Filed with the Securities and Exchange Commission on December 27, 2022

1933 Act Registration File No. 033-20827

1940 Act Registration File No. 811-05518

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-1A

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | [ | X | ] | ||

| Pre-Effective Amendment No. | [ | ] | |||

| Post-Effective Amendment No. | 300 | [ | X | ] | |

and/or

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | [ | X | ] | ||

| Amendment No. | 305 | [ | X | ] | |

(Check Appropriate Box or Boxes)

THE RBB FUND, INC.

(Exact Name of Registrant as Specified in Charter)

| 615 East Michigan Street |

| Milwaukee, Wisconsin 53202 |

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code: (609) 731-6256

Copies to:

| STEVEN PLUMP | JILLIAN BOSMANN, ESQUIRE | |

| The RBB Fund, Inc. | Faegre Drinker Biddle & Reath LLP | |

| 615 East Michigan Street | One Logan Square, Suite 2000 | |

| Milwaukee, Wisconsin 53202-5207 | Philadelphia, Pennsylvania 19103-6996 |

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective.

| [ | ] | immediately upon filing pursuant to paragraph (b) | |

| [ | X | ] | on December 31, 2022 pursuant to paragraph (b) |

| [ | ] | 60 days after filing pursuant to paragraph (a)(1) | |

| [ | ] | on (date) pursuant to paragraph (a)(1) | |

| [ | ] | 75 days after filing pursuant to paragraph (a)(2) | |

| [ | ] | on (date) pursuant to paragraph (a)(2) of Rule 485. |

If appropriate, check the following box:

| [ | ] | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

ABBEY CAPITAL FUTURES STRATEGY FUND

of

THE RBB FUND, INC.

CLASS I SHARES (TICKER: ABYIX)

CLASS A SHARES (TICKER: ABYAX)

CLASS C SHARES (TICKER: ABYCX)

CLASS T SHARES (Not Currently Available for Sale)

PROSPECTUS

December 31, 2022

Investment Adviser:

ABBEY CAPITAL LIMITED

1-2 Cavendish Row

Dublin 1, Ireland

The Securities and Exchange Commission (“SEC”) and the Commodity Futures Trading Commission (“CFTC”) have not approved or disapproved these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

Table of Contents

SUMMARY SECTION |

1 |

|

FUND INFORMATION |

12 |

|

More Information About Fund Investments |

12 |

|

More Information About Risks |

12 |

|

Principal Risks |

12 |

|

Non-Principal Risks |

19 |

|

DISCLOSURE OF PORTFOLIO HOLDINGS |

20 |

|

MORE INFORMATION ABOUT MANAGEMENT OF THE FUND |

20 |

|

Investment Adviser |

20 |

|

Trading Advisers |

22 |

|

SHAREHOLDER INFORMATION |

31 |

|

Pricing of Fund Shares |

31 |

|

Sales Charges |

31 |

|

Purchase of Fund Shares |

35 |

|

Redemption of Fund Shares |

39 |

|

Market Timing |

41 |

|

Exchange Privilege |

41 |

|

Dividends and Distributions |

42 |

|

More Information About Taxes |

42 |

|

Distribution Arrangements |

45 |

|

Additional Information |

45 |

|

FINANCIAL HIGHLIGHTS |

46 |

|

APPENDIX A |

A-1 |

|

FOR MORE INFORMATION ABOUT THE FUND |

Back Cover |

|

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund (the “Shares”).

|

Class I |

Class A |

Class C |

Class T |

|

|

|

|

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

||||

Maximum Deferred Sales Charge (Load) |

(1) |

(2) |

||

Maximum Sales Charge (Load) Imposed on Reinvested Dividends |

||||

Redemption Fee (as a percentage of amount redeemed, if applicable) |

|

|

|

|

|

Management Fees(3) |

||||

Distribution and/or Service (12b-1) Fees |

||||

Other Expenses |

||||

Total Annual Fund Operating Expenses |

||||

Fee Waivers and/or Expense Reimbursements(5) |

- |

- |

- |

- |

Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimbursements(5) |

|

(1) |

|

|

(2) |

|

|

(3) |

|

|

(4) |

|

1

|

(5) |

|

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in Class A, Class C or Class T Shares, or $1,000,000 in Class I Shares, in the Fund for the time periods indicated and then hold or redeem all of your Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the contractual expense limitation until its expiration). Although your actual costs may be higher or lower, based on these assumptions your costs of investing in the Fund would be:

1 Year |

3 Years |

5 Years |

10 Years |

|

Class I Shares |

$ |

$ |

$ |

$ |

Class A Shares |

$ |

$ |

$ |

$ |

Class C Shares |

$ |

$ |

$ |

$ |

Class T Shares |

$ |

$ |

$ |

$ |

You would pay the following expenses on Class C Shares if you did not redeem your shares at the end of the period:

1 Year |

3 Years |

5 Years |

10 Years |

|

Class C Shares |

$ |

$ |

$ |

$ |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year ended August 31, 2022, the Fund’s portfolio turnover rate was

The Fund seeks to achieve its investment objective by allocating its assets between a “Managed Futures” strategy and a “Fixed Income” strategy.

2

The Managed Futures strategy will be achieved by the Fund investing a portion of its assets in Abbey Capital Onshore Series LLC, a wholly-owned and controlled Delaware series limited liability company (the “Onshore Subsidiary”) and up to 25% of its total assets in Abbey Capital Master Offshore Fund Limited, a wholly-owned and controlled subsidiary of the Fund organized under the acts of the Cayman Islands (the “Cayman Subsidiary”). The Cayman Subsidiary will in turn invest all or substantially all of its assets in segregated portfolios of Abbey Capital Offshore Fund SPC (the “SPC” and, together with the Onshore Subsidiary and the Cayman Subsidiary, the “Subsidiaries”), a wholly-owned and controlled segregated portfolio company incorporated under the acts of the Cayman Islands. The Cayman Subsidiary will serve solely as an intermediate entity through which the Fund will invest in the SPC. The Cayman Subsidiary makes no independent investment decisions and has no investment or other discretion over the Fund’s investable assets. The Adviser may allocate assets of the SPC and the Onshore Subsidiary to multiple Managed Futures portfolios (the “Segregated Portfolios”) that include investment styles or sub-strategies such as (i) trend following, (ii) discretionary, fundamentals-based investing with a focus on macroeconomic analysis, (iii) strategies that pursue both fundamental and technical trading approaches, (iv) other specialized approaches to specific or individual market sectors such as equities, interest rates, metals, agricultural and soft commodities, and (v) systematic trading strategies which incorporate technical and fundamental variables.

The Managed Futures strategy investments are designed to achieve capital appreciation in the financial and commodities futures markets. The Adviser intends to allocate the assets of the SPC and the Onshore Subsidiary to one or more Trading Advisers to manage in percentages determined at the discretion of the Adviser. Each Trading Adviser will manage one or more of its own Segregated Portfolios. Each Trading Adviser invests according to a Managed Futures strategy in one or a combination of (i) options, (ii) futures, (iii) forwards, (iv) spot contracts, or (v) swaps, including total return swaps, each of which may be tied to (i) commodities, (ii) financial indices and instruments, (iii) foreign currencies, or (iv) equity indices. All commodities futures and commodities-related investments will be made in the Segregated Portfolios of the SPC. Each current Trading Adviser is registered with the CFTC as a Commodity Trading Advisor (“CTA”). Trading Advisers that are not registered with the SEC as investment advisers provide advice only regarding matters that do not involve securities.

The Fixed Income strategy invests the Fund’s assets primarily in investment grade fixed income securities (of all durations and maturities) in order to generate interest income and capital appreciation, which may add diversification to the returns generated by the Fund’s Managed Futures strategy.

The Fund’s Adviser seeks returns, in part, by (i) using Managed Futures strategy investments that are not expected to have returns that are highly correlated to the broad equity market, and (ii) through actively managed Fixed Income strategy investments that are not expected to have returns that are highly correlated to the broad equity market or the Managed Futures strategy. The Adviser believes that utilizing non-correlated strategies may mitigate losses in generally declining markets. However, there can be no assurance that losses will be avoided. Investment strategies that have historically been non-correlated or demonstrated low correlations to one another or to major world financial market indices may become correlated at certain times, such as during a liquidity crisis in global financial markets.

The trading strategies employ several different trading styles using different research and trading methodologies, in a wide range of global financial and commodity markets operating over multiple time frames. Many of the styles use systematic, automated trading systems, using a combination of mathematical, statistical, technical analysis, pattern recognition and macroeconomic models aimed at profiting from market trends of different durations. Trading Advisers may use discretionary approaches aimed at identifying value investments and turning points in trends. All Trading Advisers utilize a disciplined approach to risk management. The Adviser and Trading Advisers from time to time will employ hedging techniques. Key principles of the Fund’s sell discipline include predetermined relative-value objectives for sectors, issuers and specific securities, pricing performance or fundamental performance that varies from expectations, deteriorating fundamentals, overvaluation and alternative investments offering the opportunity to achieve more favorable risk-adjusted returns.

3

The markets traded include bonds, money markets, foreign exchange markets and commodity markets. Most of the trading is done in derivative markets, usually listed futures markets, but some trading in cash markets may take place when this is the most effective way to enter or exit a trading position. Both long and short positions will be taken in all markets traded. Contracts are positioned either long or short based on various characteristics related to their prices. For example, the Fund may short a particular underlying security or instrument if the Adviser or a Trading Adviser believes the price of the underlying security or instrument will decrease. The Fund invests in U.S. and non-U.S. markets and in developed and emerging markets.

As much of the trading within the Fund is in futures markets, the Fund is likely to have cash balances surplus to margin requirements. The cash portfolio will be invested on a short-term, highly liquid, basis, to meet margin calls on the futures positions.

The Fund is “non-diversified” for purposes of the Investment Company Act of 1940, as amended, (the “1940 Act”) which means that the Fund may invest in fewer securities at any one time than a diversified fund. The Fund may not invest more than 15% of its net assets in illiquid investments. The Fund’s investments in certain derivative instruments and its short selling activities involve the use of leverage.

