For further information: TRADED: NYSE (IEX) EX-99.1

Investor Contact:

William K. Grogan

Senior Vice President and Chief Financial Officer

(847) 498-7070

TUESDAY, OCTOBER 26, 2021

IDEX REPORTS RECORD THIRD QUARTER RESULTS

NORTHBROOK, IL, OCTOBER 26 - IDEX Corporation (NYSE: IEX) today announced its financial results for the three month period ended September 30, 2021.

Third Quarter 2021 Highlights

•Record orders of $774.2 million up 36 percent overall and 28 percent organically compared to Q3 2020

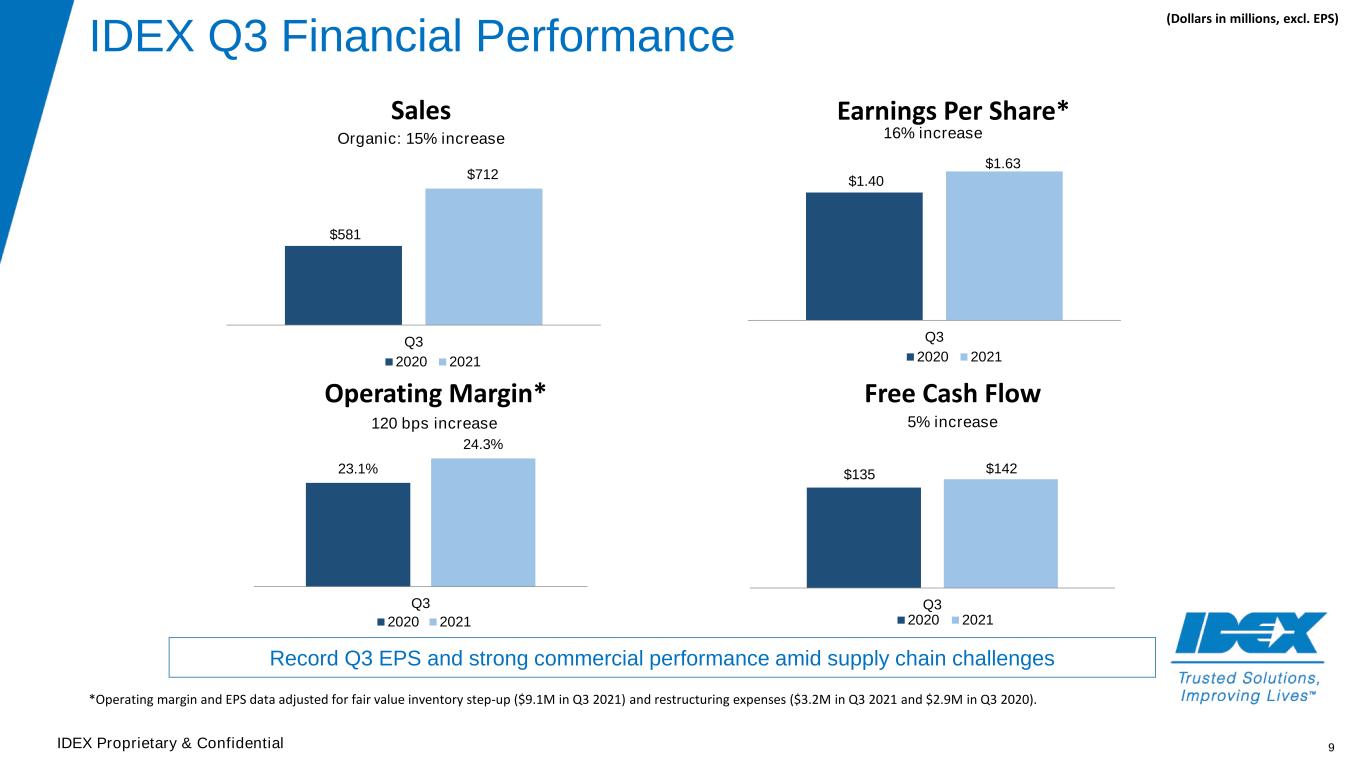

•Record sales of $712.0 million up 23 percent overall and 15 percent organically compared to Q3 2020

• Reported operating margin was 22.6 percent with adjusted operating margin of 24.3 percent

• Record reported EPS was $1.51 with record adjusted EPS of $1.63

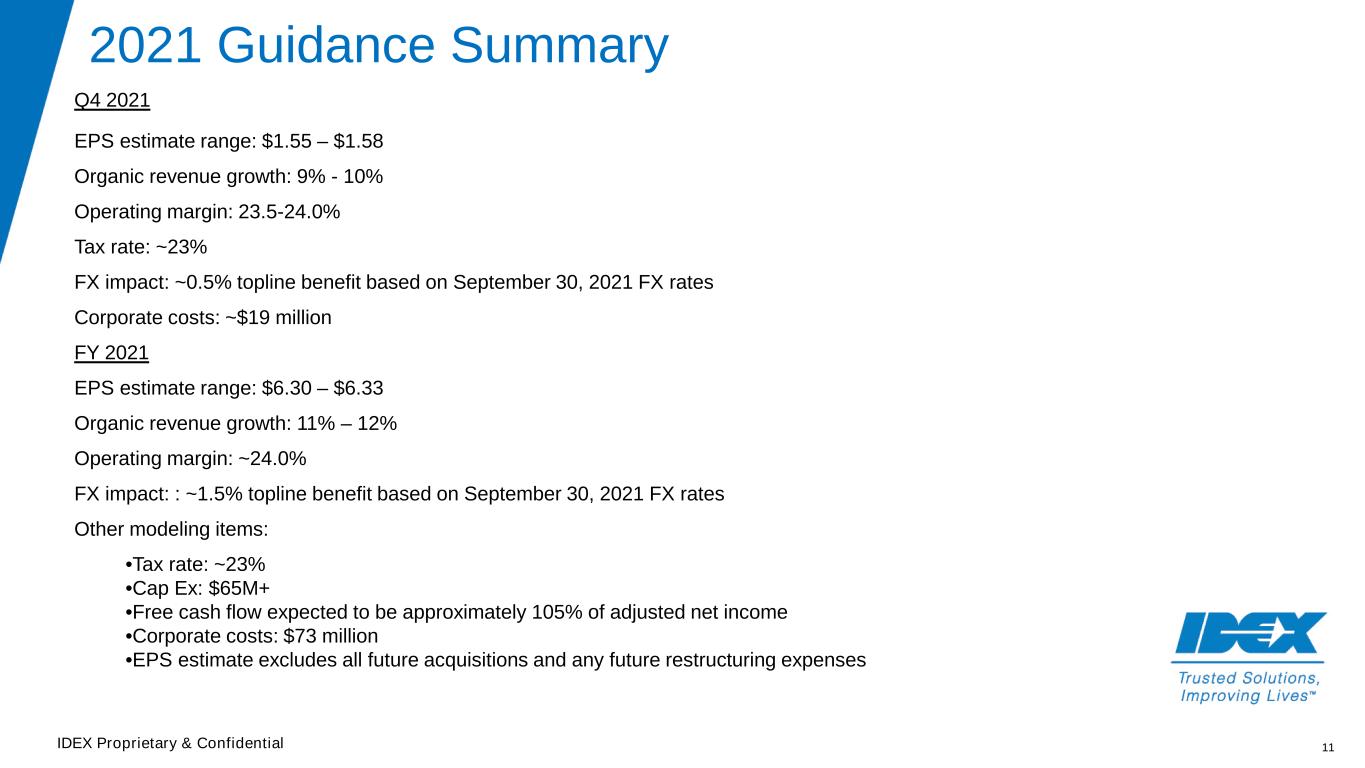

•Full year adjusted EPS guidance narrowed to $6.30 to $6.33 compared to prior guidance of $6.26 to $6.36

Third Quarter 2021

Orders of $774.2 million were up 36 percent compared with the prior year period (+28 percent organic, +7 percent acquisitions/divestitures and +1 percent foreign currency translation).

Sales of $712.0 million were up 23 percent compared with the prior year period (+15 percent organic, +7 percent acquisitions/divestitures and +1 percent foreign currency translation).

Gross margin of 43.8 percent was up 50 basis points compared with the prior year period primarily as a result of higher volume and price capture, partially offset by inflation and supply chain constraints. Adjusted gross margin, which excludes a $9.1 million pre-tax fair value inventory step-up charge related to the Airtech acquisition, was 45.0 percent, up 170 basis points compared with the adjusted prior year period.

