Exhibit

Freeport-McMoRan

Reports Second-Quarter and Six-Month 2018 Results | |

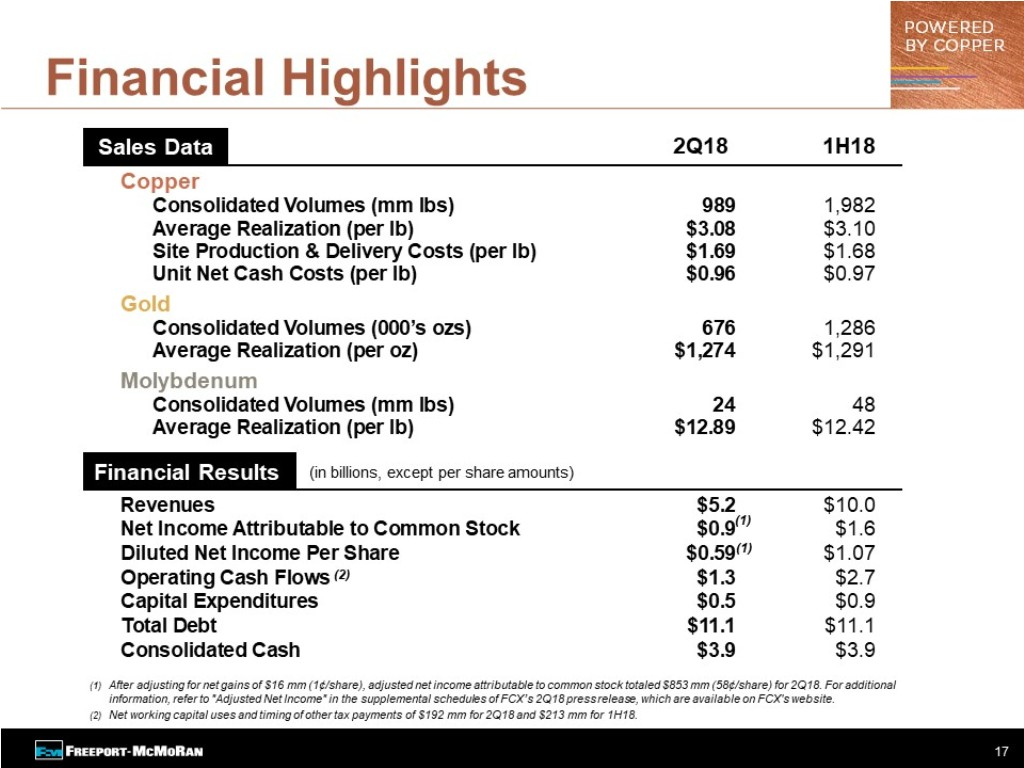

▪ | Net income attributable to common stock totaled $869 million, $0.59 per share, in second-quarter 2018. After adjusting for net gains of $16 million, $0.01 per share, second-quarter 2018 adjusted net income attributable to common stock totaled $853 million, $0.58 per share. |

| |

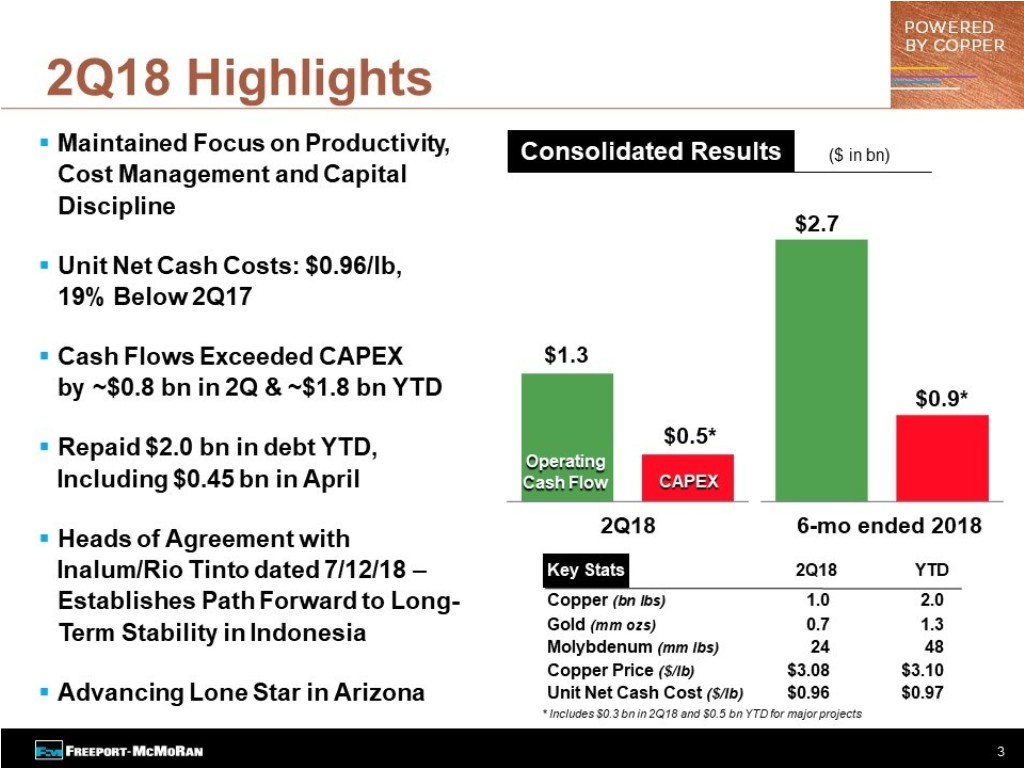

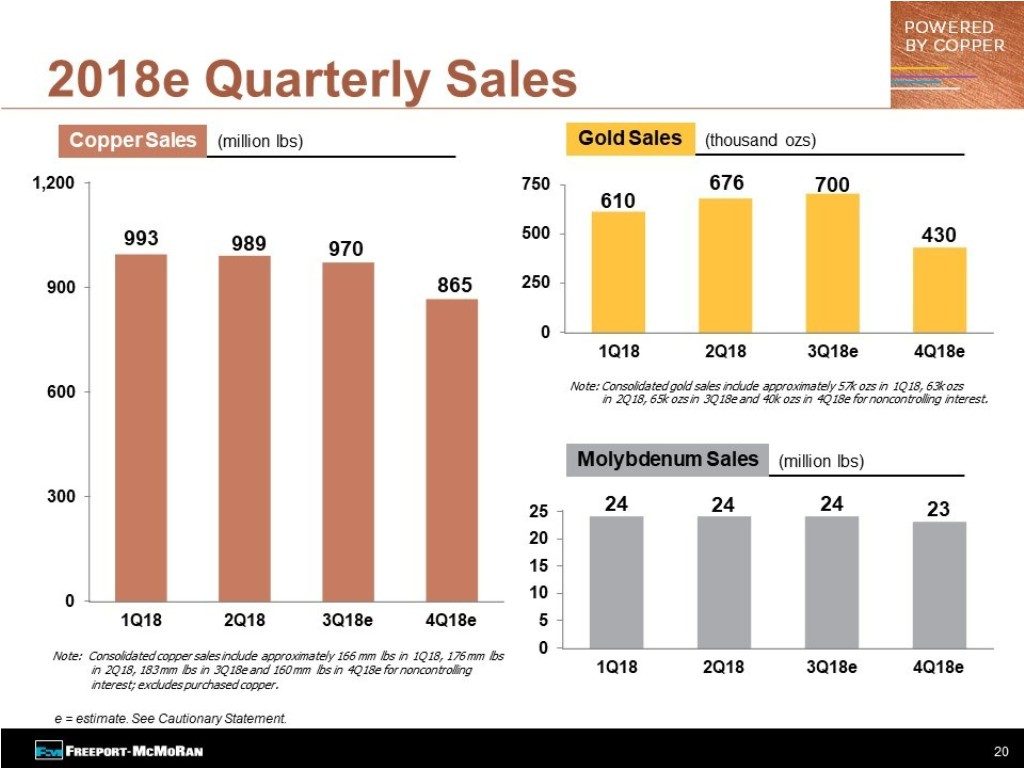

▪ | Consolidated sales totaled 989 million pounds of copper, 676 thousand ounces of gold and 24 million pounds of molybdenum in second-quarter 2018. |

| |

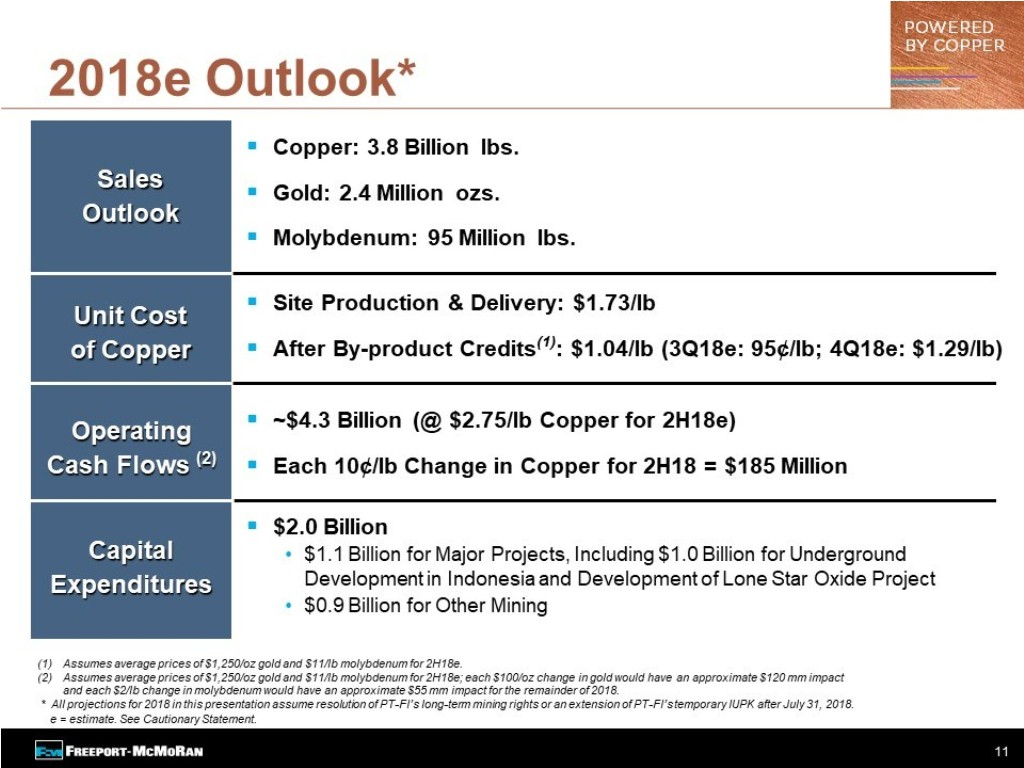

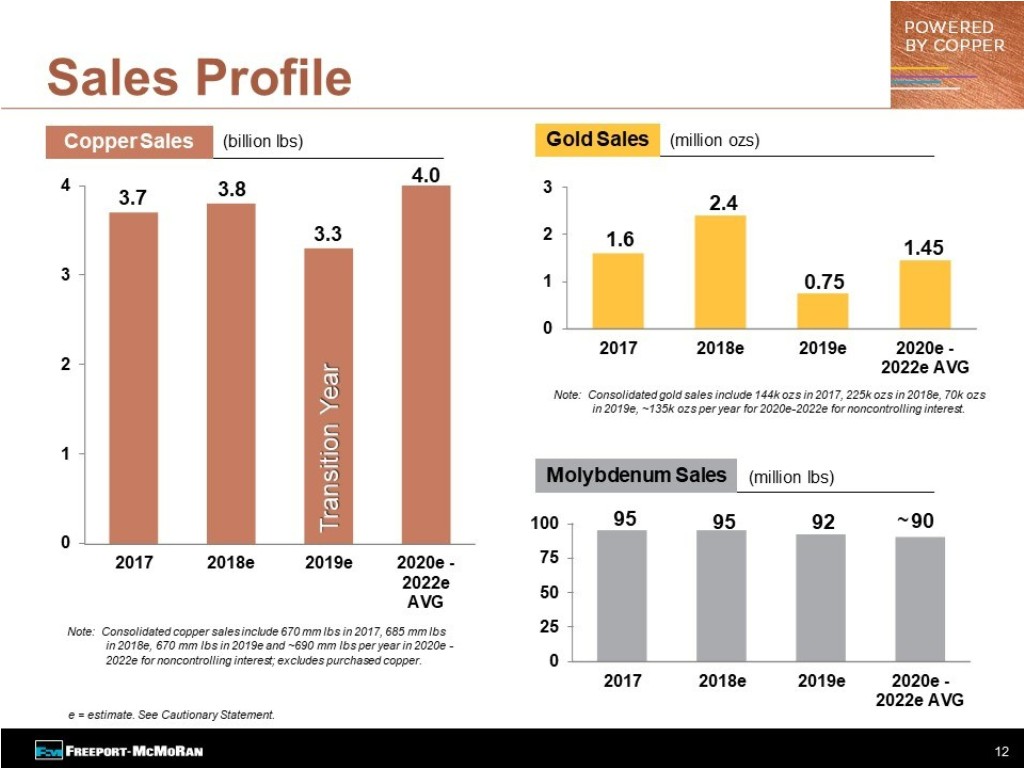

▪ | Consolidated sales for the year 2018 are expected to approximate 3.8 billion pounds of copper, 2.4 million ounces of gold and 95 million pounds of molybdenum, including 970 million pounds of copper, 700 thousand ounces of gold and 24 million pounds of molybdenum in third-quarter 2018. |

