IEX-2014.01.30-EX99.2

EXHIBIT 99.2

IDEX CORPORATION

Moderator: Michael Yates

January 30, 2014

9:30 am CT

| |

Operator: | Good morning. My name is (Karnicya), and I will be your conference operator today. At this time I would like to welcome everyone to the Q4 2013 earnings call for IDEX Corporation. |

All lines have been placed on mute to prevent any background noise. After the speakers’ remarks there will be a question and answer session. If you would like to ask a question during this time, simply press star and then the number one on your telephone keypad. If you would like to withdraw your question press the pound key.

Thank you. Mr. Yates, you may begin.

| |

Michael Yates: | Thank you, (Karnicya). This is Mike Yates, Vice President and Chief Accounting Officer for IDEX Corporation. And I want to thank you for joining us for our discussion of the IDEX fourth-quarter and full-year financial highlights. |

Last night we issued a press release outlining our Company's financial and operating performance for the 3- and 12-month periods ending December 31, 203. The press release, along with the presentation slides to be used during today's webcast, can be accessed on our Company's Web site at www.idexcorp.com. Joining me today from IDEX management are Andy Silvernail, Chairman and CEO, and Heath Mitts, Vice President and Chief Financial Officer.

The format for our call today is as follows. We will begin with Andy providing a summary of the fourth-quarter and full-year 2013 financial results. We will then walk you through the operating performance within each of our segments. And finally we will wrap up with the outlook for the first-quarter and full-year 2014. Following our prepared remarks, we'll then open the call for your questions.

If you should need to exit the call for any reason, you may access a complete replay beginning approximately two hours after the call concludes, by dialing the toll-free

number 855-859-2056 and entering conference ID 30410743. Or you may simply log on to our Company's home page for the webcast replay.

As we begin, a brief reminder this call may contain certain forward-looking statements that are subject to the Safe Harbor language in today's press release and in IDEX's filings with the Securities and Exchange Commission. With that, I will now turn the call over to our Chairman and Chief Executive Officer, Andy Silvernail. Andy?

| |

Andy Silvernail: | Thanks, Mike. Good morning, everybody. I appreciate you joining us here for our fourth-quarter and full-year wrap-up. Before I get into the discussion on the details of 2014 or the outlook for 2014 and the Q1 recap, I just want to talk a little bit about an overview of our performance, the execution of our strategy, a couple of comments on capital deployment, and our view of our markets across the globe. |

If you look at our strategy and our execution, a year ago we outlined for 2013 that we thought we were going to be faced with pretty slow markets, unevenness across the globe, and some challenges. And we got pretty much what we expected in terms of the overall end market outlook. We were committed to make our own luck, and I feel like we really did that.

We drove productivity aggressively. And we reinvested in our core markets, our core customers and new products across the globe. And the results I think showed.

Our team delivered in 2013. We had record sales, earnings, cash flow. And as we start to enter 2014 we have a pretty solid backlog across all the segments.

I would say that market conditions are marginally better. I think in the fall people got a little ahead of themselves with the overall conditions in the global markets. But I would say they are better than they were a year ago.

We've got a very strong set of businesses that have terrific positioning. And we have a team that's proven its ability to really navigate in whatever environment we're faced with. And they can really deliver results.

As I look at the highlights for 2013, we had strong growth in orders, especially in the back half of the year. Operating margins were up 110 basis points year over year. And free cash flow with 148 percent of net income, which is really outstanding.

At the same time, we made significant investments that we outlined coming into last year where we took $30 million out of our cost base in 2012 to reinvest for growth. And we did just that. And the results have started to show.

We had improving order trends in the back half of the year. We have solid backlog heading into 2014. Again, we've expanded margins, cash flow. And our return on capital is something that we have spent a lot of time internally trying to drive, and we've seen really nice improvement here this year and really over the last couple of years.

We're also delivering improvements in some of the businesses that had been underperforming in the past. Specifically, water services, our fire business, and optics. They all had really solid years in terms of improving profitability, driving execution and starting to invest in the future.

So, as I look ahead at 2014, I would say there are improving organic growth trends, even though we're still going to have what I think is an uneven environment. We expect 2014 to be modestly better than 2013. But there are clouds still on the horizon so we're going to be cautious about how we tackle these things and where we make investments. We're not going to ignore the reality of what's happening in certain places around the world.

We're really going to continue to be disciplined in our strategy and the execution of our strategy. So, the bottom line is we're going to continue to make our own luck.

Let me take a second and talk about what we're seeing across the globe. North America demand continues to be positive overall, but I think we need to keep a pretty tight grip on the end markets.

The industrial markets, specifically in North America, have been strong for a number of years. We're certainly starting to he see improvement in some of the science and technology markets versus last year. But it's important not to get ahead of ourselves.

Europe has clearly stabilized, but from a pretty low base. And I think it's going to be modestly better in 2014 versus 2013.

China, we're a long-term investor in this market. And I think 2014 is going to be better than 2013. But there's still a lot of volatility in China and we expect that to be, frankly, forever. We're making long-term investments in that region and we're going to continue to do so.

Emerging markets have been a very good story for us for a long time. And they continue to be. And we expect them to be for the long term.

Again, we anticipated a low-growth environment in 2013. 2014 I think will be a little bit better. We're really making the investments to accelerate growth.

Again, I talked about the productivity that we've gained to reinvest in growth last year. We've put money into new products, into product management. We've expanded our footprint in Asia, specifically and in the Middle East.

Our sealing business, we've put investments in selling and in a new manufacturing facility in Houston. And I think we are going to see more results from these investments as we go into this year.

Overall, an important piece to the value creation story for us is capital deployment. We're fortunate to have a great balance sheet and terrific cash flow. And, so, a differentiator for us is certainly how we use that cash.

As I look at this year, we're in a great position to continue to fund fully our organic growth and drive profitability and performance in that manner. At the same time, we're going grab those other levers. As we think about our investments that we've made, we've returned $240 million to shareholders in share repurchases and dividends, a record in 2013.

We made one acquisition in 2013. Frankly, we would have liked to have done more. And that's something we spend an awful lot of time working that funnel.

The valuation environment generally is still a challenging environment, especially for larger properties. But there are absolutely deals to be done in the range and in the market that we look at. And I think 2014 has the potential to see a few things break our way.

All right. With that, let me turn to the fourth-quarter detail. I'm on slide 5.

