SSP DEFM14A

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No.____)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to § 240.14a-12

The E. W. Scripps Company

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a‑6(i)(4) and 0‑11.

| |

1) | Title of each class of securities to which transaction applies: |

| |

2) | Aggregate number of securities to which transaction applies: |

| |

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

4) | Proposed maximum aggregate value of transaction: |

[ ] Fee paid previously with preliminary materials.

| |

[ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) | Amount Previously Paid: |

| |

2) | Form, Schedule or Registration Statement No.: |

To the shareholders of The E. W. Scripps Company and Journal Communications, Inc.:

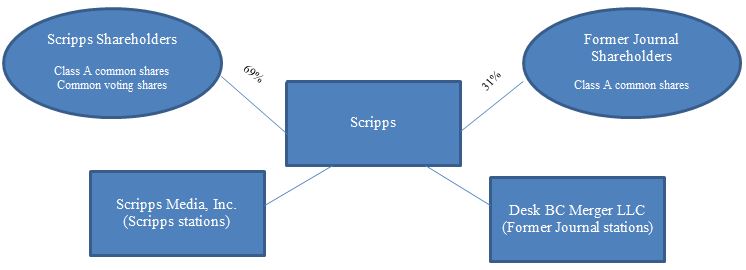

On July 30, 2014, The E. W. Scripps Company (“Scripps”) and Journal Communications, Inc. (“Journal”), together with various of their respective subsidiaries, entered into a Master Transaction Agreement providing for (1) first the spin-offs and subsequent combination of their newspaper businesses and (2) then the combination of their broadcast businesses through the merger of Journal into a wholly owned subsidiary of Scripps. The spin-offs and mergers are expected to create two industry-focused companies positioned for success. Scripps, based in Cincinnati, will own and operate television and radio stations serving 27 markets and reaching 18 percent of U.S. television households, making it the fifth-largest independent TV group in the country. Journal Media Group, Inc. ("Journal Media Group"), a newly formed public newspaper publishing entity owning the former Scripps and Journal newspapers, will be headquartered in Milwaukee and operate in 14 markets in the U.S. Scripps class A common shares are traded on the New York Stock Exchange under the symbol "SSP".

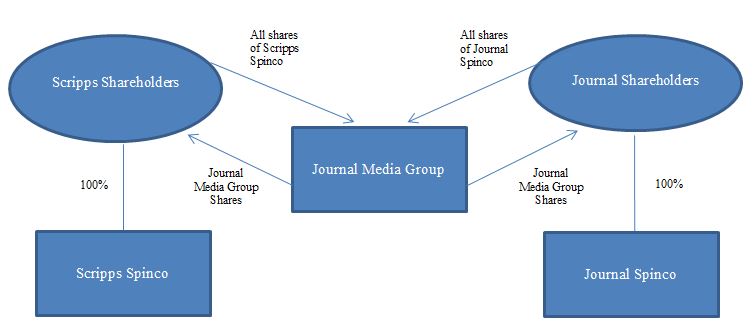

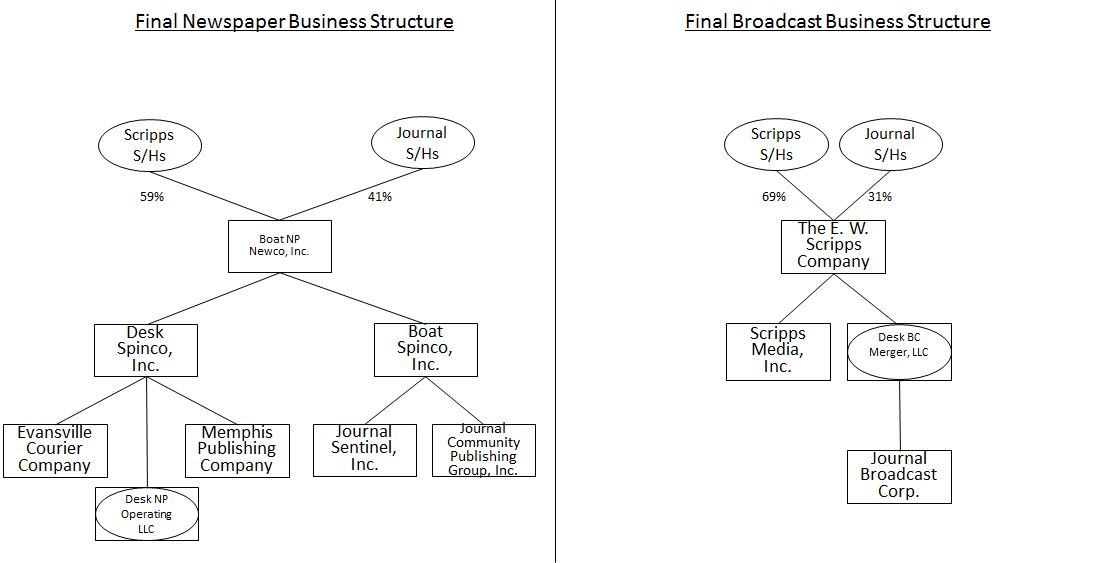

Upon completion of the transactions, each share of Journal class A and class B common stock outstanding on the share exchange record date will receive 0.5176 class A common shares of Scripps and 0.1950 shares of common stock of Journal Media Group; and each Scripps class A common share and common voting share outstanding on the share exchange record date will receive 0.2500 shares of common stock of Journal Media Group. Immediately following the completion of the transactions, holders of Journal’s common stock will own approximately 41% of the common shares of Journal Media Group and approximately 31% of the common shares of Scripps, in the form of Scripps class A common shares, with the remaining common shares of each entity owned by the Scripps shareholders. Prior to the completion of the transactions, Scripps will distribute a special cash dividend in the aggregate amount of $60.0 million to the holders of its common shares (and certain common share equivalents held by Scripps directors and employees). The transactions are intended to be tax-free at both the shareholder and corporate levels at each of Scripps and Journal, with the exceptions of the distribution of Journal Spinco to Journal shareholders, which will be taxable at the Journal corporate level, and the distribution of the $60.0 million dividend by Scripps, which may be taxable to the shareholders of Scripps.

Each of Scripps and Journal will hold a special meeting of its shareholders to consider and vote on matters necessary to complete the transactions. Information about the special meetings, the proposals to be voted on at each company’s special meeting, the proposed transactions and other related matters is contained in this joint proxy statement/prospectus, which we urge you to read carefully and in its entirety, including the annexes and exhibits and the information incorporated by reference into this joint proxy statement/prospectus.

In particular, you should consider the matters discussed under “Risk Factors” beginning on page 32 of this joint proxy statement/prospectus.

Your vote is very important, regardless of the number of shares you own. To ensure your representation at your company’s special meeting, please complete and submit your proxy in accordance with the instructions contained herein.

The Board of Directors of Scripps has approved and adopted the Master Transaction Agreement and the transactions contemplated thereby, and recommends that the holders of common voting shares of Scripps vote “FOR” the approval of each of the proposals to be voted on by them at the Scripps special meeting, as described in this joint proxy statement/prospectus.

The Board of Directors of Journal has approved and adopted the Master Transaction Agreement and the transactions contemplated thereby, and recommends that the Journal shareholders vote “FOR” the approval of each of the proposals to be voted on by them at the Journal special meeting, as described in this joint proxy statement/prospectus.

|

| |

Sincerely, | Sincerely, |

| |

Richard A. Boehne | Steven J. Smith |

Chairman, President and Chief Executive Officer | Chairman and Chief Executive Officer |

The E. W. Scripps Company | Journal Communications, Inc. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the spin-offs or mergers or the securities issuable in connection therewith, or passed upon the adequacy or accuracy of this joint proxy statement/prospectus. Any representation to the contrary is a criminal offense.

This joint proxy statement/prospectus is dated February 6, 2015, and is first being mailed or otherwise delivered to shareholders of Scripps and Journal on or about February 6, 2015.

THE E. W. SCRIPPS COMPANY

Scripps Center

312 Walnut Street

Cincinnati, Ohio 45202

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS OF THE E. W. SCRIPPS COMPANY

To be held on March 11, 2015

TO THE SHAREHOLDERS OF THE E. W. SCRIPPS COMPANY:

NOTICE IS HEREBY GIVEN that a special meeting of the shareholders of The E. W. Scripps Company, an Ohio corporation (“Scripps”), will be held on March 11, 2015 at 10 a.m., Eastern Time, at the Scripps Center, 10th floor conference center, 312 Walnut Street, Cincinnati, Ohio 45202, for the following purposes:

| |

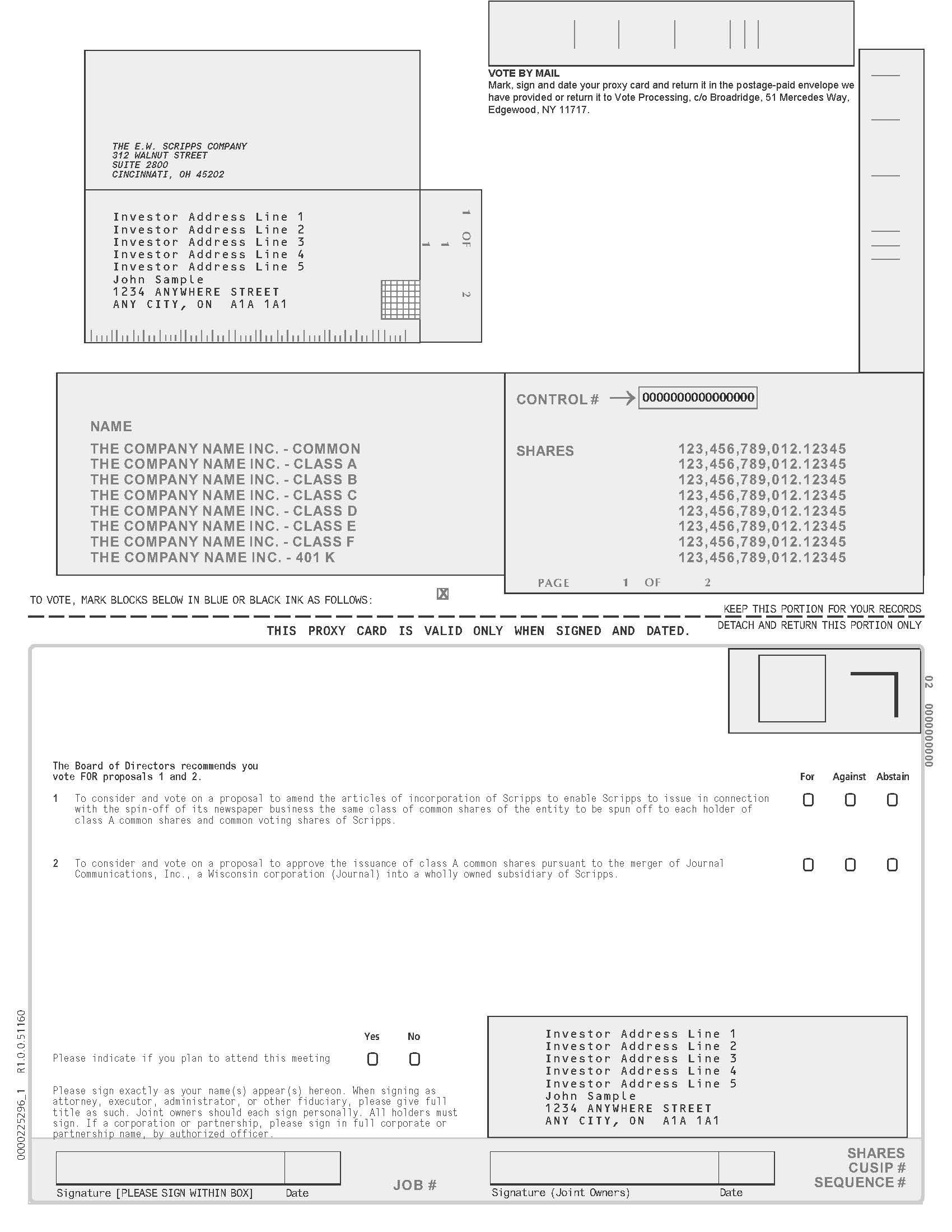

1. | to consider and vote on a proposal to amend the articles of incorporation of Scripps to enable Scripps to issue in connection with the spin-off of its newspaper business the same class of common shares of the entity to be spun off to each holder of class A common shares and common voting shares of Scripps; and |

| |

2. | to consider and vote on a proposal to approve the issuance of class A common shares pursuant to the merger of Journal Communications, Inc., a Wisconsin corporation (“Journal”) into a wholly owned subsidiary of Scripps. |

The approval of the foregoing proposals by the holders of common voting shares of Scripps is required in order to complete the spin-off of the Scripps newspaper business and combination thereof with the Journal newspaper business and the subsequent merger of Journal into a wholly owned subsidiary of Scripps by means of which we will combine the broadcast business of Journal with our broadcast business. The proposals are described in more detail in this joint proxy statement/prospectus, which you should read carefully in its entirety before you submit a proxy or otherwise vote your shares.

The holders of class A common shares of Scripps are receiving this notice for informational purposes and are not entitled to vote their shares on the proposals being submitted at the special meeting.

The Scripps Board of Directors has established February 3, 2015, as the record date for the special meeting. If you were a holder of record of common voting shares at the close of business on the record date, you are entitled to attend and to vote your shares at the special meeting. If you are present at the special meeting, you may vote in person even though you have previously returned a proxy card or submitted a proxy or voting instructions in another manner.

All Scripps shareholders are invited to attend the special meeting, whether they are entitled to vote at the meeting or not.

Shareholders will not have dissenters' rights under Ohio law with respect to either the spin-off of the Scripps newspapers and the subsequent merger thereof with the Journal newspapers or the acquisition by Scripps of the Journal broadcast business through the merger of Journal into a wholly owned subsidiary of Scripps following the newspaper spin-off.

The Board of Directors of Scripps has approved the spin-off of its newspaper business and combination of that business with the Journal newspaper business, the merger of Journal into a subsidiary of Scripps and the issuance of class A common shares pursuant to such merger, and recommends that you vote “FOR” the approval of each of the proposals described above.

Thank you for being a Scripps shareholder. I look forward to seeing you at the meeting.

By the Order of the Board of Directors,

Richard A. Boehne

Chairman, President and Chief Executive Officer

Cincinnati, Ohio

February 6, 2015

JOURNAL COMMUNICATIONS, INC.

333 West State Street

Milwaukee, Wisconsin 53203

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS OF JOURNAL COMMUNICATIONS, INC.

To be held on March 11, 2015

TO OUR SHAREHOLDERS:

We invite you to attend a special meeting of the shareholders of Journal Communications, Inc., a Wisconsin corporation (“Journal”), to be held on March 11, 2015 at 9:00 a.m., Central Time, at our corporate headquarters, second floor, 333 West State Street, Milwaukee, Wisconsin 53203. As we describe in the accompanying joint proxy statement/prospectus, our shareholders will be voting on the following matters:

| |

1. | a proposal to approve the spin-off of our newspaper business to our shareholders and the subsequent merger of the entity that will hold such newspaper business with a wholly owned subsidiary of Journal Media Group, Inc., a Wisconsin corporation; |

| |

2. | a proposal to approve the merger of Journal into a wholly owned subsidiary of The E. W. Scripps Company, an Ohio corporation (“Scripps”), following the spin-off of our newspaper business; |

| |

3. | a non-binding, advisory proposal to approve the compensation that may be paid or become payable to our named executive officers in connection with the transactions; and |

| |

4. | a proposal to approve the adjournment or postponement of the special meeting, if necessary or appropriate, to solicit additional proxies in the event there are not sufficient votes at the time of the special meeting to approve the proposals set forth in items 1 and 2 above. |

Journal will transact no other business at the special meeting other than any such business that may be properly brought before the special meeting or any adjournment or postponement thereof.

The approval of the proposals set forth in items 1 and 2 above by the holders of our common stock is required in order to (1) complete the spin-off of our newspaper business and combination thereof with the Scripps newspaper business (via the merger of the entity that will hold our newspaper business with a wholly owned subsidiary of Journal Media Group) and (2) consummate the merger of Journal into a wholly owned subsidiary of Scripps by means of which Scripps will combine our broadcast business with its broadcast business. The approval of the proposals set forth in items 3 and 4 is not required to complete the transactions. The proposals are described in more detail in this joint proxy statement/prospectus, which you should read carefully in its entirety before you submit a proxy or otherwise vote your shares.

Our Board of Directors has established January 6, 2015, as the record date for the special meeting. If you were a holder of record of our common stock at the close of business on the record date, you are entitled to attend and to vote your shares at the special meeting. If you are present at the special meeting, you may vote in person even though you have previously returned a proxy card or submitted a proxy in another manner.

The Board of Directors of Journal has approved (1) the spin-off of our newspaper business and combination of our newspaper business with the Scripps newspaper business (via the merger of the entity that will hold our newspaper business with a wholly owned subsidiary of Journal Media Group) and (2) the merger of Journal into a subsidiary of Scripps, and recommends that you vote “FOR” the approval of each of the proposals described above.

We have enclosed a proxy card along with the accompanying joint proxy statement/prospectus. Your vote is important, no matter how many shares you own. Even if you plan to attend the special meeting, please complete, date and sign the enclosed proxy card and promptly return it by mail using the postage-paid envelope we have provided. Alternatively, you may vote by calling the toll-free number or using the Internet as described in the instructions provided on the enclosed proxy card. If you attend the special meeting, then you may revoke your proxy and vote your shares in person if you would like.

Thank you for your continued support. We look forward to seeing you at the special meeting.

By the Order of the Board of Directors,

Steven J. Smith

Chairman and Chief Executive Officer

Milwaukee, Wisconsin

February 6, 2015

REFERENCES TO ADDITIONAL INFORMATION

The E. W. Scripps Company (“Scripps”) has filed a registration statement on Form S-4 of which this joint proxy statement/prospectus is a part. This joint proxy statement/prospectus does not contain all of the information included in the registration statement or in the exhibits to the registration statement.

The joint proxy statement/prospectus also incorporates by reference important business and financial information about Scripps and Journal Communications, Inc. (“Journal”) from documents previously filed with the Securities and Exchange Commission (the “SEC”) that are not included in or delivered with this joint proxy statement/prospectus. In addition, Scripps and Journal may file additional annual, quarterly and current reports, proxy statements and other business and financial information with the SEC.

The registration statement of which this joint proxy statement/prospectus is a part and the exhibits thereto, the information incorporated by reference herein, and the other information filed by Scripps and Journal with the SEC are available for you to review at the SEC’s Public Reference Room located at 100 F Street, N.E., Room 1580, Washington, DC 20549. You can obtain these documents through the SEC’s website at www.sec.gov, on Scripps’ website at www.scripps.com in the Investor Relations section and on Journal’s website at www.journalcommunications.com in the Investor Relations section. By referring to Scripps’ website, Journal’s website, and the SEC’s website, Scripps and Journal do not incorporate any such website or its contents into this joint proxy statement/prospectus.