| |

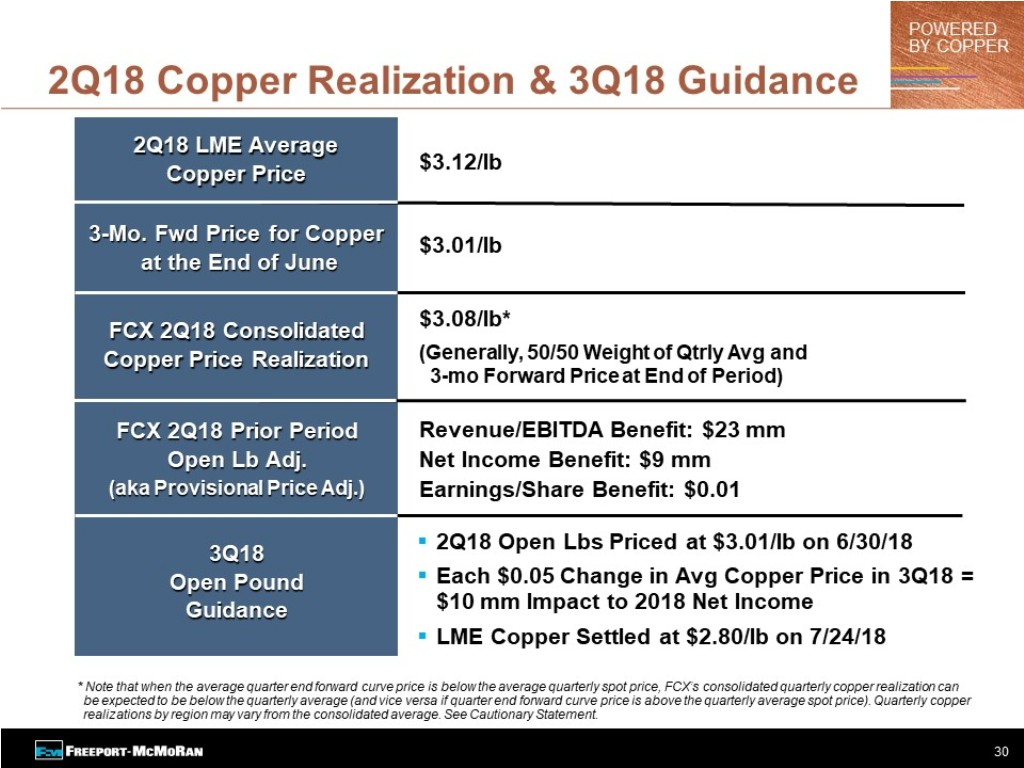

▪ | Average realized prices in second-quarter 2018 were $3.08 per pound for copper, $1,274 per ounce for gold and $12.89 per pound for molybdenum. |

| |

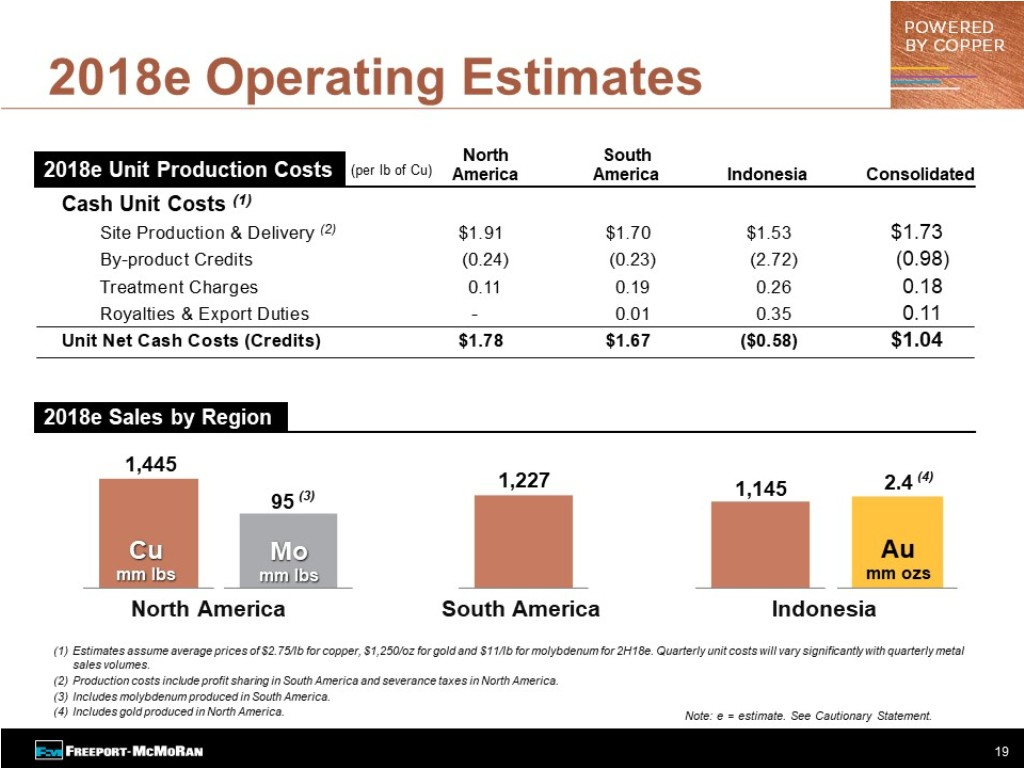

▪ | Average unit net cash costs in second-quarter 2018 were $0.96 per pound of copper and are expected to average $1.04 per pound of copper for the year 2018. |

| |

▪ | Operating cash flows totaled $1.3 billion (net of $0.2 billion in working capital uses and timing of other tax payments) in second-quarter 2018 and $2.7 billion (net of $0.2 billion in working capital uses and timing of other tax payments) for the first six months of 2018. Based on current sales volume and cost estimates, and assuming average prices of $2.75 per pound for copper, $1,250 per ounce for gold and $11.00 per pound for molybdenum for the second half of 2018, operating cash flows are expected to approximate $4.3 billion (net of $0.2 billion in working capital uses and timing of other tax payments) for the year 2018. |

| |

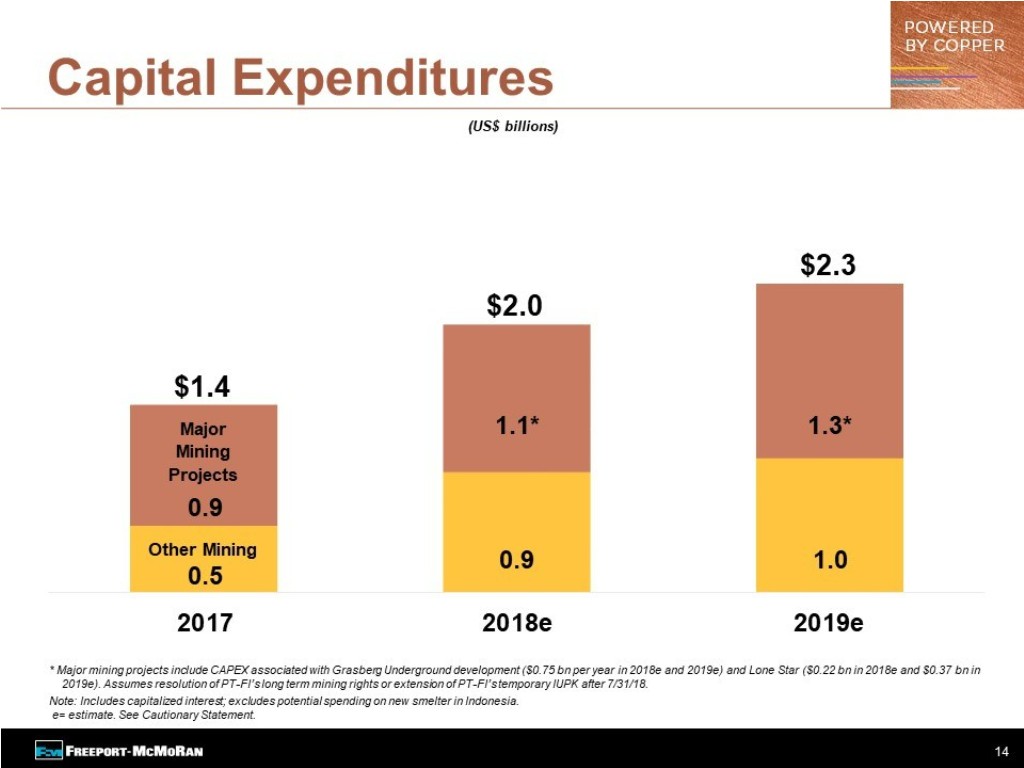

▪ | Capital expenditures totaled $0.5 billion (including approximately $0.3 billion for major mining projects) in second-quarter 2018 and $0.9 billion (including approximately $0.5 billion for major mining projects) for the first six months of 2018. Capital expenditures for the year 2018 are expected to approximate $2.0 billion, including $1.1 billion for major mining projects primarily associated with underground development activities in the Grasberg minerals district in Indonesia and development of the Lone Star oxide project in Arizona. |

| |

▪ | In April 2018, FCX repaid $454 million in debt, consisting of the redemption of $404 million of senior notes due 2022 and $50 million of senior notes due 2023. |

| |

▪ | At June 30, 2018, consolidated debt totaled $11.1 billion and consolidated cash totaled $3.9 billion. FCX had no borrowings and $3.5 billion available under its revolving credit facility at June 30, 2018. |

| |

▪ | On June 27, 2018, FCX declared a quarterly cash dividend of $0.05 per share on its common stock, which will be paid on August 1, 2018. |

| |

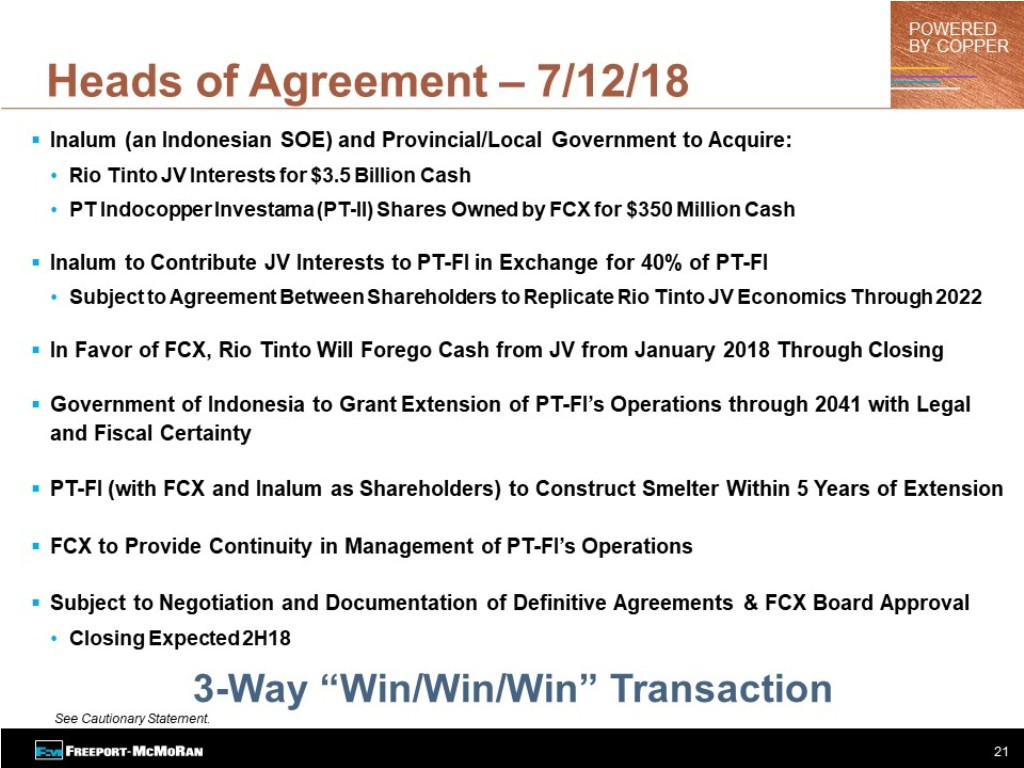

▪ | In July 2018, FCX and PT Freeport Indonesia (PT-FI) entered into a non-binding Heads of Agreement with PT Indonesia Asahan Aluminium (Persero) (Inalum) and Rio Tinto to establish a new long-term partnership between FCX, Inalum and the Indonesian government. |

PHOENIX, AZ, July 25, 2018 - Freeport-McMoRan Inc. (NYSE: FCX) reported net income attributable to common stock of $869 million ($0.59 per share) in second-quarter 2018 and $1.6 billion ($1.07 per share) for the first six months of 2018, compared with $268 million ($0.18 per share) in second-quarter 2017 and $496 million ($0.34 per share) for the first six months of 2017. After adjusting for net gains of $16 million ($0.01 per share), adjusted net income attributable to common stock totaled $853 million ($0.58 per share) in second-quarter 2018. Refer to the supplemental schedule, "Adjusted Net Income," on page VII, which is available on FCX's website, "fcx.com," for additional information.

Richard C. Adkerson, President and Chief Executive Officer, said, "Our second quarter results reflect strong performance from our global operations and a continued focus on productivity, cost management and capital discipline. During the first half of 2018, we generated $2.7 billion in cash flow from operations and capital expenditures totaled $0.9 billion, enabling further strengthening of our balance sheet and advancement of initiatives to build value for FCX shareholders. We achieved important progress during the quarter to reach a new long-term partnership structure with the Indonesian government, and we remain focused on completing negotiation and documentation of definitive agreements to restore long-term stability for our Grasberg operations.

Despite the recent decline in copper prices associated with the uncertain impact on the global economy of recent international trade actions, we remain positive on the outlook for copper prices given limitations on supply and the important role of copper in the global economy. To date, we have not experienced a decline in demand for our products, but will be prepared to adjust our plans if necessary to respond to market conditions. Our shareholders are well positioned to benefit from FCX’s global leadership position in copper, supported by a large, high-quality portfolio of long-lived, geographically diverse assets."

