UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

Table of Contents

We include website addresses throughout this proxy statement for reference only. Our website is for informational purposes only and the contents of our website or information connected thereto are not a part of this proxy statement and are not deemed incorporated by reference into this proxy statement or any other public filing made with the U.S. Securities and Exchange Commission (SEC).

| Cautionary Statement | |

| This proxy statement contains forward-looking statements, which are all statements other than statements of historical facts. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” “targets,” “intends,” “likely,” “will,” “should,” “could,” “to be,” “potential,” “assumptions,” “guidance,” “aspirations,” “future,” “commitments,” “pursues,” “initiatives,” “objectives,” “opportunities,” “strategy” and any similar expressions are intended to identify those assertions as forward-looking statements. We caution readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Important factors that can cause our actual results to differ materially from those anticipated in forward-looking statements include, but are not limited to, those described in more detail under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2022 (2022 Form 10-K), filed with the SEC. Many of the assumptions upon which such forward-looking statements are based are likely to change after the date the forward-looking statements are made. Further, we may make changes to our business plans that could affect our results. We caution investors that we undertake no obligation to update any forward-looking statements, which speak only as of the date made, notwithstanding any changes in our assumptions, changes in business plans, actual experience or other changes. This proxy statement also contains certain financial measures that are not recognized under generally accepted accounting principles (GAAP) in the United States (U.S.), including adjusted earnings before interest, taxes, depreciation and amortization (EBITDA), net debt, return on investment (ROI) and consolidated unit net cash costs. As required by SEC Regulation G, our calculation and reconciliation of unit net cash costs to amounts reported in our consolidated financial statements is in the supplemental schedules of our fourth-quarter and year ended 2022 press release, which is available on our website, fcx.com. Please refer to Annex A to this proxy statement for our calculation and reconciliation of adjusted EBITDA and net debt and other information regarding our calculations for ROI and consolidated unit net cash costs. | |

Letter to Stockholders Dear Fellow Stockholders, |

Freeport’s accomplishments in 2022 enhanced our position as a leading producer of copper. Freeport’s accomplishments in 2022 enhanced our position as a leading producer of copper.  |

|

|

On behalf of the Freeport-McMoRan (Freeport) board of directors in my role as lead independent director, I am pleased to share highlights of Freeport’s 2022 accomplishments. In 2022, Freeport achieved another year of solid operating and financial performance, with growth in production volumes, successful execution of our long-term projects at our PT Freeport Indonesia (PT-FI) operations, and a continuing drive for innovation, efficiencies and value in a challenging economic environment. Our board remains engaged with our highly experienced management team to pursue and generate long-term value responsibly and sustainably. Freeport’s accomplishments in 2022 enhanced our position as a leading producer of copper. We are strongly positioned to benefit from positive copper demand trends driven by growth in electrification and acceleration of decarbonization |

globally. Our portfolio of assets and long-term strategy is centered on benefiting from “The Power of Copper” in the years ahead. Freeport has maintained impressive momentum across our sustainability strategy and environmental, social and governance (ESG) commitments and initiatives. We are proud to have achieved the Copper Mark at all 12 of our copper producing sites globally, including our most recent award at PT-FI in February 2023. Freeport has also been awarded the Molybdenum Mark at both of our primary molybdenum mines as well as at our four copper mines that produce by-product molybdenum, making us the first primary molybdenum miner to achieve this distinction. In September 2022, we published our updated Climate Report, which details the advancement of our climate strategy and our decarbonization progress. We have four 2030 greenhouse gas (GHG) emissions reduction targets covering nearly 100% of our Scope 1 and 2 emissions and we continue to advance work to reduce our GHG emissions, improve |

|

| Freeport-McMoRan 2023 Proxy Statement | 1 |

Letter to Stockholders

|

The board is highly engaged and operates efficiently and effectively to guide management as it works to address near-term challenges while maintaining focus on our long-term business success. The board is highly engaged and operates efficiently and effectively to guide management as it works to address near-term challenges while maintaining focus on our long-term business success.  | |

our energy efficiency, and evaluate and integrate the use of lower-carbon and renewable energy sources into our energy supply. Following our multi-year board refreshment process, which led to the appointment of 6 new independent directors to the board since 2021, today, our board is comprised of 12 directors. This includes our newest director, and Freeport’s President, Kathleen Quirk. Our directors bring a wealth of experiences and perspectives, strong corporate governance credentials and skills across relevant industries, geographies and functions that collectively contribute to active independent oversight and partnership with our management team. The board is highly engaged and operates efficiently and |

effectively to guide management as it works to address near-term challenges while maintaining focus on our long-term business success. I am proud to communicate with you as Lead Independent Director and I am equally proud of the relentless commitment of our global workforce to drive our strategy of being foremost in copper. On behalf of the board, thank you for your continued trust, support and investment in Freeport. Sincerely,  DUSTAN E. MCCOY

Lead Independent Director

April 21, 2023 | |

| 2 | www.fcx.com |

Notice of 2023 Annual Meeting of Stockholders

|

DATE Tuesday, |

|

TIME 1:00 p.m. |

|

LOCATION Virtual at |

|

RECORD DATE April 10, 2023 |

Purpose of Meeting

| Board Recommendation |

Page Reference | ||||

| 1 | Elect twelve directors | FOR | 12 | ||

| 2 | Approve, on an advisory basis, the compensation of our named executive officers | FOR | 38 | ||

| 3 | Approve, on an advisory basis, the frequency of future advisory votes on the compensation of our named executive officers | 1 YEAR | 39 | ||

| 4 | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2023 | FOR | 71 |

Stockholders will also transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. Only stockholders of record as of the close of business on April 10, 2023, are entitled to participate (meaning vote and submit questions) at the annual meeting and any adjournment or postponement of the meeting.

In an effort to provide access regardless of geographic location and cost savings for our stockholders and the company, this year’s annual meeting will be conducted virtually via a live audio webcast, accessible at www.meetnow.global/FCX2023. For information regarding how to join and participate in our virtual annual meeting (including how to vote and submit questions pertinent to the meeting), please see “Questions and Answers About the Proxy Materials, Annual Meeting and Voting” beginning on page 75.

By Order of the Board of Directors.

MONIQUE A. CENAC

Assistant General Counsel and Corporate Secretary

April 21, 2023

How to Vote*

|

INTERNET Go to envisionreports.com/FCX |

|

PHONE Call toll-free 1-800-652-VOTE (8683) within the U.S., U.S. territories and Canada |

|

MAIL Mark, sign, date, and return your proxy card in the postage-paid envelope |

|

* Beneficial owners of our common stock should follow any instructions provided by their bank, broker, trustee or other nominee. | |||||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 6, 2023

This proxy statement and our 2022 annual report to stockholders are available at edocumentview.com/FCX.

| Freeport-McMoRan 2023 Proxy Statement | 3 |

About Freeport-McMoRan

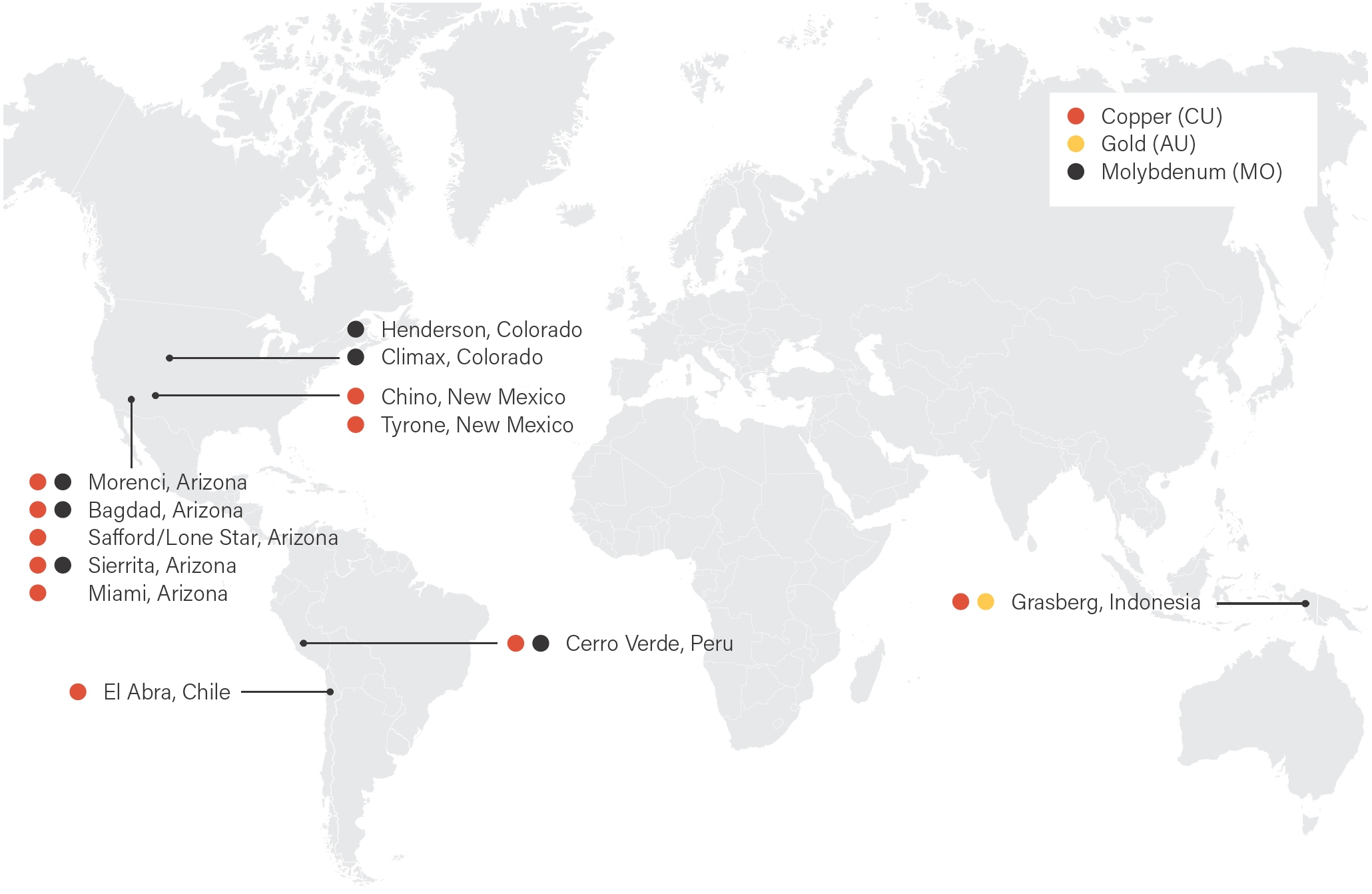

Freeport is a leading international mining company with headquarters in Phoenix, Arizona with an objective of being foremost in copper. Freeport operates large, long-lived, geographically diverse assets with significant proven and probable mineral reserves of copper, gold and molybdenum.