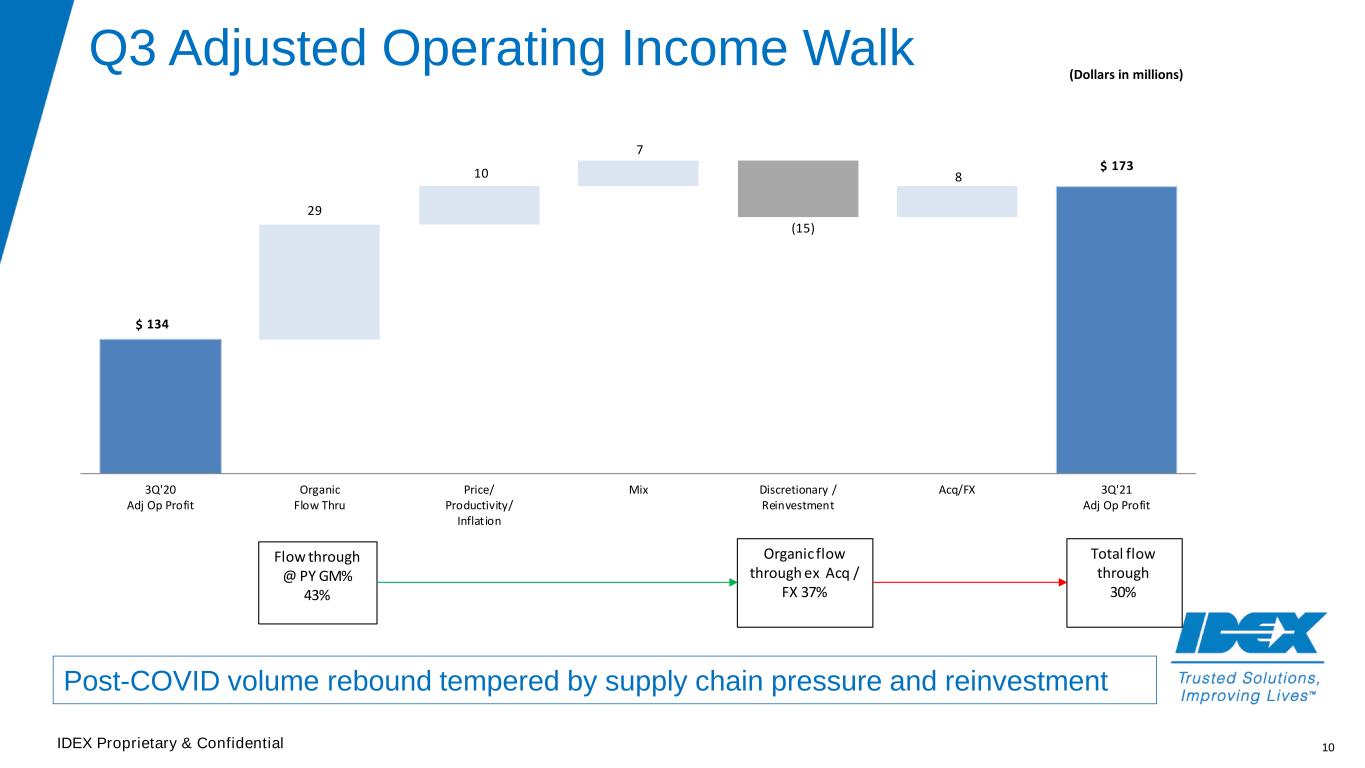

Operating income of $161.2 million resulted in an operating margin of 22.6 percent, which was flat compared with the prior year period. Adjusted operating income, which primarily excluded a $9.1 million pre-tax fair value inventory step-up charge and $3.2 million of restructuring expenses and asset impairments, was $173.1 million with an adjusted operating margin of 24.3 percent, up 120 basis points compared with the adjusted prior year period.

Provision for income taxes of $35.3 million in the third quarter of 2021 resulted in an effective tax rate (ETR) of 23.4 percent, which was higher than the prior year period ETR of 14.4 percent primarily due to the finalization of tax regulations enacted in the third quarter of 2020 as well as a decrease in the excess tax benefit related to share-based compensation in the current period.

Net income attributable to IDEX was $115.7 million, which resulted in EPS attributable to IDEX of $1.51. Adjusted EPS attributable to IDEX was $1.63, an increase of 23 cents, or 16.4 percent, from the adjusted prior year period and excluded the impacts of the fair value inventory step-up charge and restructuring expenses and asset impairments discussed above, both net of related tax benefits. EBITDA of $187.5 million was 26.3 percent of sales and covered interest expense by almost 20 times. Adjusted EBITDA of $199.4 million was 28.0 percent of sales and covered interest expense by 21 times.

Cash from operations of $156.6 million was up 2 percent from the prior year period primarily due to higher earnings, partially offset by changes in working capital and was 135 percent of net income attributable to IDEX. Free cash flow of $141.7 million was up 5 percent from the prior year period and was 113 percent of adjusted net income attributable to IDEX.

“IDEX teams continued to navigate a tremendously challenging supply chain environment and achieved strong operating results in the third quarter. We saw broad-based strength across our portfolio, resulting in record orders and sales of $774 million and $712 million, respectively. Today's global challenges will increasingly drive growth towards problem solvers like IDEX, but in the short term, our focus remains on overcoming the macro constraints that inhibit customer satisfaction while staying committed to investments needed to thrive in the future. | |||||

Our 80/20 principles serve us well by providing a framework to identify how to best support our customers in a difficult environment. I want to thank all IDEX team members across the globe who have tirelessly worked through these challenges and contributed to our success. | |||||

Our price capture continues to outpace material inflation and drive sequential improvements in gross margin. Despite targeted increases in discretionary costs and continued investment in the business, we achieved solid flow through, resulting in an adjusted operating margin of 24.3 percent and a record adjusted EPS of $1.63. | |||||

The acquisitions we made in the first half of the year are performing extremely well. ABEL Pumps is fully integrated and performing above expectations. Airtech is ahead of our integration timeline and is delivering on its growth potential. Our expanded corporate strategy and development team continues to actively work our M&A funnel as we look to deploy more capital. The balance sheet remains strong, with ample capital to support organic investments in business innovations and strategic M&A. | |||||

As we look to the fourth quarter, we expect organic sales growth of 9 to 10 percent with EPS in the range of $1.55 to $1.58. This assumes similar output to our third quarter results, coupled with a step up in targeted investments and the potential for year-end logistics challenges. For the full year, we are maintaining our projection of 11 to 12 percent organic sales growth and narrowing our adjusted EPS range to $6.30 to $6.33.” | |||||