Generally, the SPC invests primarily in commodity futures but it may also invest in financial futures, options, forwards, spot contracts and swap contracts, fixed income securities, pooled investment vehicles, including those that are not registered pursuant to the 1940 Act and other investments intended to serve as margin or collateral for the SPC’s derivative positions. The Onshore Subsidiary only invests in financial futures, options, forwards, spot contracts and swap contracts, fixed income securities, pooled investment vehicles, including those that are not registered pursuant to the 1940 Act, and other investments intended to serve as margin or collateral for derivative positions. The Fund invests in the SPC in order to gain exposure to the commodities markets within the limitations of the federal tax laws, rules and regulations that apply to regulated investment companies. Unlike the Fund and Onshore Subsidiary, the SPC may invest without limitation in commodity-linked derivatives. The Fund complies with Section 8 and Section 18 of the 1940 Act, governing investment policies and capital structure and leverage, respectively, on an aggregate basis with the Subsidiaries. The Subsidiaries also comply with Section 17 of the 1940 Act relating to affiliated transactions and custody.

In addition, to the extent applicable to the investment activities of the Subsidiaries, the Subsidiaries are subject to the same fundamental investment restrictions and will follow the same compliance policies and procedures as the Fund. Unlike the Fund, none of the Subsidiaries will seek to qualify as a regulated investment company (“RIC”) under Subchapter M of Subtitle A, Chapter 1, of the Internal Revenue Code of 1986, as amended (the “Code”). The Fund is, directly or indirectly, the sole shareholder of each Subsidiary and does not expect shares of the Subsidiaries to be offered or sold to other investors.

Risk is inherent in all investing. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time.

4

The principal risk factors affecting shareholders’ investments in the Fund (and, indirectly, in the Subsidiaries) are set forth below.

● Commodity Sector Risk: Exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, pandemics, embargoes or other trade barriers, tariffs and international economic, political and regulatory developments. The prices of energy, industrial metals, precious metals, agriculture and livestock sector commodities may fluctuate widely due to factors such as changes in value, supply and demand and governmental regulatory policies. The commodity-linked securities in which the Fund invests may be issued by companies in the financial services sector, and events affecting the financial services sector may cause the Fund’s Share value to fluctuate.

● Counterparty Risk: Counterparty risk is the risk that the other party(s) to an agreement or a participant to a transaction, such as a broker or the futures commission merchant, might default on a contract or fail to perform by failing to pay amounts due or failing to fulfill the obligations of the contract or transaction.

● Credit Risk: Credit risk refers to the possibility that the issuer of the security will not be able to make principal and interest payments when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. Securities rated in the four highest categories by the rating agencies are considered investment grade but they may also have some speculative characteristics. Investment grade ratings do not guarantee that bonds will not lose value or default. In addition, the credit quality of securities may be lowered if an issuer’s financial condition changes. The Fund could also be delayed or hindered in its enforcement of rights against an issuer, guarantor, or counterparty.

● Currency Risk: Investment in foreign securities also involves currency risk associated with securities that trade or are denominated in currencies other than the U.S. dollar and which may be affected by fluctuations in currency exchange rates. An increase in the strength of the U.S. dollar relative to a foreign currency may cause the U.S. dollar value of an investment in that country to decline. Foreign currencies also are subject to risks caused by inflation, interest rates, budget deficits and low savings rates, political factors and government controls. Forward foreign currency exchange contracts may limit potential gains from a favorable change in value between the U.S. dollar and foreign currencies. Unanticipated changes in currency pricing may result in poorer overall performance for the Fund than if it had not engaged in these contracts.

● Cyber Security Risk: Cyber security risk is the risk of an unauthorized breach and access to Fund assets, Fund or customer data (including private shareholder information), or proprietary information, or the risk of an incident occurring that causes the Fund, the Adviser, custodian, transfer agent, distributor and other service providers and financial intermediaries to suffer data breaches, data corruption or lose operational functionality or prevent Fund investors from purchasing, redeeming or exchanging shares or receiving distributions. The Fund and its Adviser have limited ability to prevent or mitigate cyber security incidents affecting third-party service providers, and such third-party service providers may have limited indemnification obligations to the Fund or the Adviser. Successful cyber-attacks or other cyber-failures or events affecting the Fund or its service providers may adversely impact and cause financial losses to the Fund or its shareholders. Issuers of securities in which the Fund invests are also subject to cyber security risks, and the value of these securities could decline if the issuers experience cyber-attacks or other cyber-failures.

● Derivatives Risk: The Fund’s investments in derivative instruments including options, forward currency exchange contracts, swaps and futures, which may be leveraged, may result in losses. Investments in derivative instruments may result in losses exceeding the amounts invested. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments.

5

● Emerging Markets Risk: Investment in emerging market securities involves greater risk than that associated with investment in foreign securities of developed foreign countries. These risks include volatile currency exchange rates, periods of high inflation, increased risk of default, greater social, economic and political uncertainty and instability, less governmental supervision and regulation of securities markets, weaker auditing and financial reporting standards, lack of liquidity in the markets, and the significantly smaller market capitalizations of emerging market issuers. The information available about an emerging market issuer may be less reliable than for comparable issuers in more developed capital markets. In addition, investments in certain emerging markets are subject to an elevated risk of loss resulting from market manipulation and the imposition of exchange controls (including repatriation restrictions). The legal rights and remedies available for investors in emerging markets may be more limited than the rights and remedies available in the U.S., and the ability of U.S. authorities (e.g., SEC and the U.S. Department of Justice) to bring actions against bad actors in emerging markets may be limited.

● Fixed Income Securities Risk: Fixed income securities in which the Fund may invest are subject to certain risks, including: interest rate risk, prepayment risk and credit/default risk. Interest rate risk involves the risk that prices of fixed income securities will rise and fall in response to interest rate changes. Prepayment risk involves the risk that in declining interest rate environments prepayments of principal could increase and require the Fund to reinvest proceeds of the prepayments at lower interest rates. Credit risk involves the risk that the credit rating of a security may be lowered.

● Foreign Investments Risk: International investing may be subject to special risks, including currency exchange rate volatility, political, social or economic instability, less publicly available information, less stringent investor protections, and differences in taxation, auditing and other financial practices. The Fund may invest in securities of foreign issuers either directly or through depositary receipts. Depositary receipts may be available through “sponsored” or “unsponsored” facilities. Holders of unsponsored depositary receipts generally bear all of the costs of the unsponsored facility. The depository of an unsponsored facility is frequently under no obligation to distribute shareholder communications received from the issuer of the deposited security or to pass through, to the holders of the receipts, voting rights with respect to the deposited securities. The depository of unsponsored depositary receipts may provide less information to receipt holders. Foreign securities in which the Fund invests may be traded in markets that close before the time that the Fund calculates its net asset value (“NAV”). Furthermore, certain foreign securities in which the Fund invests may be listed on foreign exchanges that trade on weekends or other days when the Fund does not calculate its NAV. As a result, the value of the Fund’s holdings may change on days when shareholders are not able to purchase or redeem the Fund’s shares.

● Forward and Futures Risk: The successful use of forward and futures contracts draws upon the Adviser’s and Trading Advisers’ skill and experience with respect to such instruments and are subject to special risk considerations. The primary risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of instruments held by the Fund and the price of the forward or futures contract; (b) possible lack of a liquid secondary market, and possible regulatory position limits and restrictions, for a forward or futures contract and the resulting inability to close a forward or futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Adviser’s and Trading Advisers’ inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to sell securities from its portfolio to meet daily variation margin requirements, and the Fund may have to sell securities at a time when it may be disadvantageous to do so.

● Government Intervention and Regulatory Changes: The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) (which was passed into law in July 2010) significantly revised and expanded the rulemaking, supervisory and enforcement authority of federal bank, securities and commodities regulators. There can be no assurance that future regulatory actions including, but not limited to, those authorized by the Dodd-Frank Act will not adversely impact the Fund. Major changes resulting from legislative or regulatory actions could materially affect the profitability of the Fund or the value of investments made by the Fund or force the Fund to revise its investment strategy or divest certain of its investments. Any of these developments could expose the Fund to additional costs, taxes, liabilities, enforcement actions and reputational risk.

6

On August 19, 2022, new SEC regulations governing the use of derivatives by registered investment companies became effective. Rule 18f-4 imposes limits on the amount of derivatives a fund can enter into, eliminates the asset segregation framework previously used by funds to comply with Section 18 of the 1940 Act, treats derivatives as senior securities so that a failure to comply with the limits would result in a statutory violation, and requires the Fund to establish and maintain a comprehensive derivatives risk management program and appoint a derivatives risk manager. Rule 18f-4. Rule 18f-4 may require the Fund to observe more stringent asset coverage and related requirements than were previously imposed by the 1940 Act.

● Hedging Transactions Risk: The Adviser and Trading Advisers from time to time employ various hedging techniques. The success of the Fund’s hedging strategy will be subject to the Adviser’s and Trading Advisers’ ability to correctly assess the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the investments in the portfolio being hedged. Since the characteristics of many securities change as markets change or time passes, the success of the Fund’s hedging strategy will also be subject to the Adviser’s and Trading Advisers’ ability to continually recalculate, readjust, and execute hedges in an efficient and timely manner. For a variety of reasons, the Adviser and Trading Advisers may not seek to establish a perfect correlation between such hedging instruments and the portfolio holdings being hedged. Such imperfect correlation may prevent the Fund from achieving the intended hedge or expose the Fund to risk of loss. In addition, it is not possible to hedge fully or perfectly against any risk, and hedging entails its own cost.

● High Portfolio Turnover Risk: The risk that when investing on a shorter-term basis, the Fund may as a result trade more frequently and incur higher levels of brokerage fees and commissions, and cause higher levels of current tax liability to shareholders in the Fund.

● Interest Rate Risk: Interest rate risk is the risk that prices of fixed income securities generally increase when interest rates decline and decrease when interest rates increase. The Fund may lose money if short term or long term interest rates rise sharply or otherwise change in a manner not anticipated by the Adviser and Trading Advisers. Changing interest rates may have unpredictable effects on the markets and the Fund’s investments and may also affect the liquidity of fixed income securities and instruments held by the Fund. Declines in interest rate levels could cause the Fund’s earnings to fall below the Fund’s expense ratio, resulting in a negative yield, and a decline in the Fund’s share price. A general rise in interest rates may cause investors to move out of fixed income securities on a large scale, which could adversely affect the price and liquidity of fixed income securities and could also result in increased redemptions for the Fund. Fluctuations in interest rates may also affect the liquidity of fixed income securities and instruments held by the Fund. Certain countries and regulatory bodies may use negative interest rates as a monetary policy tool to encourage economic growth during periods of deflation. In a negative interest rate environment, debt instruments may trade at negative yields, which means the purchaser of the instrument may receive at maturity less than the total amount invested.

