| Label |

Element |

Value |

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Document Type |

dei_DocumentType |

485BPOS

|

|

| Document Period End Date |

dei_DocumentPeriodEndDate |

Aug. 31, 2019

|

|

| Entity Registrant Name |

dei_EntityRegistrantName |

RBB FUND, INC.

|

|

| Entity Central Index Key |

dei_EntityCentralIndexKey |

0000831114

|

|

| Entity Inv Company Type |

dei_EntityInvCompanyType |

N-1A

|

|

| Amendment Flag |

dei_AmendmentFlag |

false

|

|

| Document Creation Date |

dei_DocumentCreationDate |

Feb. 28, 2020

|

|

| Document Effective Date |

dei_DocumentEffectiveDate |

Feb. 28, 2020

|

|

| Prospectus Date |

rr_ProspectusDate |

Feb. 28, 2020

|

|

| Abbey Capital | ABBEY CAPITAL MULTI ASSET FUND |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

SUMMARY SECTION

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The investment objective of the Abbey Capital Multi Asset Fund (the “Fund”) is to seek long-term capital appreciation.

|

|

| Objective, Secondary [Text Block] |

rr_ObjectiveSecondaryTextBlock |

Current income is a secondary objective.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Expenses and Fees

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund (the “Shares”). You may qualify for sales charge discounts if you invest, or agree to invest in the future, at least $25,000 in Class A Shares of the Fund. More information about these and other discounts is available from your financial professional, in the section of the Prospectus entitled “Shareholder Information – Sales Charges” and in the section of the Fund’s Statement of Additional Information (“SAI”) entitled “Purchase and Redemption Information – Reducing or Eliminating the Front-End Sales Charge.” Additionally, you may be required to pay commissions and/or other forms of compensation to a broker for transactions in Class I Shares of the Fund, which are not reflected in the tables or the examples below.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder Fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

February 28, 2021

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year ended August 31, 2019, the portfolio turnover rate for the Fund was 0% of the average value of its portfolio. In accordance with industry practice, derivative instruments and instruments with a maturity of one year or less at the time of acquisition are excluded from the calculation of the portfolio turnover rate, which leads to the 0% portfolio turnover rate reported above. If those instruments were included in the calculation, the Fund would have a higher portfolio turnover rate.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

none

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you invest, or agree to invest in the future, at least $25,000 in Class A Shares of the Fund.

|

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 25,000

|

|

| Expense Exchange Traded Fund Commissions [Text] |

rr_ExpenseExchangeTradedFundCommissions |

Additionally, you may be required to pay commissions and/or other forms of compensation to a broker for transactions in Class I Shares of the Fund, which are not reflected in the tables or the examples below.

|

|

| Other Expenses, New Fund, Based on Estimates [Text] |

rr_OtherExpensesNewFundBasedOnEstimates |

"Other Expenses" for Class A Shares and Class C Shares, which had not commenced operations as of the date of this Prospectus, are based on Class I Shares for the current fiscal year.

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in Class A and Class C Shares, and $1,000,000 in Class I Shares, of the Fund for the time periods indicated and then redeem all of your Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the contractual expense limitation until its expiration). Although your actual costs may be higher or lower, based on these assumptions your costs of investing in the Fund would be:

|

|

| Expense Example, No Redemption Narrative [Text Block] |

rr_ExpenseExampleNoRedemptionNarrativeTextBlock |

You would pay the following expenses on Class C Shares if you did not redeem your shares at the end of the period:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal Investment Strategies

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

The Fund seeks to achieve its investment objective by allocating its assets among a “Managed Futures” strategy, a “Long U.S. Equity” strategy and a “Fixed Income” strategy.