| Eric D. Ashleman | |||||

| Chief Executive Officer and President | |||||

Third Quarter 2021 Segment Highlights

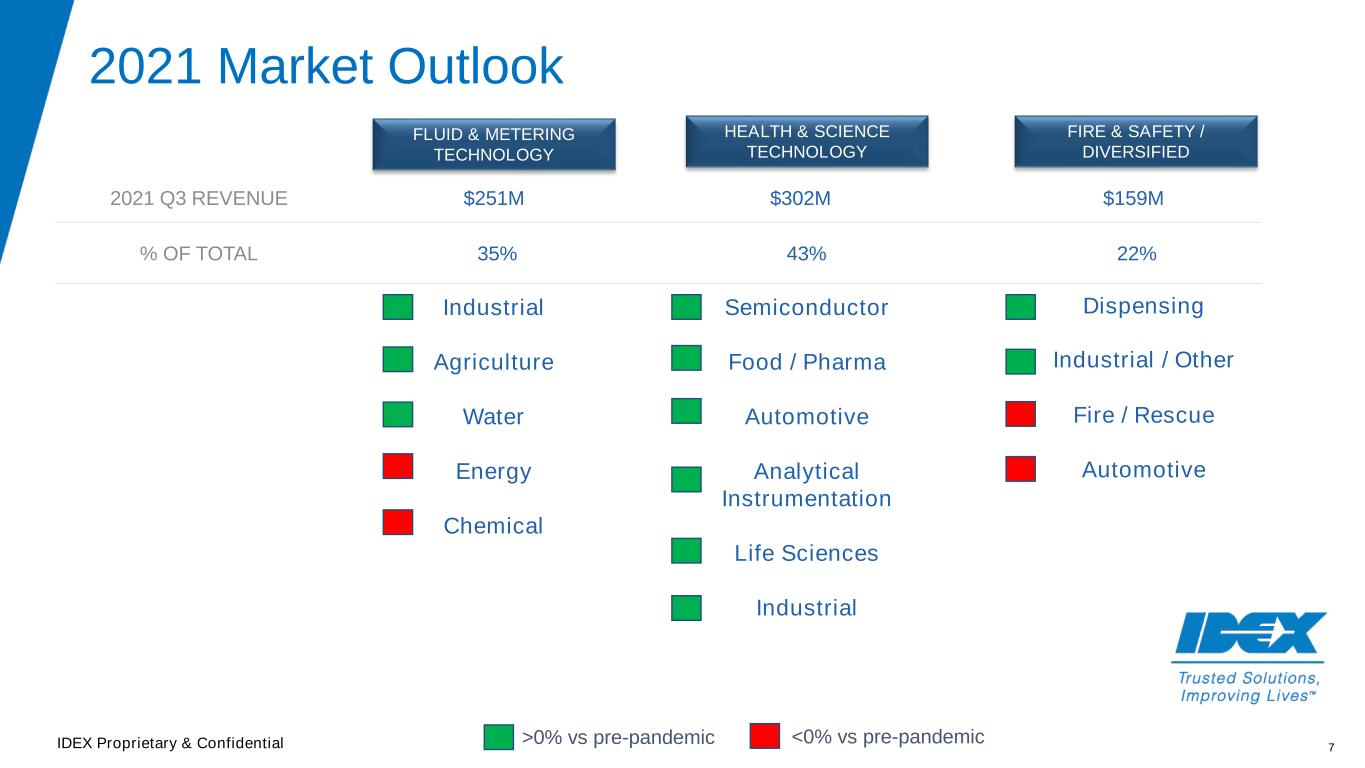

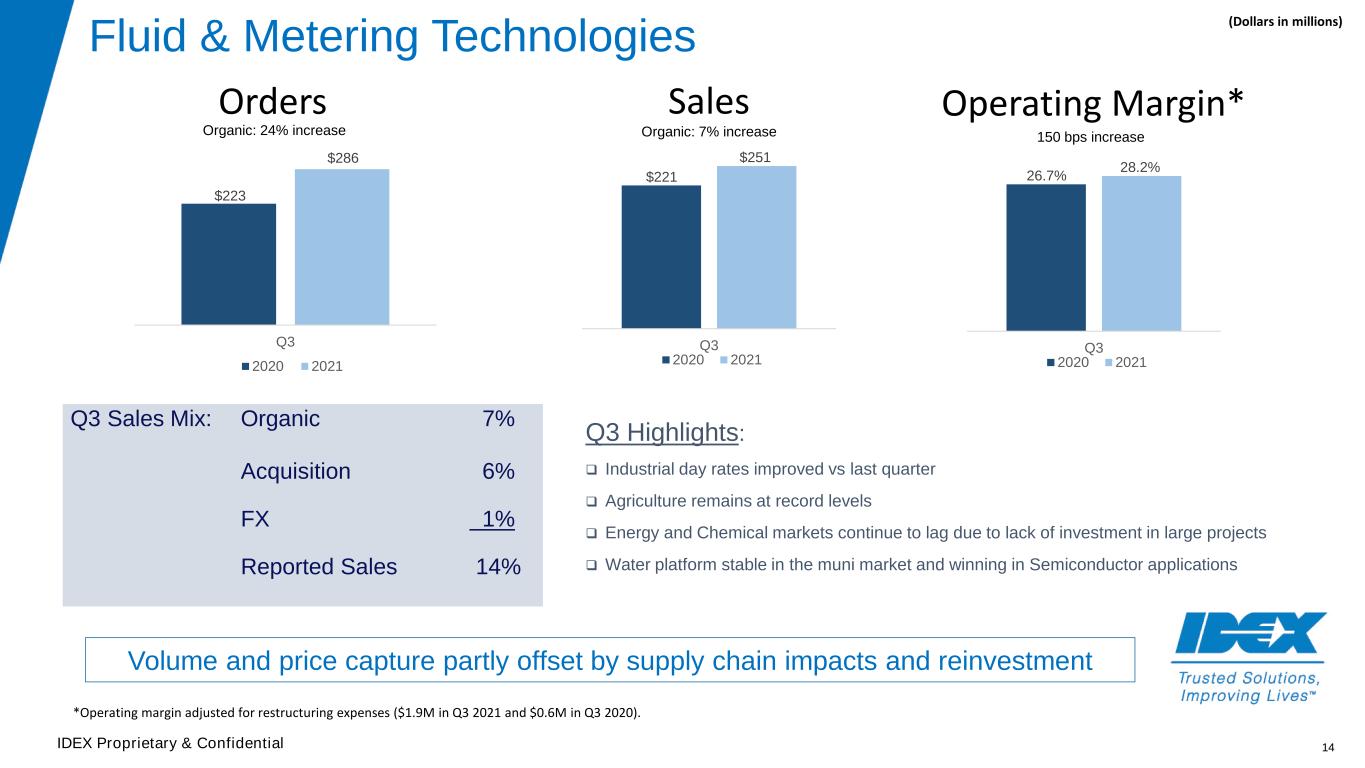

Fluid & Metering Technologies

•Sales of $251.3 million reflected a 14 percent increase compared to the third quarter of 2020 (+7 percent organic, +6 percent acquisitions and +1 percent foreign currency translation).

•Operating income of $69.0 million resulted in an operating margin of 27.5 percent, which was up 100 basis points compared with the prior year period primarily due to higher volume, price capture and favorable mix, partially offset by inflation, supply chain constraints and targeted increases in discretionary spending. Adjusted operating income, which excludes $2.0 million of restructuring expenses and asset impairments, was $71.0 million with an adjusted operating margin of 28.2 percent, a 150 basis point increase compared to the prior year period.

•EBITDA of $76.4 million resulted in an EBITDA margin of 30.4 percent. Adjusted EBITDA of $78.3 million resulted in an adjusted EBITDA margin of 31.2 percent, a 90 basis point increase compared to the prior year period.

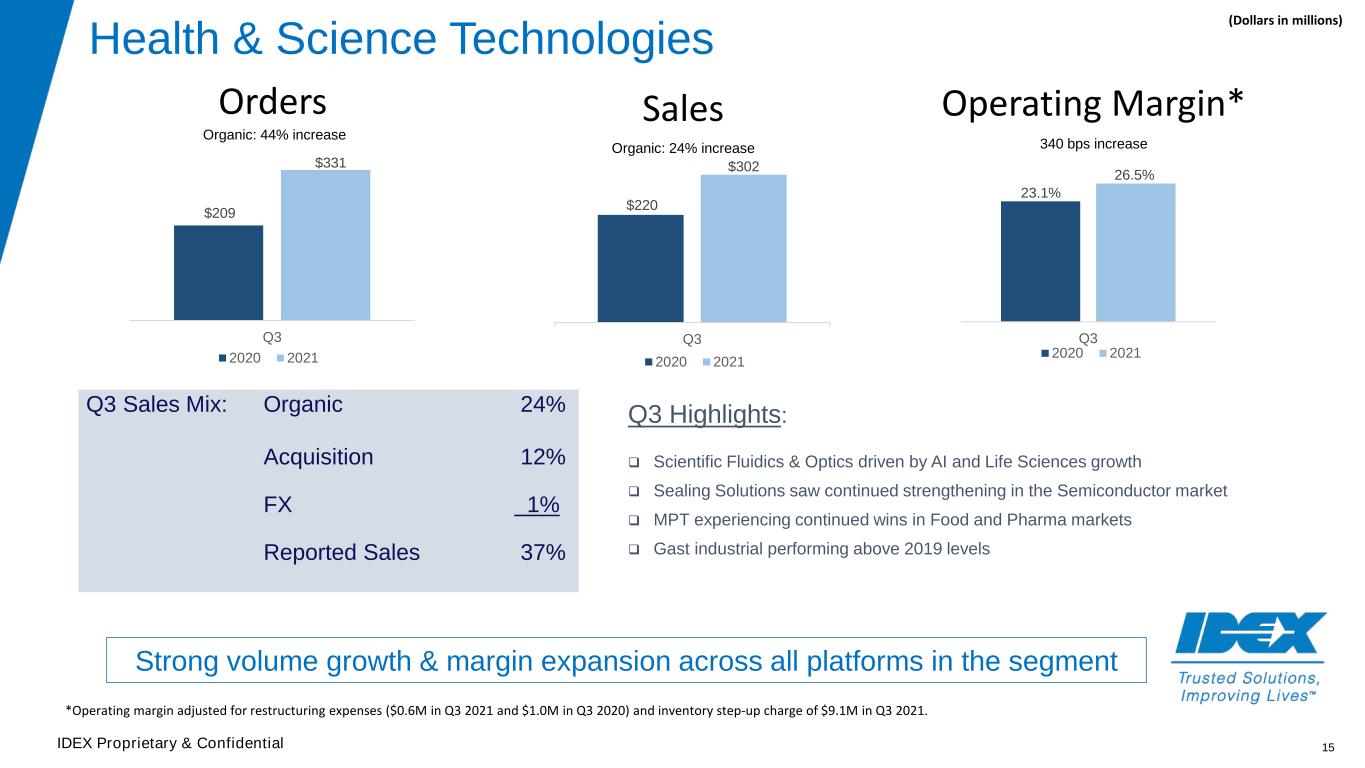

Health & Science Technologies

•Sales of $302.3 million reflected a 37 percent increase compared to the third quarter of 2020 (+24 percent organic, +12 percent acquisitions/divestitures and +1 percent foreign currency translation).

•Operating income of $70.4 million resulted in an operating margin of 23.3 percent, which was up 70 basis points compared with the prior year period primarily due to higher volume, price capture and favorable mix, partially offset by inflation, supply chain constraints, targeted increases in discretionary spending and the fair value inventory step-up charge related to the Airtech acquisition. Adjusted operating income, which excludes a $9.1 million pre-tax fair value inventory step-up charge related to the Airtech acquisition and $0.6 million of restructuring expenses and asset impairments, was $80.1 million with an adjusted operating margin of 26.5 percent, a 340 basis point increase compared to the prior year period.

•EBITDA of $85.9 million resulted in an EBITDA margin of 28.4 percent. Adjusted EBITDA of $95.7 million resulted in an adjusted EBITDA margin of 31.6 percent, a 390 basis point increase compared to the prior year period.

