IEX-2015.04.23-EX99.2

EX 99.2

IDEX Corporation First Quarter 2015 Earnings Call

April-21-2015

Confirmation # 13598710

IDEX CORPORATION

First Quarter 2015 Earnings Call

April-21-2015

Confirmation #13598710

Operator: Greetings and welcome to the First Quarter 2015 IDEX Corporation Earnings conference call. At this time, all participants are in a listen-only mode. A brief question and answer session will follow the formal presentation. If anyone should require Operator assistance during the conference, please push star, zero on your telephone keypad. As a reminder, this conference is being recorded.

It is now my pleasure to introduce your host, Mr. Michael Yates, Vice President and Chief Accounting Officer for IDEX Corporation. Thank you, Mr. Yates, you may begin.

Michael Yates: Great. Thank you, Adam. Good morning, everyone. This is Michael Yates, Vice President and Chief Accounting Officer for IDEX Corporation. Thank you for joining us for our discussion of the IDEX first quarter financial highlights. Last night, we issued a press release outlining our Company’s financial and operating performance for the three-month period ending March 31, 2015. The press release, along with the presentation slides to be used during today’s webcast, can be accessed on our Company’s website at www.idexcorp.com.

Joining me today is Andy Silvernail, our Chairman and CEO, and Heath Mitts, our Chief Financial Officer. The format for our call today is as follows: We will begin with Andy providing an update on what we are seeing in the world and then he will review the first quarter financial results. He will then walk you through the operating performance within each of our segments. Finally, we will wrap up with an outlook for the second quarter and the full year 2015. Following our prepared remarks, we’ll then open the call for your questions.

If you should need to exit the call for any reason, you may access a complete replay beginning approximately two hours after the call concludes by dialing this toll free number, 877-660-6853 and entering Conference ID 13598710, or you simply may log on to our Company’s home page for the webcast replay.

As we begin, a brief reminder. This call may contain certain forward-looking statements that are subject to the Safe Harbor language in today’s press release and in IDEX’s filings with the Securities and Exchange Commission. With that, I’ll now turn the call over to our Chairman and CEO, Andy Silvernail.

Andrew Silvernail: Thanks, Mike. Hey, good morning, everybody. I appreciate you joining us here for our first quarter conference call in 2015.

As we look at the first quarter, really, the conversation has been dominated by some of the bigger issues that are floating around the macro environment, obviously the strength of the dollar, the fall in oil prices and what I’d call a continuing overall slow economic environment. With those items as a backdrop, I’m very proud of the quarter that we just delivered. We just delivered $0.87 in earnings with an op margin of 20.3%. We

had 2% organic order growth, and we built $22 million of backlog. We had organic sales and op margin improvement in Fluid & Metering, and in Health & Science, we had organic order growth and really outstanding profit execution and improving operating margin.

We foresaw a lot of the issues that we’re all living with right now last year. We took very aggressive cost actions in the back end of the year and it certainly has prepared us for the environment that we’re in and I think, again, our ability to get ahead of the curve with some challenging items. We all know that we had these discrete comps that we were comparing against here this year, with the dispensing in particular and the macro environment that I just mentioned. But we did some, I’d say some decline here in the overall environment as we moved through the second quarter, and I’ll talk about this in more detail in the segment review, but the combination of the agricultural market thus being slower, the increasing impact of the dollar and while we’ve seen some slowdown in some large capital projects, are going to hit us by about $0.15 compared to what we talked about here in the first quarter, excuse me, in the fourth quarter, and so we’ve revised our guidance to 3.50 to 3.60.

As always, we are very focused on controlling our own destiny. We can’t control the overall macro environment and what you’ll see in this quarter and what you’ll see for the balance of the year is outstanding execution on the profit side, with a real focus on our key products and our key customers. Our core business remains very solid and we are focused on delivering for our customers with real world class execution, and so as I walk through the items here in the first quarter call, I will certainly highlight those pieces of that.

Before we get into the segment discussion, let me just talk about what we’re seeing around the world and also around capital deployment. In North America, as I mentioned, the ag markets and the energy markets, as we all know, have been soft, but that said, our daily book and term business remains solid and we expect it to be so throughout the year. The one thing that I do think is a little bit different than when we talked to you here a quarter ago is that we have seen some slowdown on the capital side, capital spending, and we’re keeping a pretty close eye on that. It’s not widespread at this time. It’s really focused around our material process business and in the energy-facing markets, but we are certainly paying attention to it.

Europe remains a tough slog generally but we did see a modest pickup here, specifically in our businesses that touch the municipal markets, and we saw that in China too. But we did a slight uptick. I certainly wouldn’t call it a sustained improvement, but we did see a modest uptick. China, as I mentioned a moment ago, the reported numbers that we all see, they really don’t show themselves on the industrial side. With the exception of the municipal markets which have improved, the China markets really remain consistent with what we’ve seen here for the last year or so.

With that, let me turn to capital deployment. We have talked about a very balanced capital deployment plan with four pillars to our plan that remain unchanged. The first is we are always going to fully invest in organic growth, and we’ve continued to make meaningful investments around our core products and our core customers. I’ll touch on some of those as we move through the segment discussion, and we do think that will continue to allow us to differentiate over time and continue to really go after the most attractive profit pools in our markets and our customers.

You saw on April 8th we increased our dividend by 14% at $0.32 a share. We are committed to being kind of in that 30% range. We’re a little bit higher than we have historically been right now, but with our outstanding cash flows and our great balance sheet, we thought that was a prudent move.

In terms of share repurchases, we would expect that we’ll be kind of net 2, 3% this year as we move through the year, and in the first quarter, we repurchased 830,000 shares at a cost of $62 million.

The final pillar to our capital deployment plan is strategic M&A, and this continues to be a very important part of our overall capital deployment strategy and our business strategy. You saw yesterday that we assigned the agreement to acquire Novotema. We have been talking to Novotema for over a year, and as a matter of fact, we’ve looked at this business a couple of times over time and we finally were able to get an agreement signed. We expect it will close in the neighborhood of 45 days pending regulatory approval. This is an outstanding business. It fits squarely within our precision sealing platform. It marries the materials capability of PPE with some really outstanding manufacturing capability within Novotema, and as a matter of fact, we had been in partnership with them, touching a number of end markets before we agreed to acquire the business.

We paid-we’re going to pay €57 million. It’s about a €30 million in sales, highly profitable and after the impact of kind of typical acquisition-related cost, it will be accretive out of the gate. Please keep in mind that our guidance for the balance of the year does not include any of the cost or the benefits of Novotema.

As you look at the rest of our M&A pipeline, it really is quite strong and I wouldn’t say it’s any change necessarily in the markets but a lot of the hard work we’ve been doing here for a long time is coming forward, and as I talked about in the last call, we have-we expect to spend north of $250 million this year and we remain committed to that bogey (ph).