The

Managed Futures strategy will be achieved by the Fund investing in managed futures investments, including (i) options, (ii)

futures, (iii) forwards, (iv) spot contracts, or (v) swaps, including total return swaps, each of which may be tied to (i)

commodities, (ii) financial indices and instruments, (iii) foreign currencies, or (iv) equity indices (the “Futures

Portfolio”). The Fund may make some or all of its investments in the Futures Portfolio through Abbey Capital Multi

Asset Offshore Fund Limited, a wholly-owned and controlled subsidiary of the Fund organized under the laws of the Cayman

Islands (the “Subsidiary”), and may invest up to 25% of its total assets in the Subsidiary. The Adviser may

allocate assets of the Subsidiary to a single Managed Futures portfolio or multiple Managed Futures portfolios that include

investment styles or sub-strategies such as (i) trend following, (ii) discretionary, fundamentals-based investing with a

focus on macroeconomic analysis, (iii) strategies that pursue both fundamental and technical trading approaches, (iv) other

specialized approaches to specific or individual market sectors such as equities, interest rates, metals, agricultural and

soft commodities, and (v) systematic trading strategies which incorporate technical and fundamental variables.

The Managed Futures strategy investments are designed to achieve capital appreciation in the financial and commodities futures markets. The Adviser intends to allocate a portion of the assets of the Fund and the Subsidiary to one or more Trading Advisers to manage in percentages determined at the discretion of the Adviser. Each current Trading Adviser is registered with the U.S. Commodity Futures Trading Commission (the “CFTC”) as a Commodity Trading Advisor (“CTA”). Trading Advisers that are not registered with the SEC as investment advisers provide advice only regarding matters that do not involve securities. The trading strategies employ several different trading styles using different research and trading methodologies, in a wide range of global financial and commodity markets operating over multiple time frames. Trading Advisers may use discretionary approaches aimed at identifying value investments and turning points in trends. The Fund invests in U.S. and non-U.S. markets and in developed and emerging markets.

The Long U.S. Equity strategy will be achieved by the Adviser targeting an allocation of approximately 50% of the Fund’s total assets in a portfolio of one or more U.S. equity index futures (the “Equity Portfolio”). The Adviser will monitor the percentage of the Fund’s total assets that form the Equity Portfolio on a daily basis. The Adviser will establish ‘rebalancing thresholds’ so that if at any time the percentage of the Fund’s total assets invested in the Equity Portfolio is above or below the target allocation of approximately 50% by a specific amount, then the Adviser will seek to rebalance the Equity Portfolio back towards its target allocation of approximately 50%. Such rebalancing thresholds will be determined by the Adviser and may be subject to change from time to time.

As part of the Long U.S. Equity strategy, the Fund may invest in all types of equity and equity-related securities, including without limitation exchange-traded and over-the-counter common and preferred stocks, futures, warrants, options, rights, convertible securities, sponsored and unsponsored depositary receipts and shares, trust certificates, participatory notes, limited partnership interests, and shares of other investment companies (including exchanged-traded funds (“ETFs”)) and real estate investment trusts (“REITs”). The Fund may also participate as a purchaser in initial public offerings of securities (“IPO”), a company’s first offering of stock to the public. The Fund defines United States companies as companies (i) that are organized under the laws of the United States; (ii) whose principal trading market is in a the United States; or (iii) that have a majority of their assets, or that derive a significant portion of their revenue or profits from businesses, investments or sales, within the United States.

The Fixed Income strategy invests the Fund’s assets primarily in investment grade fixed income securities (of all durations and maturities) in order to generate interest income and capital appreciation, which may add diversification to the returns generated by the Fund’s Managed Futures and Long U.S. Equity strategies. The level of the Fund’s assets invested in the Fixed Income Strategy will be managed and rebalanced pursuant to thresholds determined by the Adviser, which may be subject to change from time to time. In line with these thresholds, any proceeds of maturing fixed income securities will be substantially reinvested into additional fixed income securities. The Fund must set aside liquid assets to “cover” open positions with respect to its managed futures investments. The Fixed Income strategy investments may be used to help cover the Fund’s derivative positions. The Subsidiary may also cover written options with offsetting purchased options in the same commodity and maturity, or by the purchase or sale of the underlying commodity future, in an amount great than or equal to that required by an exercised option.

To achieve its investment objective, the Fund’s Adviser will target approximately 100% exposure of the Fund’s net assets to Managed Futures strategy investments and approximately 50% exposure of the Fund’s net assets to Long U.S. Equity strategy investments. The Fund’s remaining net assets will be allocated to the Fixed Income strategy investments.