Freeport’s portfolio of assets includes the Grasberg minerals district in Indonesia, one of the world’s largest copper and gold deposits; and significant mining operations in North America and South America, including the large-scale Morenci minerals district in Arizona and the Cerro Verde operation in Peru. Freeport has also achieved the Copper Mark, a comprehensive assurance framework designed to demonstrate the copper industry’s responsible production practices, at all 12 of its copper producing sites globally.

Freeport’s global workforce of over 74,000 people is dedicated to responsible production practices. By supplying responsibly produced copper, Freeport is proud to be a positive contributor to the world well beyond its operational boundaries. Additional information about Freeport is available at fcx.com.

Geographically Diverse Portfolio

|

GLOBAL INDUSTRY LEADER |

TRUSTED OPERATOR |

WORLD-CLASS DEVELOPER |

BLOCK CAVE LEADER |

RESPONSIBLE PRODUCER |

|

One of the world’s largest publicly traded copper producers; seasoned and value-driven global team; 25+ year reserve life with substantial additional resources. |

Strong reputation and franchise in four countries; synergistic operation of all assets. |

Industry-leading track record for major project execution in complex jurisdictions. |

Industry-leading technical capabilities; decades of block caving experience. |

Long-standing commitment to all of our stakeholders, including our employees, host communities and countries, customers and suppliers. |

| 4 | www.fcx.com |

About Freeport-McMoRan

|

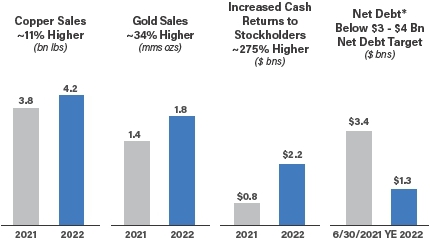

2022 Performance Highlights Strong Execution

Operational

■Growth in copper and gold sales driven largely by PT-FI underground operations

■Successfully sustaining large-scale, low-cost underground production at PT-FI

■Measurable progress on new leaching initiative in Americas

■Solid cash flow generation and capital and cost management in challenging environment

■Advanced Indonesia smelter construction projects

■Progressed options for future long-term organic growth

■Copper and molybdenum reserve additions exceeded 2022 production

Financial

■Prioritized balance sheet as cornerstone of financial policy

■Implemented performance-based payout under financial policy

■Successful $3.0 billion PT-FI public bond offering to support smelter construction

■PT-FI achieved investment grade rating from Moody’s and Fitch rating agencies

■Significant open-market debt repurchases at attractive levels

ESG

■Achieved the Copper Mark at all remaining copper producing sites

■Achieved the Molybdenum Mark at both primary molybdenum mines and at copper mines that produce by-product molybdenum

■Progressed climate strategy and water initiatives

■Continued to enhance ESG disclosures |

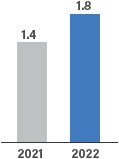

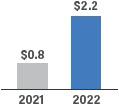

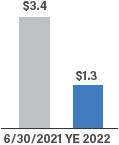

Stockholder Returns $1.3 Billion

Net debt at year-end 2022, excluding net debt associated with the Indonesia smelter projects*

~50% Free Cash Flow to Be Returned

to stockholders under performance-based payout framework

$0.60 Per Share in Common Stock Dividends

Freeport paid $0.30 per share in base dividends and $0.30 per share in variable dividends in 2022

35.1 Million Shares

Repurchased during 2022 in open market for a total cost of $1.35 billion

$3.2 Billion

Available under share repurchase program as of March 31, 2023

1.43 Billion Shares

of common stock outstanding as of March 31, 2023

|

Strategic Objectives of Financial Policy

|

Maintain strong balance sheet |

|

Provide cash returns to stockholders |

|

Advance organic growth opportunities |

| * | See Cautionary Statement |

| Freeport-McMoRan 2023 Proxy Statement | 5 |

Proxy Voting Roadmap

This proxy voting roadmap highlights select information contained elsewhere in this proxy statement. This summary does not contain all the information that you should consider, and you should read the entire proxy statement carefully before submitting your proxy and voting instructions. For more information regarding our 2022 performance, please review our 2022 annual report to stockholders (2022 annual report), which is being made available to stockholders together with these proxy materials on or about April 21, 2023.

| 1 |

PROPOSAL NO. 1: Election of Directors The board recommends a vote FOR each director nominee. |

Page 12 ► |

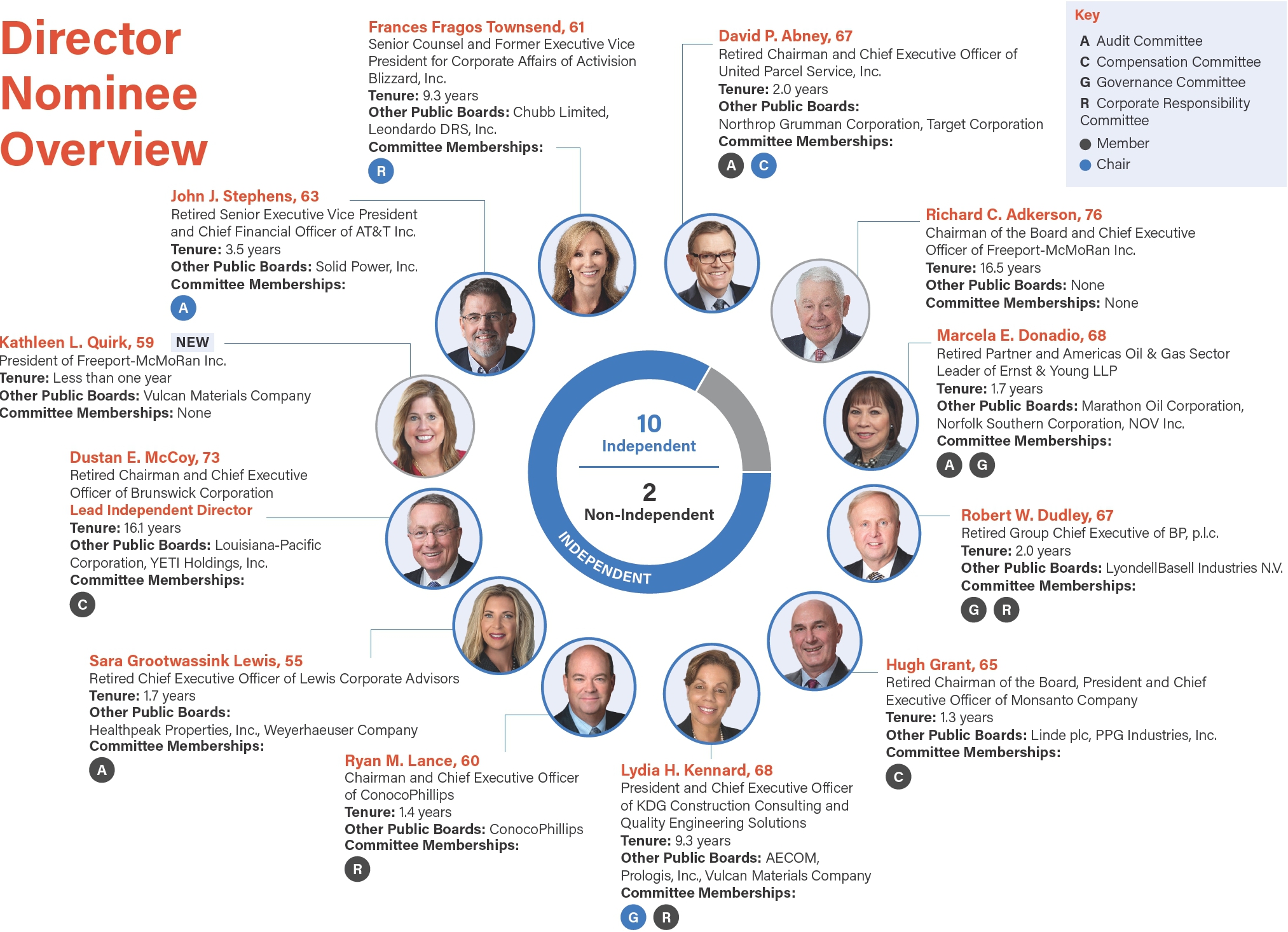

| AGE* | TENURE* | DIVERSITY | ||||

|

|

|

| * |

as of the record date, April 10, 2023 |

| 6 | www.fcx.com |

Proxy Voting Roadmap

| 2 |

PROPOSAL NO. 2: Advisory Vote on the The board recommends a vote FOR Proposal 2. |