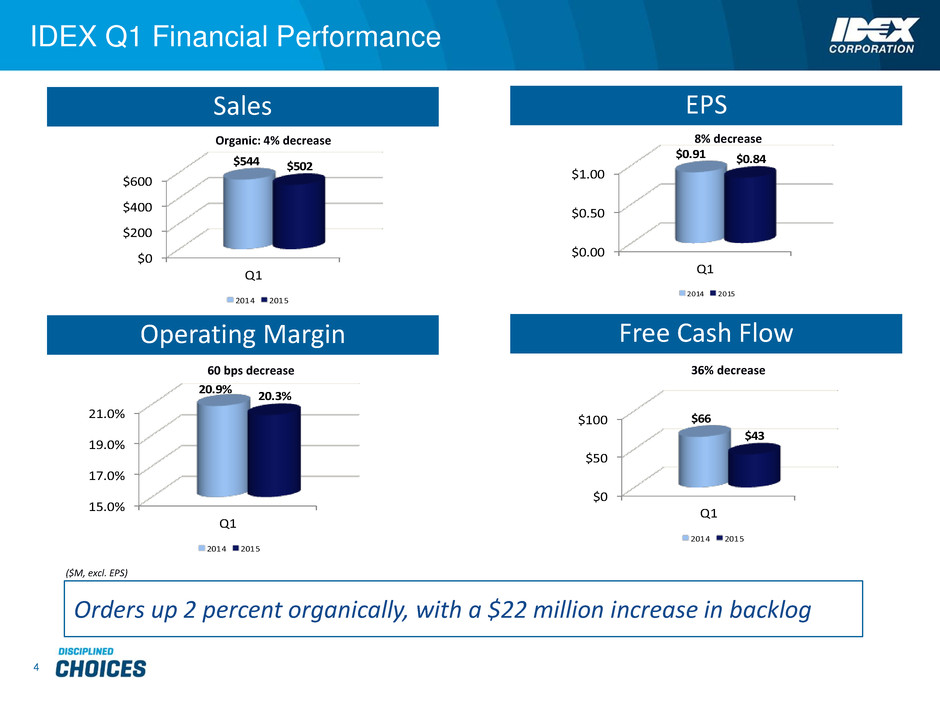

With that, let’s move to Slide 4 and we’ll talk about the overall financial performance. Orders were $524 million. That was down 2% but it was up 2% organically and we had improvement in all three segments. We had revenue of $502 million, which is down 8%, down 4% organically, and we had op margins that were down 60 basis points at 20.3%. Obviously we’ve been talking for a long time about how the first quarter would shape up and the fact it was a very difficult comp. As you know, we had the majority of that large dispensing order fulfilled in the first quarter of last year, and so that makes certainly for very difficult sales comps but also margin comps because, as you can imagine, that flows through at a nice profit level.

Cash flow for the quarter was $43 million. That was down 14 million from last year but it really is impacted by principally, a retirement-or, excuse me, a pension payment that typically falls in the second quarter and it happened to fall in the first quarter this year. So on an operational basis, we’re very much in line with our expectations. Finally, EPS for the quarter was $0.84 and that was down 8% compared to last year.

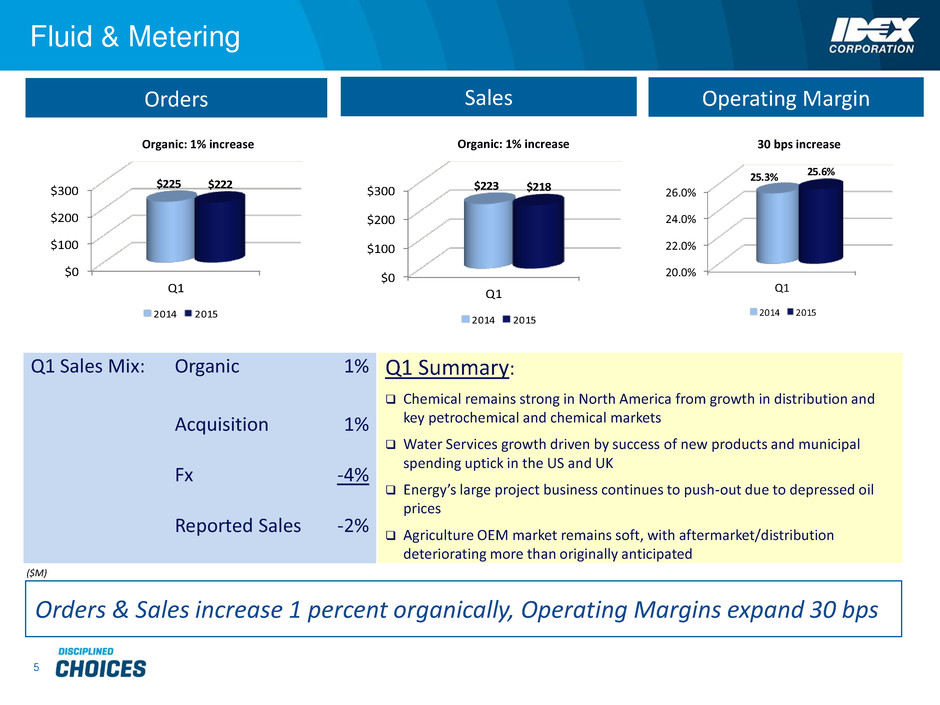

With that, let’s turn to the segment discussion. I’m on Slide 5 and I’ll start with Fluid & Metering. So FMT closed the quarter at a 1% increase in organic orders and a 1% increase in organic sales. The improved op margin by 30 basis points, again, just really good execution across the board and the impact of the restructuring actions that we took in the balance of last year. The chemical markets, petrochemical and the chemical markets remained consistently strong in Europe and North America. We’re optimistic throughout this year. We see through our distribution and through the pipeline of business that that should remain solid for us through the balance of 2015.

In particular, Viking has just done a great job. The team at Viking in terms of sales, profit execution, customer intimacy, they’ve really been nailing it here for quite some time and did so again here in the first quarter. Water services, again, I mentioned the improvement in the municipal business, really globally, and we’re seeing that in water services but on a discrete basis, the Rovion system that we launched in our iPEK business has been a real winner for us and a great example of our investments in organic growth and they’ve taken nice chunks of market share and it really shows what you do when you focus on driving great products.

Energy, our midstream business is pretty good from a book and term basis. It’s really the large capital stuff that’s closer to the wellhead that has been down really on a global basis, and that’s going to be throughout

the balance of this year. Not a surprise to us and that team is certainly managing their business for that new demand pattern.