As much of the trading within the Fund is in futures markets, the Fund is likely to have cash balances surplus to margin requirements. The cash portfolio will be invested on a short-term, highly liquid, basis, to meet margin calls on the futures positions.

The

Fund is “non-diversified” for purposes of the Investment Company Act of 1940, as amended, (the “1940 Act”),

which means that the Fund may invest in fewer securities at any one time than a diversified fund. The Fund may not invest more

than 15% of its net assets in illiquid securities. The Fund’s investments in certain derivative instruments and its short

selling activities involve the use of leverage.

Generally, the Subsidiary will invest primarily in commodity futures, but it may also invest in financial futures, option and swap contracts, fixed income securities, pooled investment vehicles, including those that are not registered pursuant to the 1940 Act and other investments intended to serve as margin or collateral for the Subsidiary’s derivative positions. The Fund invests in the Subsidiary in order to gain exposure to the commodities markets within the limitations of the federal tax laws, rules and regulations that apply to regulated investment companies. Unlike the Fund, the Subsidiary may invest without limitation in commodity-linked derivatives, however, the Subsidiary will comply with the same 1940 Act asset coverage requirements with respect to its investments in commodity-linked derivatives that are applicable to the Fund’s transactions in derivatives. In addition, to the extent applicable to the investment activities of the Subsidiary, the Subsidiary will be subject to the same fundamental investment restrictions and will follow the same compliance policies and procedures as the Fund. Unlike the Fund, the Subsidiary will not seek to qualify as a regulated investment company (“RIC”) under Subchapter M of Subtitle A, Chapter 1, of the Internal Revenue Code of 1986, as amended (the “Code”). The Fund is the sole shareholder of the Subsidiary and does not expect shares of the Subsidiary to be offered or sold to other investors.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal Investment Risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

Risk is inherent in all investing. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments. The Fund’s principal risks are presented in alphabetical order to facilitate finding particular risks and comparing them with other funds. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears. Different risks may be more significant at different times depending on market conditions or other factors.

The principal risk factors affecting shareholders’ investments in the Fund (and, indirectly, in the Subsidiary) are set forth below.

● Commodity Sector Risk: Exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. The prices of energy, industrial metals, precious metals, agriculture and livestock sector commodities may fluctuate widely due to factors such as changes in value, supply and demand and governmental regulatory policies. The commodity-linked securities in which the Fund invests may be issued by companies in the financial services sector, and events affecting the financial services sector may cause the Fund’s Share value to fluctuate.

● Counterparty Risk: Counterparty risk is the risk that the other party(s) to an agreement or a participant to a transaction, such as a broker or the futures commission merchant, might default on a contract or fail to perform by failing to pay amounts due or failing to fulfill the obligations of the contract or transaction.

● Credit Risk: Credit risk refers to the possibility that the issuer of the security will not be able to make principal and interest payments when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. Securities rated in the four highest categories by the rating agencies are considered investment grade but they may also have some speculative characteristics. Investment grade ratings do not guarantee that bonds will not lose value.

● Currency Risk: Investment in foreign securities also involves currency risk associated with securities that trade or are denominated in currencies other than the U.S. dollar and which may be affected by fluctuations in currency exchange rates. An increase in the strength of the U.S. dollar relative to a foreign currency may cause the U.S. dollar value of an investment in that country to decline. Foreign currencies also are subject to risks caused by inflation, interest rates, budget deficits and low savings rates, political factors and government controls. Forward foreign currency exchange contracts may limit potential gains from a favorable change in value between the U.S. dollar and foreign currencies. Unanticipated changes in currency pricing may result in poorer overall performance for the Fund than if it had not engaged in these contracts.