● Leveraging Risk: Investments in derivative instruments may give rise to a form of leverage. Trading Advisers may engage in speculative transactions which involve substantial risk and leverage, such as making short sales. The use of leverage by the Adviser and Trading Advisers may increase the volatility of the Fund. These leveraged instruments may result in losses to the Fund or may adversely affect the Fund’s NAV or total return, because instruments that contain leverage are more sensitive to changes in interest rates. The Fund may also have to sell assets at inopportune times to satisfy its obligations in connection with such transactions.

● Management Risk: The Fund is subject to the risk of poor investment selection. In other words, the individual investments of the Fund may not perform as well as expected, and/or the Fund’s portfolio management practices may not work to achieve their desired result.

● Manager Risk: If the Adviser and Trading Advisers make poor investment decisions, it will negatively affect the Fund’s investment performance.

● Market Risk: The NAV of the Fund will change with changes in the market value of its portfolio positions. The value of investments held by the Fund may increase or decrease in response to economic, political, financial, public health crises (such as epidemics or pandemics) or other disruptive events (whether real, expected or perceived) in the U.S. and global markets. Investors may lose money.

7

● Multi-Manager Dependence Risk: The success of the Fund’s investment strategy depends both on the Adviser’s ability to select Trading Advisers and to allocate assets to those Trading Advisers and on each Trading Adviser’s ability to execute the relevant strategy and select investments for the Fund and the Subsidiaries. The Trading Advisers’ investment styles may not always be complementary, which could adversely affect the performance of the Fund.

● New Adviser Risk: The Trading Advisers may be newly registered or not registered with the SEC and/or have not previously managed a mutual fund. Accordingly, investors in the Fund bear the risk that a Trading Adviser’s inexperience may limit its effectiveness.

● Non-Diversification Risk:

● Options Risk: Purchasing and writing put and call options are highly specialized activities and entail greater than ordinary investment risks. The Fund may not fully benefit from or may lose money on an option if changes in its value do not correspond as anticipated to changes in the value of the underlying securities.

● Quantitative Trading Strategies Risk: The Adviser and Trading Advisers may use quantitative methods to select investments. Securities or other investments selected using quantitative methods may perform differently from the market as a whole or from their expected performance for many reasons, including factors used in building the quantitative analytical framework, the weights placed on each factor, and changing sources of market returns, among others. Any errors or imperfections in quantitative analyses or models, or in the data on which they are based, could adversely affect the ability of the Adviser or a Trading Adviser to use such analyses or models effectively, which in turn could adversely affect the Fund’s performance. There can be no assurance that these methodologies will help the Fund to achieve its investment objective.

● Short Sales Risk: Short sales of securities may result in gains if a security’s price declines, but may result in losses if a security’s price rises. In a rising market, short positions may be more likely to result in losses because securities sold short may be more likely to increase in value. Short selling also involves the risks of: increased leverage, and its accompanying potential for losses; the potential inability to reacquire a security in a timely manner, or at an acceptable price; the possibility of the lender terminating the loan at any time, forcing the Fund to close the transaction under unfavorable circumstances; and the additional costs that may be incurred. The Fund may engage in short sales that are either “uncovered” or “against the box.” A short sale is “against the box” if at all times during which the short position is open, the Fund owns at least an equal amount of the securities or securities convertible into, or exchangeable without further consideration for, securities of the same issue as the securities that are sold short. Short sales “against the box” may protect the Fund against the risk of losses in the value of a portfolio security because any decline in value of the security should be wholly or partially offset by a corresponding gain in the short position. Any potential gains in the security, however, would be wholly or partially offset by a corresponding loss in the short position. Short sales that are not “against the box” involve a form of investment leverage, and the amount of the Fund’s loss on a short sale is potentially unlimited.

● Subsidiary Risk: By investing in the Subsidiaries, the Fund is indirectly exposed to the risks associated with each Subsidiary’s investments. The derivatives and other investments held by the Subsidiaries are generally similar to those that are permitted to be held by the Fund and are subject to the same risks that apply to similar investments if held directly by the Fund. The Subsidiaries are not registered under the 1940 Act, and, unless otherwise noted in this Prospectus, are not subject to all the investor protections of the 1940 Act. Changes in the laws or acts of the United States, Delaware and/or the Cayman Islands could result in the inability of the Fund and/or the Subsidiaries to continue to operate as they currently do and could adversely affect the Fund.

8

● Tax Risk: In order to qualify as a RIC, the Fund must meet certain requirements regarding the source of its income, the diversification of its assets and the distribution of its income. Under the test regarding the source of a RIC’s income, at least 90% of the gross income of the RIC each year must be qualifying income, which consists of dividends, interest, gains on investment assets and other categories of investment income. Treasury Regulations provide that income from a foreign subsidiary that is a controlled foreign corporation is qualifying income for purposes of the Fund remaining qualified as a RIC for U.S. federal income tax purposes. Notwithstanding the treatment of controlled foreign corporations in the regulations, the Internal Revenue Service (“IRS”) may take the position that income earned by the Fund through the Cayman Subsidiary may not be qualifying income because of its investment in commodities. Additionally, the IRS may take the position that certain commodity-linked structured notes may not be qualifying income. A recharacterization of income from the Cayman Subsidiary or commodity-linked structured notes could cause the Fund to fail to qualify as a RIC. If the Fund were to fail to qualify as a RIC and became subject to federal income tax, shareholders of the Fund would be subject to diminished returns. Changes in the laws or acts of the United States, Delaware and/or the Cayman Islands could result in the inability of the Fund and/or its Subsidiaries to operate as described in this Prospectus and the SAI and could adversely affect the Fund. For example, the Cayman Islands does not currently impose any income, corporate or capital gains tax or withholding tax on the Cayman Subsidiary or the SPC. If Cayman Islands act changes such that the Cayman Subsidiary and/or the SPC must pay Cayman Islands taxes, Fund shareholders would likely suffer decreased investment returns.