Finally, ag. I would say this is one place that did surprise us a little bit in the first quarter. We knew that the ag market was soft. We had been preparing for that, but we did see even a more rapid decline in the OEM ag business than we had expected. The overall distribution business and the industrial business remains good and I think it’s important to remember that Banjo has just been a great performer for us for years, it’s a terrific business, highly profitable and they’ll manage their way through what we all expected and certainly will turn at some point here. But it should be-it will be a challenge for the balance of the year.

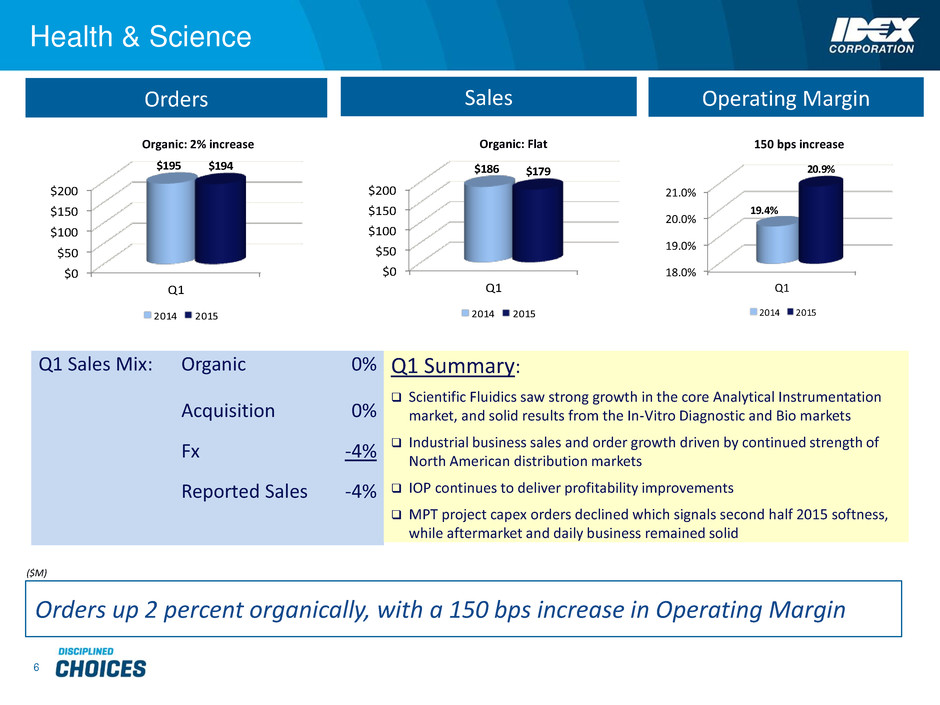

With that, let’s go to Slide 6 on to Health & Science. We had 2% organic order growth in the quarter. Organic sales were flat. But really just outstanding profit execution, up 150 basis points, improvements in productivity, great job of really going after the most attractive profit pools with new products and also the benefits of the restructuring that we went after last year. Scientific fluidics, in particular the analytical instrumentation market, remains good and we expect it to be so for the balance of the year. They came into the year with a nice backlog, and they go into the second quarter, again in a nice position.

Optics and photonics remain stable, terrific profit execution. As we’ve talked about in the last quarter, this business is now, from a profitability standpoint, where we expected it to be and demand remains stable. Industrial, the book and term business is good, so the more industrial-facing pieces of HST remains pretty good, and we expect it will be for the balance of the year.

The concerning spot for us is really material process technologies. As you know, this is a longer cycle business, more exposed to capital projects and we did see a weak quarter in orders and sales and given our visibility, we know how that will play out through the balance of the year in terms of overall sales, and so we have a pretty good mark on where that will land for the year.

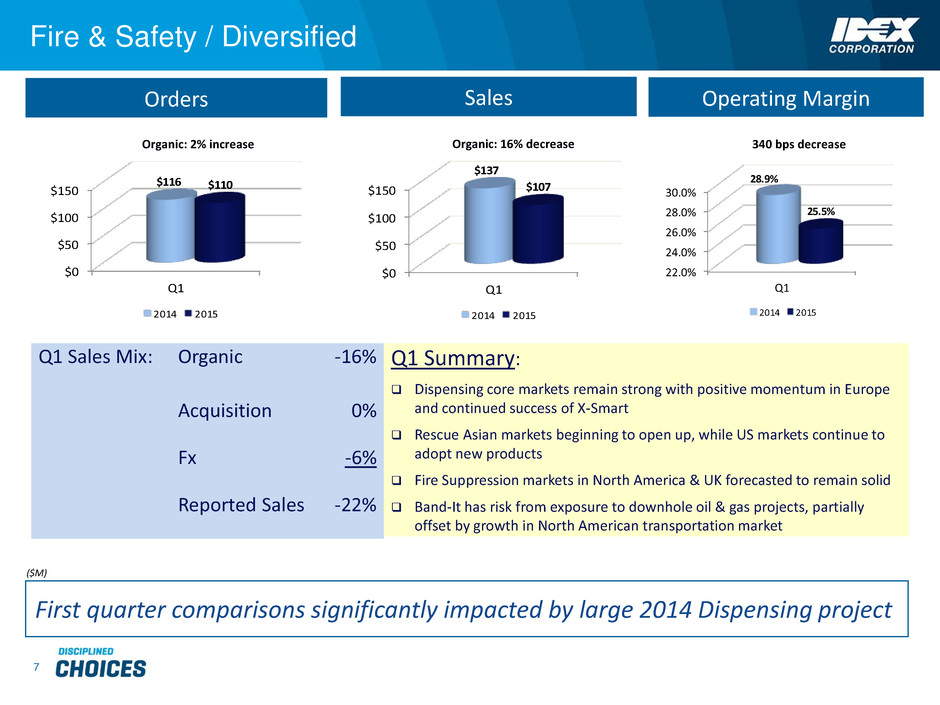

Let’s go to our last segment, that’s Diversified-I’m on Slide 7. So organic orders were up 2% and, as you all know, we expected substantial headwind on the sales front, which is down 16% organically, and of course, that flows itself through as it impacts the margin from that large dispensing order, so op margins were down 340 basis points but down from a really incredible level last year. So we’re still north of 25% in that business.

So we’ve talked a lot about the large dispensing order; don’t need to go through that again. But as you look past that, you see continuing, really a strong business profile there. Europe has gotten better in the dispensing business and the X-Smart product that we launched here a couple of years ago continues to really be a juggernaut for us. It’s been a great new product and like the Rovion, a great example of investing in core products for businesses, markets that we know well and great execution.

Fire suppression, the-North America and the UK are solid, no indicators of softness there. China has been a little bit soft but we are expecting that to pick up here as we look through the balance of the year with some of the improvement in municipal spending. Rescue, we’ve actually got some nice momentum. We talked about last year really that being a soft spot for us and first time in a long time that that business had not seen the kind of robust growth that we were used to. We’ve seen some momentum here in the first quarter and as we look in the pipeline, whether it’s in North America because of the success of eDRAULIC or some of the turnaround in the Asian markets, we’re seeing some improvement there.