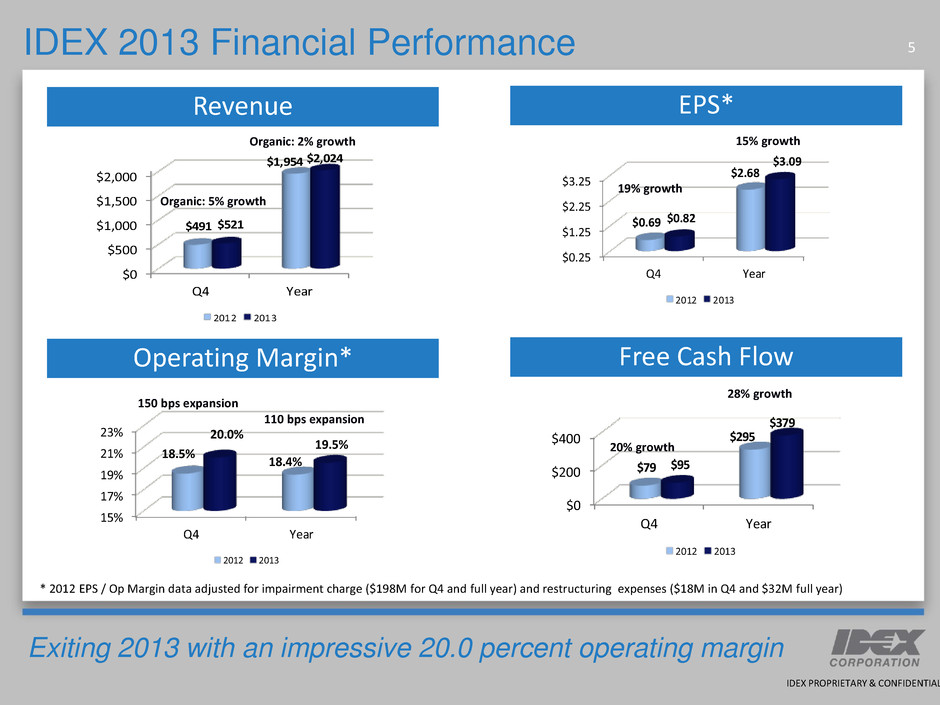

For the year we had revenue of $2 billion. It was up 4 percent, up 2 percent organically, pretty much in line with our expectations.

Really good news is we built about $48 million of backlog, and orders were up 7 percent versus the prior year. Again, we had operating margins that expanded 110 basis points. That's up to 19.5 percent.

Excellent performance on productivity, improved share and mix. So, I think really nice performance across the board in driving profitability.

Results are really highlighted by truly outstanding performance in Fluid Metering, up 250 basis points. And Health & Science which is up 150 basis points. I'll go through some more detail in a moment on both of those.

For the full year, EPS came in at $3.09. That was a 15 percent increase from our adjusted 2012 numbers.

We improved working capital by $31 million. This really accounted for the great cash conversion. We produced $379 million of free cash flow. Again, that was 148 percent of net income.

As you look at Q4, earnings were $0.82. It was above the high end of our range and was up 19 percent from prior year. Sales were up 5 percent and orders were up 8 percent. They were up 7 percent organically, as I mentioned.

These are really solid results. And I think they give us decent momentum as we go into the first quarter.

As we look to the future, we made some really targeted investments yet again, specifically in the fourth quarter. In the fourth quarter we took $6 million of costs. We took a hit to our P&L in the fourth quarter of $6 million of costs to improve our overall cost structure.

And, as always, we expect those productivity investments to pay off both in terms of profitability, more importantly in terms of investing for growth. It's really about getting ahead. And we're going continue to make those investments.

As we digest that into our P&L, we also did have something that offset that, which was a return of $4 million from Matcon. Which, really, those two things offset each other largely.

So, in summary I'm proud of 2013. We've built a strong foundation for success and I think we're in good position to deliver on 2014.

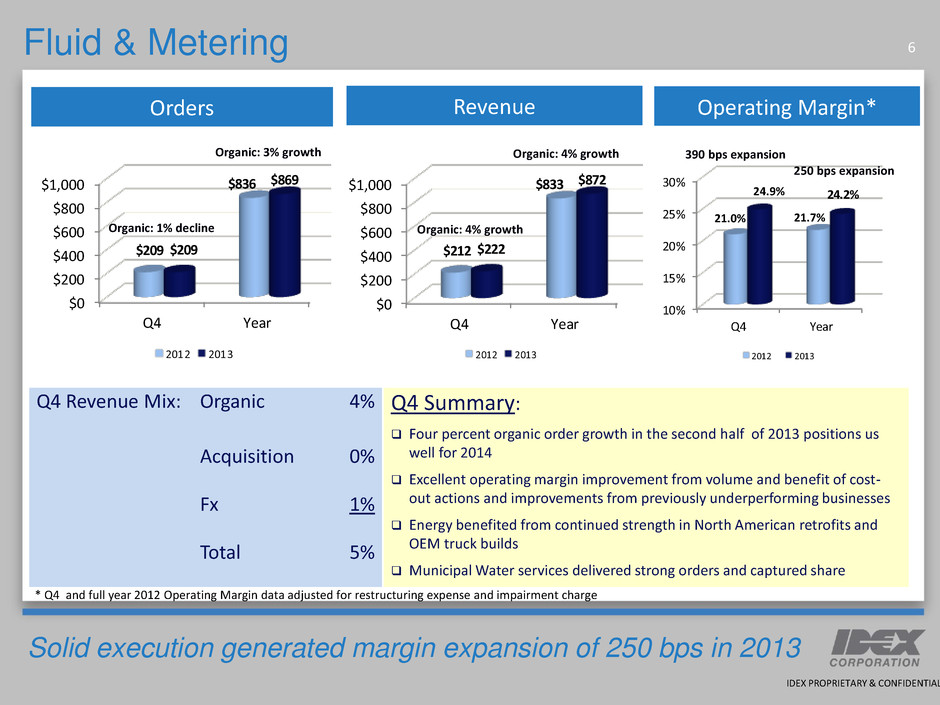

All right, let's move over to the segment discussions. I'm on slide 6. As always we'll start with Fluid & Metering.

Bottom line, Brett Finley and his team had a great year. They deserve accolades for what they got done. Very strong performance.

Orders were up 3 percent organically. Sales were up 4 percent organically. Operating margins, as I mentioned, were up 250 basis points. And they're in a really nice position as we go forward into 2014.

If you look at the different platforms, energy had a very good year. They had strong core marks, they had share gains in developed markets, and really good global expansion. A big piece of that story has been expanding across the globe and they've done a very nice job here.

Our Chemical, Food, & Process business, solid improvements in orders, sales, and operating margins. Really outstanding performance in terms of improvement coming from our Richter brand in terms of growth across the globe. And certainly our Viking brands as we continue to win our core marks and make investments for growth there.

If you look at our ag business, the Banjo brand, they had another good year. They're capturing share, they're introducing new products, and they're capitalizing on OEM demand. Order patterns remained strong in the fourth quarter, and we have pretty good visibility here through the first half of the year.

That said, we're very well aware of what's been happening in that market. And as we get through this year we'll revisit that. But so far we're still seeing some strength here coming out of Banjo.

If you look at our water business, the municipal service markets, they have improved modestly. Our win rate has been faster certainly than the markets and we've seen some decent pickup there. The team has been very successful at capturing share.

And the demand has really been driven by some big projects in the U.S. and in Japan that we've won. And I really give credit to the team there for focusing their commercial strategies and the new product strategies on some core markets that we think are most attractive in terms of growth and profitability, and executing against that.

The industrial part of water, which really focuses on dosing pumps, saw modest growth this year. And frankly we were very focused on improving the overall operating capability of that business. We saw very nice improvement in profitability there. And I think they're going to have modest growth in 2014. And we think they're well positioned for success going forward.