You can also obtain the documents by requesting them in writing or by telephone from Scripps or Journal at the following address and telephone number:

|

| |

The E. W. Scripps Company | Journal Communications, Inc. |

312 Walnut Street, 28th Floor | 333 West State Street |

Cincinnati, Ohio 45202 | Milwaukee, Wisconsin 53203 |

(513) 977-3000 | (414) 224-2000 |

Attention: Carolyn P. Micheli, Vice President, Corporate | Attention: Ashley DeYoung |

Communications and Investor Relations | Financial and Investor Analyst |

IN ORDER TO RECEIVE TIMELY DELIVERY OF THESE MATERIALS, YOU MUST MAKE REQUESTS NO LATER THAN FIVE BUSINESS DAYS BEFORE THE DATE OF THE SPECIAL MEETING FOR YOUR COMPANY.

You may also obtain these documents at no charge by requesting them in writing or by telephone from Journal’s proxy solicitor, MacKenzie Partners, Inc., 105 Madison Avenue, New York, New York 10016 (telephone number: (212) 929-5500 or toll-free at (800) 322-2885). See “Where You Can Find More Information” beginning on page 207 for more information about the documents referenced in this joint proxy statement/prospectus.

See “Where You Can Find More Information” beginning on page 207 for more information about the documents referenced in this joint proxy statement/prospectus.

In addition, if you have any questions about the transactions described in this joint proxy statement/prospectus, or about voting your shares, or would like additional copies of this joint proxy statement/prospectus, or need to obtain proxy cards or other information related to the proxy solicitation, you may contact:

|

| |

IF YOU ARE A SCRIPPS SHAREHOLDER: | IF YOU ARE A JOURNAL SHAREHOLDER: |

The E. W. Scripps Company 312 Walnut Street, 28th Floor Cincinnati, Ohio 45202 (513) 977-3732 Attention: Julie L. McGehee, Corporate Secretary | Journal Communications, Inc. 333 West State Street Milwaukee, Wisconsin 53203 (414) 224-2000 Attention: Mary Hill Taibl, General Counsel, Secretary and Chief Compliance Officer |

Journal Media Group, Inc. (“Journal Media Group”), which will own the Scripps newspaper business and the Journal newspaper business following completion of the transactions discussed in this joint proxy statement/prospectus, has filed a registration statement on Form S-4 for shares of its common stock to be issued to Scripps and Journal shareholders pursuant to those transactions. The prospectus that is included in Journal Media Group’s registration statement contains financial and other information about the combined newspaper businesses it will operate following completion of the transactions. This

joint proxy statement/prospectus contains substantially the same information as will be contained in the prospectus of Journal Media Group and a copy of the prospectus statement of Journal Media Group has been sent to you together with this joint proxy statement/prospectus. If the Scripps and Journal shareholders approve the necessary proposals submitted to them at their respective special meetings, Scripps and Journal will set the record date and distribution date for the spin-offs of the Scripps and Journal newspaper businesses as well as the closing date for all of the transactions discussed in this joint proxy statement/prospectus.

ABOUT THIS DOCUMENT

Scripps has supplied all information contained in or incorporated by reference into this joint proxy statement/prospectus relating to Scripps and Journal has supplied all information contained in or incorporated by reference into this joint proxy statement/prospectus relating to Journal. Scripps and Journal have both contributed information relating to Journal Media Group and the transactions.

This joint proxy statement/prospectus forms part of a registration statement on Form S-4 (Registration No. 333-200388) filed by Scripps with the SEC to register with the SEC class A common shares of Scripps to be issued in connection with the transactions. It constitutes a prospectus of Scripps under Section 5 of the Securities Act of 1933, as amended, and the rules thereunder, with respect to the class A common shares of Scripps to be issued to Journal shareholders. It also constitutes a proxy statement under Section 14(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and the rules thereunder, and a notice of meeting and actions to be taken at the Scripps and Journal special meetings.

RECENT DEVELOPMENTS

On December 9, 2014, Scripps entered into new five-year affiliation agreements with ABC covering its television stations in Bakersfield and San Diego, California; Denver, Colorado; Phoenix, Arizona; Cincinnati and Cleveland, Ohio; Tampa, Florida; Baltimore, Maryland; Indianapolis, Indiana; and Detroit, Michigan. Scripps’ ABC affiliate in Buffalo, which it acquired from Granite Broadcasting in June 2014, remains under a separate affiliation agreement with ABC through the end of 2018.

On December 12, 2014, the FCC granted its consent to the transfer of control of Journal’s broadcast station licenses to Scripps. The FCC consent included a grant of the failing station waiver for WACY-TV, which will permit Scripps to own both WGBA-TV and WACY-TV in Green Bay. The FCC consent has become a final order and is no longer subject to requests for reconsideration or review by third parties or by the FCC on its own motion.

TABLE OF CONTENTS

|

| | |

ANNEXES | |

| | |

| | Master Transaction Agreement |

| | Form of Amendment to Articles of Incorporation of The E.W. Scripps Company |

| | Step Plan |

| | Opinions, dated July 30, 2014, of Wells Fargo Securities, LLC |

| | Opinion, dated July 30, 2014, of Methuselah Advisors |

| | Subchapter XIII of WBCL (Dissenters' Rights) |

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETINGS

The following are brief answers to common questions that you may have regarding the Master Transaction Agreement, which we refer to as the “master agreement” and which is attached to this joint proxy statement/prospectus as Annex A, the proposed transactions, the special meetings and the consideration to be received in the proposed transactions. The questions and answers in this section may not address all questions that may be important to you as a shareholder of Scripps or Journal. To better understand these matters, and for a description of the legal terms governing the proposed transactions, we urge you to read carefully and in its entirety this joint proxy statement/prospectus, including the annexes to, and the documents incorporated by reference in, this joint proxy statement/prospectus. See “Where You Can Find More Information” beginning on page 207.

Q: What are the proposed transactions?

A: Scripps and Journal and certain of their subsidiaries entered into the master agreement on July 30, 2014. The master agreement provides for the combination of the newspaper businesses of Scripps and Journal and the combination of the broadcast businesses of Scripps and Journal by means of a multi-step spin-off and merger process. As a result of the transactions contemplated by the master agreement, the newspaper businesses of the two companies will be owned and operated by a new holding company, which we refer to as “Journal Media Group,” shares of which we expect to be listed on the New York Stock Exchange (“NYSE”) and initially owned by the shareholders of Scripps and Journal. As a further result of the transactions contemplated by the master agreement, following execution of the steps necessary for the combination of the newspaper businesses of Scripps and Journal, Scripps will combine the broadcast business of Journal by merging Journal into a wholly owned subsidiary of Scripps and issuing class A common shares of Scripps to Journal shareholders in exchange for their shares in Journal. We sometimes refer to the spin-offs and mergers and the other transactions contemplated by the master agreement, taken as a whole, as the “transactions”; to the spin-offs of the Scripps and Journal newspaper businesses, as the “Scripps newspaper spin-off”, “Journal newspaper spin-off”, or together the “newspaper spin-offs”; to the steps constituting the combination of the newspaper businesses of Scripps and Journal, as the “Scripps newspaper merger”, the “Journal newspaper merger”, or together the “newspaper mergers”; and to the combination of the broadcast businesses of Scripps and Journal, as the “broadcast merger.”

Q: Why am I receiving this document?

A: In order to complete the transactions, the shareholders of Journal must approve (1) the spin-off of its newspaper business, and subsequent combination thereof with the Scripps newspaper business and (2) the subsequent merger of Journal into a wholly owned subsidiary of Scripps, and the holders of common voting shares of Scripps must approve (i) an amendment to Scripps’ articles of incorporation to facilitate the spin-off of its newspaper business with one class of common stock and (ii) the issuance of class A common shares of Scripps pursuant to the broadcast merger. Journal is also seeking the approval of its shareholders, on an advisory basis, of the compensation that may be paid or become payable to its named executive officers in connection with the transactions, but such approval is not required to complete the transactions. Scripps and Journal will hold separate special shareholders’ meetings to obtain these approvals. We are sending you these materials to help you decide how to vote your shares with respect to the matters to be considered at the special meetings. This joint proxy statement/prospectus contains important information about the transactions, including the special meetings of the shareholders of Scripps and Journal. You should read it carefully and in its entirety. The enclosed proxy cards allow you to authorize the voting of your shares without attending your company’s special meeting.

Your vote is important regardless of how many shares you own. We encourage you to submit a proxy as soon as possible.

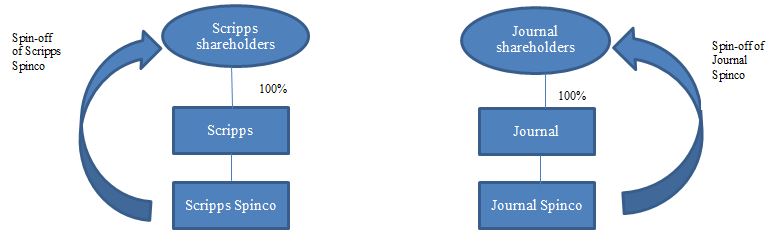

Q: What will Scripps shareholders receive in the transactions?