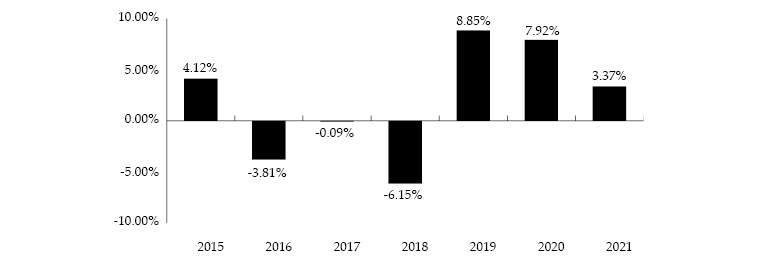

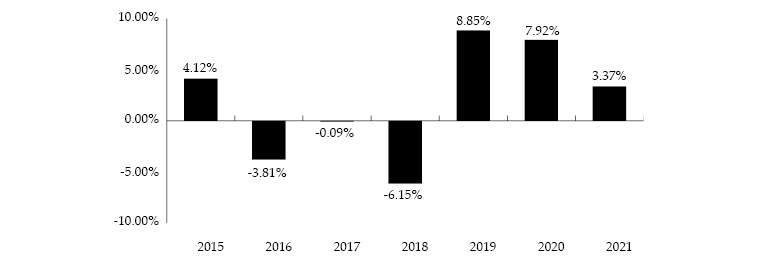

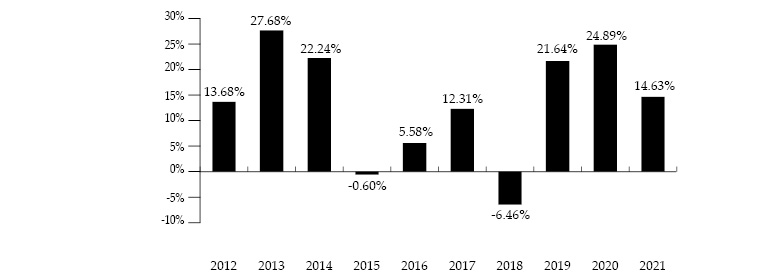

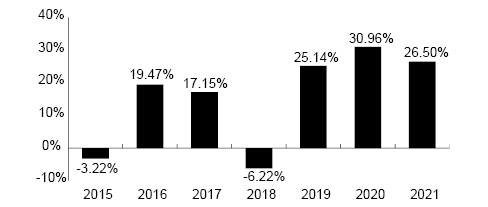

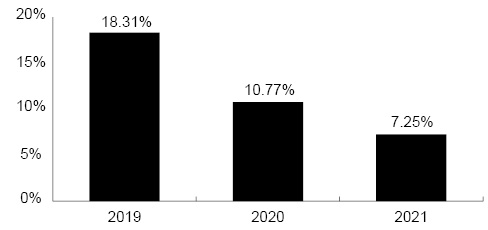

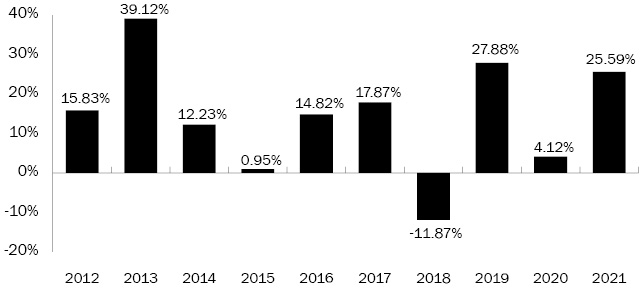

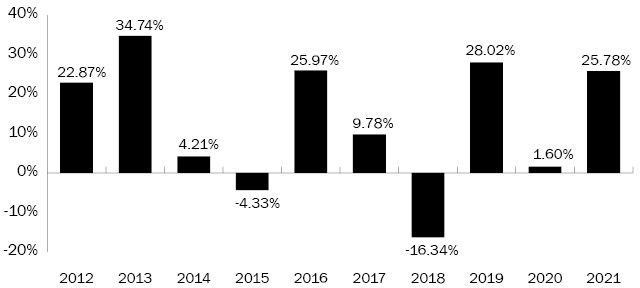

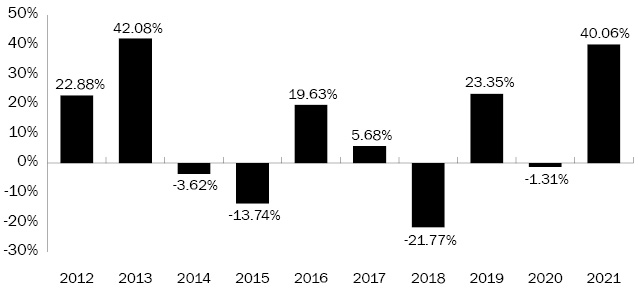

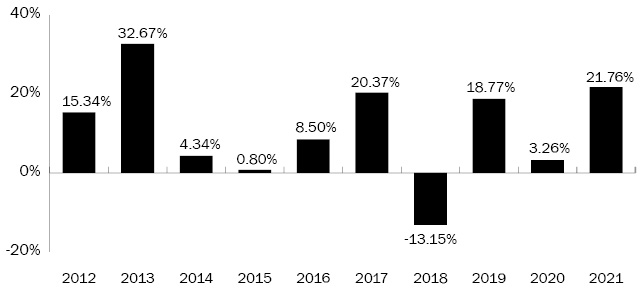

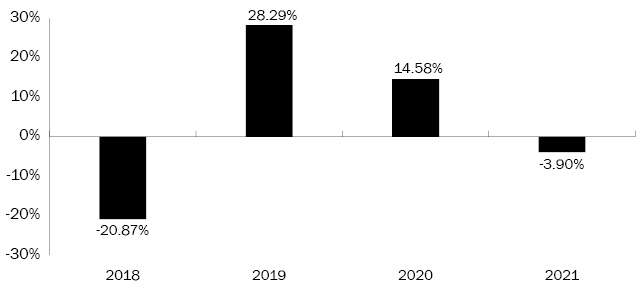

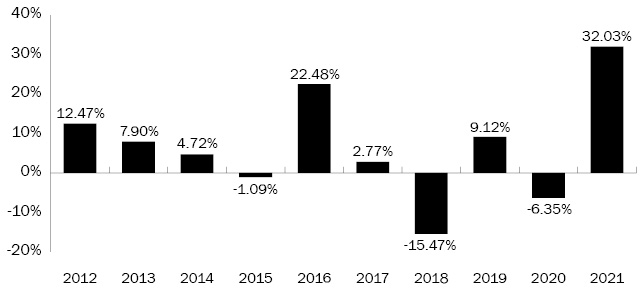

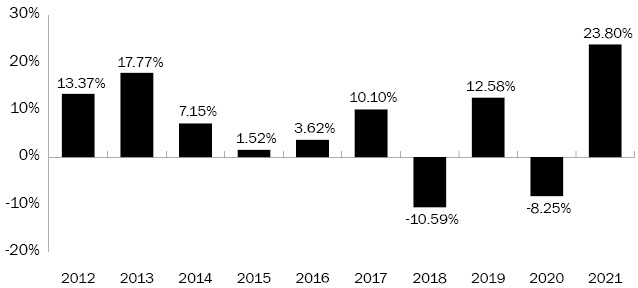

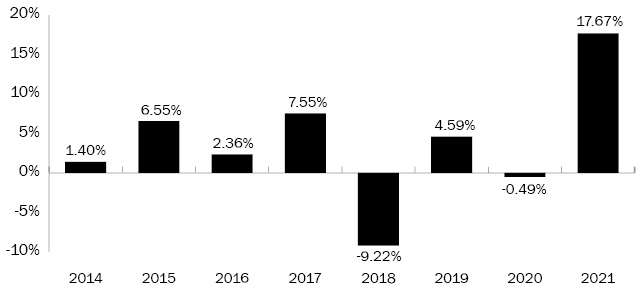

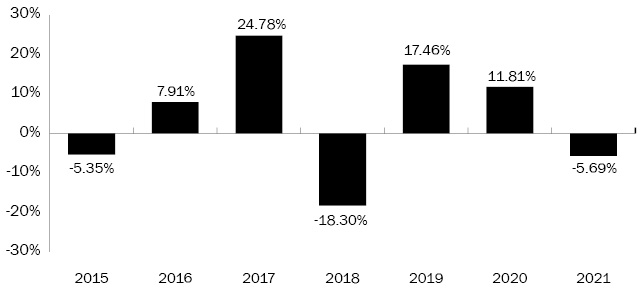

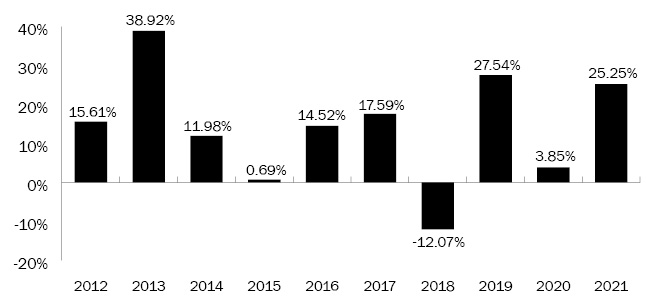

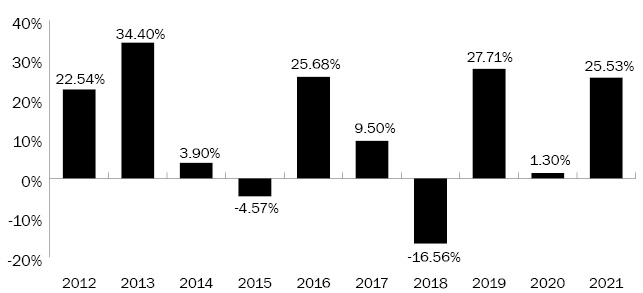

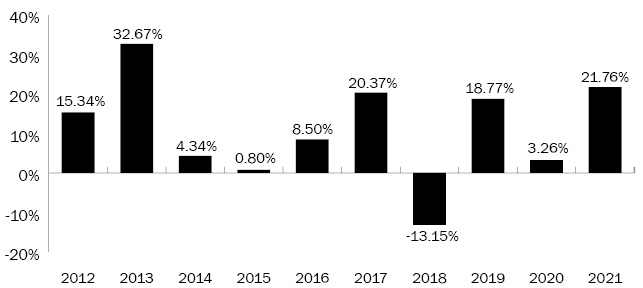

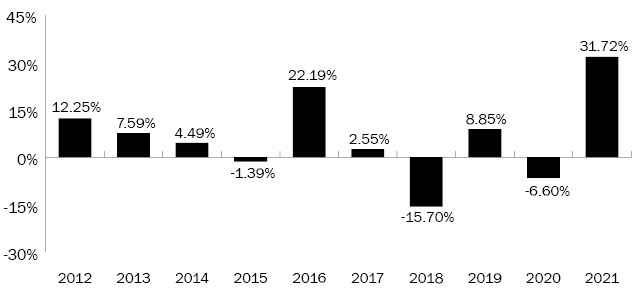

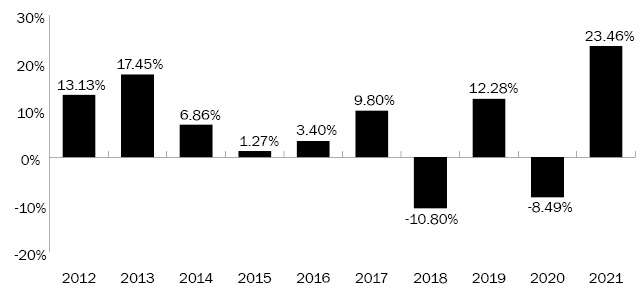

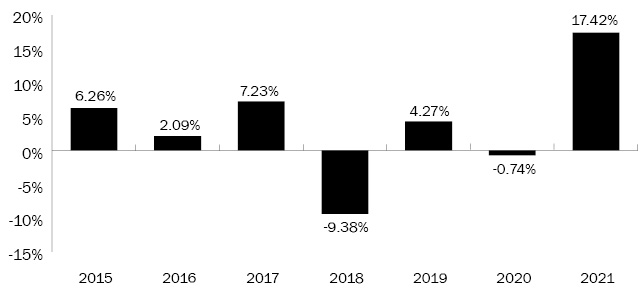

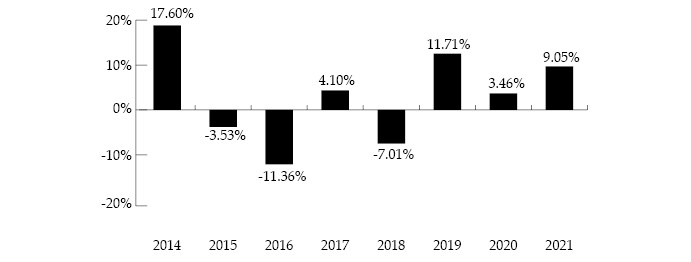