● Cyber

Security Risk: Cyber security risk is the risk of an unauthorized breach and access to Fund assets, Fund or customer data

(including private shareholder information), or proprietary information, or the risk of an incident occurring that causes the

Fund, the Adviser, custodian, transfer agent, distributor and other service providers and financial intermediaries to

suffer data breaches, data corruption or lose operational functionality or prevent Fund investors from purchasing, redeeming

or exchanging shares or receiving distributions. The Fund and its Adviser have limited ability to prevent or mitigate cyber

security incidents affecting third-party service providers. Successful cyber-attacks or other cyber-failures or events

affecting the Fund or its service providers may adversely impact and cause financial losses to the Fund or its

shareholders.

● Derivatives Risk: The Fund’s investments in derivative instruments including options, forward currency exchange contracts, swaps and futures, which may be leveraged, may result in losses. Investments in derivative instruments may result in losses exceeding the amounts invested.

● Emerging Markets Risk: Investment in emerging market securities involves greater risk than that associated with investment in foreign securities of developed foreign countries. These risks include volatile currency exchange rates, periods of high inflation, increased risk of default, greater social, economic and political uncertainty and instability, less governmental supervision and regulation of securities markets, weaker auditing and financial reporting standards, lack of liquidity in the markets, and the significantly smaller market capitalizations of emerging market issuers.

● Equity and Equity-Related Securities Risk: Investments in equity securities and equity derivatives in general are subject to market risks that may cause their prices to fluctuate over time. The value of a convertible security may not increase or decrease as rapidly as the underlying common stock. Common stocks may decline over short or even extended periods of time. The purchase of rights or warrants involves the risk that the Fund could lose the purchase value of a right or warrant if the right to subscribe to additional shares is not executed prior to the right’s or warrant’s expiration. The value of securities convertible into equity securities, such as warrants or convertible debt, is also affected by prevailing interest rates, the credit quality of the issuer and any call provision.

● Fixed Income Securities Risk: Fixed income securities in which the Fund may invest are subject to certain risks, including: interest rate risk, prepayment risk and credit/default risk. Interest rate risk involves the risk that prices of fixed income securities will rise and fall in response to interest rate changes. Prepayment risk involves the risk that in declining interest rate environments prepayments of principal could increase and require the Fund to reinvest proceeds of the prepayments at lower interest rates. Credit risk involves the risk that the credit rating of a security may be lowered.

● Foreign Investments Risk: International investing is subject to special risks, including currency exchange rate volatility, political, social or economic instability, and differences in taxation, auditing and other financial practices. The Fund may invest in securities of foreign issuers either directly or through depositary receipts. Depositary receipts may be available through “sponsored” or “unsponsored” facilities. Holders of unsponsored depositary receipts generally bear all of the costs of the unsponsored facility. The depository of an unsponsored facility is frequently under no obligation to distribute shareholder communications received from the issuer of the deposited security or to pass through, to the holders of the receipts, voting rights with respect to the deposited securities. The depository of unsponsored depositary receipts may provide less information to receipt holders.

● Forward and Futures Risk: The successful use of forward and futures contracts draws upon the Adviser’s and Trading Advisers’ skill and experience with respect to such instruments and are subject to special risk considerations. The primary risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of instruments held by the Fund and the price of the forward or futures contract; (b) possible lack of a liquid secondary market, and possible regulatory position limits and restrictions, for a forward or futures contract and the resulting inability to close a forward or futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Adviser’s and Trading Advisers’ inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to sell securities from its portfolio to meet daily variation margin requirements, and the Fund may have to sell securities at a time when it may be disadvantageous to do so.

● Hedging

Transactions Risk: The Adviser and Trading Advisers from time to time employ various hedging techniques. The success of

the Fund’s hedging strategy will be subject to the Adviser’s and Trading Advisers’ ability to correctly

assess the degree of correlation between the performance of the instruments used in the hedging strategy and the performance

of the investments in the portfolio being hedged. Since the characteristics of many securities change as markets change or

time passes, the success of the Fund’s hedging strategy will also be subject to the Adviser’s and Trading

Advisers’ ability to continually recalculate, readjust, and execute hedges in an efficient and timely manner. For a

variety of reasons, the Adviser and Trading Advisers may not seek to establish a perfect correlation between such hedging

instruments and the portfolio holdings being hedged. Such imperfect correlation may prevent the Fund from achieving the

intended hedge or expose the Fund to risk of loss. In addition, it is not possible to hedge fully or perfectly against any

risk, and hedging entails its own cost.