SUMMARY FINANCIAL DATA |

| | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | |

| 2018 | | 2017 | | 2018 | | 2017 | |

| (in millions, except per share amounts) | |

Revenuesa,b | $ | 5,168 |

| | $ | 3,711 |

| | $ | 10,036 |

| | $ | 7,052 |

| |

Operating incomea | $ | 1,664 |

| | $ | 686 |

| | $ | 3,123 |

| | $ | 1,283 |

| |

Net income from continuing operations | $ | 1,039 |

| | $ | 326 |

| | $ | 1,867 |

| | $ | 594 |

| |

Net (loss) income from discontinued operationsc | $ | (4 | ) | | $ | 9 |

| | $ | (15 | ) | | $ | 47 |

| |

Net income attributable to common stockd,e | $ | 869 |

| | $ | 268 |

| | $ | 1,561 |

| | $ | 496 |

| |

Diluted net income (loss) per share of common stock: | | | | | | | | |

Continuing operations | $ | 0.59 |

| | $ | 0.18 |

| | $ | 1.08 |

| | $ | 0.31 |

| |

Discontinued operations | — |

| | — |

| | (0.01 | ) | | 0.03 |

| |

| $ | 0.59 |

| | $ | 0.18 |

| | $ | 1.07 |

| | $ | 0.34 |

| |

Diluted weighted-average common shares outstanding | 1,458 |

| | 1,453 |

| | 1,458 |

| | 1,453 |

| |

Operating cash flowsf | $ | 1,309 |

| | $ | 1,037 |

| | $ | 2,678 |

| | $ | 1,829 |

| |

Capital expenditures | $ | 482 |

| | $ | 362 |

| | $ | 884 |

| | $ | 706 |

| |

At June 30: | | | | | | | | |

Cash and cash equivalents | $ | 3,859 |

| | $ | 4,667 |

| | $ | 3,859 |

| | $ | 4,667 |

| |

Total debt, including current portion | $ | 11,127 |

| | $ | 15,354 |

| | $ | 11,127 |

| | $ | 15,354 |

| |

| | | | | | | | |

| |

a. | For segment financial results, refer to the supplemental schedules, "Business Segments," beginning on page IX, which are available on FCX's website, "fcx.com." |

| |

b. | Includes adjustments to prior period provisionally priced concentrate and cathode copper sales totaling $23 million ($9 million to net income attributable to common stock or $0.01 per share) in second-quarter 2018, $(20) million ($(8) million to net income attributable to common stock or $(0.01) per share) in second-quarter 2017, $(70) million ($(31) million to net income |

attributable to common stock or $(0.02) per share) for the first six months of 2018 and $81 million ($35 million to net income attributable to common stock or $0.02 per share) for the first six months of 2017. For further discussion, refer to the supplemental schedule, "Derivative Instruments," beginning on page VIII, which is available on FCX's website, "fcx.com."

| |

c. | Primarily reflects adjustments to the fair value of contingent consideration related to the 2016 sale of FCX's interest in TF Holdings Limited, which will continue to be adjusted through December 31, 2019. |

| |

d. | Includes net gains of $16 million ($0.01 per share) in second-quarter 2018, $27 million ($0.01 per share) in second-quarter 2017, $27 million ($0.02 per share) for the first six months of 2018 and $34 million ($0.02 per share) for the first six months of 2017 that are described in the supplemental schedule, "Adjusted Net Income," on page VII, which is available on FCX's website, "fcx.com." |

| |

e. | FCX defers recognizing profits on intercompany sales until final sales to third parties occur. For a summary of net impacts from changes in these deferrals, refer to the supplemental schedule, "Deferred Profits," on page IX, which is available on FCX's website, "fcx.com." |

| |

f. | Includes net working capital (uses) sources and timing of other tax payments of $(192) million in second-quarter 2018, $154 million in second-quarter 2017, $(213) million for the first six months of 2018 and $343 million for the first six months of 2017. |

SUMMARY OPERATING DATA

|

| | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | |

| | 2018 | | 2017 | | 2018 | | 2017 | |

Copper (millions of recoverable pounds) | | | | | | | | | |

Production | | 1,014 |

| | 883 |

| | 1,966 |

| | 1,734 |

| |

Sales, excluding purchases | | 989 |

| | 942 |

| | 1,982 |

| | 1,751 |

| |

Average realized price per pound | | $ | 3.08 |

| | $ | 2.65 |

| | $ | 3.10 |

| | $ | 2.65 |

| |

Site production and delivery costs per pounda | | $ | 1.69 |

| | $ | 1.63 |

| | $ | 1.68 |

| | $ | 1.61 |

| |

Unit net cash costs per pounda | | $ | 0.96 |

| | $ | 1.19 |

| | $ | 0.97 |

| | $ | 1.28 |

| |

Gold (thousands of recoverable ounces) | | | | | | | | | |

Production | | 746 |

| | 353 |

| | 1,345 |

| | 592 |

| |

Sales, excluding purchases | | 676 |

| | 432 |

| | 1,286 |

| | 614 |

| |

Average realized price per ounce | | $ | 1,274 |

| | $ | 1,243 |

| | $ | 1,291 |

| | $ | 1,242 |

| |

Molybdenum (millions of recoverable pounds) | | | | | | | | | |

Production | | 24 |

| | 23 |

| | 46 |

| | 46 |

| |

Sales, excluding purchases | | 24 |

| | 25 |

| | 48 |

| | 49 |

| |

Average realized price per pound | | $ | 12.89 |

| | $ | 9.58 |

| | $ | 12.42 |

| | $ | 9.16 |

| |

| |

a. | Reflects per pound weighted-average production and delivery costs and unit net cash costs (net of by-product credits) for all copper mines, before net noncash and other costs. For reconciliations of per pound unit costs by operating division to production and delivery costs applicable to sales reported in FCX's consolidated financial statements, refer to the supplemental schedules, "Product Revenues and Production Costs," beginning on page XII, which are available on FCX's website, "fcx.com." |

Consolidated Sales Volumes

Second-quarter 2018 copper sales of 989 million pounds were higher than the April 2018 estimate of 970 million pounds and higher than second-quarter 2017 sales of 942 million pounds, primarily reflecting higher mining and milling rates and higher ore grades in Indonesia.

Second-quarter 2018 gold sales of 676 thousand ounces were lower than the April 2018 estimate of 700 thousand ounces, primarily because of timing of shipments, and were higher than second-quarter 2017 sales of 432 thousand ounces, primarily reflecting higher ore grades and operating rates in Indonesia. Lower second-quarter 2017 operating rates in Indonesia included the impact of labor disruptions at PT-FI in the first half of 2017.

Second-quarter 2018 molybdenum sales of 24 million pounds approximated the April 2018 estimate of 24 million pounds and second-quarter 2017 sales of 25 million pounds.

Sales volumes for the year 2018 are expected to approximate 3.8 billion pounds of copper, 2.4 million ounces of gold and 95 million pounds of molybdenum, including 970 million pounds of copper, 700 thousand ounces of gold and 24 million pounds of molybdenum in third-quarter 2018.

Projections for 2018 and other forward looking statements in this release assume resolution of PT-FI’s long-term mining rights or an extension of PT-FI’s temporary special mining license (IUPK) after July 31, 2018. Refer to "Indonesia Mining," beginning on page 7, for further discussion of Indonesia regulatory matters which could have a significant impact on future results.

Consolidated Unit Costs

Consolidated average unit net cash costs (net of by-product credits) for FCX's copper mines of $0.96 per pound of copper in second-quarter 2018 were lower than unit net cash costs of $1.19 per pound in second-quarter 2017, primarily reflecting higher by-product credits.

Assuming average prices of $1,250 per ounce of gold and $11.00 per pound of molybdenum for the second half of 2018 and achievement of current sales volume and cost estimates, consolidated unit net cash costs (net of by-product credits) for copper mines are expected to average $1.04 per pound of copper for the year 2018. The impact of price changes on consolidated unit net cash costs would approximate $0.015 per pound for each $50 per ounce change in the average price of gold and $0.02 per pound for each $2 per pound change in the average price of molybdenum for the second half of 2018. Quarterly unit net cash costs vary with fluctuations in sales volumes and realized prices, primarily for gold and molybdenum.

MINING OPERATIONS

North America Copper Mines. FCX operates seven open-pit copper mines in North America - Morenci, Bagdad, Safford, Sierrita and Miami in Arizona, and Chino and Tyrone in New Mexico. In addition to copper, certain of FCX's North America copper mines produce molybdenum concentrate, gold and silver.

All of the North America mining operations are wholly owned, except for Morenci. FCX records its 72 percent undivided joint venture interest in Morenci using the proportionate consolidation method.

Operating and Development Activities. FCX has significant undeveloped reserves and resources in North America and a portfolio of potential long-term development projects. Future investments will be undertaken based on the results of economic and technical feasibility studies, and are dependent on market conditions. FCX continues to study opportunities to reduce the capital intensity of its potential long-term development projects.

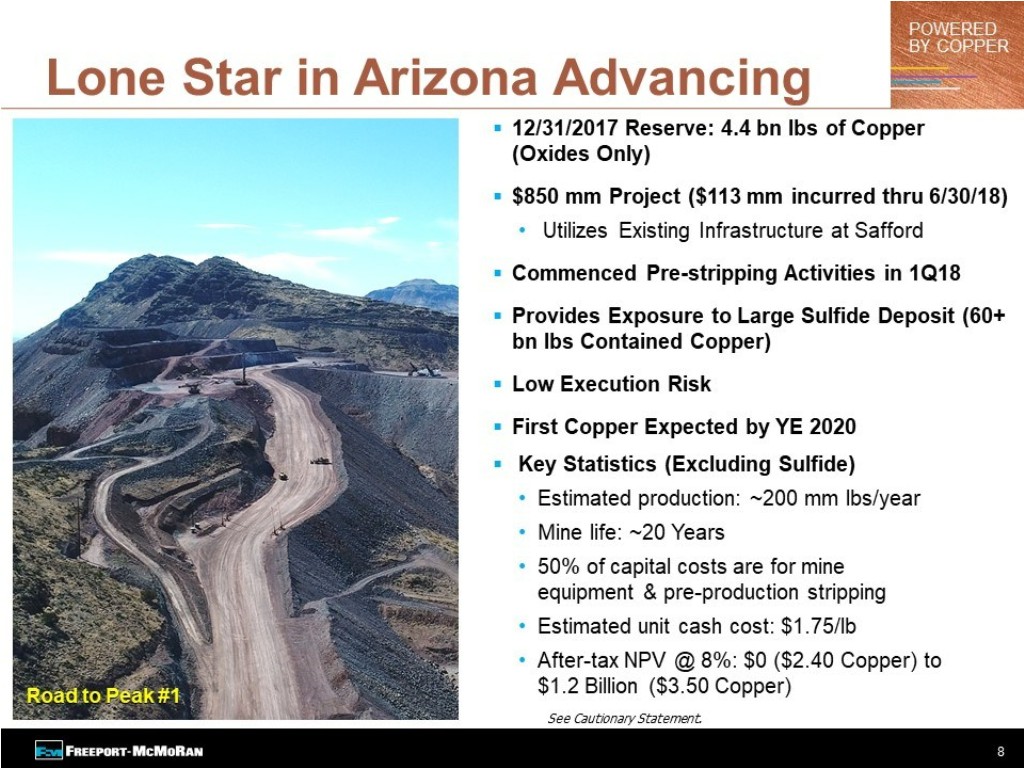

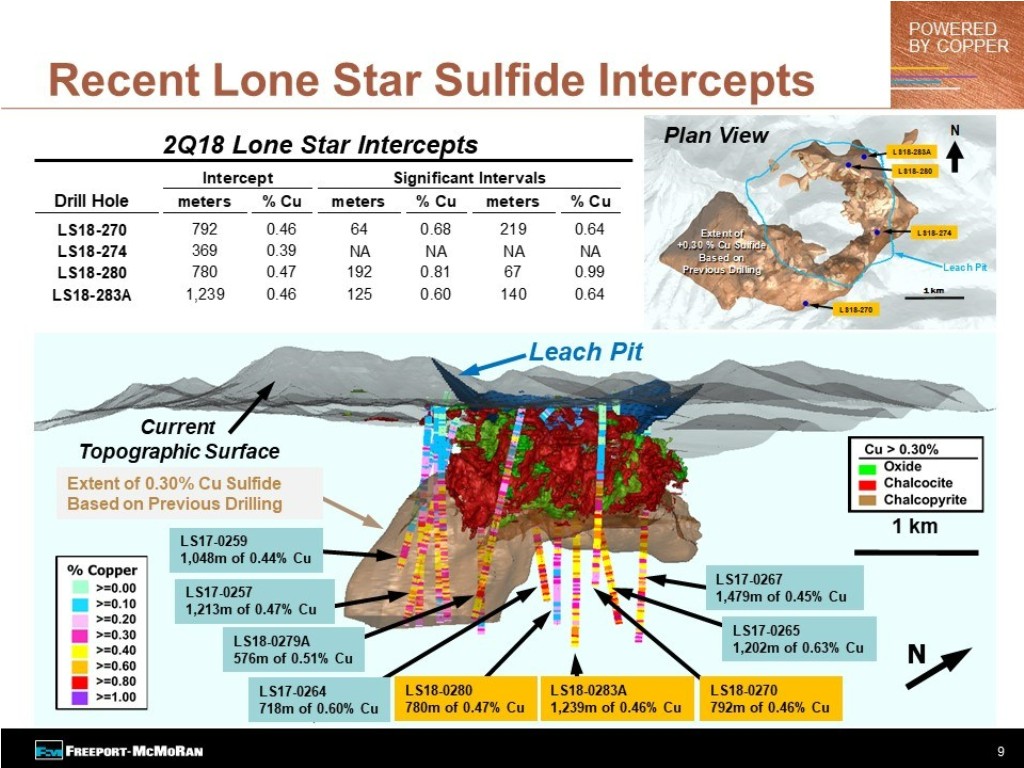

Through exploration drilling, FCX has identified a significant resource at its wholly owned Lone Star project located near the Safford operation in eastern Arizona. An initial project to develop the Lone Star oxide ores has commenced with first production expected by the end of 2020. Total capital costs, including mine equipment and pre-production stripping, are expected to approximate $850 million and will benefit from the utilization of existing infrastructure at the adjacent Safford operation. As of June 30, 2018, $113 million has been incurred for this project. Production from the Lone Star oxide ores is expected to average approximately 200 million pounds of copper per year with an approximate 20-year mine life. The project also advances the potential for development of a larger-scale district opportunity. FCX is conducting additional drilling following positive exploration results and continues to evaluate longer term opportunities available from the significant long-term sulfide potential in the Lone Star/Safford minerals district.