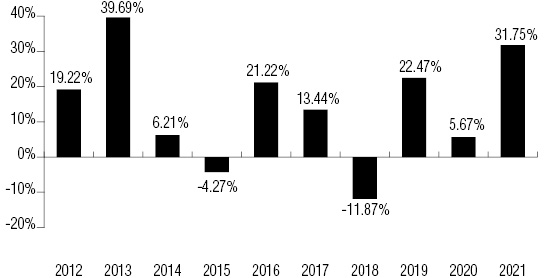

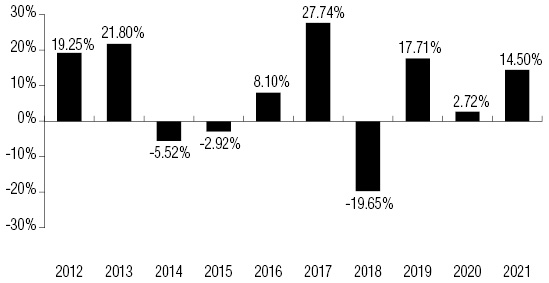

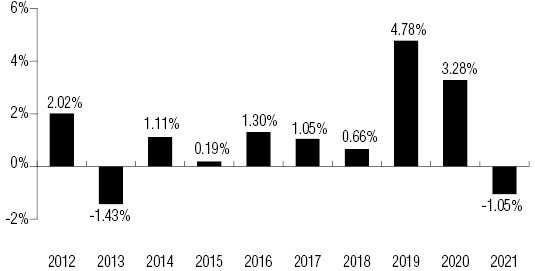

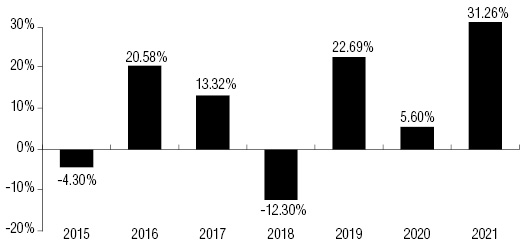

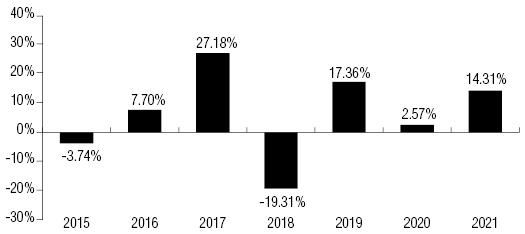

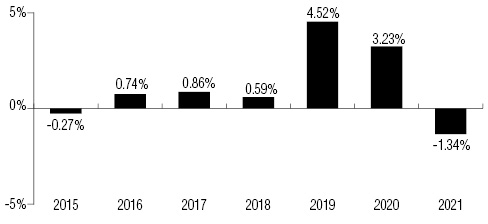

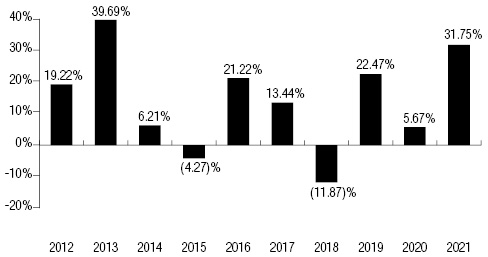

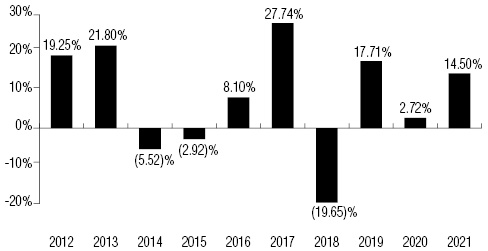

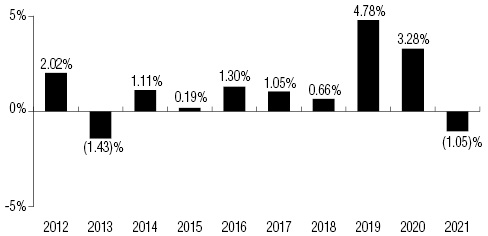

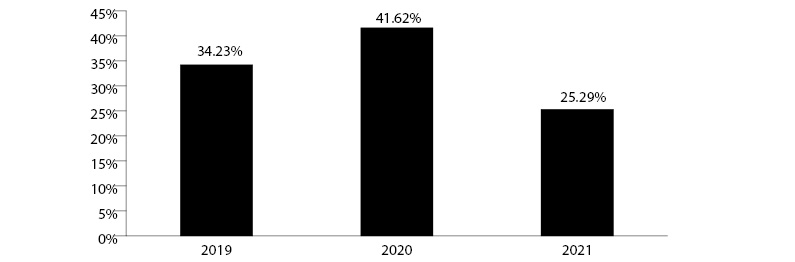

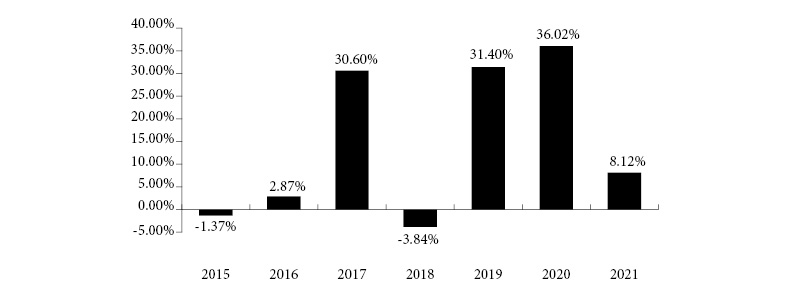

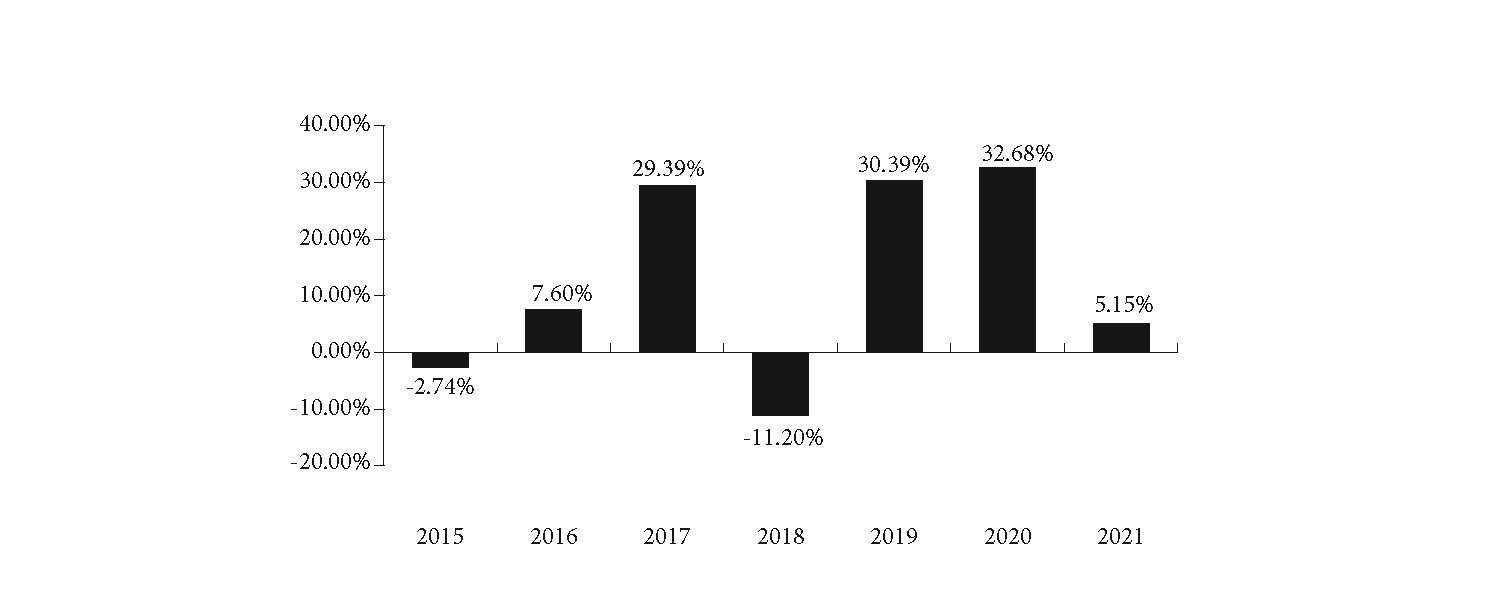

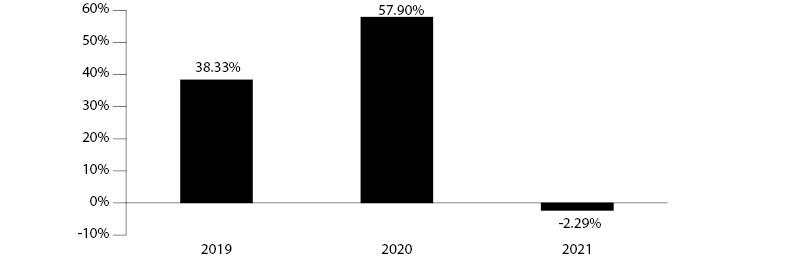

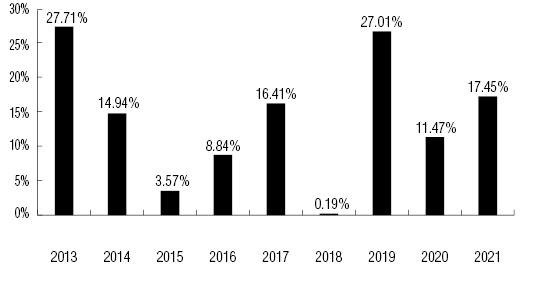

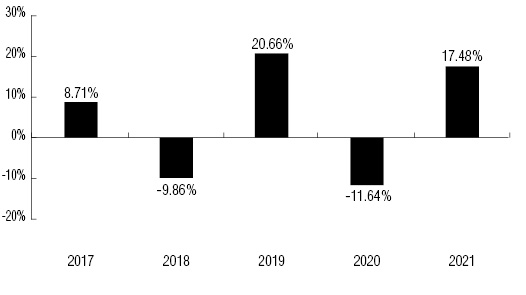

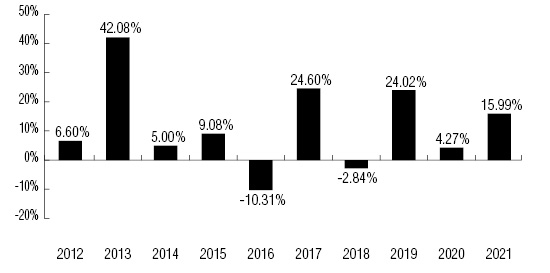

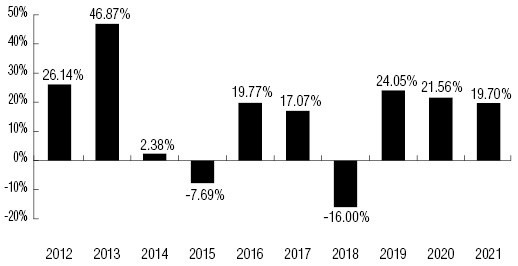

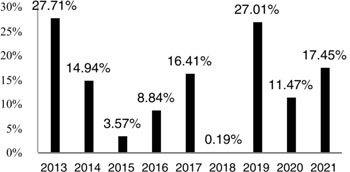

Total Returns for Calendar Years Ended December 31

During the period shown in the chart, the was (for the quarter ended ) and the was (for the quarter ended ).