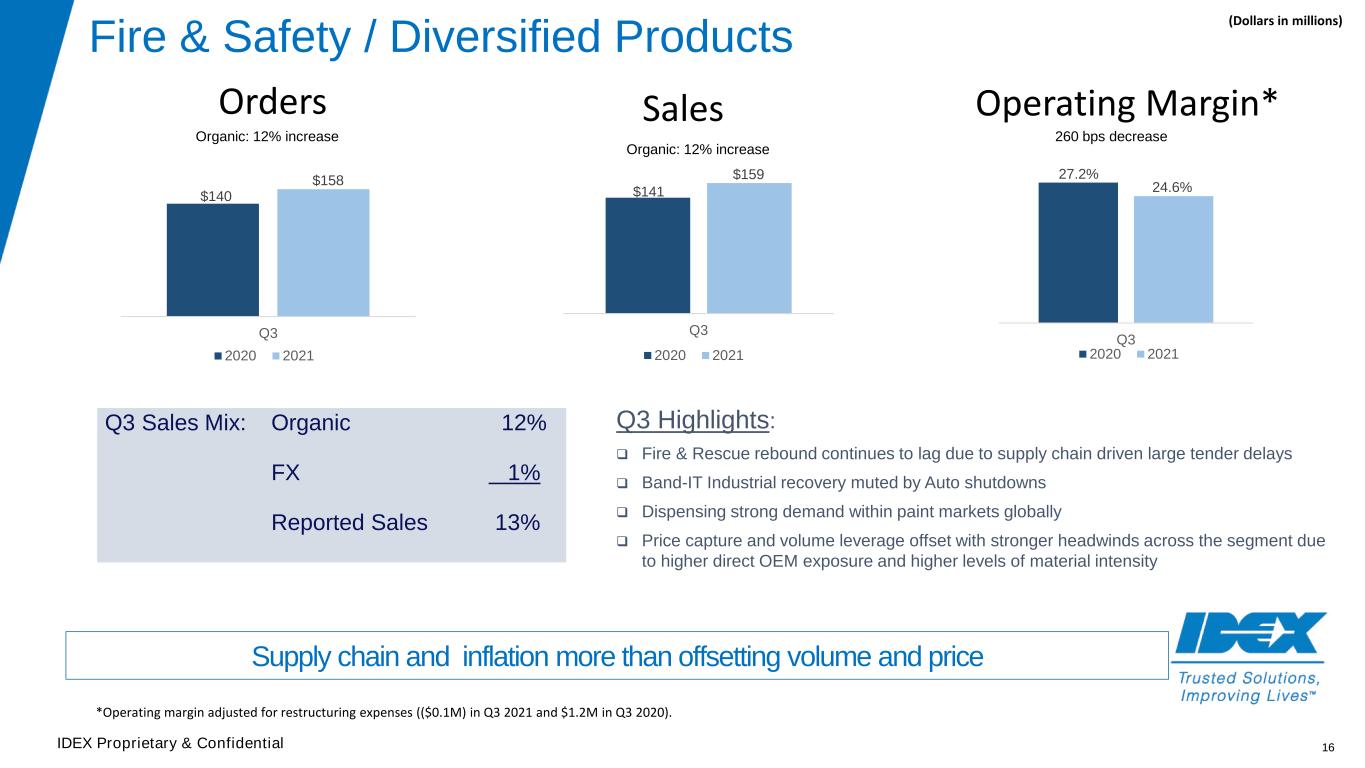

Fire & Safety/Diversified Products

•Sales of $159.1 million reflected a 13 percent increase compared to the third quarter of 2020 (+12 percent organic and +1 percent foreign currency translation).

•Operating income of $39.1 million resulted in an operating margin of 24.6 percent, which was down 170 basis points compared with the prior year period primarily as a result of inflation, supply chain constraints and targeted increases in discretionary spending. Price capture and volume leverage offsets faced stronger headwinds within the segment due to higher direct OEM exposure and higher levels of material intensity due to vertical integration. Adjusted operating income was $39.1 million with an adjusted operating margin of 24.6 percent, a 260 basis point decrease compared to the prior year period.

•EBITDA of $42.9 million resulted in an EBITDA margin of 26.9 percent. Adjusted EBITDA of $42.8 million resulted in an adjusted EBITDA margin of 26.9 percent, a 280 basis point decrease compared to the prior year period.

Corporate Costs

Corporate costs increased to $17.3 million in the third quarter of 2021 from $14.2 million in the third quarter of 2020 primarily as a result of higher variable compensation and employee-related costs.

Non-GAAP Measures of Financial Performance

The Company prepares its public financial statements in conformity with accounting principles generally accepted in the United States of America (GAAP). The Company supplements certain GAAP financial performance metrics with non-GAAP financial performance metrics. Management believes these non-GAAP financial performance metrics provide investors with greater insight, transparency and a more comprehensive understanding of the financial information used by management in its financial and operational decision-making because certain of these adjusted metrics exclude items not reflective of ongoing operations, such as fair value inventory step-up charges, restructuring expenses and asset impairments, the loss on early debt redemption, the noncash loss related to the termination of the U.S. pension plan and the impact of the settlement for a Corporate transaction indemnity. Reconciliations of non-GAAP financial performance metrics to their most comparable GAAP financial performance metrics are defined and presented below and should not be considered a substitute for, nor superior to, the financial data prepared in accordance with GAAP. The Company does not provide forward-looking guidance for EPS on a GAAP basis because it is unable to predict certain items contained in the GAAP measure without unreasonable efforts. These items may include restructuring expenses and asset impairments, special tax items, acquisition-related transaction costs and certain other unusual adjustments. There were no adjustments to GAAP financial performance metrics other than the items noted below.

•Organic orders and sales are calculated excluding amounts from acquired or divested businesses during the first twelve months of ownership or prior to divestiture and the impact of foreign currency translation.

•Adjusted gross profit is calculated as gross profit plus fair value inventory step-up charges.

•Adjusted gross margin is calculated as adjusted gross profit divided by net sales.

•Adjusted operating income is calculated as operating income plus fair value inventory step-up charges plus restructuring expenses and asset impairments plus the impact of the settlement for a Corporate transaction indemnity.

•Adjusted operating margin is calculated as adjusted operating income divided by net sales.

•Adjusted net income is calculated as net income plus fair value inventory step-up charges plus restructuring expenses and asset impairments plus the impact of the settlement for a Corporate transaction indemnity plus the loss on early debt redemption plus the noncash loss related to the termination of the U.S. pension plan, net of the statutory tax expense or benefit.

•Adjusted EPS is calculated as adjusted net income divided by the diluted weighted average shares outstanding.

•EBITDA is calculated as net income plus interest expense plus provision for income taxes plus depreciation and amortization. We reconcile EBITDA to net income on a consolidated basis as we do not allocate consolidated interest expense or consolidated provision for income taxes to our segments.

•EBITDA interest coverage is calculated as EBITDA divided by consolidated interest expense.

•Adjusted EBITDA is calculated as EBITDA plus fair value inventory step-up charges plus restructuring expenses and asset impairments plus the impact of the settlement for a Corporate transaction indemnity plus the loss on early debt redemption plus the noncash loss related to the termination of the U.S. pension plan.

•Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net sales.

•Adjusted EBITDA interest coverage is calculated as Adjusted EBITDA divided by consolidated interest expense.

•Free cash flow is calculated as cash flow from operating activities less capital expenditures.

Table 1: Reconciliations of the Change in Net Sales to Organic Net Sales

| Three Months Ended September 30, 2021 | Nine Months Ended September 30, 2021 | ||||||||||||||||||||||||||||||||||||||||||||||

| FMT | HST | FSDP | IDEX | FMT | HST | FSDP | IDEX | ||||||||||||||||||||||||||||||||||||||||

| Change in net sales | 14 | % | 37 | % | 13 | % | 23 | % | 12 | % | 25 | % | 16 | % | 18 | % | |||||||||||||||||||||||||||||||

| - Net impact from acquisitions/divestitures | 6 | % | 12 | % | — | % | 7 | % | 4 | % | 4 | % | — | % | 3 | % | |||||||||||||||||||||||||||||||

| - Impact from foreign currency | 1 | % | 1 | % | 1 | % | 1 | % | 2 | % | 3 | % | 3 | % | 3 | % | |||||||||||||||||||||||||||||||

| Change in organic net sales | 7 | % | 24 | % | 12 | % | 15 | % | 6 | % | 18 | % | 13 | % | 12 | % | |||||||||||||||||||||||||||||||

Table 2: Reconciliations of Reported-to-Adjusted Gross Profit and Margin (dollars in thousands)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Gross profit | $ | 311,569 | $ | 251,500 | $ | 910,264 | $ | 758,256 | |||||||||||||||

| + Fair value inventory step-up charges | 9,100 | — | 11,586 | 4,107 | |||||||||||||||||||

| Adjusted gross profit | $ | 320,669 | $ | 251,500 | $ | 921,850 | $ | 762,363 | |||||||||||||||

| Net sales | $ | 712,019 | $ | 581,113 | $ | 2,050,002 | $ | 1,736,824 | |||||||||||||||

| Gross margin | 43.8 | % | 43.3 | % | 44.4 | % | 43.7 | % | |||||||||||||||

| Adjusted gross margin | 45.0 | % | 43.3 | % | 45.0 | % | 43.9 | % | |||||||||||||||