Page 38 ► |

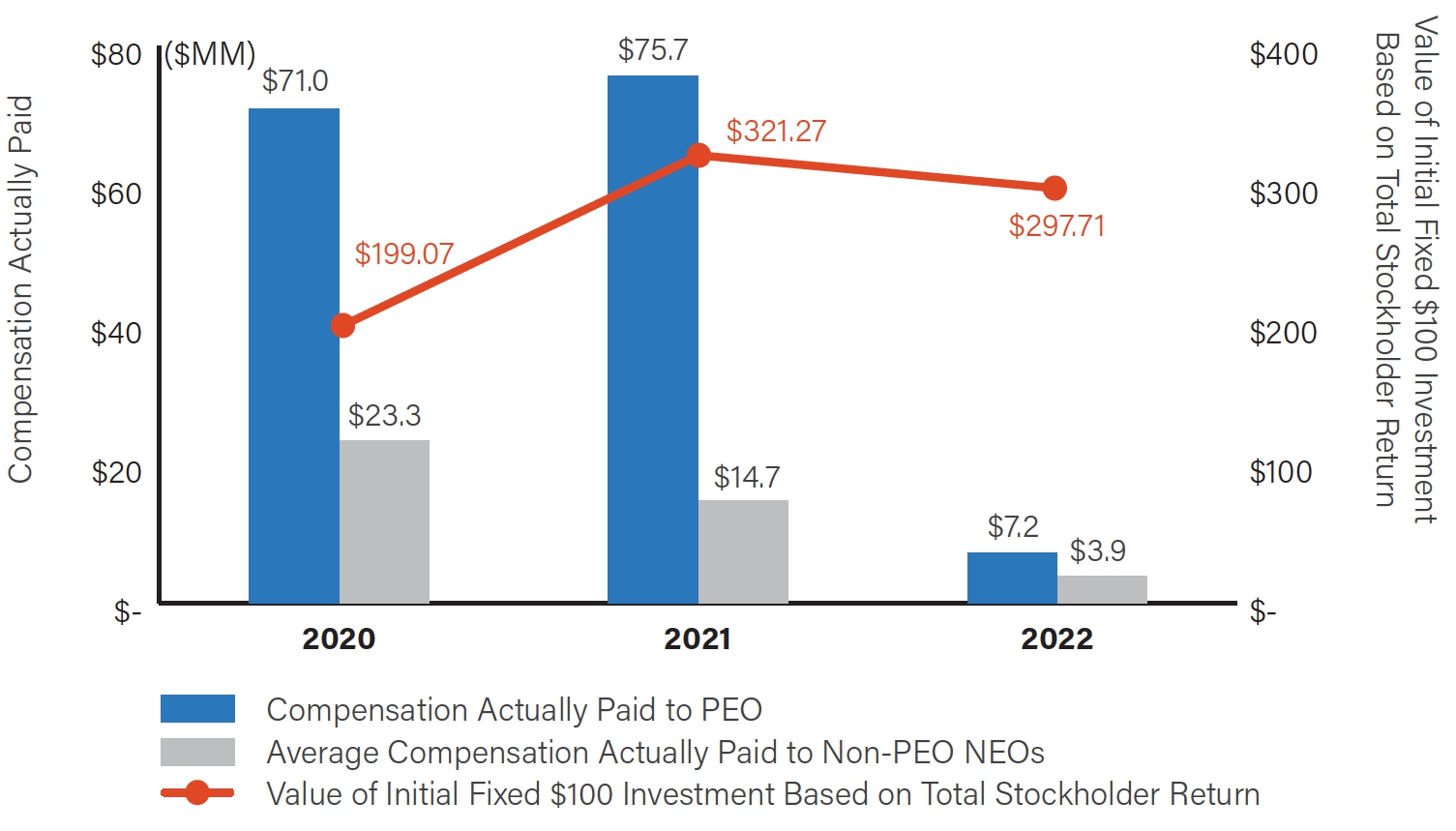

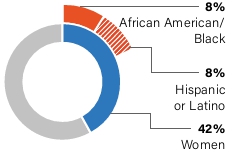

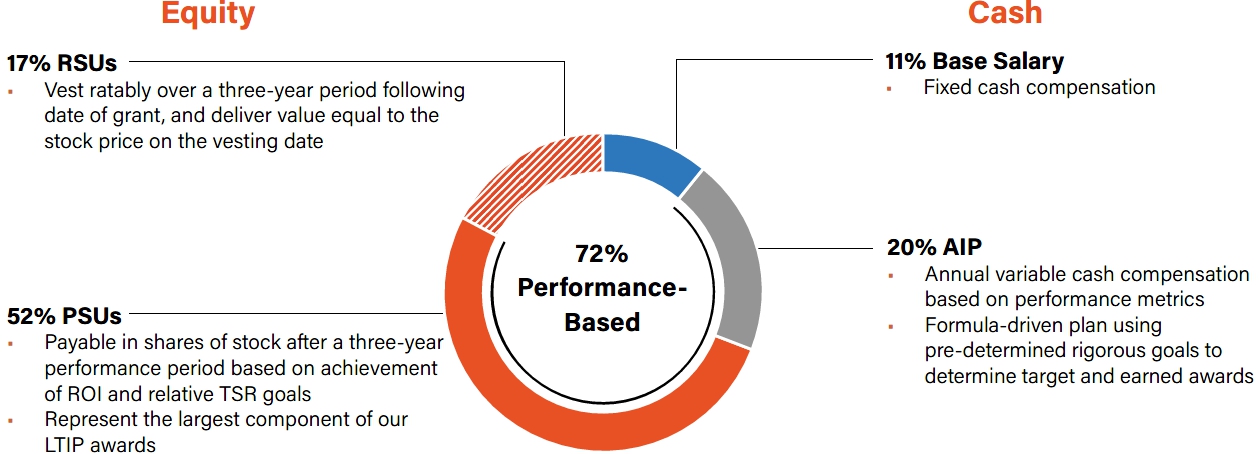

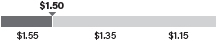

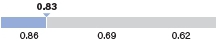

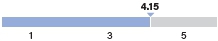

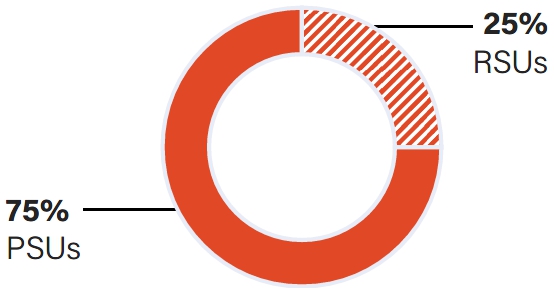

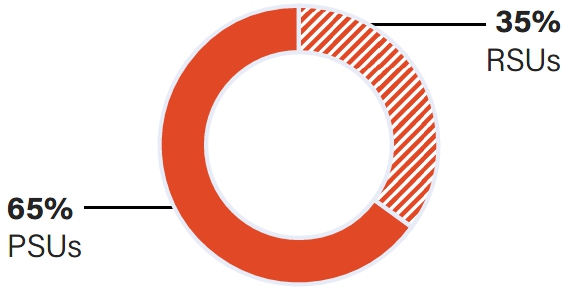

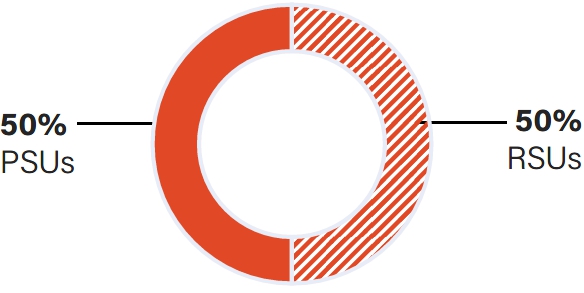

Our executive compensation program is significantly performance based – linking executive pay, company performance and results for stockholders – and is appropriately balanced with short- and long-term measures. Annual and long-term incentive awards, which provide variable, at-risk compensation, comprised 89% of our chief executive officer’s (CEO) target direct compensation for 2022, with 72% of his total target compensation being based on measurable performance objectives.

2022 CEO Target Compensation Mix

| 3 |

PROPOSAL NO. 3: Advisory Vote on the Frequency of The board recommends a vote for 1 YEAR for Proposal 3. |

Page 39 ► |

Stockholders have the opportunity to vote, on a non-binding, advisory basis, as to their preference on how frequently we should seek future advisory votes on the compensation of our named executive officers in accordance with SEC rules. We are asking our stockholders to indicate, on a non-binding, advisory basis, whether they would prefer an advisory vote on the compensation of our named executive officers to occur every one, two or three years. The board believes that the advisory vote on the compensation of our named executive officers should continue to be held annually so that stockholders may continue to provide timely, direct input on our executive compensation program.

| 4 |

PROPOSAL NO. 4: Ratification of the Appointment of The board recommends a vote FOR Proposal 4. |

Page 71 ► |

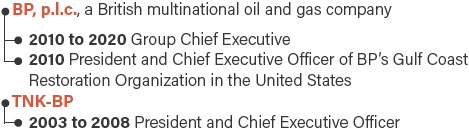

In February 2023, the audit committee appointed Ernst & Young LLP (Ernst & Young) to serve as the company’s independent registered public accounting firm for 2023. Ernst & Young has been retained as the company’s independent registered public accounting firm continuously since 2002. The audit committee and the board believe that the continued retention of Ernst & Young to serve as the company’s independent registered public accounting firm is in the best interests of the company and its stockholders.

| Freeport-McMoRan 2023 Proxy Statement | 7 |

Stakeholder Engagement

| We maintain an ongoing, proactive and expansive stakeholder engagement program, which is management-led and overseen by our board. |