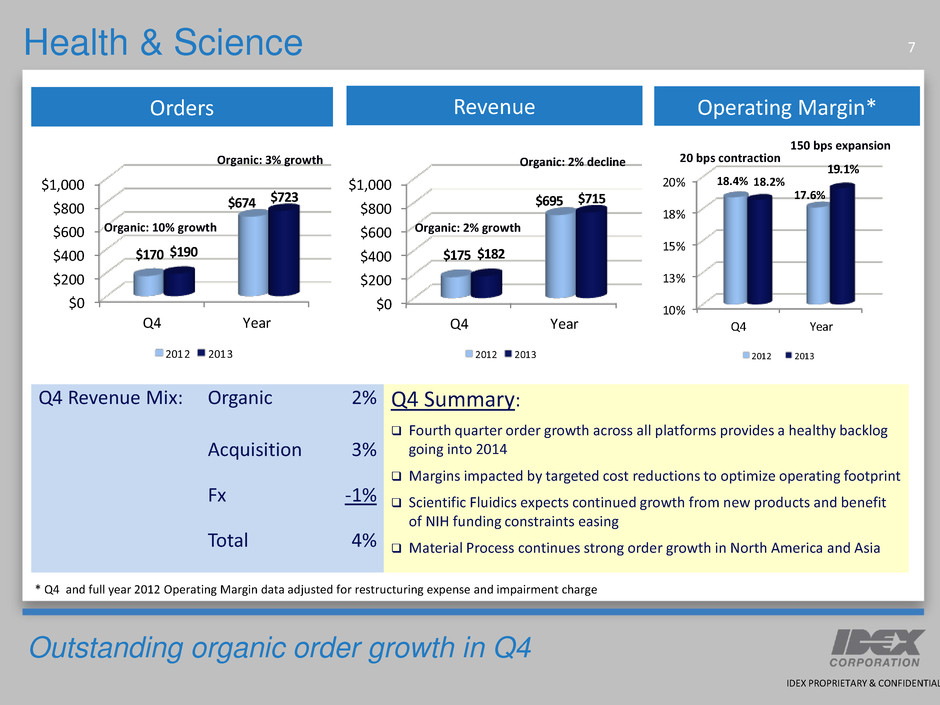

All right, let's move to slide 7, and we'll talk about Health & Science. Overall for the year solid order growth, 3 percent, and very good backlog going into 2014. Margins were up 150 basis points to 19.1 percent.

Importantly, in the quarter we saw order growth of 10 percent year over year. Margins were actually up 180 basis points if you consider the $3 million of costs that we incurred in the P&L to drive productivity. It doesn't read as attractive as that in the stated numbers but the underlying number is certainly better. I think we're again well positioned here as we go into the year.

If you look at our scientific fluidics business, this was a winner for us all year. John Arnott and the team there, they delivered orders and sales growth in every quarter of the year, even when the markets were softer, when we looked at the first part of the year.

The team has gained share, and they've exceeded market growth really through excellent customer focus and new product introductions. So nice job there with the team.

We're seeing really markets pick up modestly in the U.S.. We're starting to see some relief in some government funding issues. A little bit better end market spending. And Asia continues to be relatively strong for us.

In Optics & Photonics, as we talked about really throughout the year, we finally anniversaried the business that we walked away from in 2012. And we saw some pickup here in orders in the fourth quarter.

We expect top-line stability to continue in 2014. The markets are stabilizing and we're seeing some improvement in semiconductor and in life science. Obviously we're realizing the benefits of the cost-out actions, as we see sequential margin improvement.

So, we expect to see continued improvement here through 2014 in the Optics & Photonics business. The team there has done what we said they would do, and they're starting to really position themselves nicely.

Our Specialty Seals business had a strong fourth quarter and full year. The outlook there is positive. We're making some significant investments in that business in growth in the U.S. and in Asia. And we think - the Houston facility comes online at the end of this year, start of next year - we're going to be in a nice position to grow that business.

So, finally, within Health & Science, our material process business is a long-cycle business. And that's a little bit unusual within the IDEX portfolio. But they've had four consecutive quarters now of orders and sales growth. And pretty solid prospects and profit improvement in 2014.

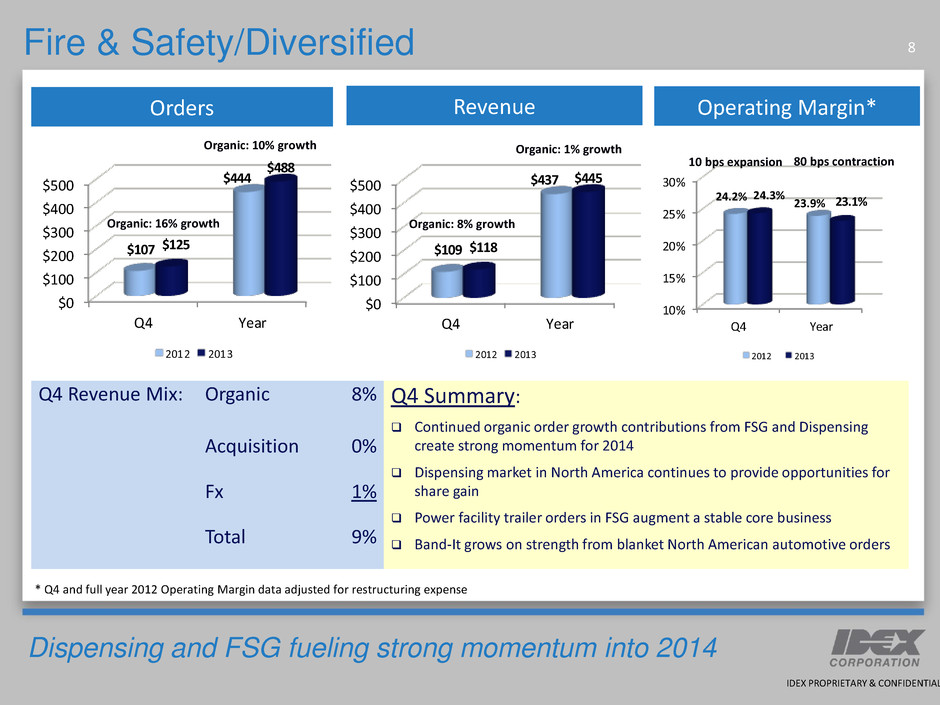

All right, I'm on our final segment, Diversified, slide 8. Overall, orders finished the year strong. It was up 10 percent year over year.

Organic sales were only up 1 percent. Obviously that's a difference in a few large orders that we talked about in the past. And obviously we'll get into some detail here.

Operating margins, they decreased 80 basis points for the year. And this decline is really due to the fact that the replenishment orders that we got in 2012 didn't repeat in full in 2013. And obviously those are some pretty high contribution margins in that business.

On the dispensing side, orders continued to be the story for the business. If you recall, last quarter we discussed the large orders that we received.

As we enter the year, obviously we have a pretty strong backlog. And that order is going to ship throughout the first half of the year. And the timing of that we've got to really keep our hands on because obviously it's a large order and important to us. The team has done a terrific job globally in terms of customer service, innovation, geographic expansion and cost improvement.

If you look at the fire suppression group, they closed out the year with four consecutive quarters or orders in sales growth. We made significant investments in 2012, and they've really come to fruition, especially in the energy markets with new products and market development that we've focused in on there. Again, nice job with overall profit expansion.

Our rescue business, they had a soft fourth quarter but it's been stable on a sequential basis. We saw, specifically in Asia, some real tightness in government spending in Asia in the back half of the year. And I suspect we're starting to see that improve a little bit. But that did hurt the overall order growth in that business in the back half of the year.

