Click Here to Edit Title October 30, 2024 Third Quarter 2024 Earnings

Click Here to Edit Titleautionary Statement 2 Cautionary Statement Under the Private Securities Litigation Reform Act; Non-GAAP Measures This presentation contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements may relate to, among other things, the Company’s fourth quarter 2024 and full year 2024 outlook including expected sales, expected organic sales, expected earnings per share, expected adjusted earnings per share, estimated net income and estimated adjusted EBITDA and the assumptions underlying these expectations, anticipated future acquisition behavior, resource deployment and focus and organic and inorganic growth, anticipated trends in end markets, anticipated growth initiatives, the anticipated benefits of the Company’s recent acquisitions and integration plans, including the projected EBITDA of Mott and the related impact and timing for such impact on the Company’s earnings, and are indicated by words or phrases such as “anticipates,” “estimates,” “plans,” “guidance,” “expects,” “projects,” “forecasts,” “should,” “could,” “will,” “management believes,” “the Company believes,” “the Company intends” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this presentation. The risks and uncertainties include, but are not limited to, the following: levels of industrial activity and economic conditions in the U.S. and other countries around the world, including uncertainties in the financial markets; pricing pressures, including inflation and rising interest rates, and other competitive factors and levels of capital spending in certain industries; the impact of severe weather events, natural disasters and public health threats; economic and political consequences resulting from terrorist attacks and wars; the Company’s ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; cybersecurity incidents; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the Company operates; developments with respect to trade policy and tariffs; interest rates; capacity utilization and the effect this has on costs; labor markets; supply chain conditions; market conditions and material costs; risks related to environmental, social and corporate governance issues, including those related to climate change and sustainability; and developments with respect to contingencies, such as litigation and environmental matters. Additional factors that could cause actual results to differ materially from those reflected in the forward-looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included in the Company’s most recent annual report on Form 10-K and the Company’s subsequent quarterly reports filed with the Securities and Exchange Commission (“SEC”) and the other risks discussed in the Company’s filings with the SEC. The forward-looking statements included here are only made as of the date of this presentation, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here. This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or our earnings release which is available on our website.

Click Here to Edit TitleIDEX Ov rview 3 • Monitoring for inflection in industrial project activity and signs of sustained recovery in Life Sciences and Semi-con markets • Drive Mott integration alongside recent HST acquisitions and deploy resources against best growth synergies • Continue to drive 8020 and operational excellence to promote optimum productivity and flowthrough Looking Ahead • FMT growth with stable day-to-day orders…Still delays in long term commitments • FSDP record sales with strong Fire & Safety and BAND-IT growth • HST strong orders growth and backlog build led by Life Sciences • Completed Mott acquisition and swiftly executing integration plans Third Quarter Results

Click Here to Edit Title Pulsimeter flow controls for wastewater management Diverse and Specialized Portfolio Intelligent Water Envirosight inspection and monitoring solutions Trebor Recirculation DI water heaters ADS sewer and stormwater management systems

Click Here to Edit TitleStrategic Value Creation Acquisition 5 New green hydrogen components facility opening Gas filters production and inspection clean room Mott

Click Here to Edit TitleQ3 2024 Financial Performance 6 ($ in millions excl. EPS) $793 $798 Q3'23 Q3'24 Sales Flat Organic* *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or in our Q3 ‘24 earnings release. 28.4% 26.9% Q3'23 Q3'24 Adj. EBITDA Margin* -150 bps $2.12 $1.90 Q3'23 Q3'24 Adj. EPS* -10% $206 $192 Q3'23 Q3'24 Free Cash Flow* -7% Performance in line with expectations coupled with strong Free Cash Flow Organic* FX M&A YoY∆ Sales Growth 0% 0% 1% 1%