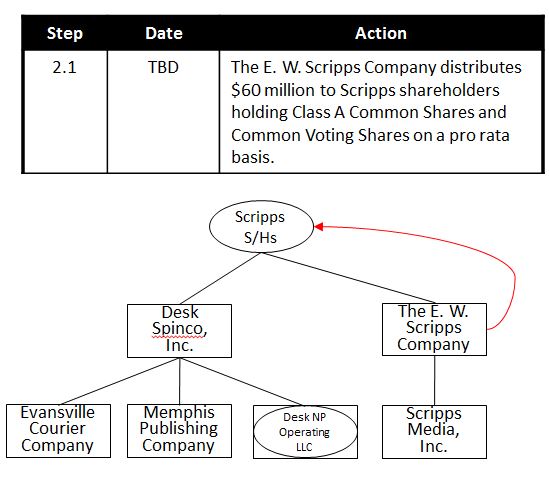

A: Prior to the completion of the transactions, Scripps will contribute its newspaper business to Scripps Spinco and Scripps will spin-off Scripps Spinco to its shareholders, whereby Scripps shareholders will be credited with one share of common stock of Scripps Spinco for each share of Scripps common stock held by them. The shares of Scripps Spinco will not be distributed to Scripps shareholders, but will be held by the exchange agent for the benefit of Scripps shareholders until those shares are exchanged for shares of common stock of Journal Media Group in connection with the newspaper mergers. As a result of the spin-off of the Scripps newspaper business and the combination thereof with the Journal newspaper business, each Scripps class A common share will ultimately be converted into 0.2500 shares of common stock of Journal Media Group, and each Scripps common voting share will ultimately be converted into 0.2500 shares of common stock of Journal Media Group. Additionally, holders of Scripps class A common shares (and unvested restricted stock units) and common voting shares of Scripps will receive their pro rata share of an aggregate $60.0 million dividend, which we refer to as the “Scripps special dividend,” payable

immediately prior to the completion of the broadcast merger. Scripps shareholders will not receive any shares in connection with the broadcast merger, but will retain their existing shares in Scripps.

Q: What will Journal shareholders receive in the transactions?

A: Prior to the completion of the transactions, Journal will contribute its newspaper business to Journal Spinco and Journal will spin-off Journal Spinco to its shareholders, whereby Journal shareholders will be credited with one share of common stock of Journal Spinco for each share of Journal common stock held by them. The shares of Journal Spinco will not be distributed to Journal shareholders, but will be held by the exchange agent for the benefit of Journal shareholders until those shares are exchanged for shares of Journal Media Group common stock in connection with the newspaper mergers. As a result of the spin-off of the Journal newspaper business and the combination thereof with the Scripps newspaper business, each share of Journal class A common stock and each share of Journal class B common stock will ultimately be converted into 0.1950 shares of common stock of Journal Media Group. As a result of the broadcast merger, each share of Journal class A common stock and each share of Journal class B common stock will ultimately be converted into 0.5176 class A common shares of Scripps. The Scripps special dividend will not be paid on Scripps class A common shares issued to Journal shareholders in the broadcast merger. Thus, Journal shareholders will receive 0.1950 shares of Journal Media Group and 0.5176 class A common shares of Scripps for each share of Journal common stock held on the share exchange record date.

Q: How were the exchange ratios determined?

A: The exchange ratios for the newspaper mergers and the broadcast merger resulted from negotiations between Scripps and its advisors, on the one hand, and Journal and its advisors, on the other hand. Each of Scripps and Journal evaluated its own businesses and the other's businesses based on information in its possession or provided by the other party. Scripps and Journal considered, among other factors, their respective views of the relative values of each company's newspaper and broadcast businesses and the potential synergies that could reasonably be expected from the combinations, the opportunity to pay a tax-efficient dividend to Scripps shareholders, the optimum number of shares of Journal Media Group to have outstanding for purposes of trading liquidity, and the potential trading range of the stocks of Scripps and Journal Media Group following completion of the transactions. There was no single definitive analysis used to determine the exchange ratios in the negotiations. Rather, the entirety of the work performed by Scripps and Journal with the assistance of their respective advisors in analyzing financial and other information informed the positions of each party in negotiating and arriving at the final exchange ratios.

Q: Why is Scripps paying a $60 million dividend to its shareholders?

A: During the negotiation of the exchange ratios, Scripps and Journal agreed that Scripps would pay a $60 million dividend to its shareholders prior to completion of the broadcast merger and the Journal shareholders would receive as a result of the broadcast merger ownership of approximately 31% of the equity of Scripps following completion of the transactions. The leverage and capital structure of Scripps following the transactions, the relative ownership of Scripps by the Scripps shareholders and the Journal shareholders following the transactions, and the economic value of a tax-efficient dividend to the Scripps shareholders were the factors considered by the parties in determining the dividend.

Q: When do you expect the transactions to be completed?

A: As of the date of this joint proxy statement/prospectus, the transactions are expected to close in the first half of 2015. The closing of the transactions is subject to various conditions, including the approval of the Scripps amendment proposal (defined below) and the Scripps share issuance proposal (defined below) by the holders of common voting shares of Scripps, and the approval of the Journal spin-off proposal (defined below) and the Journal merger proposal (defined below) by the Journal shareholders, as well as necessary regulatory consents and approvals. No assurance can be provided as to when or if the transactions will be completed, and it is possible that factors outside the control of Scripps and Journal could result in the transactions being completed at a later time, or not at all. See “The Master Transaction Agreement - Other Covenants and Agreements - Efforts to Consummate the Transactions” beginning on page 137 and “The Master Transaction Agreement - Conditions to the Transactions” beginning on page 135.

Q: When and where will the special meetings be held?

A: The Scripps special meeting will be held at the Scripps Center, 10th floor conference center, Cincinnati, 312 Walnut Street, Ohio 45202, at 10:00 a.m., Eastern Time, on March 11, 2015.

The Journal special meeting will be held at 333 West State Street, second floor, Milwaukee, Wisconsin 53203, at 9:00 a.m., Central Time, on March 11, 2015.

Q: What are the proposals on which holders of common voting shares of Scripps are being asked to vote and what is the recommendation of the Board of Directors of Scripps with respect to each proposal?

A: At the Scripps special meeting, the holders of Scripps common voting shares are being asked to:

| |

1. | Consider and vote on a proposal to amend the articles of incorporation of Scripps to allow Scripps to effect the spin-off of its newspaper business through the issuance of the same class of common shares of the entity that will own such business (which we refer to as “Scripps Spinco”) to each holder of class A common shares and each holder of common voting shares of Scripps, which we refer to as the “Scripps amendment proposal.” The proposed amendment to Scripps’ articles of incorporation is shown in Annex B attached hereto. |

| |

2. | Consider and vote on a proposal to approve the issuance of class A common shares of Scripps pursuant to the broadcast merger, which we refer to as the “Scripps share issuance proposal.” |

The Board of Directors of Scripps unanimously recommends a vote “FOR” each of the proposals referred to above.

Scripps will transact no other business at the special meeting other than any such business that may be properly brought before the special meeting or any adjournment or postponement thereof.

Q: Why is it necessary to amend the articles of incorporation of Scripps?

A: In order to obtain the consent of the Federal Communications Commission, or FCC, to our acquisition of the broadcast business of Journal, the Scripps family, which, through the Scripps Family Agreement, controls us now and will continue to control Scripps following completion of the transactions, will not be permitted to control Journal Media Group. As currently constituted, our articles of incorporation only permit us to spin-off a business with a capital structure that enables the Scripps family to control the business to be spun-off. Approval of the proposed amendment to our articles, which must be approved by the Scripps family as holders of our outstanding common voting shares, will allow us to spin-off our newspaper business without perpetuating control of that business or Journal Media Group by the Scripps family. The amendment to our articles, coupled with the amendment that the Scripps family has made to the Scripps Family Agreement to exclude the Journal Media Group shares from that Agreement, facilitated our receiving the FCC consent and being able to complete the transactions. See “Scripps Proposals to be Voted on at the Special Meeting” beginning on page 53 and “Scripps Family Agreement” beginning on page 197.

Q: Do Scripps shareholders have to vote to approve the Scripps newspaper spin-off or the Scripps newspaper merger?

A: No. No vote of Scripps shareholders, with respect to either the shares of Scripps or the shares of Scripps Spinco, is required or being sought in connection with the Scripps newspaper spin-off or the Scripps newspaper merger. Scripps Media, as the sole shareholder of Scripps Spinco, has approved the transactions contemplated by the master agreement, including the Scripps newspaper merger.

Q: What vote is required to approve the proposals being presented at the special meeting of Scripps shareholders?

A: Assuming a quorum is present, to be approved at the special meeting, the Scripps amendment proposal requires the affirmative vote of the holders of a majority of all common voting shares of Scripps outstanding on the record date for the special meeting, and the Scripps share issuance proposal requires the affirmative vote of the holders of a majority of all votes cast at the special meeting by holders of common voting shares of Scripps.

Q: Will the Scripps shareholders holding common voting shares of Scripps be asked to vote on the Scripps share issuance proposal and the Scripps amendment proposal at the special meeting if the Board of Directors has changed its recommendations for such proposals?

A: Yes, if Journal so requests. The Scripps board may change its recommendation with respect to these proposals only if it decides that a third party acquisition proposal for control of Scripps is superior to the transactions.

Q: What are the proposals on which the Journal shareholders are being asked to vote and what is the recommendation of the Board of Directors of Journal with respect to each proposal?

A: At the Journal special meeting, Journal shareholders are being asked to vote on the following matters:

| |

1. | A proposal to approve the spin-off of the Journal newspaper business and the subsequent merger of the entity that will hold such newspaper business (which we refer to as “Journal Spinco”) with a wholly owned subsidiary of Journal Media Group, which we refer to as the “Journal spin-off proposal;” |

| |

2. | A proposal to approve the broadcast merger, which we refer to as the “Journal merger proposal;” |

| |

3. | A non-binding, advisory proposal to approve the compensation that may be paid or become payable to Journal’s named executive officers in connection with the transactions, as disclosed in this joint proxy statement/prospectus, which we refer to as the “Journal compensation proposal;” and |

| |

4. | A proposal to approve the adjournment or postponement of the Journal special meeting, if necessary or appropriate, to solicit additional proxies in the event there are not sufficient votes at the time of the Journal special meeting to approve both the Journal spin-off proposal and the Journal merger proposal, which we refer to as the “Journal adjournment proposal.” |

The Board of Directors of Journal unanimously recommends a vote “FOR” each of the proposals referred to above.

Journal will transact no other business at the special meeting other than any such business that may be properly brought before the Journal special meeting or any adjournment or postponement thereof.