But a really nice job on profit improvement. And all signs that that capital is going to be released in 2014. And they'll be back to a growth here.

BAND-IT, another solid year in terms of sales growth and excellent profitability. They closed out the year with pretty decent order growth in North America. And the investment that we made in our China footprint for BAND-IT got some real momentum in the back half of 2013 and will serve us well as we get into this year.

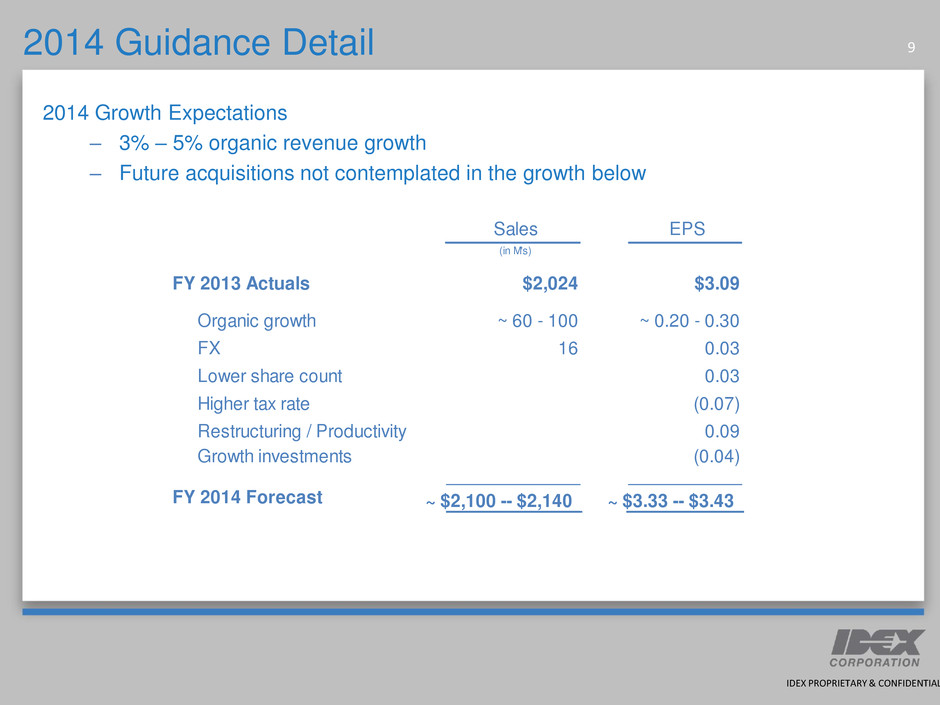

All right, let's talk about our 2014 guidance. I'm on slide 9. I'm going to start at the top of the bridge and just walk through this, like we do every year.

We anticipate low to mid single-digit growth across the platforms. This should give us $0.20 to $0.30 of EPS. And that's at the typical flow-through that you would expect from us.

If you look at FX and a lower share count, those are each going to give us about $0.03. So they're going to be a tail wind, or a good guy, for the full year of 2014.

We are going to have some head wind here on a higher tax rate. It's going to cost us $0.07 in the year. My guess is you have been hearing this from a lot of different places.

But there were a number of discrete items that happened - and Keith and I can go into any detail people want - of just tax benefits that we got in 2013 that, frankly, just aren't going to recur. At least we don't expect to recur.

Productivity I'm very happy with. Productivity is a $0.09 positive for us as we look at this year. And I'm very happy with the overall job the teams did.

We're fortunate to be in a low inflation environment and to be able to get ahead here. And we're doing so. And this really allows us to continue to fund growth initiatives. We're going to put about $0.04 a share over and above our normal investment rate and continue to try to get ahead in the business.

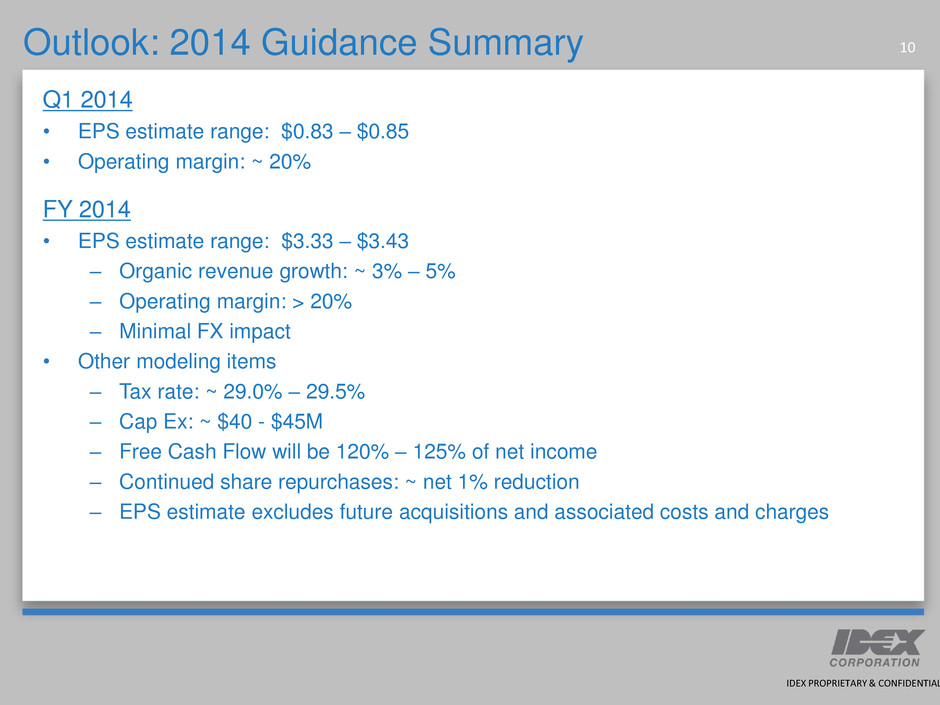

All right, I'm on the final slide here, slide 10. So, some guidance for Q1, and then the total guidance here for the full year.

In the first quarter we expect earnings to be $0.83 to $0.85. Operating margins will be right around 20 percent in the quarter. So, we think we're in decent shape in that range. Obviously we got some strength from the dispensing order that's going to help that, and we expect to have a solid first quarter.

For the full year we expect EPS to be $3.33 to $3.43. Organic growth, again, is going to be 3 percent to 5 percent.

We think operating margins are going to be about 20 percent for the full year. We had said in the past that we thought we'd have a quarter where we hit operating margins with a 2 in front of it one time in 2014. Very happy that we achieved that in the fourth quarter. And we think we have a legitimate shot of having 20 percent operating margins for all of 2014.

As always, a few other modeling items just for you to consider. The tax rate is probably going to be 29 percent to 29.5 percent. Again, I talked about some of the headwinds there, including the R&D tax credit that so far has not been renewed.

We got a one-time good guy this year from the U.K. tax benefit that flowed through our balance sheet and P&L that obviously you are not going to get that one-time benefit. And the Matcon, the $4 million in Matcon benefit that we got in the fourth quarter, had

some nice tax implications. And we're not going to see the benefits of that as we go forward.

CapEx should be somewhere in the $40 million to $45 million range. We are certainly ramping organic investment and we expect to see that come through in our CapEx. We think free cash flow will be between 120 percent and 125 percent of net income.