Click Here to Edit TitleQ3 2024 Adjusted EBITDA Walk 7 ($ in millions) *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or in our Q3 ‘24 earnings release. Price & Productivity partially offsetting volume headwinds, M&A spend and employee related costs 3Q’23 Act Adj. EBITDA Volume Flow Thru Price / Productivity / Inflation Mix Resource Investment / Discretionary Acq / Div / FX 3Q’24 ACT Adj. EBITDA Flow thru @ PY GM%* 44.2% Organic flow thru** Unfavorable **Excludes Acquisition, Divestiture, FX Total flow through Unfavorable ***Total flow through is calculated as change in Adjusted EBITDA divided by change in Net Sales

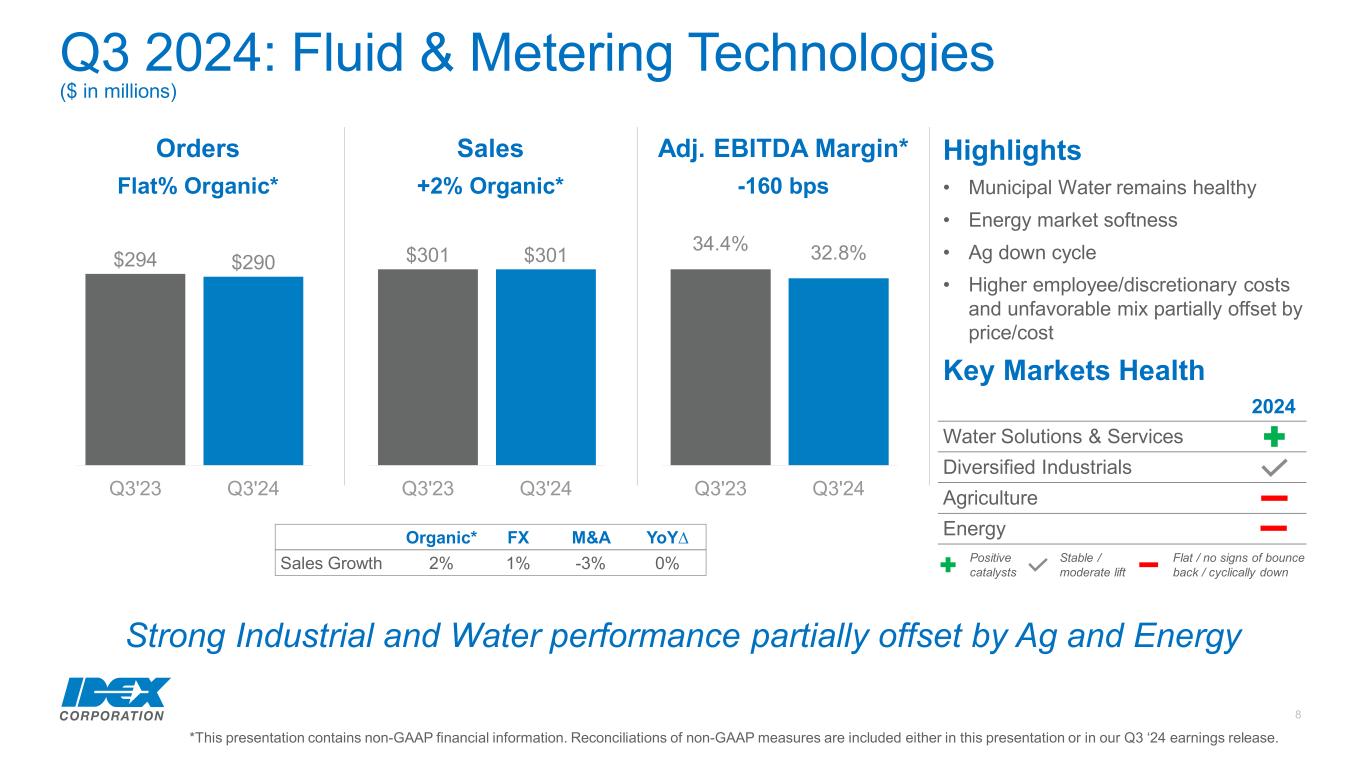

Click Here to Edit TitleQ3 2024: Fluid & Met ring Technologies $301 $301 Q3'23 Q3'24 Sales +2% Organic* *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or in our Q3 ‘24 earnings release. 34.4% 32.8% Q3'23 Q3'24 Adj. EBITDA Margin* -160 bps $294 $290 Q3'23 Q3'24 Orders Flat% Organic* Organic* FX M&A YoY∆ Sales Growth 2% 1% -3% 0% Highlights • Municipal Water remains healthy • Energy market softness • Ag down cycle • Higher employee/discretionary costs and unfavorable mix partially offset by price/cost Key Markets Health 2024 Water Solutions & Services Diversified Industrials Agriculture Energy ($ in millions) Positive catalysts Stable / moderate lift Flat / no signs of bounce back / cyclically down Strong Industrial and Water performance partially offset by Ag and Energy 8