Operating Data. Following is summary consolidated operating data for the North America copper mines for the second quarters and first six months of 2018 and 2017: |

| | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | |

| | 2018 | | 2017 | | 2018 | | 2017 | |

Copper (millions of recoverable pounds) | | | | | | | | | |

Production | | 354 |

| | 384 |

| | 702 |

| | 776 |

| |

Sales, excluding purchases | | 361 |

| | 408 |

| | 745 |

| | 783 |

| |

Average realized price per pound | | $ | 3.12 |

| | $ | 2.62 |

| | $ | 3.14 |

| | $ | 2.65 |

| |

| | | | | | | | | |

Molybdenum (millions of recoverable pounds) | | | | | | | | | |

Productiona | | 8 |

| | 8 |

| | 15 |

| | 17 |

| |

| | | | | | | | | |

Unit net cash costs per pound of copperb | | | | | | | | | |

Site production and delivery, excluding adjustments | | $ | 1.94 |

| | $ | 1.58 |

| | $ | 1.89 |

| | $ | 1.54 |

| |

By-product credits | | (0.25 | ) | | (0.16 | ) | | (0.22 | ) | | (0.15 | ) | |

Treatment charges | | 0.10 |

| | 0.10 |

| | 0.10 |

| | 0.10 |

| |

Unit net cash costs | | $ | 1.79 |

| | $ | 1.52 |

| | $ | 1.77 |

| | $ | 1.49 |

| |

| | | | | | | | | |

| |

a. | Refer to summary operating data on page 3 for FCX's consolidated molybdenum sales, which includes sales of molybdenum produced at the North America copper mines. |

| |

b. | For a reconciliation of unit net cash costs per pound to production and delivery costs applicable to sales reported in FCX's consolidated financial statements, refer to the supplemental schedules, "Product Revenues and Production Costs," beginning on page XII, which are available on FCX's website, "fcx.com." |

North America's consolidated copper sales volumes of 361 million pounds in second-quarter 2018 were lower than second-quarter 2017 sales of 408 million pounds, primarily reflecting anticipated lower ore grades and timing of second-quarter 2017 shipments. North America copper sales are estimated to approximate 1.45 billion pounds for the year 2018, compared with 1.5 billion pounds in 2017.

Average unit net cash costs (net of by-product credits) for the North America copper mines of $1.79 per pound of copper in second-quarter 2018 were higher than unit net cash costs of $1.52 per pound in second-quarter 2017, primarily reflecting lower sales volumes and higher mining and milling costs, partly offset by higher by-product credits.

Average unit net cash costs (net of by-product credits) for the North America copper mines are expected to approximate $1.78 per pound of copper for the year 2018, based on achievement of current sales volume and cost estimates and assuming an average molybdenum price of $11.00 per pound for the second half of 2018. North America's average unit net cash costs for the year 2018 would change by approximately $0.02 per pound for each $2 per pound change in the average price of molybdenum for the second half of 2018.

South America Mining. FCX operates two copper mines in South America - Cerro Verde in Peru (in which FCX owns a 53.56 percent interest) and El Abra in Chile (in which FCX owns a 51 percent interest). These operations are consolidated in FCX's financial statements. In addition to copper, the Cerro Verde mine produces molybdenum concentrate and silver.

Operating and Development Activities. Cerro Verde's expanded operations benefit from its large-scale, long-lived reserves and cost efficiencies. The Cerro Verde expansion project, which achieved capacity operating rates in early 2016, expanded the concentrator facilities' capacity from 120,000 metric tons of ore per day to 360,000 metric tons of ore per day. In March 2018, Cerro Verde received a modified environmental permit allowing it to operate its existing concentrator facilities at rates up to 409,500 metric tons of ore per day. Cerro Verde's concentrator facilities have continued to perform well, with average mill throughput rates of 385,300 metric tons of ore per day for the first six months of 2018.

Exploration results at El Abra indicate a significant sulfide resource, which could potentially support a major mill project similar to facilities constructed at Cerro Verde. FCX continues to evaluate a large-scale expansion at El Abra to process additional sulfide material and to achieve higher recoveries. Future investments will depend on technical studies, which are being advanced, economic factors and market conditions.

Operating Data. Following is summary consolidated operating data for the South America mining operations for the second quarters and first six months of 2018 and 2017: |

| | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | |

| | 2018 | | 2017 | | 2018 | | 2017 | |

Copper (millions of recoverable pounds) | | | | | | | | | |

Production | | 313 |

| | 300 |

| | 606 |

| | 604 |

| |

Sales | | 312 |

| | 287 |

| | 602 |

| | 596 |

| |

Average realized price per pound | | $ | 3.07 |

| | $ | 2.67 |

| | $ | 3.09 |

| | $ | 2.65 |

| |

| | | | | | | | | |

Molybdenum (millions of recoverable pounds) | | | | | | | | | |

Productiona | | 7 |

| | 7 |

| | 13 |

| | 13 |

| |

| | | | | | | | | |

Unit net cash costs per pound of copperb | | | | | | | | | |

Site production and delivery, excluding adjustments | | $ | 1.77 |

| | $ | 1.55 |

| | $ | 1.78 |

| | $ | 1.52 |

| |

By-product credits | | (0.22 | ) | | (0.13 | ) | | (0.24 | ) | | (0.16 | ) | |

Treatment charges | | 0.18 |

| | 0.22 |

| | 0.19 |

| | 0.22 |

| |

Royalty on metals | | 0.01 |

| | 0.01 |

| | 0.01 |

| | 0.01 |

| |

Unit net cash costs | | $ | 1.74 |

| | $ | 1.65 |

| | $ | 1.74 |

| | $ | 1.59 |

| |

| | | | | | | | | |

| |

a. | Refer to summary operating data on page 3 for FCX's consolidated molybdenum sales, which includes sales of molybdenum produced at Cerro Verde. |

| |

b. | For a reconciliation of unit net cash costs per pound to production and delivery costs applicable to sales reported in FCX's consolidated financial statements, refer to the supplemental schedules, "Product Revenues and Production Costs," beginning on page XII, which are available on FCX's website, "fcx.com." |

South America's consolidated copper sales volumes of 312 million pounds in second-quarter 2018 were higher than second-quarter 2017 sales of 287 million pounds, primarily reflecting higher mining and milling rates and timing of second-quarter 2017 shipments, partly offset by lower ore grades. Sales from South America mining are expected to approximate 1.2 billion pounds of copper for the year 2018, compared with 1.2 billion pounds of copper in 2017.

Average unit net cash costs (net of by-product credits) for South America mining of $1.74 per pound of copper in second-quarter 2018 were higher than unit net cash costs of $1.65 per pound in second-quarter 2017, primarily reflecting higher mining and input costs, partly offset by higher volumes and by-product credits. Average unit net cash costs (net of by-product credits) for South America mining are expected to approximate $1.67 per pound of copper for the year 2018, based on current sales volume and cost estimates and assuming an average price of $11.00 per pound of molybdenum for the second half of 2018.

Cerro Verde and its workers' union are negotiating a new collective labor agreement to replace the agreement that expires August 31, 2018.

Indonesia Mining. Through its 90.64 percent owned and consolidated subsidiary PT-FI, FCX's assets include one of the world's largest copper and gold deposits at the Grasberg minerals district in Papua, Indonesia. PT-FI operates a proportionately consolidated joint venture, which produces copper concentrate that contains significant quantities of gold and silver.

Regulatory Matters. PT-FI continues to actively engage with Indonesian government officials to address regulatory changes that conflict with its contractual rights in a manner that provides long-term stability for PT-FI’s operations and investment plans, and protects value for FCX’s shareholders.

The parties have been engaged in negotiation and documentation of an IUPK and accompanying documentation for assurances on legal and fiscal terms to provide PT-FI with long-term mining rights through 2041. In addition, the IUPK would provide that PT-FI construct a smelter within five years of reaching a definitive agreement and include agreement for the divestment of 51 percent of the project area interests to Indonesian participants at fair market value.

In July 2018, FCX entered into a Heads of Agreement with the Indonesian state-owned enterprise Inalum and PT-FI’s joint venture partner Rio Tinto. Under the terms of the non-binding agreement, Inalum would acquire for aggregate cash consideration of $3.85 billion all of Rio Tinto's interests associated with its joint venture with PT-FI (Joint Venture) and FCX's interests in PT Indocopper Investama, which owns 9.36 percent of PT-FI.

Inalum would contribute the Rio Tinto interests to PT-FI, which would expand PT-FI’s asset base, in exchange for a 40 percent share ownership in PT-FI, pursuant to arrangements that would enable FCX and existing PT-FI shareholders to retain the economics of the revenue and cost sharing arrangements under the Joint Venture. Following completion of the transaction, Inalum's share ownership would approximate 51 percent of PT-FI (subject to an agreement between shareholders to replicate the Joint Venture economics) and FCX's ownership would approximate 49 percent.

At closing, Rio Tinto would receive $3.5 billion and FCX would receive $350 million in cash proceeds from Inalum. In addition, Rio Tinto would forego in favor of FCX an amount equivalent to Rio Tinto's share of Joint Venture cash flows since January 1, 2018, through closing.

Following completion of the ownership restructuring, FCX does not expect its economic exposure to PT-FI to change significantly. FCX expects its share of future cash flows of the expanded PT-FI asset base, combined with the cash proceeds received in the transaction, to be comparable to its existing share of future cash flows under the current Joint Venture arrangement. FCX would also continue to manage the operations of PT-FI.

The transaction, which is expected to close during the second half of 2018, is subject to the negotiation and documentation of definitive agreements, including purchase and sale agreements, the extension and stability of PT-FI's long-term mining rights through 2041 in a form acceptable to FCX and Inalum, a shareholders’ agreement between FCX and Inalum providing for continuity of FCX’s management of PT-FI’s operations and addressing governance arrangements, and resolution of environmental regulatory matters pending before Indonesia's Ministry of Environment and Forestry satisfactory to the Indonesian government, FCX and Inalum. The terms of these agreements will be subject to approval by the FCX Board of Directors (Board).

In February 2018, PT-FI's export license was extended to February 15, 2019, and in July 2018, PT-FI's temporary IUPK was extended to July 31, 2018. PT-FI is seeking an extension of the temporary IUPK to remain in effect until definitive agreements are complete. Until definitive agreements are reached, PT-FI has reserved all rights under its Contract of Work (COW), including pursuing arbitration under the dispute resolution procedures.