● High Portfolio Turnover Risk: The risk that when investing on a shorter-term basis, the Fund may as a result trade more frequently and incur higher levels of brokerage fees and commissions, and cause higher levels of current tax liability to shareholders in the Fund.

● Interest Rate Risk: Interest rate risk is the risk that prices of fixed income securities generally increase when interest rates decline and decrease when interest rates increase. The Fund may lose money if short term or long term interest rates rise sharply or otherwise change in a manner not anticipated by the Adviser and Trading Advisers. It is likely there will be less governmental action in the near future to maintain low interest rates. The negative impact on fixed income securities from the resulting rate increases for that and other reasons could be swift and significant.

● Leveraging Risk: Investments in derivative instruments may give rise to a form of leverage. Trading Advisers may engage in speculative transactions which involve substantial risk and leverage, such as making short sales. The use of leverage by the Adviser and Trading Advisers may increase the volatility of the Fund. These leveraged instruments may result in losses to the Fund or may adversely affect the Fund’s net asset value (“NAV”) or total return, because instruments that contain leverage are more sensitive to changes in interest rates. The Fund may also have to sell assets at inopportune times to satisfy its obligations in connection with such transactions.

● Limiting Operating History Risk: The Fund has a limited operating history. There is a risk that the Fund will not grow or maintain an economically viable size, in which case the Board may determine to liquidate the Fund.

● Management Risk: The Fund is subject to the risk of poor stock selection. In other words, the individual stocks in the Fund may not perform as well as expected, and/or the Fund’s portfolio management practices do not work to achieve their desired result.

● Manager Risk: If the Adviser and Trading Advisers make poor investment decisions, it will negatively affect the Fund’s investment performance.

● Market Risk: The NAV of the Fund will change with changes in the market value of its portfolio positions. Investors may lose money.

● Multi-Manager Dependence Risk: The success of the Fund’s investment strategy depends both on the Adviser’s ability to select Trading Advisers and to allocate assets to those Trading Advisers and on each Trading Adviser’s ability to execute the relevant strategy and select investments for the Fund and the Subsidiary. The Trading Advisers’ investment styles may not always be complementary, which could adversely affect the performance of the Fund.

● New Adviser Risk: The Trading Advisers may be newly registered or not registered with the SEC and/or have not previously managed a mutual fund. Accordingly, investors in the Fund bear the risk that a Trading Adviser’s inexperience may limit its effectiveness.

● Non-Diversification Risk: The Fund is non-diversified. Compared to other funds, the Fund may invest more of its assets in a smaller number of companies. Gains or losses on a single stock may have greater impact on the Fund.

● Options Risk: Purchasing and writing put and call options are highly specialized activities and entail greater than ordinary investment risks. The Fund may not fully benefit from or may lose money on an option if changes in its value do not correspond as anticipated to changes in the value of the underlying securities.

● Quantitative

Trading Strategies Risk: The Adviser and Trading Advisers may use quantitative methods to select investments. Securities

or other investments selected using quantitative methods may perform differently from the market as a whole or from their

expected performance for many reasons, including factors used in building the quantitative analytical framework, the

weights placed on each factor, and changing sources of market returns, among others. Any errors or imperfections in

quantitative analyses or models, or in the data on which they are based, could adversely affect the ability of the Adviser or

a Trading Adviser to use such analyses or models effectively, which in turn could adversely affect the Fund’s

performance. There can be no assurance that these methodologies will help the Fund to achieve its investment objective.

● Subsidiary Risk: By investing in the Subsidiary, the Fund is indirectly exposed to the risks associated with the Subsidiary’s investments. The derivatives and other investments held by the Subsidiary are generally similar to those that are permitted to be held by the Fund and are subject to the same risks that apply to similar investments if held directly by the fund. The Subsidiary is not registered under the 1940 Act, and, unless otherwise noted in this Prospectus, is not subject to all the investor protections of the 1940 Act. Changes in the laws of the United States and/or the Cayman Islands could result in the inability of the Fund and/or the Subsidiary to continue to operate as it does currently and could adversely affect the Fund.