Click Here to Edit TitleQ3 2024: Health & Science Technologies 9 Sales -5% Organic* *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or in our Q3 ‘24 earnings release. Adj. EBITDA Margin* -40 bps Orders +20% Organic* Organic* FX M&A YoY∆ Sales Growth -5% 0% 4% -1% 2024 Industrials Semiconductor Life Sciences Analytical Instrumentation ($ in millions) Strong orders across the portfolio…swift initiation of Mott integration $313 $311 Q3'23 Q3'24 26.9% 26.5% Q3'23 Q4'24 $265 $330 Q3'23 Q3'24 Highlights • Life Sciences & Analytical Instrumentation steady • Semiconductor delayed inflection • Industrials projects continued delays • Lower volumes and higher employee costs partially offset by price/cost, productivity and acq./div. Key Markets Health Positive catalysts Stable / moderate lift Flat / no signs of bounce back / cyclically down

Click Here to Edit TitleQ3 2024: Fire & Safety / Diversified Products 10 Sales +4% Organic* *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or in our Q3 ‘24 earnings release. Adj. EBITDA Margin* -20 bps Orders +4% Organic* Organic* FX M&A YoY∆ Sales Growth 4% 0% 0% 4% Highlights • Fire NA OEM continued production ramp • BAND-IT Aero strength • Dispensing NA headwind partially offset by Emerging markets • Unfavorable mix, higher employee-related costs partially offset by price/cost Key Markets Health 2024 Fire & Rescue Aero & Defense Dispensing Auto ($ in millions) Positive catalysts Stable / moderate lift Flat / no signs of bounce back / cyclically down Record sales despite cyclical downturn in North America Dispensing $181 $188 Q3'23 Q3'24 29.3% 29.1% Q3'23 Q3'24 $155 $163 Q3'23 Q4'24