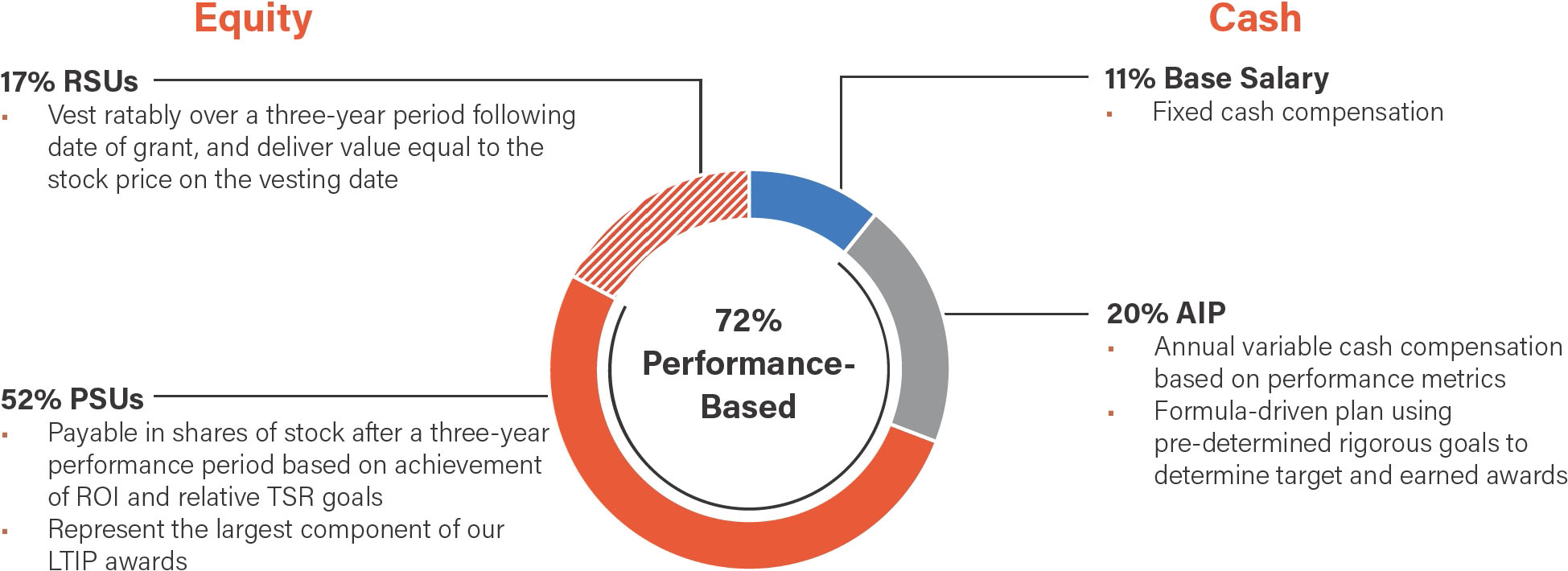

Stockholder Engagement

Direct engagement with our stockholders is a critical pillar of our stakeholder engagement program. Our stockholder engagement program is designed to address questions and concerns, provide perspective on company policies and practices and seek input. Our board and management have a history of engaging with stockholders and incorporating feedback into their decision-making processes.

| KEY TOPICS DISCUSSED IN 2022 ESG STOCKHOLDER ENGAGEMENTS (*) |

2022 ESG STOCKHOLDER ENGAGEMENT (*) | |

|

■Board composition and governance, including board oversight of ESG and incorporation of ESG metrics in executive compensation

■Climate strategy progress, including GHG emissions reduction targets and decarbonization initiatives

■Human rights and security, including progress on our human rights impact assessments

■Tailings management and risks

■Water management and risks

■Biodiversity program and risks

■Efforts to continually enhance ESG disclosures

|

| |

|

(*) Throughout the year, we also have extensive engagement with stockholders on various other matters | ||

We report feedback received from our ESG stockholder engagements to the board. Feedback regarding our 2022 ESG performance was positive, including our board composition, particularly the caliber and diversity of our board, progress on our climate strategy and the quality of our climate disclosures. |

Other Stakeholder Engagement

In addition to our stockholder engagement, we also maintain ongoing dialogue and gather input from a broader group of stakeholders throughout the year including with our customers and suppliers, members of the communities where we operate, including Indigenous Peoples, industry associations, governmental organizations and nongovernmental organizations (NGOs).

| GOALS OF STAKEHOLDER ENGAGEMENT | ADDITIONAL STAKEHOLDER ENGAGEMENTS IN 2022 | |

|

■Foster mutual understanding, trust and cooperation with a broad range of stakeholders

■Understand changing expectations of stakeholders through ongoing, constructive and proactive engagement

■Incorporate feedback from engagements into boardroom and management decision-making

■Solicit ongoing feedback regarding our governance framework and compensation practices

■Share information about our strategy and our ESG practices and performance

■Inform our actions to reduce ESG-related risks and continue to deliver positive contributions to society |

■Proxy advisory firms

■ESG analyst and ratings firms

■Downstream customers

■NGOs

■Governmental institutions and agencies

■Financial institutions

■Industry groups

■Civil society organizations

■Local and regional community stakeholders

■Development institutions |

Participants in our various stakeholder engagements throughout the year typically include senior management, including our CEO and our president, and members from our investor relations, corporate secretary and ESG teams. |

| 8 | www.fcx.com |

ESG / Sustainability

Our sustainability strategy, Accelerate the Future, Responsibly, is underpinned by the recognition that our products are key contributors to global progress, including the acceleration of decarbonization around the world. We recognize the importance of effective management, integration and governance of key ESG matters. Strong ESG performance is imperative to our long-term success and our ability to deliver shared value to our stakeholders. Our core values of safety, respect, integrity, excellence and commitment are foundational to our sustainability and business strategy, and we are committed to continuous improvement and to aligning our sustainability programs with leading practices.

Our sustainability strategy is supported by our ESG commitments, which, in alignment with our business objectives, seek to enhance responsible production practices at our sites around the world. Fundamental to this work is the health, safety and well-being of our workforce and host communities where we operate. We seek to work collaboratively with our stakeholders to support shared value creation in our host communities and countries and to recognize, respect and promote human rights everywhere we conduct business. We are dedicated to effective environmental protection and stewardship, which are key to ensuring the long-term viability of our business, including maintaining the necessary support from communities and governments.

To learn more about our sustainability strategy and ESG initiatives and progress, stockholders are encouraged to review our 2022 Annual Report on Sustainability, which is independently assured and has been published annually since 2001, as well as our most recent Climate Report and other sustainability information available on our website at fcx.com/sustainability.

| 2022 Sustainability Highlights |

Sustainability Program Aligns VOLUNTARY MEMBERSHIPS AND COMMITMENTS  SUSTAINABILITY REPORTING FRAMEWORKS  | ||||

|

12 sites Awarded the Copper Mark, including 4 in 2022 and 1 in early 2023 |

6 sites Awarded the Molybdenum Mark, including 2 primary mines and 4 copper mines that produce by-product molybdenum |

||||

|

2030 GHG Established for Atlantic Copper and primary molybdenum sites, now covering nearly 100% of our Scope 1 and 2 GHG emissions |

Wildlife Habitat 15 sites certified gold by the Wildlife Habitat Council for our biodiversity programs |

||||

|

89% Total water use efficiency |

99% Of our employees are from the countries where we operate |

||||

|

Human Rights Completed for all 5 Arizona sites and initiated at PT-FI |

$177M Invested in our communities |

||||

|

Global Tailings Standard Progressed implementation at applicable tailings storage facilities in the Americas |

|||||

| Freeport-McMoRan 2023 Proxy Statement | 9 |

ESG / Sustainability

The Copper Mark

One of the ways we demonstrate our responsible production performance is through the Copper Mark, a comprehensive assurance framework developed specifically for the copper industry. To achieve the Copper Mark, each site is required to complete an external assurance process to assess conformance with 32 ESG requirements. Awarded sites must be revalidated every three years. We have achieved the Copper Mark at all 12 of our copper producing sites globally, including most recently at PT-FI in February 2023. In addition, following the extension of the Copper Mark framework to molybdenum producers in 2022, our two primary molybdenum mines and our four copper mines that produce by-product molybdenum were awarded the Molybdenum Mark.

Climate Strategy

As one of the world’s largest copper producers, we understand our critical role in the low-carbon energy transition. We are dedicated to supplying the global economy with responsibly produced copper, which includes operating in a manner that manages and mitigates our GHG emissions and other climate-related risks and impacts. During 2022, we continued to advance our climate strategy, which is comprised of three pillars:

|

REDUCTION |

|

RESILIENCE |

|

CONTRIBUTION | ||

We strive to reduce, manage and mitigate our GHG emissions, where possible. We have four 2030 GHG emissions reduction targets, covering nearly 100% of our Scope 1 and 2 GHG emissions, which help us to manage relevant, climate-related risks and support the decarbonization of our business. Our decarbonization initiatives can be described by four primary levers: decarbonizing electricity supply, electrification of equipment, energy and asset efficiency, and process innovation. |

We strive to enhance our resilience to climate change risks (both physical and transitional) for our current and future operations, our host communities and our stakeholders. This includes working to analyze and prepare for extreme weather events, water stress and other potential climate change impacts while also supporting our host communities and responding to anticipated market and regulatory demands. |

We strive to be a positive contributor beyond our operational boundaries by responsibly producing the copper that will support the technologies needed to enable the energy transition. This includes collaborating with partners in our value chain, and industry associations, to identify climate-related solutions that will support the transition to a low-carbon economy and ultimately meet the goals of the Paris Agreement. | |||||

During 2022, we continued to advance GHG emissions reduction initiatives across our global operations, including making progress toward our 2050 net zero aspiration. We collaborated with new and existing energy partners to progress options to integrate additional renewable power for our Americas operations, and we conducted a preliminary scoping study to assess the viability of replacing PT-FI’s coal-fired power plant with a new combined-cycle gas turbine power plant to be fueled by liquified natural gas.In 2022, we announced two additional 2030 GHG emissions reduction targets (one for our Atlantic Copper smelter and refinery in Spain and one for our primary molybdenum sites), we advanced plans to submit our 2030 GHG emissions reduction targets to the Science Based Targets initiative for verification, and we continued to collaborate with equipment manufacturers and various industry associations with the aim of contributing to technological solutions that will help us achieve our climate objectives.For more information on our climate strategy, performance and progress, please see our updated Climate Report published in September 2022.

Human Capital

We believe our global workforce is the foundation of our success and a competitive advantage. Our board oversees our policies and implementation programs that govern our approach to management of our human capital, with the corporate responsibility committee having oversight of health and safety matters and the compensation committee having oversight of other human capital management matters, including those relating to workforce recruitment, retention and development, pay equity and inclusion and diversity.

| ■ | Our highest priority is the health, safety and well-being of our employees and contractors. We also aim to instill health and safety processes for our suppliers and the communities where we operate. |

| ■ | We are committed to ongoing training and development of our workforce. |

| ■ | We are committed to fostering a culture that is respectful, inclusive and representative of the communities where we operate. |

| 10 | www.fcx.com |

ESG / Sustainability

Additional information regarding our programs and activities related to our people, including our global workforce diversity data and our U.S. Equal Employment Opportunity Commission EEO-1 employment data for our U.S.-based employees, is available in our 2022 Annual Report on Sustainability.

Board Oversight of ESG

The corporate responsibility committee oversees the company’s environmental and social policies and implementation programs and related risks. The corporate responsibility committee reviews the effectiveness of the company’s strategies, programs and policy implementation with respect to health and safety, responsible production frameworks, climate, tailings management and stewardship, water stewardship, biodiversity and land management, waste management, human rights, stakeholder relations, social performance and Indigenous Peoples, responsible sourcing, and political activity and spending practices. During 2022, the corporate responsibility committee met four times.