Table 3: Reconciliations of Reported-to-Adjusted Operating Income and Margin (dollars in thousands)

| Three Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FMT | HST | FSDP | Corporate | IDEX | FMT | HST | FSDP | Corporate | IDEX | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Reported operating income (loss) | $ | 69,020 | $ | 70,374 | $ | 39,126 | $ | (17,335) | $ | 161,185 | $ | 58,402 | $ | 49,912 | $ | 37,103 | $(14,204) | $ | 131,213 | ||||||||||||||||||||||||||||||||||||||||

| + Restructuring expenses and asset impairments | 1,934 | 626 | (55) | 699 | 3,204 | 585 | 978 | 1,249 | 105 | 2,917 | |||||||||||||||||||||||||||||||||||||||||||||||||

| + Fair value inventory step-up charges | — | 9,100 | — | — | 9,100 | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| + Corporate transaction indemnity | — | — | — | (400) | (400) | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted operating income (loss) | $ | 70,954 | $ | 80,100 | $ | 39,071 | $ | (17,036) | $ | 173,089 | $ | 58,987 | $ | 50,890 | $ | 38,352 | $(14,099) | $ | 134,130 | ||||||||||||||||||||||||||||||||||||||||

| Net sales (eliminations) | $ | 251,297 | $ | 302,287 | $ | 159,106 | $ | (671) | $ | 712,019 | $ | 220,747 | $ | 220,378 | $ | 140,896 | $ | (908) | $ | 581,113 | |||||||||||||||||||||||||||||||||||||||

| Reported operating margin | 27.5 | % | 23.3 | % | 24.6 | % | n/m | 22.6 | % | 26.5 | % | 22.6 | % | 26.3 | % | n/m | 22.6 | % | |||||||||||||||||||||||||||||||||||||||||

| Adjusted operating margin | 28.2 | % | 26.5 | % | 24.6 | % | n/m | 24.3 | % | 26.7 | % | 23.1 | % | 27.2 | % | n/m | 23.1 | % | |||||||||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FMT | HST | FSDP | Corporate | IDEX | FMT | HST | FSDP | Corporate | IDEX | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Reported operating income (loss) | $ | 195,384 | $ | 212,987 | $ | 126,483 | $ | (59,866) | $ | 474,988 | $ | 176,111 | $ | 150,562 | $ | 103,977 | $ | (48,902) | $ | 381,748 | |||||||||||||||||||||||||||||||||||||||

| + Restructuring expenses and asset impairments | 4,787 | 1,693 | 161 | 1,927 | 8,568 | 2,433 | 2,162 | 1,890 | 273 | 6,758 | |||||||||||||||||||||||||||||||||||||||||||||||||

| + Fair value inventory step-up charges | 2,486 | 9,100 | — | — | 11,586 | 4,107 | — | — | — | 4,107 | |||||||||||||||||||||||||||||||||||||||||||||||||

| + Corporate transaction indemnity | — | — | — | 3,500 | 3,500 | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted operating income (loss) | $202,657 | $223,780 | $126,644 | $(54,439) | $498,642 | $182,651 | $152,724 | $105,867 | $(48,629) | $392,613 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales (eliminations) | $ | 745,939 | $ | 827,668 | $ | 479,402 | $ | (3,007) | $ | 2,050,002 | $ | 666,720 | $ | 660,105 | $ | 412,296 | $ | (2,297) | $ | 1,736,824 | |||||||||||||||||||||||||||||||||||||||

| Reported operating margin | 26.2 | % | 25.7 | % | 26.4 | % | n/m | 23.2 | % | 26.4 | % | 22.8 | % | 25.2 | % | n/m | 22.0 | % | |||||||||||||||||||||||||||||||||||||||||

| Adjusted operating margin | 27.2 | % | 27.0 | % | 26.4 | % | n/m | 24.3 | % | 27.4 | % | 23.1 | % | 25.7 | % | n/m | 22.6 | % | |||||||||||||||||||||||||||||||||||||||||

Table 4: Reconciliations of Reported-to-Adjusted Net Income and EPS (in thousands, except EPS)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Reported net income attributable to IDEX | $ | 115,742 | $ | 103,848 | $ | 330,645 | $ | 276,710 | |||||||||||||||

| + Restructuring expenses and asset impairments | 3,204 | 2,917 | 8,568 | 6,758 | |||||||||||||||||||

| + Tax impact on restructuring expenses and asset impairments | (771) | (703) | (2,060) | (1,540) | |||||||||||||||||||

| + Fair value inventory step-up charges | 9,100 | — | 11,586 | 4,107 | |||||||||||||||||||

| + Tax impact on fair value inventory step-up charges | (1,961) | — | (2,707) | (932) | |||||||||||||||||||

| + Loss on early debt redemption | — | — | 8,561 | 8,421 | |||||||||||||||||||

| + Tax impact on loss on early debt redemption | — | — | (1,841) | (1,912) | |||||||||||||||||||

| + Termination of the U.S. pension plan | — | — | 9,688 | — | |||||||||||||||||||

| + Tax impact on termination of the U.S. pension plan | — | — | (2,083) | — | |||||||||||||||||||

| + Corporate transaction indemnity | (400) | — | 3,500 | — | |||||||||||||||||||

| + Tax impact on Corporate transaction indemnity | 85 | — | (754) | — | |||||||||||||||||||

| Adjusted net income attributable to IDEX | $ | 124,999 | $ | 106,062 | $ | 363,103 | $ | 291,612 | |||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Reported diluted EPS attributable to IDEX | $ | 1.51 | $ | 1.37 | $ | 4.33 | $ | 3.64 | |||||||||||||||

| + Restructuring expenses and asset impairments | 0.04 | 0.04 | 0.11 | 0.09 | |||||||||||||||||||

| + Tax impact on restructuring expenses and asset impairments | (0.01) | (0.01) | (0.03) | (0.02) | |||||||||||||||||||

| + Fair value inventory step-up charges | 0.12 | — | 0.15 | 0.05 | |||||||||||||||||||

| + Tax impact on fair value inventory step-up charges | (0.03) | — | (0.04) | (0.01) | |||||||||||||||||||

| + Loss on early debt redemption | — | — | 0.11 | 0.11 | |||||||||||||||||||

| + Tax impact on loss on early debt redemption | — | — | (0.02) | (0.02) | |||||||||||||||||||

| + Termination of the U.S. pension plan | — | — | 0.13 | — | |||||||||||||||||||

| + Tax impact on termination of the U.S. pension plan | — | — | (0.03) | — | |||||||||||||||||||

| + Corporate transaction indemnity | — | — | 0.05 | — | |||||||||||||||||||

| + Tax impact on Corporate transaction indemnity | — | — | (0.01) | — | |||||||||||||||||||

| Adjusted diluted EPS attributable to IDEX | $ | 1.63 | $ | 1.40 | $ | 4.75 | $ | 3.84 | |||||||||||||||

| Diluted weighted average shares outstanding | 76,452 | 75,960 | 76,408 | 76,119 | |||||||||||||||||||

Table 5: Reconciliations of EBITDA to Net Income (dollars in thousands)

| Three Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FMT | HST | FSDP | Corporate | IDEX | FMT | HST | FSDP | Corporate | IDEX | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Reported operating income (loss) | $ | 69,020 | $ | 70,374 | $ | 39,126 | $ | (17,335) | $ | 161,185 | $ | 58,402 | $ | 49,912 | $ | 37,103 | $(14,204) | $ | 131,213 | ||||||||||||||||||||||||||||||||||||||||

| - Other expense (income) - net | 384 | (236) | 50 | 432 | 630 | (719) | (32) | 340 | (293) | (704) | |||||||||||||||||||||||||||||||||||||||||||||||||

| + Depreciation and amortization | 7,737 | 15,335 | 3,787 | 110 | 26,969 | 7,163 | 10,230 | 3,854 | 104 | 21,351 | |||||||||||||||||||||||||||||||||||||||||||||||||

| EBITDA | 76,373 | 85,945 | 42,863 | (17,657) | 187,524 | 66,284 | 60,174 | 40,617 | (13,807) | 153,268 | |||||||||||||||||||||||||||||||||||||||||||||||||

| - Interest expense | 9,498 | 10,642 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| - Provision for income taxes | 35,343 | 17,427 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| - Depreciation and amortization | 26,969 | 21,351 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reported net income | $ | 115,714 | $ | 103,848 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales (eliminations) | $ | 251,297 | $ | 302,287 | $ | 159,106 | $ | (671) | $ | 712,019 | $ | 220,747 | $ | 220,378 | $ | 140,896 | $ | (908) | $ | 581,113 | |||||||||||||||||||||||||||||||||||||||

| Reported operating margin | 27.5 | % | 23.3 | % | 24.6 | % | n/m | 22.6 | % | 26.5 | % | 22.6 | % | 26.3 | % | n/m | 22.6 | % | |||||||||||||||||||||||||||||||||||||||||

| EBITDA margin | 30.4 | % | 28.4 | % | 26.9 | % | n/m | 26.3 | % | 30.0 | % | 27.3 | % | 28.8 | % | n/m | 26.4 | % | |||||||||||||||||||||||||||||||||||||||||