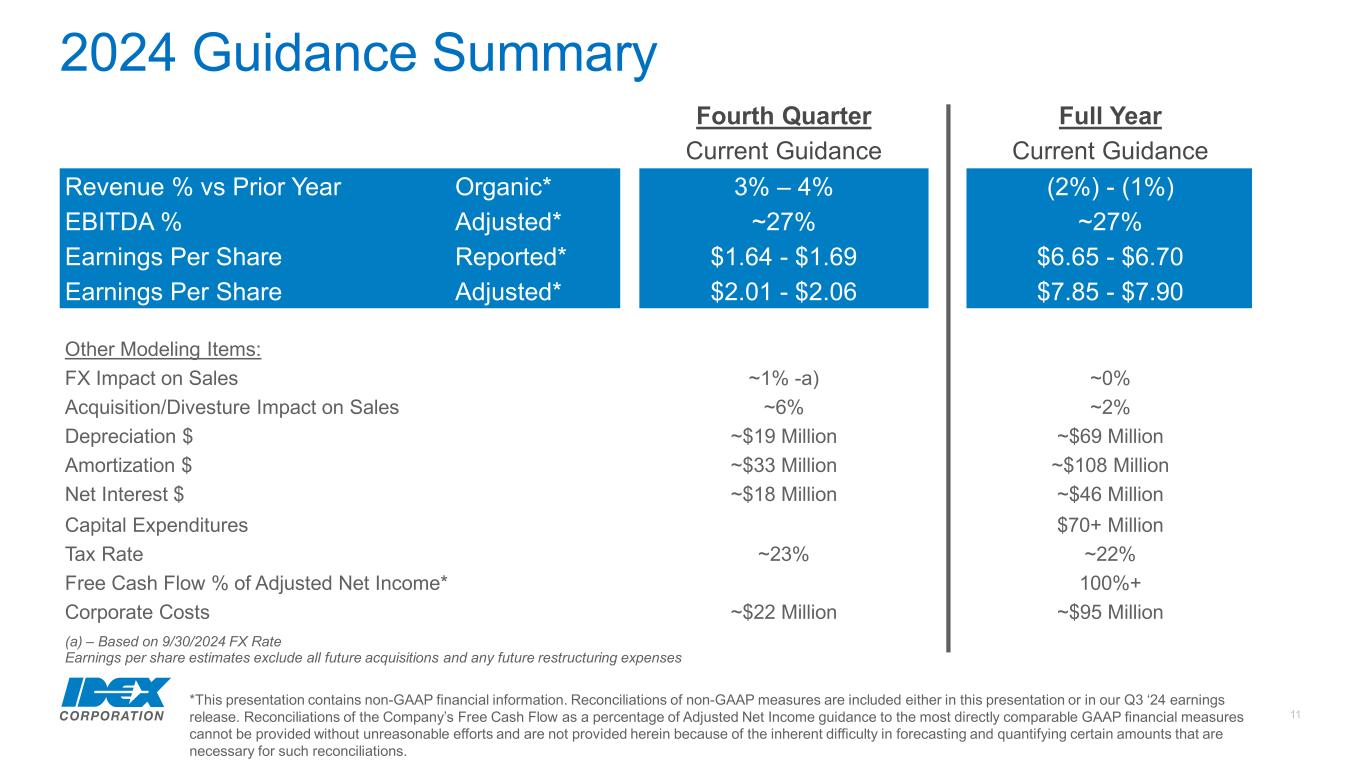

Click Here to Edit Title2024 Guidance Summary 11 *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or in our Q3 ‘24 earnings release. Reconciliations of the Company’s Free Cash Flow as a percentage of Adjusted Net Income guidance to the most directly comparable GAAP financial measures cannot be provided without unreasonable efforts and are not provided herein because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Fourth Quarter Full Year Current Guidance Current Guidance Revenue % vs Prior Year Organic* 3% – 4% (2%) - (1%) EBITDA % Adjusted* ~27% ~27% Earnings Per Share Reported* $1.64 - $1.69 $6.65 - $6.70 Earnings Per Share Adjusted* $2.01 - $2.06 $7.85 - $7.90 Other Modeling Items: FX Impact on Sales ~1% -a) ~0% Acquisition/Divesture Impact on Sales ~6% ~2% Depreciation $ ~$19 Million ~$69 Million Amortization $ ~$33 Million ~$108 Million Net Interest $ ~$18 Million ~$46 Million Capital Expenditures $70+ Million Tax Rate ~23% ~22% Free Cash Flow % of Adjusted Net Income* 100%+ Corporate Costs ~$22 Million ~$95 Million (a) – Based on 9/30/2024 FX Rate Earnings per share estimates exclude all future acquisitions and any future restructuring expenses

Click Here to Edit TitleIDEX Value Drivers ORGANIC GROWTH INORGANIC GROWTH MARGIN EXPANSION • Leading market entitlement • Pricing Execution • Growth Bets Prioritization • Strong funnel of M&A opportunities • Fast growing companies • Disciplined capital deployment • Leading the IDEX Op Model • 80/20 • Leverage