As always, this excludes the impact of acquisitions or charges associated with them. And we'll deal with those as they come up.

So, to summarize, very proud of our 2013 results. I think our team did a really nice job. I'm proud of their focus and execution and dedication to our customers, and what that turns into for results for our shareholders.

I still think we're going to have an uneven economy in 2014, and we're preparing for that. But, as always, we're going to really control our own destiny. And we're going to focus on delivering for our customers, delivering for our shareholders, and, frankly, delivering for our teammates.

So, with that I'll pause. Operator, we can open up the line for any questions.

| |

Operator: | At this time I would like to remind everyone in order to ask a question please press star and then the number one on your telephone keypad. Again, that’s star and then the number one on your telephone keypad. |

We’ll pause for just a moment to compile the Q&A roster.

Your first question is from Mike Halloran with Robert Baird.

| |

Mike Halloran: | Just want to try to align the commentary about the choppy environment, forward basis, with clearly some momentum you're seeing internally on the order line. If I look at your commentary by product category or by division, it certainly sounds like momentum is building in the majority of your portfolio. Maybe a little slower in some of the muni or government-exposed stuff like rescue or the water side. But maybe you could point out some of the areas you're a little bit more concerned in from a product category or vertical within the core portfolio today as we look to 2014. |

| |

Andy Silvernail: | Sure, Mike. First of all, good morning. When I think about my concerns that are economic, frankly they're more bigger picture concerns that are around geography. |

As an example, I think there continues to be a lot of volatility in China. We saw some nice pick-up here. There were some issues in the back half of the year.

But I don't think anyone should under-estimate that there is going to be volatility in that region on a really consistent basis as they work through a whole series of issues there. So, that's one thing, is I think, from that basis I still some - Asia, just generally is having some volatility.

I would say in Europe it's certainly better. The headlines in the news, I think, are way out in front of reality. That's improving off of a pretty slow base. And I would say the U.S. is pretty stable.

Generally, Mike, as I said in my commentary, I think that the overall economy is in a better spot than it was a year ago. My view, however, is that as we were going through the fall here, the general news cycle and commentary was ahead of reality.

So, with that said, I am pretty happy with how we're dealing with the environment that we have. Our focus on really being tightly focused on the whole series of customers and product areas where we think we have advantage and we can drive differentiation.

So, I do think we have momentum from that perspective. But I just think it's important that people don't get too far out in front of their skis.

| |

Mike Halloran: | Makes sense. And then on the cost takeout actions, maybe you could talk a little bit about - it seems like it's a little bit more than the continuous improvement paradigm you guys have. Maybe a little more specificity around what the objective was, what the goal was, and how that rolls through 2014. And as we look to 2014, any other ancillary actions like this you guys are thinking about taking? |

| |

Andy Silvernail: | This was a little bit bigger than we had thought. What I will say is the vast majority of this happened in pretty expensive places. |

We typically expect payback on things like this to be two years. That's the general payback on these kind of things. When they happen in places that are, I'll just call it easier to restructure, the payback is 18 months, but maybe sometimes 12 months.

We did a lot of work in Europe. We closed a facility in Europe, or we're closing a facility in Europe, we're in the process of that. Then we had a couple of places that I think were just arduous structures that we were able to take out some pretty high-cost infrastructure.

There aren't a lot of big chunks like this throughout the Company to go. But we are always looking at how do you drive - as you know Mike - how do you drive productivity on a regular basis.

But, also, our teams are regularly challenged with thinking bigger on some of these things. If those things develop, we'll eat it in our P&L, but I think that's a good thing for shareholders.

| |

Mike Halloran: | Last one from me, along those lines, when we think about the confidence now that you are going to be 20 percent-plus margins as we track through 2014, what's changed in the thought process for you over the last couple months? Is it maybe a little bit more clarity on the demand side? Is it this restructuring action that you've taken and the benefit that's going to roll through this year? Any other factors there? |

| |

Andy Silvernail: | We're in a little bit of a sweet spot when it comes to margin improvement. What I mean by that is, when you're in an environment like this, and it's relatively low growth and low inflation, you have control of your levers in a much more clear way. Your productivity flows through, your price flows through better. |

We don't get huge price but we get price. And when you're in a low inflation environment and you get productivity, that certainly helps a lot.

What I would say is different - it's not so much different, we've been seeing this, really, for the last couple years. But I think our organization consistently has gotten better and has maybe expanded their own assumptions about how profitable the business can be, and therefore how we act.

| |

Mike Halloran: | I appreciate the time, as always. |

| |

Operator: | Your next question is from Matt McConnell with Citi Research. |

| |

Matt McConnell: | If I could just start with a question about the first quarter. Normal seasonality would imply that that's the lowest of the year. And I know the big dispensing project is going to have an impact. But if you saw the normal step-up that you typically see through the year, it seems like even the high end of 2014 guidance wouldn't be too much of a stretch. So, is there something else that's helping first quarter that's skewing that seasonality a little bit closer to the front half of the year? |

| |

Andy Silvernail: | The dispensing piece is big. You're talking about an order that is more than 1 percent of organic growth on a full-year basis that's going to flow through in the first half of the year. That's a big number for us. |

We also - our fire business, it also had a number of pretty good-sized orders that were on the brink between Q4 and Q1. And they went into Q1. They're pretty sizable, also.

If you want back those out, we'd still have, I think, strong overall earnings growth and a decent quarter. But those really do comprise the biggest pieces of that.

| |

Matt McConnell: | OK, got it. Thanks. That helps. And on the free cash flow, obviously great performance in 2014. Is there room to take out another $30 million or so of working capital? I'm trying to get a sense of the sustainability of that free cash conversion that you've been generating. |

| |

Andy Silvernail: | Matt, that number is really high. In the kind of growth environment that we're going to be in, we'll probably consume some working capital, as we look at this year, on an absolute basis. I think we'll get better from a working capital conversion. So, in terms of the percent of working capital that we carry as a percent of sales. But, given the growth that we expect to have in that 3 percent to 5 percent range organically, we'll probably actually consume a little bit of cash there. |

Not unlike what I said to Michael on operating margins, this is an environment where it really is a good environment for driving cash conversion. When you're in a growing environment, obviously you've got to feed the businesses with more working capital. This is an environment that has really allowed us to get more efficient with working capital. And the teams did a very good job.

Now, just so everybody is aware, we will see a working capital bump up in the first quarter, maybe the second quarter, because of what's going on with these big orders.

They've got to be built, and they've got to be shipped. So the timing of when those things happen could likely have some impact on what I'll call a one-time bubble on our working capital in the first or second quarter. Just so everyone is aware of that and they can expect that and model that in.

But I think that $120 million, $125 million, Matt, is more normal for us.

| |

Matt McConnell: | OK, great, thanks. That's very helpful. |

| |

Operator: | Your next question is from Nathan Jones with Stifel. |

| |

Richard Hall: | Good morning, guys. This is actually Richard Hall on for Nathan. Just two questions for you. First, when we think about M&A, previously you have mentioned that prices are a little too high for those $100 million deals. And in your prepared remarks you said things are still challenging but there's going to be some deals to be done, maybe hinting 2014 might be nice. Could you talk about the dynamic? What are you seeing about pricing right now? |

| |

Andy Silvernail: | It really hasn't changed much from the last couple quarters. What I would say is, if you went back to last year, there was huge private equity deal flow that was floating around, second, early third quarter. That's really come down. That has come down. That volume has come out of the markets a little bit. |

What I would say, however, is that prices are still elevated. Really, it's that stuff that's north of $100 million, $150 million in enterprise value. You still see things that are consistently touching or exceeding double digits. For a deal like that to make sense for us, you've got to know exactly how you're going to get the value. There can be no question marks.