The concern, and this is a rarity for us, has been Band-It. Band-It is one of our businesses that has a decent exposure to oil and gas and they have been hit by that. Their industrial business, their kind of book and term business remains good, but they have been impacted and the one thing I certainly know about the Band-It

business is they know how to perform regardless of the market, and we expect them to turn that around as we move through the year.

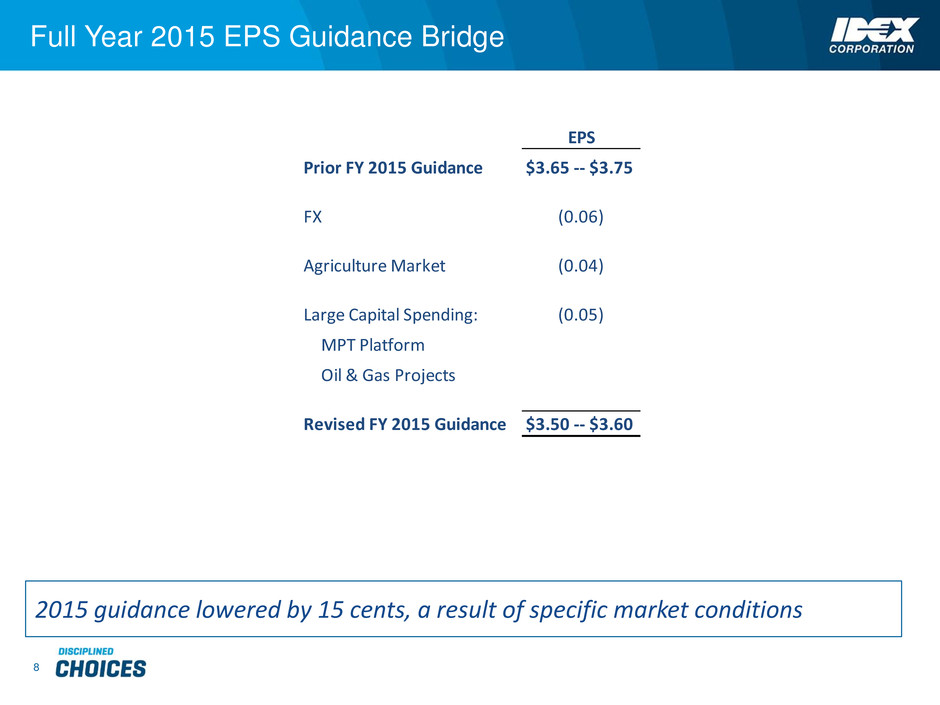

All right, let’s go to Slide 8 and let’s talk about guidance. As I stated before, we are revising our guidance for the year to 3.50 to 3.60, and I want to walk you through kind of the discrete pieces of this and, hopefully, that’ll help you out here as you think about how we’re considering the guidance. The first is really the impact of the dollar, so versus where we were in the fourth quarter call to where we are now, that’s about a $0.06 headwind for us through the balance of the year, and in total, it is about $0.21 for the full year. So obviously from a top line standpoint, we thought that the change in the dollar was going to hit us by about $85 million and now it’s going to hit us somewhere in the $110 million range at current FX rates, and that’s-that flows through at kind of 20-ish percent, plus or minus. It’s mostly translational impact-well, it’s all translational impact but obviously, that’s a big headwind as we look through the balance of the year.

Ag, just given the very high profitability of Banjo and where that’s playing out, that’s going to hit us by about $0.04 incrementally through the balance of the year, and as we look at these large projects, whether it’s material process or some of the more energy-facing, that’s about $0.05, and so again, in total, it’s about $0.15 compared to where we were at the fourth quarter.

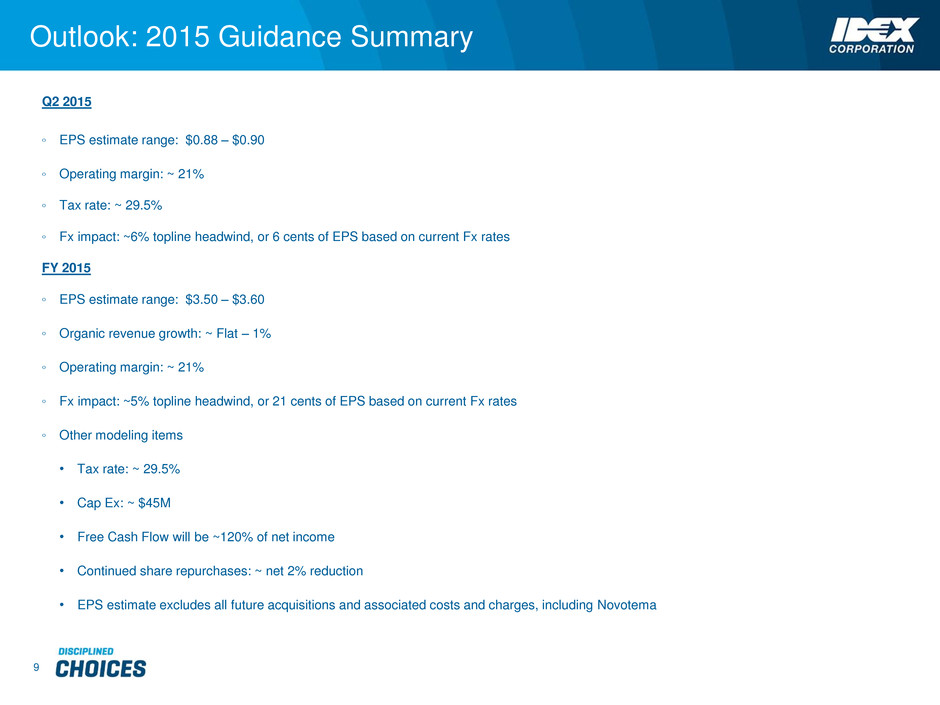

All right, let me go to the final slide here, Slide 9, and let’s reconcile the second quarter and some of the final items. So in the second quarter, we expect earnings of $0.88 to $0.90 and op margin of about 21%. That compares to $0.88 last year. Tax rate we expect to be about 29.5%, with again about a 6% top line sales headwind from FX, which is about $0.06 just in the quarter versus last year.

Here’s a couple of other items for you as you think about your modeling. I would expect op margin to be about 21% for the year. Top line, as I mentioned before, will be impacted by about $110 million versus 85 million that we talked about before, and again, about $0.21 of EPS pressure. Full year cap ex, still in the $45 million range. We expect free cash flow will be at that 120% that we talked about here at the end of the year, and we should repurchase in the neighborhood of 2 to 3% net shares here for the year.