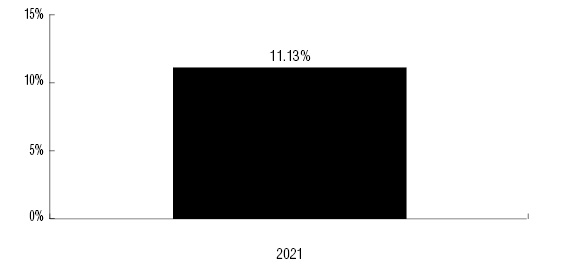

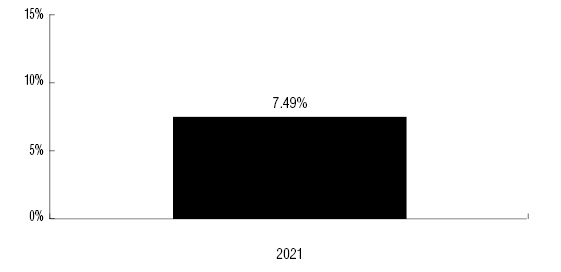

The of the Fund’s Class I Shares as of was .

9

The following table, which includes all applicable sales loads, compares the average annual total returns of the Class I Shares, Class A Shares and Class C Shares for the one-year, five-year, and since inception periods to a broad-based market index for the same periods. For Class A Shares, the table reflects the impact of the maximum sales charge of 5.75%. For this reason, returns for Class A Shares will be lower than those of Class I and Class C Shares. Average annual returns for Class T Shares are not included because they had not commenced operations prior to the date of this Prospectus. The returns for Class T Shares would be substantially similar to returns for Class I Shares because the shares are invested in the same portfolio of securities, and would differ only to the extent that the classes have different expenses.

Average Annual Total Returns for |

1 Year |

5 Years |

Since |

|

Class I Shares |

|||

– Return Before Taxes |

|||

– Return After Taxes on Distributions(1) |

|||

– Return After Taxes on Distributions and Sale of Fund Shares(1) |

|||

Class A Shares |

|||

– Return Before Taxes |

- |

||

Class C Shares |

|||

– Return Before Taxes |

|||

S&P 500® Total Return Index (reflects no deduction for fees, expenses and taxes) |

|

(1) |

|

|

(2) |

|

Management of the Fund

Investment Adviser and Trading Advisers

Abbey Capital Limited, 1-2 Cavendish Row, Dublin 1, Ireland, serves as the investment adviser to the Fund. Aspect Capital Limited, Crabel Capital Management, LLC, Eclipse Capital Management, Inc., Episteme Capital Partners (UK), LLP, Graham Capital Management, LP, P/E Global LLC, Revolution Capital Management, LLC, R. G. Niederhoffer Capital Managment, Inc., Systematica Investments Limited (acting as the general partner of Systematica Investments LP), Tudor Investment Corporation, Welton Investment Partners LLC and, Winton Capital Management Limited each serve as a Trading Adviser to the Fund.

10

Portfolio Managers

The Fund is managed by the following co-portfolio managers.

Title |

Portfolio Manager Since: |

|

Abbey Capital Limited |

||

Anthony Gannon |

Founder and Chief Investment Officer |

Inception (July 1, 2014) |

Mick Swift |

Chief Executive Officer |

Inception (July 1, 2014) |

Purchase and Sale of Information

The minimum initial investment for Class A Shares, Class C Shares and Class T Shares is $2,500, and the minimum initial investment for Class I Shares is $1,000,000. There is a minimum amount of $100 for subsequent investment in Class A Shares, Class C Shares and Class T Shares, and $1,000 in Class I Shares. Class T Shares are not currently available for sale. Certain features of the Shares, such as the initial and subsequent investment minimums and certain trading restrictions, may be modified or waived by Service Organizations, as further detailed in the section entitled “Purchase of Fund Shares – Purchases Through Intermediaries.”

You can purchase and redeem Shares of the Fund only on days the New York Stock Exchange (“NYSE”) is open. Shares of the Fund may be available through certain brokerage firms, financial institutions and other industry professionals that have entered into a distribution agreement with the Distributor (collectively, “Service Organizations”). Class T Shares, once available for sale, will be available only to investors who are investing through a Service Organization. Not all Service Organizations will make Class T Shares available to their clients. You may redeem Class T Shares on any business day by contacting your Service Organization. Consult Appendix A and a representative of your Service Organization about the availability of Class T Shares. Class I Shares, Class A Shares and Class C Shares of the Fund may also be purchased and redeemed directly through the Company by the means described below.

Purchase and Redemption by Mail:

Regular Mail: |

Overnight Delivery: |

Purchase by Wire:

Before sending any wire, call U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (the “Transfer Agent”) at 1-844-261-6484 to confirm the current wire instructions for the Fund.

Redemption by Telephone:

Call the Transfer Agent at 1-844-261-6484.

Taxes

The Fund intends to make distributions that generally may be taxed at ordinary income or capital gains rates.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund may pay the intermediary for the sale of Shares and other related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

11

FUND INFORMATION

More Information About Fund Investments

This section provides some additional information about the Fund’s investments and certain portfolio management techniques that the Fund may use. More information about the Fund’s investments and portfolio management techniques, and related risks, is included in the Statement of Additional Information (“SAI”).

The investment objective of the Fund is to seek long-term capital appreciation Current income is a secondary objective. The Fund’s investment objective is non-fundamental and may be changed by the Board of Directors of the Company (the “Board”) without the approval of the Fund’s shareholders. However, as a matter of policy, the Fund would not materially change its investment objective without informing shareholders at least 60 days in advance of any such change.

The investments and strategies described in this Prospectus are those that the Fund uses under normal conditions. The Fund may depart from its principal investment strategy in response to adverse market, economic, political or other conditions by taking temporary defensive positions (up to 100% of its assets) in all types of money market and short-term debt securities. If the Fund were to take a temporary defensive position, it may be unable for a time to achieve its investment objective.

This Prospectus describes the Fund’s principal investment strategies, and the Fund will normally invest in the types of securities described in this Prospectus. In addition to the investments and strategies described in this Prospectus, the Fund also may invest, to a lesser extent, in other securities, use other strategies and engage in other investment practices that are not part of its principal investment strategy. These investments and strategies, as well as those described in this Prospectus, are described in detail in the Fund’s SAI. There is no guarantee that the Fund will achieve its investment objective.

More Information About Risks

The following provides additional information about the principal and certain non-principal risks of investing in the Fund and, indirectly, in the Subsidiaries. More information about the Fund’s risks is included in the SAI.

Principal Risks

Commodity-Linked Derivatives. The Fund may gain exposure to the commodities markets through commodity-linked structured notes, swap agreements and commodity futures and options. These instruments have one or more commodity-dependent components. They are derivative instruments because at least part of their value is derived from the value of an underlying commodity index, commodity futures contract, index or other readily measurable economic variable. The prices of commodity-linked derivative instruments may move in different directions than investments in traditional equity and debt securities when the value of those traditional securities is declining due to adverse economic conditions. As an example, during periods of rising inflation, historically debt securities have tended to decline in value due to the general increase in prevailing interest rates. Conversely, during those same periods of rising inflation, historically the prices of certain commodities, such as oil and metals, have tended to increase. There cannot be any guarantee that derivative instruments will perform in that manner in the future, and at certain times the price movements of commodity-linked investments have been parallel to debt and equity securities.

Counterparties. To the extent the Fund invests in loans or securities traded over-the-counter, swaps, “synthetic” or derivative instruments, repurchase agreements, certain types of options or other customized financial instruments, the Fund takes the risk of non-performance by the other party to the contract. This risk may include credit risk of the counterparty and the risk of settlement default. This risk may differ materially from those entailed in exchange-traded transactions that generally are supported by guarantees of clearing organizations, daily marking-to-market and settlement, and segregation and minimum capital requirements applicable to intermediaries. Transactions entered directly between two counterparties generally do not benefit from such protections and expose the parties to the risk of counterparty default.

12

Credit/Default Risk. The credit rating of an issuer or guarantor of a security in which the Fund invests may be lowered or an issuer or guarantor of a security or the counterparty to a derivatives contract or a repurchase agreement may default on its payment obligations. The risk of loss due to default by issuers of lower-rated securities is greater because low-rated securities generally are unsecured and often are subordinated to the rights of other creditors of the issuers of such securities. The Fund also may incur additional expenses in seeking recovery on defaulted securities. The creditworthiness of firms used by the Fund to effect securities transactions in emerging and frontier market countries may not be as strong as in some developed countries. As a result, the Fund could be subject to a greater risk of loss on its securities transactions if a firm defaults on its responsibilities.

Cyber Security Risk. With the increased use of technologies such as the internet to conduct business, the Fund is susceptible to operational, information security and related risks. In general, cyber incidents can result from deliberate attacks or unintentional events. Cyber-attacks include, but are not limited to, gaining unauthorized access to digital systems (e.g., through “hacking” or malicious software coding) for purposes of misappropriating assets or sensitive information, corrupting data, or causing operational disruption. Cyber-attacks may also be carried out in a manner that does not require gaining unauthorized access, such as causing denial-of-service attacks on websites (i.e., efforts to make network services unavailable to intended users). Cyber security failures or breaches by the Fund’s Adviser and other service providers (including, but not limited to, Fund accountant, custodian, transfer agent and administrator), and the issuers of securities in which the Fund invests, have the ability to cause disruptions and impact business operations, potentially resulting in financial losses, interference with the Fund’s ability to calculate its NAV, impediments to trading, the inability of Fund shareholders to transact business, violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, reimbursement or other compensation costs, or additional compliance costs. In addition, substantial costs may be incurred in order to prevent any cyber incidents in the future. While the Adviser has established business continuity plans in the event of, and risk management systems to prevent, such cyber-attacks, there are inherent limitations in such plans and systems including the possibility that certain risks have not been identified. Furthermore, the Fund cannot control the cyber security plans and systems put in place by service providers to the Fund and issuers in which the Fund invests. The Fund and its shareholders could be negatively impacted as a result.