As you look in the, I'll call it the $25 million to $100 million range, our funnel, it looks similar to what it's looked like over the last nine months. Maybe a little bit better. And I think that's really our own doing, not so much the markets.

Don't take it that I'm signaling that something is going drop imminently. We always have a few things that could drop, and you're working through the negotiations and discussions on those things.

But I think, just generally, there are still some things to be done in the range where we think we can really drive some value. But it's not materially different. The environment is not material different than what we talked about a quarter ago.

| |

Richard Hall: | All right, very helpful. Thanks. And then, finally, I definitely appreciate the commentary about the 2014 guidance. Could you maybe walk us through the segments, of your thinking on top-line growth and just operating profitability? |

| |

Andy Silvernail: | Just across the businesses generally in each of the segments? |

| |

Andy Silvernail: | Let me start with the most confusing one first. You've got Dispensing in there. That's obviously going to have a big disconnect, because you are going to see a big overall number in the first half on a sales basis. But that obviously has a negative view in the back half of the year on an orders basis, just because of the timing of those things. And that really exacerbates what that looks like. |

What I would say, then, around FMT and HST, is very much in line with the range that we gave you, both of them. I don't think, as we're looking at today, and we've built our operating plans, I don't see it being materially different in either one of those segments in terms of overall growth.

So, I think Dispensing from a sales perspective is going to be at the high end of that range because of the big order. And then I think FMT and HST will be a little bit lower than that just because you've got more systemic, systematic growth that's happened. But not a big difference between the segments outside of that one big order.

| |

Richard Hall: | All right, I appreciate it. Thanks so much, Andy. |

| |

Operator: | Your next question is from Allison Poliniak with Wells Fargo. |

| |

Allison Poliniak: | Andy, on the growth initiative, could you help us maybe - I know it's going to be hard because I'm sure it's business by business - but how you're allocating those dollars? Is it people? New product investment? Just a little more color on that. |

| |

Andy Silvernail: | It's really two big areas. And actually this is pretty consistent with what we did last year when we made some of the bigger reinvestments. |

It really is around product and market development. And so it's people, and then to some degree it's physical capacity. And what I mean by physical capacity is, like, as an example, where we're putting more money into Houston to grow the sales office. We're building a second facility in India, and we're building out our commercial operation there. We're expanding our capabilities in the Middle East. So, what we're really doing, frankly, is we're doubling down on some places where we're getting some nice momentum.

The business for our Fire business that we've really seen some nice growth from, frankly they've created a whole other little business there, which is a trailer business that's servicing the energy markets for emergencies. So, we're funding a team there to really build that out.

So, it's more front-end sales, marketing, product development. And then it tends to be regionally or very business-centric.

| |

Allison Poliniak: | That's great. And then just going back to the acquisition, it sounds like obviously multiples are still pretty challenged. But it sounds like, from my perspective, and maybe I'm putting words in your mouth, but you're more excited about the quality of properties coming through at this point. Is that a good way to think about it? |

| |

Andy Silvernail: | Our game, when you look at our game, our game is almost always better when it's proprietary stuff that we've been working for long periods of time. You can buy things out of the investment world, and you can be successful with them. What I would say is that, while our funnel in aggregate looks about the same as it looked even six, nine months ago, there's more stuff that's in our sweet spot that's cultivated, long-term cultivated. |

So, to make sure you're not reading into anything, don't read into it that there's something that's going to happen immediately. At the same time, I would read into it that I would say that the quality of the things that are IDEX-like, in terms of both businesses and in terms of where they come from, is a little bit better.

| |

Allison Poliniak: | Thank you. |

| |

Operator: | Your next question is from Scott Graham with Jefferies. |

| |

Scott Graham: | Hi, good morning. Nice quarter, guys. The two questions I had were around the margins of the FMT and HST businesses. I'll start with the harder one, HST. The gain is in there, right? |

| |

Andy Silvernail: | No, it's not. |

| |

Scott Graham: | Where is the gain? |

| |

Heath Mitts: | Scott, this is Heath. The gain shows up in our corporate expenses. It does not get allocated out to the segments. So, it effectively nets against our corporate expenses in terms of the Matcon $4 million. |

So HST, if you wanted to look at it, absorbed $3 million of restructuring or cost-out related costs. If that was not in there, the margins for that would be around 20 percent.

| |

Scott Graham: | Yes, I can see that know. I didn't know where that was. That's excellent. But I think even more excellent was FMT. That margin rocketed this quarter. Could you talk around some of the tenets of how that happened? |

| |

Heath Mitts: | Once again, we've seen really good margin performance from the team at FMT for awhile here. But there are a few things. |

First and foremost, we definitely had some benefits of mix in the quarter. Not huge, but we had some benefits of mix. FMT, we tend to get more price there than anywhere in the business, and that certainly helped.

But the biggest thing, and the thing that's different than I think in the past, is we're getting more traction in overall productivity in those businesses. And this isn't big stuff. It's the daily stuff that you're working as a funnel, and you're working it all the time.

We spend a lot of time looking at how we're driving consistent productivity across our businesses. And I would say that FMT, certainly as we got into the back half of last year, that accelerated for them.

| |

Scott Graham: | OK. And if you don't mind, I'd appreciate being able to tack on a question to your response, Andy. You've heard me ask this question before about the old way that IDEX |

looked at productivity in the $20 million-plus buckets and what-not. I know you've moved away from that.

But are the parameters around that still generally the same, that global sourcing continues to take on maybe the lion's share of the productivity improvement? Or are there new things that you guys have hatched within the organization, some type of value stream mapping that is additive to what the old model was?

| |

Andy Silvernail: | A couple things. First of all, the reason that we've gotten away from talking about that bulk number is that, number one, the Company has gotten a lot bigger since that was the conversation. |

And, number two, if you just think about it in a simple way, we've got inherent in our businesses, about $25 million of inflation, all things being equal, that we see every year, given the size that we are today. And that's from a combination of merit increases and very modest material inflation. That's how we think - modest.

So, our starting point every year to hold even is $25 million-ish. If you think about that and you look at what we've bridged for this year, we're doing clearly better than that. And we certainly did better than that and we expect to do better than that in 2014. So that's one part of the answer.

The second part of the answer is, if you look at our cost base, materials are obviously the biggest bulk piece of our costs. But if you think of our conversion costs - and what I mean by that is if you look from material costs all the way down to operating profit - there's a lot of other costs there, whether it sits in manufacturing, or it sits in our infrastructure, that we think we should drive productivity up.

So, there is definitely a change of mind set that productivity is something that is all the way up and down the P&L and not just manufacturing. So, that's the second part.