Q: Why is it necessary for Journal shareholders to approve the Journal spin-off proposal and the Journal merger proposal?

A: Journal's amended and restated articles of incorporation require Journal to first obtain the approval of shareholders holding at least sixty-six and two-thirds percent (66 2/3%) of the voting power of the outstanding shares of Journal class A common stock and Journal class B common stock prior to the consummation of certain "strategic transactions." Each of the Journal spin-off proposal and the Journal merger proposal constitutes a "strategic transaction" under Journal's amended and restated articles of incorporation, and, therefore, Journal is seeking Journal shareholder approval with respect to each proposal. "See Journal Proposals to be Voted on at the Special Meeting" beginning on page 57.

Q: What vote is required to approve the proposals being presented at the special meeting of Journal shareholders?

A: Assuming a quorum is present, to be approved at the Journal special meeting, the Journal spin-off proposal and the Journal merger proposal each requires the affirmative vote of the holders of two-thirds of the voting power of all outstanding shares of Journal class A common stock and Journal class B common stock entitled to vote at the special meeting, voting together as a single class. If you mark “abstain” or fail to vote with respect to the Journal spin-off proposal and/or the Journal merger proposal, it will have the same effect as a vote “AGAINST” such proposals.

Assuming a quorum is present, the approval of the Journal compensation proposal requires that the number of votes cast for the Journal compensation proposal exceed the number of votes cast against it. Abstentions and broker non-votes will be counted as present in determining whether there is a quorum; however they will not constitute a vote for or against the non-binding proposal and will be disregarded in the calculation of votes cast.

Whether or not a quorum is present, the Journal adjournment proposal requires that the number of votes cast for the Journal adjournment proposal exceed the number of votes cast against it. Abstentions and broker non-votes will be counted as present in determining whether there is a quorum; however they will not constitute a vote for or against the proposal and will be disregarded in the calculation of votes cast.

Q: Will the Journal shareholders be asked to vote on the Journal spin-off proposal and the Journal merger proposal at the special meeting if the Board of Directors has changed its recommendations for such proposals?

A: Yes, if Scripps so requests. The Journal board may change its recommendation with respect to these proposals only if it decides that a third party acquisition proposal for control of Journal is superior to the transactions.

Q: What is the effect if these proposals are not approved at the special meetings?

A: If the Scripps amendment proposal or the Scripps share issuance proposal is not approved by the requisite vote at the special meeting of Scripps shareholders, or if the Journal spin-off proposal or the Journal merger proposal is not approved by the requisite vote at the special meeting of Journal shareholders, then the transactions will not occur.

Q: Who is entitled to vote at the special meetings?

A: The Board of Directors of Journal has fixed January 6, 2015, as the record date for its special meeting and the Board of Directors of Scripps has fixed February 3, 2015, as the record date for its special meeting. If you were a holder of common voting shares of Scripps or a holder of shares of class A or class B common stock of Journal at the close of business on the respective record date, you are entitled to receive notice of, and vote at, your company’s special meeting.

Q: If I am a Scripps shareholder, how many votes do I have?

A: If you are a Scripps shareholder, on each of the proposals that will be voted upon at the Scripps special meeting, you will be entitled to one vote per share of Scripps common voting shares that you owned as of the record date. As of the close of business on February 3, 2015, there were 11,932,722 common voting shares outstanding and entitled to vote. As of that date, all outstanding common voting shares were held by, or for the benefit of, descendants of the founder of Scripps.

If you are a holder of class A common shares of Scripps, you will not be entitled to vote on either of the proposals being presented at the Scripps special meeting, but you may attend the meeting.

Q: If I am a Journal shareholder, how many votes do I have?

A: If you are a holder of Journal class A common stock, on each of the proposals that will be voted upon at the Journal special meeting, you will be entitled to one vote per share of Journal class A common stock that you owned as of the record date. As of the close of business on the record date, there were 45,306,761 shares of Journal class A common stock outstanding and entitled to vote. These shares represented 45,306,761 votes as of the record date.

If you are a holder of Journal class B common stock, on each of the proposals that will be voted upon at the Journal special meeting, you will be entitled to ten votes for each share of Journal class B common stock that you owned as of the record date. As of the close of business on the record date, there were 5,593,949.282 shares of Journal class B common stock outstanding and entitled to vote. These shares represented 55,939,492 votes as of the record date.

Holders of Journal class A common stock and class B common stock will vote together as a single class on all matters at the Journal special meeting.

Q: Are any Scripps shareholders already committed to vote in favor of the Scripps amendment proposal or the Scripps share issuance proposal?

A: Certain directors of Scripps, all of whom are members of the Scripps family, have informed us that they currently intend to vote all of their common voting shares in favor of the Scripps amendment proposal and the Scripps share issuance proposal. As of January 27, 2015, these directors beneficially owned, in the aggregate, 1,593,026 common voting shares, representing approximately 13.35% of the outstanding common voting shares. Other than the foregoing directors, no members of the Scripps family, including those who are party to the Scripps Family Agreement, have committed to vote in favor of either of the proposals to be voted on at our special meeting of shareholders. See “Summary - Voting by Scripps’ Directors and Executive Officers” beginning on page 11.

Q: Are any Journal shareholders already committed to vote in favor of the Journal spin-off proposal or the Journal merger proposal?

A: The directors and executive officers of Journal have informed Journal that they currently intend to vote all of their Journal class A common stock and Journal class B common stock in favor of the Journal spin-off proposal and the Journal merger proposal. As of January 6, 2015, these persons beneficially owned, in the aggregate, 33,635 shares (or approximately 0.07%) of the Journal class A common stock and 2,607,061 shares (or approximately 46.6%) of the Journal class B common stock, representing collectively approximately 25.8% of the voting power of the Journal shareholders. See “Summary - Voting by Journal’s Directors and Executive Officers” beginning on page 11.

Q: What constitutes a quorum for each special meeting?

A: Holders of a majority of the outstanding Scripps common voting shares, represented in person or by proxy, will constitute a quorum for the Scripps special meeting.

Holders of a majority of the voting power of the outstanding Journal class A common stock and Journal class B common stock, taken together, in each case represented in person or by proxy, will constitute a quorum for the Journal special meeting.

Q: Who can attend each special meeting?

A: If you held Scripps class A common shares or common voting shares, or Journal class A common stock or class B common stock, as of the record date, you may attend your company’s special meeting. If you are a beneficial owner of stock held in “street name,” you must provide evidence of your ownership of such stock, which you can obtain from your broker, bank or other nominee, in order to attend your company’s special meeting.

Q: What if my bank, broker or other nominee holds my shares in “street name”?

A: If a bank, broker or other nominee holds your shares for your benefit but not in your own name, such shares are in “street name.” In that case, your bank, broker or other nominee will send you a voting instruction form to use in order to instruct the vote of your shares. The availability of telephone and internet voting instruction depends on the voting procedures of your bank, broker or other nominee. Please follow the instructions on the voting instruction form they send you. If your shares are held in the name of your bank, broker or other nominee and you wish to attend or vote in person at your company’s special meeting, you must contact your bank, broker or other nominee and request a document called a “legal proxy.” You must bring this legal proxy to the special meeting in order to vote in person. Your bank, broker or other nominee will not vote your shares unless you provide instructions on how to vote.

Q: If I am a Scripps shareholder holding common voting shares, how do I vote?

A: After reading and carefully considering the information contained in this joint proxy statement/prospectus, please submit a proxy or voting instructions for your Scripps common voting shares as promptly as possible so that your shares will be represented at the Scripps special meeting. If you are a holder of record of Scripps common voting shares as of the close of business on the record date, you may submit your proxy before the Scripps special meeting by marking, signing and dating your proxy card and returning it in the postage-paid envelope we have provided.

In lieu of submitting a proxy, holders of common voting shares may vote in person at the Scripps special meeting. For additional information on voting procedures, see “The Scripps Special Meeting - How to Vote” beginning on page 51.

After reading and carefully considering the information contained in this joint proxy statement/prospectus, please submit your proxy or voting instructions as soon as possible, whether or not you plan to attend the Scripps special meeting.

Q: Do the holders of Scripps class A common shares have the right to vote on the proposals?

A: No. The holders of Scripps class A common shares are receiving this joint proxy statement/prospectus for informational purposes only and are not entitled to vote their class A common shares of Scripps on any proposals being submitted at the Scripps special meeting.

Q: If I am a Journal shareholder, how do I vote?

A: After reading and carefully considering the information contained in this joint proxy statement/prospectus, please submit a proxy for your shares as promptly as possible so that your shares will be represented at the Journal special meeting. If you are a shareholder of record of Journal as of the close of business on the record date, you may submit your proxy before the Journal special meeting by marking, signing and dating your proxy card and returning it in the postage-paid envelope we have provided.

In addition, holders of record of class A common stock and class B common stock may vote in person at the Journal special meeting or by mail or through the internet. For additional information on voting procedures, see “The Journal Special Meeting - How to Vote” beginning on page 55.

After reading and carefully considering the information contained in this joint proxy statement/prospectus, please submit your proxy as soon as possible whether or not you plan to attend the Journal special meeting.

Q: What do I do if I receive more than one set of voting materials?

A: You may receive more than one set of voting materials, including multiple copies of this joint proxy statement/prospectus and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate instruction card for each brokerage account in which you hold shares. If you are a holder of record and your shares are held in more than one name, you will receive more than one proxy card. You may also receive multiple copies of this joint proxy statement/prospectus if you are a shareholder of both Scripps and Journal. Please complete, sign, date and return each proxy card and voting instruction card you receive, or, if you are a shareholder of Journal, you may submit a proxy by telephone or internet by following the instructions on each proxy card.

Q: How will my proxy be voted?