| EBITDA interest coverage | 19.7 | 14.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FMT | HST | FSDP | Corporate | IDEX | FMT | HST | FSDP | Corporate | IDEX | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Reported operating income (loss) | $ | 195,384 | $ | 212,987 | $ | 126,483 | $ | (59,866) | $ | 474,988 | $176,111 | $150,562 | $103,977 | $(48,902) | $381,748 | ||||||||||||||||||||||||||||||||||||||||||||

| - Other expense (income) - net | 5,968 | (290) | 1,833 | 9,446 | 16,957 | (35) | (91) | 148 | 7,299 | 7,321 | |||||||||||||||||||||||||||||||||||||||||||||||||

| + Depreciation and amortization | 22,743 | 38,382 | 11,510 | 327 | 72,962 | 19,370 | 30,806 | 11,409 | 389 | 61,974 | |||||||||||||||||||||||||||||||||||||||||||||||||

| EBITDA | 212,159 | 251,659 | 136,160 | (68,985) | 530,993 | 195,516 | 181,459 | 115,238 | (55,812) | 436,401 | |||||||||||||||||||||||||||||||||||||||||||||||||

| - Interest expense | 31,479 | 33,958 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| - Provision for income taxes | 95,987 | 63,759 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| - Depreciation and amortization | 72,962 | 61,974 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reported net income | $330,565 | $276,710 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales (eliminations) | $ | 745,939 | $ | 827,668 | $ | 479,402 | $ | (3,007) | $ | 2,050,002 | $ | 666,720 | $ | 660,105 | $ | 412,296 | $ | (2,297) | $ | 1,736,824 | |||||||||||||||||||||||||||||||||||||||

| Reported operating margin | 26.2 | % | 25.7 | % | 26.4 | % | n/m | 23.2 | % | 26.4 | % | 22.8 | % | 25.2 | % | n/m | 22.0 | % | |||||||||||||||||||||||||||||||||||||||||

| EBITDA margin | 28.4 | % | 30.4 | % | 28.4 | % | n/m | 25.9 | % | 29.3 | % | 27.5 | % | 28.0 | % | n/m | 25.1 | % | |||||||||||||||||||||||||||||||||||||||||

| EBITDA interest coverage | 16.9 | 12.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Table 6 : Reconciliations of EBITDA to Adjusted EBITDA (dollars in thousands)

| Three Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FMT | HST | FSDP | Corporate | IDEX | FMT | HST | FSDP | Corporate | IDEX | ||||||||||||||||||||||||||||||||||||||||||||||||||

EBITDA(1) | $ | 76,373 | $ | 85,945 | $ | 42,863 | $ | (17,657) | $ | 187,524 | $ | 66,284 | $ | 60,174 | $ | 40,617 | $ | (13,807) | $ | 153,268 | |||||||||||||||||||||||||||||||||||||||

| + Restructuring expenses and asset impairments | 1,934 | 626 | (55) | 699 | 3,204 | 585 | 978 | 1,249 | 105 | 2,917 | |||||||||||||||||||||||||||||||||||||||||||||||||

| + Fair value inventory step-up charges | — | 9,100 | — | — | 9,100 | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| + Corporate transaction indemnity | — | — | — | (400) | (400) | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 78,307 | $ | 95,671 | $ | 42,808 | $ | (17,358) | $ | 199,428 | $ | 66,869 | $ | 61,152 | $ | 41,866 | $ | (13,702) | $ | 156,185 | |||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA margin | 31.2 | % | 31.6 | % | 26.9 | % | n/m | 28.0 | % | 30.3 | % | 27.7 | % | 29.7 | % | n/m | 26.9 | % | |||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA interest coverage | 21.0 | 14.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FMT | HST | FSDP | Corporate | IDEX | FMT | HST | FSDP | Corporate | IDEX | ||||||||||||||||||||||||||||||||||||||||||||||||||

EBITDA(1) | $ | 212,159 | $ | 251,659 | $ | 136,160 | $ | (68,985) | $ | 530,993 | $ | 195,516 | $ | 181,459 | $ | 115,238 | $ | (55,812) | $ | 436,401 | |||||||||||||||||||||||||||||||||||||||

| + Restructuring expenses and asset impairments | 4,787 | 1,693 | 161 | 1,927 | 8,568 | 2,433 | 2,162 | 1,890 | 273 | 6,758 | |||||||||||||||||||||||||||||||||||||||||||||||||

| + Fair value inventory step-up charges | 2,486 | 9,100 | — | — | 11,586 | 4,107 | — | — | — | 4,107 | |||||||||||||||||||||||||||||||||||||||||||||||||

| + Loss on early debt redemption | — | — | — | 8,561 | 8,561 | — | — | — | 8,421 | 8,421 | |||||||||||||||||||||||||||||||||||||||||||||||||

| + Termination of the U.S. pension plan | 6,293 | — | 1,782 | 1,613 | 9,688 | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| + Corporate transaction indemnity | — | — | — | 3,500 | 3,500 | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 225,725 | $ | 262,452 | $ | 138,103 | $ | (53,384) | $ | 572,896 | $ | 202,056 | $ | 183,621 | $ | 117,128 | $ | (47,118) | $ | 455,687 | |||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA margin | 30.3 | % | 31.7 | % | 28.8 | % | n/m | 27.9 | % | 30.3 | % | 27.8 | % | 28.4 | % | n/m | 26.2 | % | |||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA interest coverage | 18.2 | 13.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) EBITDA, a non-GAAP financial measure, is reconciled to net income, its most directly comparable GAAP financial measure, immediately above in Table 5.

Table 7: Reconciliations of Cash Flows from Operating Activities to Free Cash Flow (in thousands)

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||

| September 30, | June 30, | September 30, | |||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2021 | 2020 | |||||||||||||||||||||||||

| Cash flows from operating activities | $ | 156,633 | $ | 153,686 | $ | 136,272 | $ | 402,229 | $ | 407,899 | |||||||||||||||||||

| - Capital expenditures | 14,894 | 18,353 | 15,984 | 45,487 | 39,438 | ||||||||||||||||||||||||

| Free cash flow | $ | 141,739 | $ | 135,333 | $ | 120,288 | $ | 356,742 | $ | 368,461 | |||||||||||||||||||

Conference Call to be Broadcast over the Internet

IDEX will broadcast its third quarter earnings conference call over the Internet on Wednesday, October 27, 2021 at 9:30 a.m. CT. Chief Executive Officer and President Eric Ashleman and Senior Vice President and Chief Financial Officer William Grogan will discuss the Company’s recent financial performance and respond to questions from the financial analyst community. IDEX invites interested investors to listen to the call and view the accompanying slide presentation, which will be carried live on its website at www.idexcorp.com. Those who wish to participate should log on several minutes before the discussion begins. After clicking on the presentation icon, investors should follow the instructions to ensure their systems are set up to hear the event and view the presentation slides, or download the correct applications at no charge. Investors will also be able to hear a replay of the call by dialing 877.660.6853 (or 201.612.7415 for international participants) using the ID #13712091.

Forward-Looking Statements

This news release contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements may relate to, among other things, the Company’s expected organic sales growth and expected earnings per share, and the assumptions underlying these expectations, plant and equipment capacity for future growth, anticipated future acquisition behavior, availability of cash and financing alternatives and the anticipated benefits of the Company’s acquisitions of ABEL Pumps and Airtech, and are indicated by words or phrases such as “anticipates,” “estimates,” “plans,” “guidance,” “expects,” “projects,” “forecasts,” “should,” “could,” “will,” “management believes,” “the Company believes,” “the Company intends” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this news release. The risks and uncertainties include, but are not limited to, the following: the duration of the COVID-19 pandemic and the continuing effects of the COVID-19 pandemic (including the emergence of variant strains) on our ability to operate our business and facilities, on our customers, on supply chains and on the U.S. and global economy generally; economic and political consequences resulting from terrorist attacks and wars; levels of industrial activity and economic conditions in the U.S. and other countries around the world; pricing pressures and other competitive factors and levels of capital spending in certain industries, all of which could have a material impact on order rates and the Company's results; the Company's ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the Company operates; developments with respect to trade policy and tariffs; interest rates; capacity utilization and the effect this has on costs; labor markets; supply chain backlogs, including risks affecting component availability, labor inefficiencies, and freight logistical challenges; market conditions and material costs; and developments with respect to contingencies, such as litigation and environmental matters. Additional factors that could cause actual results to differ materially from those reflected in the forward-looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included in the Company’s most recent annual report on Form 10-K and the Company's subsequent quarterly reports filed with the SEC as well as the other risks discussed in the Company’s filings with the SEC. The forward-looking statements included here are only made as of the date of this news release, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here.

About IDEX

IDEX (NYSE: IEX) is a company that has undoubtedly touched your life in some way. In fact, IDEX businesses make thousands of products that are mission-critical components in everyday activities. Chances are the car you’re driving has a BAND-IT® clamp holding your side airbag safely in place. If you were ever in a car accident, a Hurst Jaws of Life® rescue tool may have saved your life. If you or a family member is battling cancer, your doctor may have tested your DNA in a quest to find the best targeted medicine for you. It’s likely your DNA test was run on equipment that contains components made by our IDEX Health & Science team. Founded in 1988 with three small, entrepreneurial manufacturing companies, we’re proud to say that we now call over 40 diverse businesses around the world part of the IDEX family. With more than 7,000 employees and manufacturing operations in more than 20 countries,

IDEX is a high-performing, global company with nearly $2.5 billion in sales, committed to making trusted solutions that improve lives. IDEX shares are traded on the New York Stock Exchange under the symbol “IEX”.