Derivative Contracts. The Fund may, but need not, use derivative contracts for any of the following purposes:

|

● |

To seek to hedge against the possible adverse impact of changes in stock market prices, currency exchange rates or interest rates in the market value of its securities or securities to be purchased; |

|

● |

As a substitute for buying or selling currencies or securities; or |

|

● |

To seek to enhance the Fund’s return in non-hedging situations (which is considered a speculative activity). |

Examples of derivative contracts include: futures and options on securities, securities indices or currencies; options on these futures; forward foreign currency contracts; and interest rate or currency swaps. The Fund may use derivative contracts involving foreign currencies. A derivative contract will obligate or entitle the Fund to deliver or receive an asset or cash payment that is based on the change in value of one or more securities, currencies or indices. Even a small investment in derivative contracts can have a big impact on the Fund’s stock market, currency and interest rate exposure. Therefore, using derivatives can disproportionately increase losses and reduce opportunities for gains when stock prices, currency rates or interest rates are changing. The Fund may not fully benefit from or may lose money on derivatives if changes in their value do not correspond accurately to changes in the value of the Fund’s holdings. The other parties to certain derivative contracts present the same types of default risk as issuers of fixed income securities in that the counterparty may default on its payment obligations or become insolvent. Derivatives can also make the Fund less liquid and harder to value, especially in declining markets.

13

Additionally, on August 19, 2022, new SEC regulations governing the use of derivatives by registered investment companies became effective. Rule 18f-4 imposes limits on the amount of derivatives a fund can enter into, eliminates the asset segregation framework previously used by funds to comply with Section 18 of the 1940 Act, treats derivatives as senior securities so that a failure to comply with the limits would result in a statutory violation, and requires the Fund to establish and maintain a comprehensive derivatives risk management program and appoint a derivatives risk manager. The Fund is required to comply with Rule 18f-4 and has adopted procedures for investing in derivatives and other transactions in compliance with Rule 18f-4 Rule 18f-4 may require the Fund to observe more stringent asset coverage and related requirements than were previously imposed by the 1940 Act.

|

● |

Forward and Futures Risk. The successful use of forward and futures contracts draws upon the Adviser’s and Trading Advisers’ skill and experience with respect to such instruments and are subject to special risk considerations. The primary risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of instruments held by the Fund and the price of the forward or futures contract; (b) possible lack of a liquid secondary market, and possible regulatory position limits and restrictions, for a forward or futures contract and the resulting inability to close a forward or futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the possibility that the counterparty will default in the performance of its obligations; and (e) if the Fund has insufficient cash, it may have to sell securities from its portfolio to meet daily variation margin requirements, and the Fund may have to sell securities at a time when it may be disadvantageous to do so. |

|

● |

Forward Contracts. The Fund may utilize forward contracts that are not traded on exchanges and may not be regulated. There are no limitations on daily price movements of forward contracts. Banks and other dealers with which the Fund maintains accounts may require that the Fund deposit margin with respect to such trading. The Fund’s counterparties are not required to continue making markets in such contracts. There have been periods during which certain counterparties have refused to continue to quote prices for forward contracts or have quoted prices with an unusually wide spread (the price at which the counterparty is prepared to buy and that at which it is prepared to sell). Arrangements to trade forward contracts may be made with only one or a few counterparties, and liquidity problems therefore might be greater than if such arrangements were made with numerous counterparties. The imposition of credit controls by governmental authorities might limit such forward trading to less than the amount that the Adviser would otherwise recommend, to the possible detriment of the Fund. |

|

● |

Options. An option is a type of derivative instrument that gives the holder the right (but not the obligation) to buy (a “call”) or sell (a “put”) an asset in the near future at an agreed upon price prior to the expiration date of the option. The Fund may “cover” a call option by owning the security underlying the option or through other means. The value of options can be highly volatile, and their use can result in loss if the Adviser is incorrect in its expectation of price fluctuations. Purchasing and writing put and call options are highly specialized activities and entail greater than ordinary investment risks. The Fund may not fully benefit from or may lose money on an option if changes in its value do not correspond as anticipated to changes in the value of the underlying securities. If the Fund is not able to sell an option held in its portfolio, it would have to exercise the option to realize any profit and would incur transaction costs upon the purchase or sale of the underlying securities. Ownership of options involves the payment of premiums, which may adversely affect the Fund’s performance. To the extent that the Fund invests in over-the-counter options, the Fund may be exposed to counterparty risk. |

Fixed Income Investments. The Fund invests a portion of its assets in fixed income securities. Fixed income investments include bonds, notes (including structured notes), mortgage-backed securities, asset-backed securities, convertible securities, Eurodollar and Yankee dollar instruments, preferred stocks and money market instruments. Fixed income securities may be issued by corporate and governmental issuers and may have all types of interest rate payment and reset terms, including (without limitation) fixed rate, adjustable rate, zero coupon, contingent, deferred, payment-in-kind and auction rate features. The principal debt investments of the Fund will be fixed and floating rate securities with no reset terms.

14

The credit quality of securities held in the Fund’s portfolio is determined at the time of investment. If a security is rated differently by multiple ratings organizations, the Fund treats the security as being rated in the higher rating category. The Fund invests primarily in investment grade fixed income securities that are rated as low as Baa by Moody’s Investors Service or BBB by S&P Global Ratings (or their equivalents, or, if unrated, determined by the Adviser or applicable Sub-Adviser to be of comparable credit quality). The Fund may choose not to sell securities that are downgraded below those credit ratings after their purchase. Periods of rising interest rates may result in decreased liquidity and increased volatility in the fixed income markets. Periods of rising interest rates may result in decreased liquidity and increased volatility in the fixed income markets.

Foreign Securities. The Fund may invest in securities of foreign issuers that are traded or denominated in U.S. dollars (including equity securities of foreign issuers trading in U.S. markets) through American Depositary Receipts (“ADRs”), Global Depositary Receipts (“GDRs”), European Depositary Receipts (“EDRs”) or International Depositary Receipts (“IDRs”). Depositary receipts may be available through “sponsored” or “unsponsored” facilities. A sponsored facility is established jointly by the issuer of the security underlying the receipt and the depository, whereas an unsponsored facility is established by the depository without participation by the issuer of the underlying security. Holders of unsponsored depositary receipts generally bear all of the costs of the unsponsored facility. The depository of an unsponsored facility is frequently under no obligation to distribute shareholder communications received from the issuer of the deposited security or to pass through, to the holders of the receipts, voting rights with respect to the deposited securities. The depository of unsponsored depositary receipts may provide less information to receipt holders.

In addition, the Fund may invest in securities traded or denominated in foreign currencies and in multinational currencies such as the Euro. The Fund will value its securities and other assets in U.S. dollars. Investments in securities of foreign entities and securities denominated or traded in foreign currencies involve special risks, which include more or less foreign government regulation; less public information; less stringent investor protections; less stringent accounting, corporate governance, financial reporting and disclosure standards; and less economic, political and social stability in the countries in which the Fund invests. Changes in foreign currency rates relative to the U.S. dollar will affect the U.S. dollar value of the Fund’s assets denominated or quoted in currencies other than the U.S. dollar. Emerging market investments offer the potential for significant gains but also involve greater risks than investing in more developed countries. Political or economic instability, lack of market liquidity and government actions such as currency controls or seizure of private business or property may be more likely in emerging markets. Further, investments in certain emerging markets are subject to an elevated risk of loss resulting from market manipulation. The legal rights and remedies available for investors in emerging markets may be more limited than the rights and remedies available in the U.S., and the ability of U.S. authorities (e.g., SEC and the U.S. Department of Justice) to bring actions against bad actors in emerging markets may be limited.

Additionally, in February 2022, Russia commenced a military attack on Ukraine. The outbreak of hostilities between the two countries and the threat of wider-spread hostilities could have severe adverse effect on the region and global economies, including significant negative impacts on the markets for certain securities and commodities, such as oil and natural gas. In addition, sanctions imposed on Russia by the United States and other countries, and any sanctions imposed in future, could have a significant adverse impact on the Russian economy and related markets. The price and liquidity of investments may fluctuate widely as a result of the conflict and related events. How long the armed conflict and related events will last cannot be predicted. These tensions and any related events could have a significant impact on Fund performance and the value of Fund investments, even beyond any direct exposure the Fund may have to issuers located in these countries.

Government Intervention and Regulatory Changes. The Dodd-Frank Act significantly revised and expanded the rulemaking, supervisory and enforcement authority of federal bank, securities and commodities regulators. There can be no assurance that future regulatory actions, including, but not limited to, those authorized by the Dodd-Frank Act will not adversely impact the Fund. Major changes could materially affect the profitability of the Fund or the value of investments made by the Fund or force the Fund to revise its investment strategy or divest certain of its investments. Any of these developments could expose the Fund to additional costs, taxes, liabilities, enforcement actions and reputational risk. In addition, Rule 18f-4 under the 1940 Act governing the use of derivatives by registered investment companies became effective on August 19, 2022. See “Derivatives Contracts” above for additional information.

15

Interest Rate Risk. During periods of rising interest rates, the market value of the Fund’s fixed-income securities will tend to be lower than prevailing market interest rates. In periods of falling interest rates, the market value of the Fund’s fixed-income securities generally will tend to be higher than prevailing market interest rates. Prices of longer-term fixed income securities are typically more sensitive to changes in interest rates than prices of shorter-term fixed-income securities. Significant upward pressure on domestic interest rates and a corresponding widening of credit spreads could negatively impact the market price of emerging debt markets. Certain countries and regulatory bodies may use negative interest rates as a monetary policy tool to encourage economic growth during periods of deflation. In a negative interest rate environment, debt instruments may trade at negative yields, which means the purchaser of the instrument may receive at maturity less than the total amount invested.