As I mentioned before and as we always close out, this doesn’t take into account any of the impact of acquisitions, and we will update you here on the second quarter call of all the impact of Novotema. There will be the classic step-up charges, et cetera, that we’ll have, and we’ll net out all the impact for you as this plays on.

With that, Adam, I’m going to stop there and let’s turn it over for questions.

Operator: Thank you very much. Ladies and gentlemen, we will now be conducting a question and answer session. If you would like to ask a question, please push star, one on your telephone keypad now. A confirmation tone will indicate your line is in the question queue. You may push star, two if you would like to remove your question from the queue. For any participant using speaker equipment, it may be necessary to pick up your handset before pushing the star keys. One moment while we poll for questions.

Our first question comes from the line of Matt McConnell with RBC Capital Markets. Please go ahead with your question.

Matt McConnell: Thank you. Good morning, guys.

Andrew Silvernail: Hey, Matt.

Matt McConnell: I’m hoping you can provide a little more clarity on these large project headwinds and it sounds like midstream oil and gas is still kind of holding in pretty well but maybe correct me if I’m wrong there, so it’s uncertainty bleeding into other industrial markets, or is this specific to upstream oil and gas or just maybe a better sense of what these large project headwinds are?

Andrew Silvernail: Sure, sure. So, yes, you’re correct, Matt. The midstream has held in nicely and we expect that will for the balance of the year. The real issue is really the oil and gas side, and again, that’s kind of in line with our expectations. I will say that the capital freeze-and we expected it to be pretty aggressive, but the capital freeze that we’re seeing in the US in particular has been pretty significant, so that’s one area. You know, the other area has been around material process, and that’s more kind of general industrial-facing. A pretty decent amount of that is touching in the world of foods, and so we have seen that hold up a little bit.

We have not seen what I’ll call broad-based capital freeze but whenever you see some of the start to move like this, it raises the red flag, and so we’re paying an awful lot of attention to it. We have all of our businesses paying a lot of attention to it. Historically, we have been able to see slowdowns coming and I wouldn’t necessarily say that we’re there. I don’t want you to get that message at all. I just want you to get the message that we’ve seen a couple of places where it’s slowed down and we want to make sure that we’ve got our antenna up.

Matt McConnell: Okay, great. Yes, that makes sense. I mean, orders weren’t even (inaudible) down in any of the segments, so it certainly seems like you’re staying in front of it. So then on profitability of Novotema, anything you can help us with there? I know you gave us the multiple on sales. Anything on EBITDA?

Andrew Silvernail: Yes. So it’s a very profitable business. From an EBITDA margin, it’s IDEX-like. It’s not going to be dilutive to our margin. Matter of fact, it’s going to be accretive overall. From an EBITDA perspective, it’s a very, very profitable business and the team there, you know, we’ve known this business for a long time and they’ve done a great job of repositioning that business over time to be in more attractive markets and it’s really a wonderful combination between PPE.

So if you remember-and we bought PPE back in 2010, and there are a few things that are really unique about PPE. One of them is they have some really unique capability in material sciences, and so as we were looking at Novotema the question we had is kind of given Novotema strengths in certain end markets and in manufacturing capability, could we marry their great manufacturing and some of their end markets with our material science capability and have the same kind of very quick turnaround for customers, whether it’s new product development or operationally, could we do that? And the answer to that is yes, and so we actually-before we decided to move forward with the acquisition, we actually partnered with them and-to see if we could do this on a commercial basis. So we actually created a commercial partnership around our material science capability, their manufacturing capability and it really was incredibly successful and convinced both parties that this was the right marriage. So we’re excited to have them part of the family.

Matt McConnell: Great. I appreciate that insight. Thank you.

Andrew Silvernail: Thank you.

Operator: Thank you. Our next question comes from the line of Scott Graham with Jefferies. Please go ahead with your question.

Scott Graham: Hey, good morning.

Andrew Silvernail: Hi, Scott.

Scott Graham: So in the interest of getting Heath to say something, my hope is...

Andrew Silvernail: We have no problem with that here.

Scott Graham: My hope is that maybe you guys-and it’s really my only question because I thought your presentation was very clear and that everything made sense. Typically, you go for a certain level of productivity each year, so what do you now need incrementally to that dollar-wise? Is it, you know, $10 million? Could you just size that number for us to offset the sales shortfall?

Heath Mitts: Well, Scott, thanks for giving me my time in the sun here. You know, we are off to a really good start from a productivity perspective this year, and I think that’s reflected in the margins. You see it’s our ability to counteract, going into the quarter, we knew we were going to have the headwind from, year-over-year from the large projects (inaudible) expensing, and our ability to more than offset that and as well as the FX pressure is reflective in the segment operating results. We were very pleased-wouldn’t say pleasantly surprised but very pleased with the performance there. We’ve talked in the past about going into any given year with roughly a $25 million headwind in terms of inflation. Certainly, the material inflation is something that we’re able to hold down a little bit this year in this environment, but the wage inflation is still real, which is the 60% or so of that 25 million. So given all that, we are on track to counteract what our normal productivity, both sourcing and savings as well as op ex type of savings around scrap and overtime reduction and the ability to lever our fixed cost base is still well on track.

Now, in terms of an incremental downtick relative to when we started the year. As you know, we did a fair amount of savings, restructuring savings in the fourth quarter, where we ended up taking out about 15 or $16 million of annualized cost. That certainly has provided some level of protection, and we will consider any additional actions as necessary as we progress through the year, albeit it’s going to be somewhat selective in terms of where and how we would do those things. We don’t want to cut too close to the bone in any one area because we are making strategic organic investments and we don’t want to lose that momentum.

Scott Graham: (Inaudible) good. So essentially, the answer is you’re on track with productivity to offset your normal inflation and the incremental this year is still in the restructuring savings but if necessary, there might be a little bit of upside to that if sales don’t necessarily come through, is that a fair paraphrase?

Heath Mitts: You summarized it well.

Andrew Silvernail: Yes.

Scott Graham: All right.

Andrew Silvernail: Scott, this is Andy. If you kind of dimensionalize all this together, and I don’t think we’ve talked about it like that necessarily, but when you look at FX, you take FX, you take the impact of the large businesses that-or comps from last year those two things together, you’re talking about $35 million of profitability together that we’re comping against, plus the normal 20 to 25 million of just inflation. So you’re talking about the neighborhood of 50 to $60 million of profit comp that we are going to cover, right, as we go through this year, so even with the guidance that we have as we sit here today sometimes we lose sight of the magnitude of the execution, what the teams have done, and it’s damn good.

Scott Graham: Appreciate it, but in continuing to answer my question, Andy, I came up with another question.