The last thing I'd say is, in terms of our methodology, we have had an IDEX operating model for an awful long time. And I think it's an effective model that we just continue to mature, and we continue to deploy throughout the business. And it really helps us drive results.

| |

Scott Graham: | If I could just summarize, you're bigger, so you're doing more of what you did, and maybe more on top of. And you're looking at this thing on a net of inflation basis. |

| |

Andy Silvernail: | Absolutely. |

| |

Scott Graham: | Very good. Thanks a lot. |

| |

Operator: | Your next question is from Kevin Maczka with BBT Capital Markets. |

| |

Kevin Maczka: | If I can piggyback on the margin question, the incrementals this quarter and this year were much stronger than normal. I think you normally target something in the mid-30 percents, and we were much better than that. As we think about better organic growth in 2014, that might suggest incrementals get even better, but you're offsetting with some growth spend. Can you guys talk about that? |

If we have better organic growth and we're getting price and more traction than ever on the productivity, is it the growth spend or something else that would keep us from maybe a repeat performance of such strong incrementals?

| |

Andy Silvernail: | Let me tackle part of this and then I may have Heath tackle part of it, also. Kevin, one of the things to realize is we had two things that really helped us in 2013 from a margin expansion perspective, that those pieces of expansion that drove the incrementals are unlikely to repeat. |

The first one was we were really aggressive in 2012 in taking out costs. Because generally we were really aggressive, especially in the back half of the year. And so we saw some benefits of that throughout this year.

Secondly, we had a number of underperforming businesses. I mentioned them in my formal remarks. Water services, our fire business, our optics business, and actually even part of our water business, our other piece at our industrial water business, that were really underperforming, that we drove very meaningful profit expansion in those businesses, to the point where they look much more like the rest of IDEX, that they did not 24 months ago.

So, my point to that is we're not going to get that twice. We don't have some of those same pieces of opportunity. So what you are going to see from us is much more typical

flow-through on volume, which we've said that we think is worth $0.20 to $0.30. And then the net $0.05 of productivity is going to be what we think is incremental in terms of our effort.

Heath, what would you had to that?

| |

Heath Mitts: | Not a lot. I think I'd steer you, Kevin, towards the guidance slide, slide 9 in the guidance detail, which Andy just walked through. |

We're not talking about a significant amount of reinvestment over and above our normal run rate, which is healthy for the business. But there are some select dollars. We quantified it as around $0.04 of head wind here. But certainly that is not offsetting.

If you look at this, we are still talking about, 2013's flow-through was crazy high, north of 50 percent, because of the benefit of the cost actions that we took in 2012. However, even if you look at our 2014, we're still talking about guidance. And here, because of some additional restructuring we did in late 2013, as well as productivity initiatives that more than offset inflation, a flow-through that's still 35 percent to 40 percent.

So, I don't feel that the 50 percent was sustainable, but certainly at 3 percent to 5 percent organic revenue growth, having flow through of 35 percent, in this model, to up to 40 percent.

| |

Kevin Maczka: | Got it. That's very helpful. Then just following up, the $6 million charge in the quarter, I just want to clarify. That's entirely a cost take-out action? Or is there some new product development and growth spend component to that? And did you say that's all you're planning in terms of bigger items that you would call out at the moment, or no? |

| |

Andy Silvernail: | That is correct. Now, the $6 million is specifically tied to, I'd say, restucturing-related type of activities, where we closed one small facility and there were numerous employee actions of severance related costs in that. So there's nothing I'd say tied to a new product introduction or something. These were true operational footprint type of decisions. |

On an ongoing basis we always have some kind of amount that we pay for as we go through the P&L. This was just in the quarter a big enough number that we wanted to

note that because it did have an impact on our reported results, although we are not calling that out separately as a line item in the P&L.

| |

Heath Mitts: | Heath here. Net-net on this, the costs that we incurred to do this, we obviously ate in our P&L, but it was offset by the good guy coming back through the P&L from Matcon. So net-net those things washed themselves out. |

| |

Kevin Maczka: | OK, great, thank you. |

| |

Operator: | Your next question is from Matt Summerville with KeyBank. |

| |

Matt Summerville: | Good morning. Andy, can you talk about in the fourth quarter what your organic growth rate was by region between Americas, Europe or Asia, however you would like to talk about it? And then what your expectation is around that 3 percent to 5 percent rate by region for 2014. |

| |

Andy Silvernail: | We don't break out, we don't ever give exact numbers on that. But what I will say is that international growth was actually stronger than the U.S. in the fourth quarter. |

Now, part of that was, if you look in the U.S., we've had really strong growth consistently. The U.S. was stronger in HST and in Diversified. FMT was a little bit light in the fourth quarter in the U.S..

Asia was pretty strong. We came off of a pretty weak comparison in the fourth quarter, in China in particular. So China was strong. And then Europe was between the two.

Generally, as we're looking at the overall expectation for this year, I think the U.S. is probably - and I'm going talk about underlying markets - I think the U.S. is in the 3 range, plus or minus, somewhere in that range. I think Europe is 1 to 3, somewhere in there. And I think the merging markets, or we'll call it Asia, is probably in that 5-ish range, plus or minus.

What you will end up having is you will have one country or subregion that's really strong, and some will be weak. As an example, India was really strong for us this year until the fourth quarter. China was actually weaker. So I expect you will see some puts and takes across the regions like that.

| |

Matt Summerville: | And then in terms of pricing, can you describe what you're looking at for 2014? And then just hit on and maybe provide a little bit more granularity around the organic order decline in FMT, if that's timing, just general lumpiness, or something fundamentally different in some of the businesses. |

| |

Heath Mitts: | Matt this is Heath. The organic order decline for FMT was really - if you go back and look, it was off of a very difficult comp. There was nothing really that we comped against some project orders that were booked in the fourth quarter of last year that we didn't have this year. So, I wouldn't read into that in terms of the health of the backlog or health of the outlook for FMT for 2014. |

| |

Andy Silvernail: | I would also add to that, if you look at the third quarter, FMT was really strong. So, if you look at the back half of the year for FMT, it was up 4 year over year. |

The other question was price, right, Matt?

| |

Heath Mitts: | I'm sorry, price. Sorry about that. I'm taking notes here. Price for 2013, just as a point of reference, came in on a gross basis, gross, not including inflation, was about 1.2 percent. And our expectation for 2014 is that it will be similar. |

| |

Matt Summerville: | Great. Thanks, guys. |

| |

Operator: | Your next question is from Mark Douglass with Longbow Research. |

| |

Mark Douglass: | Good morning, gentlemen. With the geographies, can you let us know how 2013 ended, how the geography split as far as percentage of sales? |

| |

Andy Silvernail: | In terms of actually how it broke out? |

| |

Andy Silvernail: | Have you got that, the exact number? |

| |

Heath Mitts: | No, we generally don't provide it. |

| |

Andy Silvernail: | Yes, we don't usually give exact numbers in there. If you look at what we've historically guided there, it hasn't moved a ton. North America is right in the range of 50 percent of sales. |

Europe is going to be in the low to mid 20 percent - 23 percent to 25 percent. China in total is around 10 percent-ish. And then the balance of Asia and the rest of the world is going to make up the other 10 percent, 15 percent.

| |

Heath Mitts: | That's consistent with what we've put in our release in the past. We don't disclose how that swings quarter to quarter. |

| |

Andy Silvernail: | But not a big shift in 2013 versus 2012. |

| |

Mark Douglass: | OK, that's helpful. So China is reasonably a decent size, but it's -. |

| |

Andy Silvernail: | Yes, it is a decent size for us. And that's been a good investment for us, and continues to grow. |

| |

Mark Douglass: | But it's not going to kill you, either, if you see some real volatility, like it looks like we're seeing. |

| |

Andy Silvernail: | No. It's big enough to matter. And obviously when it was very strong it does help move the needle. But when it's been weaker, like even when it was last year, typically we can absorb that in other parts of our business. |

| |

Mark Douglass: | Right. And then you mentioned you had some share gains in scientific fluidics. With what appears to be a much better funding environment in life science, do you think this provides some upside to what seams to be implied low single-digit organic growth in that segment? I would throw IOP in there, as well. |

| |

Andy Silvernail: | Yes. We're guiding, again, think of 3 to 5 generally for the segment, if you look in that segment. |

Scientific fluidics specifically, I mentioned that the team there did a really nice job in 2013. The game in this business, there are really two big parts of the game. One of them is geographic expansion. The growth in that business around Asia has been a big piece of the overall story.