Click Here to Edit Title Non-GAAP Reconciliations

Table 1: Reconciliations of the Change in Net Sales to Organic Net Sales FMT HST FSDP IDEX Three Months Ended September 30, 2024 Change in net sales —% (1%) 4% 1% Less: Net impact from acquisitions/divestitures(1) (3%) 4% —% 1% Impact from foreign currency 1% —% —% —% Change in organic net sales 2% (5%) 4% —% Nine Months Ended September 30, 2024 Change in net sales (1%) (8%) 2% (3%) Less: Net impact from acquisitions/divestitures(1) (1%) 2% —% —% Impact from foreign currency —% —% —% —% Change in organic net sales —% (10%) 2% (3%) Table 2: Reconciliations of Reported-to-Adjusted Gross Profit and Gross Margin (dollars in millions) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Gross profit $ 353.9 $ 349.6 $ 1,078.1 $ 1,110.1 Fair value inventory step-up charge 2.1 1.2 4.6 1.2 Adjusted gross profit $ 356.0 $ 350.8 $ 1,082.7 $ 1,111.3 Net sales $ 798.2 $ 793.4 $ 2,405.9 $ 2,485.0 Gross margin 44.3% 44.1% 44.8% 44.7% Adjusted gross margin 44.6% 44.2% 45.0% 44.7%

Table 3: Reconciliations of Reported-to-Adjusted Net Income Attributable to IDEX and Diluted EPS Attributable to IDEX (in millions, other than per share amounts) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Reported net income attributable to IDEX $ 119.1 $ 209.1 $ 381.8 $ 487.5 Fair value inventory step-up charge 2.1 1.2 4.6 1.2 Tax impact on fair value inventory step-up charge (0.5) (0.3) (1.0) (0.3) Restructuring expenses and asset impairments 3.0 4.1 5.4 8.2 Tax impact on restructuring expenses and asset impairments (0.7) (0.9) (1.3) (1.8) Gain on sale of business(2) 0.6 (93.8) (4.0) (93.8) Tax impact on gain of sale of business — 22.7 — 22.7 Credit loss on note receivable from collaborative partner(3) — — — 7.7 Tax impact on credit loss on note receivable from collaborative partner — — — (1.6) Acquisition-related intangible asset amortization 26.5 23.8 75.0 70.6 Tax impact on acquisition-related intangible asset amortization (6.0) (5.3) (17.1) (15.8) Adjusted net income attributable to IDEX $ 144.1 $ 160.6 $ 443.4 $ 484.6 Reported diluted EPS attributable to IDEX $ 1.57 $ 2.75 $ 5.02 $ 6.42 Fair value inventory step-up charge 0.03 0.02 0.06 0.02 Tax impact on fair value inventory step-up charge — — (0.01) — Restructuring expenses and asset impairments 0.04 0.06 0.07 0.11 Tax impact on restructuring expenses and asset impairments (0.01) (0.01) (0.02) (0.03) Gain on sale of business(2) 0.01 (1.24) (0.05) (1.24) Tax impact on gain of sale of business — 0.30 — 0.30 Credit loss on note receivable from collaborative partner(3) — — — 0.10 Tax impact on credit loss on note receivable from collaborative partner — — — (0.02) Acquisition-related intangible asset amortization 0.35 0.31 0.99 0.93 Tax impact on acquisition-related intangible asset amortization (0.09) (0.07) (0.22) (0.21) Adjusted diluted EPS attributable to IDEX $ 1.90 $ 2.12 $ 5.84 $ 6.38 Diluted weighted average shares outstanding 75.9 75.9 75.9 75.9

Table 4: Reconciliations of Net Income to Adjusted EBITDA (dollars in millions) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Reported net income $ 118.9 $ 209.0 $ 381.4 $ 487.3 Provision for income taxes 35.5 52.8 106.7 132.8 Interest expense - net 10.3 13.7 27.8 40.1 Gain on sale of business(2) 0.6 (93.8) (4.0) (93.8) Depreciation 17.4 14.7 49.9 41.9 Amortization 26.5 23.8 75.0 70.6 Fair value inventory step-up charges 2.1 1.2 4.6 1.2 Restructuring expenses and asset impairments 3.0 4.1 5.4 8.2 Credit loss on note receivable from collaborative partner(3) — — — 7.7 Adjusted EBITDA $ 214.3 $ 225.5 $ 646.8 $ 696.0 Adjusted EBITDA Components: FMT $ 98.5 $ 103.6 $ 311.6 $ 323.9 HST 82.6 84.4 248.2 278.8 FSDP 54.7 52.8 159.9 157.0 Corporate and other (21.5) (15.3) (72.9) (63.7) Total Adjusted EBITDA $ 214.3 $ 225.5 $ 646.8 $ 696.0 Net sales $ 798.2 $ 793.4 $ 2,405.9 $ 2,485.0 Net income margin 14.9% 26.3% 15.9% 19.6% Adjusted EBITDA margin 26.9% 28.4% 26.9% 28.0%