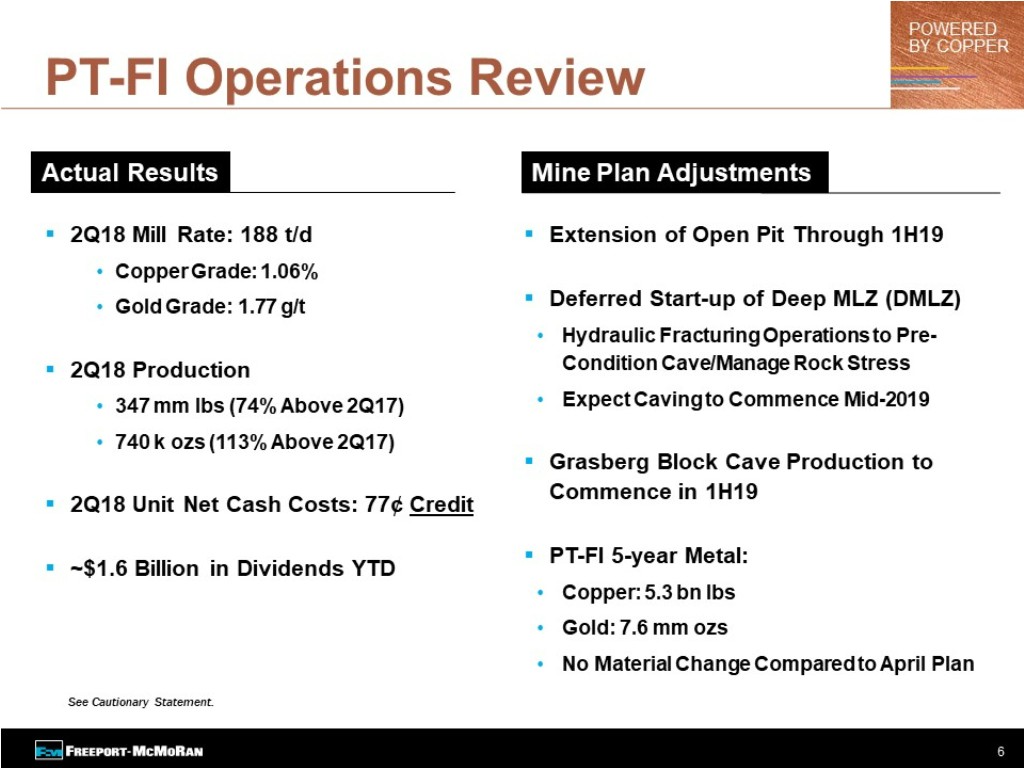

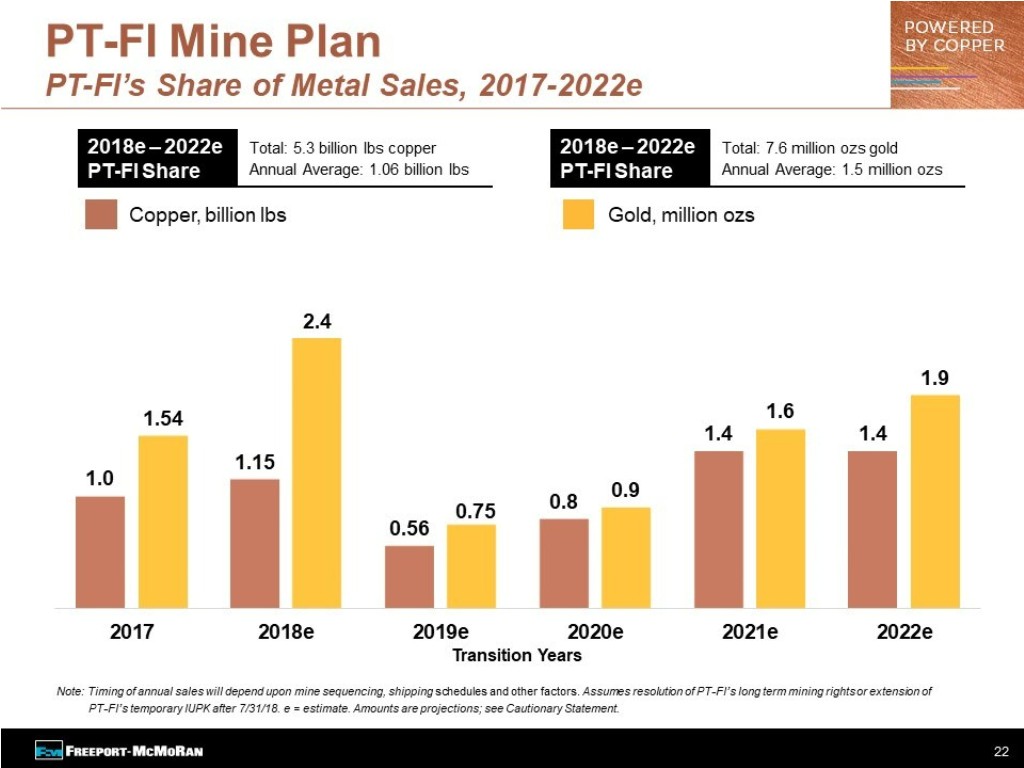

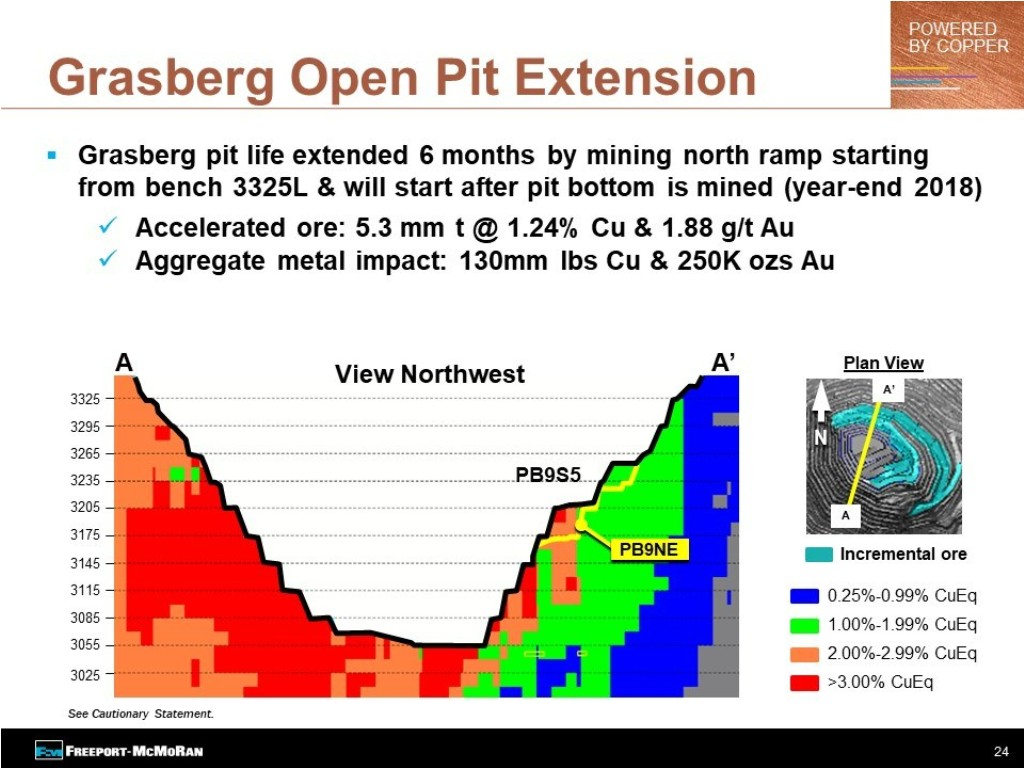

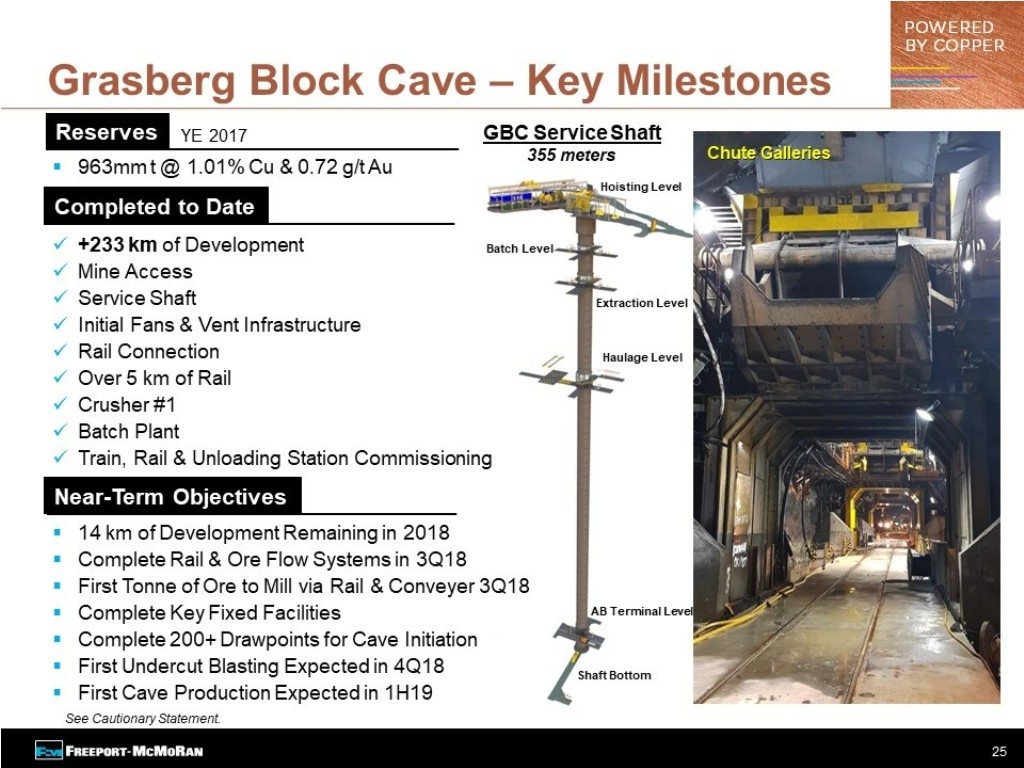

Operating and Development Activities. PT-FI is currently mining the final phase of the Grasberg open pit, which contains high copper and gold ore grades. PT-FI has revised its mine plans to extend mining activities in the open pit by approximately six months following results of an economic analysis. PT-FI expects to mine ore from the open pit until transitioning to the Grasberg Block Cave underground mine in the first half of 2019. Lower copper and gold production from Indonesia mining is expected during the transition period in 2019 and 2020.

PT-FI has several projects in the Grasberg minerals district related to the development of its large-scale, long-lived, high-grade underground ore bodies. In aggregate, these underground ore bodies are expected to produce large-scale quantities of copper and gold following the transition from the Grasberg open pit. Substantial progress has been made to prepare for the transition to mining of the Grasberg Block Cave underground mine.

Mine development activities are sufficiently advanced to commence caving in the first half of 2019. The ore flow and underground rail haulage systems are expected to be fully commissioned and operational in the second half of 2018.

PT-FI has revised its mine plan for the ramp-up of the Deep Mill Level Zone (DMLZ) underground mine following mining-induced seismic activity that began in 2017 and continued during 2018. During second-quarter 2018, PT-FI initiated plans to conduct hydraulic fracturing activities to manage rock stresses and pre-condition the DMLZ for large-scale production. PT-FI's revised mine plans, which will continue to be reviewed, currently project block cave mining activities in the DMLZ to commence in mid-2019 following a period of hydraulic fracturing activities designed to safely manage production. PT-FI continues to expect the DMLZ to reach full production rates of 80,000 metric tons per day in 2022.

Subject to reaching a definitive agreement with the Indonesian government on PT-FI's long-term mining rights, estimated annual capital spending on these projects would average $0.8 billion per year ($0.7 billion per year net to PT-FI) over the next five years. Considering the long-term nature and size of these projects, actual costs could vary from these estimates. In response to market conditions and Indonesian regulatory uncertainty, the timing of these expenditures continues to be reviewed and could be reduced or deferred significantly.

Operating Data. Following is summary consolidated operating data for the Indonesia mining operations for the second quarters and first six months of 2018 and 2017: |

| | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | |

| | 2018 | | 2017 | | 2018 | | 2017 | |

Copper (millions of recoverable pounds) | | | | | | | | | |

Production | | 347 |

| | 199 |

| | 658 |

| | 354 |

| |

Sales | | 316 |

| | 247 |

| | 635 |

| | 372 |

| |

Average realized price per pound | | $ | 3.05 |

| | $ | 2.67 |

| | $ | 3.07 |

| | $ | 2.64 |

| |

| | | | | | | | | |

Gold (thousands of recoverable ounces) | | | | | | | | | |

Production | | 740 |

| | 348 |

| | 1,335 |

| | 580 |

| |

Sales | | 671 |

| | 427 |

| | 1,274 |

| | 604 |

| |

Average realized price per ounce | | $ | 1,274 |

| | $ | 1,243 |

| | $ | 1,291 |

| | $ | 1,242 |

| |

| | | | | | | | | |

Unit net cash (credits) costs per pound of coppera | | | | | | | | | |

Site production and delivery, excluding adjustments | | $ | 1.33 |

| | $ | 1.77 |

| b | $ | 1.34 |

| | $ | 1.89 |

| b |

Gold and silver credits | | (2.76 | ) | | (2.21 | ) | | (2.67 | ) | | (2.10 | ) | |

Treatment charges | | 0.26 |

| | 0.26 |

| | 0.25 |

| | 0.27 |

| |

Export duties | | 0.18 |

| | 0.11 |

| | 0.16 |

| | 0.11 |

| |

Royalty on metals | | 0.22 |

| | 0.17 |

| | 0.22 |

| | 0.17 |

| |

Unit net cash (credits) costs | | $ | (0.77 | ) | | $ | 0.10 |

| | $ | (0.70 | ) | | $ | 0.34 |

| |

| | | | | | | | | |

| |

a. | For a reconciliation of unit net cash (credits) costs per pound to production and delivery costs applicable to sales reported in FCX's consolidated financial statements, refer to the supplemental schedules, "Product Revenues and Production Costs," beginning on page XII, which are available on FCX's website, "fcx.com." |

| |

b. | Excludes fixed costs charged directly to production and delivery costs totaling $82 million ($0.33 per pound of copper) in second-quarter 2017 and $103 million ($0.28 per pound of copper) for the first six months of 2017 associated with workforce reductions. |

Indonesia's consolidated sales of 316 million pounds of copper and 671 thousand ounces of gold in second-quarter 2018 were higher than second-quarter 2017 sales of 247 million pounds of copper and 427 thousand ounces of gold, primarily reflecting higher operating rates and ore grades. Lower second-quarter 2017 operating rates included the impact of labor disruptions in the first half of 2017.

Assuming achievement of planned operating rates for the second half of 2018, consolidated sales volumes from Indonesia mining are expected to approximate 1.15 billion pounds of copper and 2.4 million ounces of gold for

the year 2018, compared with 1.0 billion pounds of copper and 1.5 million ounces of gold for the year 2017. Because of the transition to underground mining, PT-FI's production is expected to be significantly lower in 2019 and 2020, compared to 2018.

A significant portion of PT-FI's costs are fixed and unit costs vary depending on production volumes and other factors. As a result of higher sales volumes and gold and silver credits, Indonesia had unit net cash credits (including gold and silver credits) of $0.77 per pound of copper in second-quarter 2018, compared with unit net cash costs of $0.10 per pound in second-quarter 2017.

Assuming an average gold price of $1,250 per ounce for the second half of 2018 and achievement of current sales volume and cost estimates, unit net cash credits (including gold and silver credits) for Indonesia mining are expected to approximate $0.58 per pound of copper for the year 2018. Indonesia mining's unit net cash credits for the year 2018 would change by approximately $0.06 per pound for each $50 per ounce change in the average price of gold for the second half of 2018. Because of the fixed nature of a large portion of Indonesia's costs, unit net cash credits/costs vary from quarter to quarter depending on copper and gold volumes.

Indonesia mining's projected sales volumes and unit net cash credits for the year 2018 are dependent on a number of factors, including operational performance, workforce productivity, timing of shipments, and Indonesia regulatory matters, including the resolution of PT-FI's long-term mining rights or an extension of PT-FI's temporary IUPK after July 31, 2018.

Molybdenum Mines. FCX has two wholly owned molybdenum mines - the Henderson underground mine and the Climax open-pit mine - both in Colorado. The Henderson and Climax mines produce high-purity, chemical-grade molybdenum concentrate, which is typically further processed into value-added molybdenum chemical products. The majority of molybdenum concentrate produced at the Henderson and Climax mines, as well as from FCX's North America and South America copper mines, is processed at FCX's conversion facilities.

Operating and Development Activities. Production from the Molybdenum mines totaled 9 million pounds of molybdenum in second-quarter 2018 and 8 million pounds in second-quarter 2017. Refer to summary operating data on page 3 for FCX's consolidated molybdenum sales and average realized prices, which includes sales of molybdenum produced at the Molybdenum mines, and from FCX's North America and South America copper mines.

Unit net cash costs for the Molybdenum mines averaged $8.36 per pound of molybdenum in second-quarter 2018 and $7.73 per pound in second-quarter 2017. Based on current sales volume and cost estimates, average unit net cash costs for the Molybdenum mines are expected to approximate $8.75 per pound of molybdenum for the year 2018.

For a reconciliation of unit net cash costs per pound to production and delivery costs applicable to sales reported in FCX's consolidated financial statements, refer to the supplemental schedules, "Product Revenues and Production Costs," beginning on page XII, which are available on FCX's website, "fcx.com."