A: If you submit a proxy or voting instructions by completing, signing, dating and mailing your proxy card or voting instruction card, or, if you are a Journal shareholder, by submitting your proxy by internet or by telephone, your shares will be voted in accordance with your instructions. If you are a shareholder of record as of the record date and you sign, date, and return your proxy card but do not indicate how you want to vote on any particular proposal and do not indicate that you wish to abstain with respect to that proposal, Scripps common voting shares represented by your proxy will be voted as recommended by the Scripps Board of Directors with respect to that proposal, and the Journal class A common stock or class B common stock represented by your proxy will be voted as recommended by the Journal Board of Directors with respect to that proposal.

Q: What if I mark “abstain” when voting, or do not vote on the proposals?

A: If you fail to vote in person or by proxy any shares for which you are the record owner as of the record date or fail to instruct your broker or other nominee on how to vote the shares you hold in street name, your shares will not be counted in determining whether a quorum is present at your company’s special meeting. If you mark abstain when voting, your shares will be counted in determining whether a quorum is present at your company’s special meeting.

If you are a Scripps shareholder, because the Scripps amendment proposal requires the affirmative vote of the holders of a majority of all outstanding Scripps common voting shares, failing to vote or abstaining from voting on such proposal will have the effect of a vote “AGAINST” such proposal. Failing to vote or abstaining from voting on the Scripps share issuance proposal will not constitute a vote for or against such proposal and will be disregarded in the calculation of the votes cast.

If you are a holder of Journal class A common stock or Journal class B common stock, because the Journal spin-off and merger proposals require the affirmative vote of the holders of two-thirds of the voting power of all outstanding Journal class A common stock and Journal class B common stock, voting together as a single class, your failure to vote or abstain with respect to either Journal proposal will have the effect of a vote “AGAINST” such proposal. Failing to vote or abstaining from voting on the Journal compensation proposal or the Journal adjournment proposal will not constitute a vote for or against such proposals and will be disregarded in the calculation of the votes cast.

Q: Can I change my vote after I have submitted a proxy or voting instruction card?

A: Yes. If you are a shareholder of record as of your company's applicable record date, you can change your proxy at any time before it is voted at your company’s special meeting. You can do this in one of three ways:

| |

• | you can send a signed notice of revocation to the Secretary of Scripps or Journal, as appropriate; |

| |

• | you can submit a revised proxy bearing a later date by mail, or, if you are a Journal shareholder, by internet or telephone; or |

| |

• | you can attend your company’s special meeting and vote in person, which will automatically cancel any proxy previously given, though your attendance alone will not revoke any proxy that you have previously given. |

Q: If I am a Scripps shareholder, will I be required to exchange my shares in connection with the newspaper spin-offs, newspaper mergers or the broadcast merger?

A: No. You will not be required to exchange your certificates or “book-entry” securities representing common shares of Scripps. Upon completion of the broadcast merger, certificates and “book-entry” securities representing common shares of Scripps prior to the transactions will represent an equal number of common shares of Scripps following such merger. Upon completion of the newspaper spin-offs and the newspaper mergers, you will receive “book-entry” securities representing shares of Journal Media Group common stock.

Q: If I am a Journal shareholder, will I be required to exchange my shares in connection with the newspaper spin-offs, newspaper mergers or the broadcast merger?

A: You will not be required to exchange your certificates or book-entry securities representing shares of common stock of Journal in connection with the newspaper spin-offs or the newspaper mergers. Upon completion of those transactions, you will receive book-entry securities representing your shares of Journal Media Group common stock. Similarly, you will not be required to exchange your book-entry securities representing shares of common stock of Journal in connection with the broadcast merger. Upon completion of the broadcast merger, your Journal book-entry shares will be converted into book-entry Scripps class A common shares. However, if you have certificates representing shares of Journal class A common stock, then you will be required to exchange such certificates in connection with the broadcast merger. Following completion of the broadcast merger, the exchange agent will send you a letter of transmittal to be used to exchange your certificated shares of Journal class A common stock for book-entry Scripps class A common shares.

Q: If I am a Journal shareholder and have class A stock certificates, should I send in my certificates now?

A: No. If you hold certificates representing Journal class A common stock, the exchange agent will send you written instructions informing you how to exchange your shares in connection with the broadcast merger.

Q: Are there any risks that I should consider?

A: Yes. There are risks associated with all spin-offs and business combinations, including the proposed transactions. There are also risks associated with the broadcast business of Scripps following the broadcast merger, the newspaper business of Journal Media Group, the ownership of class A common shares of Scripps following the broadcast merger and the ownership of common stock of Journal Media Group. We have described certain of these risks and other risks in more detail under “Risk Factors” beginning on page 32.

Q: What challenges will Journal Media Group face as a standalone company?

A: The following are among the challenges that Journal Media Group will face as a standalone company following completion of the transactions:

| |

• | integrating successfully the newspaper business of Journal and Scripps; |

| |

• | arranging or developing key services and functions that Journal and Scripps historically have provided for Journal Media Group's newspapers; |

| |

• | addressing the secular decline in the print newspaper business without the capital resources and diversification of business risks previously afforded to Journal Media Group's newspapers by Scripps and Journal; and |

| |

• | responding to changes in technology and to evolving industry standards and trends. |

Q: Are Scripps or Journal shareholders entitled to dissenters' rights?

A: Scripps shareholders are not entitled to dissenters' rights in connection with the transactions.

Holders of Journal class A common stock are not entitled to dissenters' rights in connection with the transactions.

Holders of Journal class B common stock may assert dissenters’ rights in connection with the broadcast merger to the extent such rights are available under Wisconsin law with respect to their Journal class B common stock and, if such rights are properly exercised, such shareholders will be entitled to receive payment of the “fair value” of such shares in accordance with Wisconsin law instead of receiving the merger consideration payable in respect of such shares in the broadcast merger.

In order to preserve any dissenters’ rights that a Journal class B shareholder may have, in addition to otherwise complying with the applicable provisions of Wisconsin law, such shareholder must have given Journal notice of his, her or its intent to demand payment of the fair value of the shares if the transactions are consummated and must demand payment in writing after receiving from Journal a notice specifying the procedure for demanding payment. For additional information on dissenters’ rights, see “Dissenters’ Rights” beginning on page 199.

Q: What are the material U.S. federal income tax consequences of the transactions to holders of Scripps common shares and Journal common stock?

A: Subject to the limitations and qualifications described in “Material U.S. Federal Income Tax Consequences of the Transactions,” for U.S. federal income tax purposes, (i) no gain or loss will be recognized by, or be includible in the income of, a U.S. Holder of Scripps common shares as a result of the Scripps newspaper contribution, Scripps newspaper spin-off, Scripps newspaper merger, or broadcast merger, except with respect to any cash received by Scripps shareholders in lieu of fractional shares of Journal Media Group, and (ii) no gain or loss will be recognized by, or be includible in the income of, a U.S. Holder of Journal common stock as a result of the Journal newspaper contribution, Journal newspaper spin-off, Journal newspaper merger, or broadcast merger, except with respect to any cash received by (a) Journal shareholders in lieu of fractional shares of Journal Media Group or Scripps or (b) holders of Journal class B common stock in connection with the exercise of dissenters’ rights. The treatment of any cash received by a U.S. Holder of Scripps common shares or Journal common stock is discussed in “Material U.S. Federal Income Tax Consequences of the Transactions.” The cash received by a Scripps shareholder in the Scripps special dividend with respect to a Scripps common share generally will be treated in the following manner:

| |

• | first as a taxable dividend to the extent of the pro rata share of Scripps’ current and accumulated earnings and profits that is allocable to the Scripps common share, if any (as of September 30, 2014, Scripps had no current or accumulated earnings and profits, and Scripps is expected not to have any current or accumulated earnings or profits for the taxable year in which the distribution is made); |

| |

• | then as a non-taxable return of capital to the extent of such shareholder’s tax basis in the Scripps share; and |

| |

• | thereafter as capital gain with respect to any remaining value. |

The obligation of Scripps to complete the transaction is conditioned upon the receipt by Scripps of an opinion from Baker & Hostetler LLP, counsel to Scripps, to the effect that for U.S. federal income tax purposes (i) the SMI newspaper contribution and the SMI newspaper distribution will qualify as a reorganization within the meaning of Sections 368(a)(1)(D) and 355 of the Internal Revenue Code of 1986, as amended (the “Code”); (ii) the SMI newspaper distribution will qualify as a distribution described in Section 355 of the Code; (iii) with respect to the SMI newspaper distribution, the Scripps Spinco common stock will be treated as “qualified property” for purposes of Section 361(c)(2) of the Code; (iv) the Scripps newspaper contribution and the Scripps newspaper spin-off will qualify as a reorganization within the meaning of Sections 368(a)(1)(D) and 355 of the Code; (v) the Scripps newspaper spin-off will qualify as a distribution described in Section 355 of the Code; (vi) with respect to the Scripps newspaper spin-off, the Scripps Spinco common stock will be treated as “qualified property” for purposes of Section 361(c)(2) of the Code; (vii) the exchange of Scripps Spinco common stock for Journal Media Group common stock pursuant to the Scripps newspaper merger will qualify as an exchange described in Section 351 of the Code and/or a reorganization described in Sections 368(a)(1)(B) and/or 368(a)(2)(E) of the Code; and (viii) the broadcast merger will qualify as a reorganization described in Section 368(a) of the Code.