● Tax Risk: In order to qualify as a RIC, the Fund must meet certain requirements regarding the source of its income, the diversification of its assets and the distribution of its income. Under the test regarding the source of a RIC’s income, at least 90% of the gross income of the RIC each year must be qualifying income, which consists of dividends, interest, gains on investment assets and other categories of investment income. In 2006, the Internal Revenue Service (“IRS”) published a ruling that income realized from swaps with respect to a commodities index would not be qualifying income. The Fund’s investment in the Subsidiary is expected to provide the Fund with exposure to the commodities markets within the limitations of the Code for qualification as a RIC, but there is a risk that the IRS could assert that the income derived from the Fund’s investment in the Subsidiary and certain commodity-linked structured notes will not be considered qualifying income for purposes of the Fund remaining qualified as a RIC for U.S. federal income tax purposes. If the Fund were to fail to qualify as a RIC and became subject to federal income tax, shareholders of the Fund would be subject to diminished returns. Changes in the laws of the United States and/or the Cayman Islands could result in the inability of the Fund and/or its Subsidiary to operate as described in this Prospectus and the SAI and could adversely affect the Fund. For example, the Cayman Islands does not currently impose any income, corporate or capital gains tax or withholding tax on the Subsidiary. If Cayman Islands law changes such that the Subsidiary must pay Cayman Islands taxes, Fund shareholders would likely suffer decreased investment returns.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments.

|

|

| Risk Nondiversified Status [Text] |

rr_RiskNondiversifiedStatus |

The Fund is non-diversified. Compared to other funds, the Fund may invest more of its assets in a smaller number of companies. Gains or losses on a single stock may have greater impact on the Fund.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance Information