Mining Exploration Activities. FCX's mining exploration activities are generally associated with its existing mines, focusing on opportunities to expand reserves and resources to support development of additional future production capacity. A drilling program to further delineate the Lone Star resource continues to indicate additional mineralization in this district. Exploration results continue to indicate opportunities for significant future potential reserve additions in North America and South America. Exploration spending is expected to approximate $90 million for the year 2018.

CASH FLOWS, CASH and DEBT

Operating Cash Flows. FCX generated operating cash flows of $1.3 billion (net of $0.2 billion in working capital uses and timing of other tax payments) in second-quarter 2018 and $2.7 billion (net of $0.2 billion in working capital uses and timing of other tax payments) for the first six months of 2018.

Based on current sales volume and cost estimates, and assuming average prices of $2.75 per pound of copper, $1,250 per ounce of gold and $11.00 per pound of molybdenum for the second half of 2018, FCX's consolidated operating cash flows are estimated to approximate $4.3 billion for the year 2018 (net of $0.2 billion in working capital uses and timing of other tax payments). The impact of price changes during the second half of 2018 on operating cash flows would approximate $185 million for each $0.10 per pound change in the average price of

copper, $60 million for each $50 per ounce change in the average price of gold and $55 million for each $2 per pound change in the average price of molybdenum.

Capital Expenditures. Capital expenditures totaled $0.5 billion in second-quarter 2018 (including approximately $0.3 billion for major mining projects) and $0.9 billion for the first six months of 2018 (including approximately $0.5 billion for major mining projects). Capital expenditures are expected to approximate $2.0 billion for the year 2018, including $1.1 billion for major mining projects primarily associated with underground development activities in the Grasberg minerals district and development of the Lone Star oxide project.

Cash. Following is a summary of the U.S. and international components of consolidated cash and cash equivalents available to the parent company, net of noncontrolling interests' share, taxes and other costs at June 30, 2018 (in billions):

|

| | | | |

Cash at domestic companies | $ | 2.9 |

| |

Cash at international operations | 1.0 |

| |

Total consolidated cash and cash equivalents | 3.9 |

| |

Noncontrolling interests' share | (0.4 | ) | |

Cash, net of noncontrolling interests' share | 3.5 |

| |

Withholding taxes and other | (0.1 | ) | |

Net cash available | $ | 3.4 |

| |

| | |

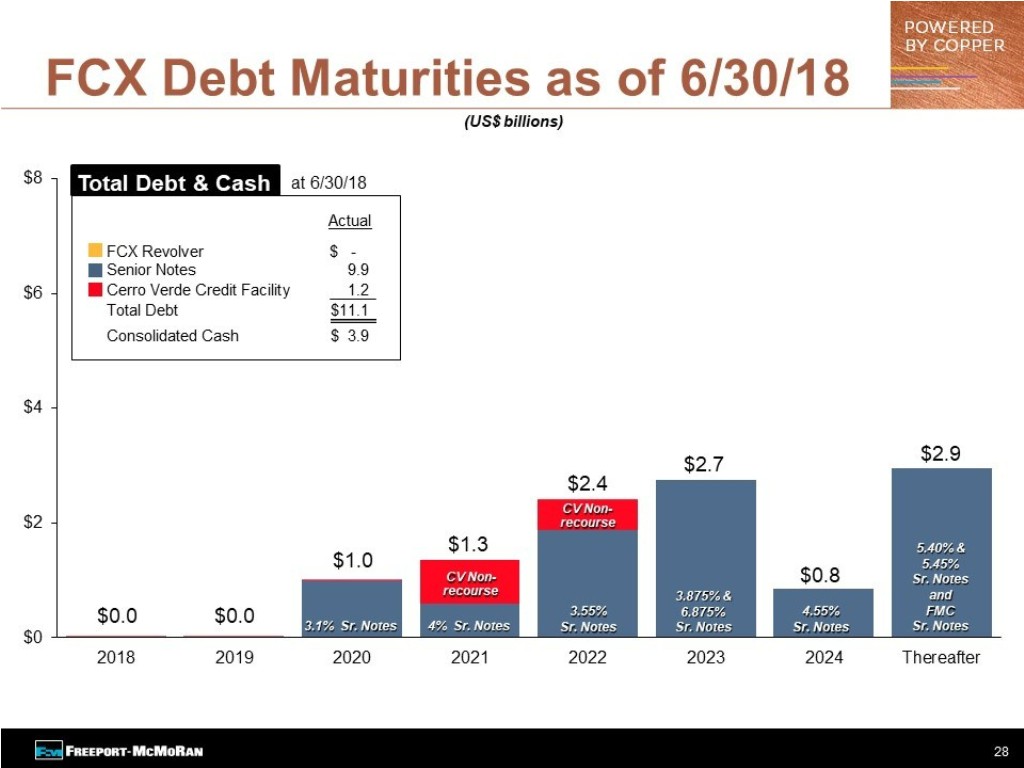

Debt. Following is a summary of total debt and the related weighted-average interest rates at June 30, 2018 (in billions, except percentages):

|

| | | | | | |

| | | Weighted- | |

| | | Average | |

| | | Interest Rate | |

Senior Notes | $ | 9.9 |

| | 4.6% | |

Cerro Verde credit facility | 1.2 |

| | 4.0% | |

Total debt | $ | 11.1 |

| | 4.5% | |

| | | | |

In April 2018, FCX redeemed $404 million of senior notes due 2022 and $50 million of senior notes due 2023, resulting in aggregate annual cash interest savings of approximately $30 million. In second-quarter 2018, FCX recorded a net gain on early extinguishment of debt totaling $9 million primarily related to these redemptions.

During April 2018, FCX entered into a new $3.5 billion, five-year, unsecured revolving credit facility with substantially similar structure and terms as its prior facility, which was scheduled to mature in May 2019. At June 30, 2018, FCX had no borrowings, $13 million in letters of credit issued and $3.5 billion available under its revolving credit facility.

FINANCIAL POLICY

In February 2018, the Board reinstated a cash dividend on FCX common stock. On June 27, 2018, FCX declared a quarterly cash dividend of $0.05 per share on its common stock, which will be paid on August 1, 2018, to shareholders of record as of July 13, 2018. The declaration of dividends is at the discretion of the Board and will depend upon FCX’s financial results, cash requirements, future prospects and other factors deemed relevant by the Board.

WEBCAST INFORMATION

A conference call with securities analysts to discuss FCX's second-quarter 2018 results is scheduled for today at 10:00 a.m. Eastern Time. The conference call will be broadcast on the Internet along with slides. Interested parties may listen to the conference call live and view the slides by accessing “fcx.com.” A replay of the webcast will be available through Friday, August 24, 2018.

-----------------------------------------------------------------------------------------------------------

FCX is a leading international mining company with headquarters in Phoenix, Arizona. FCX operates large, long-lived, geographically diverse assets with significant proven and probable reserves of copper, gold and molybdenum. FCX is the world's largest publicly traded copper producer. FCX’s portfolio of assets includes the Grasberg minerals district in Indonesia, one of the world's largest copper and gold deposits; and significant mining operations in the Americas, including the large-scale Morenci minerals district in North America and the Cerro Verde operation in South America. Additional information about FCX is available on FCX's website at "fcx.com."

Cautionary Statement and Regulation G Disclosure: This press release contains forward-looking statements in which FCX discusses its potential future performance. Forward-looking statements are all statements other than statements of historical facts, such as projections or expectations relating to ore grades and milling rates, production and sales volumes, unit net cash costs, operating cash flows, capital expenditures, the transaction contemplated by the non-binding Heads of Agreement between FCX, PT-FI, Inalum and Rio Tinto, exploration efforts and results, development and production activities and costs, liquidity, tax rates, the impact of copper, gold and molybdenum price changes, the impact of deferred intercompany profits on earnings, reserve estimates, future dividend payments, and share purchases and sales. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” "targets," “intends,” “likely,” “will,” “should,” “to be,” ”potential" and any similar expressions are intended to identify those assertions as forward-looking statements. The declaration of dividends is at the discretion of the Board and will depend on FCX's financial results, cash requirements, future prospects, and other factors deemed relevant by the Board.

FCX cautions readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, projected or assumed in the forward-looking statements. Important factors that can cause FCX's actual results to differ materially from those anticipated in the forward-looking statements include supply of and demand for, and prices of, copper, gold and molybdenum; mine sequencing; production rates; potential inventory adjustments; potential impairment of long-lived mining assets; FCX’s ability to complete the transaction contemplated by the non-binding Heads of Agreement, which is subject to the negotiation and documentation of definitive agreements, including purchase and sale agreements, the extension and stability of PT-FI's long-term mining rights through 2041 in a form acceptable to FCX and Inalum, a shareholders’ agreement between FCX and Inalum providing for continuity of FCX’s management of PT-FI’s operations and addressing governance arrangements, and resolution of administrative sanctions and environmental regulatory matters pending before Indonesia’s Ministry of Environment and Forestry satisfactory to the Indonesian government, FCX and Inalum, the terms of all of which will be subject to FCX Board approval; PT-FI’s ability to obtain an extension of its temporary IUPK after July 31, 2018; the potential effects of violence in Indonesia generally and in the province of Papua; industry risks; regulatory changes; political risks; labor relations; weather- and climate-related risks; environmental risks (including resolution of the administrative sanctions and other environmental matters pending before Indonesia's Ministry of Environment and Forestry); litigation results (including the final disposition of Indonesian tax disputes and the outcome of Cerro Verde's royalty dispute with the Peruvian national tax authority); and other factors described in more detail under the heading “Risk Factors” in FCX's Annual Report on Form 10-K for the year ended December 31, 2017, filed with the U.S. Securities and Exchange Commission (SEC) as updated by FCX's subsequent filings with the SEC.

Investors are cautioned that many of the assumptions upon which FCX's forward-looking statements are based are likely to change after the forward-looking statements are made, including for example commodity prices, which FCX cannot control, and production volumes and costs, some aspects of which FCX may not be able to control. Further, FCX may make changes to its business plans that could affect its results. FCX cautions investors that it does not intend to update forward-looking statements more frequently than quarterly notwithstanding any changes in its assumptions, changes in business plans, actual experience or other changes, and FCX undertakes no obligation to update any forward-looking statements.

This press release also contains certain financial measures such as unit net cash (credits) costs per pound of copper and molybdenum and adjusted net income, which are not recognized under U.S. generally accepted accounting principles. As required by SEC Regulation G, reconciliations of these measures to amounts reported in FCX's consolidated financial statements are in the supplemental schedules of this press release, which are also available on FCX's website, "fcx.com."

|

| | | | | | | | | | | | | | |

FREEPORT-McMoRan INC. |

SELECTED OPERATING DATA |

| | | | | | | | |

| Three Months Ended June 30, | |

| 2018 | | 2017 | | 2018 | | 2017 | |

MINING OPERATIONS: | Production | | Sales | |

COPPER (millions of recoverable pounds) | | | | |

(FCX's net interest in %) | | | | |

North America | | | | | | | | |

Morenci (72%)a | 182 |

| | 187 |

| | 183 |

| | 196 |

| |

Bagdad (100%) | 48 |

| | 43 |

| | 48 |

| | 43 |

| |

Safford (100%) | 29 |

| | 37 |

| | 32 |

| | 42 |

| |

Sierrita (100%) | 36 |

| | 40 |

| | 38 |

| | 42 |

| |

Miami (100%) | 4 |

| | 5 |

| | 4 |

| | 5 |

| |

Chino (100%) | 42 |

| | 58 |

| | 43 |

| | 63 |

| |

Tyrone (100%) | 13 |

| | 14 |

| | 13 |

| | 17 |

| |

Other (100%) | — |

| | — |

| | — |

| | — |

| |

Total North America | 354 |

| | 384 |

| | 361 |

| | 408 |

| |

| | | | | | | | |

South America | | | | | | | | |

Cerro Verde (53.56%) | 262 |

| | 260 |

| | 258 |

| | 244 |

| |

El Abra (51%) | 51 |

| | 40 |

| | 54 |

| | 43 |

| |

Total South America | 313 |

| | 300 |

| | 312 |

| | 287 |

| |

| | | | | | | | |

Indonesia | | | | | | | | |

Grasberg (90.64%)b | 347 |

| | 199 |

| | 316 |

| | 247 |

| |

Total | 1,014 |

| | 883 |

| | 989 |

| c | 942 |

| c |

Less noncontrolling interests | 179 |

| | 159 |

| | 176 |

| | 158 |

| |

Net | 835 |

| | 724 |

| | 813 |

| | 784 |

| |

| | | | | | | | |

Average realized price per pound | | | | | $ | 3.08 |

| | $ | 2.65 |

| |

| | | | | | | | |

GOLD (thousands of recoverable ounces) | | | | | | | | |

(FCX's net interest in %) | | | | | | | | |

North America (100%) | 6 |

| | 5 |

| | 5 |

| | 5 |

| |

Indonesia (90.64%)b | 740 |

| | 348 |

| | 671 |

| | 427 |

| |

Consolidated | 746 |

| | 353 |

| | 676 |

| | 432 |

| |

Less noncontrolling interests | 70 |

| | 32 |

| | 63 |

| | 40 |

| |

Net | 676 |

| | 321 |

| | 613 |

| | 392 |

| |

| | | | | | | | |

Average realized price per ounce | | | | | $ | 1,274 |

| | $ | 1,243 |

| |

| | | | | | | | |

MOLYBDENUM (millions of recoverable pounds) | | | | | | | | |

(FCX's net interest in %) | | | | | | | | |

Henderson (100%) | 3 |

| | 3 |

| | N/A |

| | N/A |

| |

Climax (100%) | 6 |

| | 5 |

| | N/A |

| | N/A |

| |

North America copper mines (100%)a | 8 |

| | 8 |

| | N/A |

| | N/A |

| |

Cerro Verde (53.56%) | 7 |

| | 7 |

| | N/A |

| | N/A |

| |

Consolidated | 24 |

| | 23 |

| | 24 |

| | 25 |

| |

Less noncontrolling interests | 3 |

| | 3 |

| | 4 |

| | 3 |

| |

Net | 21 |

| | 20 |

| | 20 |

| | 22 |

| |

| | | | | | | | |

Average realized price per pound | | | | | $ | 12.89 |

| | $ | 9.58 |

| |

| | | | | | | | |

| | | | | | | | |

a. Amounts are net of Morenci's undivided joint venture partners' interests. | | | | | | | |