The obligation of Journal to complete the transactions is conditioned upon the receipt by Journal of an opinion from Foley & Lardner LLP, counsel to Journal, to the effect that for U.S. federal income tax purposes (i) the Journal newspaper contribution and the Journal newspaper spin-off will qualify as a reorganization within the meaning of Sections 368(a)(1)(D) and 355 of the Code; (ii) the Journal newspaper spin-off will qualify as a distribution described in Section 355 of the Code; (iii) the exchange of Journal Spinco common stock for Journal Media Group common stock pursuant to the Journal newspaper merger will qualify as an exchange described in Section 351 of the Code and/or a reorganization described in Sections 368(a)(1)(B) and/or 368(a)(2)(E) of the Code; and (iv) the broadcast merger will qualify as a reorganization described in Section 368(a) of the Code. As a result of the application of Section 355(e), at the corporate level Journal will recognize gain but not loss on the distribution of shares of Journal Spinco common stock to the extent the fair market value of such shares exceeds Journal’s tax basis in such shares.

Neither Journal nor Scripps currently intends to waive the condition that it receive a favorable tax opinion as described above. If either Journal or Scripps waives any of such conditions, Journal and Scripps will revise and recirculate this joint proxy statement/prospectus and resolicit the votes of Journal and Scripps shareholders.

For a more detailed summary of the material U.S. federal income tax consequences of the mergers and for definitions of certain terms used above, see “Material U.S. Federal Income Tax Consequences of the Transactions” beginning on page 117.

Q: Who will serve as the exchange agent?

A: Computershare. As exchange agent, it will (i) credit to Scripps and Journal shareholders their shares in Journal Media Group in connection with the newspaper spin-offs and the newspaper mergers; (ii) credit to Journal shareholders who hold their shares in book-entry form their Scripps class A common shares to which they are entitled in connection with the broadcast merger; and (iii) credit to Journal shareholders who hold their shares of Journal class A common stock in certificated form Scripps class A common shares in book-entry form to which they are entitled in connection with the broadcast merger upon submission of properly completed letters of transmittal and certificates for Journal class A common stock.

Q: Whom should I contact if I have any questions about voting?

A: If you have any questions about the proxy materials or if you need assistance submitting your proxy or voting your shares or need additional copies of this document or the enclosed proxy card, the contacts are as follows:

If you are a Journal shareholder, you should contact MacKenzie Partners, Inc., the proxy solicitation agent for Journal, at 105 Madison Avenue, New York, New York 10016, (212) 929-5500 or toll-free at (800) 322-2885 or by email at proxy@mackenziepartners.com. Banks and brokerage firms should contact MacKenzie Partners, Inc. at (212) 929-5500 or by email at proxy@mackenziepartners.com.

If you are a Scripps shareholder, you should contact Julie McGehee at Scripps, at (513) 977-3000 or by email at julie.mcgehee@scripps.com with any questions.

SUMMARY

This summary highlights selected information contained elsewhere in this joint proxy statement/prospectus and may not contain all the information that may be important to you. Accordingly, we encourage you to read this joint proxy statement/prospectus carefully and in its entirety, including its annexes and the documents incorporated by reference into this joint proxy statement/prospectus. Page references have been included in this summary to direct you to a more complete description of the topics summarized below. See “Where You Can Find More Information” beginning on page 207.

References to “Scripps” are references to The E. W. Scripps Company. References to “Journal” are references to Journal Communications, Inc. References to “we” or “our” and other first person references in this joint proxy statement/prospectus refer to Scripps or Journal, as the case may be, before completion of the transactions. References to the “transactions,” unless the context requires otherwise, mean the transactions contemplated by the master agreement, taken as a whole.

Terminology

In this proxy statement/prospectus, we refer to the:

| |

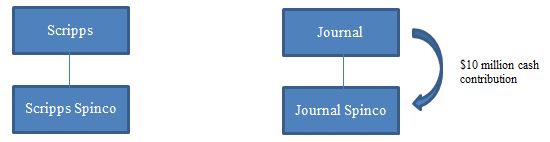

• | contribution by Journal to Journal Spinco of $10.0 million in cash prior to the Journal newspaper spin-off as the “Journal cash contribution”; |

| |

• | contribution by Scripps Media to Scripps Spinco of all of the issued and outstanding membership interests of Scripps Newspapers LLC as the “SMI newspaper contribution”; |

| |

• | distribution by Scripps Media to Scripps of all of the issued and outstanding common stock of Scripps Spinco as the “SMI newspaper distribution”; |

| |

• | contribution by Scripps to Scripps Spinco of Scripps newspaper assets and the assumption by Scripps Spinco of the Scripps newspaper liabilities as the “Scripps newspaper contribution”; |

| |

• | contribution by Journal to Journal Spinco of the Journal cash contribution and all of the issued and outstanding shares of capital stock of each of Journal Sentinel, Inc. and Journal Community Publishing Group, Inc. as the “Journal newspaper contribution”; |

| |

• | distribution of the stock of Scripps Spinco (as defined below in “Parties to the Transactions”), as the “Scripps newspaper spin-off”; |

| |

• | distribution of the stock of Journal Spinco (as defined below in “Parties to the Transactions”), as the “Journal newspaper spin-off”; |

| |

• | Scripps newspaper spin-off and the Journal newspaper spin-off together, as the “newspaper spin-offs”; |

| |

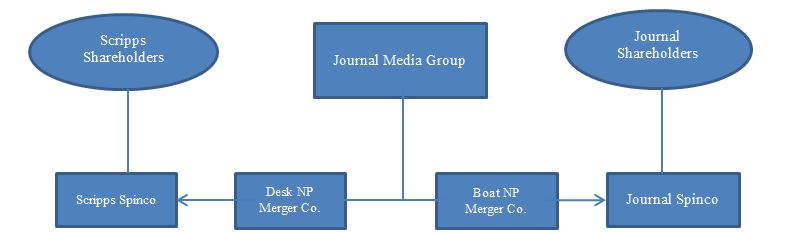

• | merger of Scripps Spinco with a wholly owned subsidiary of Journal Media Group, as the “Scripps newspaper merger”; |

| |

• | merger of Journal Spinco with a wholly owned subsidiary of Journal Media Group, as the “Journal newspaper merger”; |

| |

• | Scripps newspaper merger and the Journal newspaper merger together, as the “newspaper mergers”; |

| |

• | merger of Journal into a wholly owned subsidiary of Scripps, as the “broadcast merger”; and |

| |

• | aggregate $60.0 million dividend to be paid by Scripps to its shareholders immediately prior to completion of the broadcast merger, as the “Scripps special dividend.” |

Parties to the Transactions

The E. W. Scripps Company. The E.W. Scripps Company, headquartered in Cincinnati, Ohio, serves audiences and businesses through a portfolio of television, print and digital media brands. Scripps owns 21 local television stations as well as

daily newspapers in 13 markets across the United States. It also runs an expanding collection of local and national digital journalism and information businesses. Following completion of the transactions, Scripps will own and operate television and radio stations serving twenty-seven markets and reaching 18% of U.S. television households, making it the fifth largest independent television group in the country.

Scripps class A common shares are traded on the NYSE under the trading symbol “SSP.” Scripps’ principal executive office is located at 312 Walnut Street, 28th Floor, Cincinnati, Ohio 45202 (telephone number: (513) 977-3000).

Additional information about Scripps and its subsidiaries is included in the documents incorporated by reference into this joint proxy statement/prospectus. See “Where You Can Find More Information” beginning on page 207.

Journal Communications, Inc. Journal Communications, Inc., headquartered in Milwaukee, Wisconsin, is a diversified media company with operations in television and radio broadcasting, newspaper publishing and digital media. Journal owns and operates or provides services to 14 television stations and 35 radio stations in 11 states. In addition, Journal publishes the Milwaukee Journal Sentinel, which serves as the only major daily newspaper for the metro-Milwaukee area, and several community newspapers in Wisconsin.

Journal class A common stock is traded on the NYSE under the symbol “JRN.” Journal’s headquarters are located at 333 West State Street, Milwaukee, Wisconsin 53203 (telephone number: (414) 224-2000).

Additional information about Journal and its subsidiaries is included in the documents incorporated by reference into this joint proxy statement/prospectus. See “Where You Can Find More Information” beginning on page 207.

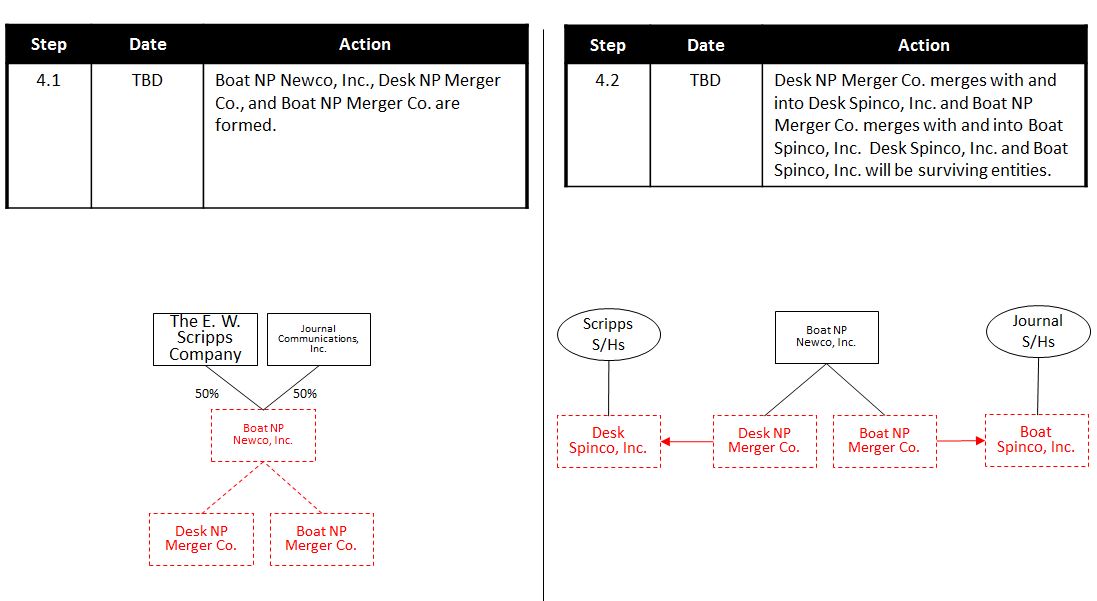

Journal Media Group. Incorporated originally as Boat NP Newco, Inc., Journal Media Group is a Wisconsin corporation currently owned equally by Scripps and Journal. Journal Media Group has not carried out any activities to date, except for activities incidental to its formation or the transactions contemplated by the master agreement. Following completion of the transactions, Journal Media Group will be the parent company of Scripps Spinco, which will operate what is now the Scripps newspaper business, and Journal Spinco, which will operate what is now the Journal newspaper business. Scripps shareholders will hold 59%, and Journal shareholders 41%, of the outstanding capital stock of Journal Media Group at the completion of the transactions. The common stock of Journal Media Group is expected to be listed for trading on the NYSE under the symbol “JMG.” Journal Media Group’s office is located at 333 West State Street, Milwaukee, Wisconsin 53203 (telephone number: (414) 224-2000).