Additionally, each of the audit, governance and compensation committees oversees key ESG matters. The audit committee oversees our global compliance program and corporate compliance procedures and our information technology and cybersecurity processes and procedures. Additionally, tax matters are included within the audit committee’s financial oversight responsibilities. The governance committee maintains our corporate governance guidelines and oversees our corporate governance practices and procedures. The compensation committee oversees the company’s human capital management policies, programs, practices and strategies, including those relating to workforce recruitment, retention and development, pay equity and inclusion and diversity.

|

2022 KEY ESG TOPICS

In 2022, the board and its committees received presentations from and had active dialogue with management on key ESG initiatives linked to our strategy and performance. |

|

|

| |

|

Board Meetings ■Workforce health and safety

■ESG stockholder engagement feedback and ESG update

■Workforce inclusion and diversity update

■Annual adoption of UK Modern Slavery Act Statement |

Corporate Responsibility Committee Meetings ■Workforce health and safety

■Climate strategy and performance update

■Human rights program, including progress on human rights impact assessments and annual adoption of UK Modern Slavery Act Statement

■Tailings management, including progress implementing the Global Industry Standard on Tailings Management in the Americas

■Update on PT-FI’s human health assessment

■Water strategy and resilience update

■Social performance and charitable contributions

■Political spending review

■Responsible sourcing of minerals program update

| |

|

Compensation Committee Meetings ■Workforce health and safety

■Workforce recruitment, retention and development update

| ||

|

|

ESG and Annual Executive Compensation

|

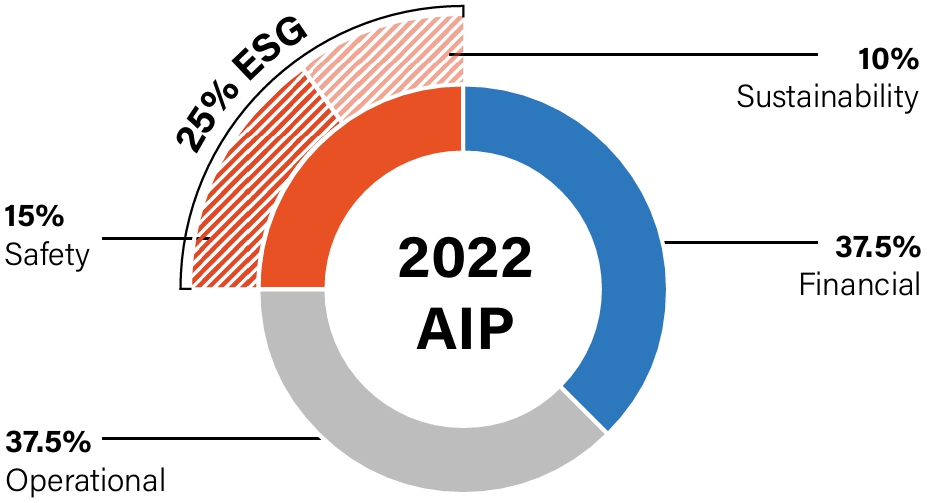

Our chairman and CEO has ultimate responsibility for the company’s ESG performance. Executive officers are held accountable for the company’s ESG performance in part through the company’s performance-based annual incentive program (AIP) via pre-determined ESG metrics aligned with our key ESG commitments and priorities. In 2022, ESG metrics collectively accounted for 25% of the AIP (15% safety and 10% sustainability). See “Executive Officer Compensation – Compensation Discussion and Analysis – Principal Components of Executive Compensation in 2022” for more information. |

|

| Freeport-McMoRan 2023 Proxy Statement | 11 |

Board and Corporate Governance Matters

|

1 |

Proposal No. 1: Election of Directors

The board recommends that you vote FOR each of the director nominees listed below. |

|

Upon the recommendation of the governance committee, the board has nominated 12 directors for election at our 2023 annual meeting to hold office until our next annual meeting and the election of their successors. Each nominee has consented to being named as a nominee in this proxy statement and to serve as a director if elected. The persons named as proxies on the proxy card intend to vote your proxy for the election of each such nominee, unless otherwise directed. If, contrary to our expectations, any nominee is unable to serve or for good cause will not serve, your proxy will be voted for a substitute nominee designated by the board, or the board may reduce its size.

Vote Required to Elect Director Nominees

Under our by-laws, in uncontested elections, directors are elected by a majority of the votes cast, meaning a candidate for director is elected if the votes in favor of his or her election exceed the votes against his or her election. In contested elections where the number of nominees exceeds the number of directors to be elected, directors are elected by a plurality vote, meaning that the director nominees who receive the most votes will be elected.

In an uncontested election, any nominee for director who receives a greater number of votes “against” his or her election than votes “for” such election will be required to promptly tender his or her resignation to the board. The governance committee will recommend to the board whether to accept or reject the tendered resignation. The board will act on the governance committee’s recommendation and publicly disclose its decision within 90 days from the date of the annual meeting of stockholders. Any director who tenders his or her resignation will not participate in the committee’s recommendation or the board action regarding whether to accept or reject the tendered resignation. In addition, if each member of the governance committee fails to be elected at the same election, the independent directors who were elected will appoint a committee to consider the tendered resignations and recommend to the board whether to accept or reject them. Any vacancies on the board may be filled by a majority of the directors then in office. Each director elected in this manner will hold office until his or her successor is elected and duly qualified.

See “Questions and Answers About the Proxy Materials, Annual Meeting and Voting” for more information.

| 12 | www.fcx.com |

Board and Corporate Governance Matters

Board Qualifications, Attributes, Skills and Experience

Our board believes that it is desirable that the following qualifications, attributes, skills and experience are represented on our board because of their particular relevance to our business.

| Experience, Qualifications, Attributes and Skills |

Why is this important to Freeport? | Directors with this Experience, Qualification, Attribute or Skill |

Natural resources, mining, commodities industry experience |

Natural resources, mining, commodities or other extractives industry experience assists the board in understanding business considerations relevant to our global activities, including operational matters and requirements, strategic planning, key risks and competitive environment. |

|

CEO experience |

Directors with CEO experience have a demonstrated record of leadership and bring valuable perspectives and practical insights on organizations, processes, strategic planning, risk and risk management, maintaining effective, sustainable and safe operations, and driving growth in order to achieve our strategic goals. |

|

International business/ global affairs |

Experience in international business/global affairs or experience related to global economic trends yields an understanding of geographically diverse business environments, regulatory matters, economic conditions and cultural perspectives that informs our global business and strategy and enhances our global operations. |

|

Accounting/ financial expertise |

Experience as an accountant, auditor, financial advisor or other similar experience is critical to oversight of the preparation and audit of our financial statements and compliance with related regulatory requirements and standards. We aim to have several directors who could qualify as audit committee financial experts (as defined by SEC rules). |

|

ESG/sustainability |

Experience advancing and implementing ESG and sustainability strategy and programs supports our responsible production commitments and risk management, including prioritizing the health, safety and well-being of our workforce and host communities where we operate, strengthening our environmental programs, including our commitment to reducing our GHG emissions and enhancing the climate resilience of our business operations, respecting human rights in all of our business practices, and attracting, developing and retaining employees, among other environmental and social priorities. |

|

Capital markets/ banking |

Experience overseeing capital markets and banking transactions and mergers and acquisitions provides the knowledge and skills necessary to evaluate and oversee the company’s design and implementation of financing and capital allocation strategies. |

|

Government/legal |

Government relations, legal, regulatory compliance and/or public policy experience offers valuable insight into the impact of laws, rules, regulations, and other governmental actions and decisions on our company and our industry. |

|

Public company board experience |

Directors who serve or have served on the boards and board committees of public companies demonstrate a deep understanding of risk oversight, succession planning, corporate governance standards and best practices of public company boards and board committees. |

|

| Freeport-McMoRan 2023 Proxy Statement | 13 |

Board and Corporate Governance Matters

Director Skills and Demographics Matrix

Our director nominees represent a range of tenures and overall experience, which contributes to a variety of perspectives and facilitates transition of institutional knowledge from longer-serving members to newer members of our board. We believe this balanced composition is in the best interest of our company and our stockholders, as our industry and strategic initiatives often have prolonged lifecycles, and it is therefore helpful to have seasoned directors who are familiar with our company and can draw on past experience and expertise balanced with newer directors who bring fresh perspectives. Our governance committee remains committed to an ongoing review of the board’s composition to ensure that we continue to have the right mix of skills, background, diversity and tenure to position the company for long-term success.

| Experience, Qualifications, Attributes and Skills |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Natural resources, mining, commodities industry experience |

|

|

|

|

|

|

|

|||||

|

CEO experience |

|

|

|

|

|

|

|

|||||

|

International business/ global affairs |

|

|

|

|

|

|

|

|

|

|

| |

|

Accounting/ financial expertise |

|

|

|

|

|

|

|

|||||

|

ESG/sustainability |

|

|

|

|

|

|

|

|

| |||

|

Capital markets/ banking |

|

|

|

|

|

|

|

|

|

|||

|

Government/legal |

|

|

|

|

|

|

|

|

|

|

|

|

|

Public company board experience |

|

|

|

|

|

|

|

|

|

|

|

|

| Demographics | |||||||||||||

| Tenure (Years)* | 2.0 | 16.5 | 1.7 | 2.0 | 1.3 | 9.3 | 1.4 | 1.7 | 16.1 | 0.2 | 3.5 | 9.3 | |

| Age (Years)* | 67 | 76 | 68 | 67 | 65 | 68 | 60 | 55 | 73 | 59 | 63 | 61 | |

| Gender (Male/Female) | M | M | F | M | M | F | M | F | M | F | M | F | |

|

* as of the record date, April 10, 2023 | |||||||||||||

| Race/Ethnicity | |||||||||||||

|

African American/Black (Not Hispanic or Latino) |

● | ||||||||||||

| Hispanic or Latino | ● | ||||||||||||

| White (Not Hispanic or Latino) | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||

| 14 | www.fcx.com |

Board and Corporate Governance Matters

Information About Director Nominees

Included below is certain information as of the record date, April 10, 2023, with respect to the director nominees, including information regarding key business experience, director positions with other public companies held currently or at any time during the last five years, and the experiences, qualifications, attributes and skills that led the governance committee and the board to determine that such person should be nominated at our 2023 annual meeting of stockholders to serve as a director of the company.

|

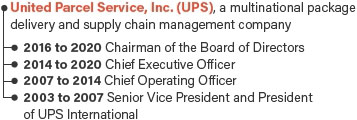

David P. Abney INDEPENDENT Retired Chairman and Chief Executive Freeport Committee Memberships ■Audit Committee

■Compensation Committee (Chair)

|

Current Public Company Directorships ■Northrop Grumman Corporation

■Target Corporation

Former Public Company Directorships ■Johnson Controls International plc

■Macy’s Inc.