| | | | | | | | |

b. Amounts are net of Grasberg's joint venture partner's interest, which varies in accordance with the terms of the joint venture agreement. |

| | | | | | | | |

c. Consolidated sales volumes exclude purchased copper of 90 million pounds in second-quarter 2018 and 62 million pounds in second- quarter 2017. |

| | | | | | | | |

|

| | | | | | | | | | | | | | |

FREEPORT-McMoRan INC. |

SELECTED OPERATING DATA (continued) |

| | | | | | | | |

| Six Months Ended June 30, | |

| 2018 | | 2017 | | 2018 | | 2017 | |

MINING OPERATIONS: | Production | | Sales | |

Copper (millions of recoverable pounds) | | | | |

(FCX's net interest in %) | | | | | | | | |

North America | | | | | | | | |

Morenci (72%)a | 351 |

| | 368 |

| | 370 |

| | 368 |

| |

Bagdad (100%) | 97 |

| | 83 |

| | 99 |

| | 81 |

| |

Safford (100%) | 62 |

| | 79 |

| | 68 |

| | 85 |

| |

Sierrita (100%) | 77 |

| | 81 |

| | 82 |

| | 80 |

| |

Miami (100%) | 8 |

| | 10 |

| | 9 |

| | 10 |

| |

Chino (100%) | 80 |

| | 120 |

| | 88 |

| | 123 |

| |

Tyrone (100%) | 26 |

| | 34 |

| | 28 |

| | 35 |

| |

Other (100%) | 1 |

| | 1 |

| | 1 |

| | 1 |

| |

Total North America | 702 |

| | 776 |

| | 745 |

| | 783 |

| |

| | | | | | | | |

South America | | | | | | | | |

Cerro Verde (53.56%) | 505 |

| | 522 |

| | 500 |

| | 512 |

| |

El Abra (51%) | 101 |

| | 82 |

| | 102 |

| | 84 |

| |

Total South America | 606 |

| | 604 |

| | 602 |

| | 596 |

| |

| | | | | | | | |

Indonesia | | | | | | | | |

Grasberg (90.64%)b | 658 |

| | 354 |

| | 635 |

| | 372 |

| |

Total | 1,966 |

| | 1,734 |

| | 1,982 |

| c | 1,751 |

| c |

Less noncontrolling interests | 346 |

| | 316 |

| | 342 |

| | 314 |

| |

Net | 1,620 |

| | 1,418 |

| | 1,640 |

| | 1,437 |

| |

| | | | | | | | |

Average realized price per pound | | | | | $ | 3.10 |

| | $ | 2.65 |

| |

| | | | | | | | |

Gold (thousands of recoverable ounces) | | | | | | | | |

(FCX's net interest in %) | | | | | | | | |

North America (100%) | 10 |

| | 12 |

| | 12 |

| | 10 |

| |

Indonesia (90.64%)b | 1,335 |

| | 580 |

| | 1,274 |

| | 604 |

| |

Consolidated | 1,345 |

| | 592 |

| | 1,286 |

| | 614 |

| |

Less noncontrolling interests | 125 |

| | 54 |

| | 120 |

| | 57 |

| |

Net | 1,220 |

| | 538 |

| | 1,166 |

| | 557 |

| |

| | | | | | | | |

Average realized price per ounce | | | | | $ | 1,291 |

| | $ | 1,242 |

| |

| | | | | | | | |

Molybdenum (millions of recoverable pounds) | | | | | | | | |

(FCX's net interest in %) | | | | | | | | |

Henderson (100%) | 7 |

| | 6 |

| | N/A |

| | N/A |

| |

Climax (100%) | 11 |

| | 10 |

| | N/A |

| | N/A |

| |

North America (100%)a | 15 |

| | 17 |

| | N/A |

| | N/A |

| |

Cerro Verde (53.56%) | 13 |

| | 13 |

| | N/A |

| | N/A |

| |

Consolidated | 46 |

| | 46 |

| | 48 |

| | 49 |

| |

Less noncontrolling interests | 6 |

| | 6 |

| | 7 |

| | 6 |

| |

Net | 40 |

| | 40 |

| | 41 |

| | 43 |

| |

| | | | | | | | |

Average realized price per pound | | | | | $ | 12.42 |

| | $ | 9.16 |

| |

| | | | | | | | |

| | | | | | | | |

a. Amounts are net of Morenci's undivided joint venture partners' interests. |

| | | | | | | | |

b. Amounts are net of Grasberg's joint venture partner's interest, which varies in accordance with the terms of the joint venture agreement. |

| | | | | | | | |

c. Consolidated sales volumes exclude purchased copper of 164 million pounds for the first six months of 2018 and 120 million pounds for the first six months of 2017.

|

| | | | | | | | |

|

| | | | | | | | | | | | |

FREEPORT-McMoRan INC. |

SELECTED OPERATING DATA (continued) |

| | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | |

| 2018 | | 2017 | | 2018 | | 2017 | |

100% North America Copper Mines | | | | | | | | |

Solution Extraction/Electrowinning (SX/EW) Operations | | | | | | | | |

Leach ore placed in stockpiles (metric tons per day) | 689,500 |

| | 692,700 |

| | 682,100 |

| | 697,300 |

| |

Average copper ore grade (percent) | 0.24 |

| | 0.29 |

| | 0.26 |

| | 0.28 |

| |

Copper production (millions of recoverable pounds) | 268 |

| | 282 |

| | 530 |

| | 559 |

| |

| | | | | | | | |

Mill Operations | | | | | | | | |

Ore milled (metric tons per day) | 307,000 |

| | 299,100 |

| | 297,900 |

| | 301,400 |

| |

Average ore grades (percent): | | | | | | | | |

Copper | 0.35 |

| | 0.39 |

| | 0.35 |

| | 0.40 |

| |

Molybdenum | 0.02 |

| | 0.03 |

| | 0.02 |

| | 0.03 |

| |

Copper recovery rate (percent) | 89.1 |

| | 86.7 |

| | 88.5 |

| | 86.6 |

| |

Production (millions of recoverable pounds): | | | | | | | | |

Copper | 157 |

| | 174 |

| | 308 |

| | 360 |

| |

Molybdenum | 9 |

| | 9 |

| | 16 |

| | 18 |

| |

| | | | | | | | |

100% South America Mining | | | | | | | | |

SX/EW Operations | | | | | | | | |

Leach ore placed in stockpiles (metric tons per day) | 246,700 |

| | 126,000 |

| | 207,600 |

| | 123,100 |

| |

Average copper ore grade (percent) | 0.30 |

| | 0.36 |

| | 0.32 |

| | 0.39 |

| |

Copper production (millions of recoverable pounds) | 75 |

| | 59 |

| | 142 |

| | 125 |

| |

| | | | | | | | |

Mill Operations | | | | | | | | |

Ore milled (metric tons per day) | 385,200 |

| | 347,600 |

| | 385,300 |

| | 343,300 |

| |

Average ore grades (percent): | | | | | | | | |

Copper | 0.38 |

| | 0.44 |

| | 0.39 |

| | 0.44 |

| |

Molybdenum | 0.01 |

| | 0.02 |

| | 0.01 |

| | 0.02 |

| |

Copper recovery rate (percent) | 84.4 |

| | 83.0 |

| | 81.7 |

| | 83.8 |

| |

Production (millions of recoverable pounds): | | | | | | | | |

Copper | 238 |

| | 241 |

| | 464 |

| | 479 |

| |

Molybdenum | 7 |

| | 7 |

| | 13 |

| | 13 |

| |

| | | | | | | | |

100% Indonesia Mining | | | | | | | | |

Ore milled (metric tons per day):a | | | | | | | | |

Grasberg open pit | 148,400 |

| | 88,600 |

| | 136,800 |

| | 71,200 |

| |

Deep Ore Zone underground mine | 29,200 |

| | 27,300 |

| | 34,300 |

| | 26,800 |

| |

Deep Mill Level Zone (DMLZ) underground mineb | 2,700 |

| | 3,800 |

| | 2,700 |

| | 3,500 |

| |

Grasberg Block Cave underground mineb | 3,800 |

| | 3,800 |

| | 3,900 |

| | 3,200 |

| |

Big Gossan underground mineb | 3,800 |

| | — |

| | 3,100 |

| | 800 |

| |

Total | 187,900 |

| | 123,500 |

| | 180,800 |

| | 105,500 |

| |

Average ore grades: | | | | | | | | |

Copper (percent) | 1.06 |

| | 1.03 |

| | 1.09 |

| | 1.08 |

| |

Gold (grams per metric ton) | 1.77 |

| | 1.16 |

| | 1.71 |

| | 1.17 |

| |

Recovery rates (percent): | | | | | | | | |

Copper | 92.7 |

| | 91.8 |

| | 92.4 |

| | 92.0 |

| |

Gold | 86.1 |

| | 85.3 |

| | 85.5 |

| | 85.1 |

| |

Production (recoverable): | | | | | | | | |

Copper (millions of pounds) | 353 |

| | 221 |

| | 693 |

| | 393 |

| |

Gold (thousands of ounces) | 816 |

| | 347 |

| | 1,489 |

| | 588 |

| |

| | | | | | | | |

100% Molybdenum Mines | | | | | | | | |

Ore milled (metric tons per day) | 28,900 |

| | 22,000 |

| | 26,000 |

| | 21,800 |

| |

Average molybdenum ore grade (percent) | 0.18 |

| | 0.20 |

| | 0.19 |

| | 0.21 |

| |

Molybdenum production (millions of recoverable pounds) | 9 |

| | 8 |

| | 18 |

| | 16 |

| |

| | | | | | | | |

| | | | | | | | |

a. Amounts represent the approximate average daily throughput processed at PT Freeport Indonesia's (PT-FI) mill facilities from each producing mine and from development activities that result in metal production. |

|

b. Targeted production rates once the DMLZ underground mine reaches full capacity are expected to approximate 80,000 metric tons of ore per day in 2022; production from the Grasberg Block Cave underground mine is expected to commence in the first half of 2019, and production from the Big Gossan underground mine restarted in fourth-quarter 2017.

|

|

|

|

| | | | | | | | | | | | | | | | |

FREEPORT-McMoRan INC. |

CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

| | | | | | | | |

| Three Months Ended | | Six Months Ended | |

| June 30, | | June 30, | |

| 2018 | | 2017a | | 2018 | | 2017a | |

| (In Millions, Except Per Share Amounts) | |

Revenuesb | $ | 5,168 |

| | $ | 3,711 |

| | $ | 10,036 |

| | $ | 7,052 |

| |

Cost of sales: | | | | | | | | |

Production and deliveryc | 2,915 |

| | 2,480 |

| | 5,723 |

| | 4,668 |

| |

Depreciation, depletion and amortization | 442 |

| | 450 |

| | 893 |

| | 839 |

| |

Total cost of sales | 3,357 |

| | 2,930 |

| | 6,616 |

| | 5,507 |

| |

Selling, general and administrative expensesc | 109 |

| | 107 |

| | 240 |

| | 258 |

| |

Mining exploration and research expenses | 24 |

| | 19 |

| | 45 |

| | 33 |

| |

Environmental obligations and shutdown costs | 59 |

| | (21 | ) | | 68 |

| | 4 |

| |

Net gain on sales of assets | (45 | ) | | (10 | ) | | (56 | ) | | (33 | ) | |

Total costs and expenses | 3,504 |

| | 3,025 |

| | 6,913 |

| | 5,769 |

| |

Operating income | 1,664 |

| | 686 |

| | 3,123 |

| | 1,283 |

| |

Interest expense, netc,d | (142 | ) | | (162 | ) | | (293 | ) | | (329 | ) | |

Net gain (loss) on early extinguishment of debt | 9 |

| | (4 | ) | | 8 |

| | (3 | ) | |

Other income (expense), netc | 20 |

| | (7 | ) | | 49 |

| e | — |

| |

Income from continuing operations before income taxes and equity in affiliated companies' net earnings (losses) | 1,551 |

| | 513 |

| | 2,887 |

| | 951 |

| |

Provision for income taxesf | (515 | ) | | (186 | ) | | (1,021 | ) | | (360 | ) | |

Equity in affiliated companies' net earnings (losses) | 3 |

| | (1 | ) | | 1 |

| | 3 |

| |

Net income from continuing operations | 1,039 |

| | 326 |

| | 1,867 |

| | 594 |

| |

Net (loss) income from discontinued operationsg | (4 | ) | | 9 |

| | (15 | ) | | 47 |

| |

Net income | 1,035 |

| | 335 |

| | 1,852 |

| | 641 |

| |

Net income attributable to noncontrolling interests: | | | | | | | | |

Continuing operations | (166 | ) | | (66 | ) | | (291 | ) | | (141 | ) | |

Discontinued operations | — |

| | (1 | ) | | — |

| | (4 | ) | |

Net income attributable to FCX common stockh | $ | 869 |

| | $ | 268 |

| | $ | 1,561 |

| | $ | 496 |

| |

| | | | | | | | |

Basic net income (loss) per share attributable to common stock: | | | | | | | | |

Continuing operations | $ | 0.60 |

| | $ | 0.18 |

| | $ | 1.08 |

| | $ | 0.31 |

| |

Discontinued operations | — |

| | — |

| | (0.01 | ) | | 0.03 |

| |

| $ | 0.60 |

| | $ | 0.18 |

| | $ | 1.07 |

| | $ | 0.34 |

| |

| | | | | | | | |

Diluted net income (loss) per share attributable to common stock: | | | | | | | | |