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

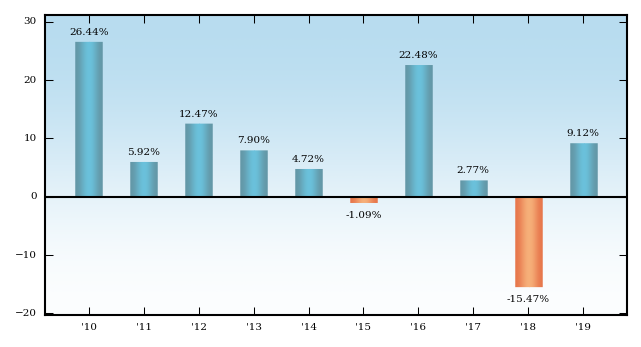

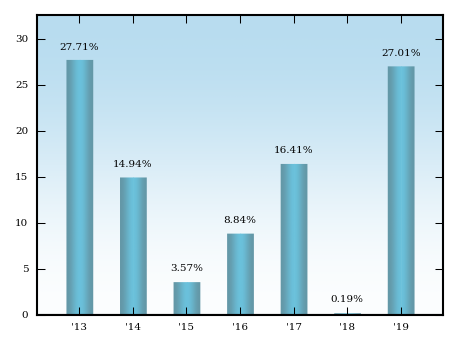

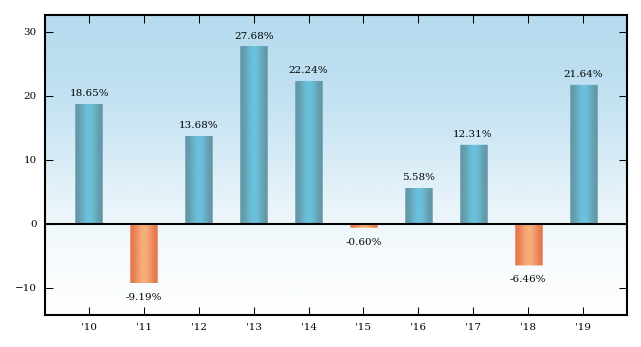

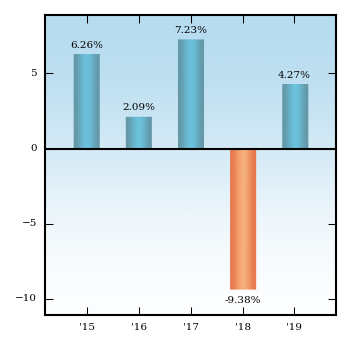

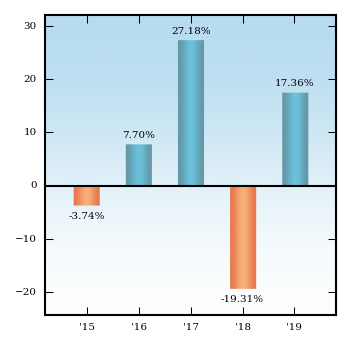

The bar chart and table below illustrate the long-term performance of the Fund. The bar chart below shows how the Fund’s performance has varied year by year and provides some indication of the risks of investing in the Fund. The bar chart assumes reinvestment of all dividends and distributions. As with all such investments, past performance (before and after taxes) is not an indication of future results. Updated performance information is available online at www.abbeycapital.com or by calling 1-844-261-6484 (toll free).

The Fund commenced operations as a series of the Company on April 11, 2018, when all of the assets of Abbey Global LP (the “Predecessor Fund”) transferred to Class I Shares of the Fund. The Fund’s objectives, policies, guidelines and restrictions are in all material respects equivalent to the Predecessor Fund. Accordingly, the performance information shown below for periods prior to April 11, 2018 is that of the Predecessor Fund. The Predecessor Fund was not registered under the 1940 Act, and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Fund had been registered under the 1940 Act, its performance may have been adversely affected. Accordingly, future Fund performance may be different than the Predecessor Fund’s restated past performance. The Predecessor Fund was not a regulated investment company under Subchapter M of the Internal Revenue Code and therefore did not distribute current or accumulated earnings and profits and was not subject to the diversification and source of income requirements applicable to regulated investment companies. Monthly returns since the inception of the Predecessor Fund are provided in Appendix A of the Prospectus.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The bar chart below shows how the Fund's performance has varied year by year and provides some indication of the risks of investing in the Fund. The bar chart assumes reinvestment of all dividends and distributions.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

1-844-261-6484

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

www.abbeycapital.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

As with all such investments, past performance (before and after taxes) is not an indication of future results.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

Total Returns for the Calendar Year s Ended December 31

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

During

the period shown in the chart, the highest quarterly return was 17.10% (for the quarter ended September 30, 2010) and the lowest

quarterly return was -15.91% (for the quarter ended September 30, 2011).

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED DECEMBER 31, 2019

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual Federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

|

|

| Performance Table Narrative |

rr_PerformanceTableNarrativeTextBlock |

The following table compares the average annual total returns for the Fund’s Class I shares, including the Predecessor Fund, before and after taxes for the past calendar year, five-year, ten-year and since inception periods to the average annual total returns of a broad-based securities market index for the same periods. Average annual returns for Class A Shares and Class C Shares of the Fund are not included because they had not commenced operations prior to the date of this Prospectus.

|

|

| Abbey Capital | ABBEY CAPITAL MULTI ASSET FUND | S&P 500® Total Return Index (reflects no deduction for fees, expenses and taxes) |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

31.49%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

11.70%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

13.56%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

8.50%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

May 14, 2002

|

|

| Abbey Capital | ABBEY CAPITAL MULTI ASSET FUND | CLASS I SHARES |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Trading Symbol |

dei_TradingSymbol |

MAFIX

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption Fee (as a percentage of amount redeemed, if applicable) |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

1.77%

|

[1] |

| Distribution and/or Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.50%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

2.27%

|

|

| Fee Waivers and/or Expense Reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.48%)

|

[2] |

| Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimbursements |

rr_NetExpensesOverAssets |

1.79%

|

|

| One Year |

rr_ExpenseExampleYear01 |

$ 18,187

|

|

| Three Years |

rr_ExpenseExampleYear03 |

66,333

|

|

| Five Years |

rr_ExpenseExampleYear05 |

117,142

|

|

| Ten Years |

rr_ExpenseExampleYear10 |

$ 256,813

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

18.65%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

(9.19%)