■United Parcel Service, Inc.

|

| SKILLS AND QUALIFICATIONS |

BUSINESS EXPERIENCE | |

|

■Executive leadership experience as former Chairman and CEO of a complex global enterprise with a large, labor-intensive workforce

■Expertise in international operations, global logistics and supply chain resilience as well as broad experience with human capital management, leading global teams and overseeing sustainability driven change, including the transition to emerging technologies

■Public company board experience as well as nonprofit leadership experience, including on the board of directors of Catalyst, a global nonprofit working to advance women into senior leadership and board positions

|

EDUCATION AND PROFESSIONAL CREDENTIALS ■B.S. in Business Administration from Delta State University |

|

Richard C. Adkerson Chairman of the Board and Chief Executive |

| SKILLS AND QUALIFICATIONS |

BUSINESS EXPERIENCE | |

|

■Recognized business leader in the mining industry, with decades of industry and operational experience, a vision for the company’s long-term strategy, connectivity to our global workforce, and strong relationships with our stakeholders

■Current member and former Chair of the International Council on Mining and Metals from 2008 to 2011 and 2020 to 2022; previously served on the Executive Board of the International Copper Association

■Member of The Business Council, the Business Roundtable and the Council on Foreign Relations; Chairman of the Advisory Council of the Kissinger Institute on China and the United States

|

EDUCATION AND PROFESSIONAL CREDENTIALS ■B.S. in Accounting with highest honors and M.B.A. from Mississippi State University and completed Advanced Management Program at Harvard Business School |

| Freeport-McMoRan 2023 Proxy Statement | 15 |

Board and Corporate Governance Matters

|

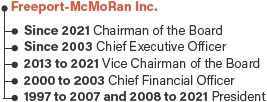

Marcela E. Donadio INDEPENDENT Retired Partner and Americas Oil & Gas Sector Freeport Committee Memberships ■Audit Committee

■Governance Committee |

Current Public Company Directorships ■Marathon Oil Corporation (Lead Independent Director)

■Norfolk Southern Corporation

■NOV Inc. |

| SKILLS AND QUALIFICATIONS |

BUSINESS EXPERIENCE | |

|

■Over 37 years of audit and public accounting experience with a specialization in domestic and international operations in all segments of the energy industry

■Comprehensive knowledge of public company financial reporting regulations and compliance requirements and a deep understanding of the strategic issues affecting companies in the extractives industry

■Experienced audit partner for multiple companies with domestic and international operations in the natural resources sector; held various energy industry leadership positions during her career |

EDUCATION AND PROFESSIONAL CREDENTIALS ■B.S. in Accounting from Louisiana State University and a Certified Public Accountant |

|

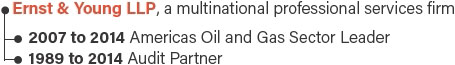

Robert W. Dudley INDEPENDENT Retired Group Chief Executive of BP, p.l.c. Freeport Committee Memberships ■Governance Committee

■Corporate Responsibility Committee

|

Current Public Company Directorships ■LyondellBasell Industries N.V.

Former Public Company Directorships ■BP, p.l.c.

|

| SKILLS AND QUALIFICATIONS |

BUSINESS EXPERIENCE | |

|

■Over 40 years of executive and business experience serving in a broad range of engineering, commercial, strategic, international and executive

roles, including leadership role in advancing BP’s decarbonization plans and other key sustainability initiatives

■Extractives industry experience, expertise in complex strategic issues and cybersecurity oversight experience

■Chairman of the Board of Axio, a leading SaaS provider of cyber risk management and quantification solutions, and director of 8 Rivers

Capital LLC, a private firm leading the invention and commercialization of sustainable, infrastructure-scale technologies for the global

energy transition

■Chairman of the Oil and Gas Climate Change Initiative (since 2016), a CEO-led initiative that aims to accelerate the oil and gas industry’s

response to climate change, Chair of the Accenture Global Energy Board, member of The Business Council and fellow of the Royal Academy

of Engineering

|

EDUCATION AND PROFESSIONAL CREDENTIALS ■B.S. in Chemical Engineering from the University of Illinois, MIM from the Thunderbird School of Global Management (now part of Arizona

State University) and M.B.A. from Southern Methodist University |

| 16 | www.fcx.com |

Board and Corporate Governance Matters

|

Hugh Grant INDEPENDENT Retired Chairman of the Board, President and Chief Executive Officer of Monsanto Company Freeport Committee Memberships ■Compensation Committee

|

Current Public Company Directorships ■Linde plc

■PPG Industries, Inc. (Lead Independent Director)

|

| SKILLS AND QUALIFICATIONS |

BUSINESS EXPERIENCE | |

|

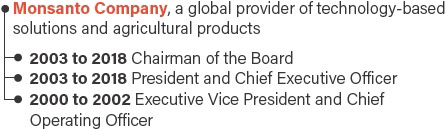

■As Chairman, President and CEO of Monsanto, he led the company’s strategic transition to become a pioneer in agriculture biotechnology;

he and the company were recognized by numerous groups for innovation, sustainability and business leadership during his tenure

■Significant executive leadership, corporate governance, managerial, operational, international, distribution and technology expertise

■Director of Invaio Sciences, Inc., a private technology company focused on unlocking the potential of the planet’s interdependent

natural systems to address pressing agricultural, sustainability and environmental challenges

■Director of CIBO Technologies, a private company that applies advanced technologies to deliver a deep understanding of agricultural systems

to help mitigate climate change, advance food system resilience and improve grower outcomes through driving the adoption of sustainable

practices

■Member of The Business Council and the American Academy of Arts & Sciences

|

EDUCATION AND PROFESSIONAL CREDENTIALS ■B.S. (Honors) in Molecular Biology and Agricultural Zoology from Glasgow University, Post Graduate Diploma in Agriculture from Edinburgh

University and M.B.A. from the International Management Centre in Buckingham, United Kingdom |

|

Lydia H. Kennard INDEPENDENT President and Chief Executive Officer of Freeport Committee Memberships ■Corporate Responsibility Committee

■Governance Committee (Chair)

|

Current Public Company Directorships ■AECOM

■Prologis, Inc.

■Vulcan Materials Company

Former Public Company Directorships ■Healthpeak Properties, Inc.

|

| SKILLS AND QUALIFICATIONS |

BUSINESS EXPERIENCE | |

|

■Over 40 years of executive and operational experience in aviation, construction management and real estate development

■Deep understanding of operational requirements and corporate governance matters

■Significant public company board experience

■Experience in environmental management and pollution control matters through her former involvement with the California Air Resources

Board

|

EDUCATION AND PROFESSIONAL CREDENTIALS ■B.A. in Urban Planning and Management from Stanford University, Master in City Planning from Massachusetts Institute of Technology and

J.D. from Harvard Law School |

| Freeport-McMoRan 2023 Proxy Statement | 17 |

Board and Corporate Governance Matters

|

Ryan M. Lance INDEPENDENT Chairman and Chief Executive Officer of Freeport Committee Memberships ■Corporate Responsibility Committee

|

Current Public Company Directorships ■ConocoPhillips

|

| SKILLS AND QUALIFICATIONS |

BUSINESS EXPERIENCE | |

|

■Over 37 years of executive and operational experience in the oil and natural gas industry; leadership role in developing and advancing

ConocoPhillips’ decarbonization plans and other key sustainability initiatives

■Extensive experience in international exploration and production, including regional responsibility at various times for Asia, Africa,

the Middle East and North America, and responsibility for technology, major projects, downstream strategy, integration and specialty functions

■Former Chairman of the American Petroleum Institute and currently serves on its Executive Committee; Chair of National Petroleum Council’s

Agenda Committee

■Member of the Business Roundtable and The Business Council and serves on the board of the National Fish and Wildlife Foundation

|

EDUCATION AND PROFESSIONAL CREDENTIALS ■B.S. in Petroleum Engineering from Montana Technological University |

|

Sara Grootwassink Lewis INDEPENDENT Retired Chief Executive Officer of Lewis Freeport Committee Memberships ■Audit Committee

|

Current Public Company Directorships ■Healthpeak Properties, Inc.

■Weyerhaeuser Company

Former Public Company Directorships ■Sun Life Financial Inc.