For further information on IDEX Corporation and its business units, visit the company’s website at www.idexcorp.com.

(Financial reports follow)

IDEX CORPORATION

Condensed Consolidated Statements of Operations

(in thousands except per share amounts)

(unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Net sales | $ | 712,019 | $ | 581,113 | $ | 2,050,002 | $ | 1,736,824 | |||||||||||||||

| Cost of sales | 400,450 | 329,613 | 1,139,738 | 978,568 | |||||||||||||||||||

| Gross profit | 311,569 | 251,500 | 910,264 | 758,256 | |||||||||||||||||||

| Selling, general and administrative expenses | 147,180 | 117,370 | 426,708 | 369,750 | |||||||||||||||||||

| Restructuring expenses and asset impairments | 3,204 | 2,917 | 8,568 | 6,758 | |||||||||||||||||||

| Operating income | 161,185 | 131,213 | 474,988 | 381,748 | |||||||||||||||||||

| Other expense (income) - net | 630 | (704) | 16,957 | 7,321 | |||||||||||||||||||

| Interest expense | 9,498 | 10,642 | 31,479 | 33,958 | |||||||||||||||||||

| Income before income taxes | 151,057 | 121,275 | 426,552 | 340,469 | |||||||||||||||||||

| Provision for income taxes | 35,343 | 17,427 | 95,987 | 63,759 | |||||||||||||||||||

| Net income | $ | 115,714 | $ | 103,848 | $ | 330,565 | $ | 276,710 | |||||||||||||||

| Net loss attributable to noncontrolling interest | 28 | — | 80 | — | |||||||||||||||||||

| Net income attributable to IDEX | $ | 115,742 | $ | 103,848 | $ | 330,645 | $ | 276,710 | |||||||||||||||

| Earnings per Common Share: | |||||||||||||||||||||||

| Basic earnings per common share attributable to IDEX | $ | 1.52 | $ | 1.38 | $ | 4.35 | $ | 3.66 | |||||||||||||||

| Diluted earnings per common share attributable to IDEX | $ | 1.51 | $ | 1.37 | $ | 4.33 | $ | 3.64 | |||||||||||||||

| Share Data: | |||||||||||||||||||||||

| Basic weighted average common shares outstanding | 76,010 | 75,352 | 75,957 | 75,423 | |||||||||||||||||||

| Diluted weighted average common shares outstanding | 76,452 | 75,960 | 76,408 | 76,119 | |||||||||||||||||||

IDEX CORPORATION

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

| September 30, 2021 | December 31, 2020 | ||||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | $ | 806,497 | $ | 1,025,851 | |||||||

| Receivables - net | 366,779 | 293,146 | |||||||||

| Inventories | 353,924 | 289,910 | |||||||||

| Other current assets | 56,161 | 48,324 | |||||||||

| Total current assets | 1,583,361 | 1,657,231 | |||||||||

| Property, plant and equipment - net | 314,631 | 298,273 | |||||||||

| Goodwill and intangible assets | 2,810,450 | 2,311,137 | |||||||||

| Other noncurrent assets | 146,137 | 147,757 | |||||||||

| Total assets | $ | 4,854,579 | $ | 4,414,398 | |||||||

| Liabilities and equity | |||||||||||

| Current liabilities | |||||||||||

| Trade accounts payable | $ | 175,864 | $ | 151,993 | |||||||

| Accrued expenses | 252,092 | 208,828 | |||||||||

| Short-term borrowings | 35 | 88 | |||||||||

| Dividends payable | 41,117 | 38,149 | |||||||||

| Total current liabilities | 469,108 | 399,058 | |||||||||

| Long-term borrowings | 1,190,078 | 1,044,354 | |||||||||

| Other noncurrent liabilities | 469,110 | 430,660 | |||||||||

| Total liabilities | 2,128,296 | 1,874,072 | |||||||||

| Shareholders' equity | 2,726,245 | 2,540,203 | |||||||||

| Noncontrolling interest | 38 | 123 | |||||||||

| Total equity | 2,726,283 | 2,540,326 | |||||||||

| Total liabilities and equity | $ | 4,854,579 | $ | 4,414,398 | |||||||

IDEX CORPORATION

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| Nine Months Ended September 30, | |||||||||||

| 2021 | 2020 | ||||||||||

| Cash flows from operating activities | |||||||||||

| Net income | $ | 330,565 | $ | 276,710 | |||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Asset impairments | 815 | 85 | |||||||||

| Depreciation and amortization | 32,281 | 30,851 | |||||||||

| Amortization of intangible assets | 40,681 | 31,123 | |||||||||

| Amortization of debt issuance expenses | 1,354 | 1,351 | |||||||||

| Share-based compensation expense | 18,575 | 21,155 | |||||||||

| Deferred income taxes | (7,070) | 1,323 | |||||||||

| Non-cash interest expense associated with forward starting swaps | 3,275 | 5,153 | |||||||||

| Termination of the U.S. pension plan | 9,688 | — | |||||||||

| Changes in (net of the effect from acquisitions/divestitures): | |||||||||||

| Receivables | (59,249) | 33,291 | |||||||||

| Inventories | (28,072) | 17,920 | |||||||||

| Other current assets | 6,041 | (27,655) | |||||||||

| Trade accounts payable | 20,962 | (11,496) | |||||||||

| Deferred revenue | 14,817 | 27,179 | |||||||||

| Accrued expenses | 17,595 | 125 | |||||||||

| Other - net | (29) | 784 | |||||||||

| Net cash flows provided by operating activities | 402,229 | 407,899 | |||||||||

| Cash flows from investing activities | |||||||||||

| Purchases of property, plant and equipment | (45,487) | (39,438) | |||||||||

| Acquisition of businesses, net of cash acquired | (575,606) | (118,159) | |||||||||

| Note receivable from collaborative partner | (4,200) | — | |||||||||

| Proceeds from disposal of fixed assets | 250 | 2,230 | |||||||||

| Other - net | 874 | (238) | |||||||||

| Net cash flows used in investing activities | (624,169) | (155,605) | |||||||||

| Cash flows from financing activities | |||||||||||

| Borrowings under revolving credit facilities | — | 150,000 | |||||||||

| Proceeds from issuance of 3.00% Senior Notes | — | 499,100 | |||||||||

| Proceeds from issuance of 2.625% Senior Notes | 499,380 | — | |||||||||

| Payment of 4.50% Senior Notes | — | (300,000) | |||||||||

| Payment of 4.20% Senior Notes | (350,000) | — | |||||||||

| Payments under revolving credit facilities | — | (150,000) | |||||||||

| Payment of make-whole redemption premium | (6,659) | (6,756) | |||||||||

| Debt issuance costs | (4,626) | (4,741) | |||||||||

| Dividends paid | (120,289) | (114,248) | |||||||||

| Proceeds from stock option exercises | 12,497 | 28,729 | |||||||||

| Repurchases of common stock | — | (110,342) | |||||||||

| Shares surrendered for tax withholding | (5,680) | (12,198) | |||||||||

| Other - net | (74) | (352) | |||||||||

| Net cash flows provided by (used in) financing activities | 24,549 | (20,808) | |||||||||

| Effect of exchange rate changes on cash and cash equivalents | (21,963) | 13,691 | |||||||||

| Net (decrease) increase in cash | (219,354) | 245,177 | |||||||||

| Cash and cash equivalents at beginning of year | 1,025,851 | 632,581 | |||||||||

| Cash and cash equivalents at end of period | $ | 806,497 | $ | 877,758 | |||||||

IDEX CORPORATION

Company and Segment Financial Information - Reported

(dollars in thousands)

(unaudited)

Three Months Ended September 30, (a) | Nine Months Ended September 30, (a) | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Fluid & Metering Technologies | ||||||||||||||||||||||||||

| Net sales | $ | 251,297 | $ | 220,747 | $ | 745,939 | $ | 666,720 | ||||||||||||||||||

Operating income (b) | 69,020 | 58,402 | 195,384 | 176,111 | ||||||||||||||||||||||

| Operating margin | 27.5 | % | 26.5 | % | 26.2 | % | 26.4 | % | ||||||||||||||||||

EBITDA(c) | $ | 76,373 | $ | 66,284 | $ | 212,159 | $ | 195,516 | ||||||||||||||||||

EBITDA margin(c) | 30.4 | % | 30.0 | % | 28.4 | % | 29.3 | % | ||||||||||||||||||

| Depreciation and amortization | $ | 7,737 | $ | 7,163 | $ | 22,743 | $ | 19,370 | ||||||||||||||||||

| Capital expenditures | 4,644 | 2,452 | 12,928 | 8,774 | ||||||||||||||||||||||

| Health & Science Technologies | ||||||||||||||||||||||||||

| Net sales | $ | 302,287 | $ | 220,378 | $ | 827,668 | $ | 660,105 | ||||||||||||||||||