And then the second part - and this has been for a long time - it's about winning high-value content on new product launches. 2011, 2012 - well, 2012 to 2013, at least through the first half, the product launches in the industry were actually pretty soft. And we are starting to see an improved cycle. And I think you are going to see a better

overall cycle as you look forward over next couple of years. It can add 1 or 2 points to growth.

Regarding the funding specifically, just as the funding wasn't a huge deal when it was struggling, it was there. Just remember that it's not a huge piece of our business that goes directly to government agencies. The bigger thing that really happens here is it gives confidence to the industry. And you see it gives confidence, and you see improvements around that.

So, I do think that both those things are tail winds to that business. But also, it's a competitive business. And it's a business that is changing in terms of its geographic footprint. So we're positive about it, we think we've got great team and we think we're going to continue to grow that.

| |

Mark Douglass: | It sounds like you're set up to outgrow the market. |

| |

Andy Silvernail: | I think in aggregate we will outgrow the market. I think we've demonstrated that. But also realize the market is really broken down into a few things. You've got, the two biggest pieces of what we call the market, are diagnostics and, for us, high pressure liquid chromatography. |

Those two pieces of business are relatively slow growth. The growth that's really happening in the industry is around biotechnology, around sequencing, and around mass spec. And we're well positioned in that, but there is a shift that's happening in that marketplace.

| |

Operator: | Your next question is from Paul Knight with Janney Capital. |

| |

Bryan Kipp: | Hi, this is actually Bryan Kipp. Congratulations on the quarter, as well. I want to reiterate it. Just wanted to dive into HST a little bit further. That 10 percent order growth that you guys reported in the quarter, do you think that can be attributed to budget flush post-NIH color and pharma and everybody else ordering on the mass spec side and the HPLC side, and then inventory build again? Or do you think it's more sustainable? |

| |

Andy Silvernail: | It's actually - the benefits of the expectation of improved spending from the government, that hasn't really showed up yet. That was really cut in the latest budget deal that you will see flow through. So you mate have a little bit in there. |

We had really strong order growth in our material process business. That was really strong off a pretty weak comp last year. Our scientific fluidics business did well.

And, again, when you look at our - we saw our Optics business turn positive. So pretty nice business there generally. Also, we had a couple of big wins in what is the more industrial side of HST.

What I'm driving at here, Bryan, is that big number isn't being driven because of some kind of massive pickup across the industry. We can put our finger on where it is. And so we're happy for it, but we don't expect 10 percent order growth going forward.

| |

Bryan Kipp: | Appreciate the color. Do you expect some additional margin leverage just because of that strong number in the first half relative to what you saw last year on the HST side? |

| |

Andy Silvernail: | I think it'll be generally normalized. I don't see it being significantly different than what it's been. When you actually lack at the margin structure, the contribution margin structure across the business, it's not materially different segment to segment. It's within a few points of each other, which is obviously good from a mix perspective. But I don't see it being a big deal. |

| |

Bryan Kipp: | OK. And just one final. You alluded to India and I know you guys are trying to double capacity out there. What's driving that strength? Is it infrastructure investments on the FMT side or is it more broader based? |

| |

Andy Silvernail: | It is principally around two things. It's around our energy business, which has had terrific success there also. And we also decided to put our manufacturing for Asia, for our Dispensing business, sits in there. |

So the X-SMART that we launched last year - which, by the way, has been nicely successful. The team deserves an awful lot of credit. They came with what I really think is a game changer in the emerging markets for that business. And they're manufacturing out of there.

Those are the two biggest pieces of the India footprint. We do some smaller things also there but those are the two big pieces.

| |

Bryan Kipp: | Thanks again and congrats. |

| |

Operator: | Your next question is from Mike Halloran with Robert Baird. |

| |

Mike Halloran: | One quick follow-up here. I just want to make sure I understand the sequentials on the Fire & Safety side of the business here. As I understand it, fourth quarter here you had some push-out on the Dispensing orders. And in an answer to an earlier question you talked about front half of the year loading in some of those Dispensing orders that you guys have talked about in the past. |

So, should we see a stair-step on the margin line, front half versus back half of the year? Or, at this point, are there some of those dispensing orders that still will stretch in the back half and maybe normalize things out a little bit as we work through the year?

| |

Heath Mitts: | Mike, this is Heath. There's a little bit of seasonality. Obviously we're going to benefit from the dispensing, the large order that we talked about in our last call, that will ship in the first half of the year. And obviously there's some nice leverage from that. |

There's also elements of the segment that tend to do better in the fourth quarter. Specifically the rescue tool business tends to be a little bit more fourth quarter heavy. And, as you know that is a highly profitable piece of the segment.

So, I wouldn't read into it too much. We'll get a better sense as we get through the first quarter and obviously update you guys in 90 days or less as to how much of that Dispensing order shipped in the first quarter and how much is remaining, and what impact that would have as we get through the end of the year. We're sorting through that with our customer right now. We'll have more guidance then in terms of what that impact was in first quarter and how you should think about the rest of the year.

| |

Mike Halloran: | Perfect. Thanks, guys. |

| |

Operator: | Your next question is from Walter Liptak with Global Hunter. |

| |

Walter Liptak: | Sorry, I wasn't able to listen to the whole call but I've got one on guidance. And you may have addressed this already. But with organics expected to go up in 2014, why wouldn't we see the same level, the 15 percent EPS growth? |

| |

Andy Silvernail: | Generally you've got a couple of things. We did address that, Walt, as we were walking through the call. You've got a couple of things. |

We had this year, we had a couple of major benefits where we restructured in 2012 and improved some under-performing businesses that you are just not going redo again. You don't get that benefit from a growth perspective twice. So, if you go back through the slide, you'll see that we walked through, in some pretty good detail, the bridge of how we get to our guidance. It's really straightforward. If you have any more detail questions you can certainly give us a call.

| |

Walter Liptak: | All right, thanks. |

| |

Operator: | At this time there are no questions. |

| |

Andy Silvernail: | OK. Thank you all very much again for being on the call today and your interest in IDEX. Obviously we're proud of how 2013 ended. I'm very proud of the team. That is certainly the thing that's most important to us here in our ability to deliver great results for shareholders, is the kind of team that we're building and the culture that we're building here. |

So, I want to thank my team for their efforts. And I appreciate your support and we look forward to a solid 2014. So thank you all.

| |

Operator: | This concludes today's conference. You may now disconnect. |

END