Scripps Media, Inc. Scripps Media, Inc., which we sometimes refer to as “Scripps Media,” is a Delaware corporation and a direct, wholly owned subsidiary of Scripps. Scripps Media owns and operates all of our broadcast television stations and all but two of our newspapers. The newspapers that are not operated by Scripps Media are owned by subsidiaries that are majority owned by Scripps. Following the completion of the transactions, Scripps Media will continue to be a direct, wholly owned subsidiary of Scripps and will continue to own the broadcast television stations that it currently owns. Scripps Media’s office is located at 312 Walnut Street, 28th Floor, Cincinnati, Ohio 45202 (telephone number: (513) 977-3000).

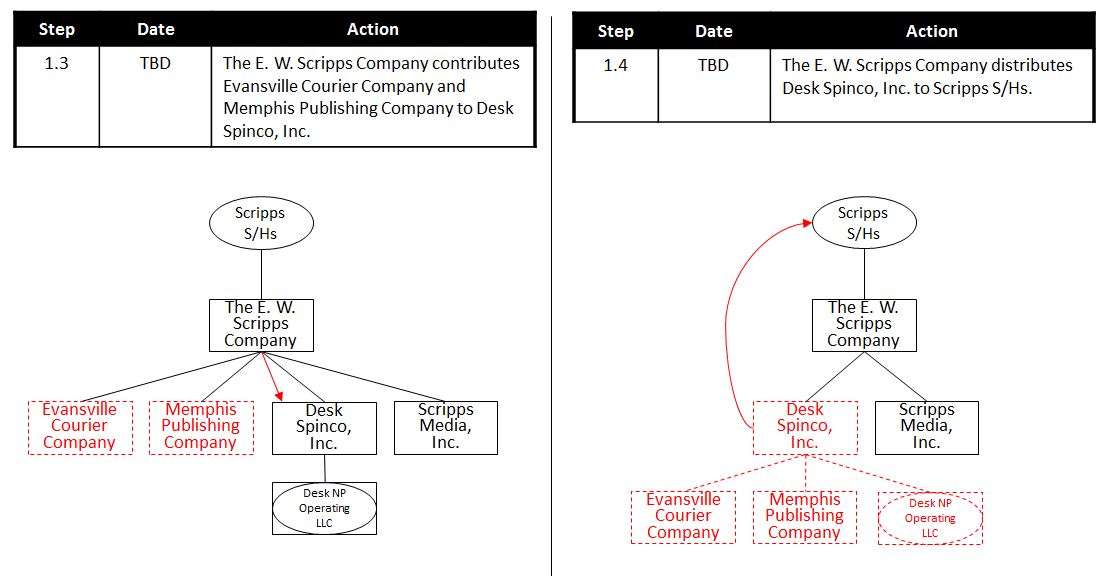

Desk Spinco, Inc. Desk Spinco, Inc., which we sometimes refer to as “Scripps Spinco” is a Wisconsin corporation and a direct, wholly owned subsidiary of Scripps Media. Scripps Spinco has been formed solely to effect the spin-off of the newspaper business of Scripps and facilitate the subsequent combination of the newspaper businesses of Scripps and Journal. Scripps Spinco has not carried out any activities to date, except for activities incidental to its formation or the transactions contemplated by the master agreement. Following completion of the transactions, Scripps Spinco will be a direct, wholly owned subsidiary of Journal Media Group owning and operating what is now the Scripps newspaper business. Scripps Spinco’s office is located at 312 Walnut Street, 28th Floor, Cincinnati, Ohio 45202 (telephone number: (513) 977-3000).

Scripps NP Operating, LLC. Scripps NP Operating, LLC, a Wisconsin limited liability company (formerly known as Desk NP Operating, LLC), which we sometimes refer to as “Scripps Newspapers LLC,” is a wholly owned subsidiary of Scripps Media. Scripps Newspapers LLC was formed solely to facilitate the spin-off of the Scripps newspaper business. Following the completion of the transactions, Scripps Newspapers LLC will continue to be a direct, wholly owned subsidiary of Scripps Spinco. Scripps Newspapers LLC has not carried out any activities to date, except for activities incidental to its formation or the transactions contemplated by the master agreement. Scripps Newspapers LLC’s office is located at 312 Walnut Street, 28th Floor, Cincinnati, Ohio 45202 (telephone number: (513) 977-3000).

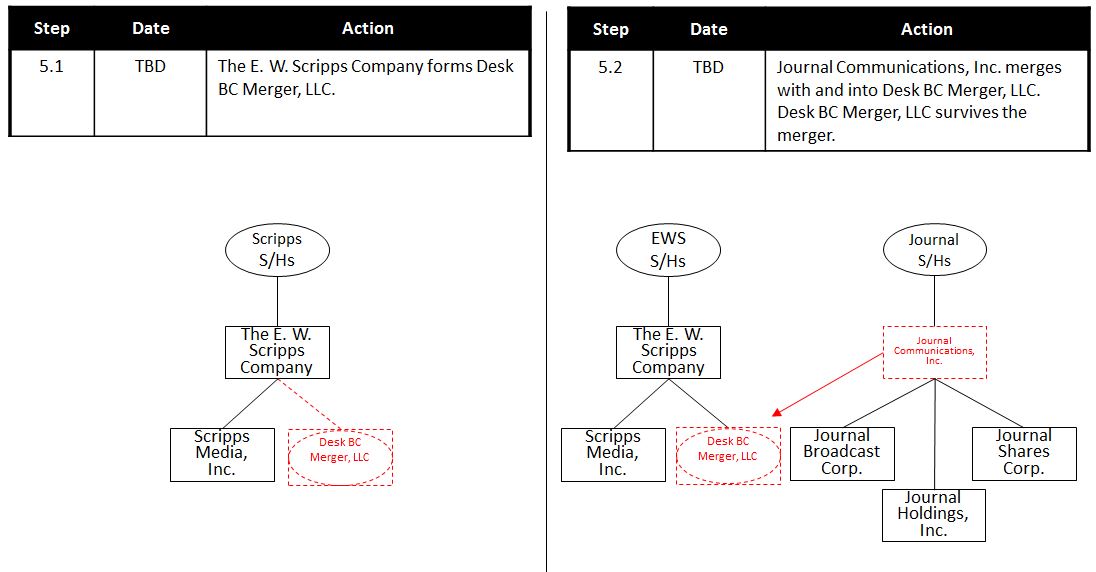

Desk BC Merger, LLC. Desk BC Merger, LLC, which we sometimes refer to as “Scripps Broadcast Merger Sub,” is a Wisconsin limited liability company and wholly owned subsidiary of Scripps. Scripps Broadcast Merger Sub was formed solely to effect the combination of the broadcast businesses of Scripps and Journal through the merger of Journal into Scripps

Broadcast Merger Sub following the spin-offs and combination of the newspaper businesses of Scripps and Journal. Scripps Broadcast Merger Sub has not carried out any activities to date, except activities incidental to its formation or the transactions contemplated by the master agreement. Following completion of the transactions, Scripps Broadcast Merger Sub will be a direct, wholly owned subsidiary of Scripps owning and operating what is now the Journal broadcast business. Scripps Broadcast Merger Sub’s office is located at 312 Walnut Street, 28th Floor, Cincinnati, Ohio 45202 (telephone number: (513) 977-3000).

Boat Spinco, Inc. Boat Spinco, Inc., which we sometimes refer to as “Journal Spinco,” is a Wisconsin corporation that is a direct, wholly owned subsidiary of Journal. Journal Spinco has been formed to effect the spin-off of Journal’s newspaper business and facilitate the subsequent combination of the Scripps and Journal newspaper businesses. Journal Spinco has not carried out any activities to date, except for activities incidental to its formation or the transactions contemplated by the master agreement. Following completion of the transactions, Journal Spinco will be a direct, wholly owned subsidiary of Journal Media Group and will operate what is now the Journal newspaper business. Journal Spinco’s office is located at 333 West State Street, Milwaukee, Wisconsin 53203 (telephone number: (414) 224-2000).

Desk NP Merger Co. Desk NP Merger Co., which we sometimes refer to as “Scripps Newspaper Merger Sub,” is a Wisconsin corporation and wholly owned subsidiary of Journal Media Group. Scripps Newspaper Merger Sub was formed solely to effect the combination of the Scripps and Journal newspaper businesses. Scripps Newspaper Merger Sub has not carried out any activities to date, except for activities incidental to its formation or the transactions contemplated by the master agreement. Following completion of the transactions, Scripps Newspaper Merger Sub will cease to exist. Scripps Newspaper Merger Sub’s office is located at 312 Walnut Street, 28th Floor, Cincinnati, Ohio 45202 (telephone number: (513) 977-3000).