Interest Rate Swaps, Total Return Swaps, Credit Default Swaps, Options on Swaps and Interest Rate Caps, Floors and Collars.

|

● |

Interest Rate Swaps. Interest rate swaps involve the exchange by the Fund with another party of their respective commitments to pay or receive interest, such as an exchange of fixed-rate payments for floating rate payments. Like a traditional investment in a debt security, the Fund could lose money by investing in an interest rate swap if interest rates change adversely. For example, if the Fund enters into a swap where it agrees to exchange a floating rate of interest for a fixed rate of interest, the Fund may have to pay more money than it receives. Similarly, if the Fund enters into a swap where it agrees to exchange a fixed rate of interest for a floating rate of interest, the Fund may receive less money than it has agreed to pay. |

|

● |

Total Return Swaps. Total return swaps are contracts that obligate one party to pay the other party an amount equal to the total return on a defined underlying asset or a non-asset reference during a specified period of time. The underlying asset might be a security or basket of securities or a non-asset reference such as a securities index. In return, the other party would make periodic payments based on a fixed or variable interest rate or on the total return from a different underlying asset or non-asset reference. The primary risks associated with total return swaps are credit risks (if the counterparty fails to meet its obligations) and market risk (if there is no liquid market for the agreement or unfavorable changes occur to the underlying asset). |

|

● |

Credit Default Swaps. Credit default swaps are contracts whereby one party makes periodic payments to a counterparty in exchange for the right to receive from the counterparty a payment equal to the par (or other agreed-upon) value of a referenced debt obligation in the event of a default by the issuer of the debt obligation. |

|

● |

Options on Swaps (“swaptions”). Swaptions are options to enter into a swap agreement. The Fund may also purchase and write (sell) swaptions. Like other types of options, the buyer of a swaption pays a non-refundable premium for the option and obtains the right, but not the obligation, to enter into an underlying swap on agreed-upon terms. The seller of a swaption, in exchange for the premium, becomes obligated (if the option is exercised) to enter into an underlying swap on agreed-upon terms. |

|

● |

Interest Rate Caps. Interest rate caps entitle the purchaser, to the extent that a specified index exceeds a predetermined interest rate, to receive payment of interest on a notional principal amount from the party selling such interest rate cap. |

|

● |

Interest Rate Floors. Interest rate floors entitle the purchaser, to the extent that a specified index falls below a predetermined interest rate, to receive payments of interest on a notional principal amount from the party selling the interest rate floor. |

|

● |

Interest Rate Collars. Interest rate collars combine a cap and a floor that are designed to preserve a certain return within a predetermined range of interest rates. |

The Fund may enter into the transactions described above for hedging purposes or to seek to increase total return (which is considered a speculative activity). The use of swaps, swaptions, and interest rate caps, floors and collars is a highly specialized activity which involves investment techniques and risks different from those associated with ordinary portfolio securities transactions. If the Adviser or a Trading Adviser is incorrect in its forecasts of market values and interest rates, the investment performance of the Fund would be less favorable than it would have been if these investment techniques were not used.

16

Leveraging Risk. The Fund’s use of futures, forward contracts, swaps, other derivative instruments and selling securities short will have the economic effect of financial leverage. The use of leverage by the Adviser and Trading Advisers may increase the volatility of the Fund. These leveraged instruments may result in losses to the Fund or may adversely affect the Fund’s NAV or total return, because instruments that contain leverage are more sensitive to changes in interest rates. The Fund may also use borrowed funds to create leverage. Although the use of leverage by the Fund may create an opportunity for increased return, it also results in additional risks and can magnify the effect of any losses. If the income and gains earned on the securities and instruments purchased with leverage proceeds are greater than the cost of the leverage, the Fund’s return will be greater than if leverage had not been used. Conversely, if the income and gains from the securities and instruments purchased with such proceeds does not cover the cost of leverage, the Fund’s return will be less than if leverage had not been used. In the event of a sudden, precipitous drop in value of the Fund’s assets, the Fund may not be able to liquidate assets quickly enough to pay off its borrowing. Short sales of securities also involve the use of leverage. Using this investment technique may adversely affect the Fund’s NAV or total return.

Market Risk. The Fund’s NAV and investment return will fluctuate based upon changes in the value of its investments. The market value of the Fund’s holdings is based upon the market’s perception of value and is not necessarily an objective measure of an investment’s value. There is no assurance that the Fund will realize its investment objective, and an investment in the Fund is not, by itself, a complete or balanced investment program. You could lose money on your investment in the Fund, or the Fund could underperform other investments.

Periods of unusually high financial market volatility and restrictive credit conditions, at times limited to a particular sector or geographic area, have occurred in the past and may be expected to recur in the future. Some countries, including the United States, have adopted or have signaled protectionist trade measures, relaxation of the financial industry regulations that followed the financial crisis, and/or reductions to corporate taxes. The scope of these policy changes is still developing, but the equity and debt markets may react strongly to expectations of change, which could increase volatility, particularly if a resulting policy runs counter to the market’s expectations. The outcome of such changes cannot be foreseen at the present time. In addition, geopolitical and other risks, including environmental and public health risks, war, natural disasters, terrorism, conflicts and social unrest may add to instability in the world economy and markets generally. As a result of increasingly interconnected global economies and financial markets, the value and liquidity of the Fund’s investments may be negatively affected by events impacting a country or region, regardless of whether the Fund invests in issuers located in or with significant exposure to such country or region.

The continuing spread of an infectious respiratory illness caused by a novel strain of coronavirus (known as COVID-19) has caused volatility, severe market dislocations and liquidity constraints in many markets and may adversely affect the Fund’s investments and operations. The outbreak was first detected in December 2019 and subsequently spread globally. The transmission of COVID-19 and efforts to contain its spread have resulted in international and domestic travel restrictions and disruptions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of and delays in healthcare service preparation and delivery, quarantines, event and service cancellations or interruptions, disruptions to business operations (including staff reductions), supply chains and consumer activity, as well as general concern and uncertainty that has negatively affected the economic environment. These disruptions have led to instability in the marketplace, including stock and credit market losses and overall volatility. The impact of COVID-19, and other infectious illness outbreaks, epidemics or pandemics that may arise in the future, could adversely affect the economies of many nations or the entire global economy, the financial performance of individual issuers, borrowers and sectors and the health of the markets generally in potentially significant and unforeseen ways. Health crises may heighten other pre-existing political, social and economic risks in a country or region. In the event of a pandemic or an outbreak, there can be no assurance that the Fund and its service providers will be able to maintain normal business operations for an extended period of time or will not lose the services of key personnel on a temporary or long-term basis due to illness or other reasons. Although vaccines for COVID-19 are available, the full impacts of a pandemic or disease outbreaks are unknown and the pace of recovery may vary from market to market, resulting in a high degree of uncertainty for potentially extended periods of time.

17

Quantitative Trading Strategies Risk. The Adviser and Trading Advisers may use quantitative methods to select investments. Securities or other investments selected using quantitative methods may perform differently from the market as a whole or from their expected performance for many reasons, including factors used in building the quantitative analytical framework, the weights placed on each factor, changing sources of market returns, changes from the factors’ historical trends, and technical issues in the construction and implementation of the models (including, for example, data problems and/or software issues), among others. Any errors or imperfections in quantitative analyses or models, or in the data on which they are based, could adversely affect the ability of the Adviser or a Trading Adviser to use such analyses or models effectively, which in turn could adversely affect the Fund’s performance. There can be no assurance that these methodologies will help the Fund to achieve its investment objective.

Short Sales. The Fund engages in short sales – including those that are not “against the box,” which means that the Fund may make short sales where the Fund does not currently own or have the right to acquire, at no added cost, securities identical to those sold short – in accordance with the provisions of the 1940 Act. In a typical short sale, the Fund borrows from a broker a security in order to sell the security to a third party. The Fund is then obligated to return a security of the same issuer and quantity at some future date. The Fund realizes a loss to the extent the security increases in value or a profit to the extent the security declines in value (after taking into account any associated costs). Short sales “against the box” may protect the Fund against the risk of losses in the value of a portfolio security because any decline in value of the security should be wholly or partially offset by a corresponding gain in the short position. Any potential gains in the security, however, would be wholly or partially offset by a corresponding loss in the short position. Short sales that are not “against the box” involve a form of investment leverage, and the amount of the Fund’s loss on a short sale is potentially unlimited. The Fund will not make a short sale if, immediately before the transaction, the market value of all securities sold short exceeds 95% of the value of the Fund’s assets.

Subsidiary Risk. The Fund will make investments through its direct and indirect wholly-owned Subsidiaries organized under the acts of the Cayman Islands and the laws of the State of Delaware. By investing in the Subsidiaries, the Fund is indirectly exposed to the risks associated with each Subsidiary’s investments. The derivatives and other investments held by a Subsidiary are generally similar to those that are permitted to be held by the Fund and are subject to the same risks that apply to similar investments if held directly by the Fund. These risks are described elsewhere in this Prospectus. There can be no assurance that the investment objective of the Subsidiaries will be achieved.

The Subsidiaries are not registered under the 1940 Act, and, unless otherwise noted in this Prospectus, are not subject to all the investor protections of the 1940 Act. However, the Fund, directly or indirectly, wholly owns and controls the Subsidiaries, making it unlikely that a Subsidiary will take action contrary to the interests of the Fund and its shareholders. The Board has oversight responsibility for the investment activities of the Fund, including its investment in the Subsidiaries, and the Fund’s role as the direct or indirect sole shareholder of each Subsidiary. The Subsidiaries will be subject to the same investment restrictions and limitations, and follow the same compliance policies and procedures, as the Fund.

Changes in the laws or acts of the United States, Delaware and/or the Cayman Islands could result in the inability of the Fund and/or its Subsidiaries to operate as described in this Prospectus and in the SAI and could adversely affect the Fund. For example, the Cayman Islands does not currently impose any income, corporate or capital gains tax or withholding tax on the Cayman Subsidiary or the SPC. If Cayman Islands act changes such that the Cayman Subsidiary and/or the SPC must pay Cayman Islands taxes, Fund shareholders would likely suffer decreased investment returns.

18

Tax Risk. There is a risk that the IRS could assert that the income derived from the Fund’s investment in certain commodity-linked structured notes will not be considered qualifying income for purposes of the Fund remaining qualified as a RIC for U.S. federal income tax purposes. In 2006, the IRS had published a ruling that income realized from swaps with respect to a commodities index would not be qualifying income. In a number of private letter rulings issued during 2006-2011, the IRS ruled that the income of such a foreign subsidiary would be qualified income each year even if it is not actually distributed to the RIC each year, but in 2011 the IRS suspended the issuance of such rulings. In addition, during 2006-2011, the IRS had also issued private letter rulings to regulated investment companies concluding that income derived from their investment in certain commodity-linked structured notes would constitute qualifying income to a fund. In 2011, the IRS indicated that the granting of these types of private letter rulings was suspended, pending further internal review of the subject. In 2016, the IRS announced that it would not issue any such rulings in the future, and it revoked the previously issued rulings. If the Fund were to fail to qualify as a RIC and became subject to federal income tax, shareholders of the Fund would be subject to diminished returns. For more information, see “More Information About Taxes”.

Non-Principal Risks