■PS Business Parks, Inc.

|

| SKILLS AND QUALIFICATIONS |

BUSINESS EXPERIENCE | |

|

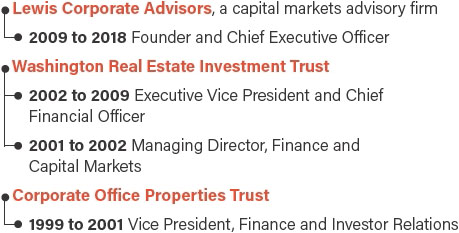

■Over 20 years of executive leadership, accounting, corporate finance and capital markets experience

■Extensive public company board experience

■Serves on the board of trustees of the Brookings Institution (member of Executive Committee), the Leadership Board for the U.S. Chamber

of Commerce Center for Capital Markets Competitiveness and the Audit Committee Council of the Center for Audit Quality; Board Leadership

Fellow and delegate for the Advisory Council for Risk Oversight for the National Association of Corporate Directors (NACD) (since 2012)

and an NACD 100 Honoree; former member of the Public Company Accounting Oversight Board Standing Advisory Group (2015-2017)

|

EDUCATION AND PROFESSIONAL CREDENTIALS ■B.S. in Finance from the University of Illinois at Urbana-Champaign, a Certified Public Accountant and a Chartered Financial Analyst

■Earned the CERT certificate in Cybersecurity Oversight from Carnegie Mellon University and the NACD, demonstrating her commitment to advanced

understanding of the role of the board and management in cybersecurity oversight |

| 18 | www.fcx.com |

Board and Corporate Governance Matters

|

Dustan E. McCoy LEAD INDEPENDENT DIRECTOR Retired Chairman and Chief Executive Officer of Brunswick Corporation Freeport Committee Memberships ■Compensation Committee

|

Current Public Company Directorships ■Louisiana-Pacific Corporation

(Lead Independent Director) ■YETI Holdings, Inc.

|

| SKILLS AND QUALIFICATIONS |

BUSINESS EXPERIENCE | |

|

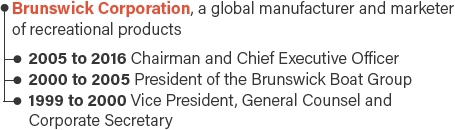

■Executive leadership, management and extensive public company boardroom experience

■Comprehensive experience with legal and compliance matters, corporate governance and disclosure matters and human capital management

■Over 20 years of experience in the natural resources and extractives industry with Ashland Oil, Inc. and as Chairman of the Board of a private quarry business

■Broad understanding of the operational, financial and strategic issues facing large global mining companies

|

EDUCATION AND PROFESSIONAL CREDENTIALS ■B.A. in Political Science from Eastern Kentucky University and J.D. from Salmon P. Chase College of Law at Northern Kentucky University |

|

Kathleen L. Quirk NEW President of Freeport-McMoRan Inc. |

Current Public Company Directorships ■Vulcan Materials Company

|

| SKILLS AND QUALIFICATIONS |

BUSINESS EXPERIENCE | |

|

■Extensive knowledge of the company’s business operations, having over 30 years of experience in the Freeport organization

■Senior member of the company’s executive team and has previously held various leadership roles at Freeport

■Proven leader and a key long-term contributor in establishing Freeport as a global leader in the copper industry

■Strong partner to Freeport’s operational leaders and instrumental in the company’s strategic planning, with responsibility for a broad range of corporate functions

|

EDUCATION AND PROFESSIONAL CREDENTIALS ■B.S. in Accounting from Louisiana State University |

| Freeport-McMoRan 2023 Proxy Statement | 19 |

Board and Corporate Governance Matters

|

John J. Stephens INDEPENDENT Retired Senior Executive Vice President and Chief Financial Officer of AT&T Inc. Freeport Committee Memberships ■Audit Committee (Chair)

|

Current Public Company Directorships ■Solid Power, Inc.

(Lead Independent Director) |

| SKILLS AND QUALIFICATIONS |

BUSINESS EXPERIENCE | |

|

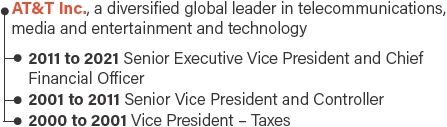

■Over 35 years of accounting and corporate finance expertise, including experience in matters of financial planning, corporate development, accounting and accounting policy, tax, auditing, treasury, investor relations, corporate real estate, business planning and financial, operational and regulatory reporting

■Senior leadership experience in the oversight of a large, publicly traded company and vast experience in financial and accounting matters, international business and affairs, mergers, acquisitions and other major corporate transactions

■Director and Audit Committee Chair of a large private food retailer

|

EDUCATION AND PROFESSIONAL CREDENTIALS ■B.S.B.A. in Accounting from Rockhurst University and J.D. from St. Louis University School of Law |

|

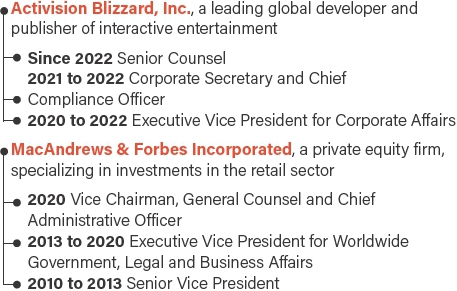

Frances Fragos Townsend INDEPENDENT Senior Counsel and Former Executive Vice Freeport Committee Memberships ■Corporate Responsibility Committee (Chair)

|

Current Public Company Directorships ■Chubb Limited

■Leonardo DRS, Inc.

(Lead Independent Director) Former Public Company Directorships ■Scientific Games Corporation

■SciPlay Corporation

■The Western Union Company

|

| SKILLS AND QUALIFICATIONS |

BUSINESS EXPERIENCE | |

|

■Over 25 years of domestic and international experience in legal, law enforcement and security sectors, including a strong background in strategic planning, risk management, intelligence and security matters, and domestic and international affairs

■Extensive personnel, public policy, business management and financial capabilities, and government, regulatory and legal experience, including complex international regulatory matters from her service in the Office of President George W. Bush as Homeland Security and Counterterrorism Advisor, Chair of the Homeland Security Council and Deputy Assistant to the President and Deputy National Security Advisor for Combatting Terrorism

■Member of the Council on Foreign Relations and the Executive Committee of the Trilateral Commission

|

EDUCATION AND PROFESSIONAL CREDENTIALS ■B.A. in Political Science and a B.S. in Psychology from American University and J.D. from the University of San Diego School of Law |

| 20 | www.fcx.com |

Board and Corporate Governance Matters

Corporate Governance Highlights

Our commitment to good corporate governance is evidenced by the following practices:

| BOARD STRUCTURE AND GOVERNANCE | ESG / SUSTAINABILITY |

|

■Active board and committee oversight of risk

■Lead independent director with clearly defined responsibilities

■Highly independent board and fully independent committees

■Demonstrated board refreshment and diversity

■Board diversity policy

■Limitations on public company board and committee service, including a limitation on audit committee service for members of our audit committee

■Director commitment policy

■Annual board and committee performance evaluations

■Regular executive sessions

|

■Long-standing commitment to sustainable and responsible production practices across priority ESG focus areas, in alignment with our sustainability strategy

■Committed to maintaining the validation of all of our copper producing sites with the Copper Mark

■Formal climate strategy and 2030 GHG emissions intensity reduction targets covering nearly 100% of Scope 1 and 2 GHG emissions

■Committed to transparently reporting on our performance through ESG disclosures which are externally assured and in alignment with best practices, including the International Financial Reporting Standards Foundation’s SASB Standards and the Task Force on Climate-related Financial Disclosures, with a focus on continuous improvement

■Extensive, long-standing tailings management program, including implementation of the Global Industry Standard on Tailings Management

|

|

STOCKHOLDER RIGHTS AND ENGAGEMENT |

STOCK OWNERSHIP |

|

■Stockholder proxy access

■Majority voting for directors

■Stockholder right to call special meetings (15%)

■Stockholder right to act by written consent

■Robust stockholder engagement program with history of responsiveness to stockholders

|

■Stock ownership guidelines of 5x annual fee (currently $125,000) for non-management directors

■Stock ownership guidelines of 6x base salary for our CEO and our president

■Stock ownership guidelines of 3x base salary for our other executive officers

|

Key Governance Practices

| 1 | Board Composition and Refreshment Board composition, director recruitment and nomination process, stockholder recommendations and nominations, board diversity policy, annual board and committee evaluations, beyond the boardroom, limitation on board and committee service and director commitment policy |

PAGE 22 |

Corporate Governance Guidelines; Principles of Business Conduct We are committed to effective corporate governance that is informed by our stockholders, promotes the long-term interests of our stockholders, strengthens board and management accountability and engenders public trust in our company. Our corporate governance guidelines, along with the charters of our principal board committees, provide the framework for the governance of our company and reflect the board’s commitment to monitor the effectiveness of governance-related policy and decision making at both the board and management levels. We are committed to the highest level of ethical and legal conduct in all of our business operations. Our principles of business conduct highlight the core values on which our company has built its reputation – safety, respect, integrity, excellence and commitment. Our principles of business conduct provide guidance for the application of these values to our business and define the expected behavior of all of our employees and our board. Amendments to, or waivers of, our principles of business conduct granted to any of our directors or executive officers will be published promptly on our website. |

| 2 | Board Oversight Areas of board oversight of strategy and risk management, including board and committee roles, enterprise risk management, management and board oversight of cybersecurity and succession planning for senior executives |

PAGE 26 | |

| 3 | Communications with the Board Communications with board and availability of corporate governance documents |

PAGE 29 | |

| 4 | Board Structure Leadership structure, board committees, 2022 board and committee meeting attendance, board independence and related person transactions |

PAGE 30 |

| Freeport-McMoRan 2023 Proxy Statement | 21 |

Board and Corporate Governance Matters

| 1 |

Board Composition and Refreshment |

|

Board Composition Our board currently consists of 12 members, 10 of whom the board has affirmatively determined are independent. Each of our current directors has been nominated to stand for election at our 2023 annual meeting. In the last five years, we have significantly refreshed our board, adding eight new directors to the board, seven of whom are independent, and successfully achieved our board refreshment objectives focused on thoughtfully enhancing the composition and size of the board, decreasing our average director tenure and age, increasing the gender, race and ethnic diversity of our board, and adding CEO experience, extractives industry experience, international experience, accounting and financial expertise and ESG/sustainability experience, including climate expertise. The addition of these new directors delivers on our multi-year refreshment strategy and our commitment to have a board with expansive and diverse experience, a deep understanding of the challenges and opportunities associated with our global business and a focus on value and sustainability for the benefit of all stakeholders. |

BOARD REFRESHMENT in the past 5 years

8 new directors have joined our board

7 of whom are independent |

Director Recruitment and Nomination Process

Our governance committee oversees the director recruitment and nomination process. The governance committee identifies, and formally considers and recommends to the board, candidates to be nominated for election to the board at each annual meeting of stockholders or as necessary to fill vacancies and newly created directorships. The governance committee carries out this responsibility through the process described below.

|

1 |

Annual Evaluation of Board Composition ■The governance committee annually reviews the composition and size of our board, recognizing the importance of refreshment to maintain a balance of tenure, diversity, skill sets and experience to position the company for long-term success.

