affiliates are not affiliated with any of the Reference Sponsors; |

| o | Our or our affiliates’ business activities relating to the stocks or securities tracked by an equity index may create conflicts of interest with you; |

| o | Securities prices generally are subject to political, economic, financial and social factors that apply to the markets in which they trade and, to a lesser extent, foreign markets; and |

| o | Time differences between the domestic and foreign markets and New York City may create discrepancies in the trading level or price of the securities. | |

| · | Uncertain tax treatment. |

| 5 |

Not suitable for all investors

Investment suitability must be determined individually for each investor. The securities described herein are not a suitable investment for all investors. In particular, no investor should purchase the securities unless they understand and are able to bear the associated market, liquidity and yield risks. Unless market conditions and other relevant factors change significantly in your favor, a sale of the securities prior to maturity is likely to result in sale proceeds that are substantially less than the Principal Amount per security. None of HSBC Securities (USA) Inc., Wells Fargo Securities, or their respective affiliates are obligated to purchase the securities from you at any time prior to maturity.

HSBC has filed a registration statement (No. 333-223208) (including a prospectus, prospectus supplement and Equity Index Underlying Supplement) with the Securities and Exchange Commission (the “SEC”) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus, prospectus supplement and Equity Index Underlying Supplement in that registration statement and other documents HSBC has filed with the SEC for more complete information about HSBC and this offering. You may get these documents for free by visiting EDGAR on the SEC’s web site at www.sec.gov. Alternatively, HSBC Securities (USA) Inc. or any dealer participating in this offering will arrange to send you the prospectus, prospectus supplement and Equity Index Underlying Supplement if you request them by calling toll-free 1-866-811-8049.

You may access these documents and the pricing supplement on the SEC web site at www.sec.gov as follows:

The pricing supplement at: https://www.sec.gov/Archives/edgar/data/83246/000110465919068108/tm1923827d28_424b2.htm

The Equity Index Underlying Supplement at: https://www.sec.gov/Archives/edgar/data/83246/000114420418010782/tv486722_424b2.htm

The prospectus supplement at: https://www.sec.gov/Archives/edgar/data/83246/000114420418010762/tv486944_424b2.htm

The prospectus at: https://www.sec.gov/Archives/edgar/data/83246/000114420418010720/tv487083_424b3.htm

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

Consult your tax advisor

Investors should review carefully the accompanying pricing supplement, Equity Index Underlying Supplement, prospectus supplement and prospectus and consult their tax advisors regarding the application of the U.S. federal tax laws to their particular circumstances, as well as any tax consequences arising under the laws of any state, local or non-U.S. jurisdiction.

| 6 |