Andrew Silvernail: Okay.

Scott Graham: I hope you don’t mind.

Andrew Silvernail: (Cross talking).

Scott Graham: It just kind of hit me, you know, you were talking about the puts and takes and as you’re, you know, weaving that together, how is the pricing component of things right now?

Andrew Silvernail: It’s actually-it’s holding up, right? It’s-I would say, total pricing is a little softer than we saw last year, meaning we’re not getting quite as much, but you’re still talking about call it the 1% range that we’re going to get. We’ve gotten a lot of questions about are we seeing price in oil and gas, and we’re fortunate given kind of where we play in the food chain that we’re not seeing that. I mean, heck, everybody gets a letter that says, “Hey, we want a price reduction,” but given our proprietary positions, whether it’s technology or the switching costs, we’re able to hold up prices pretty well.

Scott Graham: Very good. Thanks, guys.

Andrew Silvernail: Thank you.

Operator: Thank you. Our next question comes from the line of Brian Konigsberg with Vertical Research Partners. Please go ahead with your question.

Brian Konigsberg: Yes, thank you. Good morning.

Andrew Silvernail: Hey, Brian.

Brian Konigsberg: One of my two questions were taken, but I will go on to the question not asked about-so just on FX, can you just talk about how that may be impacting you from a competitive standpoint? Are you-is it becoming more difficult to compete against some of the European players, particularly maybe in HST or maybe if there is other areas in the portfolio that might have that type of dynamic going on?

Andrew Silvernail: So there are puts and takes relative to that competitively we’re pretty fortunate that the vast majority of what we do kind of where-we manufacture where we compete typically, and so we don’t necessarily see that kind of competition. Although you certainly will see some overseas competition in kind of European competitors trying to go after to the US market where we have a strong foothold-this is just-I’m just using an example. So you will see some of that, but this is, again-you know, I’ve kind of used the term, these markets are glacial, and for good and for ill, the markets move really slowly and so I think the question that you’re asking is more of a-if we stay in this sustained area for a few years, will we start to see it on new business that’s playing through, right? So, so much of our business is going into an aftermarket or a like-for-like replacement versus kind of large contracts that are going out, and so it would take years to kind of play through from a competitive standpoint, so that’s kind of one thing. So we’re not seeing it today.

The other part is remember, we’ve got a pretty decent footprint in other parts of the world. 50% of our business is non-US and 40% of it is actually produced outside of the US, so while we may see some things in a few years if the current-currencies play themselves out. We also have the benefits of being more

competitive in the businesses that we have outside of the US. So I don’t expect it’s going to be a big impact that we’ll see.

Brian Konigsberg: Great. Maybe just a follow-on. On the water business, clearly, you’re doing very well gaining share, bringing new products to market. The underlying market itself though, are you starting to see things starting to firm up? We know a number of projects have been delayed over the last couple of years. Has that-are those starting to break loose, or is really your success here just a matter of market share gains?

Andrew Silvernail: I would say we are seeing the improvement. I would say that the number of municipal bids that are going out, and in particular, the number of large dollar bids that I think people were really hesitant on, in North America in particular, have improved. So if you recall, we made a real conscious decision to reposition ourselves relative to the markets that we were going after in water services in the US and in the UK, and that was the right move in terms of focus and going after the right profit pools then and I think it’s going to pay dividends for us as those places start to free up a little bit more capital. So the businesses are better in the US and in Europe, or I should say the UK. I should say in North America and the UK, and also in China, we’ve seen that a little bit, so we’ve seen some level of improvement in China.

Brian Konigsberg: Great. All right, I’ll pass it along. Thank you.

Andrew Silvernail: Thank you.

Operator: Thank you. Our next question comes from the line of Allison Poliniak with Wells Fargo Advisors. Please go ahead with your question.

Allison Poliniak: Hi, guys, good morning.

Andrew Silvernail: Hi, Allison.

Allison Poliniak: Hi. Just, Andy, on the organic investment side, obviously a use of cash, can you maybe talk about how you’re looking at it and maybe I guess-maybe this uncertain environment, I know some of your markets are bigger and harder to move, but is it a share gain opportunity for you, or are you becoming more selective because of certain end markets at this point?

Andrew Silvernail: Yes. You have to think about organic investments at IDEX in a multi-year phase or thought process, and the reason I say that is if you think about generally any business that we have from the time of concept through, I’ll call it full demand, you’re talking about a five-year timeframe, okay if you’re just-if you’re realistic about it. So the things that we’re winning on now, if you go back to 2012 when we talked about making some major choices and cutting a billion in 2012, the benefits that we’re seeing today with those investments (inaudible), and I know sometimes for the investment community that that can be unfulfilling because you don’t get the rapid speed that you get, but that’s also why the markets are so darn defensible. So the investments that we’re making today, in reality, they’re not going to show up for, two, three, four, five years in full, but we know that we’ve got to have the patience and the discipline to play that out.

Our-the diversified space in general gets a lot of criticism around organic growth, and I’ve been asked many times kind of what’s underneath that? My believe that is, frankly, we don’t have the discipline and the patience to make the multi-year investments and you just-you have to do it and that’s what we’ve done.

Allison Poliniak: That’s great. Then last call, you talked a little bit about energy, maybe a potential benefit, you know, (inaudible) to the end of ’15, into ’16 from the sort of energy, you know, tax relief we’re getting here. Any thoughts about updates, changes just from that view?

Andrew Silvernail: No. It’s not playing itself through yet. The-except maybe the one place that we’re seeing it is actually in dispensing, and the reason I’d say that is demand that’s going through the retailers, which is putting more money in their pockets, and so if you look at the dispensing business, it really-on a global basis, that’s been pretty good, right? So if you look at the overall business there, as capital is flowing through those retailers and allows them to refurbish, it is allowing for that to flow through dispensing to some degree. It’s hard to peg it exactly, Allison, but I would say that’s one place that you could draw a line to. How it plays through the general economy-and that was my statement at the fourth quarter call typically, that can be a year or more before it goes through the consumer into the business community. So I still think we are going to live with that gap where you’ve seen massive capital cuts in the energy world and, of course, now we’re seeing the daily layoffs that are happening in those places. You’re going to see that be the near-term impact and then maybe at the end of this year, in ’16, you’ll see how that flows through back to the business community.

Allison Poliniak: Perfect. Thanks, guys.

Andrew Silvernail: Thank you.

Operator: Thank you. Our next question comes from the line of Joe Radigan with KeyBanc Capital Markets. Please go ahead with your question.

Joe Radigan: Thanks. Good morning, guys.

Andrew Silvernail: Good morning, Joe.

Joe Radigan: I guess first, what percentage of MPT is driven by project activity? Then maybe the same question for the energy piece of FMT.