Table 5: Reconciliations of Cash Flows from Operating Activities to Free Cash Flow (dollars in millions) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Cash flows from operating activities $ 205.3 $ 226.6 $ 495.5 $ 515.7 Less: Capital expenditures 13.7 20.1 49.6 68.3 Free cash flow $ 191.6 $ 206.5 $ 445.9 $ 447.4 Reported net income attributable to IDEX $ 119.1 $ 209.1 $ 381.8 $ 487.5 Adjusted net income attributable to IDEX 144.1 160.6 443.4 484.6 Operating cash flow conversion 172% 108% 130% 106% Free cash flow conversion 133% 129% 101% 92% Table 6: Reconciliation of Estimated 2024 Change in Net Sales to Change in Organic Net Sales Guidance Fourth Quarter 2024 Full Year 2024 Low End High End Low End High End Change in net sales 10% 11% —% 1% Less: Net impact from acquisitions/divestitures 6% 6% 2% 2% Impact from foreign currency 1% 1% —% —% Change in organic net sales 3% 4% (2%) (1%) Table 7: Reconciliation of Estimated 2024 Diluted EPS Attributable to IDEX to Adjusted Diluted EPS Attributable to IDEX Guidance Fourth Quarter 2024 Full Year 2024 Estimated diluted EPS attributable to IDEX $1.64 - $1.69 $6.65 - $6.70 Fair value inventory step-up charge 0.05 0.12 Tax impact on fair value inventory step-up charge (0.01) (0.03) Restructuring expenses and asset impairments — 0.08 Tax impact on restructuring expenses and asset impairments — (0.02) Gain on sale of business — (0.05) Tax impact on gain of sale of business — — Acquisition-related intangible asset amortization 0.43 1.42 Tax impact on acquisition-related intangible asset amortization (0.10) (0.32) Estimated adjusted diluted EPS attributable to IDEX $2.01 - $2.06 $7.85 - $7.90

Table 8: Reconciliation of Estimated 2024 Net Income to Adjusted EBITDA (dollars in millions) Guidance Fourth Quarter 2024 Full Year 2024 Low End High End Low End High End Estimated Reported net income $ 123.1 $ 127.4 $ 504.5 $ 508.8 Provision for income taxes 38.0 39.4 144.7 146.1 Interest expense - net 18.2 18.2 46.0 46.0 Gain on sale of business — — (4.0) (4.0) Depreciation 19.3 19.3 69.2 69.2 Amortization of intangible assets 32.6 32.6 107.6 107.6 Fair value inventory step-up charge 4.2 4.2 8.8 8.8 Restructuring expenses and asset impairments 0.4 0.4 5.8 5.8 Estimated Adjusted EBITDA $ 235.8 $ 241.5 $ 882.6 $ 888.3 Estimated Net sales $ 874.3 $ 882.3 $ 3,280.2 $ 3,288.2 Estimated Net income margin 14.1 % 14.4 % 15.4 % 15.5 % Estimated Adjusted EBITDA margin 27.0 % 27.4 % 26.9 % 27.0 % (1) Represents the sales from acquired or divested businesses during the first 12 months of ownership or prior to divestiture. (2) Activity recorded during the three months ended September 30, 2024 represents the finalization of the gain on the sale of Alfa Valvole, Srl resulting in a $0.6 million downward adjustment during the third quarter of 2024. (3) Represents a reserve on an investment with a collaborative partner recorded in Other expense (income) – net during the nine months ended September 30, 2023. During the fourth quarter of 2023, the Company converted the promissory note receivable from the collaborative partner to equity, resulting in a cost method investment with zero value.