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

13.68%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

27.68%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

22.24%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

(0.60%)

|

|

| Annual Return 2016 |

rr_AnnualReturn2016 |

5.58%

|

|

| Annual Return 2017 |

rr_AnnualReturn2017 |

12.31%

|

|

| Annual Return 2018 |

rr_AnnualReturn2018 |

(6.46%)

|

|

| Annual Return 2019 |

rr_AnnualReturn2019 |

21.64%

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

highest quarterly return

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Sep. 30, 2010

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

17.10%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

lowest quarterly return

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30, 2011

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(15.91%)

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

21.64%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

6.04%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

9.87%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

10.12%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

May 14, 2002

|

|

| Abbey Capital | ABBEY CAPITAL MULTI ASSET FUND | CLASS I SHARES | After Taxes on Distributions |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

16.33%

|

[3] |

| 5 Years |

rr_AverageAnnualReturnYear05 |

4.47%

|

[3] |

| 10 Years |

rr_AverageAnnualReturnYear10 |

9.05%

|

[3] |

| Since Inception |

rr_AverageAnnualReturnSinceInception |

9.66%

|

[3] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

May 14, 2002

|

[3] |

| Abbey Capital | ABBEY CAPITAL MULTI ASSET FUND | CLASS I SHARES | After Taxes on Distributions and Sales |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

12.98%

|

[3] |

| 5 Years |

rr_AverageAnnualReturnYear05 |

4.08%

|

[3] |

| 10 Years |

rr_AverageAnnualReturnYear10 |

7.79%

|

[3] |

| Since Inception |

rr_AverageAnnualReturnSinceInception |

8.56%

|

[3] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

May 14, 2002

|

[3] |

| Abbey Capital | ABBEY CAPITAL MULTI ASSET FUND | CLASS A SHARES |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Trading Symbol |

dei_TradingSymbol |

MAFAX

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75%

|

|

| Maximum Deferred Sales Charge (Load) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

[4] |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption Fee (as a percentage of amount redeemed, if applicable) |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

1.77%

|

[1] |

| Distribution and/or Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.50%

|

[5] |

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

2.52%

|

|

| Fee Waivers and/or Expense Reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.48%)

|

[2] |

| Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimbursements |

rr_NetExpensesOverAssets |

2.04%

|

|

| One Year |

rr_ExpenseExampleYear01 |

$ 770

|

|

| Three Years |

rr_ExpenseExampleYear03 |

1,271

|

|

| Five Years |

rr_ExpenseExampleYear05 |

1,798

|

|

| Ten Years |

rr_ExpenseExampleYear10 |

$ 3,233

|

|

| Abbey Capital | ABBEY CAPITAL MULTI ASSET FUND | CLASS C SHARES |

|

|

|

| Prospectus [Line Items] |

rr_ProspectusLineItems |

|

|

| Trading Symbol |

dei_TradingSymbol |

MAFCX

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

1.00%

|

[6] |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption Fee (as a percentage of amount redeemed, if applicable) |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

1.77%

|

[1] |

| Distribution and/or Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.50%

|

[5] |

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

3.27%

|

|

| Fee Waivers and/or Expense Reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.48%)

|

[2] |

| Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimbursements |

rr_NetExpensesOverAssets |

2.79%

|

|

| One Year |

rr_ExpenseExampleYear01 |

$ 382

|

|

| Three Years |

rr_ExpenseExampleYear03 |

962

|

|

| Five Years |

rr_ExpenseExampleYear05 |

1,666

|

|

| Ten Years |

rr_ExpenseExampleYear10 |

3,535

|

|

| One Year |

rr_ExpenseExampleNoRedemptionYear01 |

282

|

|

| Three Years |

rr_ExpenseExampleNoRedemptionYear03 |

962

|

|

| Five Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,666

|

|

| Ten Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 3,535

|

|

|

|