Operating income (b) | 70,374 | 49,912 | 212,987 | 150,562 | ||||||||||||||||||||||

| Operating margin | 23.3 | % | 22.6 | % | 25.7 | % | 22.8 | % | ||||||||||||||||||

EBITDA(c) | $ | 85,945 | $ | 60,174 | $ | 251,659 | $ | 181,459 | ||||||||||||||||||

EBITDA margin(c) | 28.4 | % | 27.3 | % | 30.4 | % | 27.5 | % | ||||||||||||||||||

| Depreciation and amortization | $ | 15,335 | $ | 10,230 | $ | 38,382 | $ | 30,806 | ||||||||||||||||||

| Capital expenditures | 8,645 | 10,558 | 27,339 | 20,842 | ||||||||||||||||||||||

| Fire & Safety/Diversified Products | ||||||||||||||||||||||||||

| Net sales | $ | 159,106 | $ | 140,896 | $ | 479,402 | $ | 412,296 | ||||||||||||||||||

Operating income (b) | 39,126 | 37,103 | 126,483 | 103,977 | ||||||||||||||||||||||

| Operating margin | 24.6 | % | 26.3 | % | 26.4 | % | 25.2 | % | ||||||||||||||||||

EBITDA(c) | $ | 42,863 | $ | 40,617 | $ | 136,160 | $ | 115,238 | ||||||||||||||||||

EBITDA margin(c) | 26.9 | % | 28.8 | % | 28.4 | % | 28.0 | % | ||||||||||||||||||

| Depreciation and amortization | $ | 3,787 | $ | 3,854 | $ | 11,510 | $ | 11,409 | ||||||||||||||||||

| Capital expenditures | 1,365 | 2,340 | 4,524 | 6,534 | ||||||||||||||||||||||

| Corporate Office and Eliminations | ||||||||||||||||||||||||||

| Intersegment sales eliminations | $ | (671) | $ | (908) | $ | (3,007) | $ | (2,297) | ||||||||||||||||||

Operating income (b) | (17,335) | (14,204) | (59,866) | (48,902) | ||||||||||||||||||||||

EBITDA(c) | (17,657) | (13,807) | (68,985) | (55,812) | ||||||||||||||||||||||

Depreciation and amortization (d) | 110 | 104 | 327 | 389 | ||||||||||||||||||||||

| Capital expenditures | 240 | 3,003 | 696 | 3,288 | ||||||||||||||||||||||

| Company | ||||||||||||||||||||||||||

| Net sales | $ | 712,019 | $ | 581,113 | $ | 2,050,002 | $ | 1,736,824 | ||||||||||||||||||

| Operating income | 161,185 | 131,213 | 474,988 | 381,748 | ||||||||||||||||||||||

| Operating margin | 22.6 | % | 22.6 | % | 23.2 | % | 22.0 | % | ||||||||||||||||||

EBITDA(c) | $ | 187,524 | $ | 153,268 | $ | 530,993 | $ | 436,401 | ||||||||||||||||||

EBITDA margin(c) | 26.3 | % | 26.4 | % | 25.9 | % | 25.1 | % | ||||||||||||||||||

Depreciation and amortization (d) | $ | 26,969 | $ | 21,351 | $ | 72,962 | $ | 61,974 | ||||||||||||||||||

| Capital expenditures | 14,894 | 18,353 | 45,487 | 39,438 | ||||||||||||||||||||||

IDEX CORPORATION

Company and Segment Financial Information - Adjusted

(dollars in thousands)

(unaudited)

Three Months Ended September 30, (a) | Nine Months Ended September 30, (a) | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Fluid & Metering Technologies | ||||||||||||||||||||||||||

| Net sales | $ | 251,297 | $ | 220,747 | $ | 745,939 | $ | 666,720 | ||||||||||||||||||

Adjusted operating income (b)(c) | 70,954 | 58,987 | 202,657 | 182,651 | ||||||||||||||||||||||

Adjusted operating margin(c) | 28.2 | % | 26.7 | % | 27.2 | % | 27.4 | % | ||||||||||||||||||

Adjusted EBITDA(c) | $ | 78,307 | $ | 66,869 | $ | 225,725 | $ | 202,056 | ||||||||||||||||||

Adjusted EBITDA margin(c) | 31.2 | % | 30.3 | % | 30.3 | % | 30.3 | % | ||||||||||||||||||

| Depreciation and amortization | $ | 7,737 | $ | 7,163 | $ | 22,743 | $ | 19,370 | ||||||||||||||||||

| Capital expenditures | 4,644 | 2,452 | 12,928 | 8,774 | ||||||||||||||||||||||

| Health & Science Technologies | ||||||||||||||||||||||||||

| Net sales | $ | 302,287 | $ | 220,378 | $ | 827,668 | $ | 660,105 | ||||||||||||||||||

Adjusted operating income (b)(c) | 80,100 | 50,890 | 223,780 | 152,724 | ||||||||||||||||||||||

Adjusted operating margin(c) | 26.5 | % | 23.1 | % | 27.0 | % | 23.1 | % | ||||||||||||||||||

Adjusted EBITDA(c) | $ | 95,671 | $ | 61,152 | $ | 262,452 | $ | 183,621 | ||||||||||||||||||

Adjusted EBITDA margin(c) | 31.6 | % | 27.7 | % | 31.7 | % | 27.8 | % | ||||||||||||||||||

| Depreciation and amortization | $ | 15,335 | $ | 10,230 | $ | 38,382 | $ | 30,806 | ||||||||||||||||||

| Capital expenditures | 8,645 | 10,558 | 27,339 | 20,842 | ||||||||||||||||||||||

| Fire & Safety/Diversified Products | ||||||||||||||||||||||||||

| Net sales | $ | 159,106 | $ | 140,896 | $ | 479,402 | $ | 412,296 | ||||||||||||||||||

Adjusted operating income (b)(c) | 39,071 | 38,352 | 126,644 | 105,867 | ||||||||||||||||||||||

Adjusted operating margin(c) | 24.6 | % | 27.2 | % | 26.4 | % | 25.7 | % | ||||||||||||||||||

Adjusted EBITDA(c) | $ | 42,808 | $ | 41,866 | $ | 138,103 | $ | 117,128 | ||||||||||||||||||

Adjusted EBITDA margin(c) | 26.9 | % | 29.7 | % | 28.8 | % | 28.4 | % | ||||||||||||||||||

| Depreciation and amortization | $ | 3,787 | $ | 3,854 | $ | 11,510 | $ | 11,409 | ||||||||||||||||||

| Capital expenditures | 1,365 | 2,340 | 4,524 | 6,534 | ||||||||||||||||||||||

| Corporate Office and Eliminations | ||||||||||||||||||||||||||

| Intersegment sales eliminations | $ | (671) | $ | (908) | $ | (3,007) | $ | (2,297) | ||||||||||||||||||

Adjusted operating income (b)(c) | (17,036) | (14,099) | (54,439) | (48,629) | ||||||||||||||||||||||

Adjusted EBITDA(c) | (17,358) | (13,702) | (53,384) | (47,118) | ||||||||||||||||||||||

Depreciation and amortization(d) | 110 | 104 | 327 | 389 | ||||||||||||||||||||||

| Capital expenditures | 240 | 3,003 | 696 | 3,288 | ||||||||||||||||||||||

| Company | ||||||||||||||||||||||||||

| Net sales | $ | 712,019 | $ | 581,113 | $2,050,002 | $1,736,824 | ||||||||||||||||||||

Adjusted operating income(c) | 173,089 | 134,130 | 498,642 | 392,613 | ||||||||||||||||||||||

Adjusted operating margin(c) | 24.3 | % | 23.1 | % | 24.3 | % | 22.6 | % | ||||||||||||||||||

Adjusted EBITDA(c) | $ | 199,428 | $ | 156,185 | $ | 572,896 | $ | 455,687 | ||||||||||||||||||

Adjusted EBITDA margin(c) | 28.0 | % | 26.9 | % | 27.9 | % | 26.2 | % | ||||||||||||||||||

Depreciation and amortization (d) | $ | 26,969 | $ | 21,351 | $ | 72,962 | $ | 61,974 | ||||||||||||||||||

| Capital expenditures | 14,894 | 18,353 | 45,487 | 39,438 | ||||||||||||||||||||||

| (a) | Three and nine month data includes the results of both the ABEL Pumps acquisition (March 2021) and the Flow MD acquisition (February 2020) in the Fluid & Metering Technologies segment and the Airtech acquisition (June 2021) in the Health & Science Technologies segment from the date of acquisition. Three and nine month data also includes the results of CiDRA Precision Services (March 2021) in the Health & Science Technologies segment through the date of disposition. | |||||||||||||||||||||||||

| (b) | Segment operating income excludes unallocated corporate operating expenses which are included in Corporate Office and Eliminations. | |||||||||||||||||||||||||

| (c) | These are non-GAAP financial measures. For a reconciliation of these non-GAAP financial measures to their most comparable measure calculated and presented in accordance with GAAP, see the reconciliation tables above. | |||||||||||||||||||||||||

| (d) | Depreciation and amortization excludes amortization of debt issuance costs and debt discounts. | |||||||||||||||||||||||||