Andrew Silvernail: So for MPT, it’s going to be in that, call it 40% range, plus or minus, that has a larger capital piece to it, and when I say “larger capital”, let’s dimensionalize that. You’re talking about 250,000 to sometimes a several million dollar project, but those are pretty rare. So when we say large capital, we’re not talking about $50 million projects or anything like that, but you can see it certainly in a quarter or two that are dry or robust. You can see how that’s going to play itself through really for the balance of the year, so the order softness that we saw here in the first quarter that’s going to play itself through as we get to the third and the fourth quarter in particular. Second quarter is actually okay in terms of what we can see in the funnel. So, that’s a little bit more lumpy than we’re used to seeing within IDEX, but that’s kind of the dimensions we’re talking about.

Joe Radigan: Okay. Then, Andy-oh, I’m sorry.

Andrew Silvernail: (Cross talking) we don’t have the same magnitude in the energy side.

Joe Radigan: Okay. Then just to be clear, have you seen any orders that were already in backlog get cancelled, or is this more restricted to kind of the go-forward order rates?

Andrew Silvernail: It’s really around, go forward. We don’t-again, generally, we don’t have a lot of exposure to kind of big capital stuff that’s in the pipeline that we have committed and we have an order getting cancelled. It’s more-when we see a large capital project, let’s say in energy, we have some business that may go into it that, just call it in that 250,000 to million dollar range, but more of it is understanding kind of how that pipeline is going to flow to what we call our book and term business. So, you’ll see Band-It as an example. When a large capital project’s happening, we know we’re going to get a large chunk of that business, but it’s not committed until kind of really late in the process. So we don’t have a lot of things sitting on our books today that are at risk of being cancelled. It’s more of kind of understanding what that pipeline’s going to look like here over the next six to 12 months.

Joe Radigan: Okay. Then I guess my next question actually is around Band-It, and I think, Andy, you’ve talked about that being sort of a bell weather for the overall economy since it touches so many end markets and...

Andrew Silvernail: Yes.

Joe Radigan: It’s a short cycle. If you exclude the oil and gas piece of it, which is understandable, have you seen any trends kind of in that base run rate business that either give you cause your concern or vice versa, reason for encouragement?

Andrew Silvernail: Yes, that’s a great question because as we were looking at their order rates and as we go through our typical business reviews, we asked kind of that same question. So we actually asked them to look specifically at-we have an energy vertical within Band-It, so we could kind of see that piece, but then we saw some weakness that we were like, “Wait a second here, what’s going on?” So we asked them to kind of dice up the country and look at it, and lo and behold, all of the weakness that they found happened to be in the four states that are-that have enormous energy exposure, so really isolated to energy. The normal kind of general distribution, book and term business, transportation business is quite good.

Joe Radigan: Okay. Then maybe one more question on HST. How should we think about the organic growth for the balance of the year? You have a relatively easy comp in the second quarter but then you’re facing, you know, plus mid-single digits in the back half, orders are up-book-to-bill was good but orders were only up organically 2%, so how are you thinking about the trajectory in HST?

Andrew Silvernail: Yes, I think we’re going to be looking at kind of 3 to 4...

Joe Radigan: Okay.

Andrew Silvernail: Three or 4% organically and-but let me kind of parse that a little because I think that’s important. I think what you’ll see are meaningfully stronger numbers in scientific fluidics. I think you’ll see that, the strength there in optics, and you’ll see the weakness that we just talked about a moment ago in MPT as it plays through the third and the fourth quarters. So as you think about kind of the core markets that we really spend a lot of time on and we’ve put a lot of our core investment in, we think that’s going to be actually pretty decent here as we move through the year.

Joe Radigan: Great. Thanks a lot, Andy.

Andrew Silvernail: Thank you.

Operator: Thank you. Our next question comes from the line of Mark Douglass with Longbow Research. Please go ahead with your question.

Mark Douglass: Hi, good morning, gentlemen.

Andrew Silvernail: Hi, Mark.

Mark Douglass: That leads me into looking at FSD. The dispensing order comp, (inaudible) what did you expect for 2015? The dispensing order comp was about 20 million in 1Q ’14, is that about right?

Andrew Silvernail: You’re talking sales, the sales number?

Mark Douglass: Yes, sales number.

Andrew Silvernail: Yes, it was more like 24 million.

Mark Douglass: Twenty-four million.

Andrew Silvernail: It was a big number.

Mark Douglass: Okay, good-that’s-because initially I think some of it you thought would roll into second quarter and...

Andrew Silvernail: Yes. If you recall, the first quarter last year, we ended up having a really strong first quarter, principally because we did pull a-our customer asked us to pull it forward into the first quarter.

Heath Mitts: Hey, Mark, this is Heath. Just to clarify though, what we talked about earlier in the year was about a $50 million worth of big projects. There was a very specific-that’s made up of two specific dispensing orders and one in the fire suppression space, so in the first quarter, it was about half of that 50 million.

Mark Douglass: Right.

Heath Mitts: In the second quarter, it’s the blended of the other two. So in total, dispensing is about 35 million, made up of two projects, and then there’s about 15 million out of the fire suppression space, that-and so we’ll still have about a 20 to $25 million headwind in Q2.

Mark Douglass: Right, and well, 3Q was pretty strong too.

Heath Mitts: It was, but the-what we’ve talked about in prior year, or in-within our guidance is really the Q1/Q2 impact on the headwind. We did have a good Q3 of last year, but it wasn’t so much tied to very specific project activity.

Mark Douglass: Okay, that was broader. Okay, so then my question then, you know, looking at ’15, I mean we’re probably talking mid single digit decline organically?

Andrew Silvernail: Yes.

Heath Mitts: Low to mid.

Andrew Silvernail: Yes, low to mid, yes.

Mark Douglass: A low to mid decline, okay, and FMT, I believe you said you were thinking low to mid single digit growth. Are we closer to flat to low single digits?

Andrew Silvernail: You’re still talking, up, kind of 2 to 3.

Mark Douglass: Two to 3?

Andrew Silvernail: Yes.

Mark Douglass: Okay. That’s helpful. Thank you.

Andrew Silvernail: Thanks.

Operator: Our next question comes from the line of Kevin Maczka from BBT Capital Markets. Please go ahead with your question.

Kevin Maczka: Thanks, good morning.

Andrew Silvernail: Morning, Kevin.

Kevin Maczka: Andy, I just wanted to piggyback on the organic growth question, and I appreciate your commentary on the fact that you have to take a long-term view and make investments now that won’t pay dividends for a few years, but can you just touch on why is that such a long cycle? Why is it five years? Is it because in some cases you’re almost inventing new markets and you have to prove to customers that they need that type of product, or is it that you’re trying to displace an entrenched competitor and maybe that’s not an easy thing to do?