■Among other factors, the governance committee considers our company’s strategy and needs; our directors’ collective knowledge, experience, expertise and diversity, including of tenure and age; and the specific qualifications, attributes, skills and experience our board deems relevant to developing criteria for potential candidates. | ||

|

2 |

Identify Potential Director Candidates ■If the governance committee determines that there is a need for new candidates, individuals may be identified through a variety of methods, including by our directors, management, stockholders and/or an independent search firm. Each candidate brought to the attention of the governance committee, regardless of who recommended such candidate, will be equally considered.

■Based on the factors and criteria developed in the assessment phase, the governance committee may engage an independent search firm to assist in identifying a potential pool of candidates. | ||

| 22 | www.fcx.com |

Board and Corporate Governance Matters

|

3 |

Review Candidate Pool ■The governance committee and the full board review the potential pool of candidates.

■In evaluating the suitability of potential director nominees, the governance committee considers personal and professional integrity, general understanding of our industry, educational and professional background, independence, diversity, experience in corporate finance and other matters relevant to the successful management of a large publicly traded company in today’s business environment, the ability and willingness to work cooperatively with other members of the board and with senior management and to devote adequate time to duties of the board.

■The governance committee also evaluates each potential director nominee in the context of the board as a whole, with the objective of recommending nominees who can best advance the long-term success of the business, be effective directors in conjunction with the full board and represent stockholder interests through the exercise of sound judgment using their diversity of experience in these various areas.

In-Depth Candidate Review ■Potential director nominees interview with each of the chairman of the board, the lead independent director and the chair of the governance committee, as well as our president.

■Due diligence is performed, including background and conflicts checks, review of director commitment levels, references and feedback from other directors and the independent search firm. | ||

|

4 |

Governance Committee Recommendation to the Board ■The governance committee reviews a candidate’s independence and all due diligence results and recommends potential directors to the board for approval.

■The governance committee and the full board will consider the nature of and time involved in a director’s service on other boards and whether any existing or anticipated outside commitments interfere with a director’s performance when evaluating the suitability of individual directors and director nominees. | ||

|

5 |

Board Appointment ■The board reviews the recommendation of the governance committee and approves the candidate’s appointment to the board. | ||

|

6 |

New Director Orientation ■Following appointment to the board, a new director orientation session with key members of our senior leadership team is promptly scheduled to facilitate a seamless onboarding experience. These orientation sessions are highly interactive and immersive. | ||

|

7 |

Stockholders Vote ■Stockholders vote on director nominees at our annual meeting. | ||

| Freeport-McMoRan 2023 Proxy Statement | 23 |

Board and Corporate Governance Matters

Stockholder Recommendations and Nominations

The governance committee will consider candidates proposed for nomination by our stockholders. Stockholders may propose candidates by submitting the names and supporting information to: Corporate Secretary, Freeport-McMoRan Inc., 333 North Central Avenue, Phoenix, Arizona 85004. Supporting information should include (a) the name and address of the candidate and the proposing stockholder; (b) a comprehensive biography of the candidate, including any self-identifying diversity characteristics, and an explanation of why the candidate is qualified to serve as a director taking into account the criteria identified in our corporate governance guidelines; (c) proof of ownership, the class and number of shares, and the length of time that the shares of our voting securities have been beneficially owned by each of the candidate and the proposing stockholder; and (d) a letter from the candidate stating his or her willingness to serve, if elected as a director.

In addition, our by-laws permit stockholders to nominate directors for consideration at an annual meeting of stockholders and, under certain circumstances, to include their nominees in our proxy statement. For a description of the process for nominating directors in accordance with our by-laws and under the applicable rules and regulations of the SEC, see “2024 Stockholder Proposals and Director Nominations.”

Board Diversity Policy

The board recognizes and embraces diversity and is actively committed to inclusion and diversity in the boardroom. In accordance with our board diversity policy, which is set forth in our corporate governance guidelines, when evaluating the diversity of potential director nominees, the governance committee considers a broad range of diversity, including diversity in terms of professional experience, skills and background, as well as diversity of gender, race and ethnicity. Further, when conducting searches for new directors, the governance committee includes qualified female and racially and/or ethnically diverse individuals in the pool of candidates.

Annual Board and Committee Evaluations

|

Our board and each of its committees have an annual self-evaluation process to ensure that they are performing effectively and in the best interests of the company and our stockholders. The governance committee oversees this annual performance evaluation process and establishes procedures to assist it in exercising this oversight function. The governance committee discusses with the full board the results of these annual performance evaluations, including any recommended changes to policies or procedures of the company, the board or any of its committees. The governance committee periodically reviews the evaluation process and revises as appropriate. In 2022, upon consultation with the lead independent director and the chair of the governance committee, the chairman of the board conducted one-on-one discussions with directors, six of whom were newly appointed to the board in 2021. The results were discussed with the full board in executive session. In 2023, the lead independent director and the chair of the governance committee plan to conduct one-on-one discussions with individual directors. The results will be aggregated and discussed with the full board in executive session. |

2022 Evaluation Topics ■Board composition and leadership structure; committee structure and composition

■Board’s role in oversight of strategy and risk management

■Meeting participation, materials and procedures

■Interactions with management and advisors

■Supporting resources, ongoing education and development opportunities

■Succession planning at the board and management level |

| 24 | www.fcx.com |

Board and Corporate Governance Matters

Beyond the Boardroom

Our board is actively engaged in overseeing our strategy and takes an active role in risk oversight. During 2022, we held six board meetings and 14 committee meetings to discuss, deliberate and make decisions on key strategic matters, at which we had a 100% director attendance rate. In addition to regular board and committee meetings, we provide channels for both new and tenured directors to engage in comprehensive onboarding and continued education in areas relevant to our business and our industry, regularly interact with our management outside the boardroom, and connect directly with our stockholders to strengthen their understanding and oversight of our business, strategy, and key priorities. The governance committee monitors and evaluates the orientation and training needs of directors and makes recommendations to the board where appropriate.

|

Director Orientation |

|

Access to Management |

|

Stockholder Engagement |

|||||||

| Following appointment to the board, a new director orientation session with key members of our senior leadership team is promptly scheduled to facilitate a seamless onboarding experience. These orientation sessions are highly interactive and immersive. | All directors have full and free access to management both during and outside of regularly scheduled board and committee meetings. | Our board values the input of our stockholders. Our board receives periodic updates on stockholder engagement led by management, and is directly involved in responding to and participating in communications where appropriate. From time to time, directors participate in direct engagement with our stockholders to discuss specific matters of mutual importance. | ||||||||||

|

Periodic Briefings from our CEO |

|

Continuing Education |

|

Site Visits | |||||||

| Our CEO provides our board with periodic updates on major business developments, milestones, important internal initiatives and communications the company has had with stockholders and other stakeholders as events arise in the ordinary course of business. These periodic briefings are intended to keep the board informed between regularly scheduled meetings on matters that are significant to our company and industry. | The company maintains a subscription for board members to the National Association of Corporate Directors (NACD), a recognized authority focused on advancing board leadership and establishing leading boardroom practices. Through NACD, directors have access to webinars and virtual education opportunities, NACD publications and complimentary registration to the annual NACD Virtual Summit. Our directors may also attend, at the company’s expense, other director continuing education programs relevant to the duties of a director, corporate governance, best board practices or the mining industry. | Periodically, directors will be invited or may request to visit certain of the company’s significant mining and other operating sites, and management will prepare educational sessions for the directors relevant to the company’s operations and plans to understand better the company’s business and culture. | ||||||||||

| Freeport-McMoRan 2023 Proxy Statement | 25 |

Board and Corporate Governance Matters

Limitation on Board and Committee Service and Director Commitment Policy

It is the expectation of the board that every director devotes the significant time and attention necessary to fulfill their duties as a director, including regularly preparing for, attending and actively participating in meetings of the board and its committees. Our corporate governance guidelines establish the following limits on our directors serving on public company boards and audit committees:

| Director Category | Limit on public company board and committee service, including Freeport |

| All directors | 4 boards |

| Directors who serve on our audit committee | 3 audit committees |

The governance committee may approve exceptions to these limitations under certain circumstances and with consideration given to public company board leadership roles and outside commitments. The governance committee and the full board will take into account the nature of and time involved in a director’s service on other boards and whether any existing or anticipated outside commitments interfere with a director’s performance when evaluating the suitability of individual directors and director nominees. Service on boards or committees of other organizations should be consistent with the company’s conflict of interest standards. Additionally, directors are expected to advise the chairman of the board, the lead independent director (if applicable) and/or the chair of the governance committee prior to accepting any other public company directorship or any assignment to the audit committee or compensation committee of the board of directors of any other public company of which such director is a member. The governance committee annually conducts a review of director commitment levels and has affirmed that all directors are currently compliant with the director commitment policy under our corporate governance guidelines.

| 2 |

Board Oversight |

Board’s Role in Oversight of Strategy and Risk Management

While our management is responsible for the day-to-day management of risk, our board and its committees are actively engaged in overseeing our strategy and take an active role in risk oversight.

| ■ | The board oversees the strategic direction of the company, and in doing so considers the potential rewards and risks of our business opportunities and challenges, and monitors the development and management of risks that impact our strategic goals. |

| ■ | The board as a whole is responsible for risk oversight at the company, with reviews of certain areas being conducted by the relevant board committees that regularly report to the full board. |

| ■ | In its risk oversight role, the board reviews, evaluates and discusses with appropriate members of management whether the risk management processes designed and implemented by management are adequate in identifying, assessing, managing and mitigating material risks facing the company, including financial, international, operational, social and environmental risks. |

The board believes that full and open communication between senior management and the directors is essential to effective risk oversight. Our lead independent director regularly meets and discusses with our chairman and CEO on a variety of matters, including business strategies, opportunities, key challenges and risks facing the company, as well as management’s risk mitigation strategies.

| 26 | www.fcx.com |

Board and Corporate Governance Matters

The chart below provides an overview of the allocation of risk management responsibilities among the board and its committees.

|

Board of Directors Responsible for risk oversight at the company |

|||

|

|||

|

Board Committees |

|||

|

Audit Committee

■Reviews and discusses with management, our internal audit firm, and our independent registered public accounting firm, the company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the company’s risk assessment and risk management policies.

■Oversees the effectiveness of the company’s internal control over financial reporting, and the company’s compliance with legal and regulatory requirements.

■Meets periodically with independent registered public accounting firm and internal audit firm in executive sessions.