Continuing operations | $ | 0.59 |

| | $ | 0.18 |

| | $ | 1.08 |

| | $ | 0.31 |

| |

Discontinued operations | — |

| | — |

| | (0.01 | ) | | 0.03 |

| |

| $ | 0.59 |

| | $ | 0.18 |

| | $ | 1.07 |

| | $ | 0.34 |

| |

| | | | | | | | |

Weighted-average common shares outstanding: | | | | | | | | |

Basic | 1,449 |

| | 1,447 |

| | 1,449 |

| | 1,447 |

| |

Diluted | 1,458 |

| | 1,453 |

| | 1,458 |

| | 1,453 |

| |

| | | | | | | | |

Dividends declared per share of common stock | $ | 0.05 |

| | $ | — |

| | $ | 0.10 |

| | $ | — |

| |

| | | | | | | | |

| |

a. | The adoption of accounting guidance related to the presentation of retirement benefits resulted in the reclassification of the non-service components of net periodic benefit cost to other income (expense), net. |

| |

b. | Revenues include adjustments to provisionally priced concentrate and cathode sales. For a summary of adjustments to provisionally priced copper sales, refer to the supplemental schedule, "Derivative Instruments," beginning on page VIII. |

| |

c. | Includes net mining and oil and gas charges that are summarized in the supplemental schedule, "Adjusted Net Income," on page VII. |

| |

d. | Consolidated interest costs (before capitalization) totaled $165 million in second-quarter 2018, $192 million in second-quarter 2017, $341 million for the first six months of 2018 and $387 million for the first six months of 2017. |

| |

e. | Includes interest received by PT-FI with the refund of prior years' tax receivables, which is summarized in the supplemental schedule, "Adjusted Net Income," on page VII. |

| |

f. | For a summary of FCX's provision for income taxes, refer to the supplemental schedule, "Income Taxes," on page VIII. |

| |

g. | Primarily reflects adjustments to the estimated fair value of contingent consideration related to the 2016 sale of FCX’s interest in TF Holdings Limited (TFHL), which will continue to be adjusted through December 31, 2019. |

| |

h. | FCX defers recognizing profits on intercompany sales until final sales to third parties occur. Refer to the supplemental schedule, "Deferred Profits," on page IX for a summary of net impacts from changes in these deferrals. |

|

| | | | | | | | |

FREEPORT-McMoRan INC. |

CONSOLIDATED BALANCE SHEETS (Unaudited) |

| | | | |

| June 30, | | December 31, | |

| 2018 | | 2017 | |

| (In Millions) | |

ASSETS | | | | |

Current assets: | | | | |

Cash and cash equivalents | $ | 3,859 |

| | $ | 4,447 |

| |

Trade accounts receivable | 1,077 |

| | 1,246 |

| |

Income and other tax receivables | 225 |

| | 325 |

| |

Inventories: | | | | |

Mill and leach stockpiles | 1,435 |

| | 1,422 |

| |

Materials and supplies, net | 1,404 |

| | 1,305 |

| |

Product | 1,337 |

| | 1,166 |

| |

Other current assets | 381 |

| | 270 |

| |

Held for sale | 625 |

| | 508 |

| |

Total current assets | 10,343 |

| | 10,689 |

| |

Property, plant, equipment and mine development costs, net | 22,923 |

| | 22,934 |

| |

Long-term mill and leach stockpiles | 1,371 |

| | 1,409 |

| |

Other assets | 2,391 |

| | 2,270 |

| |

Total assets | $ | 37,028 |

| | $ | 37,302 |

| |

| | | | |

LIABILITIES AND EQUITY | | | | |

Current liabilities: | | | | |

Accounts payable and accrued liabilities | $ | 2,420 |

| | $ | 2,321 |

| |

Accrued income taxes | 569 |

| | 565 |

| |

Current portion of environmental and asset retirement obligations | 380 |

| | 388 |

| |

Dividends payable | 73 |

| | — |

| |

Current portion of debt | 4 |

| | 1,414 |

| |

Held for sale | 353 |

| | 323 |

| |

Total current liabilities | 3,799 |

| | 5,011 |

| |

Long-term debt, less current portion | 11,123 |

| | 11,703 |

| |

Deferred income taxes | 3,702 |

| | 3,649 |

| |

Environmental and asset retirement obligations, less current portion | 3,631 |

| | 3,631 |

| |

Other liabilities | 1,931 |

| | 2,012 |

| |

Total liabilities | 24,186 |

| | 26,006 |

| |

| | | | |

Equity: | | | | |

Stockholders' equity: | | | | |

Common stock | 158 |

| | 158 |

| |

Capital in excess of par value | 26,667 |

| | 26,751 |

| |

Accumulated deficit | (13,161 | ) | | (14,722 | ) | |

Accumulated other comprehensive loss | (464 | ) | | (487 | ) | |

Common stock held in treasury | (3,726 | ) | | (3,723 | ) | |

Total stockholders' equity | 9,474 |

| | 7,977 |

| |

Noncontrolling interests | 3,368 |

| | 3,319 |

| |

Total equity | 12,842 |

| | 11,296 |

| |

Total liabilities and equity | $ | 37,028 |

| | $ | 37,302 |

| |

| | | | |

|

| | | | | | | | | |

FREEPORT-McMoRan INC. |

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) |

| | | |

| | | |

| | Six Months Ended June 30, | |

| | 2018 | | 2017 | |

| | (In Millions) | |

Cash flow from operating activities: | | | | | |

Net income | | $ | 1,852 |

| | $ | 641 |

| |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | |

Depreciation, depletion and amortization | | 893 |

| | 839 |

| |

Net gain on sales of assets | | (56 | ) | | (33 | ) | |

Stock-based compensation | | 60 |

| | 44 |

| |

Payments for Cerro Verde royalty dispute | | (21 | ) | | (21 | ) | |

Net charges for environmental and asset retirement obligations, including accretion | | 152 |

| | 87 |

| |

Payments for environmental and asset retirement obligations | | (110 | ) | | (59 | ) | |

Net charges for defined pension and postretirement plans | | 38 |

| | 70 |

| |

Pension plan contributions | | (44 | ) | | (56 | ) | |

Net (gain) loss on early extinguishment of debt | | (8 | ) | | 3 |

| |

Deferred income taxes | | 61 |

| | 55 |

| |

Loss (gain) on disposal of discontinued operations | | 15 |

| | (38 | ) | |

Decrease in long-term mill and leach stockpiles | | 38 |

| | 80 |

| |

Non-cash drillship settlements/idle rig costs and other oil and gas adjustments | | — |

| | (33 | ) | |

Oil and gas contract settlement payments | | — |

| | (70 | ) | |

Other, net | | 21 |

| | (23 | ) | |

Changes in working capital and other tax payments: | | | | |

| |

Accounts receivable | | 309 |

| | 589 |

| |

Inventories | | (468 | ) | | (101 | ) | |

Other current assets | | (20 | ) | | (2 | ) | |

Accounts payable and accrued liabilities | | 114 |

| | (267 | ) | |

Accrued income taxes and timing of other tax payments | | (148 | ) | | 124 |

| |

Net cash provided by operating activities | | 2,678 |

| | 1,829 |

| |

| | | | | |

Cash flow from investing activities: | | | | | |

Capital expenditures: | | | | | |

North America copper mines | | (232 | ) | | (67 | ) | |

South America | | (138 | ) | | (45 | ) | |

Indonesia | | (449 | ) | | (457 | ) | |

Molybdenum mines | | (2 | ) | | (2 | ) | |

Other | | (63 | ) | | (135 | ) | |

Intangible water rights and other, net | | (86 | ) | | 3 |

| |

Net cash used in investing activities | | (970 | ) | | (703 | ) | |

| | | | | |

Cash flow from financing activities: | | | | | |

Proceeds from debt | | 352 |

| | 606 |

| |

Repayments of debt | | (2,297 | ) | | (1,250 | ) | |

Cash dividends paid: | | | | | |

Common stock | | (73 | ) | | (2 | ) | |

Noncontrolling interests | | (241 | ) | | (39 | ) | |

Stock-based awards net proceeds (payments) | | 5 |

| | (8 | ) | |

Debt financing costs and other, net | | (23 | ) | | (11 | ) | |

Net cash used in financing activities | | (2,277 | ) | | (704 | ) | |

| | | | | |

Net (decrease) increase in cash, cash equivalents, restricted cash and restricted cash equivalents | | (569 | ) | | 422 |

| |

Decrease in cash and cash equivalents in assets held for sale | | 44 |

| | 7 |

| |

Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of year | | 4,631 |

| | 4,403 |

| |

Cash, cash equivalents, restricted cash and restricted cash equivalents at end of perioda | | $ | 4,106 |

| | $ | 4,832 |

| |

| | | | | |

| |

a. | Includes restricted cash and restricted cash equivalents of $247 million at June 30, 2018, and $165 million at June 30, 2017. |

FREEPORT-McMoRan INC.

ADJUSTED NET INCOME

Adjusted net income is intended to provide investors and others with information about FCX's recurring operating performance. This information differs from net income attributable to common stock determined in accordance with U.S. generally accepted accounting principles (GAAP) and should not be considered in isolation or as a substitute for measures of performance determined in accordance with U.S. GAAP. FCX's adjusted net income follows, which may not be comparable to similarly titled measures reported by other companies (in millions, except per share amounts).

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | |

| 2018 | | 2017 | |

| Pre-tax | | After-taxa | | Per Share | | Pre-tax | | After-taxa | | Per Share | |

Net income attributable to common stock | N/A |

| | $ | 869 |

| | $ | 0.59 |

| | N/A |

| | $ | 268 |

| | $ | 0.18 |

| |

| | | | | | | | | | | | |

PT-FI net charges for workforce reductions | — |

| | — |

| | — |

| | (87 | ) | b | (46 | ) | | (0.03 | ) | |

Other net mining credits (charges) | 14 |

| c | 9 |

| | 0.01 |

| | (9 | ) | | (9 | ) | | (0.01 | ) | |

Net oil and gas credits | — |

| | — |

| | — |

| | 6 |

| | 6 |

| | — |

| |

Net adjustments to environmental obligations and related litigation reserves | (50 | ) | | (50 | ) | | (0.03 | ) | | 30 |

| | 30 |

| | 0.02 |

| |

Net gain on sales of assets | 45 |

| d | 45 |

| | 0.03 |

| | 10 |

| | 10 |

| | 0.01 |

| |

Net gain (loss) on early extinguishment of debt | 9 |

| | 9 |

| | 0.01 |

| | (4 | ) | | (4 | ) | | — |

| |

Net tax creditse | N/A |

| | 7 |

| | — |

| | N/A |

| | 32 |

| | 0.02 |

| |

(Loss) gain on discontinued operationsf | (4 | ) | | (4 | ) | | — |

| | 10 |

| | 8 |

| | — |

| |

| $ | 14 |

|

| $ | 16 |

| | $ | 0.01 |

| g | $ | (44 | ) | | $ | 27 |

| | $ | 0.01 |

| |

| | | | | | | | | | | | |

Adjusted net income attributable to common stock | N/A | | $ | 853 |

| | $ | 0.58 |

| | N/A | | $ | 241 |

| | $ | 0.17 |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, | |

| 2018 | | 2017 | |

| Pre-tax | | After-taxa | | Per Share | | Pre-tax | | After-taxa | | Per Share | |

Net income attributable to common stock | N/A |

| | $ | 1,561 |

| | $ | 1.07 |

| | N/A |

| | $ | 496 |

| | $ | 0.34 |

| |

| | | | | | | | | | | | |

PT-FI charges for workforce reductions | $ | — |

| | $ | — |

| | $ | — |

| | $ | (108 | ) | b | $ | (57 | ) | | $ | (0.04 | ) | |

Other net mining credits (charges) | 10 |

| c | 8 |

| | 0.01 |

| | (28 | ) | | (28 | ) | | (0.02 | ) | |

Net oil and gas credits | — |

| | — |

| | — |

| | 4 |

| h | 4 |

| | 0.01 |

| |

Net adjustments to environmental obligations and related litigation reserves | (50 | ) | | (50 | ) | | (0.03 | ) | | 11 |

| | 11 |

| | 0.01 |

| |

Net gain on sales of assets | 56 |

| d | 56 |

| | 0.04 |

| | 33 |

| | 33 |

| | 0.02 |

| |

Net gain (loss) on early extinguishment of debt | 8 |

| | 8 |

| | — |

| | (3 | ) | | (3 | ) | | — |

| |

PT-FI interest on tax refund | 24 |

| i | 13 |

| | 0.01 |

| | — |

| | — |

| | — |

| |

Net tax creditse | N/A |

| | 7 |

| | — |

| | N/A |

| | 31 |

| | 0.02 |

| |

(Loss) gain on discontinued operationsf | (15 | ) | | (15 | ) | | (0.01 | ) | | 51 |

| | 43 |

| | 0.03 |

| |

| $ | 33 |

| | $ | 27 |

| | $ | 0.02 |

| | $ | (40 | ) | | $ | 34 |

| | $ | 0.02 |

| g |

| | | | | | | | | | | | |

Adjusted net income attributable to common stock | N/A | | $ | 1,534 |

| | $ | 1.05 |

| | N/A | | $ | 462 |

| | $ | 0.32 |

| |

| |

a. | Reflects impact to FCX net income attributable to common stock (i.e., net of any taxes and noncontrolling interests). |

| |

b. | Includes charges totaling $82 million in second-quarter 2017 and $103 million for the first six months of 2017 in production and delivery costs and $5 million for the second quarter and first six months of 2017 in selling, general and administrative expenses. |

| |

c. | Includes net credits totaling $10 million for the second quarter and first six months of 2018 in production and delivery costs and $6 million for the second quarter and first six months of 2018 in other income (expense), net, partly offset by interest expense totaling $2 million in second-quarter 2018 and $6 million for the first six months of 2018. |

| |

d. | Reflects adjustments to the estimated fair value of the potential $150 million in contingent consideration related to the 2016 sale of onshore California oil and gas properties, which will continue to be adjusted through December 31, 2020. |

| |

e. | Refer to "Income Taxes" on page VIII, for further discussion of net tax credits. |

| |

f. | Primarily reflects adjustments to the estimated fair value of the potential $120 million in contingent consideration related to the 2016 sale of FCX’s interest in TFHL, which will continue to be adjusted through December 31, 2019. |

| |