Andrew Silvernail: Yes, so if you kind of break that-but let’s just use five years as-you know, five years is one year at, I’ll call it kind of full volume, so to speak, so you’re talking-a year or two of that is going to be product development that’s really when you’re going from idea to having a product that you’re able to launch into the marketplace. The industrial customers generally, unless it’s a-you know, if it’s just a basic revision of a product, that’s a different story, but when you’re talking a new product, these customers are very, very cautious and so you generally have a testing that’s going to happen and let’s just call that a year plus or minus that you’re going to see where people are really testing the solution. Then you have the issue of just opportunity for uptake, and let me just give you an example of that. If you take a normal process facility, and this is just kind of a way to think of it, unless it’s a new facility, they generally only have wash-up (ph) somewhere between two or four weeks a year, so kind of maintenance shutdown, and so the opportunity for really bringing a product into an existing facility is-they’re relatively small windows. So you’re then really relying on some kind of refurb within a facility or you’re looking at new facilities coming online. So when you blend that all in, that’s why that timeframe is as long as it is, and again, I said this before, while it certainly leads to some frustration around your ability to change the organic growth curve quickly, it’s also the beauty of the defensibility of businesses like IDEX.

Kevin Maczka: Got it. That’s helpful. Then in SSD (ph), you’re calling the X-Smart product the juggernaut now, and I don’t think (cross talking).

Andrew Silvernail: It’s been great.

Kevin Maczka: Yes. I don’t think there’s too many individual huge needle movers within the IDEX portfolio, but can you just talk-to the extent you can talk about anything coming that we ought to be keeping an eye out for, is there something that you’re particularly excited about here for the next couple of years?

Andrew Silvernail: That’s a relatively unusual example for us and to give you a sense of it, that’s going to be a $20 million product for us when it’s all said and done, but it has taken three or four years. I would say-I’d put eDRAULIC into that same kind of category, and in both those cases, what you solved for was really a gap in the market. So with X-Smart in particular what you have now is you have an automatic dispenser that is really displacing an entire segment of the market that was manual dispensers, right, so you’ve got to the kind of price point that was attractive, and specifically in the emerging markets, that very much wanted the quality and the capability of an automatic dispenser but they were never going to reach that price point that the Western world could-where there’s enormous volume and it makes sense to have that kind of product. So we really solved that.

We’ve got a couple at Viking that are going to be in that $10 million range, one that actually will be in that $10 million range this year and a couple of other that are coming to the pipeline that look that way. We’ve got-certainly within scientific fluidics we have brought together-actually I’d say the combination of scientific fluidics and options that promise of the idea of the optical fluidic engine. You’ve seen some promise in there, the marrying of fluidics and optics that has reached that kind of level that 10 to $20 million level. But for the most part, you’re really talking about 5 to $10 million chunks that we’d look at.

Kevin Maczka: Got it. Thanks again.

Andrew Silvernail: Thank you.

Operator: Thank you. Our next question comes from the line of Joe Giordano with Cowen Group Inc. Please go ahead with your question.

Joe Giordano: Hi, guys. Thanks for taking my question. Just wanted to touch on HST a bit here. So you’re growing mid single digits back half of last year. Now this is flat organic. Am I right in thinking that that’s almost entirely from MPT? Like, has there been a second derivative decline in fluidics or anything like that?

Heath Mitts: No. No, it’s all MPT-related.

Joe Giordano: Okay. Then quickly on muni, can you maybe parse out the environment on break and fix versus capital? I know you touched on it earlier with, like, some of the larger projects and maybe US versus Europe and those kind of splits?

Andrew Silvernail: So the break/fix business had been the stronger part. We did see a couple of things break our way in the US here over the last couple of quarters, and we saw a couple of big new installations, or new projects rather, in the US-I should say North America because we had one that was meaningful in Canada. Then the UK the amp cycle that you see over there, we have one, some major pieces of that and that showed up in our order rates and that’ll be a nice piece of business for us here over the next couple of years.

Joe Giordano: Great. Thanks, guys.

Andrew Silvernail: You bet.

Operator: Thank you. Our next question is a follow-up from the line of Matt McConnell at RBC Capital Markets. Please go ahead with your follow-up.

Matt McConnell: Thanks, guys. Just wanted to touch on ag real quick. You know, based on its size and I guess the aftermarket content, I’m surprised it even has the capacity to drive a measurable change to the guidance, so are there any, you know, inventory adjustments in the channel, or are you seeing aftermarkets slow down a lot more than you expected? I would imagine that’s usually fairly steady, but just maybe size the aftermarket content there and whether that’s also participating in this weakness.

Andrew Silvernail: Sure, sure. Well, first thing to keep in mind is this is a very high contribution margin business, so certainly as you look on the continuum of IDEX, this is on the far side from an overall contribution margin, and so a small top line hit is meaningful on a bottom line just because it is at the level it is and there just isn’t the cost structure to rip out, so to speak, nor would you want to in a business like that that you believe long term in there. So relative to the demand side, Matt, the OEM side is sharper than we would have expected, and I will say that in the ag distribution channel, there is a lot of inventory, there’s no doubt about it, and so that’s going to play itself through.

In terms of the aftermarket, meaning the-again, kind of the break/fix stuff, that’s going to hold up well, right, because at the end of the day, if you’re running a sprayer, as an example, you’ve got to do the maintenance on it, this year, and typically what we see happen in cycles like this is people aren’t buying new equipment and so they’re not retiring the old equipment, or they are retiring the old equipment and what you see now is the older equipment having a little bit longer life cycle. So, that will be better but the amount of new product in the channels and what’s happening in the OEMs in terms of their production schedules, that’s pretty significant, and farm prices-or farm profits have been hit, and you guys all know the story here better than anybody. The farm profits have been hit meaningful and that’s going to take at least this year to play through and we’ll kind of judge the impact on next year.

Matt McConnell: Okay, great. Thanks very much. That helps.

Andrew Silvernail: Thank you.

Operator: Thank you. Ladies and gentlemen, we have no further questions at this time. I would like to turn the floor back over to Management for closing remarks.

Andrew Silvernail: Well, thank you, Adam, and again, we appreciate your interest in IDEX and the ability to walk you through here what’s going on. Obviously, we’re very proud of the execution that we’ve been able to do here in the first quarter, but we recognize the realities of the world and so that idea of controlling our own destiny is something that we put front and center, yes, and we’re absolutely going to do so. We always keep in mind the long-term value creation for our shareholders and our desire to be one of the superior creators of value, and we’re going to continue to work for you. So we appreciate your support and we will talk to you hear in 90 days. Thank you. Take care.

Operator: Thank you. Again, ladies and gentlemen, this does conclude our teleconference for today. You may now disconnect your lines at this time. Thank you for your participation and have a wonderful day.